UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-50938

Fieldstone Investment Corporation

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 74-2874689 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

11000 Broken Land Parkway Columbia, MD | | 21044 | | 410-772-7200 |

| (Address of principal executive offices) | | (Zip Code) | | (Telephone No., including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-accelerated Filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Number of shares of Common Stock outstanding as of November 1, 2006: 46,904,485

Table of Contents

i

PART I

ITEM 1. FINANCIAL STATEMENTS.

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Condition

September 30, 2006 and December 31, 2005

(Unaudited, in thousands, except share data)

| | | | | | | | |

| | | September 30, 2006 | | | December 31, 2005 | |

Assets | | | | | | | | |

Cash | | $ | 26,470 | | | $ | 33,536 | |

Restricted cash | | | 5,307 | | | | 7,888 | |

Mortgage loans held for sale, net | | | 243,465 | | | | 594,269 | |

Mortgage loans held for investment | | | 5,919,222 | | | | 5,570,415 | |

Allowance for loan losses—loans held for investment | | | (64,034 | ) | | | (44,122 | ) |

| | | | | | | | |

Mortgage loans held for investment, net | | | 5,855,188 | | | | 5,526,293 | |

| | | | | | | | |

Accounts receivable | | | 35,183 | | | | 7,201 | |

Accrued interest receivable | | | 35,656 | | | | 29,940 | |

Trustee receivable | | | 91,885 | | | | 130,237 | |

Prepaid expenses and other assets | | | 14,202 | | | | 16,200 | |

Real estate owned | | | 47,382 | | | | 14,997 | |

Derivative assets | | | 15,740 | | | | 35,223 | |

Deferred tax asset | | | 16,036 | | | | 17,679 | |

Furniture and equipment, net | | | 9,025 | | | | 10,151 | |

| | | | | | | | |

Total assets | | $ | 6,395,539 | | | $ | 6,423,614 | |

| | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | |

Warehouse financing—loans held for sale | | $ | 205,812 | | | $ | 434,061 | |

Warehouse financing—loans held for investment | | | 1,011,821 | | | | 378,707 | |

Securitization financing | | | 4,684,087 | | | | 4,998,620 | |

Reserve for losses—loans sold | | | 25,205 | | | | 35,082 | |

Dividends payable | | | 15,948 | | | | 26,689 | |

Accounts payable, accrued expenses and other liabilities | | | 29,273 | | | | 23,812 | |

| | | | | | | | |

Total liabilities | | | 5,972,146 | | | | 5,896,971 | |

| | | | | | | | |

Commitments and contingencies (Note 11) | | | — | | | | — | |

| | |

Shareholders’ equity: | | | | | | | | |

Common stock $0.01 par value; 90,000,000 shares authorized; 46,904,485 and 48,513,985 shares issued as of September 30, 2006 and December 31, 2005, respectively | | | 469 | | | | 485 | |

Paid-in capital | | | 473,966 | | | | 493,603 | |

Accumulated (deficit) earnings | | | (51,042 | ) | | | 37,093 | |

Unearned compensation | | | — | | | | (4,538 | ) |

| | | | | | | | |

Total shareholders’ equity | | | 423,393 | | | | 526,643 | |

| | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 6,395,539 | | | $ | 6,423,614 | |

| | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

1

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

Three and Nine Months Ended September 30, 2006 and 2005

(Unaudited; in thousands, except share and per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended

September 30, | |

| | | 2006 | | | 2005 (As

restated- see

Note 1 (g)) | | | 2006 | | | 2005 (As

restated- see

Note 1 (g)) | |

Revenues: | | | | | | | | | | | | | | | | |

Interest income: | | | | | | | | | | | | | | | | |

Loans held for investment | | $ | 107,081 | | | $ | 84,940 | | | $ | 302,634 | | | $ | 248,350 | |

Loans held for sale | | | 7,399 | | | | 7,677 | | | | 20,991 | | | | 24,810 | |

| | | | | | | | | | | | | | | | |

Total interest income | | | 114,480 | | | | 92,617 | | | | 323,625 | | | | 273,160 | |

| | | | | | | | | | | | | | | | |

Interest expense: | | | | | | | | | | | | | | | | |

Loans held for investment | | | 87,163 | | | | 54,361 | | | | 233,668 | | | | 134,742 | |

Loans held for sale | | | 4,069 | | | | 3,721 | | | | 10,261 | | | | 10,082 | |

| | | | | | | | | | | | | | | | |

Total interest expense | | | 91,232 | | | | 58,082 | | | | 243,929 | | | | 144,824 | |

| | | | | | | | | | | | | | | | |

Net interest income | | | 23,248 | | | | 34,535 | | | | 79,696 | | | | 128,336 | |

| | | | | | | | | | | | | | | | |

Provision for loan losses—loans held for investment | | | 28,035 | | | | 11,045 | | | | 38,894 | | | | 22,402 | |

| | | | | | | | | | | | | | | | |

Net interest (expense) income after provision for loan losses | | | (4,787 | ) | | | 23,490 | | | | 40,802 | | | | 105,934 | |

Gains on sales of mortgage loans, net | | | 3,393 | | | | 19,439 | | | | 15,641 | | | | 53,941 | |

Other (expense) income—portfolio derivatives | | | (13,755 | ) | | | 15,630 | | | | 9,224 | | | | 26,540 | |

Fees and other (expense) income | | | (451 | ) | | | 478 | | | | (676 | ) | | | 773 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | (15,600 | ) | | | 59,037 | | | | 64,991 | | | | 187,188 | |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Salaries and employee benefits | | | 18,553 | | | | 18,781 | | | | 58,588 | | | | 54,204 | |

Occupancy | | | 2,481 | | | | 1,703 | | | | 6,165 | | | | 4,998 | |

Depreciation and amortization | | | 1,159 | | | | 922 | | | | 3,089 | | | | 2,474 | |

Servicing fees | | | 2,730 | | | | 2,208 | | | | 8,022 | | | | 6,555 | |

General and administration | | | 8,290 | | | | 8,097 | | | | 23,595 | | | | 22,418 | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 33,213 | | | | 31,711 | | | | 99,459 | | | | 90,649 | |

| | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before income taxes | | | (48,813 | ) | | | 27,326 | | | | (34,468 | ) | | | 96,539 | |

Provision for income tax benefit (expense) | | | 3,794 | | | | (3,763 | ) | | | 7,827 | | | | (6,060 | ) |

| | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (45,019 | ) | | | 23,563 | | | | (26,641 | ) | | | 90,479 | |

Discontinued operations, net of income tax (Note 7) | | | — | | | | (538 | ) | | | (1,645 | ) | | | (1,874 | ) |

| | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (45,019 | ) | | $ | 23,025 | | | $ | (28,286 | ) | | $ | 88,605 | |

| | | | | | | | | | | | | | | | |

(Loss) earnings per share of common stock-basic and diluted: | | | | | | | | | | | | | | | | |

Continuing operations | | $ | (0.97 | ) | | $ | 0.48 | | | $ | (0.57 | ) | | $ | 1.86 | |

Discontinued operations | | | — | | | | (0.01 | ) | | | (0.03 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | (0.97 | ) | | $ | 0.47 | | | $ | (0.60 | ) | | $ | 1.82 | |

| | | | | | | | | | | | | | | | |

Basic weighted average common shares outstanding | | | 46,644,485 | | | | 48,462,126 | | | | 47,526,139 | | | | 48,462,080 | |

Diluted weighted average common shares outstanding | | | 46,644,485 | | | | 48,479,152 | | | | 47,526,139 | | | | 48,478,654 | |

See accompanying notes to condensed consolidated financial statements.

2

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Shareholders’ Equity

Nine Months Ended September 30, 2006 and 2005

(Unaudited; in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Common

shares

outstanding | | | Common

stock | | | Paid-in

capital | | | Accumulated (deficit) earnings | | | Unearned

compensation | | | Total

shareholders’

equity | |

Balance at January 1, 2006 | | 48,514 | | | $ | 485 | | | $ | 493,603 | | | $ | 37,093 | | | $ | (4,538 | ) | | $ | 526,643 | |

Common shares repurchased | | (1,632 | ) | | | (16 | ) | | | (16,832 | ) | | | | | | | — | | | | (16,848 | ) |

Restricted stock issued | | 45 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Restricted stock forfeited | | (23 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

Restricted stock compensation expense | | — | | | | — | | | | 1,380 | | | | — | | | | — | | | | 1,380 | |

Stock options compensation expense | | — | | | | — | | | | 305 | | | | — | | | | — | | | | 305 | |

Reclass unearned compensation to paid-in capital upon adoption of FASB Statement No. 123R | | — | | | | — | | | | (4,538 | ) | | | — | | | | 4,538 | | | | — | |

Dividends declared | | — | | | | — | | | | — | | | | (59,801 | ) | | | — | | | | (59,801 | ) |

Dividend equivalent rights on outstanding stock options | | — | | | | — | | | | 48 | | | | (48 | ) | | | — | | | | — | |

Net loss | | — | | | | — | | | | — | | | | (28,286 | ) | | | — | | | | (28,286 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at September 30, 2006 | | 46,904 | | | $ | 469 | | | $ | 473,966 | | | $ | (51,042 | ) | | $ | — | | | $ | 423,393 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2005 | | 48,856 | | | $ | 489 | | | $ | 497,147 | | | $ | 36,430 | | | $ | (5,985 | ) | | $ | 528,081 | |

Restricted stock forfeited | | (38 | ) | | | (1 | ) | | | (562 | ) | | | — | | | | 563 | | | | — | |

Restricted stock compensation expense | | — | | | | — | | | | — | | | | — | | | | 998 | | | | 998 | |

Performance share award | | — | | | | — | | | | 587 | | | | — | | | | (587 | ) | | | — | |

Performance share awards compensation expense | | — | | | | — | | | | — | | | | — | | | | 39 | | | | 39 | |

Stock options exercised | | 3 | | | | — | | | | 37 | | | | — | | | | — | | | | 37 | |

Stock options compensation expense | | — | | | | — | | | | 207 | | | | — | | | | — | | | | 207 | |

Costs relating to the equity registration | | — | | | | — | | | | (433 | ) | | | — | | | | — | | | | (433 | ) |

Dividends declared | | — | | | | — | | | | — | | | | (47,371 | ) | | | — | | | | (47,371 | ) |

Net income (As restated- see Note 1 (g)) | | — | | | | — | | | | — | | | | 88,605 | | | | — | | | | 88,605 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Balance at September 30, 2005 (As restated- see Note 1 (g)) | | 48,821 | | | $ | 488 | | | $ | 496,983 | | | $ | 77,664 | | | $ | (4,972 | ) | | $ | 570,163 | |

| | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated financial statements.

3

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

Nine Months Ended September 30, 2006 and 2005

(Unaudited; in thousands)

| | | | | | | | |

| | | Nine Months Ended

September 30, | |

| | | 2006 | | | 2005(As

restated- see

Note 1 (g)) | |

Cash flows from operating activities: | | | | | | | | |

Net (loss) income | | $ | (28,286 | ) | | $ | 88,605 | |

Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 3,089 | | | | 2,473 | |

Amortization of deferred origination costs—loans held for investment | | | 18,945 | | | | 19,618 | |

Amortization of securitization issuance costs | | | 7,620 | | | | 8,278 | |

Amortization of bond discount | | | 67 | | | | 315 | |

Provision for losses—loans sold | | | 6,897 | | | | 6,313 | |

Provision for loan losses—loans held for investment | | | 38,894 | | | | 22,402 | |

Stock compensation expense | | | 1,813 | | | | 1,244 | |

Loss on disposal of discontinued operations | | | 904 | | | | — | |

Loss from discontinued operations | | | 741 | | | | 1,874 | |

Increase in accounts receivable | | | (27,982 | ) | | | (261 | ) |

Increase in accrued interest receivable | | | (5,716 | ) | | | (3,213 | ) |

Decrease (increase) in trustee receivable | | | 38,352 | | | | (27,235 | ) |

Funding of mortgage loans held for sale | | | (1,773,357 | ) | | | (2,232,785 | ) |

Proceeds from sales and payments of mortgage loans held for sale | | | 1,857,286 | | | | 2,692,301 | |

Increase in prepaid expenses and other assets | | | (5,692 | ) | | | (5,293 | ) |

Decrease (increase) in deferred tax asset, net | | | 1,643 | | | | (281 | ) |

Decrease (increase) in fair market value of derivative instruments | | | 23,764 | | | | (19,690 | ) |

Increase in accounts payable, accrued expenses and other liabilities | | | 1,331 | | | | 2,140 | |

| | | | �� | | | | |

Net cash provided by operating activities from continuing operations | | | 160,313 | | | | 556,805 | |

Net cash provided by (used in) operating activities from discontinued operations | | | 97,368 | | | | (103,904 | ) |

| | | | | | | | |

Net cash provided by operating activities | | | 257,681 | | | | 452,901 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Funding of mortgage loans held for investment | | | (2,101,865 | ) | | | (2,499,285 | ) |

Payments of mortgage loans held for investment | | | 1,796,374 | | | | 1,389,851 | |

Decrease (increase) in restricted cash | | | 2,581 | | | | (7,409 | ) |

Purchase of furniture and equipment, net | | | (2,249 | ) | | | (1,846 | ) |

Proceeds from sale of real estate owned | | | 37,564 | | | | 9,392 | |

| | | | | | | | |

Net cash used in investing activities from continuing operations | | | (267,595 | ) | | | (1,109,297 | ) |

Net cash provided by (used in) investing activities from discontinued operations | | | 101 | | | | (158 | ) |

| | | | | | | | |

Net cash used in investing activities | | | (267,494 | ) | | | (1,109,455 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from warehouse financing—loans held for sale | | | 1,490,512 | | | | 2,552,556 | |

Repayment of warehouse financing—loans held for sale | | | (1,515,406 | ) | | | (2,419,397 | ) |

Proceeds from warehouse financing—loans held for investment | | | 2,202,763 | | | | 1,866,173 | |

Repayment of warehouse financing—loans held for investment | | | (1,697,138 | ) | | | (1,694,114 | ) |

Proceeds from securitization financing | | | 1,670,478 | | | | 1,639,706 | |

Repayment of securitization financing | | | (1,985,078 | ) | | | (1,354,130 | ) |

Dividends paid | | | (70,670 | ) | | | (68,872 | ) |

Costs relating to the equity registration | | | — | | | | (433 | ) |

Purchases of common stock | | | (16,848 | ) | | | — | |

Proceeds from exercise of stock options | | | — | | | | 37 | |

| | | | | | | | |

Net cash provided by financing activities from continuing operations | | | 78,613 | | | | 521,526 | |

Net cash (used in) provided by financing activities from discontinued operations | | | (75,866 | ) | | | 107,896 | |

| | | | | | | | |

Net cash provided by financing activities | | | 2,747 | | | | 629,422 | |

| | | | | | | | |

Net decrease in cash | | | (7,066 | ) | | | (27,132 | ) |

Cash at the beginning of the period | | | 33,536 | | | | 61,681 | |

| | | | | | | | |

Cash at the end of the period | | $ | 26,470 | | | $ | 34,549 | |

| | | | | | | | |

Supplemental disclosures: | | | | | | | | |

Cash paid for interest | | $ | 240,331 | | | $ | 145,031 | |

Cash paid (received) for taxes | | | 1,271 | | | | (105 | ) |

Non-cash operating and investing activities: | | | | | | | | |

Transfer from mortgage loans held for sale to real estate owned | | $ | 7,478 | | | $ | 405 | |

Transfer from mortgage loans held for investment to real estate owned | | | 82,818 | | | | 21,907 | |

Transfer from mortgage loans held for investment to mortgage loans held for sale, net | | | — | | | | 530,830 | |

Transfer from mortgage loans held for sale to mortgage loans held for investment, net | | | 145,594 | | | | — | |

See accompanying notes to condensed consolidated financial statements.

4

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

September 30, 2006

(Unaudited; in thousands, except share and per share data)

(1) Organization and Summary of Significant Accounting Policies

(a) Organization

Fieldstone Investment Corporation (FIC) was incorporated in the State of Maryland on August 20, 2003, as a wholly owned subsidiary of Fieldstone Holdings Corp. (FHC). FHC was incorporated in the State of Delaware in February 1998 as a C corporation. In July 1998, FHC purchased 100% of the shares of Fieldstone Mortgage Company (FMC), a Maryland corporation formed in 1995. Prior to 2003, FHC operated as a taxable C corporation. Effective January 1, 2003, FHC elected to be taxed as an S corporation, and FMC was treated as a qualified sub-chapter S subsidiary.

In November 2003, FIC executed a reverse merger with FHC, with FIC as the surviving entity, in a transaction that was accounted for as a merger of entities under common control whereby the historical cost basis of the assets and liabilities was retained. In connection with the merger in November 2003, FIC elected to be taxed as a Real Estate Investment Trust (REIT), and FMC, its wholly owned subsidiary, elected to be taxed as a Taxable REIT Subsidiary (TRS).

In February of 2004, FIC formed two wholly owned subsidiaries, Fieldstone Mortgage Ownership Corp. (FMOC) and Fieldstone Servicing Corp. (FSC), as Maryland corporations, which are treated as qualified REIT subsidiaries. FMOC holds securities and ownership interests in owner trusts and other financing vehicles, including securities issued by FIC or on FIC’s behalf. FMOC holds the residual interest in FIC’s securitized pools, as well as any derivatives designated as economic interest rate hedges related to securitized debt. FSC holds the rights to direct the servicing of the mortgage loans held for investment.

In May of 2005, FIC formed a wholly owned, limited purpose financing subsidiary, Fieldstone Mortgage Investment Corporation (FMIC), a Maryland corporation, which is treated as a qualified REIT subsidiary. FMIC was formed for the purpose of facilitating the financing and sale of mortgage loans and mortgage-related assets by issuing and selling securities secured primarily by, or evidencing interests in, mortgage loans and mortgage-related assets.

FMC originates, purchases, and sells non-conforming and conforming residential mortgage loans and engages in other activities related to mortgage banking. FMC originates mortgage loans through wholesale and retail business channels through its network of independent mortgage brokers serviced by regional wholesale operations centers and a network of retail branch offices located throughout the country.

Non-conforming loans that are originated are underwritten in accordance with FMC’s underwriting guidelines designed to evaluate a borrower’s credit history, capacity, willingness, and ability to repay the loan, as well as the value and adequacy of the collateral. Conforming loans that are originated are loans that meet the underwriting criteria required for a mortgage loan to be saleable to a Government Sponsored Entity (GSE), such as Fannie Mae or Freddie Mac, or institutional investors.

A substantial portion of the non-conforming loans originated by FMC are closed by FMC using funds advanced by FIC, with a simultaneous assignment of the loans to FIC. These loans are held for investment and financed by warehouse debt and by issuing mortgage-backed securities secured by these loans. FMC sells the portion of the non-conforming loans not held for investment and all of the conforming loans that it originates on a whole-loan, servicing-released basis. FMC provides interim servicing on the loans held for sale from the time of funding until the time the loans are transferred to the permanent servicer, which generally occurs between 30 and 60 days after funding. With regard to the loans held for investment, the servicing rights are transferred to FSC. Pursuant to an agreement, JPMorgan Chase Bank, National Association acts as servicer of the loans held for investment. The servicer has primary responsibility for performing the servicing functions with respect to the loans, including all collection, advancing and loan level reporting obligations, maintenance of custodial and escrow accounts, maintenance of insurance and enforcement of foreclosure proceedings.

5

FMC is licensed or exempt from licensing requirements to originate residential mortgages in 50 states and the District of Columbia. FIC is licensed or exempt from licensing requirements to fund residential mortgage loans and acquire closed residential mortgage loans in all states in which it operates.

The accompanying unaudited condensed consolidated financial statements include the accounts of FIC and its subsidiaries (together, the Company) and have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP) for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. All intercompany balances and transactions have been eliminated in consolidation.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments, consisting of normal recurring accruals, necessary for a fair presentation. The results of operations and other data for the three and nine months ended September 30, 2006 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2006. The unaudited condensed consolidated financial statements presented herein should be read in conjunction with the audited consolidated financial statements and related notes thereto in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

(b) Discontinued Operations

On January 13, 2006, the Company’s Board of Directors approved a plan to sell, close or otherwise dispose of the assets of its conforming retail and conforming wholesale segments. In February 2006, the assets pertaining to these segments’ headquarters, all wholesale offices, and certain of its retail offices were sold to third parties. The remaining assets of the conforming division were combined with the Company’s non-conforming retail offices.

In accordance with the provisions of Statement of Financial Accounting Standards No. 144,“Accounting for the Impairment or Disposal of Long-Lived Assets”(Statement No. 144), the results of operations, net of income tax, and cash flows associated with the disposal of these conforming wholesale and conforming retail offices has been classified as discontinued operations and segregated from the results of the Company’s continuing operations for all periods presented.

(c) Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Critical estimates include (i) an estimate of the representation and warranty liabilities related to the sale of mortgage loans; (ii) an estimate of losses inherent in mortgage loans held for investment, which is used to determine the related allowance for loan losses and realizable value of the Company’s accrued interest receivable; (iii) an estimate of the future loan prepayment rate of mortgage loans held for investment, which is used in the calculation of deferred origination and bond issuance cost amortization; (iv) the non-cash mark to market valuation of the interest rate swaps which economically hedge the Company’s securitization debt and (v) the fair market value of equity compensation awards. Actual results could differ from those estimates. Amounts on the consolidated statements of operations most affected by the use of estimates are the reserve for losses—loans sold (which is a component of gains on sales of mortgage loans, net), provision for loan losses—loans held for investment, interest income – loans held for investment, derivative valuations (which are a component of other income/(expense)—portfolio derivatives), stock-based compensation (which is a component of salaries and employee benefits) and deferred origination and bond issuance costs (which are components of net interest income for loans held for investment and gains on sales of mortgage loans, net, for loans held for sale).

(d) Concentration of Credit Risk

The non-conforming mortgage loans that the Company originates primarily consist of adjustable-rate mortgage (ARM) loans, the payments on which are adjustable from time to time as interest rates change, generally after an initial two year period during which the loans’ interest rates are fixed. After an initial fixed rate period, generally two-years, the borrowers’ payments on their ARM loans adjust once every six months to a pre-determined margin over a measure of market interest rates, generally the London InterBank Offered Rate (LIBOR) for one-month deposits. Many ARMs contain an “interest only” feature for the first five years of the loan, so that the borrowers do not begin to repay the principal balance of the loans until after the fifth year of the loans. After the fifth year, the

6

borrowers’ payments increase to amortize the entire principal balance owed over the remaining years of the loan. For both the three and nine months ended September 30, 2006, 41% of non-conforming mortgage loan originations were “interest only” ARMs. For both the three and nine months ended September 30, 2005, 57% of non-conforming mortgage loan originations were ARMs with an “interest only” feature.

These loan features will likely result in the borrowers’ payments increasing in the future. The interest adjustment feature generally will result in an increased payment after the second year of the loan and the interest only feature will result in an increased payment after the fifth year of the loan. Since these features will increase the debt service requirements of the borrowers, it may increase the risk of default on the Company’s investment portfolio of non-conforming loans that remain outstanding at least two years (relative to the ARM feature) or for five years (relative to the interest only feature).

For the three and nine months ended September 30, 2006, 60% and 59%, respectively, of non-conforming loan originations were underwritten with little or no supporting documentation of the borrowers’ income, under the Company’s “stated income” loan programs and “bank statement” programs. The Company mitigates its risk on such loans by establishing minimum credit score standards and otherwise evaluating the borrower’s income and cash flow. Based on its past experiences with similar loans and on industry performance data, the Company believes its strict underwriting guidelines relating to non-conforming loans help the Company to evaluate a borrower’s credit history, willingness and ability to repay the loans, as well as the value and adequacy of the borrower’s collateral. The Company’s underwriting guidelines are designed to balance the credit risk of the borrower with the loan-to-value (LTV) and interest rate of the loan. For the three and nine months ended September 30, 2005, 56% and 55%, respectively, of non-conforming loan originations were underwritten under “stated income” or “bank statement” loan programs.

For the three and nine months ended September 30, 2006, 40% and 37%, respectively, of the non-conforming loan originations included loans secured by properties located in California. The Company’s originations are concentrated heavily in California because it is the largest mortgage market in the U.S. and the Company believes that its underwriting, product design, and pricing philosophies address the characteristics of California borrowers. The Company believes these characteristics that address California borrowers to be non-standard credit profiles, interest in low down payment products, payment-focused mortgages, and higher home values. An overall decline in the economy or the residential real estate market or the occurrence of a natural disaster in California could adversely affect the value of the mortgaged properties in that state and increase the risk of delinquency, foreclosure, bankruptcy, or loss on the loans in the Company’s investment portfolio. Non-conforming loan originations secured by property located in California comprised 42% and 41% of total non-conforming loan originations for the three and nine months ended September 30, 2005, respectively.

(e) Recent Accounting Pronouncements

In September 2006, the SEC staff issued Staff Accounting Bulletin No. 108 (SAB No. 108). SAB No. 108 provides guidance on the consideration of prior year misstatements in quantifying the materiality of current year misstatements. SAB No. 108 is effective for fiscal years ending after November 15, 2006. The Company will adopt, SAB No. 108, as applicable, beginning in fiscal year 2007. Management believes that the implementation of SAB No. 108 will not have a material effect on its results of operations, statements of condition or cash flows.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (Statement No. 157). Statement No. 157 consistently defines fair value and establishes a framework for measuring fair value in generally accepted accounting principles and modifies fair value disclosure requirements in periodic SEC filings. Statement No. 157 is effective for fiscal years beginning after November 15, 2007. The Company will adopt, Statement No. 157, as applicable, beginning in fiscal year 2008. Management is currently assessing the impact that the implementation of Statement No. 157 may have on its results of operations, statements of condition or cash flows.

In June 2006, the FASB issued FASB Interpretation No. 48“Accounting For Uncertainty in Income Taxes-an interpretation of FASB Statement No. 109,”(FIN No. 48). FIN No. 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN No. 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. FIN No. 48 is effective for fiscal years beginning after December 15, 2006. The Company will adopt FIN No. 48, as applicable, beginning in fiscal year 2007. Management is currently assessing the impact that the implementation of FIN No. 48 may have on its results of operations, statements of condition or cash flows.

7

In March 2006, the FASB issued Statement of Financial Accounting Standards No. 156,“Accounting For Servicing of Financial Assets-an amendment of FASB Statement No. 140,”(Statement No. 156). Statement No. 156 amends Statement of Financial Accounting Standards No. 140,“Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities,” (Statement No. 140), with respect to the accounting for separately recognized servicing rights. Statement No. 156 requires an entity to initially recognize, at fair value, a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering into a servicing contract in certain situations. In addition, Statement No. 156 permits the subsequent measurement of servicing assets and servicing liabilities using the fair value method or the amortization method as prescribed under Statement No. 140. Statement No. 156 is effective as of the beginning of an entity’s first fiscal year that begins after September 15, 2006. The Company will adopt Statement No. 156, as applicable, beginning in fiscal year 2007. Management believes that the implementation of Statement No. 156 will not have a material effect on its results of operations, statements of condition or cash flows.

In February 2006, the FASB issued Statement of Financial Accounting Standards No. 155,“Accounting For Certain Hybrid Financial Instruments-an amendment of FASB Statements No. 133 and 140,”(Statement No. 155). Statement No. 155 amends Statement No. 133 to permit fair value remeasurement for any hybrid financial instrument with an embedded derivative that otherwise would require bifurcation, provided that the whole instrument is accounted for on a fair value basis. Statement No. 155 amends Statement No. 140 to allow a qualifying special-purpose entity to hold a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. Statement No. 155 is effective for all financial instruments acquired, issued or subject to a remeasurement (new basis) event occurring after the beginning of an entity’s first fiscal year that begins after September 15, 2006. The Company will adopt Statement No. 155, as applicable, beginning in fiscal year 2007. Management believes that the implementation of Statement No. 155 will not have a material effect on its results of operations, statements of condition or cash flows.

In December 2005, the FASB issued Staff Position 94-6-1, “Terms of Loan Products That May Give Rise to a Concentration of Credit Risk,” (FSP 94-6-1). FSP 94-6-1 clarifies that loan products that expose an originator, holder, investor, guarantor or servicer to an increased risk of non-payment or not realizing the full value of the loan, such as non-traditional loan products, may result in a concentration of credit risk as defined in Statement of Financial Accounting Standards No. 107,“Disclosures about Fair Value of Financial Instruments,” (Statement No. 107). FSP 94-6-1 also emphasizes the requirement to assess the adequacy of disclosures for all lending products (including both secured and unsecured loans) and the effect of changes in market or economic conditions on the adequacy of those disclosures. The guidance under FSP 94-6-1 is effective for interim and annual reporting periods ending on or after December 19, 2005 and for loan products that are determined to represent a concentration of credit risk, disclosure requirements of Statement No. 107 should be provided for all periods presented. The adoption of FSP 94-6-1 has not had a significant impact on the Company’s consolidated financial statements.

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123R, “Share Based Payments” (Statement No. 123R), requiring, among other things, that the compensation cost of stock options and other equity-based compensation issued to employees, which cost is based on the estimated fair value of the awards on the grant date, be reflected in the income statement over the requisite service period. In March 2005, the SEC staff issued Staff Accounting Bulletin No. 107 (SAB No. 107). SAB No. 107 expresses the views of the SEC regarding Statement No. 123R and certain rules and regulations and provides the SEC’s view regarding the valuation of share-based payment arrangements for public companies. In April 2005, the SEC amended the compliance dates for Statement No. 123R to the beginning of the next fiscal year after June 15, 2005. In November 2003, the Company adopted the fair value method of accounting for grants of stock options and restricted stock as prescribed by Statement of Financial Accounting Standards No. 148, “Accounting for Stock-Based Compensation-Transition and Disclosure.” Under this method, compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense on a straight-line basis over the award’s vesting period. The Company adopted Statement No. 123R and SAB No. 107 as of January 1, 2006, which resulted in a change in the accounting for unearned compensation whereby the balance of unearned compensation as of December 31, 2005, and all subsequent unearned compensation transactions were recorded to additional paid-in capital on the consolidated statements of condition. The implementation of Statement No. 123R and SAB No. 107 has not had a material effect on the Company’s results of operations, statements of condition or cash flows.

8

(f) Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. In accordance with Statement No. 144, the Company has reclassified the operating results of the conforming wholesale and retail offices that were disposed of in the first quarter of 2006 as discontinued operations in the condensed consolidated statements of operations for the three and nine months ended September 30, 2005. Also included in these reclassifications is the reclassification of changes in restricted cash from cash flows from operating activities to cash flows from investing activities in the amount of $7.4 million for the nine months ended September 30, 2005.

(g) Restatement

In preparing the Company’s 2005 consolidated financial statements, the Company’s management identified errors in the accounting for income taxes related to the sale of loans by FMC (the Company’s TRS) to FIC (which operates as a REIT) in the fourth quarter of 2003 and the second quarter of 2005. In each of these periods, the Company had previously recognized the entire income tax expense related to the gains on sales earned by FMC on these sales of non-conforming loans to FIC for inclusion in its investment portfolio. However, the Company determined that it should have deferred the portion of the income tax expense related to the intercompany sale of those loans that remained on the Company’s consolidated statements of condition at each period end. Such deferred tax asset should have been recognized as expense over the life of the loans. As a result, the Company has restated the accompanying 2005 condensed consolidated financial statements.

A summary of the significant effects of the restatement on the accompanying condensed consolidated financial statements is as follows:

| | | |

Condensed Consolidated Statement of Condition: |

| | | September 30,

2005 |

| | | Total Shareholder’s Equity |

As previously reported | | $ | 568,418 |

Income tax adjustment | | | 1,745 |

| | | |

As restated | | $ | 570,163 |

| | | |

| | | | | | | | | | | | |

Condensed Consolidated Statements of Operations: | |

| |

| | | Three Months Ended September 30, 2005 | |

| | | Income Tax (Expense) Benefit | | | Net

Income | | | Earnings

Per Share

(Diluted) | |

As previously reported | | $ | (2,999 | ) | | $ | 23,424 | | | $ | 0.48 | |

Income tax restatement adjustment | | | (399 | ) | | | (399 | ) | | | (0.01 | ) |

Reclassification of income tax benefit included in loss from discontinued operations | | | (365 | ) | | | — | | | | — | |

| | | | | | | | | | | | |

As restated | | $ | (3,763 | ) | | $ | 23,025 | | | $ | 0.47 | |

| | | | | | | | | | | | |

9

| | | | | | | | | | |

| Condensed Consolidated Statements of Operations: |

| |

| | | Nine Months Ended September 30, 2005 |

| | | Income Tax (Expense) Benefit | | | Net

Income | | Earnings

Per Share

(Diluted) |

As previously reported | | $ | (4,792 | ) | | $ | 88,603 | | $ | 1.82 |

Income tax restatement adjustment | | | 2 | | | | 2 | | | — |

Reclassification of income tax benefit included in loss from discontinued operations | | | (1,270 | ) | | | — | | | — |

| | | | | | | | | | |

As restated | | $ | (6,060 | ) | | $ | 88,605 | | $ | 1.82 |

| | | | | | | | | | |

(2) Mortgage Loans Held for Sale and Reserve for Losses—Sold Loans

Mortgage loans that the Company acquires or originates with the intent to sell are initially recorded at cost, including any premium paid or discount received, and subsequently adjusted for the change in the fair value during the period in which the loan was an interest rate lock commitment. Loans held for sale are carried on the books at the lower of cost or market value calculated on an aggregate basis by type of loan. Mortgage loans held for sale, net, as of September 30, 2006 and December 31, 2005 are as follows:

| | | | | | | | |

| | | September 30,

2006 | | | December 31,

2005 | |

Mortgage loans held for sale | | $ | 244,528 | | | $ | 591,840 | |

Net deferred origination costs | | | 700 | | | | 1,547 | |

Premium, net of discount | | | 471 | | | | 1,987 | |

Allowance for the lower of cost or market value | | | (2,234 | ) | | | (1,105 | ) |

| | | | | | | | |

Total | | $ | 243,465 | | | $ | 594,269 | |

| | | | | | | | |

The Company maintains a reserve for its representation and warranty liabilities related to the sale of loans and its contractual obligations to rebate a portion of any premium received when a sold loan prepays within an agreed period. The reserve, which is recorded as a liability on the consolidated statements of condition, is established when loans are sold, and is calculated as the fair value of liabilities reasonably estimated to occur during the life of the loans. The provision is recorded as a reduction of the gains on sale of loans. At September 30, 2006 and December 31, 2005, mortgage loans held for sale included approximately $7.8 million and $1.7 million, respectively, of loans repurchased pursuant to these contractual obligations, net of any related valuation allowance. Realized losses on sold loans, primarily related to early payment defaults, premium recaptures on early payoffs, and representation and warranty liability, totaled $6.3 million and $16.8 million, or 1.07% and 0.80% of total loan sales, respectively, in the three and nine months ended September 30, 2006. The net realized losses on sold loans totaled $0.8 million and $1.8 million, or 0.06% and 0.05% of total loan sales, respectively, in the three and nine months ended September 30, 2005.

As of September 30, 2006, the Company had $12.8 million of loans deemed to be unsaleable at standard sale premiums compared to $5.2 million at December 31, 2005. The Company recorded a valuation allowance of $0.7 million and $1.1 million, as of September 30, 2006 and December 31, 2005, respectively, for these loans.

The reserve for losses—loans sold is summarized as follows for the three and nine months ended September 30, 2006 and 2005:

| | | | |

Balance at June 30, 2006 | | $ | 28,028 | |

Provision | | | 3,476 | |

Realized losses | | | (6,650 | ) |

Recoveries | | | 351 | |

| | | | |

Balance at September 30, 2006 | | $ | 25,205 | |

| | | | |

| |

Balance at June 30, 2005 | | $ | 38,411 | |

Provision | | | 185 | |

Realized losses | | | (872 | ) |

Recoveries | | | 60 | |

| | | | |

| Balance at September 30, 2005 | | $ | 37,784 | |

| | | | |

10

| | | | |

Balance at December 31, 2005 | | $ | 35,082 | |

Provision | | | 6,897 | |

Realized losses | | | (17,417 | ) |

Recoveries | | | 643 | |

| | | | |

Balance at September 30, 2006 | | $ | 25,205 | |

| | | | |

| |

| Balance at December 31, 2004 | | $ | 33,302 | |

Provision | | | 6,313 | |

Realized losses | | | (1,966 | ) |

Recoveries | | | 135 | |

| | | | |

| Balance at September 30, 2005 | | $ | 37,784 | |

| | | | |

Historically, the Company has experienced substantially all of its representation and warranty losses on loans sold during the first three years following the sale. The reserve for losses—loans sold as of September 30, 2006 relates to approximately $11.3 billion of loan sales during the period of October 1, 2003 through September 30, 2006.

The market value of second lien loans decreased significantly at the end of the second quarter of 2006 due to slowing home price appreciation and a forecast of increased losses on second lien loans by prominent rating agencies. As of September 30, 2006, the Company determined that the market value of $28.1 million of its second lien loans held for sale as of that date was less than their carrying value. Accordingly, the Company recorded pre-tax charges of $0.4 million and $4.9 million, respectively, for the three and nine months ended September 30, 2006 to reduce these loans to the lower of cost or market value as a reduction in the gain on sales of mortgage loans, net.

(3) Mortgage Loans Held for Investment and Allowance for Loan Losses

The Company originates fixed-rate and adjustable-rate mortgage loans that have a contractual maturity of up to 40 years. These mortgage loans are initially recorded at cost, including any premium or discount. These mortgage loans are financed with warehouse debt until they are pledged as collateral for securitization financing. The Company is exposed to risk of loss from its loan portfolio, and establishes an allowance for loan losses taking into account a variety of criteria including the contractual delinquency status, market delinquency roll rates, market historical loss severities, and the Company’s historical loss experiences with similar loans. The adequacy of this allowance for loan losses is periodically evaluated and adjusted based on this review.

The following is a detail of the mortgage loans held for investment, net as of September 30, 2006 and December 31, 2005:

| | | | | | | | |

| | | September 30,

2006 | | | December 31,

2005 | |

Securitized mortgage loans held for investment | | $ | 4,720,465 | | | $ | 5,043,762 | |

Mortgage loans held for investment—warehouse financed | | | 1,165,136 | | | | 486,454 | |

Net deferred origination fees and costs | | | 33,621 | | | | 40,199 | |

| | | | | | | | |

Mortgage loans held for investment | | | 5,919,222 | | | | 5,570,415 | |

Allowance for loan losses—loans held for investment | | | (64,034 | ) | | | (44,122 | ) |

| | | | | | | | |

Mortgage loans held for investment, net | | $ | 5,855,188 | | | $ | 5,526,293 | |

| | | | | | | | |

The allowance for loan losses—loans held for investment for the three and nine months ended September 30, 2006 and 2005 is as follows:

| | | | |

Balance at June 30, 2006 | | $ | 44,749 | |

Provision | | | 28,035 | |

Realized losses | | | (8,750 | ) |

Recoveries | | | — | |

| | | | |

Balance at September 30, 2006 | | $ | 64,034 | |

| | | | |

| |

Balance at June 30, 2005 | | $ | 30,690 | |

Provision | | | 11,045 | |

Realized losses | | | (2,697 | ) |

Recoveries | | | 291 | |

| | | | |

Balance at September 30, 2005 | | $ | 39,329 | |

| | | | |

11

| | | | |

Balance at December 31, 2005 | | $ | 44,122 | |

Provision | | | 38,894 | |

Realized losses | | | (18,982 | ) |

Recoveries | | | — | |

| | | | |

Balance at September 30, 2006 | | $ | 64,034 | |

| | | | |

| |

Balance at December 31, 2004 | | $ | 22,648 | |

Provision | | | 22,402 | |

Realized losses | | | (6,357 | ) |

Recoveries | | | 636 | |

| | | | |

Balance at September 30, 2005 | | $ | 39,329 | |

| | | | |

Mortgage loans held for investment are placed in non-accrual status for interest income recognition when they are past-due ninety days as to either principal or interest or when, in the opinion of management, the collection of principal and interest is in doubt. Loans held for investment on non-accrual status were $251.6 million and $112.9 million as of September 30, 2006 and 2005, respectively, and $150.3 million as of December 31, 2005. Loans on non-accrual status averaged $213.1 million and $76.7 million, respectively, for the nine months ended September 30, 2006 and 2005. During the three months ended September 30, 2006 and 2005, respectively, the Company reversed previously accrued interest income relating to non-performing and delinquent loans, which would ordinarily have been recognized per contractual loan terms, of approximately $4.8 million and $2.2 million. The Company reversed interest income related to these loans of approximately $10.6 million and $5.4 million during the nine months ended September 30, 2006 and 2005, respectively.

Prior to the second quarter of 2006, the Company utilized industry loss assumptions for loans similar in credit, loan size, and product type in making estimates regarding the allowance for loan losses because the Company had limited historical loss data on past originations, all of which were sold servicing-released prior to October 2003. Beginning in the second quarter of 2006, the Company began to blend its own historical delinquency experiences with industry averages in estimating the percentage of loans that are delinquent 30+ days that will ultimately go to foreclosure. This resulted in an estimate that approximately 20% of the loans 30+ days delinquent will ultimately go to foreclosure. During the third quarter of 2006, we increased our estimate of the proportion of foreclosed properties that will be transferred to real estate owned as a result of our actual experience in the current market environment. In addition to blending our own historical delinquency experiences with industry averages, we began to utilize historical loss experiences in estimating loss severity for pools for which we have significant realized loss experience during the second quarter of 2006. Applying this methodology individually to each pool yielded an estimated average loss severity of approximately 26% for 2003, 2004 and early 2005 vintage loans. The Company continues to use industry loss severity estimates of 35% for loans originated since the second half of 2005 for which a material level of actual realized loss experience for its own loans is not available. These underlying assumptions and estimates are periodically evaluated and updated to reflect management’s current assessment of the value of the underlying collateral, actual historical loss experience, and other relevant factors impacting portfolio credit quality and inherent losses.

(4) Warehouse Financing, Loans Held for Sale and Loans Held for Investment

As of September 30, 2006, the Company had $1.75 billion of committed warehouse lines of credit with five financial entities. There were no uncommitted warehouse lines as of September 30, 2006. The facilities are secured by mortgage loans held for investment to be securitized, mortgage loans held for sale, the related investor commitments to purchase those loans held for sale, and all proceeds thereof.

Warehouse lines of credit and repurchase facilities consist of the following as of September 30, 2006 and December 31, 2005:

| | | | | | | | | | | |

| (in millions) | | Amount Outstanding as of: |

Lender | | Amount

Available | | Maturity Date | | September 30,

2006 | | December 31,

2005 |

Countrywide Warehouse Lending1 | | $ | — | | n/a | | $ | — | | $ | 34.3 |

Credit Suisse First Boston Mortgage Capital | | | 400.0 | | April 2007 | | | 305.0 | | | 195.2 |

Credit Suisse, New York Branch Commercial Paper Facility | | | 600.0 | | July 2007 | | | 449.5 | | | 415.8 |

JPMorgan Chase Bank | | | 150.0 | | July 2007 | | | 84.9 | | | 53.9 |

Lehman Brothers Bank2 | | | 300.0 | | December 2006 | | | 183.0 | | | 51.7 |

Merrill Lynch Bank USA3 | | | 300.0 | | November 2006 | | | 195.2 | | | 61.9 |

| | | | | | | | | | | |

Total | | $ | 1,750.0 | | | | $ | 1,217.6 | | $ | 812.8 |

| | | | | | | | | | | |

| 1 | Facility expired in August 2006 and was not renewed. |

| 2 | The Company intends to renew the facility prior to its current maturity date. The Company amended the facility in October 2006 to increase the committed amount to $500 million. |

| 3 | The Company renewed this facility on October 31, 2006 extending the maturity date until October 2007, increasing the committed line to $400 million and including real estate owned property among the assets that can be financed. |

12

The average outstanding amounts under these agreements were $943.2 million and $811.9 million for the three and nine months ended September 30, 2006, respectively, and $875.9 million and $744.5 million for the three and nine months ended September 30, 2005, respectively. The maximum amount outstanding under these agreements at any month-end during the nine months ended September 30, 2006 and 2005 was $1.22 billion and $1.33 billion, respectively. The weighted average interest rate on September 30, 2006, December 31, 2005 and September 30, 2005 was 5.7%, 4.7% and 4.3%, respectively. The interest rates are based on spreads to one month or overnight LIBOR, and are generally reset daily or weekly. The Company also pays facility fees based on the commitment amount and non-use fees.

A summary of coupon interest expense and facilities fees included in total interest expense in the condensed consolidated statements of operations and the weighted average cost of funds for the three and nine months ended September 30, 2006 and 2005 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| | | Amount | | Weighted

Average

Cost | | | Amount | | Weighted

Average

Cost | | | Amount | | Weighted Average Cost | | | Amount | | Weighted

Average

Cost | |

Coupon interest expense | | $ | 13,936 | | 5.8 | % | | $ | 8,920 | | 4.0 | % | | $ | 32,261 | | 5.2 | % | | $ | 20,935 | | 3.7 | % |

Facilities fees | | | 531 | | 0.2 | % | | | 956 | | 0.4 | % | | | 1,886 | | 0.3 | % | | | 2,588 | | 0.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 14,467 | | 6.0 | % | | $ | 9,876 | | 4.4 | % | | $ | 34,147 | | 5.5 | % | | $ | 23,523 | | 4.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

The warehouse lines generally have a term of 364 days or less. Management expects to renew these lines of credit prior to their respective maturity dates. The credit facilities are secured by substantially all of the Company’s non-securitized mortgage loans and contain customary financial and operating covenants that require the Company to maintain specified levels of liquidity and net worth, maintain specified levels of profitability, restrict indebtedness and investments, and require compliance with applicable laws. The Company was in compliance with all of these covenants at September 30, 2006 and December 31, 2005.

(5) Securitization Financing

During the nine months ended September 30, 2006, the Company issued $1.7 billion of mortgage-backed bonds through securitization trusts to finance the Company’s portfolio of loans held for investment. The bonds pay interest monthly based upon a weighted average spread over LIBOR. Interest rates reset monthly and are indexed to one-month LIBOR. The bonds are repaid primarily from the cash flows derived from the mortgage loans pledged to the trust. The estimated average life of the bonds is approximately 22 months, and is based on estimates and assumptions made by management. The actual period from inception to maturity may differ from management’s expectations. The Company retains the option to call the transaction and repay the bonds when the remaining unpaid principal balance of the underlying mortgage loans for each pool falls below specified levels. The securitization financings include a step up stipulation which provides that the bond margin over LIBOR will increase 1.5 to 2.0 times the original margin if the option to repay the bonds is not exercised.

The following is a summary of the securitizations issued by series during the nine months ended September 30, 2006:

| | | | | | | | |

| | | FMIT 2006-1 | | | FMIT 2006-2 | |

Bonds issued | | $ | 904,000 | | | $ | 766,000 | |

Loans pledged | | | 933,000 | | | | 800,000 | |

Deferred bond issuance costs | | $ | 3,100 | | | $ | 2,700 | |

Weighted average spread over LIBOR | | | 0.32 | % | | | 0.29 | % |

Financing costs—LIBOR plus | | | 0.08% - 2.30 | % | | | 0.09% - 1.90 | % |

13

The average securitization financing outstanding was $5.1 billion and $5.0 billion for the three and nine months ended September 30, 2006, respectively, and $4.3 billion for both the three and nine months ended September 30, 2005.

The unamortized bond issuance costs at September 30, 2006 and December 31, 2005 were $9.8 million and $11.6 million, respectively.

A summary of coupon interest expense, amortization of deferred issuance costs, and original issue discount included in total interest expense in the consolidated statements of operations, and the weighted average cost of funds of the securitization financing, for the three and nine months ended September 30, 2006 and 2005 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2006 | | | 2005 | | | 2006 | | | 2005 | |

| | | Amount | | Weighted Average Cost | | | Amount | | Weighted

Average

Cost | | | Amount | | Weighted

Average

Cost | | | Amount | | Weighted

Average

Cost | |

Coupon interest expense | | $ | 74,412 | | 5.7 | % | | $ | 43,867 | | 4.0 | % | | $ | 202,095 | | 5.4 | % | | $ | 112,708 | | 3.5 | % |

Amortization of deferred costs | | | 2,342 | | 0.2 | % | | | 4,171 | | 0.4 | % | | | 7,620 | | 0.2 | % | | | 8,278 | | 0.3 | % |

Amortization of bond discount | | | 11 | | 0.0 | % | | | 167 | | 0.0 | % | | | 67 | | 0.0 | % | | | 315 | | 0.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 76,765 | | 5.9 | % | | $ | 48,205 | | 4.4 | % | | $ | 209,782 | | 5.6 | % | | $ | 121,301 | | 3.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

The Company also has the ability to finance the rated securities it retains in securitizations through two repurchase facilities, each with an uncommitted amount of $200 million. At September 30, 2006, the Company owned $255.1 million of investment grade rated securities it retained from its securitizations, $202.2 million of which were so rated by only one nationally recognized rating agency. The first facility is with Liquid Funding, Ltd., an affiliate of Bear Stearns Bank plc. The second facility is with Lehman Brothers, Inc. and Lehman Brothers Commercial Paper Inc. Each facility bears interest at an annual rate of LIBOR plus an additional percentage.

During March 2006, the unpaid principal balance of the loans collateralizing FMIT Series 2004-1 fell below 20% of the original principal cut-off balance of the collateral, permitting FSC to exercise its right of optional termination of the financing. Management reviewed the performance of mortgage loans in the financing trust and related cost of financing and subsequently delivered notice in April 2006 to the FMIT Series 2004-1 trustee and bondholders of the exercise of the Company’s option to purchase the mortgage loans, REO property, and any other property remaining in the trust at the next payment date. The Company paid $100.4 million to third-party bondholders on April 25, 2006. The underlying collateral is included on the consolidated statement of condition as a component of loans held for investment.

Similarly, the unpaid principal balance of the loans collateralizing FMIT Series 2004-2 fell below 20% during July 2006, permitting FSC to exercise its right of optional termination of the financing. Management reviewed the performance of mortgage loans in the financing trust and related cost of financing and subsequently delivered notice in August 2006 to the FMIT Series 2004-2 trustee and bondholders of the exercise of the Company’s option to purchase the mortgage loans, REO property, and any other property remaining in the trust at the next payment date. The Company paid $122.1 million to third-party bondholders on August 25, 2006. The underlying collateral is included in the consolidated statement of condition as a component of loans held for investment.

14

The following is a summary of the outstanding securitization bond financing and weighted average interest rate by series as of September 30, 2006 and December 31, 2005:

| | | | | | | | | | | | | | |

| | | September 30, 2006 | | | December 31, 2005 | |

($ in 000s) | | Amount

Outstanding | | | Weighted Avg

Interest Rate | | | Amount

Outstanding | | | Weighted Avg

Interest Rate | |

FMIT Series 2006-2 | | $ | 752,648 | | | 5.6 | % | | $ | — | | | — | % |

FMIT Series 2006-1 | | | 835,641 | | | 5.7 | % | | | — | | | — | % |

FMIT Series 2005-3 | | | 947,447 | | | 5.7 | % | | | 1,089,820 | | | 4.7 | % |

FMIT Series 2005-2 | | | 691,076 | | | 5.8 | % | | | 872,455 | | | 4.7 | % |

FMIT Series 2005-1 | | | 396,037 | | | 5.8 | % | | | 555,650 | | | 4.7 | % |

FMIT Series 2004-5 | | | 415,987 | | | 6.0 | % | | | 595,481 | | | 4.9 | % |

FMIT Series 2004-4 | | | 275,821 | | | 6.1 | % | | | 518,283 | | | 4.9 | % |

FMIT Series 2004-3 | | | 177,238 | | | 6.3 | % | | | 523,296 | | | 4.9 | % |

FMIT Series 2004-2 | | | — | | | — | % | | | 377,500 | | | 4.9 | % |

FMIT Series 2004-1. | | | — | | | — | % | | | 233,977 | | | 5.0 | % |

FMIC Series 2003-1 | | | 36,635 | | | 8.0 | % | | | 83,308 | | | 6.1 | % |

| | | | | | | | | | | | | | |

| | | 4,528,530 | | | 5.8 | % | | | 4,849,770 | | | 4.8 | % |

Unamortized bond discount | | | (7 | ) | | | | | | (74 | ) | | | |

| | | | | | | | | | | | | | |

Subtotal securitization bond financing | | | 4,528,523 | | | | | | | 4,849,696 | | | | |

Liquid Funding repurchase facility | | | 97,175 | | | | | | | 86,079 | | | | |

Lehman Brothers repurchase facility | | | 58,389 | | | | | | | 62,845 | | | | |

| | | | | | | | | | | | | | |

Total securitization financing | | $ | 4,684,087 | | | | | | $ | 4,998,620 | | | | |

| | | | | | | | | | | | | | |

The current carrying amount of the mortgage loans pledged to the trusts was $4.7 billion and $5.0 billion as of September 30, 2006 and December 31, 2005, respectively.

(6) Derivatives and Hedging Activities

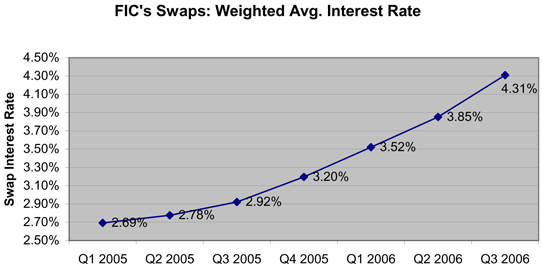

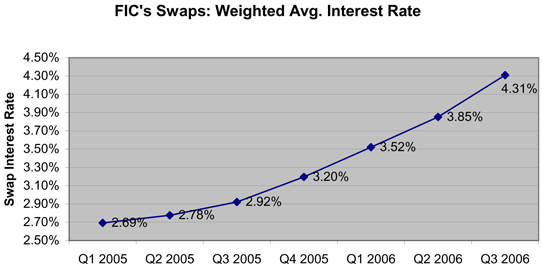

In conjunction with the financing of its portfolio of loans held for investment, the Company enters into interest rate swaps designed to be economic hedges of the floating rate warehouse and securitization debt. At September 30, 2006, the fair value of 16 interest rate swaps with positive fair values was $15.7 million and the fair value of 10 swaps with negative fair values was $4.8 million, for a net fair value of $10.8 million. At December 31, 2005, the fair value of 26 interest rate swaps with positive fair values was $35.2 million and the fair value of 3 swaps with negative fair values was $0.2 million, for a net fair value of $35.0 million. The swaps are not classified as cash flow hedges under Statement No. 133, and therefore, the mark to market valuation decrease of $25.1 million and an increase of $7.8 million have been included in earnings during the three months ended September 30, 2006 and 2005, respectively. Results of operations include the mark to market valuation decrease of $24.2 million and an increase of $16.7 million during the nine months ended September 30, 2006 and 2005, respectively. The net cash settlements paid or received on the interest rate swaps are also reported as a component of “Other income (expense)—portfolio derivatives” in the condensed consolidated statement of operations.

In conjunction with the Company’s FMIT Series 2003-1 securitization, the Company purchased an interest rate cap agreement by paying a premium of $3.0 million, determined to be an economic hedge of the floating rate debt of the security. Mark to market valuation decreases of $0.2 million and $0.5 million, respectively, have been included in earnings during the three and nine months ended September 30, 2005. During the fourth quarter of 2005, the interest rate cap expired.

15

The amounts of cash settlements and non-cash changes in value that were included in “Other income (expense)—portfolio derivatives” is as follows for the three and nine months ended September 30, 2006 and 2005:

| | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2006 | | | 2005 | | 2006 | | | 2005 |

Non-cash mark to market valuation change | | $ | (25,088 | ) | | $ | 7,630 | | $ | (24,218 | ) | | $ | 16,171 |

Net cash settlements on interest rate swaps | | | 11,333 | | | | 8,000 | | | 33,442 | | | | 10,369 |

| | | | | | | | | | | | | | |

Other income (expense)—portfolio derivatives | | $ | (13,755 | ) | | $ | 15,630 | | $ | 9,224 | | | $ | 26,540 |

| | | | | | | | | | | | | | |

(7) Discontinued Operations

On January 13, 2006, the Company’s Board of Directors approved a plan to sell, close or otherwise dispose of the assets of its conforming retail and conforming wholesale segments. In February 2006, the assets pertaining to these segments’ headquarters, all wholesale offices, and certain of its retail offices were sold to third parties. The remaining assets of the conforming division were combined with the Company’s non-conforming retail offices. The pre-tax loss on disposal was $0.9 million and is included in discontinued operations, net of income tax, in the condensed consolidated statements of operations in the first quarter of 2006.

The provisions of Statement No. 144 require the results of operations associated with these conforming wholesale and conforming retail offices to be classified as discontinued operations, net of income tax, and segregated from the Company’s continuing results of operations for all periods presented.

Operating results of discontinued operations, net of income tax, included in the condensed consolidated statements of operations are summarized as follows for the three and nine months ended September 30, 2006 and 2005:

| | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | | 2006 | | 2005 | | | 2006 | | | 2005 | |

Revenues: | | | | | | | | | | | | | | | |

Interest income | | $ | — | | $ | 2,183 | | | $ | 839 | | | $ | 4,648 | |

Interest expense | | | — | | | 1,445 | | | | 657 | | | | 2,773 | |

| | | | | | | | | | | | | | | |

Net interest income | | | — | | | 738 | | | | 182 | | | | 1,875 | |

Gains on sales of mortgage loans | | | — | | | 708 | | | | (188 | ) | | | 3,129 | |

Fees and other income | | | — | | | 183 | | | | 41 | | | | 425 | |

| | | | | | | | | | | | | | | |

Total revenues | | | — | | | 1,629 | | | | 35 | | | | 5,429 | |

| | | | | | | | | | | | | | | |

Expenses: | | | — | | | | | | | | | | | | |

| | | | |

Salaries and employee benefits | | | — | | | 1,774 | | | | 1,692 | | | | 5,800 | |

Occupancy | | | — | | | 238 | | | | 272 | | | | 713 | |

Depreciation and amortization | | | — | | | 39 | | | | 104 | | | | 110 | |

General and administration | | | — | | | 481 | | | | 727 | | | | 1,950 | |

| | | | | | | | | | | | | | | |

Total expenses | | | — | | | 2,532 | | | | 2,795 | | | | 8,573 | |

| | | | | | | | | | | | | | | |

Discontinued operations before income taxes | | | — | | | (903 | ) | | | (2,760 | ) | | | (3,144 | ) |

Income tax benefit | | | — | | | 365 | | | | 1,115 | | | | 1,270 | |

| | | | | | | | | | | | | | | |

Discontinued operations, net of income tax | | $ | — | | $ | (538 | ) | | $ | (1,645 | ) | | $ | (1,874 | ) |

| | | | | | | | | | | | | | | |

The impact of discontinued operations on cash flows from operating, cash flows from investing and cash flows from financing activities are separately presented in the condensed consolidated statements of cash flows for the nine months ended September 30, 2006 and 2005.

(8) Segment Information

The information presented below with respect to the Company’s reportable segments is consistent with the content of the business segment data reviewed by the Company’s management. This segment data uses a combination of business lines and channels to assess consolidated results. The Company has four reportable segments, which

16

include two production segments, Wholesale and Retail, and two operating segments, which include Investment Portfolio and Corporate. Prior to the first quarter of 2006, the Company reported two additional production segments referred to as its Conforming Wholesale and Conforming Retail segments. In the first quarter of 2006, the Company’s Board of Directors approved a plan to sell, close or otherwise dispose of the assets of the Conforming Wholesale and Conforming Retail segments due to the decline in profitability of these segments. In February 2006, the Company sold the assets pertaining to these divisions’ headquarters, all wholesale offices, and certain of its retail offices to third parties. The remaining assets of the conforming segment, which included retail offices in Maryland and Virginia, have been combined with the non-conforming retail offices and will be reported as a component of the Company’s Retail segment. The following discussion of results reflects the Company’s current segment structure, while the results of its former Conforming Wholesale and Conforming Retail segments are reported as discontinued operations.

The Company originates loans through two production segments: a Wholesale segment which originates non-conforming loans and a Retail segment, which originates non-conforming and conforming loans. The Investment Portfolio segment primarily includes the net interest income earned by the loans held for investment and the direct costs, including third-party servicing fees, incurred to manage the portfolio. In addition, the Company has a Corporate segment that includes the timing and other differences between actual revenues and costs and amounts allocated to the production segments. The Corporate segment also includes the effects of the deferral and capitalization of net origination costs as required by Statement of Financial Accounting Standards No. 91,“Accounting for Non-refundable Fees and Costs Associated with Originating or Acquiring Loans and Initial Direct Costs of Leases.” Financial information by segment is evaluated regularly by management and used in decision-making relating to the allocation of resources and the assessment of Company performance. For the purposes of segment information provided in the tables below, certain fees, origination costs, and other expenses recorded as a component of gains on sale of mortgage loans, net, have been reflected in total revenues or total expenses consistent with intercompany allocations reported to the Company’s management. Also, origination fees and gain on sale revenue are recognized at the time of funding by the production segments, and adjusted in the corporate segment to reflect the actual fees and gain on sale recognizable for GAAP revenue reporting when the loans are sold. The Corporate segment includes reconciling amounts necessary for the segment totals to agree to the condensed consolidated financial statements.

The assets of the Company that are specifically identified to a segment include mortgage loans held for sale and investment, trustee receivable, derivative assets, and furniture and equipment, net. All other assets are attributed to the Corporate segment. Total assets by segment at September 30, 2006 and December 31, 2005 are summarized as follows:

| | | | | | |

| | | September 30,

2006 | | December 31,

2005 |

Production – Wholesale | | $ | 197,975 | | $ | 526,914 |

Production – Retail | | | 47,932 | | | 70,632 |

Investment Portfolio | | | 5,962,739 | | | 5,691,744 |

Corporate | | | 186,893 | | | 134,324 |

| | | | | | |

Total | | $ | 6,395,539 | | $ | 6,423,614 |

| | | | | | |

17

Operating results by business segment for the three months ended September 30, 2006 are as follows:

| | | | | | | | | | | | | | | | | | | |

| | | Production | | Investment Portfolio | | | Corporate | | | Consolidated | |

| | | Wholesale | | | Retail | | | |

Revenues: | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 8,623 | | | $ | 1,291 | | $ | 107,082 | | | $ | (2,516 | ) | | $ | 114,480 | |

Interest expense | | | 5,902 | | | | 916 | | | 87,163 | | | | (2,749 | ) | | | 91,232 | |

| | | | | | | | | | | | | | | | | | | |

Net interest income | | | 2,721 | | | | 375 | | | 19,919 | | | | 233 | | | | 23,248 | |

Provision for loan losses—loans held for investment | | | | | | | | | | (28,035 | ) | | | | | | | (28,035 | ) |

Gains (losses) on sales of mortgage loans, net | | | 20,623 | | | | 8,156 | | | — | | | | (25,386 | ) | | | 3,393 | |

Other income (expense)—portfolio derivatives | | | — | | | | — | | | (13,755 | ) | | | — | | | | (13,755 | ) |

Fee and other income (expense) | | | — | | | | 162 | | | (126 | ) | | | (487 | ) | | | (451 | ) |

| | | | | | | | | | | | | | | | | | | |

Total revenues | | | 23,344 | | | | 8,693 | | | (21,997 | ) | | | (25,640 | ) | | | (15,600 | ) |

| | | | | | | | | | | | | | | | | | | |

Direct expenses1 | | | 19,660 | | | | 7,516 | | | 2,716 | | | | 3,321 | | | | 33,213 | |

Corporate overhead allocation | | | 6,129 | | | | 915 | | | — | | | | (7,044 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total expenses | | | 25,789 | | | | 8,431 | | | 2,716 | | | | (3,723 | ) | | | 33,213 | |

| | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (2,445 | ) | | | 262 | | | (24,713 | ) | | | (21,917 | ) | | | (48,813 | ) |

Income tax benefit | | | — | | | | — | | | — | | | | (3,794 | ) | | | (3,794 | ) |

| | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (2,445 | ) | | $ | 262 | | $ | (24,713 | ) | | $ | (18,123 | ) | | $ | (45,019 | ) |

| | | | | | | | | | | | | | | | | | | |

| 1 | The direct expenses of our Investment Portfolio include the allocation of corporate overhead, which is assessed to that segment through the transfer pricing of loans from the production segments. |

Operating results by business segment for the nine months ended September 30, 2006 are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Production | | | Investment Portfolio | | | Corporate | | | Consolidated | |

| | | Wholesale | | | Retail | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 23,672 | | | $ | 3,586 | | | $ | 302,634 | | | $ | (6,267 | ) | | $ | 323,625 | |

Interest expense | | | 14,906 | | | | 2,314 | | | | 233,668 | | | | (6,959 | ) | | | 243,929 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 8,766 | | | | 1,272 | | | | 68,966 | | | | 692 | | | | 79,696 | |

Provision for loan losses—loans held for investment | | | | | | | | | | | (38,894 | ) | | | — | | | | (38,894 | ) |

Gains (losses) on sales of mortgage loans, net | | | 62,716 | | | | 23,374 | | | | — | | | | (70,449 | ) | | | 15,641 | |

Other income (expense)—portfolio derivatives | | | — | | | | — | | | | 9,224 | | | | — | | | | 9,224 | |

Fee and other income (expense) | | | — | | | | 1,020 | | | | (1,708 | ) | | | 12 | | | | (676 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 71,482 | | | | 25,666 | | | | 37,588 | | | | (69,745 | ) | | | 64,991 | |

| | | | | | | | | | | | | | | | | | | | |

Direct expenses1 | | | 56,955 | | | | 25,079 | | | | 8,666 | | | | 8,759 | | | | 99,459 | |

Corporate overhead allocation | | | 16,395 | | | | 2,557 | | | | — | | | | (18,952 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 73,350 | | | | 27,636 | | | | 8,666 | | | | (10,193 | ) | | | 99,459 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before income taxes | | | (1,868 | ) | | | (1,970 | ) | | | 28,922 | | | | (59,552 | ) | | | (34,468 | ) |

Income tax benefit | | | — | | | | — | | | | — | | | | (7,827 | ) | | | (7,827 | ) |

| | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | $ | (1,868 | ) | | $ | (1,970 | ) | | $ | 28,922 | | | $ | (51,725 | ) | | | (26,641 | ) |

| | | | | | | | | | | | | | | | | | | | |