Searchable text section of graphics shown above

Review of Business Strategy and Results

1st Quarter 2005

[LOGO] | | www.FieldstoneInvestment.com |

| | |

As of May 4, 2005 | | |

• Fieldstone Investment Corporation: (NASDAQ: FICC): REIT

• Building a portfolio of non-conforming loans on-balance sheet:

• $5.1 billion at March 31, 2005 with an average FICO of 651

• Issued $5.0 billion of MBS to match-fund portfolio for life of loans

• Paid $1.09 of pre-tax dividends to shareholders for 2004

• Paid 1st Quarter 2005 dividend of $0.47

• Fieldstone Mortgage Company: Taxable REIT Subsidiary

• Performs loan origination and underwriting

• $6.2 billion of non-conforming loans in 2004

• $1.3 billion of conforming loans in 2004

• Opened 4 regional non-conforming operation centers in 2004

• Manage the quality of loans for REIT portfolio

• Sell non-conforming fixed rate, 2nds and certain hybrid loans, and all conforming loans

• Interim servicer for loans held for sale

• Can retain any after-tax earnings from loan sales to generate capital internally

*As of May 4, 2005*

2

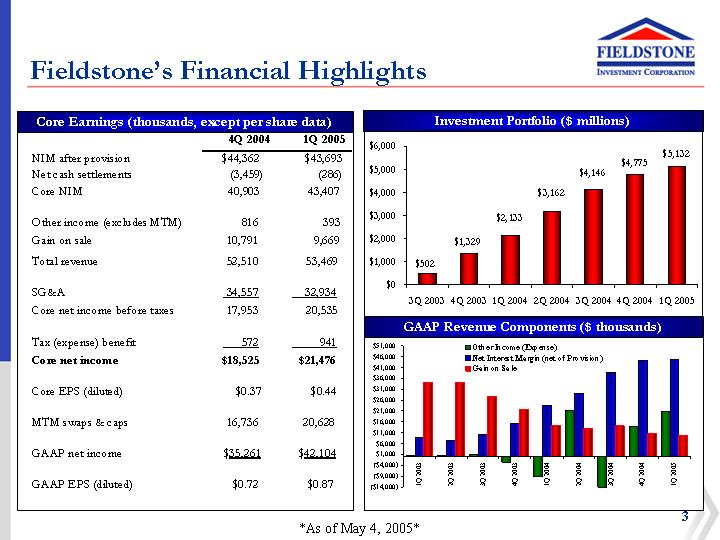

Fieldstone’s Financial Highlights

Core Earnings (thousands, except per share data)

| | 4Q 2004 | | 1Q 2005 | |

NIM after provision | | $ | 44,362 | | $ | 43,693 | |

Net cash settlements | | (3,459 | ) | (286 | ) |

Core NIM | | 40,903 | | 43,407 | |

| | | | | |

Other income (excludes MTM) | | 816 | | 393 | |

Gain on sale | | 10,791 | | 9,669 | |

Total revenue | | 52,510 | | 53,469 | |

| | | | | |

SG&A | | 34,557 | | 32,934 | |

Core net income before taxes | | 17,953 | | 20,535 | |

| | | | | |

Tax (expense) benefit | | 572 | | 941 | |

Core net income | | $ | 18,525 | | $ | 21,476 | |

| | | | | |

Core EPS (diluted) | | $ | 0.37 | | $ | 0.44 | |

| | | | | |

MTM swaps & caps | | 16,736 | | 20,628 | |

| | | | | |

GAAP net income | | $ | 35,261 | | $ | 42,104 | |

| | | | | |

GAAP EPS (diluted) | | $ | 0.72 | | $ | 0.87 | |

Investment Portfolio ($ millions)

[CHART]

GAAP Revenue Components ($ thousands)

[CHART]

3

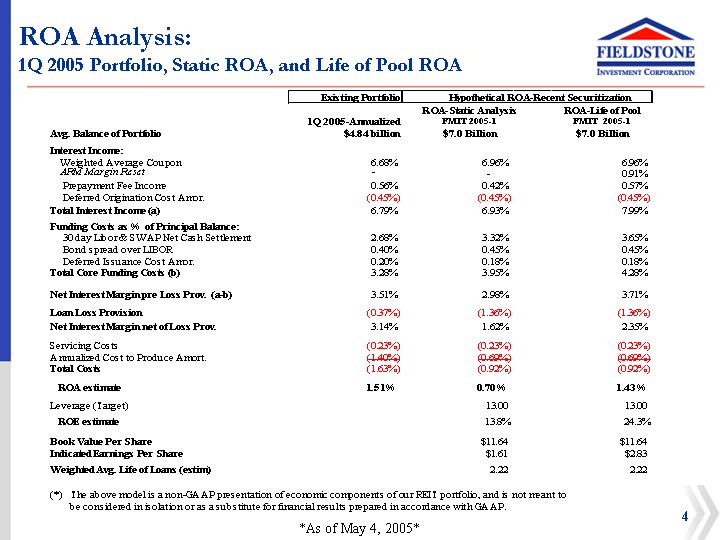

ROA Analysis:

1Q 2005 Portfolio, Static ROA, and Life of Pool ROA

| | | | Hypothetical ROA-Recent Securitization | |

| | Existing Portfolio | | ROA-Static Analysis | | ROA-Life of Pool | |

| | 1Q 2005-Annualized | | FMIT 2005-1 | | FMIT 2005-1 | |

Avg. Balance of Portfolio | | $ | 4.84 billion | | $ | 7.0 Billion | | $ | 7.0 Billion | |

Interest Income: | | | | | | | |

Weighted Average Coupon | | 6.68 | % | 6.96 | % | 6.96 | % |

ARM Margin Reset | | — | | — | | 0.91 | % |

Prepayment Fee Income | | 0.56 | % | 0.42 | % | 0.57 | % |

Deferred Origination Cost Amor. | | (0.45 | )% | (0.45 | )% | (0.45 | )% |

Total Interest Income (a) | | 6.79 | % | 6.93 | % | 7.99 | % |

| | | | | | | |

Funding Costs as% of Principal Balance: | | | | | | | |

30 day Libor & SWAP Net Cash Settlement | | 2.68 | % | 3.32 | % | 3.65 | % |

Bond spread over LIBOR | | 0.40 | % | 0.45 | % | 0.45 | % |

Deferred Issuance Cost Amor. | | 0.20 | % | 0.18 | % | 0.18 | % |

Total Core Funding Costs (b) | | 3.28 | % | 3.95 | % | 4.28 | % |

| | | | | | | |

Net Interest Margin pre Loss Prov. (a-b) | | 3.51 | % | 2.98 | % | 3.71 | % |

| | | | | | | |

Loan Loss Provision | | (0.37 | )% | (1.36 | )% | (1.36 | )% |

Net Interest Margin net of Loss Prov. | | 3.14 | % | 1.62 | % | 2.35 | % |

| | | | | | | |

Servicing Costs | | (0.23 | )% | (0.23 | )% | (0.23 | )% |

Annualized Cost to Produce Amort. | | (1.40 | )% | (0.69 | )% | (0.69 | )% |

Total Costs | | (1.63 | )% | (0.92 | )% | (0.92 | )% |

| | | | | | | |

ROA estimate | | 1.51 | % | 0.70 | % | 1.43 | % |

| | | | | | | |

Leverage (Target) | | | | 13.00 | | 13.00 | |

| | | | | | | |

ROE estimate | | | | 13.8 | % | 24.3 | % |

| | | | | | | |

Book Value Per Share | | | | $ | 11.64 | | $ | 11.64 | |

Indicated Earnings Per Share | | | | $ | 1.61 | | $ | 2.83 | |

| | | | | | | |

Weighted Avg. Life of Loans (estim) | | | | 2.22 | | 2.22 | |

| | | | | | | | | | |

(*) The above model is a non-GAAP presentation of economic components of our REIT portfolio, and is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP.

4

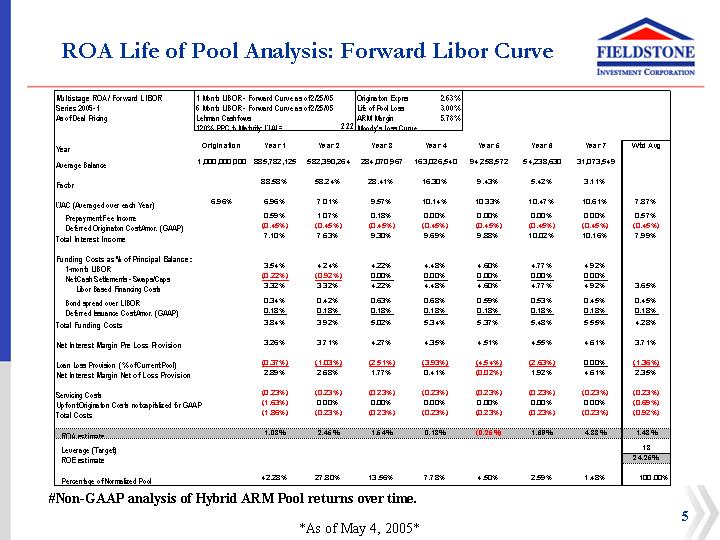

ROA Life of Pool Analysis: Forward Libor Curve

Multistage ROA / Forward LIBOR | | 1 Month LIBOR - Forward Curve as of 2/25/05 | | Origination Expns | | 2.63 | % | 1.18 | % |

Series 2005-1 | | 6 Month LIBOR - Forward Curve as of 2/25/05 | | Life of Pool Loss | | 3.00 | % | 1.35 | % |

As of Deal Pricing | | Lehman Cashflows | | ARM Margin | | 5.78 | % | | |

| | 120% PPC to Maturity: WAL= | 2.22 | Moody’s Loss Curve | | | | | |

Year | | Origination | | Year 1 | | Year 2 | | Year 3 | | Year 4 | | Year 5 | | Year 6 | | Year 7 | | Wtd Avg | |

| | | | | | | | | | | | | | | | | | | |

Average Balance | | 1,000,000,000 | | 885,782,125 | | 582,390,264 | | 284,070,967 | | 163,026,540 | | 94,258,572 | | 54,238,630 | | 31,073,549 | | | |

| | | | | | | | | | | | | | | | | | | |

Factor | | | | 88.58 | % | 58.24 | % | 28.41 | % | 16.30 | % | 9.43 | % | 5.42 | % | 3.11 | % | | |

| | | | | | | | | | | | | | | | | | | |

WAC (Averaged over each Year) | | 6.96 | % | 6.96 | % | 7.01 | % | 9.57 | % | 10.14 | % | 10.33 | % | 10.47 | % | 10.61 | % | 7.87 | % |

| | | | | | | | | | | | | | | | | | | |

Prepayment Fee Income | | | | 0.59 | % | 1.07 | % | 0.18 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.57 | % |

Deferred Origination Cost Amor. (GAAP) | | | | (0.45 | )% | (0.45 | )% | (0.45 | )% | (0.45 | )% | (0.45 | )% | (0.45 | )% | (0.45 | )% | (0.45 | )% |

Total Interest Income | | | | 7.10 | % | 7.63 | % | 9.30 | % | 9.69 | % | 9.88 | % | 10.02 | % | 10.16 | % | 7.99 | % |

| | | | | | | | | | | | | | | | | | | |

Funding Costs as % of Principal Balance: | | | | | | | | | | | | | | | | | | | |

1-month LIBOR | | | | 3.54 | % | 4.24 | % | 4.22 | % | 4.48 | % | 4.60 | % | 4.77 | % | 4.92 | % | | |

Net Cash Settlements - Swaps/Caps | | | | (0.22 | )% | (0.92 | )% | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | | |

Libor Based Financing Costs | | | | 3.32 | % | 3.32 | % | 4.22 | % | 4.48 | % | 4.60 | % | 4.77 | % | 4.92 | % | 3.65 | % |

| | | | | | | | | | | | | | | | | | | |

Bond spread over LIBOR | | | | 0.34 | % | 0.42 | % | 0.63 | % | 0.68 | % | 0.59 | % | 0.53 | % | 0.45 | % | 0.45 | % |

Deferred Issuance Cost Amor. (GAAP) | | | | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % | 0.18 | % |

Total Funding Costs | | | | 3.84 | % | 3.92 | % | 5.02 | % | 5.34 | % | 5.37 | % | 5.48 | % | 5.55 | % | 4.28 | % |

| | | | | | | | | | | | | | | | | | | |

Net Interest Margin Pre Loss Provision | | | | 3.26 | % | 3.71 | % | 4.27 | % | 4.35 | % | 4.51 | % | 4.55 | % | 4.61 | % | 3.71 | % |

| | | | | | | | | | | | | | | | | | | |

Loan Loss Provision (% of Current Pool) | | | | (0.37 | )% | (1.03 | )% | (2.51 | )% | (3.93 | )% | (4.54 | )% | (2.63 | )% | 0.00 | % | (1.36 | )% |

Net Interest Margin Net of Loss Provision | | | | 2.89 | % | 2.68 | % | 1.77 | % | 0.41 | % | (0.02 | )% | 1.92 | % | 4.61 | % | 2.35 | % |

| | | | | | | | | | | | | | | | | | | |

Servicing Costs | | | | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% |

Upfront Origination Costs not capitalized for GAAP | | | | (1.63 | )% | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | (0.69 | )% |

Total Costs | | | | (1.86 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.23 | )% | (0.92 | )% |

| | | | | | | | | | | | | | | | | | | |

ROA estimate | | | | 1.03 | % | 2.45 | % | 1.54 | % | 0.18 | % | (0.25 | )% | 1.69 | % | 4.38 | % | 1.43 | % |

| | | | | | | | | | | | | | | | | | | |

Leverage (Target) | | | | | | | | | | | | | | | | | | 13 | |

ROE estimate | | | | | | | | | | | | | | | | | | 24.25 | % |

| | | | | | | | | | | | | | | | | | | |

Percentage of Normalized Pool | | | | 42.28 | % | 27.80 | % | 13.56 | % | 7.78 | % | 4.50 | % | 2.59 | % | 1.48 | % | 100.00 | % |

#Non-GAAP analysis of Hybrid ARM Pool returns over time.

5

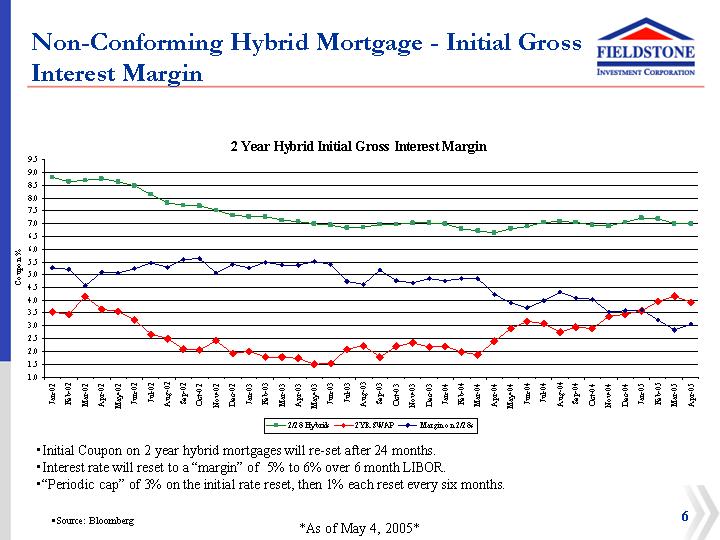

Non-Conforming Hybrid Mortgage - Initial Gross Interest Margin

2 Year Hybrid Initial Gross Interest Margin

[CHART]

• Initial Coupon on 2 year hybrid mortgages will re-set after 24 months.

• Interest rate will reset to a “margin” of 5% to 6% over 6 month LIBOR.

• “Periodic cap” of 3% on the initial rate reset, then 1% each reset every six months. .

• Source: Bloomberg

6

Hybrid Loans Funded with LIBOR Based Debt

Fieldstone Portfolio Hedging Program

Portfolio Weighted Average Swap Rate vs. Forward LIBOR Curve

[CHART]

7

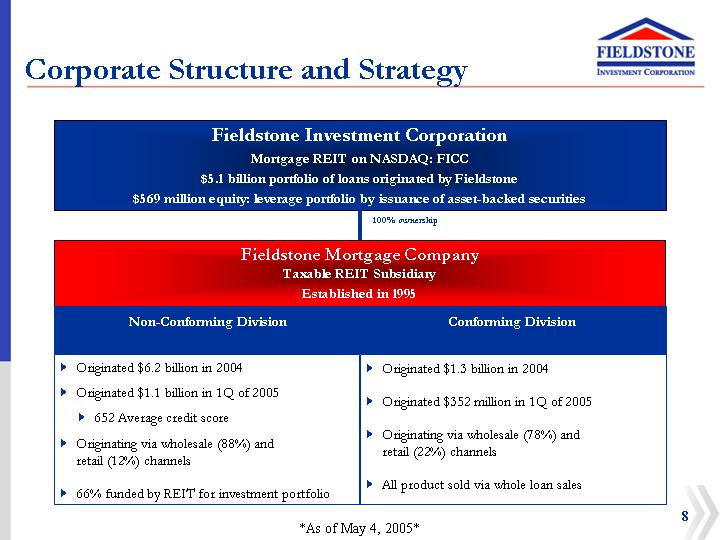

Corporate Structure and Strategy

Fieldstone Investment Corporation

Mortgage REIT on NASDAQ: FICC

$5.1 billion portfolio of loans originated by Fieldstone

$569 million equity: leverage portfolio by issuance of asset-backed securities

Fieldstone Mortgage Company

Taxable REIT Subsidiary

Established in 1995

Non-Conforming Division | | Conforming Division |

| | |

• Originated $6.2 billion in 2004 | | • Originated $1.3 billion in 2004 |

| | |

• Originated $1.1 billion in 1Q of 2005 | | • Originated $352 million in 1Q of 2005 |

| | |

• 652 Average credit score | | • Originating via wholesale (78%) and retail (22%) channels |

• Originating via wholesale (88%) and retail (12%) channels | | |

| | • All product sold via whole loan sales |

• 66% funded by REIT for investment portfolio | | |

8

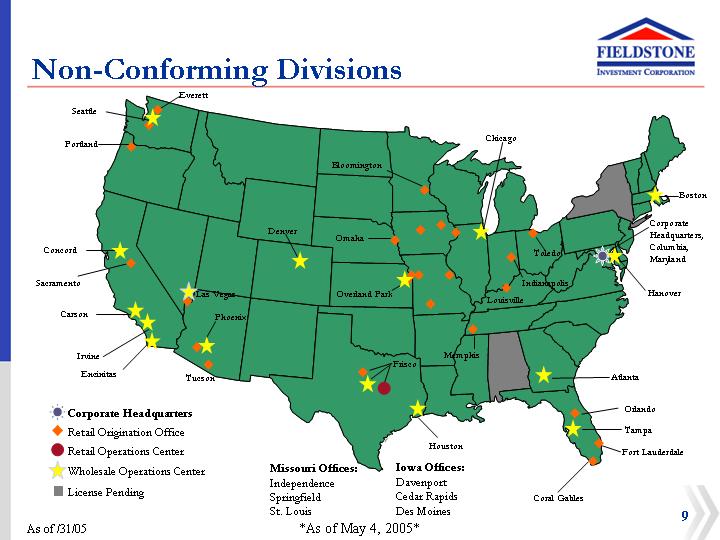

Non-Conforming Divisions

[GRAPHIC]

| Missouri Offices: | Iowa Offices: |

| Independence | Davenport |

| Springfield | Cedar Rapids |

| St. Louis | Des Moines |

9

Quarterly Originations

[CHART]

10

Portfolio Strategy

• Originate high quality non-conforming ARM loans for REIT portfolio

• 2/28 hybrid ARMs primarily

• 651 average credit score

• Interest only 2/28 ARM loans, fully amortize after five years

• Reduced documentation and higher LTV at higher average credit score

• Finance portfolio with long-term securitization debt

• On-balance sheet financing

• No “gain on sale” non-cash gains on securitization

• Committed financing with strong asset-liability management

• Retain Fieldstone loans to assure quality and minimize cost basis

• Current Target portfolio size of $6 to $7 billion

11

Fieldstone Portfolio as of March 31, 2005

Collateral Characteristics

Average Credit Score | | 651 | |

| | | |

Hybrid Arms | | 99.4 | % |

| | | |

Average Coupon | | 6.9 | % |

| | | |

Gross Margin | | 5.7 | % |

| | | |

Prepayment Fee Coverage | | 86.8 | % |

| | | |

Full Income Documentation | | 46.3 | % |

| | | |

Interest Only Loans | | 61.3 | % |

| | | |

Weighted Average LTV | | 82.1 | % |

| | | |

-LTV>90% | | 3.3 | % |

| | | |

Weighted Average CLTV | | 92.5 | % |

| | | |

State Concentration-California | | 45.8 | % |

| | | |

Average Loan Size | | $ | 193,874 | |

| | | |

-Avg. Property Value | | $ | 240,142 | |

| | | |

-Avg. Property Value-CA | | $ | 356,470 | |

Investment Portfolio Growth ($ millions)

[CHART]

Credit Score Distribution

[CHART]

12

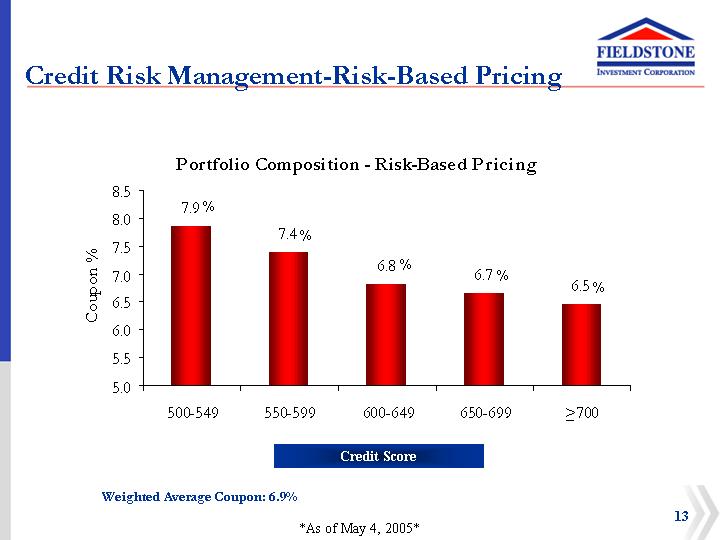

Credit Risk Management-Risk-Based Pricing

Portfolio Composition - Risk-Based Pricing

[CHART]

Weighted Average Coupon: 6.9%

13

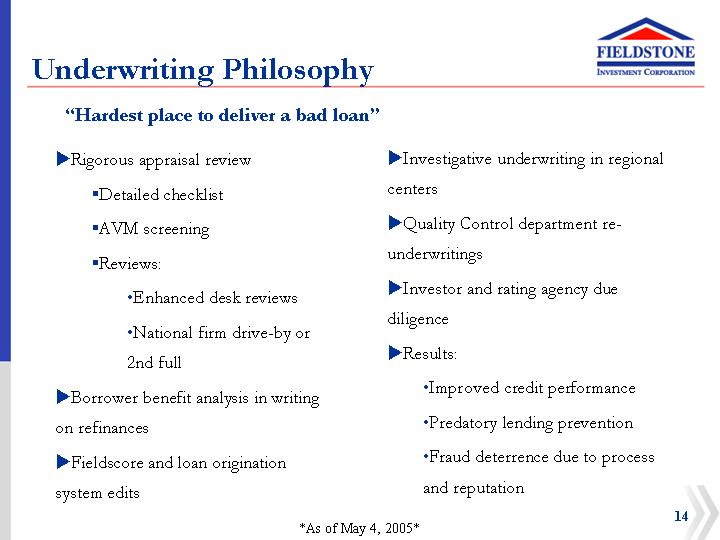

Underwriting Philosophy

“Hardest place to deliver a bad loan”

• Rigorous appraisal review

• Detailed checklist

• AVM screening

• Reviews:

• Enhanced desk reviews

• National firm drive-by or 2nd full

• Borrower benefit analysis in writing on refinances

• Fieldscore and loan origination system edits

• Investigative underwriting in regional centers

• Quality Control department re-underwritings

• Investor and rating agency due diligence

• Results:

• Improved credit performance

• Predatory lending prevention

• Fraud deterrence due to process and reputation

14

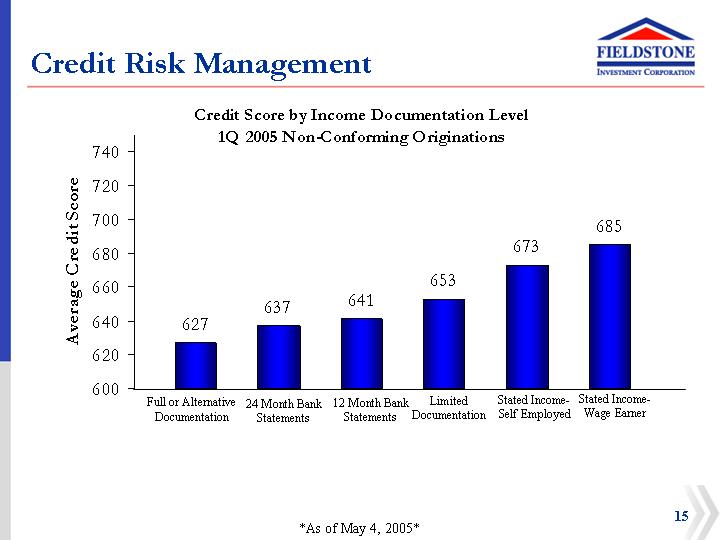

Credit Risk Management

Credit Score by Income Documentation Level

1Q 2005 Non-Conforming Originations

[CHART]

15

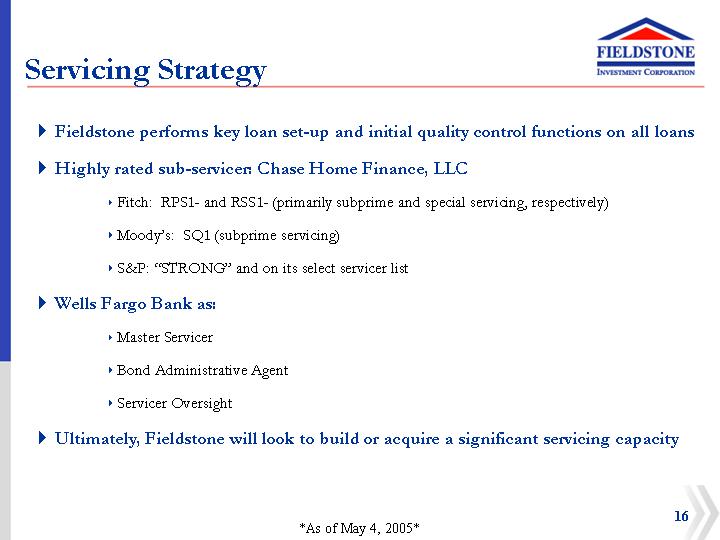

Servicing Strategy

• Fieldstone performs key loan set-up and initial quality control functions on all loans

• Highly rated sub-servicer: Chase Home Finance, LLC

• Fitch: RPS1- and RSS1- (primarily subprime and special servicing, respectively)

• Moody’s: SQ1 (subprime servicing)

• S&P: “STRONG” and on its select servicer list

• Wells Fargo Bank as:

• Master Servicer

• Bond Administrative Agent

• Servicer Oversight

• Ultimately, Fieldstone will look to build or acquire a significant servicing capacity

16

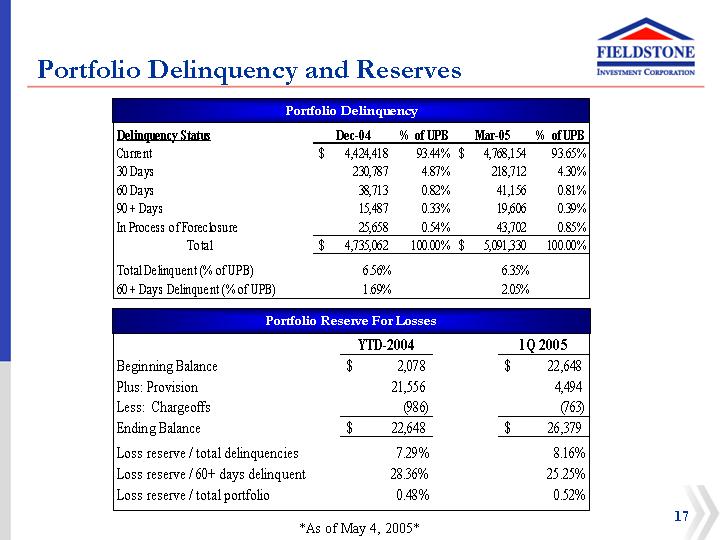

Portfolio Delinquency and Reserves

Portfolio Delinquency

Delinquency Status | | Dec-04 | | % of UPB | | Mar-05 | | % of UPB | |

Current | | $ | 4,424,418 | | 93.44 | % | $ | 4,768,154 | | 93.65 | % |

30 Days | | 230,787 | | 4.87 | % | 218,712 | | 4.30 | % |

60 Days | | 38,713 | | 0.82 | % | 41,156 | | 0.81 | % |

90 + Days | | 15,487 | | 0.33 | % | 19,606 | | 0.39 | % |

In Process of Foreclosure | | 25,658 | | 0.54 | % | 43,702 | | 0.85 | % |

Total | | $ | 4,735,062 | | 100.00 | % | $ | 5,091,330 | | 100.00 | % |

| | | | | | | | | |

Total Delinquent (% of UPB) | | 6.56 | % | | | 6.35 | % | | |

60 + Days Delinquent (% of UPB) | | 1.69 | % | | | 2.05 | % | | |

Portfolio Reserve For Losses

| | YTD-2004 | | 1Q 2005 | |

Beginning Balance | | $ | 2,078 | | $ | 22,648 | |

Plus: Provision | | 21,556 | | 4,494 | |

Less: Chargeoffs | | (986 | ) | (763 | ) |

Ending Balance | | $ | 22,648 | | $ | 26,379 | |

| | | | | |

Loss reserve / total delinquencies | | 7.29 | % | 8.16 | % |

Loss reserve / 60+ days delinquent | | 28.36 | % | 25.25 | % |

Loss reserve / total portfolio | | 0.48 | % | 0.52 | % |

17

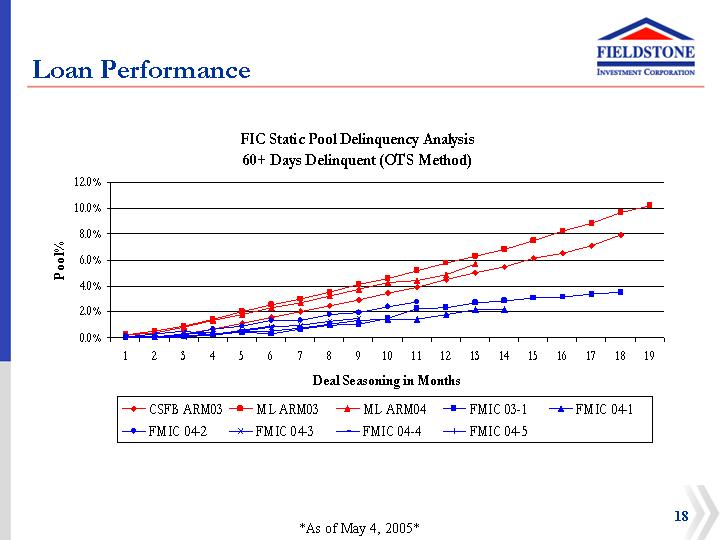

Loan Performance

FIC Static Pool Delinquency Analysis

60+ Days Delinquent (OTS Method)

[CHART]

18

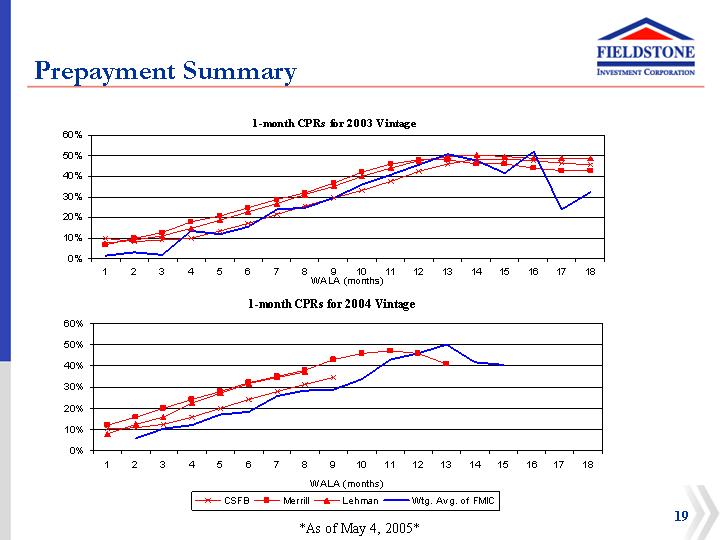

Prepayment Summary

1-month CPRs for 2003 Vintage

[CHART]

1-month CPRs for 2004 Vintage

[CHART]

19

Liquidity Risk Management

• Finance loans prior to securitization or sale with a diverse group of Wall Street and bank lenders under $2.0 billion of committed lines

• Use mortgage-backed securities (MBS) to finance REIT portfolio

• Provides long-term financing for portfolio without margin calls

• MBS market highly liquid

• Structure securitizations to cash flow NIM from month one

• Not issuing “NIM” securities

• Focus on issuing bonds rated BBB or higher

• Not reliant upon selling low rated and less liquid (BBB- or BB) bonds

• Highly efficient - weighted average bond spread of LIBOR + 35 bps on 2005-1 (to call)

[GRAPHIC]

20

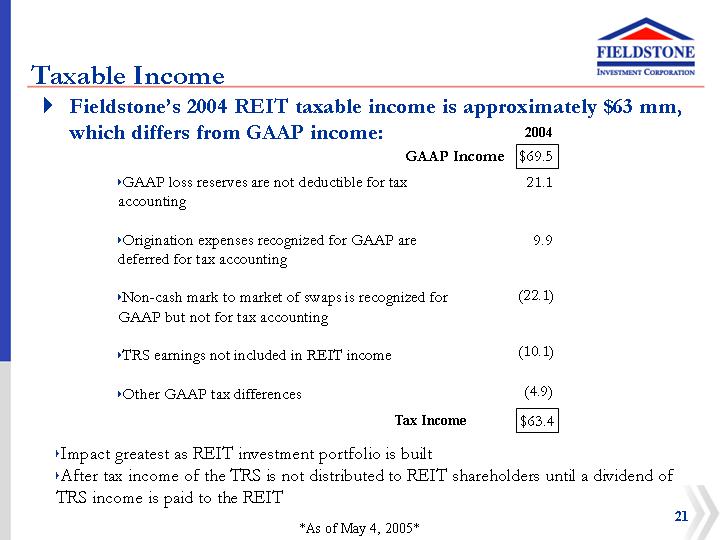

Taxable Income

• Fieldstone’s 2004 REIT taxable income is approximately $63 mm, which differs from GAAP income:

| | 2004 | |

GAAP Income | | $ | 69.5 | |

| | | | |

• GAAP loss reserves are not deductible for tax accounting | | 21.1 | |

| | | |

• Origination expenses recognized for GAAP are deferred for tax accounting | | 9.9 | |

| | | |

• Non-cash mark to market of swaps is recognized for GAAP but not for tax accounting | | (22.1 | ) |

| | | |

• TRS earnings not included in REIT income | | (10.1 | ) |

| | | |

• Other GAAP tax differences | | (4.9 | ) |

| | | |

Tax Income | | $ | 63.4 | |

• Impact greatest as REIT investment portfolio is built

• After tax income of the TRS is not distributed to REIT shareholders until a dividend of TRS income is paid to the REIT

21

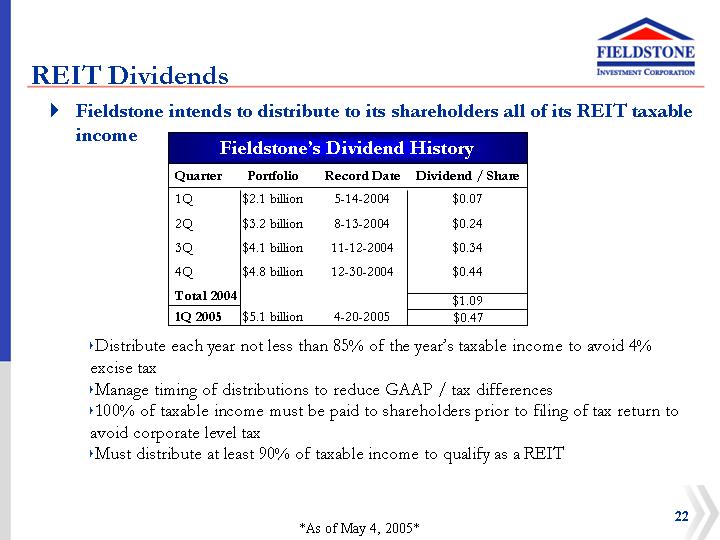

REIT Dividends

• Fieldstone intends to distribute to its shareholders all of its REIT taxable income

Fieldstone’s Dividend History

Quarter | | Portfolio | | Record Date | | Dividend / Share | |

1Q | | $ | 2.1 billion | | 5-14-2004 | | $ | 0.07 | |

| | | | | | | | | |

2Q | | $ | 3.2 billion | | 8-13-2004 | | $ | 0.24 | |

| | | | | | | | | |

3Q | | $ | 4.1 billion | | 11-12-2004 | | $ | 0.34 | |

| | | | | | | | | |

4Q | | $ | 4.8 billion | | 12-30-2004 | | $ | 0.44 | |

| | | | | | | |

Total 2004 | | | | | | $ | 1.09 | |

1Q 2005 | | $ | 5.1 billion | | 4-20-2005 | | $ | 0.47 | |

• Distribute each year not less than 85% of the year’s taxable income to avoid 4% excise tax

• Manage timing of distributions to reduce GAAP / tax differences

• 100% of taxable income must be paid to shareholders prior to filing of tax return to avoid corporate level tax

• Must distribute at least 90% of taxable income to qualify as a REIT

22

Fieldstone’s Culture and Strategy

• Each employee takes personal accountability for the success of the Team

• Focus on long term relationships with market professionals where “value added” enables rational pricing and loan quality

• Fully integrated originator of and investor in quality mortgage loans in a tax-advantaged structure

• Experienced management team focused on:

• Quality of loans and operations

• Portfolio structured for stability in multiple rate environments

• Long-term value

23

Review of Business Strategy and Results

1st Quarter 2005

[LOGO] | | www.FieldstoneInvestment.com |