PROSPECTUS

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-110763

$175,000,000

OFFER TO EXCHANGE

10.25% Senior Notes due October 1, 2011,

which have been registered under the Securities Act of 1933,

for any and all outstanding

10.25% Senior Notes due October 1, 2011,

which have not been registered under the Securities Act of 1933,

of

Hines Nurseries, Inc.

| | • | We will exchange all original notes that are validly tendered and not withdrawn before the end of the exchange offer for an equal principal amount of new notes that we have registered under the Securities Act of 1933. |

| | • | This exchange offer expires at 5:00 p.m., New York City time, on January 22, 2004, unless extended. |

| | • | No public market exists for the original notes or the new notes. We do not intend to list the new notes on any securities exchange or to seek approval for quotation through any automated quotation system. |

The new notes will be our senior unsecured senior obligations and will rank equally in right of payment with all of our other existing and future unsecured debt. The new notes will be effectively subordinated to all of our existing and future secured debt to the extent of the value of the assets securing such debt. The new notes will be guaranteed by Hines Horticulture, the parent company of Hines Nurseries, and all of Hines Horticulture’s subsidiaries, other than Hines Nurseries. The guarantees will be senior unsecured obligations and will be effectively subordinated in right of payment to all existing and future secured debt of the guarantors to the extent of the value of the assets securing such debt.

See “Risk Factors” beginning on page 18 for a discussion of the risks that holders should consider prior to making a decision to exchange original notes for new notes.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is December 23, 2003.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus.

No person is authorized in connection with this offering to give any information or to make any representation not contained in this prospectus, and, if given or made, such other information or representation must not be relied upon as having been authorized by us or the initial purchasers. The information contained herein is as of the date hereof and is subject to change, completion or amendment without notice. Neither the delivery of this prospectus at any time nor the offer, sale or delivery of any note shall, under any circumstances, create any implication that there has been no change in the information set forth herein or in our affairs since the date hereof.

In making an investment decision regarding the new notes, prospective investors must rely on their own examination of us and the terms of this offering, including the merits and risks involved. No representation is made to any offeree or purchaser of the new notes regarding the legality of an investment therein by such offeree or purchaser under any applicable legal investment or similar laws or regulations. The contents of this prospectus are not to be construed as legal, business or tax advice. Each prospective investor should consult its own counsel, accountant and other advisors as to legal, tax, business, financial and related aspects of a purchase of the new notes.

This prospectus contains summaries of the terms of certain documents. Such summaries are qualified in their entirety by reference to the full and complete text of such documents for complete information with respect thereto.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any of the new notes to any person in any jurisdiction where it is unlawful to make such an offer or solicitation.

INDUSTRY AND MARKET DATA

Industry and market data used throughout this prospectus were obtained from our own research, studies conducted by third parties and industry and general publications published by third parties and, in some cases, are management estimates based on our industry and other knowledge. We have not independently verified market and industry data from third-party sources, and we do not make any representations as to the accuracy of such information. While we believe internal company estimates are reliable and market definitions are appropriate, they have not been verified by any independent sources.

3

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all the information that you may consider important in making your investment decision, and is qualified in its entirety by the more detailed information and historical financial statements, including the new notes thereto, that are included, or incorporated by reference, in this prospectus. Therefore, you should read the entire prospectus carefully, including in particular the information set forth under “Risk Factors.” Except as otherwise required by the context, references in this prospectus to “our company,” “we,” “us” or “our” refer to the combined business of Hines Horticulture, Inc. and all of its subsidiaries. All references to “Hines Horticulture” refer to Hines Horticulture, Inc., excluding its subsidiaries. References to “Hines Nurseries” refer to Hines Nurseries, Inc., a wholly-owned subsidiary of Hines Horticulture, excluding Hines Nurseries, Inc.’s subsidiaries.

Company Overview

We are the largest commercial nursery operation in the United States, serving over 2,000 retail and commercial customers, who sell our products in more than 8,000 locations. We believe our product breadth, scale and distribution capabilities make us the only national supplier able to service the large home centers and mass merchants, as well as the independent premium garden centers throughout the United States. Our 13 commercial nurseries are strategically located in diverse geographic regions throughout the United States, and total more than 5,000 acres that produce ornamental shrubs, color plants and container grown plants. We produce approximately 5,500 plant varieties, which we believe to be more than twice the number of varieties offered by our closest national competitor. We believe the breadth and quality of our product offerings, such as our patio-ready type products which we market under the names Patio Tropics™ and Festival Pot™, assist our largest customers in their objective to become destination garden centers.

Our largest customers are leading home centers and mass merchants such as The Home Depot, Lowe’s, Wal-Mart and Target. Our national account managers and local sales managers have cultivated longstanding relationships with management at these leading retailers. We focus on serving these large retailers by providing one of the broadest assortments of high-quality products in our industry through a multi-point sales and service program. Our national scale and infrastructure enable us to meet demanding delivery schedules, fulfill large volume requirements with fresh, high-quality products and provide a variety of value-added services. With a core sales force of more than 300 professionals, which increases to more than 700 professionals during our peak selling season, we work closely with our customers to develop merchandising strategies, inventory management and marketing support. We believe the combination of our extensive product offering, high-quality, innovative plant products and our strong focus on value-added customer services is increasingly important to leading home centers and mass merchants.

We continuously develop new product programs, packaging presentations and plant varieties. Our innovative product offerings help our customers improve their sales and profitability. Such new plants typically command higher prices and profit margins than more traditional commodity-like products. Since 1998, we have commercially introduced more than 250 new plant varieties, enhancing our reputation as a product innovator in our industry. We have patents on 45 of our plant products and we have applied for patents on an additional 13 plant products.

4

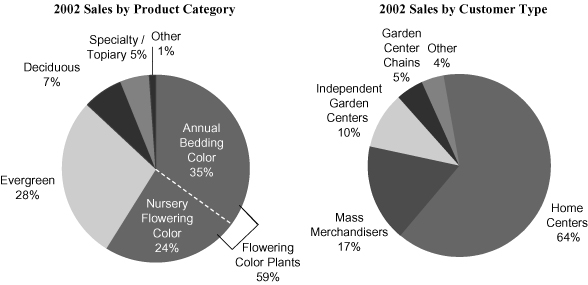

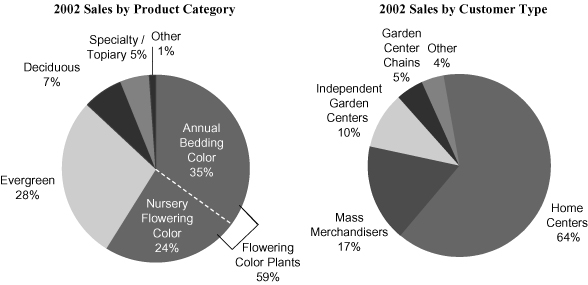

The following charts illustrate our 2002 sales by product category and by customer type:

Industry Overview

Gardening is one of the most popular leisure activities in the United States. According to the National Gardening Association’s 2002 National Gardening Survey, approximately 79% of U.S. households participate in one or more types of indoor and outdoor lawn and garden activities, spending a total of $39.6 billion in 2002 at the retail level. Over the past five years, U.S. household participation in lawn and garden activities has ranged from 67 million households in 1998 to 85 million households in 2002. Since 1997, the number of U.S. households participating in lawn and garden activities has increased at a compound annual growth rate of 5%. Average annual spending on lawn and garden activities by participating households was $466 in 2002. From 1997 to 2002, average spending on lawn and garden activities by participating households increased at a compound annual growth rate of 4%.

Nursery products such as outdoor plants, trees and shrubs were purchased by 67% of U.S. households in 2002. According to the USDA, the floriculture and nursery crop segment had estimated wholesale sales of approximately $13.8 billion in 2002. Factors contributing to the growth in our industry include, among other things, a variety of demographic and social trends, including an aging population, increased home ownership, the expanding popularity of gardening activities, and the expansion of large retailers which continue to enlarge their home and garden categories.

Competitive Strengths

We are the largest commercial nursery operation in the United States. Our national scale, leading product offering, value added services and consistent high-quality products enable us to be a key strategic supplier to the top industry retailers. The following competitive advantages have helped us establish our leading market position:

Leading Supplier in Industry. We are the only national supplier that serves both the large home centers and mass merchants, as well as the independent premium garden centers throughout the United States. Our large scale and national footprint provide us with several advantages, such as:

| | • | delivering large quantities of high-quality live plants across the continental United States; |

5

| | • | providing rapid delivery and inventory replenishment, in many cases within 24 hours; and |

| | • | developing and supplying products for national marketing programs for our top customers. |

We have served many of our top national customers for over a decade and we typically are a leading or strategic supplier to these customers. For example, over the past 15 years we have worked closely with The Home Depot as a strategic supplier to help increase their live plant sales and profitability. The Home Depot is the leading lawn and garden retailer in the United States and we are The Home Depot’s largest plant supplier.

National Coverage with Regional Diversity. Our 13 commercial nurseries are strategically located in Arizona, California, Florida, Georgia, New York, Oregon, Pennsylvania, South Carolina and Texas, and provide us with several advantages, which include:

| | • | reducing our susceptibility to adverse regional weather and market conditions; |

| | • | allowing us to deliver products to cold weather regions earlier in the spring season before similar nursery products may be available from local nurseries; and |

| | • | enabling us to timely distribute our products to our national customers. |

Largest Product Offering in Industry. With approximately 5,500 plant varieties, we have the largest product offering in the industry, which we believe to be more than twice the number offered by our closest national competitor. Additionally, we believe we have the largest pipeline of new plant varieties selected from around the world from which we typically introduce approximately 35 to 50 new products annually. Our large new product pipeline represents a considerable competitive advantage as we are able to offer and test-market more items than our competitors. New products typically command higher unit prices and yield better margins for us and our customers. We utilize our extensive product varieties to help our customers optimize their product mix and merchandising strategy which we believe significantly differentiates us from our competitors.

Value-Added Services. Through our sales force of more than 300 professionals, we provide a variety of value-added services that help our customers improve their sales and profitability. Our in-store service program helps customers improve sales through improved inventory management, product displays, promotional planning and plant maintenance. Active inventory management with fast store delivery times help drive sales growth and margins for us and our customers. In many areas, we are able to provide our customers with fresh, high-quality, retail-ready products with same or next-day delivery.

Advanced Propagation and Production Techniques. Over our 83-year history, we have developed propagation facilities and techniques enabling us to consistently provide high quality starter plants for our production. Many of our managers have Ph.D.s or other advanced degrees in horticulture or agriculture sciences, while others have extensive related technical backgrounds. Their knowledge and experience help us to consistently produce high quality plants, adopt advanced production techniques and propagate new plant varieties. It can take several years to develop a new product on a large commercial scale, a process to which our propagation methods are well suited. We believe the large investment and infrastructure required to support and create a national operation such as ours, coupled with the extensive horticultural knowledge and experience of our operations personnel, represents a significant barrier to entry.

Experienced Management and Operation Managers. Our team of executive and operations managers have an average of more than 23 years of industry experience and an average of more than 17 years with our company. In addition, each operation manager has profit and loss responsibilities for the nurseries such manager oversees and has incentives that align his or her compensation with the cash flow of the business.

6

Our Strategy

In the late 1990s, we grew our business through a series of strategic acquisitions and facility expansions. Those strategic investments filled out our national footprint, allowing us to better serve our top national customers and strengthen these key relationships. Today, we are focused on growing our business with existing customers, optimizing our product mix and fully integrating our acquired operations. We expect to achieve these goals through the implementation of the following strategy:

Grow Sales and Profits with Existing Customers. Through close coordination with our customers, we seek to improve their sales and profitability by stocking fresh products with innovative packaging to improve inventory turns and reduce spoilage rates. We believe that our selling approach will allow us to grow with our existing customers and gain market share.

| | • | Top National Customers. We plan to strengthen our longstanding relationships with our largest customers by developing merchandising and marketing programs that seek to improve their store level sales and profitability. Our scale and multi-level sales strategy permit us to develop these programs at a regional level that is aligned with our customers’ national strategies. We believe these services position us to capitalize on the increasing trend of many top retailers to reduce the number of their suppliers. |

| | • | Independent Garden Centers. With over 5,500 plant product offerings, we are an important supplier to independent garden centers who tend to serve the more discerning gardening consumers. We also offer premium independent garden centers custom labeling and packaging to enhance their marketing efforts. Our sales force works closely with our independent garden center clients to deliver these tailored products and services, reinforcing our long-term commitment to this market channel. |

Optimize Our Product Mix

| | • | Continue Shifting Product Mix Towards Higher Value Products. We believe that our ability to shift sales from commodity-like products to unique and newly packaged items represents a significant long-term opportunity for us. We frequently introduce higher-margin items which tend to be oriented toward impulse purchasing because of their unique coloration, attractive packaging and a high level of retail readiness. Our broad product offering allows us to selectively suggest new high margin product offerings to our customers to replace slower moving more commodity-like items currently on their shelves. |

| | • | Continue to Develop New Products. An important element of our product mix strategy is to develop and commercially introduce new products through the cultivation and development of new plant forms and improved plant varieties. Unique varieties that vary in coloration, size at maturity or hardiness in drought or cold conditions command higher prices, provide higher unit margins and enhance our reputation as a product innovator. We believe we are one of the few wholesale nurseries that are able to propagate large quantities of new products that are desired by home centers, mass merchants and premium independent garden centers. |

Pursue Operating Efficiencies

| | • | Continue to Fully Integrate Strategic Acquisitions. From 1995 to 2000, we made eight strategic nursery acquisitions, some which have yet to be fully integrated. These acquisitions provide an opportunity to implement our best practice standards, streamline operating processes and improve product quality. We have also recently taken steps to simplify our organizational structure to reduce costs and improve performance accountability. |

7

| | • | Optimize our Labor Resources. We seek to reduce our labor costs through investments in mechanized pruning and planting machines, integrated irrigation and fertilization systems and water recycling systems. Labor represents the largest percentage of our costs of goods sold, and we expect these investments to result in improved margins. |

History

We were founded 83 years ago in Southern California and until 1976 operated as a family-owned nursery business. In 1976, we were acquired by the Weyerhaeuser Company. We primarily sold our products to re-wholesalers until the mid-1980s, when we began focusing on developing direct relationships with retailers. In 1990, we were sold to a private investment group and certain members of management. In August 1995, we were acquired by two investment funds controlled by Madison Dearborn Partners, Inc., which we refer to as Madison Dearborn Partners, and certain members of our past and current management. In June 1998, Hines Horticulture completed an initial public offering of 5.1 million shares of its common stock and its shares trade on the Nasdaq National Market (ticker: HORT). From 1995 to 2000, we completed eight strategic nursery acquisitions and expanded acreage at a number of other locations to expand our geographic footprint and diversify our product offerings. In March 2002, we completed the sale of Sun Gro Horticulture, which we refer to as Sun Gro, which was our peat moss and growing soil mix business, and utilized the net proceeds of the sale primarily to reduce outstanding debt. Accordingly, we no longer harvest or produce peat moss or other soil mix and focus exclusively on our nursery operations.

Our Principal Investor

Investment partnerships controlled by Madison Dearborn Partners beneficially own approximately 54.3% of the common stock of Hines Horticulture. Madison Dearborn Partners has over $7 billion under management and focuses on management buyout transactions and other private equity investments across a broad spectrum of industries.

Where You Can Find Us

Our principal offices are located at 12621 Jeffrey Road, Irvine, California 92620, and our telephone number is (949) 559-4444. Our web site is located atwww.hineshorticulture.com. The information on our web site is not part of this prospectus. Hines Horticulture was incorporated in Delaware on May 1, 1998, and became the successor to the business of Hines Holdings, Inc., a Nevada corporation, as part of our reincorporation which occurred in June 1998. Hines Nurseries was incorporated in California on March 23, 1990.

8

The Refinancing

This offering of the original notes was part of a refinancing plan, which we refer to as the Refinancing, that extended the average life of our debt and provided for greater financial and operating flexibility.

The elements of the Refinancing (including the payment of related costs and expenses) were:

| | • | The Offering. Hines Nurseries issued an aggregate of $175.0 million principal amount of the original notes. |

| | • | New Credit Facility. Hines Nurseries and its subsidiaries entered into an amended and restated $185.0 million senior credit facility secured by substantially all of our assets which we sometimes refer to as our new credit facility. The new credit facility has a term of five years and consists of a $145.0 million revolving facility, with availability subject to a borrowing base, and a $40.0 million term loan facility. $27.4 million was borrowed under the new credit facility on the closing date of the offering of the original notes in connection with the Refinancing. |

| | • | Repayment of Borrowings Under Old Credit Facility. Hines Nurseries repaid in full all borrowings (consisting of revolving loans, term loans and accrued interest of $147.2 million) under our prior credit facility which we sometimes refer to as our old credit facility. |

| | • | Redemption of Outstanding Notes. Hines Nurseries redeemed all of its outstanding 12.75% senior subordinated notes due 2005. These notes were called for redemption on September 30, 2003 and the redemption was completed on October 30, 2003. |

For additional information concerning the Refinancing, see “Use of Proceeds,” “Capitalization” and “Description of New Credit Facility.”

9

The Exchange Offer

| The Exchange Offer | | We are offering to exchange up to $175,000,000 aggregate principal amount of our new 10.25% senior notes due October 1, 2011, or the new notes, for up to $175,000,000 aggregate principal amount of our original 10.25% senior notes due October 1, 2011, or the original notes, which are currently outstanding. Original notes may only be exchanged in $1,000 principal increments. In order to be exchanged, an original note must be properly tendered and accepted. All original notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer will be exchanged. |

| |

| Resales Without Further Registration | | We believe that the new notes issued pursuant to the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act provided that: |

| | |

| | | • | | you are acquiring the new notes issued in the exchange offer in the ordinary course of your business; |

| | |

| | | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, the distribution of the new notes issued to you in the exchange offer in violation of the provisions of the Securities Act; and |

| | |

| | | • | | you are not our “affiliate,” as defined under Rule 405 of the Securities Act. |

| |

| | | Each broker-dealer that receives new notes for its own account in exchange for original notes, where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See “Plan of Distribution.” |

| |

| | | The letter of transmittal states that, by so acknowledging that it will deliver and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed to use our reasonable best efforts to make this prospectus, as amended or supplemented, available to any broker-dealer for a period of 90 days after the date of this prospectus for use in connection with any such resale. See “Plan of Distribution.” |

| |

Expiration Date | | 5:00 p.m., New York City time, on January 22, 2004 unless we extend the exchange offer. |

10

Accrued Interest on the New Notes and Original Notes | | The new notes will bear interest from September 30, 2003 or the last interest payment date on which interest was paid on the original notes surrendered in exchange therefor. Holders of original notes that are accepted for exchange will be deemed to have waived the right to receive any payment in respect of interest on such original notes accrued to the date of issuance of the new notes. |

| |

Conditions to the Exchange Offer | | The exchange offer is subject to certain customary conditions which we may waive. See “The Exchange Offer—Conditions.” |

| |

Procedures for Tendering Original Notes | | Each holder of original notes wishing to accept the exchange offer must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal; or if the original notes are tendered in accordance with the book-entry procedures described in this prospectus, the tendering holder must transmit an agent’s message to the exchange agent at the address listed in this prospectus. You must mail or otherwise deliver the required documentation together with the original notes to the exchange agent. |

| |

Special Procedures for Beneficial Holders | | If you beneficially own original notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your original notes in the exchange offer, you should contact such registered holder promptly and instruct them to tender on your behalf. If you wish to tender on your own behalf, you must, before completing and executing the letter of transmittal for the exchange offer and delivering your original notes, either arrange to have your original notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

| |

Guaranteed Delivery Procedures | | You must comply with the applicable guaranteed delivery procedures for tendering if you wish to tender your original notes and: |

| | |

| | | • | | your original notes are not immediately available; or |

| | |

| | | • | | time will not permit your required documents to reach the exchange agent prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer; or |

| | |

| | | • | | you cannot complete the procedures for delivery by book-entry transfer prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

| |

Withdrawal Rights | | You may withdraw your tender of original notes at any time prior to 5:00 p.m., New York City time, on the date the exchange offer expires. |

11

Failure to Exchange Will Affect You Adversely | | If you are eligible to participate in the exchange offer and you do not tender your original notes, you will not have further exchange or registration rights and your original notes will continue to be subject to restrictions on transfer under the Securities Act. Accordingly, the liquidity of the original notes will be adversely affected. |

| |

Material United States Federal Income Tax Consequences | | The exchange of original notes for new notes pursuant to the exchange offer will not result in a taxable event. Accordingly, we believe that: |

| | |

| | | • | | no gain or loss will be realized by a United States holder upon receipt of a new note; |

| | |

| | | • | | a holder’s holding period for the new notes will include the holding period of the original notes; and |

| | |

| | | • | | the adjusted tax basis of the new notes will be the same as the adjusted tax basis of the original notes exchanged at the time of such exchange. |

| |

| | | See “Certain United States Federal Tax Consequences.” |

| |

Exchange Agent | | The Bank of New York is serving as exchange agent in connection with the exchange offer. Deliveries by hand, registered, certified, first class or overnight mail should be addressed to The Bank of New York, 101 Barclay Street, Suite 7E, New York, New York, 10286, Attention: Ms. Carolle Montreuil, Reorganization Unit. For information with respect to the exchange offer, contact the exchange agent at telephone number (212) 815-5920 or facsimile number (212) 298-1915. |

| |

| | | The Bank of New York also serves as the trustee under the indenture governing the notes. |

| |

Use of Proceeds | | We will not receive any proceeds from the exchange offer. See “Use of Proceeds.” |

12

Summary of Terms of New Notes

The exchange offer constitutes an offer to exchange up to $175.0 million aggregate principal amount of the new notes for up to an equal aggregate principal amount of the original notes. The new notes will be obligations of Hines Nurseries evidencing the same indebtedness as the original notes, and will be entitled to the benefit of the same indenture. The form and terms of the new notes are substantially the same as the form and terms of the original notes except that the new notes have been registered under the Securities Act. See “Description of Notes.”

COMPARISON WITH ORIGINAL NOTES

Freely Transferable | | The new notes will be freely transferable under the Securities Act by holders who are not restricted holders. Restricted holders are restricted from transferring the new notes without compliance with the registration and prospectus delivery requirements of the Securities Act. |

| |

Registration Rights | | The holders of the original notes currently are entitled to certain registration rights pursuant to the Registration Rights Agreement dated as of September 30, 2003, by and among the Company and the initial purchasers named therein, including the right to cause us to register the original notes under the Securities Act if the exchange offer is not consummated prior to the date which is 180 days after the issue date of the original notes. However, pursuant to the registration rights agreement, such registration rights will expire upon consummation of the exchange offer. Accordingly, holders of original notes who do not exchange their original notes for new notes in the exchange offer will not be able to reoffer, resell or otherwise dispose of their original notes unless such original notes are subsequently registered under the Securities Act or unless an exemption from the registration requirements of the Securities Act is available. |

TERMS OF NEW NOTES |

Securities Offered | | $175 million aggregate principal amount of 10.25% Senior Notes due 2011. |

| |

| | | The form and terms of the new notes will be the same as the form and terms of the original notes (including interest rate, maturity and restrictive covenants) except that: |

| | |

| | | • | | the new notes will bear a different CUSIP number from the original notes; |

| | |

| | | • | | the new notes have been registered under the Securities Act and, therefore, will not bear legends restricting their transfer; and |

| | |

| | | • | | you will not be entitled to any exchange or registration rights with respect to the new notes. |

13

| | | The new notes will evidence the same debt as the original notes. They will be entitled to the benefits of the indenture governing the original notes and will be treated under the indenture as a single class with the original notes. We refer to the new notes and the original notes collectively as the notes in this prospectus. |

| |

Issuer | | Hines Nurseries, Inc. |

| |

Maturity | | The new notes will mature on October 1, 2011. |

| |

Interest Payment | | Interest on the new notes will accrue from September 30, 2003, the issue date of the original notes, and is payable semi-annually in arrears on each April 1 and October 1, commencing April 1, 2004. The notes will bear interest at a rate of 10.25% per annum. |

| |

Guarantees | | The new notes will be guaranteed by Hines Horticulture and each of its existing and future subsidiaries (other than Hines Nurseries) on a senior basis. Hines Horticulture has no material assets other than the common stock of Hines Nurseries. |

| |

Ranking | | The new notes and the guarantees will be Hines Nurseries’ and the guarantors’ senior unsecured debt obligations and: |

| | |

| | | • | | will rank equally with all of Hines Nurseries’ and the guarantors’ existing and future senior unsecured debt; |

| | |

| | | • | | will be effectively subordinated to all of Hines Nurseries’ and the guarantors’ existing and future secured debt, including the new credit facility, to the extent of the value of the assets securing such debt; and |

| | |

| | | • | | will rank senior to Hines Nurseries’ and the guarantors’ existing and future subordinated debt. |

| |

| | | As of September 30, 2003: |

| | |

| | | • | | Hines Nurseries had approximately $67.4 million of secured debt outstanding, all under the new credit facility; |

| | |

| | | • | | the guarantors had no secured debt outstanding other than their obligations under the new credit facility; and |

| | |

| | | • | | Hines Nurseries and its subsidiaries would have been able to incur approximately $43.9 million of additional secured debt under the new credit facility. |

| |

Sinking Fund | | None. |

| |

Optional Redemption | | Hines Nurseries may redeem some or all of the new notes on or after October 1, 2007 at the redemption prices listed under “Description of Notes—Optional Redemption.” Prior to October 1, 2006, Hines Nurseries may redeem up to 35% of the aggregate principal amount of the new notes, at a redemption price equal to 110.25% of the principal amount plus accrued interest, with the net proceeds of certain equity offerings. See “Description of Notes—Optional Redemption.” |

14

Change of Control | | Upon certain specified change of control events, each holder of the new notes will have the right to require Hines Nurseries to repurchase such holder’s new notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest to the date of repurchase. See “Description of Notes—Change of Control.” |

| |

Restrictive Covenants | | The terms of the new notes place certain limitations on the ability of Hines Horticulture and its restricted subsidiaries to, among other things: |

| | |

| | | • | | incur additional debt or issue certain preferred stock; |

| | |

| | | • | | create liens; |

| | |

| | | • | | make certain restricted payments, including certain dividends and investments; |

| | |

| | | • | | sell assets, including capital stock of subsidiaries; |

| | |

| | | • | | enter into arrangements which restrict dividends from subsidiaries; |

| | |

| | | • | | issue and sell capital stock of subsidiaries; |

| | |

| | | • | | engage in transactions with affiliates; and |

| | |

| | | • | | consolidate, merge or transfer all or substantially all of their assets. |

| |

| | | These limitations will be subject to a number of exceptions and qualifications. See “Description of Notes—Certain Covenants.” |

| |

Absence of a Public Market for the Notes | | The new notes are a new issue of securities for which there is currently no established trading market. Although the initial purchasers of the original notes have informed us that they currently intend to make a market in the new notes, they are not obligated to do so and any such market making may be discontinued at any time without notice. Accordingly, there can be no assurance as to the development or liquidity of any market for the new notes. The Company does not intend to apply for listing of the new notes on any securities exchange or for quotation through the National Association of Securities Dealers Automated Quotation System. See “Risk Factors—There will not be a public market for the notes.” |

For additional information regarding the new notes, see the “Description of Notes” section of this prospectus.

Risk Factors

You should carefully consider the information under “Risk Factors” beginning on page 18 of this prospectus and all other information included in this prospectus prior to making a decision to exchange original notes for new notes.

15

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA

The summary historical financial data presented below as of the end of and for each of the years in the three-year period ended December 31, 2002 has been derived from the audited consolidated financial statements of Hines Horticulture and its subsidiaries. The consolidated financial statements as of December 31, 2002 and 2001, and of each of the years in the three-year period ended December 31, 2002, and the report thereon (which contains explanatory paragraphs related to the issues discussed in Note 1 to the consolidated financial statements regarding our sale of the assets of our wholly owned subsidiary Sun Gro Horticulture, Inc. on March 27, 2002 and our adoption of the provisions of Statement of Financial Accounting Standards No. 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended, the provisions of Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets,” and the provisions of Statement of Financial Accounting Standards No. 144, “Accounting for the Impairment of Disposal of Long Lived Assets”), are included elsewhere in this prospectus. The summary historical financial data as of September 30, 2003, and for the nine month periods ended September 30, 2002 and 2003, has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, which consist only of normal recurring adjustments, necessary for a fair presentation of the financial position and the results of operations for these periods.

The following financial information is not necessarily indicative of the operating results to be expected in the future and should be read in conjunction with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto contained elsewhere in this prospectus. The following table has been restated to reflect all of the activity of our peat moss and soil mix business as “discontinued operations” and to reclassify losses on early debt extinguishment under SFAS No. 145 previously reported as an extraordinary item to continuing operations.

| | | Year Ended December 31, (a)

| | Nine Months Ended

September 30,

| |

| | | 2002

| | | 2001

| | | 2000

| | 2003

| | 2002

| |

| | | | | | | | | | | (Unaudited) | |

| | | | | | | | | | | | | (Restated) | |

| | | (In thousands) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 336,546 | | | $ | 326,973 | | | $ | 304,202 | | $ | 297,693 | | $ | 295,918 | |

Cost of goods sold | | | 166,994 | | | | 156,490 | | | | 143,262 | | | 144,458 | | | 144,237 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Gross profit | | | 169,552 | | | | 170,483 | | | | 160,940 | | | 153,235 | | | 151,681 | |

Operating expenses | | | 122,338 | | | | 121,975 | | | | 113,198 | | | 107,123 | | | 103,296 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Operating income | | | 47,214 | | | | 48,508 | | | | 47,742 | | | 46,112 | | | 48,385 | |

Other expense, primarily interest expense | | | 33,900 | | | | 38,188 | | | | 29,071 | | | 29,533 | | | 27,109 | |

Provision for income taxes | | | 5,456 | | | | 4,627 | | | | 8,034 | | | 6,798 | | | 8,727 | |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Income from continuing operations (a) | | | 7,858 | | | | 5,693 | | | | 10,637 | | | 9,781 | | | 12,549 | |

(Loss) income from discontinued operations (b) | | | (5,413 | ) | | | (2,268 | ) | | | 1,801 | | | 4,013 | | | (6,978 | ) |

Cumulative effect of change in accounting

principle (c) | | | (55,148 | ) | | | — | | | | — | | | — | | | (55,148 | ) |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Net (loss) income | | $ | (52,703 | ) | | $ | 3,425 | | | $ | 12,438 | | $ | 13,794 | | $ | (49,577 | ) |

| | |

|

|

| |

|

|

| |

|

| |

|

| |

|

|

|

Supplemental Data: | | | | | | | | | | | | | | | | | | |

Depreciation and amortization | | $ | 8,565 | | | $ | 12,436 | | | $ | 10,582 | | $ | 7,005 | | $ | 6,515 | |

Capital expenditures | | | 7,209 | | | | 18,178 | | | | 29,686 | | | 4,173 | | | 4,533 | |

EBITDA (d) | | | 54,040 | | | | 60,944 | | | | 58,324 | | | 43,882 | | | 53,161 | |

16

| (a) | In 2000, we acquired Willow Creek Greenhouses, Inc. (January 14, 2000) and Lovell Farms, Inc. (March 3, 2000). The financial results include the operations of each acquisition since its respective acquisition date. |

| (b) | On March 27, 2002, we sold Sun Gro, our peat moss and soil mix business, for net proceeds of approximately $119 million, the majority of which was used to repay indebtedness. Our consolidated financial statements included in this prospectus reflect the financial position, results of operations and cash flows of the Sun Gro business as “discontinued operations.” For the year ended December 31, 2002, we recognized a $5.5 million loss, net of tax, from the sale and a $149,000 gain, net of tax, from the operations through the date of sale. For the years ended December 31, 2000 and 2001 the income (loss) from discontinued operations of $1.8 million and $(2.3) million, respectively, represents the net income (loss) from the operations for those periods. |

| (c) | The cumulative effect of change in accounting principle for the year ended December 31, 2002 of $55.1 million, net of tax, represents the goodwill impairment charge resulting from our adoption of SFAS No. 142, “Goodwill and Other Intangible Assets.” |

| (d) | “EBITDA” means income before interest expense, provision for income taxes and depreciation and amortization. EBITDA is not a measure of financial performance under generally accepted accounting principles, which we refer to as GAAP. EBITDA is not calculated in the same manner by all companies and accordingly is not necessarily comparable to similarly titled measures of other companies and may not be an appropriate measure for performance relative to other companies. We have presented EBITDA in this prospectus solely as supplemental disclosure because we believe it allows for a more complete analysis of our results of operations and we believe that EBITDA is useful to investors because EBITDA is commonly used to analyze companies on the basis of operating performance, leverage and liquidity. EBITDA is also used in covenants in credit facilities and high yield debt indentures to measure the borrower’s ability to incur debt and for other purposes, and may be the preferred measure for these purposes. Covenants in our new credit facility and the indenture for the notes that limit our ability to incur debt are based on EBITDA (as defined therein). EBITDA is not intended to represent, and should not be considered more meaningful than or as an alternative to, measures of operating performance as determined in accordance with GAAP. EBITDA is calculated as follows: |

| | | Year Ended December 31,

| | | Nine Months Ended

September 30,

| |

| | | 2002

| | | 2001

| | 2000

| | | 2003

| | | 2002

| |

| | | | | | | | | | | (Unaudited) | |

| | | | | | | | | | | | | | (Restated) | |

| | | (In thousands) | |

Net (loss) income | | $ | (52,703 | ) | | $ | 3,425 | | $ | 12,438 | | | $ | 13,794 | | | $ | (49,577 | ) |

Cumulative effect of change in accounting principle, net of tax | | | 55,148 | | | | — | | | — | | | | — | | | | 55,148 | |

Loss (income) from discontinued operations, net of tax | | | 5,413 | | | | 2,268 | | | (1,801 | ) | | | (4,013 | ) | | | 6,978 | |

Income tax provision | | | 5,456 | | | | 4,627 | | | 8,034 | | | | 6,798 | | | | 8,727 | |

Amortization of deferred financing expenses | | | 4,383 | | | | 4,742 | | | 1,630 | | | | 3,328 | | | | 3,332 | |

Interest rate swap agreement expense (income) | | | 2,573 | | | | 4,114 | | | — | | | | (1,496 | ) | | | 2,806 | |

Interest expense | | | 25,205 | | | | 29,332 | | | 27,441 | | | | 18,466 | | | | 19,232 | |

Depreciation and amortization expense | | | 8,565 | | | | 12,436 | | | 10,582 | | | | 7,005 | | | | 6,515 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

EBITDA | | $ | 54,040 | | | $ | 60,944 | | $ | 58,324 | | | $ | 43,882 | | | $ | 53,161 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| |

|

|

|

17

RISK FACTORS

Risks Related to this Offering and Our Capital Structure

We have a substantial amount of debt outstanding, which could hurt our future prospects and prevent us from fulfilling our obligations under the notes and our other debt obligations.

We have a significant amount of debt outstanding. As of September 30, 2003, we had total consolidated long-term debt outstanding of $242.5 million. See “Capitalization.” This debt may have several important consequences for the holders of the notes. It could:

| | • | make it more difficult for us to satisfy our obligations, including making scheduled interest payments under the notes and our other debt obligations; |

| | • | limit our ability to obtain additional financing; |

| | • | increase our vulnerability to adverse general economic conditions and commercial nursery industry conditions, including changes in interest rates; |

| | • | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, including the notes, thereby reducing the availability of our cash flow for other purposes; |

| | • | limit our flexibility in planning for, or reacting to, changes in our business and the commercial nursery industry; and |

| | • | place us at a competitive disadvantage compared to our competitors that have less debt. |

If we incur additional debt, the risks related to our substantial amount of debt could increase.

We may be able to incur substantially more debt in the future. The indenture governing the notes and the new credit facility do not prohibit us from doing so. Our new credit facility permits additional borrowings and all of those borrowings are secured by substantially all of our assets and are effectively senior to the notes and the guarantees to the extent of the value of the collateral. If we incur new debt, the related risks that we now face could intensify.

If we are unable to generate sufficient cash, we may be unable to make payments with respect to the notes.

Our ability to make payments on the notes and our other debt will depend upon our future operating performance, which will be affected by prevailing economic conditions and financial, business and other factors, some of which are beyond our control, as well as the availability of revolving credit borrowings under our new credit facility. If we are unable to service our debt, we will be forced to take actions such as reducing or delaying capital expenditures, selling assets, restructuring or refinancing our debt, or seeking additional equity capital. We may be unable to effect any of these remedies on satisfactory terms, or at all. If we cannot make scheduled payments on our debt, we will be in default and, as a result:

| | • | our debt holders could declare all outstanding principal and interest to be due and payable; |

| | • | the lenders under our new credit facility could terminate their commitments to loan us money and commence foreclosure proceedings against the assets securing the borrowings; and |

| | • | we could be forced into bankruptcy or liquidation. |

The notes and the guarantees are unsecured and are effectively subordinated to all of our secured debt to the extent of the value of the collateral.

The notes are not secured by any of our assets. As a result, the notes are effectively subordinated in right of payment to all of our secured debt to the extent of the value of the collateral. If Hines Nurseries becomes

18

bankrupt, insolvent or is liquidated, or if any of our secured debt is accelerated, the assets securing such debt will be available to pay obligations on the notes only after all of our secured debt has been paid in full. There may not be sufficient assets remaining to pay any or all amounts due on the notes. All borrowings under the new credit facility, including the guarantees thereof, are secured by substantially all of our assets. As of September 30, 2003, the notes and the guarantees thereof were effectively subordinated to approximately $67.4 million of secured debt (excluding unused commitments of $117.6 million under the new credit facility).

The terms of our debt may limit our ability to plan for or respond to changes in our business.

The new credit facility and the indenture governing the notes contain covenants that restrict our ability to, among other things:

| | • | incur additional debt or issue certain preferred stock; |

| | • | pay dividends or distributions on, or redeem or repurchase, capital stock; |

| | • | create liens or negative pledges with respect to our assets; |

| | • | make investments, loans or advances; |

| | • | make capital expenditures; |

| | • | issue, sell or allow distributions on capital stock of specified subsidiaries; |

| | • | enter into sale and leaseback transactions; |

| | • | prepay or defease specified debt; |

| | • | enter into transactions with affiliates; |

| | • | enter into specified hedging arrangements; |

| | • | merge, consolidate or sell our assets; or |

| | • | engage in any business other than the commercial nursery business. |

These covenants may affect our ability to operate our business, may limit our ability to take advantage of business opportunities as they arise and may adversely affect the conduct of our current business. A breach of a covenant in our debt instruments could cause acceleration of a significant portion of our outstanding indebtedness. These covenants are subject to important qualifications as described in “Description of New Credit Facility” and in “Description of Notes.”

If we default under our new credit facility, we may not be able to borrow under the new credit facility, and the lenders under the new credit facility would have the right to declare the outstanding borrowings under the new credit facility to be immediately due and payable.

If we default under the new credit facility for any reason, including failing to comply with the financial covenants prescribed by the new credit facility, our debts could become immediately payable at a time when we are unable to pay them, which could have a material adverse effect on our business. If the amounts outstanding under our new credit facility are accelerated, which causes an acceleration of amounts outstanding under the notes, we may not be able to repay such amounts or the notes.

Repayment of the principal of the notes and our other debt may require additional financing. We are not certain of the source or availability of any such financing at this time.

Our anticipated operating cash flows will not be sufficient to repay the principal of the notes and our other debt. Accordingly, in order to pay the principal of the notes and our other debt, we will be required to refinance our debt, sell our equity securities, sell our assets or take other actions. The foregoing actions may not enable us to pay the principal of the notes or such other debt or may not be permitted by the terms of our debt instruments then in effect.

19

We may be unable to purchase the notes following a change of control.

Under the terms of the notes, upon the occurrence of specified change of control events, we will be required to offer to repurchase all outstanding notes at 101% of the principal amount of the notes plus accrued interest. In addition, a change in control may constitute an event of default under the new credit facility and, if accelerated, we would be required to repay all outstanding borrowings under the new credit facility. We may not have sufficient funds at the time of a change of control to make the required repurchase of the notes. Our failure to make or complete an offer to repurchase the notes or to repay the debt under the new credit facility would place us in default under the indenture governing the notes.

Federal or state laws allow courts, under specific circumstances, to void debts, including guarantees, and could require holders of notes to return payments received from us and the guarantors.

If a bankruptcy proceeding or lawsuit were to be initiated by unpaid creditors, the notes and the guarantees of the notes could come under review for federal or state fraudulent transfer violations. Under federal bankruptcy law and comparable provisions of state fraudulent transfer laws, obligations under the notes or guarantees of the notes could be voided, or claims in respect of the notes or guarantees of the notes could be subordinated to all other debts of the debtor or guarantor if, among other things, the debtor or guarantor at the time it incurred the debt evidenced by such notes or guarantees:

| | • | received less than reasonably equivalent value or fair consideration for the incurrence of such debt or guarantee; and |

| | • | one of the following applies: |

| | • | | it was insolvent or rendered insolvent by reason of such incurrence; |

| | • | | it was engaged in a business or transaction for which its remaining assets constituted unreasonably small capital; or |

| | • | | it intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature. |

In addition, any payment by that debtor or guarantor under the notes or guarantees of the notes could be voided and required to be returned to the debtor or guarantor, as the case may be, or to a fund for the benefit of the creditors of the debtor or guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a debtor or guarantor would be considered insolvent if:

| | • | the sum of its debts, including contingent liabilities, was greater than the fair salable value of all of its assets; |

| | • | the present fair salable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| | • | it could not pay its debts as they become due. |

There will not be a public market for the notes.

The notes are a new issue of securities for which there is currently no established market. We do not presently intend to apply for listing of the notes on any national securities exchange or on the National Association of Securities Dealers Automated Quotation System. The initial purchasers of the original notes have advised us that they presently intend to make a market in the notes. The initial purchasers are not obligated, however, to make a market in the original notes, and any such market-making may be discontinued at any time at the sole discretion of the initial purchasers and without notice. If a market for the notes were to develop, the notes

20

could trade at prices that may be higher or lower than reflected by their initial offering price depending on many factors, including prevailing interest rates, our operating results and the market for similar securities. Historically, the market for securities such as the notes has been subject to disruptions that have caused substantial volatility in the prices of similar securities. If a market for the notes were to develop, it may be subject to similar disruptions.

Risks Related to Our Business

Our production of plants may be adversely affected by a number of agricultural factors beyond our control.

Our production of plants may be adversely affected by a number of agricultural risks, including disease, pests, freezing conditions, snow, drought or other inclement weather, and improper use of pesticides or herbicides. These factors could cause production difficulties which could damage or reduce our inventory, resulting in sales, profit and operating cash flow declines, which could be material.

Increases in water prices or insufficient availability of water could adversely affect our plant production, resulting in reduced sales and profitability.

Plant production depends upon the availability of water. Our nurseries receive their water from a variety of sources, including on-site wells, creeks, reservoirs and holding ponds, municipal water districts and irrigation water supplied to local districts by facilities owned and operated by the United States acting through the Department of Interior Bureau of Reclamation. The loss or reduction of access to water at any of our nurseries could have a material adverse effect on our business, results from operations and operating cash flows. In addition, increases in our costs for water could adversely impact our profitability and operating cash flows.

Our nursery in Arizona receives its water from on-site wells. Under Arizona’s Groundwater Management Act, these wells have been issued “grandfathered non-irrigation water” permits, which limit the amount of groundwater we can use. The availability of water depends on the groundwater aquifer, which at this time, we believe is adequate to supply our needs for this nursery as it is currently operated.

Our northern California and Oregon nurseries rely primarily on surface water supplies and, therefore, may experience fluctuations in available water supplies and serious reductions in their supplies of surface water in the event of prolonged droughts. If such reductions occur, those nurseries would have to rely on backup water supplies which are more costly than surface water supplies.

The use and price of water supplied by facilities owned and operated by the Bureau of Reclamation, including availability of subsidized water rates, is governed by federal reclamation laws and regulations. Such water is used at our Northern California nursery and is the source of a substantial majority of the water for our Oregon nursery. While we believe we are in material compliance with applicable regulations and maintain a compliance program, there can be no assurance that changes in law will not reduce availability or increase the price of reclamation water to us. Any such change could have a material adverse effect on our business, results of operations and operating cash flows.

The reclamation regulations govern who may hold an interest in irrigation lands. Under the reclamation regulations, persons having a direct or indirect beneficial economic interest in us will be treated as “indirect holders” of irrigation land owned by us in proportion to their beneficial interest in us. If any holder of our common stock (whether directly or indirectly through a broker-dealer or otherwise) is ineligible under applicable reclamation regulations to hold an indirect interest in our irrigation land, we may not be eligible to receive reclamation water on this land. Generally, the eligibility requirement of the reclamation regulations would be satisfied by a person:

| | • | who is a citizen of the United States or an entity established under federal or state law or a person who is a citizen of or an entity established under the laws of certain foreign countries (including Canada and Mexico and members of the Organization for Economic Cooperation and Development); and |

21

| | • | whose ownership, direct and indirect, of other land which is qualified to receive water from a reclamation project, when added to such person’s attributed indirect ownership of irrigation land owned by us, does not exceed certain maximum acreage limitations (generally, 960 acres for individuals and 640 acres for entities). |

While our restated certificate of incorporation contains provisions intended to prohibit ineligible holders of irrigation land from owning our common stock, such provisions may not be effective in protecting our right to continue to use reclamation water.

We face risks associated with sudden oak death.

Our California nurseries use soil media containing redwood sawdust. Redwood trees have been found susceptible to a disease called Sudden Oak Death, which we refer to as SOD, that has affected several species of trees and shrubs in California and Oregon. The U.S. Department of Agriculture and the California Department of Forest & Agriculture have enacted regulations relating to sudden oak death and, although they have not regulated soil media, they may regulate soil media in the future. Under current regulations, we are unable to ship products we grow in our Northern California facilities, Vacaville and Winters, to Canada. If these regulatory authorities enact restrictive regulations on soil media containing redwood sawdust, we may be required to modify our growing procedures and may be required to develop alternatives to the soil media we use. We may not be able to successfully develop cost effective alternatives to using Redwood sawdust in the soil media we use, or if we do develop such alternatives, implement the use of the alternatives in a manner, which does not disrupt our growing process or our sales.

SOD can infect the leaves and branches of a number of plants grown by us. Rhododendron and camellias are current plants that we grow that are on the SOD host list. If the soil media we use or a significant number of our products become infected with SOD, our products could be subject to quarantine by regulatory authorities, which would result in significant lost sales and would have a material adverse effect on our business, results from operations and operating cash flows. Additional or more stringent regulations concerning SOD could have a material adverse effect on us.

Because our business is highly seasonal, our revenues, cash flows from operations and operating results may fluctuate on a seasonal and quarterly basis.

Our business is highly seasonal. The seasonal nature of our operations results in a significant increase in our working capital during the growing and selling cycles. As a result, operating activities during the first and fourth quarters use significant amounts of cash, and in contrast, operating activities for the second and third quarters generate substantial cash as we ship inventory and collect accounts receivable. We have experienced, and expect to continue to experience, significant variability in net sales, operating cash flows and net income on a quarterly basis. The principal factor contributing to this variability is weather, particularly on weekends during the peak gardening season in the second quarter. Unfavorable weather conditions during the peak gardening season could have a material adverse effect on our net sales, cash flows from operations and operating income.

Other factors that may contribute to this variability include:

| | • | shifts in demand for live plant products; |

| | • | changes in product mix, service levels and pricing by us and our competitors; |

| | • | period-to-period changes in holidays; |

| | • | the economic stability of our retail customers; and |

| | • | our relationship with each of our retail customers. |

22

Because we depend on a core group of significant customers, our sales, cash flows from operations and results of operations may be negatively affected if our key customers reduce the amount of products they purchase from us.

Our top ten customers together accounted for approximately 78% of our net sales in 2002. Our largest customer, The Home Depot, accounted for approximately 47% of our 2002 net sales. We expect that a small number of customers will continue to account for a substantial portion of our net sales for the foreseeable future. We do not have long-term contracts with any of our retail customers, and they may not continue to purchase our products.

The loss of, or a significant adverse change in, our relationship with The Home Depot or any other major customer could have a material adverse effect on us. The loss of, or a reduction in orders from, any significant retail customers, losses arising from retail customers’ disputes regarding shipments, fees, merchandise condition or related matters, or our inability to collect accounts receivable from any major retail customer could have a material adverse effect on us. In addition, revenue from customers that have accounted for significant revenue in past periods, individually or as a group, may not continue, or if continued, may not reach or exceed historical levels in any period.

Our business and operations could be adversely affected by declining sales to Kmart.

Kmart, one of our largest customers in terms of sales in 2002, filed for bankruptcy relief under Chapter 11 of the bankruptcy code in January 2002 and emerged from the Chapter 11 reorganization process in May 2003. During the year ended December 31, 2002, our net sales to Kmart were approximately $8.0 million, a decrease of $8.6 million from 2001. During the first nine months of 2003, our net sales to Kmart have been $1.9 million less than the comparable period in 2002 and we currently believe sales to Kmart during 2003 will be less than our sales to Kmart in 2002. Our results of operations and operating cash flows could be adversely impacted if we are not able to replace the sales formerly made to Kmart.

We face intense competition, and our inability to compete effectively for any reason could adversely affect our business.

Our competition varies by region, each of which is highly competitive. Although many of our largest customers are national retailers, buying decisions are generally made locally by our customers. We compete primarily on the basis of breadth of product mix, consistency of product quality, product availability, customer service and price. We generally face competition from several local companies and usually from one or two regional companies in each of our current markets. Competition in our existing markets may also increase considerably in the future. Some of our competitors may have greater market share in a particular region or market, less debt, greater pricing flexibility or superior marketing or financial resources. Increased competition could result in lower profit margins, substantial pricing pressure, reduced market share and lower operating cash flows. Price competition, together with other forms of competition, could have a material adverse effect on our business, result of operations and operating cash flows.

Our nursery facility in Irvine, California is entirely on leased land and we do not expect the leases to be extended beyond their current terms.

Our 542-acre nursery facility and headquarters in Irvine, California are entirely on leased land. We recently entered into an amended lease agreement for this facility in which 63 new acres were added and the lease expiration schedule was changed. Under the amended lease agreement, the lease on 114 acres expires on June 30, 2006, the lease on 140 acres expires on December 31, 2006, and the lease on the remaining 288 acres expires on December 31, 2010. We do not expect these leases to be extended beyond their current terms. For the 254 acres that will expire in 2006, we are developing plans to transition a majority of the production to our Allendale, California facility and the remaining production to the parcel recently added to our facility in Irvine. For the 288

23

acres that will expire at the end of 2010, we will be required to establish new production facilities or transition production to existing facilities. We may incur substantial costs in connection with the establishment of these new production facilities or the transition of production to existing facilities.

We may not be successful in executing our transition plan or establishing suitable replacement production facilities. If we are unsuccessful in these efforts, our net sales, cash flows and operating income could be materially adversely affected. In addition, when we vacate 254 acres in 2006, we currently estimate that we will incur approximately $300,000 of removal and remediation costs. We may incur significant expenses beyond what we have forecasted if additional remedial action is required. Significant costs in excess of our estimates could have a material adverse effect on us.

We are subject to various environmental laws and regulations that govern, and impose liability, for our activities and operations. If we do not comply with these laws and regulations, our business could be materially and adversely affected.

We are subject to federal, state and local laws and regulations that govern, and impose liability for, our activities and operations which may have adverse environmental effects, such as discharges to air and water, as well as handling and disposal practices for hazardous substances and other wastes. Some of our nursery operations are conducted near residential developments, which could increase our exposure to liability for the environmental effects of our operations. Our operations have resulted, or may result, in noncompliance with or liability for cleanup under these laws. In addition, the presence of hazardous substances on our properties, or the failure to properly remediate any resulting contamination may adversely affect our ability to sell, lease or operate our properties or to borrow using them as collateral. In some cases, our liability may not be limited to the value of the property or its improvements. We cannot assure you that these matters, or any similar matters that may arise in the future, will not have a material adverse effect on us.

Certain of our operations and activities, such as water runoff from our production facilities and the use of certain pesticides, are subject to regulation by the United States Environmental Protection Agency and similar state and local agencies. These agencies may regulate or prohibit the use of such products, procedures or operations, thereby affecting our operations and profitability. In addition, we must comply with a broad range of environmental laws and regulations. Additional or more stringent environmental laws and regulations may be enacted in the future and such changes could have a material adverse effect on us.

Changes in local zoning laws may adversely affect our business.

We are subject to local zoning laws regulating the use of our owned and leased property. Some of our facilities are located in areas experiencing rapid development and growth, which typically are characterized by changes in existing zoning. Changes in local zoning laws could require us to establish new production facilities or transition production to other facilities, which could have a material adverse effect on our cash flows and results of operations.

Compliance with, and changes to labor laws, particularly those concerning seasonal workers, could significantly increase our costs.

The production of our plants is labor intensive. We are subject to the Fair Labor Standards Act as well as various federal, state and local regulations that govern matters such as minimum wage requirements, overtime and working conditions, including, but not limited, to federal and state health and worker safety rules and regulations. A large number of our seasonal employees are paid at or slightly above the applicable minimum wage level and, accordingly, changes in minimum wage laws could materially increase our costs. Non-U.S. nationals comprise a large portion of our seasonal employee workforce and changes to U.S. immigration policies that restrict the ability of immigrant workers to obtain employment in the United States and which contribute to shortages of available seasonal labor could increase our costs. Non-compliance with applicable regulations or

24

modifications to existing regulations may increase costs of compliance, require a termination of certain activities, result in fines or loss of a portion of our labor force or otherwise have a material adverse impact on our business and results of operations.

Our transportation costs are significant and we depend on independent contractors for trucking services to ship large quantities of our products and increases in transportation costs, changes in available trucking capacity and other changes affecting such carriers, as well as interruptions in service or work stoppages, could adversely impact our results of operations.

We rely extensively on the services of agents and independent contractors to provide trucking services to us. Transportation costs accounted for approximately 21% of our net sales in 2002. Our ability to ship our products, particularly during our peak shipping seasons, could be adversely impacted by shortages in available trucking capacity, changes by carriers and transportation companies in policies and practices, such as scheduling, pricing, payment terms and frequency of service, or increases in the cost of fuel, taxes and labor, and other factors not within our control. We compete with other companies who ship perishable goods for available trucking capacity and, accordingly, reductions in capacity or shortages of the agents and independent contractors who provide trucking services to us could potentially adversely impact our sales. Significant increases in transportation costs could have a material adverse effect on our business, particularly if we are not able to pass on such price increases to our customers in the form of higher prices for our products. Material interruptions in service or stoppages in transportation, whether caused by strike or otherwise, could adversely impact our business, results of operations, financial condition and operating cash flows.

We are currently implementing a new enterprise resource planning software program, and unexpected delays, expenses or disruptions in the implementation of such software program could disrupt our business or impair our ability to monitor our operations, resulting in a negative impact on our operations, financial condition and operating cash flows.