UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | |

☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | |

☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37851

AIRGAIN, INC.

(Exact name of Registrant as specified in its Charter)

| |

Delaware | 95-4523882 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

3611 Valley Centre Drive, Suite 150 San Diego, CA | 92130 |

(Address of principal executive offices) | (Zip Code) |

(760) 579-0200 (Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class

| Trading Symbol(s)

| Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share | AIRG | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2024 (the last business day of the Registrant’s most recently completed second fiscal quarter), the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $67.4 million, based on the closing price of the Registrant’s common stock on The Nasdaq Capital Market of $6.04 per share.

The number of shares of Registrant’s common stock ($0.0001 par value) outstanding as of February 20, 2025, was 11,558,901.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the Registrant’s definitive proxy statement for the 2023 annual meeting of stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after end of the fiscal year covered by this Form 10-K are incorporated by reference into Part III of this Form 10-K.

AIRGAIN, INC.

TABLE OF CONTENTS

FORM 10-K

For the Year Ended December 31, 2024

PART I

FORWARD-LOOKING STATEMENTS AND MARKET DATA

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act). All statements other than statements of historical fact contained in this annual report, including statements regarding our future operating results, financial position and cash flows, our business strategy and plans, and our objectives for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This annual report on Form 10-K also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this annual report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives. These forward-looking statements speak only as of the date of this annual report and are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors.” The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Airgain, the Airgain logo, and other trademarks or service marks of Airgain appearing in this annual report are the property of Airgain, Inc. This annual report also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this annual report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

References to “Airgain, Inc.,” “Airgain,” the “Company,” “we,” “our” and “us” include Airgain, Inc. and our wholly-owned subsidiary.

ITEM 1. BUSINESS

Overview

Headquartered in San Diego, California, Airgain, Inc. (NASDAQ: AIRG) is a leading provider of advanced wireless connectivity solutions that drive cutting-edge innovation in 5G technology. We are committed to delivering high-performance, cost-effective, and energy-efficient wireless solutions that enable rapid market deployment. Our mission is to connect the world through integrated, innovative, and optimized wireless solutions. Our diverse product portfolio serves three primary markets: enterprise, automotive, and consumer.

Our enterprise products include Smart Network Controlled Cellular Repeaters (Smart NCRs), fixed wireless access (FWA) devices, asset tracking solutions, embedded cellular modems, and antennas for access points and Internet of Things (IoT) applications. Our automotive products include our second generation AirgainConnect® Fleet system solution – a low profile, roof-mounted, all-in-one 5G vehicle gateway and aftermarket antennas. Our consumer products are comprised of embedded antennas for consumer access points, wireless gateways, smart home devices and FWA devices.

We have a rich history of providing radio frequency (RF) expertise, services, and solutions to mobile operators and major original equipment manufacturers (OEMs). We expanded our current portfolio of embedded cellular modems, asset tracking solutions and custom IoT systems with advanced 5G connectivity solutions, including our AirgainConnect Fleet vehicle gateway, Smart Network Controlled Cellular Repeaters, and FWA devices. We are leveraging our RF and systems experience, and our Mobile Network Operator (MNO) and Multiple Service Operator (MSO) relationships to deliver complex and differentiated system solutions

We use an outsource manufacturing model for our products while maintaining oversight for quality, test, and delivery timeline. Additionally, we uphold an intellectual property strategy that includes patent and trademark filings in multiple jurisdictions.

Products and Solutions

Enterprise

The enterprise market demands reliable wireless access across diverse settings, including smart cities, utilities, factories, buildings, campuses, transportation hubs, stadiums, and suburban developments.

Our Lighthouse 5G Smart Network Control Repeater (NCR) delivers a scalable, high-performance solution designed to rapidly deploy and enhance network coverage and offload network capacity for the underserved areas. The Lighthouse family of products includes:

•a low-power Micro repeater, optimized for small offices or residence seeking targeted indoor coverage expansion; and.

•a high-power network repeater, for both In Building Solutions (IBS) and outdoors for MNOs and system integrators to extend coverage and improve network performance in large areas.

In 2024, we successfully tested the performance of our Lighthouse product on several domestic and international operator networks, achieving strong performance and enhanced network coverage. In December 2024, we achieved our first commercial deployment, marking a significant milestone in scaling for this product.

In the second quarter of 2024, we launched our Fixed Wireless Access (FWA) product line, engineered to overcome 5G connectivity challenges, and enhance end-user experience. Our Lantern™ 5G FWA outdoor device integrates high-performance directional antennas, a 5G NR Sub-6 modem, and is powered via 2.5 gigabit ethernet with Power over Ethernet (PoE), ensuring seamless, high-speed connectivity in demanding environments. Built for rugged outdoor deployment, Lantern features remote management capabilities using TR-069 and a Wi-Fi-enabled installation web interface, simplifying maintenance and Deployment.

In May 2024, Lantern achieved certification from AT&T and T-Mobile and secured regulatory approvals from key industry bodies, including the Federal Communications Commission (FCC), PCS Type Certification Review Board (PTCRB), and Industry Canada (IC). Over the course of 2024, we successfully conducted several customer trials across the U.S. and international markets, supporting Lantern’s performance and market readiness. In the second quarter of 2024, we completed the first commercial deployment of Lantern.

Our asset tracking solutions are deployed across transportation, supply chain, and other specialized applications. In November 2024 we expanded our product line with AT-Flight, an asset tracker with integrated artificial intelligence that is in-flight certified to allow for full journey tracking. AT-Flight targets the healthcare and life sciences markets and uses artificial intelligence to automatically detect a flight event and activate airplane mode to comply with FAA regulations – thus eliminating the need for manual intervention. In addition to hardware, our asset tracking solution includes a recurring revenue component, our subscription-based NLink cloud-based device enablement platform, which allows for deployment and integration with enterprise systems via open application programming interfaces (API).

Our NimbeLink embedded modems serve numerous enterprise IoT sectors requiring cellular connectivity, such as packaging, logistics, EV charging, smart cities, smart buildings, agriculture, asset tracking, and self-service innovations. These NimbeLink cellular modems, which are both patented, and end-device certified, minimize the need for additional OEM end-customer carrier certifications. Our custom products feature joint engineering collaboration with strategic customers to develop industrial IoT products (IIoT) for specific applications while helping them reduce their time to market.

Our enterprise IoT and machine-to-machine (M2M) antennas are extensively deployed in diverse systems, products, and applications, including access points, gateways, FWA devices and utility meters.

Automotive

In the automotive market, our products are deployed in a wide range of vehicles in the fleet and aftermarket applications, supporting a variety of technologies that include 5G, LTE, Wi-Fi, LPWAN, GNSS, and Bluetooth. Fleet and aftermarket products in the automotive market typically consist of applications where vehicular wireless routers are paired with external antenna systems to provide connectivity to mobile assets.

In the third quarter of 2024, we completed the first commercial deployment of our second generation AirgainConnect® Fleet (AC-Fleet) system solution – a low profile, roof-mounted, all-in-one 5G vehicle gateway that provides 4G/5G cellular connectivity with built-in multi-profile eSIM, GPS, Wi-Fi, and gigabit ethernet router functionalities. The AC-Fleet solution is one of the first roof-mounted 5G vehicle gateways on the market, combining the latest 5G NR (New Radio) modem and a Wi-Fi 6 router, all in one covert form factor. At only two inches tall, AC-Fleet provides flexibility across multiple markets including public safety, transportation, transit, public and private fleets, and passenger and heavy vehicles.

In October 2024 AC-Fleet obtained T-Mobile and AT&T certifications, along with industry accreditation from the FCC, IC, PCS, and industry accreditation from the PTCRB. Our AC-Fleet platform includes hardware and a recurring revenue component including an optional annual subscription for remote access, AC-Cloud management, technical support, software updates, and extended warranty. We expect AC-Fleet to receive additional MNO certifications throughout 2025.

We offer a full line of external fleet antennas that are designed to be rugged, reliable, and flexible to meet almost any need. We design our products for performance, quality, and long product life, and our antennas connect to almost any vehicular router or modem. These antennas include high-performance and low-profile versions that mount on the roof, trunk, windshield, or dashboard and are optimized for 5G, 4G, Wi-Fi, and GNSS.

Consumer

The consumer market represents a vast audience utilizing wireless-enabled devices. Our embedded antennas are deployed in various consumer applications including access points, wireless gateways, FWA devices, Wi-Fi routers and extenders, smart TVs, smart home devices, and set-top boxes. These consumer products support a variety of technologies, products and services, including 4G/LTE, 5G, Wi-Fi, Bluetooth, LPWAN and Global Navigation Satellite System (GNSS).

In March 2024, we were awarded a multi-million-dollar deal with a tier one MSO for Wi-Fi 7 antenna solutions. Additionally, in May 2024, we announced that we secured a production purchase order for a long-term opportunity with another Tier 1 MSO for Wi-Fi 7 solutions. These wins continue Airgain’s position as a leader in Wi-Fi 7 and 5G for both FWA devices and wired broadband devices. We continue to grow our relationships with MSOs and MNOs as the market evolves with both wired and wireless broadband internet offerings.

.

Growth Strategy

Airgain is a leader in wireless connectivity solutions, dedicated to addressing critical connectivity challenges across various markets. We are evolving from a component manufacturer to a comprehensive wireless systems solutions provider, focusing on higher integration and complexity. Our growth strategy centers on two primary objectives:

Strengthening Our Core Businesses: Our embedded antennas in the consumer market, embedded modems, custom IoT solutions, and IoT antennas in the enterprise market, together with our aftermarket antennas in the automotive market, provide our foundational business. Our reputation and relationships throughout the Distribution, Value-Added-Reseller (VAR), MSO, MNO, OEM, and Original Design Manufacturer (ODM) supply chain enables us to aggregate key voice-of-the-customer product needs and challenges which is critical for innovation. Our RF design and test capabilities enable our products to be differentiated on performance and to improve the end-customer experience – specifically in Wi-Fi, LTE, 5G, and GNSS integrated systems.

Our foundational offerings include embedded antennas in the consumer market, embedded modems, custom IoT solutions, and IoT antennas in the enterprise market, and aftermarket antennas in the automotive sector. Our strong reputation and established relationships with distributors, value-added resellers (VARs), multiple system operators (MSOs), mobile network operators (MNOs), original equipment manufacturers (OEMs), and original design manufacturers (ODMs) enable us to gather critical customer insights that are essential for driving innovation. Our expertise in radio frequency (RF) design and testing allows us to differentiate our products in terms of performance, enhancing the end-customer experience, particularly in Wi-Fi, LTE, 5G, and GNSS integrated systems.

Expanding And Innovating In Connectivity: We are transitioning from being a component manufacturer to a wireless systems solution provider. This transition started with the acquisition of NimbeLink in 2021 which brought expertise in embedded modem solutions, asset tracker solutions and augmented our historical RF expertise with digital systems design, firmware, and cloud capabilities.

In the second quarter of 2024, we completed the first commercial deployment of our new line of FWA products designed to address 5G connectivity challenges, reduce deployment costs and enhance customer experiences. Our outdoor 5G LanternTM FWA device has integrated high-performance directional antennas, a 5G NR Sub-6 modem and it is powered through a 2.5 gigabit ethernet PoE connection. The Lantern 5G FWA has been ruggedized for outdoor use, includes remote management capabilities, and a Wi-Fi based easy installation web interface to help simplify the user experience.

In the third quarter of 2024, we completed the first commercial deployment of our second generation AirgainConnect® Fleet (AC-Fleet) system solution, a low profile, roof-mounted, carrier agnostic all-in-one 5G vehicle gateway that provides 5G cellular connectivity with built-in GPS, Wi-Fi, and gigabit ethernet router functionalities. The AC-Fleet solution is one of the first roof-mounted 5G vehicle gateways, combining the latest 5G NR (New Radio) modem and a Wi-Fi 6 router, all in one covert form factor. At only two inches tall, AC-Fleet provides flexibility across multiple markets including public safety, transportation, transit, public and private fleets, and vehicles.

In December 2024, we completed the first commercial deployment of our Lighthouse Smart NCRs platform. Lighthouse includes both a low-power small office and home office (SOHO) device targeting customers that need additional coverage in small areas, as well as a high-power outdoor network repeater for MNOs and systems integrators. Lighthouse smart repeaters include advanced carrier aggregation (CA), low latency, software upgradeability to support network-controlled repeater (NCR) standards, optional smart antenna technology to assist with installation and maintenance, and an optional remote management system. The smart network repeater also integrates advanced automatic gain control and echo cancellation, enabling single-pole installation.

Our focus is on driving these innovative connectivity solutions to market and increasing our serviceable available market (SAM).

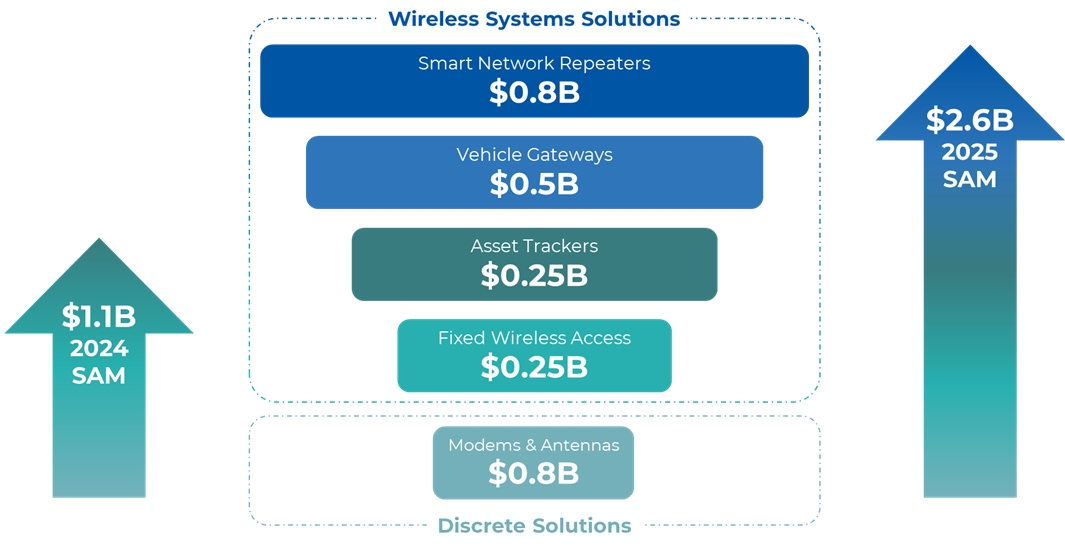

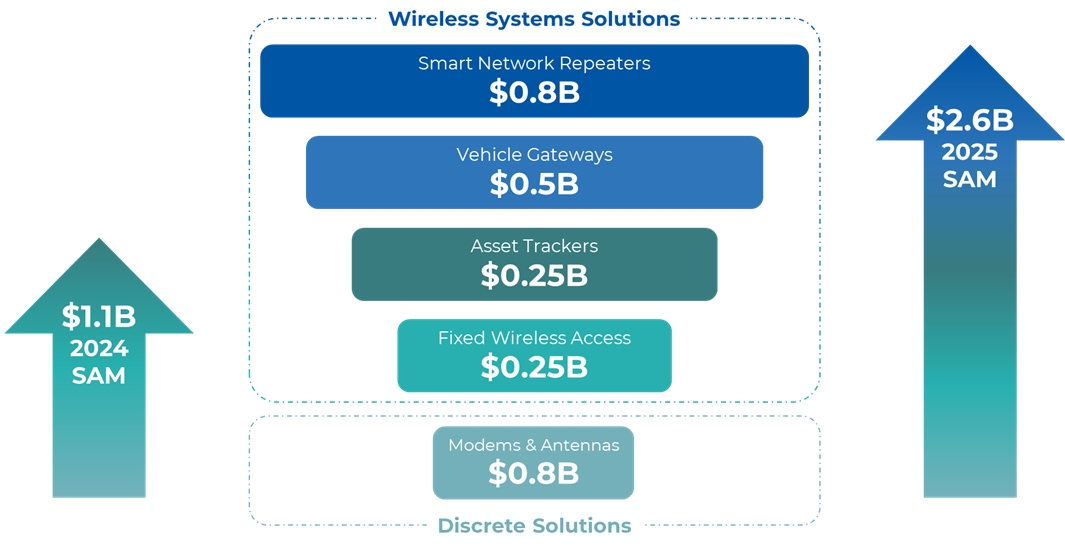

The following graphic provides a summary of our estimated SAM. Based on publicly available market research and internal estimates, we project the SAM will grow from $1.1 billion in 2024 to $2.6 billion in 2025, largely driven by the launch of our AC-Fleet vehicle gateway and our Lighthouse smart repeaters.

Airgain Estimated SAM ($B)

Sales and Marketing

Our sales and marketing organizations work together closely to improve market awareness, build a strong sales pipeline, and cultivate ongoing customer relationships to drive sales growth.

Sales

Our global sales efforts consist of direct and indirect sales teams, and indirect channel partners. Our direct sales team consists of sales personnel based in the United States, Greater China, South Korea, and Europe, while our indirect channel partners consist of distributors, engineering design companies and outside sales representatives across North America, Asia, Europe, Australia, the Middle East, and Latin America.

Our direct sales team is engaged in pre-sales, account management, and creating partnership opportunities with third parties such as service providers and OEMs. The sales process includes meeting and qualifying potential customers, and actively managing the planning stage of devices they project to bring to market. Our field application engineers (FAEs) assist these programs by providing technical support to new and existing customers.

Our indirect channel partners provide lead generation, pre-sales support, product fulfillment and, in certain circumstances, post-sales customer service and support. This channel partner network often co-sells with our direct sales team. Our channel partners provide us with additional sales leverage by sourcing new prospects, providing technical support to existing customers, upselling additional use cases, and maintaining repeat business with existing customers. These channels partners provide added coverage to customers and prospects we cannot reach directly.

Marketing

Our marketing strategy is focused on building a competitive advantage for our brands and products in the marketplace. We target two types of customers. For embedded products such as our NimbeLink modems and consumer antennas, we target design teams within OEMs and ODMs. For our integrated products, such as our asset trackers, FWA Lantern, and AirgainConnect AC-Fleet, we target distributors and the enterprise market. We use both direct and indirect promotional methods to engage our audiences. Direct methods include advertising, web properties, marketing collateral, email campaigns, paid and organic social media, search engine marketing, media relations, content marketing, direct mail, tradeshows and events, and general lead generation tactics.

Indirect methods include co-marketing efforts together with resellers, distributors, system integrators, hardware and software partners, and carriers both domestically and internationally.

Manufacturing and Operations

We are fabless and our products are manufactured by contract manufacturers (CMs) in the United States, China, Taiwan, Vietnam, and Mexico. We generally have long-term relationships with our CMs, and we work together to control global product compliance, raw materials supply and cost, production part approval processes, assembly instructions, control plans, final testing, and on-time shipment to our customers. We provide the control, test and measurement plans to the CMs to help ensure that each product conforms to the Airgain specifications, and we monitor the quality performance of our CMs through quality reports and periodic audits.

We maintain a close direct relationship with our CMs to help ensure that supply and quality meet our requirements. The contract manufacturing services required to manufacture our products can be satisfied by one or more of our CMs, however it may be time consuming and costly to qualify and implement new CM relationships. If one of our CMs suffers an interruption in their business, or experiences delays, disruptions, or quality control problems in their manufacturing operations, our ability to ship products to our customers could be delayed, and our business could be adversely affected. Our qualified CMs manufacture products according to our design specification, materials specification, quality standards, and delivery requirements. We have control and authority over the selection of materials, manufacturing, and inspection processes. Since our products manufactured in China are predominantly shipped to ODMs and CMs within Asia, we have not experienced a negative impact from tariffs imposed on exports from China to the United States

Research and Development

We invest considerable time and financial resources in research and development to engineer and deliver our products and solutions to market, while also enhancing our design and system integration capabilities and conducting quality assurance testing to improve our technology. As of December 31, 2024, we had a total of 59 employees engaged in research and development. Our engineering teams are located at research, design, and test centers in California, Arizona, Texas, Minnesota, and Florida, as well as the United Kingdom and China. Our engineering team actively participates in research and development activities to expand our capabilities and target applications for the enterprise, automotive and consumer markets. We strive to continually expand our product offerings and technology solutions over time and expect to continue to invest significantly in ongoing research and development efforts.

Additionally, for the development of certain company products, we engage with ODM partners to augment our internal engineering capability. Our ODM partners, primarily in Taiwan, enable us to scale our product development capacity quickly - especially for integrated connectivity products such as Lantern, AC-Fleet, and Lighthouse. For all such ODM-partner product developments, we maintain direct oversight and engagement to help assure projects are delivered in accordance with our quality and time-to-market expectations.

Competition

Because of our broad product line across several categories in the value chain, our competitive landscape is diverse and rapidly evolving.

Solution Providers

This category represents companies that manufacture a wide variety of products across the value chain including end-device hardware, software, components, services, and more. These companies include Digi International, Laird Connectivity, Multi-Tech Systems Inc., Lantronix, Inseego Inc., in-Hand, Peplink, Ericsson/Cradlepoint, Cisco Systems Inc., Nextivity Inc., Pulse Electronics, Samsara, Semtech, TE Connectivity, Wilson Electronics, Digital Matter, and Surecall among others. With our shift in business model towards solutions, many of these companies are direct competitors. While some partnership opportunities do exist, most of these companies strive to solve similar problems as us with their broad portfolios and consultative sales approaches.

End-Device Manufacturers

This category represents companies that manufacture and supply off-the-shelf products that are market ready, such as routers, gateways, cellular adapters, 5G repeaters, fixed wireless access devices, asset trackers, and more. These manufacturers can act as customers, partners, or competitors to us, depending on the application and

relationship. An end-customer may choose to bypass the design process entirely and purchase an off-the-shelf product to deliver device connectivity rather than embedding our modems and antennas. Our integrated products, such as the AC-Fleet, Lighthouse 5G Smart Network Repeater, Lantern FWA and asset trackers, may compete directly with these off-the-shelf products or enhance their functionality. In addition, our external antennas are designed to enhance the signal and coverage of many of these devices.

Component Manufacturers

This category represents companies that manufacture a broad array of components that compete both directly and indirectly with our products. These companies include Adant Technologies Inc., Asian Creation Communications Factory, Kyocera AVX, Baylin Technologies Inc., Blues Wireless, Fibocom, Fractus S.A., Honglin Technology Group Ltd., MobileMark, Nordic Semiconductor, Panorama Antennas, Parsec Technologies, Inc, Particle Industries Inc., PCTEL, Inc., Pinyon Technologies, Inc., Qualcomm, Quectel, Semtech, Sunwave Communications Co., Ltd., Telit, Ublox, Taoglas Limited, Wanshih Electronic Co. Ltd., WHA YU Industrial Co., Ltd, and 2J Antennas Group, among others. While we may choose to partner with some of these manufacturers to deliver products that shorten time to market, customers may also choose to complete the more intricate design work on their own using products manufactured by these companies. These component manufacturers may also expand their capabilities to be a solution provider, or end-device manufacturer, or both. As these component manufacturers evolve over time, the specific competitive situation would evolve accordingly.

In-house Design and Engineering Teams

Several of our existing customers, including OEMs and ODMs which design and build complete wireless devices, also have internal resources to design, engineer, and produce antenna, modem, router and/or repeater solutions. In such cases, we compete against the captive resource of that ODM. Several ODMs, including Arcadyan Technology Corporation, Foxconn Electronics Inc., Gemtek, Zyxel Communications, Inc. (MitraStar Technology), and Wistron Corporation, design, manufacture, and sell complete wireless devices, in direct competition with us.

The principal competitive factors in our markets include: price and total cost of ownership as a result of reliability and performance issues; brand awareness and reputation; component performance, such as reliability, range and throughput; ability to integrate with other technology infrastructures; offerings across breadth of wireless products; design and testing capabilities; lead-time and flexibility to rapidly customize solutions to individual customer requirements; relationships with semiconductor/chipset vendors; intellectual property protection; sales and marketing strength in different regions; and the ability to solve many complex RF problems across the entire spectrum of broadband connectivity.

Intellectual Property

We rely on patent, trademark, copyright and trade secret laws, confidentiality procedures, and contractual provisions to protect our technology.

As of December 31, 2024, our intellectual property portfolio is comprised of 287 granted patents and pending applications in the United States, Europe, and Asia. The scope of these patents encompasses our product offerings and technological advancements, with their terms of validity extending from the year 2025 until 2041. This patent collection encapsulates a diverse array of innovations pioneering wireless systems, including FWA, smart network controlled repeaters, vehicle gateway, antenna designs and structures, as well as the assembly and fabrication processes.

In line with our strategic evolution from a component supplier to a provider of comprehensive wireless system solutions, we have systematically grown our patent repository, escalating our filings to include broader wireless system functionalities and infrastructures.

Taken together, these patents with priority dates as far back as April 2005 form both a barrier to competition and a licensable asset for customers in the MIMO and antenna assembly categories.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use information that we regard as proprietary. We generally enter into confidentiality agreements with our employees, consultants, vendors, and customers, and generally limit access to and distribution of our proprietary information. However, we cannot ensure that the steps taken by us will prevent misappropriation of our technology. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as the laws of the United States, and many foreign countries do not enforce these laws as diligently as government agencies and private parties in the United States.

Our industry is characterized by the existence of many patents and frequent claims and related litigation regarding patent and other intellectual property rights. Leading companies in the technology industry have extensive patent portfolios. Third parties, including certain of these leading companies, may in the future assert patent, copyright, trademark and other intellectual property rights against us, our channel partners, or our customers, or we may need to engage in litigation to enforce patents issued or licensed to us, to protect our trade secrets or know-how, or to defend against claims of infringement of the rights of others. See the section titled “Risk factors—Risks Relating to Intellectual Property” for a more comprehensive description of risks related to our intellectual property.

Human Capital

As of December 31, 2024, we had a total of 121 employees and dedicated representatives, including 84 in the United States and 37 outside the United States. Among the total 121 employees and dedicated representatives, 59 were primarily engaged in research and development, 39 were primarily engaged in sales and marketing, 19 were primarily engaged in general and administration functions and 4 were primarily engaged in manufacturing operations. None of our employees are covered by a collective bargaining agreement or represented by a labor union. We consider our relationship with our employees to be good.

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, and incentivizing our management team and our employees and consultants. The principal purposes of our equity and cash incentive plans are to attract, retain, and motivate personnel through the granting of stock-based and cash-based compensation awards to align our interests and the interests of our stockholders with those of our employees and consultants.

Available Information

We file electronically with the Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make available on our investor relations website at investors.airgain.com, free of charge, copies of these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

We use our investor relations website as a means of disclosing material non-public, information and for complying with our disclosure obligations under Regulation FD. Investors should monitor such website, in addition to following our press releases, SEC filings and public conference calls and webcasts. Information relating to our corporate governance is also included on our investor relations website. The information in or accessible through the SEC and our website are not incorporated into, and are not considered part of, this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors, together with the other information contained in this annual report on Form 10-K, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding to purchase or sell shares of our common stock. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and growth prospects. If that were to happen, the trading price of our common stock could decline. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations or financial condition.

Summary of Risks Related to our Business

Our business is subject to numerous risks and uncertainties, including those described below. The principal risks and uncertainties affecting our business include, but are not limited to the following:

•The markets for our antenna and wireless systems solutions are developing and may not develop as we expect;

•Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance;

•If we are unable to manage our growth and expand our operations successfully, our business and operating results will be harmed, and our reputation may be damaged;

•Our wireless connectivity solutions and components are subject to intense competition, including competition from our suppliers and the customers to whom we sell;

•Our future success depends on our ability to develop new products and successfully introduce new and enhanced products and services for the wireless market that meet the needs of our customers;

•Any delays in our sales cycles could result in customers canceling purchases of our products;

•We have a history of losses, including an accumulated deficit of $87.2 million at December 31, 2024, and we may not be profitable in the future;

•We sell to customers who are price conscious, and to a limited number of customers, who represent a significant portion of our sales. If we were to lose any of these customers or devices, our sales could decrease significantly;

•We rely on a limited number of CMs and ODMs to produce and ship our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products;

•Our CMs purchase some components, subassemblies and products from a single or limited number of suppliers. The loss of any of these suppliers may substantially disrupt our ability to obtain orders and fulfill sales as we design in and qualify new components.

•We are developing a number of our new products and wireless connectivity solutions in partnership with other companies. If any of these companies were to fail to perform, or our partnerships were to be unsuccessful, we may not be able to bring our solutions to market successfully or on a timely basis;

•If we are unable to protect our intellectual property rights, our competitive position could be harmed, or we could be required to incur significant expenses to enforce our rights;

•Our international sales and operations subject us to additional risks that can adversely affect our operating results and financial condition;

•We are subject to governmental export and import controls and supply chain-related regulations that could impair our ability to compete in international markets due to licensing requirements, result in the disruption of our supply chains and/or subject us to liability and reputational harm if we are not in compliance with applicable laws; and

•Changes to United States tax, tariffs, Department of Defense’s Section 1260H List, and import/export regulations may have a negative effect on global economic conditions, financial markets and our business. China’s 2024 export ban on critical minerals such as gallium, germanium, and antimony has disrupted and may continue to disrupt global supply chains, driving up costs for semiconductors, sensors, and LEDs.

Risks Related to Our Business and Industry

The markets for our wireless systems solutions and components are developing and may not develop as we expect.

The wireless industry is characterized by rapidly evolving technologies, and the markets for our wireless connectivity solutions, embedded and external antennas, and IoT products may not develop as we expect. It is difficult to predict customer demand for our wireless system solutions and components, customer adoption rates, the size and growth rate of our target markets, the entry of competitive solutions and products, or the success of existing competitive solutions and products. We have historically driven revenue growth primarily through our embedded antennas, external antennas, embedded modems, and custom IoT products, largely in the consumer market. Moving forward, our goal is to drive growth in complex system solutions in the enterprise and automotive markets, including AC-Fleet, Lighthouse, Lantern, and asset tracking solutions. These markets may develop at varying growth rates, and our success in penetrating these markets will depend on various competitive factors across a number of developing industries.

Any expansion in our markets depends on several factors. For example, any growth in demand will depend on, among other things, the cost, performance, and perceived value associated with our components and the ability for our components to meet increased performance demands, refresh cycles, and device form factors. Further, as we continue to transition to a wireless systems solution provider, increased growth in the enterprise and automotive markets will depend on, among other things, acceptance of our solutions by our customers and performance of the networks on which our products operate. For example, AC-Fleet, Lighthouse, Lantern, and asset tracking solutions are dependent on the carriers’ networks that they operate on and require widespread commitments across multiple customer markets and budgets. The growth potential for these solutions may be limited, and we will need to introduce new products in the AirgainConnect, Lighthouse, Lantern, and asset tracking platforms in order to continue to grow.

As we expand our product portfolio to include more advanced system solutions, we face increased risks related to supply chain complexity, procurement of specialized components, and reliance on third-party manufacturers. Any disruption in the availability or cost of key system components, including semiconductors, modems, or RF modules, could adversely impact production and our ability to meet customer demand.

If our wireless solutions do not achieve widespread adoption, if there is a slower rollout than we expect in certain markets, or if there is a reduction in demand for our wireless connectivity solutions or components including AC-Fleet, Lighthouse, Lantern, and asset trackers, caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders and decreased sales, which would adversely affect our business, operating results, and financial condition.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance.

Our quarterly and annual operating results have fluctuated in the past and may fluctuate significantly in the future, which makes it difficult for us to predict our future operating results. The timing and size of sales of our wireless system solutions and components are variable and difficult to predict and can result in fluctuations in our net sales from period to period. In addition, our budgeted expense levels depend in part on our expectations of future sales. Because any substantial adjustment to expenses to account for lower levels of sales is difficult and takes time, we may not be able to reduce our costs sufficiently to compensate for an unexpected shortfall in net sales, and even a small shortfall in net sales could disproportionately and adversely affect our operating margin and operating results for a given quarter. Our net loss decreased from $12.4 million in the year ended December 31, 2023 to $8.7 million in the year ended December 31, 2024, and the net loss or income will fluctuate in the future. Prior to 2024, our net

losses were $12.2 million, $8.7 million and $10.1 million for the years ended December 31, 2023, 2022 and 2021, respectively.

Our operating results may also fluctuate due to a variety of other factors, many of which are outside of our control, including any change or volatility in U.S., European, Asian and global economic environments, and any of which may cause our stock price to fluctuate. Besides the other risks in this “Risk Factors” section, factors that may affect our operating results include:

•fluctuations in demand for our products and services;

•excess inventory held by customer;

•the inherent complexity, length and associated unpredictability of product development windows and product lifecycles;

•the timing and extent of investment in our targeted growth markets and the timing and amount of sales in such markets;

•our ability to develop, introduce and ship in a timely manner new products and product enhancements and anticipate future market demands that meet our customers’ requirements, and provide adequate customer support for those products;

•changes in customers’ budgets for technology purchases and delays in their purchasing cycles;

•global supply shortage including, but not limited to chips and modules, supply constraints relating to other materials and potential increasing shipping costs and related limitations on our ability to acquire mission critical components and our CM’s abilities to obtain sufficient human resources to meet our global demand;

•inflation and other increases in the cost of components, consumables, labor and other manufacturing costs;

•changing market and economic conditions and, financial institution instability.

•any significant changes in the competitive dynamics of our markets, including new entrants, or further consolidation, and the timing of product releases or upgrades by us or by our competitors;

•uncertainty surrounding the type, scope, and implementation of tariffs, trade policies, and other governmental action by the United States and other countries and the effect therefrom on international relations, sanctions, tariffs, and supply chains;

•govenment approval delays

•terrorism, political instability or war, and the imposition of sanctions or countermeasures by the United States and other countries in relation to such conflicts;

•public health crises regionally and globally, including pandemics and epidemics; and

•facility shutdowns related to local holidays in China and southeast Asia, affecting how customers make purchasing decisions.

The cumulative effects of the factors above could result in large fluctuations and unpredictability in our quarterly and annual operating earnings. Additionally, this may result in higher prices from suppliers which could negatively affect gross margins and increase operating expenses. You should not rely on our past results as an indication of future performance.

In addition, the financial markets and the global economy may be adversely affected by the current or anticipated impact of military conflicts in other countries, political unrest, tensions, and global and regional, terrorism or other geopolitical events. Sanctions imposed by the United States and other countries in response to such conflicts, may also adversely impact the financial markets and the global economy, and any economic countermeasures by affected countries and others could exacerbate market and economic instability. In addition, concerns or adverse developments regarding liquidity risk related to financial institutions or the broader financial services industry could lead to market-wide liquidity shortages, impair the ability of us or other companies to access near-term working capital needs, and create additional market and economic uncertainty. There can be no assurance that future credit and financial market instability and a deterioration in confidence in economic conditions will not occur. Our general business strategy and operating results may be adversely affected by any such economic downturn, liquidity shortages, volatile business environment, or continued unpredictable and unstable market conditions. In addition,

there is a risk that one or more of our current service providers, financial institutions, manufacturers, suppliers or customers may be adversely affected by the foregoing risks, which could adversely affect our business and operating results be adversely affected by the foregoing risks.

If we are unable to manage our growth and expand our operations successfully, our business and operating results will be harmed, and our reputation may be damaged.

We have expanded our operations in the last several years and anticipate that further significant expansion will be required to achieve our business objectives. The growth and expansion of our business and product offerings places a continuous and significant strain on our management, operational and financial resources. As we transition to a wireless system solutions provider, we expect these challenges to increase. Any such future growth would also add complexity to and require effective coordination throughout our organization. We use the services of third parties to perform tasks including design services and sales and marketing. Our growth strategy may entail expanding our group of contractors or consultants to implement additional functions going forward. Because we rely on consultants, effectively outsourcing key functions of our business, we will need to be able to manage these consultants to ensure that they successfully carry out their contractual obligations and meet expected deadlines. However, if we are unable to effectively manage our outsourced activities or if the quality of the services provided by consultants is compromised for any reason, our ability to provide quality products in a timely manner could be harmed, which may have a material adverse effect on our business operating results and financial condition.

To manage any future growth effectively, we must continue to improve and expand our information technology and financial infrastructure, our operating and administrative systems and controls, and our ability to manage headcount, capital and processes in an efficient manner. We may not be able to successfully implement improvements to these systems and processes in a timely or efficient manner, which could result in additional operating inefficiencies and could cause our costs to increase more than planned. If we do increase our operating expenses in anticipation of the growth of our business and this growth does not meet our expectations, our operating results may be negatively impacted. If we are unable to manage future expansion, our ability to provide high quality products and services could be harmed, which could damage our reputation and brand and may have a material adverse effect on our business, operating results and financial condition.

Our wireless connectivity solutions and components are subject to intense competition, including competition from our suppliers and the customers to whom we sell.

Antenna solutions are an established technical field with low intellectual property and technological barriers to entry. Antenna competition exists globally for all areas of our business and product lines. The markets in which we compete are rapidly evolving and intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. The markets are influenced by, among others, brand awareness and reputation, price, strength and scale of sales and marketing efforts, professional services and customer support, product features, reliability and performance, scalability of products, and breadth of product offerings. Due to the proprietary nature of some of our products, competition occurs primarily at the design stage. As a result, a design win by our competitors or by us typically limits further competition regarding that design. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and failure to increase, or the loss of, market share, any of which would likely seriously harm our business, operating results or financial condition.

Additionally, our transition into more system-based solutions may bring more competitors into our markets than we have traditionally faced. As our solutions begin to contain more system components and commensurate higher average selling prices, the resulting product categories may attract additional competitors, or our customers may be more likely to begin to develop competing products. We face new competition from established telematics, networking, and IoT platform providers, which may create barriers to our market entry and limit our ability to grow in these sectors.

New entrants and the introduction of other distribution models in our markets may harm our competitive position.

The markets for development, distribution, and sale of our products are rapidly evolving. New entrants seeking to gain market share by introducing new technology and new products may make it more difficult for us to sell our products, and could create increased pricing pressure, reduced profit margins, increased sales and marketing

expenses, or the loss of market share or expected market share, any of which may significantly harm our business, operating results and financial condition.

Our future success depends on our ability to develop new products and successfully introduce new and enhanced products and services for the wireless market that meet the needs of our customers.

Our sales depend on our ability to anticipate our existing and prospective customers’ needs and develop products and systems solutions that address those needs. Our future success will be contingent on our ability to introduce new solutions for wireless applications, anticipate improvements and enhancements in wireless technology and wireless standards, and to develop solutions that are competitive in the rapidly evolving wireless industry. In furtherance of these efforts, we will continue to invest significantly in ongoing research and development. However, such investments may not translate into material enhancements to our wireless solutions, which are important for us to compete effectively. As we complete our transition into a wireless systems solutions provider, our investment in research and development will grow to stay on the leading edge of next generation development and to align ourselves with the rapidly evolving technology needs of the industry. Moreover, the introduction of newly integrated wireless platforms and product and system enhancements will require coordination of our engineering efforts with those of our customers, carriers, suppliers, and manufacturers to efficiently achieve our growth objectives. As our business transitions to more complex system-based solutions, we must provide enhanced post-sales support, ongoing firmware/software updates, and higher levels of technical assistance. If we are unable to effectively support our customers in deploying and maintaining these solutions, we may experience reputational harm, reduced customer adoption, or an increase in warranty and service costs. If we fail to coordinate these efforts, develop product enhancements or introduce new solutions that meet the needs of our customers as scheduled, our operating results will be materially and adversely impacted, and our business and prospects will be harmed. We cannot assure that our new wireless solutions will meet customer expectations or that our wireless solutions will be competitive in the market.

The introduction of the next generation AirgainConnect, Lighthouse, Lantern and asset tracking platforms, and the transition to a more expansive level of advanced solutions, requires coordination of efforts and increased time and resources. If we fail to develop competitive solutions for customers with outstanding quality within the identified market window, our operating results may be materially and adversely impacted. As we rollout follow-on products and accessories for the AC-Fleet, Lighthouse, Lantern and asset tracker solutions, we may not be able to successfully develop to conform to carrier PTCRB certifications, and specific country and regulatory certifications and approvals of such products. Furthermore, our transition to full wireless system solutions introduces additional regulatory compliance challenges for new classes of devices such as Lighthouse. Our products must meet stringent equipment authorization and carrier certification requirements (such as PTCRB, FCC, and industry-specific and regional standards). Failure to secure timely authorizations or certifications or unexpected changes in regulatory requirements could delay product launches, increase costs, or impact on our ability to sell our solutions in key markets.

The successful deployment of our wireless system solutions depends on the reliability and security of our embedded software and firmware. Software bugs, cybersecurity vulnerabilities, or delays in providing necessary updates could result in product malfunctions, compromise the confidentiality, integrity, and availability of our customers’ own IT systems and/or our customers’ proprietary or other sensitive information, customer dissatisfaction, or reputational harm. Any failure to maintain robust software and cybersecurity protocols may negatively impact our business and financial performance. Furthermore, the stringent customer demands for these advanced solutions requires substantial ongoing effort and investment for solution maintenance, support, and evolution. If we are unable to continually provide such effort and investment to customers, our customers’ business could be adversely impacted, or customers could switch to competitor solutions, which would have an adverse impact on our operating results.

Furthermore, given the rapidly evolving nature of the wireless market, there can be no assurance our products and technology will not be rendered obsolete by alternative or competing technologies. The markets in which we operate are characterized by changing technology and evolving industry standards, which includes the introduction and implementation of Wi-Fi 7 and emerging 5G cellular standards. Despite years of experience in meeting customer design requirements with the latest in technological solutions, we may not be successful in identifying, developing and marketing products or systems that respond to rapid technological change, evolving technical standards and systems developed by others. Our competitors may develop technology that better meets the needs of our customers. If we do not continue to develop, manufacture and market innovative technologies or applications that meet customers’ requirements, sales may suffer, and our business may not continue to grow in line with historical rates or at all.

Any delays in our sales cycles could result in customers canceling purchases of our products.

Sales cycles for some of our products can be lengthy, often lasting several months to a year or longer. In addition, it can take additional time before a customer commences volume production of equipment that incorporates our products. Sales cycles can be lengthy for several reasons, including:

•our OEM customers and carriers usually complete a lengthy technical evaluation of our products, over which we have no control, before placing a purchase order;

•the commercial introduction of our products by OEM customers and carriers is typically limited during the initial release to evaluate product performance;

•the development and commercial introduction of products incorporating new technologies frequently are delayed; and

•certain customers of advanced antenna systems and integrated wireless solutions require successful field trials before committing to purchase our solutions, which could delay the customer decision making process.

A significant portion of our operating expense is relatively fixed and is based in large part on our forecasts of volume and timing of orders. The lengthy sales cycles make forecasting the volume and timing of product orders difficult. In addition, the delays inherent in lengthy sales cycles raise additional risks of customer decisions to cancel or change product phases. If customer cancellations or product changes were to occur, this could result in the loss of anticipated sales without sufficient time for us to reduce our operating expenses. We currently maintain significant inventories to meet forecasted future demand due to the supply chain shortages. If the forecasted demand does not materialize into purchase orders for these products, we may be required to write off our inventory balances or reduce the value of our inventory, based on a reduced sales price. A write off of the inventory, or a reduction in the inventory value due to a sales price reduction, could have an adverse effect on our financial condition and operating results.

We have a history of losses, and we may not be profitable in the future.

Before 2013 we had incurred net losses in each year since our inception. As a result, we had an accumulated deficit of $87.2 million on December 31, 2024. Airgain is transitioning to a wireless systems solutions company. Because the market for wireless systems solutions is rapidly evolving, it is difficult for us to predict our operating results. We expect our operating expenses to increase over the next several years as we hire additional personnel, particularly in engineering, sales support, customer service and experience, and marketing, and continue to develop new wireless ecosystems to address new and evolving markets. In addition, as a public company we will continue to incur significant legal, accounting, and other expenses. If our sales do not increase to offset these increases in our operating expenses, we may not be profitable in future periods. Our historical sales growth has been inconsistent and should not be considered indicative of our future performance. Any failure to sustain or increase our profitability consistently could cause the value of our common stock to materially decline.

A limited number of customers and devices represent a significant portion of our sales. If we were to lose any of these customers or devices, our sales could decrease significantly.

Customers that accounted for 10% or more of our total revenue provided approximately 54% of sales in the aggregate for the year ended December 31, 2024. Although our top customers that pay for our products have historically been ODMs and distributors, it is primarily the OEMs, carrier customers and retail-focused end-customers that drove the use of our antenna solutions and the purchase by the ODMs and distributors of our antenna solutions. In addition, a few end-customer devices which incorporate our antenna products comprise a significant amount of our sales, and the discontinuation or modification of such devices may materially and adversely affect our sales and results of operations. Moving forward, as we transition to a wireless systems solutions provider, we expect a shift toward external wireless solutions and antenna technologies in the automotive and enterprise markets that may result in a corresponding shift in the customer mix. Any significant loss of, or a significant reduction in purchases by, these other significant customers or customers that drive the use of our antenna solutions or a modification or discontinuation of a device which constitutes a significant portion of sales could have an adverse effect on our financial condition and operating results.

We sell to customers who are price conscious.

Our customers compete in segments of the electronics market. The electronics market is characterized by intense competition as companies strive to come to market with innovative designs that attract customers based upon

design, performance, cost, ease of use, and convenience. Product lifecycles can be extremely short as companies try to gain advantage over their competitors. Because of the high design and engineering costs, companies that are customers or prospects for antenna solutions are cost conscious. As a result, our customers and prospects demand price cuts in established products and negotiate aggressively for lower pricing on new products. Because of the intense competition in the antenna solution market, we encounter situations that lead to difficult price negotiations potentially resulting in lower margins than forecast. Our products generally cost more than our competitors’ products. To address these pricing constraints and remain competitive, we must consistently design high quality antenna solutions that are deemed a better value than competing solutions, while also decreasing costs.

We rely on a limited number of CMs and ODMS to produce and ship our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products.

We outsource the manufacturing, assembly and some of the testing of our products to CMs, and also engage with ODMs to substantially contribute to the development of certain of our products in addition to production and shipping. We have over the past two years engaged additional CMs and ODMs outside of China, including Vietnam, Taiwan and Mexico, to expand our capacity, and to diversify the global regions in which our products are manufactured. These CMs and ODMs are relied upon to develop, manufacture, control quality of, and ship our products. We do not have long-term contracts that commit CMs to manufacture products for us. Furthermore, political unrest or political instability, military conflict in any country in which our CMs and ODMs are located could experience political unrest, tensions and uncertainty. Global and regional, terrorism or other geopolitical events may have an adverse effect on our contract manufacturer’s ability to deliver quality products on time. Any significant change in our relationship with these manufacturers could have a material adverse effect on our business, operating results, and financial condition. We make substantially all of our purchases from our CMs and ODMs on a purchase order basis. Our CMs and ODMs are not required to manufacture our products for any specific period or in any specific quantity. We expect that it would take approximately six to nine months to transition manufacturing, quality assurance, and shipping services to new providers. Relying on CMs for manufacturing, quality assurance, and shipping also presents significant risks to us, including the inability of our CMs to:

•qualify appropriate component suppliers;

•manage capacity during periods of high demand;

•meet delivery schedules;

•assure the quality of our products;

•ensure adequate supplies of materials;

•protect our intellectual property; and

•deliver finished products at agreed-upon prices.

Additionally relying on ODMs for development, production, and shipping our products also presents significant risks to us including the inability of our ODMs to:

•develop products in timely and cost-effective way with good quality;

•assist us in ongoing support and maintenance for our products we are commercially shipping to our customers;

•meet delivery schedules for ongoing production with assured quality;

•protect Airgain’s confidential information.

Any failure by us or our CMs to timely deliver products of satisfactory quality or in sufficient quantities in compliance with applicable laws could hurt our reputation, cause customers to cancel orders or refrain from placing new orders for our products, which could have a material adverse effect on our business, operating results, and financial condition.

We may experience delays in obtaining product from manufacturers and may not be a high priority for our manufacturers.

The ability and willingness of our CMs to perform is largely outside of our control. We believe that our orders may not represent a material portion of our CMs’ total orders and, as a result, fulfilling our orders may not be a priority if

our CMs are constrained in their abilities or resources to fulfill all of their customer obligations in a timely manner. If any of our CMs suffers an interruption in its business, experiences delays, disruptions, or quality control problems in its manufacturing operations or we have to change or add additional CMs, our ability to ship products to our customers would be delayed and our sales could become volatile, and our cost of sales may increase. For example, throughout 2021 and 2022, we experienced a disruption in our supply chain for certain components located in Asia and made several purchases of available inventory in order to secure supply for our customers, sometimes at higher than our traditional prices. Additionally, any or all of the following could either limit supply or increase costs, directly or indirectly, to us or our CMs:

•financial problems of either CMs or component suppliers;

•reservation of manufacturing capacity at our contract manufactures by other companies, inside or outside of our industry;

•changes or uncertainty in U.S and non-U.S. tariffs and trade policy, economic sanctions, and other trade barriers, political unrest, or military conflict in regions where manufacturers are located; and potential conflicts involving other countries;

•industry consolidation occurring within one or more component supplier markets, such as the semiconductor market; and

•labor strikes or shortages, or restrictions imposed to limit pandemic or epidemics.

We cannot predict with certainty in the future whether a pandemic or epidemic will cause delays or disrupt our product shipments or impact manufacturing. If such disruption were to extend over a prolonged period, it could have a material impact on our sales and business and those of our customers.

Our CMs purchase some components, subassemblies and products from a single or limited number of suppliers. The loss of any of these suppliers may substantially disrupt our ability to obtain orders and fulfill sales as we design in and qualify new components.

We rely on third-party components and technology companies to provide contents of our bills of material to that ultimately configure the devices that are deployed in our integrate solutions. Thus, we rely on our CMs to obtain the components and subassemblies necessary for the manufacture of our devices. In 2024 we experienced continued relief from the shortages in supply of components that we experienced from 2021 to 2022, but we expect that we will experience shortages, constraints, hoarding, and higher prices due to export controls on critical minerals for semiconductors and tariffs in 2025. In 2023 we saw relief on supply disruptions due to over correction. A return to such shortages or other supply disruptions are possible, as well as inflation of prices of certain components, and our ability to predict the availability and pricing of such components is limited. Over the past four years, there have been and continue to exist fluctuations between shortages of certain electronic components used in our industry and a surplus that have led to ongoing uncertainty regarding lead times for the manufacture of certain components in some of our products. If shortages return or occur in the future, as, our business, operating results and financial condition would be materially adversely affected. Unpredictable price increases of such components due to market demand may occur as well. While components and supplies are generally available from a variety of sources, our CMs depend on a single or limited number of suppliers for several components for our products. Further, certain products may utilize custom components available from only one or a limited number of sources. When a component or product uses new technologies, capacity constraints may exist until the suppliers’ manufacturing capacity has increased. Many factors may affect the continued availability of these components at acceptable prices, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. There is no assurance that the supply of such components will not be delayed or constrained. If our suppliers of these components or technology were to enter into exclusive relationships with other providers of wireless networking equipment or were to discontinue providing such components and technology to us and we were unable to replace them cost effectively, or at all, our ability to provide our products would be impaired. Additionally, poor quality in any of the single or limited sourced components in our products could result in lost sales or lost sales opportunities. Our CMs generally rely on purchase orders rather than long-term contracts with these suppliers. As a result, even if available, our CMs may not be able to secure sufficient components at reasonable prices or of acceptable quality to build our products in a

timely manner. Therefore, we may be unable to meet customer demand for our products, which would have a material adverse effect on our business, operating results, and financial condition.

We rely significantly on channel partners to sell and support our products, and the failure of this channel to be effective could materially reduce our sales.

We believe that establishing and maintaining successful relationships with these channel partners is, and will continue to be, important to our financial success. Recruiting and retaining qualified channel partners and training them in our technology and product offerings require significant time and resources. To develop and expand our channel, we must continue to scale and improve our processes and procedures that support our channel partners, including investment in systems and training.

Existing and future channel partners will only work with us if we are able to provide them with competitive products on terms that are commercially reasonable to them. If we fail to maintain the quality of our products or to update and enhance them, existing and future channel partners may elect to work instead with one or more of our competitors. If channel partners stop actively selling our products, we may experience further decline in sales. In addition, the terms of our arrangements with our channel partners must be commercially reasonable for both parties. If we are unable to reach agreements that are beneficial to both parties, then our channel partner relationships will not succeed.

We have no minimum purchase commitments with any of our channel partners, and our contracts with channel partners do not prohibit them from offering products or services that compete with ours, including products they currently offer or may develop in the future and incorporate into their own systems. Some of our competitors may have stronger relationships with our channel partners than we do, and we have limited control, if any, as to whether those partners use our products, rather than our competitors’ products, or whether they devote resources to market and support our competitors’ products, rather than our offerings.

The reduction in or loss of sales by these channel partners could materially reduce our sales. If we fail to maintain relationships with our channel partners, fail to develop new relationships with other channel partners in new markets, fail to manage, train or incentivize existing channel partners effectively, fail to provide channel partners with competitive products on terms acceptable to them, or if these channel partners are not successful in their sales efforts, our sales may decrease, and our operating results could suffer.

Defects in our products or poor design and engineering services could result in lost sales and subject us to substantial liability.