NorthStar Realty Finance Corp.

399 Park Avenue, 18th Floor

New York, New York 10022

May 27, 2016

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Mail Stop 4561

Washington, D.C. 20549

Attn: Jennifer Monick, Assistant Chief Accountant

Re: NorthStar Realty Finance Corp.

Form 10-K for the year ended December 31, 2015

Filed February 29, 2016

File No. 001-32330

Form 10-Q for the quarterly period ended March 31, 2016

Filed May 10, 2016

File No. 001-32330

Dear Ms. Monick:

Set forth below is the response of NorthStar Realty Finance Corp. (together with its subsidiaries, the “Company”) to the comment of the Staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”), received by letter dated May 16, 2016 (the “Letter”), with respect to the Company’s Annual Report on Form 10-K for the year ended December 31, 2015 (the “Form 10-K”) filed on February 29, 2016 and the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2016 (the “Form 10-Q”) filed on May 10, 2016.

For convenience of reference, the Staff comment contained in the Letter is reprinted below in italics, numbered to correspond with the paragraph number assigned in the Letter and is followed by the corresponding response of the Company. Capitalized terms used herein and not defined herein have the meaning set forth in the Company's periodic filings with the Commission pursuant to the Securities Exchange Act of 1934, as amended.

Form 10-K for Fiscal Year Ended December 31, 2015

Comment No. 1

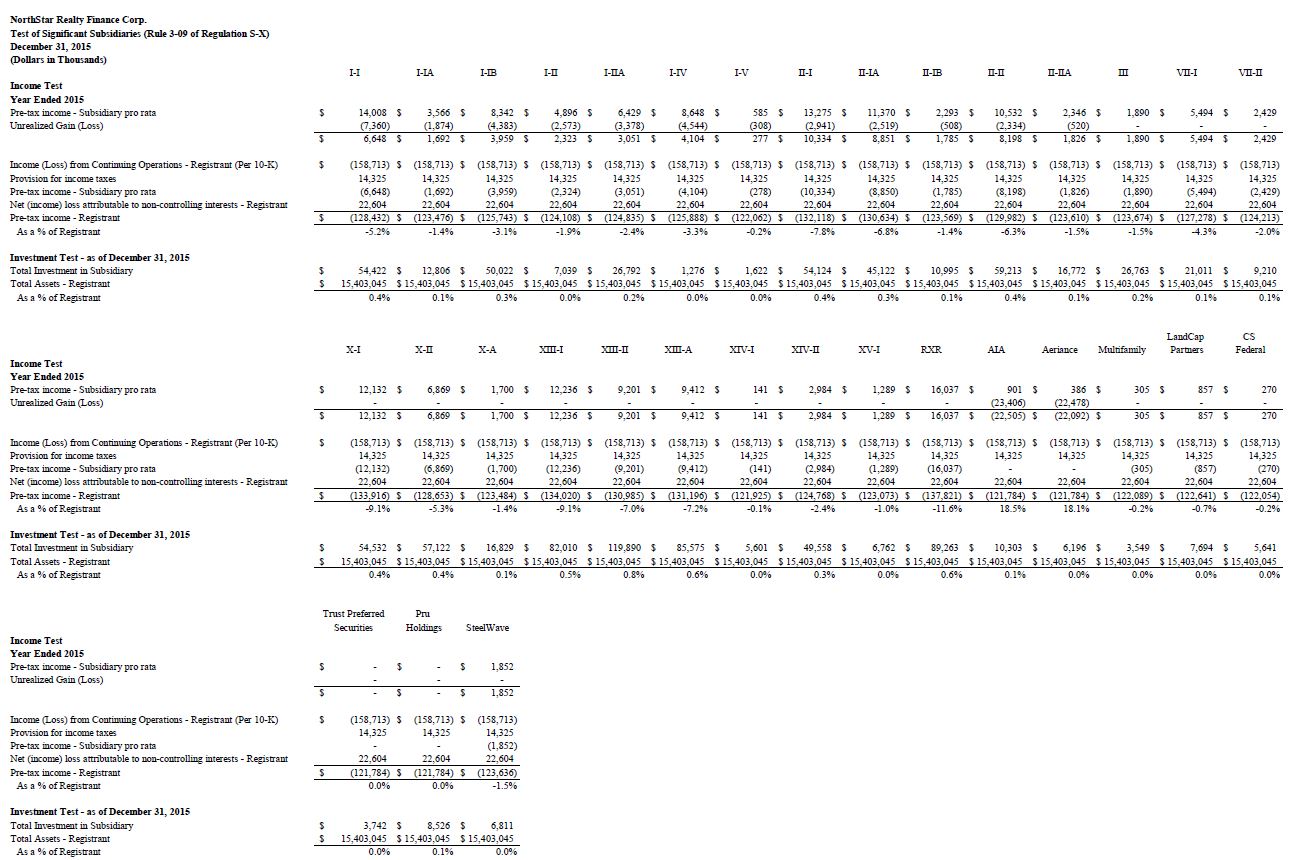

Please provide us with your Rule 3-09 significance test calculation for your equity method investments. Your calculations should reflect the equity in earnings amounts and the amounts from changes in fair value recorded in the statements of operations.

Response to Comment No. 1

The Company advises the Staff that the significance test calculation in accordance with Rule 3-09 of Regulation S-X is included in Appendix A to this Letter.

Non-GAAP Financial Measures, page 100

Net Operating Income, page 102

Comment No. 2

Please revise your disclosure of your non-GAAP measure Net operating income in future filings to provide a reconciliation of the most directly comparable financial measure or measures calculated and presented in accordance with GAAP.

Response to Comment No. 2

The Company notes the Staff’s comment and advises the Staff that it will, in future Exchange Act periodic filings commencing with the Quarterly Report on Form 10-Q for the quarter period ended June 30, 2016, revise its disclosure of its non-GAAP measure for net operating income to provide a reconciliation of the most directly comparable financial measure or measures calculated and presented in accordance with GAAP.

Notes to Consolidated Financial Statements

6. Investments in Unconsolidated Ventures, page 134

Comment No. 3

We note your disclosure at the bottom of page 135 that “NSAM Sponsored Companies and certain PE Investments, for which the Company has elected the fair value option, are accounted for under the cost method.” Please clarify for us and in future filings if these investments are recorded at fair value or at cost.

Response to Comment No. 3

The Company advises the Staff that the NSAM Sponsored Companies are cost method investments. In addition, the Company notes that certain PE Investments are cost method investments for which the Company has elected the fair value option. The Company advises the Staff that it will, in future Exchange Act periodic filings commencing with the Quarterly Report on Form 10-Q for the quarter period ended June 30, 2016, clarify such disclosure.

Form 10-Q for the quarter ended March 31, 2016

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 60

Comment No. 4

Please tell us and disclose in future filings the nature of the defaults for the debt you reference in footnote (16) on page 35.

Response to Comment No. 4

The Company advises the Staff that the nature of the defaults related to certain cross-collateralized borrowings not in compliance with the debt service coverage ratio and a certain borrowing not being in compliance with its annualized project yield covenant. The Company advises the Staff that it will, in future Exchange Act periodic filings commencing with the Quarterly Report on Form 10-Q for the quarter period ended June 30, 2016, clarify such disclosure.

* * *

As requested in the Letter, the Company hereby acknowledges that the Company is responsible for the adequacy and accuracy of the disclosure in the filing; Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the Federal securities laws of the United States.

If you should have any questions concerning this response, please contact the undersigned at (212) 547-2605 or Matt Brandwein, Chief Accounting Officer, at (212) 547-2675.

Sincerely,

/s/ Debra A. Hess

Debra A. Hess

Chief Financial Officer

|

| |

| cc: | Erin McPhee, Securities and Exchange Commission |

| | Al Tylis, NorthStar Asset Management Group Inc. |

| | Jonathan Langer, NorthStar Realty Finance Corp. |

| | Ronald Lieberman, NorthStar Realty Finance Corp. |

| | Matt Brandwein, NorthStar Realty Finance Corp. |

| | Greg Ross, Grant Thornton LLP |