Exhibit 99.2

Management’s Discussion and Analysis

Second quarter ended June 30, 2018

(Expressed in United States dollars, except per share amounts and where otherwise noted)

August 1, 2018

This Management’s Discussion and Analysis ("MD&A") should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2017 and related notes thereto which have been prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP"). References to "Entrée" and the "Company" are to Entrée Resources Ltd. and/or one or more of its wholly-owned subsidiaries. For further information on the Company, reference should be made to its continuous disclosure (including its Annual Information Form for the year ended December 31, 2017 dated March 8, 2018 ("AIF")), which is available on SEDAR at www.sedar.com. Information is also available on the Company’s website at www.EntreeResourcesLtd.com. Information on risks associated with investing in the Company’s securities is contained in the Company’s AIF. Technical and scientific information under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") concerning the Company’s material property, including information about mineral resources and reserves, is contained in the Company’s AIF and in its technical report titled "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an effective date of January 15, 2018 prepared by Amec Foster Wheeler Americas Limited ("Amec Foster Wheeler").

Q2 2018 HIGHLIGHTS

Entrée/Oyu Tolgoi JV Property

As reported by Turquoise Hill Resources Ltd. ("Turquoise Hill") on July 31, 2018:

| · | Oyu Tolgoi underground development continued to progress during Q2 2018 including underground lateral development, the fit out of Shaft 2, support infrastructure and the convey-to-surface decline. |

| · | Completion of Shaft 5 sinking in March 2018 was followed in Q2 2018 by the installation of permanent ventilation fans and commissioning of the now fully operational expanded Shaft 5 ventilation system. |

| · | During Q2 2018, Shaft 2 stripping and bracket installation was completed while cable and pipe work commenced. Fit out of Shaft 2 is expected to occur throughout 2018. |

| · | Following reduced advancement during the Shaft 5 ventilation system completion, in June 2018 a record-level of equivalent underground development was achieved with 0.9 kilometres completed. |

| · | Progress overall during Q2 2018 was 2.4 equivalent kilometres with a total of 12.7 equivalent kilometres of lateral development completed since the re-start of development. During 2018, underground development is expected to advance approximately 10.0 kilometres. |

| · | During Q2 2018, earthworks for Shafts 3 and 4 continued and the sinking package was awarded in July 2018. |

| · | Per the Oyu Tolgoi Investment Agreement, Oyu Tolgoi LLC ("OTLLC") has been exploring two domestic power options – a power plant built and operated by OTLLC at the mine site or an independent power producer located at the Tavan Tolgoi coal field. A final decision on the outcome, cost and financing of a domestic power supply has not been concluded. |

| · | Production from first draw bell remains planned for mid-2020 and sustainable first production from the Oyu Toloi mining licence in 2021. |

Cañariaco Project Royalty – Peru

| · | On June 8, 2018, the Company completed the sale of its 0.5% net smelter returns ("NSR") royalty (the "Royalty") on Candente Copper Corp.’s Cañariaco Copper Project in Northern Peru to Anglo Pacific Group PLC ("Anglo Pacific"), a public company listed on the London Stock Exchange and the Toronto Stock Exchange ("TSX"). Under the sales agreement with Anglo Pacific, the Company transferred all the issued and outstanding shares of its subsidiaries that directly or indirectly hold the Royalty to Anglo Pacific for consideration of $1.0 million, payable by the issuance of 478,951 Anglo Pacific common shares. In addition, Entrée retains the right to a portion of any future royalty income received by Anglo Pacific in relation to the Royalty ("Royalty Pass-Through Payments") as follows: |

| o | 20% of any royalty payment received for any calendar quarter up to and including December 31, 2029; |

| o | 15% of any royalty payment received for any calendar quarter commencing January 1, 2030 up to and including the quarter ending December 31, 2034; and |

| o | 10% of any royalty payment received for any calendar quarter commencing January 1, 2035 up to and including the quarter ending December 31, 2039. |

Corporate

| · | Q2 2018 net loss was $0.2 million as compared to Q2 2017 ($0.7 million) which was a reduction of 71% from the comparative period of 2017 and for the 2018 year to date, net loss was $0.9 million, which is a reduction of 53% compared to the comparative period of 2017 ($1.9 million). The reduction in the net loss was due to the gain on the sale of the Royalty and lower administration costs in the current periods. |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| · | Q2 2018 operating cash outflow after working capital was $0.6 million (Q2 2017 cash outflow was $1.1 million) and for the 2018 year to date, operating cash outflow after working capital was $0.7 million (2017 year to date cash outflow was $2.0 million). The reduction in operating cash outflow after working capital was due to lower net losses in the current periods. |

| · | The cash balance as at June 30, 2018 was $6.2 million. |

OVERVIEW OF BUSINESS

Entrée is a mineral resource company with interests in development and exploration properties in Mongolia, Peru and Australia.

The Company’s principal asset is its interest in the Entrée/Oyu Tolgoi joint venture property (the "Entrée/Oyu Tolgoi JV Property") – a carried 20% or 30% interest (depending on the depth of mineralization) in two of the Oyu Tolgoi project deposits, surrounded by a large underexplored, highly prospective land package located in the South Gobi region of Mongolia. Entrée’s joint venture partner, OTLLC, holds the remaining 80%/70% interest.

The Oyu Tolgoi project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by OTLLC (66% Turquoise Hill and 34% the Government of Mongolia), and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC. The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence, and all of the Javhlant mining licence. The Shivee Tolgoi and Javhlant mining licences are held by Entrée. The terms of the joint venture between Entrée and OTLLC (the "Entrée/Oyu Tolgoi JV") state that Entrée has a right to receive 20% of all mineralization extracted from deeper than 560 metres below surface and 30% of all mineralization extracted from above 560 metres depth.

The Entrée/Oyu Tolgoi JV Property includes the Hugo North Extension copper-gold deposit (also referred to as "HNE") and the majority of the Heruga copper-gold-molybdenum deposit. The resources at Hugo North Extension include a Probable reserve, which is part of the first lift ("Lift 1") of the Oyu Tolgoi underground block cave mining operation. Lift 1 is currently in development by project operator Rio Tinto International Holdings Ltd. ("Rio Tinto"), with first development production from the Entrée/Oyu Tolgoi JV Property expected in 2021. When completed, Oyu Tolgoi is expected to become the world’s third largest copper mine.

In addition to the Hugo North Extension copper-gold deposit, the Entrée/Oyu Tolgoi JV Property includes approximately 94% of the resource tonnes outlined at the Heruga copper-gold-molybdenum deposit, and a large exploration land package, which together form a significant component of the overall Oyu Tolgoi project.

The first two phases of the Oyu Tolgoi project are fully financed, with the Oyut open pit mine on the Oyu Tolgoi mining licence (Phase 1) currently in production and construction of Lift 1 of the Hugo North/Hugo North Extension underground block cave (Phase 2) currently in progress.

The Company also has the following assets:

| · | Blue Rose JV – a 56.53% interest in the Blue Rose joint venture ("Blue Rose JV") on minerals other than iron ore on Exploration Licence 6006 ("EL 6006") in the Olary Region of South Australia. The Blue Rose JV partners also have certain rights and royalties with respect to iron ore outlined or extracted from the area covered by EL 6006. |

| · | 478,951 Anglo Pacific common shares and the right to the Cañariaco Copper Project Royalty Pass-Through Payments. |

The Company’s corporate headquarters are located in Vancouver, British Columbia, Canada. Field operations are conducted out of local offices in Mongolia.

As at June 30, 2018, Rio Tinto beneficially owned 30,366,129 common shares (including 13,799,333 common shares held by Turquoise Hill), or 17.4% of the outstanding shares of the Company and Sandstorm Gold owned 23,900,380 common shares, or 13.7% of the outstanding shares of the Company.

Trading of the Company’s common shares commenced on the NYSE American effective July 18, 2005, under the trading symbol "EGI". On April 24, 2006, the Company’s common shares began trading on the TSX and discontinued trading on the TSX Venture Exchange. The trading symbol remained "ETG".

| Page 2 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

OUTLOOK AND STRATEGY

Entrée/Oyu Tolgoi JV Property

With the completion and filing of its updated technical report titled "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an effective date of January 15, 2018 prepared by Amec Foster Wheeler (the "2018 Technical Report") in Q1 2018, the Company is now focused on:

| · | Assessing opportunities to crystallize value ahead of production from the Entrée/Oyu Tolgoi JV Property. |

| · | Streamlining Entrée’s joint venture interest. |

| · | Educating the market about the risk profile associated with Entrée’s interest in the Entrée/Oyu Tolgoi JV Property. |

| · | Working with Entrée’s joint venture partner to advance any exploration opportunities on the Entrée/Oyu Tolgoi JV Property that may exist, including several near surface targets that have been identified. |

Corporate

Throughout 2018, the Company’s focus will be to maximize investor awareness of the results of the 2018 Technical Report and what this report means to the Company and all stakeholders, both current and potential.

Corporate costs, which include Mongolian site management, marketing, and compliance costs, remained estimated to be between $1.2 million and $1.5 million for the full 2018 year.

ENTRÉE/OYU TOLGOI JV PROPERTY AND SHIVEE WEST PROPERTY – MONGOLIA

2018 Technical Report Highlights

In Q1 2018, the Company announced the results of the 2018 Technical Report completed on its interest in the Entrée/Oyu Tolgoi JV Property. The 2018 Technical Report discusses two development scenarios, an updated reserve case (the "2018 Reserve Case") and a Life-of-Mine ("LOM") Preliminary Economic Assessment (the "2018 PEA"). The 2018 Reserve Case is based only on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Lift 1 of the Hugo North Extension underground block cave.

The 2018 PEA is an alternative development scenario completed at a conceptual level that assesses the inclusion of Hugo North Extension Lift 2 and Heruga into an overall mine plan with Hugo North Extension Lift 1. The 2018 PEA includes Indicated and Inferred resources from Hugo North Extension Lifts 1 and 2, and Inferred resources from Heruga. Significant development and capital decisions will be required for the eventual development of Hugo North Extension Lift 2 and Heruga once production commences at Hugo North Extension Lift 1.

| Page 3 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LOM highlights of the production and financial results from the 2018 Reserve Case and the 2018 PEA are summarized as follows:

| Entrée/Oyu Tolgoi JV Property | Units | 2018 Reserve Case | 2018 PEA | |||||||

| Probable Reserve Feed | 35 Mt @ 1.59% Cu, 0.55 g/t Au, 3.72 g/t Ag (1.93% CuEq) | — | ||||||||

| Indicated Resource Feed | — | 113 Mt @ 1.42% Cu, 0.50 g/t Au, 3.63 g/t Ag(1.73% CuEq) | ||||||||

| Inferred Resource Feed | — | 708 Mt @ 0.53% Cu, 0.44 g/t Au, 1.79 g/t Ag (0.82 % CuEq) | ||||||||

| Copper Recovered | Mlb | 1,115 | 10,497 | |||||||

| Gold Recovered | koz | 514 | 9,367 | |||||||

| Silver Recovered | koz | 3,651 | 45,378 | |||||||

| Entrée Attributable Financial Results | ||||||||||

| LOM Cash Flow, before-tax | $M | 382 | 2,078 | |||||||

| LOM Cash Flow, after-tax | $M | 286 | 1,522 | |||||||

| NPV5%, after-tax | $M | 157 | 512 | |||||||

| NPV8%, after-tax | $M | 111 | 278 | |||||||

| NPV10%, after-tax | $M | 89 | 192 | |||||||

Notes:

| 1. | The 2018 Reserve Case and the 2018 PEA are alternative cases and the Entrée attributable financial results are not additive. |

| 2. | Long term metal prices used in the net present value ("NPV") economic analyses are: copper $3.00/lb, gold $1,300.00/oz and silver $19.00/oz. |

| 3. | Mineral reserves and mineral resources are reported on a 100% basis. |

| 4. | Entrée has a 20% interest in the above processed material and recovered metal. |

| 5. | The mineral reserves in the 2018 Reserve Case are not additive to the mineral resources in the 2018 PEA. |

| 6. | Copper equivalent ("CuEq") is calculated as shown in the footnotes to the Mineral Resources Table below. |

The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both development options (2018 Reserve Case and 2018 PEA) the Company is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other mineral deposits located on the Oyu Tolgoi mining licence owned 100% by OTLLC. Note the production and cash flows from these two development options are not additive.

Both the 2018 Reserve Case and the 2018 PEA are based on information reported within the 2016 Oyu Tolgoi Feasibility Study ("OTFS16"), completed by OTLLC on the Oyu Tolgoi project (refer to Turquoise Hill’s press release dated October 21, 2016). OTFS16 discusses the mine plan for Lift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. Rio Tinto is managing the construction and eventual operation of Lift 1 as well as any future development of deposits included in the 2018 PEA.

Below are some of the key financial assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. All figures shown for both cases are reported on a 100% Entrée/Oyu Tolgoi JV basis, unless otherwise noted, where it is for Entrée’s 20% attributable interest. Both cases assume long term metal prices of $3.00/lb copper, $1,300.00/oz gold and $19.00/oz silver.

| Page 4 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Key items per the 2018 Reserve Case outputs are as follows:

| · | Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 1 starts in 2021 with initial block cave production starting in 2026. |

| · | 14-year mine life (5-years development production and 9-years block cave production). |

| · | Maximum production rate of approximately 24,000 tonnes per day ("tpd"), which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to reach an average mill throughput of approximately 110,000 tpd. |

| · | Total direct development and sustaining capital expenditures of approximately $262 million ($52 million attributable to Entrée). |

| · | Entrée LOM average cash cost $1.25/lb payable copper. |

| · | Entrée LOM average cash costs after credits ("C1") $0.56/lb payable copper. |

| · | Entrée LOM average all-in sustaining costs after credits ("AISC") $1.03/lb payable copper. |

Key items per the 2018 PEA outputs are as follows:

| 2018 PEA(1)(2) | ||||||||||

| Entrée/Oyu Tolgoi JV Property | Units | HNE Lift 1 + Lift 2 | HNE Lift 1+2+Heruga | |||||||

| LOM Cash Flow | $ M | |||||||||

· Before-tax | $ | 2,133 | $ | 2,078 | ||||||

· After-tax | $ | 1,595 | $ | 1,522 | ||||||

| NPV | $ M | |||||||||

· 5% | $ | 506 | $ | 512 | ||||||

| · 8% | $ | 277 | $ | 278 | ||||||

| Mine Life(3) | Years | 33 | 77 | * | ||||||

| Metal Recovered(4) | ||||||||||

· Copper | Mlb | 5,579 | 10,497 | |||||||

· Gold | Koz | 2,637 | 9,367 | |||||||

· Silver | Koz | 20,442 | 45,378 | |||||||

Notes:

| 1. | Long term metal prices used in the NPV economic analyses are: copper $3.00/lb, gold $1,300.00/oz and silver $19.00/oz. |

| 2. | The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| 3. | *The 2018 PEA covers a period from 2021 to 2097 (77 years), but there is an 11-year period (2054-2064) with no mining from the Entrée/Oyu Tolgoi JV Property when other mineralization from the Oyu Tolgoi mining licence is being mined and processed. |

| 4. | Entrée has a 20% attributable interest in the recovered metal. |

| · | Mineralization mined from the Entrée/Oyu Tolgoi JV Property is blended with production from other deposits on the Oyu Tolgoi mining licence to reach a mill throughput of 110,000 tpd. |

| · | Development schedule assumes for Entrée/Oyu Tolgoi JV Property: |

| - | 2021 start of Lift 1 development production and in 2026 initial Lift 1 block cave production |

| - | 2028 Lift 2 development production and in 2035 initial Lift 2 block cave production |

| - | 2065 Heruga development production and in 2069 initial block cave production |

| · | Total direct development and sustaining capital expenditures of approximately $8,637 million ($1,727 million attributable to Entrée). |

| · | Entrée LOM average cash cost $1.97/lb payable copper. |

| · | Entrée LOM average C1 cash costs $0.68/lb payable copper. |

| · | Entrée LOM average AISC after credits $1.83/lb payable copper. |

| Page 5 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The 2018 PEA and the 2018 Reserve Case are not mutually exclusive; if the 2018 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 and Heruga is not sterilized or reduced in tonnage or grades. Heruga could be a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provides considerable flexibility for mine planning and development. Although molybdenum is present in the Heruga deposit, the 2018 PEA does not include the construction of a molybdenum circuit for its recovery, but it could be added in the future if economic conditions for molybdenum improve. As noted in the Turquoise Hill press release dated October 21, 2016, there are also potential opportunities for increasing the underground mining rate (and mill throughput), which would require further development and sustaining capital and different operating costs, however it would likely result in Lift 2 and Heruga mineralization being mined earlier in the overall Oyu Tolgoi mine plan and potentially improved economics for Entrée.

The 2018 Technical Report has been filed on SEDAR and is available for review under the Company’s profile on SEDAR (www.sedar.com) or onwww.EntreeResourcesLtd.com.

Summary and Location of Project

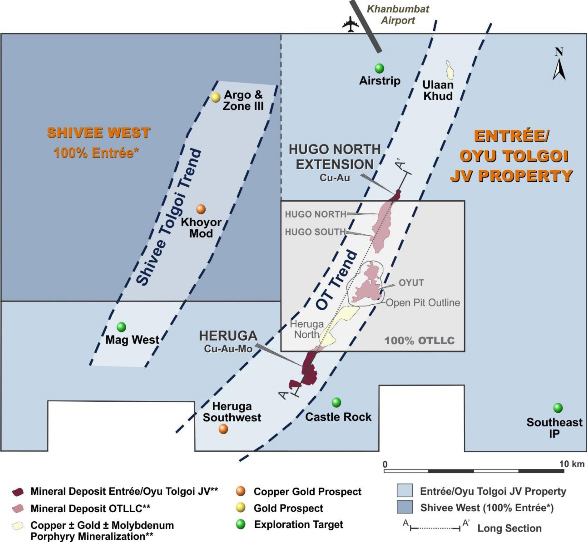

The "Entrée/Oyu Tolgoi JV Project" (shown on Figure 1) comprises the Entrée/Oyu Tolgoi JV Property and the Shivee West Property (see "Shivee West Property Summary" below). The Entrée/Oyu Tolgoi JV Project completely surrounds OTLLC’s Oyu Tolgoi mining licence and forms a significant portion of the overall Oyu Tolgoi project area. Figure 1 also shows the main mineral deposits that form the Oyu Tolgoi trend of porphyry deposits and several priority exploration targets, including Castle Rock and Southwest IP.

The Entrée/Oyu Tolgoi JV Project is located within the Aimag (province) of Ömnögovi in the South Gobi region of Mongolia, about 570 kilometres ("km") south of the capital city of Ulaanbaatar and 80 km north of the border with China.

The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence and all of the Javhlant mining licence, and hosts:

| · | The Hugo North Extension copper-gold porphyry deposit (Lift 1 and Lift 2): |

| - | Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2018 Reserve Case. It is the northern portion of the Hugo North Lift 1 underground block cave mine plan that is currently in development on the Oyu Tolgoi mining licence. Starting in approximately 2021, the development will cross north onto the Entrée/Oyu Tolgoi JV Property. Hugo North Extension Lift 1 Probable reserves include 35 million tonnes ("Mt") grading 1.59% copper, 0.55 grams per tonne ("g/t") gold, and 3.72 g/t silver. Lift 1 mineral resources are also included in the alternative development scenario, as part of the mine plan for the 2018 PEA. |

| - | Lift 2 is immediately below Lift 1 and is the next potential phase of underground mining, once Lift 1 mining is complete. Lift 2 is currently included as part of the alternative, 2018 PEA mine plan. Hugo North Extension Lift 2 resources included in the 2018 PEA mine plan are: 78 Mt (Indicated), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver; plus 88.4 Mt (Inferred), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver. |

| · | The Heruga copper-gold-molybdenum porphyry deposit is at the south end of the Oyu Tolgoi trend of porphyry deposits. Approximately 94% of the Heruga deposit occurs on the Entrée/Oyu Tolgoi JV Property. The 2018 PEA includes Heruga as the final deposit to be mined, as two separate block caves, one to the south with a slightly deeper block cave to the north. The portion of the Heruga mineral resources that occur on the Entrée/Oyu Tolgoi JV Property and are part of the alternative, 2018 PEA mine plan include 620 Mt (Inferred) grading 0.42% copper, 0.43 g/t gold, and 1.53 g/t silver. |

| · | A large prospective land package. |

Entrée has a 20% or 30% (depending on the depth of mineralization) participating interest in the Entrée/Oyu Tolgoi JV with OTLLC holding the remaining 80% (or 70%) interest. OTLLC has a 100% interest in other Oyu Tolgoi project areas, including the Oyut open pit, which is currently in production, and the Hugo North and Hugo South deposits on the Oyu Tolgoi mining licence.

| Page 6 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Figure 1 – Entrée/Oyu Tolgoi JV Project

Notes:

| 1. | *The Shivee West Property is subject to a License Fees Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property. |

| 2. | ** Outline of mineralization projected to surface. |

| 3. | Entrée has a 20% participating interest in the Hugo North Extension and Heruga resources and reserves. |

Figure 1 shows the location of a north-northeast oriented, west-looking cross section (A-A’) through the 12.4 km-long trend of porphyry deposits that comprise the Oyu Tolgoi project. The cross section is shown on Figure 2 with the Entrée/Oyu Tolgoi JV Property to the right (north) and left (south) of the central portion, the Oyu Tolgoi mining licence, held 100% by OTLLC. The deposits that are included in the mine plans for the two alternative cases, the 2018 Reserve Case and the 2018 PEA, are shown on Figure 2.

| Page 7 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Figure 2 – Cross Section Through the Oyu Tolgoi Trend of Porphyry Deposits

The 2018 Technical Report forms the basis for the scientific and technical information in this MD&A regarding the Entrée/Oyu Tolgoi JV Project. Portions of the information are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the Company’s AIF dated March 8, 2018 and to the full text of the 2018 Technical Report, which are available on the Company’s website (www.EntreeResourcesLtd.com) or on SEDAR (www.sedar.com).

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JV, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the Entrée/Oyu Tolgoi joint venture agreement ("Entrée/Oyu Tolgoi JVA"), Entrée has elected to have OTLLC debt finance Entrée’s share of costs for approved programs and budgets, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products. Available cash flow means all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally-accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the Entrée/Oyu Tolgoi JVA and generally accepted accounting principles.

Under the terms of the Entrée/Oyu Tolgoi JVA, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV will eventually share usage once underground development crosses onto the Entrée/Oyu Tolgoi JV Property. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs that will be calculated in accordance with Canadian generally accepted accounting principles determined yearly based on the estimated tonnes of concentrate produced for Entrée’s account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée’s operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée will recognize its proportionate share of costs at the time of actual expenditure.

The capital and operating costs in the 2018 Reserve Case are based on estimates prepared for OTFS16. The capital and operating costs in the 2018 PEA are based on data provided by OTLLC.

| Page 8 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The cash flows in the 2018 Reserve Case and 2018 PEA are based on data provided by OTLLC, including mining schedules and annual capital and operating cost estimates, as well as Entrée’s interpretation of the commercial terms applicable to the Entrée/Oyu Tolgoi JV, and certain assumptions regarding taxes and royalties. The cash flows have not been reviewed or endorsed by OTLLC. There can be no assurance that OTLLC or its shareholders will not interpret certain terms or conditions, or attempt to renegotiate some or all of the material terms governing the joint venture relationship, in a manner which could have an adverse effect on Entrée’s future cash flow and financial condition.

The cash flows also assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until Entrée finalizes agreements with the Government of Mongolia or other Oyu Tolgoi stakeholders, there can be no assurance that Entrée will be entitled to all the benefits of the Oyu Tolgoi Investment Agreement, including with respect to taxes and royalties. If Entrée is not entitled to all the benefits of the Oyu Tolgoi Investment Agreement, it could have an adverse effect on Entrée’s future cash flow and financial condition. For example, Entrée could be subject to a surtax royalty, which came into effect in Mongolia on January 1, 2011. To become entitled to the benefits of the Oyu Tolgoi Investment Agreement, Entrée may be required to negotiate and enter into a mutually acceptable agreement with the Government of Mongolia or other Oyu Tolgoi stakeholders, with respect to Entrée’s direct or indirect participating interest in the Entrée/Oyu Tolgoi JV or the application of a special royalty (not to exceed 5%) to Entrée’s share of the Entrée/Oyu Tolgoi JV Property mineralization or otherwise.

Mineral Resources and Mineral Reserves – Entrée/Oyu Tolgoi JV Property

The Entrée/Oyu Tolgoi JV Property mineral resource estimate for the Hugo North Extension deposit has an effective date of January 15, 2018. The mineral resource model and the mineral resource estimate have not changed since March 28, 2014, the effective date of the previous mineral resource estimate reported by Entrée.

The Entrée/Oyu Tolgoi JV mineral resource estimate for the Heruga deposit has an effective date of January 15, 2018. The mineral resource model and the mineral resource estimate have not changed since March 30, 2010, the effective date of the previous mineral resource estimate reported by Entrée.

The mineral resource estimate for the Entrée/Oyu Tolgoi JV Property is as follows:

Entrée/Oyu Tolgoi JV Property– Mineral Resources

| Contained Metal | ||||||||||||||||||||||||||||||||||||||||

| Classification | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | CuEq (%) | Cu (Mlb) | Au (Koz) | Ag (Koz) | Mo (Mlb) | ||||||||||||||||||||||||||||||

| Hugo North Extension (>0.37% CuEq Cut-Off) | ||||||||||||||||||||||||||||||||||||||||

| Indicated | 122 | 1.68 | 0.57 | 4.21 | — | 2.03 | 4,515 | 2,200 | 16,500 | — | ||||||||||||||||||||||||||||||

| Inferred | 174 | 1.00 | 0.35 | 2.73 | — | 1.21 | 3,828 | 2,000 | 15,200 | — | ||||||||||||||||||||||||||||||

| Heruga (>0.37% CuEq Cut-Off) | ||||||||||||||||||||||||||||||||||||||||

| Inferred | 1,700 | 0.39 | 0.37 | 1.39 | 113.2 | 0.64 | 14,604 | 20,410 | 75,932 | 424 | ||||||||||||||||||||||||||||||

Notes:

| 1. | Mineral resources have an effective date of January 15, 2018. Mr Peter Oshust, P. Geo, an Amec Foster Wheeler employee, is the Qualified Person responsible for the mineral resource estimate. |

| 2. | Mineral resources are reported inclusive of the mineral resources converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 3. | Mineral resources are constrained within three-dimensional shapes and above a CuEq grade. The CuEq formula was developed in 2016, and is CuEq16 = Cu + ((Au*AuRev) + (Ag*AgRev) + (Mo*MoRev)) ÷ CuRev; where CuRev = (3.01*22.0462); AuRev = (1250/31.103477*RecAu); AgRev = (20.37/31.103477*RecAg); MoRev = (11.90*0.00220462*RecMo); RecAu = Au recovery/Cu recovery; RecAg = Ag recovery/Cu recovery; RecMo = Mo recovery/Cu recovery. Differential metallurgical recoveries were taken into account when calculating the copper equivalency formula. The metallurgical recovery relationships are complex and relate both to grade and Cu:S ratios. The assumed metal prices are $3.01/lb for copper, $1,250.00/oz for gold, $20.37/oz for silver, and $11.90/lb for molybdenum. Molybdenum grades are only considered high enough to support potential construction of a molybdenum recovery circuit at Heruga, and hence the recoveries of molybdenum are zeroed out for Hugo North Extension. A NSR of $15.34/t would be required to cover costs of $8.00/t for mining, $5.53/t for processing, and $1.81/t for general and administrative ("G&A"). This translates to a CuEq break-even underground cut-off grade of approximately 0.37% CuEq for Hugo North Extension mineralization. |

| 4. | Considerations for reasonable prospects for eventual economic extraction for Hugo North included an underground resource-constraining shape that was prepared on vertical sections using economic criteria that would pay for primary and secondary development, block-cave mining, ventilation, tramming, hoisting, processing, and G&A costs. A primary and secondary development cost of $8.00/t and a mining, process, and G&A cost of $12.45/t were used to delineate the constraining shape cut-off. Inferred resources at Heruga have been constrained using a CuEq cut-off of 0.37%. |

| Page 9 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| 5. | Mineral resources are stated as in situ with no consideration for planned or unplanned external mining dilution. The contained copper, gold, and silver estimates in the mineral resource table have not been adjusted for metallurgical recoveries. |

| 6. | Mineral resources are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 7. | Figures have been rounded as required by reporting guidelines and may result in apparent summation differences. |

Entrée/Oyu Tolgoi Mineral Reserves

Entrée/Oyu Tolgoi JV Property mineral reserves are contained within the Hugo North Extension Lift 1 block cave mining plan. The mine design work on Hugo North Lift 1, including the Hugo North Extension, was prepared by OTLLC. The mineral reserve estimate is based on what is deemed minable when considering factors such as the footprint cut-off grade, the draw column shut-off grade, maximum height of draw, consideration of planned dilution and internal waste rock.

The mineral reserve estimate only considers mineral resources in the Indicated category and engineering that has been carried out to a feasibility level or better to state the underground mineral reserve. There is no Measured mineral resource currently estimated within the Hugo North Extension deposit. Copper and gold grades for the Inferred mineral resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a $17.00/t NSR. Future mine planning studies may examine lower shut-offs.

The mineral reserve estimate for the Entrée/Oyu Tolgoi JV Property is as follows:

Entrée/Oyu Tolgoi JV Property – Mineral Reserve

Hugo North Extension Lift 1

| Tonnage | NSR | Cu | Au | Ag | Recovered Metal | |||||||||||||||||||||||||||

| Classification | (Mt) | ($/t) | (%) | (g/t) | (g/t) | Cu (Mlb) | Au (Koz) | Ag (Koz) | ||||||||||||||||||||||||

| Probable | 35 | 100.57 | 1.59 | 0.55 | 3.72 | 1,121 | 519 | 3,591 | ||||||||||||||||||||||||

Notes:

| 1. | Mineral reserves have an effective date of January 15, 2018. Mr Ian Loomis, P. E., an Amec Foster Wheeler employee, is the Qualified Person responsible for the mineral reserve estimate. |

| 2. | For the underground block cave, all mineral resources within the shell has been converted to mineral reserves. This includes low-grade Indicated mineral resources and Inferred mineral resource assigned zero grade that is treated as dilution. |

| 3. | A footprint cut-off NSR of $46.00/t and column height shut-off NSR of $17.00/t were used to define the footprint and column heights. An average dilution entry point of 60% of the column height was used. |

| 4. | The NSR was calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries, and royalties using base data template 31. Metallurgical assumptions in the NSR include recoveries of 90.6% for Cu, 82.3% for Au, and 87.3% for Ag. |

| 5. | Mineral reserves are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 6. | Figures have been rounded as required by reporting guidelines, and may result in apparent summation differences. |

Exploration Potential

Rio Tinto undertakes all exploration work on the Entrée/Oyu Tolgoi JV Property on behalf of joint venture manager OTLLC, through various agreements among OTLLC, Rio Tinto and Turquoise Hill. Exploration during 2016 on the Entrée/Oyu Tolgoi JV Property outlined several near-surface porphyry prospects, the most significant being at Castle Rock and Southeast IP (refer to Figure 1). At the Castle Rock Prospect, a polymetallic (Mo-As-Sb-Te index) soil anomaly covers an area of about 1.5 km by 2.0 km and occurs coincident with a strong, near-surface induced polarization ("IP") anomaly. At the Southeast IP prospect an extensive area of 60 to 511 part per million ("ppm") copper soil anomalies, covering about 3 km by 3 km has been outlined, coincident with a strong IP anomaly. Further exploration, including drilling is budgeted for both these prospects in 2018, as well as at the Mag West and Airstrip targets. The areas to the north of Hugo North Extension and to the south of Heruga have been under-explored and remain strong targets for future exploration.

A complete description and the Company’s related history of the Entrée/Oyu Tolgoi JV is available in the Company’s AIF dated March 8, 2018, available for review on SEDAR at www.sedar.com. For additional information regarding the assumptions, qualifications and procedures associated with the scientific and technical information regarding the Entrée/Oyu Tolgoi JV Property, reference should be made to the full text of the 2018 Technical Report which is available for review on SEDAR.

| Page 10 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Shivee West Property Summary

The Shivee West Property comprises the northwest portion of the Entrée/Oyu Tolgoi JV Project and adjoins the Entrée/Oyu Tolgoi JV Property and OTLLC’s Oyu Tolgoi mining licence.

To date, no economic zones of precious or base metals mineralization have been outlined on the Shivee West Property. However, zones of gold and copper mineralization have previously been identified at Zone III/Argo Zone and Khoyor Mod. There has been no drilling on the ground since 2011, and no exploration work has been completed since 2012. In 2015, in light of the ongoing requirement to pay approximately $350,000 annually in licence fees for the Shivee West Property and a determination that no further exploration work would likely be undertaken in the near future, Entrée began to examine options to reduce expenditures in Mongolia. These options included reducing the area of the mining licence, looking for a purchaser or partner for the Shivee West Property, and rolling the ground into the Entrée/Oyu Tolgoi JV. Management determined that it was in the best interests of Entrée to roll the Shivee West Property into the Entrée/Oyu Tolgoi JV, and Entrée entered into a License Fees Agreement with OTLLC on October 1, 2015. The License Fees Agreement provides the parties will use their best efforts to amend the terms of the Entrée/Oyu Tolgoi JVA to include the Shivee West Property in the definition of Entrée/Oyu Tolgoi JV Property. Entrée determined that rolling the Shivee West Property into the Entrée/Oyu Tolgoi JV would provide the joint venture partners with continued security of tenure; Entrée shareholders would continue to benefit from any exploration or development that the Entrée/Oyu Tolgoi JV management committee approves on the Shivee West Property; and Entrée would no longer have to pay licence fees, as the parties agreed that the licence fees would be for the account of each joint venture participant in proportion to their respective interests, with OTLLC contributing Entrée’s 20% share charging interest at prime plus 2%. To date, no amended Entrée/Oyu Tolgoi JVA has been entered into and Entrée retains a 100% interest in the Shivee West Property.

Underground Development Progress

Exploration and development of the Entrée/Oyu Tolgoi JV Property is under the control of Rio Tinto on behalf of manager OTLLC. As reported by Turquoise Hill on July 31, 2018:

The main focus of underground development for 2018 continues to be underground lateral development, the fit out of Shaft 2, support infrastructure and the convey-to-surface decline. Turquoise Hill continues to expect the first draw bell in mid-2020 and sustainable first production from the Oyu Tolgoi mining licence in 2021.

Undergound lateral development was reduced during the first two months of Q2 2018 partly due to the commissioning of the new Shaft 5 permanent fans and the resulting ventilation flow transition underground. However, June subsequently achieved a record-level of equivalent underground development with 0.9 kilometres developed. Progress overall during Q2 2018 was 2.4 equivalent kilometres with a total of 12.7 equivalent kilometres of lateral development completed since the re-start of development. During 2018, underground development is expected to advance approximately 10.0 kilometres.

In March 2018, Turquoise Hill announced the completion of Shaft 5 sinking. During Q2 2018, this was followed by the installation of permanent ventilation fans and commissioning of the now fully operational expanded ventilation system.

Shaft 2 sinking was completed in January 2018. During Q2 2018, stripping and bracket installation was completed while cable and pipe work commenced. Fit out of Shaft 2 is expected to occur throughout 2018. Shaft 2 is a key part of future increases in lateral development activity.

Additionally, earthworks for Shafts 3 and 4 continued during Q2 2018 and the sinking package was awarded in July 2018.

The following table outlines the status of shafts for underground development as of June 30, 2018.

Shaft 1 (early development and ventilation) | Shaft 2 (production and ventilation)

| Shaft 5 (ventilation)

| Shaft 3 (ventilation)

| Shaft 4 (ventilation)

| |

| Total depth | 1,385 metres | 1,284 metres | 1,178 metres | 1,148 metres | 1,149 metres |

| Diameter | 6.7 metres | 10 metres | 6.7 metres | 10 metres | 11 metres |

| Completion | 2008 | Q1 2018 | Q1 2018 | Expected 2021 | Expected 2021 |

| Remaining | Complete | Complete | Complete | Not started | Not started |

During Q2 2018, advancement of the convey-to-surface decline continued to progress. The convey-to-surface system is the eventual route of the full 95,000 tonne per day underground ore delivery system to the concentrator; however, it is not a critical path item for first draw bell planned in mid-2020. Expected completion of the convey-to-surface system is 2022, which will facilitate the ramp up to full production by 2027.

Also during Q2 2018, the Primary Crusher 1 chamber was excavated. Eventually this chamber will hold the first 4,000 tonne per hour crusher to initially feed the Shaft 2 production system up to 30,000 tonne per day in the first part of underground ramp up.

OTLLC spent $291.2 million on underground expansion during Q2 2018. Total underground project spend from January 1, 2016 to June 30, 2018 was approximately $1.6 billion. In addition, OTLLC had further capital commitments of $1.2 billion as of June 30, 2018. At the end of Q2 2018, the underground project had committed 68% of direct project contracts and procurement packages, of which 71% were to Mongolian companies. Since the restart of project development, OTLLC has committed almost $1.7 billion to Mongolian vendors and contractors.

During Q4 2017, Rio Tinto undertook a schedule and cost review. Rio Tinto has provided Turquoise Hill with a high-level overview of the review’s outcomes, in which Rio Tinto concluded there were no material changes in project scope, cost or schedule. Following analysis of the review’s conclusions, Turquoise Hill is in agreement with the findings.

Per the Oyu Tolgoi Investment Agreement, OTLLC has been exploring two domestic power options – a power plant built and operated by OTLLC at the mine site or an independent power producer located at the Tavan Tolgoi coal field. A final decision on the outcome, cost and financing of a domestic power supply has not been concluded.

Q2 2018 Review

For the three and six months ended June 30, 2018, Entrée expenses related to Mongolian operations were $0.0 million and $0.1 million, respectively, compared to $0.1 million and $0.3 million for the same periods of 2017. In both 2018 and 2017, these costs represented in-country administration costs.

BLUE ROSE JV – AUSTRALIA

Summary

EL 6006, totalling 257 square kilometres, is located in the Olary Region of South Australia, 300 kilometres northeast of Adelaide and 130 kilometres west-southwest of Broken Hill. Entrée has a 56.53% interest in the Blue Rose JV to explore for minerals other than iron ore on EL 6006, with Giralia Resources Pty Ltd, a subsidiary of Atlas Iron Limited, retaining a 43.47% interest.

The rights to explore for and develop iron ore on EL 6006 are held by Fe Mines Limited ("FML"), a subsidiary of Lodestone Equities Limited ("Lodestone") pursuant to a prior agreement with the Blue Rose JV partners. On April 18, 2017, the Blue Rose JV partners entered into a Deed of Consent, Sale and Variation (the "Deed") with Lodestone and FML. In accordance with the Deed, the Blue Rose JV partners transferred title to EL 6006 and assigned their native title agreements to FML and agreed to vary a payment required to be made to the Blue Rose JV partners under the prior agreement. FML paid to the Blue Rose JV partners an aggregate A$100,000 at completion and granted to them (a) the right to receive an additional payment(s) upon completion of an initial or subsequent iron ore resource estimate on EL 6006, to a maximum of A$2 million in aggregate; and (b) a royalty equal to 0.65% of the free on board value of iron ore product extracted and recovered from EL 6006. Under the Deed, an additional A$285,000 must also be paid to the Blue Rose JV partners upon the commencement of Commercial Production (as such term is defined in the Deed).

| Page 11 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

EL 6006 is included in the Mawson Iron Project area, a venture that includes the assets of both Magnetite Mines Limited ("MGT") and Lodestone. The Braemar Iron Formation is the host rock to magnetite mineralisation on the Mawson Iron Project, with a strike length of approximately 250 km within the area controlled by both MGT and Lodestone. In addition to having numerous prospective magnetite-iron ore targets, the project is surrounded by an infrastructure rich area with access to nearby existing open user rail, port, power, gas, heavy engineering and dormitory towns.

The Braemar Iron Formation is a meta-sedimentary iron siltstone, which is inherently soft. The mineralization within the Braemar Iron Formation forms a simple dipping tabular body with only minor faulting, folding and intrusives. Grades, thickness, dip, and outcropping geometry remain very consistent over kilometres of strike.

Q2 2018 Review

Expenditures in Q2 2018 were minimal and related to administrative costs in Australia.

CANARIACO PROJECT ROYALTY PASS-THROUGH PAYMENTS

In August 2015, the Company acquired from Candente Copper Corp. (TSX:DNT) ("Candente") a 0.5% NSR royalty on Candente's 100% owned Cañariaco project in Peru for a purchase price of $500,000.

On June 8, 2018, the Company sold the Royalty to Anglo Pacific, whereby the Company transferred all the issued and outstanding shares of its subsidiaries that directly or indirectly held the Royalty to Anglo Pacific in return for consideration of $1.0 million, payable by the issuance of 478,951 Anglo Pacific common shares. In addition, Entrée retains the right to a portion of any future royalty income received by Anglo Pacific in relation to the Royalty as follows:

| · | 20% of any royalty payment received for any calendar quarter up to and including December 31, 2029; |

| · | 15% of any royalty payment received for any calendar quarter commencing January 1, 2030 up to and including the quarter ending December 31, 2034; and |

| · | 10% of any royalty payment received for any calendar quarter commencing January 1, 2035 up to and including the quarter ending December 31, 2039. |

In accordance with US GAAP, the Company has attributed a value of $nil to the Royalty Pass-Through Payment since realization of the proceeds is contingent upon several uncertain future events not wholly within the control of the Company.

The Company recognized a gain on the sale of the Royalty of $0.4 million as of June 8, 2018 as outlined below:

| Consideration received | $ | 1,000 | ||

Mineral property interest cost - Cañariaco Copper Royalty | (514 | ) | ||

| Transaction costs | (116 | ) | ||

| Gain on sale | $ | 370 |

The fair value of the common shares received was determined based on the volume weighted average price for the thirty (30) trading days immediately preceding June 5, 2018 at GBP1.57 ($2.09) per common share. The common shares received have been designated as held-for-trading financial assets.

| Page 12 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

SUMMARY OF CONSOLIDATED FINANCIAL OPERATING RESULTS

Operating Results

The Company’s operating results for the three and six months ended June 30 were:

| Three months ended June 30 | Six months ended June 30 | |||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||||||||||

| Expenses | ||||||||||||||||||||||||

| Exploration | $ | 26 | $ | 109 | $ | 142 | $ | 96 | $ | 178 | $ | 369 | ||||||||||||

| General and administration | 221 | 660 | 476 | 685 | 1,375 | 1,028 | ||||||||||||||||||

| Restructuring costs | - | - | - | - | 195 | - | ||||||||||||||||||

| Depreciation | 6 | 9 | 4 | 12 | 7 | 8 | ||||||||||||||||||

| Other | 11 | (52 | ) | - | (13 | ) | (52 | ) | - | |||||||||||||||

| Operating loss | 264 | 626 | 626 | 780 | 1,646 | 1,844 | ||||||||||||||||||

| Unrealized loss on held-for-trading investments | 69 | - | - | 69 | - | - | ||||||||||||||||||

| Foreign exchange loss (gain) | 88 | (100 | ) | 4 | 223 | (57 | ) | 439 | ||||||||||||||||

| Interest expense, net | 49 | 38 | 43 | 99 | 73 | 84 | ||||||||||||||||||

| Loss from equity investee | 62 | 55 | 60 | 75 | 103 | 107 | ||||||||||||||||||

| Operating loss before income taxes | 532 | 719 | 729 | 1,246 | 1,822 | 2,035 | ||||||||||||||||||

| Income tax recovery | - | (72 | ) | - | - | (72 | ) | - | ||||||||||||||||

| Net loss from continuing operations | 532 | 647 | 729 | 1,246 | 1,750 | 2,035 | ||||||||||||||||||

| Gain on sale of the asset | (370 | ) | - | - | (370 | ) | - | - | ||||||||||||||||

| Net loss from discontinued operations | - | 23 | 325 | - | 176 | 651 | ||||||||||||||||||

| Net loss | 161 | 670 | 1,054 | 876 | 1,926 | 2,686 | ||||||||||||||||||

| Foreign currency translation adjustment | (505 | ) | 1,708 | 52 | (1,212 | ) | 1,612 | (1,349 | ) | |||||||||||||||

| Net (gain) loss and comprehensive (gain) loss | $ | (343 | ) | $ | 2,378 | $ | 1,106 | $ | (336 | ) | $ | 3,538 | $ | 1,337 | ||||||||||

| Net loss per common share | ||||||||||||||||||||||||

| Basic/diluted | ||||||||||||||||||||||||

| Continuing operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.02 | ) | ||||||

| Discontinued operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||

| Total assets | $ | 7,654 | $ | 9,011 | $ | 55,625 | $ | 7,654 | $ | 9,011 | $ | 55,625 | ||||||||||||

| Total non-current liabilities | $ | 31,497 | $ | 31,483 | $ | 34,266 | $ | 31,497 | $ | 31,483 | $ | 34,266 | ||||||||||||

| Page 13 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

For the three and six months ended June 30, 2018, the Company’s net loss from continuing operations was $0.5 million and $1.2 million, respectively, compared to $0.6 million and $1.8 million for the comparative periods of 2017.

Exploration costs were lower in Q2 2018 compared to the comparative period of 2017 due to a reduction in staffing and general administrative costs in Mongolia.

General and administration expenditures in Q2 2018 were lower than the comparative period in 2017 due to one-time strategic reorganization costs in 2017.

Unrealized loss on held-for-trading investments ("HFT investments") is related to holding Anglo Pacific common shares. As Entree acquired the investments in Q2 2018, there is no amount in comparative periods.

Foreign exchange loss (gain) was primarily the result of movements between the C$ and US$ as the Company holds its cash in both currencies.

Interest expense (net) was primarily related to the loan payable to OTLLC pursuant to the Entrée/Oyu Tolgoi JVA and is subject to a variable interest rate.

The loss from equity investee was related to the Entrée/Oyu Tolgoi JV Property. Effective January 1, 2018, the Company commenced capitalizing direct expenditures related to the development of the Oyu Tolgoi project. As a result, the loss from equity investee was lower in 2018 year to date compared to the same period in 2017 due to the change in this accounting policy. The amount recognized as a loss from equity investee is related to exploration costs on the Entrée/Oyu Tolgoi JV Property.

Net loss from discontinued operations was due to the plan of arrangement that was completed during Q2 2017 and the amount was related to exploration costs of the US-based assets that were spun-out to Mason Resources Corp. ("Mason Resources") (see "Plan of arrangement and discontinued operations" below).

The total assets as at June 30, 2018 are lower than at June 30, 2017 due to a reduction in cash and cash equivalents for operating expenditures. The total assets as at June 30, 2017 are substantially lower than at June 30, 2016 due to the completion of the plan of arrangement and the resulting spin-out of the US-based assets into Mason Resources in Q2 2017. The non-current liabilities as at June 30, 2018 are comparable to the balances at June 30, 2017 and at June 30, 2016.

| Page 14 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Quarterly Financial Data – 2 year historic trend

| Q2 18 | Q1 18 | Q4 17 | Q3 17 | Q2 17 | Q1 17 | Q4 16 | Q3 16 | |||||||||||||||||||||||||

| Exploration | $ | 26 | $ | 70 | $ | 95 | $ | 74 | $ | 94 | $ | 69 | $ | 70 | $ | 50 | ||||||||||||||||

| General and administrative | 232 | 441 | 911 | 293 | 628 | 905 | 937 | 524 | ||||||||||||||||||||||||

| Depreciation | 6 | 6 | 6 | 7 | 4 | 3 | 4 | 4 | ||||||||||||||||||||||||

| Operating loss | 264 | 517 | 1,012 | 374 | 726 | 977 | 1,011 | 578 | ||||||||||||||||||||||||

| Unrealized loss on HFT investments | 69 | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Foreign exchange (gain) loss | 88 | 135 | 26 | (349 | ) | (100 | ) | 43 | (54 | ) | (39 | ) | ||||||||||||||||||||

| Interest expense, net | 49 | 51 | 49 | 49 | 38 | 35 | 48 | 45 | ||||||||||||||||||||||||

| Loss from equity investee | 62 | 13 | 57 | 55 | 55 | 48 | 68 | 62 | ||||||||||||||||||||||||

| Income tax recovery | - | - | - | - | (72 | ) | - | (553 | ) | - | ||||||||||||||||||||||

| Net loss from continuing operations | $ | 532 | $ | 716 | $ | 1,144 | $ | 129 | $ | 647 | $ | 1,103 | $ | 520 | $ | 646 | ||||||||||||||||

| Gain on sale of asset | (370 | ) | - | - | - | - | - | - | - | |||||||||||||||||||||||

| Net loss from discontinued operations | - | - | - | - | 23 | 153 | $ | 448 | $ | 363 | ||||||||||||||||||||||

| Net loss | $ | 162 | $ | 716 | $ | 1,144 | $ | 129 | $ | 670 | $ | 1,256 | $ | 968 | $ | 1,009 | ||||||||||||||||

| Basic/diluted loss per share – continuing operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

| Basic/diluted loss per share – discontinued operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

Exploration costs have been trending lower since Q3 2016 after the Company placed all non-material properties on care and maintenance and implemented cost reduction efforts.

General and administrative costs have been trending lower since Q3 2016 with the exception of the period from Q4 2016 to Q2 2017 during which one-time costs associated with the strategic reorganization initiatives were incurred. In Q4 2017, general and administrative costs include stock-based compensation of $0.4 million and expenditures relating to the 2018 Technical Report for the Entrée/Oyu Tolgoi JV Property of $0.2 million.

Interest expense was primarily due to accrued interest on the OTLLC loan payable, partially offset by interest income earned on cash holdings. Interest expense remains consistent quarter on quarter.

The loss from equity investee was related to the Entrée/Oyu Tolgoi JV Property and had been consistent since Q3 2016. Effective January 1, 2018, the Company commenced capitalizing direct expenditures related to the development of the Oyu Tolgoi project and, as a result, the loss from equity investee is lower in Q1 2018 compared to prior periods. In Q2 2018, the loss from equity investee includes adjustments to the capitalized direct expenditures.

Plan of arrangement and discontinued operations

On May 9, 2017, the Company completed a plan of arrangement (the "Arrangement") under Section 288 of theBusiness Corporations Act (British Columbia) pursuant to which Entrée transferred its wholly owned subsidiaries that directly or indirectly hold the Ann Mason Project in Nevada and the Lordsburg property in New Mexico including $8,843,232 in cash and cash equivalents to a newly incorporated company, Mason Resources in exchange for 77,804,786 common shares of Mason Resources ("Mason Common Shares"). Mason Resources commenced trading on the TSX on May 12, 2017 under the symbol "MNR" and on the OTCQB Venture Market on November 9, 2017 under the symbol "MSSNF".

| Page 15 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

As part of the Arrangement, Entrée then distributed 77,805,786 Mason Common Shares to Entrée shareholders by way of a share exchange, pursuant to which each existing share of Entrée was exchanged for one "new" share of Entrée and 0.45 of a Mason Common Share. Optionholders and warrantholders of Entrée received replacement options and warrants of Entrée and options and warrants of Mason Resources which were proportionate to, and reflective of the terms of, their existing options and warrants of Entrée.

The assets and liabilities that were transferred to Mason Resources were classified as discontinued operations and classified on the balance sheet as assets / liabilities held for spin-off ("Spin-off"). The discontinued operations include three entities transferred to Mason Resources pursuant to the Arrangement: Mason U.S. Holdings Inc. (formerly Entrée U.S. Holdings Inc.); Mason Resources (US) Inc. (formerly Entrée Gold (US) Inc.); and M.I.M. (U.S.A.) Inc. (collectively the "US Subsidiaries"). The Spin-off distribution was accounted for at the carrying amount, without gain or loss, and resulted in a reduction of stockholders’ (deficiency) equity of $44.2 million.

The closing of the Arrangement resulted in the following Spin-off assets and liabilities being distributed to Mason Resources on May 9, 2017:

| May 9, 2017 | December 31, 2016 | |||||||

| Current assets | ||||||||

| Cash | $ | 8,843 | $ | 129 | ||||

| Receivables and prepaids | 137 | 219 | ||||||

| 8,980 | 348 | |||||||

| Long-term assets | ||||||||

| Property, plant and equipment | 25 | 25 | ||||||

| Mineral property interest | 37,699 | 38,379 | ||||||

| Reclamation deposits and other | 481 | 481 | ||||||

| 38,205 | 38,885 | |||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | (34 | ) | (230 | ) | ||||

| Long-term liabilities | ||||||||

| Deferred income taxes | (2,937 | ) | (3,015 | ) | ||||

| Net assets | $ | 44,214 | $ | 35,988 | ||||

| Page 16 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LIQUIDITY AND CAPITAL RESOURCES

| Three months ended June 30 | Six months ended June 30 | |||||||||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||||||||||

| Cash (used in) from operating activities | ||||||||||||||||||||||||

| - Before changes in non-cash working capital items | $ | (528 | ) | $ | (514 | ) | $ | (919 | ) | $ | (755 | ) | $ | (2,232 | ) | $ | (1,977 | ) | ||||||

| - After changes in non-cash working capital items | (551 | ) | (1,061 | ) | (924 | ) | (742 | ) | (1,957 | ) | (8,343 | ) | ||||||||||||

| Cash flows from (used in) financing activities | - | (140 | ) | 25 | 130 | 5,077 | 36 | |||||||||||||||||

| Cash flows (used in) from investing activities | (106 | ) | (8,937 | ) | 37 | (106 | ) | (8,937 | ) | 34 | ||||||||||||||

| Net cash outflows | (657 | ) | (10,138 | ) | (862 | ) | (718 | ) | (5,817 | ) | (8,273 | ) | ||||||||||||

| Effect of exchange rate changes on cash | 244 | 354 | 13 | (124 | ) | 192 | 184 | |||||||||||||||||

| Cash balance | $ | 6,226 | $ | 7,766 | $ | 14,697 | $ | 6,226 | $ | 7,766 | $ | 14,697 | ||||||||||||

Cash flows after changes in non-cash working capital items in Q2 2018 were 48% lower than the comparative period of 2017 due mainly to one-time restructuring costs in 2017.

There were no financing activities in Q2 2018 and only minimal financing activities in the comparative period of 2017.

Cash flows relating to investing activities were minimal in Q2 2018. In Q2 2017, cash flows used in investing activities included the transfer of $8.8 million to Mason Resources as a capital contribution in connection to the Arrangement.

Effective January 1, 2018, the Company is now a development stage company and has not generated positive cash flows from its operations. As a result, the Company has been dependent on equity and production-based financings for additional funding. Working capital on hand at June 30, 2018 was approximately $7.3 million with a cash balance of approximately $6.2 million. Management believes it has adequate financial resources to satisfy its obligations over the next 12 month period and up to the time when the Company expects the Entrée/Oyu Tolgoi JV Property to commence production. The Company does not currently anticipate the need for additional funding during this time.

Loan Payable to Oyu Tolgoi LLC

Under the terms of the Entrée/Oyu Tolgoi JVA, OTLLC will contribute funds to approved joint venture programs and budgets on the Company’s behalf. Interest on each loan advance shall accrue at an annual rate equal to OTLLC’s actual cost of capital or the prime rate of the Royal Bank of Canada, plus two percent (2%) per annum, whichever is less, as at the date of the advance. The loan will be repayable by the Company monthly from ninety percent (90%) of the Company’s share of available cash flow from the Entrée/Oyu Tolgoi JV. In the absence of available cash flow, the loan will not be repayable. The loan is not expected to be repaid within one year.

Contractual Obligations

As at June 30, 2018, the Company had the following contractual obligations outstanding:

| Total | Less than 1 year | 1 - 3 years | 3 - 5 years | More than 5 years | ||||||||||||||||

| Lease commitments | $ | 518 | $ | 109 | $ | 344 | $ | 65 | $ | - | ||||||||||

| Page 17 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

STOCKHOLDERS’ DEFICIENCY

The Company’s authorized share capital consists of unlimited common shares without par value.

At June 30, 2018 and at the date of this MD&A, the Company had174,372,449 shares issued and outstanding.

On May 9, 2017, the Company completed the spin-out of its Ann Mason Project and Lordsburg property (the "US Projects") into Mason Resources through the Arrangement. As part of the Arrangement, Entrée shareholders received Mason Common Shares by way of a share exchange, pursuant to which each existing share of Entrée was exchanged for one "new" share of Entrée and 0.45 of a Mason Common Share. Optionholders and warrantholders of Entrée received replacement options and warrants of Entrée and options and warrants of Mason Resources which were proportionate to, and reflective of the terms of, their existing options and warrants of Entrée. As a result of the completed Arrangement, stockholders’ (deficiency) equity was reduced by $44.2 million in 2017.

In January 2017, the Company closed a non-brokered private placement in two tranches issuing a total of 18,529,484 units at a price of C$0.41 per unit for aggregate gross proceeds of C$7.6 million. Each unit consisted of one common share of the Company and one-half of one transferable common share purchase warrant. Each whole warrant entitled the holder to acquire one additional common share of the Company at a price of C$0.65 per share for a period of 5 years. No commissions or finders' fees were payable in connection with the private placement.

As part of the Arrangement, warrantholders of the Company received Mason Resources common share purchase warrants ("Mason Warrants") which were proportionate to, and reflective of the terms of, their existing warrants of the Company. In exchange for each existing warrant, the holder was issued one replacement common share purchase warrant of the Company (a "Replacement Warrant") and 0.45 of a Mason Warrant. On May 23, 2017, warrantholders of the Company received an aggregate 4,169,119 Mason Warrants each with an exercise price of C$0.23, and 9,264,735 Replacement Warrants each with an exercise price of C$0.55. The exercise prices assigned to the Replacement Warrants and the Mason Warrants reflect the allocation of the original exercise price of the existing warrants between the Replacement Warrants and the Mason Warrants issued, based on the relative market value of Mason Resources and the Company following completion of the Arrangement.

Share Purchase Warrants

At June 30, 2018 and at the date of this MD&A, the following share purchase warrants were outstanding:

| Number of share purchase warrants (000’s) | Exercise price per share C$ | Expiry date | ||||||

| 8,655 | 0.55 | January 10, 2022 | ||||||

| 610 | 0.55 | January 12, 2022 | ||||||

Stock Option Plan

The Company has adopted a stock option plan (the "Plan") to grant options to directors, officers, employees and consultants. Under the Plan, the Company may grant options to acquire up to 10% of the issued and outstanding shares of the Company. Options granted can have a term of up to ten years and an exercise price typically not less than the Company's closing stock price on the TSX on the last trading day before the date of grant. Vesting is determined at the discretion of the Board.

Under the Plan, an option holder may elect to terminate an option, in whole or in part and, in lieu of receiving shares to which the terminated option relates (the "Designated Shares"), receive the number of shares, disregarding fractions, which, when multiplied by the weighted average trading price of the shares on the TSX during the five trading days immediately preceding the day of termination (the "Fair Value" per share) of the Designated Shares, has a total dollar value equal to the number of Designated Shares multiplied by the difference between the Fair Value and the exercise price per share of the Designated Shares.

| Page 18 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

As part of the Arrangement, optionholders of the Company received Mason Resources incentive stock options ("Mason Options") which were proportionate to, and reflective of the terms of, their existing incentive stock options of the Company. In exchange for each existing incentive stock option, the holder was issued one fully vested replacement option to purchase a common share of the Company (a "Replacement Option") and 0.45 of a fully vested Mason Option. On May 23, 2017, Mason Resources awarded a total of 3,708,000 Mason Options to the Company’s optionholders in accordance with its Stock Option Plan, which was approved by the Company’s shareholders at the Annual and Special Meeting of Securityholders held to approve the Arrangement. The Mason Options were awarded with exercise prices ranging from C$0.07 per share to C$0.27 per share and expiry dates ranging from September 2017 to November 2021. On May 23, 2017, the Company’s optionholders also received an aggregate 8,240,000 Replacement Options with exercise prices ranging from C$0.18 per share to C$0.61 per share and expiry dates ranging from September 2017 to November 2021. The exercise prices assigned to the Replacement Options and the Mason Options reflect the allocation of the original exercise price of the existing options between the Replacement Options and the Mason Options issued, based on the relative market value of Mason Resources and the Company following completion of the Arrangement.

As at June 30, 2018, the Company had 7,205,000 stock options outstanding, of which 7,155,000 had vested and were exercisable.

The following is a summary of stock options outstanding as at the date of this report:

| Number of shares (000`s) | Vested (000`s) | Aggregate intrinsic value C$ (000’s) | Exercise price per share C$ | Expiry date | ||||||||||||

| 785 | 785 | 233 | 0.26 – 0.36 | Sept – Dec 2018 | ||||||||||||

| 860 | 860 | 335 | 0.18 | Dec 2019 | ||||||||||||

| 1,320 | 1,320 | 369 | 0.28 – 0.32 | July – Dec 2020 | ||||||||||||

| 2,240 | 2,240 | 473 | 0.33 – 0.36 | Mar – Nov 2021 | ||||||||||||

| 1,900 | 1,900 | 92 | 0.52 – 0.62 | May – Oct 2022 | ||||||||||||

| 100 | 50 | - | 0.63 | Feb 2023 | ||||||||||||

| 7,205 | 7,155 | 1,502 | ||||||||||||||

AMENDED SANDSTORM AGREEMENT

On February 14, 2013, the Company entered into an Equity Participation and Funding Agreement with Sandstorm (the "2013 Agreement"). Pursuant to the 2013 Agreement, Sandstorm provided an upfront refundable deposit (the "Deposit") of $40 million to the Company. The Company will use future payments that it receives from its mineral property interests to purchase and deliver metal credits to Sandstorm, in amounts that are indexed to the Company’s share of gold, silver and copper production from the currently defined Entrée/Oyu Tolgoi JV Property. Upon the delivery of metal credits, Sandstorm will also make the cash payment outlined below. In addition, the 2013 Agreement provided for a partial refund of the Deposit and a pro rata reduction in the number of metal credits deliverable to Sandstorm in the event of a partial expropriation of Entrée’s economic interest, contractually or otherwise, in the Entrée/Oyu Tolgoi JV Property.

On February 23, 2016, the Company and Sandstorm entered into an Agreement to Amend the 2013 Agreement, whereby the Company refunded 17% of the Deposit ($6.8 million) (the "Refund") in cash and shares thereby reducing the Deposit to $33.2 million for a 17% reduction in the metal credits that the Company is required to deliver to Sandstorm. At closing on March 1, 2016, the parties entered into an Amended and Restated Equity Participation and Funding Agreement (the "Amended Sandstorm Agreement"). Under the terms of the Amended Sandstorm Agreement, the Company will purchase and deliver gold, silver and copper credits equivalent to:

| · | 28.1% of Entrée’s share of gold and silver, and 2.1% of Entrée’s share of copper, produced from the Shivee Tolgoi mining licence (excluding the Shivee West Property); and |

| · | 21.3% of Entrée’s share of gold and silver, and 2.1% of Entrée’s share of copper, produced from the Javhlant mining licence. |

Upon the delivery of metal credits, Sandstorm will make a cash payment to the Company equal to the lesser of the prevailing market price and $220 per ounce of gold, $5 per ounce of silver and $0.50 per pound of copper (subject to inflation adjustments). After approximately 8.6 million ounces of gold, 40.3 million ounces of silver and 9.1 billion pounds of copper have been produced from the entire Entrée/Oyu Tolgoi JV Property (as currently defined) the cash payment will be increased to the lesser of the prevailing market price and $500 per ounce of gold, $10 per ounce of silver and $1.10 per pound of copper (subject to inflation adjustments). To the extent that the prevailing market price is greater than the amount of the cash payment, the difference between the two will be credited against the Deposit (the net amount of the Deposit being the "Unearned Balance").

| Page 19 |

| Q2 2018 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

This arrangement does not require the delivery of actual metal, and the Company may use revenue from any of its assets to purchase the requisite amount of metal credits.

Under the Amended Sandstorm Agreement, Sandstorm has a right of first refusal, subject to certain exceptions, on future production-based funding agreements. The Amended Sandstorm Agreement also contains other customary terms and conditions, including representations, warranties, covenants and events of default. The initial term of the Amended Sandstorm Agreement is 50 years, subject to successive 10-year extensions at the discretion of Sandstorm.

In addition, the Amended Sandstorm Agreement provides that the Company will not be required to make any further refund of the Deposit if Entrée’s economic interest is reduced by up to and including 17%. If there is a reduction of greater than 17% up to and including 34%, the Amended Sandstorm Agreement provides the Company with the ability to refund a corresponding portion of the Deposit in cash or common shares of the Company or any combination of the two at the Company’s election, in which case there would be a further corresponding reduction in deliverable metal credits. If the Company elects to refund Sandstorm with common shares of the Company, the value of each common share shall be equal to the volume weighted average price ("VWAP") for the five (5) trading days immediately preceding the 90th day after the reduction in Entrée’s economic interest. In no case will Sandstorm become a "control person" under the Amended Sandstorm Agreement. In the event an issuance of shares would cause Sandstorm to become a "control person", the maximum number of shares will be issued, and with respect to the value of the remaining shares, 50% will not be refunded (and there will not be a corresponding reduction in deliverable metal credits) and the remaining 50% will be refunded by the issuance of shares in tranches over time, such that the number of shares that Sandstorm holds does not reach or exceed 20%. All shares will be priced in the context of the market at the time they are issued.

In the event of a full expropriation, the remainder of the Unearned Balance after the foregoing refunds must be returned in cash.