UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

| (Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2014 |

| or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number: 001-32330

NORTHSTAR REALTY FINANCE CORP.

(Exact Name of Registrant as Specified in its Charter) |

| |

Maryland (State or Other Jurisdiction of Incorporation or Organization) | 02-0732285 (IRS Employer Identification No.) |

399 Park Avenue, 18th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | | New York Stock Exchange |

| Preferred Stock, 8.75% Series A Cumulative Redeemable, $0.01 par value | | New York Stock Exchange |

| Preferred Stock, 8.25% Series B Cumulative Redeemable, $0.01 par value | | New York Stock Exchange |

| Preferred Stock, 8.875% Series C Cumulative Redeemable, $0.01 par value | | New York Stock Exchange |

| Preferred Stock, 8.50% Series D Cumulative Redeemable, $0.01 par value | | New York Stock Exchange |

| Preferred Stock, 8.75% Series E Cumulative Redeemable, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Annual Report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | o | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2014, was $5,713,205,219, which does not reflect our market value after the spin-off which occurred after market close on June 30, 2014. As of February 26, 2015, the registrant had issued and outstanding 309,474,099 shares of common stock, $0.01 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the registrant’s 2015 Annual Meeting of Stockholders to be filed within 120 days after the end of the registrant’s fiscal year ended December 31, 2014 are incorporated by reference into this Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14.

NORTHSTAR REALTY FINANCE CORP.

FORM 10-K

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to the operating performance of our investments, our liquidity and financing needs, the effects of our current strategies and investment activities, our ability to grow following the spin-off of our asset management business and the entry into a long-term management contract with an affiliate of NorthStar Asset Management Group Inc., or NSAM, and our ability to raise and effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

| |

| • | the merger of Griffin-American Healthcare REIT II, Inc. and acquisition of its healthcare real estate portfolio may not have the full strategic and financial benefits that we expect; |

| |

| • | adverse domestic or international economic conditions and the impact of the commercial real estate industry; |

| |

| • | access to debt and equity capital and our liquidity; |

| |

| • | our use of leverage and our ability to comply with the terms of our borrowing arrangements; |

| |

| • | our ability to obtain mortgage financing on our real estate portfolio on favorable terms or at all; |

| |

| • | the effect of economic conditions on the valuation of our investments; |

| |

| • | our ability to acquire attractive investment opportunities; |

| |

| • | the spin-off of our asset management business may not have the full or any strategic and financial benefits that we expect; |

| |

| • | our performance pursuant to a long-term management contract with an affiliate of NSAM, as our manager, and the effects of becoming an externally-managed company, including our reliance on NSAM and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial base and potential incentive fees to our manager, the allocation of investments by our manager among us and the manager’s other managed companies and strategic vehicles and various conflicts of interest in our relationship with NSAM; |

| |

| • | our ability to close on the recent commitments to acquire real estate investments, including the agreements to acquire approximately $1.9 billion of real estate in Europe, and engage in joint venture transactions, each on the terms contemplated or at all; |

| |

| • | the impact of adverse conditions effecting a specific asset class in which we have investments, such as healthcare, hotel, manufactured housing, multi-tenant office and limited partnership interests in real estate private equity funds; |

| |

| • | the impact of our growth outside of the United States and pending exit from Europe through the proposed spin-off of our European real estate business; |

| |

| • | the proposed spin-off of our European real estate business may not have the full or any strategic and financial benefits that we expect or such benefits may be delayed or may not materialize at all; |

| |

| • | performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments and available for distribution; |

| |

| • | the impact of economic conditions on the tenants/operators/residents/guests of the real property that we own as well as on the borrowers of the commercial real estate debt we originate and acquire and the commercial mortgage loans underlying the commercial mortgage backed securities in which we invest; |

| |

| • | tenant/operator or borrower defaults or bankruptcy; |

| |

| • | illiquidity of properties in our portfolio; |

| |

| • | our ability to grow and profit from our commercial real estate origination activities; |

| |

| • | our ability to realize the value of the bonds and equity we purchased and/or retained in our collateralized debt obligations, or CDO, financing transactions and other securitization financing transactions and our ability to complete securitization financing transactions on terms that are acceptable to us, if at all; |

| |

| • | our ability to meet various coverage tests with respect to our CDO financing transactions; |

| |

| • | our ability to realize current and expected return over the life of our investments; |

| |

| • | any failure in our due diligence to identify all relevant facts in our underwriting process or otherwise; |

| |

| • | the impact of credit rating downgrades; |

| |

| • | our ability to manage our costs in line with our expectations and the impact on our cash available for distribution; |

| |

| • | environmental compliance costs and liabilities; |

| |

| • | effect of regulatory actions, litigation and contractual claims against us and our affiliates, including the potential settlement and litigation of such claims; |

| |

| • | competition for investment opportunities; |

| |

| • | the possibility that the net asset value of interests in certain real estate private equity funds we acquired do not necessarily reflect the fair value of such fund interests or that the actual amount of our future capital commitments underlying such fund interests varies materially from our expectations; |

| |

| • | regulatory requirements with respect to our business and the related cost of compliance; |

| |

| • | changes in domestic or international laws or regulations governing various aspects of our business; |

| |

| • | the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended; |

| |

| • | competition for qualified personnel and our ability to retain key personnel; |

| |

| • | the effectiveness of our portfolio management techniques and strategies; |

| |

| • | the impact of damage to our brand and reputation resulting from internal or external causes; |

| |

| • | failure to maintain effective internal controls and disclosure controls and procedures; and |

| |

| • | compliance with the rules governing real estate investment trusts. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in “Risk Factors” in this Annual Report on Form 10-K beginning on page 21. The risk factors set forth in our filings with the Securities and Exchange Commission could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

PART I

Item 1. Business

References to “we,” “us” or “our” refer to NorthStar Realty Finance Corp. and its subsidiaries unless the context specifically requires otherwise.

Overview

We are a diversified commercial real estate company with 82% of our total assets invested in real estate, of which 74% is invested in direct real estate investments. We generated 70% of our revenue from our real estate portfolio for the year ended December 31, 2014. Substantially all of our assets are invested in and revenues are generated from our real estate portfolio, excluding our European Portfolio (as defined below). Excluding our European Portfolio, 79% of our total assets are invested in real estate, generating 70% of our revenue for the year ended December 31, 2014. We invest in multiple asset classes across commercial real estate, or CRE, that we expect will generate attractive risk-adjusted returns and may take the form of acquiring real estate, originating or acquiring senior or subordinate loans, as well as pursuing opportunistic CRE investments, both in the United States and internationally, with a current focus on Europe. We seek to generate stable cash flow for distribution to our stockholders through our diversified portfolio of global commercial real estate assets and in turn build long-term franchise value. Effective June 30, 2014, we are externally managed and advised by an affiliate of NorthStar Asset Management Group Inc. (NYSE: NSAM), which together with its affiliates is referred to as NSAM. We are a Maryland corporation and completed our initial public offering in October 2004. We conduct our operations so as to continue to qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes.

Significant Developments

Proposed Spin-off of European Real Estate Business

On February 26, 2015, we announced that our board of directors unanimously approved a plan to spin-off our European real estate business, or the Proposed European Spin, into a newly-formed publicly-traded REIT, NorthStar Realty Europe Corp., or NRE, expected to be listed on the New York Stock Exchange, or NYSE, and potentially in Europe. Currently, we acquired or committed to acquire $2 billion of European real estate comprised of 50 properties spanning across some of Europe’s top markets, or our European Portfolio, that will be contributed to NRE upon the completion of the Proposed European Spin. NSAM will manage NRE pursuant to a long-term management agreement, on substantially similar terms as our management agreement with NSAM. The Proposed European Spin is expected to be completed in the second half of 2015.

Griffin-American Healthcare REIT II, Inc.

On December 3, 2014, we completed our previously announced merger of Griffin-American Healthcare REIT II, Inc., or Griffin-American, where we acquired all of the outstanding shares of Griffin-American in a stock and cash transaction valued at $4 billion. Griffin-American was a public REIT focused on medical office buildings, senior housing and other healthcare-related facilities and was co-sponsored by American Healthcare Investors LLC, or AHI, and Griffin Capital Corporation. Additionally, NorthStar Healthcare acquired a 14.3% equity interest in the Griffin-American portfolio for $187 million in cash, including its share of transaction costs. The European healthcare properties that we acquired from Griffin-American will not be contributed to NRE in the Proposed European Spin.

Spin-off of Asset Management Business

On June 30, 2014, we completed the spin-off of our asset management business into a separate publicly-traded company, NSAM, in the form of a tax-free distribution, or the NSAM Spin-off or Distribution. In connection with the NSAM Spin-off, each of our common stockholders received shares of NSAM’s common stock on a one-for-one basis, after giving effect to a one-for-two reverse stock split of our common stock, or Reverse Split. Upon completion of the NSAM Spin-off, our asset management business is owned and operated by NSAM and we are externally managed by an affiliate of NSAM through a management contract with an initial term of 20 years. Subsequent to the NSAM Spin-off, we continue to operate our CRE debt origination business. Most of our employees at the time of the NSAM Spin-off became employees of NSAM and executive officers, employees engaged in our loan origination business at the time of the spin-off and certain other employees became co-employees of both us and NSAM. Affiliates of NSAM also manage our previously sponsored non-traded REITs: NorthStar Real Estate Income Trust, Inc., or NorthStar Income, NorthStar Healthcare Income, Inc., or NorthStar Healthcare, and NorthStar Real Estate Income II, Inc., or NorthStar Income II, and together with any new sponsored companies, herein collectively referred to as the NSAM Sponsored Companies. In addition, NSAM owns NorthStar Realty Securities, LLC, or NorthStar Securities, our previously owned captive broker-dealer platform, which raises capital in the retail market for NSAM’s Sponsored Companies.

Prior to the Distribution, we completed an internal corporate reorganization whereby we collapsed our three tier holding company structure into a single tier. We previously conducted substantially all of our operations and made our investments through NorthStar Realty Finance Limited Partnership, or the Operating Partnership. In addition, following the reorganization

but prior to the Distribution, we completed a Reverse Split where every two shares of our issued and outstanding common stock were combined into one issued and outstanding share of our common stock.

Our Investments

The following table presents our investments as of December 31, 2014, adjusted for acquisitions and commitments to purchase real estate through February 24, 2015 (refer to the below and Recent Developments in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion) (dollars in thousands):

|

| | | | | | | | |

| | | Amount(1) | | % |

| Real Estate | | | | |

Healthcare(2) | | $ | 5,833,771 |

| | 31.5 | % |

| Hotel | | 3,050,383 |

| | 16.5 | % |

European(3) | | 1,984,230 |

| | 10.7 | % |

| Manufactured housing communities | | 1,593,618 |

| | 8.6 | % |

| Net lease | | 781,554 |

| | 4.2 | % |

| Multifamily | | 372,011 |

| | 2.0 | % |

| Multi-tenant office | | 133,421 |

| | 0.7 | % |

| Subtotal | | 13,748,988 |

| | 74.2 | % |

| Private equity fund investments | | 1,248,300 |

| | 6.7 | % |

Corporate investments(4) | | 157,380 |

| | 0.9 | % |

| Total real estate | | 15,154,668 |

| | 81.8 | % |

| CRE Debt | | | | |

| First mortgage loans | | 434,671 |

| | 2.4 | % |

| Mezzanine loans | | 149,816 |

| | 0.8 | % |

| Subordinate interests | | 201,564 |

| | 1.1 | % |

| Corporate loans | | 360,343 |

| | 1.9 | % |

| Subtotal | | 1,146,394 |

| | 6.2 | % |

| CRE debt of consolidated N-Star CDOs | | 40,922 |

| | 0.2 | % |

| Other | | 37,030 |

| | 0.2 | % |

| Total CRE debt | | 1,224,346 |

| | 6.6 | % |

| CRE Securities | | | | |

N-Star CDO bonds(5) | | 569,885 |

| | 3.1 | % |

| N-Star CDO equity | | 137,143 |

| | 0.7 | % |

| Other securities | | 119,089 |

| | 0.7 | % |

| Total CRE securities | | 826,117 |

| | 4.5 | % |

| Subtotal | | 17,205,131 |

| | 92.9 | % |

Assets underlying deconsolidated CRE Debt CDOs(6) | | 1,291,055 |

| | 7.1 | % |

| Grand total | | $ | 18,496,186 |

| | 100.0 | % |

____________________________________________________________

| |

| (1) | Based on cost for real estate investments which includes net purchase price allocation related to net intangibles, deferred costs and other assets, if any, fair value for our investments (directly or indirectly in joint ventures) owning limited partnership interests in real estate private equity funds, or PE Investments, and includes the deferred purchase price for PE Investment II, principal amount for our CRE debt and securities investments and amortized cost for N-Star CDO equity. Represents 100% of all real estate assets in consolidated joint ventures. |

| |

| (2) | Includes $498 million of Sterling denominated real estate in the United Kingdom owned in connection with the acquisition of the Griffin-American Portfolio. |

| |

| (3) | Includes $1.9 billion of commitments to purchase European assets through February 24, 2015. |

| |

| (4) | Represents our investments in RXR Realty LLC, or RXR Realty, Aerium Group, or Aerium, and Legacy Partners Commercial LLC, or Legacy Commercial. |

| |

| (5) | Includes N-Star CDO bonds with a principal amount of $108 million related to CRE securities CDOs that are eliminated in consolidation. |

| |

| (6) | Includes assets of deconsolidated CRE debt CDOs, referred to as N-Star CDOs. Based on the remittance report issued on date nearest to December 31, 2014. This amount excludes $599 million of aggregate N-Star CDO equity and N-Star CDO bonds included in CRE securities. |

We have the ability to invest in a broad spectrum of global commercial real estate assets and seek to provide attractive risk-adjusted returns to our stockholders. As a result, we pursue opportunistic investments across all our business lines including CRE equity and debt investments.

For financial information regarding our reportable segments, refer to Note 19. “Segment Reporting” in our accompanying consolidated financial statements included in Part II, Item 8. “Financial Statements and Supplementary Data.”

Underwriting Process

We use a rigorous investment and underwriting process that has been developed and utilized by our senior management team leveraging their extensive commercial real estate expertise over many years and real estate cycles which focuses on some or all of the following factors designed to ensure each investment is evaluated appropriately: (i) macroeconomic conditions that may influence operating performance; (ii) fundamental analysis of underlying real estate, including tenant rosters, lease terms,

zoning, necessary licensing, operating costs and the asset’s overall competitive position in its market; (iii) real estate market factors that may influence the economic performance of the investment, including leasing conditions and overall competition; (iv) the operating expertise and financial strength and reputation of a tenant, operator, partner or borrower; (v) the cash flow in place and projected to be in place over the term of the investment and potential return; (vi) the appropriateness of the business plan and estimated costs associated with tenant buildout, repositioning or capital improvements; (vii) an internal and third-party valuation of a property, investment basis relative to the competitive set and the ability to liquidate an investment through a sale or refinancing; (viii) review of third-party reports including appraisals, engineering and environmental reports; (ix) physical inspections of properties and markets; (x) the overall legal structure of the investment, contractual implications and the lenders’ rights; and (xi) the tax and accounting impact.

Real Estate

Overview

As part of our real estate strategy, we explore a variety of real estate investments, both directly and through joint ventures. Opportunities to purchase real estate have been bolstered by attractive long-term, non-recourse, non mark-to-market financing available through commercial mortgage-backed securities, or CMBS, and agency financing markets. Our portfolio is primarily comprised of healthcare, hotel, manufactured housing communities, net lease, multifamily properties and international real estate, with a current focus on Europe. We also invest in other opportunistic real estate investments such as indirect interests in real estate through real estate private equity funds. We also acquire hotel and certain healthcare properties through structures permitted by the REIT Investment Diversification and Empowerment Act of 2007, or RIDEA, where we participate directly in the operational cash flow of a property. Our real estate equity investments that operate under the RIDEA structure generate resident and hotel guest related income from short-term residential agreements and incur customary related operating expenses.

Our Portfolio

As of December 31, 2014, adjusted for acquisitions and commitments to purchase through February 24, 2015, $15.2 billion, or 81.8%, of our assets were invested directly in real estate properties and indirectly through our PE Investments and our corporate interests. The following table presents our direct investments in real estate properties as of December 31, 2014, adjusted for acquisitions and commitments to purchase through February 24, 2015 (refer to Recent Developments in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion) (dollars in thousands):

|

| | | | | | | | | | | | | | | |

| Type | | Number | | Amount(1) | | % | | Capacity | | Primary Locations |

| Healthcare | | | | | | | | | | | |

| Medical office buildings (MOB) | | 147 | | $ | 2,144,134 |

| | 15.6 | % | | 6.0 million |

| square feet | | IN, TX, GA, CO, IL |

Skilled nursing facilities (SNF)(2) | | 108 | | 1,332,988 |

| | 9.7 | % | | 12,700 |

| beds | | FL, PA, IL, IN, VA |

| Assisted living facilities - RIDEA (ALF-RIDEA) | | 109 | | 1,203,444 |

| | 8.8 | % | | 6,300 |

| units | | IL, OR, OH, TX, MA, WA |

| Assisted living facilities - Net lease (ALF-Net Lease) | | 83 | | 867,935 |

| | 6.3 | % | | 4,300 |

| units | | UK, NC, OR, MN, IN |

| Hospital (HOS) | | 14 | | 285,270 |

| | 2.1 | % | | 800 |

| beds | | CA, MO, TX |

| Subtotal | | 461 | | 5,833,771 |

| | 42.5 | % | | | | | |

| Hotel | | 155 | | 3,050,383 |

| | 22.2 | % | | 20,250 |

| rooms | | VA, NJ, CA, TX |

European(3) | | 50 | | 1,984,230 |

| | 14.4 | % | | 466,000 |

| square meters | | UK, France, Germany |

| Manufactured housing communities | | 123 | | 1,593,618 |

| | 11.6 | % | | 29,036 |

| pad sites | | CO, UT, FL, TX, WY, NY |

| Net lease | | | | | | | | | | | |

| Industrial | | 35 | | 378,225 |

| | 2.8 | % | | 6.1 million |

| square feet | | CA, IL, FL, GA, MI |

Office(4) | | 19 | | 338,826 |

| | 2.5 | % | | 2.3 million |

| square feet | | CA, FL, NJ, UT |

| Retail | | 10 | | 64,503 |

| | 0.5 | % | | 467,971 |

| square feet | | NH, MA, ME |

| Subtotal | | 64 | | 781,554 |

| | 5.8 | % | | | | | |

Multifamily(4) | | 12 | | 372,011 |

| | 2.6 | % | | 4,514 |

| units | | TN, GA, FL |

| Multi-tenant office | | 12 | | 133,421 |

| | 0.9 | % | | 864,000 |

| square feet | | CO, TX, CA |

| Total | | 877 | | $ | 13,748,988 |

| | 100.0 | % | | | | | |

___________________________________________________________

| |

| (1) | Represents cost, which includes net purchase price allocation of $697 million related to net intangibles. Additionally, includes $27 million of manufactured homes, $48 million of notes receivable and $339 million of escrows and other assets. |

| |

| (2) | Includes three properties with a cost of $14 million owned pursuant to the RIDEA structure. |

| |

| (3) | Includes $1.9 billion of commitments to purchase European assets through February 24, 2015. |

| |

| (4) | Includes our interest in joint ventures that own a net lease property and multifamily property of $27 million and $37 million, respectively. |

Healthcare Properties

Our healthcare properties are comprised of a diverse portfolio of medical office buildings and other properties typically leased under net leases to healthcare operators with a focus on mid-acuity facilities (i.e., skilled nursing and assisted living), with the highest concentration in private-pay assisted living facilities which we believe have the most advantageous underlying

demographic trends and fundamentals. In addition, we own healthcare properties that operate under a RIDEA structure generating resident income from short-term residential agreements and incur customary related operating expenses. For our RIDEA properties, which are primarily assisted living facilities, we are the licensed operator via a taxable REIT subsidiary, or TRS. However, as required under RIDEA, we enter into management agreements with independent third party operators to manage and operate the RIDEA facilities.

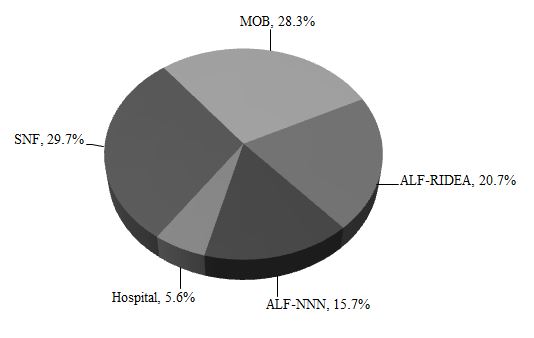

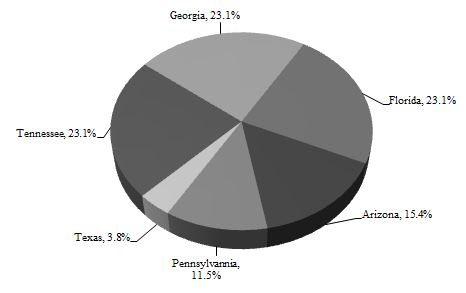

As of December 31, 2014, $5.8 billion, or 31.5%, of our assets were invested in healthcare properties. The following presents a summary of our healthcare portfolio and diversity across property type based on net cash flow:

|

| | | | |

| | | | Healthcare by Property Type |

| Total Healthcare Portfolio | $5.8 billion |

| | |

| Number of facilities | 461 |

| |

Number of units/beds(1) | 24,100 |

| |

| | | |

| Weighted average occupancy | 95 | % | |

| Weighted average lease coverage | 1.6x |

| |

| Weighted average lease term | 8.8 years |

| |

| | | |

| Net cash flow related to: | | |

| Medical office buildings/net lease/hospitals | 79 | % | |

| RIDEA | 21 | % | |

___________________________________

(1)Represents number of units for ALF/ILF property types and number of beds for SNF property types.

Hotel Portfolio

Our hotel portfolio is a geographically diverse portfolio primarily comprised of extended stay hotels and premium branded select service hotels primarily located in major metropolitan markets with the majority affiliated with top hotel brands.

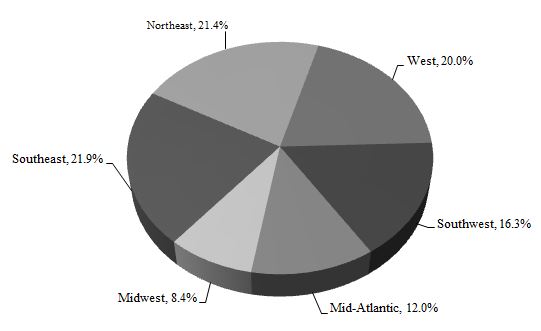

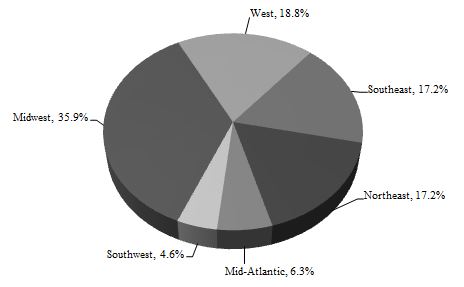

As of December 31, 2014, $3.1 billion, or 16.5%, of our assets were invested in hotel properties. The following presents a summary of our hotel portfolio and diversity across geographic location based on number of rooms:

|

| | | | |

| | | | Hotel by Geographic Location |

| Total Hotel Portfolio | $3.1 billion |

| |

| Number of hotels | 155 |

|

| Number of rooms | 20,250 |

|

Weighted average occupancy(1) | 74 | % |

| | |

| Rooms by brand: | |

| Marriott | 74 | % |

| Hilton | 16 | % |

| Starwood | 4 | % |

| Hyatt | 4 | % | |

| Intercontinental | 2 | % | |

___________________________________

(1)Represents projected weighted average occupancy for 2015.

European

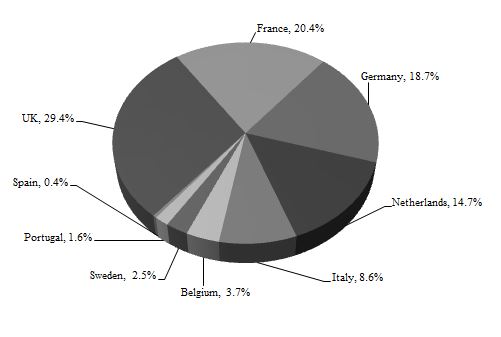

We are expanding outside the United States, with a current focus on Europe, and seek to invest in various types of commercial real estate assets. As of December 31, 2014, $2.0 billion, or 10.7%, of our assets were invested in our European Portfolio.

The following presents a summary of our European Portfolio and diversity across geographic location based on purchase price:

|

| | | | |

| | | | European by Geographic Location |

| Total European Portfolio | $2.0 billion |

| |

| Number of properties | 50 |

|

| Number of countries | 9 |

|

| Total square meters | 466,000 |

|

| | |

| Weighted average occupancy | 92 | % |

| Weighted average lease term | 5.0 years |

|

Manufactured Housing Communities

Our manufactured housing portfolio consists of communities that lease pad rental sites for placement of factory built homes located throughout the United States. The manufactured housing industry has traditionally demonstrated low cash flow volatility and steady annual rent increases, although there is no assurance that will continue to be the case.

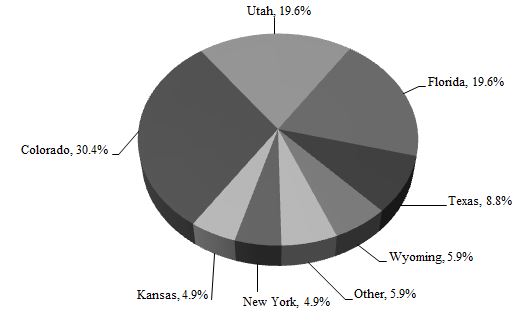

As of December 31, 2014, $1.6 billion, or 8.6%, of our assets were invested in manufactured housing communities. The following presents a summary of our manufactured housing communities portfolio and diversity across geographic location based on net cash flow:

|

| | | | |

|

|

| Manufactured Housing Communities by Geographic Location |

| Total Manufactured Housing Portfolio | $1.6 billion |

| |

| Number of communities | 123 |

|

| Number of pad rental sites | 29,036 |

|

Number of manufactured homes(1) | 3,400 |

|

| Number of states | 12 |

|

| Weighted average occupancy | 88 | % |

| | |

| Net cash flow related to: |

|

|

| Pad rental sites | 89 | % |

| Other | 11 | % |

___________________________________

(1)Represents manufactured houses available for sale or rent.

Net Lease Properties

Our real estate that is net leased to corporate tenants is primarily comprised of industrial, office and retail properties. These net lease properties are typically leased to a single tenant who agrees to pay basic rent, plus all taxes, insurance, capital and operating expenses arising from the use of the leased property generally leaving us, as owner, with minimal ongoing operational or expense obligations. We may also invest in properties that are leased to tenants for which we are responsible for some of the operating expenses and capital costs. At the end of the lease term, the tenant typically has a right to renew the lease at market rates or to vacate the property with no further ongoing obligation.

As of December 31, 2014, $782 million, or 4.2%, of our assets were invested in net lease properties, including one property owned through an unconsolidated joint venture. The following presents a summary of our net lease portfolio and diversity across geographic location based on number of properties:

|

| | | | |

| | | | Net Lease by Geographic Location |

| Total Net Lease Portfolio | $782 million |

| |

| Number of properties | 64 |

|

| Number of states | 23 |

|

| Total square feet | 8.8 million |

|

| Weighted average occupancy | 99 | % |

| Weighted average lease term | 9.7 years |

|

| | |

| Net cash flow related to: | |

| Industrial | 49 | % |

| Office | 43 | % |

| Retail | 8 | % |

Multifamily Properties

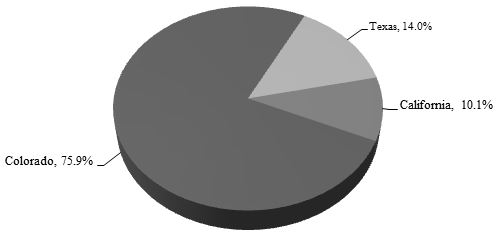

Our multifamily portfolio primarily focuses on properties located in suburban markets that we believe are well suited to capture the formation of new households.

As of December 31, 2014, $372 million, or 2.0%, of our assets were invested in multifamily properties, including one property owned through an unconsolidated joint venture. The following presents a summary of our multifamily portfolio and diversity across geographic location based on net cash flow:

|

| | | | |

| | | | Multifamily by Geographic Location |

| Total Multifamily Portfolio | $372 million |

| |

| Number of properties | 12 |

|

| Number of states | 6 |

|

| Number of units | 4,514 |

|

| | |

| Weighted average occupancy | 94 | % |

Multi-tenant Office

We, through a joint venture with Legacy Commercial, are focused on acquiring multi-tenant office properties in the western United States.

As of December 31, 2014, $133 million, or 0.7%, of our assets were invested in multi-tenant office properties, including an acquisition that occurred in February 2015. The following presents a summary of our multi-tenant office portfolio and diversity across geographic location based on cost:

|

| | | | |

| | | | Multi-tenant Office by Geographic Location |

| Total Multi-tenant Office Portfolio | $133 million |

| |

| Number of properties | 12 |

|

| Number of states | 3 |

|

| Total square feet | 864,000 |

|

| | |

| Weighted average occupancy | 90 | % |

PE Investments

Our PE Investments own limited partnership interests in real estate private equity funds acquired in the secondary market and managed by institutional-quality sponsors, which we refer to as fund interests.

As of December 31, 2014, $1.2 billion, or 6.7%, of our assets were invested in PE Investments through unconsolidated ventures or direct investments. The following table presents our indirect investment in real estate through PE Investments as of December 31, 2014 (dollars in thousands):

|

| | | | | | | | | |

| | | Portfolios | | Amount(1) | | % |

| PE Investment I | | 1 | | $ | 218,564 |

| | 17.5 | % |

| PE Investment II | | 1 | | 517,895 |

| | 41.5 | % |

| Other PE Investments | | 8 | | 511,841 |

| | 41.0 | % |

| Total | | 10 | | $ | 1,248,300 |

| | 100.0 | % |

___________________________________________________________

| |

| (1) | Represents fair value and includes the deferred purchase price for PE Investment II. |

The following tables present a summary of our PE Investments (dollars in millions):

|

| | | | | | | | | | | | | | | | | | | | | | | | |

PE Investment (1) | | Number of Funds | | Number of General Partners | | Initial NAV | | Closing NAV as a Percentage of Cost (2) | | Reported NAV Growth (3) | | Underlying Assets, at Cost | | Implied Leverage (4) | | Expected Future Contributions (5) |

PE Investment I(6) | | 49 | | 26 | | $ | 802.4 |

| | 66.2 | % | | 22.9 | % | | $ | 21,800 |

| | 51.0% | | $ | 7 |

|

PE Investment II(7) | | 24 | | 15 | | 910.0 |

| (8) | 73.5 | % | | 15.6 | % | | 23,400 |

| | 32.9% | | 4 |

|

Other PE Investments:(9) | | | | | | | | | | | | | | | | |

| PE Investment III | | 8 | | 4 | | 80.3 |

| (8) | 119.0 | % | | 8.0 | % | | 2,900 |

| | 49.4% | | 1 |

|

| PE Investment IV | | 1 | | 1 | | 8.8 |

| | 113.4 | % | | 16.1 | % | | 500 |

| | 46.4% | | — |

|

| PE Investment V | | 3 | | 1 | | 23.0 |

| | 57.8 | % | | 9.9 | % | | 900 |

| | 59.1% | | — |

|

| PE Investment VI | | 20 | | 12 | | 98.3 |

| | 77.5 | % | | 5.3 | % | | 9,400 |

| | 47.6% | | 2 |

|

| PE Investment VII | | 15 | | 13 | | 65.7 |

| | 79.2 | % | | 7.8 | % | | 1,100 |

| | 41.8% | | 1 |

|

| PE Investment IX | | 11 | | 7 | | 232.8 |

| | 135.3 | % | | 4.7 | % | | 20,600 |

| | 32.5% | | 2 |

|

| PE Investment X | | 13 | | 8 | | 160.4 |

| | 108.1 | % | | (3.7 | )% | | 6,300 |

| | 53.3% | | — |

|

| Total | | 144 | (10) | 87 | (10) | $ | 2,381.7 |

| | | | | | $ | 86,900 |

| | | | $ | 17 |

|

| |

| (1) | Based on financial data reported by the underlying funds as of September 30, 2014, which is the most recent financial information from the underlying funds, except as otherwise noted. |

| |

| (2) | Net cost represents total funded capital less distributions received. For PE Investment I, excludes any distributions in excess of contributions for funds, which represented 4% of reported net asset value, or NAV. |

| |

| (3) | The reported NAV growth is measured from the agreed upon reported NAV at date of acquisition, or Initial NAV. The reported NAV growth for PE Investments owned for less than twelve months is annualized based on actual reported income from the Initial NAV through September 30, 2014. |

| |

| (4) | Represents implied leverage for funds with investment-level financing, calculated as the underlying borrowing divided by assets at fair value. |

| |

| (5) | Represents the estimated amount of expected future contributions to funds as of December 31, 2014. |

| |

| (6) | We, together with NorthStar Income, have an ownership interest in PE Investment I of 51%, of which we own 70.5% and NorthStar Income owns 29.5%. |

| |

| (7) | We, NorthStar Income and funds managed by Goldman Sachs Asset Management each have an ownership interest in PE Investment II of 70%, 15% and 15%, respectively. PE Investment II paid an initial amount of $505 million and will pay the remaining $411 million, or 45% of the purchase price, or the Deferred Amount, by the last day of the fiscal quarter after the four year anniversary of the applicable closing date of each fund interest. As of December 31, 2014, our share of the Deferred Amount was $286 million. |

| |

| (8) | Includes the deferred purchase price for PE Investment II and PE Investment III. |

| |

| (9) | On August 19, 2014, we, through a subsidiary, entered into a joint venture with a third party to source and invest in real estate private equity funds, or PE Investment VIII. As of December 31, 2014, PE Investment VIII has not made any investments. |

| |

| (10) | Includes 14 funds and eight general partners held across multiple PE Investments. |

|

| | | | | | | | | | | | | | | | | | | | |

| | | Our Proportionate Share of PE Investments |

| | | Income | | Return of Capital | | Total Distributions (2) | | Contributions | | Net |

| PE Investment I | | | | | | | | | | |

| Year ended December 31, 2014 | | $ | 55.6 |

| | $ | 41.6 |

| | $ | 97.2 |

| | $ | 1.1 |

| | $ | 96.1 |

|

February 15, 2013 to December 31, 2014 (1) | | $ | 109.3 |

| | $ | 118.0 |

| | $ | 227.3 |

| | $ | 21.9 |

| | $ | 205.4 |

|

| | | | | | | | | | | |

| PE Investment II | | | | | | | | | | |

| Year ended December 31, 2014 | | $ | 52.6 |

| | $ | 63.3 |

| | $ | 115.9 |

| | $ | 6.0 |

| | $ | 109.9 |

|

July 3, 2013 to December 31, 2014 (1) | | $ | 81.6 |

| | $ | 139.3 |

| | $ | 220.9 |

| | $ | 17.6 |

| | $ | 203.3 |

|

| | | | | | | | | | | |

| Other PE Investments | | | | | | | | | | |

| Year ended December 31, 2014 | | $ | 25.8 |

| | $ | 100.8 |

| | $ | 126.6 |

| | $ | 6.7 |

| | $ | 119.9 |

|

Various to December 31, 2014 (1) | | $ | 25.8 |

| | $ | 109.7 |

| | $ | 135.5 |

| | $ | 6.9 |

| | $ | 128.6 |

|

| |

| (1) | Represents activity from the respective initial closing date through December 31, 2014. |

| |

| (2) | Net of a $21 million reserve for taxes in the aggregate for all PE Investments. |

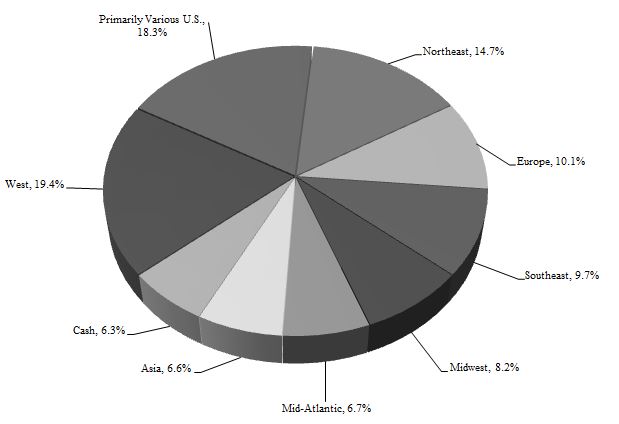

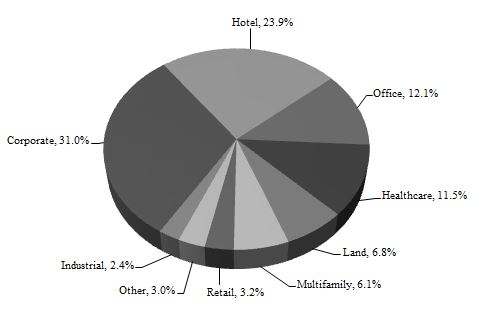

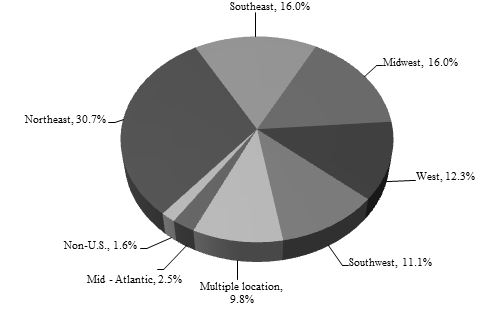

The following presents the underlying fund interests in our PE Investments by investment type and geographic location based on NAV as of September 30, 2014:

|

| | |

PE Investments by Underlying Investment Type(1) | | PE Investments by Underlying Geographic Location(1) |

| | |

____________________________________________________________

| |

| (1) | Based on individual fund financial statements. |

Corporate Investments

RXR Realty

In December 2013, we entered into a strategic transaction with RXR Realty, a leading real estate owner, developer and investment management company focused on high-quality real estate investments in the New York Tri-State area. The investment includes an approximate 30% equity interest in RXR Realty, representing $90 million as of December 31, 2014.

Aerium

In June 2014, we acquired a 15% interest in Aerium, a pan-European real estate investment manager specializing in commercial real estate properties, headquartered in Luxembourg with additional offices in London, Paris, Istanbul, Geneva, Düsseldorf and Bahrain. As of December 31, 2014, Aerium managed approximately €6.1 billion of real estate assets across 12 countries and employed over 200 professionals, some of whom provide services to NSAM.

Legacy Commercial

In September 2014, we entered into a debt and equity investment with Legacy Commercial, comprised of a 40% interest in the common equity of certain entities affiliated with Legacy Commercial. Legacy Commercial is a leading real estate investment manager, owner and operator with a portfolio of commercial assets focused in key markets in the western United States.

Commercial Real Estate Debt

Overview

Our CRE debt investment strategy is focused on originating, acquiring and asset managing CRE debt investments, including first mortgage loans, subordinate mortgage and mezzanine loans and participations in such loans and preferred equity interests.

We emphasize direct origination of our debt investments as this allows us a greater degree of control over how they are underwritten and structured and it provides us the opportunity to syndicate senior or subordinate interests in the loan to maximize returns, if desired. Further, it facilitates a more direct relationship with our borrowers which helps us maintain a robust pipeline, provides an opportunity for us to earn origination and other fees and offers us an important advantage when considering any potential future modifications or restructurings.

We believe the supply/demand imbalance driven by the large amount of maturing CRE loans creates an opportunity for us. Even with some increased supply by lenders, demand for debt capital is allowing investors with capital and real estate expertise, such as us, the opportunity to make investments with attractive risk/return profiles.

We believe we have built a franchise with a reputation for providing capital to high-quality real estate owners who want a responsive and flexible balance sheet lender. Given that we are a lender who generally retains control of the loans we originate, we are able to maintain flexibility in how we structure loans to meet the needs of our borrowers. Typical CMBS and other capital markets driven lenders generally cannot provide these types of loans due to constraints within their funding structures and because of their requirement to sell the entire loan to third parties and relinquish all control. Even when we finance our investments through securitizations, we maintain a significant capital investment in our loans. Our centralized investment organization has enabled senior management to review potential new loans early in the origination process which, unlike many large institutional lenders with several levels of approval required to commit to a loan, allows us to respond quickly and provide a high degree of certainty to our borrowers that we would close a loan on terms substantially similar to those initially proposed. We believe that this level of service has enhanced our reputation in the marketplace. In addition, we believe the early and active role of senior management in our portfolio management process has been key to maximizing recoveries of invested capital from our investments and our ability to be responsive to changing market conditions.

Our Portfolio

As of December 31, 2014, $1.1 billion, or 6.2%, of assets were invested in CRE debt, excluding CRE debt financed in consolidated N-Star CDOs and other CRE debt accounted for as joint ventures, consisting of 37 loans with an average investment size of $31 million and weighted average extended maturity of 5.0 years. We directly originated approximately 96% of our current portfolio of CRE debt investments (excluding debt investments purchased in connection with Griffin-American). The following table presents a summary of our CRE debt investments as of December 31, 2014 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Weighted Average(4) | | Floating Rate

as % of

Principal Amount(4) |

| | Number(2) | | Principal Amount | | Carrying Value | | Allocation by Investment Type(3) | | Fixed Rate | | Spread Over LIBOR | | Yield | |

| Asset Type: | | | | | | | |

|

| | | | | | | | |

| First mortgage loans | 13 |

| | | $ | 434,671 |

| | $ | 313,590 |

| | 37.9 | % | | 9.51 | % | | 6.66 | % | | 9.34 | % | | 57.2 | % |

| Mezzanine loans | 8 |

| | | 149,816 |

| | 146,088 |

| | 13.2 | % | | 13.79 | % | | 13.83 | % | | 14.05 | % | | 53.3 | % |

| Subordinate interests | 8 |

| | | 201,564 |

| | 200,237 |

| | 17.6 | % | | 13.11 | % | | 12.33 | % | | 13.01 | % | | 40.7 | % |

Corporate loans(1) | 8 |

| | | 360,343 |

| | 382,427 |

| | 31.3 | % | | 12.37 | % | | — |

| | 12.99 | % | | — |

|

| Total/Weighted average | 37 |

| | | $ | 1,146,394 |

| | $ | 1,042,342 |

| | 100.0 | % | | 11.89 | % | | 9.15 | % | | 12.00 | % | | 35.6 | % |

____________________________________________________________

| |

| (1) | Includes four revolving loans, of which $61 million is outstanding as of December 31, 2014. |

| |

| (2) | Excludes amounts related to joint ventures and CRE debt underlying our CDOs. |

| |

| (3) | Based on principal amount. |

| |

| (4) | Excludes three CRE debt investments with an aggregate principal amount of $11 million that were originated prior to 2008. |

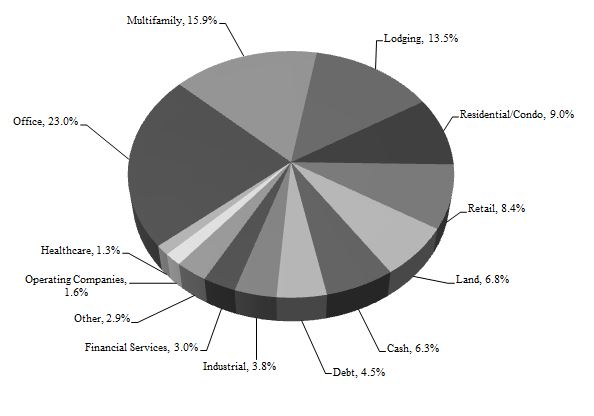

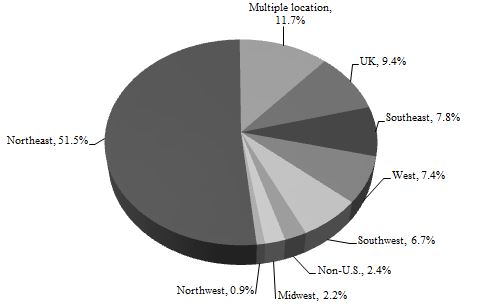

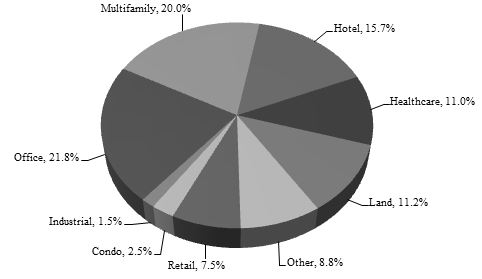

The following presents our $1.1 billion CRE debt portfolio’s diversity across property type and geographic location based on principal amount.

|

| | |

| Debt Investments by Property Type | | Debt Investments by Geographic Location |

| | |

CRE Securities

We historically originated or acquired CRE debt and securities investments that were predominately financed through permanent, non-recourse CDOs. We sponsored nine CDOs, three of which were primarily collateralized by CRE debt and six of which were primarily collateralized by CRE securities. In addition, we acquired the equity interests of two CRE debt focused CDOs, the CSE CDO and the CapLease CDO. We refer to those CRE debt and securities investments that serve as collateral for N-Star CDO financing transactions as legacy CRE debt and securities, respectively. At the time of issuance of the N-Star CDOs, we retained the below investment grade bonds, which are referred to as subordinate bonds, and preferred shares and equity notes, which are referred to as equity interests. In addition, since the initial issuance of the N-Star CDOs, we repurchased CDO bonds originally issued to third parties at discounts to par. These repurchased CDO bonds and retained subordinate bonds are herein collectively referred to as N-Star CDO bonds. We own the equity interests in all of our N-Star CDO financing transactions whether or not we consolidate these transactions on our balance sheet. Substantially all of our N-Star CDO equity is invested in our CRE debt CDOs. In fact, our CRE debt CDOs have distributed regular cash flow since their inception. We do not, however, own undivided interests in any of the assets within our N-Star CDOs and all senior and junior bondholders of the CDOs have economic interests that are senior to our equity interests.

We historically consolidated these CDO financing transactions under accounting principles generally accepted in the United States, or U.S. GAAP. Our legacy CDO business is winding down, resulting in liquidation and deconsolidation of certain of our N-Star CDOs. Repurchased N-Star CDO bonds that are consolidated are not presented as an investment but rather are eliminated in our consolidated financial statements and, as a result, the interest and realization of any discount will generally not be recorded as income in our consolidated statements of operations under U.S. GAAP. All of our CRE debt CDOs were deconsolidated in 2013 and currently only N-Star securities CDOs I and IX continue to be consolidated. All N-Star CDOs are past their reinvestment period and given the nature of these transactions, these CDOs are amortizing over time as the underlying assets paydown or are sold.

Our CRE securities portfolio is predominately comprised of N-Star CDO bonds and N-Star CDO equity of our deconsolidated N-Star CDOs and includes other securities, mostly conduit CMBS, meaning each asset is a pool backed by a large number of commercial real estate loans. We also invest in opportunistic CRE securities such as an investment in a “B-piece” CMBS.

The following table presents our interest in the N-Star CDOs as of December 31, 2014 (dollars in thousands):

|

| | | | | |

| | Number | | Amount(1) |

N-Star CDO bonds(2)(3) | | | |

| AAA | 2 | | $ | 74,500 |

|

| AA through BBB | 29 | | 334,938 |

|

| Below investment grade | 10 | | 160,447 |

|

| | 41 | | 569,885 |

|

N-Star CDO equity(4) | 5 | | 137,143 |

|

| Total | 46 | | $ | 707,028 |

|

_______________________________________________________

| |

| (1) | Based on principal amount for N-Star CDO bonds and amortized cost for N-Star CDO equity. There is no assurance we will receive the maximum amount of principal proceeds. |

| |

| (2) | Based on original credit rating. Includes nine N-Star CDO bonds with a principal amount of $108 million related to our securities CDOs that are eliminated in consolidation. |

| |

| (3) | Unencumbered N-Star CDO bonds are owned by us, of which $421 million of principal amount were repurchased at a discount to par at a weighted average original credit rating of A / A2 and a weighted average purchase price of 33%. |

| |

| (4) | Represents our equity interests in the deconsolidated CRE debt N-Star CDOs. |

The following table presents a summary of our deconsolidated N-Star CRE debt CDOs as of December 31, 2014 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Issue/Acquisition Date | N-Star IV Jun-05 | | N-Star VI Mar-06 | | N-Star VIII Dec-06 | | CapLease Aug-11 | | CSE Jul-10 | | Total |

Balance sheet as of December 31, 2014(1) | | | | | | | | | | | |

| Assets, principal amount | $ | 240,018 |

| | $ | 348,706 |

| | $ | 808,338 |

| | $ | 134,611 |

| | $ | 594,038 |

| | $ | 2,125,711 |

|

CDO bonds, principal amount(2) | 128,120 |

| | 280,137 |

| | 627,749 |

| | 120,516 |

| | 532,203 |

| | 1,688,725 |

|

| Net assets | $ | 111,898 |

| | $ | 68,569 |

| | $ | 180,589 |

| | $ | 14,095 |

| | $ | 61,835 |

| | $ | 436,986 |

|

| | | | | | | | | | | | |

CDO quarterly cash distributions and coverage tests(3) | | | | | | | | | | | |

| Equity notes and subordinate bonds | $ | 434 |

| | $ | 2,847 |

| | $ | 4,032 |

| | $ | 665 |

| | $ | 5,398 |

| | $ | 13,376 |

|

| Collateral management and other fees | 169 |

| | 335 |

| | 725 |

| | 36 |

| | 302 |

| | 1,567 |

|

Interest coverage cushion (IC)(1) | 148 |

| | 1,174 |

| | 3,574 |

| | 411 |

| | 3,903 |

| | |

|

Overcollateralization cushion (OC)(1) | 60,767 |

| | 35,471 |

| | 104,566 |

| | 9,412 |

| | 85,047 |

| | |

|

| At offering | 19,808 |

| | 17,412 |

| | 42,193 |

| | 5,987 |

| (4) | (151,595 | ) | (5) | |

| |

| (1) | Based on remittance report issued on date nearest to December 31, 2014. |

| |

| (2) | Includes all outstanding CDO bonds payable to third parties and all CDO bonds owned by us. |

| |

| (3) | IC and OC coverage to the most constrained class. |

| |

| (4) | Based on trustee report as of August 31, 2011, closest to the date of acquisition. |

| |

| (5) | Based on trustee report as of June 24, 2010, closest to the date of acquisition. |

The following presents the diversity across property type and geographic location of all CRE debt in N-Star CDOs based on principal amount:

|

| | |

| CRE Debt in N-Star CDOs by Property Type | | CRE Debt in N-Star CDOs by Geographic Location |

| | |

Financing Strategy

We seek to access a wide range of secured and unsecured debt and public and private equity capital sources to fund our investment activities and asset growth.

We predominantly use investment-level financing as part of our strategy to prudently leverage our investments and deliver attractive risk-adjusted returns to our stockholders. We pursue a variety of financing arrangements such as mortgage notes from the CMBS market, government-sponsored agencies, finance companies and European banks and securitization financing transactions. In addition, we use corporate-level financing such as credit facilities and other term borrowings. We generally seek to limit our reliance on recourse borrowings. Borrowing levels for our CRE investments may be dependent upon the nature of the assets and the related financing that is available.

The current availability of attractive long-term, non-recourse, non mark-to-market assignable financing through the CMBS and agency financing markets has bolstered opportunities to acquire real estate. For longer duration, stable investment cash flow such as those derived from net lease assets, we tend to use fixed rate financing. For investment cash flow with greater growth potential such as hotels and healthcare under a RIDEA structure, we tend to use floating rate financing which provides prepayment flexibility and may provide a better match between underlying cash flow and potential increases in interest rates.

Our financing strategy for debt investments is to obtain match-funded borrowing at rates that provide a positive net spread. In late 2011, we began using secured term credit facilities provided by major financial institutions to partially finance CRE debt, which currently provide for an aggregate of up to $240 million. Then, in November 2012 and August 2013, we, and on behalf of NorthStar Income, entered into securitized financing transactions to provide permanent, non-recourse, non-mark-to-market financing for newly-originated CRE debt investments. We will continue to seek to use the capital markets to finance our debt investments. As of December 31, 2014, we had $42 million issued as part of Securitization 2012-1 and $93 million outstanding with $147 million available borrowing under our loan facilities.

With respect to corporate-level financing, in August 2014, we entered into a corporate revolving credit facility with certain commercial bank lenders, with a total commitment amount of $500 million for a three-year term. In September 2014, we entered into a corporate term facility with a commercial bank lender with respect to the establishment of term borrowings with an aggregate principal amount of up to $500 million. As of February 24, 2015, $305 million of financing remains undrawn under our corporate revolving credit facility and $75 million of financing remains undrawn under our corporate term credit facility, subject to entering into additional term loans under such facility.

Historically, we used CDOs to finance legacy CRE debt and securities investments. Our legacy CDO business is winding down as we invest in a broader, more diverse range of CRE assets. As a result, such legacy business is a significantly smaller portion of our business today than in the past.

Portfolio Management

Subsequent to the spin-off, NSAM performs portfolio management on our behalf. The comprehensive portfolio management process generally includes day-to-day oversight by the portfolio management and servicing team, regular management meetings and an exhaustive quarterly credit review process. These processes are designed to enable management to evaluate and proactively identify asset-specific credit issues and trends on a portfolio-wide basis. Nevertheless, we cannot be certain that such review will identify all issues within our portfolio due to, among other things, adverse economic conditions or events adversely affecting specific assets; therefore, potential future losses may also stem from investments that are not identified during these credit reviews. The portfolio management team, under the direction of the Investment Committee, uses many methods to actively manage our asset base to preserve our income and capital. Credit risk management is the ability to manage our assets in a manner that preserves principal/cost and income and minimizes credit losses that could decrease income and portfolio value. For CRE equity and debt investments, frequent re-underwriting and dialogue with borrowers/tenants/operators/partners and regular inspections of our collateral and owned properties have proven to be an effective process for identifying issues early. With respect to our healthcare properties, we consider the impact of regulatory changes on operator performance and property values. During the quarterly credit review, or more frequently as necessary, investments are put on highly-monitored status and identified for possible asset impairment/loan loss reserves, as appropriate, based upon several factors, including missed or late contractual payments, significant declines in collateral performance and other data which may indicate a potential issue in our ability to recover our invested capital from an investment. The portfolio management process related to CRE debt and securities underlying our deconsolidated CDOs is limited to monitoring the CDO bonds and equity interests in such CDO financing transactions.

Regulation

We are subject, in certain circumstances, to supervision and regulation by state, federal and international governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things:

| |

| • | regulate our public disclosures, reporting obligations and capital raising activity; |

| |

| • | require compliance with applicable REIT rules; |

| |

| • | regulate credit granting activities; |

| |

| • | require disclosures to customers; |

| |

| • | govern secured transactions; |

| |

| • | set collection, taking title to collateral, repossession and claims-handling procedures and other trade practices; |

| |

| • | regulate land use and zoning; |

| |

| • | regulate the foreign ownership or management of real property or mortgages; |

| |

| • | regulate the ability of foreign persons or corporations to remove profits earned from activities within the country to the person’s or corporation’s country of origin; |

| |

| • | regulate tax treatment and accounting standards; and |

| |

| • | regulate use of derivative instruments and our ability to hedge our risks related to fluctuations in interest rates and exchange rates. |

We have elected, qualified and expect to continue to qualify to be taxed as a REIT under Section 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code. As a REIT, we must currently distribute, at a minimum, an amount equal to 90% of our taxable income. In addition, we must distribute 100% of our taxable income to avoid paying corporate federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status. These requirements include specific share ownership tests and assets and gross income composition tests. If we fail to continue to qualify as a REIT in any taxable year, we will be subject to federal income tax (including any applicable alternative minimum tax) on our taxable income at regular corporate tax rates. Even if we qualify for taxation as a REIT, we may be subject to state and local income taxes and to federal income tax and excise tax on our undistributed income. In addition, we have healthcare and hotels owned through structures permitted by RIDEA, where we participate directly in the operational cash flow of a property.

We believe that we are not, and intend to conduct our operations so as not to become regulated as, an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. We have relied, and intend to continue to rely on current interpretations of the staff of the Securities and Exchange Commission, or SEC, in an effort to continue to qualify for an exemption from registration under the Investment Company Act. For more information on the exemptions that we use refer to Item 1A. “Risk Factors - Maintenance of our Investment Company Act exemption imposes limits on our operations.”

Real estate properties owned by us and the operations of such properties are subject to various international, federal, state and local laws and regulations concerning the protection of the environment, including air and water quality, hazardous or toxic substances and health and safety. In addition, such properties are required to comply with the Americans with Disabilities Act of 1990, or the ADA, the Fair Housing Act, applicable fire and safety regulations, building codes and other land use regulations. For further information regarding environmental matters and the ADA, refer to “Environmental Matters” and “ADA” below.

We also own and manage healthcare properties. As such, we or our operators, as the case may be, are subject to numerous international, federal, state and local healthcare laws and regulations that are subject to frequent and substantial changes (sometimes applied retroactively) resulting from legislation, adoption of rules and regulations and administrative and judicial interpretations of existing laws. Refer to “Healthcare Regulation” below.

In addition, we own hotels, which are subject to various covenants, laws, ordinances and regulations, including regulations relating to common areas. We believe each of our hotels has the necessary permits and approvals to operate its business.

We are also subject to regulation governing mortgage lending. Although most states do not regulate commercial real estate finance, certain states impose limitations on interest rates and other charges and on certain collection practices and creditor remedies and require licensing of lenders and financiers and adequate disclosure of certain contract terms. We are also required to comply with certain provisions of the Equal Credit Opportunity Act that are applicable to CRE loans.

We are also subject to regulation with respect to certain of our loan servicing activities, such as Regulation AB, which requires certain disclosures regarding our servicing activities and compliance with servicing criteria and also requires that we deliver compliance statements.

In the judgment of management, while we do incur significant expense complying with the various regulations to which we are subject, existing statutes and regulations have not had a material adverse effect on our business. However, it is not possible to forecast the nature of future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition, results of operations or prospects.

Environmental Matters

A wide variety of federal, state and local environmental and occupational health and safety laws and regulations affect our properties. These complex federal and state statutes, and their enforcement, involve a myriad of regulations, many of which involve strict liability on the part of the potential offender. Some of these federal and state statutes may directly impact us. Under various federal, state and local environmental laws, ordinances and regulations, an owner of real property or a secured lender, such as us, may be liable for the costs of removal or remediation of hazardous or toxic substances at, under or disposed of in connection with such property, as well as other potential costs relating to hazardous or toxic substances (including government fines and damages for injuries to persons and adjacent property). The cost of any required remediation, removal, fines or personal or property damages and the owner's or secured lender's liability therefore could exceed or impair the value of the property, and/or the assets of the owner or secured lender. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner's ability to sell or rent such property or to borrow using such property as collateral which, in turn, could reduce our revenues.

ADA

Our properties must comply with the ADA and any similar state or local laws to the extent that such properties are “public accommodations” as defined in those statutes. The ADA may require removal of barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. To date, we have not received any notices of noncompliance with the ADA that have caused us to incur substantial capital expenditures to address ADA concerns. Should barriers to access by persons with disabilities be discovered at any of our properties, we may be directly or indirectly responsible for additional costs that may be required to make facilities ADA-compliant. Noncompliance with the ADA could result in the imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations pursuant to the ADA is an ongoing one and we continue to assess our properties and make modifications as appropriate in this respect.

Healthcare Regulation

Overview

Assisted living, memory care, independent living, hospitals, skilled nursing facilities and other healthcare providers that operate healthcare properties in our portfolio are subject to extensive federal, state and local laws, regulations and industry standards governing their operations. Failure to comply with any of these, and other, laws could result in loss of licensure; loss of certification or accreditation; denial of reimbursement; imposition of fines; suspension or exclusion from federal and state healthcare programs; or closure of the facility. Although the properties within our portfolio may be subject to varying levels of governmental scrutiny, we expect that the healthcare industry, in general, will continue to face increased regulation and pressure in the areas of fraud and abuse, cost control and management of the provision of services, among others. We also expect that efforts by third-party payors, such as the federal Medicare program, state Medicaid programs and private insurers, to impose greater and more stringent cost controls upon operators will intensify and continue. Changes in laws, regulations, reimbursement, and enforcement activity can all have a significant effect on the operations and financial condition of our tenants, managers and operators, which in turn may adversely impact us, as set forth below and under Item 1A. “Risk Factors” in this report.

Fraud and Abuse Enforcement

Healthcare providers, including, but not limited to skilled nursing facilities and hospitals (and some senior housing facilities), are subject to federal and state laws and regulations that govern the operations and financial and other arrangements that may be entered into by healthcare providers, and prohibiting fraudulent and abusive practices by such providers. These laws include: (i) laws requiring providers to furnish only medically necessary services and submit to the government valid and accurate statements for each service; (ii) state anti-kickback laws and the Federal Anti-Kickback Statute, which generally prohibit persons from offering, providing, soliciting, or receiving remuneration to induce either the referral of an individual or the furnishing of a good or service for which payment may be made under a government healthcare program, such as Medicare or Medicaid; (iii) the federal physician self-referral law (commonly known as the Stark Law), which generally prohibits the submission of claims to Medicare for payment that were the result of a referral by a physician who has a financial relationship with the health service provider and analogous state laws; and (iv) the Civil Monetary Penalties Act and the Federal False

Claims Act including its “whistleblower” provisions, which prohibits, among other things, the knowing presentation of a false or fraudulent claim for certain healthcare services. Additionally, certain laws, including HIPAA and the Health Reform Laws (both defined and discussed further below) have broadened the federal fraud and abuse laws to enhance both the scope (e.g. private payers) and the penalties for non-compliance with the laws.

Enforcement of healthcare fraud has increased due in large part to amendments to the Federal False Claims Act that encourages private individuals to sue on behalf of the government. Sanctions for violations of these laws, regulations, and other applicable guidance may include, but are not limited to, criminal and/or civil penalties and fines, loss of licensure, immediate termination of government payments and exclusion from government healthcare programs, any of which could have a material adverse effect on the ability of an operator to meet its financial obligations to us.

Reimbursement

Federal, state and private managed care payor reimbursement methodologies applied to healthcare providers continue to evolve. Federal and state authorities have considered and may seek to implement new or modified reimbursement methodologies that may negatively impact healthcare property operations. The impact of any such changes, if implemented, may result in a material adverse effect on our healthcare property operations.

Skilled Nursing Facilities and Hospitals. Skilled nursing facilities and hospitals typically receive most of their revenues from the Medicare and Medicaid programs, with the balance representing reimbursement payments from private managed care payors, including private insurers and self-pay patients. Skilled nursing facilities and hospitals are subject to periodic pre- and post-payment reviews, and other audits by federal and state authorities. A review or audit of a property operator’s claims could result in recoupments, denials or delay of payments in the future, each of which could have a significant negative consequence.

Medicare Reimbursement. Medicare, a federal program, is a significant payor source for our skilled nursing facilities and hospitals. Skilled nursing facilities are reimbursed under the Medicare Skilled Nursing Facility Prospective Payment System, or SNF PPS. Hospitals are reimbursed by Medicare under prospective payment systems which vary based upon the type of hospital, geographic location and service furnished. For skilled nursing facilities and hospitals, there are risks that costs will exceed the fixed payments, and payments will be insufficient as compared to actual costs of delivering care, which could result in financial difficulties for the facilities. Recent attention on billing practices and payments and/or ongoing government pressure to reduce spending by government healthcare programs, could result in lower payments to skilled nursing facilities and/or hospitals and, as a result, may impair an operator’s ability to meet its financial obligations to us.

Medicaid Reimbursement. Medicaid is also a significant payor source for our skilled nursing facilities and hospitals. The federal and state governments share responsibility for financing Medicaid. The percentage of Medicaid dollars used for long-term care varies from state to state, due in part to different ratios of elderly population and eligibility requirements. Within certain federal guidelines, states have a fairly wide range of discretion to determine eligibility and reimbursement methodology. Many states reimburse long-term care facilities using fixed daily rates, which are applied prospectively based on patient acuity and the historical costs incurred in providing patient care. Certain states are attempting to slow the rate of growth in Medicaid expenditures by freezing rates or restricting eligibility and benefits. In addition, federal budgetary proposals could have lower federal spending for Medicaid, potentially impacting provider Medicaid reimbursement rates. Finally, certain states have elected not to expand their Medicaid eligibility criteria pursuant to recent healthcare reform laws, as described further below. In these states, there may be fewer individuals receiving insurance through state Medicaid programs and healthcare providers may continue to have a population of uninsured patients that require treatment. Other states that have opted to expand Medicaid may later choose to discontinue or modify that expansion. Reductions in Medicaid reimbursement rates or patient eligibility could materially affect revenues of our facilities.

Senior Housing Facilities (assisted living, independent living and memory care facilities, excluding skilled nursing facilities). While the majority of revenues received by the operators of our senior housing facilities are from private pay sources, a small portion of their revenue is received from Medicaid reimbursement. There can be no guarantee that a state Medicaid program will continue to reimburse for services at current levels or continue to be available to our residents. Rates generated at facilities will vary by payor mix, market conditions and resident acuity. Rates paid by self-pay residents are set by the facilities and are determined by local market conditions and operating costs.

Licensure, Certification and CON