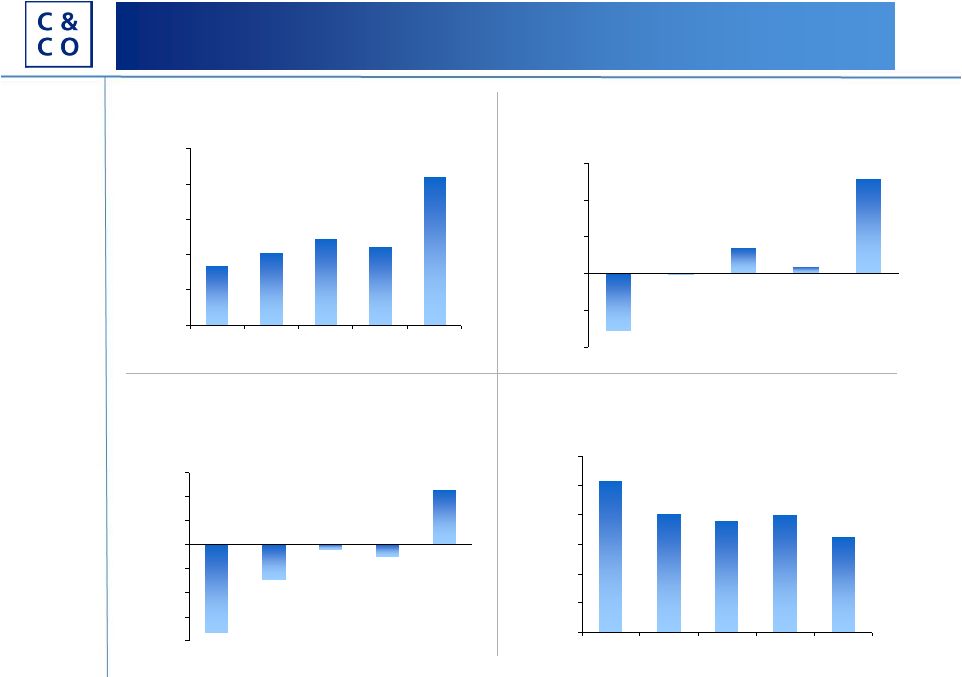

18 • 1Q10 net trading revenue of $22.8 million, a 101% increase over prior year quarter. • Comp as a % of revenue in 2010 is projected to be 65-70% during this period of significant hiring of investment professionals in capital markets. Pay for performance. Variable compensation structure. • 1Q10 non-comp expenses as a % of revenue of 18.5%, excluding depreciation & amortization. Efficient, scalable operations. Low fixed-cost structure. Targeting annual run-rate of $24- $26 million. • 1Q10 operating income of $6.2 million, adjusted operating income of $7.7 million. (1) Total operating expenses in accordance with Generally Accepted Accounting Principals (GAAP) excluding compensation & benefits and depreciation & amortization. (2) Adjusted operating income (loss) represents operating income (loss), computed in accordance with GAAP, before depreciation and amortization, impairments of intangible assets, and share-based compensation expense. See reconciliation table on page 24. Statements of Operations Improving Financial Performance COHEN P&L ($000s) 1Q09 2Q09 3Q09 4Q09 1Q10 New issue 227 $ 518 $ 480 $ 591 $ 668 $ Asset management 9,299 7,614 6,871 7,364 6,770 Principal transactions & other (3,924) 2,620 6,311 1,950 11,527 Net trading 11,317 9,694 10,907 12,247 22,768 Total revenue 16,919 20,446 24,569 22,152 41,733 Compensation and benefits 17,439 16,656 18,762 17,662 27,131 % of Total Revenue 103% 81% 76% 80% 65% Non-comp operating expenses (1) 5,164 4,959 4,768 7,245 7,709 Depreciation & amortization 654 635 630 624 643 Operating income (loss) (6,337) (1,805) 410 (3,379) 6,249 % of Total Revenue -37% -9% 2% -15% 15% Non-operating expense (income) 1,080 1,126 817 (2,342) 1,689 Net income (7,417) (2,931) (407) (1,037) 4,561 Less: Non-controlling interest - - - (87) 1,646 Net inc attributable to COHN (7,417) $ (2,931) $ (407) $ (950) $ 2,915 $ % of Total Revenue -44% -14% -2% -4% 7% Earnings per share (0.77) $ (0.30) $ (0.04) $ (0.10) $ 0.28 $ Fully-diluted earnings per share (0.77) $ (0.30) $ (0.04) $ (0.10) $ 0.28 $ Basic shares 9,612 9,612 9,612 9,723 10,318 Fully-diluted shares 9,612 9,612 9,612 9,723 15,602 Adjusted operating income (loss) (2) (4,649) $ (67) $ 2,138 $ 568 $ 7,692 $ Per fully-diluted share (2) (0.48) $ (0.01) $ 0.22 $ 0.06 $ 0.49 $ |