UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2009

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission File Number 001-34018

(Exact name of registrant as specified in its charter)

| Nevada | | 98-0479924 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

300, 611 10th Avenue SW

Calgary, Alberta, Canada

(Address of principal executive offices, including zip code)

(403) 265-3221

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | NYSE Amex (formerly American Stock Exchange) |

| | Toronto Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨

Non-accelerated filer ¨ (do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $789,170,812 (including shares issuable upon exercise of exchangeable shares). Aggregate market value excludes an aggregate of 1,082,633 shares of common stock and 11,633,442 shares issuable upon exercise of exchangeable shares held by officers and directors and by each person known by the registrant to own 5% or more of the outstanding common stock on such date. Exclusion of shares held by any of these persons should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

On February 22, 2010, the following numbers of shares of the registrant’s capital stock were outstanding: 227,414,754 shares of the registrant’s Common Stock, $0.001 par value; one share of Special A Voting Stock, $0.001 par value, representing 8,642,857 shares of Gran Tierra Goldstrike Inc., which are exchangeable on a 1-for-1 basis into the registrant’s Common Stock; and one share of Special B Voting Stock, $0.001 par value, representing 12,581,523 shares of Gran Tierra Exchangeco Inc., which are exchangeable on a 1-for-1 basis into the registrant’s Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this report, to the extent not set forth herein, is incorporated by reference from the Registrant’s definitive proxy statement relating to the 2010 annual meeting of stockholders, which definitive proxy statement will be filed with the Securities and Exchange Commission within 120 days after the fiscal year to which this Report relates.

GRAN TIERRA ENERGY INC.

ANNUAL REPORT ON FORM 10-K

Year ended December 31, 2009

TABLE OF CONTENTS

| | | | | Page No. |

| PART I | | | | |

| Item 1. | | Business | | 3 |

| Item 1A. | | Risk Factors | | 13 |

| Item 1B. | | Unresolved Staff Comments | | 23 |

| Item 2. | | Properties | | 23 |

| Item 3. | | Legal Proceedings | | 35 |

| Item 4. | | Reserved | | 35 |

| PART II | | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 36 |

| Item 6. | | Selected Financial Data | | 39 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 40 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 62 |

| Item 8. | | Financial Statements and Supplementary Data | | 64 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 95 |

| Item 9A. | | Controls and Procedures | | 95 |

| Item 9A(T) | | Controls and Procedures | | 97 |

| Item 9B. | | Other Information | | 97 |

| PART III | | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | 97 |

| Item 11. | | Executive Compensation | | 97 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 97 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 98 |

| Item 14. | | Principal Accounting Fees and Services | | 98 |

| PART IV | | | | |

| Item 15. | | Exhibits, Financial Statement Schedules | | 98 |

| SIGNATURES | | 99 |

This Annual Report on Form 10-K, particularly in Item 1. “Business”, Item 2 “Properties” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the Securities Act) and Section 21E of the Securities Exchange Act of 1934 (the Exchange Act). All statements other than statements of historical facts included in this Annual Report on Form 10-K including without limitation statements in the Management’s Discussion and Analysis of Financial Condition and Results of Operations regarding our financial position, estimated quantities and net present values of reserves, business strategy, plans and objectives of our management for future operations, covenant compliance, capital spending plans and those statements preceded by, followed by or that otherwise include the words “believe”, “expects”, “anticipates”, “intends”, “estimates”, “projects”, “target”, “goal”, “plans”, “objective”, “should”, or similar expressions or variations on such expressions are forward-looking statements. We can give no assurances that the assumptions upon which the forward-looking statements are based will prove to be correct and because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by the forward-looking statements. There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements, including, but not limited to, those set out in Part I, Item 1A “Risk Factors” in this Annual Report on Form 10-K. The information included herein is given as of the filing date of this Form 10-K with the Securities and Exchange Commission (“SEC”) and, except as otherwise required by the federal securities laws, we disclaim any obligations or undertaking to publicly release any updates or revisions to any forward-looking statement contained in this Annual Report on Form 10-K to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Item 1. Business

General

Gran Tierra Energy Inc. together with its subsidiaries (“Gran Tierra” or “we”) is an independent international energy company engaged in oil and gas acquisition, exploration, development and production. We own oil and gas properties in Colombia, Argentina and Peru. A detailed description of our properties can be found under Item 2 “Properties”. All dollar ($) amounts referred to in this Form 10-K are United States (U.S.) dollars, unless otherwise indicated.

On November 14, 2008, we completed the acquisition of all of the outstanding common stock of Solana Resources Limited ("Solana") pursuant to a plan of arrangement under the Business Corporations Act (Alberta). Solana was an international resource company engaged in the acquisition, exploration, development and production of oil and natural gas. Solana was incorporated in Canada with its head office in Calgary, Alberta, Canada.

In 2009, our geographic focus was on South America. We focused on development of producing fields and generation of exploration prospects in Colombia. In Argentina we maintained existing production and worked on the evaluation of a natural gas project. In Peru we worked on our Environmental Impact Assessments and on evaluating data in order to prepare for 2010’s seismic acquisition and drilling program. We also expanded our geographic focus by opening an office in Brazil, and also establishing a business development team in Calgary to pursue opportunities in Brazil.

Our principal executive offices are located at 300, 611-10th Avenue S.W., Calgary, Alberta, Canada. The telephone number at our principal executive office is (403) 265-3221. Our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments to such reports and all other filings pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, which we make available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC, are available free of charge to the public on our website www.grantierra.com. To access our SEC filings, select SEC Filings from the investor relations menu on our website, which will provide a list of our SEC filings. Our website address is provided solely for informational purposes. We do not intend, by this reference, that our website should be deemed to be part of this Annual Report. Any materials we have filed with the SEC may be read and/or copied at the SEC’s Public Reference Room at 100 F Street N.E. Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding us. The SEC’s website address is www.SEC.gov.

The Oil and Gas Business

In the discussion that follows, and in Item 2 “Properties”, we discuss our interests in wells and/or acres in gross and net terms. Gross oil and natural gas wells or acres refer to the total number of wells or acres in which we own a working interest. Net oil and natural gas wells or acres are determined by multiplying gross wells or acres by the working interest that we own in such wells or acres. Working interest refers to the interest we own in a property, which entitles us to receive a specified percentage of the proceeds of the sale of oil and natural gas, and also requires us to bear a specified percentage of the cost to explore for, develop and produce that oil and natural gas. A working interest owner that owns a portion of the working interest may participate either as operator or by voting his/her percentage interest to approve or disapprove the appointment of an operator and the drilling and other major activities in connection with the development of a property.

We also refer to royalties and farm-in or farm-out transactions. Royalties are paid to governments on the production of oil and gas, either in kind or in cash. Royalties also include overriding royalties paid to third parties. Our reserves, production and sales are reported net after deduction of royalties. Farm-in or farm-out transactions refer to transactions in which a portion of a working interest is sold by an owner of an oil and gas property. The transaction is labeled a farm-in by the purchaser of the working interest and a farm-out by the seller of the working interest. Payment in a farm-in or farm-out transaction can be in cash or in-kind by committing to perform and/or pay for certain work obligations.

Several items that relate to oil and gas operations, including aeromagnetic and aerogravity surveys, seismic operations and several kinds of drilling and other well operations, are also discussed in this document.

Aeromagnetic and aerogravity surveys are a remote sensing process by which data is gathered about the subsurface of the earth. An airplane is equipped with extremely sensitive instruments that measure changes in the earth's gravitational and magnetic field. Variations as small as 1/1,000th in the gravitational and magnetic field strength and direction can indicate structural changes below the ground surface. These structural changes may influence the trapping of hydrocarbons. These surveys are an inexpensive way of gathering data over large regions.

Seismic data is used by oil and natural gas companies as their principal source of information to locate oil and natural gas deposits, both for exploration for new deposits and to manage or enhance production from known reservoirs. To gather seismic data, an energy source is used to send sound waves into the subsurface strata. These waves are reflected back to the surface by underground formations, where they are detected by geophones which digitize and record the reflected waves. Computers are then used to process the raw data to develop an image of underground formations. 2-D Seismic is the standard acquisition technique used to image geologic formations over a broad area. 2-D seismic data is collected by a single line of energy sources which reflect seismic waves to a single line of geophones. When processed, 2-D seismic data produces an image of a single vertical plane of sub-surface data. 3-D seismic data is collected using a grid of energy sources, which are generally spread over several square miles. A 3-D survey produces a three dimensional image of the subsurface geology by collecting seismic data along parallel lines and creating a cube of information that can be divided into various planes, thus improving visualization. Consequently, 3-D seismic data is generally considered a more reliable indicator of potential oil and natural gas reservoirs in the area evaluated.

Wells drilled are classified as either exploration or development. An exploration well is a well drilled in search of a previously undiscovered hydrocarbon-bearing reservoir. A development well is a well drilled to develop a hydrocarbon-bearing reservoir that is already discovered. Exploration and development wells are tested during and after the drilling process to determine if they have oil or natural gas that can be produced economically in commercial quantities. If they do, the well will be completed for production, which could involve any range of a wide variety of equipment, the specifics of which depend on a number of technical geological and engineering considerations. If there is no oil or natural gas (a “dry” well), or there is oil and natural gas but the quantities are too small and/or too difficult to produce, the well will be abandoned. Abandonment is a completion operation that involves closing or “plugging” the well and remediating the drilling site. An injector well is a development well that will be used to inject fluid into a reservoir to increase production from other wells.

Workover is a term used to describe remedial operations on a previously completed well to clean, repair and/or maintain the well for the purposes of increasing or restoring production. It could include well deepening, plugging portions of the well, working with cementing, scale removal, acidizing, fracture stimulation, changing tubulars or installing/changing equipment to provide artificial lift.

BOPD is a commonly used abbreviation in the oil and gas business which means barrels of oil per day.

In our discussion below, we refer to various oil fields and blocks. A more detailed discussion of these areas is set forth in Item 2 of this Form 10-K.

Development of Our Business

We made our initial acquisition of oil and gas producing and non-producing properties in Argentina in September 2005. During 2006, we acquired oil and gas producing and non-producing assets in Colombia, non-producing assets in Peru and additional properties in Argentina. During 2008, we increased our holdings in Colombia through our acquisition of Solana. In 2009 we added exploration blocks by converting our two Technical Evaluation Areas to three exploration and exploitation blocks. As a result of these acquisitions we hold as of December 31, 2009:

| | · | 1,056,803 gross acres in Colombia (753,376 net) covering twelve Exploration and Production contracts, three of which are producing and all but one are operated by Gran Tierra; |

| | · | 1,628,473 gross acres (1,290,644 net) in Argentina covering seven Exploration and Production contracts, five of which are producing, and all but one are operated by Gran Tierra; and |

| | · | 3,436,040 acres in Peru owned 100% by Gran Tierra, which constitute frontier exploration, in two Exploration and Production contracts operated by Gran Tierra. |

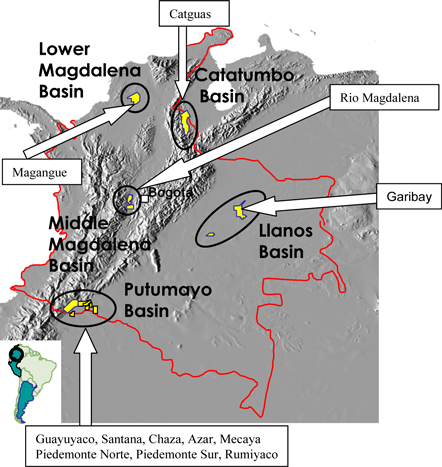

Colombia

Putumayo Basin Pipeline Infrastructure

In Colombia in 2009, on the Chaza Block, we continued the development of our Costayaco field, completing Costayaco-6 as an injector well and drilling four development wells (Costayaco 7 through 10). The Costayaco field reached its production plateau rate during 2009. We also drilled one exploration well on the Chaza block in December, which was plugged and abandoned in January 2010. On our Rio Magdalena block, we acquired seismic data, completed our Popa-2 well which was drilled in 2008 and commenced a long term production test on this well. We drilled one other exploration well in 2009, on the Guachiria Norte block, which we plugged and abandoned. One exploration well, which was plugged and abandoned, was drilled on the Talora block. We also acquired and evaluated seismic data on several other blocks. We were awarded three new exploration and exploitation blocks in Colombia – Rumiyaco, Piedemonte Norte and Piedemonte Sur - that came from the two Technical Evaluation Areas to which we previously had rights. We continued to execute our ongoing rationalization of non-core properties in our portfolio. We sold three blocks – Guachiria, Guachiria Norte and Guachiria Sur; we entered into letters of intent with regard to the sale of our interests in two other blocks – Catguas and Garibay; and we entered into assignment agreements for two blocks – Rio Magdalena and Mecaya. Finally, we relinquished our rights to two blocks – Talora and San Pablo.

Details of our 2010 plans are contained in Item 2 “Properties.”

Argentina

Gran Tierra lands highlighted in yellow. Other licenses in grey. Green dots are producing oil fields, red dots are producing gas/condensate fields.

In Argentina in 2009, we completed several successful workovers, upgraded facilities on our El Vinalar and El Chivil blocks and installed production facilities and commenced production on our Ipaguazu block. We conducted a feasibility study for production on the natural gas well on our Valle Morado block, which was considered successful, as the well showed signs of production capability. Finally, we relinquished our rights to the Nacatimbay block.

Details of our 2010 plans are contained in Item 2 “Properties.”

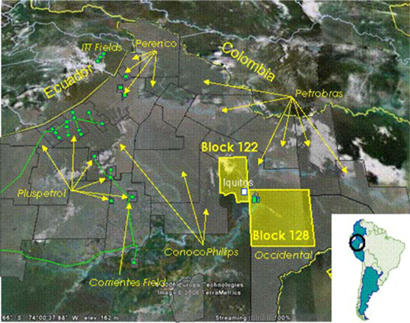

Peru

Gran Tierra lands highlighted in yellow. Other licenses in grey. Green dots are producing oil fields

In Peru in 2009, we completed Environmental Impact Assessments (“EIAs”) over blocks 122 and 128, along with engineering feasibility studies on both blocks and geological studies. We opened two offices in Peru in the fourth quarter, an administrative office in Lima and an operational office in Iquitos.

Details of our 2010 plans are contained in Item 2 “Properties.”

Brazil

In September 2009, we opened a business development office in Rio de Janiero, Brazil. We are currently looking for opportunities to acquire oil and gas assets in that country. We have staff in Brazil and in Calgary evaluating oil and gas investment opportunities and developing business relationships. We have no oil and gas properties in Brazil to date.

Revenues, profit (loss) and total assets

Our revenues and profit (loss) for each of the last three years, and our total assets as of December 31, 2009 and 2008, are set forth in Item 8 “Financial Statements and Supplementary Data”, which information is incorporated by reference here. Our total assets as of December 31, 2007, were $112.8 million.

Business Strategy

Our plan is to continue to build an international oil and gas company through acquisition and exploitation of under-developed prospective oil and gas assets, and to develop these assets with exploration and development drilling to grow commercial reserves and production. Our initial focus is in select countries in South America, currently Colombia, Argentina, Peru, and Brazil; we will consider other regions for future growth should those regions make strategic and commercial sense in creating additional value.

We have applied a two-stage approach to growth, initially establishing a base of production, development and exploration assets by selective acquisitions, and secondly achieving future growth through drilling. We intend to duplicate this business model in other areas as opportunities arise. We pursue opportunities in countries with proven petroleum systems; attractive royalty, taxation and other fiscal terms; and stable legal systems. In the petroleum industry, geologic settings with proven petroleum source rocks, migration pathways, reservoir rocks and traps are referred to as petroleum systems.

A key to our business plan is positioning — being in the right place at the right time with the right resources. The fundamentals of this strategy are described in more detail below:

| | · | Position in countries that are welcoming to foreign investment, that provide attractive fiscal terms, that have stable legal systems, that offer opportunities that we believe have been previously ignored or undervalued, and that have an active market with many available deals; |

| | · | Build a balanced portfolio of production, development and exploration assets and opportunities; |

| | · | Retain operatorship of assets whenever possible to retain control of work programs, budgets, prospect generation, drilling operations and development activities; |

| | · | Engage qualified, experienced and motivated professionals; |

| | · | Establish an effective local presence, with strong constructive relationships with host governments, ministries, agencies and communities in which we operate; |

| | · | Consolidate initial land/property positions to build operating efficiency; and |

| | · | Manage asset and drilling portfolios closely, assessing value to the company and making changes where needed. |

Research and Development

We have not expended any resources on pursuing research and development initiatives. We use existing technology and processes for executing our business plan.

Markets and Customers

Ecopetrol S.A. (“Ecopetrol”), the Colombian National Oil Company, is the purchaser of most of our crude oil sold in Colombia. We deliver our oil to Ecopetrol through our transportation facilities which include pipelines, gathering systems and trucking. We completed pipelines in 2008 to transport oil from our discoveries at Juanambu and Costayaco to our existing pipeline system, replacing previous transportation by truck. In 2009, we reached the maximum production rate from our Costayaco field in the Putumayo Basin of approximately 13,000 BOPD after royalties. The majority of the oil produced is transported by pipeline. Varying amounts of oil are trucked from Santana Station to Ecopetrol’s storage terminal at Orito and from Costayaco to Ecopetrol’s storage terminal at Neiva, which is approximately 300 kilometers north of the Chaza block. Crude oil prices for sales to Ecopetrol are defined by a multi-year contract with Ecopetrol, based on West Texas Intermediate (“WTI”) price less adjustments for quality and transportation. These contracts are subject to renegotiation periodically and generally contain mutual termination provisions with thirty days notice. Our oil in Colombia is good quality light oil. In 2009, we received 25% of our revenue in Colombian pesos, and 75% of revenue in U.S. dollars. Under new contracts with Ecopetrol effective for 2010, we will receive 100% of our revenue in U.S. dollars. Sales to Ecopetrol accounted for 94% of our revenues in 2009, 89% of our revenues in 2008, and 75% of our revenues in 2007.

Gas produced on the Magangue block is sold to Surtigas. The gas price is determined by contract with the customer. Sales to Surtigas accounted for less than 1% of our revenues in 2009 and 2008. We had no sales to Surtigas prior to 2008.

In accordance with our debt facility with Standard Bank PLC, we are required to hedge a portion of production from our Colombian operations. We entered into a costless collar financial derivative contract for crude oil based on WTI price, with a floor of $48.00 and a ceiling of $80.00, for a three-year period, for 400 barrels of oil per day from March 2007 to December 2007, 300 barrels of oil per day from January 2008 to December 2008, and 200 barrels of oil per day from January 2009 to February 2010.

We market our own share of production in Argentina. The purchaser of most of our oil in Argentina is Refineria del Norte S.A. (“Refiner S.A.”) Starting in December 2008 and ending in May 2009, we shipped two truckloads per day from our El Chivil field to Polipetrol S.A. in the Mendoza Province. In Argentina, export prices for crude oil are subject to an export tax based on WTI price. An amount equivalent to the export tax is applied to domestic sales, which has the effect of limiting the actual realized price for domestic sales. Our crude oil prices are agreed on a spot basis with our refiners, based on WTI price less adjustments for quality, transportation and an adjustment equivalent to the export tax. We receive revenues in Argentine pesos, based on U.S. dollar prices with the exchange rate fixed on the sales invoice date. Our contract with Refiner S.A. expired January 1, 2008; however, we are continuing sales of our oil under oral agreement with Refiner S.A, and spot sales contracts. Sales to Refiner accounted for 5.8% of our revenues in 2009, 9% of our revenues in 2008, and 25% of our revenues in 2007.

There were no sales in any other country other than Colombia and Argentina in 2009, 2008 and 2007.

See “Our Oil Sales Will Depend on a Relatively Small Group of Customers, Which Could Adversely Affect Our Financial Results ” and “ Negative Economic, Political and Regulatory Developments in Argentina May Negatively Affect our Operations ” in Item 1A “Risk Factors” for a description of the risks faced by our dependency on a small number of customers and the regulatory systems under which we operate.

Competition

The oil and gas industry is highly competitive. We face competition from both local and international companies in acquiring properties, contracting for drilling and other oil field equipment and securing trained personnel. Many of these competitors have financial and technical resources that exceed ours, and we believe that these companies have a competitive advantage in these areas. Others are smaller, and we believe our technical and financial capabilities give us a competitive advantage over these companies.

See “Competition in Obtaining Rights to Explore and Develop Oil and Gas Reserves and to Market Our Production May Impair Our Business” in Item 1A “Risk Factors” for risks associated with competition.

Geographic Information

Information regarding our geographic segments, including information on revenues, assets, expenses, and income can be found in Note 4 to the Financial Statements, Segment and Geographic Reporting, in Item 8 “Financial Statements and Supplementary Data”, which information is incorporated by reference here. Long lived assets are Property, Plant and Equipment, which includes all oil and gas assets, furniture and fixtures, automobiles and computer equipment. No long lived assets are held in our country of domicile, which is the United States of America. Corporate assets include assets held by our corporate head office in Calgary, Alberta, Canada, and assets held in Peru and Brazil.

Regulation

The oil and gas industry in Colombia, Argentina, Peru and Brazil is heavily regulated. Rights and obligations with regard to exploration, development and production activities are explicit for each project; economics are governed by a royalty/tax regime. Various government approvals are required for property acquisitions and transfers, including, but not limited to, meeting financial and technical qualification criteria in order to be certified as an oil and gas company in the country. Oil and gas concessions are typically granted for fixed terms with opportunity for extension.

Colombia

In Colombia, prior to 2004, state owned Ecopetrol was the administrator of all hydrocarbons and therefore executed contracts with oil companies under different contractual types such as Association contracts and Shared Risk Contracts. Under Association Contracts, the oil companies assumed all risk during the exploration phase and Ecopetrol had the right to back-in if a discovery, commercial under Ecopetrol’s terms, was made.

Effective June 2004, the regulatory regime in Colombia underwent a significant change with the formation of the Agencia Nacional de Hidrocarburos or National Hydrocarbons Agency (“ANH”). The ANH is now the administrator of the hydrocarbons in the country and therefore is responsible for regulating the Colombian oil industry, including managing all exploration lands. Ecopetrol became a public company owned in majority by the state with the main purpose of exploring and producing hydrocarbons similar to any other oil company. However, Ecopetrol continues to have rights under the existing contracts executed with oil companies before ANH was created. Ecopetrol continues to be the major purchaser and marketer of crude oil in Colombia, and also operates the majority of the oil transportation infrastructure in the country.

In conjunction with this change, the ANH developed a new exploration risk contract that took effect near the end of the first quarter of 2005. This Exploration and Production Contract has significantly changed the way the industry views Colombia. In place of the earlier association contracts in which the contractor assumed all the exploration risk and Ecopetrol had the right to back-in afterwards, the new agreement provides full risk/reward benefits for the contractor. Under the terms of the contract the successful operator retains the rights to all reserves, production and income from any new exploration block, subject to existing royalty and tax regulations. Each contract contains an exploration phase and a production phase. The exploration phase will contain a number of exploration periods and each period will have an associated work commitment. The production phase will last a number of years (usually 24) from the declaration of a commercial hydrocarbon discovery.

Gran Tierra operates in Colombia through two branches – Gran Tierra Energy Colombia Ltd. and Solana Petroleum Exploration (Colombia) Ltd. Both are qualified as operators of oil and gas properties by ANH.

When operating under a contract, the contractor is the owner of the hydrocarbons extracted from the contract area during the performance of operations, and pays royalties which are collected by ANH or Ecopetrol, depending on the type of contract. The contractor can market the hydrocarbons in any manner whatsoever, subject to a limitation in the case of natural emergencies where the law specifies the manner of sale.

Argentina

The Hydrocarbons Law 17.319, enacted in June 1967, established the basic legal framework for the current regulation of exploration and production of hydrocarbons in Argentina. The Hydrocarbons Law empowers the National Executive to establish a national policy for development of Argentina’s hydrocarbon reserves, with the main purpose of satisfying domestic demand. However, on January 5, 2007, Hydrocarbon Law 26.197 was passed by the Government of Argentina. This new legal framework replaces article one of the Hydrocarbons Law 17.319 and provides for the provinces to assume complete ownership, authority and administration of the crude oil and natural gas reserves located within their territories, including offshore areas up to 12 marine miles from the coast line. This includes all exploration, exploitation and transportation concessions.

On June 3, 2002, the Argentine government issued a resolution authorizing the Energy Secretariat to limit the amount of crude oil that companies can export. The restriction was to be in place from June 2002 to September 2002. However, on June 14, 2002, the government agreed to abandon the limit on crude export volumes in exchange for a guarantee from oil companies that domestic demand will be supplied. Oil companies also agreed not to raise natural gas and related prices to residential customers during the winter months and to maintain gasoline, natural gas and oil prices in line with those in other South American countries.

Near the end of 2007, the Argentine government issued decrees changing the withholding tax structure and further regulating oil exports. The effects on Gran Tierra are noted in “ Negative Economic, Political and Regulatory Developments in Argentina, Including Export Controls, May Negatively Affect our Operations ” in Item 1A “Risk Factors”.

At the end of 2008, the Argentine government launched the Gas Plus and Petroleum Plus programs, new programs designed to stimulate investments in and production of natural gas and oil through providing incentives for new production of natural gas or oil, either from new discoveries, enhanced recovery techniques or reactivation of older fields. Companies must apply for the incentives, and qualification is based on a complex set of formulas involving increased production over a calculated base and increases in proved reserves for the year. Gran Tierra received credit under the Petroleum Plus program related to our production for the fourth quarter of 2008. Gran Tierra did not qualify for credit for oil production in 2009, however will continue to apply for credit under each program as applicable.

Peru

Peru’s hydrocarbon legislation, which includes the Organic Hydrocarbon Law No. 26221 and the regulations thereunder (the “Organic Hydrocarbon Law”), governs our operations in Peru. This legislation covers the entire range of petroleum operations, defines the roles of Peruvian government agencies which regulate and interact with the oil and gas industry, requires that investments in the petroleum sector be undertaken solely by private investors (either national or foreign), and provides for the promotion of the development of hydrocarbon activities based on free competition and free access to all economic activities. This law provides that pipeline transportation and natural gas distribution must be handled via contracts with the appropriate governmental authorities. All other petroleum activities are to be freely operated and are subject only to local and international safety and environment standards.

Under this legal system, Peru is the owner of the hydrocarbons located below the surface in its national territory. However, Peru has given the ownership right to extracted hydrocarbons to Perupetro S.A. (Perupetro), a state company responsible for promoting and overseeing the investment of hydrocarbon exploration and exploitation activities in Peru. Perupetro is empowered to enter into contracts for either the exploration and exploitation or just the exploitation of petroleum and natural gas on behalf of Peru, the nature of which are described further below. The Peruvian government also plays an active role in petroleum operations through the involvement of the Ministry of Energy and Mines, the specialized government department in charge of devising energy, mining and environmental protection policies, enacting the rules applicable to all these sectors and supervising compliance with such policies and rules. We are subject to the laws and regulations of all of these entities and agencies.

Perupetro generally enters into either license contracts or service contracts for hydrocarbon exploration and exploitation. Peru’s laws also allow for other contract models, but the investor must propose contract terms compatible with Peru’s interests. We only operate under license contracts and do not foresee operating under any services contracts. A company must be qualified by Perupetro to enter into hydrocarbon exploration and exploitation contracts in Peru. In order to qualify, the company must meet the standards under the Regulations Governing the Qualifications of Oil Companies. These qualifications generally require the company to have the technical, legal, economic and financial capacity to comply with all obligations it will assume under the contract based on the characteristics of the area requested, the possible investments and the environmental protection rules governing the performance of its operations. When a contractor is a foreign investor, it is expected to incorporate a subsidiary company or registered branch in accordance with Peru’s corporate law and appoint representatives in accordance with the Organic Hydrocarbon Law who will interact with Perupetro.

Gran Tierra has been qualified by Perupetro with respect to our current contracts. However, Perupetro reviews the qualification for each specific contract to be signed by a company. Additionally, the qualification for foreign companies is granted in favor of the home office or corporation, which is jointly and severally liable at all times for the technical, legal, economic and financial capacity of its Peruvian subsidiary or branch.

When operating under a license contract, the licensee is the owner of the hydrocarbons extracted from the contract area during the performance of operations, and pays royalties which are collected by Perupetro. The licensee can market or export the hydrocarbons in any manner whatsoever, subject to a limitation in the case of natural emergencies where the law stipulates such manner.

Brazil

In Brazil, law No. 2,004/53 instituted the state monopoly of the petroleum industry and created Petróleo Brasileiro S.A (“Petrobras”), a corporation using public and private funds under control of the Federal Union of Brazil (“Federal Union”), to be the exclusive operator of exploration and production concessions in Brazil.

Amendment No. 9 to the Federal Constitution, issued on November 9, 1995, authorized the Federal Union to execute contracts with state and private companies for the exploration and production of oil and natural gas, as well as for the refining, transportation, import and export of oil, natural gas and its by-products, discontinuing Petrobras’ exclusive right to operate exploration and production concessions in Brazil.

Oil and natural gas located in Brazil, whether onshore or offshore, are the property of the Federal Union. Under the principles of the Federal Constitution the national territory comprises all land and the continental shelf. Brazil is a signatory of the conventions regulating the economic use of the sea and its subsoil. Brazil is thus entitled to the enjoyment of the resources over the territorial sea and marine platform up to the limits indicated in the pertinent treaties. Part of the revenues from the exploitation of the hydrocarbon resources collected by the Federal Union is passed on to States and Municipalities.

The new institutional and regulatory model is governed by Law No. 9,748/97, the Petroleum Law, which controls the granting of concessions and authorization for carrying out exploration and production activities to Brazilian companies, i.e., those created in accordance with Brazilian laws, with head offices and management located within the national territory.

In accordance with the Petroleum Law, the acquisition of oil and natural gas property and oil and gas operations by state and private companies are subject to legal, technical and economic standards and regulations issued by the National Petroleum Agency (“ANP”), the agency created by the Petroleum Law and vested with regulatory and inspection authority to ensure adequate operational procedures with respect to industry activities and the supply of fuels throughout the national territory.

ANP has authority for the implementation of the national oil and natural gas policy. ANP conducts bid rounds to award exploration, development and production contracts, as well as to approve the construction and operation of refineries and gas processing units, transportation facilities (including port terminals), import and export of oil and natural gas, as well as supervision of the activities which integrate the petroleum industry and the general enforcement of the Petroleum Law.

The granting of concession contracts is preceded by a public bid procedure, regulated by ANP. Any company evidencing technical, financial and legal standards under the applicable regulations may qualify and apply for particular blocks made available for concession contracts at each licensing round. Qualified companies may compete alone or in association with other companies, including through the formation of “consortia” (unincorporated joint-ventures), provided they agree to comply with all the applicable requirements of the Brazilian Corporate Law. Blocks awarded and the duration of the exploration and production periods are defined in the contracts which, besides the usual covenants that can be found in oil concessions, such as exploration and development programs, relinquishment of areas, and unitization, include reversion to the state of certain assets at the end of the concession. Contracts may be assigned/transferred to other Brazilian companies that comply with the technical, financial and legal requirements established by ANP.

Concessionaires are required under Law No. 9,478 to pay the government dues and fees, in addition to the charges for sale of pre-bid data and information. ANP has the power to determine the criteria under which the Government Take will be assessed within the limits established by Decree No. 2,705/98. Government Take comprises (i) signature bonus, (ii) royalties, (iii) special participation and (iv) area rentals.

Gran Tierra Energy Brasil, Ltda. is currently working on the necessary filings in order to qualify as an operator of oil and natural gas concessions in Brazil.

See Item 1A “Risk Factors” for information regarding the regulatory risks that we face.

Environmental Compliance

Our activities are subject to existing laws and regulations governing environmental quality and pollution control in the foreign countries where we maintain operations. Our activities with respect to exploration, drilling and production from wells, facilities, including the operation and construction of pipelines, plants and other facilities for transporting, processing, treating or storing crude oil and other products, are subject to stringent environmental regulation by provincial and federal authorities in Colombia, Argentina and Peru. Such regulations relate to environmental impact studies, permissible levels of air and water emissions, control of hazardous wastes, construction of facilities, recycling requirements, reclamation standards, among others. Risks are inherent in oil and gas exploration, development and production operations, and significant costs and liabilities may be incurred in connection with environmental compliance issues. All licenses and permits which we may require to carry out exploration and production activities may not be obtainable on reasonable terms or on a timely basis, and such laws and regulations may have an adverse effect on any project that we may wish to undertake.

In 2010, we plan to spend approximately $3.6 million in Colombia on capital programs related to environmental matters, including facilities upgrades, studies, assessments and remediation. We plan to spend approximately $150,000 in Argentina on capital programs related to environmental matters, including environmental studies and fire system upgrades. In Peru, capital costs for environmental projects will be about $1.6 million.

In 2009, we experienced a limited number of environmental incidents and enacted many environmental initiatives as follows:

| | · | In Colombia, we dealt with several incidents: |

| | · | In February 2009, there was a fire at our Juanambu-1 well that occurred during operations related to maintenance on a generator. Approximately six barrels of oil were spilled and clean up costs were approximately $6,000. Total damage to equipment was estimated at $500,000, and production valued at approximately $125,000 was deferred due to shutting down production facilities while dealing with the incident. |

| | · | A number of small incidents on our blocks occurred during the year, each of which causing small quantities of oil to be spilled. In each incident Gran Tierra completed a full clean up and remediation of the affected area. Total barrels lost to these incidents were approximately 170 barrels and clean up costs totaled approximately $30,000. |

| | · | In Argentina, a contracted transportation provider had two incidents while transporting Gran Tierra’s oil. In March 2009, a tanker overturned during an accident and a small quantity of hydrocarbons (approximately 10 barrels) was spilled. In July 2009, a subcontractor of the same service provider had an accident with a cyclist while transporting Gran Tierra’s oil. We suspended our contract with the transportation provider following the second incident and contracted the services of another transportation company. |

| | · | We have a Corporate Health, Safety and Environment Management System and follow Environmental Best Practices. We have an environmental risk management program in place as well as a waste management system. Air and water testing occur regularly, and environmental contingency plans have been prepared for all sites and ground transportation of crude oil. We implemented a regular quarterly comprehensive reporting system in 2009, and continue with a schedule of internal audit and routine checking of practices and procedures. |

| | · | In Peru, we completed the process of conducting an EIA on each of our blocks. The costs for 2009 for these EIAs were approximately $945,000, with total costs to date totaling about $1.6 million. We have also made contributions to PROCREL, a local non-governmental organization that works on conservation programs, biodiversity and sustainable development in Peru. |

We will continue to strive to be in compliance with all environmental and pollution control laws and regulations in Colombia, Argentina and Peru. We plan to continue enacting environmental, health and safety initiatives in order to minimize our environmental impact and expenses. We also plan to continue and improve internal audit procedures and practices in order to monitor current performance and search for improvement.

We expect the cost of compliance with Federal, State and local provisions which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment for the remainder of our operations, will not be material to our company.

Community Relations

In 2009, we commenced standardized, quarterly reporting on our community relations initiatives. We also continuously monitor the needs of the communities we operate in to ensure that our investments meet their requirements and have the highest impact possible.

In addition to employing local people and hiring local companies as often as feasible in all of our operations, we have a program of community investment in all of our operating areas. Projects completed in 2009 are as follows:

Colombia

Gran Tierra invested approximately $500,000 in many projects in our operating areas as outlined below:

| | - | Provided support for education through various projects, including providing tuition, supplies, transportation and construction of facilities for students in all levels of education. |

| | - | Supported community groups in projects that benefited local families with agriculture and fisheries projects. We provided fiscal support, construction of facilities, transportation of materials and other expertise to the projects. |

| | - | Various projects for the support of cultural identity such as sponsorship of local festivals that celebrate indigenous culture and history; construction of a workshop for local artisans and community centers; sponsorship of local people to attend a conference of indigenous people from various areas in the country; another sponsorship for delegates to a national conference of community associations; purchase of an FM radio transmitter for one area to allow communities in the area to connect; support for the improvement of local churches; and providing Christmas gifts to children of local communities. |

| | - | Various programs for strengthening local infrastructure such as road and bridge construction, canalization of part of the River Mocoa to protect a local port, and materials and other resources for electrification. |

| | - | Projects related to health, basic sanitation and housing including improving health facilities, providing supplies to health facilities, providing materials for house construction, constructing community kitchens and community centres, and finally completion of the first stage of construction of a local fire station. |

| | - | Programs supporting sport and recreation such as constructing sport complexes and playgrounds in various districts, sponsoring sports camps, and providing equipment. |

Argentina

In Argentina we invested approximately $43,000 in the following projects:

| | - | A partnership with the organization Voces y Ecos (Voices and Echoes) to distribute education materials. |

| | - | Provided basic life necessities (food, clothing) to impoverished people in our operating areas. |

| | - | Provided funds for the purchase of clothing for the communities in our area of operations. |

| | - | Along with our joint venture partners in the Palmar Largo block, several other initiatives were undertaken, including projects aimed at developing sustainable incomes for the communities in the area; fuel and security for local hospitals; and construction of reservoirs and water wells. These projects were operated by PlusPetrol. |

Peru

In Peru, we conducted community consultation and education sessions held with various communities located on our two blocks. Costs for these programs are included in the costs above related to the EIA’s for Peru. Representatives of Gran Tierra attended sessions with local residents to provide information on the operations we will conduct during our exploration program, and also to gather information from the residents on the needs in the areas. In addition to the EIA work, we spent approximately $30,000 on other initiatives.

Employees

At December 31, 2009, we had 269 full-time employees — 21 located in the Calgary corporate office, 209 in Colombia (99 staff in Bogota and 110 field personnel), 35 in Argentina (18 office staff in Buenos Aires and 17 field personnel), two in Peru (both field and office staff) and two in Brazil, both office staff. None of our employees are represented by labor unions, and we consider our employee relations to be good.

Item 1A. Risk Factors

Risks Related to Our Business

Our Lack of Diversification Will Increase the Risk of an Investment in Our Common Stock.

Our business focuses on the oil and gas industry in a limited number of properties in Colombia, Argentina and Peru, and we have opened a development office in Brazil. Most of our production in Colombia and Argentina is limited to one basin per country. As a result, we lack diversification, in terms of both the nature and geographic scope of our business. Accordingly, factors affecting our industry or the regions in which we operate, including the geographic remoteness of our operations and weather conditions, will likely impact us more acutely than if our business was more diversified.

We May Encounter Difficulties Storing and Transporting Our Production, Which Could Cause a Decrease in Our Production or an Increase in Our Expenses.

To sell the oil and natural gas that we are able to produce, we have to make arrangements for storage and distribution to the market. We rely on local infrastructure and the availability of transportation for storage and shipment of our products, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate. This could be particularly problematic to the extent that our operations are conducted in remote areas that are difficult to access, such as areas that are distant from shipping and/or pipeline facilities. In certain areas, we may be required to rely on only one gathering system, trucking company or pipeline, and, if so, our ability to market our production would be subject to their reliability and operations. These factors may affect our ability to explore and develop properties and to store and transport our oil and gas production, and may increase our expenses.

Furthermore, future instability in one or more of the countries in which we will operate, weather conditions or natural disasters, actions by companies doing business in those countries, labor disputes or actions taken by the international community may impair the distribution of oil and/or natural gas and in turn diminish our financial condition or ability to maintain our operations.

The majority of our oil in Colombia is delivered by a single pipeline to Ecopetrol and sales of oil could be disrupted by damage to this pipeline. Once delivered to Ecopetrol, all of our current oil production in Colombia is transported by an export pipeline which provides the only access to markets for our oil. Problems on these pipelines can cause interruptions to our producing activities if they are for a long enough duration that our storage facilities become full. For example, we experienced disruptions in transportation on this pipeline in March and April of 2008, and again in each of June, July and August of 2009, as a result of sabotage by guerrillas. In addition, there is competition for space in these pipelines, and additional discoveries in our area of operations by other companies could decrease the pipeline capacity available to us. Trucking is an alternative to transportation by pipeline, however it is generally more expensive and carries higher safety risks for the company and the public.

As the majority of current oil production in Argentina is trucked to a local refinery, sales of oil can be delayed by adverse weather and road conditions, particularly during the months November through February when the area is subject to periods of heavy rain and flooding. While storage facilities are designed to accommodate ordinary disruptions without curtailing production, delayed sales will delay revenues and may adversely impact our working capital position in Argentina. Furthermore, a prolonged disruption in oil deliveries could exceed storage capacities and shut-in production, which could have a negative impact on future production capability.

Guerrilla Activity in Colombia Could Disrupt or Delay Our Operations, and We Are Concerned About Safeguarding Our Operations and Personnel in Colombia.

A 40-year armed conflict between government forces and anti-government insurgent groups and illegal paramilitary groups - both funded by the drug trade - continues in Colombia. Insurgents continue to attack civilians and violent guerilla activity continues in many parts of the country.

We operate principally in the Putumayo basin in Colombia, and have properties in other basins, including the Catatumbo, Llanos, Middle Magdalena and Lower Magdalena basins. The Putumayo and Catatumbo regions have been prone to guerilla activity in the past. In 1989,our predecessor company’s facilities in one field were attacked by guerillas and operations were briefly disrupted. Pipelines have also been targets, including the Ecopetrol - operated Trans Andean export pipeline which transports oil from the Putumayo region. In March and April of 2008, and again in each of June, July, August and October of 2009, sections of the Trans Andean pipeline were blown up by guerillas, which temporarily reduced our deliveries to Ecopetrol during the effected periods.

Continuing attempts to reduce or prevent guerilla activity may not be successful and guerilla activity may disrupt our operations in the future. There can also be no assurance that we can maintain the safety of our operations and personnel in Colombia or that this violence will not affect our operations in the future. Continued or heightened security concerns in Colombia could also result in a significant loss to us.

Our Business May Suffer If We Do Not Attract and Retain Talented Personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting the business of Gran Tierra. We have an executive management team consisting of Dana Coffield, our President and Chief Executive Officer, Martin Eden, our Vice President, Finance and Chief Financial Officer, Shane O’Leary, our Chief Operating Officer, Rafael Orunesu, our President of Gran Tierra Argentina SA, Julian Garcia, our President of Gran Tierra Colombia, and Julio Moreira, our President of Gran Tierra Brazil. The loss of any of these individuals or our inability to attract suitably qualified individuals to replace any of them could materially adversely impact our business. We may also experience difficulties in certain jurisdictions in our efforts to obtain suitably qualified staff and retain staff that are willing to work in that jurisdiction. We do not currently carry life insurance for our key employees.

Our success depends on the ability of our management and employees to interpret market and geological data successfully and to interpret and respond to economic, market and other business conditions in order to locate and adopt appropriate investment opportunities, monitor such investments and ultimately, if required, successfully divest such investments. Further, our key personnel may not continue their association or employment with Gran Tierra and we may not be able to find replacement personnel with comparable skills. If we are unable to attract and retain key personnel, our business may be adversely affected.

Our Oil Sales Will Depend on a Relatively Small Group of Customers, Which Could Adversely Affect Our Financial Results.

Oil sales in Colombia are made mainly to Ecopetrol. While oil prices in Colombia are related to international market prices, lack of competition and reliance on a limited number of customers for sales of oil may diminish prices and depress our financial results.

The entire Argentine domestic refining market is small and export opportunities are limited by available infrastructure. As a result, our oil sales in Argentina will depend on a relatively small group of customers, and currently, on just one customer. The lack of competition in this market could result in unfavorable sales terms which, in turn, could adversely affect our financial results. Currently all operators in Argentina are operating without sales contracts. We cannot provide any certainty as to when the situation will be resolved or what the final outcome will be.

Strategic Relationships Upon Which We May Rely are Subject to Change, Which May Diminish Our Ability to Conduct Our Operations.

Our ability to successfully bid on and acquire additional properties, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements will depend on developing and maintaining effective working relationships with industry participants and on our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. These realities are subject to change and may impair Gran Tierra’s ability to grow.

To develop our business, we endeavor to use the business relationships of our management and board of directors to enter into strategic relationships, which may take the form of joint ventures with other private parties or with local government bodies, or contractual arrangements with other oil and gas companies, including those that supply equipment and other resources that we will use in our business. We may not be able to establish these strategic relationships, or if established, we may not be able to maintain them. In addition, the dynamics of our relationships with strategic partners may require us to incur expenses or undertake activities we would not otherwise be inclined to in order to fulfill our obligations to these partners or maintain our relationships. If we fail to make the cash calls required by our joint venture partners in the joint ventures we do not operate, we may be required to forfeit our interests in these joint ventures. If our strategic relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct our operations.

In addition, in cases where we are the operator, our partners may not be able to fulfill their obligations, which would require us to either take on their obligations in addition to our own, or possibly forfeit our rights to the area involved in the joint venture. Alternatively, our partners may be able to fulfill their obligations, but will not agree with our proposals as operator of the property. In this case there could be disagreements between joint venture partners that could be costly in terms of dollars, time, deterioration of the partner relationship, and/or our reputation as a competent operator.

In cases where we are not the operator of the joint venture, the success of the projects held under these joint ventures is substantially dependent on our joint venture partners. The operator is responsible for day to day operations, safety, environmental compliance and relationships with government and vendors.

We have various work obligations on our blocks that must be fulfilled or we could face penalties, or lose our rights to those blocks if we do not fulfill our work obligations. Failure to fulfill obligations in one block can also have implications on the ability to operate other blocks in the country ranging from delays in government process and procedure to loss of rights in other blocks or in the country as a whole. Failure to meet obligations in one particular country may also have an impact on our ability to operate in others.

Our Business is Subject to Local Legal, Political and Economic Factors Which are Beyond Our Control, Which Could Impair Our Ability to Expand Our Operations or Operate Profitably.

We operate our business in Colombia, Argentina and Peru, have opened an in-country office in Brazil to expand our operations into that country and may eventually expand to other countries in the world. Exploration and production operations in foreign countries are subject to legal, political and economic uncertainties, including terrorism, military repression, social unrest, strikes by local or national labor groups, interference with private contract rights (such as privatization), extreme fluctuations in currency exchange rates, high rates of inflation, exchange controls, changes in tax rates, changes in laws or policies affecting environmental issues (including land use and water use), workplace safety, foreign investment, foreign trade, investment or taxation, as well as restrictions imposed on the oil and natural gas industry, such as restrictions on production, price controls and export controls. For example, starting on November 21, 2008, we were forced to reduce production in Colombia on a gradual basis, culminating on December 11, 2008 when we suspended all production from the Santana, Guayuyaco and Chaza blocks in the Putumayo Basin. This temporary suspension of production operations was the result of a declaration of a state of emergency and force majeure by Ecopetrol due to a general strike in the region. In January 2009, the situation was resolved and we were able to resume production and sales shipments.

South America has a history of political and economic instability. This instability could result in new governments or the adoption of new policies, laws or regulations that might assume a substantially more hostile attitude toward foreign investment, including the imposition of additional taxes. In an extreme case, such a change could result in termination of contract rights and expropriation of foreign-owned assets. Any changes in oil and gas or investment regulations and policies or a shift in political attitudes in Argentina, Colombia, Peru or Brazil or other countries in which we intend to operate are beyond our control and may significantly hamper our ability to expand our operations or operate our business at a profit.

For instance, changes in laws in the jurisdiction in which we operate or expand into with the effect of favoring local enterprises, and changes in political views regarding the exploitation of natural resources and economic pressures, may make it more difficult for us to negotiate agreements on favorable terms, obtain required licenses, comply with regulations or effectively adapt to adverse economic changes, such as increased taxes, higher costs, inflationary pressure and currency fluctuations. In certain jurisdictions the commitment of local business people, government officials and agencies and the judicial system to abide by legal requirements and negotiated agreements may be more uncertain, creating particular concerns with respect to licenses and agreements for business. These licenses and agreements may be susceptible to revision or cancellation and legal redress may be uncertain or delayed. Property right transfers, joint ventures, licenses, license applications or other legal arrangements pursuant to which we operate may be adversely affected by the actions of government authorities and the effectiveness of and enforcement of our rights under such arrangements in these jurisdictions may be impaired.

Foreign Currency Exchange Rate Fluctuations May Affect Our Financial Results.

We expect to sell our oil and natural gas production under agreements that will be denominated in United States dollars and foreign currencies. Many of the operational and other expenses we incur will be paid in the local currency of the country where we perform our operations. Our production is primarily invoiced in United States dollars, but payment is also made in Argentine and Colombian pesos, at the then-current exchange rate. As a result, we are exposed to translation risk when local currency financial statements are translated to United States dollars, our company’s functional currency. Since we began operating in Argentina (September 1, 2005), the rate of exchange between the Argentine peso and US dollar has varied between 3.05 pesos to one US dollar to 3.94 pesos to the US dollar, a fluctuation of approximately 29%. Exchange rates between the Colombian peso and US dollar have varied between 2,632 pesos to one US dollar to 1,648 pesos to one US dollar since September 1, 2005, a fluctuation of approximately 60%.

In addition, a foreign exchange loss of $17.7 million, of which $17.4 million is an unrealized non-cash foreign exchange loss, was recorded in 2009 primarily due to the translation of a deferred tax liability recorded on the purchase of Solana. The deferred tax liability is denominated in Colombian pesos and the devaluation of 9% in the US dollar against the Colombian Peso in 2009 resulted in the foreign exchange loss.

Exchange Controls and New Taxes Could Materially Affect our Ability to Fund Our Operations and Realize Profits from Our Foreign Operations.

Foreign operations may require funding if their cash requirements exceed operating cash flow. To the extent that funding is required, there may be exchange controls limiting such funding or adverse tax consequences associated with such funding. In addition, taxes and exchange controls may affect the dividends that we receive from foreign subsidiaries.

Exchange controls may prevent us from transferring funds abroad. For example, the Argentine government has imposed a number of monetary and currency exchange control measures that include restrictions on the free disposition of funds deposited with banks and tight restrictions on transferring funds abroad, with certain exceptions for transfers related to foreign trade and other authorized transactions approved by the Argentine Central Bank. The Central Bank may require prior authorization and may or may not grant such authorization for our Argentine subsidiaries to make dividend payments to us and there may be a tax imposed with respect to the expatriation of the proceeds from our foreign subsidiaries.

Competition in Obtaining Rights to Explore and Develop Oil and Gas Reserves and to Market Our Production May Impair Our Business.

The oil and gas industry is highly competitive. Other oil and gas companies will compete with us by bidding for exploration and production licenses and other properties and services we will need to operate our business in the countries in which we expect to operate. Additionally, other companies engaged in our line of business may compete with us from time to time in obtaining capital from investors. Competitors include larger, foreign owned companies, which, in particular, may have access to greater resources than us, may be more successful in the recruitment and retention of qualified employees and may conduct their own refining and petroleum marketing operations, which may give them a competitive advantage. In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. In the event that we do not succeed in negotiating additional property acquisitions, our future prospects will likely be substantially limited, and our financial condition and results of operations may deteriorate.

Maintaining Good Community Relationships and Being a Good Corporate Citizen may be Costly and Difficult to Manage.

Our operations have a significant effect on the areas in which we operate. In order to enjoy the confidence of local populations and the local governments, we must invest in the communities where were operate. In many cases, these communities are impoverished and lack many resources taken for granted in North America. The opportunities for investment are large, many and varied; however, we must be careful to invest carefully in projects that will truly benefit these areas. Improper management of these investments and relationships could lead to a delay in operations, loss of license or major impact to our reputation in these communities, which could adversely affect our business.

Our Operations Involve Substantial Costs and are Subject to Certain Risks Because the Oil and Gas Industries in the Countries in Which We Operate are Less Developed.

The oil and gas industry in South America is not as efficient or developed as the oil and gas industry in North America. As a result, our exploration and development activities may take longer to complete and may be more expensive than similar operations in North America. The availability of technical expertise, specific equipment and supplies may be more limited than in North America. We expect that such factors will subject our international operations to economic and operating risks that may not be experienced in North American operations.

Negative Political and Regulatory Developments in Argentina May Negatively Affect our Operations.

The crude oil and natural gas industry in Argentina is subject to extensive regulation including land tenure, exploration, development, production, refining, transportation, and marketing, imposed by legislation enacted by various levels of government and, with respect to pricing and taxation of crude oil and natural gas, by agreements among the federal and provincial governments, all of which are subject to change and could have a material impact on our business in Argentina. The Federal Government of Argentina has implemented controls for domestic fuel prices and has placed a tax on crude oil and natural gas exports.

Any future regulations that limit the amount of oil and gas that we could sell or any regulations that limit price increases in Argentina and elsewhere could severely limit the amount of our revenue and affect our results of operations.

Currently most oil and gas producers in Argentina are operating without sales contracts. In 2008, a new withholding tax regime for exports was introduced without specific guidance as to its application. The domestic price was regulated in a similar way, so that both exported and domestically sold products were priced the same. Producers and refiners of oil in Argentina were unable to determine an agreed sales price for oil deliveries to refineries. Also, the price for refiners’ gasoline production was capped below the price that would be received for crude oil. Therefore, the refineries’ price offered to oil producers reflects their price received, less taxes and operating costs and their usual mark up. Along with most other oil producers in Argentina, we are continuing deliveries to the refinery. In our case we are negotiating sales on a spot price basis with one, Refiner S.A., and the price is negotiated on a month by month basis. From January to May 2009, we delivered two truckloads per day to Polipetrol in Mendoza province, and that price was negotiated weekly. We stopped delivering to Polipetrol in May 2009, due to possible financial problems at the refinery. The Provincial Governments have also been hurt by these changes as their effective royalty take has been reduced and capital investment in oilfields has declined, and so they are lobbying to change the situation. We are working with other oil and gas producers in the area, as well as Refiner S.A., to lobby the federal government for change. The government introduced the Petro Plus and Gas Plus programs in 2009, which grant higher prices to producers that sell production from new reserves. This is a positive step forward that will hopefully lead to further opening of price regulation in Argentina.

The United States Government May Impose Economic or Trade Sanctions on Colombia That Could Result In A Significant Loss To Us.

Colombia is among several nations whose eligibility to receive foreign aid from the United States is dependent on its progress in stemming the production and transit of illegal drugs, which is subject to an annual review by the President of the United States. Although Colombia is currently eligible for such aid, Colombia may not remain eligible in the future. A finding by the President that Colombia has failed demonstrably to meet its obligations under international counternarcotics agreements may result in any of the following:

| · | all bilateral aid, except anti-narcotics and humanitarian aid, would be suspended; |

| · | the Export-Import Bank of the United States and the Overseas Private Investment Corporation would not approve financing for new projects in Colombia; |

| · | United States representatives at multilateral lending institutions would be required to vote against all loan requests from Colombia, although such votes would not constitute vetoes; and |

| · | the President of the United States and Congress would retain the right to apply future trade sanctions. |