Exhibit 99.1

Form 51-102F3

Material Change Report

| Item 1. | Name and Address of Company |

Entrée Resources Ltd. (the “Company” or “Entrée”)

Suite 1650 - 1066 West Hastings Street

Vancouver, BC V6E 3X1

| Item 2. | Date of Material Change |

January 15, 2018

| Item 3. | News Release |

The News Release dated January 15, 2018 (the “News Release”) was disseminated via Cision Ltd. to the Canadian and U.S. Investor Network.

| Item 4. | Summary of Material Change |

On January 15, 2018, the Company announced the results of an updated Feasibility Study that was completed on its interest in the Entrée/Oyu Tolgoi joint venture property (the “Entrée/Oyu Tolgoi JV Property”) in Mongolia. The updated Feasibility Study discusses two development scenarios, an updated reserve case (the “2018 Reserve Case”) and a Life-of-Mine (“LOM”) Preliminary Economic Assessment (“2018 PEA”). The 2018 Reserve Case is based only on mineral reserves attributable to the Entrée/Oyu Tolgoi joint venture (the “Entrée/Oyu Tolgoi JV”) from the first lift (“Lift 1”) of the Hugo North Extension underground block cave. Lift 1 of Hugo North (including Hugo North Extension) is currently in development by project operator Rio Tinto, with first development production from Hugo North Extension expected in 2021. When completed, Oyu Tolgoi will become the world’s third largest copper mine.

The 2018 PEA is an alternative development scenario completed at a conceptual level that assesses the inclusion of the Hugo North Extension Lift 2 and Heruga deposits into an overall mine plan with Hugo North Extension Lift 1. The 2018 PEA includes Indicated and Inferred resources from Hugo North Extension Lifts 1 and 2, and Inferred resources from Heruga. Significant development and capital decisions will be required for the eventual development of the two additional Entrée/Oyu Tolgoi JV deposits (Hugo North Extension Lift 2 and Heruga) once production commences at Hugo North Extension Lift 1.

LOM highlights of the production and financial results from the 2018 Reserve Case and the 2018 PEA are summarized in Table 1.

Table 1. Summary LOM Production and Financial Results - Entrée/Oyu Tolgoi JV Property

| Entrée/Oyu Tolgoi JV Property | Units | 2018 Reserve Case | 2018 PEA |

| LOM Processed Material | |||

| Probable Reserve Feed | 35 Mt @ 1.59% Cu, 0.55 g/t Au, 3.72 g/t Ag (1.93% CuEq) | - - | |

| Indicated Resource Feed | - - | 113 Mt @ 1.42% Cu, 0.50 g/t Au, 3.63 g/t Ag(1.73% CuEq) | |

| Inferred Resource Feed | - - | 708 Mt @ 0.53% Cu, 0.44 g/t Au, 1.79 g/t Ag (0.82 % CuEq) | |

| Copper Recovered | Mlb | 1,115 | 10,497 |

| Gold Recovered | koz | 514 | 9,367 |

| Silver Recovered | koz | 3,651 | 45,378 |

| Entrée Attributable Financial Results | |||

| LOM Cash Flow, pre-tax | US$M | 382 | 2,078 |

| NPV(5%), after-tax | US$M | 157 | 512 |

| NPV(8%), after-tax | US$M | 111 | 278 |

| NPV(10%), after-tax | US$M | 89 | 192 |

Notes:

• Long term metal prices used in the net present value (“NPV”) economic analyses are: copper $3.00/lb, gold $1,300.00/oz, silver $19.00/oz

• Mineral reserves and mineral resources are reported on a 100% basis

• Entrée has a 20% interest in the above processed material and recovered metal

• The mineral reserves in the 2018 Reserve Case are not additive to the mineral resources in the 2018 PEA

• Copper equivalent (“CuEq”) is calculated as shown in the footnote to Table 7 - Entrée/Oyu Tolgoi JV Property Mineral Resources in this Material Change Report

The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both development options (2018 Reserve Case and 2018 PEA) Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by Entrée’s joint venture partner, Oyu Tolgoi LLC (“OTLLC”). Note the production and cash flows from these two development options are not additive.

Both the 2018 Reserve Case and the 2018 PEA are based on information reported within the 2016 Oyu Tolgoi Feasibility Study (“OTFS16”), completed by OTLLC on the Oyu Tolgoi project (refer to Turquoise Hill Resources press release dated October 21, 2016). OTFS16 discusses the mine plan forLift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. Rio Tinto is managing the construction and eventual operation of Lift 1 as well as any future development of deposits included in the 2018 PEA.

The results of the 2018 Reserve Case and the 2018 PEA will be summarized by Amec Foster Wheeler Americas Limited (“Amec Foster Wheeler”) in a National Instrument (“NI”) 43-101 Technical Reportthat will be filed under the Company’s SEDAR profile at www.sedar.com within 45 days of the News Release and on the Company’s website.

| -2- |

Robert Cinits, P.Geo., the Company’s Vice President, Corporate Development and a Qualified Person as defined by NI 43-101, approved the scientific and technical information in this Material Change Report. All references to “$” in this Material Change Report are to currency of the United States.

| Item 5. | Full Description of Material Change |

5.1 Full Description of Material Change

On January 15, 2018, the Company announced the results of an updated Feasibility Study that was completed on its interest in the Entrée/Oyu Tolgoi JV Property. Entrée has a 20% participating interest in the Entrée/Oyu Tolgoi JV with OTLLC holding the remaining 80% interest. The Entrée/Oyu Tolgoi JV Property comprises a significant portion of the long-life, high-grade Oyu Tolgoi copper-gold mining project in Mongolia. The updated Feasibility Study only reports on mineral resources and reserves attributable to the Entrée/Oyu Tolgoi JV.

The updated Feasibility Study discusses two development scenarios, the 2018 Reserve Case and the 2018 PEA. The 2018 Reserve Case is based only on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Lift 1 of the Hugo North Extension underground block cave. Lift 1 of Hugo North (including Hugo North Extension) is currently in development by project operator Rio Tinto, with first development production from Hugo North Extension expected in 2021. When completed, Oyu Tolgoi will become the world’s third largest copper mine.

The 2018 PEA is an alternative development scenario completed at a conceptual level that assesses the inclusion of the Hugo North Extension Lift 2 and Heruga deposits into an overall mine plan with Hugo North Extension Lift 1. The 2018 PEA includes Indicated and Inferred resources from Hugo North Extension Lifts 1 and 2, and Inferred resources from Heruga. Significant development and capital decisions will be required for the eventual development of the two additional Entrée/Oyu Tolgoi JV deposits (Hugo North Extension Lift 2 and Heruga) once production commences at Hugo North Extension Lift 1.

LOM highlights of the production and financial results from the 2018 Reserve Case and the 2018 PEA are summarized in Table 1.

| -3- |

Table 1. Summary LOM Production and Financial Results – Entrée/Oyu Tolgoi JV Property

| Entrée/Oyu Tolgoi JV Property | Units | 2018 Reserve Case | 2018 PEA |

| LOM Processed Material | |||

| Probable Reserve Feed | 35 Mt @ 1.59% Cu, 0.55 g/t Au, 3.72 g/t Ag (1.93% CuEq) | ---- | |

| Indicated Resource Feed | ---- | 113 Mt @ 1.42% Cu, 0.50 g/t Au, 3.63 g/t Ag | |

| Inferred Resource Feed | ---- | 708 Mt @ 0.53% Cu, 0.44 g/t Au, 1.79 g/t Ag (0.82 % CuEq) | |

| Copper Recovered | Mlb | 1,115 | 10,497 |

| Gold Recovered | koz | 514 | 9,367 |

| Silver Recovered | koz | 3,651 | 45,378 |

| Entrée Attributable Financial Results | |||

| LOM Cash Flow, pre-tax | US$M | 382 | 2,078 |

| NPV(5%), after-tax | US$M | 157 | 512 |

| NPV(8%), after-tax | US$M | 111 | 278 |

| NPV(10%), after-tax | US$M | 89 | 192 |

| Notes: |

· Long term metal prices used in the net present value ("NPV") economic analyses are: copper $3.00/lb, gold $1,300.00/oz, silver $19.00/oz · Mineral reserves and mineral resources are reported on a 100% basis · Entrée has a 20% interest in the above processed material and recovered metal · The mineral reserves in the 2018 Reserve Case are not additive to the mineral resources in the 2018 PEA · Copper equivalent ("CuEq") is calculated as shown in the footnote to Table 7 – Entrée/Oyu Tolgoi JV Property Mineral Resources in this press release |

The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both development options (2018 Reserve Case and 2018 PEA) Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by OTLLC. Note the production and cash flows from these two development options are not additive.

Both the 2018 Reserve Case and the 2018 PEA are based on information reported within OTFS16, completed by OTLLC on the Oyu Tolgoi project (refer to Turquoise Hill Resources press release dated October 21, 2016). OTFS16 discusses the mine plan forLift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. Rio Tinto is managing the construction and eventual operation of Lift 1 as well as any future development of deposits included in the 2018 PEA.

Mr. Stephen Scott, Entrée’s President and CEO commented, “It is a rare privilege for a growing company like Entrée to own a significant interest in a project like Oyu Tolgoi, one of the world’s most important new copper and gold mines, as we move into the battery revolution. We are extremely pleased with the robust results of both the 2018 Reserve Case and the 2018 PEA, whichshould help investors understand the tremendous underlying value of Entrée’s flagship asset. However,this is not the end of the story, as there is still significant potential for improvement with predicted higher long-term copper prices, increasing demand for copper and the tremendous long-term development optionality of the Oyu Tolgoi project.Completion of this Technical Report enables us to discuss the updated economics of our 2018 Reserve Case, and more importantly, preliminary economics for potential future phases of the Oyu Tolgoi mine, beyond Lift 1, including Hugo North Extension Lift 2 and Heruga, where a significant amount of the Entrée/OyuTolgoi JV’s mineralization and potential value occurs. At the throughput rate used for the 2018 PEA, the Oyu Tolgoi underground project has an expected mine life of roughly 77 years, which may be extended through future exploration success on the Entrée/Oyu Tolgoi JV Property.Entrée believes that conservative assumptions have been applied in the report, particularly with respect to future mining phases. There is potential for the value of Entrée’s share of the Oyu Tolgoi project as reported to increase as more information is confirmed by detailed future work.”

| -4- |

Mr. Scott continued,“We are very pleased that OTLLC and Rio Tinto have worked collaboratively with us to provide the underlying data required to develop our Technical Report. We applaud their on-going efforts to advance the Oyu Tolgoi project including the Entrée/Oyu Tolgoi JV Property to where it is today. We also look forward to working with them to deliver further exploration success along the highly prospective Oyu Tolgoi copper porphyry trend and elsewhere on the Entrée/Oyu Tolgoi JV Property.Given the manageable project development risk, low capital risk to production and our strong treasury, Entrée is very well placed to create value for shareholders as underground development continues to advance. In many ways, Entrée’s joint venture interest has the characteristics of a royalty or revenue stream with the benefits of a producer.”

Entrée/Oyu Tolgoi JV Property

The Entrée/Oyu Tolgoi JV Property comprises a significant portion of the overall Oyu Tolgoi project area, including the Hugo North Extension copper-gold deposit on the Shivee Tolgoi mining licence, the Heruga copper-gold-molybdenum deposit on the Javhlant mining licence and a large prospective land package. Entrée has a 20% participating interest in the Entrée/Oyu Tolgoi JV with OTLLC holding the remaining 80% interest. OTLLC has a 100% interest in other Oyu Tolgoi project areas, including the Oyut open pit, which is currently in production, and the Hugo North and Hugo South deposits on the Oyu Tolgoi mining licence.

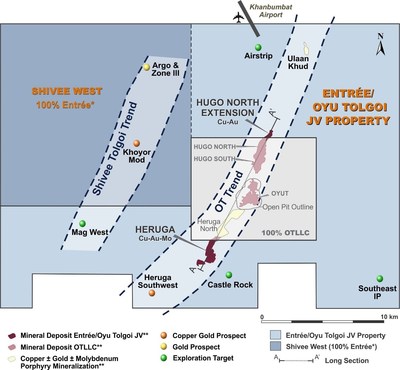

The area of the Entrée/Oyu Tolgoi JV Project, which includes the Entrée/Oyu Tolgoi JV Property and the Shivee West Property is shown on Figure 1. This figure also shows the main mineral deposits that form the Oyu Tolgoi Trend of porphyry deposits and several priority exploration targets, including Castle Rock and Southwest IP.

| -5- |

Figure 1 – Entrée/Oyu Tolgoi JV Project

| Notes: | Entrée has a 20% carried interest in the Hugo North Extension and Heruga resources and reserves. |

| * Shivee West is subject to a License Fees Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property. | |

| ** Outline of mineralization projected to surface |

| · | The Hugo North Extension deposit (Lift 1 and Lift 2) |

| · | Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2018 Reserve Case. It is the northern portion of the Hugo North Lift 1 underground block cave mine plan that is currently in development on the Oyu Tolgoi mining licence. Starting in approximately 2021, the development will cross north onto the Entrée/Oyu Tolgoi JV Property. Hugo North Extension Lift 1 Probable reserves include 35 million tonnes ("Mt") grading 1.59% copper, 0.55 grams per tonne ("g/t") gold, and 3.72 g/t silver. Lift 1 mineral resources are also included in the alternative development scenario, as part of the mine plan for the 2018 PEA. |

| · | Lift 2 is immediately below Lift 1 and is the next potential phase of underground mining, once Lift 1 mining is complete. Lift 2 is currently included as part of the alternative, 2018 PEA mine plan. Hugo North Extension Lift 2 resources included in the 2018 PEA mine plan are: 78 Mt (Indicated), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver; plus 88.4 Mt (Inferred), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver. |

| · | TheHerugacopper-gold-molybdenum deposit is at the south end of the Oyu Tolgoi trend of porphyry deposits. Approximately 94% of the Heruga deposit occurs on the Entrée/Oyu Tolgoi JV Property. The 2018 PEA includes Heruga as the final deposit to be mined, as two separate block caves, one to the south with a slightly deeper block cave to the north. The portion of the Heruga mineral resources that occur on the Entrée/Oyu Tolgoi JV Property and are part of the alternative, 2018 PEA mine plan include 620 Mt (Inferred) grading 0.42% copper, 0.43 g/t gold, and 1.53 g/t silver. |

| -6- |

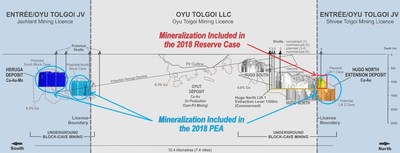

Figure 2 shows a north-south oriented, west-looking cross section through the 12.4 kilometre-long trend of porphyry deposits that comprise the Oyu Tolgoi project. The Entrée/Oyu Tolgoi JV Property is to the right (north) and left (south) of the central portion, the Oyu Tolgoi mining licence, held 100% by OTLLC. The deposits that are included in the mine plans for the two alternative cases, the 2018 Reserve Case and the 2018 PEA, are shown on Figure 2.

Figure 2 – Cross Section Through the Oyu Tolgoi Trend of Porphyry Deposits

Below are some of the key financial assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. All figures shown for both cases are reported on a 100% Entrée/Oyu Tolgoi JV basis, unless otherwise noted, where it is for Entrée's 20% attributable interest. Both cases assume long term metal prices of $3.00/lb copper, $1,300.00/oz gold, and $19.00/oz silver.

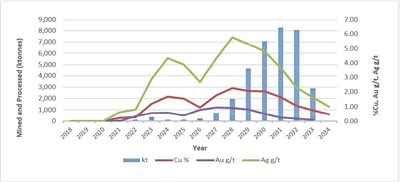

2018 Reserve Case Outputs:

| · | Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 1 starts in 2021 with initial block cave production starting in 2026 |

| · | 14-year mine life (5-years development production and 9-years block cave production; Figure 3) |

| · | Maximum production rate of approximately 24,000 tonnes per day ("tpd"), which is blended with production from OTLLC's Oyut open pit deposits and Hugo North deposit to reach an average mill throughput of approximately 110,000 tpd |

| · | Total direct development and sustaining capital expenditures of approximately $262 million ($52 million attributable to Entrée) |

| · | Entrée LOM average cash cost $1.25/lb payable copper |

| · | Entrée LOM average cash costs after credits ("C1") $0.56/lb payable copper |

| · | Entrée LOM average all-in sustaining costs ("AISC") $1.03/lb payable copper |

| -7- |

Figure 3 – 2018 Reserve Case (Lift 1) Mine Production

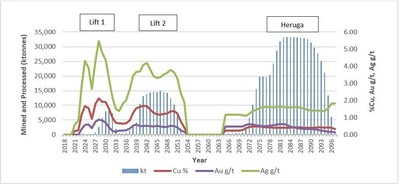

2018 PEA Outputs:

| · | Mineralization mined from the Entrée/Oyu Tolgoi JV Property is blended with production from other deposits on the Oyu Tolgoi mining licence to reach a mill throughput of 110,000 tpd |

| · | Development schedule assumes for Entrée/Oyu Tolgoi JV Property (refer to Figure 4): |

| · | 2021 start of Lift 1 development production and in 2026 initial Lift 1 block cave production |

| · | 2028 Lift 2 development production and in 2035 initial Lift 2 block cave production |

| · | 2065 Heruga development production and in 2069 initial block cave production |

| · | Total direct development and sustaining capital expenditures of approximately $8,637 million ($1,727 million attributable to Entrée) |

| · | Entrée LOM average cash cost $1.97/lb payable copper |

| · | Entrée LOM average C1 $0.68/lb payable copper |

| · | Entrée LOM average AISC $1.83/lb payable copper |

Figure 4 – 2018 PEA Mine Production

| -8- |

Note, the 2018 PEA and the 2018 Reserve Case are not mutually exclusive; if the 2018 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 and Heruga is not sterilized or reduced in tonnage or grades. Heruga could be a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provides considerable flexibility for mine planning and development. Although molybdenum is present in the Heruga deposit (refer to Table 7), the 2018 PEA does not include the construction of a molybdenum circuit for its recovery, but it could be added in the future if economic conditions for molybdenum improve. As noted in the Turquoise Hill Resources press release dated October 21, 2016, there are also potential opportunities for increasing the underground mining rate (and mill throughput), which would require further development and sustaining capital and different operating costs, however it would likely result in Lift 2 and Heruga mineralization being mined earlier in the overall Oyu Tolgoi mine plan and potentially improved economics for Entrée.

Mining Methods

Underground mining on the Entrée/Oyu Tolgoi JV Property (for both the 2018 Reserve Case and the 2018 PEA), is planned to be by large-scale panel caving, which is a variation of block caving. The size, geotechnical characteristics and depth of mineralization at the deposits on the Entrée/Oyu Tolgoi JV Property make block caving the best suited mining method, and although the method has large, early capital investment requirements, it is highly productive and has low operating costs.

The overall Hugo North and Hugo North Extension mine design in OTFS16 for Lift 1 consists of 203 kilometres (“km”) of lateral development, five shafts (for access for mining personnel and equipment, for production, and for intake and exhaust ventilation) and a decline tunnel from surface. Of this development, only Shaft 4* (for ventilation) occurs on the Entrée/Oyu Tolgoi JV Property and approximately 16.4 km of lateral development. The caved material will primarily be transported to surface along conveyors in the decline tunnel, however a portion may be hauled to surface through one of the shafts. The underground mine will operate at a nominal 95 ktpd, which will be a blend of mineralization from other Oyu Tolgoi project deposits with mineralization from the Entrée/Oyu Tolgoi JV Property at rates ranging from approximately 300 to 23,000 tpd over the life of the 2018 Reserve Case and at rates ranging from approximately 260 to 92,000 tpd over the 2018 PEA (note these ranges of feed production rates include the years of low-tonnage development production for Lift 1, Lift 2 and Heruga).*Note: In mid-December 2017 OTLLC notified Entrée the most likely location of Shaft 4 would be moved a short distance south, just within the boundaries of the Oyu Tolgoi mining licence. As of the date of this Material Change Report, no engineering plans nor updated capital and operating cost estimates had been provided to Entrée to support this decision and therefore for the purposes of the Technical Report Shaft 4 is still assumed to be on the Entrée/Oyu Tolgoi JV Property. Movement of the shaft will result in lower direct capital costs for the Entrée/Oyu Tolgoi JV in both the 2018 Reserve Case and the 2018 PEA.

The mineral deposits on the Entrée/Oyu Tolgoi JV Property will be developed, operated and processed by Rio Tinto on behalf of OTLLC, the manager of the Entrée/Oyu Tolgoi JV.

Processing and Metallurgy

Various phases of metallurgical testing have been completed on samples of drill core from Hugo North Extension and Heruga. For Hugo North Extension this work has consisted of mineralogical characterization, grindability testing, and batch and locked cycle flotation testing. Locked cycle flotation testing has demonstrated that a conventional flotation flow sheet with moderate grinds, two stages of cleaning, and low reagent additions are able to generate a saleable copper concentrate, with levels of potential penalty elements identified that can be managed through blending or occasional penalty charges. Payable by-product levels of gold and silver are present in the copper concentrates.

| -9- |

Metallurgical predictions for the three deposits are summarized in Table 2 below.

Table 2. Summary of Entrée/Oyu Tolgoi JV Property Metallurgical Results

| Deposit | Copper Concentrate Grades | Recovery (%) | ||||

| Cu (%) | Au (g/t) | Ag (g/t) | Cu | Au | Ag | |

| HNE1,2 - Lift 1 Reserve | 31 | 10 | 71 | 90.6 | 82.3 | 87.3 |

| HNE1,2 - Lift 1 Resource | 31 | 10 | 71 | 91.7 | 83.4 | 88.6 |

| HNE1 - Lift 2 | 29 | 10 | 76 | 90.5 | 82.2 | 87.2 |

| Heruga | 25 | 24 | 87 | 86.2 | 78.6 | 81.9 |

| 1HNE = Hugo North Extension. |

| 2Note differences in Lift 1 reserve and resource recoveries are due to differences in the mine production schedule feed rates and grades. |

The process plant is sized at 110,000 tpd of mill feed which will be fed by a mix of mineralization from the Entrée/Oyu Togoi JV Property and from other Oyu Tolgoi project deposits and will consist of conventional SAG mill / ball mill / grinding circuit (SABC) followed by flotation. A fifth ball mill will be added to the current plant to achieve a finer primary grind P80 of 150–160 µm for mineralization from Hugo North and Hugo North Extension. Copper concentrate will be bagged on site and trucked to a smelter in China.

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JV, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the Entrée/Oyu Tolgoi JV, Entrée has elected to have OTLLC debt finance Entrée's share of costs for approved programs and budgets, with interest accruing at OTLLC's actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée's share of products. Available cash flow means all net proceeds of sale of Entrée's share of products in a month less Entrée's share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally-accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the Entrée/Oyu Tolgoi JV and generally accepted accounting principles.

Under the terms of the Entrée/Oyu Tolgoi JV, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV will eventually share usage once underground development crosses onto the Entrée/Oyu Tolgoi JV Property. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs that will be calculated in accordance with Canadian generally accepted accounting principles determined yearly based on the estimated tonnes of concentrate produced for Entrée's account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée's operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

| -10- |

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée will recognize its proportionate share of costs at the time of actual expenditure.

The capital and operating costs in the 2018 Reserve Case are based on estimates prepared for OTFS16. The capital and operating costs in the 2018 PEA are based on data provided by OTLLC.

A summary of the Entrée/Oyu Tolgoi JV capital expenditures, including expansion and sustaining capital for both the 2018 Reserve Case and the 2018 PEA is shown in Table 3. A summary of the amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence for both the 2018 Reserve Case and the 2018 PEA is shown in Table 4.

Table 3. Entrée/Oyu Tolgoi JV Property Direct Development and Sustaining Capital

| 2018 Reserve Case | 2018 PEA | |||||

| Description | Unit | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | |

| Entrée/Oyu Tolgoi JV Property Mine Development & Sustaining Capital(1)(2)(3) | ||||||

| Mine Shaft 4 | $ M | 28.9 | 5.8 | 19.1 | 3.8 | |

| HNE Lift 1 Development | $ M | 232.8 | 46.6 | 232.8 | 46.6 | |

| HNE Lift 2 Construction & Development | $ M | - | - | 1,209.7 | 241.9 | |

| Heruga Construction & Development(2) | $ M | - | - | 7,175.7 | 1,435.1 | |

| Total Mine Development Capital | $ M | 261.7 | 52.3 | 8,637.3 | 1,727.4 | |

| Notes | (1) – Capital costs are inclusive of indirect costs, Mongolian custom duties and VAT and contingency. |

| (2) – For the purposes of the Technical Report, it has been assumed that all underground infrastructure for Heruga will be constructed on the Entrée/Oyu Tolgoi JV Property. | |

| (3) – HNE means Hugo North Extension. | |

| (4) - Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

Table 4. Entrée/Oyu Tolgoi JV Amortization Charges for Capital Costs Incurred by OTLLC

| 2018 Reserve Case | 2018 PEA | |||||

| Description | Unit | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | Entrée/Oyu Tolgoi JV | Entrée 20% Attributable | |

| Amortization Charges for OTLLC Capital Costs(1)(2) | ||||||

| Mine Shaft #2 | $ M | 22.5 | 4.5 | 14.8 | 3.0 | |

| Mine Shaft #3 | $ M | 24.6 | 4.9 | 16.3 | 3.3 | |

| Mine Shaft #5 | $ M | 7.3 | 1.5 | 4.8 | 1.0 | |

| Hugo North Lift #1 U/G Construction | $ M | 205.7 | 41.1 | 136.0 | 27.2 | |

| Hugo North Lift #2 U/G Construction | $ M | - | - | 415.2 | 83.0 | |

| Infrastructure & CHP | $ M | 48.1 | 9.6 | 31.8 | 6.4 | |

| Concentrator | $ M | 18.2 | 3.6 | 131.7 | 26.3 | |

| Tailings | $ M | 38.0 | 7.6 | 1,039.7 | 207.9 | |

| Reclamation | $ M | 31.3 | 6.3 | 56.3 | 11.3 | |

| Total Amortization Charges | $ M | 395.7 | 79.1 | 1,846.7 | 369.3 | |

| Notes | (1) – These capital items are required for both the 2018 Reserve Case and the 2018 PEA. The 2018 PEA assumes that the same capital items, with additional modifications would be used to produce from Hugo North Extension Lift 2. Under the 2018 PEA, the total amount of the amortization charges for these capital items is allocated over a larger resource base, therefore, the total amortization charges to the Entrée/Oyu Tolgoi JV for these specific capital items is lower than the 2018 Reserve Case. |

| (2) – OTLLC capital costs are inclusive of indirect costs, Mongolian custom duties and VAT and contingency. | |

| (3) - Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

| -11- |

The average LOM operating costs for the Entrée/Oyu Tolgoi JV Property 2018 Reserve Case and the 2018 PEA (including amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence) are shown in Table 5.

Table 5. Entrée/Oyu Tolgoi JV Property Average LOM Operating Expenditures

| Description | Unit | 2018 Reserve Case | 2018 PEA |

| Mining | $/t processed | 6.19 | 5.67 |

| Processing | $/t processed | 8.41 | 9.37 |

| Infrastructure and Other Operating | $/t processed | 2.04 | 2.04 |

| Amortized Mining Costs | $/t processed | 8.86 | 0.251 |

| Amortized Process Costs | $/t processed | 0.52 | 0.162 |

| Amortized Tailings Costs | $/t processed | 1.09 | 1.27 |

| Total Refining & Transportation Costs | $/t processed | 8.66 | 3.75 |

| Total Operating Expenditure | $/t processed | 35.76 | 22.51 |

| Administration Charge (2% during development; 2.5% during production) | $/t processed | 1.32 | 0.84 |

| Total | $/t processed | 37.08 | 23.35 |

| 1Mining amortized cost are significantly reduced for the 2018 PEA because the Lift 1 costs are being divided by the total resource tonnage for presentation purposes; nonetheless, within the financial model Lift 1 costs are amortized against Lift 1 tonnage and captured during Lift 1 mining. |

| 2 Process amortized costs are significantly lower for the 2018 PEA because the concentrate expansion costs are amortized against the resource tonnage within the financial model including Lift 1, Lift 2, and Heruga. |

| Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

Mine site cash costs are shown in Table 6. Cash costs are those costs relating to the direct operating costs of the mine site, including mining, concentration, tailings, operational support costs, infrastructure, smelting and refining and administration fees. Total cash costs after credits (C1 costs) are the cash costs less the revenue from the gold and silver by-products. The all-in sustaining cost (AISC) is calculated according to World Gold Council guidance. It is the C1 costs plus mineral royalty and capital costs. AISC costs exclude income tax and financing charges.

| -12- |

Table 6. Entrée/Oyu Tolgoi JV Property Unit Operating Costs by Copper Production

| Description | Unit | LOM Average 2018 Reserve Case | LOM Average 2018 PEA |

| Mine Site Cash Cost | $/lb Payable Copper | 0.95 | 1.66 |

| TC/RC, Royalties & Transport | $/lb Payable Copper | 0.29 | 0.32 |

| Total Cash Costs Before Credits | $/lb Payable Copper | 1.25 | 1.97 |

| Gold Credits | $/lb Payable Copper | 0.62 | 1.22 |

| Silver Credits | $/lb Payable Copper | 0.06 | 0.08 |

| Total Cash Costs After Credits (C1) | $/lb Payable Copper | 0.56 | 0.68 |

| Total All-in Sustaining Costs After Credits (AISC) | $/lb Payable Copper | 1.03 | 1.83 |

| Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

The cash flows in the 2018 Reserve Case and 2018 PEA are based on data provided by OTLLC, including mining schedules and annual capital and operating cost estimates, as well as Entrée's interpretation of the commercial terms applicable to the Entrée/Oyu Tolgoi JV, and certain assumptions regarding taxes and royalties. The cash flows have not been reviewed or endorsed by OTLLC. There can be no assurance that OTLLC or its shareholders will not interpret certain terms or conditions, or attempt to renegotiate some or all of the material terms governing the joint venture relationship, in a manner which could have an adverse effect on Entrée's future cash flow and financial condition.

The cash flows also assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until Entrée finalizes agreements with the Government of Mongolia or other Oyu Tolgoi stakeholders, there can be no assurance that Entrée will be entitled to all the benefits of the Oyu Tolgoi Investment Agreement, including with respect to taxes and royalties. If Entrée is not entitled to all the benefits of the Oyu Tolgoi Investment Agreement, it could have an adverse effect on Entrée's future cash flow and financial condition. For example, Entrée could be subject to a surtax royalty, which came into effect in Mongolia on January 1, 2011. To become entitled to the benefits of the Oyu Tolgoi Investment Agreement, Entrée may be required to negotiate and enter into a mutually acceptable agreement with the Government of Mongolia or other Oyu Tolgoi stakeholders, with respect to Entrée's direct or indirect participating interest in the Entrée/Oyu Tolgoi JV or the application of a special royalty (not to exceed 5%) to Entrée's share of the Entrée/Oyu Tolgoi JV Property mineralization or otherwise.

Mineral Resources and Mineral Reserves – Entrée/Oyu Tolgoi JV Property

The Entrée/Oyu Tolgoi JV Property mineral resource estimate for the Hugo North Extension deposit has an effective date of January 15, 2018. The mineral resource model and the mineral resource estimate have not changed since March 28, 2014, the effective date of the previous mineral resource estimate completed by Entrée/Oyu Tolgoi.

The Entrée/Oyu Tolgoi JV mineral resource estimate for the Heruga deposit has an effective date of January 15, 2018. The mineral resource model and the mineral resource estimate have not changed since March 30, 2010, the effective date of the previous mineral resource estimate completed by Entrée/Oyu Tolgoi.

The mineral resources on the Entrée/Oyu Tolgoi JV property are provided in Table 7.

| -13- |

Table 7 – Entrée/Oyu Tolgoi JV Property Mineral Resources

| Entrée/Oyu Tolgoi JV Property– Mineral Resources | ||||||||||

| Classification | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | CuEq (%) | Contained Metal | |||

Cu (Mlb) | Au (Koz) | Ag (Koz) | Mo (Mlb) | |||||||

| Hugo North Extension (>0.37% CuEq Cut-Off) | ||||||||||

| Indicated | 122 | 1.68 | 0.57 | 4.21 | ___ | 2.03 | 4,515 | 2,200 | 16,500 | ___ |

| Inferred | 174 | 1.00 | 0.35 | 2.73 | ___ | 1.21 | 3,828 | 2,000 | 15,200 | ___ |

| Heruga (>0.37% CuEq Cut-Off) | ||||||||||

| Inferred | 1,700 | 0.39 | 0.37 | 1.39 | 113.2 | 0.64 | 14,604 | 20,410 | 75,932 | 424 |

| 1. | Mineral resources have an effective date of January 15, 2018. Mr Peter Oshust, P. Geo, an Amec Foster Wheeler employee, is the Qualified Person responsible for the mineral resource estimate. |

| 2. | Mineral resources are reported inclusive of the mineral resources converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 3. | Mineral resources are constrained within three-dimensional shapes and above a CuEq grade. The CuEq formula was developed in 2016, and is CuEq16 = Cu + ((Au*AuRev) + (Ag*AgRev) + (Mo*MoRev)) ÷ CuRev; where CuRev = (3.01*22.0462); AuRev = (1250/31.103477*RecAu); AgRev = (20.37/31.103477*RecAg); MoRev = (11.90*0.00220462*RecMo); RecAu = Au recovery/Cu recovery; RecAg = Ag recovery/Cu recovery; RecMo = Mo recovery/Cu recovery. Differential metallurgical recoveries were taken into account when calculating the copper equivalency formula. The metallurgical recovery relationships are complex and relate both to grade and Cu:S ratios. The assumed metal prices are $3.01/lb for copper, $1,250.00/oz for gold, $20.37/oz for silver, and $11.90/lb for molybdenum. Molybdenum grades are only considered high enough to support potential construction of a molybdenum recovery circuit at Heruga, and hence the recoveries of molybdenum are zeroed out for Hugo North Extension. A net smelter return ("NSR") of $15.34/t would be required to cover costs of $8.00/t for mining, $5.53/t for processing, and $1.81/t for G&A. This translates to a CuEq break-even underground cut-off grade of approximately 0.37% CuEq for Hugo North Extension mineralization. |

| 4. | Considerations for reasonable prospects for eventual economic extraction for Hugo North included an underground resource-constraining shape that was prepared on vertical sections using economic criteria that would pay for primary and secondary development, block-cave mining, ventilation, tramming, hoisting, processing, and general and administrative ("G&A") costs. A primary and secondary development cost of $8.00/t and a mining, process, and G&A cost of $12.45/t were used to delineate the constraining shape cut-off. Inferred resources at Heruga have been constrained using a CuEq cut-off of 0.37%. |

| 5. | Mineral resources are stated as in situ with no consideration for planned or unplanned external mining dilution. The contained copper, gold, and silver estimates in the mineral resource table have not been adjusted for metallurgical recoveries. |

| 6. | Mineral resources are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 7. | Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

Entrée/Oyu Tolgoi Mineral Reserves

Entrée/Oyu Tolgoi JV Property mineral reserves are contained within the Hugo North Extension Lift 1 block cave mining plan (Table 8). The mine design work on Hugo North Lift 1, including the Hugo North Extension, was prepared by OTLLC. The mineral reserve estimate is based on what is deemed minable when considering factors such as the footprint cut-off grade, the draw column shut-off grade, maximum height of draw, consideration of planned dilution and internal waste rock.

The mineral reserve estimate only considers mineral resources in the Indicated category and engineering that has been carried out to a feasibility level or better to state the underground mineral reserve. There is no Measured mineral resource currently estimated within the Hugo North Extension deposit. Copper and gold grades for the Inferred mineral resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a $17.00/t NSR. Future mine planning studies may examine lower shut-offs.

| -14- |

Table 8. Hugo North Extension Mineral Reserves Statement

Entrée/Oyu Tolgoi JV Property – Mineral Reserve Hugo North Extension Lift 1 | ||||||||

| Classification | Tonnage | NSR | Cu | Au | Ag | Recovered Metal | ||

| (Mt) | ($/t) | (%) | (g/t) | (g/t) | Cu (Mlb) | Au (Koz) | Ag (Koz) | |

| Probable | 35 | 100.57 | 1.59 | 0.55 | 3.72 | 1,121 | 519 | 3,591 |

| 1. | Mineral reserves have an effective date of January 15, 2018. Mr Ian Loomis, P. E., an Amec Foster Wheeler employee, is the Qualified Person responsible for the mineral reserve estimate. |

| 2. | For the underground block cave, all mineral resources within the shell has been converted to mineral reserves. This includes low-grade Indicated mineral resources and Inferred mineral resource assigned zero grade that is treated as dilution. |

| 3. | A footprint cut-off NSR of $46.00/t and column height shut-off NSR of $17/t were used to define the footprint and column heights. An average dilution entry point of 60% of the column height was used. |

| 4. | The NSR was calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries, and royalties using base data template 31. Metallurgical assumptions in the NSR include recoveries of 90.6% for Cu, 82.3% for Au, and 87.3% for Ag. |

| 5. | Mineral reserves are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 6. | Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

Exploration Potential

Exploration by OTLLC during 2016 on the Entrée/Oyu Tolgoi JV Property has outlined several near-surface porphyry prospects, the most significant being at Castle Rock and Southeast IP (refer to Figure 1). At the Castle Rock Prospect, a polymetallic (Mo-As-Sb-Te index) soil anomaly covers an area of about 1.5 km by 2.0 km and occurs coincident with a strong, near-surface induced polarization ("IP") anomaly. At the Southeast IP prospect an extensive area of 60 to 511 ppm copper soil anomalies, covering about 3 km by 3 km has been outlined, coincident with a strong IP anomaly. Further exploration, including drilling is budgeted for both these prospects in 2018. The areas to the north of Hugo North Extension and to the south of Heruga have been under-explored and remain strong targets for future exploration.

Data Verification - Technical Discussion

Greg Kulla, P.Geo, is an independent Qualified Person under NI 43-101, and has verified the drill hole database supporting mineral resources at Hugo North Extension and Heruga. Mr. Kulla visited the site four times in 2011, at which time he inspected the drilling, logging, sampling, and laboratory analysis procedures, observed core and core photos, and compared a random selection of original collar and down hole survey sheets, drill logs, and assay certificates with the drill hole database. He also reviewed documentation supporting the migration of the drill hole database to acQuire and made spot checks comparing acQuire database results with original drill collar, down hole survey, lithology, and assay results. The drill results specific to the Heruga deposit and exploration results from geochemical and geophysical surveys within the Shivee Tolgoi and Javhlant mining licences were not verified by Mr Kulla. However, the Heruga drill results were collected using the same procedures as used for the Oyut and Hugo North deposits and quality control sample results supporting Heruga assay results form part of the sample database reviewed. Mr. Kulla concludes the drill hole database is suitable to support mineral resource estimation.

Peter Oshust, P.Geo., Principal Geologist of Amec Foster Wheeler who is a Qualified Person for the purposes of NI 43-101 and who is independent of the Company, reviewed the mineral resource estimates and models. Mr. Oshust has visited the site eight times since 2011; most recently in March 2016. During these visits to the project he was involved primarily in updates to the geological models and mineral resource estimates for the Hugo North and Oyut deposits. While on-site in 2011 he was based at the Hugo North mine complex and in 2012 at the Oyu Tolgoi core-logging facility. He also visited the mineralogy lab, Oyut open pit mine, and the processing plant. The mineral resource updates included due diligence reviews of processes and verification of the inputs to the models including data collection and database integrity. He both reviewed and participated in geological model construction, and block grade estimation, validation, and documentation. Mr. Oshust concludes that the mineral resource estimates were prepared in accordance with the May 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves and will support mine planning.

| -15- |

Ian Loomis, P.E., Ph.D., is an independent Qualified Person under NI 43-101 and has verified the mining engineering that supports the mineral reserve estimate to be within normal mining engineering practice for block cave mining systems; he has compared the relevant subset of the block models to be consistent in terms of tonnes and grade with respect to the engineering work produced to date for both reserve (2018 Reserve) and resource (2018 PEA) cases. Dr. Loomis has also visited the mine site (November 2017) and observed the current mine development and construction activities. Additionally, he has had several discussions with personnel responsible for the underground mine planning activities.

Hank Wong, P.Eng, is an independent Qualified Person under NI-43-101, and has reviewed the metallurgical test work, processing facilities, and processing plans proposed for Hugo North Extension and Heruga. Mr. Wong visited the Oyu Tolgoi concentrator in September 2017, held discussions with process staff, and reviewed the relevant test work and metallurgical projections developed. Mr. Wong concludes the test work, projections, and facility plans are suitable to support the statements on production.

Kirk Hanson, P.E., MBA is an independent Qualified Person under NI-43-101, and has reviewed financial inputs including: PwC guidance document on Mongolia tax, third party legal opinion, Entrée's guidance document on how to apply the Entrée/Oyu Tolgoi JV terms to the financial model, and operating and capital cost inputs provided by multiple internal and external sources. Mr. Hanson prepared both the reserve (2018 Reserve Case) and resource (2018 PEA) case financial models.

Technical Report

Further technical information supporting the disclosure in this Material Change Report, including data verification, key assumptions, parameters, risks and other factors, will be provided in the NI 43-101 Technical Report that the Company will file under the Company’s SEDAR profile at www.sedar.com within 45 days of the News Release and on the Company’s website.

Non-US GAAP Performance Measurement

"Cash costs" and ASIC are non-US GAAP performance measurements. These performance measurements are included because these statistics are widely accepted as the standard of reporting cash costs of production in North America. These performance measurements do not have a meaning within US GAAP and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measurements should not be considered in isolation as a substitute for measures of performance in accordance with US GAAP.

This Material Change Report contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws with respect to corporate strategies and plans; requirements for additional capital; uses of funds; the value and potential value of assets and the ability of Entrée to maximize returns to shareholders; potential types of mining operations; construction and continued development of the Oyu Tolgoi underground mine; the expected timing of first development production from Lift 1 of the Entrée/Oyu Tolgoi JV Property; anticipated future production and mine life; the future prices of copper, gold, molybdenum and silver; the estimation of mineral reserves and resources; the realization of mineral reserve and resource estimates; anticipated future production, capital and operating costs, cash flows and mine life; capital, financing and project development risk; discussions with the Government of Mongolia, Rio Tinto, OTLLC and Turquoise Hill Resources on a range of issues including Entrée’s interest in the Entrée/Oyu Tolgoi JV Property, the Shivee Tolgoi and Javhlant mining licences and certain material agreements; potential actions by the Government of Mongolia with respect to the Shivee Tolgoi and Javhlant mining licences and Entrée’s interest in the Entrée/Oyu Tolgoi JV Property; the potential for Entrée to be included in or otherwise receive the benefits of the Oyu Tolgoi Investment Agreement or another similar agreement; the potential for the Government of Mongolia to seek to directly or indirectly invest in Entrée’s interest in the Hugo North Extension and Heruga deposits; potential size of a mineralized zone; potential expansion of mineralization; potential discovery of new mineralized zones; potential metallurgical recoveries and grades; plans for future exploration and/or development programs and budgets; permitting time lines; anticipated business activities; proposed acquisitions and dispositions of assets; and future financial performance.

| -16- |

In certain cases, forward-looking statements and information can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budgeted", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", "will be taken", "occur" or "be achieved". While the Company has based these forward-looking statements on its expectations about future events as at the date that such statements were prepared, the statements are not a guarantee of Entrée’s future performance and are based on numerous assumptions regarding present and future business strategies, local and global economic conditions, legal proceedings and negotiations and the environment in which Entrée will operate in the future, including the price of copper, gold, silver and molybdenum, and the status of Entrée’s relationship and interaction with the Government of Mongolia, OTLLC, Rio Tinto and Turquoise Hill Resources. With respect to the construction and continued development of the Oyu Tolgoi underground mine, important risks, uncertainties and factors which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements and information include, amongst others, the timing and cost of the construction and expansion of mining and processing facilities; the timing and availability of a long term power source for the Oyu Tolgoi underground mine; the ability of OTLLC to draw down on the supplemental debt under the Oyu Tolgoi project finance facility and the availability of additional financing on terms reasonably acceptable to OTLLC, Turquoise Hill Resources and Rio Tinto to further develop Oyu Tolgoi; delays, and the costs which would result from delays, in the development of the underground mine; projected copper, gold, silver and molybdenum prices and demand; and production estimates and the anticipated yearly production of copper, gold, silver and molybdenum at the Oyu Tolgoi underground mine. The 2018 PEA is based on a conceptual mine plan that includes Inferred resources. Numerous assumptions were made in the preparation of the 2018 PEA, including with respect to mineability, capital and operating costs, production schedules, the timing of construction and expansion of mining and processing facilities, and recoveries, that may change materially once production commences at Hugo North Extension Lift 1 and additional development and capital decisions are required. Any changes to the assumptions underlying the 2018 PEA could cause actual results to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements and information relating to the 2018 PEA.

Other uncertainties and factors which could cause actual results to differ materially from future results expressed or implied by forward-looking statements and information include, amongst others, unanticipated costs, expenses or liabilities; discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries; the size, grade and continuity of deposits not being interpreted correctly from exploration results; the results of preliminary test work not being indicative of the results of future test work; fluctuations in commodity prices and demand; changing foreign exchange rates; actions by Rio Tinto, Turquoise Hill Resources and/or OTLLC and by government authorities including the Government of Mongolia; the availability of funding on reasonable terms; the impact of changes in interpretation to or changes in enforcement of laws, regulations and government practices, including laws, regulations and government practices with respect to mining, foreign investment, royalties and taxation; the terms and timing of obtaining necessary environmental and other government approvals, consents and permits; the availability and cost of necessary items such as power, water, skilled labour, transportation and appropriate smelting and refining arrangements; and misjudgements in the course of preparing forward-looking statements.

In addition, there are also known and unknown risk factors which may cause the actual results, performance or achievements of Entrée to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements and information. Such factors include, among others, risks related to international operations, including legal and political risk in Mongolia; risks associated with changes in the attitudes of governments to foreign investment; risks associated with the conduct of joint ventures; discrepancies between actual and anticipated production, mineral reserves and resources and metallurgical recoveries; global financial conditions; changes in project parameters as plans continue to be refined; inability to upgrade Inferred mineral resources to Indicated or Measured mineral resources; inability to convert mineral resources to mineral reserves; conclusions of economic evaluations; future prices of copper, gold, silver and molybdenum; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining government approvals, permits or licences or financing or in the completion of development or construction activities; environmental risks; title disputes; limitations on insurance coverage; as well as those factors discussed in the Company’s most recently filed Management’s Discussion and Analysis and in the Company’s Annual Information Form for the financial year ended December 31, 2016, dated March 10, 2017 filed with the Canadian Securities Administrators and available at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company is under no obligation to update or alter any forward-looking statements except as required under applicable securities laws.

5.2 Disclosure for Restructuring Transactions

Not Applicable.

| -17- |

| Item 6. | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not Applicable.

| Item 7. | Omitted Information |

Not Applicable.

| Item 8. | Executive Officer |

Susan McLeod, Vice President, Legal Affairs

604.687.4777

| Item 9. | Date of Report |

Dated at Vancouver, BC, this 19th day of January, 2018.

| -18- |