- GTE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Gran Tierra Energy (GTE) DEF 14ADefinitive proxy

Filed: 24 Mar 22, 7:58pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Gran Tierra Energy Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

TO OUR STOCKHOLDERS,

We invite you to attend the Annual Meeting of Gran Tierra Energy Inc., (“Gran Tierra” or the “Company”) which will be on May 4, 2022, at 11:00 a.m. Mountain Time. This year’s Annual Meeting will be a virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the Annual Meeting of Stockholders online, vote your shares electronically and submit your questions during the meeting by visiting https://web.lumiagm.com/244491258.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement describes the business to be conducted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to submit your vote via the internet or mail.

I encourage you to read our 2021 Annual Report and Sustainability Report for additional information about Gran Tierra’s objectives and results in 2021. After the many challenges in 2020 that the world faced, 2021 was a year of strong recovery for the energy industry and Gran Tierra. Our top tier, low-decline, onshore, conventional asset base continued to prove its high quality as the Company returned to strong growth in 2021 in terms of oil production, reserves, funds flow from operations, free cash flow and after-tax net asset value (“NAV”) per share. We achieved strong oil reserve replacement driven by our successful, on-budget development programs and waterflood initiatives.

During the challenging pandemic, we optimized our cost structure and have maintained those benefits through 2021. Continued reserves growth through optimization and increases in free cashflow (“FCF”) are a testament to our high-quality assets combined with development infrastructure investments made in 2017-2019 that are providing benefits to shareholders. The Company’s 2021 net income of $42 million was the highest achieved since 2018 and funds flow from operations reached $186 million, the highest since 2019, and an increase of 312% from $45 million in 2020. We also generated $37 million of free cash flow, the highest generated since 2012.

We saw tremendous results resuming production with a 2021 average working interest production of 26,507 barrels (“bbl”) of oil per day (“BOPD”), a 17% increase from 2020. The increase in production was the direct result of the development of key assets with successful drilling and workover campaigns in the Acordionero and Costayaco fields, combined with ongoing waterflood optimization throughout the Company’s portfolio. The successful drilling and workover campaigns also resulted in material Proved reserves additions, particularly in the Company’s core assets. The Proved Developed Producing (“PDP”) reserves replacement ratio was 148%, with PDP reserves additions of 14.3 million bbl of oil equivalent (MMBOE), while the Total Proved (“1P”) reserves replacement ratio was 123%, with 1P reserves additions of 11.9 MMBOE. The Company’s strong 1P reserves replacement resulted in 1P reserves of 81 MMBOE (100% oil) as of year-end 2021. Finally, we strengthened our balance sheet by paying down debt which had been used to acquire assets and install infrastructure to efficiently and effectively optimize the value of our assets.

Looking to 2022, we are very excited for our planned development drilling programs in the Middle Magdalena Valley and Putumayo Basins in Colombia, and the restart of our exploration drilling program, which we expect to include our first exploration wells in the Oriente basin in Ecuador. In addition to growth through our existing assets in Colombia and Ecuador, we continue to look at opportunities in other select basins to diversify and enhance the Company’s future potential for the coming decades. These activities, combined with a more constructive oil price environment, are expected to allow Gran Tierra to continue to resume growth through ongoing development of our existing assets and potential exploration discoveries. Furthermore, in the Company’s high case for 2022 guidance, which assumes a Brent oil price of $80/bbl, we forecast that Gran Tierra could generate $100-120 million of 2022 free cash flow, which would allow us to completely pay down our bank credit facility before the end of the first half of 2022.

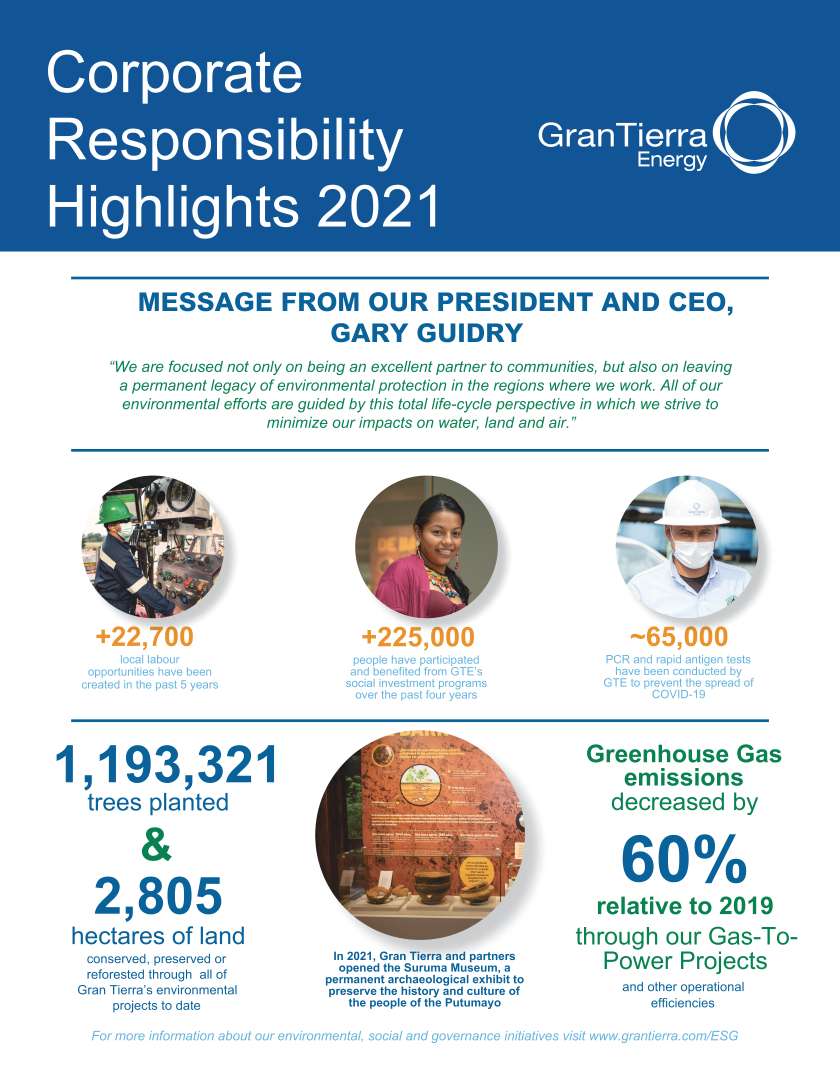

Finally, our Environmental, Social and Governance (ESG) focus continues which we achieve through our “Beyond Compliance” philosophy. Where Gran Tierra identifies significant opportunities and benefits to the environment and communities, we voluntarily strive to go beyond what is legally required to protect the environment and provide social benefits, because it is the right thing to do. In 2021, for the first time GTE reported Scope 2 greenhouse gas (“GHG”) emissions (indirect operations from external power sources), in addition to Scope 1 GHG emissions, in the Company’s yearly GHG emissions report. Our 2020 results saw an overall GHG emissions reduction in excess of 60% relative to 2019 and were achieved via the Company’s gas-to-power projects and additional operational efficiencies. Gran Tierra is also focused on nature-based solutions to emissions and have planted a total of 1,193,321 trees and have conserved, preserved or reforested 2,805 hectares of land through all our environmental efforts since 2018.

Shareholders who have any questions should contact the Company’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 1-855-476-7987 (toll-free within North America) or 1-416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

On behalf of our Board of Directors and the team at Gran Tierra, I want to thank all our stakeholders for their continued support.

Sincerely,

| /s/ Gary S. Guidry

Gary S. Guidry President and Chief Executive Officer |

March 25, 2022

Notice of Meeting

Annual Meeting of the Stockholders of Gran Tierra Energy Inc.

Date: Wednesday, May 4, 2022 |

Time: 11:00 a.m. |

Location: Virtual-only meeting via live webcast online at | ||||||

The business of the meeting is to:

| 1. | Elect the nine nominees specified in the accompanying proxy statement to serve as directors. |

| 2. | Ratify the appointment of KPMG LLP as Gran Tierra’s independent registered public accounting firm for 2022. |

| 3. | Approve, on an advisory basis, the compensation of Gran Tierra’s named executive officers as disclosed in the accompanying proxy statement. |

| 4. | To indicate, on an advisory basis, the preferred frequency of solicitation of stockholder advisory votes on the compensation of Gran Tierra’s named executive officers. |

| 5. | Approve Gran Tierra’s 2007 Equity Incentive Plan, as amended, as more particularly described in the accompanying proxy statement. |

| 6. | Conduct any other business properly brought before the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice.

This notice and the attached proxy statement are first being mailed to our stockholders beginning on March 25, 2022. Holders of shares on March 8, 2022, the record date, are entitled to notice of, and to vote at, our meeting or any adjournment thereof.

In light of the COVID-19 pandemic and to mitigate the risks to the health and safety of our community, stockholders and employees, Gran Tierra will be holding its annual meeting in a virtual-only format by way of webcast accessed at https://web.lumiagm.com/244491258 and no physical or in-person meeting will be held. A virtual-only meeting will provide all stockholders an equal opportunity to participate at the annual meeting regardless of their geographic location or the particular constraints, circumstances or risks they may be facing as a result of COVID-19. Stockholders will be able to attend the Annual Meeting of Stockholders online and vote their shares electronically and submit questions during the meeting.

If you are a registered stockholder, to attend the Annual Meeting and vote your shares electronically and submit questions during the meeting, you will need control number included on the Notice of Internet Availability of Proxy Materials or proxy card that accompanied your proxy materials. If you are the beneficial owner of shares held in “street name”, you must request and obtain a valid proxy from your broker or other agent in order to attend the Annual Meeting and vote your shares electronically and submit questions during the meeting.

We are using the “Notice and Access” method of providing proxy materials to our stockholders which provides our stockholders with a convenient way to access the proxy materials and vote, while allowing us to lower the costs of printing and distributing the proxy materials and reduce the environmental impact of our meeting. We will mail to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) in lieu of a paper copy of our proxy materials. Stockholders receiving the Notice may review the proxy materials online or request a paper copy by following the instructions set forth in the Notice.

Please submit your proxy or voting instructions on the Internet or by telephone promptly by following the instructions about how to view the proxy materials on your Notice of Internet Availability of Proxy Materials so that your shares can be voted, regardless of whether you expect to attend the annual meeting. If you received your proxy materials by mail, you may submit your proxy or voting

instructions on the Internet or you may submit your proxy by marking, dating, signing and returning the enclosed proxy/confidential voting instruction card. If you attend the annual meeting, you may withdraw your proxy and vote in person.

Shareholders who have any questions should contact the Company’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 1-855-476-7987 (toll-free within North America) or 1-416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

By order of the Board of Directors

/s/ Gary S. Guidry

Gary S. Guidry President and Chief Executive Officer |

Calgary, Alberta, Canada

March 25, 2022

Proxy Statement Table of Contents

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 57 | ||||

PROPOSAL 5: APPROVAL OF THE GRAN TIERRA 2007 EQUITY INCENTIVE PLAN, AS AMENDED AND RESTATED | 58 | |||

| 66 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| A-1 | ||||

This summary highlights information contained elsewhere within this proxy statement. You should read the entire proxy statement carefully and consider all information before voting. Page references are supplied to help you find further information in this proxy statement. This summary does not contain all of the information you should consider, and we encourage you to read the entire proxy statement before voting.

References to “we”, “us”, “our”, “Gran Tierra” or the “Company” are to Gran Tierra Energy Inc.

This proxy statement is first being mailed to our stockholders beginning on March 25, 2022. Holders of shares on March 8, 2022, the record date, are entitled to notice of, and to vote at, our meeting or any adjournment thereof.

Important Notice Regarding the Availability of Materials for the 2022 Annual Meeting of Shareholders to be Held on May 4, 2022: The proxy statement and our Annual Report for the fiscal year ended December 31, 2021 are available free of charge at https://www.grantierra.com/investor-relations/2022-annual-meeting.

2022 Annual Meeting of Stockholders

Date: May 4, 2022 |

|

Time: 11:00 a.m. |

|

Location: Virtual-only meeting via live https://web.lumiagm.com/ |

|

Record Date: March 8, 2022 | ||||||

Voting Matters and Board Recommendations

Voting Matter | Board Vote Recommendation | |

Proposal 1: Election of Directors (page 10)

The Board and the Nominating and Corporate Governance Committee believe that each of the director nominees possesses the necessary qualifications and skills to provide effective oversight of the business and quality advice and counsel to our management team. | FOR each nominee | |

Proposal 2: Ratification of Selection of Independent Auditors (page 32)

The Board and the Audit Committee believe that the retention of KPMG LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s selection of the independent registered public accounting firm. | FOR | |

Proposal 3: Advisory Vote to Approve Named Executive Officer Compensation (page 35)

The Company seeks a non-binding advisory vote from its stockholders to approve the compensation of its named executive officers as described in the Compensation Discussion and Analysis section beginning on page 39 and the Compensation Tables section beginning on page 50 and ending on page 56. Our executive compensation program reflects our philosophy of aligning executive compensation with the interests of our stockholders and a commitment to pay for performance. | FOR | |

Proposal 4: Advisory Vote on the Frequency of Solicitation of Advisory Vote to Approve Named Executive Officer Compensation (page 57)

The Company seeks a non-binding advisory vote from its stockholders to indicate the preferred frequency of solicitation of stockholder advisory votes on the compensation of Gran Tierra’s named executive officers. An annual vote will give stockholders an opportunity to provide real-time feedback to the Company on its pay practices. | EVERY YEAR | |

| Gran Tierra Energy 2022 Proxy Statement | 1 | |

PROXY STATEMENT SUMMARY

Voting Matter | Board Vote Recommendation | |

Proposal 5: Approval of 2007 Equity Incentive Plan, as amended (page 58)

In order for Gran Tierra to continue to have the flexibility to grant market-competitive levels of stock options and other equity grants to current employees and future strategic hires, the Company seeks approval to increase the number of shares of Common Stock available for issuance under the Incentive Plan to 23,333,065 shares in respect of stock awards granted on or after January 1, 2022 shares, which will result in: (i) a 5,000,000 share increase in the shares available for issuance from 18,333,065 shares at December 31, 2021; and (ii) an amendment of subsection 4(a) of Gran Tierra’s 2017 Equity Incentive Plan to increase the total number of shares authorized for issuance pursuant to stock awards from 22,223,817 shares in respect of stock awards granted on or after January 1, 2021 to 23,333,065 shares in respect of stock awards granted on or after January 1, 2022. | FOR | |

Director Nominees

The following table provides summary information about each director nominee. See pages 11 to 19 for more information.

Director Nominee | Director Since | Age | Committees | |||||||

Robert B. Hodgins Chairman | 2015 | 70 | • Audit Committee • Compensation Committee • Nominating and Corporate Governance Committee | |||||||

Gary S. Guidry President and Chief Executive Officer | 2015 | 66 | ||||||||

Peter J. Dey | 2015 | 81 | • Nominating and Corporate Governance Committee • Compensation Committee • Health, Safety & Environment Committee | |||||||

Evan Hazell | 2015 | 63 | • Audit Committee • Health, Safety & Environment Committee • Reserves Committee | |||||||

Alison Redford | 2021 | 57 | • Audit Committee • Nominating and Corporate Governance Committee • Health, Safety and Environment Committee | |||||||

Ronald W. Royal | 2015 | 72 | • Audit Committee • Health, Safety & Environment Committee • Reserves Committee | |||||||

Sondra Scott | 2017 | 55 | • Nominating and Corporate Governance Committee • Health, Safety & Environment Committee • Reserves Committee | |||||||

David P. Smith | 2015 | 63 | • Audit Committee • Compensation Committee | |||||||

Brooke Wade | 2015 | 68 | • Compensation Committee • Nominating and Corporate Governance Committee • Reserves Committee | |||||||

| 2 | Gran Tierra Energy 2022 Proxy Statement | |

PROXY STATEMENT SUMMARY

Corporate Governance

We are committed to good corporate governance practices, which promote the long-term interests of our stockholders and strengthens our Board and management accountability.

Highlights of our corporate governance practices include the following:

| ✓ | Independent Board Chair |

| ✓ | 8 of 9 director nominees are independent |

| ✓ | Annual elections of all directors |

| ✓ | Majority voting for directors with resignation policy |

| ✓ | 100% independent Committee members |

| ✓ | Annual self-evaluation of the Board and Committees |

| ✓ | Stock ownership guidelines for directors and officers |

| ✓ | No Tax Gross-Up provisions in any new executive agreements (currently only applies to Chief Executive Officer in order to be equalized to Canadian colleagues) |

| ✓ | Policy prohibiting speculative trading of the Company’s stock |

| ✓ | Limited trading windows |

| ✓ | Clawback policy |

| ✓ | Stockholders may call special meetings of stockholders |

| ✓ | No stockholder rights (“poison pill”) or similar plan |

| ✓ | Regular executive sessions of independent directors |

| ✓ | Stockholders have the right to fill director vacancies caused by director removal |

Executive Compensation Highlights

Our compensation philosophy and programs are based on the following core principles:

| • | attract and retain highly capable individuals and offer competitive compensation opportunities, |

| • | pay for performance, and |

| • | align the interests of management with our stockholders. |

Our equity compensation program is designed to be aligned with the interests of our stockholders and focus on pay-for-performance:

| • | The majority of 2021 executive compensation is considered to be “at risk” because its value is based on specific performance criteria and/or stock price appreciation and payout is not guaranteed. |

| • | In 2021, 80% of the value of equity awards granted to the Named Executive Officers (“NEOs”) consisted of performance share units (“PSUs”) and 20% consisted of stock options. |

| • | The target for base salaries is approximately the 50th percentile as compared to the Company’s compensation peer group. |

Equity Incentive Plan Amendments

The purpose of this amendment is to ensure that Gran Tierra has a sufficient reserve of common stock available under the Equity Incentive Plan to continue to grant stock options and other awards at market-competitive levels determined appropriate by the Board. In order for Gran Tierra to continue to have the flexibility to grant market-competitive levels of stock options to current employees and future strategic hires, the Board determined that it was prudent to increase the fixed reserve of common stock available under the Incentive Plan by 5,000,000 shares (approximately 1.4% of the Gran Tierra common stock outstanding on March 8, 2022) such that there are 23,333,065 shares available for issuance pursuant to awards granted on or after January 1, 2022 (approximately 6.4% of the Gran Tierra common stock outstanding on March 8, 2022).

| Gran Tierra Energy 2022 Proxy Statement | 3 | |

Questions and Answers About the Proxy Materials and 2022 Annual Meeting

Why am I receiving these materials?

We are sending you these proxy materials because the Board of Directors (the “Board”) of Gran Tierra Energy Inc., a Delaware corporation (“Gran Tierra” or the “Company”), is soliciting your proxy to vote at the 2022 annual meeting of stockholders, including at any adjournments or postponements of the annual meeting. You are invited to attend the annual meeting, which is being held in a virtual-only format by way of webcast accessed at https://web.lumiagm.com/244491258, to vote on the proposals described in this proxy statement. However, you do not need to attend the annual meeting to vote your shares. Instead, if you are a stockholder of record of our common stock, you may simply complete, sign and return the proxy card if you received a paper copy of our proxy materials, or follow the instructions below to submit your proxy over the telephone or through the internet. See “How do I vote” below for further information on how to vote, including if you hold our common stock through a broker in “street name” or hold exchangeable shares.

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. We are sending to our stockholders of record the proxy materials, including this proxy statement and an annual report, or a Notice Regarding the Availability of Proxy Materials (the “Notice”). We intend that our stockholders who hold their stock in “street name” will receive a Notice from their broker, bank or other agent in which they hold the stock in “street name,” unless they have specified otherwise. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the proxy materials and Notice beginning on March 25, 2022 to all stockholders of record entitled to vote at the annual meeting. We expect that the Notice will be sent to stockholders who hold their stock in “street name” on or about this same date.

How do I attend the annual meeting?

The annual meeting will be held on Wednesday, May 4, 2022, at 11:00 a.m. (Mountain time) and will be held solely by remote communication, in a virtual-only format.

Instructions to Attend Online Meeting

| • | Log in online at https://web.lumiagm.com/244491258. The Meeting ID is 244-491-258. We recommend that you log in 15 minutes before the annual meeting starts. |

| • | Enter the control number found on the form of proxy or Notice, as applicable, into the Shareholder login section. |

| • | Enter the password: grantierra22 |

| • | If you are a proxyholder, enter the credentials provided by Odyssey Trust Company |

| • | If you are a guest, complete the Guest login information. |

Who can vote at the annual meeting?

Only stockholders of record at the close of business on March 8, 2022, will be entitled to vote at the annual meeting. On this record date, there were 367,692,131 shares of common stock outstanding and entitled to vote.

A list of stockholders of record will be made available to participants who join the annual meeting as a “Shareholder” at https://web.lumiagm.com/244491258.

Stockholders of Record: Shares Registered in Your Name

If at the close of business on March 8, 2022, your shares were registered directly in your name with Gran Tierra’s transfer agent, Odyssey Trust Company, then you are a stockholder of record. Registered stockholders will receive a proxy form containing the relevant details concerning the business of the meeting, including a control number required to access the virtual annual meeting.

| 4 | Gran Tierra Energy 2022 Proxy Statement | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND 2022 ANNUAL MEETING

Whether or not you plan to attend the annual meeting, we urge you to fill out and return the proxy or vote by proxy by telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If at the close of business on March 8, 2022, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice, and/or these proxy materials if you have received them, are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares electronically or submit questions at the annual meeting unless you request and obtain a valid proxy from your broker or other agent. See “How Do I Vote? - Beneficial Owner: Shares Registered in the Name of Broker or Bank” below for additional information about attending and participating in the Annual Meeting.

What am I voting on?

There are five matters scheduled for a vote:

| 1. | Election of nine nominees named in the proxy statement to serve on the Board until the next annual meeting and until their respective successors are duly elected and qualified; |

| 2. | Ratification of the appointment of KPMG LLP as the independent registered public accounting firm for 2022; and |

| 3. | Approval, on an advisory basis, of the compensation of Gran Tierra’s named executive officers, as disclosed in this proxy statement. |

| 4. | Approval, on an advisory basis, of the preferred frequency of solicitation of stockholder advisory votes on the compensation of Gran Tierra’s named executive officers. |

| 5. | Approval of Gran Tierra’s 2007 Equity Incentive Plan, as amended to increase the aggregate number of shares authorized for issuance under the plan to 23,333,065 shares. |

What if another matter is properly brought before the annual meeting?

The Board knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the annual meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

Will I be able to submit questions during the virtual annual meeting?

Stockholders will be able to submit questions through the virtual meeting website. Questions pertinent to meeting matters that comply with the meeting rules of conduct will be answered during the meeting, subject to time constraints. However, we reserve the right to exclude questions that are not pertinent to meeting matters, irrelevant to the business of the Company, derogatory or in bad taste, or relate to pending or threatened litigation, personal grievances or are otherwise inappropriate. Questions that are substantially similar may be grouped and answered once to avoid repetition.

How do I vote?

You may either vote “For” or “Against” or abstain from voting with respect to each nominee to the Board and each of the other matters to be voted on.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote electronically at the annual meeting, vote by proxy on the internet or by telephone, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote electronically even if you have already voted by proxy.

| Gran Tierra Energy 2022 Proxy Statement | 5 | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND 2022 ANNUAL MEETING

| • | To vote electronically during the meeting, once you have logged into the annual meeting, you will be able to vote your shares electronically by clicking on the “Cast Your Vote” link on the meeting center site. It is important that you remain connected to the internet at all times during the annual meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the annual meeting. |

| • | To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us by 11:00 a.m. (Mountain time) on May 2, 2022, we will vote your shares as you direct. |

To vote on the internet, go to https://login.odysseytrust.com/pxlogin and follow the on-screen instructions. You will need the control number located on the Notice or Form of Proxy to access the voting site. Your internet vote must be received by 11:00 a.m. (Mountain time) on May 2, 2022, to be counted. The Chair of the Meeting reserves the right to accept late proxies and may waive or extend the proxy cut-off, with or without notice, but is under no obligation to accept or reject any particular late proxy.

We provide the option for internet proxy voting to allow you to vote your shares, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions, or these proxy materials and an annual report and form of proxy, from that organization rather than from Gran Tierra. Simply follow the voting instructions you receive from your broker, bank, or other agent to ensure that your vote is counted. If you have received these proxy materials and voting instructions therein, simply complete and mail the voting instructions to ensure that your vote is counted. Alternatively, if permitted by your broker or bank, you may vote by telephone or on the internet as instructed by your broker, bank or other agent. To vote electronically during the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent and appoint yourself as a proxyholder. Follow the instructions from your broker, bank, or other agent included with these proxy materials, or contact your broker, bank, or other agent to request a proxy form.

The Corporation may utilize the Broadridge QuickVote™ service to assist Non-Registered (Beneficial) Shareholders with voting over the telephone. Alternatively, Kingsdale Advisors may contact such Beneficial Shareholders to assist them with conveniently voting directly over the phone.

Shareholders who have any questions should contact the Company’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 1-855-476-7987 (toll-free within North America) or 1-416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

A shareholder has the right to appoint a person or entity (who need not be a shareholder) to attend and act for him/her on his/her behalf at the meeting other than the persons named in the enclosed instrument of Proxy. Shareholders who wish to appoint a third party proxyholder to represent them at the online meeting must submit their proxy or voting instruction form (if applicable) prior to registering your proxyholder. Registering your proxyholder is an additional step once you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Username to participate in the meeting. To register a proxyholder, shareholders MUST email Grantierra@odysseytrust.com and provide Odyssey Trust Company with their proxyholder’s contact information, so that Odyssey Trust Company may provide the proxyholder with a Username via email. Requests for registration must be received by Odyssey Trust Company no later than 11:00 a.m. (Mountain Time), on Friday, April 29, 2022. You will receive a confirmation of your registration by email after Odyssey Trust Company receives your registration materials. At the time of the meeting, go to https://web.lumiagm.com/244491258 and enter your control number and the meeting password, grantierra22.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 8, 2022. Cumulative voting is not permitted.

| 6 | Gran Tierra Energy 2022 Proxy Statement | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND 2022 ANNUAL MEETING

What if I return a proxy card or otherwise vote but do not make specific choices?

Stockholder of Record; Shares Registered in Your Name

If you are a holder of record and return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all nine nominees for director, “For” the ratification of the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022, “For” the advisory vote to approve named executive officer compensation and “For” the approval of Gran Tierra’s 2007 Equity Incentive Plan, as amended. If any other matter is properly presented at the annual meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Beneficial Owner; Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, your broker or other nominee may not vote your shares on any proposal other than the ratification of the selection of KPMG LLP as our independent registered public accounting firm at the annual meeting. See “What are ‘broker non-votes’?” below. We encourage you to provide voting instructions to the organization that holds your shares to ensure that your vote is counted on all five proposals.

What happens if I do not vote?

Stockholder of Record; Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, over the internet or in person at the annual meeting, your shares will not be voted.

Beneficial Owner; Shares Registered in the Name of a Broker or Bank

If you hold your shares in “street name,” you will receive instructions from your broker, bank or other nominee describing how to vote your shares. If you do not instruct your broker, bank or other nominee how to vote your shares, they may vote your shares as they decide as to each matter for which they have discretionary authority under the rules of the NYSE American. This year, the only matter with respect to which they may vote your shares without voting instructions is the proposal to ratify the selection of KPMG LLP as our independent registered public accounting firm (Proposal 2).

There are also non-discretionary matters for which brokers, banks and other nominees do not have discretionary authority to vote unless they receive timely instructions from you. When a broker, bank or other nominee does not have discretion to vote on a particular matter and you have not given timely instructions on how the broker, bank or other nominee should vote your shares, a “broker non-vote” results. Although any broker non-vote would be counted as present at the meeting for purposes of determining a quorum, it would be treated as not entitled to vote with respect to non-discretionary matters.

If your shares are held in “street name” and you do not give voting instructions, pursuant to NYSE American Company Guide Section 723, the record holder will not be permitted to vote your shares with respect to Proposals 1, 3, 4 or 5. If your shares are held in “street name” and you do not give voting instructions, the record holder will nevertheless be entitled to vote your shares with respect to Proposal 2.

Abstentions occur when stockholders are present at the annual meeting but voluntarily abstain on any of the matters upon which the stockholders are voting.

Who is paying for this proxy solicitation?

We have retained Kingsdale Advisors to help us with this process, at an estimated cost of $50,000. We pay the costs associated with soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

Shareholders who have any questions should contact the Company’s strategic shareholder advisor and proxy solicitation agent, Kingsdale Advisors, at 1-855-476-7987 (toll-free within North America) or 1-416-867-2272 (collect call outside North America) or by e-mail at contactus@kingsdaleadvisors.com.

| Gran Tierra Energy 2022 Proxy Statement | 7 | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND 2022 ANNUAL MEETING

What does it mean if I receive more than one Notice or more than one set of proxy materials?

If you receive more than one Notice or more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices or the instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record; Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date, or vote again by telephone or on the internet; |

| • | You may send a timely written notice that you are revoking your proxy to Gran Tierra’s Corporate Secretary at 900, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada T2P 0R3; or |

| • | You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted and must be received by 11:00 a.m. (Mountain time) on May 2, 2022, to be counted. The Chair of the Meeting reserves the right to accept late proxies and may waive or extend the proxy cut-off, with or without notice, but is under no obligation to accept or reject any particular late proxy.

Beneficial Owner; Shares Registered in the Name of a Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

Stockholders who desire to present proposals at the 2023 annual meeting of stockholders and to have proposals included in our proxy materials pursuant to Rule 14a-8 under the Exchange Act must submit their proposals to us at our principal executive offices (to the Corporate Secretary at 900, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada T2P 0R3), not later than the close of business on November 24, 2022. If the date of the 2023 annual meeting is changed by more than 30 days from the date of the 2022 annual meeting, the deadline for submitting proposals is a reasonable time before we begin to print and mail the proxy materials for our 2023 annual meeting.

Our Bylaws provide that stockholders may nominate persons for election to the Board of Directors or bring any other business before the stockholders at the 2023 annual meeting only by sending to our Corporate Secretary a notice containing the information required by our Bylaws. Notice to us must be made not less than 30 or more than 65 days prior to the date of the annual meeting; provided, however, that if the annual meeting is to be held on a date that is less than 50 days after the date on which the public announcement of the date of the annual meeting was made by Gran Tierra, notice may be made not later than the close of business on the 10th day following the day on which public announcement of the date of the annual meeting is first made by Gran Tierra. Detailed information about how to make stockholder proposals or nominations for our annual meetings of stockholders can be found in our Bylaws.

How are votes counted?

Votes will be counted by the inspector of election appointed for the annual meeting, who will separately count, for the proposal to elect directors and the other proposals, votes “For,” “Against,” abstentions and, if applicable, broker non-votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE American to be “non-routine,” the broker or nominee cannot vote the shares on such proposals. A “broker non-vote” occurs with respect to a proposal when a broker or nominee has discretionary authority to vote on one or more “routine” proposals to be voted on at a meeting of stockholders but is not permitted to vote on other “non-routine” proposals without instructions from the beneficial owner and the beneficial owner fails to provide the nominee with such instructions. Under the applicable rules of the NYSE American, each of Proposal 1, Proposal 3, Proposal 4 and Proposal 5 are considered non-routine and a broker will lack the authority to vote shares at his/her discretion on such proposals. Proposal 2 is considered a routine matter and a broker will be permitted to exercise his/her discretion.

| 8 | Gran Tierra Energy 2022 Proxy Statement | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND 2022 ANNUAL MEETING

How many votes are needed to approve each proposal?

| • | Proposal No. 1, the election of directors: our bylaws provide for a majority voting standard for the election of directors in uncontested elections, which is generally defined as an election in which the number of nominees does not exceed the number of directors to be elected at the meeting. Because this is an uncontested election, each director shall be elected by the vote of a majority of the votes cast at a meeting of stockholders at which a quorum is present. A “majority of the votes cast” means that the number of shares voted “For” a director nominee must exceed the number of votes cast “Against” that director nominee. For these purposes, abstentions and broker non-votes will not count as a vote “For” or “Against” a nominee’s election and will have no effect in determining whether a director nominee has received a majority of the votes cast. If an incumbent director is not elected by a majority of the votes cast, the incumbent director must promptly tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the director’s resignation or whether other action should be taken. The Board will act on the Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision within 90 days from the date of the certification of the election results. |

| • | Proposal No. 2, the ratification of the appointment of KPMG LLP as Gran Tierra’s independent registered public accounting firm for 2022, will be approved if it receives the affirmative vote of shares representing a majority of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote “Against.” We do not expect that there will be any broker non-votes, as this is a routine matter. |

| • | Proposal No. 3, the advisory vote to approve named executive officer compensation, as disclosed in this proxy statement, will be approved if it receives the affirmative vote of shares representing a majority of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote “Against.” Broker non-votes will have no effect. |

| • | Proposal No. 4, the advisory vote on the frequency of solicitation of an advisory vote to approve named executive officer compensation, will be approved if it receives the affirmative vote of shares representing a majority of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote “Against.” Broker non-votes will have no effect. Because this proposal has three possible substantive responses (every year, every two years, and every three years), if none of the frequency alternatives receives the vote of shares representing a majority of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter, then we will consider stockholders to have approved the frequency that receives a plurality of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter. |

| • | Proposal No. 5, the approval of Gran Tierra’s Amended and Restated 2007 Equity Incentive Plan, as amended will be approved if it receives the affirmative vote of shares representing a majority of the votes present in person or represented by proxy at the meeting and entitled to vote on the matter. Abstentions will have the same effect as a vote “Against.” Broker non-votes will have no effect. |

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding outstanding shares of Gran Tierra’s capital stock representing at least one-third of the total number of votes that may be cast at the annual meeting are present at the annual meeting in person or represented by proxy. On the record date, there were 367,692,131 votes that could be cast. Thus, holders of outstanding shares representing at least 122,564,044 votes must be present in person or represented by proxy at the annual meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the Chair of the annual meeting or the holders of a majority of shares present at the annual meeting in person or represented by proxy must adjourn the annual meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting.

What proxy materials are available on the internet?

The notice of meeting, proxy statement and annual report to stockholders are available to view on Gran Tierra’s website at: https://www.grantierra.com/investor-relations/2022-annual-meeting

See “How do I vote?” above for voting instructions.

| Gran Tierra Energy 2022 Proxy Statement | 9 | |

Corporate Governance and Board Matters

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors is nominating the nine individuals identified below for election as directors. Unless you specify differently, proxies received will be voted FOR Robert B. Hodgins, Peter J. Dey, Gary S. Guidry, Evan Hazell, Alison Redford, Ronald W. Royal, Sondra Scott, David P. Smith and Brooke Wade. Each director to be elected and qualified will hold office until the next annual meeting of stockholders and until his or her successor is elected, or, if sooner, until the director’s death, resignation or removal. Each of the nominees listed below is currently a director of Gran Tierra. It is Gran Tierra’s policy to invite nominees for directors to attend the annual meeting and all of the Directors attended the 2022 annual meeting of stockholders.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nine nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by Gran Tierra.

| 10 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES NAMED BELOW.

| ROBERT B. HODGINS

Age: 70 Calgary, Alberta, Canada Director since May 2015

Director and Independent Businessman

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 93.9%

|

Mr. Hodgins has been a corporate director and independent businessman since November 2004. Prior thereto, Mr. Hodgins served as the Chief Financial Officer of Pengrowth Energy Trust (a TSX and NYSE-listed energy trust) from 2002 to 2004. Prior to that, Mr. Hodgins held the position of Vice President and Treasurer of Canadian Pacific Limited (a Toronto Stock Exchange (“TSX”) and NYSE-listed diversified energy, transportation and hotels company) from 1998 to 2002 and was Chief Financial Officer of TransCanada PipeLines Limited (a TSX and NYSE-listed energy transportation company) from 1993 to 1998. At present, Mr. Hodgins serves as a director of AltaGas Ltd., EnerPlus Corporation and MEG Energy Corp. Since September 2018, Mr. Hodgins holds the non-executive, part-time position of Senior Advisor, Investment Banking at Canaccord Genuity Corp. Mr. Hodgins received an Honours Bachelor of Arts in Business from the Richard Ivey School of Business at the University of Western Ontario and received a Chartered Professional Accountant designation and was admitted as a member of the Institute of Chartered Accountants of Ontario in 1977 and Alberta in 1991. Mr. Hodgins is a member of the Institute of Corporate Directors.

Qualifications: With 30-plus years in the oil and gas industry as an executive and director and a strong reputation in the Canadian business community, Mr. Hodgins brings valuable industry and leadership experience to the Board. As a Chartered Professional Accountant and experienced executive in senior financial roles with several Canadian companies, Mr. Hodgins qualifies as one of Gran Tierra’s Audit Committee financial experts.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Chair | 7/7 | 100% | |||

Audit Committee | Member | 4/4 | 100% | |||

Compensation Committee | Member | 3/3 | 100% | |||

Nominating and Corporate Governance Committee | Member | 3/3 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 20,000 | 848,230 | 17,220 | |||

2020 | 20,000 | 593,745 | 17,220 | |||

Other Public Board Directorships | Committee Position(s) (1) | |||||

AltaGas Ltd. (TSX) | • Audit Committee • Governance Committee | |||||

Enerplus Corporation (TSX) | • Compensation and Human Resources Committee • Corporate Governance & Nominating Committee (Chair) | |||||

MEG Energy Corp. (TSX) | • Audit Committee (Chair) • Corporate Governance and Nominating Committee | |||||

| (1) | The Board of Directors has determined that Mr. Hodgins’ ability to effectively serve on the Company’s Audit Committee is not impaired by his membership on the Audit Committee of the other public boards listed above. |

| Gran Tierra Energy 2022 Proxy Statement | 11 | |

PROPOSAL 1: ELECTION OF DIRECTORS

| GARY S. GUIDRY

Age: 66 Calgary, Alberta, Canada Director since May 2015

Non-Independent Director - President and Chief Executive Officer

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 92.6%

|

Mr. Guidry is a professional engineer and has more than 40 years of experience developing and maximizing assets in the international oil and gas industry. Mr. Guidry has direct experience managing large, international projects, including assets in Latin America, Africa, the Middle-East and Asia. Prior to joining Gran Tierra, Mr. Guidry was the President and Chief Executive Officer of Caracal Energy Inc., a London Stock Exchange listed oil and gas company with operations in Chad, Africa. He held that position from mid-2011 until the company was acquired by Glencore plc for $1.8 billion in mid-2014. In 2014, Mr. Guidry was awarded the Oil Council Executive of the Year award for his leadership role with Caracal. Prior to Caracal, Mr. Guidry was the President and Chief Executive Officer of Orion Oil and Gas (TSX listed), which operated in western Canada from mid-2009 until mid-2011 when it was merged. From May 2005 until December 2008, he was the President and Chief Executive Officer of Tanganyika Oil Company (TSX listed) which operated in Syria and Egypt. Prior to Tanganyika, Mr. Guidry was Chief Executive Officer of Calpine Natural Gas Trust. Mr. Guidry is an Alberta-registered Professional Engineer and a member of the Association of Professional Engineers and Geoscientists. He received a Bachelor of Science in Petroleum Engineering from Texas A&M University in 1980.

Qualifications: Mr. Guidry, as Chief Executive Officer, is responsible for the operations, financial management and implementation of the Company’s strategy. Mr. Guidry’s extensive experience in the oil and gas industry and international operations developed through his experience as a senior executive at several publicly traded companies brings valuable expertise and perspective to the Board.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Year | Common Shares | PSUs | Stock Options | |||

2021 | 3,809,692 | 3,807,591 | 2,334,239 | |||

2020 | 3,665,749 | 2,529,835 | 1,836,214 | |||

Other Public Board Directorships | Committee Position(s) | |||||

Africa Oil Corp. | • Audit Committee • Compensation Committee (Chair) • Reserves Committee (Chair) | |||||

PetroTal Corp. (1) | • Reserves Committee • Health, Safety, Environment and Social Committee | |||||

| (1) | PetroTal Corp. was formerly a related company. In November 2021 the Company sold its entire stake in PetroTal Corp.’s common shares. Mr. Guidry and Mr. Ellson were both nominated to the board of PetroTal Corp in 2017. |

During the past five years, Mr. Guidry previously served as a Director of Shamaran Petroleum Corp. (until June 2018).

| 12 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS

| PETER J. DEY

Age: 81 Toronto, Ontario, Canada Director since May 2015

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 93.5%

|

Mr. Dey has been the Chairman of Paradigm Capital Inc., an investment dealer, since November 2005. Mr. Dey was a Partner of the Toronto law firm Osler, Hoskin & Harcourt LLP, where he specialized in corporate board issues and mergers and acquisitions, from 2001 to 2005, and prior to that from 1985 to 1994 and from 1973 to 1983. From 1994 to 2001, Mr. Dey was Chairman of Morgan Stanley Canada Limited. From 1993 to 1995, Mr. Dey chaired The Toronto Stock Exchange Committee on Corporate Governance in Canada that released the December 1994 report entitled “Where Were the Directors?”, known as the Dey Report and is the co-author of the recently released report: “360 Degree Governance: Where are the Directors in a World of Crisis”. Mr. Dey has also served as Chairman of the Ontario Securities Commission and was Canada’s representative to the Organisation for Economic Co-operation and Development (“OECD”) Task Force that developed the OECD Principles of Corporate Governance released in May of 1999. Mr. Dey attended Queen’s University, where he earned his Bachelor of Science in 1963 and Dalhousie University, where he earned his Bachelor of Laws degree in 1966. He received his Master of Laws degree from Harvard University in 1967.

Qualifications: With more than 40 years of experience dealing with issues of corporate governance ranging from serving on public boards to private practice as a lawyer, Mr. Dey provides significant value to the board of directors of Gran Tierra.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Nominating and Corporate Governance Committee | Chair | 3/3 | 100% | |||

Compensation Committee | Member | 3/3 | 100% | |||

Health, Safety and Environment Committee | Member | 4/4 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 20,000 | 932,079 | 247,639 | |||

2020 | 20,000 | 646,956 | 186,362 | |||

Other Public Board Directorships | Committee Position (s) | |||||

None | ||||||

During the past five years, Mr. Dey previously served as a Director of the following public companies: Guayana Goldfields Inc. (until June 2019), Goldcorp Inc. (until April 2017) and Granite REIT Inc. (until June 2017).

| Gran Tierra Energy 2022 Proxy Statement | 13 | |

PROPOSAL 1: ELECTION OF DIRECTORS

| EVAN HAZELL

Age: 63 Calgary, Alberta, Canada Director since June 2015

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 95.1%

|

Mr. Hazell has been an independent businessman since 2011. He has been involved in the global oil and gas industry for approximately 40 years, initially as a petroleum engineer and then as an investment banker. From 1998 to 2011, Mr. Hazell acted as a managing director at several financial institutions including HSBC Global Investment Bank and RBC Capital Markets. At present he serves as a director of Kaisen Energy Corp. Mr. Hazell holds a Bachelor of Applied Science degree from Queen’s University, a Master of Engineering degree from the University of Calgary, and a Master of Business Administration degree from the University of Michigan, and is licensed as a Professional Engineer in Alberta.

Qualifications: Mr. Hazell has extensive experience in the global energy industry as well as in the financial sector. Mr. Hazell also has significant experience at nonprofit organizations. His education in business and engineering provides significant value to Gran Tierra.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Health, Safety and Environment Committee | Chair | 4/4 | 100% | |||

Reserves Committee | Member | 3/3 | 100% | |||

Audit Committee | Member | 4/4 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 55,000 | 774,268 | 238,281 | |||

2020 | 55,000 | 539,479 | 190,828 | |||

Other Public Board Directorships | Committee Position(s) | |||||

None | ||||||

During the past five years, Mr. Hazell previously served as a Director of the following public companies: Oryx Petroleum Corporation Limited (until June 2016) and Opera America (until August 2021).

| 14 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS

| ALISON M. REDFORD QC

Age: 57 Calgary, Alberta, Canada Director since September 2021

Independent Director

|

Ms. Redford serves as an advisor to national governments and ministries in emerging economies on regulatory reform to promote transparency and investor confidence. She provides independent advice on the creation of regulatory regimes related to climate, social and governance sustainability most recently in Pakistan, Afghanistan, South Sudan and Guyana. Separately, Ms. Redford also serves as a strategic advisor to public companies operating in volatile political climates to assess risk and ensure regulatory compliance, particularly as it relates to Extractive Industries Transparency Initiatives and Community Benefits Agreements for affected Indigenous people. Previously, Ms. Redford served as Premier of Alberta from 2011 to 2014 and as Minister of Justice and Attorney General from 2008. She graduated from the College of Law at the University of Saskatchewan (1988) and also obtained a Master of Arts degree from the School of Oriental and African Studies at the University of London (2021). Ms. Redford was appointed Queens Counsel in 2008. Ms. Redford is a holder of the Institute of Corporate Directors Director designation.

Qualifications: Ms. Redford brings to the Board more than 25 years of experience from most recently serving as an advisor to national governments and ministries in emerging economies on regulatory reform to promote transparency and investor confidence. As well as serving as Premier of Alberta, Minister of Justice and Attorney General to private practice as a lawyer, Ms. Redford provides significant value to the board of directors of Gran Tierra.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 2/2 | 100% | |||

Audit Committee | Member | 0 | — | |||

Nominating and Corporate Governance Committee | Member | 0 | — | |||

Health, Safety & Environment Committee | Chair | 0 | — | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 0 | 41,861 | 85,000 | |||

| Gran Tierra Energy 2022 Proxy Statement | 15 | |

PROPOSAL 1: ELECTION OF DIRECTORS

| RONALD W. ROYAL

Age: 72 Abbotsford, British Columbia, Canada Director since May 2015

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 95.1%

|

Mr. Royal has been an independent businessman since April 2007. Mr. Royal has more than 35 years of experience with Imperial Oil Ltd. and ExxonMobil’s international upstream affiliates. From 2011 to 2014, he served on the board of directors of Caracal Energy Inc., and prior to 2010, several other boards of private oil companies. Prior to retiring in 2007, Mr. Royal was President and Production Manager of Esso Exploration and Production Chad Inc. and resided in N’Djamena, Chad from 2002 to 2007. In 2003, he was awarded the title “Chevalier de l’Ordre National du Chad” for his contribution to the economic development of Chad. Mr. Royal received his Bachelor of Applied Science from the University of British Columbia in 1972 and completed the Executive Development Program at Cornell University in 1986. He has been a member of the Association of Professional Engineers and Geoscientists of Alberta since 1972.

Qualifications: Mr. Royal brings to the Board over 35 years of experience in senior executive roles in the oil and gas industry, having previously held a variety of management positions both domestically and internationally.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Audit Committee | Member | 4/4 | 100% | |||

Health, Safety & Environment Committee | Member | 4/4 | 100% | |||

Reserves Committee | Chair | 3/3 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 254,667 | 965,286 | 247,639 | |||

2020 | 254,667 | 680,163 | 186,362 | |||

Other Public Board Directorships | Committee Position(s) | |||||

Valeura Energy Inc. | • Audit Committee • Reserves & Health, Safety and Environment Committee | |||||

| 16 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS

| SONDRA SCOTT

Age: 55 New York, New York Director since September 2017

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 94.2%

|

Ms. Scott is an independent businesswoman with more than 25 years of experience as an energy and risk analytics business leader. Ms. Scott was formerly Chief Executive Officer for U.S. and Europe of ADEC Innovations, a leading ESG information and consulting firm where she led a team of professionals providing ESG, environmental and sustainability technical, software and strategy solutions. Prior to this, Ms. Scott was Chief Operating Officer of Verisk Financial where she was responsible for leading the company’s global operations team in support their range of portfolio, bankruptcy, fraud and spend solutions. Before joining Verisk Financial in 2020, Ms. Scott was President of Verisk Maplecroft, a leading risk analytics company. Prior to this, Ms. Scott filled a number of roles at Wood Mackenzie over a 13-year period. Her most recent position was head of Global Markets where she led a team focusing on macro energy economics and risk. Previously, Ms. Scott led Wood Mackenzie’s energy consultancy practice. Ms. Scott holds a Master of Science, Petroleum Engineering and Economics degree from a joint program with the University of Pennsylvania and the Institut Francais du Petrole (IFP) and received a Bachelor of Arts, Economics and Earth Sciences degree from Wesleyan University.

Qualifications: Ms. Scott has more than 25 years of experience as an energy and risk analytics business leader. She has significant leadership experience having led multi-sized global research and consultancy teams. Ms. Scott has worked in the United States, the United Kingdom, and Latin America, globalizing businesses and building local practices.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Health, Safety & Environment Committee | Member | 4/4 | 100% | |||

Nominating and Corporate Governance Committee | Member | 3/3 | 100% | |||

Reserves Committee | Member | 2/2 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 0 | 755,787 | 85,000 | |||

2020 | 0 | 630,516 | 85,000 | |||

Other Public Board Directorships | Committee Position(s) | |||||

None | ||||||

| Gran Tierra Energy 2022 Proxy Statement | 17 | |

PROPOSAL 1: ELECTION OF DIRECTORS

| DAVID P. SMITH

Age: 63 Parry Sound, Ontario, Canada Director since May 2015

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 95.3%

|

Mr. Smith is a corporate director with extensive experience in the investment banking, investment research and management industry. He has been the Chairman of the Board of Directors of Superior Plus Corp., a diversified energy and specialty chemicals company, since August 2014. From March 2004 to August 2015, Mr. Smith served as Chair of the Audit Committee of Superior Plus Corp. Previously, Mr. Smith was Managing Partner of Enterprise Capital Management Inc. from 1997 to 2011. Mr. Smith is a Chartered Financial Analyst and graduated with honors from the University of Western Ontario with a degree in Business Administration in 1981.

Qualifications: Mr. Smith brings to the Board significant financial expertise, having spent his professional career in investment banking, investment research and management. His experience as the Chairman at Superior Plus Corp. and his previous experience as a director and member of the audit committee of other public companies provide valuable perspective to Gran Tierra’s Board. Mr. Smith’s education and experience qualifies him as one of Gran Tierra’s Audit Committee financial experts.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Audit Committee | Chair | 4/4 | 100% | |||

Compensation Committee | Member | 3/3 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 555,000 | 427,967 | 252,105 | |||

2020 | 555,000 | 296,875 | 190,828 | |||

Other Public Board Directorships | Committee Position(s) | |||||

Superior Plus Corp. | • Chairman • Governance and Nominating Committee • Compensation Committee | |||||

| 18 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS

| BROOKE WADE

Age: 68 Vancouver, British Columbia, Canada Director since June 2015

Independent Director

Shareholder approval rating at the 2021 Gran Tierra annual meeting: 94.0%

|

Mr. Wade is the President of Wade Capital Corporation, a private investment company active in private equity, oil and gas, real estate and industrial businesses. From 1994 until 2005, Mr. Wade was the co-founder and Chairman and Chief Executive Officer of Acetex Corporation, a publicly traded chemical company specializing in acetyls, specialty polymers, and films. In July 2005, Acetex was acquired by Blackstone. Prior to founding Acetex Corporation, Mr. Wade was founding President and Chief Executive Officer of Methanex Corporation. In 1991, Ocelot Industries spun out its oil and gas assets and began a plan of growth through acquisition into what is today Methanex Corporation—the world’s largest methanol producer. Prior to joining Ocelot, he was involved in a number of independent business ventures. Mr. Wade serves on the boards of several private companies including Novinium, Inc., Belkin Enterprises Ltd., Chairman of Atlas Power Technologies Inc. and is a member of the Advisory Board of Northbridge Capital Partners and is a participant of AEA Investors groups of funds. In addition, Mr. Wade is a member of the Dean’s Advisory Council of the John F. Kennedy School of Government at Harvard University. Mr. Wade earned a Bachelor of Commerce Degree from the University of Calgary in 1974 and received his Chartered Accountant designation in 1977. In 2012, Mr. Wade became a Fellow of the Institute of Chartered Accountants of British Columbia.

Qualifications: Mr. Wade’s extensive executive experience provides the Board with strong leadership and decision-making capabilities. His service on other public company boards provides Gran Tierra with public company senior executive and board member perspectives and judgment important to guiding our company.

Board and Committee Participation | Position | Meetings | Attendance | |||

Board of Directors | Member | 7/7 | 100% | |||

Compensation Committee | Chair | 3/3 | 100% | |||

Nominating and Corporate Governance Committee | Member | 3/3 | 100% | |||

Reserves Committee | Member | 3/3 | 100% | |||

Year | Common Shares | DSUs | Stock Options | |||

2021 | 2,133,600 | 965,286 | 247,639 | |||

2020 | 2,133,600 | 680,163 | 186,362 | |||

Other Public Board Directorships | Committee Position(s) | |||||

None | ||||||

During the past five years, Mr. Wade previously served as a Director of PKM Canada Limited, formerly, Kinder Morgan Canada Limited (until November 2019).

Majority Voting Standard

Our Bylaws provide for a majority voting standard for the election of directors in uncontested elections, which is generally defined as an election in which the number of nominees does not exceed the number of directors to be elected at the meeting. Because this is an uncontested election, each director shall be elected by the vote of a majority of the votes cast at a meeting of stockholders at which a quorum is present. A “majority of the votes cast” means that the number of shares voted “For” a director nominee must exceed the number of votes cast “Against” that director nominee. For these purposes, abstentions and broker non-votes will not count as a vote “For” or “Against” a nominee’s election and will have no effect in determining whether a director nominee has received a majority of the votes cast. If an incumbent director is not elected by a majority of the votes cast, the incumbent director must promptly tender his or her or her resignation to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the director’s resignation or whether other action should be taken. The Nominating and Corporate Governance Committee shall recommend, and the Board of Directors’ decision shall be, to accept the resignation absent exceptional circumstances. The Board will act on the Nominating and Corporate Governance Committee’s

| Gran Tierra Energy 2022 Proxy Statement | 19 | |

PROPOSAL 1: ELECTION OF DIRECTORS

recommendation within 90 days from the date of the meeting of stockholders and publicly disclose its decision If the Board of Directors determines not to accept a resignation, the public disclosure shall fully state the reasons for such decision. A director who tenders his or her or her resignation after failing to receive a majority of the votes cast will not participate in the Nominating and Corporate Governance Committee’s or the Board’s recommendation or decision or any deliberations related thereto.

Other Information Regarding Our Directors

Our above-listed directors have neither been convicted in any criminal proceeding during the past ten years nor been parties to any judicial or administrative proceeding during the past ten years that resulted in a judgment, decree or final order enjoining them from future violations of, or prohibiting activities subject to, federal or state securities laws or a finding of any violation of federal or state securities law or commodities law. Similarly, no bankruptcy petitions have been filed by or against any business or property of any of our directors or officers, nor has any bankruptcy petition been filed against a partnership or business association in which these persons were general partners or executive officers.

Skills Matrix

Below is a listing of each director’s key skills, together with a description of those key skills and experience desirable to support the strategic direction of Gran Tierra. Not every director is expected to be skilled in every area, however, we aim for the Board to have a balance of skills and experience. We believe the combination of the skills and qualifications shown below demonstrates how our board is well-positioned to provide effective oversight and strategic advice to our management.

Skills And Experience | Peter J. Dey | Gary S. Guidry (President & Chief Executive Officer) | Evan Hazell | Robert B. Hodgins (Chair) | Alison Redford | Ronald W. Royal | Sondra Scott | David P. Smith | Brooke Wade | |||||||||||||||||||||||||||

Relevant Industry Skills | ||||||||||||||||||||||||||||||||||||

Energy Industry Executive Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Health, Safety and Environment Issues | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Engineering / Geology / Geophysics | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

Hydrocarbon Transportation and Marketing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

General Business Skills | ||||||||||||||||||||||||||||||||||||

Leadership | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Board Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Finance / Capital Markets | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||

Mergers and Acquisitions | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Legal and Governance | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Government and Public Affairs | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

International Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||

Human Resources and Compensation | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Information Technology | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||

Risk Management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Strategic Planning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

Accounting /Audit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Independence of the Board of Directors

The Company believes in the importance of directors’ independence and follows rules of the NYSE American. As required under the NYSE American listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board.

The Board conducts an annual review regarding the independence from the Company’s management of each of its members. After review of all relevant identified transactions or relationships between each director, or any of his or her family members, and Gran Tierra, its senior management and its independent auditors, the Board has affirmatively determined that, other than Mr. Guidry, each of our directors and nominees for director (Peter J. Dey, Evan Hazell, Robert B. Hodgins, Alison Redford, Ronald W. Royal, Sondra Scott, David P. Smith and Brooke Wade), are independent directors within the meaning of the applicable NYSE American listing standards. In making this determination, the Board found that none of these directors or nominees for director had a material

| 20 | Gran Tierra Energy 2022 Proxy Statement | |

PROPOSAL 1: ELECTION OF DIRECTORS