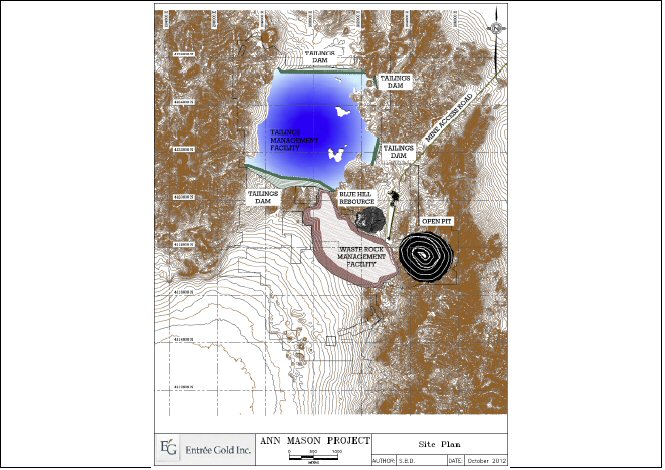

The mill is to be constructed to the northeast of the open pit and consists of a process plant and the supporting infrastructure for mining operations. A mining equipment garage, as well as mine dry, offices, and warehouse, are also included in the site complex. Access to the site will be via an upgraded access road to the northeast of the Ann Mason Project.

The anticipated power demand will be 105 megawatts (“MW”) during peak production. Power will come from the existing NV Energy, 120 kilovolt (“kV”) transmission line in service just east of the town of Yerington. A tap from this line will be constructed along with 10 kilometres of new 120 kV line to service the site. The line will feed two main substation transformers.

Tailings for the Ann Mason operation will be located to the northwest of the deposit. Two large dams will be constructed at either end of the valley to contain the tailings. The north dam will be constructed primarily of rock fill with some cycloning of tailings. The south dam, and largest will be initially rock fill then cyclone tailings. Additionally, two smaller rockfill dams will be on the east side of the tailings management facility. The tailings management facility as proposed is sufficient to encompass the full quantity of tailings material for the PEA schedule with capacity available with either a reduction in freeboard or increase in the tailings dam height.

The process plant will be located on the topographic saddle to the northwest of the Ann Mason pit. A large flat area is present that will accommodate the full plant, mobile equipment maintenance shop and offices. Material from the mine for processing will be transported to the mill by an overland conveyor from a primary crusher located on the edge of the existing pit design.

Table 9 shows a summary of the capital costs for the Ann Mason Project.

Initial capital requirements (preproduction) are estimated to be $1,010.4 million. Production starts in Year 1 and the tail end of the start-up capital requirements will be partially offset by revenue in that year. Capital requirements for Year 1 total $272.9 million. The indirect and contingency values vary by capital cost item; the percentages applied are shown in Table 10.

Operating costs were developed for a 100,000 tpd mining and milling operation with a 24-year milling life. The pre-strip requirements add an additional three years prior to milling commencement.

Diesel fuel pricing is estimated at $1 per litre using a $100/barrel reference price. This estimate was derived from a price quotation for off-road diesel fuel delivered to site with applicable taxes considered. The price for electrical power was set at $0.064/kWh, based on current Nevada industrial pricing.

G&A costs are based on an average of 53 people; 16 staff and 37 hourly. Additional charges, such as public relations, recruitment, logistics, and busing, are also included in the G&A costs. Mine employees will be located in the immediate area, and no camp will be provided or required.

Concentrate transportation costs are estimated using values from logistics firms. Delivery of the concentrate will be by bulk trailers and hauled either to the port of Stockton, California, or by truck/rail to Coos Bay, Oregon, or Vancouver, Washington, for delivery to customers overseas. The molybdenum concentrate will be stored in tote bags and delivered to locations in the United States, either Arizona or Pennsylvania. At this level of study, no definitive sales contracts have been negotiated.

Port costs consider the handling of the bulk material, assaying, and cost of the referee on the concentrate grade.

Shipping to smelter cost is based on current seaborne rates for delivery to various smelters in the Pacific Rim for the copper concentrate.

A summary of all the operating cost categories on a cost per tonne mill feed basis over the total mill feed tonnage is shown in Table 11. Costs associated with those items directly attributable to the concentrate are reported in cost per tonne of concentrate.

The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The analysis is based on a LOM plan for 24 years at a processing rate of 100,000 tpd. The decision to use the 100,000 tpd rate was determined early in the study through various trade-off studies. This provided a reasonable NPV while maintaining LOM capital (including sustaining capital) below $2 billion.

The tonnes and grades from the five-phase design for the open pit phases were used in the discounted cash flow (“DCF”) analysis. The breakdown of indicated and inferred material utilized in the analysis is shown in Table 12 to highlight the percentage of material currently in the indicated category. Two additional phases were designed, complete with access, but while still economic, did not benefit the NPV of the overall project at current metal prices. These demonstrate upside potential for the mine.

The DCF analysis was completed using different metal prices with low, base, high and spot price cases examined. All of the prices in those options were below the three-year trailing average prices for each of the metals as of September 17, 2012. Table 13 summarizes the metal prices used in the low, base and high scenarios.

The Base Case is the scenario chosen by AGP and the Company, with the other scenarios showing price sensitivities. The results for the Base Case indicate the potential for a NPV7.5 of $1,106 million with an IRR of 14.8%. The payback period is 6.4 years, with payback occurring in the seventh year of production (Table 14).

Potential revenue from the various metal streams with the Base Case pricing had copper as the dominant value from the deposit at $14.6 billion or 93.2% of the total revenue. This is followed by molybdenum at $449 million for 2.9% of the revenue, then gold at $432.8 million (2.8%) and silver at $172.2 million (1.1%).

The metal terms considered copper smelting to cost $65 per dry metric tons (“dmt”) and refining to cost $0.065/lb for an average concentrate grade of 30%. The molybdenum roasting fees would be $1.15/lb with 99% payable. Silver and gold would both be payable at 97% with refining charges of $1.00/oz silver and $10.00/oz gold.

The mineral reserve and resource estimates presented above have been calculated in accordance with National Instrument 43-101 as required by Canadian securities regulatory authorities, which differ from standards of the U.S. Securities and Exchange Commission (“SEC”). The resource estimates contained in this discussion would not be permitted in reports of U.S. Companies filed with the SEC. See, “Cautionary Note to United States Investors Regarding Mineral Reserve and Resource Estimates”.

Table 15 shows other key pre-tax production statistics developed as part of the analysis. The values do not take into account the 0.4% NSR royalty granted to Sandstorm.

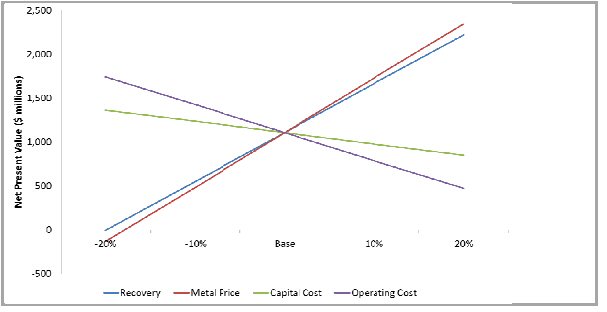

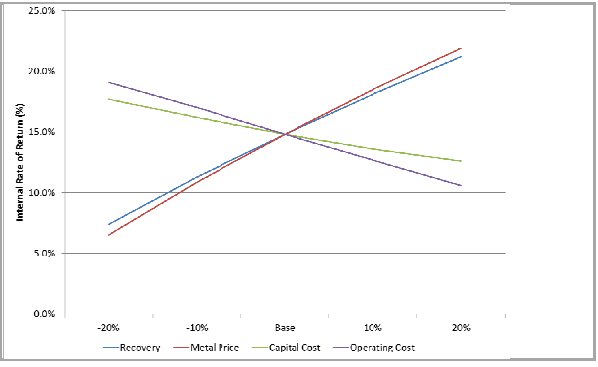

Sensitivities to various inputs were examined on the Base Case. The items varied were recovery, metal prices, capital cost, and operating cost. The results of that analysis are shown in Figure 20 and Figure 21.

Table 15 – Metal Production Statistics, Cash Cost Calculations and Key Economic Parameters

The greatest sensitivity for developing the Ann Mason deposit is metal prices. The Base Case prices that are used consider a price of copper at $3.00/lb. Three-year trailing average price for copper as of September 17, 2012 was $3.61/lb. The Base Case copper price is 27% lower than the three-year average. A further 20% reduction of that price would see a copper price of $2.40/lb.

The second most sensitive parameter is recovery. To calculate the sensitivity to recovery, a percentage factor was applied to each metal recovery in the same proportion. Therefore, while sensitivity exists, actual practice may show less fluctuation than is considered in this analysis. Recovery testwork has not indicated recoveries in the range of 75% which the -20% change in recovery would represent. As copper represents 93.2% of the revenue, this large a swing in recovery has the obvious effect of influencing the economics, but may not be realistic.

The operating cost is the next most sensitive item. With the mine being a bulk mining operation, focus on this cost is instrumental to maintaining attractive project economics. Any opportunity to shorten waste hauls would have a positive effect on the economics.

The least most sensitive item is capital cost. While changes in the cost have an effect, in comparison to the other three parameters, its effect is less significant. If the capital costs go up by 20%, the net present value change from the base drops to $849 million from $1,106 million.

The discounted cash flows in the PEA are pre-tax. Taxable income for income tax purposes is as defined in the Internal Revenue Code and regulations issued by the Department of Treasury and the Internal Revenue Service. The Federal income tax rate is approximately 35% in accordance with Internal Revenue Service Publication 542.

Nevada does not have a State corporate income tax. However, Nevada has a Net Proceeds of Mining Tax, which is an ad valorem property tax assessed on minerals mined or produced in Nevada when they are sold or removed from the State. The tax is separate from, and in addition to, any property tax paid on land, equipment and other assets. In general, while the tax rate applied to the net proceeds is based on a sliding scale depending on the net proceeds as a percentage of gross proceeds, the effective rate is 5%.

No royalties are payable to the United States Government for the Ann Mason Project, as set out in the PEA.

Environmental

In the course of considering Entrée’s approved PoO, the BLM prepared an Environmental Assessment (the “EA”) that considered the potential impact of the PoO on the environment. Substantial environmental studies were conducted in the preparation of the EA. These studies documented that historic and pre-historic cultural resources, habitat of certain special interest species of plants and/or wildlife, and other concerns exist or could exist in the vicinity of Ann Mason.

Mining has been a significant business in Nevada for many years, and many mines have been permitted on the public lands in Nevada. Consequently the regulatory agencies are familiar with mining activities, and complying with the respective agency permit application requirements allows permits to be issued in a rather timely manner. The most important, time consuming, and costly permits/approvals required for the development of Ann Mason are:

| ● | Plan of Operations approval by the BLM. |

| | |

| ● | Water Pollution Control Permit from the NDEP - BMRR. |

| | |

| ● | Reclamation Permit from the BMRR. |

| | |

| ● | Air Quality Permit from the NDEP - Bureau of Air Pollution Control. |

| | |

| ● | Special Use Permit from Lyon County and Development Permit from Douglas County. |

With the PEA completed and better understanding of the size and scope of the Ann Mason Project, the data collection and testwork can begin to prepare for the next stage of study and ultimately permit applications.

Basic data collection needs to commence as soon as possible covering a wide range of diverse subjects: weather, water flows, vegetation, wildlife, and socioeconomic. A comprehensive program will need to be established to collect the required information necessary to comply with the respective agency permit application requirements. This is of critical importance to ensure that the permits may be issued in a timely manner.

A detailed Prefeasibility plan will be required to build upon the other information collected. Data collection and testwork should coincide with portions of the permit application process. Detailed environmental and engineering information must be collected in at least the following areas:

| ● | Seasonal data of at least 12 months may be required for some of the elements above. |

| | |

| ● | Reclamation of mine activities will be a significant part of the BLM Plan of Operations and the BMRR, and plans for closure must be approved by both agencies prior to initiation of mining activities. Entrée will work with both agencies to develop cost effective reclamation methods including reclamation concurrently with mine operations as appropriate. Reclamation costs will be developed along with detailed mine development plans, and an acceptable reclamation bond will be posted with the BLM. |

| | |

All aspects of the Ann Mason Project must be designed and operated to avoid and/or minimize environmental impacts as required by the permits. Air quality, water quality, and operating parameters will be monitored, also as required by the permits. Specific details of Ann Mason design, operation, and monitoring will be developed through consultation with the appropriate agencies and through preparation of specific permit applications.

In general, Lyon and Douglas Counties and the state of Nevada are receptive to metal mining activities, and mining provides a large part of local and state revenue. The Company will work with Lyon and Douglas Counties and nearby towns including Yerington, Weed Heights, Mason and communities in Smith Valley to reduce potential impacts.

Near Term Exploration and Development Plans

With the completion of a positive PEA study, Entrée is now evaluating the most efficient and effective way of advancing the Ann Mason Project. Work programs will focus on high priority targets that could enhance Ann Mason Project economics. Drilling results from 2013 enhanced our understanding of the geometry and potential of the Ann Mason and Blue Hill deposits. Three of the five core holes drilled at Ann Mason extended copper mineralization 190 metres to 250 metres northwest and northeast of the deposit and within the current pit design. In addition, Ann Mason mineralization remains open in several directions and future drilling programs will be needed to test this potential.

Drilling at Blue Hill extended known mineralization 750 metres further west and increases the potential to discover a much larger mineralized system at depth. Copper oxide and mixed oxide/sulphide mineralization remains open in several directions. To the east, oxide and mixed mineralization is truncated by the low angle Blue Hill Fault, however, underlying sulphide mineralization continues in this direction. Drilling of the underlying sulphide target remains very widely-spaced, but has identified a target area more than one kilometre in width, which remains open in most directions. Further drilling will be required in the Blue Hill area and if successful could provide additional feed for a potential SX/EW operation.

The area between the Ann Mason and Blue Hill deposits has seen only wide-spaced, mostly shallow drilling to date and remains a high priority target for future exploration for both additional sulphide and oxide mineralization. South of Ann Mason, soil surveying and mapping suggests potential for near surface oxide copper mineralization which could have a positive impact on the Ann Mason Project.

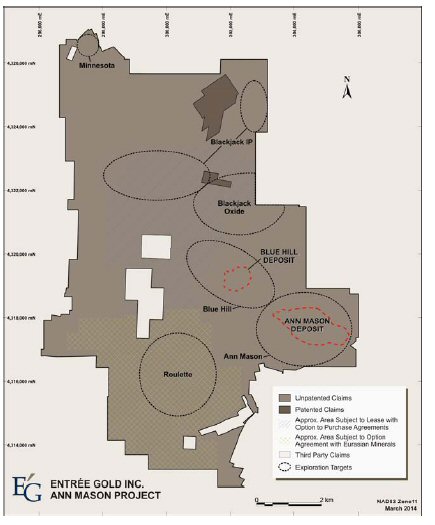

Several other high-priority targets on the Ann Mason Project property require further exploration. These include the Roulette, Blackjack IP and Blackjack Oxide targets and the Minnesota copper skarn target. In the Blackjack area, IP and surface copper oxide exploration targets have been identified for drill testing. The Minnesota skarn target requires further drilling to test deeper IP and magnetic anomalies.

The Company anticipates minimal field work in 2014 pending improvement in metal prices and in the mining investment environment.

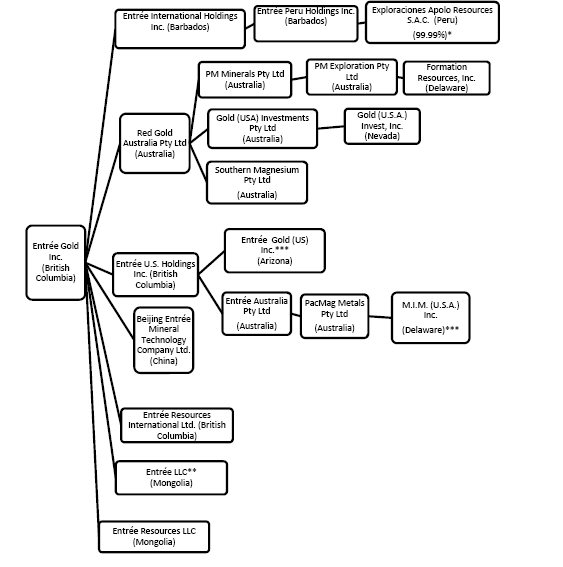

NON-MATERIAL PROPERTIES

Entrée has interests in other non-material properties in the United States, Australia and Peru as follows. For additional information regarding these non-material properties, including Entrée’s ownership interest and obligations, see the Company’s Management’s Discussion and Analysis for the financial year ended December 31, 2013, which is available on SEDAR at www.sedar.com.

| ● | Lordsburg Property, New Mexico. The Lordsburg claims cover 2,013 ha adjacent to the historic Lordsburg copper-gold-silver district in New Mexico. Drilling at Lordsburg has been successful in discovering a new porphyry copper-gold occurrence in an area previously known only for vein-style gold mineralization. No work was completed in 2013. Future drilling will be directed towards expanding the existing drill defined copper and gold zone. |

| | |

| ● | Shamrock Property, Nevada. The Shamrock property is a copper skarn exploration target located in the Yerington copper porphyry district in western Nevada, approximately 5 kilometres southeast of the Ann Mason Project. |

| | |

| ● | Eagle Flats Property, Nevada. The Eagle Flats property consists of 58 unpatented lode claims, 65 kilometres east of Yerington, in Mineral County, Nevada. |

| | |

| ● | Blue Rose Joint Venture, Australia. The Blue Rose copper-iron-gold-molybdenum joint venture property covers exploration licence 5129 in the Olary Region of South Australia, 300 kilometres north-northeast of Adelaide. Magnetite iron formations occur in the southern portion of this 1,000 square kilometre tenement, and a zone of copper oxide mineralization and a gold target (Golden Sophia) are located in the north-central area of the tenement. |

| | |

Soil sampling by the joint venture over the Golden Sophia shallow gold target confirmed the previous Battle Mountain gold in soil anomaly and defined a new, linear gold anomaly located approximately 700 metres to the northeast.

| ● | Lukkacha Property, Peru. The Lukkacha property is located in Tacna Province of southeastern Peru. The property consists of seven concessions totalling 4,400 ha which cover two large areas of surface alteration, iron oxides and quartz veining approximately 50 kilometres along the structural trend southeast from the giant Toquepala mining operation of Grupo Mexico. The property has never been drilled and represents a unique opportunity for early stage exploration within an under-explored major copper district. The property is situated within 50 kilometres of the international border with Chile, and initiation of further exploration (geophysics and drilling) is subject to Entrée obtaining a Supreme Decree allowing it to work on the property. |

Item 4A. Unresolved Staff Comments

None.

Item 5. Operating and Financial Review and Prospects

We are an exploration stage resource company engaged in exploring mineral resource properties. We have interests in development and exploration properties in Mongolia, the United States, Australia and Peru. Our two principal assets are our interest in the Lookout Hill property in Mongolia and our Ann Mason Project in Nevada.

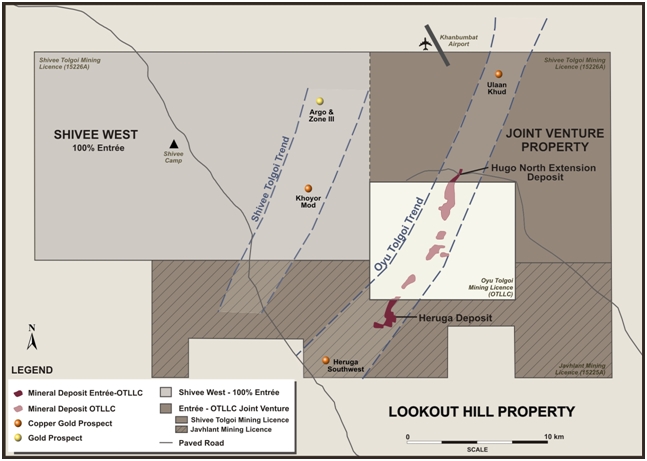

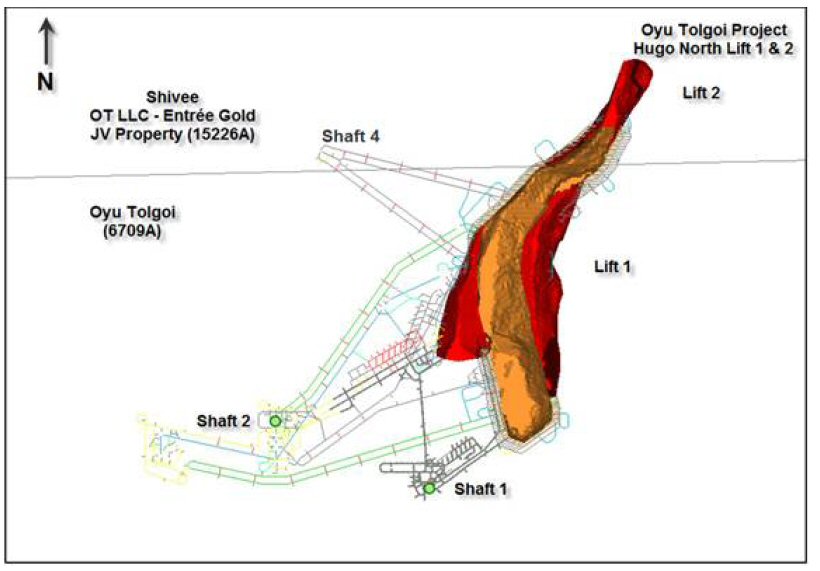

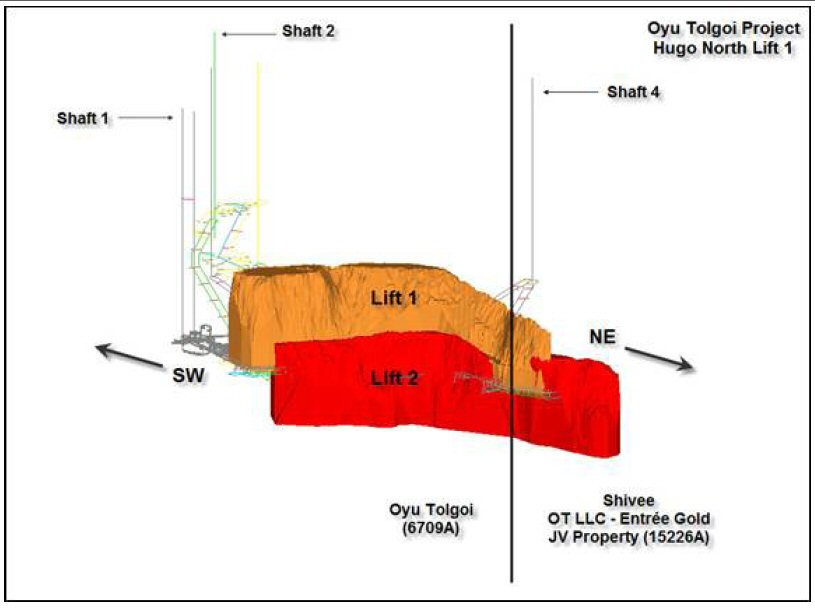

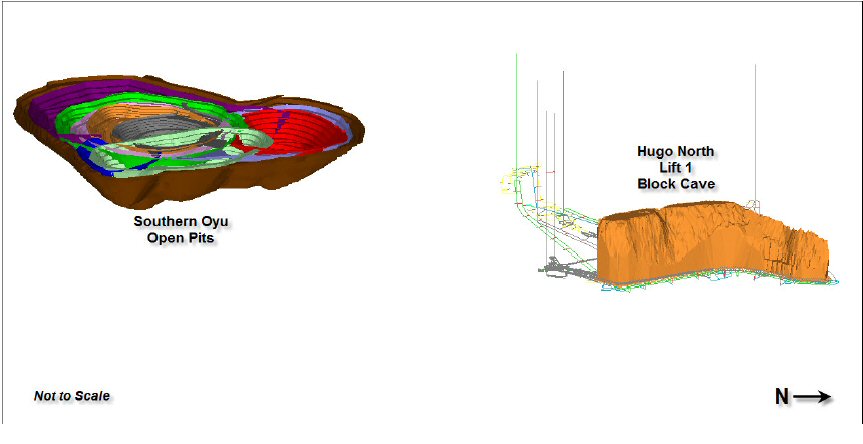

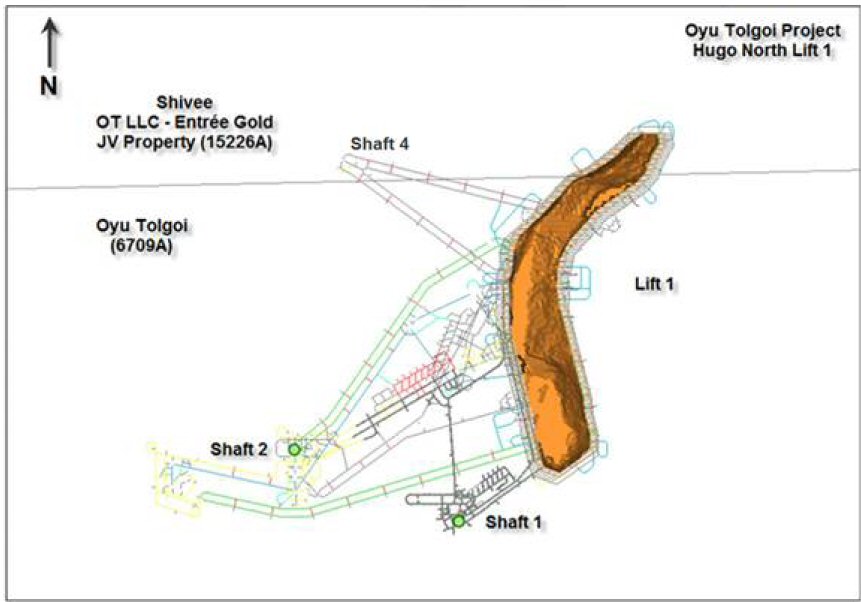

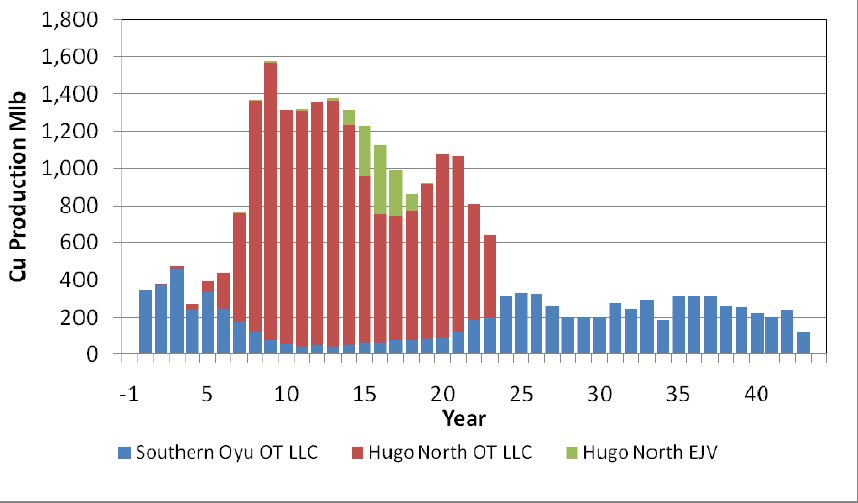

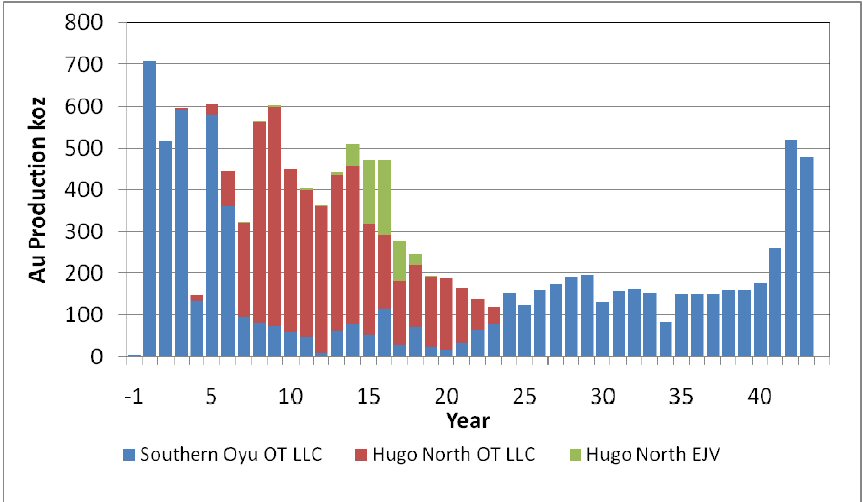

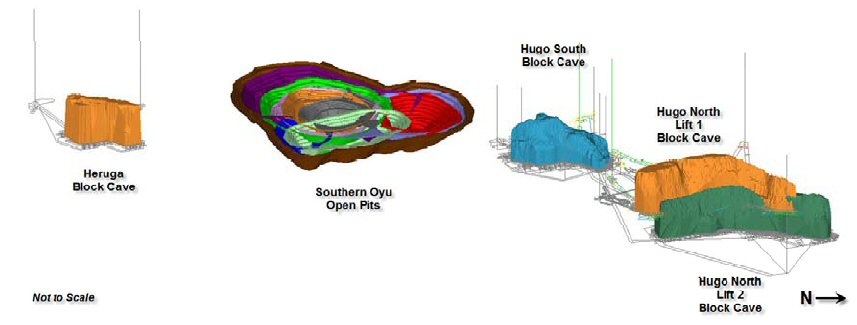

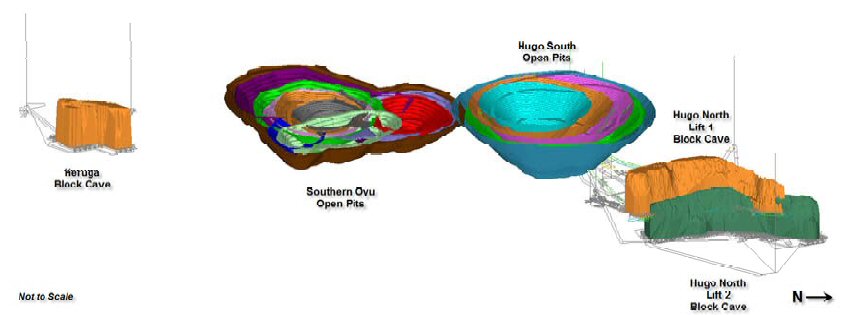

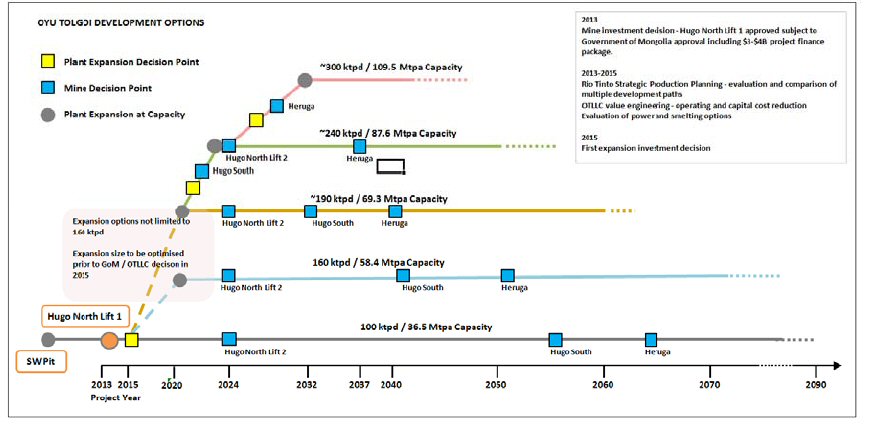

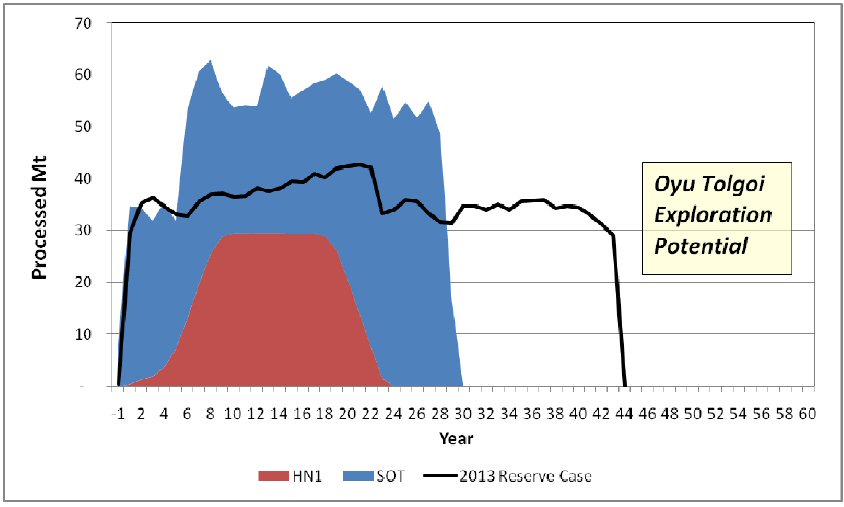

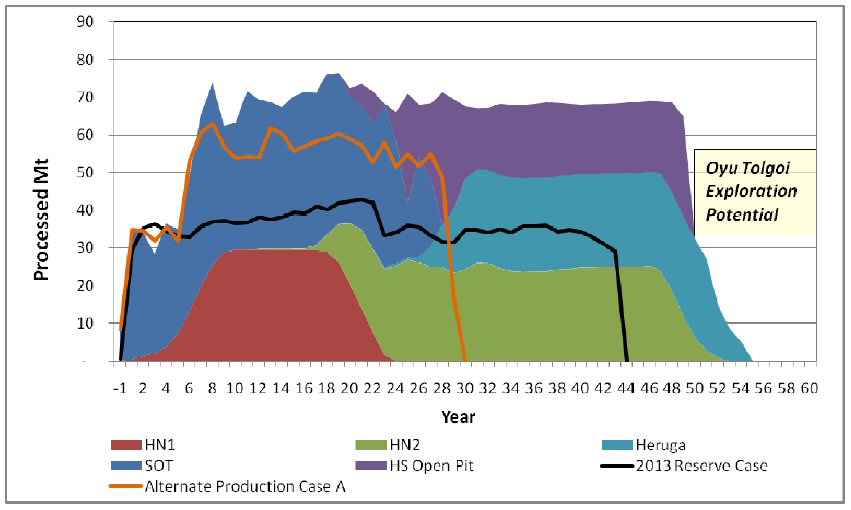

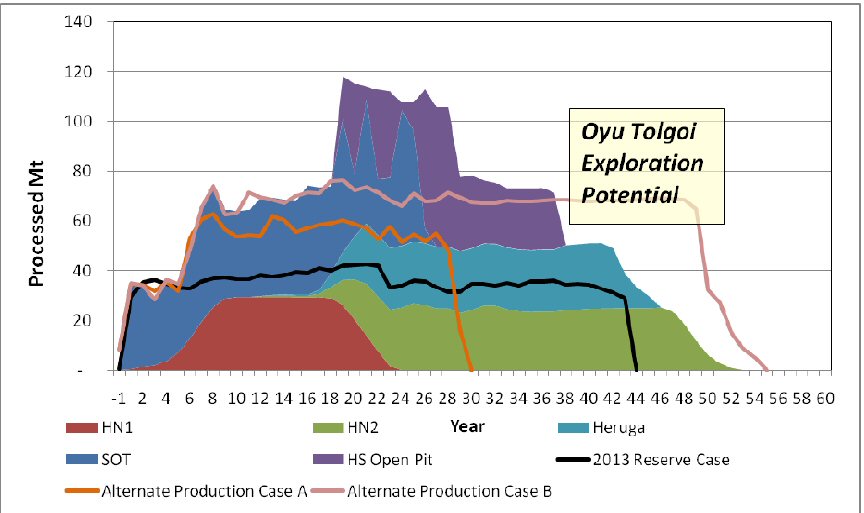

The Lookout Hill property includes the Hugo North Extension and the Heruga deposits, which host indicated (Hugo North Extension) and inferred mineral resources. The indicated resource at Hugo North Extension includes a probable reserve, which is included in Lift 1 of the Oyu Tolgoi underground block cave mining operation. Lift 1 is currently scheduled to generate first development production in 2019. A second lift for the Oyu Tolgoi underground block cave operation, including additional resources from Hugo North Extension, has been proposed but has not yet been modeled within the existing mine plan.

The Ann Mason Project includes the Ann Mason and the Blue Hill deposits, which host indicated (Ann Mason) and inferred mineral resources. The Company reported the results of the Ann Mason deposit PEA on October 24, 2012.

Our financial statements for the years ended December 31, 2013, 2012, and 2011 have been prepared in accordance with US GAAP. The consolidated financial statements have been prepared under the historical cost convention, as modified by financial assets and financial liabilities at fair value through profit or loss. The Company has consistently applied the same accounting policies throughout all periods presented, as if these policies had always been in effect.

Critical accounting policies and Use of Estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the period. Actual results could differ from these estimates.

The Company must make estimates and judgments in determining income tax expense for financial statement purposes. These estimates and judgments occur in the calculation of tax credits, benefits, and deductions, and in the calculation of certain tax assets and liabilities that arise from differences in the timing of recognition of revenue and expense for tax and financial statement purposes. Significant changes in these estimates may result in an increase or decrease to the tax provision in a subsequent period. The Company must assess the likelihood that we will be able to recover any deferred tax assets. If recovery is not likely, the provision for taxes must be increased by recording a valuation allowance against the deferred tax assets. However, should there be a change in the ability to recover any deferred tax assets, the tax provision would increase in the period in which it is determined that the recovery was not likely. Recovery of a portion of the deferred tax assets is impacted by Company plans with respect to holding or disposing of certain assets. Changes in economic conditions, exploration results, metal prices and other factors could result in changes to the estimates and judgements used in determining the income tax expense.

The Company capitalizes the cost of acquiring mineral property interests, including undeveloped mineral property interests, until the viability of the mineral interest is determined. Capitalized acquisition costs are expensed if it is determined that the mineral property has no future economic value. The Company must make estimates and judgments in determining if any capitalized amounts should be written down by assessing if future cash flows, including potential sales proceeds, related to the mineral property are estimated to be less than the property's total carrying value. The carrying value of each mineral property is reviewed periodically, and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Reductions in the carrying value of a property would be recorded to the extent that the total carrying value of the mineral property exceeds its estimated fair value.

The Company follows accounting guidelines in determining the value of stock option compensation, as disclosed in Note 9 to the Annual Financial Statements for the year ended December 31, 2013. Unlike other numbers in the accounts, this is a calculated amount not based on historical cost, but on subjective assumptions introduced to an option pricing model, in particular: (1) an estimate for the average future hold period of issued stock options before exercise, expiry or cancellation; and (2) future volatility of the Company’s share price in the expected hold period (using historical volatility as a reference). Given that there is no market for the options and they are not transferable, the resulting value calculated is not necessarily the value the holder of the option could receive in an arm’s-length transaction.

The Company’s accounting policy is to expense exploration costs on a project by project basis consistent with US GAAP. The policy is consistent with that of other exploration companies that have not established mineral reserves. When a mineral reserve has been objectively established further exploration costs would be deferred. Management is of the view that its current policy is appropriate for the Company.

Changes in Accounting Policies

The accounting pronouncements issued by the Financial Accounting Standards Board during the year ended December 31, 2013 were not applicable to the Company.

A detailed summary of all of the Company’s significant accounting policies and the estimates derived therefrom is included in Note 2 to the Annual Financial Statements for the year ended December 31, 2013.

The following discussion is intended to supplement the audited consolidated financial statements of the Company for the years ended December 31, 2013, 2012 and 2011, and the related notes thereto, which have been prepared in accordance with US GAAP. This discussion should be read in conjunction with the audited consolidated financial statements contained in this Annual Report on Form 20-F. This discussion contains “forward-looking statements” that are subject to risk factors set out under the heading “Item 3. Key Information – D. Risk Factors”. See “Cautionary Note Regarding Forward-Looking Statements” above.

SELECTED ANNUAL FINANCIAL INFORMATION

| | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | |

| | | | | | | | | | |

| Total Revenues | | $ | - | | | $ | - | | | $ | - | |

| Net Loss | | | (11,422,025 | ) | | | (15,196,129 | ) | | | (17,140,208 | ) |

| Net loss per share, basic and diluted | | | (0.08 | ) | | | (0.12 | ) | | | (0.15 | ) |

| Working capital | | | 46,394,496 | | | | 4,699,256 | | | | 19,004,136 | |

| Total assets | | | 97,395,105 | | | | 64,173,530 | | | | 74,589,810 | |

| Total long term liabilities | | | 50,956,860 | | | | 15,286,041 | | | | 13,720,492 | |

(1) Working Capital is defined as Current Assets less Current Liabilities. | | | | | |

For the year ended December 31, 2013, net loss was $11,422,025 compared to $15,196,129 in the year ended December 31, 2012. During the year ended December 31, 2013, Entrée incurred lower operating expenditures, primarily from decreased exploration expenses on the Ann Mason Project, further described below, relative to the year ended December 31, 2012. Other factors that contributed to the lower operating expenditures include higher foreign exchange gains, a significant deferred income tax recovery and a decreased loss from the Entrée-OTLLC Joint Venture resulting in decreased losses from equity investee. The lower operating expenditures were partially offset by higher general and administration and higher consultancy and advisory fees related primarily to expenditures associated with the Sandstorm financing and ongoing efforts to resolve Mongolian contractual matters. As at December 31, 2013, working capital was $46,394,496 compared to $4,699,256 as at December 31, 2012. The increase in working capital is due to cash proceeds received from the financing package with Sandstorm consisting of three components: a $40 million equity participation and funding agreement, a C$10 million private placement and a $5 million payment from Sandstorm in return for a 0.4% NSR royalty on the Ann Mason and Blue Hill deposits. As at December 31, 2013, total assets were $97,395,105 compared to $64,173,530 as at December 31, 2012. The increase in total assets over the prior year is primarily the net effect of an increase in working capital described above. As at December 31, 2013, total long term liabilities were $50,956,860 compared to $15,286,041 as at December 31, 2012. The increase in long term liabilities over the prior year is largely due to the recording of the Sandstorm $40 million equity participation and funding agreement Deposit as deferred revenue.

Results of operations are summarized as follows:

| | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | |

| | | | | | | |

| Exploration | | $ | 5,808,316 | | | $ | 7,966,902 | |

| General and administrative | | | 5,510,641 | | | | 4,295,800 | |

| Consultancy and advisory fees | | | 1,941,130 | | | | - | |

| Stock-based compensation | | | 1,422,297 | | | | 1,207,878 | |

| Impairment of mineral property interests | | | 437,732 | | | | 486,746 | |

| Current income tax expense | | | 319,112 | | | | - | |

| Interest expense | | | 260,453 | | | | 229,359 | |

| Loss from equity investee | | | 146,051 | | | | 1,012,156 | |

| Depreciation | | | 102,941 | | | | 150,654 | |

| Fair value adjustment of asset backed commercial papers | | | (147,564 | ) | | | - | |

| Interest income | | | (431,596 | ) | | | (190,449 | ) |

| Gain on sale of mineral property interest | | | (451,892 | ) | | | (104,914 | ) |

| Foreign exchange loss (gain) | | | (1,113,728 | ) | | | (187,773 | ) |

| Deferred income tax recovery | | | (2,381,868 | ) | | | 329,770 | |

| Net loss | | $ | 11,422,025 | | | $ | 15,196,129 | |

Mineral properties expenditures are summarized as follows:

| | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | |

| | | | | | | |

| US | | $ | 3,940,264 | | | $ | 5,857,999 | |

| Mongolia | | | 1,355,493 | | | | 1,964,883 | |

| Other | | | 807,235 | | | | 411,472 | |

| Total costs | | | 6,102,992 | | | | 8,234,354 | |

| Less stock-based compensation | | | (294,676 | ) | | | (267,452 | ) |

| Total expenditures, cash | | $ | 5,808,316 | | | $ | 7,966,902 | |

MONGOLIA

Lookout Hill – Joint Venture Property

Since formation, and as of December 31, 2013, the Entrée-OTLLC Joint Venture had expended $26.3 million to advance the project. Under the terms of the Entrée-OTLLC Joint Venture, OTLLC contributed on Entrée’s behalf the required cash participation amount of $6.0 million, equal to 20% of the $26.3 million incurred to date, plus interest at prime plus 2%.

In mid-December 2012 a new drill hole was collared at the north end of Heruga on the Javhlant licence but directed northwest onto the Oyu Tolgoi licence. In early February 2013, the hole passed onto the Oyu Tolgoi licence at a depth of approximately 1,500 metres and still above the mineralized zone. The hole terminated February 26, 2013 at a depth of 2,067 metres within the Oyu Tolgoi licence. No exploration has been completed by OTLLC on the Joint Venture Property since February 2013 and no work is currently planned for 2014.

Lookout Hill - Shivee West

Entrée has a 100% interest in the western portion of the Shivee Tolgoi mining licence.

No work has been completed on Shivee West in 2013. The Company does not anticipate significant exploration and development on Shivee West until the current regulatory environment in Mongolia has been stabilized.

For the year ended December 31, 2013, Shivee West expenses were $1,355,493 compared to $1,964,883 during the year ended December 31, 2012. The lower expenses in 2013 compared to 2012 resulted from a decrease in exploration and development expenses and lower personnel and consulting fees.

UNITED STATES

Ann Mason Project, Nevada

The Ann Mason Project is Entrée’s most advanced project outside of Mongolia. To date, excluding any capitalized mineral property acquisition costs, Entrée has expended approximately $26.0 million on the Ann Mason Project including $3,807,805 in the year ended December 31, 2013.

With the completion of a positive PEA study, Entrée is now evaluating the most efficient and effective way of advancing the Ann Mason Project. Work programs will focus on high priority targets that could enhance Ann Mason Project economics. In 2013, limited drilling at the Ann Mason deposit was designed to test for extensions of mineralization, primarily along the northeast and northwest margins of the deposit, and to extend mineralization within the current pit design. Limited drilling at Blue Hill tested for additional areas of copper oxide mineralization and potential for underlying sulphide mineralization.

At Blue Hill, copper oxide and mixed mineralization remains open in several directions. To the east, oxide and mixed mineralization is truncated by the low angle Blue Hill Fault, however, underlying sulphide mineralization continues in this direction. Drilling of the underlying sulphide target remains very widely-spaced, but has identified a target area more than one kilometre in width, which remains open in most directions. Significant molybdenum mineralization was also intersected in two of the drill holes targeting the sulphide mineralization. Most recent drill holes were targeted to test oxide mineralization; however, two diamond holes (EG-BH-11-019 and -021) were drilled east of the oxide copper zone to test deeper sulphide copper potential. In addition, hole EG-BH-11-031, located approximately one kilometre east of Blue Hill, intersected a near-surface zone of copper-oxide mineralization assaying an average of 0.28% copper over 13.8 metres from a depth of 22.2 metres. Further drilling will be required in this area and if successful could provide additional feed for a potential SX/EW operation.

The area between the Ann Mason and Blue Hill deposits has seen only wide-spaced, mostly shallow drilling to date and remains a high priority target for future exploration for both additional sulphide and oxide mineralization. South of Ann Mason, soil surveying and mapping suggests potential for near surface oxide copper mineralization which could have a positive impact on the Ann Mason Project.

Several other high-priority targets on the Ann Mason Project property require further exploration. These include the Roulette, Blackjack IP and Blackjack Oxide targets and the Minnesota copper skarn target. In the Blackjack area, IP and surface copper oxide exploration targets have been identified for drill testing. The Minnesota skarn target requires further drilling to test deeper IP and magnetic anomalies.

Baseline environmental studies commenced in the second quarter of 2013 and include wildlife, biology, archaeology and cultural surveys. These studies will be used to expand the area covered under the existing PoO. Studies were largely complete at the end of 2013 except for minor additional cultural and raptor field surveys.

In April 2013, the Company mobilized an RC rig and a core rig onto the Ann Mason Project to test the Ann Mason and Blue Hill deposits and new exploration targets described above. All drilling was completed in July 2013 and the rigs demobilized from site.

At the Ann Mason deposit, core drilling was designed to test for extensions of mineralization, primarily along the northeast and northwest margins of the deposit and to extend mineralization within the current pit design. In total, 993 metres of RC pre-collar drilling and 2,159 metres of core drilling were completed in five holes which varied in depth from 502 to 811 metres. Two RC holes totalling 180 metres were drilled to test a new exploration target located 950 metres west of the Ann Mason deposit.

Significant drill results from the 2013 Ann Mason drilling include:

| ● | Near the east end of the deposit, hole EG-AM-13-035 intersected 220 metres (from 262 metres depth) averaging 0.30% copper, 0.07 g/t gold and 1.70 g/t silver. Included within the intersection is a higher-grade interval of 100 metres grading 0.43% copper, 0.11 g/t gold and 2.75 g/t silver. |

| ● | Drill holes EG-AM-13-033 and 034, on the northeast side of the deposit, returned 310 metres of 0.21% copper and 46.0 metres of 0.27% copper, respectively and extend copper mineralization up to 250 metres northeast of the current mineral resource. The copper intercept in hole EG-AM-13-33 included 0.014% molybdenum, which is higher than typical values for the deposit. |

| ● | EG-AM-13-036, while primarily pyritic, extends weak copper mineralization up to 190 metres north of the Ann Mason resource boundary. Higher grade copper mineralization in this area is interpreted to occur below the drilled depth of holes EG-AM-13-036 and 037. EG-AM-13-037 is located 240 metres east-southeast of EG-AM-13-036 and encountered strong faulting with no significant copper mineralization. |

Two shallow, widely-spaced RC holes (totalling 180 metres) were also completed about 500 to 900 metres to the west of Ann Mason to test a new, near-surface oxide copper target. Holes EG-AM-13-038 and 039 encountered narrow intervals of 0.16% – 0.20% oxide copper within strong, quartz-sericite-pyrite alteration. Deeper sulphide potential below these holes remains untested.

The drilling at Blue Hill successfully tested for westward extensions of the current deposit and also highlighted the structural complexity of the Blue Hill area. The drilling included five RC holes totalling 669 metres and two previously drilled RC holes, which were deepened with core (162 metres and 171 metres) to test underlying sulphide mineralization. In addition, four RC holes, totalling 419 metres, tested near-surface oxide copper near EG-BH-11-031 to the east of Blue Hill.

Significant 2013 Blue Hill drill results include:

| ● | EG-BH-13-040, located 750 metres west of the current Blue Hill resource, encountered several thin zones of oxide copper mineralization grading between 0.13% and 0.14% copper over widths ranging between 3 metres and 35 metres. In addition, 11 metres of 0.24% copper sulphide mineralization was intersected at the bottom of the hole. This drill hole is located on the edge of a largely untested, strong IP anomaly. |

| ● | On the west side of the deposit, EG-BH-13-036 adds 16 metres of oxide mineralization grading 0.21% copper between two lenses within the current resource and EG-BH-13-037 adds 29 metres of oxide mineralization grading 0.14% copper, above the current resource. |

| ● | Within the deposit, previous RC hole EG-BH-11-027 was deepened 171 metres with core drilling and encountered 0.19% copper in sulphides over 43 metres in the hanging wall of a major low-angle structure below the Blue Hill Fault. |

| ● | Four RC holes, EG-BH-13-032, 033, 034 and 035, were drilled in the vicinity of EG-BH-11-031 (0.28% oxide copper over 13.8 metres) to test the extent of oxide copper mineralization between Ann Mason and Blue Hill. Two of the holes (EG-BH-13-032 and 035) intersected thinner intervals of similar grade mineralization (3 metres grading 0.25% copper). Oxide mineralization remains open to the north and to the west. |

A short program of fill-in IP (31 line-kilometres) was completed in June 2013.

For the year ended December 31, 2013, Ann Mason Project expenditures were $3,807,805 compared to $5,691,528 during the year ended December 31, 2012. The lower expenses in 2013 resulted primarily from a decrease in drilling activities and consulting fees. The Company anticipates minimal field work in 2014 pending improvement in metal prices and in the mining investment environment.

Lordsburg and Oak Grove, New Mexico

In June 2007, Entrée entered into an agreement with Empirical Discovery LLC ("Empirical") to explore for and develop porphyry copper targets in southeastern Arizona and southwestern New Mexico.

On May 2, 2012, Entrée entered into an agreement (the "Purchase Agreement") with Empirical to purchase a 100% interest in two targets - the Lordsburg property in New Mexico, and the Oak Grove property. In September 2013 Entrée abandoned the Oak Grove property and recorded an impairment of mineral property interests of $437,732.

Pursuant to the Purchase Agreement, Entrée paid $100,000 and issued 500,000 common shares of the Company. The Lordsburg property is subject to a 2% NSR royalty granted to Empirical, which may be bought down to 1% for $1 million if the buydown option is exercised on or before January 1, 2015. The buydown option may be extended to January 1, 2016 or January 1, 2017, in which case the buydown price will be $2 million and $200,000 will be payable for each 12 month extension. The buydown price and extension payments are payable in cash or a combination of cash and common shares at Entrée’s election.

The Lordsburg claims cover 2,013 ha adjacent to the historic Lordsburg copper-gold-silver district in New Mexico. Drilling at Lordsburg has been successful in discovering a porphyry copper-gold occurrence in an area previously known only for vein-style gold mineralization. Future drilling will be directed towards expanding the existing drill defined copper and gold zone.

The proposed Plan of Operations for Lordsburg has been approved by the BLM and an Application to Conduct Mineral Exploration has been approved by the New Mexico Division of Mining and Minerals. The Lordsburg Plan of Operations/Environmental Assessment and Application to Conduct Mineral Exploration provides for drilling on 65 additional sites and 28.2 acres of surface disturbance.

Shamrock, Nevada

The Shamrock property, acquired through the acquisition of PacMag, is a copper skarn exploration target located in the Yerington copper porphyry district in western Nevada. Entrée has a 100% interest in 41 unpatented and 13 patented lode mining claims covering approximately 362 ha (895 acres).

Eagle Flats, Nevada

In March 2011, Entrée entered into a mining lease and option to purchase agreement with respect to 58 unpatented lode claims, 65 kilometres east of Yerington, in Mineral County, Nevada. Under the agreement, as amended, Entrée leases the claims for combined payments of $125,000 over five years, and reimbursed $30,000 in property and recording costs. Entrée has an option to purchase the claims for $500,000, subject to a 2% NSR royalty which may be bought down to a 1% NSR royalty for $500,000. After the fifth anniversary, Entrée must pay $40,000 per year, either as a lease payment or an advanced royalty payment, depending on whether the option has been exercised. Advanced royalty payments will be credited against future NSR royalty payments.

AUSTRALIA

Blue Rose Joint Venture

Entrée has a 53.7% interest in the Blue Rose copper-iron-gold-molybdenum joint venture property, with Giralia Resources Pty Ltd, now a subsidiary of Atlas Iron Limited (ASX:AGO) ("Atlas"), retaining a 46.3% interest. The property is located in the Olary Region of South Australia, 300 kilometres north-northeast of Adelaide. Magnetite iron formations occur in the southern portion of this 1,000 square kilometre tenement, and a zone of copper oxide mineralization and a gold target (Golden Sophia) are located in the north-central area of the tenement. The joint venture covers tenement EL5129, which was granted on July 19, 2012, for a 3-year term.

In September 2010, the joint venture entered into an agreement with Bonython Metals Group Pty Ltd ("BMG"), a private Australian resource company. BMG purchased 100% of the iron ore rights on the joint venture property in exchange for 6% of BMG’s future issued capital. On February 27, 2012, the Federal Court of Australia ordered that BMG be wound up; a liquidator has been appointed. In October 2013, pursuant to an agreement whereby a third party acquired the Blue Rose joint venture’s iron ore rights from BMG, Entrée received the first of two cash payments of A$475,478 plus GST.

Soil sampling was completed by the joint venture over the Golden Sophia shallow gold target in August 2011. The survey confirmed the previous Battle Mountain gold in soil anomaly and defined a new, linear gold anomaly located approximately 700 metres to the northeast.

On October 23, 2013, the Blue Rose joint venture filed a Part 9B native title application under the South Australia Mining Act and the Wilyakali and Ngadjuri groups registered as native title claimants. Native title agreements must be concluded with claimants prior to any exploration on the joint venture license. Native title agreements have been signed with the Wilyakali and Ngadjuri groups.

PERU

In September 2010, Entrée entered into a conditional agreement with a private Peruvian company whereby Entrée may acquire an initial 70% interest in the Lukkacha property located in Tacna Province of southeastern Peru. The property is situated within 50 kilometres of the international border with Chile, and initiation of work is subject to Entrée obtaining a Supreme Decree allowing it to work on the property. Subject to obtaining the Supreme Decree, Entrée may earn a 70% interest by making cash payments totaling $215,000 and expending a minimum of $1.5 million on exploration, to include a minimum 6,000 metres of diamond drilling, within 24 months. Once Entrée has earned a 70% interest, it may acquire a further 30% interest by paying the vendors $2 million within 24 months. The vendors would retain a 2% NSR royalty, half of which may be purchased at any time for $1 million.

The property consists of seven concessions totaling 4,400 ha which cover two large areas of surface alteration, iron oxides and quartz veining approximately 50 kilometres along the structural trend southeast from the giant Toquepala mining operation of Grupo Mexico. The property has never been drilled and represents a unique opportunity for early stage exploration within an under-explored major copper district. Further exploration (geophysics and drilling) is dependent on receipt of the Supreme Decree. As a first step in obtaining the Supreme Decree, a joint military inspection of the property took place on September 12, 2013. The military submitted a favourable written opinion to the General Secretary of the Ministry of Defense on September 15, 2013.

For the year ended December 31, 2013, Lukkacha expenses were $134,454 compared to $41,646 during the year ended December 31, 2012.

GENERAL AND ADMINISTRATIVE

For the year ended December 31, 2013, general and administrative expense, excluding foreign exchange gains and losses and before stock-based compensation, was $5,510,641 compared to $4,295,800 during the year ended December 31, 2012 and compared to $4,921,284 during the year ended December 31, 2011. The increase in 2013 was due to a number of factors including higher legal and accounting fees and increases in personnel and consulting expenses compared to 2012.

STOCK-BASED COMPENSATION

For the year ended December 31, 2013, stock-based compensation expense was $1,422,297 compared to $1,207,878 during the year ended December 31, 2012 and compared to $991,161 during the year ended December 31, 2011. During the year ended December 31, 2013, 7,560,000 options were granted with a fair value of $1,421,371, compared to 1,882,000 options that were granted with a fair value of $1,124,930 during the year ended December 31, 2012, and compared to 575,000 options that were granted with a fair value of $944,319 during the year ended December 31, 2011.

INTEREST INCOME AND EXPENSE

For the year ended December 31, 2013, interest expense was $260,453 (December 31, 2012 - $229,359; December 31, 2011 - $151,952). Interest expense is due to accrued interest on the OTLLC loan payable. For the year ended December 31, 2013, interest income was $431,596 (December 31, 2012 - $190,449; December 31, 2011 - $342,343). The Company earns interest income on its invested cash, which increased compared to the equivalent period last year due to higher principal amounts invested following completion of the Sandstorm financing.

VALUATION OF LONG-TERM INVESTMENT

Equity Method Investment

As further described in the notes to the Annual Financial Statements, Entrée accounts for its interest in a joint venture with OTLLC as a 20% equity investment. As at December 31, 2013, the Company’s investment in the Entrée-OTLLC Joint Venture was $96,367 (December 31, 2012 - $96,205). The Company’s share of the loss of the Entrée-OTLLC Joint Venture was $146,051 for the year ended December 31, 2013 (December 31, 2012 - $1,012,156; December 31, 2011 - $2,397,085) plus accrued interest expense of $260,453 for the year ended December 31, 2013 (December 31, 2012 - $229,359; December 31, 2011 - $151,952). The decrease in the loss from equity investee for the year ended December 31, 2013 compared to last year was due to decreased exploration expenses incurred by the Entrée-OTLLC Joint Venture in the year.

OUTLOOK

Entrée is primarily focused on exploring its principal properties in Nevada and Mongolia. In addition, Entrée is engaged in evaluating acquisition opportunities which are complementary to its existing projects, particularly large tonnage base and precious metal targets in mining friendly jurisdictions. These efforts have resulted in the consolidation of the Ann Mason Project in Nevada (including through the acquisition of PacMag and the agreement with Eurasian) and the acquisition of the Lordsburg property in New Mexico. The commodities Entrée is most likely to pursue include copper, gold and molybdenum, which are often associated with large tonnage, porphyry related environments. Smaller, higher grade systems will be considered by Entrée if they demonstrate potential for near-term production and cash-flow.

Entrée has not generated any revenue from operations since its incorporation and Entrée anticipates that it will continue to incur operating expenses without revenues until the Joint Venture Property in Mongolia is brought into production or it builds and operates a mine on one or more of its other mineral properties. As at December 31, 2013, Entrée had working capital of approximately $46.4 million. Entrée’s average monthly operating expenses for the year ended December 31, 2013, were approximately $1.1 million, including exploration, general and administrative expenses and investor relations expenses. On February 15, 2013, the Company entered into a financing package with Sandstorm for gross proceeds of approximately $55 million consisting of three components: a $40 million equity participation and funding agreement, a C$10 million private placement and a $5 million payment from Sandstorm in return for a 0.4% NSR royalty on the Ann Mason and Blue Hill deposits. The funds from the financing package will be used to support operations in Mongolia, advance the Ann Mason Project, for working capital requirements and for other general corporate purposes.

| | | Three Months Ended December 31, 2013 | | | Three Months Ended September 30, 2013 | | | Three Months Ended June 30, 2013 | | | Three Months Ended March 31, 2013 | |

| | | | | | | | | | | | | |

| Exploration | | $ | 1,426,239 | | | $ | 1,168,327 | | | $ | 1,904,636 | | | $ | 1,603,790 | |

| General and administrative | | | 1,648,610 | | | | 1,072,706 | | | | 1,217,555 | | | | 2,802,332 | |

| Foreign exchange loss (gain) | | | (765,656 | ) | | | 662,337 | | | | (892,725 | ) | | | (117,684 | ) |

| Consultancy and advisory fees | | | 309,462 | | | | 320,567 | | | | 324,175 | | | | 986,926 | |

| Gain on sale of mineral property interest | | | (451,892 | ) | | | - | | | | - | | | | - | |

| Impairment of mineral property interests | | | - | | | | - | | | | 437,732 | | | | - | |

| Loss from operations | | | (2,166,763 | ) | | | (3,223,937 | ) | | | (2,991,373 | ) | | | (5,275,364 | ) |

| Interest income | | | 126,664 | | | | 140,418 | | | | 100,948 | | | | 63,566 | |

| Interest expense | | | (66,331 | ) | | | (65,313 | ) | | | (64,553 | ) | | | (64,256 | ) |

| Loss from equity investee | | | (29,756 | ) | | | (23,049 | ) | | | 19,683 | | | | (112,929 | ) |

| Fair value adjustment of asset backed | | | | | | | | | | | | | |

| commercial papers | | | - | | | | - | | | | 147,564 | | | | - | |

| Current income tax expense | | | (319,112 | ) | | | - | | | | - | | | | - | |

| Deferred income tax recovery | | | 1,331,336 | | | | 241,279 | | | | 512,114 | | | | 297,139 | |

| Net loss | | $ | (1,123,962 | ) | | $ | (2,930,602 | ) | | $ | (2,275,617 | ) | | $ | (5,091,844 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per share, basic and diluted | | $ | (0.01 | ) | | $ | (0.02 | ) | | $ | (0.02 | ) | | $ | (0.04 | ) |

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2012 | | | Three Months Ended September 30, 2012 | | | Three Months Ended June 30, 2012 | | | Three Months Ended March 31, 2012 | |

| | | | | | | | | | | | | | | | | |

| Exploration | | $ | 987,942 | | | $ | 1,228,341 | | | $ | 2,402,084 | | | $ | 3,615,987 | |

| General and administrative | | | 1,206,757 | | | | 961,429 | | | | 1,107,937 | | | | 2,110,757 | |

| Foreign exchange loss (gain) | | | 61,536 | | | | (354,197 | ) | | | 79,550 | | | | 25,338 | |

| Gain on sale of mineral property interest | | | - | | | | - | | | | - | | | | (104,914 | ) |

| Impairment of mineral property interests | | | 486,746 | | | | - | | | | - | | | | - | |

| Loss from operations | | | (2,742,981 | ) | | | (1,835,573 | ) | | | (3,589,571 | ) | | | (5,647,168 | ) |

| Interest income | | | 22,293 | | | | 29,328 | | | | 50,710 | | | | 88,118 | |

| Interest expense | | | (63,134 | ) | | | (58,705 | ) | | | (55,344 | ) | | | (52,176 | ) |

| Loss from equity investee | | | (281,055 | ) | | | (238,988 | ) | | | (189,507 | ) | | | (302,606 | ) |

| Deferred income tax recovery (expense) | | | (1,912,557 | ) | | | 204,780 | | | | 539,007 | | | | 839,000 | |

| Net loss | | $ | (4,977,434 | ) | | $ | (1,899,158 | ) | | $ | (3,244,705 | ) | | $ | (5,074,832 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per share, basic and diluted | | $ | (0.04 | ) | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.04 | ) |

Exploration costs were lower in the year ended December 31, 2013 compared to the year ended December 31, 2012, primarily due to decreased drilling activity and consulting fees on the Ann Mason Project during the year ended December 31, 2013. General and administrative costs, excluding stock-based compensation changes, were approximately 26% higher in the year ended December 31, 2013 compared to the year ended December 31, 2012. This increase is primarily attributable to the increase in legal fees associated with closing of the Sandstorm transaction and increased personnel and consulting expenses. During the three months ended March 31, 2013, the Company incurred consultancy and advisory fees of $936,926 related to the Sandstorm financing agreement. During the three months ended December 31, 2011, Entrée sold the Togoot licence and recorded a gain on sale of mineral property interest of $1,474,640. During the three months ended March 31, 2012, Entrée sold its interest in the Northling property and recorded a gain on sale of mineral property interest of $104,914. During the three months ended December 31, 2013, Entrée received the first of two cash payments of $451,892 pertaining to an agreement whereby a third party acquired the Blue Rose joint venture iron ore rights. Loss from equity investee was lower in the year ended December 31, 2013 compared to the year ended December 31, 2012 due to decreased expenditures on the Joint Venture Property. During the year ended December 31, 2013, Entrée recorded deferred income tax recovery of $2,381,868 compared to deferred income tax expense of $329,770 during the year ended December 31, 2012.

| A. | Liquidity and Capital Resources |

To date, Entrée has not generated revenues from its operations, has been dependent on equity and production-based financings for additional funding and is considered to be in the exploration stage. Working capital on hand at December 31, 2013 was $46,394,496. Cash was $46,701,216 at December 31, 2013. On February 15, 2013, the Company closed the approximately $55 million financing package with Sandstorm which will be used to support operations in Mongolia, advance the Ann Mason Project and for general working capital requirements. In the event of a partial expropriation of Entrée’s interest in the Joint Venture Property, which is not reversed during the abeyance period provided for in the equity participation and funding agreement, the Company will be required to return a pro rata portion of the Deposit (the amount of the repayment not to exceed the amount of the Unearned Balance).

Under the terms of the Entrée-OTLLC Joint Venture, Entrée elected to have OTLLC debt finance Entrée’s share of costs on the Joint Venture Property, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. As at December 31, 2013, the total amount that OTLLC has contributed to costs on the Company’s behalf, including interest, is approximately $6.0 million.

Operating activities

Cash provided by operations was $27,979,150 for the year ended December 31, 2013 compared to the $12,801,856 used in operations for the year ended December 31, 2012. This increase is primarily due to cash proceeds of $40 million received from the funding agreement with Sandstorm and is partially offset by expenditures on mineral property exploration and general and administrative.

Financing activities

Cash provided by financing activities during the year ended December 31, 2013 and 2012 and common shares issued for cash were as follows:

| | | Year Ended December 31, 2013 | | | Year Ended December 31, 2012 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | | | | | | | | | |

| Private placement | | | 17,857,142 | | | $ | 9,722,897 | | | | - | | | $ | - | |

| Exercise of over allotment | | | - | | | | - | | | | 1,320,455 | | | | 1,628,583 | |

| Share issuance costs | | | - | | | | (86,636 | ) | | | - | | | | (108,058 | ) |

| | | | 17,857,142 | | | $ | 9,636,261 | | | | 1,320,455 | | | $ | 1,520,525 | |

The 2013 private placement was part of the Sandstorm financing package.

Investing activities

During the year ended December 31, 2013, Entrée made payments of $50,000 related to mineral property acquisitions (December 31, 2012 – $3,910,000). During the year ended December 31, 2013, Entrée received cash proceeds of $115,180 on the release of reclamation deposits compared to cash payments of $207,962 related to reclamation deposits in 2012. During the year ended December 31, 2013, Entrée expended $7,623 on equipment, primarily for exploration activities (December 31, 2012 – $35,893). During the year ended December 31, 2013, Entrée received cash proceeds of $5 million from Sandstorm in return for a 0.4% NSR royalty on the Ann Mason and Blue Hill deposits. During the year ended December 31, 2013, Entrée received the first of two cash payments of $451,892 pertaining to an agreement whereby a third party acquired the Blue Rose joint venture iron ore rights. During the year ended December 31, 2012, Entrée sold its interest in the Northling property for proceeds of $104,914, net of taxes.

Outstanding share data

As at December 31, 2013 and March 27, 2014, there were 146,734,385 common shares outstanding. In addition, as at December 31, 2013, there were 14,400,500 stock options outstanding with exercise prices ranging from C$0.30 to C$3.47 per share. As at March 27, 2014, there were 13,061,500 stock options outstanding with exercise prices ranging from C$0.30 to C$3.47 per share. There were no warrants outstanding at December 31, 2013 or at March 27, 2014.

CAPITAL RESOURCES

Entrée had no commitments for capital assets at December 31, 2013.

At December 31, 2013, Entrée had working capital of $46,394,496 compared to $4,699,256 as at December 31, 2012. On February 15, 2013, the Company closed the approximately $55 million financing package with Sandstorm.

OFF-BALANCE SHEET TRANSACTIONS

Entrée has no off-balance sheet arrangements except for the contractual obligation noted below.

| B. | Research and Development, Patents and Licenses, etc. |

None.

While the Company does not have any producing mines it is directly affected by trends in the metal industry. At the present time global metal prices are extremely volatile. Base metal prices and gold prices, driven by rising global demand, climbed dramatically and approached near historic highs over the past several years. These prices have declined significantly since these recent highs.

Overall market prices for securities in the mineral resource sector and factors affecting such prices, including base metal prices, political trends in the countries such companies operate, and general economic conditions, may have an effect on the terms on which financing is available to the Company, if at all.

Except as disclosed, the Company does not know of any trends, demand, commitments, events or uncertainties that will result in, or that are reasonably likely to result in, its liquidity either materially increasing or decreasing at present or in the foreseeable future. Material increases or decreases in liquidity are substantially determined by the success or failure of the Company’s exploration programs.

The Company’s financial assets and liabilities generally consist of cash and cash equivalents, short-term investments, receivables, deposits, accounts payable and accrued liabilities and loans payable, some of which are denominated in foreign currencies including United States dollars, Mongolian Tugriks and Australian dollars. The Company is at risk to financial gain or loss as a result of foreign exchange movements against the Canadian dollar. The Company does not currently have major commitments to acquire assets in foreign currencies; but historically it has incurred the majority of its exploration costs in foreign currencies.

| D. | Off-balance sheet arrangements |

The Company has no off-balance sheet arrangements.

| E. | Tabular disclosure of contractual obligations |

The following table lists, as at December 31, 2013, the Company’s contractual obligations. Entrée is committed to make lease payments totaling $806,392 over its four year office lease in Vancouver, Canada and two office, three warehouse and five accommodation leases in the United States.

| | | Less than 1 Year | | | 1-3 Years | | | 3-5 Years | | | Total | |

| | | | | | | | | | | | | |

| Office leases | | $ | 296,734 | | | $ | 421,673 | | | $ | 87,985 | | | $ | 806,392 | |

| Total | | $ | 296,734 | | | $ | 421,673 | | | $ | 87,985 | | | $ | 806,392 | |

The Company seeks safe harbor for our forward-looking statements contained in Items 5.E and F. See the heading “Cautionary Note Regarding Forward-Looking Statements” above.

Item 6. Directors, Senior Management and Employees

| A. | Directors and Senior Management |

The following is a list of the Company’s directors and executive officers as at December 31, 2013. The directors were elected by the Company’s shareholders on June 27, 2013 and are elected for a term of one year, which term expires at the election of the directors at the next annual meeting of shareholders.

The Company’s Board consisted of seven directors as at December 31, 2013. The following is a brief account of the education and business experience of each director and executive officer, indicating each person’s principal occupation during the last five years.

Gregory Crowe, President, Chief Executive Officer and Director

Mr. Crowe has been a director and President of the Company since July 3, 2002 and has been Chief Executive Officer of the Company since July 16, 2003.

Mr. Crowe was self-employed from 1997 to 2002, providing exploration and management services for junior resource companies.

Mr. Crowe is a professional geologist with more than 25 years of exploration, business and entrepreneurial experience throughout North America, Latin America, Africa and Southeast Asia. Prior to joining the Company, Mr. Crowe was a senior executive with Acrex Ventures Ltd., a junior resource company active in Ontario, and co-founder and President of Azimuth Geological Inc., a private consulting company specializing in exploration and management services for junior and major mining companies such as Rio Algom Ltd., the Prime Group and Westmin Resources Limited. Mr. Crowe also worked for Yuma Copper Corp. from 1994 to 1997, where he was instrumental in transforming Yuma Copper Corp. from a junior exploration company into a copper producer with two mines in Chile.

Mr. Crowe obtained a Bachelor of Geology degree from Carlton University and a Master of Geology degree from the University of Calgary. He is a member of the Association of Professional Engineers and Geoscientists of British Columbia, and the Prospectors and Developers Association of Canada.

The Rt. Honourable Lord Howard of Lympne, Chairman and Director

The Rt. Honourable Lord Howard of Lympne has been a director of the Company since May 16, 2007, served as the Company’s non-executive Deputy Chairman between May 16, 2007 and June 27, 2013 and was appointed non-executive Chairman on June 27, 2013.

He is the former leader of the Conservative Party in Britain, a distinguished lawyer, and served as a Member of Parliament in Britain for 27 years. He filled many government posts, including Home Secretary, Secretary of State for Employment and Secretary of State for the Environment, as well as Shadow Foreign Secretary and Shadow Chancellor. After his retirement from the House of Commons at the 2010 General Election, Lord Howard was created a Life Peer. He was created a Companion of Honour in the Queen’s Birthday Honours List, 2011.

James Harris, Non-Executive Deputy Chairman and Director

Mr. Harris has been a director of the Company since January 29, 2003, served as the Company’s non-executive Chairman between March 15, 2006 and June 27, 2013 and was appointed non-executive Deputy Chairman on June 27, 2013.

Mr. Harris is a corporate, securities and business lawyer with over 30 years experience in British Columbia and internationally. He has extensive experience with the acquisition and disposition of assets, corporate structuring and restructuring, regulatory requirements and corporate filings, and corporate governance. Mr. Harris was also a Founding Member of the Legal Advisory Committee of the former Vancouver Stock Exchange. Mr. Harris has completed the Directors’ Education Program of the Institute of Corporate Directors and is an Institute-certified Director. Mr. Harris has also completed a graduate course in business at the London School of Economics.

Mark Bailey, Director

Mr. Bailey has been a director of the Company since June 28, 2002.

Mr. Bailey is an exploration geologist with more than 35 years of industry experience. Between 1995 and 2012, he was the President and Chief Executive Officer of Minefinders Corporation Ltd. (“Minefinders”), a precious metals mining company that operated the multi-million ounce Dolores gold and silver mine in Mexico before being acquired by Pan American Silver Corp. Before joining Minefinders, Mr. Bailey held senior positions with Equinox Resources Inc. and Exxon Minerals. Since 1984, Mr. Bailey has worked as a consulting geologist with Mark H. Bailey & Associates LLC.

Lindsay Bottomer, Director

Mr. Bottomer has been a director of the Company since June 28, 2002. From October 16, 2005 until his retirement on December 31, 2013, he served first as the company’s Vice-President, Corporate Development and then as the Company’s Vice-President, Business Development.

Mr. Bottomer is a professional geologist with 40 years experience in global mineral exploration and development with major and junior mining companies, the last 24 years based in Vancouver, BC. He was President and Chief Executive Officer of Silver Quest Resources Ltd. from 2001 to 2005, and a founding director of Richfield Ventures Corp. until its takeover by New Gold Inc. in June 2011 for approximately $480 million. Mr. Bottomer has also served as Director of Canadian Exploration with Echo Bay Mines Ltd., and Vice-President of New Projects with Prime Equities International.

Mr. Bottomer obtained a Bachelor of Science (Honours) degree in geology from the University of Queensland and a Master of Applied Science degree from McGill University. Mr. Bottomer is a member of the Association of Professional Engineers and Geoscientists of British Columbia and a Fellow of the Australasian Institute of Mining and Metallurgy. He is also Past President of the British Columbia and Yukon Chamber of Mines and served for six years from 2002 to 2008 as an elected councillor on the Association of Professional Engineers and Geoscientists of British Columbia.

Alan Edwards, Director

Mr. Edwards has been a director of the Company since March 8, 2011.

Mr. Edwards has 30 years of diverse mining industry experience. He is a graduate of the University of Arizona, where he obtained a Bachelor of Science Degree in Mining Engineering and an MBA (Finance). Mr. Edwards is currently the President of AE Consulting, a Colorado based company. Mr. Edwards is the non-executive Chairman of the Board of AuRico Gold Inc., AQM Copper Inc., and Oracle Mining Corp., and is a director of U.S. Silver & Gold Inc. He served as President and Chief Executive Officer of Copper One Inc. from 2009 to 2011, as President and Chief Executive Officer of Frontera Copper Corporation from 2007 to 2009, and as Executive Vice President and Chief Operating Officer of Apex Silver Mines Corporation from 2004 to 2007, where he directed the engineering, construction and development of the San Cristobal project in Bolivia. Mr. Edwards has also worked for Kinross Gold Corporation, P.T. Freeport Indonesia, Cyprus Amax Minerals Company and Phelps Dodge Mining Company, where he started his career.

Gorden Glenn, Director

Mr. Glenn has been a director of the Company since June 18, 2012.

Mr. Glenn has over 20 years of mining, exploration and investment banking experience. He has been the interim Chief Executive Officer, President and a director of Auriga Gold Corp. since July 2012. Between December 2011 and April 2012 he served as Chief Executive Officer and a director of AMR Mineral Metal Inc. Between August 2010 and December 2011, Mr. Glenn was the Managing Director of Mining Investment Banking for Desjardins Securities. Prior to that, Mr. Glenn was the Vice President & Director of Mining Investment Banking at TD Securities. Holding a BScH in Geological Sciences from Queen’s University in Kingston, Ontario, he started his career as a project geologist with Inmet Mining and Kennecott Canada Inc. before switching to the capital markets where he worked as a mining analyst prior to joining TD Securities in 2005.

Bruce Colwill, Chief Financial Officer

Mr. Colwill was appointed to the position of Chief Financial Officer on February 1, 2011.

Mr. Colwill has over 20 years of experience with public and private companies, in a variety of sectors including oil and gas, biotech, financial services and manufacturing. Most recently, Mr. Colwill served as Chief Financial Officer of Transeuro Energy Corp., a public oil and gas company and acted as a financial consultant to private and public companies. Between 2001 and 2009, Mr. Colwill served as Chief Financial Officer of Neuromed Pharmaceuticals Ltd. Mr. Colwill began his career with KPMG, first in Canada and then in Poland. Mr. Colwill is a Chartered Accountant and a member of the Canadian Institute of Chartered Accountants and the Institute of Chartered Accountants of British Columbia. Mr. Colwill holds a BBA from Simon Fraser University.

Robert Cann, Vice President, Exploration

Mr. Cann has been the Company’s Exploration Manager since July, 2002 and was appointed to the position of Vice President, Exploration on August 11, 2005.

Since joining Entrée in 2002, Mr. Cann has been in charge of the start-up and management of all of the Company’s support operations and exploration projects. Mr. Cann has more than 30 years of international exploration experience including extensive experience in international project management and development, geological consulting and office management. Prior to joining the Company, Mr. Cann was Exploration Manager for Spokane/Sand River Resources in Chihuahua, Mexico, from 1999 to 2000. From 1995 through 1999, Mr. Cann worked as an independent consulting geologist for various companies contemplating property acquisitions in Honduras, Mexico, Peru, Bolivia and Nevada. Mr. Cann holds a Master of Science degree in Economic Geology from the University of British Columbia and is a member of the Association of Professional Engineers and Geoscientists of British Columbia, the Canadian Institute of Mining and Metallurgy (CIMM) and the Society of Economic Geologists.

Mona Forster, Executive Vice President

Ms. Forster joined the Company as Business Manager in October 2003 and was appointed to the position of Executive Vice President in November 2010.

Ms. Forster has over 25 years of experience in administration and management, primarily in the mining industry. She worked at an operating gold mine in the Northwest Territories for five years, in addition to positions in head office for the same producer and within exploration and environmental consulting firms. She was an elected director of the Association for Mineral Exploration British Columbia (AME BC) for seven years, including a term as Chair of the Board of Directors. Ms. Forster remains active on several committees related to AME BC. She is also an appointed member of the BC HR Taskforce: Exploration, Mining, Stone, Sand & Gravel, a government-industry task force struck in 2007 to address the need for skilled and qualified workers within the mining industry in BC. Ms. Forster holds an MBA from Simon Fraser University and is a member of AME BC, Prospectors and Developers Association of Canada, Canadian Investor Relations Institute and Canadian Society of Corporate Secretaries.

Susan McLeod, Vice President, Legal Affairs and Corporate Secretary

Ms. McLeod joined the Company as Vice President, Legal Affairs on September 22, 2010 and was appointed Corporate Secretary on November 22, 2010.

Prior to joining Entrée, Ms. McLeod was in private practise in Vancouver, Canada since 1997, most recently with Fasken Martineau DuMoulin LLP (from 2008 to 2010) and P. MacNeill Law Corporation (from 2003 to 2008). She has worked as outside counsel to public companies engaged in international mineral exploration and mining. She has advised clients with respect to corporate finance activities, mergers and acquisitions, corporate governance and continuous disclosure matters, and mining-related commercial agreements. Ms. McLeod holds a B.Sc. and an LLB from the University of British Columbia, and is a member of the Law Society of British Columbia.

Robert Cinits, Vice President, Corporate Development

Mr. Cinits has been the Company’s Director of Technical Services since July, 2011 and was appointed to the position of Vice President, Technical Services on June 27, 2013. On January 1, 2014, Mr. Cinits was appointed to the position of Vice President, Corporate Development.

Mr. Cinits has been in charge of overseeing the completion of all of the Company’s mineral resource and reserve estimates and technical reports since July, 2011. More recently he has been managing the Company’s evaluation of strategic opportunities and acquisitions. He has extensive experience in project management and development and geological consulting. Prior to joining the Company, Mr. Cinits was the Chief Operating Officer for MinCore Inc., a private, Toronto-based exploration company with projects in Sinaloa, Mexico, from 2007 to 2011. From 2003 through 2006, Mr. Cinits worked for AMEC as the Manager of Geology and Mining for the Lima Peru office. He was involved in numerous feasibility and pre-feasibility studies, as well as PEAs, resource estimates and mine and project audits/reviews throughout South America and other locations worldwide. Mr. Cinits has also worked for several consulting groups and junior mining companies since 1985. Mr. Cinits holds a Bachelor of Science degree in Geology from the University of Toronto and is a member of the Association of Professional Engineers and Geoscientists of British Columbia and the Society of Economic Geologists.

Family Relationships

There are no family relationships between any directors or executive officers of the Company.

Arrangements

There are no known arrangements or understandings with any major shareholders, customers, suppliers or others, pursuant to which any of the Company’s officers or directors was selected as an officer or director of the Company.

Conflicts of Interest

There are no existing or potential conflicts of interest among the Company, its directors, officers or promoters as a result of their outside business interests with the exception that certain of the Company’s directors, officers and promoters serve as directors, officers and promoters of other companies, as set out below, and, therefore, it is possible that a conflict may arise between their duties as a director, officer or promoter of the Company and their duties as a director or officer of such other companies.

The directors and officers of the Company are aware of the existence of laws governing accountability of directors and officers for corporate opportunity and requiring disclosures by directors of conflicts of interest and the Company will rely upon such laws in respect of any directors’ and officers’ conflicts of interest or in respect of any breaches of duty by any of its directors or officers. All such conflicts will be disclosed by such directors or officers in accordance with the British Columbia Business Corporations Act, and they will govern themselves in respect thereof to the best of their ability in accordance with the obligations imposed upon them by law.

The majority of the Company’s directors are also directors, officers or shareholders of other companies that are engaged in the business of acquiring, developing and exploiting natural resource properties including properties in countries where the Company is conducting its operations. Such associations may give rise to conflicts of interest from time to time. Such a conflict poses the risk that the Company may enter into a transaction on terms which place the Company in a worse position than if no conflict existed. The directors of the Company are required by law to act honestly and in good faith with a view to the best interest of the Company and to disclose any interest which they may have in any project or opportunity of the Company. However, each director has a similar obligation to other companies for which such director serves as an officer or director. The Company has no specific internal policy governing conflicts of interest.