EXHIBIT 99.1

ENTRÉE GOLD INC.

Amended and Restated Annual Information Form

FOR THE YEAR ENDED

DECEMBER 31, 2009

DATED November 2, 2010

TABLE OF CONTENTS

| DATE OF INFORMATION | | | 3 | |

| | | | | |

| FORWARD LOOKING STATEMENT | | | 3 | |

| | | | | |

| CURRENCY AND EXCHANGE | | | 4 | |

| | | | | |

| DEFINED TERMS AND ABBREVIATIONS | | | 4 | |

| | | | | |

| CANADIAN DISCLOSURE STANDARDS FOR MINERAL RESOURCES AND MINERAL RESERVES | | | 4 | |

| | | | | |

| CORPORATE STRUCTURE | | | 4 | |

| | | | | |

| Name, Address and Incorporation | | | 4 | |

| Intercorporate Relationships | | | 6 | |

| | | | | |

| GENERAL DEVELOPMENT OF THE BUSINESS | | | 6 | |

| | | | | |

| Three Year History | | | 7 | |

| Significant Acquisitions in 2009 | | | 8 | |

| | | | | |

| DESCRIPTION OF THE BUSINESS | | | 9 | |

| | | | | |

| General | | | 9 | |

| Entrée-Ivanhoe Joint Venture | | | 10 | |

| Investment by Ivanhoe Mines and Rio Tinto in Entrée Gold Inc. | | | 11 | |

| Investments by Rio Tinto in Ivanhoe Mines | | | 12 | |

| Environmental Compliance | | | 13 | |

| Competition | | | 14 | |

| Employees | | | 14 | |

| | | | | |

| MATERIALS MINERAL PROPERTIES | | | 14 | |

| | | | | |

| MONGOLIA | | | 15 | |

| Lookout Hill Property | | | 15 | |

| History | | | 16 | |

| Property Location and Accessibility | | | 17 | |

| Climate | | | 17 | |

| Regional Geology | | | 17 | |

| Mongolian Government | | | 18 | |

| Joint Venture Property - Mineral Resources | | | 18 | |

| Joint Venture Property - Mineral Reserves | | | 21 | |

| Integrated Development Plan 2010 | | | 22 | |

| Recent Developments - Entrée-Ivanhoe Joint Venture Property | | | 26 | |

| Shivee West | | | 26 | |

| USA | | | 27 | |

| Ann Mason Property | | | 27 | |

| Location, Accessibility, Climate and Local Resources | | | 27 | |

| History | | | 28 | |

| Mineral Resource Estimate | | | 29 | |

| Sampling and Analysis | | | 29 | |

| Current Exploration Program | | | 29 | |

| | | | | |

| NON-MATERIAL PROJECTS | | | 30 | |

| Mongolia - Togoot - Nomkhon Bohr | | | 30 | |

USA - Blackjack and Roulette - Nevada | | | 30 | |

| USA - Empirical Discovery Agreement 2007 | | | 31 | |

| USA - Empirical Discovery Agreement 2008 | | | 31 | |

| CHINA - Huaixi | | | 32 | |

| CANADA - Crystal | | | 33 | |

| AUSTRALIA - Blue Rose Joint Venture | | | 33 | |

| AUSTRALIA - Mystique Joint Venture | | | 34 | |

| AUSTRALIA - Corktree Joint Venture | | | 34 | |

| AUSTRALIA - Northling Joint Venture | | | 34 | |

| PERU - Lukkacha Project | | | 34 | |

| | | | | |

| RISK FACTORS | | | 35 | |

| | | | | |

| DIVIDENDS | | | 45 | |

| | | | | |

| CAPITAL STRUCTURE | | | 45 | |

| | | | | |

| MARKET FOR SECURITIES | | | 45 | |

| | | | | |

| ESCROWED SECURITIES | | | 46 | |

| | | | | |

| DIRECTORS AND OFFICERS | | | 46 | |

| | | | | |

| PROMOTERS | | | 54 | |

| | | | | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | | 54 | |

| | | | | |

| INTEREST IN MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 54 | |

| | | | | |

| TRANSFER AGENTS AND REGISTRARS | | | 54 | |

| | | | | |

| MATERIAL CONTRACTS | | | 54 | |

| | | | | |

| INTEREST OF EXPERTS | | | 56 | |

| | | | | |

| ADDITIONAL INFORMATION | | | 56 | |

APPENDIX

ENTRÉE GOLD INC.

ANNUAL INFORMATION FORM

DATE OF INFORMATION

Unless otherwise specified in this Annual Information Form, the information herein is presented as at December 31, 2009, the last date of the Company’s most recently completed financial year.

FORWARD LOOKING STATEMENT

This Annual Information Form (the “AIF”) and documents incorporated by reference herein contain “forward-looking statements” and “forward looking information” (together the “forward looking statements”) within the meaning of securities legislation and the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date of this AIF or, in the case of documents incorporated by reference herein, as of the date of such documents and the Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable securities laws.

Forward-looking statements include, but are not limited to, the future price of gold and copper, the estimation of mineral reserves and resources, the realization of mineral reserve and resource estimates, the timing and amount of estimated future production, costs of production, capital expenditures, cost and timing of the development of new deposits, success of exploration activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims and limitations on insurance coverage. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" or “does not expect”, “is expected”, “budget� 221;, “scheduled”, "estimates", “forecasts”, “intends”, “anticipates”, or “does not anticipate” or “believes” or variations of such words and phrases or statements that certain actions, events or results "may", “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of the Company’s future performance and are subject to risks, uncertainties, assumptions and other factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Such factors and assumptions include, amongst others, the effects of general economic conditions, changing foreign exchange rates and actions b y government authorities, uncertainties associated with legal proceedings and negotiations and misjudgements in the course of preparing forward-looking statements. In addition, there are also known and unknown risk factors which may cause the actual results, performances or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, risks related to international operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold and copper; possible variations in ore reserves, grade recovery and rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining government approvals or financi ng or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Risk Factors” in this AIF. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

CURRENCY AND EXCHANGE

The Company’s financial statements are stated in United States dollars and are prepared in conformity with United States Generally Accepted Accounting Principles.

In this AIF, all dollar amounts are expressed in U.S. dollars unless otherwise specified. Because the Company’s principal executive office is located in Canada, many of its obligations are and will continue to be incurred in Canadian dollars (including, by way of example, salaries, rent and similar expenses). Where the disclosure is not derived from the annual financial statements for the year ended December 31, 2009, the Company has not converted Canadian dollars to U.S. dollars for purposes of making the disclosure in this AIF.

DEFINED TERMS AND ABBREVIATIONS

As used in this AIF, the terms "we", "us", "our", “the Company” and "Entrée" mean Entrée Gold Inc. and its wholly-owned subsidiaries.

CANADIAN DISCLOSURE STANDARDS FOR MINERAL RESOURCES AND MINERAL RESERVES

Canadian disclosure standards for the terms “Mineral Reserve,” “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which adopts the definitions of the terms ascribed by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) in the CIM Standards on Mineral Resources and Mineral Reserves, as may be amended from time to time by the CIM.

The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in the United States Securities and Exchange Commission ("SEC") Industry Guide 7. Under SEC Guide 7 standards, a "Final" or "Bankable" feasibility study is required to report reserves, the three year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. "Inferred Mineral Resources" may only be separately disclosed, have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian ru les, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of our mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CORPORATE STRUCTURE

Name, Address and Incorporation

Entrée Gold Inc. is an exploration stage company engaged in the exploration of mineral resource properties located in Mongolia, the USA, Peru, Australia, China and Canada. The Company’s principal executive office is located at:

Suite 1201 - 1166 Alberni Street

Vancouver, British Columbia, Canada V6E 3Z3

Phone: (604) 687-4777

Fax: (604) 687-4770

Website: www.entreegold.com.

Information contained on the Company’s website does not form part of this AIF. The Company’s registered and records office is at 2900-550 Burrard Street, Vancouver, BC, Canada V6C 0A3 and its agent for service of process in the United States of America is National Registered Agents, Inc., 1090 Vermont Avenue NW, Suite 910, Washington, DC 20005.

The Company maintains an administrative office in Ulaanbaatar, the capital of Mongolia, to support Mongolian operations. The address of the Mongolian office is:

Jamyan Gun Street-5

Ar Mongol Travel Building

Suite #201, #202,

Sukhbaatar District, 1st Khoroo,

Ulaanbaatar, Mongolia

Phone: 976.11.318562 / 330953

Fax: 976.11.319426

The Company maintains an administrative office in Golden, Colorado to support US operations at the following address:

2221 East Street, Suite 210,

Golden, CO 80401

Our Company was incorporated in British Columbia, Canada, on July 19, 1995, under the name Timpete Mining Corporation. On February 5, 2001, we changed our name to Entrée Resources Inc. On October 9, 2002 we changed our name from Entrée Resources Inc. to Entrée Gold Inc. and, on January 22, 2003, we changed our jurisdiction of domicile from British Columbia to the Yukon Territory by continuing our company into the Yukon Territory. On May 27, 2005, the Company changed the governing jurisdiction from the Yukon Territory to British Columbia by continuing into British Columbia under the British Columbia Business Corporation Act.

At inception our Memorandum and Articles authorized us to issue up to 20 million common shares without par value. On September 30, 1997, we subdivided our authorized capital on a two new shares for one old share basis, resulting in authorized capital of 40 million common shares without par value. On February 5, 2001, we subdivided our common shares on a four new shares for one old share basis, thus increasing our authorized capital to 160 million common shares without par value and simultaneously reduced our authorized capital to 100 million common shares without par value. On October 9, 2002 we consolidated our authorized capital, both issued and unissued, on the basis of one new share for each two old shares, resulting in authorized capital of 50 million common shares without par value and simultaneou sly increased the authorized capital from 50 million common shares without par value to 100 million common shares without par value. On May 20, 2004, we received approval from our shareholders to increase our authorized share capital from 100 million common shares without par value to an unlimited number of common shares, all without par value (the “Entrée Shares”). This increase became effective June 16, 2004, the date we filed the amendment to our Articles.

The Entrée Shares traded on the TSX Venture Exchange until 24 April 2006. On 24 April 2006, Entrée began trading on the Toronto Stock Exchange (“TSX”) under the symbol “ETG”. The Entrée Shares also trade on the NYSE Amex, formerly the American Stock Exchange, under the symbol “EGI” and on the Frankfurt Stock Exchange under the symbol “EKA”.

Intercorporate Relationships

We own our property interests through the 19 subsidiaries set out in our organizational chart below. All of our subsidiaries are 100% owned.

*Entrée LLC holds the Shivee Tolgoi and Javhlant mining licences in Mongolia. A portion of the Shivee Tolgoi mining licence area and all of the Javhlant mining licence area are held beneficially for a joint venture between Entrée and Oyu Tolgoi LLC (“OT LLC”). OT LLC is owned as to 66% by Ivanhoe Mines Ltd., and as to 34% by the Government of Mongolia. Unless the context otherwise requires, OT LLC and Ivanhoe Mines Ltd. are together, “Ivanhoe Mines”. See “Summary Description of the Business” below. The balance of the Shivee Tolgoi mining licence area is 100% owned by Entrée.

**MIM (USA) Inc. holds the Ann Mason project in Nevada, United States. The project is 100% owned by Entrée.

GENERAL DEVELOPMENT OF THE BUSINESS

The Company is actively engaged in looking for properties to acquire and manage, which are complementary to its existing projects, particularly large tonnage base and precious metal targets in eastern Asia and the Americas.

The commodities the Company is most likely to pursue include copper, gold and molybdenum, which are often associated with large tonnage, porphyry related environments. Our material properties are the Lookout Hill project in Mongolia, and the Ann Mason project in Nevada, United States. We also have interests in early exploration stage properties in Mongolia, United States, Australia, Canada, Peru and China.

Smaller, higher grade systems will be considered by the Company if they demonstrate potential for near-term production and cash-flow. If the Company is able to identify smaller, higher grade bodies that may be indicative of concealed larger tonnage mineralized systems, it may negotiate and enter into agreements to acquire them.

Three Year History

The following is a timeline summarizing Company activities in the last three years, with reference to further discussion in relevant sections contained within this AIF:

| March 2007 | The Company announced an updated resources estimate for the Hugo North Extension deposit, Lookout Hill project, Mongolia. | Pg 18 |

| June 2007 | Exercise of warrants by Rio Tinto Exploration Canada Inc. (“Rio Tinto”) and Ivanhoe Mines Ltd. (at a premium to market) resulting in over C$20 million added to the Company’s treasury. | Pg 12 |

| August 2007 | The Company entered into an option agreement with Empirical Discovery LLC (“Empirical”) to explore targets in southeast Arizona and southwest New Mexico. | Pg 31 |

| November 2007 | The Company completed a short form prospectus offering for gross proceeds of C$30 million (the “Treasury Offering”). | Pg 12 |

| November 2007 | Rio Tinto and Ivanhoe Mines Ltd. exercised their pre-emptive rights to maintain ownership resulting in over C$13 million added to the Company’s treasury. | Pg 32 |

| November 2007 | The Company entered into an agreement with Zhejiang No. 11 Geological Brigade to explore for copper in Zhejiang Province, China. | Pg 30 |

| January 2008 | The Company entered into a second option agreement with Empirical to explore on licences near Bisbee, Arizona. | Pg 31 |

| March 2008 | The Company announced the first Heruga deposit resource estimate, Lookout Hill project, Mongolia. | Pg 20 |

| June 2008 | OT LLC completed its earn-in requirements, including expenditures of $35 million resulting in the formation of a joint venture on a portion of the Lookout Hill property. | Pg 10 |

| August 2008 | Discovery of coal at Nomkhon Bohr on the Company’s Toogoot exploration licence in Mongolia. | Pg 29 |

| January 2009 | Discovery of porphyry style mineralization at Lordsburg, New Mexico. | Pg 32 |

| July 2009 | The Company entered into an agreement with Honey Badger Exploration Inc. (“Honey Badger”) to option the Blackjack property in Nevada. | Pg 30 |

| July 2009 | The Company’s agreement with Rio Tinto expired, however, Rio Tinto retains a pre-emptive right to maintain its ownership percentage. | Pg 12 |

| September, 2009 | The Company entered into an agreement with Bronco Creek Exploration Inc. (now a subsidiary of Eurasian Minerals Ltd., collectively, “Bronco Creek”) to option the Roulette property in Nevada. | Pg 30 |

| September 2009 | The Company entered into an agreement with Taiga Consultants Ltd. (“Taiga”) to option the Crystal property in central British Columbia. | Pg 32 |

| October 2009 | Investment Agreement (the “Investment Agreement”) is signed in Mongolia (by Ivanhoe Mines Ltd., Oyu Tolgoi LLC and Rio Tinto International Holdings Ltd.) which is subject to 10 conditions precedent to be satisfied before it is finalized. | Pg 18 |

| October 2009 | Shivee Tolgoi and Javhlant (Lookout Hill) mining licences received. | Pg 15 |

| November 2009 | The Company entered into a Scheme Implementation Agreement with PacMag Metals Limited (“PacMag”), to acquire all outstanding shares and options through Australian Schemes of Arrangement. | Pg 8 |

| March 2010 | The Company announced an updated Heruga deposit resource estimate, Lookout Hill project, Mongolia. | Pg 20 |

| March 2010 | The conditions precedent included in the Investment Agreement are satisfied and the Investment Agreement takes legal effect. | Pg 18 |

| May 2010 | The Company announces the first NI 43-101 compliant ore reserves defined on the Hugo North Extension deposit and the release of the 2010 Integrated Development Plan by Ivanhoe Mines Ltd. | Pg 19 |

| June 2010 | The Company announces that it has commenced drilling programs on the Blackjack and Roulette copper projects. | Pg 30 |

| June 2010 | The Company announces the filing of a comprehensive NI 43-101 compliant technical report for Lookout Hill, which includes information from Ivanhoe’s 2010 Integrated Development Plan. | Pg 21 |

| June 2010 | The Company announces that it has completed its acquisition of PacMag. | Pg 8 |

| July 2010 | The Company announces the receipt of its Togoot mining licence which includes the Nomkhon Bohr coal discovery. | Pg 29 |

| September 2010 | The Company announces an agreement to acquire a majority interest in the Lukkacha project in Peru. | Pg 34 |

| September 2010 | The Company announces an agreement to option the iron ore rights of the Blue Rose joint venture to Bonython Metals Group Pty Ltd. | Pg33 |

| September 2010 | The Company announced the discovery of a new porphyry system on the Roulette property, Nevada. | Pg 31 |

Significant Acquisitions

In June 2010, the Company closed a transaction with PacMag Metals Limited (“PacMag”), whereby the Company acquired all of the outstanding shares and options of PacMag through Australian Schemes of Arrangement (the “Schemes”). Implementation of the Schemes was overwhelmingly supported by the shareholders and optionholders of PacMag on June 4, 2010 and final approval was granted by the Federal Court of Australia on June 15, 2010, with the Schemes becoming effective on June 16, 2010. All regulatory and administrative matters were addressed and the transaction closed as of June 30, 2010 (the “Effective Date”). Consideration for the PacMag shares acquired were payable with a combination of Entrée Shares and cash, with the cash consideration calculated using the Bank o f Canada noon rate as of the Effective Date, which was June 16, 2010. Trading of PacMag shares on the Australian Securities Exchange (“ASX”) was suspended as of June 16, 2010. Each PacMag shareholder received 0.1018 Entrée Shares and C$0.0415 (AUD$0.0469) cash for each PacMag share. In addition, Entrée acquired all outstanding PacMag options for aggregate consideration of 293,610 Entrée Shares and C$387,479. The aggregate consideration payable by Entrée for all PacMag shares and options was 15,020,801 Entrée Shares and C$6,533,000. With the acquisition of PacMag, Entrée acquired the Ann Mason property located in the Yerington district of Nevada. The acquisition of PacMag also brought other projects in South Australia, Western Australia, Nevada, North Dakota and Arizona into the Company’s portfolio.

A Form 51-102F4 The Business Acquisition Report with respect to the acquisition of PacMag was filed on SEDAR on November 1, 2010.

DESCRIPTION OF THE BUSINESS

General

The Company is in the mineral resource business. This business generally consists of three stages: exploration, development and production. Mineral resource companies that are in the exploration stage have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage. The Company is in the exploration and development stage.

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land and mineral rights or the acquisition of specific, but limited mineral rights to the land (e.g., a license, lease or concession). After acquisition, exploration typically begins with a surface examination by a professional geologist with the aim of identifying areas of potential mineralization, followed by detailed sampling and mapping of rock exposures along with possible geophysical and geochemical grid surveys over un-exposed portions of the property (i.e., underground), and possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonl y includes systematic regularly-spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, and in sufficiently-advanced properties, gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. Exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

The Company’s primary property asset is the Lookout Hill property in Mongolia, which is comprised of two mining licences: Shivee Tolgoi and Javhlant. The Shivee Tolgoi and Javhlant mining licences completely surround Oyu Tolgoi LLC’s Oyu Tolgoi project, and host the Hugo North Extension of the Hugo Dummett North copper-gold deposit and the Heruga copper-gold-molybdenum deposit. These deposits are located within a land area subject to a joint venture between Entrée and Ivanhoe Mines (the “Entrée-Ivanhoe Joint Venture”).

A map is provided on page 16 to illustrate the areas of Lookout Hill more clearly, and further detail regarding the Lookout Hill project in Mongolia is described under “Material Mineral Properties” below.

Entree’s project portfolio includes an additional key asset, the recently acquired Ann Mason porphyry deposit in Nevada, which is 100% owned by Entree. The Ann Mason deposit, which has an inferred mineral resource, was acquired as part of the PacMag transaction which closed in June 2010. The map on page 28 shows the project location and proximity to infrastructure. More information about the Ann Mason project is provided in the “Material Mineral Properties” section beginning on page 14.

Aside from its two material projects, Entrée has exploration projects in Mongolia, the USA, China, Australia, Canada and Peru. Please see the “Non-Material Projects” section beginning on page 30 for more information.

The Company's exploration activities are under the supervision of Robert Cann, P.Geo., Entrée's Vice President, Exploration. Mr. Cann is a "qualified person" as defined in NI 43-101. Except where otherwise noted, Mr. Cann is also responsible for the preparation of technical information in this AIF.

All mineral rock samples from our Mongolian properties are prepared and analyzed by SGS Mongolia LLC in Ulaanbaatar, Mongolia. Coal samples from Mongolia have been prepared and analyzed by SGS Mongolia LLC and by SGS-CSTC Standards Technical Services Co., Ltd., Tianjin, China, and more recently by ACTLABS in Ulaanbaatar. Coal check samples were analyzed at Loring Laboratories Ltd. in Calgary, Canada. Samples from Arizona, New Mexico and Nevada are analyzed at ALS Chemex in Sparks, Nevada, at Skyline Assayer and Laboratories, Tuscon, Arizona and at Acme Analytical Laboratories, Vancouver, British Columbia, Canada. All samples from China are analyzed at ALS Chemex, Guangzhou and at SGS-CSTC Standards Technical Services Co., Ltd., Tianjin. Samples from the Crystal Property, BC are analyzed at Loring Labora tories Ltd. in Calgary, Canada and at Acme Analytical Laboratories, Vancouver.

Entree-Ivanhoe Joint Venture

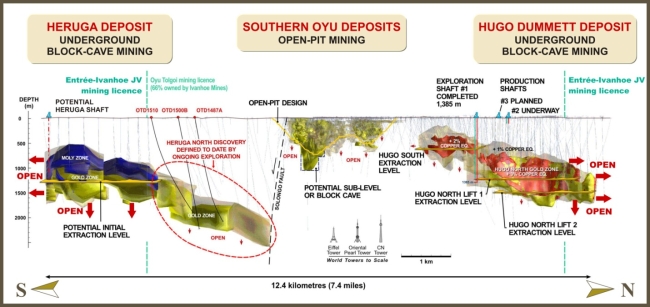

Entrée entered into an arm’s-length Equity Participation and Earn-In Agreement (the “Earn-In Agreement”) in October 2004 with Ivanhoe Mines Ltd., a portion of which was subsequently assigned to Oyu Tolgoi LLC. Oyu Tolgoi LLC holds title to the Oyu Tolgoi mining licence located adjacent to and surrounded by Entrée’s Lookout Hill property. The Oyu Tolgoi project is comprised of a series of deposits containing copper, gold, silver and molybdenum, being developed by Oyu Tolgoi LLC, and includes the Joint Venture Property. The deposits stretch over 12 kilometres (“km”), from the Hugo Dummett North deposit in the north through the adjacent Hugo Dummett South deposit, through to the Southern Oyu deposits and extending to the Heruga deposit in the south. & #160;Hugo Dummett North extends onto the Shivee Tolgoi mining licence, where it is known as the Hugo North Extension; the Heruga copper-gold-molybdenum deposit is within the Javhlant mining licence but mineralization extends north across the licence boundary towards the Southwest Deposit on the Oyu Tolgoi licence.

Figure 1 - Idealized Profile of Southern Oyu, Hugo Dummett and Heruga Deposits (Section Looking West)

The Earn-in Agreement provided that Oyu Tolgoi LLC would have the right, subject to certain conditions outlined in the Earn-in Agreement, to earn a participating interest in a mineral exploration project and, if warranted, a development and mining project on a portion of the Lookout Hill property (the “Joint Venture Property”). Under the Earn-in Agreement, Oyu Tolgoi LLC would conduct exploration activities in an effort to determine if the Oyu Tolgoi mineralized system extended onto the Joint Venture Property. Following execution of the Earn-in Agreement, Oyu Tolgoi LLC undertook an aggressive exploration program, which eventually confirmed the presence of two resources on Lookout Hill within the Joint Venture Property: the Hugo North Extension indicated and inferred resource to the north of Oyu Tolgoi , and the inferred resource of the Heruga deposit to the south of Oyu Tolgoi.

As of June 30, 2008, Oyu Tolgoi LLC had expended a total of $35 million on exploration on the Joint Venture Property and in accordance with the Earn-In Agreement, Entrée and Oyu Tolgoi LLC formed the Entrée-Ivanhoe Joint Venture. As of the year ended December 31, 2009, the Entrée-Ivanhoe Joint Venture expended approximately $2.5 million. Oyu Tolgoi LLC has contributed Entrée’s 20% portion of the expenditures as an advance against future earnings.

By expending over $35 million in exploration and development, Oyu Tolgoi LLC earned an 80% interest in minerals deeper than 560 metres extracted from below the surface on the Joint Venture Property and a 70% interest in minerals above that elevation. The Company can elect to be carried to production by Oyu Tolgoi LLC through debt financing at prime +2% (set by the Royal Bank of Canada) or Oyu Tolgoi LLC’s cost of capital, whichever is less, with Entree’s share of development costs repaid only from 90% of future production cash flow. This stipulation prevents dilution of Entrée’s interest as the project progresses.

Certain of Ivanhoe Mines Ltd.'s rights and obligations under the Earn-In Agreement, including a right to nominate one member of our Board of Directors, a pre-emptive right to enable Ivanhoe Mines Ltd. to preserve their ownership percentage in our Company, and an obligation to vote their shares as our Board of Directors directs on certain matters, expired with the formation of the Entrée-Ivanhoe Joint Venture. Oyu Tolgoi LLC’s right of first refusal to the remainder of Lookout Hill is maintained with the formation of the Entree-Ivanhoe Joint Venture.

Management believes that both the initial Earn-in Agreement and the Entrée-Ivanhoe Joint Venture are of significant benefit to the Company. The Earn-in Agreement enabled us to raise money that the Company used to pursue exploration activities on the balance of the Lookout Hill property and elsewhere. It also enabled the exploration of the Joint Venture Property at little or no cost to the Company, leading to the delineation of indicated and inferred mineral resource estimates for the Hugo North Extension and the discovery and subsequent definition of a significant inferred resource on the Heruga deposit.

Investment by Ivanhoe Mines and Rio Tinto in Entrée Gold Inc.

Under the terms of the Earn-In Agreement, Ivanhoe Mines Ltd. purchased 4.6 million Entrée Shares with a full warrant attached for C$4.6 million, which was a premium to market at the time.

In June 2005, Rio Tinto plc, through its subsidiary Rio Tinto Exploration Canada Inc. (formerly Kennecott Canada Exploration Inc.) (“Rio Tinto”), completed a private placement into Entrée, whereby it purchased 5,665,730 units at a price of C$2.20 per unit, which consisted of one Entrée Share and two warrants (one “A” warrant and one “B” warrant). Two “A” warrants entitled Rio Tinto to purchase one Entrée Share for C$2.75 within two years; two “B” warrants entitled Rio Tinto to purchase one Entrée Share for C$3.00 within two years. Proceeds from Rio Tinto’s investment were $10,170,207.

In June 2005, Ivanhoe Mines Ltd. exercised its unit warrants and purchased 4.6 million Entrée Shares at C$1.10 per Entrée Share, resulting in proceeds to Entrée of C$4,069,214, in order to preserve its pre-emptive right to maintain proportionate ownership of Entree Shares. Ivanhoe Mines Ltd. then exercised its pre-emptive right in July 2005 and took part in the private placement, purchasing 1,235,489 units, resulting in further proceeds to Entrée of C$2,217,209. Rio Tinto purchased an additional 641,191 units of the private placement to maintain proportional ownership, resulting in further proceeds of C$1,150,681.

On June 27, 2007, Rio Tinto exercised its “A” and “B” warrants that were due to expire in order to maintain its percentage ownership of the Entrée Shares and the Company issued 6,306,920 Entrée Shares for cash proceeds of C$17,051,716.

On June 29, 2007, Ivanhoe Mines Ltd. exercised its “A” and “B” warrants that were due to expire in order to maintain its percentage ownership of the Entrée Shares and the Company issued 1,235,488 Entrée Shares for cash proceeds of C$3,340,327.

On November 26, 2007, Entrée closed a short form prospectus offering of 10 million Entrée Shares at a price of C$3.00 per Entrée Shares for gross proceeds of C$30 million (the “Treasury Offering”) pursuant to an underwriting agreement between the Company and BMO Nesbitt Burns (the “Underwriter”). The Underwriter received a fee of C$1.8 million, being 6% of the gross proceeds of the Treasury Offering.

On November 26, 2007, in order to maintain its percentage ownership of Entrée Shares, Ivanhoe Mines Ltd. exercised its pre-emptive rights and acquired, concurrently with the closing of the Treasury Offering, an aggregate of 2,128,356 Entrée Shares at a price of C$3.00 per Entrée Shares for additional gross proceeds of C$6,385,068.

On November 26, 2007, in order to maintain its percentage ownership of Entrée Shares, Rio Tinto exercised its pre-emptive rights and acquired, concurrently with the closing of the Treasury Offering, an aggregate of 2,300,284 Entrée Shares at a price of C$3.00 per Entrée Shares for additional gross proceeds of C$6,900,852.

At December 31, 2009, Ivanhoe Mines Ltd. owned approximately 14.2% of the issued and outstanding Entrée Shares.

At November 1, 2010, Ivanhoe Mines Ltd. owned approximately 12.1% of the issued and outstanding Entrée Shares .

At December 31, 2009, Rio Tinto owned approximately 15.4% of the issued and outstanding Entrée Shares.

At November 1, 2010, Rio Tinto owned approximately 13.1% of the issued and outstanding Entrée Shares.

Rio Tinto is no longer required to vote its Entrée Shares as the Company’s Board of Directors directs on matters pertaining to fixing the number of directors to be elected, the election of directors, the appointment and remuneration of auditors and the approval of any corporate incentive compensation plan or any amendment thereof. Rio Tinto retains the right to preserve its ownership percentage in the Company, unless their proportionate share falls below 10% of the issued and outstanding Entrée Shares.

Investment by Rio Tinto in Ivanhoe Mines

In October 2006, Rio Tinto plc announced that it had agreed to invest up to $1.5 billion to acquire up to a 33.35% interest in Ivanhoe Mines Ltd. through its subsidiary Rio Tinto International Holdings Limited (“Rio Tinto Holdings”). The proceeds from this investment were targeted to fund the joint development of the Oyu Tolgoi project. An initial tranche of $303 million was invested to acquire 9.95% of the outstanding shares of Ivanhoe Mines Ltd. On September 12, 2007, Rio Tinto announced that Rio Tinto Holdings would provide Ivanhoe Mines Ltd. with a convertible credit facility of $350 million for interim financing for the Oyu Tolgoi project. The credit facility was directed at maintaining the momentum of mine development activities at Oyu Tolgoi while Ivanhoe Mines Ltd. and Rio Tinto Holdings worked towards finalising an Investment Agreement (“Investment Agreement”) with the Government of Mongolia, which was completed on March 31, 2010. If converted, this investment could result in Rio Tinto Holdings owning 46.65% of Ivanhoe Mines Ltd.

Rio Tinto plc and Ivanhoe Mines Ltd. announced in October 2009 that Rio Tinto Holdings intended to complete the Tranche 2 private placement financing (as defined within the October 2006 agreement). With the completion of this financing, which totalled $388 million, on October 29, 2009, Rio Tinto Holdings increased its equity ownership in Ivanhoe Mines Ltd. to 19.7%. In February 2010, Rio Tinto plc announced that it had agreed to invest, through subsidiaries, a further $232,400,000 to acquire 15,000,000 common shares in satisfaction of the purchase price for key mining and milling equipment for the Oyu Tolgoi mining complex. The investment in February increased Rio Tinto plc’s ownership, through its subsidiaries, to 22.4% of Ivanhoe Mines Ltd.’s outstanding common shares.

On June 29, 2010, Ivanhoe Mines Ltd. announced that Rio Tinto Holdings had exercised the 46,026,522 Series A warrants it held, for an additional $393.1 million investment in Ivanhoe Mines Ltd., which raised Rio Tinto Holdings’ ownership to 29.6% of outstanding Ivanhoe Mines Ltd. common shares. Proceeds from the exercise of the warrants were to be used to help fund the development and construction of the Oyu Tolgoi mining complex.

On September 13, 2010, Ivanhoe Mines Ltd. announced that it had converted Rio Tinto Holdings’ maturing $350 million convertible credit facility, plus accrued interest of $50.8 million, into approximately 40.1 million common shares of Ivanhoe Mines Ltd., increasing Rio Tinto Holdings’ ownership in Ivanhoe Mines Ltd. from 29.6% to 34.9%.

Environmental Compliance

The Company’s current and future exploration and development activities, as well as future mining and processing operations, if warranted, are subject to various federal, state and local laws and regulations in the countries in which we conduct our activities. These laws and regulations govern the protection of the environment, prospecting, development, production, taxes, labour standards, occupational health, mine safety, toxic substances and other matters. Company management expects to be able to comply with those laws and does not believe that compliance will have a material adverse effect on our competitive position. The Company intends to obtain all licenses and permits required by all applicable regulatory agencies in connection with our mining operations and exploration activities. � 60;The Company intends to maintain standards of compliance consistent with contemporary industry practice.

Mongolia

Holders of an exploration or mining licence in Mongolia must comply with environmental protection obligations established in the Environmental Protection Law of Mongolia, Law of Environmental Impact Assessment and the Minerals Law. These obligations include: preparation of an Environmental Impact Assessment (EIA) for exploration and mining proposals; submitting an annual environmental protection plan; posting an annual bond against completion of the protection plan; and submitting an annual environmental report.

Environmental bonds have been paid to the local governments, Khanbogd and Bayan-Ovoo Soums, for restoration and environmental management works required for exploration work undertaken at Lookout Hill. The environmental bond requirements were recently changed with the 2006 amendments to the Minerals Law, with the bonds now required to be paid to the government ministry in charge of environment. Entree is awaiting the implementation of administrative procedures for the new bonding requirements prior to transferring the bonds to the government ministry in charge of environment. Entree pays to the local soums annual fees for water, land and road usage.

2010 exploration work planned and completed on the portion of the Shivee Tolgoi mining licence that is not subject to the Entrée-Ivanhoe Joint Venture (“Shivee West”) will include drill pad construction which involves surface disturbance and excavation. Bonds remain in place at Bayan-Ovoo and Khanbogd soums equal to approximately $900 each. These bonds cover environmental reclamation to the end of 2010. These amounts are refundable to the Company on request once all environmental work has been completed to the satisfaction of the local soum.

Entree also pays annual fees for water, land and road usage to the local soums.

Development and exploration on the Entrée – Ivanhoe Joint Venture is controlled and managed by Oyu Tolgoi LLC, which is responsible for all environmental compliance.

Ann Mason, Nevada

Exploration permits issued by the appropriate Federal (BLM) and Nevada Department of Environmental Protection are required for all exploration operations that include drilling or result in surface disturbance.

The Nevada State Office of the BLM holds a reclamation bond in the form of a cash payment from our subsidiary MIM (USA) Inc. in the amount of $84,132, which will be reimbursed once all reclamation work is complete and the agency has signed off on re-vegetation of drill sites and access roads. The bonded area covers up to 45 acres of disturbance over 10 years within a 2,060 acre project area. Entrée is in the process of increasing the size of the project area. Entree Gold (US) Inc. has been named operator of the Ann Mason project and is now a co-principal on the Ann Mason reclamation bond.

Competition

The mineral exploration, development, and production industry is largely unintegrated. We compete with other exploration companies looking for mineral resource properties, the resources that can be produced from them and in hiring skilled professionals to direct related activities. While we compete with other exploration companies in the effort to locate and license mineral resource properties, we do not compete with them for the removal or sale of mineral products from our properties, nor will we do so if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist world-wide for the sale of gold and other mineral products. Therefore, we will likely be able to sell any gold or mineral products that we ar e able to identify and produce. Our ability to be competitive in the market over the long term is dependent upon our ability to hire qualified people as well as the quality and amount of ore discovered, cost of production and proximity to our market. Due to the large number of companies and variables involved in the mining industry, it is not possible to pinpoint our direct competition.

Employees

At December 31, 2009, the Company had twenty-three employees working for us on a full-time or part-time basis. Eleven employees are based in Vancouver, five employees are based in Ulaanbaatar, Mongolia, two employees are in our office in Beijing and five employees support our Mongolian and US field programs. During the 2009 field season, the Company also contracted five expatriate geologists, geological technicians, camp support personnel and summer students at the Lookout Hill project. In addition to the expatriate employees, the Company hires up to 100 local personnel, including geologists, labourers, geophysical helpers, geochemical helpers, cooks, camp maintenance personnel, drivers and translators in Mongolia. These local personnel are hired as needed throughout each field season. The number of l ocal hires fluctuates throughout the year, depending on the workload.

In the United States, the Company’s field operations are headed by a geologist who is supported by three geologists, a core tech, an administrative assistant and labourers on an as-needed basis.

None of our employees belong to a union or are subject to a collective agreement. We consider our employee relations to be good.

MATERIAL MINERAL PROPERTIES

Entrée is a Canadian mineral exploration company based in Vancouver, British Columbia and focused on the worldwide exploration of gold and copper prospects. Entrée’s expertise is in acquiring prospective ground and exploring for deep and/or concealed porphyry deposits.

The Company’s main asset, the Lookout Hill property in Mongolia, forms an integral part of the development of Oyu Tolgoi mining complex, part of a developing copper camp in southern Mongolia.

Entree’s project portfolio includes an additional key asset, the recently acquired Ann Mason porphyry deposit in Nevada, which is 100% owned by Entree. This project lies within another promising copper camp located near Yerington, Nevada and contains an inferred mineral resource.

MONGOLIA

Lookout Hill Property

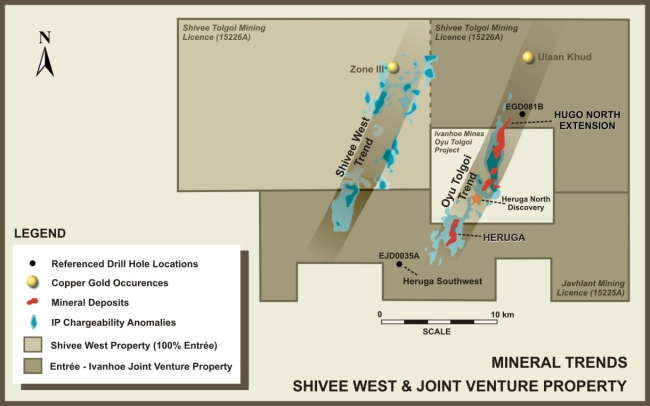

Lookout Hill is comprised of two mining licences: Shivee Tolgoi and Javhlant. Shivee Tolgoi and Javhlant completely surround Oyu Tolgoi LLC’s Oyu Tolgoi project and host the Hugo North Extension copper-gold deposit and the Heruga copper-gold-molybdenum deposits respectively. These deposits are located within a land area subject to a joint venture between Entree and Oyu Tolgoi LLC (the “Entrée-Ivanhoe Joint Venture”). Oyu Tolgoi LLC is owned 66% by Ivanhoe Mines Ltd., and 34% by the Government of Mongolia.

The beneficial ownership of the Shivee Tolgoi and Javhlant mining licences is divided between Entrée and the Entrée-Ivanhoe Joint Venture as described below:

| ● | The Entrée-Ivanhoe Joint Venture beneficially holds 39,864 hectares consisting of the eastern portion of Shivee Tolgoi and all of Javhlant mining licences (the “Joint Venture Property”) and is governed by a joint venture agreement between Entrée and Oyu Tolgoi LLC (a subsidiary of Ivanhoe Mines Ltd. and the Government of Mongolia). The Joint Venture Property is contiguous with, and on three sides (to the north, east and south) surrounds Oyu Tolgoi LLC’s Oyu Tolgoi project. The Joint Venture Property hosts the Hugo North Extension deposit and the Heruga deposit. |

| ● | The portion of the Shivee Tolgoi mining licence outside of the Joint Venture Property (“Shivee West”) covers an area of 35,242 hectares. Shivee West is 100% owned by Entrée and is subject to a first right of refusal by Oyu Tolgoi LLC. |

The illustration below depicts the different areas of Lookout Hill:

Figure 2 – Shivee West and Joint Venture Property

The Company's Javhlant and Shivee Tolgoi exploration licences were converted to mining licences in October 2009. The total estimated annual fees in order to maintain both the licences in good standing are approximately $1.1 million. Approximately $600,000 of the total is recoverable from the Entrée-Ivanhoe Joint Venture.

A mining licence may be granted for up to 30 years, plus two subsequent 20 year terms (cumulative total of 70 years). After issuance of a mining licence, we are required to pay to the Mongolian government a licence fee of $15.00 per hectare per year for gold or base metal projects and $5.00 per hectare for coal projects.

The following table is a summary of the Lookout Hill mining licences and their renewal status:

| Name of Property | License Number | Date Granted | Renewal Date | Expiration Date |

| Javhlant | 15225A | October 27, 2009 | October 27, 2039 | TBD |

| Shivee Tolgoi | 15226A | October 27, 2009 | October 27, 2039 | TBD |

Ivanhoe Mines announced the release of the Integrated Development Plan 2010 (“IDP10”) on May 11, 2010. IDP10 declares the first underground mineral reserves for the Hugo North deposit, including Entrée’s Hugo North Extension deposit which is contained within the Shivee Tolgoi mining licence. The probable reserve for the Hugo North Extension deposit totals 27 million tonnes (“Mt”) grading 1.85% copper and 0.72 grams per tonne (“g/t”) gold.

On June 11, 2010, the Company filed an updated technical report titled "Lookout Hill Property Technical Report 2010" (the "June 2010 Technical Report"). The June 2010 Technical Report is dated June 9, 2010 and was prepared by AMEC Minproc Limited ("Minproc") in Perth Australia, a "qualified person" as defined in NI 43-101. Unless stated otherwise, information in this AIF of a scientific or technical nature regarding the Lookout Hill project is summarized, derived or extracted from the June 2010 Technical Report. For a complete description of the assumptions, qualifications and procedures associated with the information in the June 2010 Technical Report, reference should be made to the full text of the June 2010 Technical Report, which is available for review on SEDAR located at www.sedar.com.

History

Entree entered into an option agreement with a private Mongolian mining company, Mongol Gazar Co. Ltd. (“Mongol Gazar) in 2002, to acquire three exploration licences.

Mongol Gazar was originally awarded the exploration licences by the Mongolian Government in March and April 2001. In November 2003, Entrée entered into a purchase agreement with Mongol Gazar, which replaced the existing option agreement.

In April 2004, Entree reached an agreement with Mongol Gazar, whereby Entree acquired 100% ownership of the title to the exploration licences and was absolved of any rights and obligations to Mongol Gazar.

These exploration licences have subsequently been converted to mining licences and two of them form the Lookout Hill Property.

Property Location and Accessibility

Lookout Hill is located within the Aimag of Omnogovi (also spelled Umnogobi) in the South Gobi region of Mongolia (an 'Aimag' is the local equivalent of a state or province), about 570 km south of the capital city of Ulaanbaatar and 80 km north of the border with China.

The city of Ulaanbaatar has the nearest international airport to the property with regularly scheduled commercial flights from various Asian destinations. The flying times from Seoul, Korea and Beijing, China to Ulaanbaatar are about 2.5 and 1.5 hours, respectively. Access to the project by road is possible year round; however, the unpaved road is in poor condition. Short periods of no road access can occur, due to frequent heavy winds and dust storms, or more rarely, snowstorms in the winter. The driving time for the 630 km trip by 4 wheel drive truck from Ulaanbaatar to the site is approximately ten to 12 hours.

Alternatively, access is possible by air, to Oyu Tolgoi’s private landing strip at the adjacent Oyu Tolgoi site. Although the air strip is designated for use by Ivanhoe Mines, Entrée personnel are permitted to occasionally use the charter aircraft to arrive at the site. Flying time from Ulaanbaatar is approximately 1.5 hours.

There are few inhabitants living within the boundaries of Lookout Hill and no towns or villages of significant size. The people who do live there are mostly nomadic herders.

Entrée is currently engaged in a small program of basic infrastructure improvements to assist the nearby communities in the vicinity of the project. In addition, Entrée maintains close contact with the district officials as part of their community relations efforts.

Climate

The southern Gobi region has a continental, semi-desert climate with cool springs and autumns, hot summers, and cold winters. The average annual precipitation is approximately 80 millimetres ("mm"), 90% of which falls in the form of rain with the remainder as snow. Snowfall accumulations rarely exceed 50 mm. Maximum rainfall events of up to 43 mm have been recorded for short-term storm events. In an average year, rain falls on only 25 to 28 days and snow falls on 10 to 15 days. Local records indicate that thunderstorms are likely to occur between two and eight days a year at the project area, with an average total of 29 hours of electrical activity annually. An average storm will have up to 83 lightning flashes a minute.

Temperatures range from an extreme maximum of about 36°C to an extreme minimum of about -31°C. The air temperature in wintertime fluctuates between -5°C and -31°C. In the coldest month, January, the average temperature is -12°C.

Wind is usually present at the site. Very high winds are accompanied by sand storms that often severely reduce visibility for several hours at a time. The records obtained from 9 months of monitoring at the Oyu Tolgoi project weather station show that the average wind speed in April is 5.5 metres per second ("m/s"). However, windstorms with gusts of up to 40 m/s occur for short periods. Winter snowstorms and blizzards with winds up to 40 m/s occur in the Gobi region between five and eight days a year. Spring dust storms are far more frequent, and these can continue through June and July.

Regional Geology

The Lookout Hill property lies within the Palaeozoic age Gurvansayhan Terrane in southern Mongolia, a component of the Altaid orogenic collage, which is a continental-scale belt dominated by compressional tectonic forces. The Gurvansayhan Terrane consists of highly-deformed accretionary complexes and oceanic island arc assemblages. The island arc terrane is dominated by basaltic volcanics and intercalated volcanogenic sedimentary rocks (Upper Devonian Alagbayan Formation), intruded by pluton-sized, hornblende-bearing granitoids of mainly quartz monzodiorite to possibly granitic composition. Carboniferous-age sedimentary rocks (Sainshandhudag Formation) overlie this assemblage.

Major structures in this area include the Gobi–Tien Shan sinistral strike-slip fault system, which splits eastward into a number of splays in the project area, and the Gobi–Altai Fault system, which forms a complex zone of sedimentary basins overthrust by basement blocks to the north and northwest.

Mongolian Government

In August 2009, the Mongolian Parliament approved amendments to four laws, including the insertion of a sunset provision to cancel the three-year-old, 68% windfall profits tax on copper and gold effective January 1, 2011. These amendments allowed the Mongolian Government, Ivanhoe Mines Ltd. and Rio Tinto Holdings to conclude the negotiations necessary to finalise an investment agreement.

On October 6, 2009, Ivanhoe Mines Ltd., Oyu Tolgoi LLC (then known as Ivanhoe Mines Mongolia Inc.) and Rio Tinto Holdings signed the Investment Agreement with the Mongolian Government. The Investment Agreement regulates the relationship between these parties and stabilises the long term tax, legal, fiscal, regulatory and operating environment to support the development of the Oyu Tolgoi project. The contract area defined in the Investment Agreement includes the Javhlant and Shivee Tolgoi mining licences, including Shivee West which is 100% owned by Entrée and not currently subject to the Entrée-Ivanhoe Joint Venture. Conditions precedent of the Investment Agreement were satisfied within six months of the signing date, and the achievement of this milestone was announced on March 31, 2010 by Rio Tinto plc and Ivanhoe Mines Ltd.

The Investment Agreement specifies that the Oyu Tolgoi licence and Ivanhoe Mines’ interest in the Entree-Ivanhoe Joint Venture Property, as specified in the contract area, is held by Oyu Tolgoi LLC, a Mongolian subsidiary company owned 34% by the Mongolian Government and 66% by Ivanhoe Mines Ltd. Entrée is not presently a party to the Investment Agreement. However, Ivanhoe Mines Ltd. has agreed under the terms of the Earn-In Agreement to use its best efforts to cause Entrée to be brought within the ambit of, made subject to and to be entitled to the benefits of the Investment Agreement. In order to become a party to the Investment Agreement, the Government of Mongolia may require Entrée or the Entrée-Ivanhoe Joint Venture to agree to certain concessions, including with respect to the ownership of the Entrée-Ivanhoe Joint Venture or the scope of the lands to be covered by the Investment Agreement.

Joint Venture Property – Mineral Resources

Exploration on the Joint Venture Property has been minimal subsequent to completion of the previous resource calculations on both the Hugo North Extension and the Heruga deposits early in 2008. One 721 metre (“m”) diamond hole was drilled in 2008 on Ulaan Khud, that lies 7 km northeast of Hugo North Extension, and 11 additional diamond holes were completed on Heruga in 2008 as infill and to test the eastern edge of the deposit. In addition, in late 2008 a detailed magnetometer survey was completed over Heruga and over the Hugo North Extension deposit areas. Exploration in 2009 was restricted to deep penetrating induced polarization surveys over Hugo North Extension and over Heruga, and a single 229 m diamond hole on Javhlant.

The following Table 1 summarizes the mineral resources for the Hugo North Extension deposit and the Heruga deposit as reproduced in the June 2010 Technical Report. The resource estimate for the Hugo North Extension deposit is effective as of February 20, 2007 and is based on drilling completed to November 1, 2006. The Heruga mineral resource estimate is effective as of March 30, 2010.

Table 1 Entrée-Ivanhoe Mines Joint Venture Mineral Resources (0.6% CuEq cut-off), based on Technical Report March 2010 |

| Deposit | Tonnage (t) | Copper (%) | Gold (g/t) | CuEq (%) | Contained Metal |

Copper (000 lb) | Gold (oz) | CuEq (000 lb) |

| Hugo North Extension Deposit |

Indicated Shivee Tolgoi (Hugo North) | 117 000 000 | 1.80 | 0.61 | 2.19 | 4 640 000 | 2 290 000 | 5 650 000 |

Inferred Shivee Tolgoi (Hugo North) | 95 500 000 | 1.15 | 0.31 | 1.35 | 2 420 000 | 950 000 | 2 840 000 |

| Heruga Deposit |

| Inferred Heruga Javhlant | 910 000 000 | 0.48 | 0.49 | 0.87 | 9 570 000 | 14 300 000 | 17 390 000 |

Notes:

| ● | Copper Equivalent (CuEq) has been calculated using assumed metal prices of $1.35/lb for copper, $650/oz for gold, and $10 .50 for molybdenum;. The equivalence formula was calculated assuming that gold and molybdenum recovery was 91% and 72% of copper recovery respectively. CuEq was calculated using the formula: CuEq% = Cu% + ((Au g/t*18.98)+(Mo g/t*.01586))/29.76. |

| ● | Mo content in Heruga deposit is 141 ppm and included in calculation of CuEq. |

| ● | The contained copper, gold, copper and molybdenum in the tables have not been adjusted for metallurgical recovery. |

| ● | The 0.6% CuEq cut-off is highlighted as the base case resource for underground bulk mining. |

| ● | The mineral reserves are not additive to the mineral resources. |

| ● | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| ● | Entrée– Ivanhoe Joint Venture includes a portion of the Shivee Tolgoi licence and the entire Javhlant licence, which are held by Entrée and are planned to be operated by OT LLC. OT LLC will receive 80% and Entrée will receive 20% of cash flows after capital and operating costs. |

Hugo North Extension Deposit

The Hugo North Extension deposit within the Joint Venture Property contains copper–gold porphyry-style mineralization associated with quartz monzodiorite intrusions, concealed beneath a deformed sequence of Upper Devonian and Lower Carboniferous sedimentary and volcanic rocks.

The copper sulphides in the high-grade zone at Hugo North Extension comprises relatively coarse bornite impregnating quartz and disseminated in wall rocks of varying composition, usually intergrown with subordinate chalcopyrite. Bornite is dominant in the highest-grade parts of the deposit (with these zones averaging around 3% to 5% Cu) and is zoned outward to chalcopyrite (to zones averaging around 2% Cu for the high–grade chalcopyrite dominant mineralization). Bornite and chalcopyrite are important copper bearing minerals that contain approximate 35% and 63% (respectively) in their crystal structure. High grade gold values within the Oyu Tolgoi mineralized system are associated with the presence of bornite.

Geological models were constructed by Ivanhoe Mines using lithological and structural interpretations completed in late 2006. Quantitative Group Pty Ltd. (“QG”) checked the lithological and structural shapes for interpretational consistency on section and plan, and found them to have been properly constructed.

Resource estimates were undertaken using MineSight® commercial mine planning software. Industry accepted methods were used to create interpolation domains based on mineralized geology, and grade estimation based on ordinary kriging. The assays were composited into 5 m down-hole composites; block sizes were 20 x 20 x 15 m.

The mineral resources were classified using logic consistent with the CIM definitions required by NI 43–101. Inspection of the model and drill hole data on plans and sections showed geological and grade continuity. When taken together with spatial statistical evaluation and investigation of confidence limits in predicting planned annual production, blocks were assigned as indicated resources if they fell within the current drill hole spacing, which is on 125 x 70 m centres. Blocks were assigned to the Inferred resource category if they fell within 150 m of a drill hole composite.

The base case copper equivalent cut-off grade assumptions for the Hugo North Extension deposit were determined using operating cost estimates from similar deposits.

Heruga Deposit

The Heruga mineral resource estimate was updated in March 2010 and remained unchanged in the June 2010 Technical Report. This estimate is in conformance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) mineral resource and mineral reserve definitions referred to in NI 43-101. The mineral resource estimate was prepared under the supervision of Scott Jackson and John Vann of QG in Perth. The Heruga deposit within the Joint Venture Property contains copper–gold-molybdenum porphyry-style mineralization hosted in Devonian basalts and quartz monzodiorite intrusions, concealed beneath a deformed sequence of Upper Devonian and Lower Carboniferous sedimentary and volcanic rocks. The deposit is cut by several major brittle fault systems, partitioning the deposit into di screte structural blocks. Internally, these blocks appear relatively undeformed, and consist of southeast-dipping volcanic and volcaniclastic sequences. The stratiform rocks are intruded by quartz monzodiorite stocks and dykes that are probably broadly contemporaneous with mineralization. The deposit is shallowest at the south end (approximately 500 m below surface) and plunges gently to the north.

QG reviewed Ivanhoe Mines’ quality assurance/quality control procedures in 2008 and 2009 and found them to be followed and to exceed industry standards.

The database used to estimate the mineral resources for the Heruga deposit consists of samples and geological information from 43 drill holes, including daughter holes, totalling 58,276 m.

The alteration at Heruga is typical of porphyry style deposits, with notably stronger potassic alteration at deeper levels. Locally intense quartz-sericite alteration with disseminated and vein pyrite is characteristic of mineralized quartz monzodiorite. Molybdenite mineralization seems to spatially correlate with stronger quartz-sericite alteration.

Modelling of mineralization zones for resource estimation purposes revealed that there is an upper copper-driven zone and a deeper gold-driven zone of copper-gold mineralization at Heruga. In addition, there is significant (100 ppm to 1000 ppm) molybdenum mineralization in the form of molybdenite.

A close-off date of 31 May, 2009 for survey (collar and down hole) data was utilized for constructing the geological domains.

Ivanhoe Mines created three dimensional shapes (wireframes) of the major geological features of the Heruga Deposit. To assist in the estimation of grades in the model, Ivanhoe also manually created three dimensional grade shells (wireframes) for each of the metals to be estimated. Construction of the grade shells took into account prominent lithological and structural features, in particular the four major sub-vertical post-mineralisation faults. For copper, a single grade shell at a threshold of 0.3% Cu was used. For gold, wireframes were constructed at thresholds of 0.3 g/t and 0.7 g/t. For molybdenum, a single shell at a threshold of 100 ppm was constructed. These grade shells took into account known gross geological controls in addition to broadly adhe ring to the above mentioned thresholds.

QG checked the structural, lithological and mineralized shapes to ensure consistency in the interpretation on section and plan. The wireframes were considered to be properly constructed and honoured the drill data.

Resource estimates were undertaken by Ivanhoe using Datamine® commercial mine planning software. The methodology was very similar to that used to estimate the Hugo North deposits. Interpolation domains were based on mineralized geology, and grade estimation based on ordinary kriging. Bulk density was interpolated using an inverse distance to the third power methodology. The assays were composited into 5 m down-hole composites; block sizes were 20 x 20 x 15 m.

As an independent check, QG also built a model from scratch using the same wireframes and drill data used in the Ivanhoe Mines model. Gold, copper and molybdenum were interpolated using independently generated variograms and search parameters. QG compared the two estimates and consider that they agree well within acceptable limits thus adding additional support to the estimate built by Ivanhoe Mines.

The mineral resources for Heruga were classified using logic consistent with the CIM definitions required by NI 43–101. Blocks within 150 m of a drill hole were initially considered to be Inferred. A three dimensional wireframe was constructed inside of which the nominal drill spacing was less than 150 m.

Joint Venture Property - Mineral Reserves

Ivanhoe Mines has prepared a study titled Integrated Development Plan 2010 (IDP10) which represents the first opportunity to publically update the previous Oyu Tolgoi Integrated Development Plan 2005 (IDP05) for all aspects of the project within the framework of a signed and effective Investment Agreement with the Government of Mongolia. The IDP10 was published in a technical report by Ivanhoe Mines in June 2010 and included work on the Entrée-Ivanhoe Joint Venture Property. The qualified persons responsible for the Ivanhoe Mines technical report are the same qualified persons responsible for the reporting of the results of the study work on the Entrée-Ivanhoe Joint Venture.

On June 11, 2010, the Company filed an updated NI 43-101 compliant technical report titled "Lookout Hill Property Technical Report 2010" (the "June 2010 Technical Report"). The June 2010 Technical Report is dated June 9, 2010 and was prepared by AMEC Minproc Limited ("Minproc") in Perth Australia, a "qualified person" as defined in NI 43-101. The June 2010 Technical Report considers the conclusions and recommendations raised within IDP10 in the context of the Company’s operations.

Unless stated otherwise, information in this AIF of a scientific or technical nature regarding the Lookout Hill Project is summarized, derived or extracted from the June 2010 Technical Report. For a complete description of the assumptions, qualifications and procedures associated with the information in June 2010 Technical Report, reference should be made to the full text of the June 2010 Technical Report, which is available for review on SEDAR located at www.sedar.com.

The Entrée-Ivanhoe Joint Venture Property mineral reserve is contained within the Hugo North Block Cave Lift 1 as defined within the Integrated Development Plan 2010 prepared by OT LLC in June 2010. Stantec Mining prepared the Hugo North mineral reserve by applying the block cave mining method parameters to the Hugo Dummett mineral resource block model. The mine planning work has been prepared using industry standard mining software, assumed metal prices and smelter terms as set forth in the June 2010 Technical Report. The estimate was prepared on a simplified project analysis on a pre-tax basis. Key outstanding variables noted by Stantec Mining include the marketing matters, water supply and management and power supply. The report only considers mineral resources in the indic ated category, and engineering that has been carried out to a prefeasibility level or better to state the underground mineral reserve. There is no measured resource in the Hugo North mineral resource. Copper and gold grades on inferred resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a $20/tonne net smelter returns (“NSR”), further mine planning will examine lower cut-offs. The Hugo North mineral reserve is on both the OT LLC Oyu Tolgoi licence and the Entrée-Ivanhoe Joint Venture Shivee Tolgoi licence.

Table 2 Entrée-Ivanhoe Joint Venture Mineral Reserve, 11 May 2010 |

| Classification | Ore (Mt) | NSR ($/t) | Cu (%) | Au (g/t) | Copper (Billion lb) | Gold (Moz) |

| Proven | - | - | - | - | - | - |

| Probable | 27 | 55.57 | 1.85 | 0.72 | 1.0 | 0.5 |

| Total Entrée-Ivanhoe Joint Venture | 27 | 55.57 | 1.85 | 0.72 | 1.0 | 0.5 |

Notes:

| ● | Table shows only the part of the mineral reserve on the Entrée-Ivanhoe Joint Venture Shivee Tolgoi licence. |

| ● | Metal prices used for calculating the Hugo North Underground NSR are copper $1.50/lb, gold $640/oz, and silver $10.50/oz based on long term metal price forecasts at the beginning of the mineral reserve work. The analysis indicates that the mineral reserve is still valid at these metal prices. |

| ● | The NSR has been calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries and royalties. |

| ● | For the underground block cave all material within the shell has been converted to mineral reserve this includes low grade Indicated material and Inferred material assigned zero grade treated as dilution. |

| ● | Only measured resources were used to report proven reserves and only indicated resources were used to report probable reserves. |

● | The Entrée-Ivanhoe Joint Venture Shivee Tolgoi licence is held by Entrée and is planned to be operated by OT LLC. OT LLC will receive 80% and Entrée 20% of cash flows after capital and operating costs. |

| ● | The base case financial analysis has been prepared using current long term metal price estimates of copper $2.00/lb, gold $850/oz, and silver $13.50/oz. |

| ● | The mineral reserves are not additive to the mineral resources. |

Integrated Development Plan 2010

IDP10 presents two complementary development cases:

| ● | Reserve Case, based strictly on proven and probable mineral reserves; and |

| ● | Life of Mine (Sensitivity) Case, which adds a large base of inferred resources to the Reserve Case. |

The Reserve Case sets out the likely path of development for the initial phases of the Oyu Tolgoi group of deposits (Southern Oyu pits 1 through 9 and Hugo North Lift 1) and is based on a prefeasibility level of study. The Reserve Case is a prefeasibility quality level study complying with NI 43-101, although some parts of the Oyu Tolgoi project are further advanced and are considered at feasibility level. The work of the IDP10 meets the standards of US Industry Guide 7 requirements for reporting reserves. Some of the mineral resources from within the Entrée-Ivanhoe Project Property in Hugo North Extension have been converted to mineral reserve.

The Life of Mine (Sensitivity) Case reflects the development flexibility that exists with respect to later phases of the Oyu Tolgoi group of deposits (Heruga, Hugo South and the second lift of Hugo North), which will require separate development decisions in the future based on then prevailing conditions and the development experience obtained from developing and operating the initial phases of the Oyu Tolgoi project. Accordingly, the Life of Mine (Sensitivity) Case is effectively a preliminary assessment. Insofar as the Life of Mine (Sensitivity) Case includes an economic analysis that is based, in part, on inferred mineral resources, the Life of Mine (Sensitivity) Case does not have as high a level of certainty as the Reserve Case. Inferred mineral resources are considered too speculative geologically to have the economic considerations applied to them that would allow them to be categorized as mineral reserves, and there is no certainty that the Life of Mine (Sensitivity) Case will be realized. Mineral resources in the indicated and inferred categories with the Entrée-Ivanhoe Project Property in the Hugo North Extension and Heruga have been included in this analysis.

IDP10 provides a detailed outline of the likely development path for these reserves and the subsequent development of the remainder of the currently identified Oyu Tolgoi resources. Independent reviews completed in the preparation of this report, indicate a number of areas where project value can be further improved or optimized. The report also notes that management has considerable flexibility after initial construction and operations commence to further optimize the economic returns to stakeholders.

Given the extent of the mineral discoveries associated with the Oyu Tolgoi project and the potential for additional discoveries, Ivanhoe Mines and the Government of Mongolia agreed that the approved Investment Agreement should conform with the provision of Mongolia’s current Minerals Law specifying that certain deposits of strategic importance qualify for 30 years of stabilized tax rates and regulatory provisions, with an option of extending the term of the Investment Agreement for an additional 20 years. Major taxes and rates stabilized for the life of the agreement include: corporate income tax, customs duty, value-added tax; excise tax; royalties; exploration and mining licences; and immovable property and/or real estate tax.

The long term Investment Agreement stabilizes the fiscal regime for the Oyu Tolgoi project. OT LLC is undertaking a comprehensive implementation review following a binding Investment Agreement in order to develop a final project schedule and budget.

Both the Reserve Case and the Life of Mine (Sensitivity) Case include resources from the Oyu Tolgoi deposit (wholly owned by OT LLC) and Entrée-Ivanhoe Joint Venture licence areas. The initial production period of each case is the same.

Oyu Tolgoi has a large mineral resource providing management with flexibility in studying alternative paths for mine development to match future economic conditions. When broken down, the Life of Mine (Sensitivity) Case currently includes ore from seven distinct mining areas, and although the development of some of these areas are interdependent, most represent separate investment decisions to be made at some future time.

Five deposits have been identified in the mineral resource at Oyu Tolgoi; they are Southwest and Central, Hugo South, Hugo North and Heruga. Southwest and Central comprise the Southern Oyu and Hugo South and Hugo North (including Hugo North Extension) comprise the Hugo Dummett deposit. For mine planning purposes, the nine open pit stages at Southern Oyu and one block cave at Hugo North have been identified for the mineral reserve. In addition to these, long term mine planning has identified potential for another block cave lift at Hugo North, open pit or block caving at Hugo South and two block caving scenarios at Heruga. The mine planning work in IDP05 and confirmed in IDP10 suggests the following relative ranking for overall return from each deposit, from highest value to lowest:

The Reserve Case assumes processing of 1.4 billion tonnes (“Bt”) of ore over a 27 year period, mined from the Southern Oyu open pit and the first lift in the Hugo North underground block cave.

The Life of Mine (Sensitivity) Case extends the mine inventory to include inferred material and assumes processing of 3.01 Bt over 60 years. In this case, resources from the planned second lift in Hugo North, Hugo South and the Heruga deposit are added to the mining inventory, as they would be when considered in Mongolia. The mining areas that are included in the Reserve Case and in the Life of Mine (Sensitivity) Case are shown in Figure 3.

Figure 3 IDP10 Mining Areas

IDP10 outlines the initial construction of a concentrator and infrastructure to support production at a nominal capacity of 100 kilotonnes per day (“kt/d”). The predominant source of ore at start up is the Southern Oyu Open Pit. In parallel to this surface construction, underground infrastructure and mine development is ongoing for the Hugo North underground block cave deposit. Stockpiling allows the higher grade ore from Hugo North to gradually displace the open pit ore as the underground production ramps up to reach 85 kt/d.

At the end of Year 5, an expansion to the concentrator is completed in conjunction with production from Hugo North passing 10 million tonnes per annum (“Mt/a”) toward its full production level of 29.5 Mt/a. This provides the capacity to process 158 kt/d for the duration of the operation. Ongoing planning work using inferred resources has identified the potential for further expansions to between 210 kt/d and 265 kt/d.