| | |

| | 1900 K Street, NW Washington, DC 20006-1110 +1 202 261 3300 Main +1 202 261 3333 Fax www.dechert.com |

| |

| | STEPHEN T. COHEN stephen.cohen@dechert.com +1 202 261 3304 Direct |

April 13, 2022

VIA EDGAR

Ashley Vroman-Lee

Division of Investment Management

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549-0504

| | Re: | RBC Funds Trust (the “Trust” or “Registrant”) |

File Nos.: 333-111986; 811-21475

Dear Ms. Vroman-Lee:

We are writing in response to comments provided telephonically on March 28, 2022 with respect to Post-Effective Amendment No. 158 filed on Form N-1A on February 18, 2022 for the Trust under the Securities Act of 1933, as amended (“Securities Act”), and the Investment Company Act of 1940, as amended (“1940 Act”). The Trust has considered your comments and has authorized us to make the responses and changes discussed below to the registration statement on its behalf. Capitalized terms used but not defined in this letter have the meanings given to them in the Fund’s registration statement.

| | |

Comment 1. | | The Fund’s principal investment strategies state that the Fund may invest up to 20% of its assets in other investment companies. If appropriate, please include a line in the fees and expenses table for acquired fund fees and expenses (“AFFE”). |

| |

| | Response 1. The Fund confirms that the Fund’s estimated AFFE is not expected to exceed 0.01% of the Fund’s average net assets, and, therefore, a line for AFFE is not necessary in the fees and expenses table. |

| |

Comment 2. | | The Fund’s principal investment strategies state that in determining whether a country is emerging or developed, the Fund may consider “classifications by the Fund’s index.” Please revise the disclosure to reference the Fund’s “benchmark index” to reflect the fact that the Fund is not an index fund. |

| | |

| | Response 2. The Fund has revised the disclosure accordingly. |

| |

Comment 3. | | The Fund’s principal investment strategies suggest that the Fund can invest in the securities of issuers of any size. If the Fund intends to invest in small cap issuers, please add appropriate disclosure in the Principal Investment Strategies and Principal Risks sections of the Fund’s prospectus. |

| |

| | Response 3. The Fund confirms that it does not intend to principally invest in small cap issuers. |

| |

Comment 4. | | Disclose where appropriate how the Fund will approach relevant ESG proxy issues for its portfolio companies. Alternatively, explain why the Fund believes that such disclosure is not required. |

| |

| | Response 4. The Fund does not believe such disclosure is required and the Fund will vote proxies in accordance with the proxy voting policy, which will be included as Appendix B to the Fund’s Statement of Additional Information. |

| |

Comment 5. | | Consider including an ESG Risk tile for the Fund or explain why such a risk tile is not appropriate. |

| |

| | Response 5. The Fund has added the following to its Item 9 additional risks: |

| |

| | ESG Strategy Risk. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. The incorporation of ESG factors into the investment analysis which can encourage a greater emphasis on long-term performance may result in the Fund’s forgoing near-term/short-term opportunities to buy certain securities when it might otherwise be advantageous to do so, or selling securities for ESG reasons when it might be otherwise disadvantageous for it to do so. |

| |

| | A company’s ESG performance or the Sub-Advisor’s assessment of a company’s ESG performance could vary over time to reflect changes in a company’s ESG performance, which could mean that a company could move from being an investment of the Fund to being divested due to ESG concerns, or conversely change from being previously considered not suitable for investment, to becoming investable. Where companies may subsequently be considered not investable for ESG reasons, there may be a delay such that the Fund is temporarily invested in such companies as |

2

| | |

| | the Sub-Advisor seeks to execute the transactions in an orderly manner to minimize the impact on the Fund. Although ESG information originates from a range of different sources, the assessment of ESG performance is ultimately subjective. As a result, there can be significant differences in interpretations of what it means for a company to qualify for investment. For instance, the Sub-Advisor may determine that a particular security has demonstrated sufficiently improving management and/or performance practices affecting the quality of its business related to the Sub-Advisor’s internal priority ESG considerations, such that the Sub-Advisor considers it is suitable to invest in, while another investor may have a different view. |

| |

Comment 6. | | Please provide the updated Performance Information for the Fund. |

| |

| | Response 6. The updated Performance Information for the Fund is attached hereto as Exhibit A. |

| |

Comment 7. | | The Principal Investment Strategies disclosure provided in response to Item 9 of Form N-1A is almost identical to the disclosure provided in response to Item 4 of Form N-1A. Please consider revising the disclosure to reflect the fact that the disclosure provided in response to Item 4 should be a summary of the more robust disclosure provided in response to Item 9. |

| |

| | Response 7. The Fund has revised the Principal Investment Strategies disclosure provided in response to Item 4 accordingly. |

| |

Comment 8. | | Please revise the disclosure in the Additional Risks section of the prospectus to clarify whether the risks disclosed in this section are principal risks of investing in the Fund. |

| |

| | Response 8. The Fund has revised the disclosure accordingly to clarify that the risks presented in the Additional Risks section of the prospectus are non-principal risks. |

* * * * *

3

If you would like to discuss any of these responses in further detail or if you have any questions, please feel free to contact me at (202) 261-3304. Thank you.

Sincerely,

/s/ Stephen T. Cohen

Stephen T. Cohen

4

Exhibit A

Performance Information

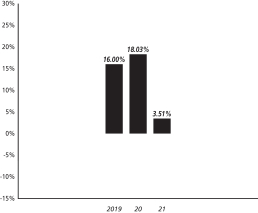

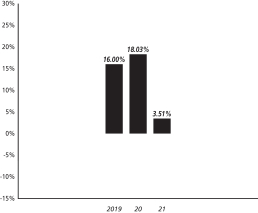

The bar chart and performance table provide an indication of the risks of an investment in the Fund by showing changes in performance of the Fund’s Class I shares from year to year and by showing how the Fund’s Class I shares average annual total returns (before and after taxes) compare with those of a broad-based securities index. No performance is shown for the Fund’s Class A shares because the Class A Shares had not commenced operations prior to the date of this prospectus. The returns for Class A shares may be different than the returns of Class I shares shown in the bar chart and performance table because fees and expenses of the two classes differ. Past performance (before and after taxes) does not indicate how the Fund will perform in the future. Updated information on the Fund’s performance can be obtained by visiting https://us.rbcgam.com/mutual-funds/ or by calling 1-800-422-2766.

Annual Total Returns – Class I Shares

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | During the period shown in the chart for the Class I Shares of the Fund: | | |

| | Best quarter: | | Q4 2020 26.58% |

| | Worst quarter: | | Q1 2020 (27.70)% |

The year-to-date return of Class I shares as of March 31, 2022 was (7.46)%.

Performance Table

The table below shows after-tax returns for Class I shares. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as qualified retirement plans. In some cases, returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes because the calculations assume that the investor received a tax benefit for any loss incurred on the sale of the shares. The inception date of Class I is February 9, 2018.

| | | | |

| Average Annual Total Returns (for the periods ended December 31, 2021) |

| | | Past Year | | Since Inception |

Class I Before Taxes | | 3.51% | | 3.78% |

Class I After Taxes on Distributions | | (0.70)% | | 2.23% |

Class I After Taxes on Distributions and Sale of Shares | | 2.85% | | 2.46% |

MSCI Emerging Markets Net Total Return USD Index (reflects no deduction for fees, expenses or taxes; inception calculated from February 9, 2018) | | (2.54)% | | 4.38% |