ANNUAL INFORMATION FORM

OF

FRONTEER DEVELOPMENT GROUP INC.

Suite 1650, 1055 West Hastings Street

Vancouver, B.C.

Canada

V6E 2E9

1 (604) 632-4677

For the fiscal year ended December 31, 2009

Dated March 29, 2010

TABLE OF CONTENTS

| PRELIMINARY NOTES | 1 |

| | |

| CURRENCY | 1 |

| | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| | |

| CAUTIONARY NOTE CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES | 2 |

| | |

| CORPORATE STRUCTURE OF THE CORPORATION | 3 |

| | |

| Name and Incorporation | 3 |

| Intercorporate Relationships | 4 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 6 |

| | |

| Three Year History | 6 |

| | |

| DESCRIPTION OF THE BUSINESS | 9 |

| | |

| Employees | 10 |

| Competitive Conditions | 10 |

| | |

| RISK FACTORS | 11 |

| | |

| MINERAL PROPERTIES | 21 |

| | |

| Northumberland Property | 21 |

| Long Canyon Project, Nevada | 29 |

| Sandman Property, Nevada | 38 |

| Zaca Property, California | 46 |

| Halilaga Property, Turkey | 52 |

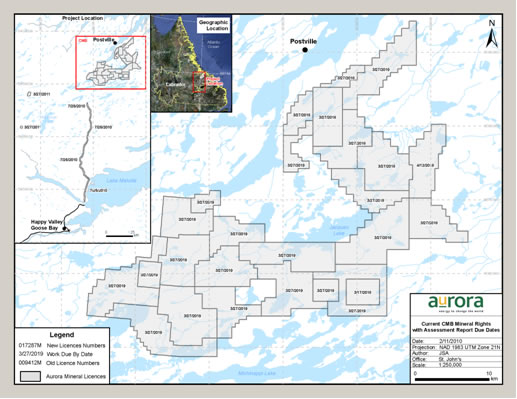

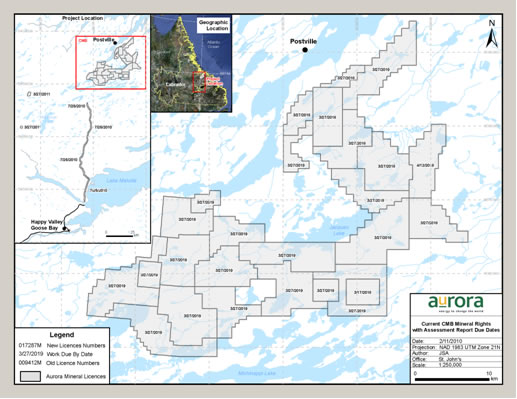

| CMB Uranium Property, Labrador, Canada | 57 |

| Agi Dagi and Kirazli Properties, Turkey | 68 |

| | |

| DIVIDENDS | 69 |

| | |

| DESCRIPTION OF CAPITAL STRUCTURE | 69 |

| | |

| MARKET FOR SECURITIES | 69 |

| | |

| PRIOR SALES | 70 |

| | |

| DIRECTORS AND OFFICERS | 70 |

| | |

| Name, Address, Position and Occupation | 70 |

| Aggregate Ownership of Securities | 72 |

| | |

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 73 |

| | |

| CONFLICTS OF INTEREST | 74 |

| | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 74 |

| | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 75 |

| | |

| Restructuring Agreements | 75 |

| Acquisition of Aurora | 76 |

| | |

| REGISTRAR AND TRANSFER AGENT | 76 |

- i -

- ii -

PRELIMINARY NOTES

�� Throughout this Annual Information Form (“AIF”), Fronteer Development Group Inc. is referred to as “Fronteer” or the “Corporation”. All information contained herein is as at December 31, 2009, unless otherwise stated.

CURRENCY

All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This AIF contains “forward-looking information” and “forward-looking statements” which include, but are not limited to, statements or information concerning the future financial or operating performance of the Corporation and its business, operations, properties and condition, the future price of uranium, iron oxide, copper, gold and other metal prices, the estimation of mineral resources or potential expansion of mineralization, the realization of mineral resource estimates, the timing and amount of estimated future production, costs of production and mine life of the various mineral projects of Fronteer, the timing and amount of estimated capital, operating and exploration expenditures, costs and timing of the development of new deposits and of future exploration and development activities, estimated exploration budgets and timing of expenditures and community relations activities, requirements for additional capital, government regulation of mining operations, environmental risks and reclamation expenses, title disputes and other claims or existing, pending or threatened litigation or other proceedings, limitations of insurance coverage and the timing and possible outcome of regulatory and permitting matters and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements, and involve known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Fronteer to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements and information. Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “will”, “projects”, or “believes” or variations (including negative variations) of such words and phrases, or statements that certain actions, events, results or conditions “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and forward-looking information are based upon a number of estimates and assumptions of management at the date the statements are made, and are inherently subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual performance, achievements, actions, events, results or conditions to be materially different from those projected in the forward-looking statements and forward-looking information. Many assumptions are based on factors and events that are not within the control of Fronteer and there is no assurance they will prove to be correct. Such factors include, among others: general business, economic, competitive, political, regulatory and social uncertainties; the actual results of current exploration activities; actual results of reclamation activities; conclusions of economic evaluations; fluctuations in the value of Canadian and United States dollars relative to each other; changes in project parameters as plans continue to be refined; changes in labour costs or other costs of production; future prices of uranium, iron oxide, copper, gold and other metal prices; changes in the worldwide price of other commodities such as coal, fuel, electricity and fluctuations in resource prices, currency exchange rates and interest rates; possible variations of mineral grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry, including but not limited to environmental risks and hazards, cave-ins, pit-wall failures, flooding, rock bursts and other acts of God or natural disasters or unfavourable operating conditions and losses; political instability, hostilities, insurrection or acts of war or terrorism; delays in obtaining governmental approvals or financing or in the completion of exploration, development or construction activities; changes in government legislation and regulation; changes in ownership interest in any project; increased infrastructure and/or operating costs; Fronteer’s ability to renew existing licenses and permits or obtain required licenses and permits; changes or disruptions in market conditions; variations in ore grade or recovery rates; risks relating to international operations and joint ventures; changes in project parameters; disruptions or changes in the credit or securities markets and market fluctuations in prices for Fronteer’s securities; inflationary or deflationary pressures; the need to obtain and maintain licenses and permits and comply with laws and regulations or other regulatory requirements; the speculative nature of mineral exploration and development, including the risk of diminishing quantities or grades of mineralization; contests over title to properties; operating or technical difficulties in connection with mining or development activities; employee relations and shortages of skilled personnel and contractors; the risks involved in the exploration, development and mining business generally; and the factors discussed in the section entitled “Risk Factors” in this AIF. Although the Corporation has attempted to identify important factors that could cause actual performance, achievements, actions, events, results or conditions to differ materially from those described in forward-looking statements or forward-looking information, there may be other factors that cause performance, achievements, actions, events, results or conditions to differ from those anticipated, estimated or intended.

- 2 -

Forward-looking statements and forward-looking information contained herein are made as of the date of this AIF and the Corporation disclaims any obligation to update any forward-looking statements or forward-looking information, whether as a result of new information, future events or results or otherwise , except as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements or forward-looking information.

CAUTIONARY NOTE CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

Information in this AIF, including any information incorporated by reference, and disclosure documents of Fronteer that are filed with Canadian and United States securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources” and “inferred resources”. Shareholders in the United States are advised that, while such terms are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility, pre-feasibility or other technical reports or studies, except in rare cases. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of contained ounces is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report resources as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in these documents may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

- 3 -

National Instrument 43-101 —Standards of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators, which has established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates of Fronteer contained in this AIF, including any information contained in certain documents referenced in this AIF, have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System.

The individuals named throughout this AIF are the “Qualified Persons”, as defined under NI 43-101, who supervised the preparation of the scientific and technical information contained in the applicable technical reports referenced in this AIF, which form the basis for the scientific and technical information reproduced in this AIF, as applicable.

CORPORATE STRUCTURE OF THE CORPORATION

Name and Incorporation

Fronteer Development Group Inc. (“Fronteer” or the “Corporation”) was incorporated under the name 1334970 Ontario Inc. under theBusiness Corporations Act (Ontario), as amended or supplemented, on January 11, 1999. On February 2, 1999, the Corporation filed Articles of Amendment to change its name to “Fronteer Development Group Inc.”.

The registered office of the Corporation is located at 40 King Street West, 2100 Scotia Plaza, Toronto, Ontario M5H 3C2, and the head office and principal place of business of the Corporation is located at Suite 1650, 1055 West Hastings Street, Vancouver, British Columbia V6E 2E9.

Fronteer is a reporting issuer in each of the Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador. The Fronteer common shares (the “Common Shares”) are listed and posted for trading on the Toronto Stock Exchanged (the “TSX”) and the NYSE Amex (the “NYSE Amex”) under the symbol “FRG”.

Fronteer currently proposes to seek approval from its shareholders to amend the Articles of the Corporation to effect a change of name of the Corporation to “Fronteer Gold Inc.”, or any such other name as the Board of Directors of the Corporation (the “Board”), in its discretion, may approve, and the TSX, the NYSE Amex, and the regulatory authorities under the applicable corporate laws may permit. The proposed name change has been approved by resolutions of the Board and is believed by the Board to be in the best interests of the Corporation to help clarify for investors the primary focus of the Corporation, as it focuses its efforts on becoming a gold producer. In anticipation of the proposed name change, the Corporation has also applied to register “Fronteer Gold Inc.” as a trade-mark owned by the Corporation throughout Canada and the United States, which trade-mark application is pending. The Corporation does not intend to change the ticker symbol (FRG) under which the Common Shares are currently listed on the TSX and the NYSE Amex. Further details concerning the proposed name change are contained in the Corporation’s management information circular dated March 25, 2010, a copy of which is available on SEDAR atwww.sedar.com.

For further information regarding Fronteer, reference is made to Fronteer’s filings with the Canadian securities regulatory authorities available on SEDAR atwww.sedar.com and Fronteer’s filings with the SEC available atwww.sec.gov.

- 4 -

Intercorporate Relationships

The following chart sets forth the names of the significant subsidiaries and investments under significant influence of the Corporation as at December 31, 2009, the percentage of ownership of each such company by the Corporation (directly or indirectly) and the respective jurisdictions of incorporation of each such company:

- 5 -

| 1. | As discussed in this AIF further below under “General Development of the Business – Three Year History”, subsequent to December 31, 2009, Fronteer sold 100% of its interest in Fronteer Eurasia Madencilik Anonim Sirketi (“Fronteer Eurasia”) to Alamos Gold Inc. |

- 6 -

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

On December 1, 2006, the Corporation completed the acquisition by way of private placement of 5,310,000 units, consisting of one common share (each an “LA Share”) and one half of one common share purchase warrant, of Latin American Minerals Inc. (“LA”), a public corporation listed on the TSX Venture Exchange. In April 2007, the Corporation acquired a further 900,000 LA Shares directly from an LA shareholder at a price of $0.45 per share. In June 2007, Fronteer acquired a further 2,000,000 units (the “2007 Units”) of LA at a price of $1.00 per 2007 Unit as part of a larger private placement of 12,000,000 2007 Units by LA. Each 2007 Unit was comprised of one common share in the capital of LA and one-half of one common share purchase warrant. Each whole warrant entitled Fronteer to acquire one additional LA Share at a price of $1.25 for a period of 12 months from closing of the offering. The Corporation’s entire investment in LA was sold in March 2008 for $0.65 per share for aggregate proceeds of $5,295,450.

On March 15, 2007, the Corporation announced it had closed a short form prospectus offering pursuant to which the Corporation issued 4,100,000 Common Shares at a price of $14.75 per share to raise gross proceeds of $60,475,000. The over-allotment option granted by the Corporation in connection with this offering was subsequently partially exercised on April 5, 2007, pursuant to which the Corporation issued an additional 398,000 Common Shares at a price of $14.75 per share to raise additional aggregate gross proceeds of $5,870,500.

On and as of June 30, 2005, a U.S. Delaware corporation, WSMC Gold Corp. (“WSMC”), a wholly-owned subsidiary of Western States Minerals Corporation (“Western States Minerals”), consolidated the rights to possess, explore, develop and mine the precious metals mineral interests (collectively, the “Mineral Interests”) of Western States Minerals, Zaca Resources Corp. (“Zaca Resources”) and 26 Ranch Inc. (“Ranch” and together with Western States Minerals and Zaca Resources, the “Safra Companies”). In addition, Western States Royalty Corporation (“Western States Royalty”), an affiliate of WSMC, acquired a portfolio of royalties (the “Mineral Royalties”) on the properties of NewWest Gold Corporation (“NewWest”), subject to the right of Zaca Resources to retain a 3% royalty on one of those properties as a lessor (the “Zaca Royalty”).

As part of various transactions completed prior to or as of July 5, 2006 (the “Pre-IPO NewWest Restructuring”), such Mineral Interests and Mineral Royalties (including the Zaca Royalty) were sold or contributed to four new Delaware limited liability corporations as follows: NWG Royalty LLC, NewWest Gold LLC, Nevada Western Gold LLC and Zaca Mining LLC (collectively, the “LLCs”). The LLCs were in turn sold to a Barbados company, NWG Investments Inc. (“NWG”) that is, indirectly, wholly-owned by Mr. Jacob Safra. Following these transactions, pursuant to a contribution agreement amongst NewWest and NWG (the “LLC Purchase Agreement”), NWG and therefore indirectly Mr. Jacob Safra, acquired all of the issued and outstanding shares of NewWest in exchange for the acquisition by NewWest of a 100% interest in each of the LLCs. Under a further contribution agreement (the “LLC Sale Agreement”), NewWest acquired all of the issued and outstanding shares of a newly formed Delaware corporation, NewWest Gold USA Inc. (“NewWest USA”), in exchange for the acquisition by NewWest USA of 100% of NewWest’s interests in the LLCs. In October 2006, NewWest Gold LLC and Zaca Mining LLC were merged into NewWest USA. After giving effect to these transactions and Fronteer’s subsequent acquisition of NewWest described below, Fronteer acquired and continues to hold all Mineral Interests through Fronteer Development (USA) Inc. (“Fronteer USA”) (formerly NewWest USA) andFronteer Gold LLC (formerlyNevada Western Gold LLC), and holds all Mineral Royalties (including the Zaca Royalty)through Fronteer Royalty LLC (formerly NWG Royalty LLC). See also “Interest of Management and Others in Material Transactions”. On August 29, 2006, NewWest completed an initial public offering after which Mr. Safra’s indirect interest in NewWest was reduced to approximately 86%.

- 7 -

On September 24, 2007, Fronteer announced that it had closed its acquisition of 100% of the common shares of NewWest. As part of the acquisition agreement, the Corporation exchanged 0.26 of a Common Share of Fronteer for each NewWest share acquired. As a result of this acquisition, Fronteer presently holds 100% of the common shares of NewWest. Upon completion of the acquisition of all of the issued and outstanding shares of NewWest by the Corporation as discussed above, Mr. Safra, primarily through NWG, currently owns approximately 10.8% of all of the issued and outstanding Common Shares of Corporation as of the date of this AIF according to Mr. Safra’s insider reports on file with the System for Electronic Data on Insiders (“SEDI”). For further details of this acquisition, please refer to the Business Acquisition Report of the Corporation dated November 7, 2007, a copy of which is available on SEDAR atwww.sedar.com.

On February 6, 2008, Fronteer announced that Newmont Mining Corporation (“Newmont”) notified the Corporation that it would not be fulfilling its earn-in obligation at the Northumberland project. As a result, the Corporation regained 100% control of Northumberland. Newmont agreed to grant the Corporation a free license to use Newmont’s patented N2TEC flotation process technology. In return,Fronteer has granted Newmont preferential ore processing rights for any ore developed from Northumberland. On February 6, 2008, the Corporation also announced that it had signed a letter of intent with Newmont outlining terms with respect to a new joint venture on the Corporation’s Sandman project. This letter of intent was subsequently replaced by a definitive option and joint venture agreement between Fronteer and Newmont dated June 1, 2008. For further details, please see the section of this AIF entitled “Material Contracts” below. Under the terms of this agreement, Newmont may earn an initial 51% interest in the Sandman project within 36 months by:

| | 1. | Spending a minimum US$14,000,000 on exploration; |

| | | |

| | 2. | Making a production decision supported by a bankable feasibility study; |

| | | |

| | 3. | Reporting reserves; |

| | | |

| | 4. | Making a commitment to fund and construct a mine; |

| | | |

| | 5. | Advancing the necessary permits; and |

| | | |

| | 6. | Contributing an adjacent mineral interest to the joint venture. |

Newmont may earn an additional 9% interest in the Sandman project by spending a further US$9,000,000 on development. Fronteer retains a 2% net smelter return royalty on production of the first 310,000 ounces at the Sandman project. Fronteer can also elect to have Newmont arrange financing for its 40% share of development costs. To date, Newmont has met its ongoing obligations under this agreement.

For further details, please refer to the material change report of the Corporation dated February 6, 2008, a copy of which is available on SEDAR atwww.sedar.comand on the Corporation’s Form 6K filed on the same date with the SEC and available atwww.sec.gov.

As discussed in greater detail below under the section entitled “Mineral Properties – Long Canyon Project, Nevada”, Fronteer indirectly acquired it’s right to earn a 51% interest in the Long Canyon Project pursuant to a joint venture agreement between AuEx Ventures, Inc. (“AuEx”) and Fronteer USA (formerly NewWest USA) in 2006. In September 2008, the Corporation announced that it had completed its expenditure requirement on the Long Canyon Project, thereby earning a 51% interest. The Corporation is now the manager of the joint venture with AuEX pursuant to the joint venture agreement and both parties contribute their proportionate share of the funding for the Long Canyon Project to maintain their percentage interest.

On April 8, 2008, Aurora Energy Resources Inc. (“Aurora”), then a public company with its common shares listed and posted for trading on the TSX and in which Fronteer then held an approximate 42.3% interest, announced that the Nunatsiavut Government voted eight to seven in favour of implementing a three-year moratorium on uranium mining on Labrador Inuit Lands, but will continue to allow uranium exploration. Aurora reported that it believed the basis for the mining moratorium is to allow time for the Nunatsiavut Government and the Government of Newfoundland and Labrador, through the Regional Planning Authority, to formulate a Land Use Plan as required by the Labrador Inuit Land Claims Agreement.

- 8 -

On December 22, 2008, the Corporation announced its intention to make an offer (the “Offer”) to acquire all of the issued and outstanding common shares of Aurora, other than common shares already owned by Fronteer, including common shares that became issued and outstanding after the date of the Offer but before the expiry time of the Offer upon the conversion, exchange or exercise of options or other securities of Aurora that are convertible into or exchangeable or exercisable for common shares of Aurora (the “Aurora Shares”) on the basis of 0.825 of a Fronteer Common Share for each Aurora Share. Fronteer formally commenced its Offer by mailing a take-over bid circular to Aurora shareholders on January 23, 2009.

In connection with the Offer, certain institutional shareholders of Aurora entered into lock-up agreements pursuant to which they agreed, subject to certain exceptions, to deposit under the Offer and not withdraw Aurora Shares representing in the aggregate 19,234,700 Aurora Shares representing approximately 26% of the then issued and outstanding Aurora Shares.

On March 2, 2009, the expiry date of the Offer, Fronteer took up and accepted for payment a total of approximately 36,526,336 Aurora Shares. As of that date, Fronteer increased its ownership interest from approximately 42.3% to approximately 92.1% of the issued and outstanding Aurora Shares. Fronteer issued 30,134,229 common shares as payment for the Aurora Shares acquired under the Offer. Subsequently, in April 2009, Fronteer completed the acquisition of all of the remaining outstanding Aurora Shares pursuant to a second step amalgamation transaction, whereby all of the remaining outstanding Aurora Shares not acquired under the Offer were acquired for the same consideration as offered by Fronteer under its Offer. Subsequent to the amalgamation transaction, Aurora ceased to be a reporting issuer and the Aurora Shares were delisted from the TSX. Aurora is now a 100% wholly-owned subsidiary of Fronteer. For further details of this acquisition, please refer to the Business Acquisition Report of the Corporation dated June 9, 2009, a copy of which is available on SEDAR atwww.sedar.com.

On June 10, 2009, Fronteer announced its intention to subscribe for six million units of East Asia Minerals Corporation (“East Asia”) through participation in a non-brokered private placement of 9.1 million units. The 6,000,000 units of East Asia were acquired at a price of $0.51 per unit. Each unit was comprised of one common share in the capital of East Asia and one-half of one common share purchase warrant. Each whole warrant entitled Fronteer to acquire one common share of East Asia at an exercise price of $0.75 for a period of 2.5 years from the closing of the private placement. Fronteer’s acquisition represented approximately 9.3% of the then issued and outstanding common shares of East Asia. During 2009, Fronteer disposed of all of the common shares of East Asia, realizing a gross profit of approximately $9,562,000. Subsequent to December 31, 2009, Fronteer exercised the warrants and sold the additional 3,000,000 common shares acquired pursuant to such exercise for further gross proceeds of approximately $12,150,000.

On September 8, 2009, Fronteer announced the results of a positive preliminary economic assessment (“PEA”) for the Michelin Uranium Property owned by Aurora. The PEA, prepared by AMEC Americas Limited, supports a financially robust open-pit and underground uranium mining operation at the Michelin and Jacques Lake deposits, and a milling facility at the Michelin site capable of processing approximately 10,000 tonnes of mineralization per day, which will produce up to 7.3 million pounds of U3O8per annum. Direct cash costs are estimated at US$28.57 per pound of U3O8over the expected 17-year mine life. Based on the results of the PEA, at an 8% discount rate, the Project’s pre-tax net present value is approximately US$914 million with a pre-tax internal rate of return of 19.2% on an unlevered 100% equity basis, and a pay-back period of 4.7 years. See “Mineral Properties - CMB Uranium Property, Labrador, Canada” below for further details.

- 9 -

On September 22, 2009, Fronteer, Teck Cominco Arama ve Madencilik Sanayi Ticaret (“TMST”) and Alamos Gold Inc. (“Alamos”), entered into a letter agreement (“MOU”) proposing terms on which Alamos would acquire 100% of the Agi Dagi and Kirazli gold projects from TMST (60%) and Fronteer (40%) through the acquisition of certain Turkish subsidiaries held directly by TMST and Fronteer through its wholly-owned subsidiary, Fronteer Eurasia. Subsequently, pursuant to the terms of the MOU, Fronteer, TMST and Alamos entered into a share purchase agreement dated December 7, 2009 in respect of the proposed sale of the projects to Alamos. Further details are set out below under “Material Contracts”. On January 5, 2010, the conditions precedent to closing the sale transaction were satisfactorily completed and the purchase price was paid by Alamos in exchange for the shares in the Turkish subsidiaries. The Agi Dagi and Kirazlí projects were sold to Alamos for US$40 million in cash and the issuance of 4 million Alamos common shares to TMST (as to 60%) and Fronteer (as to 40%). Immediately following the closing, certain corporate law requirements were undertaken in Turkey to document the transfer of the shares and to replace the boards of the Turkish subsidiaries. These requirements were completed early on January 6, 2010. See “Mineral Properties - Agi Dagi and Kirazli Properties” below for further details.

On December 1, 2009, Fronteer announced the results of a positive PEA for the Long Canyon Project, owned 51% and managed by the Corporation pursuant to its joint venture with AuEx, located in Nevada, USA. The PEA, prepared by Mine Development Associates (MDA) of Reno, Nevada, and reviewed by AMEC Americas Limited, supports a financially robust open-pit, run-of-mine (ROM), heap-leach operation. Based on the results of the PEA, at a 5% discount rate, and US$800/oz gold price, the project’s pre-tax net present value (NPV) is approximately US$145 million with a pre-tax internal rate of return (IRR) of 64% on an unleveraged 100% equity basis, and a pay-back period of 1.3 years. See “Mineral Properties – Long Canyon Property” below for further details.

On December 4, 2009, Fronteer announced the results of an independent Economic Impact Assessment of the Michelin Uranium Project which indicated significant long-term economic benefits to regional governments and communities in Labrador, Canada.

The study estimates the Michelin Project would generate the following combined benefits for the communities and governments of Nunatsiavut and Newfoundland and Labrador (using data taken from the Michelin PEA):

- - 31,200 person years of employment

- - $2.9 billion in business and individual income

- - $1.8 billion in tax revenues

Over the life of the mine, the Project would also provide significant benefits to other Canadian provinces and the federal government, including a combined $2.9 billion in income and $2.3 billion in tax revenues. The study was conducted by Strategic Concepts, Inc. (SCI) and Wade Locke Economic Consulting, experienced consulting firms specializing in Canadian resource-based economic impact assessments, with particular expertise in Newfoundland and Labrador projects. The purpose of the study was to measure the economic impacts of the Michelin Project on governments and economies locally and across Canada.

DESCRIPTION OF THE BUSINESS

The Corporation is principally engaged in the acquisition, exploration and development of mineral properties or interests in corporations controlling mineral properties of interest to the Corporation. The Corporation began concentrating its efforts in the area of mineral exploration in June of 2001. Prior to that, it was involved in the development, building and marketing of residential real estate properties, primarily in the Province of Ontario. Fronteer’s principal exploration properties are currently located in Nevada, U.S.A. and in the Biga region of northwestern Turkey, and it holds additional properties in California, U.S.A. Through its ownership of Aurora, Fronteer also has exposure to uranium projects in Newfoundland and Labrador, Canada (including the Michelin uranium deposit, the Jacques Lake deposit and four other deposits (known as the Gear, Nash, Inda and Rainbow deposits)). The Corporation has on occasion, sold interests in mineral properties or corporations controlling mineral properties when they no longer fit the Corporation’s growth strategy.

- 10 -

Fronteer is focused on discovering and advancing deposits with strong production potential, with a particular focus on building low-cost gold production from projects that it controls and operates. Fronteer’s vision is to advance a robust pipeline of projects stretching from exploration through to production. In particular, Fronteer has an interest in several major gold projects throughout Nevada, United States and a copper-gold project in northwest Turkey. Among its large portfolio of precious metal mineral rights in Nevada, Fronteer’s key projects include a 100% interest in Northumberland, one of the largest undeveloped Carlin-style gold deposits in the state; a 51% interest in Long Canyon as part of its joint venture with AuEx Ventures Inc., a discovery defining an entirely new gold trend in the Eastern Great Basin; and Sandman, a property in which Newmont Mining Corporation has the option to acquire up to a 60% interest by advancing the project to a production decision by 2011. In Turkey, as part of a joint venture with a subsidiary of Teck Resources Ltd. (“Teck”), Fronteer has built and retains a 40% interest in the Halilaga project that includes a copper-gold porphyry deposit. Two gold projects also built by the Corporation in this same area of Turkey and also jointly held with Teck, were sold to Alamos in early January 2010, as discussed above.

As none of Fronteer’s properties are currently in production, it is not currently distributing any minerals in the market. In the event that one or more of Fronteer’s properties move into production, it is anticipated that gold and other metals can be readily sold on numerous markets throughout the world and it would not be difficult to ascertain the market price of such metals at any particular time.

Fronteer has no debt and is not invested in any short-term commercial paper or asset-backed securities. Fronteer has approximately $168,100,000 in cash and short term deposits primarily held with large Canadian and US commercial banks and 22,900,000 in the approximate fair value of available for sale investments. For further details concerning the Corporation’s material mineral properties, please see “Mineral Properties” below.

Employees

As at March 29, 2010, the Corporation and its subsidiaries had 57 employees.

Competitive Conditions

The mineral exploration and mining business is competitive in all phases of exploration, development and production. The Corporation competes with a number of other entities in the search for and the acquisition of potentially productive mineral properties. As a result of this competition, the majority of which is with companies with greater financial resources than the Corporation, the Corporation may be unable to acquire attractive properties in the future on terms it considers acceptable. The Corporation also competes with other resource companies, many of whom have greater financial resources and/or more advanced properties, in attracting equity and other capital necessary for the Corporation to advance the exploration and development of its mineral properties.

The ability of the Corporation to acquire additional properties depends on, among other things, its available working capital, its ability to explore and develop its existing properties, its ability to attract and retain highly-skilled employees, and on its ability to select, acquire and bring to production suitable properties or prospects for mineral exploration and development. Factors beyond the control of the Corporation may affect the marketability of minerals mined or discovered by the Corporation. Mineral prices have historically been subject to fluctuations and are affected by numerous factors beyond the control of the Corporation. See “Risk Factors” for further details concerning various factors that may cause Fronteer’s actual performance, achievements, actions, events, results or conditions to differ materially from those anticipated, estimated or intended.

- 11 -

RISK FACTORS

An investment in securities of the Corporation involves a significant degree of risk and should be considered speculative due to the nature of the Corporation’s business and the present stage of its development. In addition to the other information set forth elsewhere in this AIF, the following risk factors should be carefully reviewed by prospective investors. These risks may not be the only risks faced by Fronteer. Risks and uncertainties not presently known by Fronteer or which are presenting considered immaterial may also adversely affect Fronteer’s business, properties, results of operations and/or condition (financial or otherwise). All references to “Fronteer” or the “Corporation” in this section entitled “Risk Factors” include Fronteer and its subsidiaries and joint ventures, except where the context otherwise requires

Exploration, Development and Operating Risks

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of precious metals and other minerals may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral resources and reserves, to develop metallurgical processes, and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs currently planned by the Corporation will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which include: the particular attributes of the deposit, such as quantity and quality of the minerals and proximity to infrastructure; mineral prices, which are highly cyclical and subject to fluctuation; actual costs required to bring a deposit into production; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, permitting, importing and exporting of minerals, and environmental protection and reclamation. The exact effect of these factors cannot be accurately predicted but could have a material adverse effect upon the Corporation’s properties and operations.

Mining operations generally involve a high degree of risk. The operations of the Corporation are subject to all the hazards and risks normally encountered in the exploration, development and production of precious metals and other minerals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although adequate precautions to minimize risk will be taken, milling operations are subject to hazards such as equipment failure or the failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability.

There is no certainty that the expenditures made by the Corporation towards the search and evaluation of precious metals and other minerals will result in discoveries of mineral resources, mineral reserves or any other mineral occurrences.

- 12 -

Reliability of Resource Estimates

Calculations of mineral reserves and mineral resources and metal recovery are estimates only. There is no certainty that any of the mineral resources identified on any of the Corporation’s properties to date will be realized. Until a deposit is actually mined and processed the quantity of mineral resources and grades must be considered as estimates only. In addition, the quantity of mineral resources may vary depending on, among other things, precious metal prices. Any material change in quantity of mineral resources, grade, or stripping ratio may also affect the economic viability of any project undertaken by the Corporation. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in a larger scale test under on-site conditions or during production.

Fluctuations in gold, uranium and other precious or base metal prices, results of drilling, metallurgical testing and production and the evaluation of studies, reports and plans subsequent to the date of any estimate may require revision of such estimate. Any material reductions in estimates of mineral resources could have a material adverse effect on the Corporation’s properties, results of operations and financial condition.

Environmental Risks and Hazards

All phases of the Corporation’s operations are subject to environmental regulation in the various jurisdictions in which it operates. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation and international standards are evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation and standards, if any, will not adversely affect the Corporation’s business, condition or operations. Environmental hazards may exist on the properties on which the Corporation holds interests which are unknown to the Corporation at present and which have been caused by previous or existing owners or operators of the properties.

Government approvals, approval of aboriginal people and other members of surrounding communities and licenses and permits are currently and will in the future be required in connection with the operations of the Corporation. To the extent such approvals are required and not obtained, the Corporation may be curtailed or prohibited from continuing its mining operations or from proceeding with planned exploration or development of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Corporation and cause increases in exploration expenses, capital expenditures or production costs, or reduction in levels of production at producing properties, or require abandonment or delays in the development of new mining properties.

- 13 -

Permits and Licenses

The Corporation cannot be certain that it will receive the necessary permits and licenses or on acceptable terms required to conduct further exploration and to develop its properties and bring them into production. The failure to obtain such permits or licenses, or delays in obtaining such permits or licenses, could increase the Corporation’s costs and delay its activities, and could adversely affect the properties, business or operations of the Corporation.

Government approvals, approval of aboriginal people and other members of surrounding communities and permits and licenses are currently and will in the future be required in connection with the operations of the Corporation. To the extent such approvals are required and not obtained, the Corporation may be curtailed or prohibited from continuing its mining operations or from proceeding with planned exploration or development of mineral properties. In October 2007, the Nunatsiavut Government initiated the next steps towards formulating its policy on uranium mining on Labrador Inuit Lands, and struck a committee to further study the issue. In March 2008, Aurora reported that the Nunatsiavut Assembly passed on first reading a bill to institute a three-year moratorium on uranium mining and milling. In April 2008, the bill was considered again on second reading by the Assembly, at which time the Nunatsiavut Government approved a three year moratorium on mining of uranium, but continues to allow uranium exploration at this stage. As a result, Aurora dramatically altered its development schedule and scaled back operations in Labrador. Fronteer, through Aurora, continues to actively engage the local community in Labrador, and continues to assess the impact this legislation would have on its exploration and development schedule. However, any amendments to this legislation or an extension to the moratorium could have a material adverse effect on Aurora and its operations and, therefore, on the business and operations of Fronteer.

The Corporation has also experienced past permitting delays on the Halilaga Property in Turkey. Currently, the Turkish government is not issuing new forestry permits, which may be required to conduct exploration of the Halilaga Property that is not yet subject to a valid forestry permit. Mining legislation in Turkey is also subject to change as the forestry permit issue continues to be addressed.

Government Regulation

The mining, processing, development and mineral exploration activities of the Corporation are subject to various laws, rules and regulations governing prospecting, development, production, taxes, employment and labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people, and other matters. Although the Corporation believes its exploration and development activities are currently being carried out in accordance with all applicable material rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing laws, rules and regulations will not be applied in a manner which could limit or curtail exploration, production or development. Amendments to current laws, rules and regulations governing operations and activities of mining and milling or more stringent implementation thereof could have a substantial adverse impact on the Corporation.

No History of Mineral Production

The Corporation has never had any interest in mineral producing properties. There is no assurance that commercial quantities of minerals will be discovered at any of the properties of the Corporation or any future properties, nor is there any assurance that the exploration programs of the Corporation thereon will yield any positive results. Even if commercial quantities of minerals are discovered, there can be no assurance that any property of the Corporation will ever be brought to a stage where mineral resources can profitably be produced thereon. Factors which may limit the ability of the Corporation to produce mineral resources from its properties include, but are not limited to, the price of the mineral resources which are currently being explored for, availability of additional capital and financing, the actual costs of bringing properties into production, and the nature of any mineral deposits.

- 14 -

Competition from Other Energy Sources and Public Acceptance of Nuclear Energy

Nuclear energy competes with other sources of energy, including oil, natural gas, coal and hydroelectricity. These other energy sources are to some extent interchangeable with nuclear energy, particularly over the longer term. Lower prices of oil, natural gas, coal and hydro-electricity may result in lower demand for uranium concentrate and uranium conversion services. Furthermore, the growth of the uranium and nuclear power industry beyond its current level will depend upon continued and increased acceptance of nuclear technology as a means of generating electricity. Because of unique political, technological and environmental factors that affect the nuclear industry, the industry is subject to public opinion risks which could have an adverse impact on the demand for nuclear power and increase the regulation of the nuclear power industry. As a result, the interest of the Corporation in the CMB Uranium Property, which is engaged primarily in uranium exploration, may be materially adversely affected.

Current Global Financial Conditions

Current global financial conditions have been subject to increased volatility and numerous financial institutions have either gone into bankruptcy or have had to be rescued by governmental authorities. Access to public financing has been negatively impacted by both sub-prime mortgages and the liquidity crisis affecting the asset-backed commercial paper market. As such, the Corporation is subject to counterparty risk and liquidity risk. These factors may impact the ability of the Corporation to obtain equity or debt financing in the future and, if obtained, on terms favourable to the Corporation. If these increased levels of volatility and market turmoil continue, the Corporation’s operations could be adversely impacted and the value and the price of the Common Shares and other securities could continue to be adversely affected. In addition, these factors may impact the ability of the Corporation to obtain loans and other credit facilities in the future and, if obtained, on terms favourable to the Corporation. If these increased levels of volatility and market turmoil continue, the Corporation’s planned growth could be adversely impacted.

Trends

There are significant uncertainties regarding the price of metals and resources and the availability of equity financing for the purposes of mineral exploration and development. The price of metals and resources has been and continues to be volatile and financial markets have deteriorated to the point where it remains extremely difficult for companies to raise new capital. The Corporation’s future performance is largely tied to the development of its current mineral properties and the overall financial markets. Current financial markets are likely to continue to be volatile in Canada for the remainder of the calendar year and potentially into 2011, reflecting ongoing concerns about the stability of the global economy and weakened global growth prospects. As well, concern about global growth has led to sustained drops in the commodity markets. Unprecedented uncertainty in the credit markets has also led to increased difficulties in borrowing/raising funds. Companies worldwide have been affected particularly negatively by these trends. As a result, the Corporation may have difficulties raising equity financing for the purposes of mineral exploration and development, particularly without excessively diluting present shareholders of the Corporation. In addition, with continued market volatility and slower worldwide economic growth, the Corporation’s strategy is to continue to build community support and advance exploration and development of its properties until such time as the capital markets stabilize.These trends may limit the Corporation’s ability to develop and/or further explore its mineral properties.

- 15 -

Insurance and Uninsured Risks

The business of the Corporation is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to properties of the Corporation or others, delays in mining, monetary losses and possible legal liability.

Although the Corporation may maintain insurance to protect against certain risks in such amounts as it considers to be reasonable, such insurance will not cover all the potential risks associated with a mining corporation’s operations. The Corporation may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration, development and production is not generally available to the Corporation or to other companies in the mining industry on acceptable terms. The Corporation might also become subject to liability for pollution or other hazards which it may not be insured against or which the Corporation may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Corporation to incur significant costs that could have a material adverse effect upon its business, financial performance and results of operations.

Infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on the availability of adequate infrastructure. Reliable roads, bridges, power sources, fuel and water supply and the availability of skilled labour and other infrastructure are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the business, operations, condition and results of operations of the Corporation.

In particular, water rights and access to water at the Long Canyon Property is important for the ongoing success of the project. The Great Basin area of Nevada has many competing demands for water and access to sufficient water will need to be negotiated by the Corporation, often with a number of different water rights holders. There is no guarantee that the Corporation will secure these water and access rights going forward or on reasonable terms.

Land Title

Title insurance generally is not available, and the ability of the Corporation to ensure that it has obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Furthermore, the Corporation has not conducted surveys of the claims in which it holds interests and, therefore, the precise area and location of such claims may be in doubt or challenged. Accordingly, the Corporation’s properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects which could have a material adverse impact on the Corporation’s properties and business operations, condition and results of operations. In addition, the Corporation may be unable to operate its properties as permitted or to enforce its rights with respect to its properties.

- 16 -

Costs of Land Reclamation

It is difficult to determine the exact amounts which will be required to complete all land reclamation activities in connection with the properties in which the Corporation holds an interest. Reclamation bonds and other forms of financial assurance represent only a portion of the total amount of money that will be spent on reclamation activities over the life of a mine. Accordingly, it may be necessary to revise planned expenditures and operating plans in order to fund reclamation activities. Such costs may have a material adverse impact upon the business, financial condition and results of operations of the Corporation.

Competition

The mining industry is competitive in all of its phases. The Corporation faces strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, precious metals. Many of these companies are larger and have greater financial resources, operational experience and technical capabilities than the Corporation. As a result of this competition, the Corporation may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, the revenues, operations and financial condition of the Corporation could be materially adversely affected. See also the section of this AIF entitled “Competitive Conditions” above.

Subsidiaries and Joint Ventures

The Corporation operates the Long Canyon Property and the Halilaga Property through joint ventures with AuEx and Teck, respectively, and operates other of its properties through subsidiaries. The Corporation is therefore subject to the typical risks associated with the conduct of joint ventures, including disagreement on how to develop, operate or finance the project. In addition, any limitation on the transfer of cash or other assets between the Corporation and such entities, or among such entities, could restrict the Corporation’s ability to fund its operations efficiently. Any such limitations, or the perception that such limitations may exist now or in the future, could have an adverse impact on the Corporation’s valuation and stock price.

Hedging

The Corporation does not have a hedging policy and has no current intention of adopting such a policy. Accordingly, the Corporation has no protections from declines in mineral prices.

Additional Capital

The exploration and development of the Corporation’s properties will require substantial additional financing. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, development or production on any or all such properties or even a loss of property interest. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favourable to the Corporation. In addition, any future financing may be dilutive to existing shareholders of the Corporation.

Acquisitions and integration

From time to time, the Corporation examines opportunities to acquire additional mining assets and businesses. Any acquisition that the Corporation may choose to complete may be of a significant size, may change the scale of the Corporation’s business and operations, and may expose the Corporation to new geographic, political, operating, financial and geological risks. The Corporation’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, negotiate acceptable terms for any such acquisition, and integrate the acquired operations successfully with those of the Corporation.

- 17 -

Any acquisitions would be accompanied by risks. For example, there may be a significant change in commodity prices after the Corporation has committed to complete the transaction and established the purchase price or exchange ratio; a material ore body may prove to be below expectations; the Corporation may have difficulty integrating and assimilating the operations and personnel of any acquired companies, realizing anticipated synergies and maximizing the financial and strategic position of the combined enterprise, and maintaining uniform standards, policies and controls across the organization; the integration of the acquired business or assets may disrupt the Corporation’s ongoing business and its relationships with employees, customers, suppliers and contractors; and the acquired business or assets may have unknown liabilities which may be significant. In the event that the Corporation chooses to raise debt capital to finance any such acquisition, the Corporation’s leverage will be increased. If the Corporation chooses to use equity as consideration for such acquisition, existing shareholders may suffer dilution. Alternatively, the Corporation may choose to finance any such acquisition with its existing resources. There can be no assurance that the Corporation would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Fluctuations in Metal Prices

There can be no assurance that metal prices received, if any, will be such that any property of the Corporation can be mined at a profit. The price of the Common Shares, and the financial results and exploration, development and mining activities of the Corporation may in the future be significantly and adversely affected by declines in the price of uranium, iron oxide, copper, gold and other minerals and base metals. The price of uranium, iron oxide, copper, gold and other minerals and base metals fluctuates widely and is affected by numerous factors beyond the control of the Corporation, including but not limited to, the sale or purchase of commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the Canadian and United States dollars and foreign currencies, global and regional supply and demand, the political and economic conditions and production costs of major mineral-producing countries throughout the world, and the cost of substitutes, inventory levels and carrying charges. With respect to uranium, such factors include, among other things, the demand for nuclear power, political, social and economic conditions and governmental regulation in uranium producing and consuming countries, uranium supply from secondary sources, uranium production levels and costs of production. Future price declines in the market value of uranium, iron oxide, copper, gold and other minerals and base metals could cause development of and commercial production from the Corporation’s properties to be impracticable. Depending on the price of uranium, iron oxide, copper, gold and other minerals and base metals, cash flow from mining operations may not be sufficient and the Corporation could be forced to discontinue production and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Corporation’s mining properties, if any, is dependent upon the prices of uranium, iron oxide, copper, gold and other minerals and base metals being adequate to make these properties economic.

In addition to adversely affecting any resource and reserve estimates of the Corporation and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Exchange Rate Fluctuations

Exchange rate fluctuations may affect the costs that the Corporation incurs in its operations. Precious metals and other minerals are generally sold in US dollars and the costs of the Corporation are generally incurred in Canadian dollars, Mexican Pesos and Turkish Lira. The appreciation of non-US dollar currencies against the US dollar can increase the cost of exploration and production in US dollar terms, which could materially and adversely affect the Corporation’s profitability, results of operations and financial condition.

- 18 -

In addition, the Corporation has a significant US dollar denominated future income tax liability that, when translated to Canadian dollars, can result in significant swings to the foreign exchange gain or loss on the Corporation’s statement of operations. This future income tax liability, primarily relates to the difference between the accounting and tax values of the assets acquired upon Fronteer’s prior acquisition of NewWest. The Corporation does not have any immediate plans to reduce this liability and as a result the swings in foreign exchange gain or loss may continue.

The size of the future income tax liability is also affected by the recognition of future income tax assets, primarily relating to loss carryforwards. There is uncertainty whether the losses will expire, unused, which may affect the amount of the future income tax liability realized.

Future Sales of Common Shares by Existing Shareholders

In addition to more global changes or disruptions in economic and market conditions which impact the liquidity and trading price of the Corporation’s Common Shares and are outside of the control of the Corporation, sales of a large number of Common Shares of the Corporation in the public markets, or the potential for such sales, could decrease the trading price of such Common Shares and could impair the ability of the Corporation to raise capital through future sales of such Common Shares. The Corporation has previously issued Common Shares at an effective price per share which is lower than the current market price of its Common Shares. Accordingly, a significant number of shareholders of the Corporation have an investment profit in such Common Shares that they may seek to liquidate.

Litigation

Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Fronteer is currently subject to threatened litigation and may be involved in disputes with other parties in the future which may result in litigation or other proceedings. The results of litigation or any other proceedings cannot be predicted with certainty. If Fronteer is unable to resolve these disputes favourably, it could have a material adverse effect on our financial position, results of operations or the Corporation’s property development. See “Legal Proceedings and Regulatory Actions” below for further details.

Passive Foreign Investment Company (“PFIC”)

The Corporation is in the process of determining whether it meets the definition of PFIC, within the meaning of Sections 1291 through 1298 of the USInternal Revenue Code of 1986, as amended, for the 2009 tax year. For the 2008 and 2007 tax years, the Corporation determined that it was a PFIC. The Corporation may or may not be a PFIC in the future, depending on changes in its assets and business operations. A US shareholder who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to numerous special US federal income taxation rules, which may have adverse tax consequences to such shareholder and such shareholder may elect to be taxed under two alternative tax regimes. A US shareholder should consult its own US tax advisor with respect to an investment in the Corporation’s Common Shares and to ascertain which of the alternative tax regimes, if any, might be beneficial to the US shareholder’s own facts and circumstances.

- 19 -

Foreign Private Issuer Status

In order to maintain the Corporation’s current status as a “foreign private issuer,” as such term is defined in Rule 3b-4 under the USSecurities Exchange Act of 1934, as amended, for US securities law purposes, the Corporation must not have any of the following as of the last business day of its most recently completed second fiscal quarter (as assessed in accordance with SEC requirements): (i) a majority of its executive officers or directors are US citizens or residents, (ii) more than 50% of its assets are located in the US, or (iii) the business of the Corporation is principally administered in the US. The Corporation may in the future lose its foreign private issuer status if it fails to meet any of the aforementioned criteria.

The regulatory and compliance costs to the Corporation under US securities laws as a US domestic issuer may be significantly more than the costs the Corporation incurs as a Canadian foreign private issuer eligible to use the Multi-Jurisdictional Disclosure System (“MJDS”). If the Corporation is not a foreign private issuer, it would not be eligible to use MJDS or other foreign issuer forms and would be required to file periodic and current reports and registration statements on US domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer. In addition, the Corporation may lose the ability to rely upon exemptions from the NYSE Amex (previously American Stock Exchange) corporate governance requirements that are available to foreign private issuers. Further, if the Corporation engages in capital raising activities after losing its foreign private issuer status, there is a higher likelihood that investors may require the Corporation to file resale registration statements with the SEC as a condition to any such financing.

Key Executives and Employees

The Corporation and its ability to achieve its future goals and objectives is dependent, in part, upon the services of key executives, including the directors of the Corporation, and a small number of highly skilled and experienced executives and personnel. Due to the relatively small size of the Corporation, the loss of these persons or the inability of the Corporation to attract and retain additional highly-skilled employees may adversely affect its business and future operations.

Comprehensive Environmental Response, Compensation and Liability Act

TheComprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) in the United States imposes strict, joint and several liability on parties associated with releases or threats of releases of hazardous substances. Liable parties include, among others, the current owners and operators of facilities at which hazardous substances were disposed or released into the environment and past owners and operators of properties who owned such properties at the time of such disposal or release. This liability could include response costs for removing or remediating the release and damages to natural resources. Since early 1999, the United States Forest Service (“USFS”) has been conducting a CERCLA remediation action at the Corporation’s Zaca Property under its Interdepartmental Abandoned Mine Lands Watershed Cleanup Initiative (“IAMLWCI”) program. The focus of the cleanup efforts is on relatively low-volume acid mine drainage from historic mine tunnels, a portion of which are on patented lands owned by one of the Safra Companies, and tailings on land at the Zaca Property, all of which pre-date the Corporation’s acquisition of its leasehold interest in the Zaca Property. The cleanup efforts are being administered by the USFS. To date, the USFS has not sought contribution from the Corporation, WSMC or any of the Safra Companies for the cleanup. However, the Corporation cannot rule out the possibility that the Corporation, WSMC or any of the Safra Companies or any of their respective successors may be held liable to contribute to the USFS’s remediation or other CERCLA response costs at some time in the future. Any liability could adversely affect the Corporation’s properties, financial condition and results of operations.

- 20 -

Political Stability and Government Regulation Risks

Some of the operations of the Corporation are currently conducted in Turkey and the Corporation may acquire or invest in additional properties located in less stable jurisdictions in the future and, as such, the operations of the Corporation are and may increasingly be exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties vary from country to country and include, but are not limited to: terrorism; hostage taking; military repression; fluctuations in currency exchange rates; high rates of inflation; labour unrest; the risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; changes in taxation policies; and changing political conditions and governmental regulations, including changing environmental legislation.

Changes, if any, in mining or investment policies or shifts in political attitudes in Turkey or other jurisdictions in which the Corporation holds properties or assets may adversely affect the operations or profitability of the Corporation. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on operations, income taxes, expropriation of property, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the properties, business, operations or financial condition of the Corporation.

Price and Volatility of Public Stock

The market price of securities of Fronteer has experienced wide fluctuations which may not necessarily be related to the financial condition, operating performance, underlying asset values or prospects of Fronteer. It may be anticipated that any market for Common Shares will be subject to market trends generally and the value of Common Shares on the TSX and/or the NYSE Amex may be affected by such volatility.

Enforcement of Civil Liabilities

The Corporation is a corporation existing under thelaws of the Province of Ontario, Canada. Some of the Corporation’s assets are located outside the United States and many of its directors and officers are residents of countries other than the United States. As a result, it may be difficult for investors to effect service of process within the United States upon the Corporation and its directors and officers, or to realize in the United States upon judgments of courts of the United States predicated upon civil liability of the Corporation and its directors and officers under United States federal securities laws.

Internal Controls

�� Internal controls over financial reporting are procedures designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance with respect to the reliability of financial reporting and financial statement preparation.

- 21 -

Conflicts of Interest

Certain of the directors and officers of the Corporation also serve as directors and/or officers of other companies involved in natural resource exploration and development and, consequently, there exists the possibility for such directors and officers to be in a position of conflict. Any decision made by any of such directors and officers involving the Corporation should be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Corporation and its shareholders. In addition, each of the directors is required to declare and refrain from voting on any matter in which such directors may have a conflict of interest in accordance with the procedures set forth in theBusiness Corporations Act (Ontario) and other applicable laws, as amended or supplemented from time to time. The Corporation has also adopted a formal code of ethics to govern the activities of its directors, officers and employees.

Dividend Policy

No dividends on the Common Shares of the Corporation have been paid by the Corporation to date. Payment of any future dividends, if any, will be at the discretion of the Corporation’s board of directors after taking into account many factors, including the Corporation’s operating results, financial condition, and current and anticipated cash needs.

Investment Company Act Status

The Corporation could become subject to regulation as an “investment company” under theUnited States Investment Company Act of 1940, as amended (“Investment Company Act”) in the future. If the Corporation becomes subject to regulation under the Investment Company Act and an exemption from such regulation is not available, the consequences to the Corporation and its operations could be material and adverse. In addition, the costs associated with the Corporation avoiding any such regulation under the Investment Company Act could be significant and result in a material change in the operations of the Corporation.

MINERAL PROPERTIES

As at March 29, 2010, the Corporation holds an interest in six (6) mineral properties that are considered to be material within the meaning of applicable Canadian securities laws: (i) the Northumberland Property; (ii) the Long Canyon Property; (iii) the Sandman Property; (iv) the Zaca Property; (v) the Halilaga Property; and (vi) the CMB Uranium Property. At December 31, 2009, the Company held an interest in the Agi Dagi Property and the Kirazli Property, in Turkey. While the Agi Dagi and Kirazlí Properties would have constituted material mineral properties of Fronteer as of December 31, 2009, as discussed above under “General Development of the Business – Three Year History”, these properties were subsequently sold by Teck and Fronteer to Alamos and, accordingly, as of the date of this AIF, Fronteer no longer holds any interest in such properties.

Northumberland Property