Foundation HealthCare, Inc. Presentation Piper Jaffray Annual Healthcare Conference Stanton Nelson, CEO Hugh King, CFO December 2015 Do the right thing... Do it all the time. www.FDNH.com Exhibit 99.1

Forward Looking Statements This presentation may include certain forward looking statements. All statements other than statements of historical fact, included herein, including, without limitation, statements regarding future plans and objectives of Foundation Healthcare or the Corporation, are forward-looking statements that involve various risks, assumptions, estimates, and uncertainties. These statements reflect the current internal projections, expectations or beliefs of Foundation Healthcare and are based on information currently available to the Corporation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. All of the forward looking statements contained in this presentation are qualified by these cautionary statements and the risk factors described above. Furthermore, all such statements are made as of the date this presentation is given and Foundation Healthcare assumes no obligation to update or revise these statements, except as otherwise required by law. An investment in Foundation Healthcare is speculative due to the nature of the Corporation's business. Investors must rely upon the ability, expertise, judgment, discretion, integrity, and good faith of the Management of the Corporation. Do the right thing... Do it all the time. www.FDNH.com

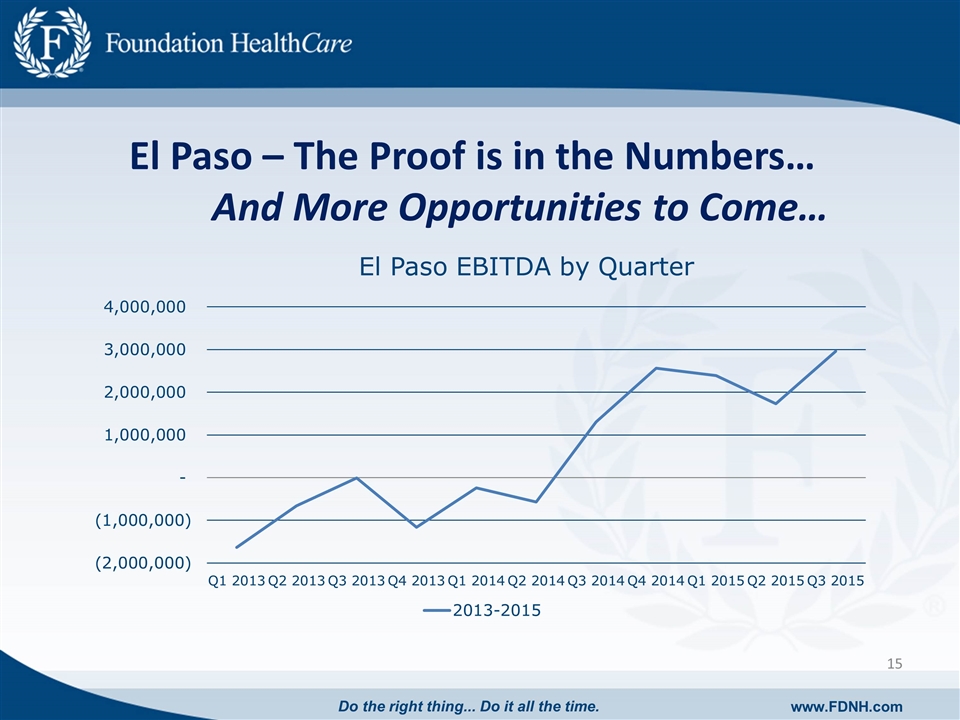

Specialized surgical services – one of the fastest growing segments in healthcare 3 surgical hospitals, 10 ambulatory surgical centers (ASCs) Facilities in 7 states; 800+ employees. 650+ full-time, 150+ part-time. Physician partners : 270+ owners and 165 non-owners Management – proven operators with tremendous bench strength Track record of improving operating performance and margins (El Paso case study) Highly-scalable – surgically-focused business with ability to drive revenue growth with related services Proven ancillary model in existing markets What We Do Do the right thing... Do it all the time. www.FDNH.com

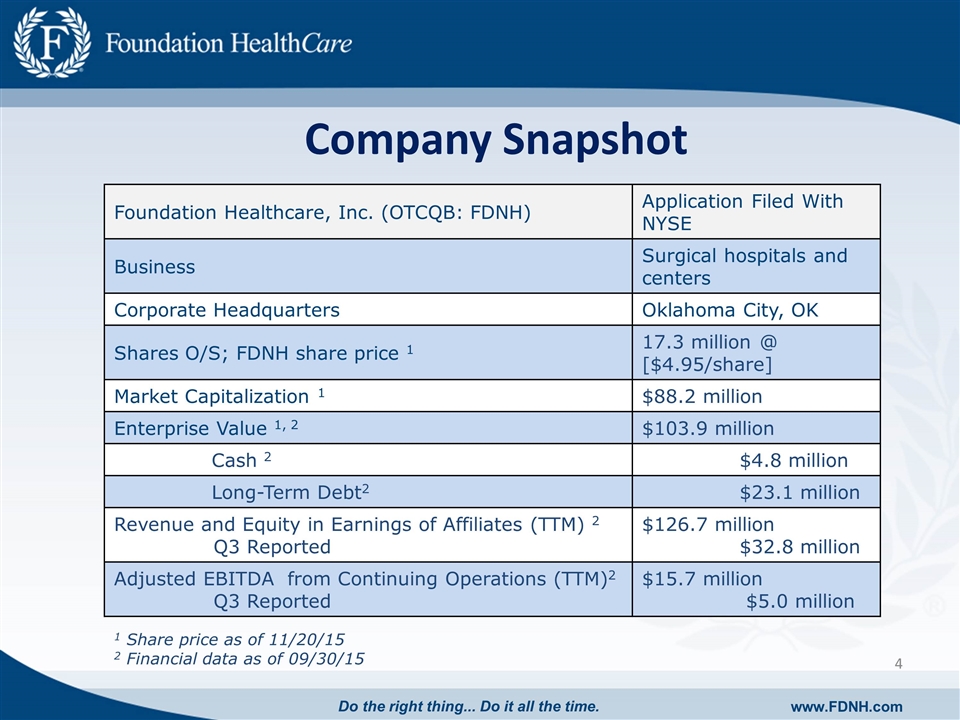

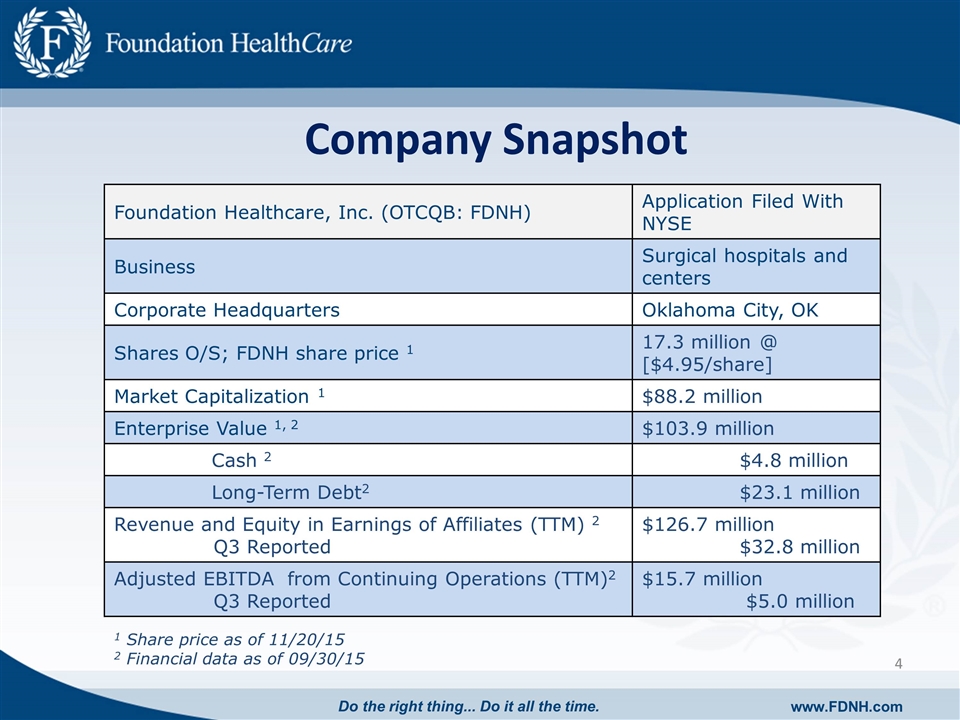

Foundation Healthcare, Inc. (OTCQB: FDNH) Application Filed With NYSE Business Surgical hospitals and centers Corporate Headquarters Oklahoma City, OK Shares O/S; FDNH share price 1 17.3 million @ [$4.95/share] Market Capitalization 1 $88.2 million Enterprise Value 1, 2 $103.9 million Cash 2 $4.8 million Long-Term Debt2 $23.1 million Revenue and Equity in Earnings of Affiliates (TTM) 2 Q3 Reported $126.7 million $32.8 million Adjusted EBITDA from Continuing Operations (TTM)2 Q3 Reported $15.7 million $5.0 million 1 Share price as of 11/20/15 2 Financial data as of 09/30/15 Company Snapshot Do the right thing... Do it all the time. www.FDNH.com

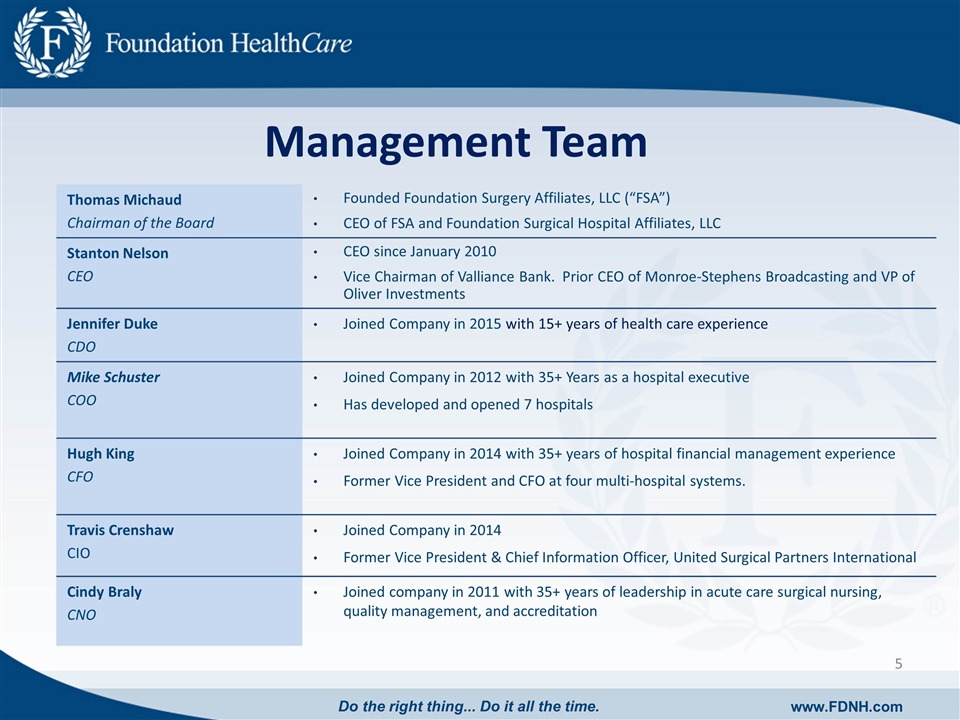

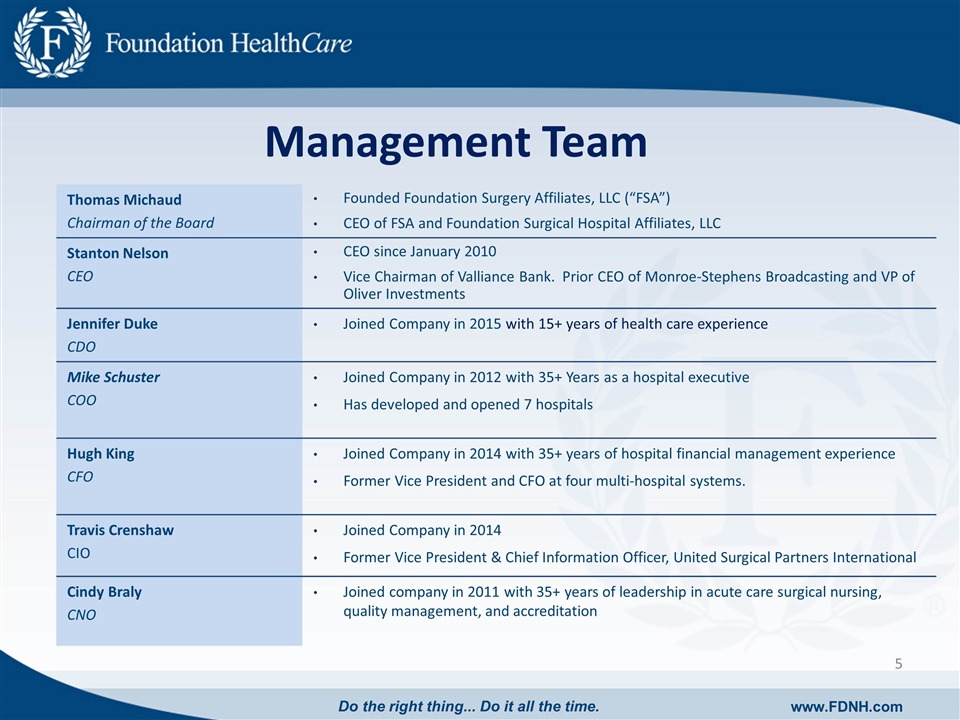

Management Team Thomas Michaud Chairman of the Board Founded Foundation Surgery Affiliates, LLC (“FSA”) CEO of FSA and Foundation Surgical Hospital Affiliates, LLC Stanton Nelson CEO CEO since January 2010 Vice Chairman of Valliance Bank. Prior CEO of Monroe-Stephens Broadcasting and VP of Oliver Investments Jennifer Duke CDO Joined Company in 2015 with 15+ years of health care experience Mike Schuster COO Joined Company in 2012 with 35+ Years as a hospital executive Has developed and opened 7 hospitals Hugh King CFO Joined Company in 2014 with 35+ years of hospital financial management experience Former Vice President and CFO at four multi-hospital systems. Travis Crenshaw CIO Joined Company in 2014 Former Vice President & Chief Information Officer, United Surgical Partners International Cindy Braly CNO Joined company in 2011 with 35+ years of leadership in acute care surgical nursing, quality management, and accreditation Do the right thing... Do it all the time. www.FDNH.com

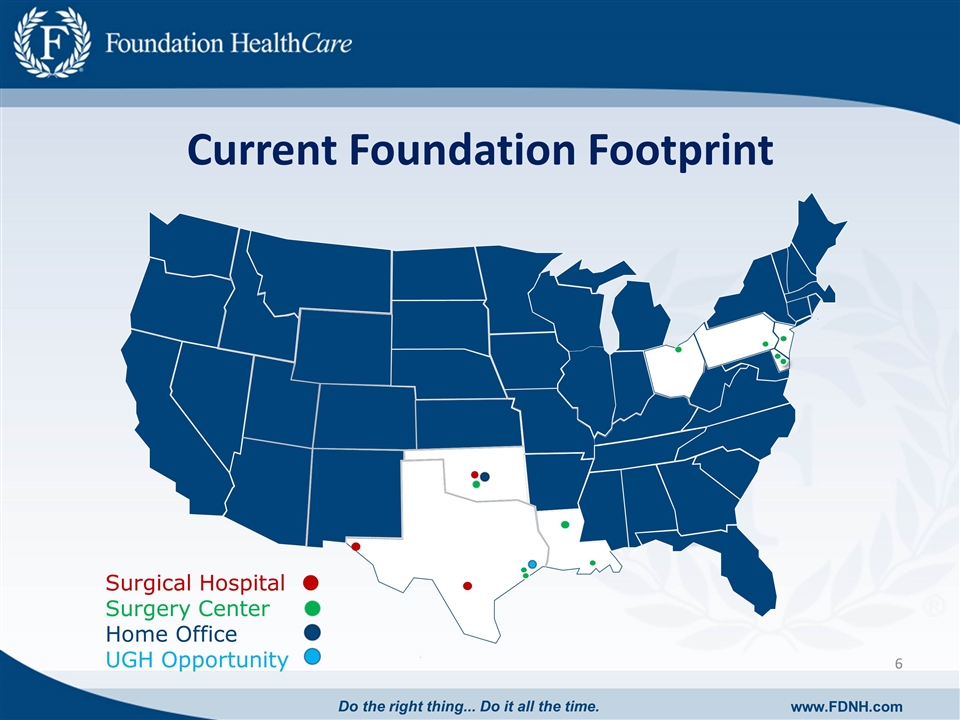

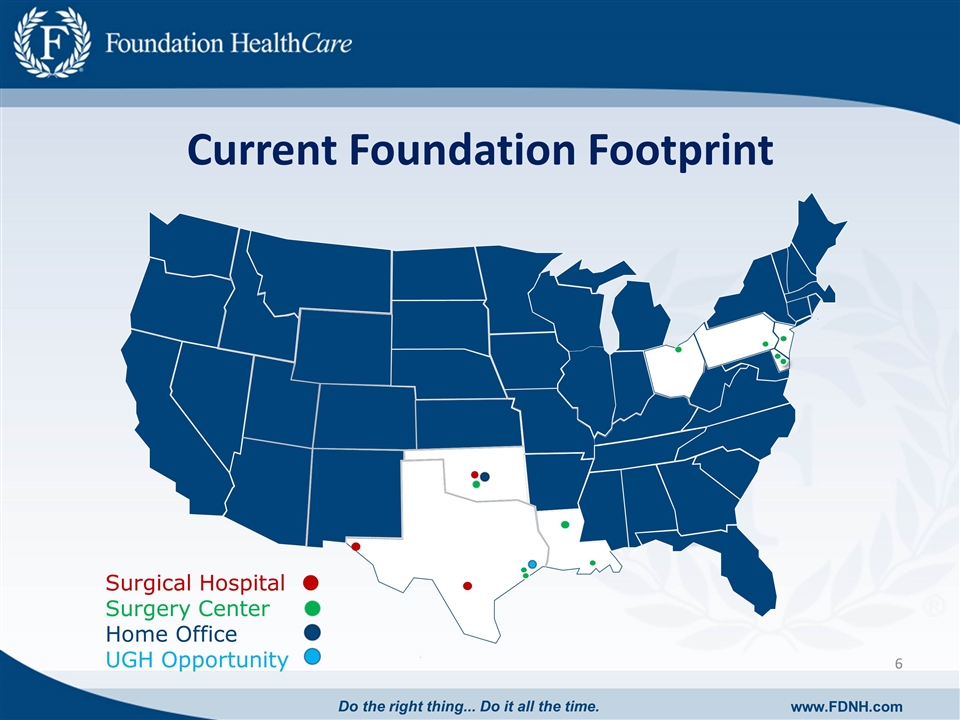

Current Foundation Footprint Surgical Hospital Surgery Center Home Office UGH Opportunity Do the right thing... Do it all the time. www.FDNH.com

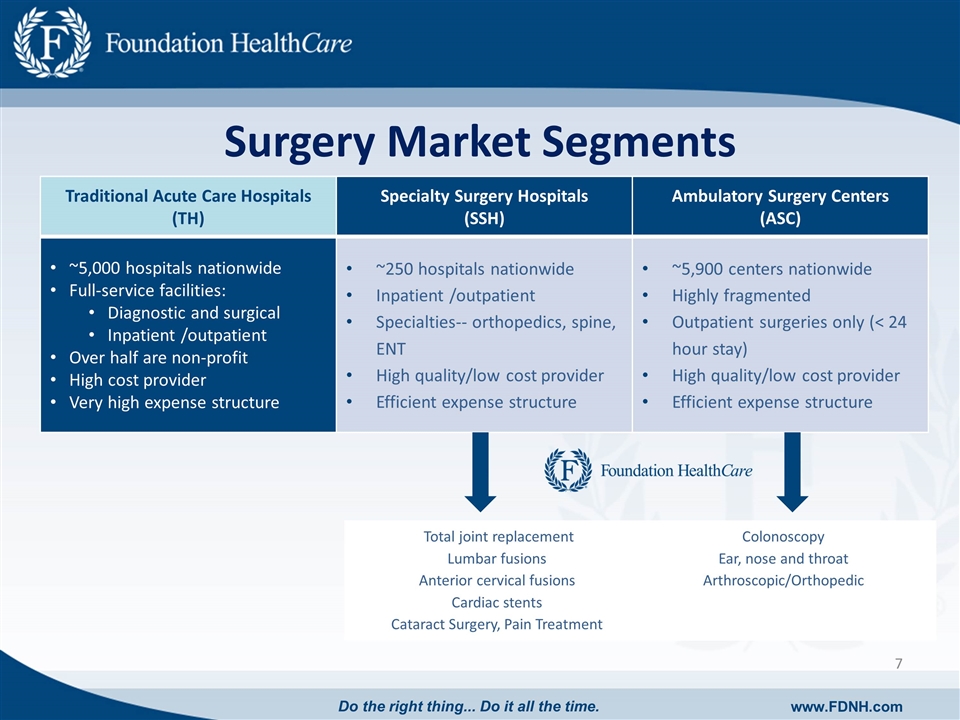

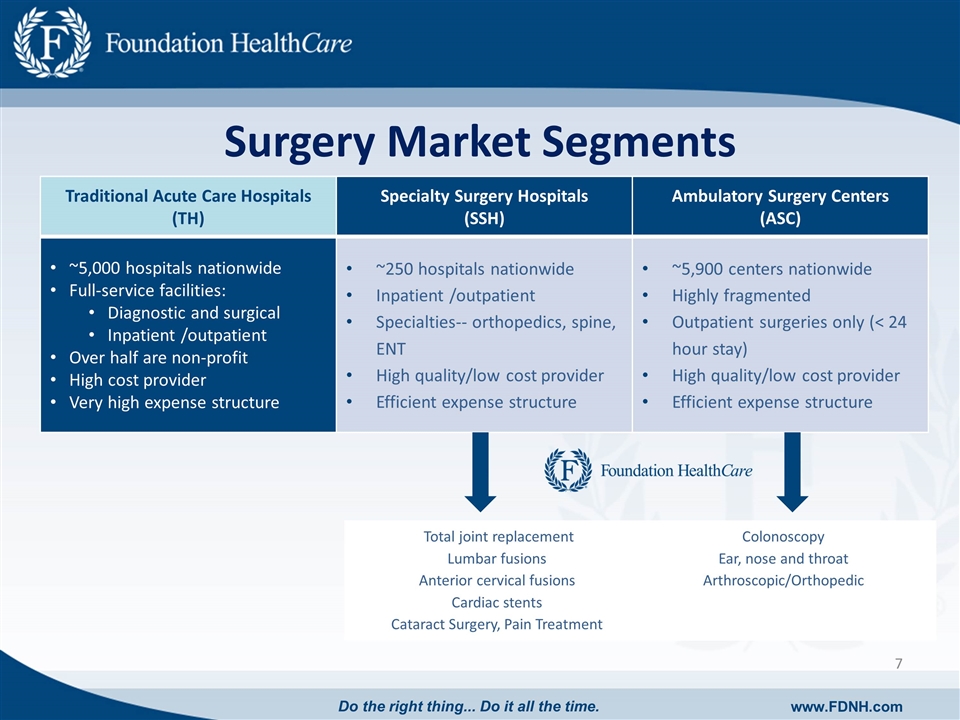

Surgery Market Segments Traditional Acute Care Hospitals (TH) Specialty Surgery Hospitals (SSH) Ambulatory Surgery Centers (ASC) ~5,000 hospitals nationwide Full-service facilities: Diagnostic and surgical Inpatient /outpatient Over half are non-profit High cost provider Very high expense structure ~250 hospitals nationwide Inpatient /outpatient Specialties-- orthopedics, spine, ENT High quality/low cost provider Efficient expense structure ~5,900 centers nationwide Highly fragmented Outpatient surgeries only (< 24 hour stay) High quality/low cost provider Efficient expense structure Total joint replacement Lumbar fusions Anterior cervical fusions Cardiac stents Cataract Surgery, Pain Treatment Colonoscopy Ear, nose and throat Arthroscopic/Orthopedic Do the right thing... Do it all the time. www.FDNH.com

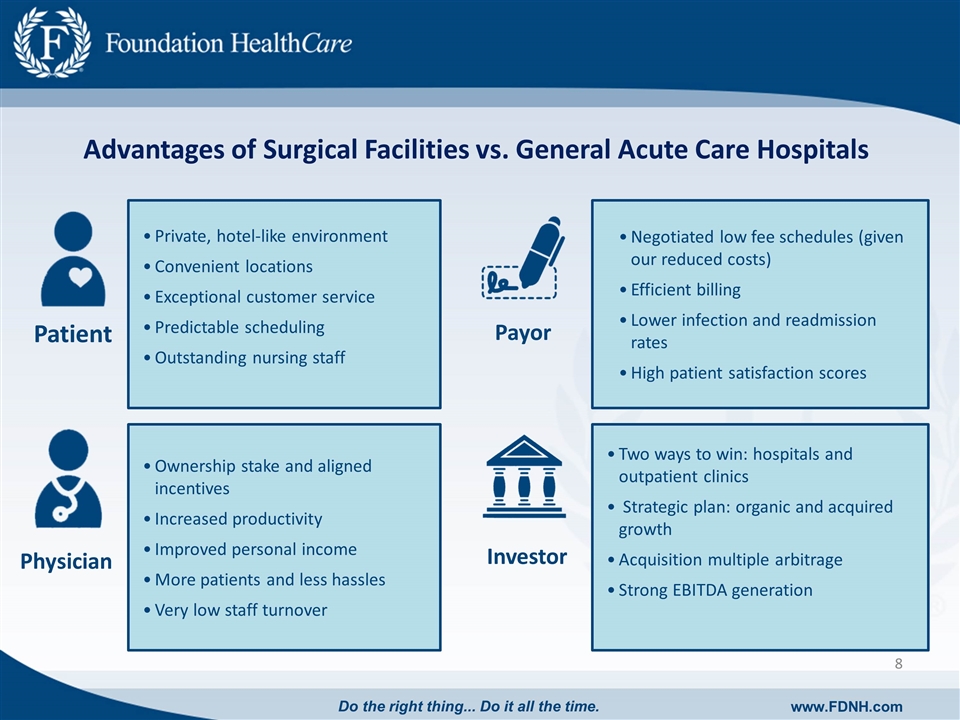

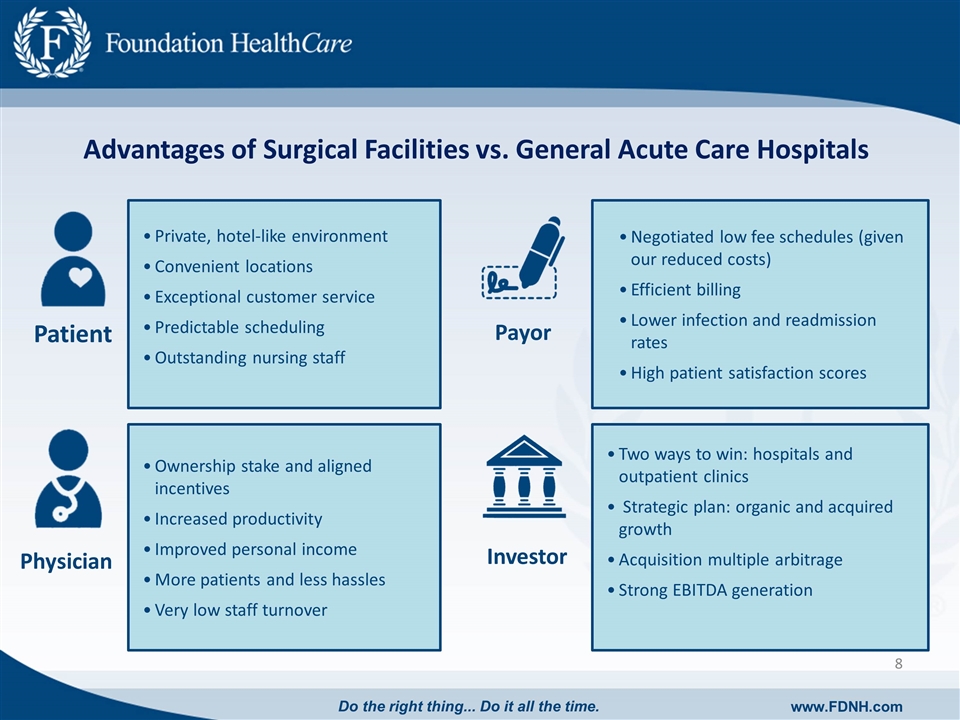

Advantages of Surgical Facilities vs. General Acute Care Hospitals Private, hotel-like environment Convenient locations Exceptional customer service Predictable scheduling Outstanding nursing staff Negotiated low fee schedules (given our reduced costs) Efficient billing Lower infection and readmission rates High patient satisfaction scores Ownership stake and aligned incentives Increased productivity Improved personal income More patients and less hassles Very low staff turnover Two ways to win: hospitals and outpatient clinics Strategic plan: organic and acquired growth Acquisition multiple arbitrage Strong EBITDA generation Patient Payor Investor Physician Do the right thing... Do it all the time. www.FDNH.com

Our Approach to Acquisitions Do the right thing... Do it all the time. www.FDNH.com

Highly-refined Business Plan Goal: strong regional clusters of surgery hospitals and affiliated outpatient surgery centers Intensive, data-driven analysis of states, regions and individual targets: Step 1: identify favorable regional environments (demographics, reimbursement and regulation) Step 2: identify facilities with near-term revenue / EBITDA contributions and regional proximity Rapid and seamless integration: Step 3: leverage our managerial expertise, systems and analytical tools Step 4: use sophisticated data analytics to monitor and improve operating performance Do the right thing... Do it all the time. www.FDNH.com

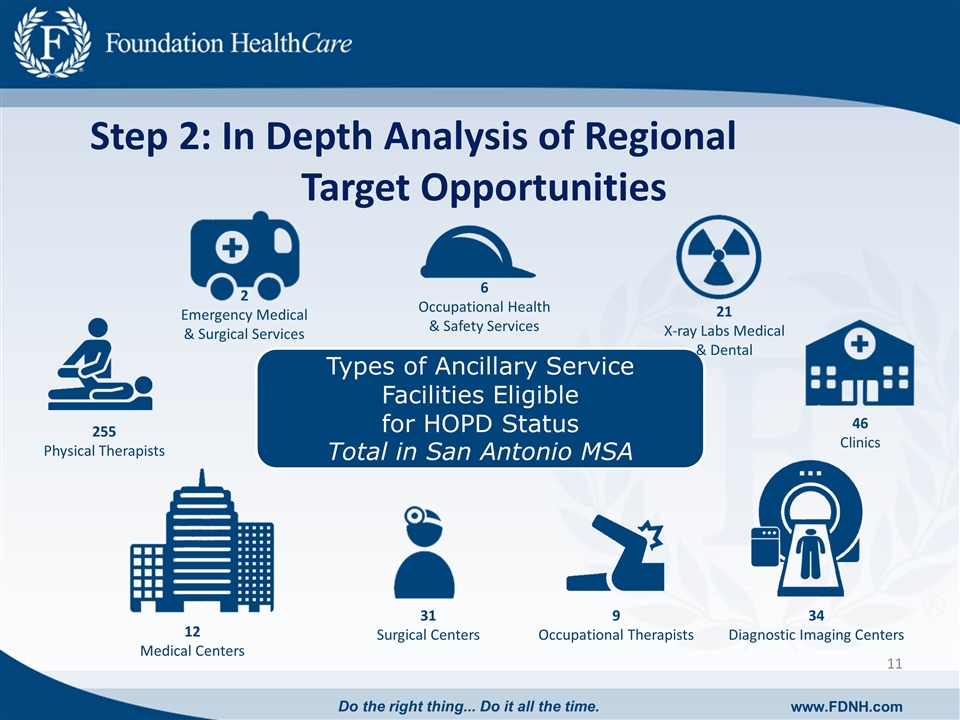

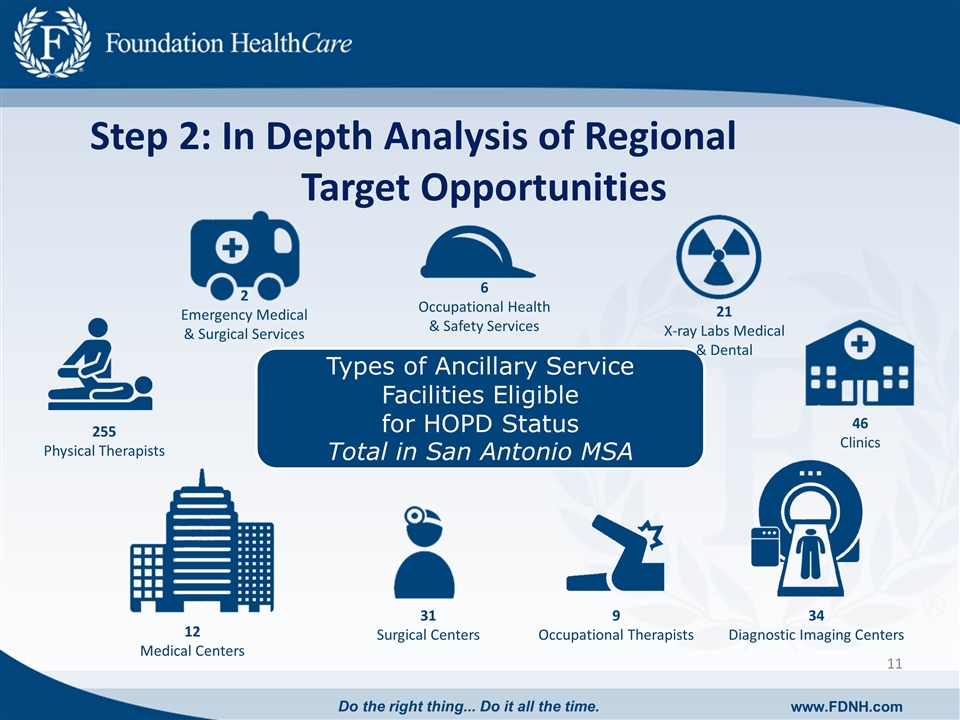

Step 2: In Depth Analysis of Regional Target Opportunities Types of Ancillary Service Facilities Eligible for HOPD Status Total in San Antonio MSA 2 Emergency Medical & Surgical Services 6 Occupational Health & Safety Services 21 X-ray Labs Medical & Dental 46 Clinics 34 Diagnostic Imaging Centers 9 Occupational Therapists 31 Surgical Centers 12 Medical Centers 255 Physical Therapists Do the right thing... Do it all the time. www.FDNH.com

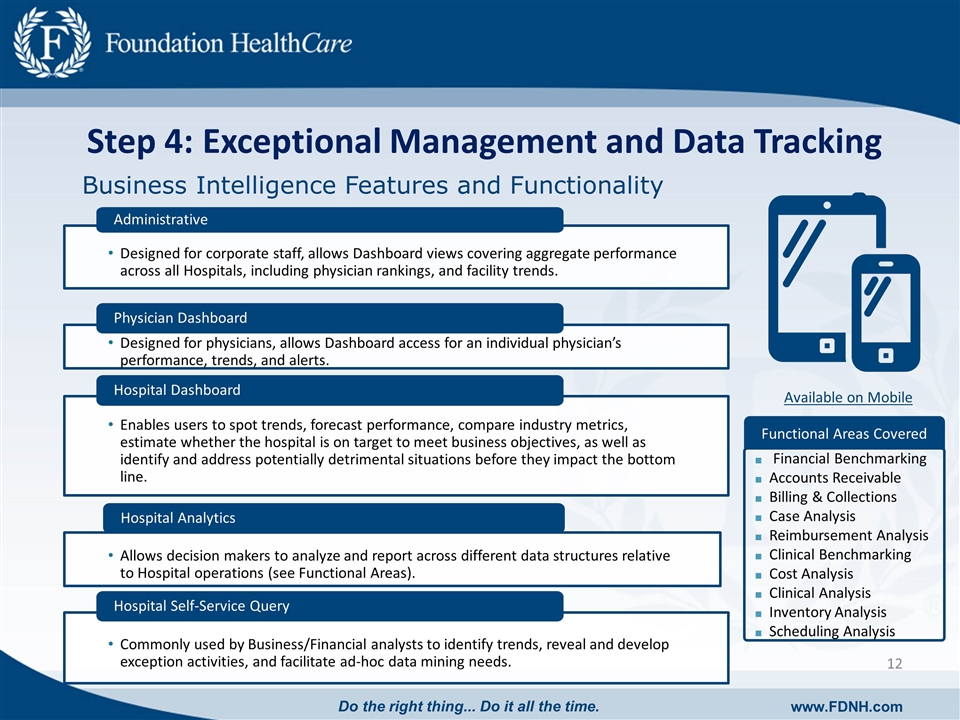

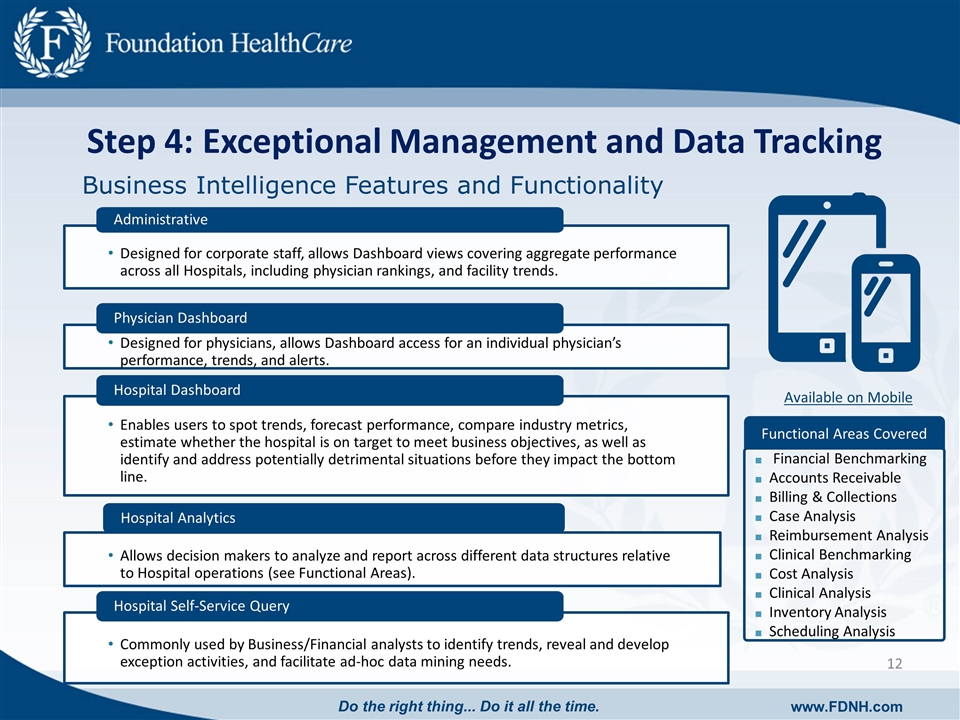

Step 4: Exceptional Management and Data Tracking Business Intelligence Features and Functionality Designed for corporate staff, allows Dashboard views covering aggregate performance across all Hospitals, including physician rankings, and facility trends. Administrative Designed for physicians, allows Dashboard access for an individual physician’s performance, trends, and alerts. Physician Dashboard Enables users to spot trends, forecast performance, compare industry metrics, estimate whether the hospital is on target to meet business objectives, as well as identify and address potentially detrimental situations before they impact the bottom line. Hospital Dashboard Allows decision makers to analyze and report across different data structures relative to Hospital operations (see Functional Areas). Hospital Analytics Commonly used by Business/Financial analysts to identify trends, reveal and develop exception activities, and facilitate ad-hoc data mining needs. Hospital Self-Service Query Available on Mobile Functional Areas Covered Financial Benchmarking Accounts Receivable Billing & Collections Case Analysis Reimbursement Analysis Clinical Benchmarking Cost Analysis Clinical Analysis Inventory Analysis Scheduling Analysis Do the right thing... Do it all the time. www.FDNH.com

Case Study: El Paso Do the right thing... Do it all the time. www.FDNH.com

Case Study 1: El Paso Diagnostic Imaging Centers Physical Therapists Wound Care Oncology Reference Lab Surgical Centers Do the right thing... Do it all the time. www.FDNH.com

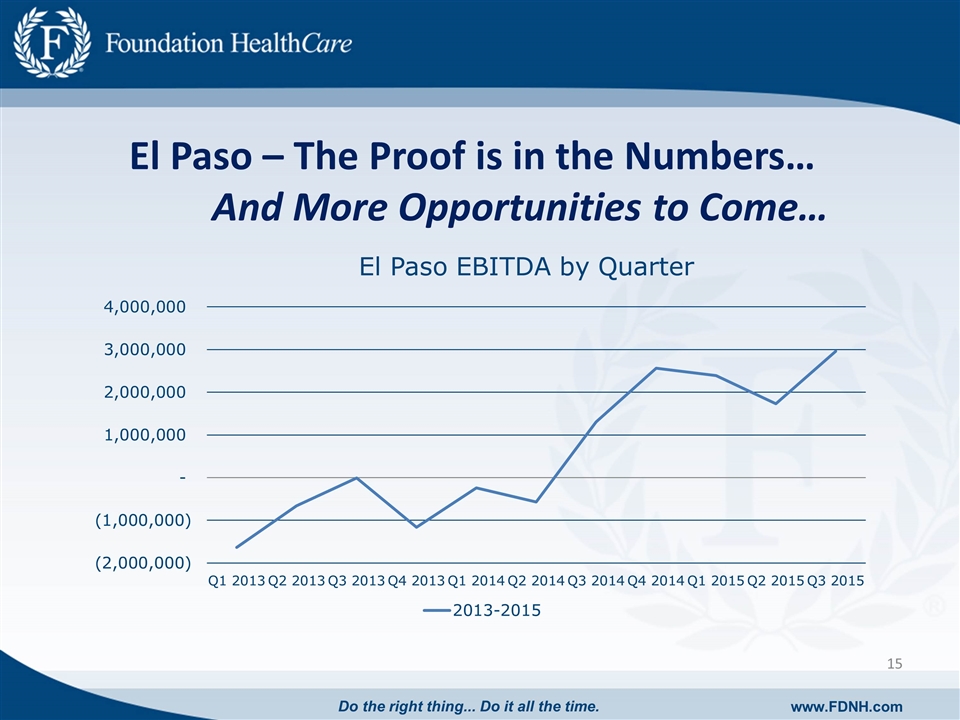

El Paso – The Proof is in the Numbers… And More Opportunities to Come… Do the right thing... Do it all the time. www.FDNH.com

Tactical Growth: Organic and Acquired Improve operating metrics of existing facilities Better surgical throughput with systems infrastructure, software systems and best practices Create a “clustered” facility footprint of hospitals and affiliated outpatient clinics Economies of scale for purchasing; new branding opportunities While HOPDs and ASCs are both outpatient clinics, hospital affiliates receive higher reimbursement; hence, we plan to acquire ASCs and affiliate them with our hospitals Target rich environment, highly fragmented, accretive opportunities Increase ownership stakes in our surgical facilities to > 50% (majority) over time Greater operational control, revenues and profit margins Do the right thing... Do it all the time. www.FDNH.com

Financial Discussion Do the right thing... Do it all the time. www.FDNH.com

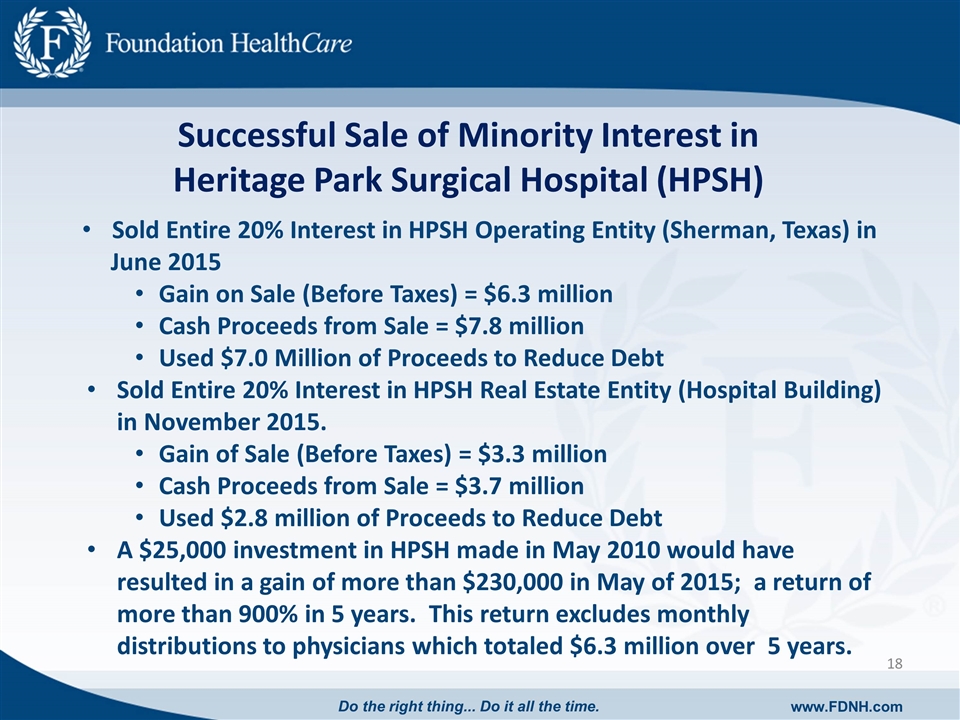

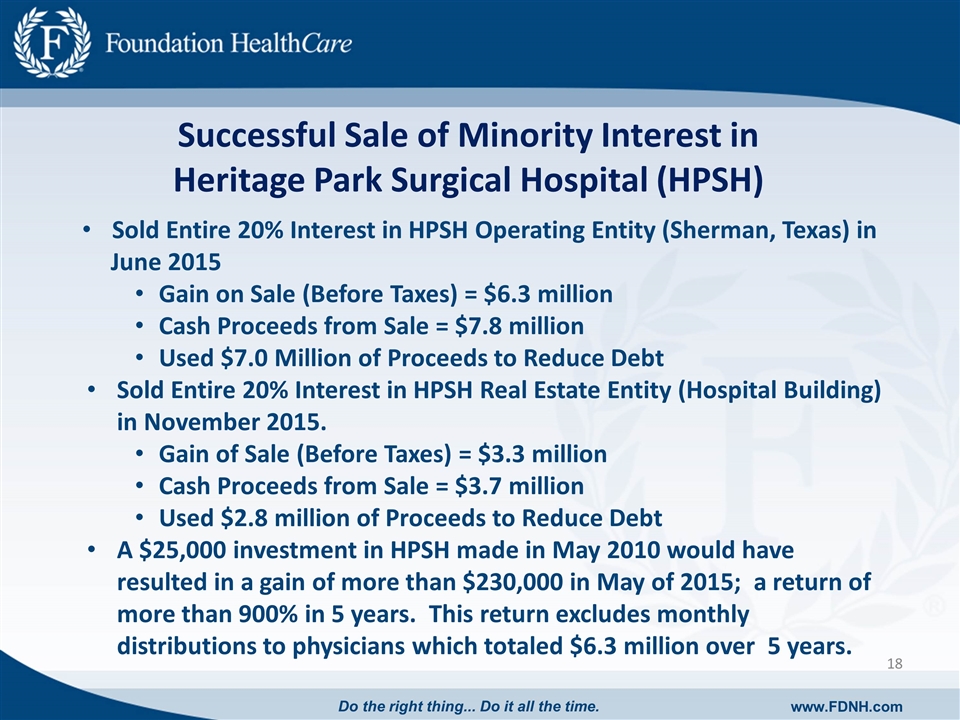

Successful Sale of Minority Interest in Heritage Park Surgical Hospital (HPSH) Sold Entire 20% Interest in HPSH Operating Entity (Sherman, Texas) in June 2015 Gain on Sale (Before Taxes) = $6.3 million Cash Proceeds from Sale = $7.8 million Used $7.0 Million of Proceeds to Reduce Debt Sold Entire 20% Interest in HPSH Real Estate Entity (Hospital Building) in November 2015. Gain of Sale (Before Taxes) = $3.3 million Cash Proceeds from Sale = $3.7 million Used $2.8 million of Proceeds to Reduce Debt A $25,000 investment in HPSH made in May 2010 would have resulted in a gain of more than $230,000 in May of 2015; a return of more than 900% in 5 years. This return excludes monthly distributions to physicians which totaled $6.3 million over 5 years. Do the right thing... Do it all the time. www.FDNH.com

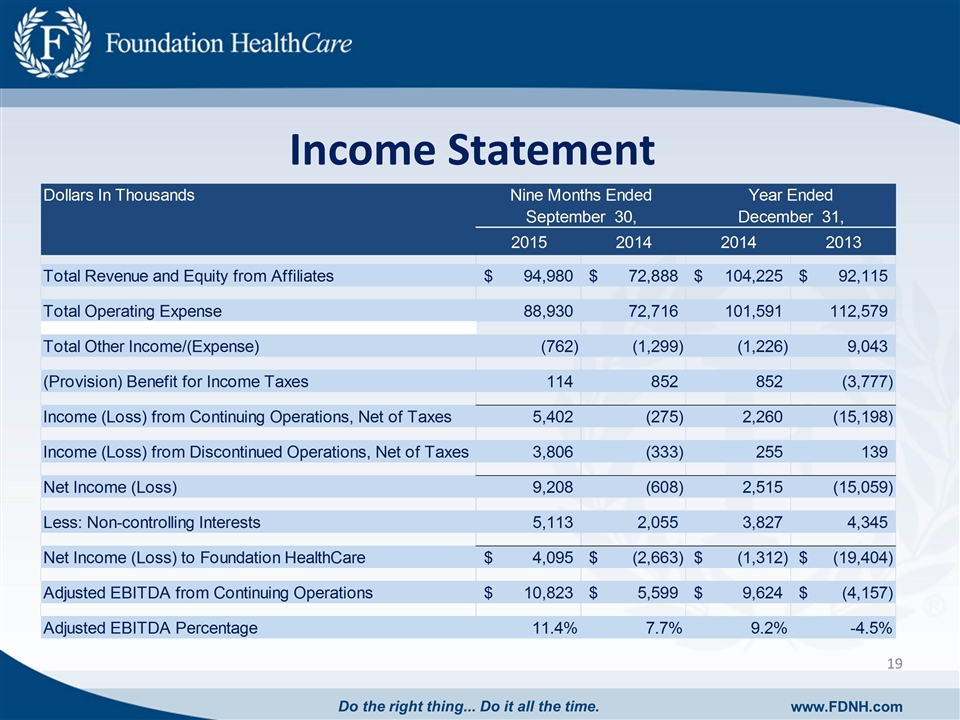

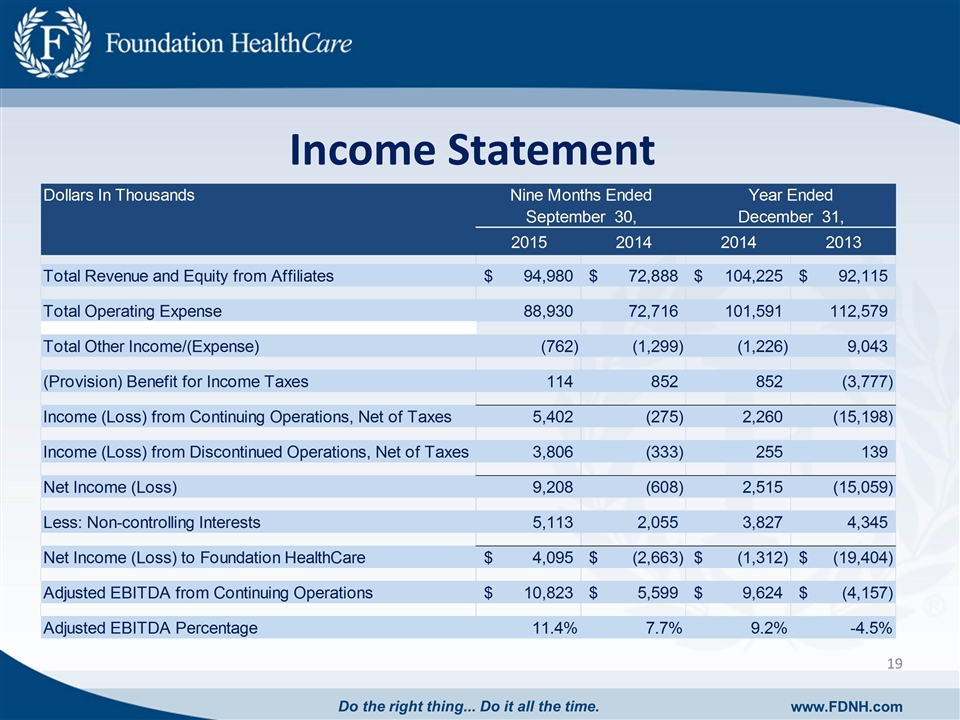

Income Statement Do the right thing... Do it all the time. www.FDNH.com Dollars In Thousands Nine Months Ended Year Ended September 30, December 31, 2015 2014 2014 2013 Total Revenue and Equity from Affiliates $94,980 $72,888 $,104,225 $92,115 Total Operating Expense 88930 72716 101591 112579 Total Other Income/(Expense) -762 -1299 -1226 9043 (Provision) Benefit for Income Taxes 114 852 852 -3777 Income (Loss) from Continuing Operations, Net of Taxes 5402 -275 2260 -15198 Income (Loss) from Discontinued Operations, Net of Taxes 3806 -333 255 139 Net Income (Loss) 9208 -608 2515 -15059 Less: Non-controlling Interests 5113 2055 3827 4345 Net Income (Loss) to Foundation HealthCare $4,095 $-2,663 $-1,312 $,-19,404 Adjusted EBITDA from Continuing Operations $10,823 $5,599 $9,624 $-4,157 Adjusted EBITDA Percentage 0.11395030532743736 7.7% 9.2% -4.5%

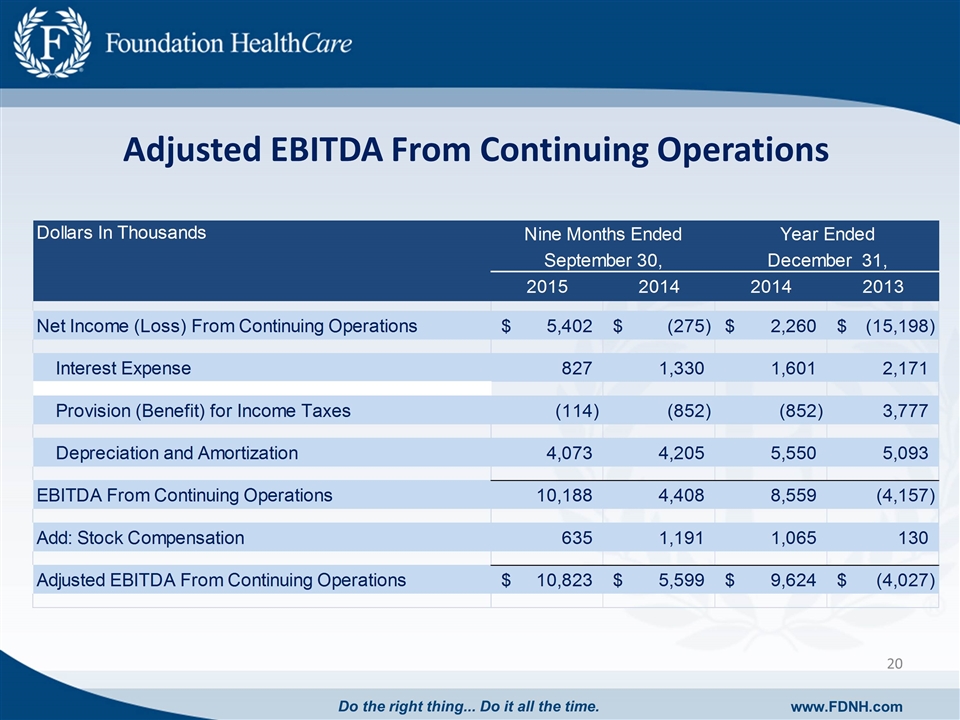

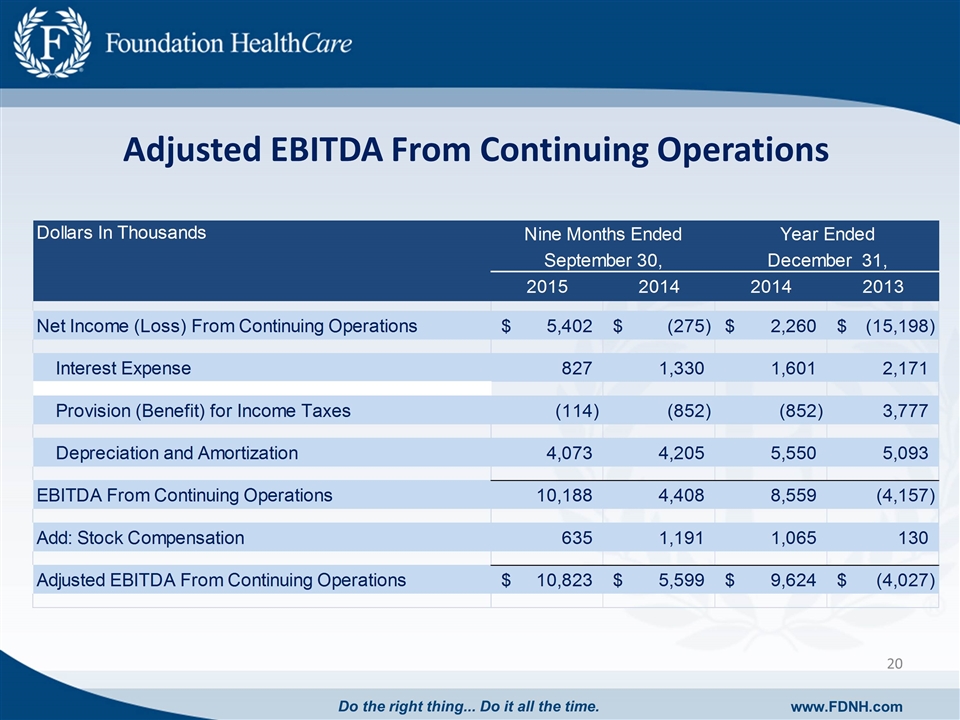

Adjusted EBITDA From Continuing Operations Do the right thing... Do it all the time. www.FDNH.com Dollars In Thousands Nine Months Ended Year Ended September 30, December 31, 2015 2014 2014 2013 Net Income (Loss) From Continuing Operations $5,402 $-,275 $2,260 $,-15,198 Interest Expense 827 1330 1601 2171 Provision (Benefit) for Income Taxes -114 -852 -852 3777 Depreciation and Amortization 4073 4205 5550 5093 EBITDA From Continuing Operations 10188 4408 8559 -4157 Add: Stock Compensation 635 1191 1065 130 Adjusted EBITDA From Continuing Operations $10,823 $5,599 $9,624 $-4,027

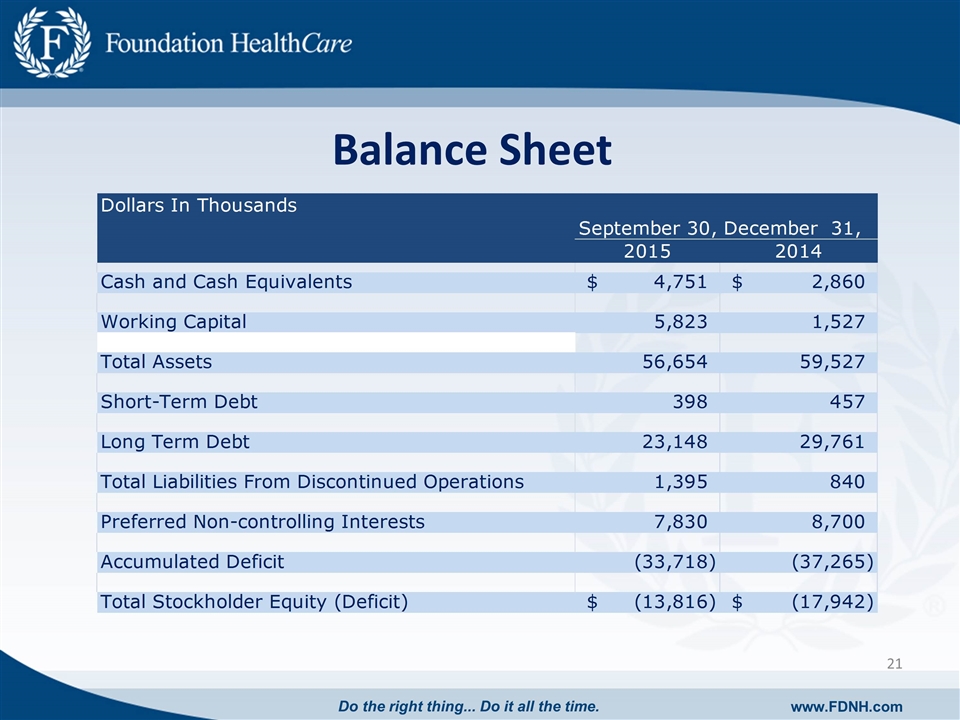

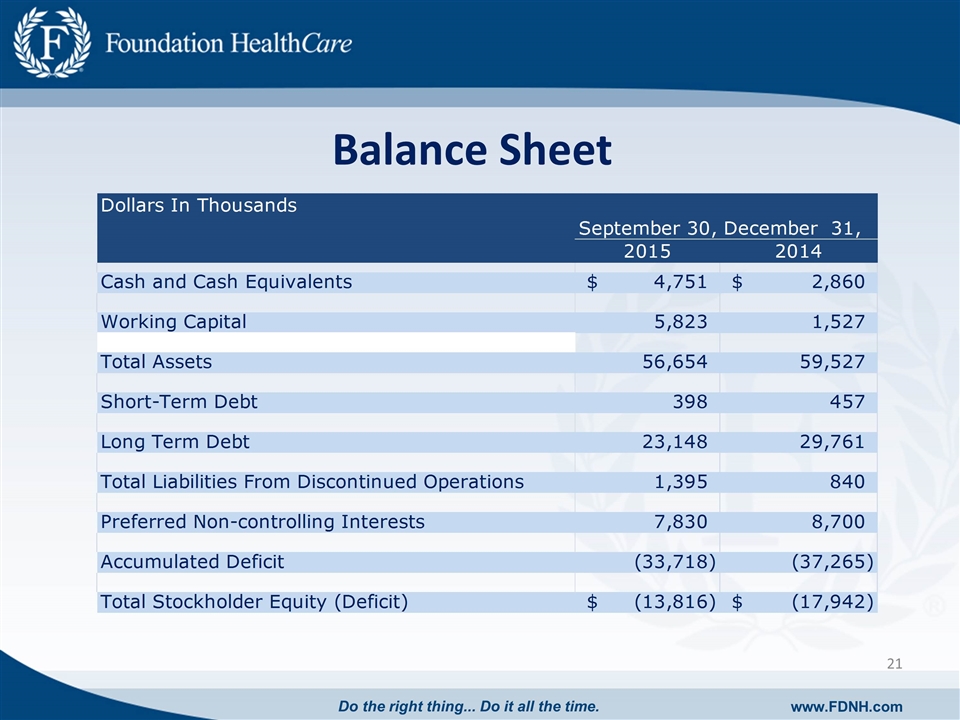

Balance Sheet Do the right thing... Do it all the time. www.FDNH.com Dollars In Thousands September 30, December 31, 2015 2014 Cash and Cash Equivalents $4,751 $2,860 Working Capital 5823 1527 Total Assets 56654 59527 Short-Term Debt 398 457 Long Term Debt 23148 29761 Total Liabilities From Discontinued Operations 1395 840 Preferred Non-controlling Interests 7830 8700 Accumulated Deficit -33718 -37265 Total Stockholder Equity (Deficit) $,-13,816 $,-17,942

UGH Opportunity Do the right thing... Do it all the time. www.FDNH.com

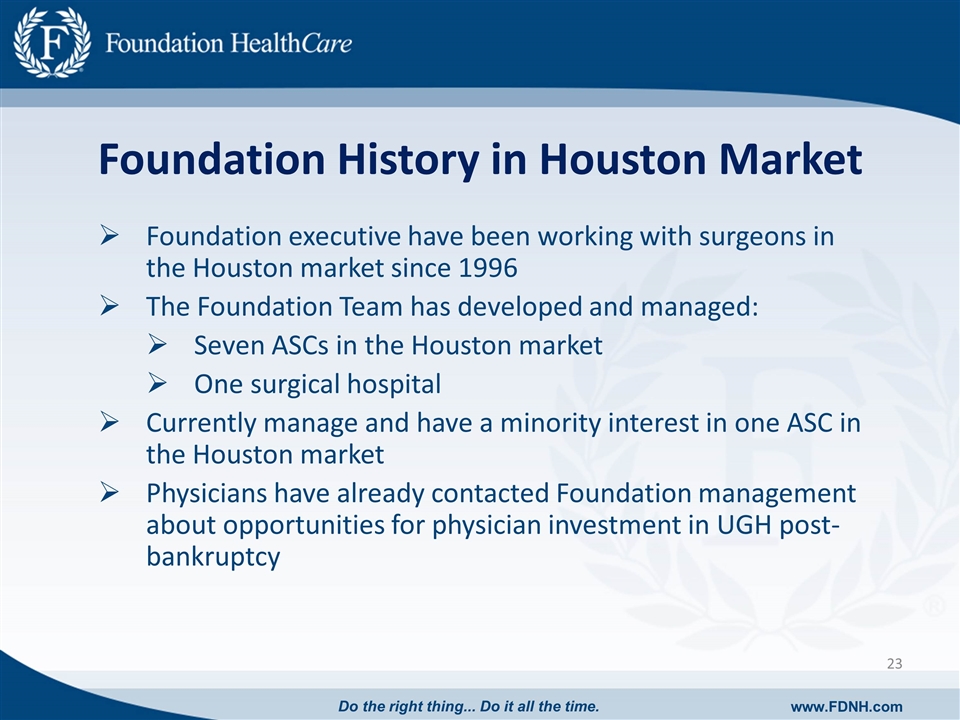

Foundation History in Houston Market Foundation executive have been working with surgeons in the Houston market since 1996 The Foundation Team has developed and managed: Seven ASCs in the Houston market One surgical hospital Currently manage and have a minority interest in one ASC in the Houston market Physicians have already contacted Foundation management about opportunities for physician investment in UGH post- bankruptcy Do the right thing... Do it all the time. www.FDNH.com

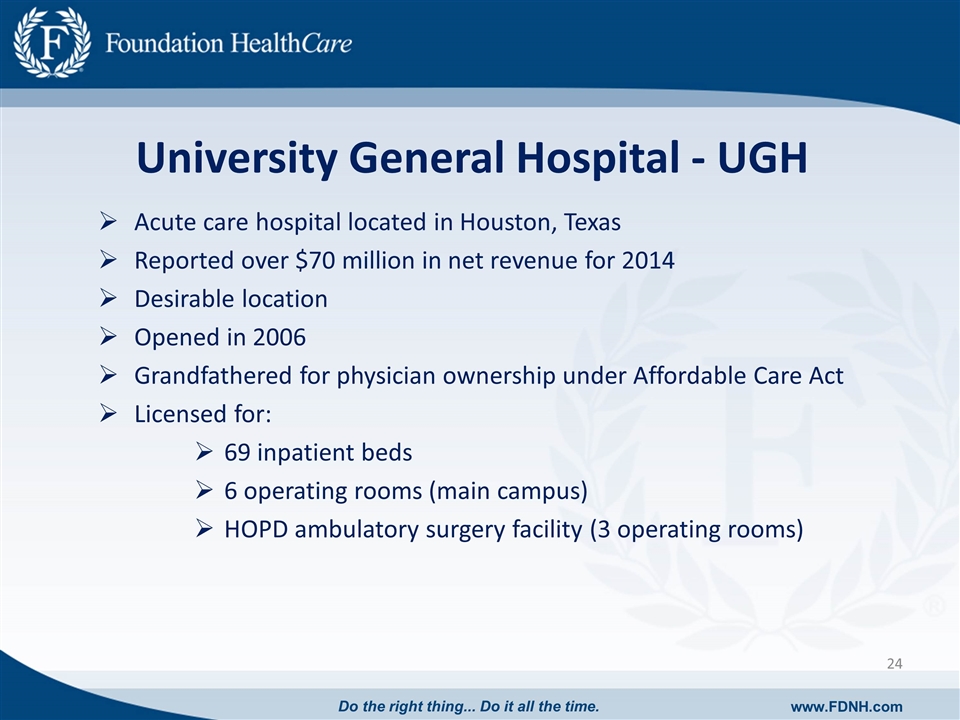

University General Hospital - UGH Acute care hospital located in Houston, Texas Reported over $70 million in net revenue for 2014 Desirable location Opened in 2006 Grandfathered for physician ownership under Affordable Care Act Licensed for: 69 inpatient beds 6 operating rooms (main campus) HOPD ambulatory surgery facility (3 operating rooms) Do the right thing... Do it all the time. www.FDNH.com

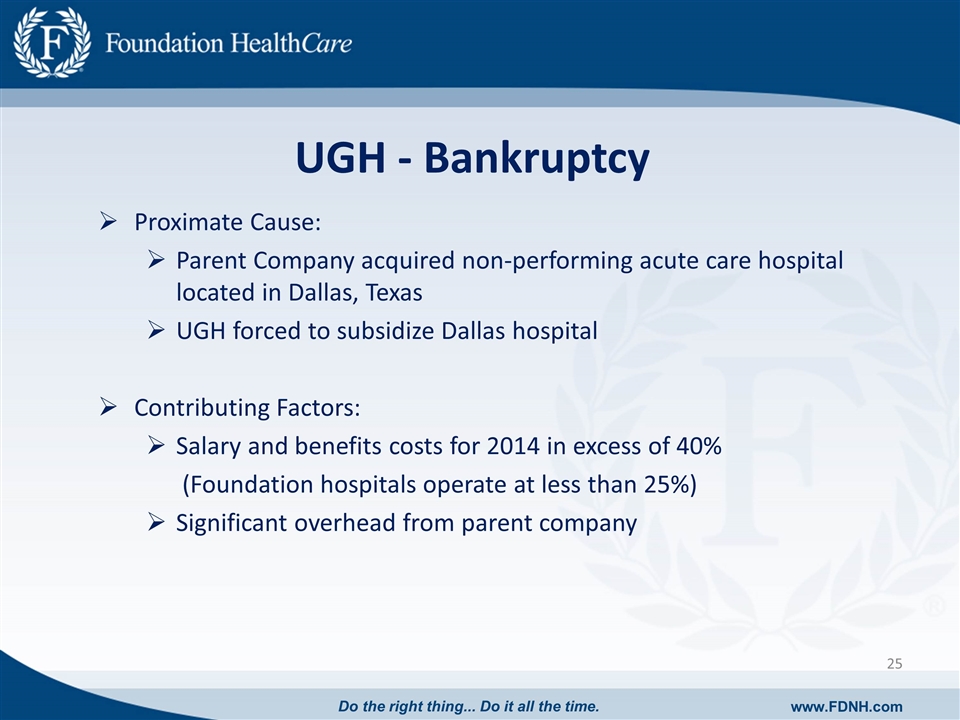

UGH - Bankruptcy Proximate Cause: Parent Company acquired non-performing acute care hospital located in Dallas, Texas UGH forced to subsidize Dallas hospital Contributing Factors: Salary and benefits costs for 2014 in excess of 40% (Foundation hospitals operate at less than 25%) Significant overhead from parent company Do the right thing... Do it all the time. www.FDNH.com

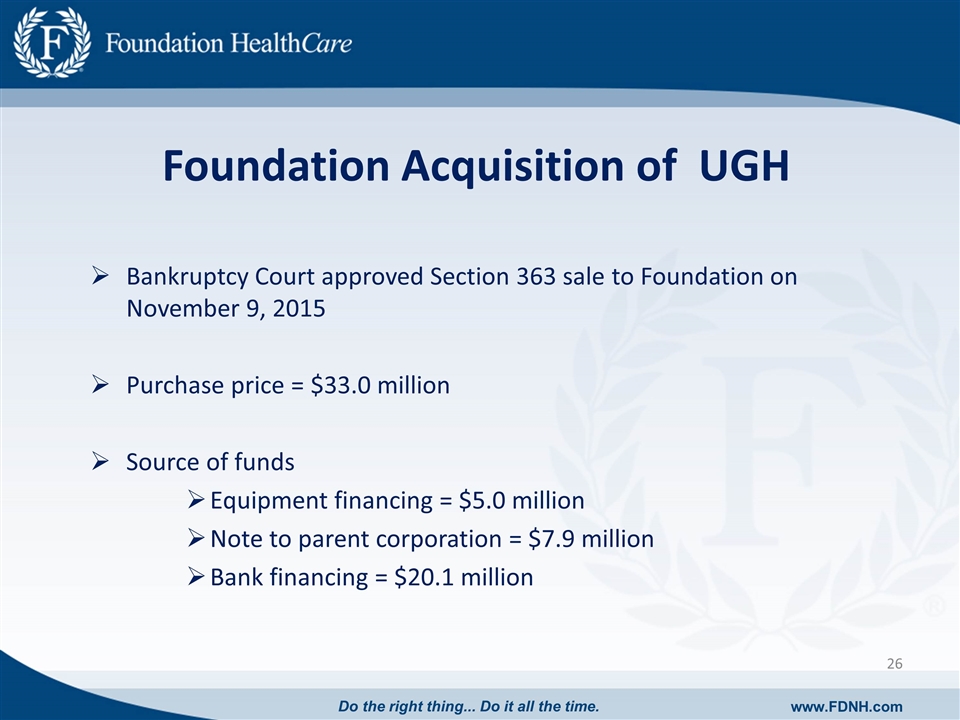

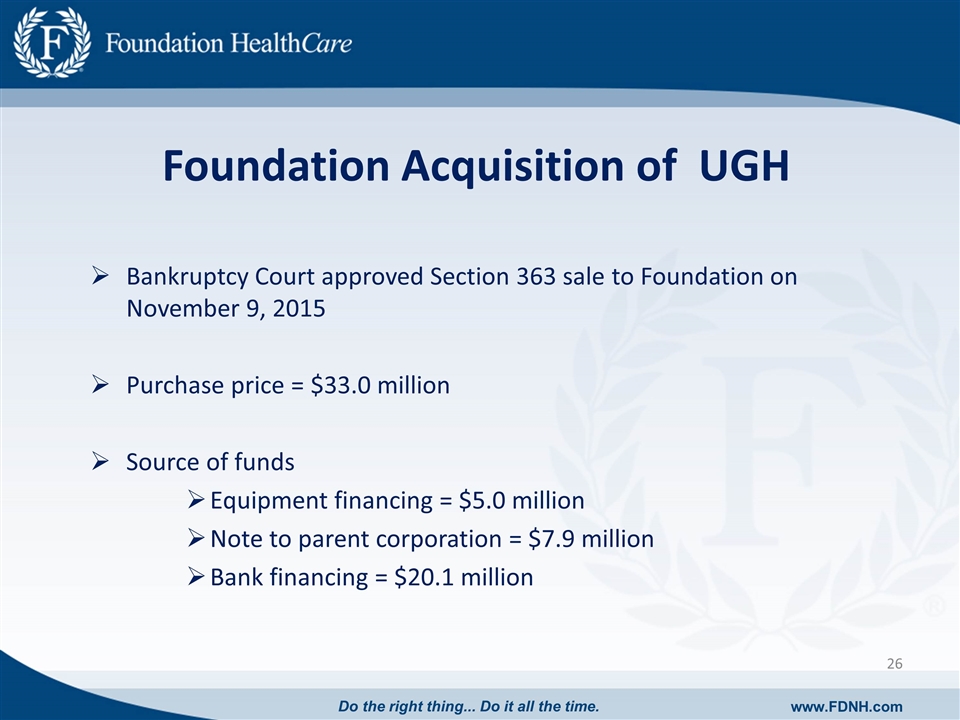

Foundation Acquisition of UGH Bankruptcy Court approved Section 363 sale to Foundation on November 9, 2015 Purchase price = $33.0 million Source of funds Equipment financing = $5.0 million Note to parent corporation = $7.9 million Bank financing = $20.1 million Do the right thing... Do it all the time. www.FDNH.com

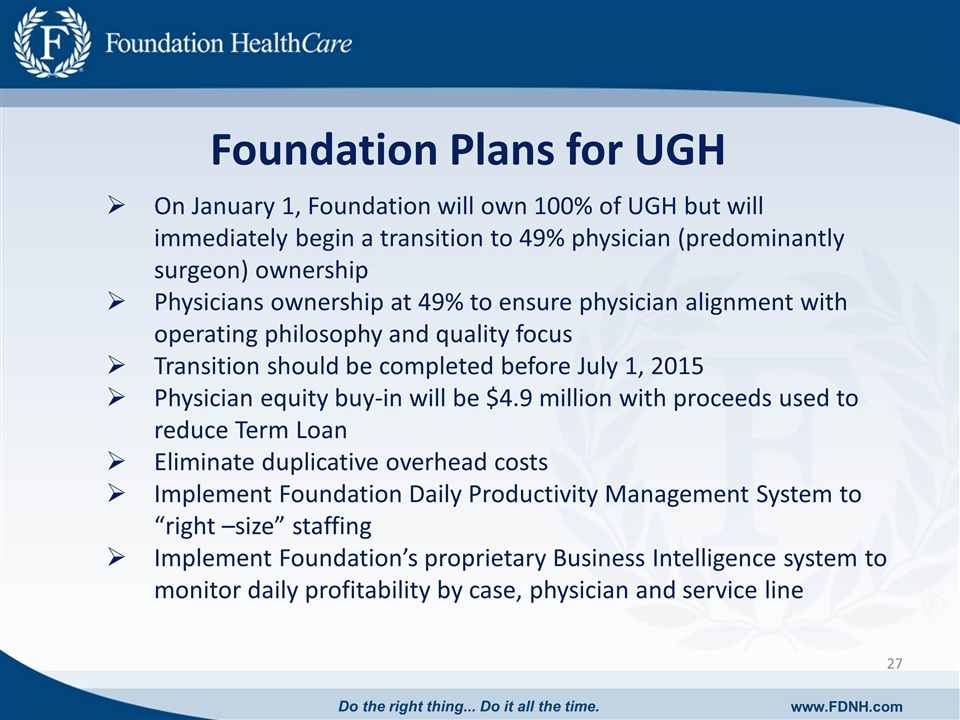

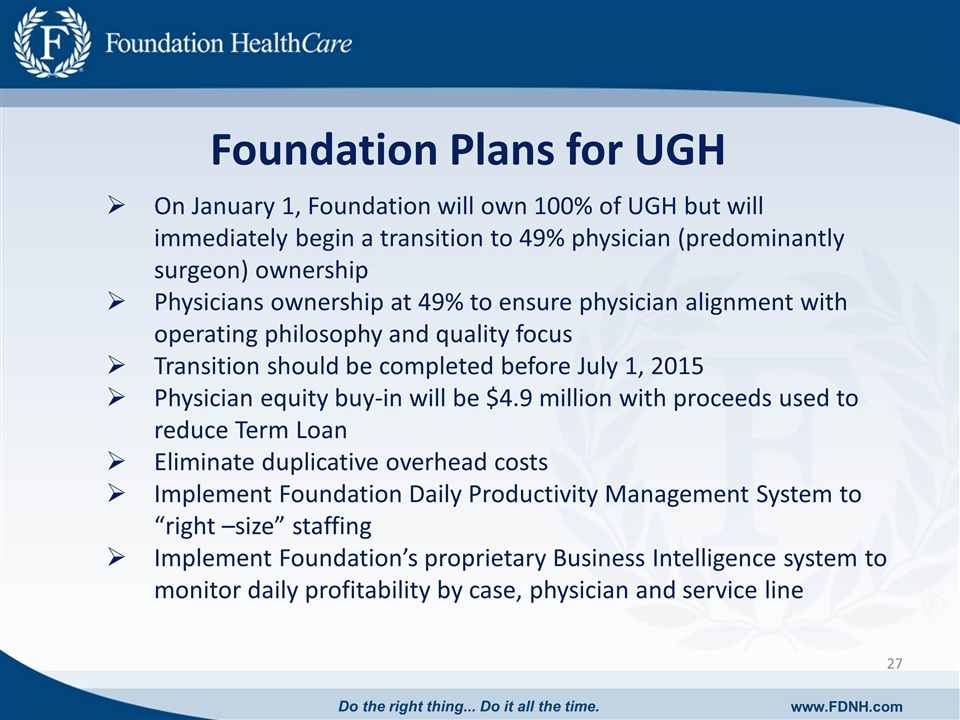

Foundation Plans for UGH On January 1, Foundation will own 100% of UGH but will immediately begin a transition to 49% physician (predominantly surgeon) ownership Physicians ownership at 49% to ensure physician alignment with operating philosophy and quality focus Transition should be completed before July 1, 2015 Physician equity buy-in will be $4.9 million with proceeds used to reduce Term Loan Eliminate duplicative overhead costs Implement Foundation Daily Productivity Management System to “right –size” staffing Implement Foundation’s proprietary Business Intelligence system to monitor daily profitability by case, physician and service line Do the right thing... Do it all the time. www.FDNH.com

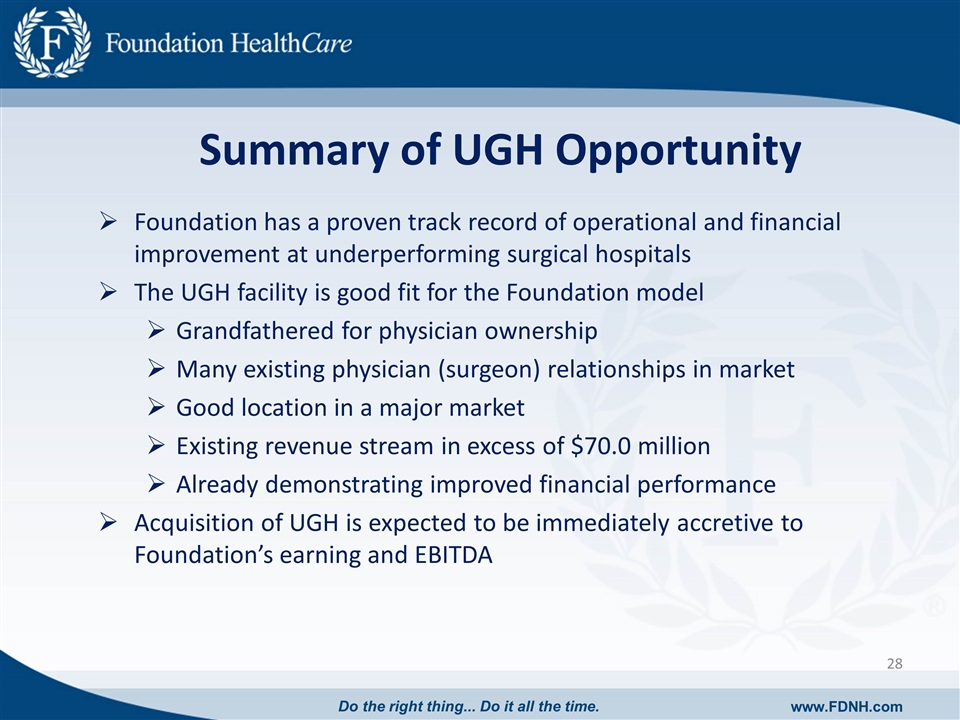

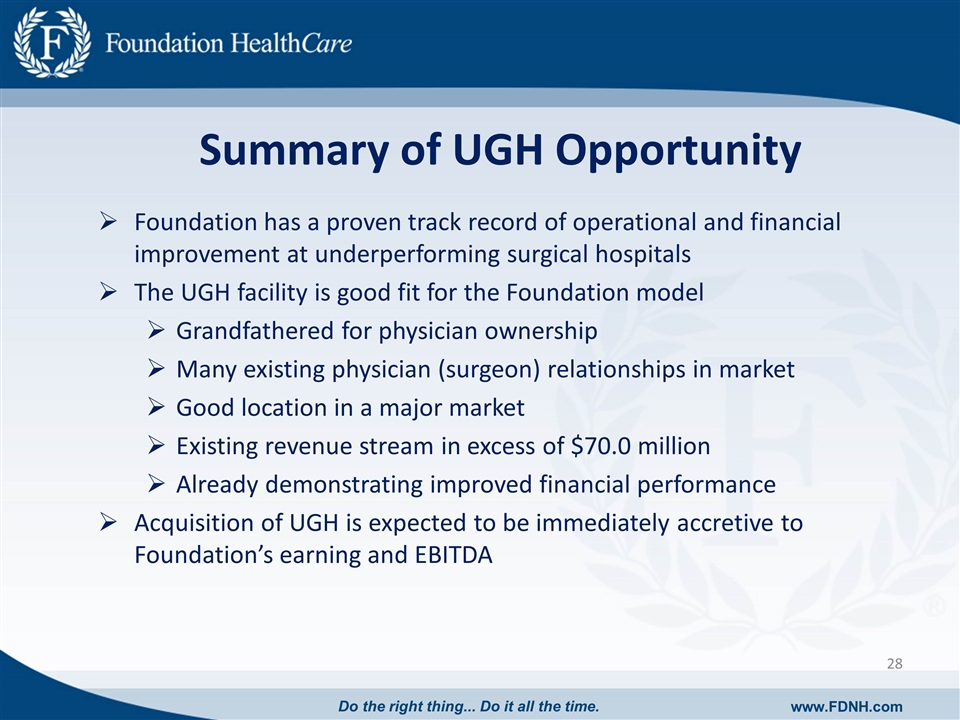

Summary of UGH Opportunity Foundation has a proven track record of operational and financial improvement at underperforming surgical hospitals The UGH facility is good fit for the Foundation model Grandfathered for physician ownership Many existing physician (surgeon) relationships in market Good location in a major market Existing revenue stream in excess of $70.0 million Already demonstrating improved financial performance Acquisition of UGH is expected to be immediately accretive to Foundation’s earning and EBITDA Do the right thing... Do it all the time. www.FDNH.com

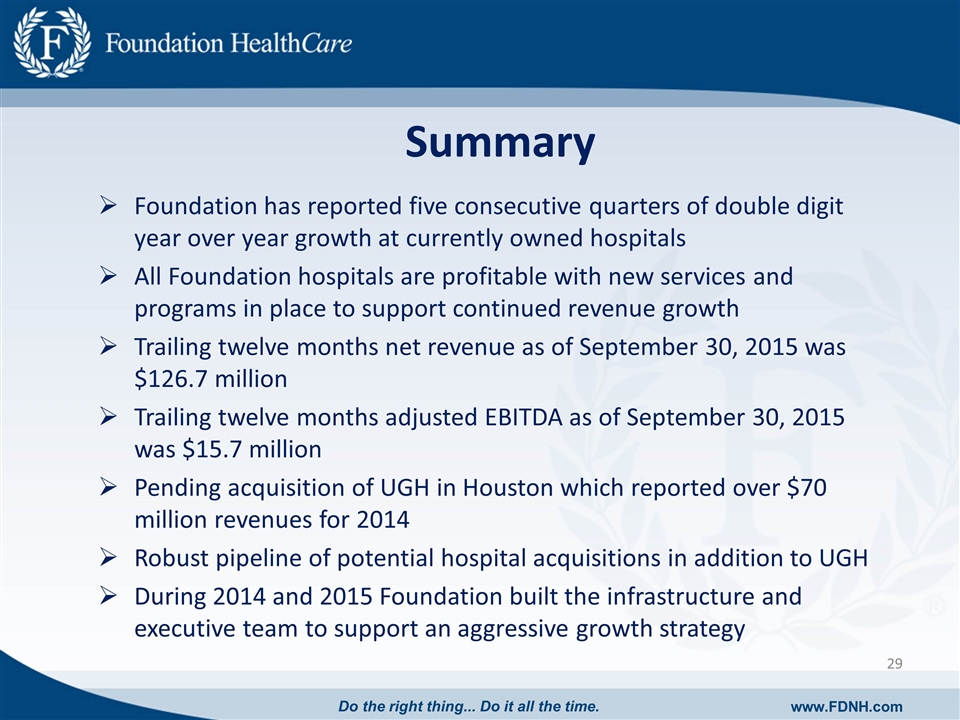

Summary Foundation has reported five consecutive quarters of double digit year over year growth at currently owned hospitals All Foundation hospitals are profitable with new services and programs in place to support continued revenue growth Trailing twelve months net revenue as of September 30, 2015 was $126.7 million Trailing twelve months adjusted EBITDA as of September 30, 2015 was $15.7 million Pending acquisition of UGH in Houston which reported over $70 million revenues for 2014 Robust pipeline of potential hospital acquisitions in addition to UGH During 2014 and 2015 Foundation built the infrastructure and executive team to support an aggressive growth strategy Do the right thing... Do it all the time. www.FDNH.com

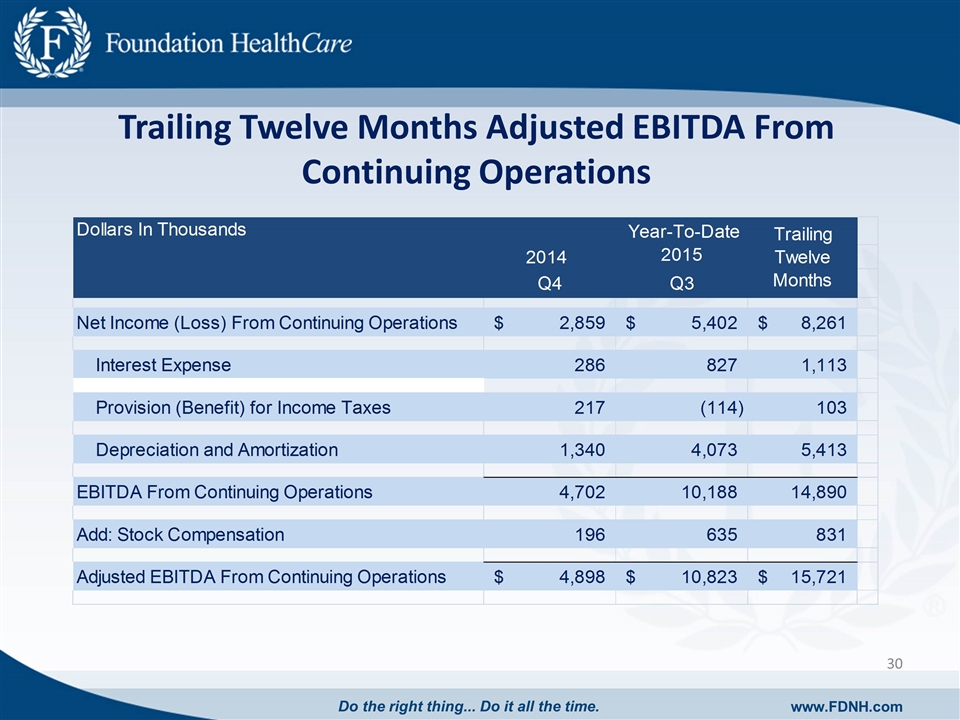

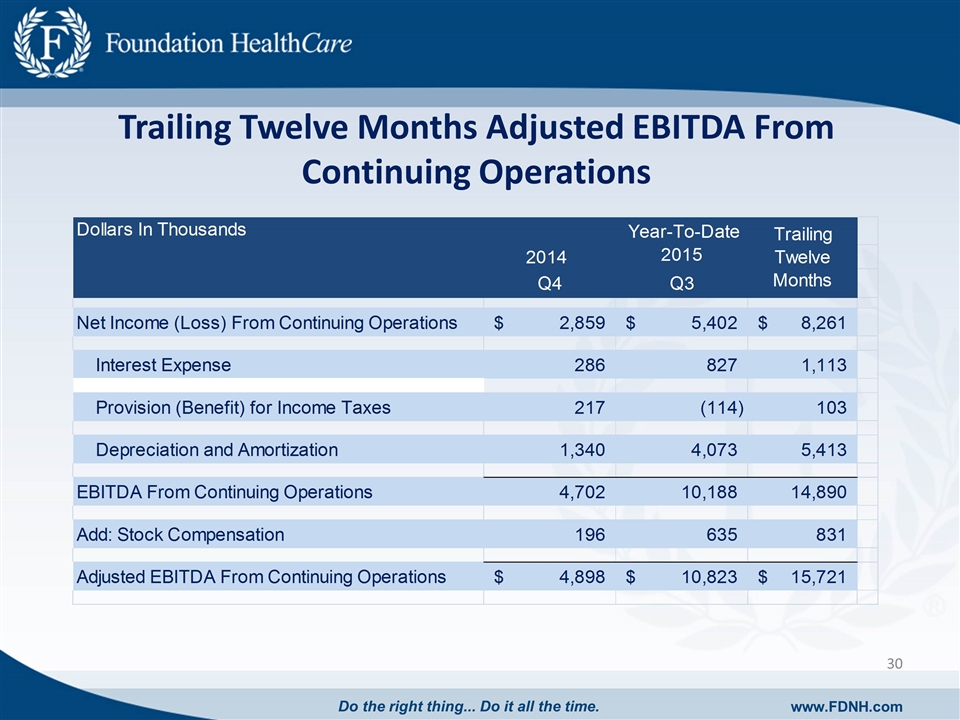

Trailing Twelve Months Adjusted EBITDA From Continuing Operations Do the right thing... Do it all the time. www.FDNH.com Dollars In Thousands Year-To-Date 2015 Trailing Twelve Months 2014 Q4 Q3 Net Income (Loss) From Continuing Operations $2,859 $5,402 $8,261 Interest Expense 286 827 1113 Provision (Benefit) for Income Taxes 217 -114 103 Depreciation and Amortization 1340 4073 5413 EBITDA From Continuing Operations 4702 10188 14890 Add: Stock Compensation 196 635 831 Adjusted EBITDA From Continuing Operations $4,898 $10,823 $15,721

Foundation HealthCare 14000 N. Portland Ave., Suite 200 Oklahoma City, OK 73134 800.783.0404 Do the right thing... Do it all the time. www.FDNH.com