Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2012

Commission File Number: 001-32330

NORTHSTAR REALTY FINANCE CORP.

(Exact Name of Registrant as Specified in its Charter)

| | |

Maryland

(State or Other Jurisdiction of

Incorporation or Organization) | | 11-3707493

(IRS Employer

Identification No.) |

399 Park Avenue, 18th Floor New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant's Telephone Number, Including Area Code)

Indicate by the check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

The Company has one class of common stock, par value $0.01 per share, 113,357,448 shares outstanding as of May 1, 2012.

Table of Contents

NORTHSTAR REALTY FINANCE CORP.

QUARTERLY REPORT

For the Three Months Ended March 31, 2012

TABLE OF CONTENTS

| | | | | | |

Index | |

| | Page | |

|---|

Part I. | | Financial Information | | | 5 | |

Item 1. | | Financial Statements | | | | |

| | Consolidated Balance Sheets as of March 31, 2012 (unaudited) and December 31, 2011 | | | 5 | |

| | Consolidated Statements of Operations (unaudited) for the three months ended March 31, 2012 and 2011 | | | 6 | |

| | Consolidated Statements of Comprehensive Income (Loss) (unaudited) for the three months ended March 31, 2012 and 2011 | | | 7 | |

| | Consolidated Statements of Equity as of March 31, 2012 (unaudited) and December 31, 2011 | | | 8 | |

| | Consolidated Statements of Cash Flows (unaudited) for the three months ended March 31, 2012 and 2011 | | | 9 | |

| | Notes to the Consolidated Financial Statements (unaudited) | | | 10 | |

Item 2. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 55 | |

Item 3. | | Quantitative and Qualitative Disclosures About Market Risk | | | 81 | |

Item 4. | | Controls and Procedures | | | 83 | |

Part II. | | Other Information | | | 84 | |

Item 1. | | Legal Proceedings | | | 84 | |

Item 2. | | Unregistered Sales of Equity Securities and Use of Proceeds | | | 84 | |

Item 6. | | Exhibits | | | 84 | |

Signatures | | | 89 | |

2

Table of Contents

FORWARD LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as "may," "will," "should," "potential," "intend," "expect," "seek," "anticipate," "estimate," "believe," "could," "project," "predict," "continue," "future" or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to the operating performance of our investments, our financing needs, the effects of our current strategies, loan and securities activities, our ability to manage our collateralized debt obligations, or CDOs, and our ability to raise capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward looking statements. These factors include, but are not limited to:

- •

- adverse economic conditions and the impact on the commercial real estate finance industry;

- •

- access to debt and equity capital and our liquidity;

- •

- our use of leverage;

- •

- our ability to meet various coverage tests with respect to our CDOs;

- •

- our ability to obtain mortgage financing on our net lease properties;

- •

- the affect of economic conditions on the valuations of our investments;

- •

- the impact of economic conditions on the borrowers of the commercial real estate debt we originate and the commercial mortgage loans underlying the commercial mortgage backed securities in which we invest;

- •

- any failure in our due diligence to identify all relevant facts in our underwriting process or otherwise;

- •

- credit rating downgrades;

- •

- tenant or borrower defaults or bankruptcy;

- •

- illiquidity of properties in our portfolio;

- •

- environmental compliance costs and liabilities;

- •

- effect of regulatory actions, litigation and contractual claims against us and our affiliates, including the potential settlement and litigation of such claims;

- •

- competition for investment opportunities;

- •

- regulatory requirements with respect to our business and the related cost of compliance;

- •

- the impact of any conflicts arising from our asset management business;

- •

- the ability to raise capital for the non-listed real estate investment trusts, or REITs, we sponsor;

3

Table of Contents

- •

- changes in laws or regulations governing various aspects of our business;

- •

- the loss of our exemption from the definition of "investment company" under the Investment Company Act of 1940, as amended;

- •

- competition for qualified personnel and our ability to retain key personnel;

- •

- the effectiveness of our risk management systems;

- •

- failure to maintain effective internal controls;

- •

- whether the decision issued by the Court of Appeal of the State of California, Second Appellate District in our favor associated with litigation involving net lease investments formerly leased to Washington Mutual Bank stands and is no longer subject to further appeal;

- •

- compliance with the rules governing REITs; and

- •

- the risk factors described in Item 1A. of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 under the heading "Risk Factors."

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Quarterly Report on Form 10-Q are based upon information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. The factors set forth in the Risk Factors section could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

4

Table of Contents

PART I. Financial Information

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in Thousands, Except Share Data)

| | | | | | | |

| | March 31, 2012

(Unaudited) | | December 31,

2011 | |

|---|

Assets | | | | | | | |

VIE Financing Structures | | | | | | | |

Restricted cash | | $ | 284,478 | | $ | 261,295 | |

Operating real estate, net | | | 316,360 | | | 313,227 | |

Real estate securities, available for sale | | | 1,319,297 | | | 1,358,282 | |

Real estate debt investments, net | | | 1,597,915 | | | 1,631,856 | |

Investments in and advances to unconsolidated ventures | | | 59,930 | | | 60,352 | |

Receivables, net of allowance of $1,237 in 2012 and $1,179 in 2011 | | | 22,306 | | | 22,530 | |

Derivative assets, at fair value | | | 25 | | | 61 | |

Deferred costs and intangible assets, net | | | 44,833 | | | 47,499 | |

Assets of properties held for sale | | | 897 | | | 3,198 | |

Other assets | | | 23,752 | | | 23,135 | |

| | | | | | |

| | | 3,669,793 | | | 3,721,435 | |

| | | | | | |

Non-VIE Financing Structures | | | | | | | |

Cash and cash equivalents | | | 193,940 | | | 144,508 | |

Restricted cash | | | 36,851 | | | 37,069 | |

Operating real estate, net | | | 777,483 | | | 776,222 | |

Real estate securities, available for sale | | | 157,644 | | | 115,023 | |

Real estate debt investments, net | | | 88,316 | | | 78,726 | |

Investments in and advances to unconsolidated ventures | | | 33,865 | | | 33,205 | |

Receivables | | | 13,330 | | | 8,958 | |

Receivables, related parties | | | 5,370 | | | 5,979 | |

Unbilled rent receivable | | | 12,406 | | | 11,891 | |

Derivative assets, at fair value | | | 4,828 | | | 5,674 | |

Deferred costs and intangible assets, net | | | 48,189 | | | 50,885 | |

Other assets | | | 10,980 | | | 16,862 | |

| | | | | | |

| | | 1,383,202 | | | 1,285,002 | |

| | | | | | |

Total assets | | $ | 5,052,995 | | $ | 5,006,437 | |

| | | | | | |

Liabilities | | | | | | | |

VIE Financing Structures | | | | | | | |

CDO bonds payable (see Note 9) | | $ | 2,266,914 | | $ | 2,273,907 | |

Mortgage notes payable | | | 228,525 | | | 228,525 | |

Secured term loan | | | 14,682 | | | 14,682 | |

Accounts payable and accrued expenses | | | 15,423 | | | 15,754 | |

Escrow deposits payable | | | 73,383 | | | 52,660 | |

Derivative liabilities, at fair value | | | 211,987 | | | 226,481 | |

Other liabilities | | | 49,534 | | | 55,007 | |

| | | | | | |

| | | 2,860,448 | | | 2,867,016 | |

| | | | | | |

Non-VIE Financing Structures | | | | | | | |

Mortgage notes payable | | | 557,064 | | | 554,732 | |

Credit facility | | | 69,825 | | | 64,259 | |

Exchangeable senior notes | | | 216,546 | | | 215,853 | |

Junior subordinated notes, at fair value | | | 176,928 | | | 157,168 | |

Accounts payable and accrued expenses | | | 26,300 | | | 50,868 | |

Escrow deposits payable | | | 157 | | | 196 | |

Derivative liabilities, at fair value | | | — | | | 8,193 | |

Other liabilities | | | 33,932 | | | 48,538 | |

| | | | | | |

| | | 1,080,752 | | | 1,099,807 | |

| | | | | | |

Total liabilities | | | 3,941,200 | | | 3,966,823 | |

| | | | | | |

Commitments and contingencies (see Note 15) | | | | | | | |

Equity | | | | | | | |

NorthStar Realty Finance Corp. Stockholders' Equity | | | | | | | |

Preferred stock, 8.75% Series A, $0.01 par value, $60,000 liquidation preference as of March 31, 2012 and December 31, 2011 | | | 57,867 | | | 57,867 | |

Preferred stock, 8.25% Series B, $0.01 par value, $230,000 and $190,000 liquidation preference as of March 31, 2012 and December 31, 2011, respectively | | | 218,703 | | | 183,505 | |

Common stock, $0.01 par value, 500,000,000 shares authorized, 113,357,448 and 96,044,383 shares issued and outstanding at March 31, 2012 and December 31, 2011, respectively | | | 1,133 | | | 960 | |

Additional paid-in capital | | | 897,827 | | | 809,826 | |

Retained earnings (accumulated deficit) | | | (57,542 | ) | | (8,626 | ) |

Accumulated other comprehensive income (loss) | | | (32,287 | ) | | (36,160 | ) |

| | | | | | |

Total NorthStar Realty Finance Corp. stockholders' equity | | | 1,085,701 | | | 1,007,372 | |

Non-controlling interests | | | 26,094 | | | 32,242 | |

| | | | | | |

Total equity | | | 1,111,795 | | | 1,039,614 | |

| | | | | | |

Total liabilities and equity | | $ | 5,052,995 | | $ | 5,006,437 | |

| | | | | | |

See accompanying notes to consolidated financial statements.

5

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in Thousands, Except Share and Per Share Data)

(Unaudited)

| | | | | | | |

| | Three Months Ended

March 31, | |

|---|

| | 2012 | | 2011 | |

|---|

Revenues | | | | | | | |

Interest income | | $ | 80,712 | | $ | 97,640 | |

Rental and escalation income | | | 28,433 | | | 32,927 | |

Commission income | | | 7,399 | | | 918 | |

Other revenue | | | 725 | | | 333 | |

| | | | | | |

Total revenues | | | 117,269 | | | 131,818 | |

Expenses | | | | | | | |

Interest expense | | | 35,298 | | | 33,420 | |

Real estate properties—operating expenses | | | 4,686 | | | 12,497 | |

Asset management expenses | | | 1,497 | | | 2,171 | |

Commission expense | | | 5,649 | | | 717 | |

Other costs, net | | | 192 | | | — | |

Provision for loan losses | | | 6,840 | | | 24,500 | |

Provision for loss on equity investment | | | — | | | 4,482 | |

General and administrative | | | | | | | |

Salaries and equity-based compensation(1) | | | 14,130 | | | 12,741 | |

Auditing and professional fees | | | 1,782 | | | 2,419 | |

Other general and administrative | | | 5,149 | | | 3,672 | |

| | | | | | |

Total general and administrative | | | 21,061 | | | 18,832 | |

Depreciation and amortization | | | 12,306 | | | 8,082 | |

| | | | | | |

Total expenses | | | 87,529 | | | 104,701 | |

| | | | | | |

Income (loss) from operations | | | 29,740 | | | 27,117 | |

Equity in earnings (losses) of unconsolidated ventures | | | (501 | ) | | (2,228 | ) |

Other income (loss) | | | 20,258 | | | 10,138 | |

Unrealized gain (loss) on investments and other | | | (95,406 | ) | | (152,218 | ) |

Realized gain (loss) on investments and other | | | 15,352 | | | 10,734 | |

| | | | | | |

Income (loss) from continuing operations | | | (30,557 | ) | | (106,457 | ) |

Income (loss) from discontinued operations | | | — | | | 409 | |

Gain (loss) on sale from discontinued operations | | | — | | | 5,031 | |

| | | | | | |

Net income (loss) | | | (30,557 | ) | | (101,017 | ) |

Less: net (income) loss allocated to non-controlling interests | | | 1,963 | | | 5,464 | |

Preferred stock dividends | | | (5,323 | ) | | (5,231 | ) |

Contingently redeemable non-controlling interest accretion | | | — | | | (3,009 | ) |

| | | | | | |

Net income (loss) attributable to NorthStar Realty Finance Corp. common stockholders | | $ | (33,917 | ) | $ | (103,793 | ) |

| | | | | | |

Net income (loss) per share from continuing operations (basic/diluted) | | $ | (0.33 | ) | $ | (1.40 | ) |

Income (loss) per share from discontinued operations (basic/diluted) | | | — | | | 0.01 | |

Gain per share on sale of discontinued operations (basic/diluted) | | | — | | | 0.06 | |

| | | | | | |

Net income (loss) per common share attributable to NorthStar Realty Finance Corp. common stockholders (basic/diluted) | | $ | (0.33 | ) | $ | (1.33 | ) |

| | | | | | |

Weighted average number of shares of common stock: | | | | | | | |

Basic | | | 102,247,118 | | | 78,196,016 | |

| | | | | | |

Diluted | | | 107,393,827 | | | 82,534,563 | |

| | | | | | |

Dividends declared per share of common stock | | $ | 0.15 | | $ | 0.10 | |

| | | | | | |

- (1)

- The quarters ended March 31, 2012 and 2011 include $2.3 million and $2.0 million, respectively, of equity-based compensation expense.

See accompanying notes to consolidated financial statements.

6

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Amounts in Thousands)

(Unaudited)

| | | | | | | |

| | Three Months Ended

March 31, | |

|---|

| | 2012 | | 2011 | |

|---|

Net income (loss) | | $ | (30,557 | ) | $ | (101,017 | ) |

Other comprehensive income (loss): | | | | | | | |

Unrealized gain (loss) on real estate securities, available for sale | | | 2,195 | | | — | |

Reclassification adjustment for gains (losses) included in net income (loss) | | | 1,873 | | | 1,874 | |

| | | | | | |

Total other comprehensive income (loss) | | | 4,068 | | | 1,874 | |

Comprehensive income (loss) | | | (26,489 | ) | | (99,143 | ) |

Less: Comprehensive (income) loss attributable to non-controlling interests | | | (1,768 | ) | | 5,365 | |

| | | | | | |

Comprehensive income (loss) attributable to NorthStar Realty Finance Corp. | | $ | (28,257 | ) | $ | (93,778 | ) |

| | | | | | |

See accompanying notes to consolidated financial statements.

7

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Amounts in Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Preferred Stock | |

| |

| |

| |

| |

| |

| |

| |

| |

|---|

| | Series A | | Series B | | Common Stock | |

| | Retained

Earnings

(Accumulated

Deficit) | | Accumulated

Other

Comprehensive

Income (Loss) | | Total

NorthStar

Stockholders'

Equity | |

| |

| |

|---|

| | Additional

Paid-in

Capital | | Non-

controlling

Interests | | Total

Equity | |

|---|

| | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | |

|---|

Balance at December 31, 2010 | | | 2,400 | | $ | 57,867 | | | 7,600 | | $ | 183,505 | | | 78,105 | | $ | 781 | | $ | 723,102 | | $ | 293,382 | | $ | (36,119 | ) | $ | 1,222,518 | | $ | 55,173 | | $ | 1,277,691 | |

Net proceeds from offering of common stock | | | — | | | — | | | — | | | — | | | 17,250 | | | 173 | | | 69,132 | | | — | | | — | | | 69,305 | | | — | | | 69,305 | |

Reclassification of equity compensation to liability | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,136 | ) | | (2,136 | ) |

Non-controlling interest contribution to joint venture | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 144 | | | 144 | |

Non-controlling interest distributions | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (13,202 | ) | | (13,202 | ) |

Dividend reinvestment and stock purchase plan | | | — | | | — | | | — | | | — | | | 62 | | | — | | | 264 | | | — | | | — | | | 264 | | | — | | | 264 | |

Amortization of equity-based compensation | | | — | | | — | | | — | | | — | | | — | | | — | | | 17 | | | — | | | — | | | 17 | | | 11,665 | | | 11,682 | |

Contingently redeemable non-controlling interest accretion | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,178 | ) | | — | | | (5,178 | ) | | — | | | (5,178 | ) |

Equity component of exchangeable notes | | | — | | | — | | | — | | | — | | | — | | | — | | | 10,971 | | | — | | | — | | | 10,971 | | | — | | | 10,971 | |

Other comprehensive income (loss) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (41 | ) | | (41 | ) | | 26 | | | (15 | ) |

Conversion of LTIP units | | | — | | | — | | | — | | | — | | | 628 | | | 6 | | | 6,340 | | | — | | | — | | | 6,346 | | | (6,346 | ) | | — | |

Dividends on common stock | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (38,994 | ) | | — | | | (38,994 | ) | | (1,809 | ) | | (40,803 | ) |

Dividends on preferred stock | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (20,925 | ) | | — | | | (20,925 | ) | | — | | | (20,925 | ) |

Net income (loss) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (236,911 | ) | | — | | | (236,911 | ) | | (11,273 | ) | | (248,184 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at December 31, 2011 | | | 2,400 | | $ | 57,867 | | | 7,600 | | $ | 183,505 | | | 96,045 | | $ | 960 | | $ | 809,826 | | $ | (8,626 | ) | $ | (36,160 | ) | $ | 1,007,372 | | $ | 32,242 | | $ | 1,039,614 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net proceeds from offering of common stock | | | — | | $ | — | | | — | | $ | — | | | 17,250 | | $ | 172 | | $ | 90,140 | | $ | — | | $ | — | | $ | 90,312 | | $ | — | | $ | 90,312 | |

Net proceeds from offering of preferred stock | | | — | | | — | | | 1,600 | | | 35,198 | | | — | | | — | | | — | | | — | | | — | | | 35,198 | | | — | | | 35,198 | |

Redemptions of non-controlling interests | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,357 | ) | | — | | | — | | | (2,357 | ) | | 2,357 | | | — | |

Non-controlling interest distributions | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,797 | ) | | (6,797 | ) |

Dividend reinvestment plan | | | — | | | — | | | — | | | — | | | 8 | | | — | | | 43 | | | — | | | — | | | 43 | | | — | | | 43 | |

Amortization of equity-based compensation | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,329 | | | 2,329 | |

Other comprehensive income (loss) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,873 | | | 3,873 | | | 195 | | | 4,068 | |

Conversion of LTIP units | | | — | | | — | | | — | | | — | | | 54 | | | 1 | | | 175 | | | — | | | — | | | 176 | | | (176 | ) | | — | |

Dividends on common stock | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,999 | ) | | — | | | (14,999 | ) | | (2,093 | ) | | (17,092 | ) |

Dividends on preferred stock | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,323 | ) | | — | | | (5,323 | ) | | — | | | (5,323 | ) |

Net income (loss) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (28,594 | ) | | — | | | (28,594 | ) | | (1,963 | ) | | (30,557 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2012 (unaudited) | | | 2,400 | | $ | 57,867 | | | 9,200 | | $ | 218,703 | | | 113,357 | | $ | 1,133 | | $ | 897,827 | | $ | (57,542 | ) | $ | (32,287 | ) | $ | 1,085,701 | | $ | 26,094 | | $ | 1,111,795 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

8

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in Thousands)

(Unaudited)

| | | | | | | |

| | Three Months Ended

March 31, | |

|---|

| | 2012 | | 2011 | |

|---|

Cash flows from operating activities: | | | | | | | |

Net income (loss) | | $ | (30,557 | ) | $ | (101,017 | ) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

Equity in (earnings) loss of unconsolidated ventures | | | 501 | | | 2,228 | |

Depreciation and amortization | | | 12,306 | | | 8,747 | |

Amortization of premium/discount on investments | | | (19,957 | ) | | (30,967 | ) |

Interest accretion on investments | | | (337 | ) | | (708 | ) |

Amortization of deferred financing costs | | | 860 | | | 1,307 | |

Equity-based compensation | | | 2,329 | | | 2,034 | |

Unrealized (gain) loss on investments and other | | | 73,864 | | | 124,564 | |

Realized gain on sale of investments and other | | | (15,352 | ) | | (15,765 | ) |

Reversal of accrued loss and other costs | | | (22,041 | ) | | — | |

Other income | | | (258 | ) | | — | |

Distributions from unconsolidated ventures | | | 252 | | | 133 | |

Amortization of capitalized above/below market leases | | | (284 | ) | | — | |

Unbilled rent receivable | | | (686 | ) | | (169 | ) |

Provision for loss on equity investment | | | — | | | 4,482 | |

Provision for loan losses | | | 6,840 | | | 24,500 | |

Allowance for uncollectable accounts | | | 118 | | | 33 | |

Changes in assets and liabilities: | | | | | | | |

Restricted cash | | | (3,002 | ) | | (11,846 | ) |

Receivables | | | (5,340 | ) | | (5,363 | ) |

Other assets | | | 9,982 | | | 4,499 | |

Receivables from related parties | | | 2,489 | | | (1,301 | ) |

Accounts payable and accrued expenses | | | (23,794 | ) | | (5,953 | ) |

Real estate debt investment origination fees | | | 888 | | | 2,333 | |

Other liabilities | | | (216 | ) | | (2,471 | ) |

| | | | | | |

Net cash provided by (used in) operating activities | | | (11,395 | ) | | (700 | ) |

Cash flows from investing activities: | | | | | | | |

Acquisitions of operating real estate, net | | | (7,650 | ) | | — | |

Improvements of operating real estate | | | (399 | ) | | (16 | ) |

Deferred costs and intangible assets | | | (267 | ) | | (73 | ) |

Net proceeds from disposition of operating real estate | | | 5,068 | | | 14,939 | |

Acquisitions of real estate securities, available for sale | | | (54,871 | ) | | (93,070 | ) |

Proceeds from sales of real estate securities, available for sale | | | 100,562 | | | 91,310 | |

Repayments on real estate securities, available for sale | | | 29,840 | | | 7,433 | |

Originations/acquisitions of real estate debt investments | | | (47,781 | ) | | (48,814 | ) |

Repayments on real estate debt investments | | | 63,120 | | | 53,884 | |

Proceeds from sales of real estate debt investments | | | 5,343 | | | 11,941 | |

Other receivables | | | 3,303 | | | — | |

Investment in and advances to unconsolidated ventures | | | (1,165 | ) | | (392 | ) |

Distributions from unconsolidated ventures | | | 169 | | | 163 | |

| | | | | | |

Net cash provided by (used in) investing activities | | | 95,272 | | | 37,305 | |

Cash flows from financing activities: | | | | | | | |

Settlement of derivative instrument | | | (8,163 | ) | | — | |

Collateral held by derivative counterparties | | | — | | | 3,000 | |

Borrowings of mortgage notes | | | 4,500 | | | 20,920 | |

Repayments of mortgage notes | | | (2,168 | ) | | (21,458 | ) |

Borrowings under credit facility | | | 9,607 | | | — | |

Repayments of credit facility | | | (4,041 | ) | | — | |

Proceeds from CDO bonds reissuance | | | 7,558 | | | — | |

Proceeds from CDO bonds | | | 10,000 | | | 5,000 | |

Repayments of CDO bonds | | | (141,295 | ) | | (44,480 | ) |

Repurchases of CDO bonds | | | (7,450 | ) | | (34,170 | ) |

Repayments of secured term loans | | | — | | | (22,199 | ) |

Payment of deferred financing costs | | | (88 | ) | | (9,692 | ) |

Change in restricted cash | | | 754 | | | 15,819 | |

Proceeds from exchangeable senior notes | | | — | | | 172,500 | |

Repurchases of exchangeable senior notes | | | — | | | (37,698 | ) |

Proceeds from preferred stock offering | | | 35,198 | | | — | |

Proceeds from common stock offering | | | 90,312 | | | — | |

Proceeds from dividend reinvestment and stock purchase plan | | | 43 | | | 76 | |

Dividends (common and preferred) | | | (20,322 | ) | | (13,039 | ) |

Distributions / repayments to non-controlling interests | | | (8,890 | ) | | (3,685 | ) |

| | | | | | |

Net cash provided by (used in) financing activities | | | (34,445 | ) | | 30,894 | |

Net increase (decrease) in cash and cash equivalents | | | 49,432 | | | 67,499 | |

Cash and cash equivalents—beginning of period | | | 144,508 | | | 125,439 | |

| | | | | | |

Cash and cash equivalents—end of period | | $ | 193,940 | | $ | 192,938 | |

| | | | | | |

See accompanying notes to consolidated financial statements.

9

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Amounts in Thousands, Except Per Share Data

1. Formation and Organization

NorthStar Realty Finance Corp., a real estate finance company and Maryland corporation (the "Company"), is an internally-managed real estate investment trust ("REIT"), which was formed in October 2003 in order to continue and expand the commercial real estate ("CRE") debt, CRE securities and net lease businesses conducted by its predecessor. In addition, the Company engages in asset management and other activities related to real estate and real estate finance. Substantially all of the Company's assets, directly or indirectly, are held by, and the Company conducts its operations, directly or indirectly, through NorthStar Realty Finance Limited Partnership, a Delaware limited partnership and the operating partnership of the Company (the "Operating Partnership").

2. Summary of Significant Accounting Policies

Basis of Quarterly Presentation

The accompanying consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP") for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company's financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company's consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2011, which was filed with the Securities and Exchange Commission ("SEC").

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, and its subsidiaries, which are majority-owned and controlled by the Company or a variable interest entity ("VIE") where the Company is the primary beneficiary. All significant intercompany balances have been eliminated in consolidation.

A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and its quantitative analysis on the forecasted cash flows of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents, has a potentially significant interest in the entity and controls such entity's significant decisions. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including, but not limited to: which activities most

10

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

2. Summary of Significant Accounting Policies (Continued)

significantly impact the VIE's economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE's purpose and design, including the risks the VIE was designed to create and passthrough to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements. Actual results could differ materially from these estimates and assumptions.

Reclassifications

Certain prior period amounts have been reclassified in the consolidated financial statements to conform to the current period presentation.

Comprehensive Income

The Company reports consolidated comprehensive income in separate statements following its consolidated statements of operations. Comprehensive income is defined as the change in equity resulting from net income (loss) and other comprehensive income (loss) ("OCI"). The Company's components of OCI principally include: (i) unrealized gain (loss) of securities available for sale for which the fair value option is not elected; and (ii) unrealized gain (loss) on derivative instruments that are or were deemed to be effective hedges.

Fair Value Option

The fair value option provides an election that allows companies to irrevocably elect fair value for certain financial assets and liabilities on an instrument-by-instrument basis at initial recognition. Changes in fair value for assets and liabilities for which the election is made will be recognized in earnings as they occur.

Real Estate Debt Investments

CRE debt investments are generally intended to be held to maturity and, accordingly, are carried at cost, net of unamortized loan origination fees, discounts and unfunded commitments. CRE debt investments that are deemed to be impaired are carried at amortized cost less a loan loss reserve, if deemed appropriate, and represents fair value.

Real Estate Securities

The Company classifies its CRE securities as available for sale on the acquisition date. Available for sale securities are recorded at fair value. The Company has generally elected to apply the fair value

11

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

2. Summary of Significant Accounting Policies (Continued)

option of accounting for its CRE securities portfolio. For those CRE securities for which the fair value option of accounting was elected, any unrealized gains (losses) from changes in fair value are recorded in unrealized gains (losses) on investments and other in the Company's consolidated statements of operations.

The Company may decide to not elect the fair value option for certain CRE securities due to the nature of the particular instrument. For those CRE securities for which the fair value option of accounting was not elected, any unrealized gains (losses) from the change in fair value is reported as a component of accumulated other comprehensive income (loss) in the Company's consolidated statements of equity, to the extent impairment losses are considered temporary.

Operating Real Estate

Operating real estate is carried at historical cost less accumulated depreciation. The Company follows the purchase method of accounting for acquisitions of operating real estate held for investment, where the purchase price of operating real estate is allocated to tangible assets such as land, building, tenant improvements and other identified intangibles. The Company evaluates whether real estate acquired in connection with a foreclosure, UCC/deed in lieu of foreclosure or a consentual modification of a loan (herein collectively referred to as a foreclosure) ("REO") constitutes a business and whether business combination accounting is relevant. Any excess upon foreclosure of a property between the carrying value of a loan over the estimated fair value of the property is charged to provision for loan losses.

Operating real estate, including REO, which has met the criteria to be classified as held for sale, is separately presented in the consolidated balance sheets. Such operating real estate is reported at the lower of its carrying value or its estimated fair value less the cost to sell. Once a property is determined to be held for sale, depreciation is no longer recorded. In addition, the results of operations are reclassified to income (loss) from discontinued operations in the consolidated statements of operations. Other REO for which the Company intends to market for sale in the near term is recorded at estimated fair value.

Revenue Recognition

Real Estate Debt Investments

Interest income is recognized on an accrual basis and any related discount, premium, origination costs and fees are amortized over the life of the investment using the effective interest method. The amortization is reflected as an adjustment to interest income in the consolidated statements of operations. The accretion of discount or amortization of a premium is discontinued if such loan is reclassified to held for sale.

Loans acquired at a discount with deteriorated credit quality are accreted to expected recovery. The Company continues to estimate the amount of recovery over the life of such loans. A subsequent increase in expected future cash flows is recognized as an adjustment to the accretable yield prospectively over the remaining life of such loan.

12

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

2. Summary of Significant Accounting Policies (Continued)

Real Estate Securities

Interest income is recognized using the effective interest method with any purchased premium or discount accreted through earnings based upon expected cash flows through the expected maturity date of the security. Changes to expected cash flows may result in a change to the yield which is then used prospectively to recognize interest income.

Operating Real Estate

Rental income from operating real estate is derived from leasing of space to various types of corporate tenants and healthcare operators. The leases are for fixed terms of varying length and generally provide for annual rentals and expense reimbursements to be paid in monthly installments. Rental income from leases is recognized on a straight-line basis over the term of the respective leases.

Credit Losses and Impairment on Investments

Provision for Loan Losses

Loans are considered impaired when based on current information and events, it is probable that the Company will not be able to collect principal and interest amounts due according to the contractual terms. Management assesses the credit quality of the portfolio and adequacy of loan loss reserves on a quarterly basis, or more frequently as necessary. Significant judgment of the Company is required in this analysis. The Company considers the estimated net recoverable value of the loan as well as other factors, including but not limited to fair value of any collateral, the amount and the status of any senior debt, the prospects for the borrower and the competitive situation of the region where the borrower does business. Because this determination is based upon projections of future economic events, which are inherently subjective, the amounts ultimately realized may differ materially from the carrying value as of the balance sheet date. If upon completion of the assessment, the fair value of the underlying collateral is less than the net carrying value of the loan, a loan loss reserve is recorded with a corresponding charge to the provision for loan losses. The loan loss reserve for each loan is maintained at a level that is determined to be adequate by management to absorb probable losses.

Income recognition is suspended for loans at the earlier of the date at which payments become 90-days past due or when, in the opinion of the Company, a full recovery of income and principal becomes doubtful. When the ultimate collectability of the principal of an impaired loan is in doubt, all payments are applied to principal under the cost recovery method. When the ultimate collectability of the principal of an impaired loan is not in doubt, contractual interest is recorded as interest income when received, under the cash basis method until an accrual is resumed when the loan becomes contractually current and performance is demonstrated to be resumed. A loan is written off when it is no longer realizable and/or legally discharged.

Real Estate Securities

CRE securities for which the fair value option is elected are not evaluated for other-than-temporary impairment ("OTTI") as changes in fair value are recorded in the Company's consolidated statements of operations. Realized losses on such securities are reclassified to realized

13

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

2. Summary of Significant Accounting Policies (Continued)

gain (loss) on investments and other as losses occur. CRE securities for which the fair value option is not elected are evaluated for OTTI quarterly.

Operating Real Estate

The Company's real estate portfolio is reviewed on a quarterly basis, or more frequently as necessary, to assess whether there are any indicators that the value of its operating real estate may be impaired or that its carrying value may not be recoverable. A property's value is considered impaired if the Company's estimate of the aggregate future undiscounted cash flows to be generated by the property is less than the carrying value of the property. In conducting this review, the Company considers U.S. macroeconomic factors, including real estate sector conditions, together with asset specific and other factors. To the extent an impairment has occurred and is considered to be other than temporary, the loss will be measured as the excess of the carrying amount of the property over the calculated fair value of the property.

Allowances for doubtful accounts for tenant receivables are established based on periodic review of aged receivables resulting from estimated losses due to the inability of tenants to make required rent and other payments contractually due. Additionally, the Company establishes, on a current basis, an allowance for future tenant credit losses on billed and unbilled rents receivable based upon an evaluation of the collectability of such amounts.

Troubled Debt Restructuring

CRE debt investments modified in a troubled debt restructuring ("TDR") are modifications granting a concession to a borrower experiencing financial difficulties where a lender agrees to terms that are more favorable to the borrower than is otherwise available in the current market. Management judgment is necessary to determine whether a loan modification is considered a TDR. Troubled debt that is fully satisfied via foreclosure, repossession or other transfers of assets is generally included in the definition of TDR. Loans acquired as a pool with deteriorated credit quality that have been modified are not considered a TDR.

Other

Refer to the section of the Company's Annual Report on Form 10-K for the year ended December 31, 2011 entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies" for a full discussion of the Company's critical accounting policies.

Recently Issued Pronouncements

In May 2011, the Financial Accounting Standards Board ("FASB") issued an accounting update to amend existing guidance concerning fair value measurements and disclosures. The update is intended to achieve common fair value measurements and disclosure requirements under U.S. GAAP and International Financial Reporting Standards and is effective in the first interim or annual period beginning after December 15, 2011. The Company adopted this accounting update in the first quarter

14

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

2. Summary of Significant Accounting Policies (Continued)

2012 and the required disclosures have been incorporated into Note 4 of the consolidated financial statements. The adoption did not have a material impact on the consolidated financial statements.

In June 2011, the FASB issued an accounting update concerning the presentation of comprehensive income. The update requires either a single, continuous statement of comprehensive income be included in the statement of operations or an additional statement of comprehensive income immediately following the statement of operations. The update does not change the components of OCI that must be reported but it eliminates the option to present other comprehensive income on the statement of equity. In December 2011, the FASB issued an accounting update to defer the requirement to present the reclassification adjustments to OCI by component and are currently redeliberating this requirement. The remaining requirements of the accounting update are effective for the Company the first quarter of 2012 and should be applied retrospectively to all periods reported after the effective date. There is no impact on the consolidated financial statements as the Company currently complies with the update.

3. Variable Interest Entities

The Company has evaluated its CRE debt and security investments, investments in unconsolidated ventures, liabilities to subsidiary trusts issuing preferred securities ("junior subordinated notes") and its collateralized debt obligations ("CDOs") to determine whether they are a VIE. The Company monitors these investments and, to the extent it has determined that it potentially owns a majority of the current controlling class, analyzes them for potential consolidation. The Company will continue to analyze future investments and liabilities, as well as reconsideration events, including a modified loan deemed to be a troubled debt restructuring, pursuant to the VIE requirements. These analyses require considerable judgment in determining the primary beneficiary of a VIE. This could result in the consolidation of an entity that would otherwise not have been consolidated or the non-consolidation of an entity that would have otherwise have been consolidated.

Consolidated VIEs (the Company is the primary beneficiary)

The Company has sponsored nine CDOs, which are referred to as the N-Star CDOs. In addition, the Company has acquired the equity interests of two CDOs, the CSE RE 2006-A CDO ("CSE CDO") and the CapLease 2005-1 CDO ("CapLease CDO"). The Company collectively refers to subordinate CDO bonds, preferred shares and equity notes as equity interests in a CDO. In the case of the CSE CDO, the Company was delegated the collateral management and special servicing rights, and for the CapLease CDO, the Company acquired the collateral management rights.

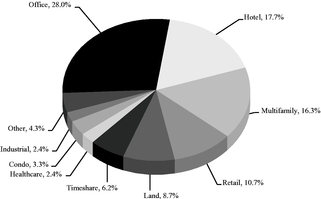

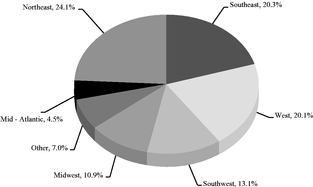

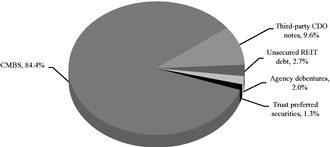

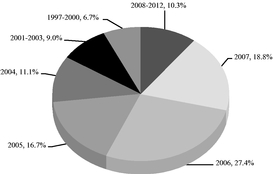

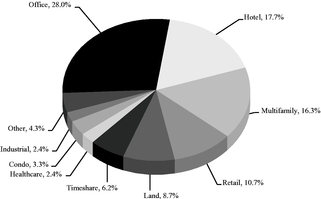

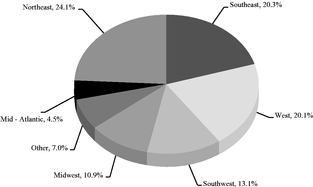

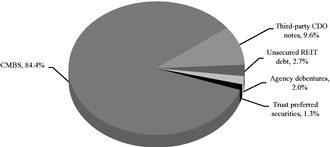

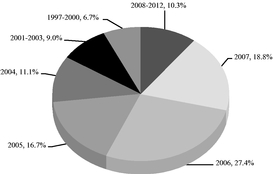

The CRE debt investments that serve as collateral for the CDO financing transactions include first mortgage loans, subordinate mortgage interests, mezzanine loans, credit tenant loans ("CTLs") and other loans. The CRE securities that serve as collateral for the CDO financing transactions include commercial mortgage-backed securities ("CMBS"), unsecured REIT debt and CDO notes backed primarily by CRE securities and CRE debt. By financing these assets with long-term borrowings through the issuance of CDO bonds, the Company seeks to generate attractive risk-adjusted equity returns and to match the term of its assets and liabilities. In connection with these financing transactions, the Company has various forms of significant ongoing involvement, which may include: (i) holding senior or subordinated interests in the CDOs; (ii) asset management; and (iii) entering into

15

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

3. Variable Interest Entities (Continued)

derivative contracts to manage interest rate risk. Each CDO transaction is considered a VIE. The Company has determined it is the primary beneficiary, and as a result, consolidates all of its CDO financing transactions, including the CSE CDO and CapLease CDO.

The following table displays the classification and carrying value of assets and liabilities of consolidated VIEs as of March 31, 2012 (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated Variable Interest Entities | |

|---|

| | N-Star I | | N-Star II | | N-Star III | | N-Star IV | | N-Star V | | N-Star VI | | N-Star VII | | N-Star VIII | | N-Star IX | | CSE

CDO | | CapLease

CDO | | Total | |

|---|

Assets of consolidated VIEs: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted cash(1) | | $ | 8,793 | | $ | 211 | | $ | 55,658 | | $ | 12,132 | | $ | 87 | | $ | 45,627 | | $ | 8,589 | | $ | 48,848 | | $ | 31,285 | | $ | 69,040 | | $ | 4,208 | | $ | 284,478 | |

Operating real estate, net | | | — | | | — | | | — | | | 68,000 | | | — | | | — | | | — | | | 243,010 | | | — | | | 5,350 | | | — | | | 316,360 | |

Real estate securities, available for sale | | | 169,313 | | | 149,550 | | | 152,911 | | | 30,894 | | | 168,793 | | | 35,625 | | | 197,843 | | | 9,022 | | | 334,125 | | | 57,721 | | | 13,500 | | | 1,319,297 | |

Real estate debt investments, net | | | — | | | — | | | 24,882 | | | 228,104 | | | — | | | 301,619 | | | — | | | 478,107 | | | 37,306 | | | 404,245 | | | 123,652 | | | 1,597,915 | |

Investments in and advances to unconsolidated ventures | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 59,930 | | | — | | | — | | | — | | | 59,930 | |

Receivables, net of allowance | | | 1,587 | | | 1,312 | | | 1,600 | | | 1,426 | | | 1,687 | | | 1,018 | | | 2,426 | | | 3,148 | | | 3,875 | | | 3,493 | | | 734 | | | 22,306 | |

Derivative assets, at fair value | | | — | | | — | | | — | | | — | | | — | | | — | | | 25 | | | — | | | — | | | — | | | — | | | 25 | |

Deferred costs and intangible assets, net | | | — | | | — | | | — | | | 3,577 | | | — | | | 103 | | | — | | | 41,153 | | | — | | | — | | | — | | | 44,833 | |

Assets of properties held for sale | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 897 | | | — | | | 897 | |

Other assets | | | 388 | | | 19 | | | 7 | | | 877 | | | 27 | | | 2,675 | | | 3,351 | | | 2,506 | | | 153 | | | 13,580 | | | 169 | | | 23,752 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets of consolidated VIEs(2) | | | 180,081 | | | 151,092 | | | 235,058 | | | 345,010 | | | 170,594 | | | 386,667 | | | 212,234 | | | 885,724 | | | 406,744 | | | 554,326 | | | 142,263 | | | 3,669,793 | |

Liabilities of consolidated VIEs: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CDO bonds payable | | | 159,302 | | | 109,471 | | | 154,927 | | | 143,011 | | | 127,801 | | | 182,930 | | | 172,623 | | | 361,007 | | | 236,712 | | | 501,215 | | | 117,915 | | | 2,266,914 | |

Mortgage notes payable | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 228,525 | | | — | | | — | | | — | | | 228,525 | |

Secured term loan | | | — | | | — | | | — | | | — | | | — | | | 14,682 | | | — | | | — | | | — | | | — | | | — | | | 14,682 | |

Accounts payable and accrued expenses | | | 918 | | | 81 | | | 775 | | | 1,507 | | | 458 | | | 563 | | | 341 | | | 4,832 | | | 1,598 | | | 3,151 | | | 1,199 | | | 15,423 | |

Escrow deposits payable | | | — | | | — | | | — | | | 4,731 | | | — | | | 27,129 | | | — | | | 23,907 | | | 339 | | | 16,572 | | | 705 | | | 73,383 | |

Derivative liabilities, at fair value | | | 4,743 | | | 9,664 | | | 15,910 | | | — | | | 37,620 | | | 8,103 | | | 49,859 | | | 25,011 | | | 48,180 | | | 12,897 | | | — | | | 211,987 | |

Other liabilities | | | — | | | — | | | — | | | 1,475 | | | — | | | — | | | 349 | | | 20,183 | | | 27,510 | | | 17 | | | — | | | 49,534 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities of consolidated VIEs(3) | | | 164,963 | | | 119,216 | | | 171,612 | | | 150,724 | | | 165,879 | | | 233,407 | | | 223,172 | | | 663,465 | | | 314,339 | | | 533,852 | | | 119,819 | | | 2,860,448 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets | | $ | 15,118 | | $ | 31,876 | | $ | 63,446 | | $ | 194,286 | | $ | 4,715 | | $ | 153,260 | | $ | (10,938 | ) | $ | 222,259 | | $ | 92,405 | | $ | 20,474 | | $ | 22,444 | | $ | 809,345 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

- (1)

- Includes $4.5 million available for re-investment in N-Star CDO IX.

- (2)

- Assets of each of the consolidated VIEs may only be used to settle obligations of the respective VIE.

- (3)

- Creditors of each of the consolidated VIEs have no recourse to the general credit of the Company.

The Company did not provide financial support to any of its consolidated VIEs for the three months ended March 31, 2012. As of March 31, 2012, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to any of its consolidated VIEs.

Unconsolidated VIEs (the Company is not the primary beneficiary, but has a variable interest)

Based on management's analysis, the Company is not the primary beneficiary of VIEs it has identified since it does not have both the: (i) power to direct the activities that most significantly

16

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

3. Variable Interest Entities (Continued)

impact the VIE's economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. Accordingly, these VIEs are not consolidated into the Company's financial statements as of March 31, 2012.

Real Estate Securities

The Company has identified eight CRE securities with a fair value of $83.3 million as a variable interest in a VIE. The Company has determined that it is not the primary beneficiary, and as such, the VIE should not be consolidated in the Company's financial statements.

In 2011, in connection with three existing CMBS investments, the Company became the controlling class of a securitization the Company did not sponsor. The Company determined each securitization was a VIE. However, the Company determined at that time and continues to believe that it does not currently or potentially hold a significant interest in any of these securitizations and, therefore, is not the primary beneficiary. As such, these VIEs are not consolidated.

In March 2011, in connection with existing investments of certain CMBS, the Company became the controlling class of a securitization that the Company did not sponsor. The Company determined it was the primary beneficiary due to having ownership in more than 50% of the controlling class and the right to appoint the special servicer, which gave the Company the power to direct the activities that impact the economic performance of the VIE. However, the Company sold a significant portion of this investment, and as such, it was determined the Company was no longer the primary beneficiary. Then, in September 2011, the Company was appointed special servicer for a loan in this securitization. The Company does not currently or potentially hold a significant interest and, therefore, is not the primary beneficiary. As such, the VIE is not consolidated.

In June 2011, the Company acquired the "B-piece" in a new $2.1 billion CMBS securitization. The Company was appointed as special servicer for the securitization. The Company has determined that the securitization is a VIE. However, the Company, determined at that time and continues to believe that it does not currently or potentially hold a significant interest and, therefore, is not the primary beneficiary. As such, the VIE is not consolidated.

In August 2011, the Company invested in a securitization collateralized by originally investment grade rated N-Star CDO bonds. The fair value is $22.4 million as of March 31, 2012. The Company has determined that the securitization is a VIE. However, the Company determined at that time and continues to believe that it does not have the power to direct the activities that most significantly impact the economic performance of the VIE and does not currently or potentially hold a significant interest and, therefore, is not the primary beneficiary. As such, the VIE is not consolidated.

In February 2012, in connection with an existing CMBS investment, the Company became the controlling class of a securitization the Company did not sponsor and was appointed as special servicer for a loan in the securitization. The Company determined the securitization was a VIE. However, the Company determined at that time and continues to believe that it does not currently or potentially hold a significant interest and, therefore, is not the primary beneficiary. As such, the VIE is not consolidated.

17

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

3. Variable Interest Entities (Continued)

In March 2012, the Company invested in a securitization collateralized by originally investment grade rated N-Star CDO bonds. The fair value is $23.4 million as of March 31, 2012. The Company has determined that the securitization is a VIE. However, the Company determined at that time and continues to believe that it does not have the power to direct the activities that most significantly impact the economic performance of the VIE and does not currently or potentially hold a significant interest and, therefore, is not the primary beneficiary. As such, the VIE is not consolidated.

NorthStar Realty Finance Trusts

The Company owns all of the common stock of NorthStar Realty Finance Trusts I through VIII (collectively, the "Trusts"). The Trusts were formed to issue trust preferred securities. The Company determined that the holders of the trust preferred securities were the primary beneficiaries of the Trusts. As a result, the Company did not consolidate the Trusts and has accounted for the investment in the common stock of the Trusts under the equity method of accounting.

The following table displays the classification, carrying value and maximum exposure of unconsolidated VIEs as of March 31, 2012 (amounts in thousands):

| | | | | | | | | | | | | |

| | Unconsolidated Variable

Interest Entities | |

| |

| |

|---|

| | Junior

Subordinated

Notes, at

Fair Value | | Real Estate

Securities,

Available

for Sale | | Total | | Maximum

Exposure

to Loss(1) | |

|---|

Real estate securities, available for sale | | $ | — | | $ | 83,333 | | $ | 83,333 | | $ | 83,333 | |

| | | | | | | | | | |

Total assets | | | | | | 83,333 | | | 83,333 | | | 83,333 | |

Junior subordinated notes, at fair value | | | 176,928 | | | — | | | 176,928 | | | NA | |

| | | | | | | | | | |

Total liabilities | | | 176,928 | | | — | | | 176,928 | | | NA | |

| | | | | | | | | | |

Net asset (liability) | | $ | (176,928 | ) | $ | 83,333 | | $ | (93,595 | ) | | NA | |

| | | | | | | | | | |

- (1)

- The Company's maximum exposure to loss as of March 31, 2012 would not exceed the carrying value of its investment.

The Company did not provide financial support to any of its unconsolidated VIEs during the three months ended March 31, 2012. As of March 31, 2012, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to any of its unconsolidated VIEs.

4. Fair Value

Fair Value Measurement

The Company follows fair value guidance in accordance with U.S. GAAP to account for its financial instruments. The Company categorizes its financial instruments, based on the priority of the inputs to the valuation technique, into a three-level fair value hierarchy. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the

18

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

lowest priority to unobservable inputs (Level 3). If the inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

Financial assets and liabilities recorded at fair value on the consolidated balance sheets are categorized based on the inputs to the valuation techniques as follows:

| | | | |

| Level 1. | | Quoted prices for identical assets or liabilities in an active market. |

Level 2. |

|

Financial assets and liabilities whose values are based on the following: |

|

|

a) |

|

Quoted prices for similar assets or liabilities in active markets. |

|

|

b) |

|

Quoted prices for identical or similar assets or liabilities in non-active markets. |

|

|

c) |

|

Pricing models whose inputs are observable for substantially the full term of the asset or liability. |

|

|

d) |

|

Pricing models whose inputs are derived principally from or corroborated by observable market data for substantially the full term of the asset or liability. |

Level 3. |

|

Prices or valuation techniques based on inputs that are both unobservable and significant to the overall fair value measurement. |

Determination of Fair Value

The following is a description of the valuation techniques used to measure fair value and the general classification of these instruments pursuant to the fair value hierarchy.

Real Estate Securities

CRE securities are generally valued using a third-party pricing service or broker quotations. These quotations are not adjusted and are based on observable inputs that can be validated, and as such, are classified as Level 2 of the fair value hierarchy. Certain CRE securities are valued based on a single broker quote or an internal price which have less observable pricing, and as such, are classified as Level 3 of the fair value hierarchy.

Derivative Instruments

Derivative instruments are valued using a third-party pricing service. These quotations are not adjusted and are generally based on valuation models with market observable inputs such as interest rates and contractual cash flows, and as such, are classified as Level 2 of the fair value hierarchy. Derivative instruments are also assessed for credit valuation adjustments due to the risk of non-performance by the Company and derivative counterparties. However, since the majority of the Company's derivatives are held in non-recourse CDO financing structures where, by design, the derivative contracts are senior to all the CDO bonds payable, there is no material impact of a credit valuation adjustment.

19

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

CDO Bonds Payable

CDO bonds payable are valued using quotations from nationally recognized financial institutions that acted as underwriter for the transactions. These quotations are not adjusted and are generally based on valuation models using market observable inputs for interest rates and other unobservable inputs for assumptions related to the timing and amount of expected future cash flows, the discount rate, estimated prepayments and projected losses. CDO bonds payable are classified as Level 3 of the fair value hierarchy.

Junior Subordinated Notes

Junior subordinated notes are valued using quotations from nationally recognized financial institutions. These quotations are not adjusted and are generally based on a valuation model using market observable inputs for interest rates and other unobservable inputs for assumptions related to the implied credit spread of the Company's other borrowings and the timing and amount of expected future cash flows. Junior subordinated notes are classified as Level 3 of the fair value hierarchy.

Fair Value Measurement

Financial assets and liabilities recorded at fair value on a recurring basis are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

20

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

The following tables set forth the Company's financial assets and liabilities that were accounted for at fair value on a recurring basis as of March 31, 2012 and December 31, 2011 by level within the fair value hierarchy (amounts in thousands):

| | | | | | | | | | | | | |

| | March 31, 2012 | |

|---|

| | Level 1 | | Level 2 | | Level 3 | | Total | |

|---|

Assets: | | | | | | | | | | | | | |

Real estate securities, available for sale: | | | | | | | | | | | | | |

CMBS | | $ | — | | $ | 978,537 | | $ | 273,014 | | $ | 1,251,551 | |

Third-party CDO notes | | | — | | | — | | | 90,992 | | | 90,992 | |

Unsecured REIT debt | | | — | | | 85,195 | | | 338 | | | 85,533 | |

Trust preferred securities | | | — | | | — | | | 26,600 | | | 26,600 | |

Agency debentures | | | — | | | 22,265 | | | — | | | 22,265 | |

| | | | | | | | | | |

Subtotal real estate securities, available for sale | | | — | | | 1,085,997 | | | 390,944 | | | 1,476,941 | |

Derivative assets | | | — | | | 4,853 | | | — | | | 4,853 | |

| | | | | | | | | | |

Total assets | | $ | — | | $ | 1,090,850 | | $ | 390,944 | | $ | 1,481,794 | |

| | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | |

CDO bonds payable(1) | | $ | — | | $ | — | | $ | 2,148,999 | | $ | 2,148,999 | |

Junior subordinated notes | | | — | | | — | | | 176,928 | | | 176,928 | |

Derivative liabilities | | | — | | | 211,987 | | | — | | | 211,987 | |

| | | | | | | | | | |

Total liabilities | | $ | — | | $ | 211,987 | | $ | 2,325,927 | | $ | 2,537,914 | |

| | | | | | | | | | |

- (1)

- Excludes CapLease CDO bonds payable for which the fair value option was not elected.

| | | | | | | | | | | | | |

| | December 31, 2011 | |

|---|

| | Level 1 | | Level 2 | | Level 3 | | Total | |

|---|

Assets: | | | | | | | | | | | | | |

Real estate securities, available for sale: | | | | | | | | | | | | | |

CMBS | | $ | — | | $ | 936,315 | | $ | 336,421 | | $ | 1,272,736 | |

Third-party CDO notes | | | — | | | — | | | 63,567 | | | 63,567 | |

Unsecured REIT debt | | | — | | | 90,824 | | | 3,474 | | | 94,298 | |

Trust preferred securities | | | — | | | — | | | 19,145 | | | 19,145 | |

Agency debentures | | | — | | | 23,559 | | | — | | | 23,559 | |

| | | | | | | | | | |

Subtotal real estate securities, available for sale | | | — | | | 1,050,698 | | | 422,607 | | | 1,473,305 | |

Derivative assets | | | — | | | 5,735 | | | — | | | 5,735 | |

| | | | | | | | | | |

Total assets | | $ | — | | $ | 1,056,433 | | $ | 422,607 | | $ | 1,479,040 | |

| | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | |

CDO bonds payable(1) | | $ | — | | $ | — | | $ | 2,145,239 | | $ | 2,145,239 | |

Junior subordinated notes | | | — | | | — | | | 157,168 | | | 157,168 | |

Derivative liabilities | | | — | | | 234,674 | | | — | | | 234,674 | |

| | | | | | | | | | |

Total liabilities | | $ | — | | $ | 234,674 | | $ | 2,302,407 | | $ | 2,537,081 | |

| | | | | | | | | | |

- (1)

- Excludes CapLease CDO bonds payable for which the fair value option was not elected.

21

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

The following table presents additional information about the Company's financial assets and liabilities which are measured at fair value on a recurring basis as of March 31, 2012 and December 31, 2011, for which the Company has utilized Level 3 inputs to determine fair value (amounts in thousands):

| | | | | | | | | | | | | | | | | | | |

| | March 31, 2012 | | December 31, 2011 | |

|---|

| | Real Estate

Securities | | CDO Bonds

Payable | | Junior

Subordinated

Notes | | Real Estate

Securities | | CDO Bonds

Payable | | Junior

Subordinated

Notes | |

|---|

Beginning balance | | $ | 422,607 | | $ | 2,145,239 | | $ | 157,168 | | $ | 492,576 | | $ | 2,258,805 | | $ | 191,250 | |

Transfers into Level 3(1) | | | 40,826 | | | — | | | — | | | 469,209 | | | — | | | — | |

Transfers out of Level 3(1) | | | (102,874 | ) | | — | | | — | | | (434,036 | ) | | — | | | — | |

Purchases / borrowings / amortization | | | 26,531 | | | 17,609 | | | — | | | 146,152 | | | 65,199 | | | — | |

Sales | | | (18,052 | ) | | — | | | — | | | (111,437 | ) | | — | | | — | |

Paydowns | | | (10,236 | ) | | (129,537 | ) | | — | | | (23,361 | ) | | (325,989 | ) | | — | |

Repurchases | | | — | | | (7,450 | ) | | — | | | — | | | (75,316 | ) | | — | |

Losses (realized or unrealized) | | | | | | | | | | | | | | | | | | | |

Included in earnings | | | (12,682 | ) | | 125,579 | | | 19,760 | | | (216,939 | ) | | 225,186 | | | — | |

Included in other comprehensive income (loss) | | | — | | | — | | | — | | | (7,676 | ) | | — | | | — | |

Gains (realized or unrealized) | | | | | | | | | | | | | | | | | | | |

Included in earnings | | | 39,752 | | | (2,441 | ) | | — | | | 108,109 | | | (2,646 | ) | | (34,082 | ) |

Included in other comprehensive income (loss) | | | 5,072 | | | — | | | — | | | 10 | | | — | | | — | |

| | | | | | | | | | | | | | |

Ending balance | | $ | 390,944 | | $ | 2,148,999 | | $ | 176,928 | | $ | 422,607 | | $ | 2,145,239 | | $ | 157,168 | |

| | | | | | | | | | | | | | |

Gains (losses) included in earnings attributable to the change in unrealized gains (losses) relating to assets or liabilities still held. | | $ | (7,586 | ) | $ | (123,138 | ) | $ | (19,760 | ) | $ | (121,258 | ) | $ | (197,053 | ) | $ | 34,082 | |

| | | | | | | | | | | | | | |

- (1)

- Transfers between Level 2 and Level 3 represent a fair value measurement from a third-party pricing service or a broker quotation that has become less observable during the period. Transfers are assumed to occur at the beginning of the period.

The Company relied on the third-party pricing exception with respect to the requirement to provide quantitative disclosures about significant Level 3 inputs being used. The Company believes such broker quotes may be based on market transactions with comparable coupons and credit (such as credit support and delinquency rates). Significant increases (decreases) in any one of the inputs in isolation may result in a significantly different fair value for, financial assets and liabilities utilizing such Level 3 inputs.

The Company's non-recurring financial measurements include the measurement of provision for loan losses on CRE debt and provision for loss on equity investments in unconsolidated ventures, which are classified as Level 3 of the fair value hierarchy. For the three months ended March 31, 2012, the

22

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

provision for loan losses are generally based on a discounted cash flow model of a loan's underlying collateral. The key unobservable inputs used to determine the provision for loan loss for the three months ended March 31, 2012, included discount rates ranging from 7.0% to 15.5% and capitalization rates ranging from 5.0% to 23.0%. Refer to Note 7 for a further discussion of impairment on our CRE debt and Note 8 for a discussion of impairment on investments in unconsolidated ventures, if any.

Fair Value Option

The Company has generally elected to apply the fair value option of accounting to the following financial assets and liabilities existing at the time of adoption or at the time the Company recognizes the eligible item for the purpose of consistent accounting application: CRE securities; CDO bonds payable; and junior subordinated notes. The Company may decide not to elect the fair value option for certain of its financial assets or liabilities due to the nature of the instrument. As of March 31, 2012, the Company had 16 CRE securities with an aggregate carrying value of $137.5 million for which the fair value option was not elected and the CapLease CDO bonds payable with a carrying value of $117.9 million for which the fair value option was not elected.

The following table sets forth the fair value of the Company's financial instruments for which the fair value option was elected as of March 31, 2012 and December 31, 2011 (amounts in thousands):

| | | | | | | |

| | March 31,

2012 | | December 31,

2011 | |

|---|

Assets: | | | | | | | |

Real estate securities, available for sale:(1) | | | | | | | |

CMBS | | $ | 1,172,900 | | $ | 1,199,660 | |

Third-party CDO notes | | | 32,116 | | | 40,231 | |

Unsecured REIT debt | | | 85,533 | | | 94,298 | |

Trust preferred securities | | | 26,600 | | | 19,145 | |

Agency debentures | | | 22,265 | | | 23,559 | |

| | | | | | |

Total assets | | $ | 1,339,414 | | $ | 1,376,893 | |

| | | | | | |

Liabilities: | | | | | | | |

CDO bonds payable(2) | | $ | 2,148,999 | | $ | 2,145,239 | |

Junior subordinated notes | | | 176,928 | | | 157,168 | |

| | | | | | |

Total liabilities | | $ | 2,325,927 | | $ | 2,302,407 | |

| | | | | | |

- (1)

- March 31, 2012 excludes 16 CRE securities with an aggregate carrying value of $137.5 million for which the fair value option was not elected. December 31, 2011 excludes ten CRE securities with an aggregate carrying value of $96.4 million for which the fair value option was not elected.

- (2)

- March 31, 2012 and December 31, 2011 excludes CapLease CDO bonds payable with a carrying value of $117.9 million and $128.7 million for which the fair value option was not elected, respectively.

23

Table of Contents

NORTHSTAR REALTY FINANCE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Amounts in Thousands, Except Per Share Data

4. Fair Value (Continued)

The following table presents the difference between the fair value and the aggregate principal amount of assets and liabilities, for which the fair value option has been elected as of March 31, 2012 (amounts in thousands):

| | | | | | | | | | |

| | Fair Value at

March 31,

2012 | | Amount

Due Upon

Maturity | | Difference | |