UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| Filed by the Registrant x |

|

| Filed by a Party other than the Registrant ¨ |

|

| Check the appropriate box: |

|

¨ Preliminary Proxy Statement |

|

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement |

|

¨ Definitive Additional Materials |

|

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

FREMONT MICHIGAN INSURACORP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT

FREMONT MICHIGAN ISURACORP, INC.

FREMONT, MICHIGAN 49412

To Be Held May 11, 2006

Mailed to Security Holders April 3, 2006

Fremont Michigan InsuraCorp, Inc.

933 East Main Street

Fremont, Michigan 49412-9753

April 3, 2006

Dear Fellow Shareholder:

The Annual Meeting of Shareholders of Fremont Michigan InsuraCorp, Inc. will be held Thursday, May 11, 2006, at 10:00 a.m., local time, at the Fremont City Library, 104 East Main Street, Fremont, Michigan 49412.

The matters to be acted upon at the meeting are:

| | (a) | The election of three Class III directors; |

| | (b) | To ratify the adoption of the Company’s Stock Incentive Plan of 2006; |

| | (c) | To ratify the appointment of BDO Seidman, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2006; and |

| | (d) | Such other matters as may properly come before the Fremont Michigan InsuraCorp, Inc. annual meeting or any adjournment thereof. |

The proxy statement and the enclosed form of proxy are being furnished to shareholders on or about April 3, 2006. Please review the enclosed material andsign, date and return the proxy card. Regardless of whether you plan to attend the annual meeting in person, please vote now so that the matters coming before the meeting may be acted upon.

I look forward to seeing you at the annual meeting.

|

| Respectfully yours, |

|

Richard E. Dunning President and Chief Executive Officer |

IMPORTANT — PLEASE VOTE PROMPTLY

YOUR VOTE IS IMPORTANT. EVEN IF YOU PLAN TO ATTEND THE

MEETING, SHAREHOLDERS ARE URGED TO VOTE, SIGN, DATE AND

RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE PREPAID

ENVELOPE. YOUR PROMPT RESPONSE IS APPRECIATED.

Fremont Michigan InsuraCorp, Inc.

933 East Main Street

Fremont, Michigan 49412-9753

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 11, 2006

To The Shareholders:

NOTICE IS HEREBY GIVEN that, pursuant to the call of its directors, the Annual Meeting of Shareholders of Fremont Michigan InsuraCorp, Inc. will be held at the Fremont City Library at 104 East Main Street, Fremont, Michigan 49412, on May 11, 2006, at 10:00 a.m., local time, for the purpose of considering and voting on the following matters:

| | 1. | Election of three Class III directors for a term of three years from the date of election and until their successors shall have been elected and qualified (Matter No. 1); |

| | 2. | To ratify the adoption of the Fremont Michigan InsuraCorp, Inc. Stock Incentive Plan of 2006; (Matter No. 2); |

| | 3. | To ratify the appointment of BDO Seidman, LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2006 (Matter No. 3); and |

| | 4. | Such other matters as may properly come before the Fremont Michigan InsuraCorp, Inc. annual meeting or any adjournment thereof. |

Only those shareholders of record at the close of business on March 20, 2006, shall be entitled to notice of and to vote at the meeting. A proxy statement, a proxy card and a self-addressed postage prepaid envelope are enclosed. Please complete, sign and date the proxy card and return it promptly in the envelope provided. If you attend the meeting, you may revoke your proxy and vote in person.

This notice, the accompanying proxy statement and form of proxy are sent to you by order of the Board of Directors.

|

Respectfully yours, |

|

|

Donald E. Bradford Corporate Secretary |

Fremont, Michigan

April 3, 2006

Fremont Michigan InsuraCorp, Inc.

933 East Main Street

Fremont, Michigan 49412

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

GENERAL

Introduction

This proxy statement and enclosed proxy card are being mailed to the shareholders of Fremont Michigan InsuraCorp, Inc. (“Fremont” or the “Company”) on or about April 3, 2006, in connection with the solicitation of proxies by the Board of Directors of Fremont. The proxies will be voted at the Annual Meeting of Shareholders of Fremont to be held on Thursday, May 11, 2006, at 10:00 a.m., local time, at the Fremont City Library at 104 East Main Street, Fremont, Michigan 49412 (the “Annual Meeting”). Fremont’s Annual Report on Form 10-K for the year ended December 31, 2005, accompanies this proxy statement.

Solicitation of Proxies

The cost of the solicitation of proxies will be borne by Fremont. In addition to the use of the mails, some directors and officers of Fremont may solicit proxies, without additional compensation, in person, by telephone, email, telegram, or otherwise. Arrangements may be made by Fremont with banks, brokerage houses and other custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of shares held by them of record, and Fremont may reimburse them for reasonable expenses they incur in so doing.

Record Date and Voting Securities

As of the close of business on March 20, 2006 (the “Record Date”), there were outstanding 862,128 shares of Class A Common stock, no par value (the “Fremont Common Stock”), the only class of capital stock of Fremont outstanding. Each share is entitled to one vote for each matter presented for a vote. Holders of record of Fremont Common Stock as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting.

If the enclosed proxy card is appropriately marked, signed and returned in time to be voted at the Annual Meeting, the shares represented by the proxy will be voted in accordance with the instructions marked thereon. Signed proxies not marked to the contrary will be voted “FOR” the election of the nominees for Fremont’s Board of Directors, “FOR” ratification of the appointment of BDO Seidman, LLP as the independent registered public accounting firm for the year ending December 31, 2006 and “FOR” the ratification of the Stock Incentive Plan of 2006.

Right of Revocation

Proxies may be revoked at any time before they have been exercised by filing with the Corporate Secretary of Fremont an instrument of revocation or a duly executed proxy bearing a later date. Any shareholder attending the Annual Meeting also may revoke a previously granted proxy by voting in person at the Annual Meeting.

1

Quorum

Under Fremont’s Bylaws, the holders of a majority of the stock issued and outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

There are no persons or entities known to Fremont or its management who own of record or beneficially, as of the Record Date, more than 5% of the outstanding shares of Fremont Common Stock.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information concerning the number of shares of Fremont Common Stock beneficially owned, as of March 20, 2006, by each present director, nominee for director, and each executive officer named in the compensation table set forth elsewhere herein.

| | | | |

Name of Beneficial Owner(1) | | Amount and

Nature of

Beneficial

Ownership(2) | | Percent

of

Class |

Donald E. Bradford(3) | | 6,314 | | * |

Michael A. DeKuiper | | 5,381 | | * |

Marvin R. Deur | | 12,037 | | 1.4 |

Richard E. Dunning | | 25,705 | | 3.0 |

William L. Johnson | | 5,261 | | * |

William A. Hall, Sr. | | 10,103 | | 1.2 |

Jack G. Hendon | | 3,081 | | * |

Kurt M. Dettmer | | 4,283 | | * |

Kenneth J. Schuiteman | | 7,761 | | * |

Jack A. Siebers | | 3,500 | | * |

Donald VanSingel | | 2,553 | | * |

Harold L. Wiberg | | 5,262 | | * |

Officers, Directors and Nominees for Director as a Group (13 persons) | | 91,741 | | 10.6 |

| (1) | Each of the identified beneficial owners, including the officers, directors and nominees for director, has sole investment and voting power as to all the shares beneficially owned with the exception of those shares held indirectly by certain officers, directors and nominees for director as noted in the footnotes below. |

| (2) | Includes shares held by the Company’s 401(k) Plan Trust and allocated to their Plan accounts. |

| (3) | Of the 6,314 shares, 5,261 shares are held by the Darling Family Trust. Mr. Bradford is a trustee of the trust and has shared voting and investment powers over the trust shares, but disclaims beneficial ownership of the shares held by the trust. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

All reports required by Section 16(a) were filed on time.

2

MATTER NO. 1

ELECTION OF FREMONT DIRECTORS

General

Under Fremont’s Articles of Incorporation, the total number of directors may be determined by a vote of a majority of the board of directors then in office. The number of directors for 2006 has been set by the Board at nine. The Board has determined that each of Messrs. Bradford, Hendon, Johnson, Schuiteman and VanSingel are independent directors as such term is defined by the director independence standards of The Nasdaq National Market (“Nasdaq”).

Fremont’s Board of Directors is divided into three classes with directors serving three-year terms. One-third of the directors will be elected at each annual meeting of shareholders.

Nominees and Continuing Directors

The Board of Directors fixed the number of directors in Class III at three and has nominated Donald E. Bradford, Richard E. Dunning and William L. Johnson for election as Class III directors for three-year terms to expire at the 2009 Annual Meeting of Shareholders, or until their successors are duly elected and qualified. Directors Bradford, Dunning and Johnson served as directors of Fremont and Fremont Insurance prior to its conversion. The remaining directors also served prior to the conversion, and will continue to serve in accordance with the terms of the Class I directors which expire in 2007 and the Class II directors which expire in 2008.

The Articles of Incorporation of Fremont permit nominations for election to the Board of Directors to be made by the Board of Directors or by any shareholder entitled to vote for the election of directors. All nominations for director to be made at the Annual Meeting by shareholders entitled to vote for the election of directors must be preceded by notice in writing, delivered or mailed by first class United States mail, postage prepaid, to the Secretary of Fremont not less than 120 days prior to the Annual Meeting, such notice must contain the following information: (a) the name, age, business address, and residence address of each nominee; (b) the principal occupation or employment of each nominee; (c) the number of shares of capital stock of Fremont which are beneficially owned by the nominee; (d) a statement that the nominee is willing to be nominated; and (e) and such other information concerning each such nominee as would be required under the rules of the Securities and Exchange Commission in a proxy statement soliciting proxies for the election of such nominees. No notice of nomination for election as a director has been received from any shareholder as of the date of this proxy statement. If a nomination is attempted at the Annual Meeting that does not comply with the procedures required by the Articles of Incorporation or if any votes are cast at the Annual Meeting for any candidate not duly nominated, then such nomination or such votes may be disregarded.

Pursuant to Fremont’s bylaws directors are elected by a plurality of votes cast, without regard to either (i) broker non-votes, or (ii) proxies as to which authority to vote for one or more of the nominees being proposed is withheld. The three persons receiving the highest number of votes cast for Class III directors at the Annual Meeting will be elected as Class III directors. Abstentions and broker non-votes will not constitute or be counted as “votes” cast for purposes of the Annual Meeting, but will be counted for purposes of determining the presence of a quorum.

It is intended that shares represented by proxies will be voted for the nominees listed, each of whom is now a director of Fremont and each of whom has expressed his willingness to serve, or for any substitute nominee or nominees designated by the Fremont Board of Directors in the event any nominee or nominees become unavailable for election. The Fremont Board of Directors has no reason to believe that any of the nominees will not serve if elected.

3

The following tables set forth as to each of the nominees for election as a Class III director and as to each of the continuing Class I and Class II directors, their position with Fremont, principal occupation, business experience and age. There are no family relationships between any of the listed persons, except that Mr. DeKuiper’s daughter is married to Kevin G. Kaastra, Fremont’s Vice President of Finance.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF ALL NOMINEES AS DIRECTORS.

Nominees for Election as Class III Directors — Term Expires in 2009

| | | | | | |

Name Position with Fremont; Principal Occupation | | Age | | Director Since | | Directorship in other Reporting Companies |

Donald E. Bradford Director and Secretary; Director of Fremont Insurance since 1982; retired in 1997 after approximately 40 years as owner and operator of the Bradford Agency, an independent insurance agency in Sparta, Michigan; | | 69 | | 2003 | | None |

| | | |

Richard E. Dunning Director, President and Chief Executive Officer; President and Chief Executive Officer of Fremont Insurance since 1997; | | 59 | | 2003 | | None |

| | | |

William L. Johnson Director and Vice-Chairman of the Board; Director of Fremont Insurance since 2003; formerly the Chairman, President and Chief Executive Officer of Semco Energy, Inc. from 1996 to 2002; is currently employed as President and CEO of Berean Group, LLC, a business consulting firm; | | 63 | | 2003 | | None |

Continuing Class I Directors — Term Expires in 2007

| | | | | | |

Name Position with Fremont; Principal Occupation | | Age | | Director Since | | Directorship in other Reporting Companies |

Michael A. DeKuiper Director; Director of Fremont Insurance since 1997; is employed as President of The White Agency, Inc. an independent insurance agency in Fremont, Grant and Twin Lake, Michigan and has been employed there since 1971. | | 58 | | 2003 | | None |

| | | |

Kenneth J. Schuiteman Director; Director of Fremont Insurance since 1985; was the owner of two automobile dealerships in Fremont, Michigan until he retired in 2002; | | 69 | | 2003 | | None |

| | | |

Jack A. Siebers Director; Director of Fremont Insurance since 1999; has practiced business law for over 36 years and is employed as a principal in the law firm of Siebers Mohney PLC in Grand Rapids, Michigan; | | 64 | | 2003 | | None |

4

Continuing Class II Directors — Term Expiring in 2008

| | | | | | |

Name Position with Fremont; Principal Occupation | | Age | | Director

Since | | Directorship in other Reporting Companies |

Jack G. Hendon Director; Director of Fremont Insurance since 2003; employed as a certified public accountant for over 21 years and is employed by H&S Companies, a holding company for Hendon & Slate, P.C., a certified public accounting firm, H&S Computers and H&S Financial in Fremont, Michigan; | | 50 | | 2003 | | None |

| | | |

Donald VanSingel Chairman of the Board; Chairman of Fremont Insurance since 1997 and Director since 1978; served for 20 years as a Representative in the Michigan House of Representatives, is employed since 1993 as a lobbyist with Government Consultant Services in Lansing, Michigan; | | 62 | | 2003 | | None |

| | | |

Harold I. Wiberg Director; Director of Fremont Insurance since 1999; is employed as President of Bonek Agency, Inc., an independent insurance agency in Suttons Bay, Michigan and has been employed there since 1974; | | 54 | | 2003 | | None |

Executive Officers Who Are Not Directors

| | | | |

Name Position with Fremont | | Age | | Principal Occupation During Past Five Years |

Kurt M. Dettmer Vice President and Marketing Manager of Fremont Insurance; | | 38 | | Vice President of Fremont Insurance since 2005, Marketing Manager of Fremont Insurance since 2004; Mr. Dettmer began his career with Fremont Insurance in 1998 as a claims adjuster; |

| | |

Marvin R. Deur Senior Vice President — Administration and Treasurer; Senior Vice President — Administration and Treasurer of Fremont Insurance; | | 54 | | Senior Vice President — Administration of Fremont Insurance since 2005 and Treasurer since 1995. Mr. Deur began his career with Fremont Insurance as an accountant in 1982; |

| | |

William A. Hall, Sr. First Vice President and Chief Operating Officer; Director, First Vice President and Chief Operating Officer of Fremont Insurance; | | 60 | | First Vice President of Fremont Insurance since 1986, Director of Fremont Insurance since 1988 and Chief Operating Officer since 1990; Began his career with Fremont insurance in 1972 as a marketing representative; |

| | |

Kevin G. Kaastra Vice President of Finance; Vice President of Finance of Fremont Insurance; | | 35 | | Vice President of Finance of Fremont Insurance since 2005; Mr. Kaastra, a certified public accountant, began his career with Fremont Insurance in 2003 as the Controller; Prior to joining Fremont, Mr. Kaastra was employed as a certified public accountant in public accounting for 10 years. |

5

Board and Committees

The Board of Directors has various standing committees including an Audit Committee, Compensation Committee, and Governance Committee. The role of the Governance Committee includes serving as the nominating committee. Directors are expected to attend meetings of the Board, meetings of the committees on which they serve and the Fremont Annual Meeting. During 2005, the Board of Directors held 3 meetings, the Audit Committee held 3 meetings, the Compensation Committee held 2 meetings, and the Governance Committee held 2 meetings. Each director attended at least 75% of the combined total of meetings of the Board of Directors and of each committee of which he was a member. There were 3 executive sessions of the Board of Directors excluding management.

The Audit Committee is comprised of Directors Hendon (Chairman), Bradford, and Johnson, each of whom is independent in the judgment of the Board of Directors. The Committee is responsible for the appointment, compensation, oversight and termination of Fremont’s independent auditors. The Committee is required to pre-approve audit and non-audit services performed by the independent auditors. The Committee also assists the Board in providing oversight over the integrity of Fremont’s financial statements and Fremont’s compliance with applicable legal and regulatory requirements. The Committee also is responsible for, among other things, reporting to Fremont’s Board on the results of the annual audit and reviewing the financial statements and related financial and non-financial disclosures included in Fremont’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Importantly, from a corporate governance perspective, the Audit Committee regularly evaluates the independent auditors’ independence from Fremont and Fremont’s management, including approving legally permitted, non-audit services provided by Fremont’s auditors and the potential impact of the services on the auditors’ independence. The Committee meets periodically with Fremont’s independent auditors outside of the presence of Fremont’s management, and possesses the authority to retain professionals to assist it in meeting its responsibilities without consulting with management. The Committee reviews and discusses with management earnings releases, including the use of pro forma information and financial information provided to analysts and rating agencies. The Committee discusses with management and the independent auditors the effect of accounting initiatives. The Committee also is responsible for receiving and retaining complaints and concerns relating to accounting and auditing matters.

The Governance Committee is comprised of Directors Johnson (Chairman), Bradford and VanSingel, each of whom is independent in the judgment of the Board of Directors. The Governance Committee is responsible for nominating individuals to stand for election as directors at the Annual Meeting of Shareholders, assisting the Board in the event of any vacancy on the Board by identifying individuals qualified to become Board members, recommending to the Board qualified individuals to fill such vacancy, recommending to the Board, on an annual basis, nominees for each Board Committee and to make independent recommendations to the Board of Directors as to the best practices for Board governance and evaluation of Board performance. The Committee has the responsibility to develop and recommend criteria for the selection of director nominees to the Board. The Committee has the power to apply standards for independence imposed by Fremont and all applicable federal laws in connection with such identification process. The Governance Committee will consider nominees recommended by shareholders and, in considering such candidates, the Committee will apply the same criteria it applies in connection with Committee-recommended candidates. Shareholders may nominate persons for election as directors in accordance with the procedures set forth in Article VII of Fremont’s Articles of Incorporation. Notification of such nomination, containing the required information, must be mailed or delivered to the secretary of Fremont not less than 120 days prior to the annual meeting.

The Compensation Committee is comprised of Directors Bradford (Chairman), Johnson, Schuiteman and VanSingel, each of whom is independent in the judgment of the Board of Directors. All of our employees are employed directly by Fremont Insurance that provides management services to Fremont. The Compensation Committee is responsible for reviewing and making recommendations regarding the compensation and benefits of employees, and granting stock awards to employees, management and directors under Fremont’s stock incentive plans.

6

Compensation of Directors

Executive officers of Fremont who are directors or members of committees of the Fremont Board of Directors or its subsidiaries receive no compensation for their service, but may be reimbursed for actual expenses incurred in connection with their duties. Non-employee directors of Fremont receive an annual retainer of $1,200 as a director, plus an additional annual retainer of $600 for each committee on which they serve and a meeting fee of $300 for each board or committee meeting attended. On December 29, 2005, each of the non-employee directors received a non-qualified stock option grant of 100 shares of Fremont Common Stock under the Fremont’s Stock-Based Compensation Plan. The grants were made on the same terms as grants to employees. The directors also receive the benefit of a group accidental death plan providing $100,000 of coverage.

CERTAIN TRANSACTIONS WITH EXECUTIVE OFFICERS AND DIRECTORS

Mr. Michael A. DeKuiper, a director, is the President and principal of The White Agency, Inc. This agency is currently appointed as an agent with and writes insurance for Fremont Insurance. The White Agency is one of Fremont Insurance’s largest producers. The terms and conditions of the agency agreement between The White Agency and Fremont Insurance are similar in all material respects to agency agreements with the other agents of Fremont Insurance. Fremont Insurance pays The White Agency commissions on business produced. The agency is also able to earn profit sharing commissions based on the profit margins of the business produced. Total regular and profit sharing commissions earned by The White Agency were $304,000, $305,000 and $283,000 in 2005, 2004 and 2003, respectively. The commission rates, including profit sharing commission opportunity, are the same as other agents of Fremont Insurance. The White Agency is an independent agent and also writes with regional and national insurers that may be competitors of Fremont Insurance.

Mr. Harold L. Wiberg, a director, is the President and an owner of the Bonek Agency, Inc. This agency is appointed as an agent of Fremont Insurance and writes insurance for Fremont Insurance. The terms and conditions of the agency agreement between the Bonek Agency and Fremont Insurance are similar in all material respects to agency agreements with the other agents of Fremont Insurance. Fremont Insurance pays the Bonek Agency commissions on business produced. The agency is also able to earn profit sharing commissions based on the profit margins of the business produced. Total regular and profit sharing commissions earned by the Bonek Agency were $118,000, $104,000 and $101,000 in 2005, 2004 and 2003, respectively. The commission rates, including profit sharing commission opportunity, are the same as other agents of Fremont Insurance. Bonek Agency is an independent agent and also writes with regional and national insurers that may be competitors of Fremont Insurance.

Mr. Jack A. Siebers, a director, is a principal in the law firm of Siebers Mohney PLC. Fremont Insurance has retained this law firm for certain corporate legal matters in the past and plans to continue to do so in the future. Legal fees paid by Fremont Insurance to Mr. Siebers’ law firm were approximately $55,000, $261,000 and $121,000 in 2005, 2004 and 2003, respectively.

7

EXECUTIVE COMPENSATION

Compensation Paid to Executive Officers

The following table sets forth information regarding the compensation of Fremont’s President and Chief Executive Officer, and the other executive officers whose total annual salary and bonus for the year ended December 31, 2005, exceeded $100,000. This compensation information is for each of the fiscal years ended December 31, 2005, 2004 and 2003. All compensation paid to these executive officers was paid by Fremont Insurance. No other executive officer of Fremont or any affiliates received compensation in excess of $100,000 for the fiscal year ended December 31, 2005.

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | Annual Compensation | | Long-Term Compensation |

Name and

Principal Position | | Year | | Salary(1)

($) | | Bonus(1)

($) | | Other

Annual

Compensation(2) ($) | | Restricted

Stock Awards

($) | | Securities

Underlying

Options/SARs

(#) | | All Other

Compensation

($)(3) |

Richard E. Dunning President and Chief Executive Officer | | 2005

2004

2003 | | 146,500

138,000

132,500 | | 41,370

20,000

14,575 | | —

—

— | | —

—

— | | 200

8,000

— | | 7,268

4,859

3,954 |

| | | | | | | |

William A. Hall, Sr. First Vice President and Chief Operating Officer | | 2005

2004

2003 | | 98,500

93,150

90,000 | | 17,730

1,000

9,900 | | —

—

— | | —

—

— | | 200

2,500

— | | 4,432

2,907

2,700 |

| | | | | | | |

Marvin R. Deur Senior Vice President — Administration and Treasurer | | 2005

2004

2003 | | 86,500

81,600

80,000 | | 16,570

3,000

8,800 | | —

—

— | | —

—

— | | 400

3,500

— | | 3,938

2,896

2,400 |

| | | | | | | |

Kurt M. Dettmer Vice President and Marketing Manager of Fremont Insurance | | 2005

2004

2003 | | 84,981

69,737

59,515 | | 17,548

3,395

5,952 | | —

—

— | | —

—

— | | 400

3,000

— | | 3,977

2,331

1,785 |

| (1) | Includes amounts deferred under Fremont Insurance’s 401(k) Plan. All employees who work at least 1000 hours per year may, after their first six months of service, may participate in the 401(k) Plan and elect to defer a percentage of their eligible earnings as employee voluntary contributions to the Plan. |

| (2) | Fremont Insurance provided other benefits to the executive officers in connection with their employment. The value of these personal benefits, which is not directly related to job performance, is not included in the table above because the value of the benefits does not exceed the lesser of $50,000 or 10% of the salary and bonus paid to any executive officer. |

| (3) | Represents amounts contributed by Fremont Insurance as matching and discretionary contributions under the 401(k) Plan. Fremont Insurance will make a matching contribution equal to 50% of the employee’s voluntary contributions to the Plan. In 2005 and 2004, matching contributions were capped at 4.5% and 3%, respectively, of the employee’s eligible compensation. Discretionary contributions are set from year to year by the Compensation Committee and are awarded as a fixed percentage of salary to all participants. |

8

The following table sets forth information concerning 2005 grants of stock options made by Fremont under the Stock-Based Compensation Plan during the fiscal year ended December 31, 2005 to the following Executive Officers:

Option Grants for Year Ended December 31, 2005

| | | | | | | | | | | | | |

Name | | Number of Securities Underlying Options Granted (#)(A) | | Percent of Total Options Granted to Employees in Year Ended 12/31/05 | | | Exercise Price ($/sh) | | Expiration Date | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term |

| | | | | | 5% ($)(B) | | 10% ($)(B) |

Richard E. Dunning | | 200 | | 4.12 | % | | 22.08 | | 12-29-2015 | | 2,777 | | 7,038 |

William A. Hall, Sr. | | 200 | | 4.12 | % | | 22.08 | | 12-29-2015 | | 2,777 | | 7,038 |

Marvin R. Deur | | 400 | | 8.25 | % | | 22.08 | | 12-29-2015 | | 5,554 | | 14,076 |

Kurt M. Dettmer | | 400 | | 8.25 | % | | 22.08 | | 12-29-2015 | | 5,554 | | 14,076 |

| (A) | Options become exercisable in 20% increments each year beginning December 29, 2006. |

| (B) | Represents the value of such option at the end of its 10-year term (without discounting to present value), assuming the market price of the Common Stock appreciates from the exercise price beginning on the grant date at an annually compounded rate of 5% or 10%. These amounts represent assumed rates of appreciation only. Actual gains, if any, will be dependent on overall market conditions and on the future performance of the Common Stock. There can be no assurance that the price appreciation reflected in this table will be achieved. This format is prescribed by the Securities and Exchange Commission and is not intended to forecast future appreciation of shares of the Common Stock. |

Options Value Table

The following table sets forth information concerning exercises and fiscal year end values of Company stock options during the fiscal year ended December 31, 2005 by the following Executive Officers:

Aggregated Option Exercises and Fiscal Year End Option Values

for Year Ended December 31, 2005

| | | | | | | | |

Name | | Shares Acquired on Exercise (#) | | Value Realized ($) | | Number of Securities Underlying Unexercised Options at December 31, 2005 Exercisable/Unexercisable | | Value of Unexercised In-the-Money Options at December 31, 2005 Exercisable/Unexercisable ($)(1) |

Richard E. Dunning | | — | | — | | 1,600/6,600 | | 35,200/140,800 |

William A. Hall, Sr. | | — | | — | | 500/2,200 | | 11,000/44,000 |

Marvin R. Deur | | — | | — | | 700/3,200 | | 15,400/61,600 |

Kurt M. Dettmer | | — | | — | | 600/2,800 | | 13,200/52,800 |

| (1) | Fair market value is $22.00 per share, the last sales price of the Company’s Common Stock on December 31, 2005. |

9

Employment Agreements

On March 16, 2004, the Compensation Committee of Fremont approved employment agreements with Mr. Dunning, Mr. Deur, and Mr. Hall. The agreement for Mr. Dunning provides for a period of employment continuing until the third anniversary of any change in control of Fremont. The term “change in control” as used in the employment agreements is defined as a change in control of a nature that would be required to be reported in response to Item 6(e) of Schedule 14A of Regulation 14A promulgated under the Securities Exchange Act of 1934, as amended (“Exchange Act”), or any successor to such regulation, whether or not Fremont is registered under the Exchange Act; provided that, without limitation, such a change in control shall be deemed to have occurred if: (i) any “person” (as such term is used in Sections 13(d) and 14(d) of the Exchange Act) is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of Fremont representing 25% or more of the combined voting power of Fremont’s then outstanding securities; or (ii) during any period of two consecutive years, individuals who at the beginning of such period constitute the Board of Directors of Fremont cease for any reason to constitute at least a majority of that Board unless the election, or the nomination for election by stockholders, of each new director was approved by a vote of at least two-thirds of the directors then still in office who were directors at the beginning of the period.

The employment agreements for the other two officers provide for a three year employment term, but at least 90 days prior to the annual anniversary date of each agreement, our board of directors may determine whether or not to extend the term of each agreement for an additional one year. Any party to an agreement may elect not to extend that agreement for an additional year by providing written notice at least 90 days prior to any annual anniversary date.

If Mr. Dunning were terminated by Fremont other than for cause, disability, retirement or death, or voluntarily terminates employment for “good reason” due to breach of his employment agreement, then he would be entitled to (i) a cash severance amount equal to 2.99 times his average annual compensation over his most recent three taxable years, payable in equal monthly installments over 36 months (or, at the option of Fremont, in a lump sum payment discounted using the applicable federal rate), and (ii) a continuation of benefits similar to those he is receiving at the time of such termination for the same term. If Mr. Dunning is terminated after a change in control and the amount of the change in control payments constitutes an excess payment under Section 280G of the Internal Revenue Code, Mr. Dunning will also receive an additional cash payment (“Gross-Up”) so that after payment of all applicable excise taxes including those assessed on the change in control payment and the federal, state and local income taxes on the Gross-Up payment, he is placed in the same after-tax position he would have been in if such payments of compensation and benefits had not constituted an excess parachute payment.

If an officer, other than Mr. Dunning, is terminated by Fremont other than for cause, disability, retirement or death, or if the officer voluntarily terminates employment for “good reason” due to breach of his employment agreement after a change in control, then he would be entitled to (i) a cash severance amount equal to 2 times his average annual compensation over his most recent two taxable years, payable in equal monthly installments over 24 months (or at the option of Fremont in a discounted lump sum), and (ii) a continuation of benefits similar to those he is receiving at the time of such termination for the same term.

Although these employment agreements could increase the cost of any acquisition of control of Fremont, we do not believe that their terms would have a significant anti-takeover effect.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following is a report by the Compensation Committee of the Board of Directors of Fremont. The objectives of the report are to provide shareholders with a clear explanation of the overall executive compensation philosophy, strategies, and specific executive compensation plans, and to meet all proxy disclosure rules relating to executive compensation established by regulatory bodies.

10

Compensation Committee

The Compensation Committee is comprised of four (4) non-employee, independent directors appointed from the Board of Directors of Fremont. The Compensation Committee held 2 meetings in 2005. The Compensation Committee is of the opinion that the Company’s objective is to provide incentives to encourage all the Company’s executive officers and employees to perform at the highest level.

During 2005, the Compensation Committee administered executive compensation with the following factors under consideration:

| | • | | Support the acquisition and retention of competent executives, |

| | • | | Deliver the total executive compensation package in a cost-effective manner, |

| | • | | Reinforce key business objectives, |

| | • | | Provide competitive compensation opportunities for competitive results, |

| | • | | Emphasize the enhancement of shareholder value, and |

| | • | | Comply with applicable regulations. |

In establishing appropriate compensation levels, the Compensation Committee analyzes comparative compensation data from three sources specific to the insurance industry. Additionally, the Compensation Committee studies the overall impact of payroll and fringe benefits on the Company by reviewing the Company’s historic payroll-to-premium ratios and the total cost of payroll and fringe benefits for the Company in the current year. Each Executive’s compensation records for the past three years are reviewed and management’s performance reviews and recommendations are considered in the decision on each executive’s level of compensation. The components of executive compensation are designed to encourage decisions and actions that have a positive impact on the overall performance of Fremont. For that reason, these components are focused on executive officers who have the greatest opportunity to influence the achievement of strategic corporate objectives. The major components of the executive pay are summarized below:

| | • | | A market-competitive executive base salary, |

| | • | | Base benefits that are generally available to all employees, and |

| | • | | Cash bonus based on the profitability of the Company. |

The Chief Executive Officer (“CEO”) is evaluated by the Compensation Committee each year. The CEO is evaluated on the overall performance of the Company. The Compensation Committee evaluates the CEO on a broad range of factors relative to the Company’s financial strength and performance. This includes comparing the Company’s performance to other companies engaged in insurance and financial services. All of these factors are given relatively equal weight by the Compensation Committee in evaluating the CEO’s compensation.

The Compensation Committee first seeks to set the CEO’s compensation in light of the standards mentioned above as well as the performance of the Company in relation to expectations of the Board. The compensation of other executives is set by reference to the compensation of the CEO and competitive pay practices in the industry. The Compensation Committee evaluates the performance of the management team annually in relation to opportunities presented to them, challenges addressed by them and the results achieved. This process is partially subjective and is not intended to, and cannot be expected to, result in changes in executive compensation which are in direct proportion to increases or decreases in the Company’s net income, return on equity or any other single quantitative measure or a predetermined combination of quantitative measures during the year.

The Omnibus Budget Reconciliation Act of 1993 (OBRA) Section 162(m) prohibits a publicly owned company from taking a compensation tax deduction for annual compensation in excess of $1,000,000 for any of the Fremont’s executive officers. However, to the extent that it is performance-based and certain guidelines are

11

met, compensation in excess of $1,000,000 is exempt from this limitation. The Compensation Committee does not believe that the deduction limit imposed by OBRA will affect compensation deductibility given the compensation opportunities of Fremont’s executive officers under the existing executive compensation programs. The Compensation Committee notes that none of the Named Officers received annual compensation in excess of $1,000,000. The Compensation Committee will continue to evaluate the potential impact of Section 162(m) and take such actions as it deems appropriate.

/s/ Donald E. Bradford

/s/ William L. Johnson

/s/ Kenneth J. Schuiteman

/s/ Donald VanSingel

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee of our Board of Directors are currently Messrs. Bradford, Johnson, Schuiteman and VanSingel. None of Fremont’s executive officers serves as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving on Fremont’s Board of Directors or Compensation Committee.

MATTER NO. 2

RATIFICATION OF FREMONT MICHIGAN INSURACORP, INC.

STOCK INCENTIVE PLAN OF 2006

Description of the Stock Incentive Plan of 2006

Shareholders are being asked to ratify and approve the Fremont Michigan InsuraCorp, Inc. Stock Incentive Plan of 2006 (the “Plan”), which provides stock compensation to Fremont’s key employees and non-employee directors. The Plan was adopted by the Board of Directors on February 24, 2006. The following summary of major features of the Plan is subject to the specific provisions in the full text of the Plan set forth as Exhibit “A” to this proxy statement.

Pursuant to the Plan, 75,000 shares of Fremont Common Stock will be reserved for future issuance by Fremont, in the form of newly-issued shares in satisfaction of awards under the Plan. If awards should expire, become unexercisable or be forfeited for any reason without having been exercised or without becoming vested in full, the shares of common stock subject to those awards would be available for the grant of additional awards.

The stock purchase price for any stock options granted will not be less than 100% of the fair market value of a share of Common Stock on the date the option is granted. Fremont will not receive any payment for granting stock options. The Plan will be administered by Compensation Committee.

Purpose of the Plan

Fremont management believes Fremont requires a performance-oriented culture, and Fremont will create greater shareholder value if stock ownership levels are provided. The Plan permits Fremont, under the supervision of the Compensation Committee, to make stock option and restricted stock awards to employees and non-employee directors. The purpose of these stock awards is to attract and retain superior people, further align employees and non-employee directors with shareholder interests, closely link employee and non-employee compensation with Fremont’s performance, and maintain high levels of employee and non-employee director

12

stock ownership. The Plan also will become an essential component of the total compensation package offered to key employees and will reflect the importance placed on motivating and rewarding superior results with long-term incentives. Therefore, the ratification and approval of the Plan is vital to Fremont’s ability to achieve its future goals.

Eligibility

Only employees of Fremont and its subsidiaries and affiliates and non-employee directors of Fremont are eligible to receive awards under the Plan. The Compensation Committee will determine which employees and directors will be eligible to receive awards under the Plan.

Awards

Subject to certain limits set forth in the Plan, the Compensation Committee has the discretionary authority to determine the size of an award and any vesting or performance-based requirements. However, no participant shall be granted, during any calendar year, awards with respect to more 7,500 shares. Awards under the Plan may be in the form of nonqualified stock options, restricted stock or other stock-based form, in the discretion of the Compensation Committee. The Compensation Committee, at the time of award, shall provide for a date or dates on which an award will become vested, including a date that may be tied to the satisfaction of one or more performance goals. No awards have been granted or allocated under the Plan and as of this date the Compensation Committee has not made a determination of the amounts or timing of awards that it may grant under the Plan.

Adjustments

In the event of a stock dividend, recapitalization, stock split, reorganization, merger, spin-off, repurchase or exchange of Fremont Common Stock, or similar event affecting Fremont Common Stock, the number and kind of shares granted under the Plan, the number and kind of shares subject to outstanding stock options and restricted stock awards, and the exercise price of outstanding stock options will be adjusted as the Compensation Committee deems appropriate.

Exercise of Stock Options

The exercise price of stock options granted under the Plan may not be less than the fair market value of Fremont Common Stock on the date of grant and the option term may not be longer than 10 years and one month. The Compensation Committee will determine at the time of grant when each stock option becomes exercisable. Payment of the exercise price of a stock option may be in cash by the participant. Fremont will require, prior to issuing Fremont Common Stock under the Plan, that the participant who is an employee remit an amount in cash or Fremont Common Stock sufficient to satisfy any tax withholding requirements.

Vesting of Restricted Stock

Awards of restricted stock lose their restrictions (i.e. the restrictions lapse) at the conclusion of a specified period of continuous employment or service with Fremont, and/or its subsidiary, and/or achievement of performance goals.

Transferability

Stock options granted under the Plan are transferable only as provided by the rules of the Compensation Committee, by the participant’s last will and testament, and by the applicable laws of descent and distribution. Restricted stock may not be sold, transferred, assigned, pledged, or otherwise encumbered or disposed of until the applicable restrictions lapse.

13

Change in Control

Stock options and restricted stock awarded under the Plan will become exercisable and fully vested upon the occurrence of a “change in control,” as defined in the Plan.

Termination, Death, and Retirement

Subject to certain exceptions, the ability to exercise vested stock options will expire thirty days after the termination of a participant’s employment with Fremont or a subsidiary or affiliate or service as a non-employee director of Fremont. Except, in the case of involuntary termination or retirement, stock options will expire three months after termination or retirement of a participant’s employment or service (one year, in the case of death or disability). The Compensation Committee may accelerate or waive any service requirement upon the death or disability of an option holder. The Compensation Committee cannot accelerate or waive performance goals unless a change in control occurs as described more fully in the Plan. Restricted stock awards are generally subject to the same provisions with respect to the acceleration of vesting and performance goals as described above.

Administration of the Plan

The Plan will be administered by the Compensation Committee. The Compensation Committee will select the Fremont employees and non-employee directors who will receive awards, determine the number of shares covered thereby, and establish the terms, conditions, and other provisions of the grants. The Compensation Committee may interpret the Plan and establish, amend, and rescind any rules relating to the Plan.

Amendments

Subject to approval of the Board of Directors where required, the Compensation Committee may terminate, amend, or suspend the Plan, but no action may be taken by the Compensation Committee or the Board of Directors (except those described earlier in the Section entitled “Adjustments”) without the approval of the shareholders to:

| | • | | materially increase the number of shares that may be issued under the Plan; |

| | • | | permit granting of stock options at less than fair market value; |

| | • | | permit the repricing of outstanding stock options; |

| | • | | permit the reload of exercised stock options; or |

| | • | | amend the maximum shares set forth that may be granted as stock options to any employee. |

Tax Consequences

There are no tax consequences to the participant or to Fremont by reason of the grant of a nonqualified stock option. Upon the exercise of a nonqualified stock option, the participant normally will recognize taxable ordinary income equal to the excess, if any, of the shares’ fair market value on the exercise date over the exercise price. For participants who are employees of Fremont, Fremont is required to withhold, from regular wages, an amount based on the ordinary income recognized by the participant. Subject to the provisions of Code Section 162(m) with respect to grants to employees and satisfaction of tax reporting requirements, Fremont will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by a participant. Upon subsequent disposition of the shares acquired upon exercise of a nonqualified stock option, the participant will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such shares plus any amount recognized as ordinary income upon exercise of the nonqualified stock option. Such gain or loss will be long-term or short-term, depending on whether the participant held the shares for more or less than one year.

Code Section 162(m) denies a deduction to any publicly held corporation for compensation paid to certain “covered employees” in a taxable year to the extent that compensation to such covered employee exceeds

14

$1,000,000. Compensation attributable to options when combined with all other types of compensation received by a covered employee from Fremont, may cause this limitation to be exceeded in any particular year. Certain kinds of compensation, including qualified “performance-based compensation,” are disregarded for purposes of the deduction limitation. In accordance with Treasury Regulations issued under Code Section 162(m), compensation attributable to stock options will qualify as performance-based compensation if the award is granted by the Compensation Committee comprised solely of “outside directors” and either: (i) the plan contains a per-employee limitation on the number of shares for which such options may be granted during a specified period, the per-employee limitation is approved by the shareholders, and the exercise price of the option is no less than the fair market value of the shares on the date of grant, or (ii) the option is granted (or exercisable) only upon the achievement (as specified in writing by the Compensation Committee) of an objective performance goal established in writing by the Compensation Committee while the outcome is substantially uncertain, and the option is approved by shareholders.

Restricted stock awards are taxed under Code Section 83. Generally, no tax is due when the award is initially made, but an award becomes taxable when it is no longer subject to a “substantial risk of forfeiture” (i.e., becomes vested or transferable). Income tax is paid on the value of the stock at ordinary rates when the restrictions lapse, and then at capital gain rates on post-exercise appreciation when the shares are sold. Fremont is required to withhold applicable taxes when an award to a participant who is an employee of Fremont becomes vested. Fremont will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the participant.

Other Information

If the Plan is approved by the shareholders, Fremont anticipates that the shares subject to the Plan will be registered with the Securities and Exchange Commission and with any applicable state securities commission where registration is required. The cost of such registration will be borne by Fremont.

As provided above, only employees of Fremont or its subsidiaries and non-employee directors of Fremont will be eligible to receive stock options or restricted stock under the Plan. This includes the executive officers listed in the Summary Compensation Table including under the section entitled “Executive Compensation” in this proxy statement.

Pursuant to Fremont’s bylaws, if a quorum is present, the vote of the majority of the shares present in person or represented by proxy is required to approve this matter. Broker non-votes will not constitute or be counted as “votes” cast for this matter, but will be counted for purposes of determining the presence of a quorum.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTEFOR THE APPROVAL OF THE STOCK INCENTIVE PLAN OF 2006.

15

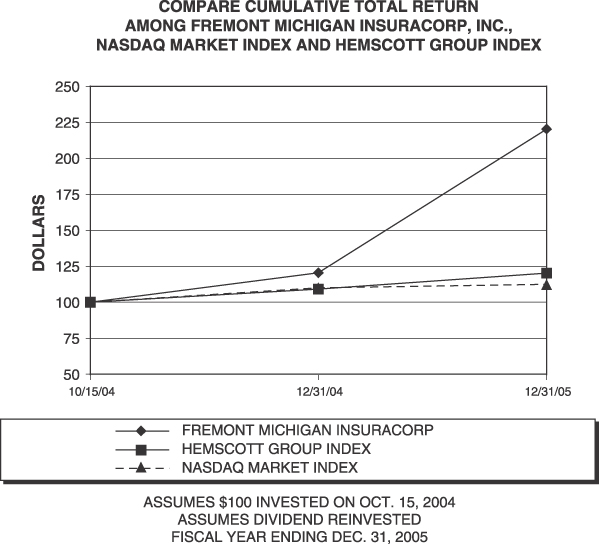

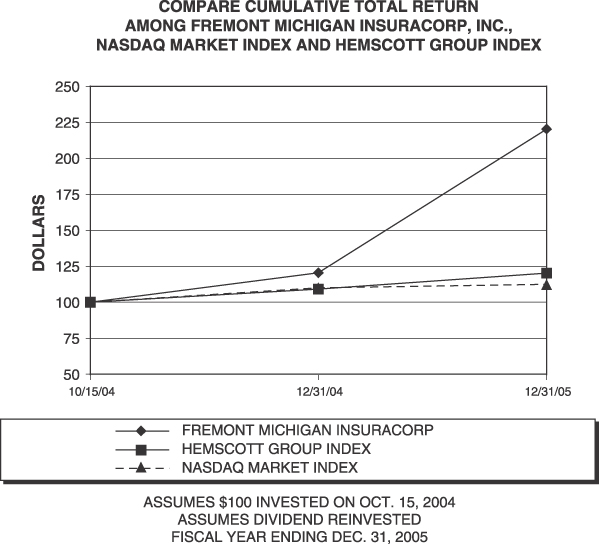

STOCK PERFORMANCE GRAPH

The following line graph compares (i) the cumulative total shareholder return (i.e., the change in share price plus the cumulative amount of dividends, if any, assuming dividend reinvestment, divided by the beginning of the year share price, expressed as a percentage) on the Company’s Class A Common Stock, with (ii) with the cumulative total return of the NASDAQ STOCK MARKET and (iii) with the cumulative total return of an industry peer group (the “Peer Group”) for the period commencing on October 15, 2004, the closing date of the Company’s initial public offering, through December 31, 2005. The Peer Group is the Hemscott Industry Group 432 comprised of 107 property and casualty insurance companies.

16

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors of Fremont is comprised of three independent Directors, Messrs. Hendon, Bradford and Johnson. The Board has determined their independence based on the Nasdaq definition of an independent director. The Audit Committee operates under a written charter adopted by the Board of Directors on September 21, 2004. A copy of the charter was attached to Fremont’s Proxy Statement dated April 7, 2005 for the 2005 Annual Meeting of Shareholders. The Board of Directors has designated Mr. Jack G. Hendon as “audit committee financial expert” of the Audit Committee.

The Audit Committee has reviewed the audited financial statements of Fremont for the fiscal year ended December 31, 2005, and discussed them with management and Fremont’s independent accountants, BDO Seidman, LLP. The Audit Committee also has discussed with the independent accountants the matters required to be discussed by the U.S. Statement of Auditing Standards No. 61.

The Audit Committee has received from the independent accountants the written disclosures and letter required by the U.S. Independence Standards Board Standard No. 1, and the Audit Committee has discussed the accountants’ independence from Fremont and management with the accountants. Furthermore, the Audit Committee has considered whether the fees paid by Fremont to BDO Seidman, LLP and described below are compatible with maintaining BDO Seidman, LLP’s independence from Fremont. Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that Fremont’s audited financial statements for the fiscal year ended December 31, 2005, be included in Fremont’s Annual Report on Form 10-K for that fiscal year for filing with the Securities and Exchange Commission.

This report is submitted on behalf of the members of the Audit Committee:

/s/ Jack G. Hendon, Chairman

/s/ Donald E. Bradford

/s/ William L. Johnson

INDEPENDENT PUBLIC ACCOUNTANTS

BDO Seidman, LLP has audited Fremont’s financial statements for the fiscal year ended December 31, 2005, and the report on such financial statements appears in the Annual Report to Shareholders. Effective May 26, 2005, the Company’s Audit Committee appointed BDO Seidman, LLP to act as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company for the year ended December 31, 2005.

Up until May 26, 2005, the accounting firm of PricewaterhouseCoopers LLP (“PWC”) had acted as the Company’s independent registered accountant to audit the financial statements of the Company and its consolidated subsidiary. On May 26, 2005, Fremont dismissed PricewaterhouseCoopers LLP (“PWC”) as the independent registered public accounting firm for the Company. The Company’s Audit Committee approved the dismissal of PWC as its independent registered public accounting firm. PWC’s reports on the consolidated financial statements of the Company for the years ended December 31, 2004 and 2003 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle. During the years ended December 31, 2004 and 2003 and through May 26, 2005, there were no disagreements with PWC on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PWC, would have caused PWC to make reference to the subject matter of the disagreements in their reports on the Company’s consolidated financial statements for such years. During the years ended December 31, 2004 and 2003 and through May 26, 2005, there have been no reportable events, as defined in Item 304 (a)(1)(v) of the Securities and Exchange Commission’s Regulation S-K. The Company received a letter from PWC stating that they agreed with the above. A copy of such letter was filed as Exhibit 16.1 to Fremont’s Form 8-K filed June 2, 2005.

Representatives of BDO Seidman, LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions from shareholders.

17

Audit Fees of Independent Auditors

The following table sets forth the aggregate fees billed to Fremont and its subsidiary by BDO Seidman, LLP for the fiscal year ended December 31, 2005 and by Pricewaterhouse Coopers, LLP for the years ended December 31, 2005 and December 31, 2004.

| | | |

| BDO Seidman, LLP | | | |

| December 31, 2005 | | | |

Audit Fees | | $ | 155,000 |

Audit-Related Fees | | | — |

Tax Fees | | | — |

| | | |

Total Fees | | $ | 155,000 |

| | | |

| |

| Pricewatershouse Coopers, LLP | | | |

| December 31, 2005 | | | |

Audit Fees | | $ | 19,700 |

Audit-Related Fees | | | — |

Tax Fees | | | 16,500 |

| | | |

Total Fees | | $ | 36,200 |

| | | |

| |

| December 31, 2004 | | | |

Audit Fees | | $ | 186,000 |

Audit-Related Fees | | | 293,000 |

Tax Fees | | | 10,000 |

| | | |

Total Fees | | $ | 489,000 |

| | | |

Audit fees included the audit of Fremont’s annual financial statements, reviews of Fremont’s quarterly financial statements, statutory and regulatory audits, consents and other services related to SEC matters. Audit related fees include accounting consultations related to benefit plan accruals and conversion of financial statements from the statutory method of accounting to GAAP and activities associated with registration of securities with the Securities and Exchange Commission (“SEC”). Tax fees included tax compliance services rendered in connection with federal, state and local income tax returns and transaction planning advice. The Audit Committee may, from time to time, grant pre-approval to those permissible non-audit services classified as “all other services” that it believes are routine and recurring services, and would not impair the independence of the auditor. A list of the SEC’s prohibited non-audit services is attached to the pre-approval policy. The SEC’s rule and relevant guidance will be consulted to determine the precise definitions of these services and the applicability of exceptions to certain of the prohibitions. The pre-approval fee levels for all services to be provided by the independent auditors will be established annually by the Audit Committee. Any proposed services exceeding these levels will require specific pre-approval by the Audit Committee.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services by Independent Auditors

The Audit Committee pre-approves all audit and legally permissible non-audit services provided by the independent auditors in accordance with the pre-approval policies and procedures adopted by the Audit Committee. These services may include audit services, audit-related services, tax services and other services. Under the policy, pre-approved services include pre-approval of non-prohibited services for a limited dollar amount. The Audit Committee may delegate pre-approval authority to one or more of its members. Such member must report any decisions to the Audit Committee at the next scheduled meeting. All services performed by BDO Seidman, LLP in 2005 and PricewaterhouseCoopers, LLP in 2004 and 2005 were pre-approved in accordance with the pre-approval policy.

18

MATTER NO. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of BDO Seidman, LLP to act as the independent registered public accountants to audit the Company’s 2006 consolidated financial statements. We are asking our shareholders to ratify the appointment of BDO as the Company’s independent registered public accounting firm for 2006. The affirmative vote of the holders of a majority of the shares of the Company’s common stock voting in person or by proxy is required to ratify the appointment of the independent registered public accounting firm. Abstentions and broker non-votes will be disregarded for purposes of determining the number of votes counted toward this vote.

If the shareholders fail to ratify the appointment of BDO, the Audit Committee would reconsider its appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in our shareholders’ best interests.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFYING THE APPOINTMENT OF BDO SEIDMAN, LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO AUDIT THE COMPANY’S 2006 CONSOLIDATED FINANCIAL STATEMENTS.

CORPORATE GOVERNANCE DOCUMENTS

A copy of the Company’s Code of Ethics for Senior Financial Officers and the charters of the Company’s Audit Committee and Governance Committee are available on the Company’s website under Investor Information atwww.fmic.comand any shareholder may obtain a printed copy of these documents by writing to Investor Relations, Fremont Michigan InsuraCorp, Inc., 933East Main Street, Fremont, Michigan 49412, by e-mail at: invrel@fmic.com or by calling Investor Relations at (231) 924-0300.

FINANCIAL INFORMATION

A copy of the Company’s Annual Report on Form 10-K, including financial statements and financial statement schedules, for the year ending December 31, 2005 is being mailed along with this proxy statement to all persons solicited.

The Company will provide without charge to each person solicited and all beneficial shareholders upon written request by any such person, a copy of the Company’s Annual Report on Form 10-K, including financial statements and financial statement schedules, required to be filed with the Securities and Exchange Commission pursuant to Rule 13a-1under the Securities Exchange Act for the Company’s most recent fiscal year. The request should be directed to Fremont Michigan InsuraCorp, Inc., 933East Main Street, Fremont, Michigan 49412, Attention: Investor Relations.

OTHER MATTERS

The Board of Directors knows of no other matters to be presented at the Annual Meeting. If, however, any other business should properly come before the Annual Meeting, or any adjournment thereof, it is intended that the proxies will be voted with respect thereto in accordance with the best judgment of the persons named in the proxies.

19

COMPLAINTS AND CONCERNS

Shareholders and other interested parties who desire to communicate directly with the Company’s independent, non-management directors should submit communications in writing addressed to Audit Committee Chairman, Fremont Michigan InsuraCorp, Inc., 933East Main Street, Fremont, Michigan 49412. Shareholders, employees and other interested parties who desire to express a concern relating to accounting or auditing matters should communicate directly with the Company’s Audit Committee in writing addressed to Audit Committee Chairman, Fremont Michigan InsuraCorp, Inc., 933East Main Street, Fremont, Michigan 49412.

SHAREHOLDER PROPOSALS FOR NEXT ANNUAL MEETING

Any shareholder desiring to present a proposal to be considered at the 2007 Annual Meeting of Shareholders should submit the proposal in writing to: Chairman, Fremont Michigan InsuraCorp, Inc., 933East Main Street, Fremont, Michigan 49412 no later than December 3, 2006.

| | | | |

| | | | By Order of the Board of Directors, |

| | |

April 3, 2006 | | | | Corporate Secretary |

20

EXHIBIT “A”

FREMONT MICHIGAN INSURACORP, INC.

STOCK INCENTIVE PLAN OF 2006

February 24, 2006

1. PURPOSES

The general purposes of this Stock Incentive Plan (the “Plan”) are to encourage employees and non-employee directors of Fremont Michigan InsuraCorp, Inc. (the “Company”) and its Affiliates (as defined below) to acquire a proprietary interest in the Company in order to create an increased incentive to contribute to the Company’s future success and prosperity, and to enhance the ability of the Company and its Affiliates to attract and retain exceptionally qualified individuals upon whom the sustained progress, growth, and profitability of the Company depend, thus enhancing the value of the Company for the benefit of its stockholders.

2. DEFINITIONS

“Affiliate” means any entity in which the Company directly or indirectly has a significant equity interest under generally accepted accounting principles and any other entity in which the Company has a significant direct or indirect equity interest as determined by the Committee. The term shall also include any entity which, with respect to the Company, satisfies the definitions of “parent corporation” or “subsidiary corporation” stated in Section 424 of the Code.

“Award”means any Option, Stock Appreciation Right, Restricted Stock, Restricted Stock Unit, Performance Award, Dividend Equivalent, or Other Stock-Based Award granted under the Plan.

“Award Agreement” means a written agreement, contract, or other instrument or document evidencing an Award.

“Board” means the Board of Directors of the Company.

“Code” means the Internal Revenue Code of 1986, as amended.

“Committee” means the Compensation Committee of the Board of Directors.

“Disability” means, with respect to a given Participant at a given time, any medically determinable physical or mental impairment that the Committee, on the basis of competent, medical evidence, reasonably determines has rendered or will render the Participant permanently and totally disabled within the meaning of Section 422(c)(6) of the Code (or such successor section as is in effect at the time).

“Dividend Equivalent” means a right granted under Section 6(e) of the Plan.

“Effective Date” means February 24, 2006, subject to approval by the stockholders of the Company at the 2006 Annual Meeting of Shareholders or any adjournment thereof.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Fair Market Value” means, with respect to a Share on a given date: (a) if the Shares are listed for trading on a national securities exchange (including, for this purpose, the National Market System (“NMS”) of the National Association of Securities Dealers Automated Quotation System (“NASDAQ”)) on that date, the closing Share price on that exchange (or, if there is more then one, the principal such exchange), or, for the NMS, the last sale price, on the day immediately preceding the date as of which fair market value is being determined, or on the next preceding day on which Shares were there traded if no Shares were traded on the immediately preceding day; (b) if the Shares are not listed for trading on any securities exchange (including the NMS) on that date but are reported by NASDAQ, and market information concerning the Shares is published on a regular basis in The

A-1

Wall Street Journal or The New York Times, the average of the daily bid and low asked prices of the Shares, as so published, on the day nearest preceding the date in question for which the prices were published; (c) if (a) is inapplicable and market information concerning the Shares is not regularly published as described in (b), the average of the high bid and low asked prices of the Shares in the over-the-counter market on the day nearest preceding the date in question as reported by NASDAQ (or, if NASDAQ does not report prices for the Shares, another generally accepted reporting service); or (d) if none of the above are applicable, the fair market value of a Share as, of the date in question, determined by the Committee.

“Non-Qualified Stock Option” means an Option that is not an Incentive Stock Option.

“Option” means an option to buy Shares granted under Section 6(a) of the Plan.

“Other Stock-Based Award” means a right granted under Section 6(f) of the Plan.

“Participant” means an employee or non-employee director of the Company or any Affiliate designated to be granted an Award under the Plan.

“Performance Award” means a right granted under Section 6(d) of the Plan.

“Restricted Period”means the period of time during which an Award of Restricted Stock or Restricted Stock Units is subject to transfer restrictions and potential forfeiture.

“Restricted Stock” means a Share granted under Section 6(c) of the Plan.

“Restricted Stock Unit” means a right granted under Section 6(c) of the Plan that is denominated in Shares.

“Rule 16b-3” means Securities and Exchange Commission Rule 16b-3 (or any successor rule or regulation), as applicable with respect to the Company at a given time.

“Section 16” means Section 16 of the Exchange Act and the rules and regulations implementing it, or any successor provision, rule, or regulation in effect at a given time.

“Section 16 Reporting Person” means a person who is a director or officer of the Company for purposes of Section 16.

“Shares” means shares of the Company’s common stock, no par value per share, or such other securities or property as may become the subject of Awards, or become subject to Awards, pursuant to an adjustment made under Section 4 (b) of the Plan.

“Stock Appreciation Right” means a right granted under Section 6(b) of the Plan.

3. ADMINISTRATION

The Committee shall administer the Plan. Subject to the terms and limitations stated in the Plan, and to applicable law, the Committee’s authority shall include without limitation the power to:

(a) designate Participants;

(b) determine the types of Awards to be granted and the times at which Awards will be granted;

A-2

(c) determine the number of Shares to be covered by Awards and any payments, rights, or other matters to be calculated in connection with them;

(d) determine the terms and conditions of Awards and amend the terms and conditions of outstanding Awards, including the acceleration of vesting of rights granted by Awards and the shortening of a Restricted Period;

(e) determine how, whether, to what extent, and under what circumstances Awards may be settled or exercised in cash, Shares, other Awards, or other securities or property, or canceled, forfeited, or suspended;

(f) determine how, whether, to what extent, and under what circumstances cash, Shares, other Awards, other securities or property, or other amounts payable with respect to an Award shall be deferred, whether automatically or at the election of the holder or of the Committee;

(g) determine the methods and procedures for establishing the value of any property (including, without limitation, Shares or other securities) transferred, exchanged, given, or received with respect to the Plan or any Award;

(h) prescribe and amend the forms of Award Agreements and other instruments required under or advisable with respect to the Plan;

(i) interpret and administer the Plan, Award Agreements, Awards, and any contract, document, instrument, or agreement relating to it;

(j) establish, amend, suspend, or waive such rules and regulations and appoint such agents as it shall deem appropriate for the administration of the Plan;

(k) decide all questions and settle all controversies and disputes which may arise in connection with the Plan, Award Agreements, or Awards;

(l) delegate to one or more other directors of the Company (who need not be “non-employee directors” within the meaning of Rule 16b-3) the authority to designate and grant Awards to Eligible Participants, provided those Participants are not Section 16 Reporting Persons; and

(m) make any other determination and take any other action that the Committee deems necessary or desirable for the interpretation, application, or administration of the Plan, Award Agreements, or Awards.

All designations, determinations, interpretations, and other decisions with respect to the Plan, Award Agreements, or any Award shall be within the sole discretion of the Committee, may be made at any time, and shall be final, conclusive, and binding. To the extent that and for so long as the Committee may delegate to one or more other directors its authority to designate Participants and grant Awards as permitted by subsection (l) above, subsequent references in the Plan to the “Committee” shall be construed to include such other director or directors acting pursuant to the delegated authority.

4. SHARES AVAILABLE FOR AWARDS

(a)Shares Available. Subject to adjustment as provided in Section 4(b):

(i)Initial Authorization. The total number of shares of Common Stock for which Awards may be issued under this Plan shall not exceed 75,000 Shares.

(ii)Accounting for Awards. For purposes of this Section 4:

(A) if an Award (other than a Dividend Equivalent) is denominated in Shares, the number of Shares covered by the Award, or to which the Award relates, shall be counted on the date of grant of the Award against the aggregate number of Shares available for granting Awards under the Plan, to the extent determinable on that date, and, as long as the number of Shares is not then determinable, under procedures adopted by the Committee consistent with the purposes of the Plan; and

A-3

(B) Dividend Equivalents and Awards not denominated in Shares shall be counted against the aggregate number of Shares available for granting Awards under the Plan in such amount and at such time as the Committee shall determine under procedures adopted by the Committee consistent with the purposes of the Plan; PROVIDED, HOWEVER, that Awards that operate in tandem with (whether granted simultaneously with or at a different time from), or that are substituted for, other Awards or restricted stock awards or stock options granted under any other plan of the Company may be counted or not counted under procedures adopted by the Committee in order to avoid double counting.

(iii)Sources of Shares Deliverable under Awards. Any Shares delivered pursuant to an Award may consist, in whole or in part, of authorized but unissued Shares or of Shares reacquired by the Company, including but not limited to Shares purchased on the open market.