Exhibit 99.1

Review of Business Strategies and Results

3(rd)Quarter 2006

www.FieldstoneInvestment.com

Disclaimer

FORWARD-LOOKING STATEMENTS

This presentation may contain “forward-looking statements” within the meaning of the federal securities laws including, but not limited to (i) statements regarding the expected building of Fieldstone’s portfolio and origination business in 2006 and 2007; (ii) the expected achievement of targeted leveraged returns on new loans; (iii) the decision to retain fewer loans originated in the fourth quarter of 2006 in its investment portfolio, (iv) expectations regarding its funding levels, cost to produce, and initiatives on origination growth and cost management; (v) initiatives designed to mitigate portfolio delinquencies and losses and the results of those initiatives, (vi) expectations regarding its competitive position, (vii) opinions with respect to maintenance of its liquidity position, (viii) statements regarding market condition and opportunity, and (ix) management’s guidance on 4th quarter dividends. These statements are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Actual results and the timing of certain events may differ materially from those indicated by such forward-looking statements due to a variety of risks and uncertainties, many of which are beyond Fieldstone’s ability to control or predict, including but not limited to (i) Fieldstone’s ability to successfully implement or change aspects of its portfolio strategy; (ii) interest rate volatility and the level of interest rates generally; (iii) the sustainability of loan origination volumes and levels of origination costs; (iv) continued availability of credit facilities for the liquidity Fieldstone needs to support its origination of mortgage loans; (v) the ability to sell or securitize mortgage loans on favorable economic terms; (vi) deterioration in the credit quality of Fieldstone’s loan portfolio; (vii) the nature and amount of competition; (viii) the impact of changes to the fair value of Fieldstone’s interest rate swaps on its net income, which will vary based upon changes in interest rates and could cause net income to vary significantly from quarter to quarter; and (ix) other risks and uncertainties outlined in Fieldstone Investment Corporation’s periodic reports filed with the Securities and Exchange Commission. The information contained in the presentation materials is summary information that is intended to be considered in the context of the Company’s SEC filings and other public announcements that the Company may make, by press release or otherwise, from time to time. These statements are made as of the date of this presentation, or as otherwise indicated, and Fieldstone undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

REGULATION G DISCLOSURES

Information on core net income, core earnings per share, core net interest income after provision, and REIT taxable income appearing elsewhere in this presentation may fall under the SEC’s definition of “non-GAAP financial measures.” Management believes the core financial measures are useful because they include the current period effects of Fieldstone’s economic hedging program but exclude the non-cash mark to market derivative value changes. The portion of the non-cash mark to market amounts excluded from the core financial measures, that ultimately will be a component of future core financial measures, depends on the level of actual interest rates in the future. Management believes the presentation of REIT taxable income provides useful information to investors regarding the annual distribution to Fieldstone’s investors. As required by Regulation G, a reconciliation of each of these core financial measures to the most directly comparable measure under GAAP is included in this presentation.

BASIS OF PRESENTATION

Financial information in this presentation presents the results of Fieldstone’s previous conforming origination business as a discontinued operation, following the sale in the first quarter of 2006 of the assets related to that business. Fieldstone’s continuing operations include its Investment Portfolio, Wholesale, Retail, and Corporate segments. With the exception of net income and core net income, the results of operations discussed in this presentation do not include the results of the discontinued operations, unless otherwise indicated.

Table of Contents page

I. Fieldstone Summary 4 II. Portfolio Summary 16 III. Origination Summary 21

Supplemental Data :

REIT Taxable Income 26

Peer Collateral Data 27

Collateral Performance and Trends 28

Securitization Structure and Valuations 31

Collateral Risk-Adjusted Coupons 33

Portfolio Delinquency and Early Defaults Detail 34

3

Strategic Summary

Fieldstone’s Business Proposition

Vertically integrated origination of and investment in residential mortgages

Complete dis-intermediation of the sector: pre-tax earnings direct to shareholders

Strong focus on loan quality, portfolio management and liquidity

Strategic Imperatives for Fieldstone in 2007

Lower cost to originate: in the origination branches and in the home office

Increased origination volume of non-prime, alt-A and full value loans

Improved delinquency and loss management of loans held for investment

Current Market Conditions

Intense competition for loans in a contracting mortgage market

Low sale margins will continue, and only low-cost originators can profit on sale of loans

Slower Home Price Appreciation will:

increase delinquencies of borrowers that needed appreciation to afford their homes

increase opportunities for purchasers to afford to buy homes

Consolidation of mortgage origination capacity by largest financial service institutions

Market Opportunity

Strong economy, job growth and aging and growing population remain positive for home prices

Attractive, risk-adjusted returns continue to be available on leveraged investments in non-prime loans

Non-prime and alt-A market share will increase due to continued growth of consumer debt

Difficult market conditions will eliminate competition from poorly capitalized participants

The most sophisticated participants in the residential market are buying origination capacity

4

Fieldstone Summary Information

Publicly traded on NASDAQ: FICC

Fieldstone’s businesses include:

Originating residential mortgage loans, in its Taxable REIT Subsidiary (TRS)

Investing in a mortgage portfolio in the REIT for net interest income over time

Issuing mortgage-backed securities to finance loans in the portfolio

Selling non-portfolio loans from the TRS for current period gains

REIT Portfolio:

Total at 3Q ‘06: $5.9 Billion

Primarily 2/28 ARM first liens

Match fund with:

MBS securities for life of loan

Swaps during fixed rate period

Origination business:

Began operations in 1995

Licensed in 50 states

Wholesale and Retail, non-prime and alt-A products

1,100 employees, including 375 AEs/Los

Headquartered in Columbia, Maryland

5

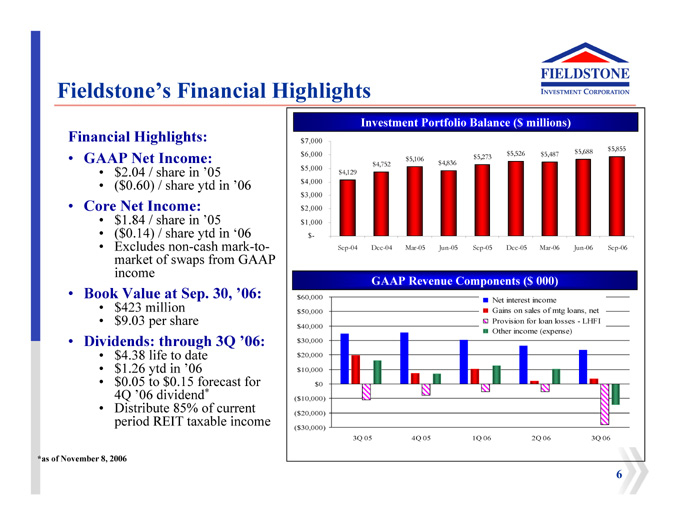

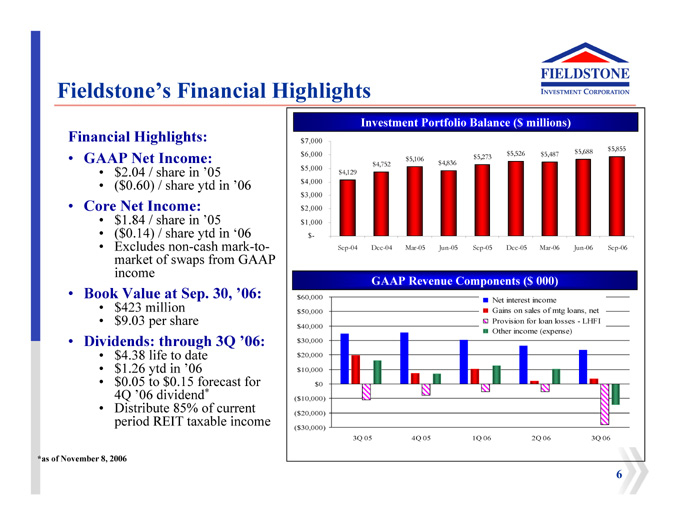

Fieldstone’s Financial Highlights

Financial Highlights:

GAAP Net Income:

$2.04 / share in ’05

($0.60) / share ytd in ’06

Core Net Income:

$1.84 / share in ’05

($0.14) / share ytd in ’06

Excludes non-cash mark-to-market of swaps from GAAP income

Book Value at Sep. 30, ’06:

$423 million

$9.03 per share

Dividends: through 3Q ’06:

$4.38 life to date

$1.26 ytd in ’06

$0.05 to $0.15 forecast for 4Q ’06 dividend*

Distribute 85% of current period REIT taxable income

Investment Portfolio Balance ($ millions)

$7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $-

$5,688 $5,855 $5,526 $5,487 $5,106 $5,273 $4,752 $4,836 $4,129

Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06

GAAP Revenue Components ($ 000)

$60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0($ 10,000)($ 20,000)($ 30,000)

Net interest income Gains on sales of mtg loans, net Provision for loan losses - LHFI Other income (expense)

3Q 05 4Q 05 1Q 06 2Q 06 3Q 06

*as of November 8, 2006

6

Capital Structure and Liquidity

Fieldstone maintains a strong capital structure: at Sep. 30, ‘06:

$423 million of net worth 13:1 portfolio debt to equity ratio

Fieldstone maintains a high level of liquidity: at Sep. 30, ‘06:

$ 181 million of cash and available liquidity

$ 1.75 billion of lines of credit in place

$ 2.25 billion of lines of credit as of November 15, 2006

7

Current Market Conditions

Mortgage originators under significant pressure

Intense competition for loans in a contracting mortgage market

Increased levels of early payment defaults and repurchase requests

Continued imperative to lower costs requires significant investments in systems

Volatile interest markets make hedging more difficult

Seasonal slowing is compounded by firms “for-sale” driving volume with low rates

Increased delinquencies for recent non-conforming credit borrowers generally

Slower home price appreciation reduces the ability of borrowers to refinance

Lack of equity appreciation in recent vintage loans means more will roll to REO

Speculative buying in 2003 to 2006 will result in higher delinquencies and losses

Delinquencies and losses on 2005 and 2006 loans higher than for 2002 thru 2004 loans, up to historic levels experienced on loans originated prior to 2002

Home Price Appreciation is expected to continue to be slow nationally

Risk highest for investor loans and for largest loans with least demand

Incentives for speculative buying have been wrung out of the market

Markets that never over-heated should continue steady price increases

Median and lower priced primary residences will hold value for the homeowner

8

Market Opportunity

Origination growth positive over the long term

Rising consumer debt will drive demand for non-prime and Alt-A products

Aging and growing population will support home price appreciation

Challenging market will eliminate poorly capitalized originators

Sophisticated buyers continue to purchase origination capacity in residential markets

Positive total return opportunity in REIT investment portfolio

Life-of-Pool risk-adjusted returns on new loans still attractive

Forward rates, losses, prepayments and expenses modeled

Increased risk premiums for the sector will lower sale margins but improve risk-adjusted portfolio returns

Forward yield curve anticipates lower interest rates in the future

Positive longer term for housing, mortgage industry and borrower credit

Little impact on existing net interest spreads on loans held for investment due to swaps

Non-cash charge to income to reduce the carrying value of the swaps as rates fall

9

Fieldstone’s Strategic Initiatives for 2007

Reduce Cost to Originate

Improve Servicing of Loan Portfolio

Increase Market Share and Fundings

10

Fieldstone’s Strategic Initiatives for 2007

Reduce Cost to Originate

Reduce number of operations centers

Lower premiums paid for wholesale loans

Achieve efficiencies from use of new Loan Origination System

Train customers on self-serve use of on-line technology

Commission plan focused on net revenue, after expenses

11

Fieldstone’s Strategic Initiatives for 2007

Improve Servicing of Loan Portfolio

Accelerated manual intervention on delinquent loans

Set-up loans initially with the permanent servicer

Engaged delinquency and loss mitigation over-seer for 2006 loans

Retain only selected products for portfolio:

Already have eliminated weaker products

Historically have excluded investor properties and high dollar value properties

12

Fieldstone’s Strategic Initiatives for 2007

Increase Market Share and Fundings

Simplified, discounted rate sheet on-line

Focus customers on self-serve use of on-line technology

Add sales force in strategic markets

Add higher credit products with appropriate revenue opportunities

Innovate on non-conforming cash flow features, not credit

Real-time automation delivered on hand-held devices

13

Fieldstone Remains Focused on Loan Quality

Appraisal Reviews

AVM or review appraisal on all loans

Lower tolerances for AVM values in current real estate market

Focus on recent sale and listing information for current valuations

Borrower Credit

FICO-driven underwriting guidelines

Focus on debt ratio, disposable income and well-established credit history

Eliminate lowest FICO, high CLTV programs

Fraud Avoidance

“Hawk Alert” and SSN validations on all loans

Validate full doc. income using IRS form 4506T

Validate reasonableness of stated income

Proof of identification required at closing

Chain of Title review on all purchase transactions

Borrower benefit documented in writing on non-prime refinances

Terminate business with brokers with poorly performing loans

14

Fieldstone’s Third Quarter 2006 Results

Fieldstone posted a $45 million GAAP loss for the third quarter of 2006, because:

Gain on Sale margins were lower

Portfolio net interest margin was lower

Operating costs were flat

Expected portfolio losses were sharply higher

Interest rate swaps’ mark-to-market was significantly lower

At September 30, 2006, after this loss, Fieldstone still had:

$423 million of Shareholders’ equity, $9.03 per share

$181 million of liquidity

Fieldstone’s 3Q ‘06 operating loss included $53 million of non-cash reserves:

$28 million for potential future losses, based on higher current portfolio delinquencies

$25 million for mark-to-market declines in the value of interest rate swap agreements

The 3Q results were disappointing, however:

Fieldstone is working to reduce the delinquencies of loans in its portfolio, with a goal that the actual losses be less than the amounts reserved

The mark-to-market decline in the market value of the swap agreements reflects lower expected interest rates, which generally is positive for Fieldstone and its borrowers, not a reduction in the economic yield of the portfolio

15

Fieldstone’s Investment Portfolio: Strategic Proposition

Originate high quality non-conforming loans for REIT portfolio

2/28 hybrid ARMs primarily

648 average credit score as of September 30, 2006

Higher average credit score balanced by reduced documentation and higher LTV

Focus on median and lower priced, owner occupied homes

Interest Only hybrid ARM’s begin amortizing after five years

Finance portfolio with long-term securitization debt

On-balance sheet financing

No “gain on sale” non-cash gains on securitization

Committed financing with strong asset-liability management

Retain Fieldstone loans to assure quality

Lock in spreads and return gains to shareholders

Protection of current spreads with interest rate swaps

Pre-tax REIT taxable income distributed as dividends to shareholders

16

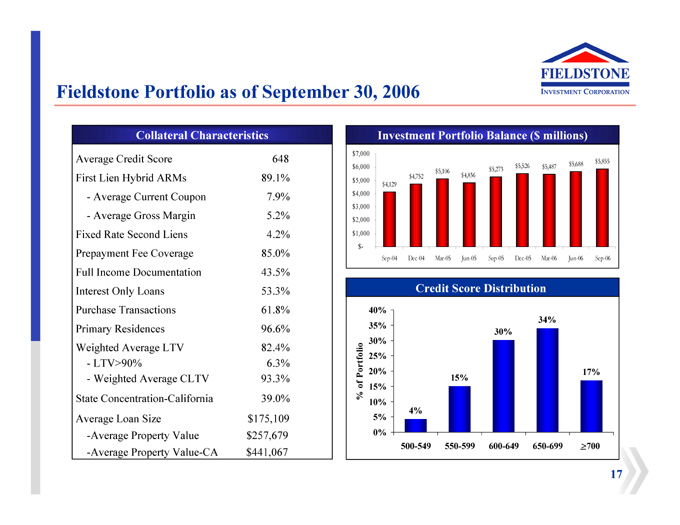

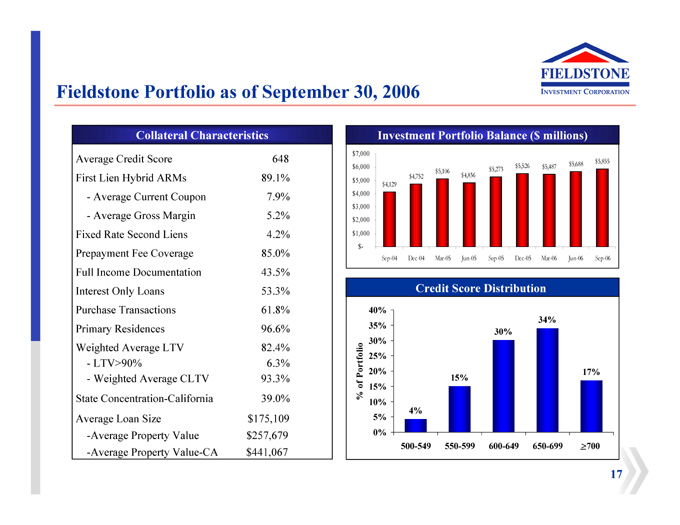

Fieldstone Portfolio as of September 30, 2006

Collateral Characteristics

| | | | |

Average Credit Score | | | | 648 |

First Lien Hybrid ARMs | | | | 89.1% |

Average Current Coupon | | | | 7.9% |

Average Gross Margin | | | | 5.2% |

Fixed Rate Second Liens | | | | 4.2% |

Prepayment Fee Coverage | | | | 85.0% |

Full Income Documentation | | | | 43.5% |

Interest Only Loans | | | | 53.3% |

Purchase Transactions | | | | 61.8% |

Primary Residences | | | | 96.6% |

Weighted Average LTV | | | | 82.4% |

LTV>90% | | | | 6.3% |

Weighted Average CLTV | | | | 93.3% |

State Concentration-California | | | | 39.0% |

Average Loan Size | | $ | | 175,109 |

Average Property Value | | $ | | 257,679 |

Average Property Value-CA | | $ | | 441,067 |

Investment Portfolio Balance ($ millions)

$7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $-

$5,688 $5,855 $5,526 $5,487 $5,106 $5,273 $4,752 $4,836 $4,129

Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 Mar-06 Jun-06 Sep-06

Credit Score Distribution

% of Portfolio

40% 35% 30% 25% 20% 15% 10% 5% 0%

4% 15% 30% 34% 17%

500-549 550-599 600-649 650-699 > 700

17

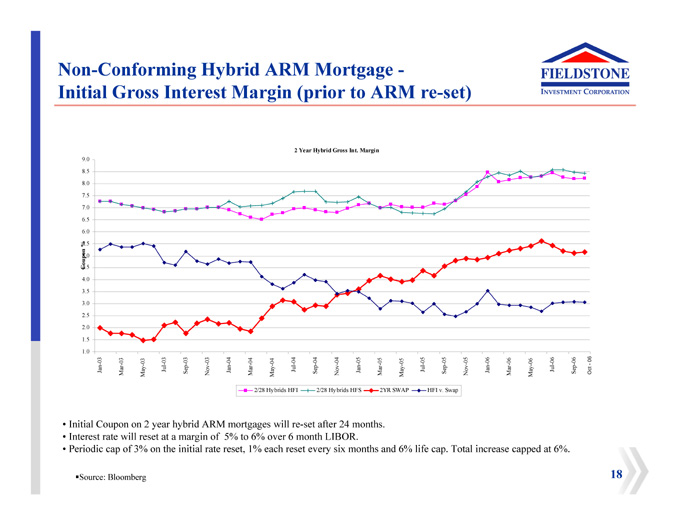

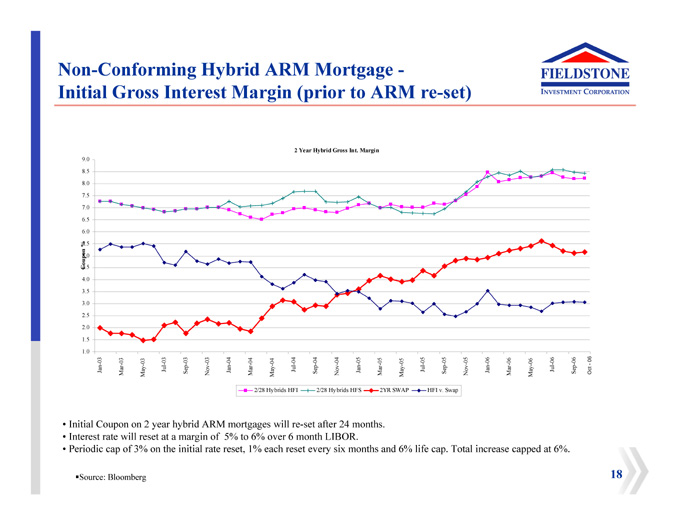

Non-Conforming Hybrid ARM Mortgage -

Initial Gross Interest Margin (prior to ARM re-set)

2 Year Hybrid Gross Int. Margin

9.0 8.5 8.0 7.5 7.0 6.5 6.0 % 5.5Coupon5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0

Jan-03 Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04 Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Oct - 06

2/28 Hybrids HFI 2/28 Hybrids HFS 2YR SWAP HFI v. Swap

Initial Coupon on 2 year hybrid ARM mortgages will re-set after 24 months.

Interest rate will reset at a margin of 5% to 6% over 6 month LIBOR.

Periodic cap of 3% on the initial rate reset, 1% each reset every six months and 6% life cap. Total increase capped at 6%.

Source: Bloomberg

18

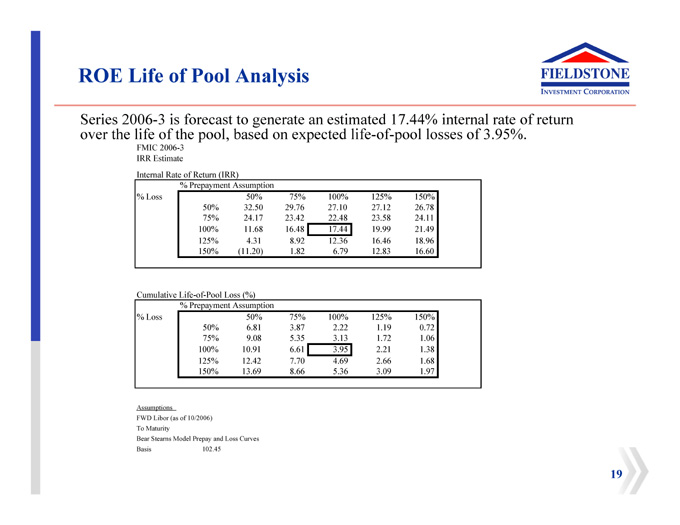

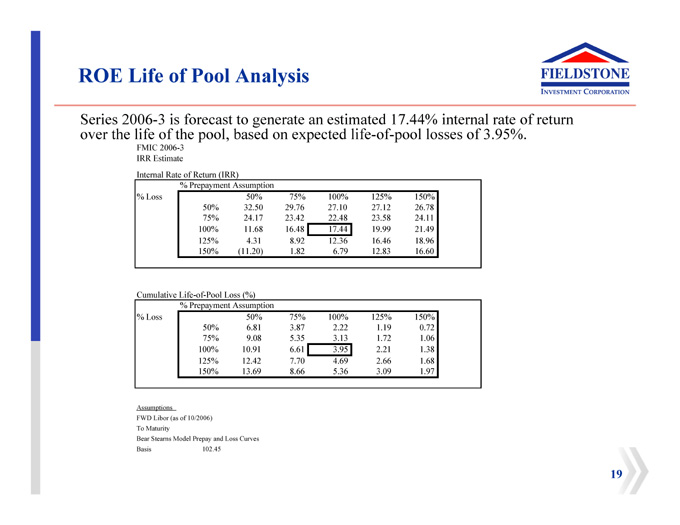

ROE Life of Pool Analysis

Series 2006-3 is forecast to generate an estimated 17.44% internal rate of return over the life of the pool, based on expected life-of-pool losses of 3.95%.

FMIC 2006-3

IRR EstimateInternal Rate of Return (IRR)

| | | | | | | | | | | | | | | | | | |

| | | % Prepayment Assumption | | | | | | | |

% Loss | | | | | 50 | % | | 75 | % | | 100 | % | | 125 | % | | 150 | % |

| | | 50 | % | | 32.50 | | | 29.76 | | | 27.10 | | | 27.12 | | | 26.78 | |

| | | 75 | % | | 24.17 | | | 23.42 | | | 22.48 | | | 23.58 | | | 24.11 | |

| | | 100 | % | | 11.68 | | | 16.48 | | | 17.44 | | | 19.99 | | | 21.49 | |

| | | 125 | % | | 4.31 | | | 8.92 | | | 12.36 | | | 16.46 | | | 18.96 | |

| | | 150 | % | | (11.20 | ) | | 1.82 | | | 6.79 | | | 12.83 | | | 16.60 | |

| | | | | | | | | | | | | | | | | | |

Cumulative Life-of-Pool Loss (%) | | | | | | | | | | | | | |

| | | % Prepayment Assumption | | | | | | | |

% Loss | | | | | 50 | % | | 75 | % | | 100 | % | | 125 | % | | 150 | % |

| | | 50 | % | | 6.81 | | | 3.87 | | | 2.22 | | | 1.19 | | | 0.72 | |

| | | 75 | % | | 9.08 | | | 5.35 | | | 3.13 | | | 1.72 | | | 1.06 | |

| | | 100 | % | | 10.91 | | | 6.61 | | | 3.95 | | | 2.21 | | | 1.38 | |

| | | 125 | % | | 12.42 | | | 7.70 | | | 4.69 | | | 2.66 | | | 1.68 | |

| | | 150 | % | | 13.69 | | | 8.66 | | | 5.36 | | | 3.09 | | | 1.97 | |

Assumptions

FWD Libor (as of 10/2006)

To Maturity

Bear Stearns Model Prepay and Loss Curves

Basis 102.45

19

Hybrid Loans Funded with LIBOR Based Debt

Fieldstone Portfolio Hedging Program

FIC Weighted Average Swap Cost vs. Debt Outstanding

Millions

6,000 5,000 4,000 3,000 2,000 1,000 0

Weighted Average Swap Rate

5.50% 5.00% 4.50% 4.00% 3.50% 3.00% 2.50% 2.00%

10/23/2006 12/23/2006 2/23/2007 4/23/2007 6/23/2007 8/23/2007 10/23/2007 12/23/2007 2/23/2008 4/23/2008 6/23/2008 8/23/2008 10/23/2008 12/23/2008 2/23/2009 4/23/2009 6/23/2009 8/23/2009 10/23/2009

Total Debt Total Swaps Wtd Avg SWAP % Forward 1 Month LIBOR

20

Fieldstone’s Origination Strategy

Established loan origination channels since 1995:

Focus on loan quality, customer service and operating efficiency

Opportunistic product development

Net-Revenue based commissions

Quality-based management incentives

Mortgage loan operations driven by technology:

On-Line loan pre-qualifications and submissions

Electronic document delivery, funding and imaging

Implementing new origination system to increase loans per person, lower origination cost

Deliver products and pricing using hand-held technology real-time direct to PDAs

Stable business-to-business sourcing:

Wholesale originations from professional brokers

Retail originations from small financial service companies

Compete on service and product design, not rate or credit

Cultivate a learning organization to enhance:

products

customer service

operating efficiencies

21

National Origination Franchise

Everett

Seattle

Chicago

Portland

Bloomington

Boston

Corporate

Denver

Headquarters,

Omaha

Concord Columbia,

Maryland

Hanover

Sacramento

Wichita

Indianapolis

Las Vegas

Overland Park

Carson

Phoenix

Chatsworth

Irvine

Memphis

Frisco

Encinitas

Atlanta

Plano

Albuquerque

Corp. HQ

Retail Office Tampa

52 offices in 21 states

Retail Op Center Houston

Boca Raton

248 wholesale AEs Arlington

Wholesale Office Ft. Lauderdale Wholesale Op Center 130 retail LOs

22

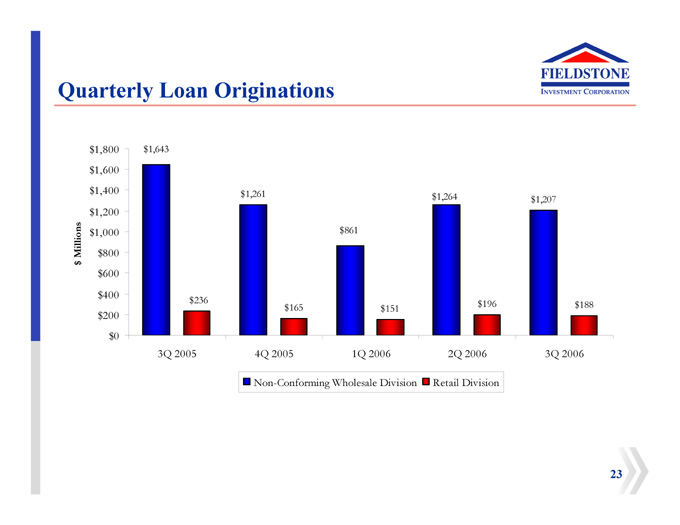

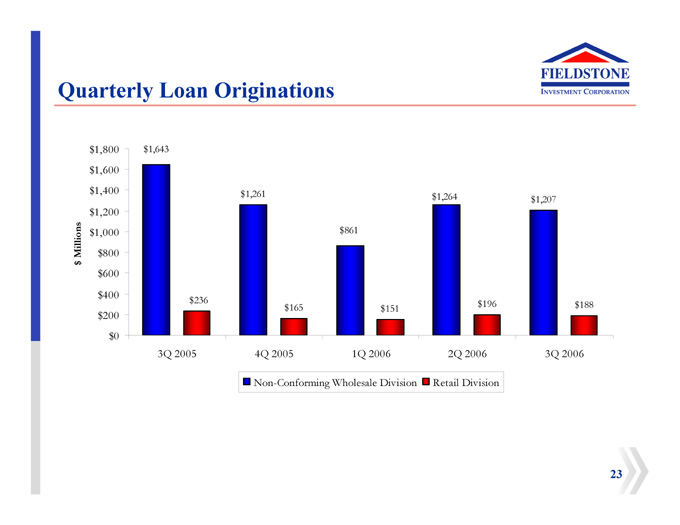

Quarterly Loan Originations

$ Millions

$ 1,800 $ 1,600 $ 1,400 $ 1,200 $ 1,000 $ 800 $ 600 $ 400 $ 200 $0

$1,643 $1,261 $1,264 $1,207 $861 $236 $196 $165 $151 $188

3Q 2005 4Q 2005 1Q 2006 2Q 2006 3Q 2006

Non-Conforming Wholesale Division Retail Division

23

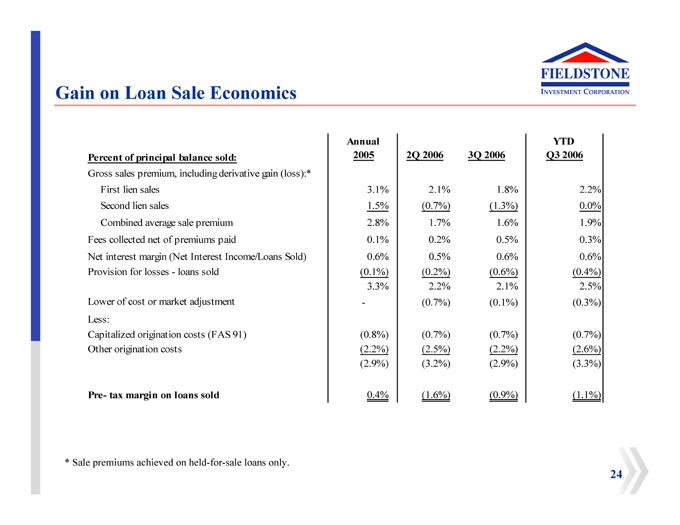

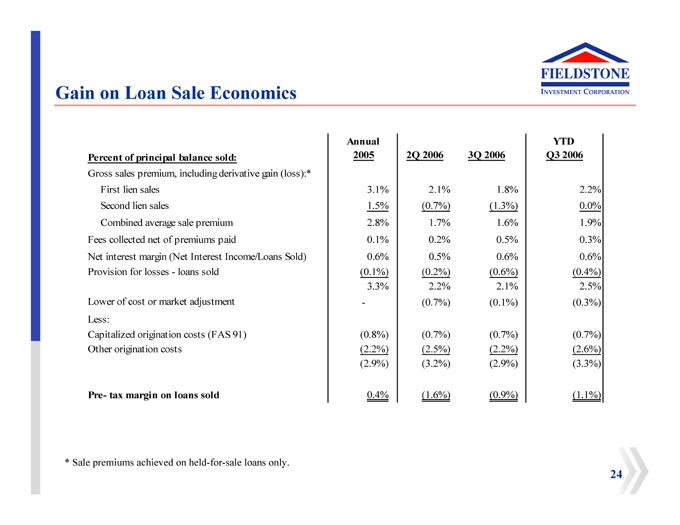

Gain on Loan Sale Economics

| | | | | | | | | | | | |

| | | Annual | | | | | | | | | YTD | |

Percent of principal balance sold: | | 2005 | | | 2Q 2006 | | | 3Q 2006 | | | Q3 2006 | |

Gross sales premium, including derivative gain (loss):* | | | | | | | | | | | | |

First lien sales | | 3.1 | % | | 2.1 | % | | 1.8 | % | | 2.2 | % |

Second lien sales | | 1.5 | % | | (0.7 | %) | | (1.3 | %) | | 0.0 | % |

Combined average sale premium | | 2.8 | % | | 1.7 | % | | 1.6 | % | | 1.9 | % |

Fees collected net of premiums paid | | 0.1 | % | | 0.2 | % | | 0.5 | % | | 0.3 | % |

Net interest margin (Net Interest Income/Loans Sold) | | 0.6 | % | | 0.5 | % | | 0.6 | % | | 0.6 | % |

Provision for losses - loans sold | | (0.1 | %) | | (0.2 | %) | | (0.6 | %) | | (0.4 | %) |

| | | 3.3 | % | | 2.2 | % | | 2.1 | % | | 2.5 | % |

Lower of cost or market adjustment | | - | | | (0.7 | %) | | (0.1 | %) | | (0.3 | %) |

Less: | | | | | | | | | | | | |

Capitalized origination costs (FAS 91) | | (0.8 | %) | | (0.7 | %) | | (0.7 | %) | | (0.7 | %) |

Other origination costs | | (2.2 | %) | | (2.5 | %) | | (2.2 | %) | | (2.6 | %) |

| | | (2.9 | %) | | (3.2 | %) | | (2.9 | %) | | (3.3 | %) |

Pre- tax margin on loans sold | | 0.4 | % | | (1.6 | %) | | (0.9 | %) | | (1.1 | %) |

* Sale premiums achieved on held-for-sale loans only.

24

Supplemental Data

3rdQuarter 2006

www.FieldstoneInvestment.com

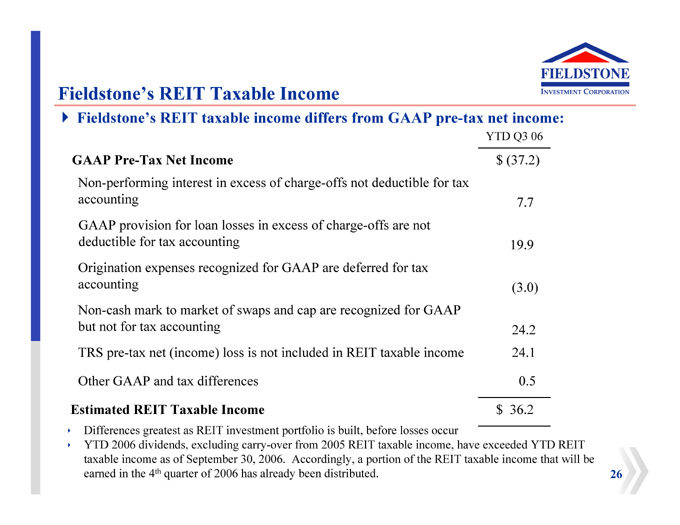

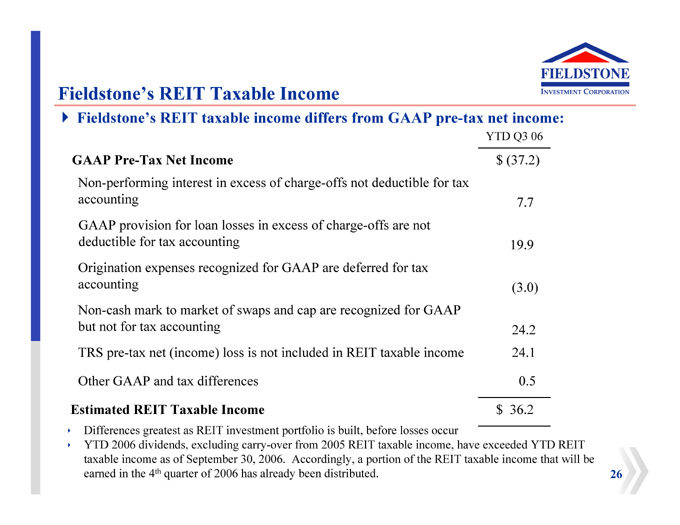

Fieldstone’s REIT Taxable Income

Fieldstone’s REIT taxable income differs from GAAP pre-tax net income:

| | | | | | |

| | | | YTD Q3 06 | |

GAAP Pre-Tax Net Income | | $ | | | (37.2 | ) |

Non-performing interest in excess of charge-offs not deductible for tax | | | | | | |

accounting | | | | | 7.7 | |

GAAP provision for loan losses in excess of charge-offs are not | | | | | | |

deductible for tax accounting | | | | | 19.9 | |

Origination expenses recognized for GAAP are deferred for tax | | | | | | |

accounting | | | | | (3.0 | ) |

Non-cash mark to market of swaps and cap are recognized for GAAP | | | | | | |

but not for tax accounting | | | | | 24.2 | |

TRS pre-tax net (income) loss is not included in REIT taxable income | | | | | 24.1 | |

Other GAAP and tax differences | | | | | 0.5 | |

Estimated REIT Taxable Income | | $ | | | 36.2 | |

Differences greatest as REIT investment portfolio is built, before losses occur

YTD 2006 dividends, excluding carry-over from 2005 REIT taxable income, have exceeded YTD REIT taxable income as of September 30, 2006. Accordingly, a portion of the REIT taxable income that will be earned in the 4(th)quarter of 2006 has already been distributed.

26

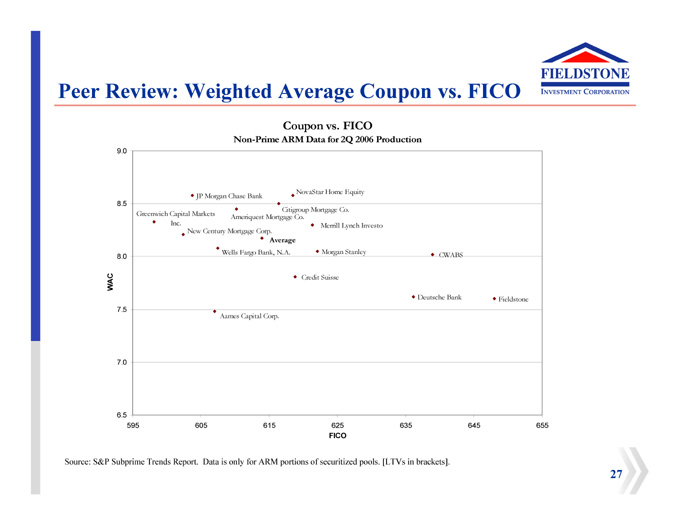

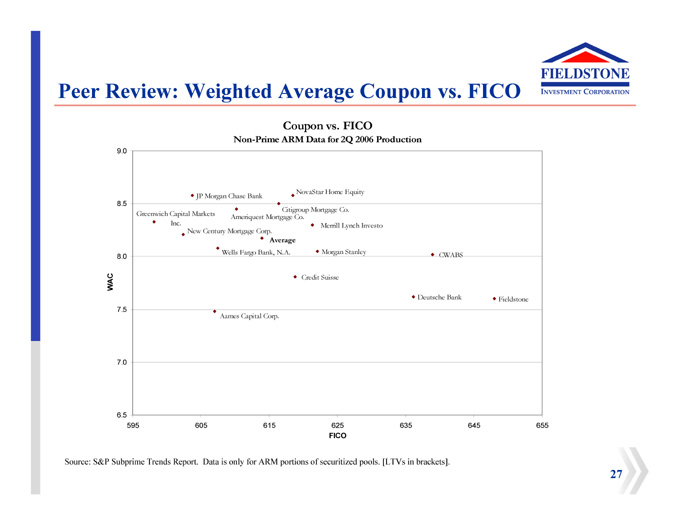

Peer Review: Weighted Average Coupon vs. FICO

Coupon vs. FICO

Non-Prime ARM Data for 2Q 2006 Production

9.0 8.5 8.0 WAC 7.5 7.0 6.5

JP Morgan Chase Bank NovaStar Home Equity

Citigroup Mortgage Co.

Greenwich Capital Markets Inc.

Ameriquest Mortgage Co.

Merrill Lynch Investo

New Century Mortgage Corp.

Average

Wells Fargo Bank, N.A.

Morgan Stanley

CWABS

Credit Suisse

Deutsche Bank

Fieldstone

Aames Capital Corp.

595 605 615 625 635 645 655 FICO

Source: S&P Subprime Trends Report. Data is only for ARM portions of securitized pools. [LTVs in brackets].

27

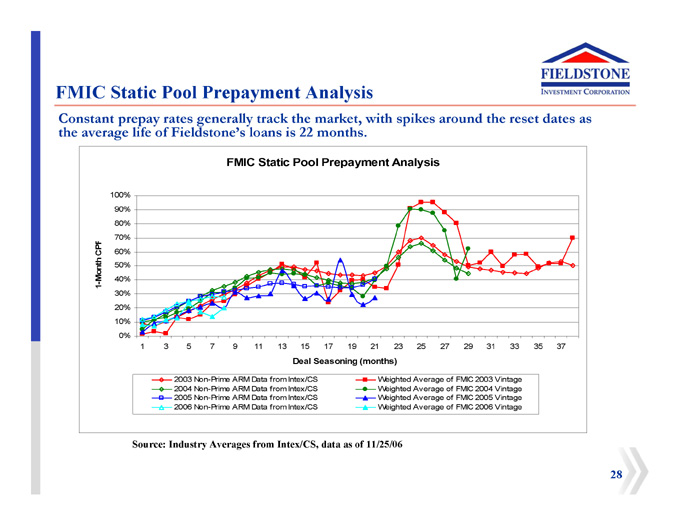

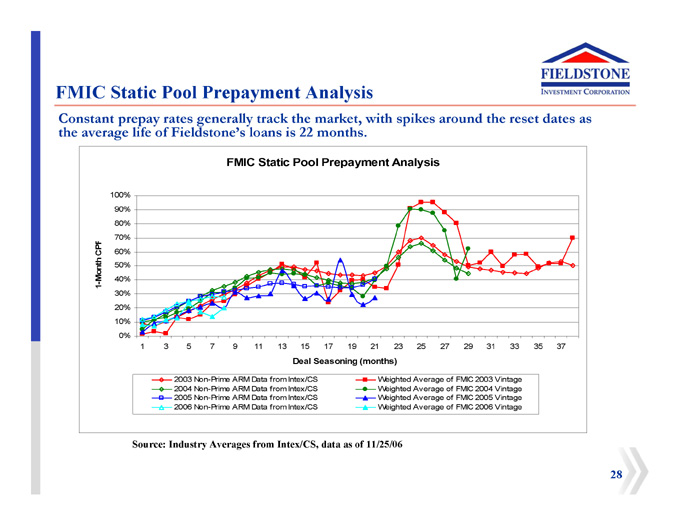

FMIC Static Pool Prepayment Analysis

28

FIELDSTONE INVESTMENT CORPORATION

Constant prepay rates generally track the market, with spikes around the reset dates as the average life of Fieldstone’s loans is 22 months.

FMIC Static Pool Prepayment Analysis

1-Month CPR

Deal Seasoning (months)

2003 Non-Prime ARM Data from Intex/CS

2004 Non-Prime ARM Data from Intex/CS

2005 Non-Prime ARM Data from Intex/CS

2006 Non-Prime ARM Data from Intex/CS

Weighted Average of FMIC 2003 Vintage

Weighted Average of FMIC 2004 Vintage

Weighted Average of FMIC 2005 Vintage

Weighted Average of FMIC 2006 Vintage

Source: Industry Averages from Intex/CS, data as of 11/25/06

1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

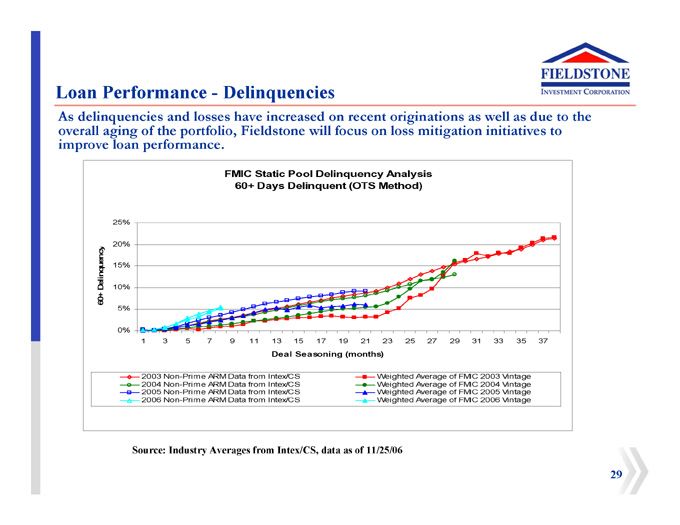

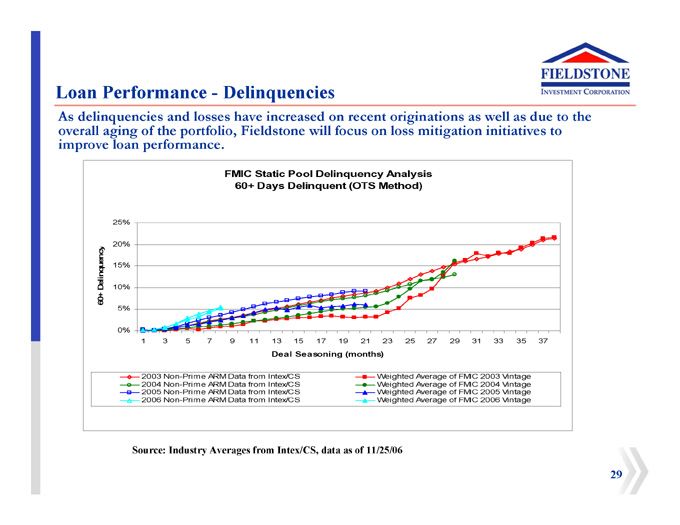

Loan Performance - Delinquencies

As delinquencies and losses have increased on recent originations as well as due to the overall aging of the portfolio, Fieldstone will focus on loss mitigation initiatives to improve loan performance.

FMIC Static Pool Delinquency Analysis

29

60+ Days Delinquent (OTS Method)

60+ Delinquency

Deal Seasoning (months)

1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37

25% 20% 15% 10% 5% 0%

Deal Seasoning (months)

2003 Non-Prime ARM Data from Intex/CS

2004 Non-Prime ARM Data from Intex/CS

2005 Non-Prime ARM Data from Intex/CS

2006 Non-Prime ARM Data from Intex/CS

Weighted Average of FMIC 2003 Vintage

Weighted Average of FMIC 2004 Vintage

Weighted Average of FMIC 2005 Vintage

Weighted Average of FMIC 2006 Vintage

Source: Industry Averages from Intex/CS, data as of 11/25/06

FIELDSTONE INVESTMENT CORPORATION

FMIC Static Pool Cumulative Loss Analysis

FMIC Static Pool Cumulative Loss Analysis

30

Cumulative Loss %

1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37

1.00% 0.90% 0.80% 0.70% 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00%

Deal Seasoning (months)

2003 Non-Prime ARM Data from Intex/CS

2004 Non-Prime ARM Data from Intex/CS

2005 Non-Prime ARM Data from Intex/CS

2006 Non-Prime ARM Data from Intex/CS

Weighted Average of FMIC 2003 Vintage

Weighted Average of FMIC 2004 Vintage

Weighted Average of FMIC 2005 Vintage

Weighted Average of FMIC 2006 Vintage

Source: Industry Averages from Intex/CS, data as of 11/25/06

FIELDSTONE INVESTMENT CORPORATION

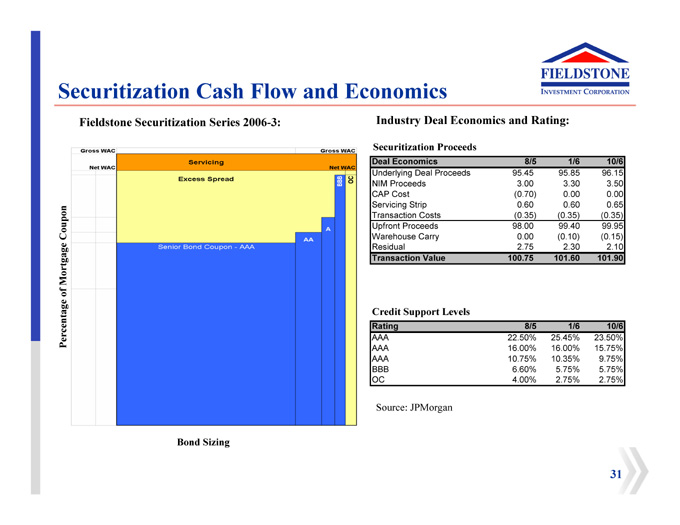

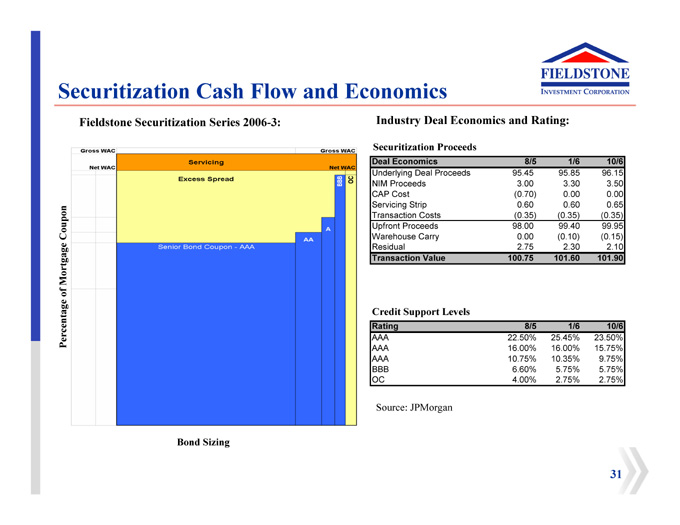

Securitization Cash Flow and Economics

Fieldstone Securitization Series 2006-3:

Percentage of Mortgage Coupon

Gross WAC

Net WAC

Servicing

Excess Spread

Gross WAC

Net WAC

Senior Bond Coupon - AAA

AA A OC BBB

Bond Sizing

Industry Deal Economics and Rating:

Securitization Proceeds

| | | | | | | | | |

Deal Economics | | 8/5 | | | 1/6 | | | 10/6 | |

Underlying Deal Proceeds | | 95.45 | | | 95.85 | | | 96.15 | |

NIM Proceeds | | 3.00 | | | 3.30 | | | 3.50 | |

CAP Cost | | (0.70 | ) | | 0.00 | | | 0.00 | |

Servicing Strip | | 0.60 | | | 0.60 | | | 0.65 | |

Transaction Costs | | (0.35 | ) | | (0.35 | ) | | (0.35 | ) |

Upfront Proceeds | | 98.00 | | | 99.40 | | | 99.95 | |

Warehouse Carry | | 0.00 | | | (0.10 | ) | | (0.15 | ) |

Residual | | 2.75 | | | 2.30 | | | 2.10 | |

Transaction Value | | 100.75 | | | 101.60 | | | 101.90 | |

Credit Support Levels

| | | | | | | | | |

Rating | | 8/5 | | | 1/6 | | | 10/6 | |

AAA | | 22.50 | % | | 25.45 | % | | 23.50 | % |

AAA | | 16.00 | % | | 16.00 | % | | 15.75 | % |

AAA | | 10.75 | % | | 10.35 | % | | 9.75 | % |

BBB | | 6.60 | % | | 5.75 | % | | 5.75 | % |

OC | | 4.00 | % | | 2.75 | % | | 2.75 | % |

Source: JPMorgan

31

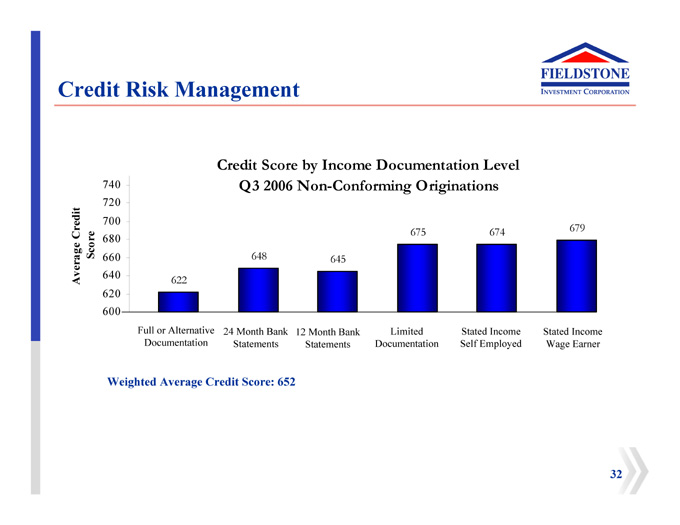

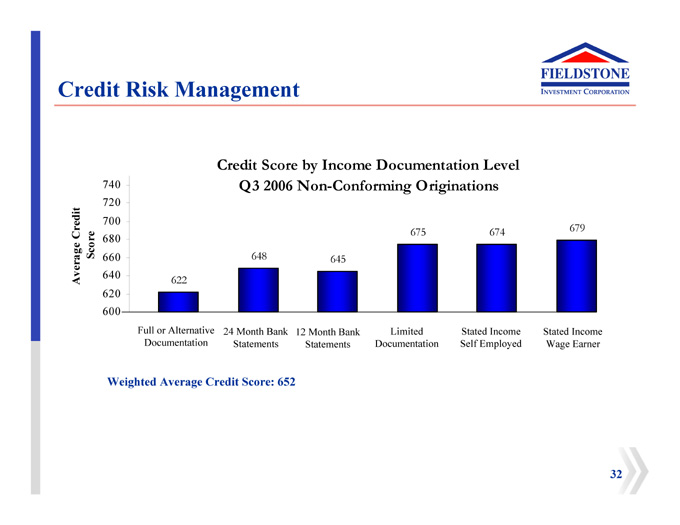

Credit Risk Management

Credit Score by Income Documentation Level

Q3 2006 Non-Conforming Originations

Average Credit

Score

740 720 700 680 660 640 620 600

675 674 679 648 645 622

Full or Alternative Documentation

24 Month Bank Statements

12 Month Bank Statements

Limited Documentation

Stated Income Self Employed

Stated Income Wage Earner

Weighted Average Credit Score: 652

32

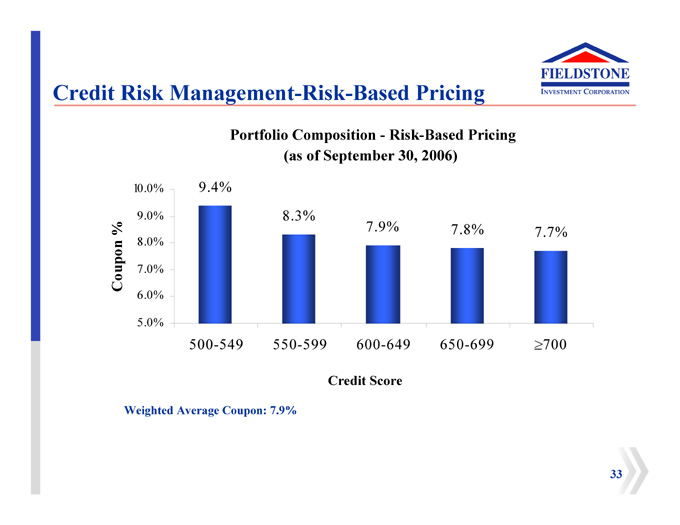

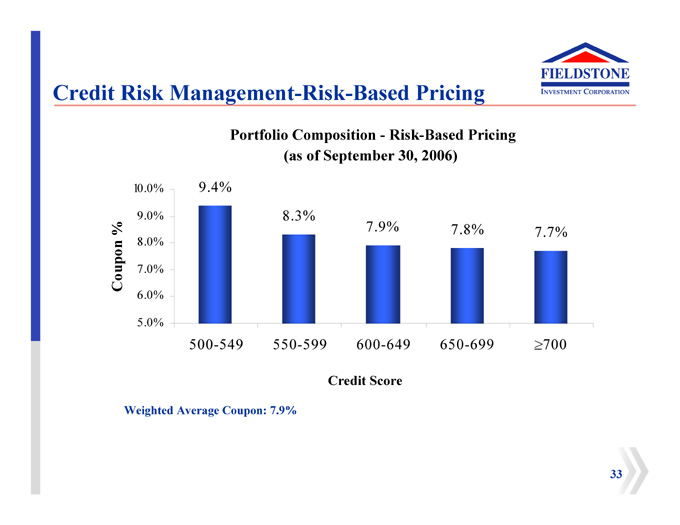

Credit Risk Management-Risk-Based Pricing

Portfolio Composition - Risk-Based Pricing (as of September 30, 2006)

Coupon %

10.0% 9.0% 8.0% 7.0% 6.0% 5.0%

9.4% 8.3% 7.9% 7.8% 7.7%

500-549 550-599 600-649 650-699 > 700

Credit Score

Weighted Average Coupon: 7.9%

33

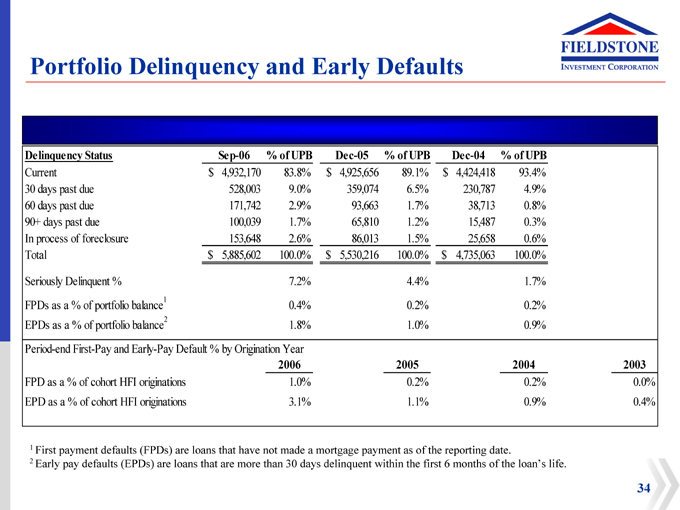

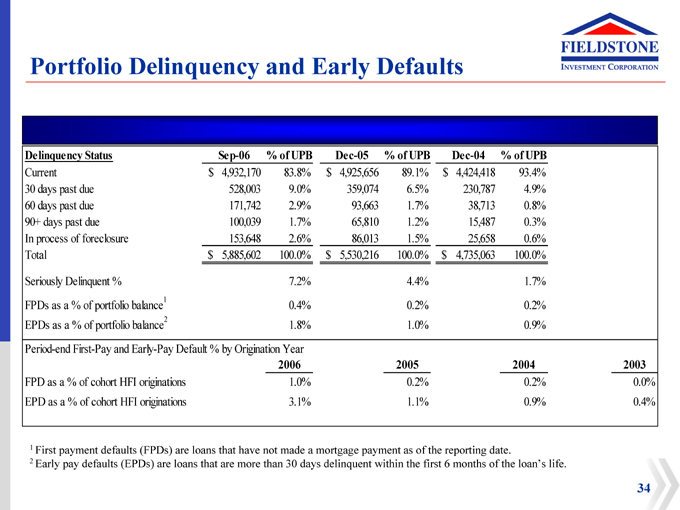

Portfolio Delinquency and Early Defaults

Delinquency Status Sep-06 % of UPB Dec-05 % of UPB Dec-04 % of UPB

Current $ 4,932,170 83.8% $ 4,925,656 89.1% $ 4,424,418 93.4%

30 days past due 528,003 9.0% 359,074 6.5% 230,787 4.9%

60 days past due 171,742 2.9% 93,663 1.7% 38,713 0.8%

90+ days past due 100,039 1.7% 65,810 1.2% 15,487 0.3%

In process of foreclosure 153,648 2.6% 86,013 1.5% 25,658 0.6%

Total $ 5,885,602 100.0% $ 5,530,216 100.0% $ 4,735,063 100.0%

Seriously Delinquent % 7.2% 4.4% 1.7%

FPDs as a % of portfolio balance1 0.4% 0.2% 0.2%

EPDs as a % of portfolio balance2 1.8% 1.0% 0.9%

Period-end First-Pay and Early-Pay Default % by Origination Year 2006 2005 2004 2003

FPD as a % of cohort HFI originations 1.0% 0.2% 0.2% 0.0%

EPD as a % of cohort HFI originations 3.1% 1.1% 0.9% 0.4%

1 First payment defaults (FPDs) are loans that have not made a mortgage payment as of the reporting date.

2 Early pay defaults (EPDs) are loans that are more than 30 days delinquent within the first 6 months of the loan’s life.

34

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Non-GAAP Financial Measures and Regulation G Reconciliations

Core net income, core earnings per share, core net interest income, and REIT taxable income are non-GAAP financial measures of Fieldstone’s earnings within the meaning of Regulation G promulgated by the Securities and Exchange Commission.

Core net income is net income less the non-cash mark to market gains (losses) on interest rate swap and cap agreements and the amortization of interest rate swap buydown payments.

Core earnings per share is core net income available to common shareholders divided by the weighted average diluted number of shares outstanding during the period.

Core net interest income after provision for loan losses is net interest income after provision for loan losses adjusted to include (a) the net cash settlements on the existing interest rate swaps and caps economically hedging the variable rate debt financing Fieldstone’s investment portfolio, (b) the net cash settlements to terminate these derivatives prior to maturity and (c) the amortization of interest rate swap buydown payments. Core net interest income after provision for loan losses does not include the net cash settlements incurred or paid to terminate swaps or caps related to loans ultimately sold, which are a component of “Gains on sales of mortgage loans, net” in the consolidated statement of operations.

REIT taxable income is consolidated GAAP pre-tax net income plus (a) provision for loan losses in excess of actual charge-offs and (b) variance in recognition of net origination expenses, less (c) taxable REIT subsidiary pre-tax net (income) loss, and (d) mark to market valuation changes on derivatives.

Management believes the core financial measures are useful to investors because they include the current period effects of Fieldstone’s economic hedging program but exclude the non-cash mark to market derivative value changes and the amortization of swap buydown payments. Fieldstone uses interest rate swap and cap agreements to create economic hedges of the variable rate debt it issues to finance its investment portfolio. Changes in the fair value of these agreements, which reflect the potential future cash settlements over the remaining lives of the agreements according to the market’s changing projections of interest rates, are recognized in the line item “Other income (expense) – portfolio derivatives” on the consolidated statements of operations. This single line item includes both the actual cash settlements related to the agreements that occurred during the period and recognition of the non-cash changes in the fair value of the agreements over the period. The actual cash settlements include regular monthly payments or receipts under the terms of the swap agreements and amounts paid or received to terminate the agreements prior to maturity.

Management believes that the presentation of REIT taxable income provides useful information to investors regarding the estimated annual distributions to our investors.

As required by Regulation G, a reconciliation of each of these non-GAAP financial measures to the most directly comparable measure under GAAP is provided below.

FIELDSTONE INVESTMENT CORPORATION AND SUBSIDIARIES

Non-GAAP Financial Measures

Regulation G Reconciliations

3rd Quarter 2006

Core net income and core earnings per share:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

| | | Nine Months Ended

September 30, 2006

| | | Year Ended

December 31, 2005

| |

(Dollars in thousands, except share and per share data)

| | September 30, 2006

| | | June 30, 2006

| | | |

Core net income | | | | | | | | | | | | | | | | |

Net income | | $ | (45,019 | ) | | $ | 3,805 | | | $ | (28,286 | ) | | $ | 99,390 | |

Less: Mark to market (gain) loss on portfolio derivatives included in “Other income (expense) - portfolio derivatives” | | | 25,088 | | | | 1,024 | | | | 24,218 | | | | (8,999 | ) |

Less: Amortization of interest rate swap buydown payments | | | (779 | ) | | | (781 | ) | | | (2,427 | ) | | | (755 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Core net income | | $ | (20,710 | ) | | $ | 4,048 | | | $ | (6,495 | ) | | $ | 89,636 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Core earnings per share: | | | | | | | | | | | | | | | | |

Net income | | $ | (45,019 | ) | | $ | 3,805 | | | $ | (28,286 | ) | | $ | 99,390 | |

Less: Dividends on unvested restricted stock | | | (74 | ) | | | (97 | ) | | | (249 | ) | | | (591 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income available to common shareholders | | | (45,093 | ) | | | 3,708 | | | | (28,535 | ) | | | 98,799 | |

Less: Mark to market (gain) loss on portfolio derivatives | | | 25,088 | | | | 1,024 | | | | 24,218 | | | | (8,999 | ) |

Amortization of interest rate swap buydown payments | | | (779 | ) | | | (781 | ) | | | (2,427 | ) | | | (755 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Core net income available to common shareholders | | $ | (20,784 | ) | | $ | 3,951 | | | $ | (6,744 | ) | | $ | 89,045 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings per share - basic and diluted | | $ | (0.97 | ) | | $ | 0.08 | | | $ | (0.60 | ) | | $ | 2.04 | |

Core earnings per share - basic and diluted | | $ | (0.45 | ) | | $ | 0.08 | | | $ | (0.14 | ) | | $ | 1.84 | |

Diluted weighted average common shares outstanding | | | 46,644,485 | | | | 47,677,853 | | | | 47,526,139 | | | | 48,464,445 | |

Book value per share | | $ | 9.03 | | | $ | 10.31 | | | $ | 9.03 | | | $ | 10.86 | |

Shares outstanding at period end | | | 46,904,485 | | | | 46,904,485 | | | | 46,904,485 | | | | 48,513,985 | |

Core net interest income after provision for loan losses:

| | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands)

| | Sept. 30, 2006

| | | June 30, 2006

| | | March 31, 2006

| | | Dec. 31, 2005

| | | Sept. 30, 2005

| |

Net interest income | | $ | 23,248 | | | $ | 26,255 | | | $ | 30,193 | | | $ | 35,370 | | | $ | 34,535 | |

Less: Provision for loan losses - loans held for investment | | | 28,035 | | | | 5,466 | | | | 5,393 | | | | 7,663 | | | | 11,045 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income after provision for loan losses | | $ | (4,787 | ) | | $ | 20,789 | | | $ | 24,800 | | | $ | 27,707 | | | $ | 23,490 | |

Plus: Net cash settlements received (paid) on portfolio derivatives included in “Other income (expense) - portfolio derivatives” | | | 11,333 | | | | 11,845 | | | | 10,264 | | | | 14,101 | | | | 8,000 | |

Less: Amortization of interest rate swap buydown payments | | | (779 | ) | | | (781 | ) | | | (867 | ) | | | (531 | ) | | | (224 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Core net interest income after provision for loan losses | | $ | 5,767 | | | $ | 31,853 | | | $ | 34,197 | | | $ | 41,277 | | | $ | 31,266 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Estimated REIT taxable income:

| | | | |

(Dollars in 000,000’s)

| | Nine Months Ended

September 30, 2006

| |

Consolidated GAAP pre-tax net (loss)/income | | $ | (37.2 | ) |

Plus: Non-performing interest in excess of actual charge-offs | | | 7.7 | |

Plus: Provision for loan losses in excess of actual charge-offs | | | 19.9 | |

Plus: Variance in recognition of net origination expenses | | | (3.0 | ) |

Less: Taxable REIT subsidiary pre-tax net loss/(income) | | | 24.1 | |

Less: Mark to market valuation changes on derivatives | | | 24.2 | |

Miscellaneous other | | | 0.5 | |

| | |

|

|

|

Estimated REIT taxable income | | $ | 36.2 | |

| | |

|

|

|