Exhibit 99.2

ENTRÉE RESOURCES LTD.

NOTICE OF ANNUAL GENERAL MEETING

June 10, 2021

Notice is hereby given that the Annual General Meeting (the “Meeting”) of the shareholders of Entrée Resources Ltd. (the “Company”) will be held as a virtual format meeting via audio conference on Thursday, June 10, 2021, at the hour of 10:30 am (local time in Vancouver, BC) for the following purposes:

| 1. | To receive the annual financial statements of the Company for its financial year ended December 31, 2020 and the auditor’s report thereon; |

| 2. | To determine the number of directors at six; |

| 3. | To elect directors for the ensuing year; |

| 4. | To re-appoint Davidson & Company LLP, Chartered Professional Accountants, as the Company’s auditor for the ensuing financial year and to authorize the directors to set the auditor’s remuneration; and |

| 5. | To consider and, if thought appropriate, pass an ordinary resolution approving the Company’s Deferred Share Unit Plan and ratifying deferred share unit grants made during the financial year ended December 31, 2020. |

Due to the continually evolving global COVID-19 public health emergency and in consideration of the health and safety of our shareholders, employees, directors, stakeholders and broader community, the Meeting will be held in a virtual format via audio conference. Shareholders and proxyholders will not be able to physically attend the Meeting. All shareholders will have an opportunity to listen to the Meeting, and registered shareholders and duly appointed proxy holders will be permitted to ask questions and vote in person at the Meeting by dialing 1-877-407-2991 (Event 14) (toll free North America) or 201-389-0925 (Event 14) (International) on Thursday, June 10, 2021, at 10:30 am Vancouver time (PDT).

| All shareholders are encouraged to vote before the Meeting by completing the accompanying form of proxy (“Proxy”) or voting instruction form and returning it in the manner and by the date and time specified in the instructions provided therein. Registered shareholders who have previously submitted a Proxy for the Meeting may still attend and listen to the Meeting, but not vote in person at the Meeting. |

The accompanying Proxy is solicited by management of the Company.

If your shares are registered in the name of a “nominee” (usually a bank, trust company, securities dealer or other financial institution), you should carefully follow the instructions provided by your nominee to ensure your vote is counted.

DATED at Vancouver, British Columbia, this 6th day of May, 2021.

BY ORDER OF THE BOARD

| “Stephen Scott” |

| Stephen Scott |

| President and Chief Executive Officer |

The securityholder materials are being sent to both registered and non-registered shareholders. If you are a non-registered shareholder and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary on your behalf.

By choosing to send these materials to you directly, the Company (and not the intermediary holding on your behalf) has assumed responsibility for (a) delivering these materials to you; and (b) executing your proper voting instructions. Please return your voting instructions as specified in the voting instruction form.

Information Circular

for the

Annual General Meeting

of

ENTRÉE RESOURCES LTD.

to be held on

THURSDAY, JUNE 10, 2021

INFORMATION CIRCULAR

ENTRÉE RESOURCES LTD.

Suite 1650 - 1066 West Hastings Street

Vancouver, British Columbia, Canada V6E 3X1

Website: http://www.EntreeResourcesLtd.com

(all information as at May 6, 2021 unless otherwise noted)

PERSONS MAKING THE SOLICITATION

This information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies being made by the management of Entrée Resources Ltd. (“Entrée” or the “Company”) for use at the Annual General Meeting of the Company’s shareholders (the “Meeting”) to be held on Thursday, June 10, 2021 at the time and place and for the purposes set forth in the accompanying notice of meeting. While it is expected that the solicitation will be made primarily by mail, proxies may be solicited personally or by telephone by directors, officers and employees of the Company. All costs of this solicitation will be borne by the Company.

Due to the continually evolving global COVID-19 public health emergency and in consideration of the health and safety of our shareholders, employees, directors, stakeholders and broader community, the Meeting will be held in a virtual format via audio conference. Shareholders and proxyholders will not be able to physically attend the Meeting. All shareholders will have an opportunity to listen to the Meeting, and registered shareholders and duly appointed proxy holders will be permitted to ask questions and vote at the Meeting by dialing 1-877-407-2991 (Event 14) (toll free North America) or 201-389-0925 (Event 14) (International) on Thursday, June 10, 2021, at 10:30 am Vancouver time (PDT).

| All shareholders are encouraged to vote before the Meeting by completing the accompanying form of proxy (“Proxy”) or voting instruction form (“VIF”) and returning it in the manner and by the date and time specified in the instructions provided therein. Registered shareholders who have previously submitted a Proxy for the Meeting may still attend and listen to the Meeting, but not vote in person at the Meeting. |

MAILING OF INFORMATION CIRCULAR

This Information Circular is being mailed together with a notice of meeting, request card and Proxy or VIF (collectively, the “Meeting Materials”), in accordance with applicable laws, except to those shareholders who requested the information to be delivered by electronic mail. We are not sending Meeting Materials using notice and access this year. If you are a shareholder and you wish to receive the Company’s annual financial statements and/or interim financial statements and the accompanying management’s discussion and analysis (“MD&A”) thereon, please complete and return the request card included in the Meeting Materials.

VOTING OPTIONS

We are holding the Meeting in a virtual format via audio conference this year to proactively deal with the potential issues arising from the unprecedented public health impact of COVID-19 and to limit and mitigate risks to the health and safety of our shareholders, employees, directors, stakeholders and our broader community.

There are different ways to submit your voting instructions, depending on whether you are a registered or beneficial shareholder. All shareholders are encouraged to vote before the Meeting by completing a Proxy or VIF in accordance with the instructions provided therein. Beneficial shareholders should also carefully follow all instructions provided by their intermediaries to ensure that their shares are voted at the Meeting.

Registered shareholders and duly appointed proxyholders who which to attend and vote in person at the virtual Meeting must be connected to the audio conference at all times during the Meeting in order to vote when required. It is your responsibility to ensure connectivity to the audio conference for the duration of the Meeting. You should allow ample time to check into the Meeting and complete any related procedures as directed.

Registered Shareholders

You are a registered shareholder if you have your shares registered in your name.

Registered shareholders and duly appointed proxy holders will be able to attend, participate and vote at the Meeting by calling 1-877-407-2991 (Event 14) (toll-free in Canada and USA) or 201-389-0925 (Event 14) (International) on Thursday, June 10, 2021, at 10:30 am Vancouver time (PDT).

Registered shareholders are encouraged to vote on the matters before the Meeting in advance of the Meeting by reading the notes to the Proxy and completing and returning the Proxy to Computershare Investor Services Inc. in the manner specified in the notes to the Proxy, no later than 10:30 am Vancouver time (PDT) on June 8, 2021. Registered shareholders who have previously submitted a Proxy for the Meeting may still attend and listen to the Meeting, but not vote in person at the Meeting.

Registered shareholders who wish to appoint a third-party proxy holder to represent them at the Meeting must submit their duly completed proxy form and register the proxy holder. See “Voting by Proxy” below.

If you are a registered shareholder and you plan to attend the virtual Meeting via audio conference and vote in person, you DO NOT need to complete and return the Proxy. Your vote will be taken and counted at the Meeting.

Non-Registered Holders

Only shareholders whose names appear on the records of the Company as the registered holders of shares or duly appointed proxyholders are permitted to vote at the Meeting.

Most shareholders of the Company are beneficial shareholders (“Non-Registered Holders”) because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased their shares. More particularly, a person is a Non-Registered Holder in respect of shares which are held on behalf of the person: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered registered retirement savings plans, registered retirement income funds, registered education savings plans, registered disability savings plans and similar plans); or (b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited) of which the Intermediary is a participant.

There are two kinds of Non-Registered Holders - those who object to their name being made known to the Company (objecting beneficial owners or “OBOs”) and those who do not object to the Company knowing who they are (non-objecting beneficial owners, or “NOBOs”).

The Company takes advantage of certain provisions of National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), which permit the Company to directly deliver the Meeting Materials to NOBOs who have not waived the right to receive them. As a result, NOBOs can expect to receive the Meeting Materials, including a scannable VIF, from the Company’s agent, Broadridge Financial Solutions, Inc. (“Broadridge”). These VIFs are to be completed and returned to Broadridge in accordance with the instructions on the VIF. Broadridge is required to follow the voting instructions properly received from NOBOs. Broadridge will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions to the Company’s transfer agent, Computershare Investor Services Inc. (“Computershare”), with respect to the common shares represented by the VIFs that they receive.

NOBOs should carefully follow the instructions on the enclosed VIF, including those regarding when and where to complete the VIF that is to be returned to the Company’s agent, Broadridge. NOBOs can send their voting instructions by phone or by mail or through the internet.

If you are a NOBO and you plan to attend the Meeting and vote in person, insert your name (or the name of the person that you wish to attend and vote on your behalf) in the blank space provided for that purpose on the VIF provided by Broadridge, and return the completed VIF to Computershare or send to the Company or Computershare a written request that you or your nominee be appointed as proxy holder. If management is holding a proxy with respect to the shares you beneficially own, the Company must arrange, without expense to you, to appoint you or your nominee as proxy holder in respect of those shares. Under NI 54-101, unless corporate law does not allow it, if you or your nominee is appointed as a proxy holder by the Company in this manner, you or your nominee, as applicable, must be given the authority to attend, vote and otherwise act for and on behalf of management in respect of all matters that come before the Meeting and any adjournment or postponement of the Meeting. If the Company receives your instructions at least one business day before the deadline for the submission of proxies, the Company is required to deposit the proxy within that deadline, in order to appoint you or your nominee as proxy holder. If you request that you or your nominee be appointed as proxy holder, you or your appointed nominee, as applicable, will need to attend the virtual Meeting in person via audio conference in order for your vote to be counted.

In accordance with the requirements of NI 54-101, the Company has distributed copies of the Meeting Materials to the Intermediaries for onward distribution to OBOs. Intermediaries are required to forward the Meeting Materials to OBOs unless in the case of certain proxy-related materials, the OBO has waived the right to receive them. Very often, Intermediaries use service companies to forward the Meeting Materials to OBOs. With those Meeting Materials, Intermediaries or their service companies should provide OBOs with a “request for voting instruction form” which, when properly completed and signed by the OBO and returned to the Intermediary or service company, will constitute voting instructions which the Intermediary must follow. The purpose of this procedure is to permit OBOs to direct the voting of the common shares of the Company that they beneficially own.

OBOs should sign and date the request for voting instruction form that your Intermediary sends to you, and follow the instructions for returning the form. Your Intermediary is responsible for properly executing your voting instructions. The Company will pay for your Intermediary to deliver the Meeting Materials and the request for voting instruction form to you.

If you are an OBO and you wish to attend the Meeting and vote in person, insert your name (or the name of the person you want to attend and vote on your behalf) in the blank space provided for that purpose on the request for voting instructions form and return it to your Intermediary or send your Intermediary a written request that you or your nominee be appointed as proxy holder. Your Intermediary is required under NI 54-101 to arrange, without expense to you, to appoint you or your nominee as proxy holder in respect of your shares. Under NI 54-101, unless corporate law does not allow it, if your Intermediary makes an appointment in this manner, you or your nominee, as applicable, must be given authority to attend, vote and otherwise act for and on behalf of your Intermediary (who is the registered shareholder) in respect of all matters that come before the Meeting and any adjournment or postponement of the Meeting. An Intermediary who receives your instructions at least one business day before the deadline for submission of proxies is required to deposit the proxy within that deadline, in order to appoint you or your nominee as proxy holder. If you request that your Intermediary appoint you or your nominee as proxy holder, you or your appointed nominee, as applicable, will need to attend the virtual Meeting in person via audio conference in order for your vote to be counted.

VOTING BY PROXY

If you are a registered shareholder and you do not wish to attend the virtual Meeting via audio conference, you can appoint someone to attend and vote your shares as your proxy holder.

Accompanying this Information Circular is a form of proxy for use at the Meeting (the “Proxy”).

The individuals named in the Proxy are directors or officers of the Company. A REGISTERED SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON OR COMPANY (WHO NEED NOT BE A SHAREHOLDER) TO ATTEND AND ACT FOR AND ON THE REGISTERED SHAREHOLDER’S BEHALF AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY INSERTING SUCH PERSON’S OR COMPANY’S NAME IN THE BLANK SPACE PROVIDED IN THE PROXY AND STRIKING OUT THE TWO PRINTED NAMES, OR BY COMPLETING ANOTHER PROPER FORM OF PROXY. A Proxy will not be valid unless it is completed, dated and signed and delivered to Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting. Proxies received after such time may be accepted or rejected by the chair of the Meeting in the chair’s sole discretion. If you have sent in your Proxy, you MAY NOT vote in person at the Meeting unless you have properly revoked your Proxy.

Complete the Proxy to appoint your proxy holder. The named persons on the Proxy will vote on your behalf at the Meeting. If you appoint a proxy holder other than the named persons, that proxy holder must attend and vote at the Meeting for your vote to be counted.

A Proxy will not be valid unless it is signed by the registered shareholder or by the registered shareholder’s attorney duly authorized in writing. If you are the representative of a registered shareholder that is a corporation or association, the Proxy should bear the seal of the corporation or association, and must be executed by an officer or an attorney duly authorized in writing. If the Proxy is executed by an attorney for an individual registered shareholder or by an officer or attorney of a registered shareholder that is a corporation or association, the instrument so empowering the officer or attorney, as the case may be, or a notarial copy thereof, must accompany the Proxy.

All common shares represented at the Meeting by properly executed Proxies will be voted (including on any ballot) or withheld from voting in accordance with your instructions as a registered shareholder. On the Proxy you can specify how you want your proxy holder to vote your shares, or you can allow the proxy holder to decide for you. If you, as a registered shareholder, specify a choice on the Proxy with respect to any matter to be acted upon, your shares will be voted in accordance with your instructions as specified in the Proxy you deposit.

If you appoint the officers or directors set out in the Proxy (the management designees) and do not specify how you want your shares voted, your shares will be voted FOR all of the matters set out in the accompanying notice of meeting.

The enclosed Proxy, when properly signed and delivered and not revoked, confers discretionary authority upon the persons appointed proxy holders thereunder to vote with respect to any amendments or variations of matters identified in the notice of meeting and with respect to other matters which may properly come before the Meeting. At the time of the printing of this Information Circular, management of the Company knows of no such amendment, variation or other matter which may be presented to the Meeting. However, if any other matters which are not now known to management should properly come before the Meeting, then the management designees if named as your proxy holders intend to vote in accordance with the judgement of management.

REVOCATION OF PROXIES

A registered shareholder who has given a Proxy may revoke it by sending a new completed Proxy with a later date, or a written note signed by the registered shareholder or by the registered shareholder’s attorney duly authorized in writing. A registered shareholder can also revoke a Proxy in any manner permitted by law. If you are a representative of a registered shareholder that is a corporation or association, the written note should bear the seal of the corporation or association and must be executed by an officer or by an attorney duly authorized in writing. To be effective, the written note must be deposited with Computershare at 510 Burrard Street, 2nd Floor, Vancouver, British Columbia, V6C 3B9, at any time up to and including the last business day preceding the day of the Meeting or any adjournment of it, or, as to any matter in respect of which a vote has not already been cast pursuant to such Proxy, with the chair of the Meeting on the day of the Meeting, or any adjournment of it. Only registered shareholders have the right to revoke a Proxy. NOBOs that wish to change their vote must in sufficient time in advance of the Meeting contact Broadridge to arrange to change their vote. OBOs who wish to change their vote must in sufficient time in advance of the Meeting, arrange for their respective Intermediaries to change their vote and if necessary revoke their proxy in accordance with the revocation procedures set out above.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at the date hereof, the Company has issued and outstanding 187,811,770 fully paid and non-assessable common shares without par value, each share carrying the right to one vote on all matters to be acted upon at the Meeting.

Any shareholder of record at the close of business on Thursday, May 6, 2021 who either personally attends the virtual Meeting via audio conference or who has completed and delivered a Proxy in the manner specified, subject to the provisions described above, will be entitled to vote or to have such shareholder’s shares voted at the Meeting.

To the best of the knowledge of the directors and executive officers of the Company, the only persons who, or corporations which, beneficially own, or control or direct, directly or indirectly, shares carrying 10% or more of the voting rights attached to all outstanding shares of the Company are:

| Shareholder Name | Number of Shares | Percentage of Issued Shares |

| Rio Tinto International Holdings Limited | 31,981,129(1) | 17.0% |

| Sandstorm Gold Ltd. (“Sandstorm”) | 44,605,240 | 23.7% |

| (1) | Rio Tinto International Holdings Limited (“Rio Tinto”) holds 17,441,796 common shares directly. It also has a beneficial interest in 14,539,333 common shares held by Turquoise Hill Resources Ltd. (“Turquoise Hill”). |

NUMBER OF DIRECTORS

Management of the Company is seeking shareholder approval of an ordinary resolution setting the number of directors of the Company at six for the ensuing year.

ELECTION OF DIRECTORS

Majority Voting Policy

The board of directors (the “Board”) adopted a majority voting policy in May 2013. If the number of shares “withheld” from voting for the election of a nominee is greater than the number of shares voted “for” his or her election, the director must submit his or her resignation to the Non-Executive Chair of the Board promptly after the shareholders’ meeting. The Corporate Governance and Nominating Committee of the Board (the “CGNC”) will consider the resignation and will recommend to the Board whether or not to accept it. The Board will accept the resignation in question unless, after considering the recommendations of the CGNC, including the factors considered by the CGNC and any other factors that the members of the Board consider relevant, the Board determines that exceptional circumstances exist, which warrant rejection of the resignation. The Board will make its decision as to whether to accept or reject the resignation in question within 90 days following the meeting of shareholders. The Company will promptly announce the Board’s decision in a press release, including any reasons for the Board not accepting a resignation, and will file a copy of the press release with the Toronto Stock Exchange (“TSX”). The policy does not apply if there is a contested director election or where the election involves a proxy battle.

Advance Notice Provisions

At the Company’s Annual General Meeting of shareholders held on June 27, 2013, shareholders confirmed the alteration of the Company’s Articles by the addition of advance notice provisions as Part 14B (the “Advance Notice Provisions”). The Advance Notice Provisions: (i) facilitate an orderly and efficient annual general or, where the need arises, special meeting, process; (ii) ensure that all shareholders receive adequate notice of the director nominations and sufficient information regarding all director nominees; and (iii) allow shareholders to register an informed vote after having been afforded reasonable time for appropriate deliberation.

The Advance Notice Provisions provide shareholders, directors and management of the Company with a clear framework for nominating directors of the Company. Only persons who are eligible under the Business Corporations Act (British Columbia) (the “Business Corporations Act”) and who are nominated in accordance with the following procedures set forth in the Advance Notice Provisions shall be eligible for election as directors of the Company. At any annual general meeting of shareholders, or at any special meeting of shareholders if one of the purposes for which the special meeting was called is the election of directors, nominations of persons for election to the Board may be made only: (a) by or at the direction of the Board, including pursuant to a notice of meeting; (b) by or at the direction or request of one or more shareholders pursuant to a “proposal” made in accordance with Part 5, Division 7 of the Business Corporations Act, or pursuant to a requisition of the shareholders made in accordance with section 167 of the Business Corporations Act; or (c) by any person (a “Nominating Shareholder”): (A) who, at the close of business on the date of the giving by the Nominating Shareholder of the notice provided for in the Advance Notice Provisions and at the close of business on the record date for notice of such meeting, is entered in the securities register of the Company as a holder of one or more shares carrying the right to vote at such meeting or who beneficially owns shares that are entitled to be voted at such meeting and provides evidence of such ownership that is satisfactory to the Company, acting reasonably; and (B) who complies with the notice procedures set forth in the Advance Notice Provisions. The Company has calculated that the deadline for complying with the notice procedures set forth in the Advance Notice Provisions is May 11, 2021.

Nominees

The term of office of each of the present directors expires at the Meeting. The Board has directed that the persons named below be presented for election at the Meeting as its nominees. The Board does not contemplate that any of these nominees will be unable to serve as a director. Each director elected will hold office until the next annual general meeting of the Company or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with the Articles of the Company or with the provisions of the Business Corporations Act.

The following are the Board’s nominees for election as directors, including the province or state and country in which each is ordinarily resident, the period or periods during which each has served as a director, the first and last positions held in the Company, their present principal occupations and the number of common shares of the Company or any of its subsidiaries beneficially owned, or controlled or directed, directly or indirectly, by each nominee.

For the purposes of disclosing positions held in the Company, “Company” includes the Company and any parent or subsidiary thereof. Unless otherwise stated, any nominees named below not elected at the last annual general meeting have held the principal occupation or employment indicated for at least five years. The information as to country of residence, principal occupation and number of shares beneficially owned, or controlled or directed, directly or indirectly by the nominees is not within the knowledge of the management of the Company and has been furnished by the respective nominees. Unless otherwise stated, all information is as at May 6, 2021.

Mark Bailey, 72 Arizona, U.S.A. Non-Executive Chair of the Board Independent Director since June 28, 2002 Other Public Company Directorships: Fiore Gold Ltd. | Mr. Bailey has been a director of the Company since June 28, 2002. On February 5, 2018, Mr. Bailey was appointed Non-Executive Chair of the Board. Mr. Bailey is a mining executive and registered professional geologist with 44 years of industry experience. Between 1995 and 2012, he was the President and Chief Executive Officer of Minefinders Corporation Ltd. (“Minefinders”), a precious metals mining company that operated the multi-million ounce Dolores gold and silver mine in Mexico before being acquired by Pan American Silver Corp. Before joining Minefinders, Mr. Bailey held senior positions with Equinox Resources Inc. and Exxon Minerals. Since 1984, Mr. Bailey has worked as a consulting geologist with Mark H. Bailey & Associates LLC. Mr. Bailey is currently the non-executive Chairman of the Board of Fiore Gold Ltd. and was a director of Mason Resources Corp. until its acquisition by Hudbay Minerals Inc. Mr. Bailey was a director of Core Gold Ltd. until its acquisition by Titan Minerals Ltd in 2020. |

| Meetings Attended since January 1, 2020 |

| Board | 6/6 | 100% |

| Committee Meetings Attended since January 1, 2020 |

| Compensation | 2/2 | 100% |

| Technical | 1/1 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 874,493 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 50,000 | C$0.55 | January 10, 2022 |

| 25,000 | C$0.60 | September 13, 2023 |

Stephen Scott, 60 British Columbia, Canada Executive Director since April 1, 2016 Other Public Company Directorships: Atalaya Mining plc Victoria Gold Corp. | Mr. Scott was appointed to the position of Interim Chief Executive Officer on November 16, 2015. He was appointed to the positions of President, Chief Executive Officer and director on April 1, 2016. Mr. Scott has over 30 years of global experience in all mining industry sectors. Before joining the Company, he was the President of Minenet Advisors. Between 2000 and 2014, Mr. Scott held various global executive positions with Rio Tinto including General Manager Commercial, Rio Tinto Copper and President and Director of Rio Tinto Indonesia. He is an experienced public company director having served as an independent director on the boards of a number of TSX and AIM listed public mining companies. Mr. Scott holds a Bachelor of Business and Graduate Certificate in Corporate Secretarial Practises from Curtin University in Western Australia. Mr. Scott was also the President, Chief Executive Officer and a director of Mason Resources Corp. until its acquisition by Hudbay Minerals Inc. |

| Meetings Attended since January 1, 2020 |

| Board | 6/6 | 100% |

| Committee Meetings Attended since January 1, 2020 |

| Technical | 1/1 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 780,524 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 48,780 | C$0.55 | January 10, 2022 |

| 50,000 | C$0.60 | September 13, 2023 |

Michael Price, 65 London, United Kingdom Independent Director since February 5, 2018 Other Public Company Directorships: Galiano Gold Inc. | Dr. Price has been a director of the Company since February 5, 2018. Dr. Price has over 40 years of experience in mining and mining finance. He is currently a Non-Executive Director of Galiano Gold Inc. and is the London Representative of Resource Capital Funds. During his career, Dr. Price has served as Managing Director, Joint Global Head of Mining and Metals, Barclays Capital, Managing Director, Global Head of Mining and Metals, Societe Generale and Head of Resource Banking and Metals Trading, NM Rothschild and Sons. Dr. Price has B.Sc. and Ph.D. qualifications in Mining Engineering from University College Cardiff and he has a Mine Manager’s Certificate of Competency (South Africa). |

| Meetings Attended since January 1, 2020 |

| Board | 5/6 | 83% |

| Committee Meetings Attended since January 1, 2020 |

| Audit | 5/5 | 100% |

| Technical | 1/1 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 70,000 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 35,000 | C$0.60 | September 13, 2023 |

Alan Edwards, 63 Arizona, U.S.A. Independent Director since March 8, 2011 Other Public Company Directorships: Americas Gold and Silver Corporation Orvana Minerals Corp. Tonogold Resources, Inc. | Mr. Edwards has been a director of the Company since March 8, 2011. Mr. Edwards has more than 35 years of diverse mining industry experience. He is a graduate of the University of Arizona, where he obtained a Bachelor of Science Degree in Mining Engineering and an MBA (Finance). Mr. Edwards is currently the President of AE Resources Corp., an Arizona based company. Mr. Edwards is the Non-Executive Chairman of the Board of Tonogold Resources, Inc. and a director of Americas Gold and Silver Corporation and Orvana Minerals Corp. He served as the Non-Executive Chair of the Board of Mason Resources Corp. until its acquisition by Hudbay Minerals Inc. He also served as the non-executive Chairman of the Board of Rise Gold Corp. from April 2017 to September 2018, AQM Copper Inc. from October 2011 to January 2017 and AuRico Gold Inc. (Alamos Gold Inc. following its combination with AuRico Gold in July 2015) from July 2013 to November 2015. Mr. Edwards served as the Chief Executive Officer of Oracle Mining Corporation, a Vancouver based company, from 2012 to 2013. He also previously served as President and Chief Executive Officer of Copper One Inc. and Frontera Copper Corporation, and as Executive Vice President and Chief Operating Officer of Apex Silver Mines Corporation, where he directed the engineering, construction and development of the San Cristobal project in Bolivia. Mr. Edwards has also worked for Kinross Gold Corporation, P.T. Freeport Indonesia, Cyprus Amax Minerals Company and Phelps Dodge Mining Company, where he started his career. |

| Meetings Attended since January 1, 2020 |

| Board | 6/6 | 100% |

| Committee Meetings Attended since January 1, 2020 |

| Compensation | 2/2 | 100% |

| Corporate Governance & Nominating | 3/3 | 100% |

| Technical | 1/1 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 782,783 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 60,975 | C$0.55 | January 10, 2022 |

| 37,500 | C$0.60 | September 13, 2023 |

James Harris, 69 British Columbia, Canada Independent Director since January 29, 2003 Other Public Company Directorships: Farstarcap Investment Corp. Essex Minerals Inc. | Mr. Harris has been a director of the Company since January 29, 2003, served as the Company’s Non-Executive Chair between March 15, 2006 and June 27, 2013 and served as the Company’s Non-Executive Deputy Chair between June 27, 2013 and February 28, 2015. Mr. Harris was formerly a corporate, securities and business lawyer with over 30 years’ experience in Canada and internationally. He has extensive experience with the acquisition and disposition of assets, corporate structuring and restructuring, regulatory requirements and corporate filings, and corporate governance. Mr. Harris was also a Founding Member of the Legal Advisory Committee of the former Vancouver Stock Exchange. Mr. Harris has completed the Directors’ Education Program of the Institute of Corporate Directors and is an Institute accredited Director (ICD.D). Mr. Harris has also completed a graduate course in business at the London School of Economics. Mr. Harris was a director of Mason Resources Corp. until its acquisition by Hudbay Minerals Inc. |

| Meetings Attended since January 1, 2020 |

| Board | 6/6 | 100% |

| Committee Meetings Attended since January 1, 2020 |

| Compensation | 2/2 | 100% |

| Corporate Governance & Nominating | 3/3 | 100% |

| Audit | 5/5 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 1,150,000 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 67,500 | C$0.55 | January 10, 2022 |

| 30,000 | C$0.60 | September 13, 2023 |

Anna Stylianides, 55 British Columbia, Canada Independent Director since July 13, 2015 Other Public Company Directorships: Gabriel Resources Ltd. Sabina Gold & Silver Corp. Altius Minerals Corporation Altius Renewable Royalties Corp. | Ms. Stylianides has been a director of the Company since July 13, 2015. Ms. Stylianides has 30 years of experience in global capital markets and has spent much of her career in investment banking, private equity, and corporate management and restructuring. She began her career in corporate law by joining the firm of Webber Wentzel Attorneys in 1990 after graduating from the University of the Witwatersrand in Johannesburg, South Africa. In 1992, she joined Investec Merchant Bank Limited where she specialized in risk management and gained extensive experience in the areas of corporate finance, structured finance, mergers and acquisitions, structuring, specialized finance and other banking and financial services transactions. She was also involved in designing and structuring of financial products for financial institutions and corporations. Ms. Stylianides was until most recently the Executive Director of Eco Oro Minerals Corp., a precious metals exploration and mining development company with a portfolio of projects in northeastern Colombia, and is currently a director of Gabriel Resources Ltd., Sabina Gold & Silver Corp., Altius Minerals Corporation and Altius Renewable Royalties Corp. |

| Meetings Attended since January 1, 2020 |

| Board | 6/6 | 100% |

| Committee Meetings Attended since January 1, 2020 |

| Corporate Governance & Nominating | 3/3 | 100% |

| Audit | 5/5 | 100% |

| Common Shares Beneficially Owned, Controlled or Directed: |

| 192,171 |

| Common Share Purchase Warrants Beneficially Owned, Controlled or Directed: |

| Number of Warrants | Exercise Price | Expiry Date |

| 36,585 | C$0.55 | January 10, 2022 |

| 22,000 | C$0.60 | September 13, 2023 |

Composition of Board Committees

| Committee | Membership |

| Audit | Anna Stylianides (chair), Michael Price, James Harris |

| Compensation | James Harris (chair), Mark Bailey, Alan Edwards |

| Corporate Governance & Nominating | James Harris (chair), Anna Stylianides, Alan Edwards |

| Technical | Alan Edwards (chair), Mark Bailey, Stephen Scott, Michael Price |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Other than as disclosed below, none of the proposed directors:

| (a) | are, as at the date of this Information Circular, or have been, within ten years before the date of this Information Circular, a director, Chief Executive Officer (“CEO”) or Chief Financial Officer (“CFO”) of any company that: |

| i) | was subject to an order that was issued while the proposed director was acting in the capacity as director, CEO or CFO; or |

| ii) | was subject to an order that was issued after the proposed director ceased to be a director, CEO or CFO and which resulted from an event that occurred while that person was acting in the capacity as director, CEO or CFO; |

| (b) | are, as at the date of this Information Circular, or has been within ten years before the date of this Information Circular, a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | have, within the ten years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed trustee. |

Alan Edwards, a director of the Company, was Chairman of the Board of Oracle Mining Corp. (“Oracle”) until his resignation effective February 15, 2015. On December 23, 2015, Oracle announced that the Superior Court of Arizona had granted the application of Oracle’s lender to appoint a receiver and manager over the assets, undertaking and property of Oracle Ridge Mining LLC.

In addition, none of the proposed directors has been subject to:

| (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a nominee as director. |

2017 PLAN OF ARRANGEMENT

On February 28, 2017, the Company announced that the Board had approved a spin-out of the Company’s Ann Mason Project in Nevada and Lordsburg property in New Mexico along with US$8.84 million in cash into a newly incorporated wholly-owned subsidiary, Mason Resources Corp. (“Mason Resources”), through a plan of arrangement under Section 288 of the Business Corporations Act (the “Arrangement”). The Arrangement closed on May 9, 2017. Shareholders received common shares of Mason Resources by way of a share exchange, pursuant to which each existing common share of the Company was exchanged for one “new” common share of the Company and 0.45 of a common share of Mason. Mason’s common shares commenced trading on the TSX on May 12, 2017 under the symbol “MNR”, and on the OTCQB on November 9, 2017 under the symbol “MSSNF”.

As part of the Arrangement, option holders and warrant holders of the Company received replacement options and warrants of the Company and options and warrants of Mason Resources which were proportionate to, and reflective of the terms of, their original options and warrants of the Company. The exercise prices assigned to the replacement options and warrants of the Company and the Mason Resources options and warrants reflect the allocation of the exercise prices of the original options and warrants between the replacement options and warrants and the Mason Resources options and warrants issued, based on the relative market value of Mason Resources and the Company following completion of the Arrangement.

On May 9, 2017, the Company entered into an Administrative Services Agreement with Mason Resources (the “Administrative Services Agreement”), pursuant to which the Company provided office space, furnishings and equipment, communications facilities and personnel necessary for Mason Resources to fulfill its basic day-to-day head office and executive responsibilities on a pro-rata cost-recovery basis.

On December 19, 2018, Mason Resources and Hudbay Minerals Inc. (“Hudbay”) completed a plan of arrangement under Part 9, Division 5 of the Business Corporations Act whereby Hudbay acquired all the issued and outstanding common shares of Mason Resources it did not already own for C$0.40 per common share. Mason Resources’ shares were delisted from the TSX and the OTCQB and Mason Resources ceased to be a reporting issuer under applicable Canadian securities laws. Mason Resources terminated the Administrative Services Agreement on December 19, 2018, concurrently with the completion of the plan of arrangement.

STATEMENT OF EXECUTIVE COMPENSATION

For the purposes of this Information Circular, “executive officer” of the Company means an individual who at any time during the year was the Chair, or a Vice-Chair or President of the Company; any Vice President in charge of a principal business unit, division or function including sales, finance or production; and any individual who performed a policy-making function in respect of the Company.

Set out below are particulars of compensation paid to the following persons (the “Named Executive Officers” or “NEOs”):

| 3. | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than C$150,000 for that financial year; and |

| 4. | any individual who would be a NEO under paragraph (3) but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year. |

As at December 31, 2020, the end of the most recently completed financial year of the Company, the Company had three NEOs.

Compensation Discussion and Analysis

The Compensation Committee of the Board typically meets in the fall of each year to discuss and determine the recommendations that it will make to the Board regarding executive officer compensation. The general objectives of the Company’s compensation strategy are to (a) compensate executive officers in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long-term shareholder value; (b) align management’s interests with the long-term interests of shareholders; (c) provide a compensation package that is commensurate with other comparable companies to enable the Company to attract and retain talent; and (d) ensure that the total compensation package is designed in a manner that takes into account the fact that the Company is without a history of earnings, current market and industry circumstances and the Company’s ability to raise capital.

In the course of its annual compensation evaluation, the Compensation Committee considers, among such other factors as it may deem relevant, the CEO’s recommendations with respect to compensation of other executive officers, the extent to which corporate goals have been achieved, the Company’s overall performance, awards given to executive officers in prior years, and general market conditions and economic outlook.

The Compensation Committee considers three elements of compensation - a base salary for the next financial year, a discretionary cash bonus to reward superior performance, and grants pursuant to the Company’s long-term security-based compensation arrangements. Base salary comprises the portion of executive compensation that is fixed, whereas discretionary cash bonuses and security-based compensation represent compensation that is “at risk” depending on whether the executive officer is able to meet or exceed his or her applicable performance expectations, and overall performance of the Company. No specific formula has been developed to assign a specific weighting to each of these components. Rather, the Compensation Committee focuses on ensuring that the total compensation package for each executive officer meets the general objectives of the Company’s compensation strategy.

Base salary is used to provide executive officers a set amount of money during the year with the expectation that each executive officer will perform his or her responsibilities to the best of his or her ability and in the best interests of the Company. Generally, the Compensation Committee makes recommendations regarding each executive officer’s base salary for the upcoming year after taking multiple factors into account, including the overall performance of the Company, general market performance and economic outlook, base salaries paid to executive officers of comparable companies, the performance of the executive officer, and the executive officer’s experience level and responsibilities.

The granting of incentive stock options and deferred share units (“DSUs”) provides a link between executive officer compensation and the Company’s share price. It also rewards management for achieving results that improve Company performance and thereby increase shareholder value. Stock options and/or DSUs are generally granted to executive officers on an annual basis. In making a determination as to whether a grant of long-term incentive stock options and/or DSUs is appropriate, and if so, the number of options and/or DSUs that should be awarded, the Compensation Committee will consider, among such other factors as it may deem relevant, the value in securities of the Company that the Compensation Committee intends to award as compensation, current and expected future performance of the executive officer, the potential dilution to shareholders and the cost to the Company, previous awards made to the executive officer and the limits imposed by the terms of the Company’s Stock Option Plan (the “Stock Option Plan”) and Deferred Share Unit Plan (the “DSU Plan”) and the TSX. The Company considers the granting of incentive stock options and DSUs to be a particularly important element of compensation as it allows the Company to encourage and reward each executive officer’s efforts to increase value for shareholders without requiring the Company to use cash from its treasury. The terms and conditions of the Company’s stock option and DSU grants, including vesting provisions, are determined by the Board at the time of grant, subject to the limits imposed by the terms of the Stock Option Plan and DSU Plan, as applicable.

Finally, the Compensation Committee will consider whether it is appropriate and in the best interests of the Company to award a discretionary cash bonus to executive officers and if so, in what amount. The extent to which management has achieved goals for the year will be evaluated by the Compensation Committee and the Board, and the actual amount of discretionary cash bonuses that will be paid out, if any, will be recommended by the Compensation Committee and approved by the Board in its discretion based upon that evaluation.

The Company operates in a very competitive industry and competes with other companies for the recruitment and retention of qualified employees. The Company’s business requires specialized skills and knowledge in the areas of geology and engineering, strategic planning, corporate finance, government relations, financial modelling, accounting, compliance, regulatory matters, negotiation and drafting of agreements and corporate governance, among others. Therefore, it is important that the Company provide competitive compensation to attract and retain such talent.

Administrative Services Agreement with Mason Resources

Effective May 9, 2017, the Company entered into the Administrative Services Agreement with Mason Resources, pursuant to which the Company provided office space, furnishings and equipment, communications facilities and personnel necessary for Mason Resources to fulfill its basic day-to-day head office and executive responsibilities on a pro-rata cost-recovery basis. Mason Resources terminated the Administrative Services Agreement on December 19, 2018, concurrently with the closing of the acquisition of Mason Resources by Hudbay.

During the term of the Administrative Services Agreement, Mason Resources’ executive officers did not receive salaried compensation from Mason Resources. Instead Mason Resources had sufficient access to and the use of the Company’s executive officers to enable Mason Resources to achieve its corporate goals and objectives. The Company was the sole employer and was responsible for paying 100% of executive officer salaries for services provided by executive officers to both the Company and Mason Resources. The Company then invoiced Mason Resources for its proportionate share of actual costs for the executive officers, including base salary, benefits, vacation pay, perquisites, professional memberships and continuing education expenses. The Company could also propose discretionary cash bonuses to be allocated between the Company and Mason Resources to reward exceptional service by executive officers to Mason Resources and the Company, taken as a whole.

Compensation and Assessments

In February 2018, the Compensation Committee met to assess the performance of the Company and management as a whole. Key corporate goals set by management, approved by the Board and achieved in the prior year included:

| • | completing the Arrangement; |

| • | engaging Wood Canada Limited (formerly Amec Foster Wheeler Americas Limited) to complete an updated Technical Report on the Company’s interest in the Entrée/Oyu Tolgoi joint venture property in Mongolia; |

| • | raising investor awareness of the Company’s key asset; and |

| • | further initiatives to reduce the Company’s cash burn rate, including by entering into the Administrative Services Agreement. |

Following its assessment, the Compensation Committee determined that it was appropriate to recommend to the Board that discretionary cash bonuses be awarded to the NEOs. The award was approved by the Board on February 27, 2018. The Company proposed to Mason Resources that the cost of the discretionary cash bonuses be allocated between the Company and Mason Resources to reward exceptional service by the NEOs to Mason Resources and the Company over the previous year, taken as a whole. As the NEOs were principally focussed on completing the Arrangement until May 2017 and the NEOs spent 50% of their time providing services to Mason Resources thereafter, the parties agreed that it was appropriate to allocate 50% of the cost of the discretionary cash bonuses to Mason Resources as follows:

| NEO | Total Bonus Paid to NEO (C$) | Amount of Bonus Allocated to Mason Resources (C$) |

| Stephen Scott | $80,000 | $40,000 |

| Duane Lo | $36,000 | $18,000 |

| Susan McLeod | $40,000 | $20,000 |

In December 2018, the Compensation Committee met to discuss executive officer compensation for 2019 and determined that no salary increases, or discretionary cash bonuses should be recommended to the Board at that time. The Compensation Committee recommended to the Board that a cash bonus of up to C$200,000 be paid to Mr. Scott if the Company completes a fundamental transaction by December 31, 2019 or such later date as may be approved by the Board. The Board approved the Compensation Committee’s recommendation and also directed the Compensation Committee to establish a separate bonus pool from which discretionary cash bonuses may be allocated and distributed to other executive officers (excluding the CEO) if the Company completes a fundamental transaction by December 31, 2019 or such later date as may be approved by the Board. In September 2019, the Board approved a separate bonus pool for executive officers (excluding the CEO) of up to C$150,000. In December 2019, the Board extended the date by which a fundamental transaction must be completed to December 31, 2020.

In December 2019, the Compensation Committee met to discuss executive officer compensation for 2020 and recommended modest salary increases for Mr. Scott (5.23% increase to C$342,000 per annum), Mr. Lo (3.47% increase to C$155,200 per annum based on 65% full time equivalent (“FTE”)) and Ms. McLeod (5.15% increase to C$265,000 per annum) effective January 1, 2020. In determining that salary increases were appropriate, the Board noted that Ms. McLeod had not had a salary increase since January 1, 2015 and Mr. Scott and Mr. Lo had not had salary increases since they commenced employment in 2016. The Board also approved the Compensation Committee’s recommendation to award modest discretionary cash bonuses to the NEOs for their work in 2018 and 2019 as follows:

| NEO | Discretionary Cash Bonus Paid to NEO in 2019 (C$) |

| Stephen Scott | $22,000 |

| Duane Lo | $11,000 (based on 65% FTE) |

| Susan McLeod | $17,000 |

The Board also extended the date by which a fundamental transaction must be completed for the purposes of the bonus pools to December 31, 2020.

In December 2020, the Compensation Committee met to discuss executive officer compensation for 2021 and did not recommend salary increases for the NEOs but did recommend the award of discretionary cash bonuses to the NEOs for their work in 2020, including the completion of a non-brokered private placement. The Board approved payment of the following discretionary cash bonuses as recommended by the Compensation Committee:

| NEO | Discretionary Cash Bonus Paid to NEO in 2020 (C$) |

| Stephen Scott | $50,000 |

| Duane Lo | $25,000 (based on 65% FTE) |

| Susan McLeod | $30,000 |

The Compensation Committee also recommending that the bonus pool established for Mr. Scott in the event the Company completes a fundamental transaction be rolled into and included in the bonus pool for the other NEOs and that the size of the bonus pool be increased to C$700,000. The Board accepted the Compensation Committee’s recommendation and extended the date by which a fundamental transaction must be completed to December 31, 2021.

In 2020, the Compensation Committee asked external counsel to draft the DSU Plan, to promote the alignment of interests between directors, officers, employees and consultants (“Designated Participants”) and shareholders of the Company, assist the Company in attracting, retaining and motivating Designated Participants, and provide a compensation system for Designated Participants that is reflective of the responsibility, commitment and risk accompanying their management role over the medium term. On the recommendation of the Compensation Committee, the Board adopted and approved the DSU Plan subject to shareholder approval. Shareholders are being asked to approve the DSU Plan at the Meeting. The Compensation Committee also recommended, and the Board approved, DSU grants to the NEOs, provided that the DSUs may not vest or be redeemed prior to the Company obtaining shareholder approval of the DSU Plan and ratification of the DSU grants. If shareholders do not approve the DSU Plan and ratify the DSU grants at the Meeting, the DSUs that have been granted will be null and void and will be deemed to have been rescinded.

Management has also annually proposed, and the Compensation Committee has recommended, option awards for directors, officers, employees and consultants of the Company, as a means of rewarding performance without depleting the Company’s treasury.

The Board can exercise discretion to award compensation absent attainment of corporate goals or to reduce or increase the size of any award. The Board did not exercise this discretion in 2020 with respect to any NEO.

In the course of conducting its annual review of compensation, the Compensation Committee considers the implications and risks associated with the Company’s executive compensation policies, philosophy and practices. As discussed above, the Compensation Committee follows an overall compensation model which ensures that an adequate portion of overall compensation for executive officers is “at risk” and only realized through the performance of the Company over both the short-term and long-term. The Compensation Committee reviews the model to ensure that there are sufficient features to mitigate the incentive for excessive risk taking. Some of the key risk mitigating features include:

| • | balanced design, between fixed and variable pay and between short-term and long-term incentives; and |

| • | a greater reward opportunity derived from long-term incentives compared to short-term incentives, creating a greater focus on sustained performance over time. |

The Company does not permit its executive officers or directors to hedge any of the equity compensation granted to them.

Compensation Governance

The Compensation Committee is composed of James Harris (chair), Mark Bailey and Alan Edwards, all of whom are independent directors, applying the definition set out in section 1.4 of National Instrument 52-110 - Audit Committees (“NI 52-110”). Each member of the Compensation Committee has served on various other public company boards, which gives them sufficient direct experience in executive compensation to assist them in making decisions about the suitability of the Company’s compensation practices and policies.

The Board has adopted a Compensation Committee Charter, which governs the organization of the Compensation Committee and sets out the duties and responsibilities of the chair and the Compensation Committee as a whole.

The primary objective of the Compensation Committee is to discharge the responsibilities of the Board relating to compensation and benefits of the executive officers and directors of the Company. The Committee shall consist of three or more directors appointed by the Board, each of whom must be independent. The Committee shall meet as many times as it deems necessary, but not less frequently than one time per year. The CEO may not be present during the Compensation Committee’s voting or deliberations.

Responsibilities of the Compensation Committee include:

| • | Reviewing and approving on an annual basis corporate goals and objectives relevant to CEO compensation, evaluating the CEO’s performance in light of those goals and objectives and setting the CEO’s compensation level based on this evaluation. In determining the long-term incentive component of CEO compensation, the Compensation Committee will consider, among such other factors as it may deem relevant, the Company’s performance, shareholder returns, the value of similar incentive grants to chief executive officers at comparable companies and the grants given to the CEO in past years; |

| • | Reviewing and approving on an annual basis the adequacy and form of compensation and benefits of all other executive officers and directors, and making recommendations to the Board in that regard; |

| • | Making recommendations to the Board with respect to the Stock Option Plan, DSU Plan and any other incentive compensation plans and equity-based plans; |

| • | Determining the recipients of, and the nature and size of security-based compensation grants and bonuses awarded from time to time, in compliance with applicable securities law, stock exchanges and other regulatory requirements; and |

| • | Approving inducement grants, which include grants of options, DSUs or stock to new employees in connection with a merger or acquisition, as well as any tax-qualified, non-discriminatory employee benefit plans or non-parallel non-qualified plans, to new employees. |

The Compensation Committee is acutely aware of the dual responsibility that non-executive directors have for overseeing the Company’s corporate governance and long-term sustainability, as well as its compensation plans. In the course of determining compensation for non-executive directors, the Compensation Committee tries to ensure that non-executive director interests are closely aligned with those of shareholders, and that best practices for corporate governance are observed in the course of structuring non-executive director pay. In particular, the Compensation Committee is committed to structuring director pay in a manner that enables directors to maintain their independence. One of the ways that the Compensation Committee attempts to achieve this is by imposing reasonable limits on independent director participation in the Company’s security-based compensation arrangements.

The Compensation Committee has the authority to retain outside advisors, including the sole authority to retain or terminate consultants to assist the Compensation Committee in the evaluation of compensation of executive officers and directors. No compensation consultant or advisor has been retained by the Company, and no fees have been paid to a compensation consultant or advisor, in either of the Company’s two most recently completed financial years.

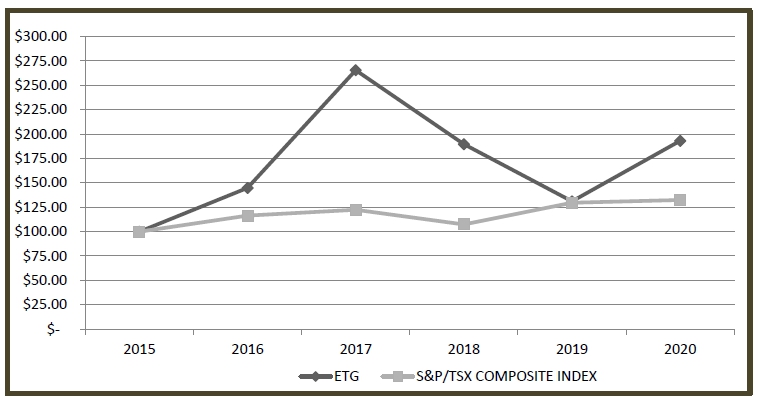

Performance Graph

The following chart compares the yearly percentage change in cumulative total shareholder return for C$100 invested in common shares of the Company beginning on December 31, 2015 with the cumulative total return of the S&P/TSX Composite Index for the five most recently completed financial years of the Company.

Entree Resources Ltd. (“ETG”)

Comparison of Five Year Total Common Shareholders’ Return

(as at December 31st of each year) (C$)

| | Dec 2015 | Dec 2016 | Dec 2017 | Dec 2018 | Dec 2019 | Dec 2020 |

| ETG | $100 | $144.83 | $265.52 | $186.21 | $131.03 | $193.10 |

| S&P/TSX COMPOSITE INDEX | $100 | $116.43 | $122.37 | $107.37 | $129.61 | $132.46 |

The trend in overall compensation for the Company’s NEOs over the five years has largely tracked the S&P/TSX Composite Index but not the performance of the market price of the Company’s shares. Starting in 2015, the Company’s share price began to increase as a result of the restart of underground development at the Oyu Tolgoi project, changes to management, concerted efforts to reduce the Company’s cash burn rate, rising commodity prices and a new investor relations strategy. In 2017 and 2018, the market price of the Company’s shares on the TSX significantly outperformed the S&P/TSX Composite Index as a result of a successful non-brokered private placement, completion of the Arrangement and completion of an updated Technical Report on the Entrée/Oyu Tolgoi joint venture property. The Company’s share price declined in 2019 as a result of a decline in metal prices, heightened uncertainty in Mongolia and disclosure by Turquoise Hill regarding potential Oyu Tolgoi mine design modifications and delays. In 2020, the Company’s share price recovered and significantly outperformed the S&P/TSX Composite Index as a result of strengthening copper prices, the completion of an updated mine plan, resources and reserves and Oyu Tolgoi Feasibility Study by the Company’s joint venture partner Oyu Tolgoi LLC, and a successful non-brokered private placement. NEO salaries generally did not change over the five-year period. The Company paid modest discretionary cash bonuses to the NEOs in 2018, 2019 and 2020.

Summary Compensation Table

The following table is a summary of compensation paid or granted to the NEOs for the last three financial years ending December 31, 2020, 2019 and 2018.

| Name and Principal Position | Year | Salary

(US$)(4) | Share-based awards

(US$)(1) (10) | Option-based awards (2)

(US$) | Non-equity incentive plan compensation (US$)(3) (4) | Pension value (US$) | All other compensation (US$)(4) | Total compensation (US$) |

| | | | | | Annual incentive plans | Long-term incentive plans | | | |

Stephen Scott, President and CEO(5) | 2020 | $268,615 | $31,857 | $66,149 | $39,040 | Nil | Nil | Nil | $405,600 |

| 2019 | $250,231 | Nil | $76,495 | $16,939 | Nil | Nil | Nil | $343,665 |

| 2018 | $236,860(6)(7) | Nil | $109,387 | $58,642(6) | Nil | Nil | Nil | $404,890 (6) |

Duane Lo, CFO | 2020 | $121,898 | $23,892 | $42,524 | $19,520 | Nil | Nil | Nil | $207,834 |

| 2019 | $115,491 | Nil | $38,248 | $8,469 | Nil | Nil | Nil | $162,208 |

| 2018 | $151,188 (7)(8) | Nil | $54,694 | $26,389 (7) | Nil | Nil | Nil | $232,270 (7) |

Susan McLeod, Vice President, Legal Affairs & Corporate Secretary | 2020 | $208,137 | $23,892 | $42,524 | $23,424 | Nil | Nil | Nil | $297,978 |

| 2019 | $194,025 | Nil | $38,248 | $13,089 | Nil | Nil | Nil | $245,362 |

| 2018 | $184,724 (9) | Nil | $54,694 | $29,321 (9) | Nil | Nil | Nil | $268,738 (9) |

| (1) | The share-based awards (DSUs) are valued using the Company’s share price on the grant date which is consistent with IFRS. The practice of the Company is to grant all share-based awards in Canadian currency, and then convert the grant date fair value amount to U.S. currency for reporting the value of the grants in the Company’s financials. The conversion rate for each grant is the average of the rates quoted by the Bank of Canada as its daily average exchange rate of the last day of the three months in the quarter in which the grant is made. The exchange rate used to convert the value of the 2020 share-based awards to US$ is 1.2807. |

| (2) | The Company uses the Black-Scholes option-pricing model for determining fair value of stock options issued at the grant date. The Company selected the Black-Scholes option-pricing model because it is widely used in estimating option-based compensation values by Canadian and U.S. public companies. The practice of the Company is to grant all option-based awards in Canadian currency, and then convert the grant date fair value amount to U.S. currency for reporting the value of the grants in the Company’s financials. The conversion rate for each grant is the average of the rates quoted by the Bank of Canada as its daily average exchange rate of the last day of the three months in the quarter in which the grant is made. The conversion rates for the purpose of the grants in this table are presented below and are based on the applicable conversion rate on the date of grant, each as supplied by the Bank of Canada. |

| (3) | The Company does not have a formal annual incentive program however, bonuses are granted as determined by the Compensation Committee and approved by the Board on an individual basis. The Company does not presently have a pension incentive plan for any of its executive officers, including its NEOs. |

| (4) | All compensation is negotiated and settled in Canadian dollars. The exchange rate used to convert 2020 compensation to US$ is 1.2732 (2019 - 1.2988; 2018 - 1.3642). |

| (5) | Mr. Scott is also a director of the Company. Mr. Scott did not receive compensation from the Company for acting as a director, and no portion of the total compensation disclosed above was received by Mr. Scott as compensation for acting as a director. |

| (6) | Mr. Scott was also the President and CEO of Mason Resources until its acquisition by Hudbay. The Company is Mr. Scott’s employer and was responsible for paying 100% of Mr. Scott’s salary for his services to both the Company and Mason Resources, which is reported in “Salary” above. Pursuant to the Administrative Services Agreement between the Company and Mason Resources, between December 1, 2018 and December 19, 2018 (the termination of the Administrative Services Agreement), the Company provided Mason Resources with access to and the use of 50% of Mr. Scott’s time, and Mason Resources paid the Company 50% of the Company’s actual cost of Mr. Scott’s salary, bonus and benefits during that period. |

| (7) | Mr. Lo was also the CFO of Mason Resources until its acquisition by Hudbay. The Company is Mr. Lo’s employer and was responsible for paying 100% of Mr. Lo’s salary for his services to both the Company and Mason Resources, which is reported in “Salary” above. Pursuant to the Administrative Services Agreement between the Company and Mason Resources, between December 1, 2018 and December 19, 2018 (the termination of the Administrative Services Agreement), the Company provided Mason Resources with access to and the use of 50% of Mr. Lo’s time, and Mason Resources paid the Company 50% of the Company’s actual cost of Mr. Lo’s salary, bonus and benefits during that period. |

| (8) | Effective October 1, 2018, Mr. Lo began to provide part-time (65% FTE) services to the Company at an annual salary of C$150,000. |

| (9) | Ms. McLeod was also the Chief Legal Officer and Corporate Secretary of Mason Resources until its acquisition by Hudbay. The Company is Ms. McLeod’s employer and was responsible for paying 100% of Ms. McLeod’s salary for her services to both the Company and Mason Resources, which is reported in “Salary” above. Pursuant to the Administrative Services Agreement between the Company and Mason Resources, between December 1, 2018 and December 19, 2018 (the termination of the Administrative Services Agreement), the Company provided Mason Resources with access to and the use of 50% of Ms. McLeod’s time, and Mason Resources paid the Company 50% of the Company’s actual cost of Ms. McLeod’s salary, bonus and benefits during that period. |

| (10) | The share-based awards (DSUs) may not vest or be redeemed prior to the Company obtaining shareholder approval of the DSU Plan and ratification of the DSU grants. If shareholders do not approve the DSU Plan and ratify the DSU grants at the Meeting, the DSUs that have been granted will be null and void and will be deemed to have been rescinded. |

The following table provides the exchange rates used to convert the value of the option-based awards from Canadian dollars to U.S. dollars as reported above.

| Name | Date of Grant | Expiry Date | Exercise Price (C$) | Options Granted | Exchange Rates to US$ |

| Stephen Scott | 8-Dec-20 | 7-Dec-25 | $0.51 | 350,000 | C$1.28/US$1 |

| 10-Dec-19 | 9-Dec-24 | $0.365 | 500,000 | C$1.30/US$1 |

| 19-Dec-18 | 18-Dec-23 | $0.55 | 500,000 | C$1.36/US$1 |

| Duane Lo | 8-Dec-20 | 7-Dec-25 | $0.51 | 225,000 | C$1.28/US$1 |

| 10-Dec-19 | 9-Dec-24 | $0.365 | 250,000 | C$1.30/US$1 |

| 19-Dec-18 | 18-Dec-23 | $0.55 | 250,000 | C$1.36/US$1 |

| Susan McLeod | 8-Dec-20 | 7-Dec-25 | $0.51 | 225,000 | C$1.28/US$1 |

| 10-Dec-19 | 9-Dec-24 | $0.365 | 250,000 | C$1.30/US$1 |

| 19-Dec-18 | 18-Dec-23 | $0.55 | 250,000 | C$1.36/US$1 |

The Company employs Stephen Scott as President and CEO under an employment agreement dated April 1, 2016, as amended. Under his employment agreement, Mr. Scott is required to provide the Company with one month’s prior notice in the event he wishes to resign. The Company may terminate his employment without cause by providing him with 18 months’ working notice, or an amount equal to the salary Mr. Scott otherwise would receive over the working notice period (or a combination thereof). In the event Mr. Scott’s employment is terminated without cause or he resigns for Good Reason (as defined below) within the one-year period following a Change of Control (as defined below), Mr. Scott will be entitled to 24 months’ salary and the aggregate amount of all other remuneration, bonuses and benefits that he would otherwise have received over the ensuing 24-month period. See “Termination and Change of Control Benefits” below.

The Company employs Duane Lo part-time as Chief Financial Officer under an employment agreement dated November 1, 2016, as amended. Mr. Lo is required to provide the Company with one month’s prior notice in the event he wishes to resign. The Company may terminate his employment without cause by providing him with six months’ working notice plus an additional month of working notice for each year of employment completed, to a maximum of twelve months’ working notice, or an amount equal to the salary Mr. Lo otherwise would receive over the working notice period (or a combination thereof). In the event Mr. Lo’s employment is terminated without cause or he resigns for Good Reason within the one year period following a Change of Control, Mr. Lo will be entitled to a lump sum amount equal to 18 months’ salary (calculated using his annualized salary based on full-time employment) and the aggregate amount of all other remuneration, bonuses and benefits that he would otherwise have received over the ensuing 18-month period (collectively, the “Lo Severance Amount”). See “Termination and Change of Control Benefits” below.

The Company employs Susan McLeod as Vice President, Legal Affairs and Corporate Secretary under an employment agreement dated September 21, 2010, as amended. Ms. McLeod is required to provide the Company with one month’s prior notice in the event she wishes to resign. The Company may terminate her employment without cause by providing her with a lump sum amount equal to 18 months’ salary and the aggregate amount of all other remuneration, bonuses and benefits that she would otherwise have received over the ensuing 18-month period (collectively, the “McLeod Severance Amount”). Ms. McLeod will be entitled to the McLeod Severance Amount in the event she elects to terminate her employment within 90 days following a Change of Control or as a result of conditions that amount to constructive dismissal. See “Termination and Change of Control Benefits” below.

Incentive Plan Awards

The following table is a summary of all option-based awards and share-based awards to the NEOs that were outstanding at the end of the most recently completed financial year.

| | Option-based Awards | Share-based Awards |

| Name | Number of Securities underlying unexercised options

(#) | Option exercise price (C$) | Option expiration date | Value of unexercised in-the-money options

(C$)(1) | Number of shares or units of shares that have not vested

(#) | Market or payout value of share-based awards that have not vested

(C$)(3) | Market or payout value of vested share-based awards not paid out or distributed ($) |

| Stephen Scott | 400,000 | $0.36(2) | November 21, 2021 | $80,000 | Nil | Nil | Nil |

| 325,000 | $0.52 | October 15, 2022 | $13,000 | Nil | Nil | Nil |

| 500,000 | $0.55 | December 18, 2023 | $5,000 | Nil | Nil | Nil |

| 500,000 | $0.365 | December 9, 2024 | $97,500 | Nil | Nil | Nil |

| 350,000 | $0.51 | December 7, 2025 | $17,500 | 80,000 | $44,800 | Nil |

| Duane Lo | 100,000 | $0.33(2) | March 31, 2021 | $23,000 | Nil | Nil | Nil |

| 250,000 | $0.36(2) | November 21, 2021 | $50,000 | Nil | Nil | Nil |

| 200,000 | $0.52 | October 15, 2022 | $8,000 | Nil | Nil | Nil |

| 250,000 | $0.55 | December 18, 2023 | $2,500 | Nil | Nil | Nil |

| 250,000 | $0.365 | December 9, 2024 | $48,750 | Nil | Nil | Nil |

| 225,000 | $0.51 | December 7, 2025 | $11,250 | 60,000 | $33,600 | Nil |

| Susan McLeod | 200,000 | $0.36(2) | November 21, 2021 | $40,000 | Nil | Nil | Nil |

| 225,000 | $0.52 | October 15, 2022 | $9,000 | Nil | Nil | Nil |

| 250,000 | $0.55 | December 18, 2023 | $2,500 | Nil | Nil | Nil |

| 250,000 | $0.365 | December 9, 2024 | $48,750 | Nil | Nil | Nil |

| 225,000 | $0.51 | December 7, 2025 | $11,250 | 60,000 | $33,600 | Nil |

| (1) | Calculated using the closing price of the Company’s common shares on the TSX on December 31, 2020 (being the last trading day of 2020) of C$0.56 and subtracting the exercise price of in-the-money options. |