Exhibit 99.2

|

Management’s Discussion and Analysis First Quarter Ended March 31, 2021 (Expressed in United States dollars, except per share amounts and where otherwise noted) |

May 14, 2021

This Management’s Discussion and Analysis ("MD&A") should be read in conjunction with the condensed consolidated interim financial statements for the period ended March 31, 2021 and related notes thereto which have been prepared in accordance with IFRS 34, Interim Financial Reporting of the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, as well as the annual audited consolidated financial statements for the year ended December 31, 2020, which are in accordance with IFRS, and the related MD&A. References to "Entrée" and the "Company" are to Entrée Resources Ltd. and/or one or more of its wholly-owned subsidiaries. For further information on the Company, reference should be made to its continuous disclosure (including its most recently filed annual information form ("AIF")), which is available on SEDAR at www.sedar.com. Information is also available on the Company’s website at www.EntreeResourcesLtd.com. Information on risks associated with investing in the Company’s securities is contained in the Company’s most recently filed AIF. Technical and scientific information under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") concerning the Company’s material property, including information about mineral resources and reserves, is contained in the Company’s most recently filed AIF and in its technical report titled "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an effective date of January 15, 2018 prepared by Wood Canada Limited (formerly known as Amec Foster Wheeler Americas Limited).

Q1 2021 HIGHLIGHTS

Oyu Tolgoi Underground Development Update

The Oyu Tolgoi project in Mongolia includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by Entrée’s joint venture partner Oyu Tolgoi LLC ("OTLLC") and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC (see "Overview of Business" below). On May 12, 2021, OTLLC’s 66% shareholder Turquoise Hill Resources Ltd. ("Turquoise Hill") provided an update on Oyu Tolgoi underground development:

| · | The COVID-19 situation in Mongolia remains fragile and subject to rapid change despite a widespread vaccination program. OTLLC is constantly adapting to the changing circumstances to prioritize the health and safety of its employees. |

| · | During the first quarter 2021, the Oyu Tolgoi underground project was impacted by COVID-19 cases at site, requiring OTLLC to periodically suspend work as a health and safety precaution. COVID-19 measures implemented by OTLLC, including restrictions on travel from Ulaanbaatar to site, have significantly impacted the number of workers that remain at site to continue underground development. Turquoise Hill expects that COVID-19 restrictions will continue to impact underground construction and development in the second quarter 2021 and is working with OTLLC and Rio Tinto International Holdings ("Rio Tinto") to monitor and assess the situation. |

| · | On April 9, 2021, Turquoise Hill announced that it has reached a binding agreement (the "Heads of Agreement") with Rio Tinto on a funding plan to complete the construction of the first lift ("Lift 1") of the Oyu Tolgoi underground project, including Lift 1 of the Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property. Successful implementation of the Heads of Agreement is subject to achieving alignment with the relevant stakeholders in addition to Rio Tinto (including existing lenders, any potential new lenders and the Government of Mongolia), market conditions and other factors. |

| · | Achievement of the technical criteria required for a mid-2021 commencement of the undercut on the Oyu Tolgoi mining licence remains on track. However, the exact timing of the undercut is under increasing pressure due to the rapidly evolving recent COVID-19 impacts. Non-technical criteria, including confirmation of necessary regulatory and legislative approvals required by the Government of Mongolia, are still pending and are critical elements for consideration to proceed with the decision to commence the undercut. Turquoise Hill is working with OTLLC and other stakeholders to ensure that important aspects for a successful project are met prior to commencing the undercut. |

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| · | At the end of the first quarter 2021, cumulative underground development progress is 56,264 equivalent metres with cumulative conveyor to surface advancement of 13,832 equivalent metres. Progress in March was impacted by COVID-19 restrictions and controls and Turquoise Hill anticipates that development rates will continue to be impacted into the second quarter 2021. Although development work has slowed, almost all of the development required for the commencement of the undercut is complete. |

| · | Ongoing work suspensions continue to affect progress on Shafts 3 and 4 and the overall impact of these delays is under review. Progress remains dependent on mobilizing key vendors and additional sinking resources into country and cleared from quarantine. Additional shaft sinking specialists are in Mongolia and are expected to arrive on site in May 2021. Shafts 3 and 4 are not required to support Panel 0 commencement, however they are required to support production from Panels 1 and 2 during ramp up to 95,000 tonnes per day. |

| · | In the first quarter 2020, OTLLC submitted a resources and reserves update for registration pursuant to local regulatory requirements in Mongolia. On July 2, 2020, Turquoise Hill announced the completion of an updated Oyu Tolgoi Feasibility Study ("OTFS20"), which incorporates the new block cave mine design for Hugo North Lift 1 Panel 0 previously announced by Turquoise Hill on May 13, 2020. The expert review of the resources and reserves update is in progress and OTFS20 is expected to be considered for endorsement by the Mongolian regulators following registration. |

| · | OTFS20 incorporates an update to the first sustainable production schedule and capital cost estimates for the underground mine development based on the new Panel 0 mine design. On December 18, 2020, Turquoise Hill announced the completion and delivery by Rio Tinto of the definitive estimate of cost and schedule (the "Definitive Estimate"), which refines the analysis contained in OTFS20. OTLLC board approval of the Definitive Estimate will be considered following registration of the resources and reserves update and endorsement of OTFS20. |

| · | The Hugo North (including Hugo North Extension) Lift 1 mine plan incorporates the development of three panels and in order to reach the full sustainable production rate of 95,000 tonnes per day from the underground operations, all three panels need to be in production. The Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property is located at the northern portion of Panel 1. |

| · | Turquoise Hill has advised that several mining studies are in progress, which are focused on the evaluation of different design and sequencing options for Panels 1 and 2 as part of OTLLC’s planned Pre-Feasibility and Feasibility Study level work. These studies are underpinned by additional geology and geotechnical data that is being collected from underground and surface drilling, which was ongoing during the first quarter 2021. As more drilling is completed, mine design refinements and updates will be communicated by Turquoise Hill. Turquoise Hill expects the first of these design updates in the second half of 2021. |

Corporate

| • | Q1 2021 operating loss was $0.5 million compared to an operating loss of $0.4 million in Q1 2020. |

| • | Q1 2021 operating cash outflow before working capital was $0.4 million and was consistent with the comparative quarter of Q1 2020. |

| • | As at March 31, 2021, the cash balance was $6.9 million and the working capital balance was $6.9 million. |

| • | The Company recognizes the unprecedented situation surrounding the ongoing COVID-19 pandemic and is closely monitoring the effect of the COVID-19 pandemic on its business and operations and will continue to update the market on the impacts to the Company’s business and operations in relation to these extraordinary circumstances. |

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

OVERVIEW OF BUSINESS

Entrée is a mineral resource company with interests in development and exploration properties in Mongolia, Peru and Australia.

The Company’s principal asset is its interest in the Entrée/Oyu Tolgoi joint venture property (the "Entrée/Oyu Tolgoi JV Property") - a carried 20% participating interest in two of the Oyu Tolgoi project deposits, and a carried 20% or 30% interest (depending on the depth of mineralization) in the surrounding large, underexplored, highly prospective land package located in the South Gobi region of Mongolia. Entrée’s joint venture partner, OTLLC, holds the remaining interest.

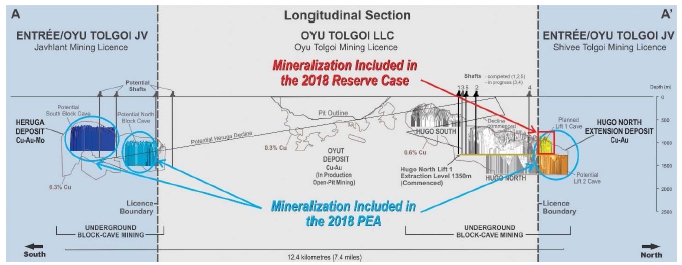

The Oyu Tolgoi project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by OTLLC (66% Turquoise Hill and 34% the Government of Mongolia), and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC. The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence, and all of the Javhlant mining licence, which mostly surround the Oyu Tolgoi mining licence (Figure 1). Both the Shivee Tolgoi and Javhlant mining licences are held by Entrée. The terms of the Entrée/Oyu Tolgoi joint venture (the "Entrée/Oyu Tolgoi JV") state that Entrée has a 20% participating interest with respect to mineralization extracted from deeper than 560 metres below surface and a 30% participating interest with respect to mineralization extracted from above 560 metres depth.

The Entrée/Oyu Tolgoi JV Property includes the Hugo North Extension copper-gold deposit (also referred to as "HNE") and the majority of the Heruga copper-gold-molybdenum deposit. The resources at Hugo North Extension include a Probable reserve, which is part of Lift 1 of the Oyu Tolgoi underground block cave mining operation. Lift 1 is in development by project operator Rio Tinto. By 2030, Oyu Tolgoi is expected to be the fourth largest copper mine in the world.

In addition to the Hugo North Extension copper-gold deposit, the Entrée/Oyu Tolgoi JV Property includes approximately 94% of the resource tonnes outlined at the Heruga copper-gold-molybdenum deposit and a large exploration land package, which together form a significant component of the overall Oyu Tolgoi project.

The Company also has the following assets:

| • | Blue Rose JV - a 56.53% interest in the Blue Rose joint venture ("Blue Rose JV") on minerals other than iron ore on Exploration Licence 6006 ("EL 6006") in the Olary Region of South Australia. The Blue Rose JV partners also have certain rights and royalties with respect to iron ore outlined or extracted from the area covered by EL 6006. |

| • | The right to Cañariaco Project Royalty Pass-Through Payments (see "Investments" section below). |

The Company’s corporate headquarters are located in Vancouver, British Columbia, Canada. Field operations are conducted out of local offices in Mongolia.

As at March 31, 2021 and the date of this MD&A, Rio Tinto Rio Tinto beneficially owns 31,981,129 common shares (including 14,539,333 common shares held by Turquoise Hill), or 17.1% (17.0% as at the date of this MD&A) of the outstanding shares of the Company. As at March 31, 2021, Sandstorm Gold Ltd. ("Sandstorm") owned 43,466,678 common shares, or 23.3% of the outstanding shares of the Company. As at the date of this MD&A, Sandstorm owns 44,605,240 common shares, or 23.7% of the outstanding shares of the Company.

Effective October 1, 2019, the Company voluntarily withdrew its common shares from listing on NYSE American and its common shares commenced trading on the OTCQB under the trading symbol "ERLFF". On April 24, 2006, the Company’s common shares began trading on the Toronto Stock Exchange ("TSX") and discontinued trading on the TSX Venture Exchange. The trading symbol remained "ETG".

OUTLOOK AND STRATEGY

The Company’s primary objective for the 2021 year is to work with other Oyu Tolgoi stakeholders to advance potential amendments to the joint venture agreement (the "Entrée/Oyu Tolgoi JVA") that currently governs the relationship between Entrée and OTLLC and upon finalization, transfer the Shivee Tolgoi and Javhlant mining licences to OTLLC as manager of the Entrée/Oyu Tolgoi JV. The form of Entrée/Oyu Tolgoi JVA was agreed between the parties in 2004, prior to the execution of the 2009 Oyu Tolgoi Investment Agreement among the Government of Mongolia, OTLLC, Rio Tinto and Turquoise Hill (the "Oyu Tolgoi Investment Agreement") and commencement of underground development. The Company currently is registered in Mongolia as the 100% ultimate holder of the Shivee Tolgoi and Javhlant mining licences.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The Company believes that amendments that align the interests of all stakeholders as they are now understood, would be in the best interests of all stakeholders, provided there is no net erosion of value to Entrée. No agreements have been finalized and there are no assurances agreements may be finalized in the future.

In addition, the Company is currently in the process of reviewing the data and assumptions underlying OTFS20, the OTFS20 block cave designs, updated costs and schedules and the updated mineral resources and reserves in order to assess the potential impact on the Entrée/Oyu Tolgoi JV Property resources and reserves and its impact on the 2018 Technical Report (see "2018 Technical Report Highlights"). The Company will update the market following completion of its review and assessment.

ENTRÉE/OYU TOLGOI JV PROPERTY AND SHIVEE WEST PROPERTY - MONGOLIA

2018 Technical Report Highlights

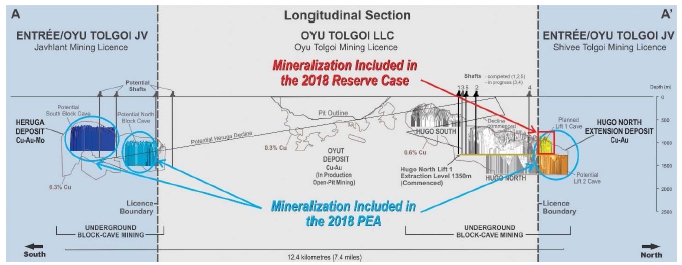

In Q1 2018, the Company announced the results of a technical report (the "2018 Technical Report") completed on its interest in the Entrée/Oyu Tolgoi JV Property. The 2018 Technical Report discusses two development scenarios, a reserve case (the "2018 Reserve Case") and a Life of Mine ("LOM") Preliminary Economic Assessment (the "2018 PEA"). The 2018 Reserve Case is based only on mineral reserves attributable to the Entrée/Oyu Tolgoi JV from Lift 1 of the Hugo North Extension underground block cave.

The 2018 PEA is an alternative development scenario completed at a conceptual level that assesses the inclusion of the second lift of Hugo North Extension ("Lift 2") and Heruga into an overall mine plan with Hugo North Extension Lift 1. The 2018 PEA includes Indicated and Inferred resources from Hugo North Extension Lifts 1 and 2, and Inferred resources from Heruga. Significant development and capital decisions will be required for the eventual development of Hugo North Extension Lift 2 and Heruga once production commences at Hugo North Extension Lift 1.

Both the 2018 Reserve Case and the 2018 PEA are based on information reported within the 2016 Oyu Tolgoi Feasibility Study ("OTFS16"), completed by OTLLC on the Oyu Tolgoi project (refer to Turquoise Hill’s press release dated October 21, 2016). OTFS16 discusses the mine plan for Lift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. In May 2020, a design change for Hugo North Lift 1 Panel 0 on the Oyu Tolgoi mining licence was approved by OTLLC, Turquoise Hill and Rio Tinto. The new mine design was incorporated in OTFS20, which was completed in July 2020 but is still subject to regulatory endorsement and acceptance. The OTFS20 Lift 1 mine plan incorporates the development of three panels and in order to reach the full sustainable production rate of 95,000 tonnes per day ("tpd") from the underground operations, all three panels need to be in production. Hugo North Extension on the Entrée/Oyu Tolgoi JV Property is located in the northern portion of Panel 1. The new design, many fundamentals of which remain unchanged from OTFS16, provides for 120 metre structural pillars included to the north and south of Panel 0, protecting ore handling infrastructure (which will be moved into the structural pillars) and increasing the optionality of sequencing Panel 1 and Panel 2. In December 2020, Turquoise Hill announced the completion and delivery by Rio Tinto of the Definitive Estimate of project cost and schedule, which refines the analysis contained in OTFS20. Several mining studies are also currently in progress, which are focused on the evaluation of different design and sequencing options for Panels 1 and 2 as part of OTLLC’s planned Pre-Feasibility and Feasibility Study level work. These studies are underpinned by additional geology and geotechnical data that is being collected by OTLLC from underground and surface drilling. Data collection and analysis is being prioritized to complete study work in line with mining progression.

The Company is currently in the process of reviewing the data and assumptions underlying OTFS20, the OTFS20 block cave designs, updated costs and schedules and the updated mineral resources and reserves in order to assess the potential impact, whether positive or negative, on Entrée/Oyu Tolgoi JV Property resources and reserves as well as production and financial assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. The results of the Company’s assessment may differ materially from the results of the 2018 Technical Report and/or from OTLLC’s planned Pre-Feasibility and Feasibility Study level work on Panel 1. The Company will update the market following completion of its review and assessment. Until such time, the Company considers the information set out below of a scientific or technical nature regarding the Entrée/Oyu Tolgoi JV Property to be current.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LOM highlights of the production from the 2018 Reserve Case and the 2018 PEA are summarized as follows:

| Entrée/Oyu Tolgoi JV Property | Units | 2018 Reserve Case | 2018 PEA |

| Probable Reserve Feed | | 35 Mt @ 1.59% Cu, 0.55 g/t Au, 3.72 g/t Ag (1.93% CuEq) | — |

| Indicated Resource Feed | | — | 113 Mt @ 1.42% Cu, 0.50 g/t Au, 3.63 g/t Ag (1.73% CuEq) |

| Inferred Resource Feed | | — | 708 Mt @ 0.53% Cu, 0.44 g/t Au, 1.79 g/t Ag (0.82 % CuEq) |

| Copper Recovered | Mlb | 1,115 | 10,497 |

| Gold Recovered | koz | 514 | 9,367 |

| Silver Recovered | koz | 3,651 | 45,378 |

Notes:

| 1. | Mineral reserves and mineral resources are reported on a 100% basis. |

| 2. | Entrée has a 20% interest in the above processed material and recovered metal. |

| 3. | The mineral reserves in the 2018 Reserve Case are not additive to the mineral resources in the 2018 PEA. |

| 4. | Copper equivalent ("CuEq") is calculated as shown in the footnotes to the Mineral Resources Table below. |

| 5. | The copper, gold and silver recovered in the 2018 Reserve Case are not additive to the copper, gold and silver recovered in the 2018 PEA. |

The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both development options (2018 Reserve Case and 2018 PEA) the 2018 Technical Report only contemplates the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other mineral deposits located on the Oyu Tolgoi mining licence owned 100% by OTLLC. Note the production and cash flows from these two development options are not additive.

Below are some of the key production assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. All figures shown for both cases are reported on a 100% Entrée/Oyu Tolgoi JV basis.

Key items per the 2018 Reserve Case outputs are as follows:

| • | Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 1 is assumed to start in 2021 with initial block cave production starting in 2026. |

| • | 14-year mine life (5-years development production and 9-years block cave production). |

| • | Maximum production rate of approximately 24,000 tpd, which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to reach an average mill throughput of approximately 110,000 tpd. |

Key items per the 2018 PEA outputs are as follows:

| Entrée/Oyu Tolgoi JV Property | Units | 2018 PEA (1) |

| HNE Lift 1 + Lift 2 | HNE Lift 1+2+Heruga |

| Mine Life (2) | Years | 33 | 77* |

Metal Recovered (3) • Copper • Gold • Silver | Mlb Koz Koz | 5,579 2,637 20,442 | 10,497 9,367 45,378 |

Notes:

| 1. | The economic analysis in the 2018 PEA does not have as high a level of certainty as the 2018 Reserve Case. The 2018 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2018 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability. |

| 2. | *The 2018 PEA covers a period from 2021 to 2097 (77 years), but there is an 11-year period (2054-2064) with no mining from the Entrée/Oyu Tolgoi JV Property when other mineralization from the Oyu Tolgoi mining licence is being mined and processed. |

| 3. | Entrée has a 20% attributable interest in the recovered metal. |

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| • | Mineralization mined from the Entrée/Oyu Tolgoi JV Property is blended with production from other deposits on the Oyu Tolgoi mining licence to reach a mill throughput of 110,000 tpd. |

| • | Development schedule assumptions for Entrée/Oyu Tolgoi JV Property: |

| – | 2021 start of Lift 1 development production and in 2026 initial Lift 1 block cave production |

| – | 2028 Lift 2 development production and in 2035 initial Lift 2 block cave production |

| – | 2065 Heruga development production and in 2069 initial block cave production |

The 2018 PEA and the 2018 Reserve Case are not mutually exclusive; if the 2018 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 and Heruga is not sterilized or reduced in tonnage or grades. Heruga could be a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provides considerable flexibility for mine planning and development.

The Company is currently in the process of reviewing the data and assumptions underlying OTFS20, the OTFS20 block cave designs, updated costs and schedules and the updated mineral resources and reserves in order to assess the potential impact, whether positive or negative, on key production assumptions (including development schedule) and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. The results of the Company’s assessment may differ materially from the results of the 2018 Technical Report and/or from OTLLC’s planned Pre-Feasibility and Feasibility Study level work on Panel 1.

The 2018 Technical Report has been filed on SEDAR and is available for review under the Company’s profile on SEDAR (www.sedar.com) or on www.EntreeResourcesLtd.com.

Summary and Location of Project

The "Entrée/Oyu Tolgoi JV Project" (shown on Figure 1) comprises the Entrée/Oyu Tolgoi JV Property and the Shivee West Property (see "Shivee West Property Summary" below). The Entrée/Oyu Tolgoi JV Project completely surrounds OTLLC’s Oyu Tolgoi mining licence and forms a significant portion of the overall Oyu Tolgoi project area. Figure 1 also shows the main mineral deposits that form the Oyu Tolgoi trend of porphyry deposits and several priority exploration targets, including Airstrip, Bumbat Ulaan, Mag West, Gravity Ridge and Southwest IP.

The Entrée/Oyu Tolgoi JV Project is located within the Aimag (province) of Ömnögovi in the South Gobi region of Mongolia, about 570 kilometres ("km") south of the capital city of Ulaanbaatar and 80 km north of the border with China.

The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence and all of the Javhlant mining licence, and hosts:

| • | The Hugo North Extension copper-gold porphyry deposit (Lift 1 and Lift 2): |

| – | Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2018 Reserve Case. It is the northern portion of the Hugo North Lift 1 underground block cave mine plan that is currently in development on the Oyu Tolgoi mining licence. Based on the mine design discussed in OTFS16 and the 2018 Technical Report, development would cross north onto the Entrée/Oyu Tolgoi JV Property in approximately 2021. Hugo North Extension Lift 1 Probable reserves include 35 million tonnes ("Mt") grading 1.59% copper, 0.55 grams per tonne ("g/t") gold, and 3.72 g/t silver. Lift 1 mineral resources are also included in the alternative development scenario, as part of the mine plan for the 2018 PEA. The Company is currently in the process of reviewing OTFS20 in order to assess the potential impact on mineral resources and reserves and the development schedule for the Entrée/Oyu Tolgoi JV Property. The results of the Company’s assessment may differ materially from the results of the 2018 Technical Report and/or from OTLLC’s planned Pre-Feasibility and Feasibility Study level work on Lift 1 Panel 1. |

| – | Lift 2 is immediately below Lift 1 and is the next potential phase of underground mining, once Lift 1 mining is complete. Lift 2 is currently included as part of the alternative, 2018 PEA mine plan. Hugo North Extension Lift 2 resources included in the 2018 PEA mine plan are: 78 Mt (Indicated), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver; plus 88.4 Mt (Inferred), grading 1.34% copper, 0.48 g/t gold, and 3.59 g/t silver. |

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| • | The Heruga copper-gold-molybdenum porphyry deposit is at the south end of the Oyu Tolgoi trend of porphyry deposits. Approximately 94% of the Heruga deposit occurs on the Entrée/Oyu Tolgoi JV Property. The 2018 PEA includes Heruga as the final deposit to be mined, as two separate block caves, one to the south with a slightly deeper block cave to the north. The portion of the Heruga mineral resources that occur on the Entrée/Oyu Tolgoi JV Property and are part of the alternative, 2018 PEA mine plan include 620 Mt (Inferred) grading 0.42% copper, 0.43 g/t gold, and 1.53 g/t silver. |

| • | A large prospective land package. |

Entrée has a 20% or 30% (depending on the depth of mineralization) participating interest in the Entrée/Oyu Tolgoi JV with OTLLC holding the remaining 80% (or 70%) interest. OTLLC has a 100% interest in other Oyu Tolgoi project areas, including the Oyut open pit, which is currently in production, and the Hugo North and Hugo South deposits on the Oyu Tolgoi mining licence.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Figure 1 - Entrée/Oyu Tolgoi JV Project

Notes:

| 1. | *The Shivee West Property is subject to a License Fees Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property. |

| 2. | ** Outline of mineralization projected to surface. |

| 3. | Entrée has a 20% participating interest in the Hugo North Extension and Heruga resources and reserves. |

Figure 1 shows the location of a north-northeast oriented, west-looking cross section (A-A’) through the 12.4 km-long trend of porphyry deposits that comprise the Oyu Tolgoi project. The cross section is shown on Figure 2 with the Entrée/Oyu Tolgoi JV Property to the right (north) and left (south) of the central portion, the Oyu Tolgoi mining licence, held 100% by OTLLC. The deposits that are included in the mine plans for the two alternative cases, the 2018 Reserve Case and the 2018 PEA, are shown on Figure 2.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Figure 2 - Cross Section Through the Oyu Tolgoi Trend of Porphyry Deposits

The 2018 Technical Report forms the basis for the scientific and technical information in this MD&A regarding the Entrée/Oyu Tolgoi JV Project. Portions of the information are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the Company’s AIF dated March 31, 2021 and to the full text of the 2018 Technical Report, which are available on the Company’s website (www.EntreeResourcesLtd.com) or on SEDAR (www.sedar.com).

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JV, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the Entrée/Oyu Tolgoi JVA, Entrée has elected to have OTLLC debt finance Entrée’s share of costs for approved programs and budgets, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products. Available cash flow means all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally-accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the Entrée/Oyu Tolgoi JVA and generally accepted accounting principles.

Under the terms of the Entrée/Oyu Tolgoi JVA, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV will eventually share usage once underground development crosses onto the Entrée/Oyu Tolgoi JV Property. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs that will be calculated in accordance with Canadian generally accepted accounting principles determined yearly based on the estimated tonnes of concentrate produced for Entrée’s account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée’s operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée will recognize its proportionate share of costs at the time of actual expenditure.

The 2018 Technical Report is based on data provided by OTLLC, including mining schedules and annual capital and operating cost estimates prepared for OTFS16, as well as Entrée’s interpretation of the commercial terms applicable to the Entrée/Oyu Tolgoi JV, and certain assumptions regarding taxes and royalties. The 2018 Technical Report has not been reviewed or endorsed by OTLLC. There can be no assurance that OTLLC or its shareholders will not interpret certain terms or conditions, or attempt to renegotiate some or all of the material terms governing the joint venture relationship, in a manner which could have an adverse effect on Entrée’s future cash flow and financial condition.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The Company is currently in the process of reviewing the data and assumptions underlying OTFS20, the OTFS20 block cave designs, updated costs and schedules and the updated mineral resources and reserves in order to assess the potential impact, whether positive or negative, on Entrée’s share of capital and operating costs in the two alternative cases, the 2018 Reserve Case and the 2018 PEA. The results of the Company’s assessment may differ materially from the results of the 2018 Technical Report and/or from OTLLC’s planned Pre-Feasibility and Feasibility Study level work on Panel 1. The Company will update the market following completion of its review and assessment.

Mineral Resources and Mineral Reserves - Entrée/Oyu Tolgoi JV Property

The following Entrée/Oyu Tolgoi JV Property mineral resource estimates reported in the 2018 Technical Report for the Hugo North Extension and Heruga deposits have an effective date of January 15, 2018:

| Entrée/Oyu Tolgoi JV Property- Mineral Resources |

| Classification | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | CuEq (%) | Contained Metal |

Cu (Mlb) | Au (Koz) | Ag (Koz) | Mo (Mlb) |

| Hugo North Extension (>0.37% CuEq Cut-Off) |

| Indicated | 122 | 1.68 | 0.57 | 4.21 | ___ | 2.03 | 4,515 | 2,200 | 16,500 | ___ |

| Inferred | 174 | 1.00 | 0.35 | 2.73 | ___ | 1.21 | 3,828 | 2,000 | 15,200 | ___ |

| Heruga (>0.37% CuEq Cut-Off) |

| Inferred | 1,700 | 0.39 | 0.37 | 1.39 | 113.2 | 0.64 | 14,604 | 20,410 | 75,932 | 424 |

Notes:

| 1. | Mineral resources have an effective date of January 15, 2018. |

| 2. | Mineral resources are reported inclusive of the mineral resources converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 3. | Mineral resources are constrained within three-dimensional shapes and above a CuEq grade. The CuEq formula was developed in 2016, and is CuEq16 = Cu + ((Au*AuRev) + (Ag*AgRev) + (Mo*MoRev)) ÷ CuRev; where CuRev = (3.01*22.0462); AuRev = (1250/31.103477*RecAu); AgRev = (20.37/31.103477*RecAg); MoRev = (11.90*0.00220462*RecMo); RecAu = Au recovery/Cu recovery; RecAg = Ag recovery/Cu recovery; RecMo = Mo recovery/Cu recovery. Differential metallurgical recoveries were taken into account when calculating the copper equivalency formula. The metallurgical recovery relationships are complex and relate both to grade and Cu:S ratios. The assumed metal prices are $3.01/lb for copper, $1,250.00/oz for gold, $20.37/oz for silver, and $11.90/lb for molybdenum. Molybdenum grades are only considered high enough to support potential construction of a molybdenum recovery circuit at Heruga, and hence the recoveries of molybdenum are zeroed out for Hugo North Extension. A net smelter return ("NSR") of $15.34/t would be required to cover costs of $8.00/t for mining, $5.53/t for processing, and $1.81/t for general and administrative ("G&A"). This translates to a CuEq break-even underground cut-off grade of approximately 0.37% CuEq for Hugo North Extension mineralization. |

| 4. | Considerations for reasonable prospects for eventual economic extraction for Hugo North included an underground resource-constraining shape that was prepared on vertical sections using economic criteria that would pay for primary and secondary development, block-cave mining, ventilation, tramming, hoisting, processing, and G&A costs. A primary and secondary development cost of $8.00/t and a mining, process, and G&A cost of $12.45/t were used to delineate the constraining shape cut-off. Inferred resources at Heruga have been constrained using a CuEq cut-off of 0.37%. |

| 5. | Mineral resources are stated as in situ with no consideration for planned or unplanned external mining dilution. The contained copper, gold, and silver estimates in the mineral resource table have not been adjusted for metallurgical recoveries. |

| 6. | Mineral resources are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 7. | Figures have been rounded as required by reporting guidelines and may result in apparent summation differences. |

Entrée/Oyu Tolgoi Mineral Reserves

Entrée/Oyu Tolgoi JV Property mineral reserves are contained within the Hugo North Extension Lift 1 block cave mining plan. The mine design work on Hugo North Lift 1, including the Hugo North Extension, was prepared by OTLLC. The mineral reserve estimate is based on what is deemed minable when considering factors such as the footprint cut-off grade, the draw column shut-off grade, maximum height of draw, consideration of planned dilution and internal waste rock.

The mineral reserve estimate only considers mineral resources in the Indicated category and engineering that has been carried out to a Feasibility level or better to state the underground mineral reserve. There is no Measured mineral resource currently estimated within the Hugo North Extension deposit. Copper and gold grades for the Inferred mineral resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a $17.00/t NSR. Future mine planning studies may examine lower shut-offs.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The following Entrée/Oyu Tolgoi JV Property mineral reserve estimate reported in the 2018 Technical Report has an effective date of January 15, 2018:

Entrée/Oyu Tolgoi JV Property - Mineral Reserve Hugo North Extension Lift 1 |

| Classification | Tonnage | NSR | Cu | Au | Ag | Recovered Metal |

| (Mt) | ($/t) | (%) | (g/t) | (g/t) | Cu (Mlb) | Au (Koz) | Ag (Koz) |

| Probable | 35 | 100.57 | 1.59 | 0.55 | 3.72 | 1,121 | 519 | 3,591 |

Notes:

| 1. | Mineral reserves have an effective date of January 15, 2018. |

| 2. | For the underground block cave, all mineral resources within the shell has been converted to mineral reserves. This includes low-grade Indicated mineral resources and Inferred mineral resource assigned zero grade that is treated as dilution. |

| 3. | A footprint cut-off NSR of $46.00/t and column height shut-off NSR of $17.00/t were used to define the footprint and column heights. An average dilution entry point of 60% of the column height was used. |

| 4. | The NSR was calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries, and royalties using base data template 31. Metallurgical assumptions in the NSR include recoveries of 90.6% for Cu, 82.3% for Au, and 87.3% for Ag. |

| 5. | Mineral reserves are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 6. | Figures have been rounded as required by reporting guidelines and may result in apparent summation differences. |

Shivee West Property Summary

The Shivee West Property comprises the northwest portion of the Entrée/Oyu Tolgoi JV Project and adjoins the Entrée/Oyu Tolgoi JV Property and OTLLC’s Oyu Tolgoi mining licence (Figure 1).

To date, no economic zones of precious or base metals mineralization have been outlined on the Shivee West Property. However, zones of gold and copper mineralization have previously been identified at Zone III/Argo Zone and Khoyor Mod. There has been no drilling on the ground since 2011, and no exploration work has been completed since 2012. In 2015, in light of the ongoing requirement to pay approximately $350,000 annually in licence fees for the Shivee West Property and a determination that no further exploration work would likely be undertaken in the near future, Entrée began to examine options to reduce expenditures in Mongolia. These options included reducing the area of the mining licence, looking for a purchaser or partner for the Shivee West Property, and rolling the ground into the Entrée/Oyu Tolgoi JV. Management determined that it was in the best interests of Entrée to roll the Shivee West Property into the Entrée/Oyu Tolgoi JV, and Entrée entered into a License Fees Agreement with OTLLC on October 1, 2015. The License Fees Agreement provides the parties will use their best efforts to amend the terms of the Entrée/Oyu Tolgoi JVA to include the Shivee West Property in the definition of Entrée/Oyu Tolgoi JV Property. Entrée determined that rolling the Shivee West Property into the Entrée/Oyu Tolgoi JV would provide the joint venture partners with continued security of tenure; Entrée shareholders would continue to benefit from any exploration or development that the Entrée/Oyu Tolgoi JV management committee approves on the Shivee West Property; and Entrée would no longer have to pay licence fees, as the parties agreed that the licence fees would be for the account of each joint venture participant in proportion to their respective interests, with OTLLC contributing Entrée’s 20% share charging interest at prime plus 2%. To date, no amended Entrée/Oyu Tolgoi JVA has been entered into and Entrée retains a 100% interest in the Shivee West Property.

Underground Development Progress

Oyu Tolgoi Project

On May 12, 2021, Turquoise Hill provided an update regarding the Oyu Tolgoi project.

In the first quarter 2020, OTLLC submitted a resources and reserves update for registration as required pursuant to local regulatory requirements in Mongolia. On July 2, 2020, Turquoise Hill announced the completion of OTFS20, which incorporates a new block cave mine design for Hugo North Lift 1 Panel 0 previously announced by Turquoise Hill on May 13, 2020. The expert review of the resources and reserves update is in progress and OTFS20 is expected to be considered for endorsement following registration.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

OTFS20 incorporates an update to the first sustainable production schedule and capital cost estimates for the underground mine development based on the new Panel 0 mine design. On December 18, 2020, Turquoise Hill announced the completion and delivery by Rio Tinto of the Definitive Estimate, which refines the analysis contained in OTFS20. The results of the Definitive Estimate include a revised base case development capital cost of $6.75 billion for the new design, confirmation that sustainable first production from the Oyu Tolgoi mining licence is forecast to occur in October 2022, and verification that all surface infrastructure required for sustainable first production from Panel 0 on the Oyu Tolgoi mining licence is now complete. Additional project infrastructure will still be needed to support the production ramp-up profile and the life of mine material handling infrastructure capacity. The Definitive Estimate also finalized pillar locations on the Panel 0 boundaries and optimized the drawpoint layout to minimize exposure to the lower fault. OTLLC board approval of the Definitive Estimate will be considered following registration of the resources and reserves update and endorsement of OTFS20.

The Hugo North (including Hugo North Extension) Lift 1 mine plan incorporates the development of three panels and in order to reach the full sustainable production rate of 95,000 tpd from the underground operations, all three panels need to be in production. The Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property is located at the northern portion of Panel 1.

The new block cave design incorporated in OTFS20 varies from the previous design through:

| • | 120 metre structural pillars included to the north and south of Panel 0, protecting ore handling infrastructure and increasing the optionality of sequencing Panel 1 and Panel 2; |

| • | Ore handling facilities moved into the structural pillars, improving excavation stability; |

| • | Drawpoint spacing updated from 28 metres x 15 metres to 31 metres x 18 metres, improving extraction level stability; and |

| • | Modified panel initiation approach for Panel 0, minimizing stress damage to extraction level. |

Turquoise Hill believes the existing Feasibility Study designs for Panel 1 and Panel 2 remain executable based on the current orebody understanding. However, with the introduction of structural pillars, Panels 1 and 2 become independent, allowing for much greater operational flexibility. According to Turquoise Hill this provides opportunities to:

| • | Optimize the extraction level elevation for each panel independently; |

| • | Evaluate the potential to convert Measured and Indicated mineral resources below the current Lift 1 extraction level to Probable mineral reserves; |

| • | Complete additional confirmatory drilling and data collection in support of potential Panel 1 and Panel 2 design refinements; and |

| • | Include structural pillar recovery level(s) in the integrated Hugo North Lift 1 mine design. |

Turquoise Hill has advised that several mining studies are in progress, which are focused on the evaluation of different design and sequencing options for Panels 1 and 2 as part of OTLLC’s planned Pre-Feasibility and Feasibility Study level work. These studies are underpinned by additional geology and geotechnical data that is being collected from underground and surface drilling, which was ongoing during the first quarter 2021. As more drilling is completed, mine design refinements and updates will be communicated by Turquoise Hill. Turquoise Hill expects the first of these design updates in the second half of 2021.

Turquoise Hill also announced on July 2, 2020 its updated mineral resources and mineral reserves prepared in accordance with the requirements of NI 43-101 and CIM Definition Standards for mineral resources and mineral reserves (2014). The new mine design for Panel 0 reduces the mineral reserve estimate for the overall Hugo North Lift 1 underground mine due to the inclusion of the two structural pillars planned to be located on the Oyu Tolgoi mining licence. However, the ore tonnes and contained copper, gold and silver for the Probable mineral reserve that Turquoise Hill reported for Hugo North Extension Lift 1 on the Entrée/Oyu Tolgoi JV Property have all increased.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The COVID-19 situation in Mongolia remains fragile and subject to rapid change despite a widespread vaccination program. OTLLC is constantly adapting to the changing circumstances to prioritize the health and safety of its employees.

During the first quarter 2021, the Oyu Tolgoi underground project was impacted by COVID-19 cases at site, requiring OTLLC to periodically suspend work as a health and safety precaution. COVID-19 measures implemented by OTLLC, including restrictions on travel from Ulaanbaatar to site, have significantly impacted the number of workers that remain at site to continue underground development. Turquoise Hill expects that COVID-19 restrictions will continue to impact underground construction and development in the second quarter 2021 and is working with OTLLC and Rio Tinto to monitor and assess the situation.

Despite COVID-19 impacts, overall project construction progress on the Material Handling System 1 ("MSH1"), which is required for sustainable first production, remains broadly in line with the Definitive Estimate. During the first quarter 2021 the Primary Crusher 1 ("PC1") bottom shells were installed and the top shells were moved to the crusher chamber for installation. In addition, conveyor belt pulling commenced on the main conveyor between PC1 and Shaft 2. Although progress on MHS1 is expected to slow in the second quarter 2021 due to site COVID-19 restrictions, it is not expected to materially impact the timing of undercut commencement and sustainable first production from the Oyu Tolgoi mining licence. Truck Chutes are being constructed and despite some schedule delay remain on track for completion, as necessary to support sustainable first production.

At the end of the first quarter 2021, cumulative underground development progress is 56,264 equivalent metres with cumulative conveyor to surface advancement of 13,832 equivalent metres. Progress in March was impacted by COVID-19 restrictions and controls and Turquoise Hill anticipates that development rates will continue to be impacted into the second quarter 2021. Although development work has slowed, almost all of the development required for the commencement of the undercut is complete.

Ongoing work suspensions continue to affect progress on Shafts 3 and 4 and the overall impact of these delays is under review. Progress remains dependent on mobilizing key vendors and additional sinking resources into country and cleared from quarantine. Additional shaft sinking specialists are in Mongolia and are expected to arrive on site in May 2021. Shafts 3 and 4 are not required to support Panel 0 commencement, however they are required to support production from Panels 1 and 2 during ramp up to 95,000 tonnes per day.

On April 9, 2021, Turquoise Hill announced that it has reached a binding Heads of Agreement with Rio Tinto on a funding plan to complete the construction of Lift 1 of the Oyu Tolgoi underground project, including Lift 1 of the Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property. Successful implementation of the Heads of Agreement is subject to achieving alignment with the relevant stakeholders in addition to Rio Tinto (including existing lenders, any potential new lenders and the Government of Mongolia), market conditions and other factors. The Heads of Agreement addresses the estimated remaining funding required of approximately $2.3 billion. Under the Heads of Agreement, the parties will pursue re-profiling of existing project debt to better align with the revised mine plan, project timing and cash flows to reduce the currently projected funding requirements of OTLLC by up to $1.4 billion. In addition, they will seek to raise up to $500 million in senior supplemental debt under the existing project financing arrangements from selected international financial institutions. Rio Tinto has agreed to address any potential shortfalls from the re-profiling and additional senior supplemental debt of up to $750 million by providing a senior co-lending facility on the same terms as OTLLC’s project financing. Turquoise Hill has also agreed to compete an equity offering of common shares for up to $500 million in the form of, and at Turquoise Hill’s discretion, either (i) a rights offering of common shares or (ii) a public offering or private placement of common shares, in either case sufficient to satisfy any remaining funding shortfall of up to $500 million within six months of the senior co-lending facility becoming available.

The Definitive Estimate assumes COVID-19 related restrictions in 2021 that are no more stringent than those experienced in September 2020. The recent COVID-19 restrictions are being assessed for potential impacts to the underground development capital estimate and to the overall project schedule, which Turquoise Hill reports are at a -10% to +15% level of accuracy. The results of the Definitive Estimate are also subject to certain business case risks identified by Rio Tinto including Government of Mongolia approvals of OTFS20 and supporting documents and achievement of certain milestones identified in the amended Power Source Framework Agreement ("PSFA").

Turquoise Hill has reported that the commencement of the undercut in mid-2021 is a key project milestone and it is critical to ensure that, once commenced, the undercut and drawpoint construction continues unimpeded. Achievement of the technical criteria required for a mid-2021 commencement of the undercut on the Oyu Tolgoi mining licence remains on track. However, the exact timing of the undercut is under increasing pressure due to the rapidly evolving recent COVID-19 impacts. Non-technical criteria, including confirmation of necessary regulatory and legislative approvals required by the Government of Mongolia, are still pending and are critical elements for consideration to proceed with the decision to commence the undercut. Turquoise Hill is working with OTLLC and other stakeholders to ensure that important aspects for a successful project are met prior to commencing the undercut.

Turquoise Hill has advised that any significant delay to the undercut would have a materially adverse impact on the schedule for Panel 0 as well as the timing and quantum of underground capital expenditure and would materially adversely impact the timing of expected cash flows from Panel 0, thereby increasing the amount of Turquoise Hill’s incremental funding requirement.

On January 11, 2021, Turquoise Hill announced the Government of Mongolia has advised Rio Tinto that it is dissatisfied with the results of the Definitive Estimate, and the Government of Mongolia is concerned that the significant increase in the development costs of the Oyu Tolgoi project has eroded the economic benefits it anticipated to receive. The Government of Mongolia has stressed the importance of achieving a comprehensive solution that addresses both financial issues between OTLLC shareholders as well as economic and social issues of importance to Mongolia, such as water usage, tax payments, and social issues related to employees, in order to implement the Oyu Tolgoi project successfully. In particular, the Government of Mongolia has expressed its intention to initiate discussions with respect to the termination and replacement of the 2015 Oyu Tolgoi Underground Mine Development and Financing Plan (the "Mine Plan"). While acknowledging Oyu Tolgoi’s significant contributions to Mongolia, Turquoise Hill reported it continues to engage with the Government of Mongolia and remains open to improving the Mine Plan to deliver even greater benefits from Oyu Tolgoi to all stakeholders.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

As reported by Turquoise Hill, OTLLC’s board of directors has approved a resolution establishing a special board committee mandated to conduct an independent review of the causes of the cost overruns and delays to the Oyu Tolgoi underground development announced in 2019. The special committee will also consider the cost and schedule update reported in the Definitive Estimate to enable its further consideration by the OTLLC board of directors. The special committee is comprised of four members: two members nominated by Turquoise Hill and two members nominated by Erdenes Oyu Tolgoi LLC. The special committee is required to select and engage an independent and reputable firm of experts in the field of project management and mine planning to provide a report to the special committee within six months of commencing the investigation.

Oyu Tolgoi Power Supply

OTLLC currently sources power for the Oyu Tolgoi mine from China’s Inner Mongolian Western grid, via overhead power line, pursuant to back-to-back power purchase agreements with Mongolia’s National Power Transmission Grid JSC, the relevant Mongolian power authority, and Inner Mongolia Power International Cooperation Co., Ltd (“IMPIC”), the Chinese power generation company.

OTLLC is obliged under the Oyu Tolgoi Investment Agreement to secure a long-term domestic power source for the Oyu Tolgoi mine. The PSFA entered into between OTLLC and the Government of Mongolia on December 31, 2018 provides a binding framework and pathway for long-term power supply to the Oyu Tolgoi mine. The PSFA originally contemplated the construction of a coal-fired power plant at Tavan Tolgoi, which would be majority-owned by OTLLC and situated close to the Tavan Tolgoi coal mining district located approximately 150 km from the Oyu Tolgoi mine.

According to Turquoise Hill, on April 14, 2020, the Minister of Energy notified OTLLC of the Government’s decision to develop and fund a State-Owned Power Plant ("SOPP") to be located at the Tavan Tolgoi coal fields instead of an OTLLC led plant, which would supply power to the Oyu Tolgoi mine and potentially other regional mines.

On June 28, 2020, Turquoise Hill announced that the Government of Mongolia and OTLLC reached an agreement to prioritize SOPP in order to support the Government’s decision. The PSFA has been amended to reflect joint prioritization and progression of SOPP in accordance with and subject to agreed milestones. The agreed milestones in the amended PFSA include signing a power purchase agreement by March 31, 2021, commencement of construction by no later than July 1, 2021 and commissioning of SOPP within four years thereafter, and, negotiating an extension to the existing power import agreement by March 1, 2021, to ensure that there is no disruption to the power supply required to safeguard Oyu Tolgoi’s ongoing operations and development.

If the milestones are not met as provided for in the amendment, then OTLLC will be entitled to select from and implement the alternative power solutions specified in the PSFA (as amended), including an OTLLC-led coal-fired power plant and a primary renewables solution, and the Government of Mongolia would be obliged to support such decision.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The first two PSFA amendment milestones (execution of the extension of the existing power import agreement and execution of the SOPP power purchase agreement) were not met by the original dates of March 1, 2021 and March 31, 2021, respectively.

The Ministry of Energy has formally notified Rio Tinto on February 25, 2021 that the Tavan Tolgoi thermal power station project will be implemented and will be connected to the Central Energy System and operated with integrated dispatch control in accordance with relevant laws and regulations. A separate letter was sent from the Ministry of Energy to OTLLC on the same date, and it stated that an agreement on the long-term power supply to OTLLC is related to the extension of the power import arrangements with IMPIC and extending the power import agreement with IMPIC in a way that satisfies both the Government of Mongolia’s and OTLLC’s requirements is ongoing. In recognizing the linkage of the extension of IMPIC supply arrangements with the progress on resolving the issue of domestic power supply, the Ministry of Energy proposed that milestones under the PSFA amendment be extended pending further discussions at the sub-working group.

As per the request from the Ministry of Energy, OTLLC is engaging with the sub-working group to agree to a standstill period following the lapsing of the milestones and to discuss the long-term power solution that would enable reliable supply from the Mongolian grid (Central Energy System). During the standstill period, OTLLC would not exercise its rights to select and proceed with an alternative power solution but would not waive its right to do so in the future.

OTLLC continues to collaborate with the Government of Mongolia to ensure a secure, stable and reliable long-term power solution is implemented with an immediate focus on extending the IMPIC supply arrangements prior to the commencement of the undercut.

Oyu Tolgoi Tax Assessment

On February 20, 2020, Turquoise Hill announced that OTLLC has been unable to reach a resolution of its previously announced dispute with the Mongolian Tax Authority with respect to a tax assessment for approximately $155 million relating to an audit on taxes imposed and paid by OTLLC between 2013 and 2015. OTLLC will be proceeding with the initiation of a formal international arbitration proceeding in accordance with the dispute resolution provisions in the Oyu Tolgoi Investment Agreement. Turquoise Hill remains of the opinion that OTLLC has paid all taxes and charges required to be paid under the Oyu Tolgoi Investment Agreement, the 2011 Amended and Restated Shareholders’ Agreement (the "Shareholders’ Agreement"), the Mine Plan and Mongolian law.

On December 23, 2020, Turquoise Hill announced that OTLLC has received, and is evaluating, a tax assessment for approximately $228 million cash tax from the Mongolian Tax Authority relating to an audit on taxes imposed and paid by OTLLC between 2016 and 2018. On January 11, 2021, Turquoise Hill announced that OTLLC has given notice of its intention to apply to the Tribunal in the arbitration for leave to amend its statement of claim to include the issues raised in the 2016-2018 tax assessment, as many of the matters raised are of a similar nature to the matters raised in the 2013-2015 tax assessment.

In February 2021, OTLLC received notices of payment from the Capital City tax department for the amounts disputed under the 2016-2018 tax assessment. In March 2021, OTLLC received notices of payment totalling $126 million relating to amounts disputed under the 2013-2015 tax assessment. Under Article 43.3 of the Mongolian General Tax Law, the amounts were due and paid by OTLLC within 10 business days from the date of the notices of payment. Under the same legislation, OTLLC is entitled to a refund in the event of a favourable decision from the relevant dispute resolution authorities.

On May 3, 2021, Turquoise Hill announced that the Government of Mongolia filed its statement of defence together with a counterclaim seeking the rejection of OTLLC’s tax claims in their entirety. In the event OTLLC’s tax claims are not dismissed in their entirety, the Government of Mongolia is seeking in the counterclaim an alternative declaration that the Oyu Tolgoi Investment Agreement is void.

Mongolian Parliamentary Working Group

As reported by Turquoise Hill, in March 2018, the Speaker of the Mongolian Parliament appointed a Parliamentary Working Group ("Working Group") that consisted of 13 Members of Parliament to review certain contractual agreements with the Government of Mongolia that underpin the Oyu Tolgoi project, including the Oyu Tolgoi Investment Agreement and the Mine Plan. Upon completion of the Working Group’s review, a resolution was submitted to the Economic Standing Committee of the Parliament and subsequently passed in a plenary session of the Parliament of Mongolia on November 21, 2019. Resolution 92 was published on December 6, 2019 and includes measures to improve the implementation of the Oyu Tolgoi Investment Agreement and the Shareholders’ Agreement, improve the Mine Plan and explore and resolve options to have a product sharing arrangement or swap Mongolia’s equity holding of 34% for a special royalty. Representatives from Turquoise Hill and Rio Tinto have engaged in discussions with representatives of the relevant newly appointed Cabinet members of the Government of Mongolia to work together and resolve the issues raised in Resolution 92.

A new Working Group led by the Deputy Speaker was established in February 2021 to monitor the implementation of Resolution 92. The Working Group is comprised of 20 members across seven sub-committees that will monitor and provide support to the government working group in discussions with Turquoise Hill and Rio Tinto.

On May 12, 2021, Turquoise Hill reported that it was in Ulaanbaatar with Rio Tinto in March and April 2021 to discuss a path forward to address outstanding concerns that the Government of Mongolia has with respect to the Oyu Tolgoi underground development project including in relation to Parliamentary Resolution 92. Turquoise Hill remains committed to its presence in Mongolia and, in all discussions with Rio Tinto and the Government of Mongolia, is focused on maximizing value for all stakeholders. Turquoise Hill reported that constructive engagement was achieved with the Working Group and Turquoise Hill anticipates resumption of discussions in June 2021 following the Mongolian Presidential election.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Entree/Oyu Tolgoi JV Property

The Company is currently in the process of reviewing the data and assumptions underlying OTFS20, the block cave designs, the updated costs and schedules and the updated mineral resources and reserves in order to assess the potential impact on Entrée/Oyu Tolgoi JV Property resources and reserves as well as production and financial assumptions and outputs from the two alternative cases, the 2018 Reserve Case and the 2018 PEA. The Company will update the market following completion of its review. Until the Company’s review is completed, it is unable to verify the scientific and technical disclosures made by Turquoise Hill. For information on the Company’s interest in Entrée/Oyu Tolgoi JV Property, see the 2018 Technical Report available on SEDAR at www.sedar.com.

Q1 2021 Review

For the three months ended March 31, 2021 and March 31, 2020, Entrée expenses related to Mongolian operations consisted of costs in relation to reviewing the data and assumptions underlying OTFS20 in relation to the Entrée/Oyu Tolgoi JV and in-country administration expenses which were not significant.

BLUE ROSE JV - AUSTRALIA

Summary

Entrée has a 56.53% interest in the Blue Rose JV to explore for minerals other than iron ore on EL 6006, with Giralia Resources Pty Ltd, a subsidiary of Atlas Iron Pty Ltd (part of the Hancock Group of Companies), retaining a 43.47% interest. EL 6006, totalling 257 square kilometres, is located in the Olary Region of South Australia, 300 kilometres northeast of Adelaide and 130 kilometres west-southwest of Broken Hill.

The rights to explore for and develop iron ore on EL 6006 are held by Lodestone Mines Pty Ltd ("Lodestone"), which is also the licence holder. The Blue Rose JV partners were granted (a) the right to receive an additional payment(s) upon completion of an initial or subsequent iron ore resource estimate on EL 6006, to a maximum of A$2 million in aggregate; and (b) a royalty equal to 0.65% of the free on board value of iron ore product extracted and recovered from EL 6006. An additional A$285,000 must also be paid to the Blue Rose JV partners upon the commencement of commercial production.

The Braemar Iron Formation is the host rock to magnetite mineralisation on EL 6006. The Braemar Iron Formation is a meta-sedimentary iron siltstone, which is inherently soft. The mineralization within the Braemar Iron Formation forms a simple dipping tabular body with only minor faulting, folding and intrusives. Grades, thickness, dip, and outcropping geometry remain very consistent over kilometres of strike.

Q1 2021 Review

Expenditures in Q1 2021 were minimal and related to administrative costs in Australia.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

SUMMARY OF CONSOLIDATED FINANCIAL OPERATING RESULTS

Operating Results

The Company’s operating results for the three months ended March 31 were:

| | | Three months ended March 31 | |

| | | 2021 | | 2020 | |

| Expenses | | | | |

| Project expenditures | | $ | 87 | | $ | 34 | |

| General and administrative | | | 339 | | | 320 | |

| Depreciation | | | 30 | | | 26 | |

| Operating loss | | | 456 | | | 380 | |

| Foreign exchange (gain) loss | | | (93 | ) | | 632 | |

| Interest income | | | (8 | ) | | (24 | ) |

| Interest expense | | | 85 | | | 87 | |

| Loss from equity investee | | | 35 | | | 54 | |

| Finance costs | | | 4 | | | 5 | |

| Deferred revenue finance costs | | | 968 | | | 833 | |

| Net loss | | | 1,447 | | | 1,967 | |

| Other comprehensive loss (income) | | | | | | | |

| Foreign currency translation | | | 638 | | | (4,050 | ) |

| Total comprehensive loss (income) | | $ | 2,085 | | $ | (2,083 | ) |

| Net loss per common share | | | | | | | |

| Basic and fully diluted | | $ | (0.01 | ) | $ | (0.01 | ) |

| Total assets | | $ | 7,539 | | $ | 5,344 | |

| Total non-current liabilities | | $ | 59,575 | | $ | 50,089 | |

Operating Loss:

During the three months ended March 31, 2021, the Company’s operating loss was $0.5 million compared to an operating loss of $0.4 million for the three months ended March 31, 2020.

Project expenditures in Q1 2021 were higher than Q1 2020 due to professional and advisory fees related to advancing potential amendments to the Entrée/Oyu Tolgoi JVA.

General and administration and depreciation costs have been consistent in Q1 2021 compared to Q1 2020.

Holding costs on all other properties were insignificant.

Non-operating Items:

The foreign exchange gain in Q1 2021 was primarily the result of movements between the C$ and US dollar as the Company holds its cash in both currencies and the loan payable is denominated in US dollars.

Interest expense was primarily related to the loan payable to OTLLC pursuant to the Entrée/Oyu Tolgoi JVA and is subject to a variable interest rate.

The amount recognized as a loss from equity investee is related to exploration costs on the Entrée/Oyu Tolgoi JV Property.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Deferred revenue finance costs are related to recording the non-cash finance costs associated with the deferred revenue balance, specifically the Sandstorm stream.

The total assets as at March 31, 2021 were higher than at March 31, 2020 due to funds received from the private placement completed during Q3 2020. See "Shareholder’s Deficiency" section below. Total non-current liabilities have increased since March 31, 2020 due to recording the non-cash deferred revenue finance costs each quarter.

Quarterly Financial Data - 2 year historic trend

| | | Q1 21 | Q4 20 | Q3 20 | Q2 20 | Q1 20 | Q4 19 | Q3 19 | Q2 19 |

| Project expenditures | | $ | 87 | | $ | 41 | | $ | 59 | | $ | 80 | | $ | 34 | | $ | 39 | | $ | 63 | | $ | 31 | |

| General and administrative | | | 339 | | | 437 | | | 286 | | | 387 | | | 320 | | | 402 | | | 326 | | | 386 | |

| Share-based compensation | | | — | | | 538 | | | — | | | — | | | — | | | 339 | | | — | | | — | |

| Depreciation | | | 30 | | | 22 | | | 25 | | | 25 | | | 26 | | | 25 | | | 27 | | | 26 | |

| Operating loss | | | 456 | | | 1,038 | | | 370 | | | 492 | | | 380 | | | 805 | | | 416 | | | 443 | |

| Foreign exchange (gain) loss | | | (93 | ) | | (358 | ) | | (155 | ) | | (315 | ) | | 632 | | | (137 | ) | | 84 | | | (122 | ) |

| Interest expense, net | | | 77 | | | 65 | | | 69 | | | 61 | | | 63 | | | 50 | | | 44 | | | 42 | |

| Loss from equity investee | | | 35 | | | 60 | | | 37 | | | 35 | | | 54 | | | 96 | | | 77 | | | 40 | |

| Deferred revenue finance costs | | | 968 | | | 890 | | | 869 | | | 861 | | | 833 | | | 837 | | | 820 | | | 804 | |

| Finance costs | | | 4 | | | 4 | | | 5 | | | 5 | | | 5 | | | 6 | | | 6 | | | 7 | |

| Net loss | | $ | 1,447 | | $ | 1,699 | | $ | 1,195 | | $ | 1,139 | | $ | 1,967 | | $ | 1,657 | | $ | 1,447 | | $ | 1,214 | |

| Basic/diluted loss per share | | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) |

| USD:CAD FX Rate(1) | | | 1.2575 | | | 1.2732 | | | 1.3339 | | | 1.3628 | | | 1.4187 | | | 1.2988 | | | 1.3243 | | | 1.3087 | |

| 1. | USD:CAD foreign exchange rate was the quarter ended rate per the Bank of Canada. |

Project expenditures have been consistent since Q2 2019 with minimal variability quarter to quarter, with the exception of Q1 2021 and Q2 2020, whereby the Company’s professional and advisory fees increased related to advancing potential amendments to the Entrée/Oyu Tolgoi JVA and reviewing the data and assumptions related to OTFS20.

General and administrative expenses have been consistent since Q2 2019 with the exception of Q4 2020 which was higher due mainly to compensation costs. There have been negative cost variances in relation to foreign exchange as the CAD has strengthened against the USD during the past 2 quarters.

Share-based compensation expenditures in Q4 2020 included option and deferred share unit ("DSU") grants and Q4 2019 included option grants.

Interest expense, net, consists of accrued interest on the OTLLC loan payable, partially offset by interest income earned on invested cash. Interest expense was consistent quarter on quarter.

The loss from equity investee was related to the Entrée/Oyu Tolgoi JV Property and fluctuations are due to exploration activity and foreign exchange changes.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LIQUIDITY AND CAPITAL RESOURCES

| | | | Three months ended March 31 |

| | | 2021 | 2020 |

| Cash flows used in operating activities | | | | | | | |

| - Before changes in non-cash working capital items | | $ | (420 | ) | $ | (422 | ) |

| - After changes in non-cash working capital items | | | (432 | ) | | (385 | ) |

| Cash flows from (used in) financing activities | | | 10 | | | (22 | ) |

| Cash flows used in investing activities | | | (24 | ) | | — | |

| Net cash outflows | | | (446 | ) | | (407 | ) |

| Effect of exchange rate changes on cash | | | 67 | | | (203 | ) |

| Cash balance | | $ | 6,881 | | $ | 4,770 | |

| Cash flows used in operating activities per share | | | | | | | |

| - Before changes in non-cash working capital items | | $ | (0.00 | ) | $ | (0.00 | ) |

| - After changes in non-cash working capital items | | $ | (0.00 | ) | $ | (0.00 | ) |

Cash flows before changes in non-cash working capital items in Q1 2021 were comparable to the same period in 2020.

Cash flows from (used in) financing activities were immaterial in both Q1 2021 and Q1 2020.

Cash flows used in investing activities were immaterial in both Q1 2021 and Q1 2020.

The Company is an exploration stage company and has not generated positive cash flows from its operations. As a result, the Company has been dependent on equity and production-based financings for additional funding. Working capital on hand at March 31, 2021 was approximately $6.9 million. Management believes it has adequate financial resources to satisfy its obligations over the next 12-month period. The Company does not currently anticipate the need for additional funding during this time.

Loan Payable to Oyu Tolgoi LLC

Under the terms of the Entrée/Oyu Tolgoi JVA, the Company has elected to have OTLLC contribute funds to approved joint venture programs and budgets on the Company’s behalf, each such contribution to be treated as a non-recourse loan. Interest on each loan advance shall accrue at an annual rate equal to OTLLC’s actual cost of capital or the prime rate of the Royal Bank of Canada, plus two percent (2%) per annum, whichever is less, as at the date of the advance. The loan will be repayable by the Company monthly from ninety percent (90%) of the Company’s share of available cash flow from the Entrée/Oyu Tolgoi JV. In the absence of available cash flow, the loan will not be repayable. The loan is not expected to be repaid within one year.

| Q1 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Contractual Obligations

As at March 31, 2021, the Company had the following contractual obligations outstanding:

| | | Total | | Less than 1 year | | 1 - 3 years | | 3-5 years | | More than 5 years |

| Lease commitments | | $ | 241 | | | $ | 155 | | | $ | 86 | | | $ | — | | | $ | — | |

SHAREHOLDERS’ DEFICIENCY

The Company’s authorized share capital consists of unlimited common shares without par value.

At March 31, 2021, the Company had 186,660,002 shares issued and outstanding and at the date of this MD&A, the Company had 187,811,770 shares issued and outstanding.

Share Purchase Warrants

As at March 31, 2021, the Company had 14,403,735 share purchase warrants outstanding.

Subsequent to March 31, 2021, share purchase warrants to purchase 1,151,768 common shares with an exercise price of C$0.55 were exercised and the Company received gross proceeds of C$633,472.

The following share purchase warrants were outstanding as at the date of this report:

| Number of share purchase warrants (000’s) | Exercise price per share purchase warrant C$ | Expiry date |

| 7,503 | 0.55 | January 10, 2022 |

| 610 | 0.55 | January 12, 2022 |

| 5,139 | 0.60 | September 14, 2023 |