Acetyl derivatives and polyols are commodity products characterized by cyclicality in pricing. The principal raw materials used in the acetyl derivatives business line are acetic acid, various alcohols, methanol, acetaldehyde, propylene, ethylene and synthesis gas.

The customers of acetyl derivatives are primarily engaged in the production of paints, coatings and adhesives. The sale of formaldehyde is based on both long and short term agreements. Polyols are sold globally to a wide variety of customers, primarily in the coatings and resins and the specialty products industries. Oxo products are sold into a wide variety of end uses, including plasticizers, acrylates and solvents/ethers. The oxo market is characterized by oversupply and numerous competitors.

Polyvinyl alcohol ("PVOH") is a performance chemical engineered to satisfy particular customer requirements. Global demand for polyvinyl alcohol is estimated to be 840,000 tonnes, according to Tecnon and Celanese estimates. According to Stanford Research International's December 2003 report on PVOH, Celanese is the largest North American producer of polyvinyl alcohol and the third largest producer in the world.

PVOH is used in adhesives, building products, paper coatings, films and textiles. The primary raw material to produce polyvinyl alcohol is vinyl acetate monomer, and acetic acid is produced as a by-product. Prices vary depending on industry segment and end use application. Products are sold on a global basis, and competition is from all regions of the world. Therefore, regional economies and supply and demand balances affect the level of competition in other regions. Polyvinyl alcohol is sold to a diverse group of regional and multinational customers. The customers of Celanese's polyvinyl alcohol business line are primarily engaged in the production of adhesives, paper, films, building products, and textiles.

Emulsions are a key component of water-based quality surface coatings, adhesives, non-woven textiles and other applications. According to Kline & Co., a chemicals industry consultant, based on sales, Celanese held a number two position in emulsions (excluding styrene butadiene resins) in Europe and a number one position in European VAM-based emulsions in 2001. Emulsions are made from vinyl acetate monomer, acrylate esters and styrene. Emulsions and emulsion powders are sold to a diverse group of regional and multinational customers. Customers for emulsions are manufacturers of water-based quality surface coatings, adhesives, and non-woven textiles. Customers for emulsion powders are primarily manufacturers of building products.

Celanese's specialties business line produces (i) carboxylic acids used in detergents, synthetic lubricants and plasticizers, (ii) amines used in agrochemicals, herbicides, and in the treatment of rubber and water and (iii) oxo derivatives and special solvents which are used as raw materials for the fragrance and food ingredients industry.

The prices for these products are generally relatively stable due to long-term contracts with customers in industries that are not generally subject to the cyclical trends of commodity chemicals. The primary raw materials for these products are olefins and ammonia, which are purchased from world market suppliers based on international prices. The specialties business line primarily serves global markets in the synthetic lubricant, agrochemical, rubber processing and other specialty chemical areas. Much of the specialties business line involves "one customer, one product" relationships, where the business develops customized products with the customer, but the specialties business line also sells several chemicals which are priced more like commodity chemicals.

Our principal competitors in the Chemical Products segment include Acetex Corporation, Air Products and Chemicals, Inc., Atofina S.A., BASF, Borden Chemical, Inc., BP p.l.c., Chang Chun

Petrochemical Co., Ltd., Daicel, Dow, Eastman Chemical Corporation ("Eastman"), E. I. Du Pont de Nemours and Company ("DuPont"), Methanex Corporation, Millennium Chemicals Inc., Nippon Goshei, Perstorp Inc., Rohm & Haas Company, Showa Denko K.K., and Kuraray Co. Ltd.

Acetate Products

Global demand for cellulose acetate fiber is estimated to be approximately 700,000 tons, with approximately 85% comprising cigarette filter tow and the remaining 15% textile filament, according to Celanese 2003 estimates. While filter tow demand is expected to grow 1% per annum, acetate filament is expected to decline by 4 to 6% per annum. According to the 2002 Stanford Research Institute International Chemical Economics Handbook, Celanese is the world's leading producer of acetate fibers, including production through its joint ventures in Asia.

Celanese produces acetate flake by processing wood pulp with acetic anhydride. Celanese purchases wood pulp that is made from reforested trees from major suppliers and produces acetic anhydride internally. The acetate flake is then further processed into acetate fiber in the form of a tow band or filament.

The acetate filter products business line produces acetate tow, which is used primarily in cigarette filters. The acetate tow market continues to be characterized by stability and slow growth. The acetate filament business line is a supplier to the textile industry. Demand for acetate filament is dependent on fashion trends and the world economy.

Sales in the acetate filter products industry are principally to the major tobacco companies that account for a majority of worldwide cigarette production.

In the acetate filament industry, Celanese's sales are made to textile companies that range in size from the largest in the industry to others which are quite small. The textile companies either weave or knit the acetate filament yarns to produce greige fabrics. The greige fabrics are then dyed and finished, either by the greige fabrics manufacturer or by converters who buy the fabrics and contract with dyeing and finishing companies to process the fabrics. The finished fabrics are sold to manufacturers who cut and sew the fabrics into apparel for retail stores.

The textile industry, in particular the apparel portion of the industry, continues to undergo structural changes as production moves from high-wage to low-wage countries. In recent years, this has resulted in a changing customer base for all participants in the textile chain.

Competition

Principal competitors in the Acetate Products segment include Acordis Industrial Nederland BV, Daicel, Eastman, Mitsubishi Rayon Company, Limited, Novaceta S.p.a., and Rhodia S.A. ("Rhodia").

Technical Polymers Ticona

Ticona develops, produces and supplies a broad portfolio of high performance technical polymers including polyacetals and ultra-high-molecular-weight polyethylene. Polyacetals are estimated to have a 3-4% annual estimated growth in the U.S. and Western Europe, according to SRI Consulting. Ticona's technical polymers have chemical and physical properties enabling them, among other things, to withstand high temperatures, resist chemical reactions with solvents and resist fracturing or stretching. These products are used in a wide range of performance-demanding applications in the automotive and electronics sectors and in other consumer and industrial goods, often replacing metal or glass.

Ticona's customer base consists primarily of a large number of plastic molders and component suppliers, which are often the primary suppliers to original equipment manufacturers, or OEMs. Ticona works with these molders and component suppliers as well as directly with the OEMs to develop and improve specialized applications and systems.

Prices for most of these products, particularly specialized product grades for targeted applications, generally reflect the value added in complex polymer chemistry, precision formulation and compounding,

112

and the extensive application development services provided. The specialized product lines are not particularly susceptible to cyclical swings in pricing. Polyacetals pricing, mainly in standard grades, is, however, somewhat more price competitive, with many minimum-service providers competing for volume sales.

Polyacetals are used for mechanical parts, in automotive applications including door lock systems, seat belt mechanisms, fuel senders and in electrical, consumer, medical and industrial applications such as razors, shower handsets, medical dosage systems and gears for appliances.

The primary raw material for polyacetals is formaldehyde, which is manufactured from methanol. Ticona currently purchases formaldehyde in the United States from our Chemical Products segment and, in Europe, manufactures formaldehyde from purchased methanol.

Ultra high molecular weight polyethylene, or PE-UHMW, is a type of high density polyethylene (HDPE) specialty material that is very tough and abrasion and impact resistant. It is therefore used in different end-markets from traditional HDPE. It can be found in sheet form, molded into stock shapes, or spun into high-strength fibers. Its most common end uses are compression-molded sheets, porous parts, ram-extruded sheets, profiles, filters and rods. GUR, a form of PE-UHMW, is an engineered material used in heavy-duty automotive and industrial applications such as car battery separator panels and industrial applications, such as flood gates and conveyor belts, as well as in specialty medical and consumer applications, such as porous tips for marker pens, sports equipment, orthopedic devices or in water filtration. The basic raw material for PE-UHMW is ethylene.

Polyesters are used in a wide variety of automotive, electrical and consumer applications, including ignition system parts, radiator grilles, airbags, electrical switches, appliance housings, boat fittings and perfume bottle caps. Raw materials for polyesters vary.

Liquid crystal polymers, or LCPs are used in electrical and electronics applications and for precision parts with thin walls and complex shapes. Fortron, a polyphenylene sulphide, or PPS, product, is used in a wide variety of automotive and other applications, especially those requiring heat and/or chemical resistance, including fuel system parts, radiator pipes and halogen lamp housings, and often replaces metal in these demanding applications. Celstran and Compel are long fiber reinforced thermoplastics, which impart extra strength and stiffness, making them more suitable for larger parts than conventional thermoplastics.

A number of Ticona's polyacetals customers, particularly in the appliance, electrical components, toys and certain sections of the electronics/telecommunications fields, have moved tooling and molding operations to Asia, particularly southern China. To meet the expected increased demand in this region, Ticona, along with Polyplastics, Mitsubishi Gas Chemical Company Inc., and Korea Engineering Plastics agreed on a production joint venture to construct and operate a 60,000 metric ton polyacetals facility in China.

Ticona's principal customers are suppliers to the automotive industries as well as industrial suppliers. These customers primarily produce engineered products, and Ticona works closely with its customers to assist them to develop and improve specialized applications and systems.

Competition

Ticona's principal competitors include BASF, DuPont, General Electric Company DSM NV, and Solvay S.A. Other competitors include Asahi Kasei Corporation, Mitsubishi Plastics, Inc., Bayer AG, Chevron Phillips Chemical Company, L.P., Braskem S.A., Teijin and Toray Industries Inc.

Performance Products

According to SRI Consulting, sales of high-intensity sweeteners represented approximately 11% of the $9.5 billion food additive businesses in the U.S., Western Europe and Japan in 2003. Nutrinova's food ingredients business consists of the production and sale of high intensity sweeteners and food protection ingredients, such as sorbic acids and sorbates, as well as the resale of dietary fiber products worldwide and the resale of other food ingredients in Japan, Australia, Mexico and the United States. Acesulfame-K, marketed under the trademark Sunett, is used in a variety of beverages, confections and dairy products throughout the world. It is a long lasting product independent of temperature and has synergies with other

113

sweeteners, both nutritive and non-nutritive. The primary raw materials for this product are diketene and sulfur trioxide. Sunett pricing for targeted applications reflects the value added in the precision formulations and extensive technical services provided.

Nutrinova's food protection ingredients are used in foods, beverages and personal care products. The primary raw materials for these products are ketene and crotonaldehyde. Sorbates pricing is extremely sensitive to demand and industry capacity and is not necessarily dependent on the prices of raw materials.

Competition

The principal competitors for Nutrinova's Sunett sweetener are Holland Sweetener Company, The Nutrasweet Company, Ajinomoto Co., Inc., Tate & Lyle and several Chinese manufacturers. In sorbates, Nutrinova competes with Nantong AA, Daicel, Chisso Corporation, Cheminova, Yu Yao/Ningbo, Yancheng AmeriPac and other Japanese and Chinese manufacturers of sorbates.

114

BUSINESS

Background

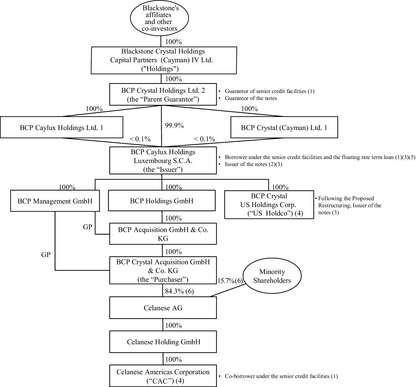

Pursuant to a voluntary tender offer commenced in February 2004 (the "Tender Offer"), the Purchaser, an indirect wholly owned subsidiary of the Issuer and the Parent Guarantor, in April 2004 acquired approximately 84.3% of the Celanese Shares outstanding as of March 31, 2004. Both the Issuer and the Parent Guarantor are recently-formed companies which, apart from the financing of the Transactions, do not have any independent external operations other than through the indirect ownership of the Celanese Shares. Accordingly, no separate financial statements of the Issuer or the Parent Guarantor on a stand-alone basis are included in this prospectus and financial and other information of Celanese is presented herein. Celanese is not an obligor on the notes and on the issue date none of its subsidiaries will guarantee the notes. Further, the Issuer is limited in its ability to exercise managerial control over Celanese, including with respect to the payment of dividends and other distributions by Celanese to the Issuer, until the Domination Agreement has become effective. Although the Purchaser intends to acquire the remaining Celanese Shares and expects the Domination Agreement with Celanese to become effective, the Issuer cannot assure you that either of these events will take place. See "The Transactions."

Celanese

Celanese is a leading global industrial chemicals company with strong competitive positions in its major products and production technologies. Celanese's business involves processing chemical raw materials, such as ethylene and propylene, and natural products, including natural gas and wood pulp, into value-added chemicals and chemical-based products. Celanese's leadership position is based on two key factors: its significant market shares and competitive cost structures in its major products. Celanese's competitive cost structures are based on economies of scale, vertical integration, technical know-how and the use of advanced technologies. Celanese's portfolio consists of four main business segments: Chemical Products, Acetate Products, Technical Polymers Ticona and Performance Products.

As of December 31, 2003, Celanese had approximately 9,500 employees worldwide on a continuing basis. As of December 31, 2003, Celanese had 24 production plants and six research centers in ten countries. Most of Celanese's facilities are located in the Americas, principally in the three North America Free Trade Agreement countries: the United States, Canada and Mexico. Celanese also has major operations, including significant joint ventures, in Asia. In 2003, 39 percent of net sales was to customers located in North America, 40 percent to customers in Europe, 18 percent to customers in Asia and Australia and 3 percent to customers in the rest of the world. Celanese has a large and diverse global customer base consisting principally of major industrial companies. In 2003, sales to Celanese's 10 largest customers accounted for less than 30 percent of Celanese's net sales and the single largest customer represented less than 7 percent of Celanese's net sales.

115

Segment Overview

The table below illustrates each segment's net sales to external customers for the year ended December 31, 2003, as well as each segment's major products and end-use markets.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Chemical

Products |  | Technical

Polymers Ticona |  | Acetate

Products |  | Performance

Products |

| 2003 Net Sales(1) |  | $2,968 million |  | $762 million |  | $655 million |  | $169 million |

| Major Products |  | • Acetic acid

• Vinyl acetate

monomer (VAM)

• Polyvinyl Alcohol

(PVOH)

• Emulsions

• Acetic anhydride

• Acetate esters

• Carboxylic acids

• Methanol |  | • Polyacetal (POM)

• UHMW-PE

(GUR)

• Liquid crystal

polymers (Vectra)

• Polyphenylene

Sulfide (Fortron) |  | • Acetate tow

• Acetate filament

|  | • Sunett sweetener

• Sorbates

|

| Major End-Use Markets |  | • Paints

• Coatings

• Adhesives

• Lubricants

• Detergents

|  | • Fuel system

components

• Conveyor belts

• Electronics

• Seat belt

mechanisms |  | • Cigarette filters

• Textiles |  | • Beverages

• Confections

• Baked goods

• Dairy products |

|

|  |

| (1) | 2003 net sales of $4,603 million also include $49 million in net sales from Other Activities. |

Chemical Products

The Chemical Products segment produces and supplies acetyl products, including acetic acid, acetate esters, vinyl acetate monomer, or VAM, polyvinyl alcohol, and emulsions. Acetic acid is used in the production of other basic chemicals. Acetate esters are used in paints, coatings and inks. Vinyl acetate monomer is primarily used in a variety of adhesives, paints and coatings. Polyvinyl alcohol is made from vinyl acetate monomer and is used in adhesives, paper coatings, films and textiles. Emulsions and emulsion powders are a key component of water based quality surface coatings, adhesives, non-woven textiles and building products. Most of the other chemicals produced in this segment are organic solvents and intermediates for pharmaceutical, agricultural and chemical products. Celanese is a leading global producer of acetic acid, and the world's largest producer of vinyl acetate monomer and the largest North American producer of methanol, the major raw material used for the production of acetic acid. Celanese is the largest polyvinyl alcohol producer in North America and the third largest producer in the world. Based on sales, the emulsions business holds a number two position in conventional emulsions (excluding styrene butadiene resins or SBRs) in Europe and a number one position in VAM-based emulsions in Europe. The business is also a leading supplier of emulsion powders globally.

Technical Polymers Ticona

The Technical Polymers Ticona segment develops, produces and supplies a broad portfolio of high performance technical polymers for use in automotive and electronics products and in other consumer and industrial applications, often replacing metal or glass. Together with Celanese's 45% owned joint venture Polyplastics, its 50%-owned joint venture Korea Engineering Plastics Company Ltd., and Fortron Industries, its 50-50 joint venture with Kureha Chemicals Industry of Japan, Celanese is a leading participant in the global technical polymers business. The primary products within the Ticona segment are Hostaform/Celcon, Celanese's polyacetal, or POM, offerings, and GUR, an ultra high molecular weight polyethylene. Hostaform and Celcon are used in a broad range of products including automotive components, electronics and appliances. GUR is used in battery separators, conveyor belts, filtration equipment, coatings and medical devices.

116

Acetate Products

The Acetate Products segment primarily produces and supplies acetate tow (filter products) and acetate filament. Products from this segment are found in cigarette filters, fashion apparel, linings and home furnishings. Celanese is one of the world's leading producers of acetate tow and acetate filament, including production by its joint ventures in China.

Performance Products

The Performance Products segment consists of Nutrinova, the food ingredients business, which produces and sells a high intensity sweetener and food protection ingredients, such as sorbates, for the food, beverage and pharmaceuticals industries.

Other Activities

Celanese's portfolio contains other businesses and activities separate from its principal business segments, which consist primarily of general corporate functions, captive insurance companies, the innovative products subsidiaries Celanese Ventures GmbH and Celanese Advanced Materials, Inc., companies that provide infrastructure services, and other ancillary businesses. Celanese Ventures GmbH promotes research projects that lie outside Celanese's principal businesses or, due to their long-term perspective and widely spread application possibilities, cannot be operated by the business alone. Celanese Advanced Materials, Inc. consists of the high performance polymer, polybenzimidazole or PBI, and the Vectran polymer fiber product lines.

Competitive Strengths

Celanese has benefited from the following competitive strengths:

Leading Market Positions

Celanese has #1 or #2 market positions worldwide in products that make up a majority of its sales. Celanese is a leading global producer of acetic acid and the world's largest producer of vinyl acetate monomer. Ticona and its joint ventures, Polyplastics and KEP, are leading suppliers of polyacetals and other engineering resins in North America, Europe and the Asia/Pacific region. Celanese's leadership positions are based on its significant market shares, proprietary technology and competitive cost structures in its major products.

Low Cost Producer

Celanese's competitive cost structures are based on economies of scale, vertical integration, technical know-how and the use of advanced technologies. Celanese's production of acetyl products employs industry leading proprietary and licensed technologies, including its proprietary AO Plus acid-optimization technology for the production of acetic acid and VAntage vinyl acetate monomer technology. AO Plus enables plant capacity to be increased with minimal investment, while VAntage enables significant increases in production efficiencies, lower operating costs and increases in capacity at ten to fifteen percent of the cost of building a new plant.

Global Reach

Celanese operates 24 production facilities throughout the world, with major operations in North America, Europe and Asia. Celanese's infrastructure of manufacturing plants, terminals, and sales offices provides Celanese with a competitive advantage in anticipating and meeting the needs of its global and local customers in well-established and growing markets while its geographic diversity mitigates the potential impact of volatility in any individual country or region. Celanese has a strong and growing presence in Asia (particularly in China) where joint ventures owned by Celanese and its partners operate nine additional facilities.

Strategic Investments

Celanese's strategic investments, consisting primarily of its extensive network of joint ventures, enable it to minimize investments necessary to access new markets, while also generating significant cash

117

flow and earnings for Celanese. Celanese's joint ventures are important components of Celanese's strategy. Celanese actively manages its investments in its joint ventures with its venture partners. Between January 1, 2001 and December 31, 2003, Celanese received $291 million in dividends and other distributions from its joint ventures.

Strong Cash Flow Generation

Celanese has generated a high level of cash flow for the past several years based on its low-cost production, diverse product base, consisting of basic and high performance products, and presence in numerous geographic markets. Celanese has strengthened its cash flow through its disciplined management of working capital, its selective capital expenditures programs and its continual focus on cost reduction.

Diversity of Products and End-Use Markets

Celanese offers its customers a broad range of products. Celanese also benefits from exposure to a wide variety of different end-use markets, which helps to mitigate the potential impact of volatility in any individual end-use market. For example, the Ticona technical polymers business offers customers a broad range of high-quality engineering plastics to meet the needs of customers in numerous end-use markets, such as automotive, electrical/electronics, appliance and medical. The Chemical Products business has leading market positions in an integrated chain of basic and performance-based acetyl products, sold into diverse industrial applications.

Business Strategies

Celanese is pursuing the following business strategies:

Maintain Cost Advantage and Productivity Leadership

Celanese continually seeks opportunities to reduce its production and raw material costs. Advanced process control projects help to generate significant savings in energy and raw materials while increasing yields in production units. Most significantly, Celanese intends to intensify the implementation of Six Sigma, which has become a pervasive and important tool in both operations and administration for achieving greater productivity and growth. Celanese announced in July 2003 that it intends to purchase most of its North American internal methanol requirements from Southern Chemical Corporation beginning in 2005 under a multi-year agreement at a lower cost than Celanese's present cost for methanol. Celanese is also engaged in several projects and process technology improvements focused on energy reduction. Celanese also intends to continue using best practices to reduce costs and increase equipment reliability in maintenance and project engineering.

Maximize Cash Flow and Reduce Debt

Despite a difficult operating environment over the past several years, Celanese has generated a significant amount of cash flow. Between January 1, 2001 and December 31, 2003, Celanese generated over $1.2 billion of net cash provided by operating activities which it has used principally to repay debt and make capital and strategic investments. Celanese believes there are significant opportunities to further increase its cash flow through increasing productivity, managing trade working capital, receiving cash dividends from its joint ventures and continuing to pursue cost reduction efforts. Celanese believes in a focused capital expenditure plan that is dedicated to attractive investment projects. Celanese intends to use its free cash flow to reduce indebtedness and pursue selective expansions of its businesses.

Deliver Value-Added Solutions

Celanese is continually developing new products and industry leading production technologies that solve customer problems. For example, Ticona has worked closely with fuel system suppliers to develop an acetal copolymer with the chemical and impact resistance necessary to withstand exposure to hot diesel

118

fuels. In its emulsions business, Celanese pioneered a technological solution that leads the industry in product offerings for ecologically friendly, emulsions for solvent-free interior paints. Celanese believes that its customers value its expertise and Celanese will continue to work with them to enhance the quality of its products.

Enhance Value of Portfolio

Celanese seeks to further optimize its business portfolio through divestitures, acquisitions and strategic investments that enable Celanese to focus on businesses in which it can achieve market, cost and technology leadership over the long term. Celanese intends to continue its strategy of evaluating opportunities to expand its product mix into higher value-added products.

Focused Business Investment

Celanese intends to continue investing strategically in growth areas, including new production capacity, to extend its global market leadership position. Historically, Celanese's strong market position has enabled it to initiate capacity growth to take advantage of projected demand growth. For example, Celanese is preparing to build a 600,000 metric ton per year world-scale acetic acid plant in China, the world's fastest growing market for acetic acid and its derivatives. Celanese also has plans to increase the capacity of its GUR ultra high molecular weight polyethylene plant in Germany by 10,000 tons per year, which will increase Ticona's worldwide capacity by 17% in the second half of 2004. Celanese expects to continue to benefit from its investments and capacity expansion that enable it to meet increases in global demand.

Business Segments

Chemical Products

The Chemical Products segment consists of six business lines: Acetyls, Acetyl Derivatives and Polyols, Polyvinyl Alcohol, Emulsions, Specialties, and other chemical activities. All business lines in this segment mainly conduct business using the "Celanese" trade name, except Polyvinyl Alcohol, which uses the trademark Celvol, and Emulsions, which uses the trademarks Mowilith and Celvolit. The following table lists key products and their major end use markets.

|  |  |  |  |  |  |

| Key Chemical Products |  | Major End Use Markets |

| Methanol |  | Formaldehyde and Acetic Acid |

| Acetic Acid |  | Vinyl Acetate Monomer, Acetic Anhydride and Purified Terephthalic Acid or PTA, an Intermediate used in the production of Polyester resins, films and fibers |

| Acetic Anhydride |  | Cellulose Acetate and Pharmaceuticals |

| Vinyl Acetate Monomer |  | Paints, Adhesives, Paper Coatings, Films and Textiles |

| Acetate Esters |  | Coatings, Inks |

| Oxo Alcohols |  | Plasticizers, Acrylates, Esters, Solvents and Inks |

| Polyvinyl Alcohol |  | Adhesives, Building Products, Paper Coatings, Films and Textiles |

| Emulsions |  | Water-Based Quality Surface Coatings, Adhesives, Non-Woven Textiles |

| Emulsion Powders |  | Building Products |

| Carboxylic Acids |  | Lubricants, Detergents and Specialties |

| Amines |  | Agricultural Products and Water Treatments |

| |  | |

|

119

Business Lines

Acetyls. The acetyls business line produces:

|  |

| • | Acetic acid, used to manufacture vinyl acetate monomer and other acetyl derivatives. Celanese manufactures acetic acid for its own use, as well as for sale to third parties, including producers of purified terephthalic acid, or PTA, and to other participants in the acetyl derivatives business. |

|  |

| • | Vinyl acetate monomer, used in a variety of adhesives, paints, films, coatings and textiles. Celanese manufactures vinyl acetate monomer for its own use, as well as for sale to third parties. |

|  |

| • | Methanol, principally used internally in the production of acetic acid and formaldehyde. The balance is sold to the merchant market. |

|  |

| • | Acetic anhydride, a raw material used in the production of cellulose acetate, detergents and pharmaceuticals. |

|  |

| • | Acetaldehyde, a major feedstock for the production of polyols. Acetaldehyde is also used in other organic compounds such as pyridines, which are used in agricultural products. |

Celanese is a leading global producer of acetic acid and the world's leading producer of vinyl acetate monomer according to the Tecnon Orbichem's Acetic Acid and Vinyl Acetate 1999-2009 World Survey September 2003 report. According to data from the CMAI 2002-2003 World Methanol Analysis, Celanese is the largest producer of methanol in North America.

Acetic acid, methanol, and vinyl acetate monomer, like other commodity products, are characterized by cyclicality in pricing. The principal raw materials in these products are natural gas and ethylene, which are purchased from numerous sources; carbon monoxide, which is purchased by Celanese under long-term contracts; methanol, which is both manufactured and purchased by Celanese under short-term contracts; and butane, which is purchased from several suppliers. All these raw materials, except carbon monoxide, are themselves commodities and are available from a wide variety of sources.

Celanese's production of acetyl products employs leading proprietary and licensed technologies, including Celanese's proprietary AO Plus acid-optimization technology for the production of acetic acid and VAntage vinyl acetate monomer technology. AO Plus enables plant capacity to be increased with minimal investment, while VAntage enables significant increases in production efficiencies, lower operating costs and increases in capacity at 10 to 15 percent of the cost of building a new plant.

Acetyl Derivatives and Polyols. The acetyl derivatives and polyols business line produces a variety of solvents, polyols, formaldehyde and other chemicals, which in turn are used in the manufacture of paints, coatings, adhesives, and other products.

Many acetyl derivatives products are derived from Celanese's production of acetic acid and oxo alcohols. Primary products are:

|  |

| • | Ethyl acetate, an acetate ester that is a solvent used in coatings, inks and adhesives and in the manufacture of photographic films and coated papers; |

|  |

| • | Butyl acetate, an acetate ester that is a solvent used in inks, pharmaceuticals and perfume; |

|  |

| • | Propyl acetate, an acetate ester that is a solvent used in inks, lacquers and plastics; |

|  |

| • | Methyl ethyl ketone, a solvent used in the production of printing inks and magnetic tapes; |

|  |

| • | Butyric acid, an intermediate for the production of esters used in artificial flavors; |

|  |

| • | Propionic acid, an organic acid used to protect and preserve grain; and |

|  |

| • | Formic acid, an organic acid used in textile dyeing and leather tanning. |

Polyols and formaldehyde products are derivatives of methanol and are made up of the following products:

|  |

| • | Formaldehyde, primarily used to produce adhesive resins for plywood, particle board, polyacetal engineering resins and a compound used in making polyurethane; |

120

|  |

| • | Polyol products such as pentaerythritol, used in coatings and synthetic lubricants; trimethylolpropane, used in synthetic lubricants; neopentyl glycol, used in powder coatings; and 1,3 butylene glycol, used in flavorings and plasticizers. |

Oxo alcohols and intermediates are produced from propylene and ethylene and include:

|  |

| • | Butanol, used as a solvent for lacquers, dopes and thinners, and as an intermediate in the manufacture of chemicals, such as butyl acrylate; |

|  |

| • | Propanol, used as an intermediate in the production of amines for agricultural chemicals, and as a solvent for inks, resins, insecticides and waxes; |

|  |

| • | Synthesis gas, used as an intermediate in the production of oxo alcohols and specialties. |

Acetyl derivatives and polyols are commodity products characterized by cyclicality in pricing. The principal raw materials used in the acetyl derivatives business line are acetic acid, various alcohols, methanol, acetaldehyde, propylene, ethylene and synthesis gas. Celanese manufactures many of these raw materials for its own use as well as for sales to third parties, including its competitors in the acetyl derivatives business. Celanese purchases propylene and ethylene from a variety of sources. Celanese manufactures acetaldehyde for its European production, but it purchases all its acetaldehyde requirements for its North American operations from Petroleos Mexicanos, the Mexican national oil company. Petroleos Mexicanos has been a reliable supplier. Acetaldehyde is also available from other sources.

Polyvinyl Alcohol. Polyvinyl alcohol is a performance chemical engineered to satisfy particular customer requirements. It is used in adhesives, building products, paper coatings, films and textiles. The primary raw material to produce polyvinyl alcohol is vinyl acetate monomer, while acetic acid is produced as a by-product. Prices vary depending on industry segment and end use application. Products are sold on a global basis, and competition is from all regions of the world. Therefore, regional economies and supply and demand balances affect the level of competition in other regions. According to Stanford Research International's December 2003 report on PVOH, Celanese is the largest North American producer of polyvinyl alcohol and the third largest producer in the world.

Emulsions. Celanese purchased the emulsions business of Clariant AG on December 31, 2002. The products in this business are sold under the Mowilith and Celvolit brands and include conventional emulsions, high-pressure vinyl acetate ethylene emulsions, and powders. Emulsions are made from vinyl acetate monomer, acrylate esters and styrene. Emulsions are a key component of water-based quality surface coatings, adhesives, non-woven textiles and other applications. According to Kline & Co., a chemicals industry consultant, based on sales the business held a number two position in emulsions (excluding SBRs) in Europe and a number one position in European VAM-based emulsions in 2001.

Specialties. The specialties business line produces:

|  |

| • | Carboxylic acids such as pelargonic acid, used in detergents and synthetic lubricants, and heptanoic acid, used in plasticizers and synthetic lubricants; |

|  |

| • | Amines such as methyl amines, used in agrochemicals, monoisopropynol amines, used in herbicides, and butyl amines, used in the treatment of rubber and in water treatment; and |

|  |

| • | Oxo derivatives and special solvents, such as crotonaldehyde, which is used by the Performance Products segment for the production of sorbates, as well as raw materials for the fragrance and food ingredients industry. |

The prices for these products are relatively stable due to long-term contracts with customers whose industries are not generally subject to the cyclical trends of commodity chemicals.

The primary raw materials for these products are olefins and ammonia, which are purchased from world market suppliers based on international prices.

In March 2002, Celanese formed Estech, a venture with Hatco Corporation, a leading producer of synthetic lubricants, for the production and marketing of neopolyol esters or NPEs. This venture, in which Celanese holds a 51 percent interest, built and operates a 7,000 metric ton per year NPE plant at Celanese's Oberhausen, Germany site. The plant came on stream in the fourth quarter of 2003. Neopolyol

121

esters are used as base stocks for synthetic lubricants in refrigeration, automotive, aviation and industrial applications, as well as in hydraulic fluids. Celanese supplies Estech with carboxylic acids and polyols, the main raw materials for producing NPEs.

Celanese contributed its commercial, technical and operational C3-oxo business activities in Oberhausen, Germany to European Oxo GmbH, Celanese's European oxo chemicals joint venture with Degussa AG. The joint venture began operations in October 2003.

Facilities

The Chemical Products segment has production sites in the United States, Canada, Mexico, Singapore, Spain, Sweden, Slovenia and Germany. The emulsions business line also has tolling arrangements in the United Kingdom, France and Greece. Celanese also participates in a joint venture in Saudi Arabia that produces methanol and MTBE. Over the last few years, Celanese has continued to shift its production capacity to lower cost production facilities while expanding in growth markets, such as China. As a result, Celanese plans to shut down its formaldehyde unit in Edmonton, Alberta, Canada during 2004. Celanese announced plans to build a 600,000 metric ton acetic acid plant in Nanjing, China, which is expected to come on stream in late 2005 or early 2006.

Capital Expenditures

The Chemical Products segment's capital expenditures were $109 million, $101 million, and $63 million for the years 2003, 2002 and 2001, respectively. The capital expenditures incurred during the last three years related primarily to efficiency and safety improvement-related items associated with the normal operations of the business, as well as spending for a new plant for synthesis gas, an important raw material for the production of oxo alcohols and specialties, at Celanese's Oberhausen site. The new plant, which will supply European Oxo GmbH and Celanese, came on stream in the third quarter of 2003 and is expected to improve reliability and reduce production costs. Capital expenditures in 2003 also included the integration of a company-wide SAP system.

Markets

The following table illustrates net sales by destination of the Chemical Products segment by geographic region for the years ended December 31, 2003, 2002 and 2001.

Net Sales to External Customers Destination — Chemical Products

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| |  | $ |  | % of

Segment |  | $ |  | % of

Segment |  | $ |  | % of

Segment |

| |  | (in millions, except percentages) |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| North America |  | | 1,181 | |  | | 39 | % |  | | 1,039 | |  | | 44 | % |  | | 1,140 | |  | | 47 | % |

| Europe/Africa |  | | 1,183 | |  | | 40 | % |  | | 817 | |  | | 35 | % |  | | 858 | |  | | 35 | % |

| Asia/Australia |  | | 522 | |  | | 18 | % |  | | 418 | |  | | 18 | % |  | | 368 | |  | | 15 | % |

| Rest of World |  | | 82 | |  | | 3 | % |  | | 71 | |  | | 3 | % |  | | 73 | |  | | 3 | % |

|

The Chemical Products segment markets its products both directly to customers and through distributors. It also utilizes a number of "e-channels", including its website at www.chemvip.com, as well as system to system linking through its industry portal, Elemica.

In the acetyls business line, the methanol market is regional and highly dependent on the demand for products made from methanol. In addition to its own demands for methanol, Celanese's production is sold to a few regional customers who are manufacturers of chemical intermediates and to a lesser extent, by manufacturers in the wood products industry. Celanese typically enters into short-term contracts for the sale of methanol. Acetic acid and vinyl acetate monomer are global businesses which have several large customers. Generally, Celanese supplies these global customers under multi-year contracts. The customers of acetic acid and vinyl acetate monomer produce polymers used in water-based paints, adhesives, paper coatings, film modifiers and textiles. Celanese has long-standing relationships with most of these customers.

122

Polyvinyl alcohol is sold to a diverse group of regional and multinational customers mainly under single year contracts. The customers of the polyvinyl alcohol business line are primarily engaged in the production of adhesives, paper, films, building products, and textiles.

Emulsions and emulsion powders are sold to a diverse group of regional and multinational customers. Customers for emulsions are manufacturers of water-based quality surface coatings, adhesives, and non-woven textiles. Customers for emulsion powders are primarily manufacturers of building products.

Acetyl derivatives and polyols are sold to a diverse group of regional and multinational customers both under multi-year contracts and on the basis of long-standing relationships. The customers of acetyl derivatives are primarily engaged in the production of paints, coatings and adhesives. In addition to its own demand for acetyl derivatives to produce cellulose acetate, Celanese sells acetyl derivatives to other participants in the cellulose acetate industry. Celanese manufactures formaldehyde for its own use as well as for sale to a few regional customers that include manufacturers in the wood products and chemical derivatives industries. The sale of formaldehyde is based on both long and short term agreements. Polyols are sold globally to a wide variety of customers, primarily in the coatings and resins and the specialty products industries. Oxo products are sold to a wide variety of customers, primarily in the construction and automotive industries. The oxo market is characterized by oversupply and numerous competitors.

The specialties business line primarily serves global markets in the synthetic lubricant, agrochemical, rubber processing and other specialty chemical areas. Much of the specialties business line involves "one customer, one product" relationships, where the business develops customized products with the customer, but the specialties business line also sells several chemicals which are priced more like commodity chemicals.

Competition

Principal competitors of Celanese in the Chemical Products segment include Acetex Corporation, Air Products and Chemicals, Inc., Atofina S.A., BASF, Borden Chemical, Inc., BP p.l.c. ("BP"), Chang Chun Petrochemical Co., Ltd., Daicel, Dow, Eastman Chemical Corporation ("Eastman"), E. I. Du Pont de Nemours and Company ("DuPont"), Methanex Corporation ("Methanex"), Millennium Chemicals Inc. ("Millennium"), Nippon Goshei, Perstorp Inc., Rohm & Haas Company, Showa Denko K.K., and Kuraray Co. Ltd.

Technical Polymers Ticona

Ticona develops, produces and supplies a broad portfolio of high performance technical polymers. The following table lists key Ticona products, their trademarks, and their major markets.

|  |  |  |  |  |  |

| Key Ticona Products |  | Major Markets |

| Hostaform/Celcon (Polyacetals) |  | Automotive, Electronics, Consumer Products and Medical |

| GUR (Ultra High Molecular Weight Polyethylene or PE-UHMW) |  | Profiles, Battery Separators, Industrial Specialties. Filtration, Coatings and Medical |

| Celanex/Vandar/Riteflex/Impet (Polyester Engineering Resins) |  | Electrical, Electronics, Automotive, Appliances and Consumer Products |

| Vectra (Liquid Crystal Polymers) |  | Electronics, Telecommunications, Medical and Consumer Products |

| Fortron (Polyphenylene Sulfide or PPS) |  | Electronics, Automotive and Industrial |

| Celstran, Compel (long fiber reinforced thermoplastics) |  | Automotive and Industrial |

|

Ticona's technical polymers have chemical and physical properties enabling them, among other things, to withstand high temperatures, resist chemical reactions with solvents and resist fracturing or stretching. These products are used in a wide range of performance-demanding applications in the automotive and electronics sectors and in other consumer and industrial goods, often replacing metal or glass.

123

Ticona is an innovation-oriented business. Ticona focuses its efforts on developing new markets and applications for its product lines, often developing custom formulations to satisfy the technical and processing requirements of a customer's applications. For example, Ticona has worked closely with fuel system suppliers to develop an acetal copolymer with the chemical and impact resistance necessary to withstand exposure to hot diesel fuels in the new generation of common rail diesel engines. The product can also be used in automotive fuel sender units where it remains stable at the high operating temperatures present in direct-injection diesel engines. Ticona is also developing products such as Topas, a metallocene catalyst based cycloolefin copolymer, or COC. Topas is developing markets and applications where transparency, high temperature resistance and water vapor barrier properties are key requirements.

Ticona's customer base consists primarily of a large number of plastic molders and component suppliers, which are often the primary suppliers to original equipment manufacturers, or OEMs. Ticona works with these molders and component suppliers as well as directly with the OEMs to develop and improve specialized applications and systems.

Prices for most of these products, particularly specialized product grades for targeted applications, generally reflect the value added in complex polymer chemistry, precision formulation and compounding, and the extensive application development services provided. The specialized product lines are not particularly susceptible to cyclical swings in pricing. Polyacetals pricing, mainly in standard grades, is, however, somewhat more price competitive, with many minimum-service providers competing for volume sales.

Product Lines

Polyacetals are sold under the trademarks Celcon in North America and Hostaform in Europe and the rest of the world. Polyplastics and Korea Engineering Plastics, in which Ticona holds 45 and 50 percent ownership interests, respectively, are leading suppliers of polyacetals and other engineering resins in the Asia/Pacific region. Polyacetals are used for mechanical parts, including door locks and seat belt mechanisms, in automotive applications and in electrical, consumer and industrial applications such as keyboards, ski bindings, and gears for appliances.

The primary raw material for polyacetals is formaldehyde, which is manufactured from methanol. Ticona currently purchases formaldehyde and methanol in the United States from Celanese's Chemical Products segment and, in Europe, manufactures formaldehyde from purchased methanol.

GUR, an ultra high molecular weight polyethylene or PE-UHMW, is an engineered material used in heavy-duty automotive and industrial applications such as car battery separator panels and industrial conveyor belts, as well as in specialty medical and consumer applications, such as porous tips for marker pens, sports equipment and prostheses. The basic raw material for GUR is ethylene.

Polyesters such as Celanex polybutylene terephthalate, or PBT, and Vandar, a series of PBT-polyester blends, are used in a wide variety of automotive, electrical and consumer applications, including ignition system parts, radiator grilles, electrical switches, appliance housings, boat fittings and perfume bottle caps. Impet-Hipolyethylene terephthalate, or PET, is a polyester which exhibits rigidity and strength useful in large injection molded part applications, as well as high temperature resistance in automotive or electrical/electronic applications. Riteflex is a co-polyester which adds flexibility to the range of high performance properties offered by Ticona's other products. Raw materials for polyesters vary. Base monomers, such as dimethyl terephthalate or DMT and PTA, are widely available with pricing dependent on broader polyester fiber and packaging resins market conditions. Smaller volume specialty co-monomers for these products are typically supplied by a few companies.

Liquid crystal polymers, or LCPs, such as Vectra, are used in electrical and electronics applications and for precision parts with thin walls and complex shapes. Fortron, a polyphenylene sulphide, or PPS, product, is used in a wide variety of automotive and other applications, especially those requiring heat and/or chemical resistance, including fuel system parts, radiator pipes and halogen lamp housings, and often replaces metal in these demanding applications. Fortron is manufactured by Fortron Industries, Ticona's 50-50 joint venture with Kureha Chemicals Industry of Japan. Celstran and Compel are long fiber

124

reinforced thermoplastics, which impart extra strength and stiffness, making them more suitable for larger parts than conventional thermoplastics.

Facilities

Ticona has polymerization, compounding and research and technology centers in Germany and the United States, as well as additional compounding facilities in Brazil. Ticona's Kelsterbach, Germany production site is located in close proximity to one of the sites being considered for a new runway under the Frankfurt airport's expansion plans. The construction of this particular runway could have a negative effect on the plant's current production capacity and future development. While the state government and the owner of the airport promote the expansion of this option, it is uncertain whether this option is in accordance with applicable laws. Neither the final outcome of this matter nor its timing can be predicted at this time.

Capital Expenditures

Ticona's capital expenditures were $56 million, $61 million, and $86 million for the years 2003, 2002 and 2001, respectively. Ticona had expenditures in each of these three years relating primarily to efficiency and safety improvement-related items associated with the normal operations of the business. In addition, Ticona had expenditures in 2001 and 2002 for significant capacity expansions at its Bishop, Texas and Shelby, North Carolina sites. Ticona doubled its U.S. capacity for GUR PE-UHMW by building a new 30,000 metric tons per year facility in Bishop, Texas, replacing the existing plant in Bayport, Texas. The new plant came on stream in the third quarter of 2002. Ticona is expanding its Oberhausen GUR PE-UHMW capacity by 10,000 metric tons per year. This expansion is expected to come on stream in 2004. In the fourth quarter of 2002, Ticona increased capacity by 6,000 metric tons at its polyacetals facility in Kelsterbach, Germany and commenced a further increase of 17,000 metric tons, which will come on stream in 2004. The capital expenditures for 2003 also include construction of a new administrative building in Florence, Kentucky and integration of a company-wide SAP system.

Markets

The following table illustrates the destination of the net sales of the Technical Polymers Ticona segment by geographic region for the years ending December 31, 2003, 2002 and 2001.

Net Sales to External Customers by Destination — Technical Polymer Ticona

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| |  | $ |  | % of

Segment |  | $ |  | % of

Segment |  | $ |  | % of

Segment |

| |  | (in millions, except percentages) |

| North America |  | | 350 | |  | | 45 | % |  | | 319 | |  | | 48 | % |  | | 316 | |  | | 50 | % |

| Europe/Africa |  | | 373 | |  | | 49 | % |  | | 300 | |  | | 46 | % |  | | 284 | |  | | 45 | % |

| Asia/Australia |  | | 19 | |  | | 3 | % |  | | 18 | |  | | 3 | % |  | | 12 | |  | | 2 | % |

| Rest of World |  | | 20 | |  | | 3 | % |  | | 19 | |  | | 3 | % |  | | 20 | |  | | 3 | % |

|

Ticona's sales in the Asian market are made through its joint ventures, Polyplastics, Korea Engineering Plastics and Fortron Industries, which are accounted for under the equity method and therefore not included in Ticona's consolidated net sales. If Ticona's portion of the sales made by these joint ventures were included in the chart above, the percentage of sales sold in Asia/Australia would be substantially higher. A number of Ticona's polyacetals customers, particularly in the appliance, electrical components, toys and certain sections of the electronics/telecommunications fields, have moved tooling and molding operations to Asia, particularly southern China. To meet the expected increased demand in this region, Ticona, along with Polyplastics, Mitsubishi Gas Chemical Company Inc., and Korea Engineering Plastics agreed on a joint venture to construct and operate a world-scale 60,000 metric ton polyacetals facility in China. When completed, Ticona will indirectly own an approximate 38 percent interest in this joint venture. Work on the new facility commenced in July 2003, and the new plant is expected to start operations in the second quarter of 2005.

125

Ticona's principal customers are suppliers to the automotive industries as well as industrial suppliers. These customers primarily produce engineered products, and Ticona works closely with its customers to assist them to develop and improve specialized applications and systems. Ticona has long-standing relationships with most of its major customers, but it also uses distributors for most of its major products, as well as a number of electronic channels, such as its BuyTiconaDirect on-line ordering system, and other electronic marketplaces to reach a larger customer base. For most of Ticona's product lines, contracts with customers typically have a term of one to two years. A significant swing in the economic conditions of the end markets of Ticona's principal customers could significantly affect the demand for Ticona's products.

Competition

Ticona's principal competitors include BASF, Bayer AG, DuPont, General Electric Company and Solvay S.A. Smaller regional competitors include Asahi Kasei Corporation, DSM NV, Mitsubishi Plastics, Inc., Chevron Phillips Chemical Company, L.P., Braskem S.A., Teijin and Toray Industries Inc.

Acetate Products

The Acetate Products segment consists of two major business lines, acetate filter products and acetate filament. Both these business lines use the "Celanese" brand to market their products. The following table lists key products of the Acetate Products segment and their major markets.

|  |  |  |  |  |  |

| Key Acetate Products |  | Major Markets |

| Acetate Tow |  | Cigarette Filters |

| Acetate Filament |  | Fashion Apparel, Linings and Home Furnishings |

|

Business Lines

Products from the two major business lines are found in cigarette filters, fashion apparel, linings and home furnishings. According to the 2002 Stanford Research Institute International Chemical Economics Handbook, Celanese is the world's leading producer of acetate fibers, including production of its joint ventures in Asia.

Celanese produces acetate flake by processing wood pulp with acetic anhydride. Celanese purchases wood pulp that is made from reforested trees from major suppliers and produces acetic anhydride internally. The acetate flake is then further processed into acetate fiber in the form of a tow band or filament.

The acetate filter products business line produces acetate tow, which is used primarily in cigarette filters. The acetate tow market continues to be characterized by stability and slow growth.

Celanese has a 30 percent interest in three manufacturing joint ventures with Chinese state-owned enterprises that produce cellulose acetate flake and tow in China. Additionally, in 2003, 21 percent of Celanese's sales of acetate tow were sold to the state-owned tobacco enterprises, the largest single market for acetate tow in the world. As demand for acetate tow in China exceeds local supply, Celanese and its Chinese partners have agreed to expand capacity at their three manufacturing joint ventures. Although increases in manufacturing capacity of the joint ventures will reduce, beginning in 2005, the volume of Celanese's future direct sales of cellulose acetate tow to China, the dividends paid by the joint ventures to Celanese are projected to increase once the expansions are complete in 2007.

The acetate filament business line is a supplier to the textile industry. Demand for acetate filament is dependent on fashion trends and the world economy. Although the popularity of knit garments in the U.S. fashion industry has had a positive effect on demand for acetate filament, global demand for lining and shell material has declined due to fashion trends, such as the prevalence of casual office wear. In addition, market conditions in North America and Asia have significantly affected the global textile business and negatively affected consumption of all fibers, including acetate. Product substitution from acetate filament to polyester fibers and other filaments has also occurred. Celanese continues to work more closely with downstream apparel manufacturers and major retailers to increase awareness of acetate's suitability for high-end fashion apparel due to its breathable and luxurious qualities.

126

The Acetate Products segment is continuing its cost reduction and operations improvement efforts. These efforts are directed toward reducing costs while achieving higher productivity of employees and equipment. In addition to restructuring activities undertaken in prior periods, Celanese outsourced the operation and maintenance of its utility operations at the Narrows, Virginia and Rock Hill, South Carolina plants in 2003. Celanese also commenced the relocation and the closure of its Charlotte, North Carolina administrative and research and development facility to the Rock Hill and Narrows locations. The relocation will be completed in 2004. Celanese is continuing to assess its worldwide acetate production capacity, and it is probable that Celanese will close certain facilities in the latter half of this decade.

Facilities

The Acetate Products segment has production sites in the United States, Canada, Mexico and Belgium, and participates in three manufacturing joint ventures in China.

Capital Expenditures

The Acetate Products segment's capital expenditures were $39 million, $30 million, and $31 million for the years 2003, 2002 and 2001, respectively. The capital expenditures incurred during these years related primarily to efficiency, environmental and safety improvement-related items associated with the normal operations of the business. Capital expenditures in 2003 also included the integration of a company-wide SAP system.

Markets

The following table illustrates the destination of the net sales of the Acetate Products segment by geographic region for the years ending December 31, 2003, 2002 and 2001.

Net Sales to External Customers by Destination — Acetate Products

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| |  | $ |  | % of

Segment |  | $ |  | % of

Segment |  | $ |  | % of

Segment |

| |  | (in millions, except percentages) |

| North America |  | | 189 | |  | | 29 | % |  | | 188 | |  | | 30 | % |  | | 226 | |  | | 33 | % |

| Europe/Africa |  | | 192 | |  | | 29 | % |  | | 167 | |  | | 26 | % |  | | 149 | |  | | 22 | % |

| Asia/Australia |  | | 258 | |  | | 40 | % |  | | 256 | |  | | 41 | % |  | | 287 | |  | | 42 | % |

| Rest of World |  | | 16 | |  | | 2 | % |  | | 21 | |  | | 3 | % |  | | 20 | |  | | 3 | % |

|

Sales in the acetate filter products industry are principally to the major tobacco companies that account for a majority of worldwide cigarette production. Celanese's contracts with most of its customers, including its largest customer, with whom it has a long-standing relationship, are entered into on an annual basis. In recent years, the cigarette industry has experienced consolidation. In the acetate filter products industry, changes in the cigarette manufacturer customer base and shifts among suppliers to those customers have had significant effects on acetate tow prices in the industry as a whole.

In the acetate filament industry, Celanese's sales are made to textile companies that range in size from the largest in the industry to others which are quite small. The textile companies either weave or knit the acetate filament yarns to produce greige fabrics. The greige fabrics are then dyed and finished, either by the greige fabrics manufacturer or by converters who buy the fabrics and contract with dyeing and finishing companies to process the fabrics. The finished fabrics are sold to manufacturers who cut and sew the fabrics into apparel for retail stores.

The textile industry, in particular the apparel portion of the industry, continues to undergo structural changes as production moves from high-wage to low-wage countries. In recent years, this has resulted in a changing customer base for all participants in the textile chain from the yarn manufacturer to the garment manufacturer. Market conditions in North America and Asia have reduced profitability in the

127

global textile industry. Many North American manufacturers in the textile chain have reduced capacity, vertically integrated with other manufacturers or exited from the business. Although demand in the Asian market continues to rise, intense competition has eroded pricing and reduced profitability. Product substitution to polyester and other fibers has also occurred. Celanese's acetate filament business has been adversely affected by these trends in the industry.

Celanese is participating in the expanding Asian filament market through its marketing alliance with Teijin Limited. Teijin agreed to assist Celanese with qualifying its acetate filament with customers beginning in January 2002 and Celanese has successfully transitioned a majority of that business. Teijin discontinued acetate filament production in March 2002.

Competition

Principal competitors in the Acetate Products segment include Acordis Industrial Nederland bv, Daicel, Eastman, Mitsubishi Rayon Company, Limited, Novaceta S.p.a., and Rhodia S.A. ("Rhodia").

Performance Products

The Performance Products segment consists of the food ingredients business conducted by Nutrinova.

This business uses its own trade names to conduct business. The following table lists key products of the Performance Products segment and their major markets.

|  |  |  |  |  |  |

| Key Performance Products |  | Major Markets |

| Sunett (Acesulfame-K) |  | Beverages, Confections, Dairy Products and Pharmaceuticals |

| Sorbates |  | Dairy Products, Baked Goods, Beverages, Animal Feeds, Spreads and Delicatessen Products |

| |  | |

|

Business Lines

Nutrinova's food ingredients business consists of the production and sale of high intensity sweeteners and food protection ingredients, such as sorbic acids and sorbates, as well as the resale of dietary fiber products worldwide and the resale of other food ingredients in Japan, Australia, Mexico and the United States.

Acesulfame-K, a high intensity sweetener marketed under the trademark Sunett, is used in a variety of beverages, confections and dairy products throughout the world. The primary raw materials for this product are diketene and sulfur trioxide. Sunett pricing for targeted applications reflects the value added in the precision formulations and extensive technical services provided. Nutrinova's strategy is to be the most reliable and highest quality producer of this product, to develop new applications for the product and to expand into new markets. Nutrinova maintains a strict patent enforcement strategy, which has resulted in favorable outcomes in a number of patent infringement matters in Europe and the United States. Nutrinova's European and U.S. patents for making Sunett expire in 2005.

Nutrinova's food protection ingredients are used in foods, beverages and personal care products. The primary raw materials for these products are ketene and crotonaldehyde. Sorbates pricing is extremely sensitive to demand and industry capacity and is not necessarily dependent on the prices of raw materials.

Facilities

Nutrinova has production facilities in Germany, as well as sales and distribution facilities in all major world markets.

Capital Expenditures

The Performance Products segment's capital expenditures were $2 million, $4 million, and $2 million for the years 2003, 2002 and 2001, respectively. The capital expenditures incurred during these years related to efficiency and safety improvement items associated with the normal operation of the business.

128

Markets

The following table illustrates the destination of the net sales of the Performance Products segment by geographic region for the years ending December 31, 2003, 2002 and 2001.

Net Sales to External Customers by Destination — Performance Products

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Year Ended December 31, |

| |  | 2003 |  | 2002 |  | 2001 |

| |  | $ |  | % of

Segment |  | $ |  | % of

Segment |  | $ |  | % of

Segment |

| |  | (in millions, except percentages) |

| North America |  | | 73 | |  | | 43 | % |  | | 56 | |  | | 37 | % |  | | 51 | |  | | 36 | % |

| Europe/Africa |  | | 59 | |  | | 35 | % |  | | 55 | |  | | 36 | % |  | | 52 | |  | | 37 | % |

| Asia/Australia |  | | 28 | |  | | 17 | % |  | | 25 | |  | | 17 | % |  | | 23 | |  | | 16 | % |

| Rest of World |  | | 9 | |  | | 5 | % |  | | 15 | |  | | 10 | % |  | | 16 | |  | | 11 | % |

| |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

|

Nutrinova directly markets Sunett® primarily to a limited number of large multinational and regional customers in the beverage and food industry under long-term and annual contracts. Nutrinova markets food protection ingredients primarily through regional distributors to small and medium sized customers and directly through regional sales offices to large multinational customers in the food industry. Nutrinova is currently developing markets and new applications for its omega-3 fatty acid, docosahexanoeic acid, Nutrinova — DHA™. Potential application areas include functional foods and beverages, dietary supplements, clinical nutrition and pharmaceutical end-uses.

Competition

The principal competitors for Nutrinova's Sunett sweetener are Holland Sweetener Company, The Nutrasweet Company, Ajinomoto Co., Inc. and several Chinese manufacturers. In sorbates, Nutrinova competes with Nantong AA, Daicel, Chisso Corporation, Yu Yao/Ningbo, Yancheng AmeriPac and other Japanese and Chinese manufacturers of sorbates.

Other Activities

Other Activities includes revenues mainly from the captive insurance companies, Celanese Ventures GmbH, Celanese Advanced Materials, Inc., as well as corporate activities, several service companies and other ancillary businesses, which do not have significant sales.

Celanese's two wholly-owned captive insurance companies are a key component of Celanese's global risk management program, as well as a form of self insurance for the property, liability and workers compensation risks of Celanese. The captive insurance companies issue insurance policies to Celanese subsidiaries to provide consistent coverage amid fluctuating costs in the insurance market and to lower long-term insurance costs by avoiding or reducing commercial carrier overhead and regulatory fees. The captive insurance companies issue insurance policies and coordinate claims handling services with third party service providers. They retain risk at levels approved by the board of management and obtain reinsurance coverage from third parties to limit the net risk retained. One of the captive insurance companies also insures certain third party risks.

Celanese Ventures promotes research projects that lie outside Celanese's principal businesses or, due to their long-term perspective and widely-spread application possibilities, cannot be operated by the principal businesses alone. Celanese Ventures is presently active in developing high temperature membrane electrode assemblies or MEAs for fuel cells, and it inaugurated the world's first pilot plant for MEAs at Celanese's Frankfurt site. Celanese Ventures is also developing new catalysts for high performance polymers. Celanese Advanced Materials consists of the high performance polymer PBI and the Vectran polymer fiber product lines.

Acquisitions and Divestitures

Celanese Acquired the Following Businesses:

|  |

| • | As a part of its strategy of forward integration, Celanese purchased the European emulsions and global emulsion powders business of Clariant AG on December 31, 2002 valued at $154 million. |

129

Celanese Divested the Following Businesses:

|  |

| • | In September 2003, Celanese and Dow reached an agreement for Dow to purchase the acrylates business of Celanese. This transaction was completed in February 2004. |

|  |

| • | In December 2003, the Ticona segment completed the sale of its nylon business line to BASF. |

|  |

| • | Effective January 1, 2002, Celanese sold its interest in InfraServ GmbH & Co. Deponie Knapsack KG ("Deponie") to Trienekens AG. |

|  |

| • | In December 2002, Celanese sold Trespaphan, its global oriented polypropylene film business, to a consortium consisting of the Dor-Moplefan Group and Bain Capital, Inc. |

|  |

| • | During 2002, Celanese sold its global allylamines and U.S. alkylamines businesses to U.S. Amines Ltd. |

|  |

| • | In January 2001, Celanese sold its investment in Infraserv GmbH & Co. Muenchsmuenster KG to Ruhr Oel GmbH. |

|  |

| • | In January 2001, Celanese sold its CelActiv™ and Hoecat catalyst business to Synetix. |

|  |

| • | In April 2001, Celanese sold NADIR filtration GmbH, formerly Celgard GmbH, to KCS Industrie Holding AG. |

|  |

| • | In June 2001, Celanese sold its ownership interest in Hoechst Service Gastronomie GmbH to Eurest Deutschland GmbH and Infraserv GmbH & Co. Hoechst KG. |

|  |

| • | In October 2001, Celanese sold its ownership interest in Covion Organic Semiconducters GmbH, a developer and producer of light-emitting organic polymers, to Avecia, its joint venture partner in Covion Organic Semiconductors GmbH. |

For further information on the acquisitions and divestitures discussed above, see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Summary of Consolidated Results — 2003 Compared with 2002 — Discontinued Operations for the Years Ended December 31, 2003, 2002 and 2001" and Note 7 to the Consolidated Financial Statements.

Raw Materials and Energy

Celanese purchases a variety of raw materials from sources in many countries for use in its production processes. Celanese has a policy of maintaining, when available, multiple sources of supply for materials. However, some of Celanese's individual plants may have single sources of supply for some of their raw materials, such as carbon monoxide and acetaldehyde. In 2003, a primary U.S. supplier of wood pulp to the Acetate Products segment shut down its pulp facility. This closure resulted in increased operating costs for expenses associated with qualifying wood pulp from alternative suppliers and significant increases in wood pulp inventory levels. Celanese has secured alternative sources of wood pulp supply. Although Celanese has been able to obtain sufficient supplies of raw materials, there can be no assurance that unforeseen developments will not affect Celanese's raw material supply. Even if Celanese has multiple sources of supply for a raw material, there can be no assurance that these sources can make up for the loss of a major supplier. Nor can there be any guarantee that profitability will not be affected should Celanese be required to qualify additional sources of supply in the event of the loss of a sole supplier. In addition, the price of raw materials varies, often substantially, from year to year.

A substantial portion of Celanese's products and raw materials are commodities whose prices fluctuate as market supply/demand fundamentals change. For example, the volatility of prices for natural gas and ethylene (whose cost is in part linked to natural gas prices) has increased in recent years. Celanese's production facilities rely largely on coal, fuel oil, natural gas and electricity for energy. Most of the raw materials for Celanese's European operations are centrally purchased by a subsidiary of Celanese, which also buys raw materials on behalf of third parties. Celanese manages its exposure through the use of derivative instruments and forward purchase contracts for commodity price hedging, entering into long-term supply agreements, and multi-year purchasing and sales agreements. Celanese's policy, for the majority of its natural gas and butane requirements, allows entering into supply agreements and

130

forward purchase or cash-settled swap contracts, generally for up to 24 months. During 2003, Celanese entered into forward purchase and cash-settled swap contracts for approximately 50 percent of its estimated natural gas requirements, generally for up to three to six months forward. As these forward contracts expire, Celanese may be exposed to future price fluctuations if the forward purchase contracts are not replaced, or if it elects to replace them, Celanese may have to do so at higher costs. Although Celanese seeks to offset increases in raw material prices with corresponding increases in the prices of its products, it may not be able to do so, and there may be periods when such product price increases lag behind raw material cost increases. In the future, Celanese may modify its practice of purchasing a portion of its commodity requirements forward, and consider utilizing a variety of other raw material hedging instruments in addition to forward purchase contracts in accordance with changes in market conditions.

Research and Development

All of Celanese's businesses conduct research and development activities to increase competitiveness. Celanese's Technical Polymers Ticona and Performance Products segments in particular are innovation-oriented businesses that conduct research and development activities to develop new, and optimize existing, production technologies, as well as to develop commercially viable new products and applications.

The Chemical Products segment has been focusing on improving core production technologies, such as improving catalyst development, and supporting both debottlenecking and cost reduction efforts.

The Acetate Products segment has been concentrating on developing new fabrics using acetate filament and new applications for other acetate materials, such as their use in disposable consumer materials.