Exhibit 99.1

Fieldstone Investment Corporation

Review of Business Strategy and Results

| JMP Securities Research Conference |

| www.FieldstoneInvestment.com |

Disclaimer |

|

FORWARD-LOOKING STATEMENTS

This presentation may contain “forward-looking statements” within the meaning of the federal securities laws and, if so, are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Actual results and the timing of certain events may differ materially from those indicated by such forward-looking statements due to a variety of risks and uncertainties, many of which are beyond Fieldstone’s ability to control or predict, including but not limited to (i) Fieldstone’s ability to successfully implement or change aspects of its portfolio strategy; (ii) interest rate volatility and the level of interest rates generally; (iii) loan origination volumes and levels of origination costs; (iv) continued availability of credit facilities for the origination of mortgage loans; (v) the ability to sell or securitize mortgage loans; (vi) deterioration in the credit quality of Fieldstone’s loan portfolio; (vii) the nature and amount of competition; (viii) the impact of changes to the fair value of Fieldstone’s interest rate swaps on its net income, which will vary based upon changes in interest rates and could cause net income to vary significantly from quarter to quarter; (ix) Fieldstone’s ability to fully and timely execute its stock repurchase program on favorable terms; and (x) other risks and uncertainties outlined in Fieldstone Investment Corporation’s periodic reports filed with the Securities and Exchange Commission (SEC) from time to time. These statements are made as of the date of this presentation, and Fieldstone undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

This presentation contains information with respect to (i) loan originations and portfolio characteristics for the fourth quarter and year ended December 31, 2005 and (ii) the results of operations and other data for the three and nine months ended September 30, 2005. This information is not necessarily indicative of the results that may be expected for the fourth quarter of 2005 or the fiscal year ending December 31, 2005 and should be read in conjunction with our periodic reports filed with the Securities and Exchange Commission from time to time as well as the risks and uncertainties outlined in our periodic reports and discussed above in the statements regarding forward looking statements.

This presentation also contains expectations with regard to 2006 dividends, which are based on, among other things, REIT taxable income. There can be no assurance that Fieldstone’s actual REIT taxable income or other financial condition or results of operations for the year ending December 31, 2006 will be as anticipated in the 2006 dividend guidance. Actual results may be materially higher or lower than the guidance provided for 2006. In addition, the declaration and payment of dividends is subject to review and approval from time to time by Fieldstone’s Board of Directors and there can be no assurance that the Board of Directors will not modify Fieldstone’s dividend payments or expectations. Further, Fieldstone’s REIT taxable income may differ materially from its reported net income due primarily to differing rules between GAAP and tax accounting for the timing of recognition of credit losses, origination expenses, equity based compensation and hedge positions.

REGULATION G DISCLOSURES

Information on core net income, core income before taxes, core earnings per share (diluted), core net interest income after provision, core book value per share, pre-tax margin on non-conforming loans sold and REIT taxable income appearing elsewhere in this presentation may fall under the SEC’s definition of “non-GAAP financial measures.” Management believes the core financial measures are useful because they include the current period effects of Fieldstone’s economic hedging program but exclude the non-cash mark to market derivative value changes. The portion of the non-cash mark to market amounts excluded from the core financial measures, that ultimately will be a component of future core financial measures, depends on the level of actual interest rates in the future. Management believes the presentation of pre-tax margin on non-conforming loans sold provides useful information to the investors because it discloses the total economic contribution to the Company from the sale of non-conforming loans. Management believes the presentation of REIT taxable income provides useful information to investors regarding the annual distribution to Fieldstone’s investors. As required by Regulation G, a reconciliation of each of these core financial measures to the most directly comparable measure under GAAP is included in this presentation.

2

Corporate Structure and Strategy |

|

Fieldstone Investment Corporation

Mortgage REIT on NASDAQ: FICC

• $5.5 billion portfolio of Fieldstone’s loans

• Pay dividends of portfolio earnings, pre-tax

• Dividends since inception of $3.12 per share

• 2005 dividends paid of $2.03 per share

• 2006 dividend guidance: $1.84 to $2.04 per share

| 100% ownership |

Fieldstone Mortgage Company

Taxable REIT Subsidiary

Established in 1995

• Originated $5.9 billion of non-conforming loans in 2005; $6.2 billion of non-conforming loans in 2004

• Originated $1.4 billion of non-conforming loans in 4Q of 2005

• Mix of wholesale (91%) and retail (9%) originations

• Retained 62% of non-conforming loan production for investment portfolio in 4Q of 2005

• Sells non-portfolio loans for cash gains on sale

• Provides interim servicing and initial loan set up

3

Fieldstone’s Investment Proposition |

|

• REIT / TRS business model for stable income over time:

• Investment Portfolio $5.5 billion at year end 2005, target approximately $6.0 billion in 2006, 13:1 leverage

• TRS with national franchise, originating approximately $5.0 billion to $6.2 billion N-C loans in 2006

• Retain after tax cash gains from TRS sales of excess loan originations

• Focus on Portfolio Management:

• Manage liquidity, interest rate, yield curve and prepayment risk

• Cash flow immediately from limited leverage and no NIM sales

• ARM loans primarily, hedge 2/28’s with swaps

• Issue MBS for life-of-loan match funding, current cash flow

• Retain our own loan production for high quality and low basis in portfolio

• CEO first managed REIT mortgage portfolio in 1988

• Market Opportunity:

• Borrowers transition from Conforming to N-C / Alt-A as rates and debt ratios rise

• N-C lending based on RE values, not falling interest rates

• Fieldstone focuses on stable owner-occupied purchase sector

• Residential real estate values will continue to increase over time:

• RE prices supported by strong demand, limited supply

• Fieldstone’s average properties are ~ $247,000, $395,000 in CA

4

Fieldstone Portfolio as of December 31, 2005 |

|

Collateral Characteristics

Average Credit Score |

| 650 |

| |

Hybrid ARMs |

| 95.2 | % | |

Average Current Coupon |

| 7.1 | % | |

Average Gross Margin |

| 5.8 | % | |

Prepayment Fee Coverage |

| 86.0 | % | |

Full Income Documentation |

| 44.9 | % | |

Interest Only Loans |

| 60.1 | % | |

Purchase Transactions |

| 60.5 | % | |

Primary Residences |

| 95.4 | % | |

Weighted Average LTV |

| 80.7 | % | |

- LTV>90% |

| 4.6 | % | |

- Weighted Average CLTV |

| 92.7 | % | |

State Concentration-California |

| 41.3 | % | |

|

|

|

| |

Average Loan Size |

| $ | 189,625 |

|

- Average Property Value |

| $ | 246,656 |

|

- Average Property Value-CA |

| $ | 394,673 |

|

Investment Portfolio Principal Balance ($ millions)

Credit Score Distribution

5

Fieldstone’s Financial Highlights Through September 2005 |

|

Core Earnings ($ thousands, except per share data)

|

| 3Q 2005 |

| 2Q 2005 |

| ||

Net int income after provision |

| $ | 24,228 |

| $ | 39,888 |

|

Net cash settlements rec’d (paid) |

| 8,000 |

| 2,655 |

| ||

Amortization of interest rate swap buydown payments |

| (224 | ) | — |

| ||

Core net int income after provision |

| 32,004 |

| 42,543 |

| ||

|

|

|

|

|

| ||

Other income (excludes MTM) |

| 661 |

| 144 |

| ||

Gains on sales of mtg loans, net |

| 20,147 |

| 27,254 |

| ||

Total revenues |

| 52,812 |

| 69,941 |

| ||

Total expenses |

| (34,243 | ) | (32,045 | ) | ||

Core income before income taxes |

| 18,569 |

| 37,896 |

| ||

Income tax expense |

| (2,999 | ) | (2,734 | ) | ||

Core net income |

| $ | 15,570 |

| $ | 35,162 |

|

|

|

|

|

|

| ||

MTM gain (loss) swaps & caps |

| 7,630 |

| (12,087 | ) | ||

Amortization of interest rate swap buydown payments |

| 224 |

| — |

| ||

Net income |

| $ | 23,424 |

| $ | 23,075 |

|

|

|

|

|

|

| ||

Earnings per share (diluted) |

| $ | 0.48 |

| $ | 0.47 |

|

Core earnings per share (diluted) |

| $ | 0.32 |

| $ | 0.72 |

|

|

|

|

|

|

| ||

Book value per share |

| $ | 11.64 |

| $ | 11.66 |

|

Core book value per share |

| $ | 10.96 |

| $ | 11.13 |

|

Investment Portfolio Principal Balance ($ millions)

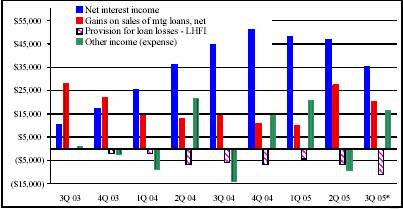

GAAP Revenue Components ($ thousands)

* Net interest income for the 3Q 05 includes a $4.6 million increase in the deferred origination and issuance costs related to faster prepayment speed estimates

6

Fieldstone’s REIT Dividends |

|

• Fieldstone intends to pay to its shareholders all its REIT taxable income

Fieldstone’s Dividend History

Quarter |

| Portfolio |

| Record Date |

| Dividend / Share |

| ||

1Q |

| $ | 2.1 billion |

| 5-14-2004 |

| $ | 0.07 |

|

2Q |

| $ | 3.2 billion |

| 8-13-2004 |

| 0.24 |

| |

3Q |

| $ | 4.1 billion |

| 11-12-2004 |

| 0.34 |

| |

4Q |

| $ | 4.8 billion |

| 12-30-2004 |

| 0.44 |

| |

Total 2004 |

|

|

|

|

| $ | 1.09 |

| |

1Q |

| $ | 5.1 billion |

| 4-20-2005 |

| $ | 0.47 |

|

2Q |

| $ | 4.8 billion |

| 7-20-2005 |

| 0.50 |

| |

3Q |

| $ | 5.3 billion |

| 10-19-2005 |

| 0.51 |

| |

4Q |

| $ | 5.5 billion |

| 12-30-2005 |

| 0.52 |

| |

Special Dividend |

|

|

| 12-30-2005 |

| 0.03 |

| ||

Total 2005 |

|

|

|

|

| $ | 2.03 |

| |

Total Dividends Paid |

|

|

|

|

| $ | 3.12 |

| |

• Dividend guidance for 2006 of between $1.84 and $2.04 per share

• Distributed initially approximately 85% of the year’s taxable income

• Distribute the remaining balance of taxable income in the following year

• Carried $0.21 per share from 2004 into 2005

• 2006 dividend guidance includes an estimate of $0.33 per share attributable to REIT taxable income from 2005 to be distributed in 2006

7

Fieldstone’s REIT Taxable Income: Nine Months 2005 |

|

• Fieldstone’s REIT taxable income differs from GAAP pre-tax net income:

|

| 2004 |

| YTD 9/30/05 |

| ||

GAAP Pre-Tax Net Income |

| $ | 69.5 |

| $ | 93.4 |

|

• GAAP provision for loan losses in excess of charge-offs are not deductible for tax accounting |

| 21.1 |

| 19.1 |

| ||

|

|

|

|

|

| ||

• Origination expenses recognized for GAAP are deferred for tax accounting |

| 9.9 |

| 13.3 |

| ||

|

|

|

|

|

| ||

• Non-cash mark to market of swaps and cap are recognized for GAAP but not for tax accounting |

| (22.1 | ) | (16.2 | ) | ||

|

|

|

|

|

| ||

• TRS pre-tax net income is not included in REIT taxable income |

| (10.1 | ) | (13.3 | ) | ||

|

|

|

|

|

| ||

• Other GAAP and tax differences |

| (5.1 | ) | (6.4 | ) | ||

Estimated REIT Taxable Income |

| $ | 63.2 |

| $ | 89.9 |

|

• Differences greatest as REIT investment portfolio is built, before losses occur

• Any after tax income of the TRS is retained until a dividend of TRS income is paid to the REIT, and then it is distributed to REIT shareholders as a regular corporate dividend

8

Non-Conforming Hybrid ARM Mortgage - |

|

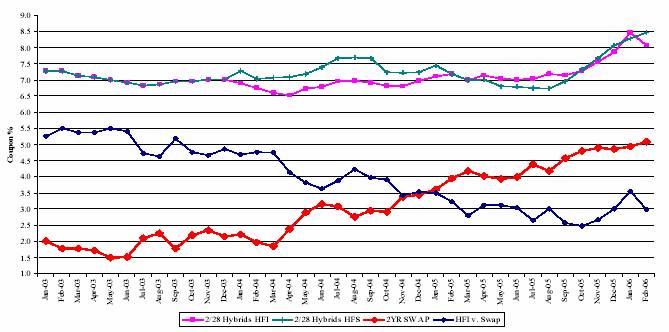

2 Year Hybrid Gross Int. Margin

• Initial Coupon on 2 year hybrid ARM mortgages will re-set after 24 months.

• Interest rate will reset to a “margin” of 5% to 6% over 6 month LIBOR.

• Periodic cap of 3% on the initial rate reset, 1% each reset every six months and 6% life cap.

• Source: Bloomberg

9

Life of Pool Portfolio: Positive All-In Returns |

|

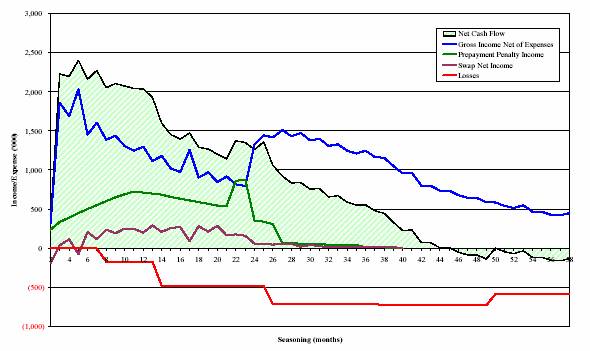

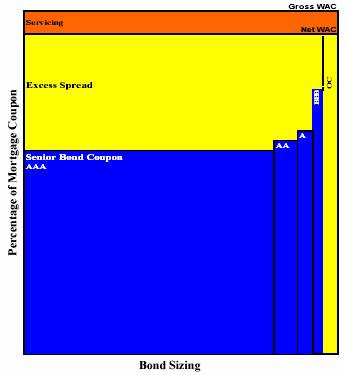

Components of Net Income - Series 2005-3

10

ROA Life of Pool Analysis: Forward LIBOR Curve |

|

|

|

|

| Year |

| ||||||||||

|

| varies |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Wtd Avg |

|

Average Balance |

|

| * | 1,033,348,873 |

| 684,286,844 |

| 353,193,977 |

| 207,577,882 |

| 118,161,071 |

|

|

|

Current Factor Average |

|

|

| 89 | % | 59 | % | 31 | % | 18 | % | 10 | % |

|

|

Current Factor at End of Year |

|

|

| 76 | % | 43 | % | 24 | % | 14 | % | 0 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross WAC (Average) |

|

| * | 7.32 |

| 7.89 |

| 10.15 |

| 10.57 |

| 10.54 |

| 8.34 |

|

Prepayment Fee Income |

|

| * | 0.65 |

| 1.07 |

| 0.20 |

| 0.00 |

| 0.00 |

| 0.62 |

|

Deferred Orig. Cost Amort |

|

|

| (0.52 | ) | (0.52 | ) | (0.52 | ) | (0.52 | ) | (0.52 | ) | (0.52 | ) |

Total Interest Income |

|

|

| 7.45 |

| 8.44 |

| 9.84 |

| 10.06 |

| 10.02 |

| 8.44 |

|

1-month LIBOR |

|

| * | 4.63 |

| 4.97 |

| 4.88 |

| 4.99 |

| 5.07 |

| 4.82 |

|

Net Cash Settlements Swap/Cap |

|

| * | (0.18 | ) | (0.35 | ) | (0.10 | ) | (0.01 | ) | 0.00 |

| (0.20 | ) |

LIBOR based Financing Cost |

|

|

| 4.45 |

| 4.62 |

| 4.78 |

| 4.98 |

| 5.07 |

| 4.62 |

|

Bond Spread over LIBOR |

|

| * | 0.53 |

| 0.75 |

| 0.98 |

| 0.85 |

| 0.83 |

| 0.70 |

|

Deferred Issuance Cost Amort |

|

|

| 0.16 |

| 0.16 |

| 0.16 |

| 0.16 |

| 0.16 |

| 0.16 |

|

Total Funding Costs |

|

|

| 5.14 |

| 5.53 |

| 5.92 |

| 5.99 |

| 6.06 |

| 5.49 |

|

NIM: Pre-Loss |

|

|

| 2.31 |

| 2.91 |

| 3.92 |

| 4.07 |

| 3.97 |

| 2.95 |

|

Loan Loss Provision |

|

| * | 0.11 |

| 0.86 |

| 2.48 |

| 4.31 |

| 5.31 |

| 1.29 |

|

NIM: Net of Losses |

|

|

| 2.20 |

| 2.04 |

| 1.43 |

| (0.24 | ) | (1.35 | ) | 1.66 |

|

Sub-Servicing Costs |

|

|

| 0.22 |

| 0.23 |

| 0.23 |

| 0.23 |

| 0.23 |

| 0.23 |

|

Upfront Origination Costs |

|

| * | 1.27 |

|

|

|

|

|

|

|

|

| 0.55 |

|

ROA Estimate |

|

|

| 0.70 |

| 1.81 |

| 1.20 |

| (0.47 | ) | (1.58 | ) | 0.88 |

|

ROE (13x Leverage) |

|

|

|

|

|

|

|

|

|

|

|

|

| 17.80 |

|

Assumptions

CSFB Pricing Cash flows for 2005-3

120% of PPC Curve (run to 10% Call)

Forward LIBOR as of 10/24/2005

Origination Expenses: 2.36%

Lifetime Losses: 3.0% (only 2.5% losses are realised by call date)

* Non-GAAP analysis of Hybrid ARM Pool returns over time *

11

Hybrid Loans Funded with LIBOR Based Debt |

|

FIC Weighted Average Swap Cost vs. Debt Outstanding

12

ROA Analysis: 3Q 2005 Portfolio |

|

|

| YTD 12/31/2004 |

| YTD 9/30/2005 |

| Variance |

| |||

Average balance of portfolio |

| $ | 3.07 billion |

| $ | 4.82 billion |

| $ | 1.75 billion |

|

Interest income: |

|

|

|

|

|

|

| |||

Weighted average coupon |

| 6.61 | % | 6.66 | % | 0.05 | % | |||

Prepayment fee income |

| 0.39 | % | 0.67 | % | 0.28 | % | |||

Deferred origination cost amortization |

| (0.39 | )% | (0.54 | )% | (0.15 | )% | |||

Total interest income (a) |

| 6.61 | % | 6.79 | % | 0.18 | % | |||

|

|

|

|

|

|

|

| |||

Funding costs as % of portfolio principal balance: |

|

|

|

|

|

|

| |||

30 day LIBOR and swap net cash settlement |

| 1.81 | % | 2.72 | % | (0.91 | )% | |||

Bond and warehouse spread over LIBOR |

| 0.70 | % | 0.44 | % | 0.26 | % | |||

Deferred issuance cost amortization |

| 0.12 | % | 0.24 | % | (0.12 | )% | |||

Total core funding costs (b) |

| 2.63 | % | 3.40 | % | (0.77 | )% | |||

|

|

|

|

|

|

|

| |||

Net interest margin pre loss provision (a-b) |

| 3.98 | % | 3.39 | % | (0.59 | )% | |||

|

|

|

|

|

|

|

| |||

Loan loss provision |

| (0.70 | )% | (0.60 | )% | 0.10 | % | |||

Net interest margin net of loss provision |

| 3.28 | % | 2.79 | % | (0.49 | )% | |||

|

|

|

|

|

|

|

| |||

Servicing costs |

| (0.21 | )% | (0.18 | )% | 0.03 | % | |||

Current period production costs |

| (0.93 | )% | (0.89 | )% | 0.04 | % | |||

Portfolio and home office expenses |

| (0.39 | )% | (0.62 | )% | (0.23 | )% | |||

Total other costs |

| (1.53 | )% | (1.69 | )% | (0.16 | )% | |||

|

|

|

|

|

|

|

| |||

ROA estimate |

| 1.75 | % | 1.10 | % | (0.65 | )% | |||

13

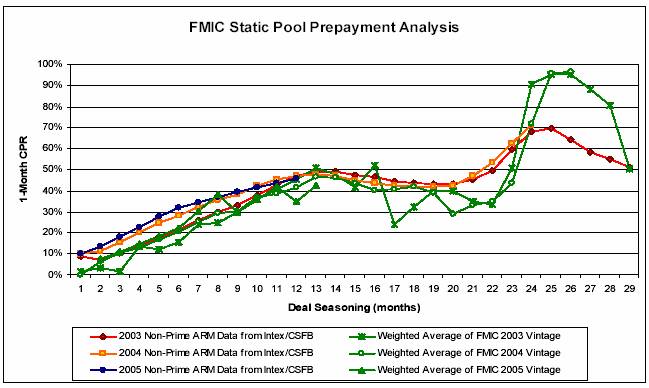

Prepayment Summary |

|

14

Loan Performance - Delinquencies |

|

15

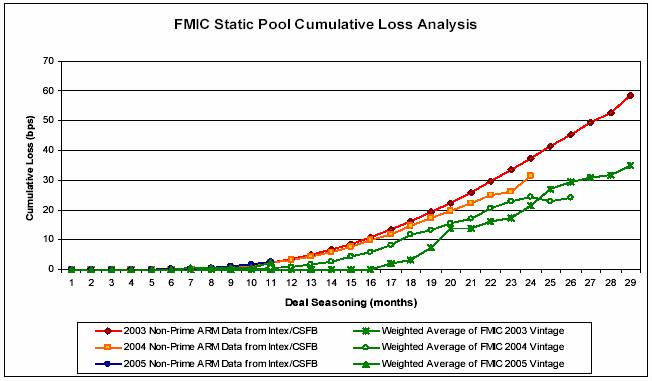

Loan Performance –Losses |

|

16

Non-Conforming Loan Sale Economics |

|

Percent of principal balance sold: |

| 2004 |

| 1Q 2005 |

| 2Q 2005 |

| 3Q 2005 |

| YTD 9/30/05 |

|

Gross premiums from whole loan sales, net of hedging gains and losses |

| 2.93 | % | 2.60 | % | 3.28 | % | 2.73 | % | 2.97 | % |

Fees collected net of premiums paid |

| 0.12 | % | 0.21 | % | (0.07 | )% | 0.08 | % | 0.03 | % |

Net interest margin (1) |

| 0.57 | % | 0.34 | % | 0.52 | % | 0.38 | % | 0.47 | % |

Provision for losses - loans sold (2) |

| (0.37 | )% | (0.44 | )% | (0.27 | )% | (0.39 | )% | (0.20 | )% |

|

| 3.25 | % | 2.71 | % | 3.46 | % | 2.80 | % | 3.27 | % |

|

|

|

|

|

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

Capitalized origination costs (FAS 91) |

| (0.76 | )% | (0.75 | )% | (0.74 | )% | (0.71 | )% | (0.74 | )% |

Other origination costs |

| (2.08 | )% | (3.07 | )% | (1.60 | )% | (1.58 | )% | (1.84 | )% |

|

| (2.84 | )% | (3.82 | )% | (2.34 | )% | (2.29 | )% | (2.58 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax margin on NC loans sold |

| 0.41 | % | (1.11 | )% | 1.12 | % | 0.51 | % | 0.69 | % |

(1) Net interest margin is the net interest income on loans held for sale divided by loans sold.

(2) Actual 3Q 05 provision was 0.03% due to a reversal of reserves for prior periods based on positive loan performance; the amount shown above is the amount reserved in 3Q 05 prior to the reversal.

17

Market Conditions and Opportunity |

|

• Non-conforming credit mortgage market is stable

• Growing segment of the market as consumer debt and interest rates rise

• Prime borrowers “transition” with higher payments and debt ratios

• Originations based on real estate values, not changes in interest rates

• Fixed income market provides deep liquidity

• Wide demand for the asset class, supports whole loan sale prices

• Spreads of investment grade MBS are near historic tight margins

• If spreads widen, Fieldstone will benefit as an investor in its loans

• Residential real estate values have continued to increase

• Housing Market driven by growing demand, limited supply

• Purchase market stable: MBA estimate $1.46 Trillion in 2006, versus $1.48 Trillion in 2005

• MBA estimate of home price appreciation is 5.45% in 2006

• Positive total return opportunity in REIT investment portfolio

• Life-of-Pool returns on new ARM loans still attractive

• Forward rates, losses, prepayments and expenses modeled

• Ability to grow capital base and portfolio with TRS earnings

18

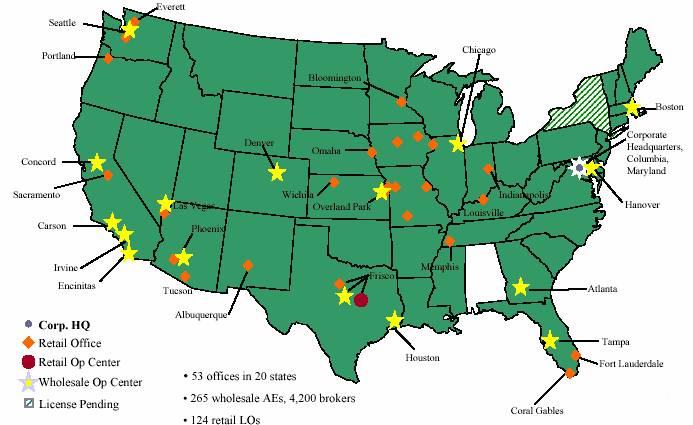

National Non-Conforming Franchise: September 2005 |

|

19

Fieldstone’s Origination Franchise |

|

• Established loan origination channels (in TRS) since 1996:

• Focus on loan quality, customer service and operating efficiency

• Opportunistic product development

• Revenue-based commissions

• Quality-based management incentives

• Cultivate a learning organization to enhance

• products

• customer service

• operating efficiencies

• Stable business-to-business sourcing:

• Wholesale originations from professional brokers

• Retail originations from small financial service companies

• Compete on service and product design, not rate or credit

• Mortgage loan operations driven by technology:

• On-Line loan pre-qualifications and submissions

• Electronic document delivery, funding and imaging

• Implementing new origination system to increase loans per person, lower origination cost

20

Underwriting Philosophy |

|

“Hardest place to deliver a bad loan”

• Rigorous appraisal review checklist:

• AVM screening of all loans

• Reviews:

• Enhanced desk reviews, field review or 2nd full appraisal by approved appraisers

• Chain of title on purchase

• Local underwriting to prevent fraud

• Fraud detection added to credit report

• SSN validation

• IRS form 4506 on full doc

• Proof of borrower identity

• Data integrity and compliance from

• Fieldscore on-line pre-qual

• Loan origination system edits

• Clayton compliance review

• Borrower benefit analysis in writing on non-conforming refinances

• Quality Control department tests monthly: 15% sample

• Investor and banker due diligence

• Production Manager compensation tied to loan performance

21

Servicing Strategy |

|

• Fieldstone performs key loan set-up and initial quality control functions on all loans

• Highly rated sub-servicer: JPMorgan Chase Bank

• Fitch: RPS1- and RSS1- (primary subprime and special servicing, respectively)

• Moody’s: SQ1 (subprime servicing)

• S&P: “STRONG” and on its select servicer list

• Wells Fargo Bank is engaged on securitizations as:

• Master Servicer, including Servicer Oversight

• Bond Administrative Agent

• Ultimately, Fieldstone will look to build or acquire a significant servicing capacity

• Will allow focus on special servicing, loss mitigation and product refinement

• Source of revenue, but will increase cost of servicing, at least temporarily

22

Fieldstone’s Investment Proposition |

|

• REIT / TRS business model for stable income over time:

• Investment Portfolio $5.5 billion at year end 2005, target approximately $6.0 billion in 2006, 13:1 leverage

• TRS with national franchise, originating approximately $5.0 billion to $6.2 billion N-C loans in 2006

• Portfolio net interest margin paid to shareholders on a pre-tax basis

• Retain after tax cash gains from TRS sales of excess loan originations

• Strategic Portfolio Management:

• Manage liquidity, interest rate, yield curve and prepayment risk

• Cash flow immediately from limited leverage, no NIM sales

• ARM loans primarily, hedge 2/28’s with swaps

• Issue MBS for life-of-loan match funding, current cash flow

• Retain in portfolio high FICO loans for quality, with a low basis

• Experienced Management: experience through cycles:

• CEO first managed public REIT mortgage portfolio in 1988

• SVP / Portfolio Manager previously managed a $12 billion fixed income portfolio, and began trading mortgages in 1991

• Senior Production management with 20+ years experience in origination and trading

• Chief Credit Officer has 25+ years as a non-conforming lender

23

Fieldstone Investment Corporation

Review of Business Strategy and Results

| JMP Securities Research Conference |

| www.FieldstoneInvestment.com |

Supplemental Data

| www.FieldstoneInvestment.com |

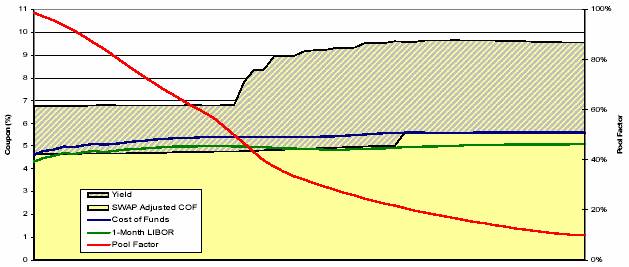

Life of Pool Portfolio: Cost of Funds and Yield Analysis |

|

S-1

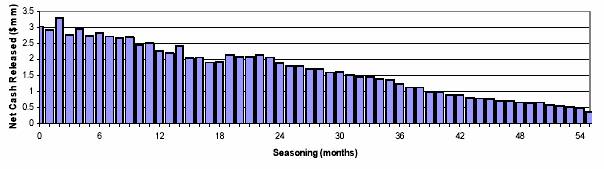

Securitization Cash Flow and Economics |

|

Fieldstone Securitization Series 2005-3:

Industry Deal Economics and Rating:

Securitization Proceeds

Deal Economics |

| 4/05 |

| 8/05 |

| 1/06 |

|

Underlying Deal Proceeds |

| 97.05 |

| 95.45 |

| 95.85 |

|

NIM Proceeds |

| 5.55 |

| 3.00 |

| 3.30 |

|

CAP Cost |

| (1.30 | ) | (0.70 | ) | 0.00 |

|

Servicing Strip |

| 0.60 |

| 0.60 |

| 0.60 |

|

Transaction Costs |

| (0.35 | ) | (0.35 | ) | (0.35 | ) |

Upfront Proceeds |

| 101.55 |

| 98.00 |

| 99.40 |

|

Warehouse Carry |

| 0.10 |

| 0.00 |

| (0.10 | ) |

Residual |

| 1.60 |

| 2.75 |

| 2.30 |

|

Transaction Value |

| 103.25 |

| 100.75 |

| 101.60 |

|

Credit Support Levels

Rating |

| 4/05 |

| 8/05 |

| 1/06 |

|

AAA |

| 21.15 | % | 22.50 | % | 25.45 | % |

AA |

| 14.65 | % | 16.00 | % | 16.00 | % |

A |

| 9.30 | % | 10.75 | % | 10.35 | % |

BBB |

| 5.35 | % | 6.60 | % | 5.75 | % |

OC |

| 2.75 | % | 4.00 | % | 2.75 | % |

Source: JPMorgan

S-2

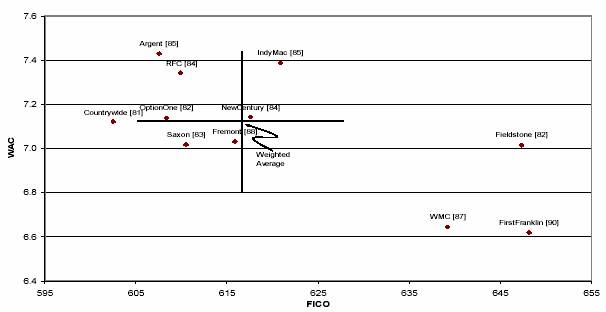

Peer Review: Weighted Average Coupon vs. FICO |

|

Weighted Average Coupon vs. FICO

Non-Prime ARM Data for 2005 Production*

Source: JP Morgan/Loan Performance. Data is only for ARM portions of securitized pools. [LTVs in brackets].

*2005 Production data includes only the first two quarters of 2005.

S-3

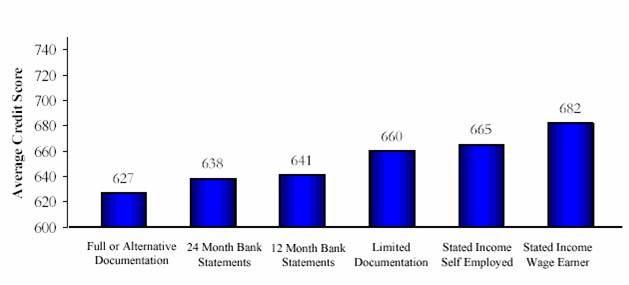

Credit Risk Management |

|

Credit Score by Income Documentation Level

4Q 2005 Non-Conforming Originations

S-4

Credit Risk Management-Risk-Based Pricing |

|

Portfolio Composition - Risk-Based Pricing

(as of December 31, 2005)

Weighted Average Coupon: 7.1%

S-5

Quarterly Loan Originations |

|

S-6

Portfolio Delinquency |

|

Portfolio Delinquency

Delinquency Status |

| Dec-05 |

| % of UPB |

| Sep-05 |

| % of UPB |

| ||

Current |

| $ | 4,925,656 |

| 89.07 | % | $ | 4,835,343 |

| 91.71 | % |

30 days |

| 359,074 |

| 6.49 | % | 258,807 |

| 4.91 | % | ||

60 days |

| 93,663 |

| 1.69 | % | 64,461 |

| 1.22 | % | ||

90+ days |

| 65,810 |

| 1.19 | % | 37,707 |

| 0.72 | % | ||

In process of foreclosure |

| 86,013 |

| 1.56 | % | 76,161 |

| 1.44 | % | ||

Total |

| $ | 5,530,216 |

| 100.00 | % | $ | 5,272,479 |

| 100.00 | % |

Total delinquent (% of UPB) |

| 10.93 | % |

|

| 8.29 | % |

|

| ||

60+ days delinquent (% of UPB) |

| 4.44 | % |

|

| 3.38 | % |

|

| ||

S-7

Warehouse and Securitization Financing |

|

• Finance loans prior to securitization or sale with a diverse group of Wall Street and bank lenders under $2.275 billion in lines of credit

• Use mortgage-backed securities (MBS) to finance REIT portfolio

• Provides long-term financing for portfolio without margin calls

• MBS market highly liquid

• Structure securitizations to cash flow NIM from month one

• Not issuing “NIM” securities

• Focus on issuing bonds rated BBB or higher

• Not reliant upon selling low rated and less liquid (BBB- or BB) bonds

• Highly efficient - weighted average bond spread of LIBOR + 37 bps on 2005-3 (to call)

S-8

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Review of Business Strategy and Results - Non-GAAP Financial Measures

JMP Securities Research Conference

Regulation G Reconciliations

March 8, 2006

Core income before income taxes, core net income, core earnings per share (diluted) and core book value per share:

Core income before income taxes, core net income, core earnings per share (diluted) and core book value per share appearing in the March 8, 2006 presentation, “Review of Business Strategy and Results,” is a non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission. Management believes that the presentation of core income before income taxes, core net income, core earnings per share (diluted) and core book value per share provide useful information to investors because these measures exclude the non-cash mark to market gains or losses on interest rate swap and cap agreements. The following table is a reconciliation of income before income taxes, net income and earnings per share (diluted) in the consolidated statements of operations and book value per share, presented in accordance with GAAP, to core income before income taxes, core net income, core earnings per share (diluted) and core book value per share. The presentation of these core financial measures is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP.

|

| Three Months Ended |

| ||||

(Dollars in 000’s, except share and per share data) |

| September 30, |

| June 30, |

| ||

Core income before income taxes and core net income: |

|

|

|

|

| ||

Income before income taxes |

| $ | 26,423 |

| 25,809 |

| |

Less: | Mark to market (gain) loss on portfolio derivatives |

|

|

|

|

| |

| included in “Other income (expense) - portfolio derivatives” |

|

|

|

|

| |

| Market to market interest rate swaps |

| (7,858 | ) | 11,788 |

| |

| Mark to market interest rate cap |

| 228 |

| 299 |

| |

| Total mark to market on portfolio derivatives |

| (7,630 | ) | 12,087 |

| |

|

|

|

|

|

| ||

Less: Amortization of interest rate swap buydown payments |

| (224 | ) | — |

| ||

Core income before income taxes |

| 18,569 |

| 37,896 |

| ||

Provision for income tax expense |

| (2,999 | ) | (2,734 | ) | ||

Core net income |

| $ | 15,570 |

| 35,162 |

| |

|

|

|

|

|

| ||

Core earnings per share: |

|

|

|

|

| ||

Net income |

| $ | 23,424 |

| 23,075 |

| |

Less: | Dividends on unvested restricted stock |

| (187 | ) | (176 | ) | |

Income available to common shareholders |

| 23,237 |

| 22,899 |

| ||

Less: | Mark to market (gain) loss on portfolio derivatives |

| (7,630 | ) | 12,087 |

| |

| Amortization of interest rate swap buydown payments |

| (224 | ) | — |

| |

| Core net income available to common shareholders |

| $ | 15,383 |

| 34,986 |

|

|

|

|

|

|

| ||

Earnings per share - diluted |

| $ | 0.48 |

| 0.47 |

| |

Core earnings per share - diluted |

| $ | 0.32 |

| 0.72 |

| |

|

|

|

|

|

| ||

Diluted weighted average common shares outstanding |

| 48,479,152 |

| 48,462,126 |

| ||

|

|

|

|

|

| ||

Core book value per share: |

|

|

|

|

| ||

Equity at end of period |

| $ | 568,418 |

| 569,196 |

| |

Less: | Cumulative mark to market (gain) loss on portfolio derivatives |

| (33,285 | ) | (25,655 | ) | |

| Amortization of interest rate swap buydown payments |

| (224 | ) | — |

| |

Core equity at end of period |

| $ | 534,909 |

| 543,541 |

| |

|

|

|

|

|

| ||

Book value per share |

| $ | 11.64 |

| 11.66 |

| |

Core book value per share |

| $ | 10.96 |

| 11.13 |

| |

|

|

|

|

|

| ||

Shares outstanding at period end |

| 48,820,876 |

| 48,835,876 |

| ||

Core net interest income after provision for loan losses:

Core net interest income after provision for loan losses appearing in the March 8, 2006 presentation, “Review of Business Strategy and Results,” is a non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission.

Management believes that the presentation of core net interest income after provision for loan losses provides useful information to investors because this measure includes the effect of the net cash settlements on the existing interest rate swap and cap agreements economically hedging the variable rate debt financing the portfolio of mortgage loans and the net cash settlements incurred or paid to terminate those derivatives prior to maturity. Core net interest income after provision for loan losses does not include the net cash settlements incurred or paid to terminate swaps or caps related to loans ultimately sold. The following table is a reconciliation of net interest income after provision for loan losses in the consolidated statements of operations, presented in accordance with GAAP, to core net interest income after provision for loan losses. The presentation of core net interest income after provision for loan losses is not meant to be considered in isolation or as a substitute for GAAP.

|

| Three Months Ended |

| ||||

(Dollars in 000’s) |

| September 30, |

| June 30, |

| ||

Net interest income after provision for loan losses |

| $ | 24,228 |

| 39,888 |

| |

Plus: | Net cash settlements received (paid) on portfolio derivatives included in “Other income (expense) - portfolio derivatives” |

| 8,000 |

| 2,655 |

| |

Less: | Amortization of interest rate swap buydown payments |

| (224 | ) | — |

| |

Core net interest income after provision for loan losses |

| $ | 32,004 |

| 42,543 |

| |

Pre-tax margin on non-conforming loans sold:

Pre-tax margin on non-conforming loans sold appearing in the March 8, 2006 presentation, “Review of Business Strategy and Results,” is a non-GAAP financial measure within the meaning of Regulation G promulgated by the Securities and Exchange Commission. Management believes that the presentation of pre-tax margin on non-conforming loans sold provides useful information to investors because this measure discloses the total economic contribution to the Company from the sale of non-conforming loans. The following table is a reconciliation of gains on sales of mortgage loans, net in the consolidated statements of operations, presented in accordance with GAAP, to pre-tax margin on non-conforming loans sold. The presentation of pre-tax margin on non-conforming loans sold is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP.

(Dollars in 000’s) |

| Year Ended |

| Three Months |

| Three Months |

| Three Months |

| Nine Months |

| |||

Gains on sales of mortgage loans, net |

| $ | 52,147 |

| 9,669 |

| 27,254 |

| 20,147 |

| 57,070 |

| ||

Less: | Gains on sales of conforming mortgages, net |

| (9,440 | ) | (1,788 | ) | (1,913 | ) | (1,057 | ) | (4,518 | ) | ||

Plus: | Net interest margin - non-conforming loans held for sale |

| 12,575 |

| 1,680 |

| 6,025 |

| 3,407 |

| 11,700 |

| ||

Less: | Total expenses - non-conforming loans held for sale |

| (46,148 | ) | (14,990 | ) | (18,423 | ) | (14,176 | ) | (46,801 | ) | ||

Pre-tax margin on non-conforming loans sold |

| $ | 9,134 |

| (5,429 | ) | 12,943 |

| 8,321 |

| 17,451 |

| ||

|

|

|

|

|

|

|

|

|

|

|

| |||

Non-conforming loans sold |

| $ | 2,220,609 |

| 488,274 |

| 1,158,674 |

| 896,584 |

| 2,543,532 |

| ||

|

|

|

|

|

|

|

|

|

|

|

| |||

Pre-tax margin on non-conforming loans sold |

| 0.41 | % | -1.11 | % | 1.12 | % | 0.93 | % | * | 0.69 | % | ||

* Presentation excluded 0.42% credit to loan loss provision in Q3 2005

Estimated REIT taxable income

Estimated REIT taxable income appearing in the March 8, 2006 presentation, “Review of Business Strategy and Results,” is a non-GAAP financial measures within the meaning of Regulation G promulgated by the Securities and Exchange Commission. Management believes that the presentation of estimated REIT taxable income provides useful information to investors regarding the estimated annual distributions to our investors. The presentation of estimated REIT taxable income is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP.

The following table is a reconciliation of pre-tax net income in the consolidated statements of operations, presented in accordance with GAAP, to estimated REIT taxable income for the year ended December 31, 2004, and the nine months ended September 30, 2005.

(Dollars in 000’s) |

| Year Ended |

| Nine Months |

| ||

Consolidated GAAP pre-tax net income |

| $ | 69,530 |

| 93,395 |

| |

Plus: | Provision for loan losses in excess of actual charge-offs |

| 21,056 |

| 19,064 |

| |

| Variance in recognition of net origination expenses |

| 9,922 |

| 13,342 |

| |

|

|

|

|

|

| ||

Less: | Taxable REIT subsidiary pre-tax net income |

| 10,091 |

| 13,311 |

| |

| Mark to market valuation changes on derivatives |

| 22,079 |

| 16,171 |

| |

| Miscellaneous other |

| 5,143 |

| 6,443 |

| |

Estimated REIT taxable income |

| $ | 63,195 |

| 89,876 |

| |