Exhibit 99.2

|

Management’s Discussion and Analysis Third Quarter Ended September 30, 2021 (Expressed in United States dollars, except per share amounts and where otherwise noted) |

November 12, 2021

This Management’s Discussion and Analysis ("MD&A") should be read in conjunction with the condensed consolidated interim financial statements for the period ended September 30, 2021 and related notes thereto which have been prepared in accordance with IFRS 34, Interim Financial Reporting of the International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, as well as the annual audited consolidated financial statements for the year ended December 31, 2020, which are in accordance with IFRS, and the related MD&A. References to "Entrée" and the "Company" are to Entrée Resources Ltd. and/or one or more of its wholly-owned subsidiaries. For further information on the Company, reference should be made to its continuous disclosure (including its most recently filed annual information form ("AIF")), which is available on SEDAR at www.sedar.com. Information is also available on the Company’s website at www.EntreeResourcesLtd.com. Information on risks associated with investing in the Company’s securities is contained in the Company’s most recently filed AIF. Technical and scientific information under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") concerning the Company’s material property, including information about mineral resources and reserves, is contained in the Company’s most recently filed AIF and in its technical report titled "Entrée/Oyu Tolgoi Joint Venture Project, Mongolia, NI 43-101 Technical Report" with an effective date of October 8, 2021 prepared by Wood Canada Limited ("Wood").

Q3 2021 HIGHLIGHTS

Entrée/Oyu Tolgoi JV Property

On October 21, 2021, Entrée reported it had filed an amended Technical Report ("2021 Technical Report") for its interest in the Entrée/Oyu Tolgoi joint venture property in Mongolia ("Entrée/Oyu Tolgoi JV Property"). The 2021 Technical Report has an original effective date of May 17, 2021, and an amended effective date of October 8, 2021.

| • | Updated information provided by Entrée’s joint venture partner Oyu Tolgoi LLC ("OTLLC") on the concentrate tonnes and grade to be produced from the first lift ("Lift 1") of the Hugo North Extension copper-gold deposit resulted in changes to certain financial results and outputs for the Hugo North Extension Lift 1 Feasibility Study ("2021 Reserve Case"). |

| • | 2021 Reserve Case after-tax NPV(8%) increased 15% from $114 million to $131 million as a result of an increase in Hugo North Extension Lift 1 payable copper in concentrate. |

| • | There are no changes to the Preliminary Economic Assessment ("2021 PEA") on a conceptual second lift ("Lift 2") of the Hugo North Extension deposit or to the mineral resource or reserve estimates based on the updated information provided by OTLLC. |

Oyu Tolgoi Underground Development Update

The Oyu Tolgoi project in Mongolia includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by Entrée’s joint venture partner OTLLC and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC (see "Overview of Business" below). On November 2, 2021, OTLLC’s 66% shareholder Turquoise Hill provided an update on Oyu Tolgoi underground development:

| • | During the third quarter 2021, underground development progress continued to be significantly impacted by COVID-19 constraints on-site and in Mongolia, including restrictions on movement of both domestic and international expertise. |

| • | Mongolia continued to experience a significant number of COVID-19 cases, which continued to limit the ability of OTLLC to maintain normal roster changes for workers. Average workforce numbers remained below 50% of planned requirements. OTLLC expects a return to normal workforce numbers by the end of 2021. |

| • | All workers at the Oyu Tolgoi site have had two doses of vaccine, and a third dose program is well advanced. |

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| • | The scheduled mid-2021 commencement of the undercut on the Oyu Tolgoi mining licence remains delayed pending resolution of certain non-technical undercut criteria. Turquoise Hill continues to engage Rio Tinto and various Mongolian governmental bodies in an effort to resolve outstanding issues. Turquoise Hill reported that together with Rio Tinto, it recently tabled a proposal to the Government of Mongolia which Turquoise Hill believes addresses all major outstanding issues while ensuring that OTLLC will continue to deliver compelling value to all partners. |

| • | Design optimization study work continues on Panels 1 and 2. The Hugo North Extension deposit is located at the northern portion of Panel 1. To support these studies, additional data is being collected from surface and underground drilling. This data is used to refine the structural and geotechnical models, which form the basis of the mine design. Although drilling has been hampered by COVID-19 cases and restrictions on the movement of people, Turquoise Hill reported that study work remains broadly on schedule, with the Panel 1 study scheduled for completion in early 2023. |

| • | Progress on Shafts 3 and 4 has been impacted by quarantine requirements and international travel restrictions related to COVID-19. No significant development progress was made during the third quarter 2021. Shafts 3 and 4 are required to provide ventilation to support production from Panels 1 and 2 during ramp up to 95,000 tonnes per day ("tpd"). OTLLC has advised Turquoise Hill that a 9-month delay on Shafts 3 and 4 is currently forecast. Commencement of Panel 1 is currently forecast to occur approximately 11 months later than the Definitive Estimate. Efforts continue to minimize the delays to Panels 1 and 2 due to ventilation constraints ahead of commissioning of Shafts 3 and 4. Sinking of Shaft 4 recommenced in mid-October and preparatory work for Shaft 3 is continuing. |

| • | At the end of the third quarter 2021, cumulative underground development progress was 60,085 equivalent metres with cumulative conveyor to surface advancement of 15,174 equivalent metres. Turquoise Hill anticipates that development rates will continue to be impacted by COVID-19 restrictions and controls into the fourth quarter 2021. |

| • | In September 2021, the updated Resources and Reserves ("RR19") was approved by the Minerals Council of Mongolia. OTLLC expects to submit the 2020 Oyu Tolgoi Feasibility Study ("OTFS20") for assessment once the RR19 registration process progresses further. |

Corporate

| • | Q3 2021 operating loss was $0.5 million compared to an operating loss of $0.4 million in Q3 2020. |

| • | Q3 2021 operating cash outflow before working capital was $0.5 million compared to $0.3 million in Q3 2020. |

| • | As at September 30, 2021, the cash balance was $6.7 million and the working capital balance was $6.7 million. |

| • | The Company recognizes the unprecedented situation surrounding the ongoing COVID-19 pandemic and is closely monitoring the effect of the COVID-19 pandemic on its business and operations and will continue to update the market on the impacts to the Company’s business and operations in relation to these extraordinary circumstances. |

| • | The 2021 Technical Report assumes first development production from Hugo North Extension Lift 1 in H2 2022. The Company continues to monitor the situation in Mongolia including with respect to possible delays to commencement of Panel 1. The Company will assess the potential impact of any delays as it becomes aware of them and will update the market accordingly. |

OVERVIEW OF BUSINESS

Entrée is a mineral resource company with interests in development and exploration properties in Mongolia, Peru and Australia.

The Company’s principal asset is its interest in the Entrée/Oyu Tolgoi JV Property - a carried 20% participating interest in two of the Oyu Tolgoi project deposits, and a carried 20% or 30% interest (depending on the depth of mineralization) in the surrounding large, underexplored, highly prospective land package located in the South Gobi region of Mongolia. Entrée’s joint venture partner, OTLLC, holds the remaining interest.

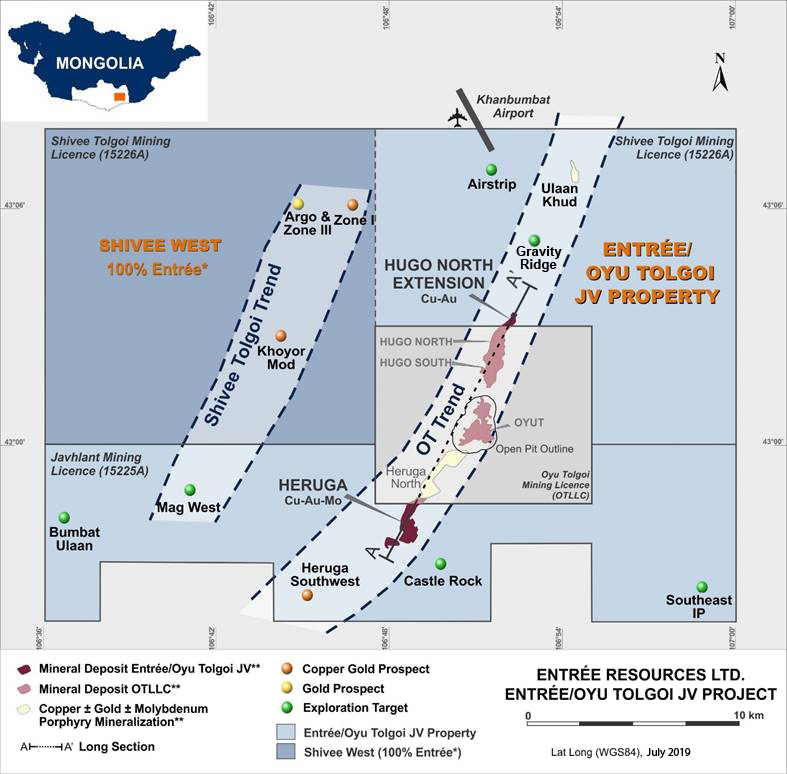

The Oyu Tolgoi project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held by OTLLC (66% Turquoise Hill and 34% the Government of Mongolia), and the Entrée/Oyu Tolgoi JV Property, which is a partnership between Entrée and OTLLC. The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence, and all of the Javhlant mining licence, which mostly surround the Oyu Tolgoi mining licence (Figure 1). Both the Shivee Tolgoi and Javhlant mining licences are held by Entrée. The terms of the Entrée/Oyu Tolgoi joint venture (the "Entrée/Oyu Tolgoi JV") state that Entrée has a 20% participating interest with respect to mineralization extracted from deeper than 560 metres below surface and a 30% participating interest with respect to mineralization extracted from above 560 metres depth.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

The Entrée/Oyu Tolgoi JV Property includes the Hugo North Extension copper-gold deposit (also referred to as "HNE") and the majority of the Heruga copper-gold-molybdenum deposit. The resources at Hugo North Extension include a Probable reserve, which is part of Lift 1 of the Oyu Tolgoi underground block cave mining operation. Lift 1 is in development by project operator Rio Tinto. By 2030, Oyu Tolgoi is expected to be the fourth largest copper mine in the world.

In addition to the Hugo North Extension copper-gold deposit, the Entrée/Oyu Tolgoi JV Property includes approximately 93% of the resource tonnes outlined at the Heruga copper-gold-molybdenum deposit and a large exploration land package, which together form a significant component of the overall Oyu Tolgoi project.

The Company also has the following assets:

| • | Blue Rose JV - a 56.53% interest in the Blue Rose joint venture ("Blue Rose JV") on minerals other than iron ore on Exploration Licence 6006 ("EL 6006") in the Olary Region of South Australia. The Blue Rose JV partners also have certain rights and royalties with respect to iron ore outlined or extracted from the area covered by EL 6006. |

| • | The right to Cañariaco Project Royalty Pass-Through Payments (see "Investments" section below). |

The Company’s corporate headquarters are located in Vancouver, British Columbia, Canada. Field operations are conducted out of local offices in Mongolia.

As at September 30, 2021 and the date of this MD&A, Rio Tinto Rio Tinto beneficially owns 31,981,129 common shares (including 14,539,333 common shares held by Turquoise Hill), or 16.9% (16.8% as at the date of this MD&A) of the outstanding shares of the Company. As at September 30, 2021, Sandstorm Gold Ltd. ("Sandstorm") owned 47,559,340 common shares, or 25.1% of the outstanding shares of the Company. As at the date of this MD&A, Sandstorm owns 48,955,240 common shares, or 25.7% of the outstanding shares of the Company.

Effective October 1, 2019, the Company voluntarily withdrew its common shares from listing on NYSE American and its common shares commenced trading on the OTCQB under the trading symbol "ERLFF". On April 24, 2006, the Company’s common shares began trading on the Toronto Stock Exchange ("TSX") and discontinued trading on the TSX Venture Exchange. The trading symbol remained "ETG".

OUTLOOK AND STRATEGY

The Company’s primary objective for the 2021 year is to work with other Oyu Tolgoi stakeholders to advance potential amendments to the joint venture agreement (the "Entrée/Oyu Tolgoi JVA") that currently governs the relationship between Entrée and OTLLC and upon finalization, transfer the Shivee Tolgoi and Javhlant mining licences to OTLLC as manager of the Entrée/Oyu Tolgoi JV. The form of Entrée/Oyu Tolgoi JVA was agreed between the parties in 2004, prior to the execution of the 2009 Oyu Tolgoi Investment Agreement among the Government of Mongolia, OTLLC, Rio Tinto and Turquoise Hill (the "Oyu Tolgoi Investment Agreement") and commencement of underground development. The Company currently is registered in Mongolia as the 100% ultimate holder of the Shivee Tolgoi and Javhlant mining licences.

The Company believes that amendments that align the interests of all stakeholders as they are now understood, would be in the best interests of all stakeholders, provided there is no net erosion of value to Entrée. No agreements have been finalized and there are no assurances agreements may be finalized in the future.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

ENTRÉE/OYU TOLGOI JV PROPERTY AND SHIVEE WEST PROPERTY - MONGOLIA

2021 Technical Report Highlights

The 2021 Technical Report on the Company’s interest in the Entrée/Oyu Tolgoi JV Property discusses the 2021 Reserve Case based on mineral reserves attributable to the Entrée/Oyu Tolgoi JV Lift 1 of the Hugo North Extension deposit. Lift 1 of Hugo North (including Hugo North Extension) is currently in development by project operator Rio Tinto as an underground block cave. The 2021 Technical Report contemplates first development production from Hugo North Extension in H2 2022. The 2021 Reserve Case aligns the Company’s disclosure with that of other Oyu Tolgoi project stakeholders with respect to OTLLC’s OTFS20 completed on Hugo North (including Hugo North Extension) Lift 1 (see Turquoise Hill’s press release dated July 2, 2020).

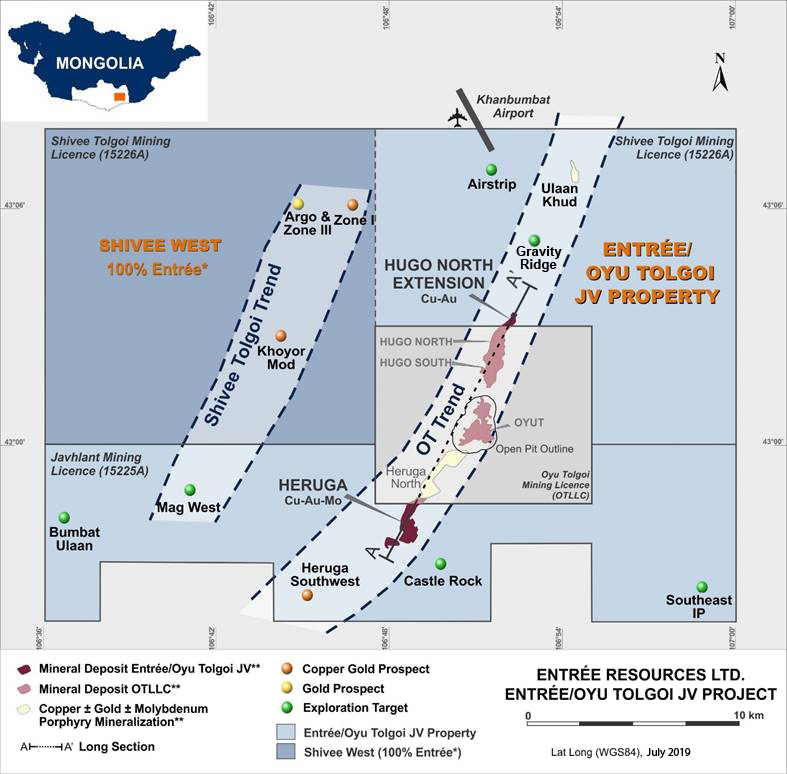

The 2021 Technical Report also discusses a 2021 PEA on a conceptual Lift 2 of the Hugo North Extension deposit. The 2021 PEA is based on Indicated and Inferred mineral resources from Lift 2, as the second potential phase of development and mining on the Hugo North Extension deposit. Lift 2 is directly below Lift 1 and continues further to the north (see Figure 2 below). There is no overlap in the mineral reserves from the 2021 Reserve Case and the mineral resources from the 2021 PEA. Development and capital decisions will be required for the eventual development of Lift 2 once production commences at Hugo North Extension Lift 1.

LOM highlights of the production and financial results from the 2021 Reserve Case and the 2021 PEA are summarized as follows:

| Entrée/Oyu Tolgoi JV Property | Units | 2021 Reserve Case (Lift 1) | 2021 PEA (Lift 2) |

| Attributable Financial Results | | | |

| Cash Flow, pre-tax | US$M | 449 | 1,982 |

| NPV(5%), after-tax | US$M | 185 | 541 |

| NPV(8%), after-tax | US$M | 131 | 306 |

| NPV(10%), after-tax | US$M | 104 | 213 |

| | | | |

| LOM Recovered Metal | | | |

| Copper Recovered | Mlb | 1,249 | 4,564 |

| Gold Recovered | koz | 549 | 2,025 |

| Silver Recovered | koz | 3,836 | 15,067 |

| | | | |

| LOM Processed Material | | | |

| Probable Reserve Feed | | 40 Mt @ 1.54% Cu, 0.53 g/t Au, 3.63 g/t Ag | - - |

| Indicated Resource Feed | | - - | 77.9 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) |

| Inferred Resource Feed | | - - | 87.8 Mt @ 1.35% Cu, 0.49 g/t Au, 3.6 g/t Ag (1.64% CuEq) |

Notes:

| 1. | Long term metal prices used in the net present value ("NPV") economic analyses for the 2021 Reserve Case and the 2021 PEA are: copper $3.25/lb, gold $1,591.00/oz, silver $21.08/oz. |

| 2. | Mineral reserves in the 2021 Reserve Case, and mineral resources in the 2021 PEA mine plan are reported on a 100% basis. |

| 3. | Entrée has a 20% interest in the above processed material and recovered metal. |

| 4. | The Mineral reserves that form the basis of the 2021 Reserve Case are from a separate portion of the Hugo North Extension deposit than the mineral resources in the 2021 PEA. |

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| 5. | Copper equivalent ("CuEq") is calculated as shown in the notes to the Entrée/Oyu Tolgoi JV Property Mineral Resources table below. |

| 6. | 2021 Reserve Case cash flows are discounted to the beginning of 2021. |

| 7. | 2021 PEA cash flows are discounted to the beginning of 2027, the beginning of Hugo North Lift 2 development. Attributable Entrée/Oyu Tolgoi JV production begins in 2031 and ramps up to stable production in 2043. Final Entrée/Oyu Tolgoi JV attributable production concludes in 2056. |

| 8. | The 2021 Reserve Case and 2021 PEA are exclusive of each other. |

| 9. | Indicated and Inferred resource average expected run-of-mine feed grade of 1.35% copper, 0.49 g/t gold, and 3.6 g/t silver (1.64% CuEq) includes dilution and mine losses. |

The economic analysis in the 2021 PEA is based on a conceptual mine plan and does not have as high a level of certainty as the 2021 Reserve Case. The 2021 PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the 2021 PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

In both the 2021 Reserve Case and the 2021 PEA, Entrée is only reporting the production and cash flows attributable to the Entrée/Oyu Tolgoi JV Property, not production and cash flows for other Oyu Tolgoi project areas owned 100% by OTLLC. The production and cash flows from the 2021 Reserve Case and the 2021 PEA are from separate parts of the Hugo North Extension deposit and there is no overlap of the mineralization.

Both the 2021 Reserve Case and the 2021 PEA are based on information supplied by OTLLC or reported within OTFS20. OTFS20 discusses the mine plan for Lift 1 of the Hugo North (including Hugo North Extension) underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. Rio Tinto is managing the construction and eventual operation of Lift 1, as well as any future development of Lift 2 or other deposits on the Entrée/Oyu Tolgoi JV Property.

The Lift 1 mine design presented in OTFS20 and the 2021 Reserve Case is subject to future refinements and updates. Hugo North (including Hugo North Extension) Lift 1 surface and underground drilling programs will support the evaluation by OTLLC of different design and sequencing options for Panels 1 and 2 as part of OTLLC’s planned Pre-Feasibility and Feasibility level work. The Hugo North Extension deposit is located at the northern portion of Panel 1. Entrée has not yet received any details or results of OTLLC’s surface and underground drilling programs.

Neither OTFS20 nor the results of the 2021 Reserve Case and 2021 PEA reflect the impacts of the COVID-19 pandemic or potential delays pending the resolution by OTLLC of certain non-technical issues, which are ongoing and continue to be assessed by OTLLC. In particular, progress on Shafts 3 and 4 has been impacted by quarantine requirements and international travel restrictions related to COVID-19. Shafts 3 and 4 are required to provide ventilation to support production from Panels 1 and 2 during ramp up to 95,000 tpd. According to Turquoise Hill, OTLLC is currently forecasting a 9-month delay to Shafts 3 and 4. Commencement of Panel 1 is currently forecast to occur approximately 11 months later than the Definitive Estimate. Efforts to minimize the delays to Panels 1 and 2 due to ventilation constraints ahead of commissioning of Shafts 3 and 4 continue.

On December 18, 2020, Turquoise Hill announced that a Definitive Estimate that refines the analysis in OTFS20 and broadly confirms the economics and assumptions presented therein has been completed and delivered to OTLLC by Rio Tinto. The Company has not received a copy of the Definitive Estimate and it was not reviewed or relied upon in the preparation of the 2021 Reserve Case or the 2021 PEA. According to Turquoise Hill, the Definitive Estimate assumes COVID-19 related restrictions in 2021 that are no more stringent than those experienced in September 2020. On October 14, 2021, Turquoise Hill reported that more stringent COVID-19 restrictions through the end of the third quarter 2021 have resulted in a cumulative increase of $140 million to the underground development capital estimate in the Definitive Estimate. This does not include impacts arising from outstanding non-technical criteria that must be resolved before the undercut can commence on the Oyu Tolgoi mining licence, and delayed commitments pending OTLLC board approval of the Definitive Estimate (including the resulting increase to the budget). In the event of a significant delay in commencement of the undercut, which was scheduled for mid-2021, the development costs and schedule in OTFS20 and the 2021 Reserve Case and 2021 PEA could be materially impacted.

Below are some of the key financial assumptions and outputs from the 2021 Reserve Case and the 2021 PEA. All figures shown for both cases are reported on a 100% Entrée/Oyu Tolgoi JV basis, unless otherwise noted. Both cases assume long term metal prices.

Key items per the 2021 Reserve Case outputs are as follows:

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| • | Assumes Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 1 will start in H2 2022 with the first draw bell in 2026, peak production in 2034, and final production in 2038. |

| • | 17-year Lift 1 LOM production (includes 4-years development production followed by 13-years block cave production). |

| • | Maximum production rate of approximately 25,000 tpd, which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd. |

| • | Total recovered metal over the LOM of Hugo North Extension Lift 1: 1,249,000 lbs copper, 549,000 oz gold, 3,836,000 oz silver. |

| • | Total direct development and sustaining capital expenditures of approximately $275.7 million ($55.1 million attributable to Entrée). |

| • | Entrée LOM average cash cost $1.57/lb payable copper. |

| • | Entrée LOM average cash costs after credits ("C1") $0.79/lb payable copper. |

| • | Entrée LOM average all-in sustaining costs ("AISC") $1.26/lb payable copper. |

Key items per the 2021 PEA outputs are as follows:

| • | Assumes Entrée/Oyu Tolgoi JV Property development production from Hugo North Extension Lift 2 to start in approximately 2034 with the first draw bell in 2038, peak production in 2047 and final production in 2055. |

| • | 22-year Lift 2 mine life (4-years development production and 18-years block cave production). |

| • | Maximum production rate of approximately 40,500 tpd, which is blended with production from OTLLC’s Oyut open pit deposit and Hugo North deposit to supply a maximum mill throughput rate of 125,000 tpd. |

| • | Total metal production over the LOM of Hugo North Extension Lift 2: 4,564,000 lbs copper, 2,025,000 oz gold, 15,067,000 oz silver. |

| • | Total direct development and sustaining capital expenditures of approximately $1,589.6 million ($319.7 million attributable to Entrée). |

| • | Entrée LOM average cash cost $1.10/lb payable copper. |

| • | Entrée LOM average C1 $0.30/lb payable copper. |

| • | Entrée LOM average AISC $0.92/lb payable copper. |

The 2021 Reserve Case and the 2021 PEA are mutually exclusive. If the 2021 Reserve Case is developed and brought into production, the mineralization from Hugo North Extension Lift 2 is not sterilized or reduced in tonnage or grades. In addition, the Heruga deposit, which is not included in either the 2021 Reserve Case or the 2021 PEA, provides a great deal of future potential and with further exploration and development could become a completely standalone underground operation, independent of other Oyu Tolgoi project underground development, and provide considerable flexibility for mine planning and development.

The 2021 Technical Report has been filed on SEDAR and is available for review under the Company’s profile on SEDAR (www.sedar.com) or on www.EntreeResourcesLtd.com.

Summary and Location of Project

The "Entrée/Oyu Tolgoi JV Project" (shown on Figure 1) comprises the Entrée/Oyu Tolgoi JV Property and the Shivee West Property (see "Shivee West Property Summary" below). The Entrée/Oyu Tolgoi JV Project completely surrounds OTLLC’s Oyu Tolgoi mining licence and forms a significant portion of the overall Oyu Tolgoi project area. Figure 1 also shows the main mineral deposits that form the Oyu Tolgoi trend of porphyry deposits and several priority exploration targets, including Airstrip, Bumbat Ulaan, Mag West, Gravity Ridge and Southwest IP.

The Entrée/Oyu Tolgoi JV Project is located within the Aimag (province) of Ömnögovi in the South Gobi region of Mongolia, about 570 kilometres ("km") south of the capital city of Ulaanbaatar and 80 km north of the border with China.

The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of the Shivee Tolgoi mining licence and all of the Javhlant mining licence, and hosts:

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| • | The Hugo North Extension copper-gold porphyry deposit (Lift 1 and Lift 2): |

| – | Lift 1 is the upper portion of the Hugo North Extension copper-gold porphyry deposit and forms the basis of the 2021 Reserve Case. It is the northern portion of the Hugo North Lift 1 underground block cave mine plan that is currently in development on the Oyu Tolgoi mining licence. The 2021 Reserve Case assumes initial development production will start on the Entrée/Oyu Tolgoi JV Property in H2 2022. Hugo North Extension Lift 1 Probable reserves include 40 million tonnes ("Mt") grading 1.54% copper, 0.53 grams per tonne ("g/t") gold, and 3.63 g/t silver. |

| – | Lift 2 is directly below and extends north beyond Lift 1 and is the next potential phase of underground mining on the Entrée/Oyu Tolgoi JV Property, once Lift 1 mining is complete. Mineral resources from Lift 2 form the basis of the 2021 PEA mine plan, which include 78 Mt (Indicated) and 88 Mt (Inferred). The average expected run-of-mine feed grade of 1.35% copper, 0.49 g/t gold, and 3.6 g/t silver (1.64% CuEq; see the notes to the Entrée/Oyu Tolgoi JV Property Mineral Resources table below) includes dilution and mine loss. |

| • | The Heruga copper-gold-molybdenum porphyry deposit is at the south end of the Oyu Tolgoi trend of porphyry deposits. Approximately 93% of the Heruga deposit occurs on the Entrée/Oyu Tolgoi JV Property where Inferred mineral resources include: 1,400 Mt grading 0.41% copper, 0.40 g/t gold, 1.5 g/t silver and 120 parts per million ("ppm") molybdenum (0.68% CuEq; see the notes to the Entrée/Oyu Tolgoi JV Property Mineral Resources table below). While Heruga is not included in the 2021 PEA, it provides opportunity for future exploration and potential development. |

| • | A large prospective land package. |

Entrée has a 20% or 30% (depending on the depth of mineralization) participating interest in the Entrée/Oyu Tolgoi JV with OTLLC holding the remaining 80% (or 70%) interest. OTLLC has a 100% interest in other Oyu Tolgoi project areas, including the Oyut open pit, which is currently in production, and the Hugo North and Hugo South deposits on the Oyu Tolgoi mining licence.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

Figure 1 - Entrée/Oyu Tolgoi JV Project

Notes:

| 1. | *The Shivee West Property is subject to a License Fees Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property. |

| 2. | ** Outline of mineralization projected to surface. |

| 3. | Entrée has a 20% participating interest in the Hugo North Extension and Heruga resources and reserves. |

Figure 1 shows the location of a north-northeast oriented, west-looking cross section (A-A’) through the 12.4 km-long trend of porphyry deposits that comprise the Oyu Tolgoi project. The cross section is shown on Figure 2 with the Entrée/Oyu Tolgoi JV Property to the right (north) and left (south) of the central portion, the Oyu Tolgoi mining licence, held 100% by OTLLC.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

Figure 2 - Cross Section Through the Oyu Tolgoi Trend of Porphyry Deposits

The 2021 Technical Report forms the basis for the scientific and technical information in this MD&A regarding the Entrée/Oyu Tolgoi JV Project. Portions of the information are based on assumptions, qualifications and procedures which are not fully described herein. Reference should be made to the Company’s AIF dated March 31, 2021 and to the full text of the 2021 Technical Report, which are available on the Company’s website (www.EntreeResourcesLtd.com) or on SEDAR (www.sedar.com).

Capital and Operating Costs

Under the terms of the Entrée/Oyu Tolgoi JV, OTLLC is responsible for 80% of all costs incurred on the Entrée/Oyu Tolgoi JV Property for the benefit of the Entrée/Oyu Tolgoi JV, including capital expenditures, and Entrée is responsible for the remaining 20%. In accordance with the terms of the Entrée/Oyu Tolgoi JVA, Entrée has elected to have OTLLC debt finance Entrée’s share of costs for approved programs and budgets, with interest accruing at OTLLC’s actual cost of capital or prime +2%, whichever is less, at the date of the advance. Debt repayment may be made in whole or in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products. Available cash flow means all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of Entrée/Oyu Tolgoi JV activities for the month that are operating costs under Canadian generally-accepted accounting principles.

The following is a description of how Entrée recognizes its share of Oyu Tolgoi project capital costs, specifically, the timing of recognition under the terms of the Entrée/Oyu Tolgoi JVA and generally accepted accounting principles.

Under the terms of the Entrée/Oyu Tolgoi JVA, any mill, smelter and other processing facilities and related infrastructure will be owned exclusively by OTLLC and not by Entrée. Mill feed from the Entrée/Oyu Tolgoi JV Property will be transported to the concentrator and processed at cost (using industry standards for calculation of cost including an amortization of capital costs). Underground infrastructure on the Oyu Tolgoi mining licence is also owned exclusively by OTLLC, although the Entrée/Oyu Tolgoi JV will eventually share usage once underground development crosses onto the Entrée/Oyu Tolgoi JV Property. As a result of this, Entrée recognizes those capital costs incurred by OTLLC on the Oyu Tolgoi mining licence as an amortization charge for capital costs that will be calculated in accordance with Canadian generally accepted accounting principles determined yearly based on the estimated tonnes of concentrate produced for Entrée’s account during that year relative to the estimated total life-of-mine concentrate to be produced (for processing facilities and related infrastructure), or the estimated total life-of-mine tonnes to be milled from the relevant deposit(s) (in the case of underground infrastructure). The charge is made to Entrée’s operating account when the Entrée/Oyu Tolgoi JV mine production is actually milled.

For direct capital cost expenditures on the Entrée/Oyu Tolgoi JV Property, Entrée will recognize its proportionate share of costs at the time of actual expenditure.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

The capital and operating costs in the 2021 Reserve Case are based on estimates prepared for OTFS20 or information provided by OTLLC. Capital cost and sustaining cost estimates in the 2021 PEA were prepared as separate and independent estimates by OTLLC. Wood reviewed the estimates and accepts them as reasonable.

The cash flows in the 2021 Reserve Case and 2021 PEA are based on information provided by OTLLC, including mining schedules and annual capital and operating cost estimates, as well as Entrée’s interpretation of the commercial terms applicable to the Entrée/Oyu Tolgoi JV, and certain assumptions regarding taxes and royalties. The cash flows have not been reviewed or endorsed by OTLLC. There can be no assurance that OTLLC or its shareholders will not interpret certain terms or conditions or attempt to renegotiate some or all of the material terms governing the joint venture relationship, in a manner which could have an adverse effect on Entrée’s future cash flow and financial condition.

The cash flows also assume that Entrée will ultimately have the benefit of the standard royalty rate of 5% of sales value, payable by OTLLC under the Oyu Tolgoi Investment Agreement. Unless and until Entrée finalizes agreements with the Government of Mongolia or other Oyu Tolgoi stakeholders, there can be no assurance that the Entrée/Oyu Tolgoi JV will not be subject to additional taxes and royalties, such as the surtax royalty which came into effect in Mongolia on January 1, 2011, which could have an adverse effect on Entrée’s future cash flow and financial condition. In the course of finalizing such agreements, Entrée may have to make certain concessions, including with respect to the economic benefit of Entrée’s interest in the Entrée/Oyu Tolgoi JV Property, Entrée’s direct or indirect participating interest in the Entrée/Oyu Tolgoi JV or the application of a special royalty (not to exceed 5%) to Entrée’s share of the Entrée/Oyu Tolgoi JV Property mineralization or otherwise.

2021 Reserve Case Capital and Operating Costs

Amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence for the 2021 Reserve Case are summarized as follows:

| | | 2021 Reserve Case | |

| Description | Unit | Entrée/Oyu

Tolgoi JV | Entrée 20%

Attributable | |

| |

| Amortization Charges for OTLLC Capital Costs | | | | |

| Hugo North Lift #1 U/G Construction | $ M | 574.5 | 114.9 | |

| Infrastructure & Central Heating Plant | $ M | 58.9 | 11.8 | |

| Tailings Storage Facility and Infrastructure Sustaining Capital | $ M | 39.0 | 7.8 | |

| Concentrator Sustaining Capital | $ M | 9.1 | 1.8 | |

| Concentrator Expansion | $ M | 19.6 | 3.9 | |

| Total Facilities Capital | $ M | 701.0 | 140.2 | |

| | | | | | |

Notes: OTLLC capital costs are inclusive of indirect costs, Mongolian custom duties and VAT and contingency. Figures have been rounded as required by reporting guidelines and may result in apparent summation differences.

The total 2021 Reserve Case underground mine development cost is estimated to be $275.7 million, of which $55.1 million is Entrée’s attributable portion. The 2021 Reserve Case has incorporated a capital expenditure contingency of 15.1%. The overall accuracy of the capital cost estimates is within ±20%.

The average LOM operating costs for the Entrée/Oyu Tolgoi JV Property 2021 Reserve Case (including amortization charges for capital costs incurred by OTLLC on the Oyu Tolgoi mining licence) are as follows:

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| Description | Unit | 2021 Reserve

Case |

| Mining | $/t processed | 8.75 |

| Processing | $/t processed | 7.44 |

| Infrastructure and Other Operating | $/t processed | 2.32 |

| Amortized Mining Costs | $/t processed | 15.93 |

| Amortized Process Costs | $/t processed | 0.72 |

| Amortized Tailings Costs | $/t processed | 0.98 |

| Total Refining & Transportation Costs | $/t processed | 8.36 |

| Total Operating Expenditure | $/t processed | 44.51 |

| Administration Charge (2% during development; 2.5% during production) and annual licence fees | $/t processed | 1.50 |

| Total | $/t processed | 46.01 |

Note: Figures have been rounded as required by reporting guidelines and may result in apparent summation differences.

Mine site cash costs are shown in the following table. Cash costs are those costs relating to the direct operating costs of the mine site, including mining, concentration, tailings, operational support costs, infrastructure, smelting and refining and administration fees. Total cash costs after credits (C1 costs) are the cash costs less the revenue from the gold and silver by-products. The all-in sustaining cost (AISC) is calculated according to World Gold Council guidance. It is the C1 costs plus mineral royalty and capital costs. AISC costs exclude income tax and financing charges. The underground mining operating cost estimates have incorporated a 5.6% contingency. The sustaining capital costs includes a 7.45% contingency.

| Description | Unit | 2021 Reserve Case

Average |

| Mine site cash cost | $/lb payable copper | 1.29 |

| TC/RC, royalties and transport | $/lb payable copper | 0.29 |

| Total cash costs before credits | $/lb payable copper | 1.57 |

| Gold credits | $/lb payable copper | (0.72) |

| Silver credits | $/lb payable copper | (0.06) |

| Total cash costs after credits | $/lb payable copper | 0.79 |

| Total all-in sustaining costs after credits | $/lb payable copper | 1.26 |

Notes: TC/RC = treatment and refining charges. Figures have been rounded as required by reporting guidelines and may result in apparent summation differences.

Mineral Resources and Mineral Reserves - Entrée/Oyu Tolgoi JV Property

The following Entrée/Oyu Tolgoi JV Property mineral resource estimates reported in the 2021 Technical Report for the Hugo North Extension and Heruga deposits have an effective date of March 31, 2021. Mineral resources for the Hugo North Extension deposit are reported inclusive of those mineral resources that were converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| Entrée/Oyu Tolgoi JV Property - Mineral Resources |

| Classification | Tonnage (Mt) | Cu (%) | Au (g/t) | Ag (g/t) | Mo (ppm) | CuEq (%) | Contained Metal |

Cu (Mlb) | Au (Koz) | Ag (Koz) | Mo (Mlb) |

| Hugo North Extension (>0.41% CuEq Cut-Off) |

| Indicated | 120 | 1.70 | 0.58 | 4.3 | n/a | 2.04 | 4,500 | 2,200 | 16,000 | n/a |

| Inferred | 167 | 1.02 | 0.36 | 2.8 | n/a | 1.23 | 3,800 | 1,900 | 15,000 | n/a |

| Heruga (>0.41% CuEq Cut-Off) |

| Inferred | 1,400 | 0.41 | 0.40 | 1.5 | 120 | 0.68 | 13,000 | 18,000 | 66,000 | 370 |

Notes:

| 1. | Mineral resources have an effective date of March 31, 2021. |

| 2. | Metal prices used for CuEq and cut-off grade calculation for both Hugo North Extension and Heruga are: $3.08/lb copper, $1,292.00/oz gold, $19.00/oz silver and $10.00/lb molybdenum (Heruga only). Metallurgical recoveries used for CuEq and cut-off grade calculation at Hugo North Extension are 93% for copper, 80% for gold and 81% for silver. Metallurgical recoveries used for CuEq and cut-off grade calculation at Heruga are 82% for copper, 73% for gold, 78% for silver and 60% for molybdenum. |

| 3. | Mineral resources at Hugo North Extension are constrained within a conceptual mining shape constructed at a nominal 0.50% CuEq grade and above a CuEq grade of 0.41% CuEq. The CuEq formula is CuEq = Cu + ((Au * 35.7175) + (Ag * 0.5773)) / 67.9023 taking into account differentials between metallurgical performance and price for copper, gold and silver. |

| 4. | The overall geometry and depth of the Heruga deposit make it amenable to underground mass mining methods. Mineral resources are stated above a CuEq grade. The CuEq formula is CuEq = Cu + ((Au * 37.0952) + (Ag * 0.5810) + (Mo * 0.0161)) / 67.9023 taking into account differentials between metallurgical performance and price for copper, gold, silver and molybdenum. |

| 5. | A CuEq break-even cut-off grade of 0.41% CuEq for Hugo North Extension mineralization and covers mining, processing and G&A operating cost and the cost of primary and secondary block cave mine development. |

| 6. | A CuEq break-even cut-off grade of 0.41% CuEq is used for the Heruga mineralization and covers mining, processing and G&A operating cost and the cost of primary and secondary block cave mine development. |

| 7. | Mineral resources are stated as in situ with no consideration for planned or unplanned external mining dilution. |

| 8. | Mineral resources are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 9. | Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences. |

Entrée/Oyu Tolgoi Mineral Reserves

Entrée/Oyu Tolgoi JV Property mineral reserves are contained within the Hugo North Extension Lift 1 block cave mining plan. The mine design work on Hugo North Lift 1, including the Hugo North Extension, was prepared by OTLLC and was used as the basis for OTFS20. The mineral reserve estimate is based on what is deemed minable when considering factors such as the footprint cut-off grade, the draw column shut-off grade, maximum height of draw, consideration of planned dilution and internal waste rock.

The mineral reserve estimate only considers mineral resources in the Indicated category and engineering that has been carried out to a Feasibility level or better to state the underground mineral reserve. There is no Measured mineral resource currently estimated within the Hugo North Extension deposit. Copper and gold grades for the Inferred mineral resources within the block cave shell were set to zero and such material was assumed to be dilution. The block cave shell was defined by a $17.84/t NSR. Future mine planning studies may examine lower shut-offs.

The following Entrée/Oyu Tolgoi JV Property Hugo North Extension Lift 1 mineral reserve estimate has an effective date of May 15, 2021:

Entrée/Oyu Tolgoi JV Property - Mineral Reserve Hugo North Extension Lift 1 |

| Classification | Tonnage | NSR | Cu | Au | Ag | Contained Metal |

| (Mt) | ($/t) | (%) | (g/t) | (g/t) | Cu (Mlb) | Au (Koz) | Ag (Koz) |

| Probable | 40 | 97.52 | 1.5 | 0.53 | 3.63 | 1,340 | 676 | 4,613 |

Notes:

| 1. | Mineral reserves have an effective date of May 15, 2021. |

| 2. | For the underground block cave, all Indicated mineral resources within the cave outline were converted to Probable mineral reserves. No Proven mineral reserves have been estimated. The estimation includes low-grade Indicated mineral resources and Inferred mineral resource assigned zero grade that is treated as dilution. |

| 3. | A column height shut-off NSR of $17.84/t was used to define the footprint and column heights. The NSR calculation assumed metal prices of $3.08/lb Cu, $1,292.00/oz Au, and $19.00/oz Ag. The NSR was calculated with assumptions for smelter refining and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries, and royalties using OTLLC’s Base Data Template 38. Mineral reserves are reported on a 100% basis. OTLLC has a participating interest of 80%, and Entrée has a participating interest of 20%. Notwithstanding the foregoing, in respect of products extracted from the Entrée/Oyu Tolgoi JV Property pursuant to mining carried out at depths from surface to 560 metres below surface, the participating interest of OTLLC is 70% and the participating interest of Entrée is 30%. |

| 4. | Numbers have been rounded as required by reporting guidelines and may result in apparent summation differences. |

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

Shivee West Property Summary

The Shivee West Property comprises the northwest portion of the Entrée/Oyu Tolgoi JV Project and adjoins the Entrée/Oyu Tolgoi JV Property and OTLLC’s Oyu Tolgoi mining licence (Figure 1).

To date, no economic zones of precious or base metals mineralization have been outlined on the Shivee West Property. However, zones of gold and copper mineralization have previously been identified at Zone III/Argo Zone and Khoyor Mod. There has been no drilling on the ground since 2011, and no exploration work has been completed since 2012. In 2015, in light of the ongoing requirement to pay approximately $350,000 annually in licence fees for the Shivee West Property and a determination that no further exploration work would likely be undertaken in the near future, Entrée began to examine options to reduce expenditures in Mongolia. These options included reducing the area of the mining licence, looking for a purchaser or partner for the Shivee West Property, and rolling the ground into the Entrée/Oyu Tolgoi JV. Management determined that it was in the best interests of Entrée to roll the Shivee West Property into the Entrée/Oyu Tolgoi JV, and Entrée entered into a License Fees Agreement with OTLLC on October 1, 2015. The License Fees Agreement provides the parties will use their best efforts to amend the terms of the Entrée/Oyu Tolgoi JVA to include the Shivee West Property in the definition of Entrée/Oyu Tolgoi JV Property. Entrée determined that rolling the Shivee West Property into the Entrée/Oyu Tolgoi JV would provide the joint venture partners with continued security of tenure; Entrée shareholders would continue to benefit from any exploration or development that the Entrée/Oyu Tolgoi JV management committee approves on the Shivee West Property; and Entrée would no longer have to pay licence fees, as the parties agreed that the licence fees would be for the account of each joint venture participant in proportion to their respective interests, with OTLLC contributing Entrée’s 20% share charging interest at prime plus 2%. To date, no amended Entrée/Oyu Tolgoi JVA has been entered into and Entrée retains a 100% interest in the Shivee West Property.

Underground Development Progress

Oyu Tolgoi Project

On November 2, 2021, Turquoise Hill provided an update regarding the Oyu Tolgoi project.

COVID-19 impacts in Mongolia are ongoing. During the third quarter 2021, underground development progress continued to be significantly impacted by COVID-19 constraints on-site and in Mongolia, including restrictions on movement of both domestic and international expertise.

Mongolia continued to experience a significant number of COVID-19 cases, which continued to limit the ability of OTLLC to maintain normal roster changes for workers. Average workforce numbers remained below 50% of planned requirements. OTLLC expects a return to normal workforce numbers by the end of 2021. All workers at the Oyu Tolgoi site have had two doses of vaccine, and a third dose program is well advanced.

In the first quarter 2020, OTLLC submitted a resources and reserves update (RR19) for registration as required pursuant to local regulatory requirements in Mongolia. On July 2, 2020, Turquoise Hill announced the completion of OTFS20, which incorporates a new block cave mine design for Hugo North Lift 1 Panel 0 previously announced by Turquoise Hill on May 13, 2020. In September 2021, RR19 was approved by the Minerals Council of Mongolia, and OTLLC expects to submit OTFS20 for assessment once the RR19 registration process proceeds further.

The Hugo North (including Hugo North Extension) Lift 1 mine plan incorporates the development of three panels, and in order to reach the full sustainable production rate of 95,000 tpd from the underground operations all three panels need to be in production. The Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property is located at the northern portion of Panel 1.

The new block cave design incorporated in OTFS20 varies from the previous design through:

| • | 120 metre structural pillars included to the north and south of Panel 0, protecting ore handling infrastructure and increasing the optionality of sequencing Panel 1 and Panel 2; |

| • | Ore handling facilities moved into the structural pillars, improving excavation stability; |

| • | Drawpoint spacing updated from 28 metres x 15 metres to 31 metres x 18 metres, improving extraction level stability; and |

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

| • | Modified panel initiation approach for Panel 0, minimizing stress damage to the extraction level. |

The Lift 1 mine design presented in OTFS20 and the 2021 Reserve Case is subject to future refinements and updates. OTLLC’s planned Pre-Feasibility and Feasibility level study work on Panels 1 and 2 is ongoing, with data collected from Hugo North (including Hugo North Extension) Lift 1 surface and underground drilling programs supporting OTLLC’s evaluation of different design and sequencing options for Panels 1 and 2. Although drilling has been hampered by COVID-19 cases and restrictions on the movement of people, Turquoise Hill reported that study work remains broadly on schedule, with the Panel 1 study scheduled for completion in early 2023. To date, OTLLC has not provided Entrée with any details or results of surface and underground drilling programs as they relate to the Entrée/Oyu Tolgoi JV Property.

Progress on Shafts 3 and 4 has been impacted by quarantine requirements and international travel restrictions related to COVID-19. No significant development progress was made during the third quarter 2021. Shafts 3 and 4 are required to provide ventilation to support production from Panels 1 and 2 during ramp up to 95,000 tpd. OTLLC has advised Turquoise Hill that a 9-month delay on Shafts 3 and 4 is currently forecast. Commencement of Panel 1 is currently forecast to occur approximately 11 months later than the Definitive Estimate. Efforts to minimize the delays to Panels 1 and 2 due to ventilation constraints ahead of Shafts 3 and 4 commissioning continue. Sinking of Shaft 4 recommenced in mid-October and preparatory work for Shaft 3 is continuing.

Commencement of the undercut on the Oyu Tolgoi mining licence, which had been scheduled for mid-2021, remains delayed pending resolution of certain non-technical undercut criteria. These criteria include the support of all OTLLC directors to increase the underground development capital investment and to commence discussions with project finance lenders, obtaining outstanding, required regulatory approvals and agreement on a pathway to meet Oyu Tolgoi’s long-term power requirements. Turquoise Hill reported that in the event the necessary additional investment to progress underground development is not supported by all directors of the OTLLC board by the end of November 2021, OTLLC will be at risk of having to slow down further work on the underground development. Turquoise Hill continues to engage Rio Tinto and various Mongolian governmental bodies to resolve the outstanding non-technical undercut criteria. Turquoise Hill reported that together with Rio Tinto, it recently tabled a proposal to the Government of Mongolia which Turquoise Hill believes addresses all major outstanding issues while ensuring that OTLLC will continue to deliver compelling value to all partners.

Turquoise Hill now expects sustainable production from Panel 0 on the Oyu Tolgoi mining licence to be delayed to H1 2023, broadly in line with the currently forecast 6-month delay to commencement of the undercut. According to Turquoise Hill, any significant further delay would negatively impact the underground project schedule, including the timing of sustainable production for Panel 0, the timing to commence Panel 2 and the timing and quantum of underground capital expenditure.

Despite COVID-19 restraints significantly impacting underground development progress during the third quarter 2021, breakthrough of the conveyor decline was achieved in August 2021, and OTLLC is forecasting breakthrough of the service decline in November 2021. Construction of Material Handling System 1 is almost complete. No-load commissioning commenced in the third quarter 2021 and is currently expected to be completed by the end of January 2022. Construction of the first on-footprint truck chute is well advanced and currently forecast to be completed by February 2022.

At the end of the third quarter 2021, cumulative underground development progress was 60,085 equivalent metres with cumulative conveyor to surface advancement of 15,174 equivalent metres. Turquoise Hill anticipates that development rates will continue to be impacted by COVID-19 restrictions and controls into the fourth quarter 2021.

On December 18, 2020, Turquoise Hill announced the completion and delivery by Rio Tinto of the Definitive Estimate, which refines the analysis contained in OTFS20. The results of the Definitive Estimate include a revised base case development capital cost of $6.75 billion for the new design, confirmation that sustainable first production from the Oyu Tolgoi mining licence is forecast to occur in October 2022, and verification that all surface infrastructure required for sustainable first production from Panel 0 on the Oyu Tolgoi mining licence is complete. The Definitive Estimate assumes COVID-19 related restrictions in 2021 that are no more stringent than those experienced in September 2020. On October 14, 2021, Turquoise Hill reported that the additional 2021 development cost impact of the known COVID-19 delays is estimated to be $140 million up to September 30, 2021. According to Turquoise Hill, this increase includes the currently known, incremental, time-related costs of COVID-19 restrictions. It does not include any impacts arising from associated schedule delays or delated commitments pending OTLLC board approval of the Definitive Estimate, which are still under assessment.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

On January 11, 2021, Turquoise Hill announced the Government of Mongolia has advised Rio Tinto that it is dissatisfied with the results of the Definitive Estimate, and the Government of Mongolia is concerned that the significant increase in the development costs of the Oyu Tolgoi project has eroded the economic benefits it anticipated to receive. The Government of Mongolia has stressed the importance of achieving a comprehensive solution that addresses both financial issues between OTLLC shareholders as well as economic and social issues of importance to Mongolia, such as water usage, tax payments, and social issues related to employees, in order to implement the Oyu Tolgoi project successfully. In particular, the Government of Mongolia has expressed its intention to initiate discussions with respect to the termination and replacement of the 2015 Oyu Tolgoi Underground Mine Development and Financing Plan (the "Mine Plan"). While acknowledging Oyu Tolgoi’s significant contributions to Mongolia, Turquoise Hill reported it continues to engage with the Government of Mongolia and remains open to improving the Mine Plan to deliver even greater benefits from Oyu Tolgoi to all stakeholders.

On April 9, 2021, Turquoise Hill announced that it has reached a binding Heads of Agreement with Rio Tinto on a funding plan to complete the construction of Lift 1 of the Oyu Tolgoi underground project, including Lift 1 of the Hugo North Extension deposit on the Entrée/Oyu Tolgoi JV Property. Successful implementation of the Heads of Agreement is subject to achieving alignment with the relevant stakeholders in addition to Rio Tinto (including existing lenders, any potential new lenders and the Government of Mongolia), market conditions and other factors. The Heads of Agreement addresses the then estimated remaining funding required of approximately $2.3 billion. Under the Heads of Agreement, the parties will pursue re-profiling of existing project debt to better align with the revised mine plan, project timing and cash flows to reduce the currently projected funding requirements of OTLLC by up to $1.4 billion. In addition, they will seek to raise up to $500 million in senior supplemental debt under the existing project financing arrangements from selected international financial institutions. Rio Tinto has agreed to address any potential shortfalls from the re-profiling and additional senior supplemental debt of up to $750 million by providing a senior co-lending facility on the same terms as OTLLC’s project financing. Turquoise Hill has also agreed to compete an equity offering of common shares for up to $500 million in the form of, and at Turquoise Hill’s discretion, either (i) a rights offering of common shares or (ii) a public offering or private placement of common shares, in either case sufficient to satisfy any remaining funding shortfall of up to $500 million within six months of the senior co-lending facility becoming available.

Turquoise Hill is reviewing preliminary information received from OTLLC that suggests Turquoise Hill’s base case estimated incremental funding requirement is now $3.6 billion. A significant delay to the initiation of the undercut on the Oyu Tolgoi mining licence would materially adversely impact the timing of expected cash flows from Panel 0 thereby increasing the amount of Turquoise Hill’s incremental funding requirement. This could also, in turn, adversely affect the ability of Turquoise Hill and OTLLC to obtain additional funding or re-profile existing debt as contemplated in the Heads of Agreement.

Oyu Tolgoi Power Supply

OTLLC currently sources power for the Oyu Tolgoi mine from China’s Inner Mongolian Western grid, via overhead power line, pursuant to back-to-back power purchase agreements with Mongolia’s National Power Transmission Grid JSC, the relevant Mongolian power authority, and Inner Mongolia Power International Cooperation Co., Ltd ("IMPIC"), the subsidiary of Inner Mongolia’s power grid company.

OTLLC is obliged under the Oyu Tolgoi Investment Agreement to secure a long-term domestic power source for the Oyu Tolgoi mine. The Power Source Framework Agreement ("PSFA") entered into between OTLLC and the Government of Mongolia on December 31, 2018 provides a binding framework and pathway for long-term power supply to the Oyu Tolgoi mine. The PSFA originally contemplated the construction of a coal-fired power plant at Tavan Tolgoi, which would be majority-owned by OTLLC and situated close to the Tavan Tolgoi coal mining district located approximately 150 km from the Oyu Tolgoi mine.

According to Turquoise Hill, on April 14, 2020, the Minister of Energy notified OTLLC of the Government’s decision to develop and fund a State-Owned Power Plant ("SOPP") to be located at the Tavan Tolgoi coal fields instead of an OTLLC led plant, which would supply power to the Oyu Tolgoi mine and potentially other regional mines.

On June 28, 2020, Turquoise Hill announced that the Government of Mongolia and OTLLC reached an agreement to prioritize SOPP in order to support the Government’s decision. The PSFA has been amended to reflect joint prioritization and progression of SOPP in accordance with and subject to agreed milestones. The agreed milestones in the amended PFSA include signing a power purchase agreement by March 31, 2021, commencement of construction by no later than July 1, 2021 and commissioning of SOPP within four years thereafter, and, negotiating an extension to the existing power import agreement by March 1, 2021, to ensure that there is no disruption to the power supply required to safeguard Oyu Tolgoi’s ongoing operations and development.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

If the milestones are not met as provided for in the amendment, then OTLLC will be entitled to select from and implement the alternative power solutions specified in the PSFA (as amended), including an OTLLC-led coal-fired power plant, the Mongolian grid and a primary renewables solution, and the Government of Mongolia would be obliged to support such decision.

The first three PSFA amendment milestones (execution of the extension of the existing power import agreement, execution of the SOPP power purchase agreement and commencement of construction) were not met by the original dates of March 1, 2021, March 31, 2021 and July 1, 2021, respectively.

The Ministry of Energy formally notified Rio Tinto and OTLLC on February 25, 2021 that the Government of Mongolia’s preference is to supply power to Oyu Tolgoi from the Central Energy System through a Mongolian grid Electricity Supply Agreement ("ESA"). According to Turquoise Hill, Rio Tinto and OTLLC have expressed willingness to consider Mongolian grid supply provided certain key conditions can be met, including the National Power Transmission Grid securing a suitable extension of the power import arrangements with IMPIC to ensure certainty of power supply to Oyu Tolgoi until such time as the Mongolian grid is able to deliver stable and reliable power to Oyu Tolgoi over the long term.

OTLLC continues to collaborate with the Government of Mongolia to ensure a secure, stable and reliable long-term power solution is implemented with an immediate focus on negotiating the ESA as well as extending the IMPIC supply arrangements prior to the commencement of the undercut.

Oyu Tolgoi Tax Assessment

On February 20, 2020, Turquoise Hill announced that OTLLC has been unable to reach a resolution of its previously announced dispute with the Mongolian Tax Authority with respect to a tax assessment for approximately $155 million relating to an audit on taxes imposed and paid by OTLLC between 2013 and 2015. OTLLC will be proceeding with the initiation of a formal international arbitration proceeding in accordance with the dispute resolution provisions in the Oyu Tolgoi Investment Agreement. Turquoise Hill remains of the opinion that OTLLC has paid all taxes and charges required to be paid under the Oyu Tolgoi Investment Agreement, the 2011 Amended and Restated Shareholders’ Agreement (the "Shareholders’ Agreement"), the Mine Plan and Mongolian law.

On December 23, 2020, Turquoise Hill announced that OTLLC has received, and is evaluating, a tax assessment for approximately $228 million cash tax from the Mongolian Tax Authority relating to an audit on taxes imposed and paid by OTLLC between 2016 and 2018. On January 11, 2021, Turquoise Hill announced that OTLLC has given notice of its intention to apply to the Tribunal in the arbitration for leave to amend its statement of claim to include the issues raised in the 2016-2018 tax assessment, as many of the matters raised are of a similar nature to the matters raised in the 2013-2015 tax assessment.

In February 2021, OTLLC received notices of payment from the Capital City tax department for the amounts disputed under the 2016-2018 tax assessment. In March 2021, OTLLC received notices of payment totalling $126 million relating to amounts disputed under the 2013-2015 tax assessment. Under Article 43.3 of the Mongolian General Tax Law, the amounts were due and paid by OTLLC within 10 business days from the date of the notices of payment. Under the same legislation, OTLLC is entitled to recover the amounts in the event of a favourable decision from the relevant dispute resolution authorities.

On May 3, 2021, Turquoise Hill announced that the Government of Mongolia filed its statement of defence together with a counterclaim seeking the rejection of OTLLC’s tax claims in their entirety. In the event OTLLC’s tax claims are not dismissed in their entirety, the Government of Mongolia is seeking in the counterclaim an alternative declaration that the Oyu Tolgoi Investment Agreement is void.

Negotiations to Resolve Non-Technical Undercut Criteria

Turquoise Hill reported that it continues to engage Rio Tinto and various Mongolian governmental bodies to resolve the remaining outstanding non-technical undercut criteria. Nevertheless, delayed resolution of outstanding issues, as well as the slowing of discussions as a result of the COVID-19 situation in Mongolia, will delay the expected timing for initiation of the undercut on the Oyu Tolgoi mining licence. Turquoise Hill advised that any significant further delay to the initiation of the undercut would result in further, unfavourable impacts to the underground project schedule, including the timing of sustainable production from Panel 0, the timing to commence Panel 2 and the timing and quantum of underground capital expenditure, all of which would adversely impact the timing of expected cash flows thereby further increasing the quantum of Turquoise Hill’s estimated incremental funding requirement. This could in turn adversely affect the ability of Turquoise Hill and OTLLC to obtain additional funding or re-profile existing debt as contemplated within the timeframe set out in the Heads of Agreement. Turquoise Hill further advised that in the event the necessary additional investment to progress underground development is not supported by all directors of the OTLLC board by the end of November 2021, OTLLC will be at risk of having to slow down further work on the underground development. Turquoise Hill remains committed to seeking resolution of outstanding issues and remains mobilized in Mongolia to continue discussions with the Government to progress timely resolution for the benefit of all stakeholders. Turquoise Hill reported that in conjunction with Rio Tinto, it recently tabled a proposal to the Government of Mongolia, which Turquoise Hill believes addresses all of the major outstanding issues while ensuring that OTLLC will continue to deliver compelling value to all partners.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

Q3 2021 Review

For the nine months ended September 30, 2021, Entrée expenses related to Mongolian operations consisted of costs in relation to the 2021 Technical Report and in-country administration expenses which were not significant.

BLUE ROSE JV - AUSTRALIA

Summary

Entrée has a 56.53% interest in the Blue Rose JV to explore for minerals other than iron ore on EL 6006, with Giralia Resources Pty Ltd, a subsidiary of Atlas Iron Pty Ltd (part of the Hancock Group of Companies), retaining a 43.47% interest. EL 6006, totalling 257 square kilometres, is located in the Olary Region of South Australia, 300 kilometres northeast of Adelaide and 130 kilometres west-southwest of Broken Hill.

The rights to explore for and develop iron ore on EL 6006 are held by Lodestone Mines Pty Ltd ("Lodestone"), which is also the licence holder. The Blue Rose JV partners were granted (a) the right to receive an additional payment(s) upon completion of an initial or subsequent iron ore resource estimate on EL 6006, to a maximum of A$2 million in aggregate; and (b) a royalty equal to 0.65% of the free on board value of iron ore product extracted and recovered from EL 6006. An additional A$285,000 must also be paid to the Blue Rose JV partners upon the commencement of commercial production.

The Braemar Iron Formation is the host rock to magnetite mineralisation on EL 6006. The Braemar Iron Formation is a meta-sedimentary iron siltstone, which is inherently soft. The mineralization within the Braemar Iron Formation forms a simple dipping tabular body with only minor faulting, folding and intrusives. Grades, thickness, dip, and outcropping geometry remain very consistent over kilometres of strike.

Q3 2021 Review

Expenditures in Q3 2021 were minimal and related to administrative costs in Australia.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

SUMMARY OF CONSOLIDATED FINANCIAL OPERATING RESULTS

Operating Results

The Company’s operating results for the three and nine months ended September 30 were:

| | Three months ended September 30 | | | Nine months ended September 30 |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Expenses | | | | | | | | |

| Project expenditures | | $ | 169 | | | $ | 59 | | | $ | 414 | | | $ | 173 | |

| General and administrative | | | 310 | | | | 286 | | | | 1,093 | | | | 993 | |

| Depreciation | | | 30 | | | | 25 | | | | 87 | | | | 76 | |

| Operating loss | | | 509 | | | | 370 | | | | 1,594 | | | | 1,242 | |

| Foreign exchange loss (gain) | | | 210 | | | | (155 | ) | | | 16 | | | | 162 | |

| Interest income | | | (5 | ) | | | (15 | ) | | | (23 | ) | | | (60 | ) |

| Interest expense | | | 88 | | | | 84 | | | | 259 | | | | 253 | |

| Loss from equity investee | | | 41 | | | | 37 | | | | 112 | | | | 126 | |

| Finance costs | | | 3 | | | | 5 | | | | 10 | | | | 15 | |

| Deferred revenue finance costs | | | 1,021 | | | | 869 | | | | 2,995 | | | | 2,563 | |

| Other | | | 9 | | | | — | | | | 9 | | | | — | |

| Loss for the period | | | 1,876 | | | | 1,195 | | | | 4,972 | | | | 4,301 | |

| Other comprehensive loss (income) | | | | | | | | | | | | | | | | |

| Foreign currency translation | | | 1,497 | | | | 1,043 | | | | (91 | ) | | | (1,169 | ) |

| Total comprehensive loss | | $ | 3,373 | | | $ | 2,238 | | | $ | 4,881 | | | $ | 3,132 | |

| Net loss per common share | | | | | | | | | | | | | | | | |

| Basic and fully diluted | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.02 | ) |

| Total assets | | $ | 7,311 | | | $ | 8,049 | | | $ | 7,311 | | | $ | 8,049 | |

| Total non-current liabilities | | $ | 61,220 | | | $ | 54,749 | | | $ | 61,220 | | | $ | 54,749 | |

Operating Loss:

During the three months ended September 30, 2021, the Company’s operating loss was $0.5 million compared to an operating loss of $0.4 million for the three months ended September 30, 2020.

Project expenditures in Q3 2021 were higher compared to Q3 2020 due to expenses in 2021 relating to the 2021 Technical Report and professional fees related to advancing potential amendments to the Entrée/Oyu Tolgoi JVA.

General and administration expenditures in Q3 2021 were higher than Q3 2020 due to cost impacts in relation to the strengthening of the C$ against the US dollar.

Depreciation costs were consistent in Q3 2021 compared to Q3 2020.

Holding costs on all other properties were insignificant.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

Non-operating Items:

The foreign exchange loss in Q3 2021 was primarily the result of movements between the C$ and US dollar as the Company holds its cash in both currencies and the loan payable is denominated in US dollars.

Interest expense was primarily related to the loan payable to OTLLC pursuant to the Entrée/Oyu Tolgoi JVA and is subject to a variable interest rate.

The amount recognized as a loss from equity investee is related to exploration costs on the Entrée/Oyu Tolgoi JV Property.

Deferred revenue finance costs are related to recording the non-cash finance costs associated with the deferred revenue balance, specifically the Sandstorm stream.

The total assets as at September 30, 2021 were lower than at September 30, 2020 due to a lower cash balance from operating activities. Total non-current liabilities have increased since September 30, 2020 due to recording the non-cash deferred revenue finance costs each quarter.

Quarterly Financial Data - 2 year historic trend

| | | Q3 21 | | Q2 21 | | Q1 21 | | Q4 20 | | Q3 20 | | Q2 20 | | Q1 20 | | Q4 19 |

| Project expenditures | | $ | 169 | | | $ | 158 | | | $ | 87 | | | $ | 41 | | | $ | 59 | | | $ | 80 | | | $ | 34 | | | $ | 39 | |

| General and administrative | | | 310 | | | | 444 | | | | 339 | | | | 437 | | | | 286 | | | | 387 | | | | 320 | | | | 402 | |

| Share-based compensation | | | — | | | | — | | | | — | | | | 538 | | | | — | | | | — | | | | — | | | | 339 | |

| Depreciation | | | 30 | | | | 27 | | | | 30 | | | | 22 | | | | 25 | | | | 25 | | | | 26 | | | | 25 | |

| Operating loss | | | 509 | | | | 629 | | | | 456 | | | | 1,038 | | | | 370 | | | | 492 | | | | 380 | | | | 805 | |

| Foreign exchange (gain) loss | | | 210 | | | | (101 | ) | | | (93 | ) | | | (358 | ) | | | (155 | ) | | | (315 | ) | | | 632 | | | | (137 | ) |

| Interest expense, net | | | 92 | | | | 76 | | | | 77 | | | | 65 | | | | 69 | | | | 61 | | | | 63 | | | | 50 | |

| Loss from equity investee | | | 41 | | | | 36 | | | | 35 | | | | 60 | | | | 37 | | | | 35 | | | | 54 | | | | 96 | |

| Deferred revenue finance costs | | | 1,021 | | | | 1,006 | | | | 968 | | | | 890 | | | | 869 | | | | 861 | | | | 833 | | | | 837 | |

| Finance costs | | | 3 | | | | 3 | | | | 4 | | | | 4 | | | | 5 | | | | 5 | | | | 5 | | | | 6 | |

| Net loss | | $ | 1,876 | | | $ | 1,649 | | | $ | 1,447 | | | $ | 1,699 | | | $ | 1,195 | | | $ | 1,139 | | | $ | 1,967 | | | $ | 1,657 | |

| Basic/diluted loss per share | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

| USD:CAD FX Rate(1) | | | 1.2741 | | | | 1.2394 | | | | 1.2575 | | | | 1.2732 | | | | 1.3339 | | | | 1.3628 | | | | 1.4187 | | | | 1.2988 | |

| 1. | USD:CAD foreign exchange rate was the quarter ended rate per the Bank of Canada. |

Project expenditures in Q3 2021 and Q2 2021 were higher compared to prior quarters due to expenses relating to the 2021 Technical Report and to professional fees related to advancing potential amendments to the Entrée/Oyu Tolgoi JVA.

General and administrative expenses in Q3 2021 were consistent to prior quarters. In Q2 2021 and Q4 2020, expenses were higher due mainly to compensation costs.

Share-based compensation expenditures in Q4 2020 included option and deferred share unit ("DSU") grants and Q4 2019 included option grants.

Interest expense, net, consists of accrued interest on the OTLLC loan payable, partially offset by interest income earned on invested cash.

The loss from equity investee was related to the Entrée/Oyu Tolgoi JV Property and fluctuations are due to exploration activity and foreign exchange changes.

Q3 2021 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted)

LIQUIDITY AND CAPITAL RESOURCES

| | | Three months ended

September 30 | | Nine months ended

September 30 |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Cash flows used in operating activities | | | | | | | | | | | | | | | | |

| - Before changes in non-cash working capital items | | $ | (464 | ) | | $ | (310 | ) | | $ | (1,488 | ) | | $ | (1,171 | ) |

| - After changes in non-cash working capital items | | | (679 | ) | | | (296 | ) | | | (1,447 | ) | | | (1,088 | ) |

| Cash flows from financing activities | | | 136 | | | | 3,196 | | | | 892 | | | | 3,151 | |

| Cash flows used in investing activities | | | (1 | ) | | | — | | | | (33 | ) | | | — | |

| Net cash (outflows) inflows | | | (544 | ) | | | 2,900 | | | | (588 | ) | | | 2,063 | |

| Effect of exchange rate changes on cash | | | (143 | ) | | | (44 | ) | | | (4 | ) | | | (41 | ) |

| Cash balance | | $ | 6,668 | | | $ | 7,402 | | | $ | 6,668 | | | $ | 7,402 | |

| Cash flows used in operating activities per share | | | | | | | | | | | | | | | | |

| - Before changes in non-cash working capital items | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

| - After changes in non-cash working capital items | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

Cash flows before changes in non-cash working capital items in Q3 2021 were higher than the same period in 2020 due to costs associated with professional fee expenses.

Cash flows from financing activities in Q3 2021 were due to funds received from warrant exercises. Cash flows from financing activities in Q3 2020 were due to funds received from a private placement.

Cash flows used in investing activities were immaterial in both Q3 2021 and Q3 2020.

The Company is an exploration stage company and has not generated positive cash flows from its operations. As a result, the Company has been dependent on equity and production-based financings for additional funding. Working capital on hand at September 30, 2021 was approximately $6.7 million. Management believes it has adequate financial resources to satisfy its obligations over the next 12-month period and beyond. The Company does not currently anticipate the need for additional funding during this time.

Loan Payable to Oyu Tolgoi LLC

Under the terms of the Entrée/Oyu Tolgoi JVA, the Company has elected to have OTLLC contribute funds to approved joint venture programs and budgets on the Company’s behalf, each such contribution to be treated as a non-recourse loan. Interest on each loan advance shall accrue at an annual rate equal to OTLLC’s actual cost of capital or the prime rate of the Royal Bank of Canada, plus two percent (2%) per annum, whichever is less, as at the date of the advance. The loan will be repayable by the Company monthly from ninety percent (90%) of the Company’s share of available cash flow from the Entrée/Oyu Tolgoi JV. In the absence of available cash flow, the loan will not be repayable. The loan is not expected to be repaid within one year.

Contractual Obligations

As at September 30, 2021, the Company had the following contractual obligations outstanding:

| | Total | Less than 1 year | 1 - 3 years | 3-5 years | More than 5 years |

| Lease commitments | $ 127 | $ 117 | $ 10 | $ — | $ — |