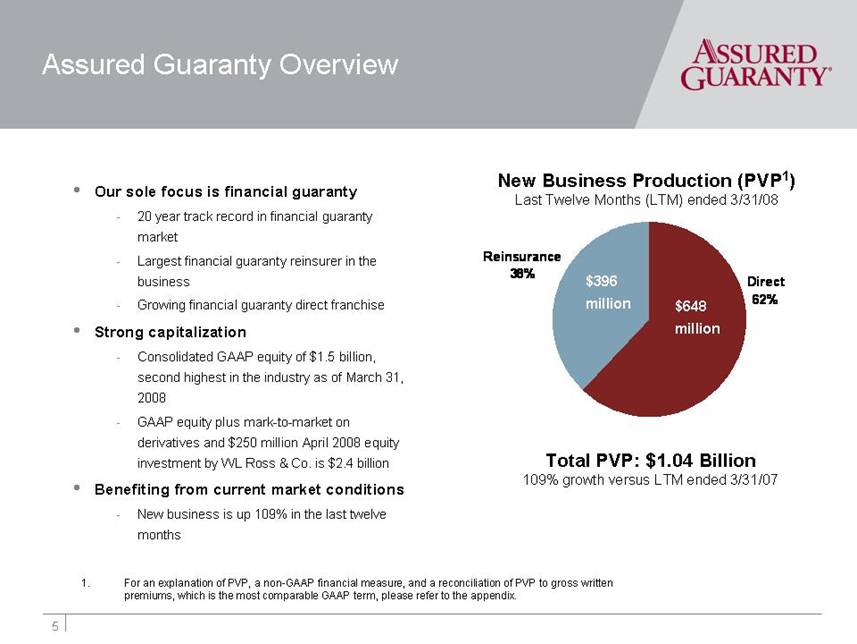

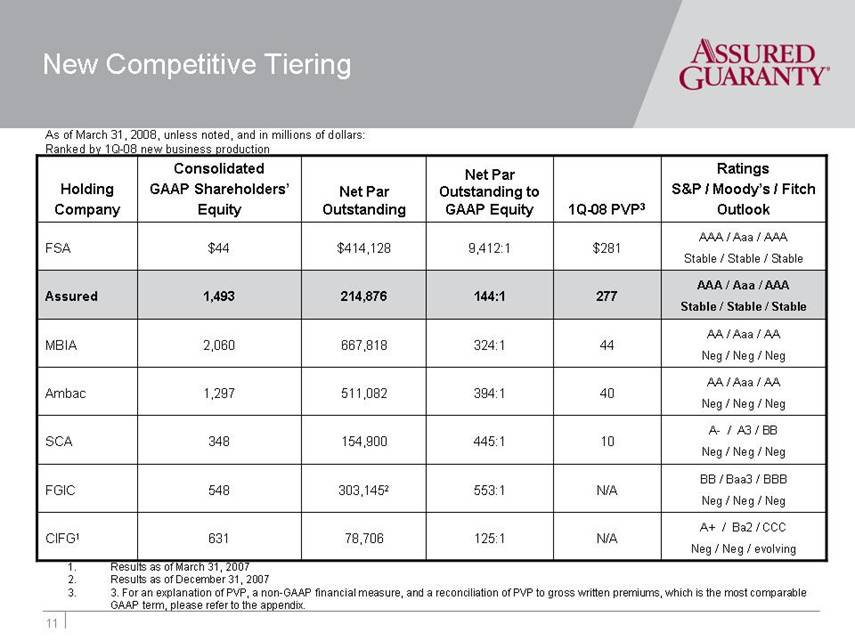

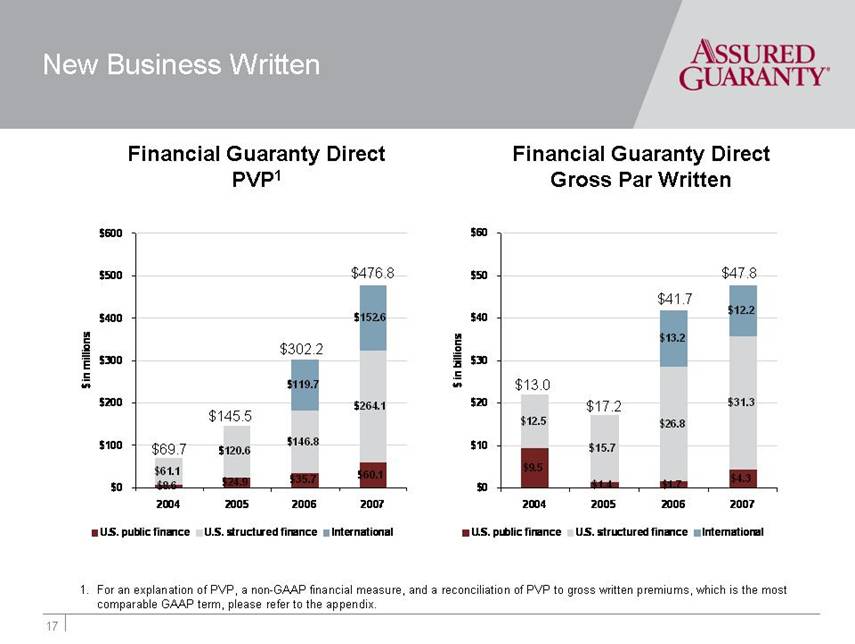

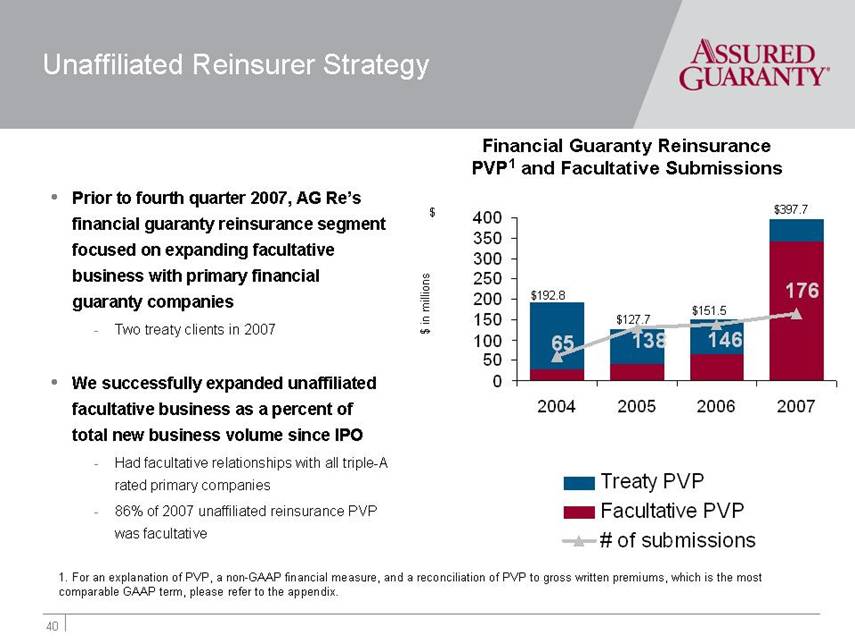

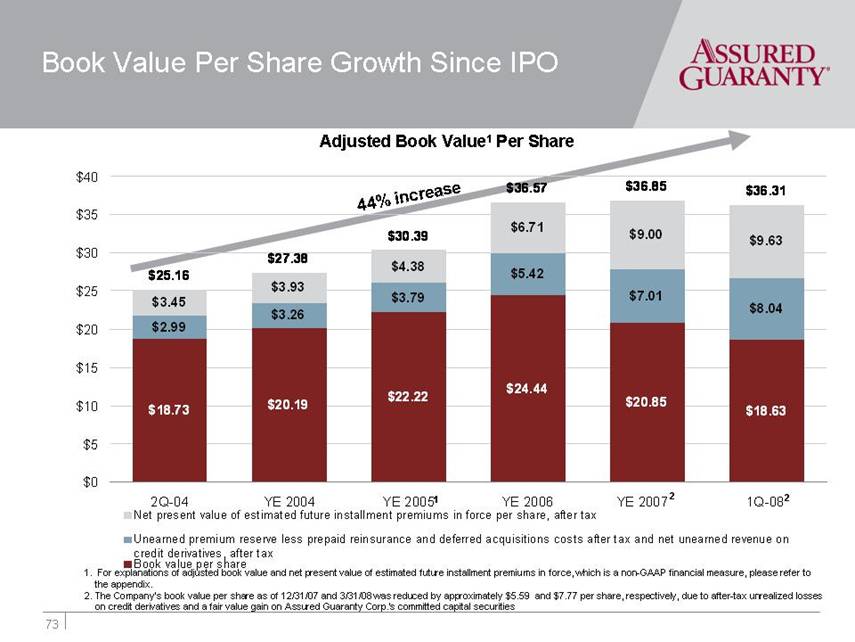

| 84 Appendix: Explanation of Non-GAAP Financial Measures Adjusted book value, which is a non-GAAP financial measure, is defined as shareholders’ equity (book value) plus the after-tax value of the unearned premium reserve net of prepaid reinsurance premiums, plus the net present value of estimated future installment premiums in force, less future ceding commissions, after tax discounted at 6%, less deferred acquisition costs, after tax. Management believes that adjusted book value is a useful measure for management, equity analysts and investors because the calculation of adjusted book value permits an evaluation of the net present value of the Company’s in-force premiums and capital base. The premiums described above will be earned in future periods, but may differmaterially from the estimated amounts used in determining current adjusted book value due to changes in market interest rates, refinancing or refunding activity, prepayment speeds, policy changes or terminations, credit defaults, and other factors that management cannot control or predict. This measure should not be viewed as a substitute for book value determined in accordance with GAAP. Operating income, which is a non-GAAP financial measure, is defined as net income (loss) excluding i) after-tax realized gains (losses) on investments and ii) after-tax unrealized gains (losses) on credit derivatives and the fair value adjustment of the Company’s committed capital securities, other than the Company‘s net estimate of after-tax incurred case and portfolio loss and loss adjusted expense reserves for credit derivatives. Operating return on equity (ROE) represents operating income as a percentage of average shareholders’ equity, excluding accumulated other comprehensive income and after-tax unrealized gains (losses) on credit derivatives. Management believes that operating income and operating ROE are useful measures for management, investors and analysts because the presentation of operating income and operating ROE enhance the understanding of Assured’s results of operations by highlighting the underlying profitability of Assured’s business. Realized gains (losses) on investments and unrealized gains (losses) on credit derivatives and the fair value adjustment of the Company’s committed capital securities, other than the portion attributable to the Company’s net estimate of incurred case and portfolio loss and loss adjustment expense reserves for credit derivatives, are excluded because the amount of both of these gains (losses) is heavily influenced by, and fluctuates, in part, according to market interest rates, credit spreads and other factors that management cannot control or predict. These measures should not be viewed as substitutes for net income (loss) or ROE determined in accordance with GAAP. Present value of gross written premiums or PVP, which is a non-GAAP financial measure, is defined as gross upf ront and installment premiums received and the present value of gross estimated future installment premiums, on contracts written in the current period, discounted at 6% per year. Management believes that PVP is a useful measure for management, equity analysts and investors because it permits the evaluation of the value of new business production for Assured by taking into account the value of estimated future installment premiums on new contracts underwritten in a reporting period, which GAAP gross premiums written does not adequately measure. Actual future net earned or written premiums may differ from PVP due to factors such as prepayments, amortizations, refundings, contract terminations or defaults that may or may not be influenced by market interest rates, refinancing or refunding activity, prepayment speeds, policy changes or terminations, credit defaults, or other factors that management cannot control or predict. This measure should not be viewed as a substitute for gross written premiums determined in accordance with GAAP. Net present value of estimated future installment premiums in force, which is a non-GAAP financial measure, is defined as the present value of estimated future installment premiums from our in-force book of business, net of reinsurance and discounted at 6%. Management believes that net present value of estimated future installment premiums in force is a useful measure for management, equity analysts and investors because it permits an evaluation of the value of future estimated installment premiums. Estimated future premiums may change from period to period due to changes in par outstanding, maturity, or other factors that management cannot control or predict that result from market interest rates, refinancing or refunding activity, prepayment speeds, policy changes or terminations, credit defaults, or other factors. There is no comparable GAAP financial measure. For adjusted book value, net present value of estimated future installment premiums in force, and PVP, Assured uses 6% as the present value discount rate because it is the approximate taxable equivalent yield on Assured’s investment portfolio for the periods presented. |