December 31, 2019 Exhibit 10.75 Bruce Stern [Address Redacted] Dear Bruce: This letter agreement (the “Agreement”) will confirm our understanding regarding your separation from Assured Guaranty Ltd. and its Affiliates (as defined in Section 3.5) (collectively referred to as the “Company”). SECTION 1 SEPARATION DATE In discussions with the Company, you and the Company have agreed that you will resign as Executive Officer of the Company, effective as of December 31, 2019 (the “Resignation Date”). Subject to the terms of this Agreement, during the period beginning on January 1, 2020 and ending on May 1, 2020 (the “Termination Date” and the period between January 1, 2020 and the Termination Date referred to as the “Transition Period”), you shall remain employed by the Company as a non-executive officer with a title of Senior Advisor to the Chief Executive Officer of the Company. The effective date of your separation from all positions and employment with the Company will be the Termination Date or, if earlier, the date your termination occurs for any other reason (the date of your termination referred to as the “Separation Date”). The offer to you set forth in this Agreement shall remain outstanding during the period described in the release of claims attached hereto as Exhibit A (the “First Release”), provided that the Company may, in its sole discretion, by written notice to you, extend this date. The release of claims attached hereto as Exhibit B (the “Second Release”) should be signed and returned to the Company on or after your Separation Date such that the Second Release becomes effective within the sixty-day period following your Separation Date. SECTION 2 PAYMENTS AND BENEFITS You shall be entitled to compensation, benefits, payments, and distributions from the Company in accordance with this Section 2. 2.1. Amounts Prior to Termination Date. (a) Base Salary. Your annual base salary through the Separation Date shall remain at no less than $500,000. (b) 2019 Cash Incentive Payment. The Company shall pay you a cash incentive award related to your 2019 performance (the “2019 Cash Incentive Payment”) in a total amount equal to one million nine hundred twenty-seven thousand and eight hundred dollars ($1,927,800) (with such total amount consisting of $1,227,800 as a cash payment for your Assured Guaranty Ltd. 30 Woodbourne Avenue, 5th Floor main 441 279 5700 info@assuredguaranty.com www.assuredguaranty.com Hamilton HM 08 fax 441 279 5701 Bermuda

non-equity incentive grant for 2019 and $700,000 as a cash payment in lieu of any equity grants in 2020 for your 2019 performance). Consistent with past practice and subject to your continued employment through the Termination Date and compliance with the terms of this Agreement, the Company shall pay you a cash payment equal to one million two hundred twenty-seven thousand eight hundred dollars ($1,227,800) at the same time that the non-equity incentive payments are made to other employees of the Company and in no event later than March 15, 2020. Subject to your continued employment through the Termination Date and compliance with the terms of this Agreement, including the requirements of Section 2.2 and Section 3, the Company shall pay the remaining seven hundred thousand dollars ($700,000) between February 1, 2021 and March 15, 2021 as specified below in Section 2.2(c). If you incur a termination for any reason prior to the Termination Date or you breach the terms of this Agreement, you shall forfeit your right to receive any unpaid portion of the 2019 Cash Incentive Payment. (c) Employee Benefits. Prior to your Separation Date, you shall remain eligible for the employee benefits plans maintained by the Company subject to the terms of such plans. (d) Within thirty days of the Separation Date or such earlier date as required by applicable law, the Company shall pay you (i) the amount of all earned and previously unpaid salary for the period ending on your Separation Date, based upon your then-current annual base salary, and (ii) an amount that is in settlement of any and all vacation days that you have accrued but did not use, and to which you are entitled from the Company. You will not accrue or be entitled to any vacation after your Separation Date. 2.2. Amounts On or After the Termination Date. Subject to you remaining employed until the Termination Date (except as provided below), your signing and not revoking the First and Second Release, and your continued compliance with the terms of Section 3 below, the Company shall pay you the following (collectively referred to herein as the “Separation Payments”); provided, however, that, if the Second Release does not become effective on or before the sixtieth day after your Termination Date or you violate the terms of Section 3 below, you shall forfeit your right to receive the Separation Payments: (a) Severance Payment. The Company shall pay you two million one hundred four thousand six hundred thirty-one dollars ($2,104,631) in a single lump-sum payment no later than the sixty-day anniversary of your Separation Date (the “Severance Payment”). The Severance Payment consists of the total of the amounts which you are entitled to receive pursuant to the Assured Guaranty Ltd. Executive Severance Plan (the “Severance Plan”) following a termination without cause, including an amount for one-year of salary, plus an amount equal to your pro-rata bonus (as determined pursuant to the Severance Plan based on the average of your annual bonuses for the last three calendar years prior to the Separation Date), plus an amount equal to your bonus amount (as determined pursuant to the Severance Plan based on the average of your annual bonuses for the last three calendar years prior to the Separation Date determined however without regard to $700,000 of the 2019 Cash Incentive Payment that is being paid in lieu of equity and determined without regard to the Transaction Bonus (as defined below)), plus an amount equal to twelve months of your health and dental premiums based on your election as in effect as of the Separation Date. 2

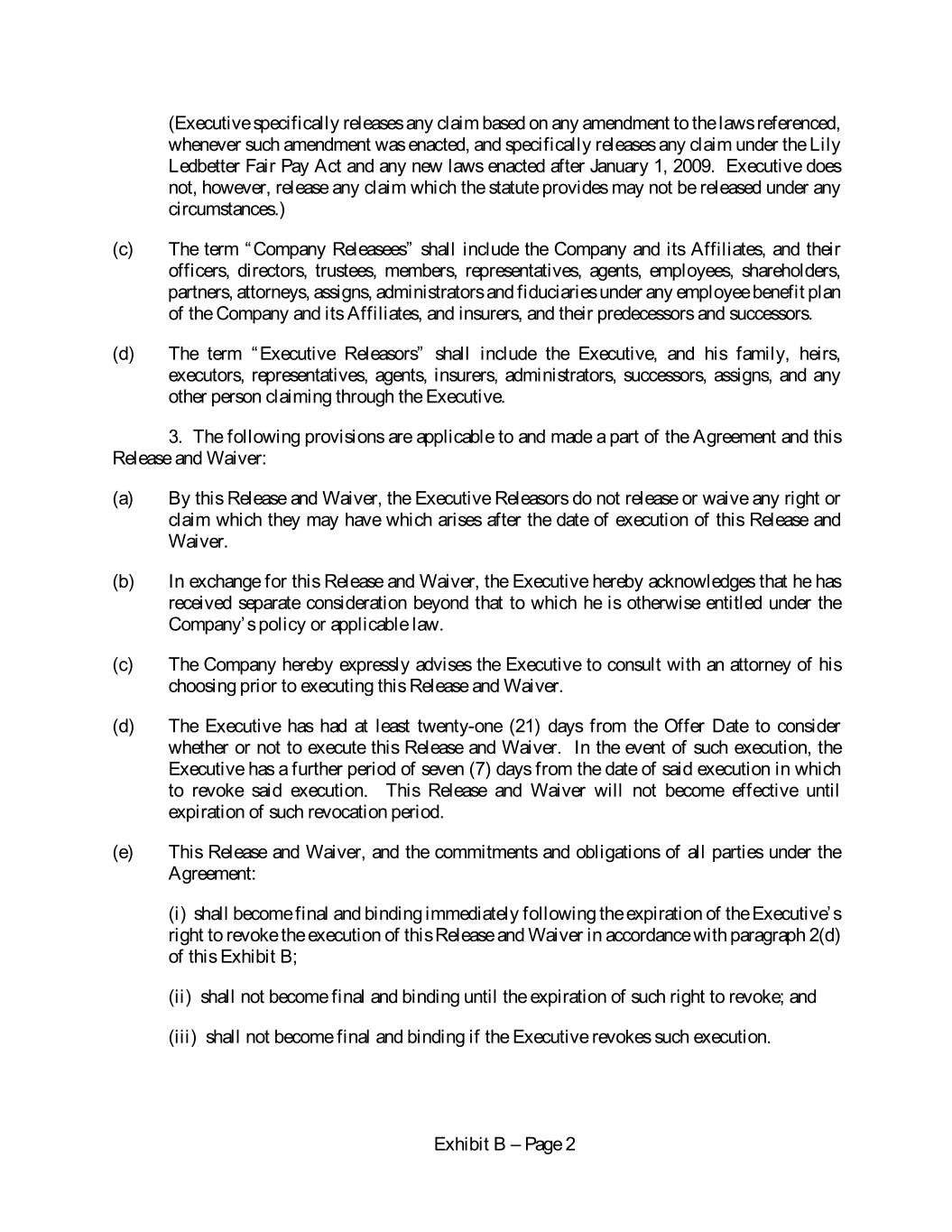

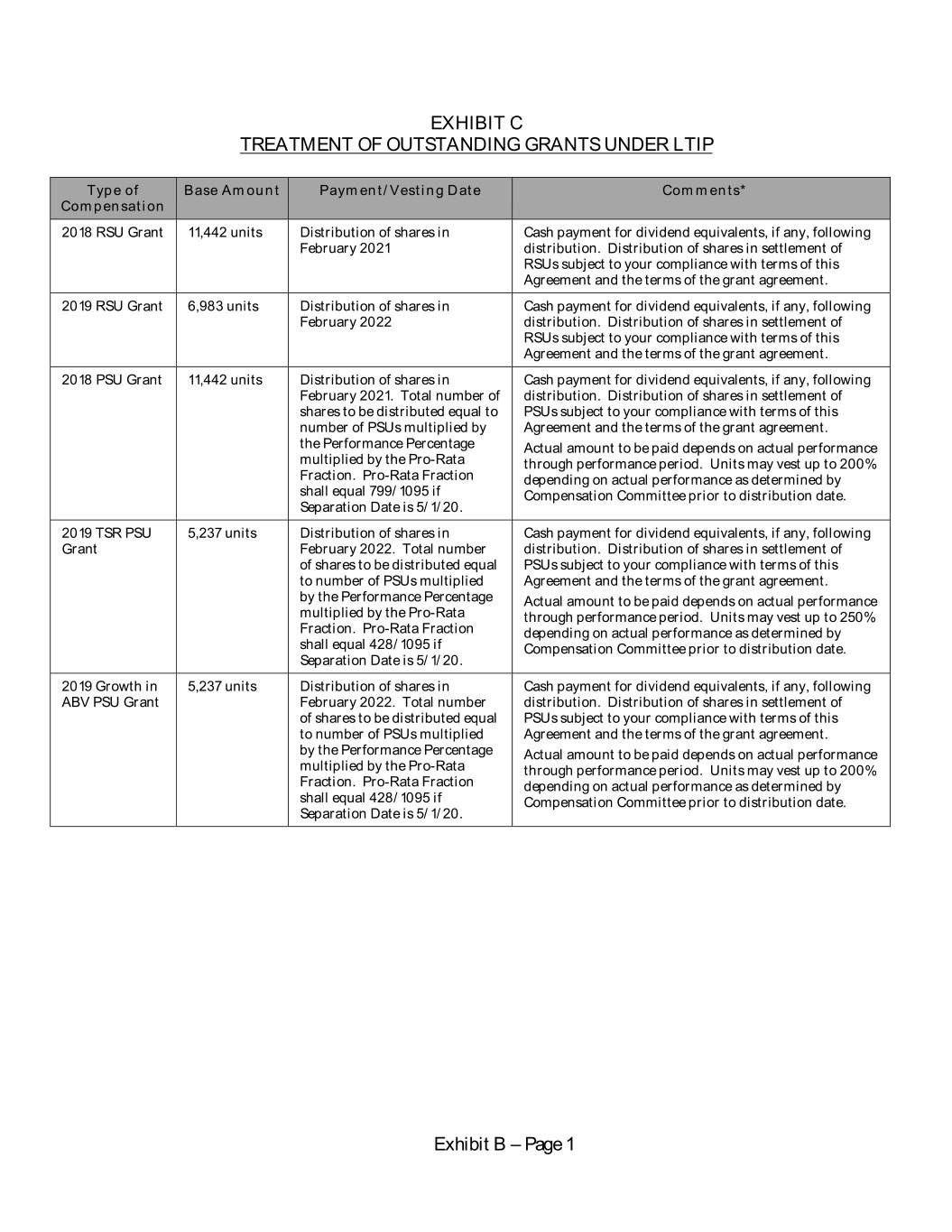

(b) Transaction Bonus. Subject to the consummation of the transaction on which you have been working pursuant to which Assured Guaranty Municipal Corp. or an Affiliate will purchase certain business operations on or prior to May 1, 2021, the Company shall pay you five hundred thousand dollars ($500,000) (the “Transaction Bonus”) in a single lump sum payment during calendar year 2021 and in any event no later than May 31, 2021. For the avoidance of doubt, if such transaction does not close on or before May 1, 2021 or if you do not satisfy the conditions to receive the Severance Payment, you shall forfeit your right to receive the Transaction Bonus. (c) Remaining 2019 Cash Incentive Payment. The Company shall pay the remaining seven hundred thousand dollars ($700,000) of the 2019 Cash Incentive Payment in a single-lump sum payment between February 1, 2021 and March 15, 2021. (d) Restricted Stock Units. You shall become fully vested and receive a distribution of shares pursuant to the restricted stock unit (“RSU”) awards granted previously pursuant to the LTIP (“RSU Distributions”) as described in Exhibit C. (e) Performance Stock Units. You shall be entitled to pro-rata vesting pursuant to the performance stock unit (“PSU”) awards granted previously pursuant to the LTIP in the amounts determined by the Compensation Committee based on the achievement of the performance goals as of the last day of the applicable performance period (“PSU Distributions”) as described in Exhibit C. 2.3. COBRA Coverage. On and after your Separation Date, your entitlement to continue medical coverage under the benefit plans of the Company will be determined in accordance with any retiree medical provisions of the plans and with the provisions of section 4980B of the Internal Revenue Code of 1986, as amended (the “Code”), and section 601 of the Employee Retirement Income Security Act of 1974, as amended (which continuation coverage is sometimes referred to as “COBRA coverage”). 2.4. Other Benefits. You will be entitled to benefits under the Company’s qualified retirement plan and according to the terms of such plan, and you will be entitled to a distribution of your accrued benefits in the AG US Group Services Inc. Supplemental Executive Retirement Plan (the “SERP”) following the Separation Date pursuant to the terms of such plan. Except as otherwise provided herein, all other benefits shall cease as of the Separation Date. 2.5. Withholding. All amounts otherwise payable under this Agreement shall be subject to customary withholding and other employment taxes, and shall be subject to such other withholding as may be required in accordance with the terms of this Agreement. 2.6. Other Payments. Except as specified in this Section 2, or as otherwise expressly provided in or pursuant to the Agreement, you shall be entitled to no compensation, benefits or other payments or distributions, and references in the First Release and the Second Release to the release of claims against the Company shall be deemed to also include reference to the release of claims against all compensation and benefit plans and arrangements established or maintained by the Company . 3

SECTION 3 PROTECTION OF COMPANY INTERESTS 3.1. Restrictive Covenants. As a condition to receiving the payments in Section 2, you expressly agree and acknowledge that you agree to the terms of this Section 3, and you expressly agree and acknowledge that all applicable terms of the LTIP and all award agreements for awards previously granted to you pursuant to the LTIP shall survive and that you remain bound by the terms of such agreements (including, but not limited to, all applicable restrictive covenants contained in such agreements which shall apply to each applicable award under the LTIP in addition to the restrictive covenants listed in this Section 3). 3.2. Non-competition and Non-solicitation. You agree that you shall not, at any time during your employment with the Company or during the two-year period following the Separation Date, directly or indirectly engage in a Competitive Activity. For purposes of this Agreement, “Competitive Activity” shall mean (i) your engaging in an activity, directly or indirectly, whether as an employee, consultant, director, partner, principal, agent, distributor, representative, stockholder (except as a less than one percent stockholder of a publicly traded company or a less than five percent stockholder of a privately held company) or otherwise, within the United States, Bermuda, Europe or Australia, if such activities involve insurance or reinsurance of entities or risks that are competitive with the insurance or reinsurance business then being conducted or contemplated by the Company or any Affiliate and which, during the period covered by your employment, were conducted or contemplated by the Company or any Affiliate; or (ii) you engaging in any activity, directly or indirectly, whether on behalf of yourself or any other person or entity (x) to solicit any client and/or customer of the Company or any Affiliate or (y) to hire any employee or former employee of the Company or any present or former Affiliate of the Company or encourage any employee of the Company or Affiliate to leave the employ of the Company or Affiliate. 3.3. Non-Disparagement. At all times prior to and following the Separation Date, you agree that you shall not make any statements or express any views that disparage the business reputation or goodwill of the Company and/or any of its Affiliates. 3.4. Confidentiality. You agree that you shall not, without the prior written consent of the Company, use, or disclose to any person (other than an employee of either of the Company or an Affiliate, or other person, to whom disclosure is necessary to the performance by you of your duties in the employ of the Company or Affiliate) any confidential or proprietary information about the Company or any Affiliate or their business, unless and until such information has become known to the public generally (other than as a result of unauthorized disclosure by you). The foregoing covenants by you shall be without limitation as to time and geographic applications. Nothing in this Section 3.4 or this Agreement prohibits you from reporting possible violations of applicable law or regulation to any governmental agency or entity or making other disclosures that are protected under the whistleblower provisions of any applicable law or regulation. 3.5. Property. You represent and warrant that you have or prior to the Separation Date you will have (i) removed your personal effects from your office at the Company, (ii) vacated such office, (iii) returned to the Company all property of the Company , including, without limitation, any Company computer, Blackberry, iPhone, iPad, any keys, credit cards, passes, files, confidential documents or material, or other property belonging to the Company or its Affiliates, and (iv) returned all writings, files, records, correspondence, notebooks, notes and other documents 4

and things (including any copies thereof) containing any trade secrets relating to the Company or its Affiliates. For purposes of the preceding sentence, the term “trade secrets” shall mean information, including a formula, pattern, compilation, program device, method, technique, or process, that: (i) derives independent economic value, actual or potential, from not being generally known to, and not being readily ascertainable by proper means by, other persons who can obtain economic value from its disclosure or use, and (ii) is the subject of efforts that are reasonable under the circumstances to maintain its secrecy. You further represent and warrant that (i) prior to your Separation Date, you have not deleted or altered any documents, files or information in the Company computer, BlackBerry, iPhone, iPad, or in the Company’s electronic or other records, or duplicated, downloaded or otherwise retained any documents, files or other information belonging to the Company or its Affiliates, other than a routine deletion or alteration in the ordinary course of business and (ii) after your Separation Date, you will not delete or alter any documents, files or information in the Company laptop computer, BlackBerry, iPhone, iPad, or duplicated, downloaded or otherwise retained any documents, files or other information belonging to the Company or its Affiliates, other than a routine deletion or alteration in the ordinary course of business. For purposes of this Agreement, the term “Affiliate” means (a) any corporation, partnership, joint venture or other entity which, owns, directly or indirectly, at least a fifty percent interest in the Company (or any successor to the Company); (b) any corporation, partnership, joint venture or other entity in which at least a fifty percent interest is owned, directly or indirectly, by the Company or by any entity that is an Affiliate by reason of clause (a) next above; or (c) any other corporation, partnership, joint venture or other entity which is under common control with the Company. For purposes of the definition of Affiliate, “control” (including with correlative meanings, the terms “controlling”, “controlled by” or “under common control with”), as used with respect to any entity, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such entity, whether through the ownership of voting securities or by contract or otherwise. 3.6. No Interference With Rights: The Parties agree that nothing in this Agreement shall be construed to prohibit you from challenging illegal conduct or engaging in protected activity, including without limitation reporting possible violations of any law or regulation to any governmental agency or entity or making other disclosures that are protected under the whistleblower provisions of any law or regulation, filing a charge or complaint with, and/or participating in any investigation or proceeding conducted by, the National Labor Relations Board, the Equal Employment Opportunity Commission, the Securities and Exchange Commission, and/or any other federal, state or local government agency. Further, the Parties agree that nothing in this Agreement shall be construed to interfere with the ability of any federal, state or local government agency to investigate any such charge or complaint, or your ability to communicate voluntarily with any such agency. However, by signing this Agreement, you understand that you are waiving your right to receive individual relief based on claims asserted in any such charge or complaint, except where such a waiver is prohibited. You understand that your release of claims as contained in this Agreement does not extend to any rights you may have under any laws governing the filing of claims for COBRA, unemployment, disability insurance and/or workers’ compensation benefits. You further understand that nothing herein shall be construed to prohibit you from: (a) challenging the Company’s failure to comply with its promises to make payment and provide other consideration under this Agreement; (b) asserting your right to any vested benefits to which you are entitled pursuant to the terms of the applicable plans and/or applicable law; (c) challenging the knowing and voluntary nature of your release of claims under the Age 5

Discrimination in Employment Act of 1967; and/or (d) asserting any claim that cannot lawfully be waived by private agreement. 3.7. Cooperation. You agree that you will reasonably cooperate with the Company , and their respective counsel in connection with any investigation, administrative proceeding or litigation, or in response to a reasonable request for assistance from the Company or its Affiliates, relating to any matter that occurred during your employment in which you were involved or of which you have knowledge. The Company or its Affiliates will reimburse you for your reasonable costs incurred, upon proper and timely submission of receipts with respect thereto, in accordance with the Company’s or its Affiliates’ then-current policy, practices or procedures. You agree that, in the event you are subpoenaed by any person or entity (including, but not limited to, any government agency) to provide documents or give testimony (in a deposition, court proceeding or otherwise) or are requested by a governmental or regulatory body to provide an interview, which in any way relates to your employment by the Company or any of its Affiliates, you will give prompt notice of such request to General Counsel, AG US Group Services Inc., 1633 Broadway, New York, NY 10019 (generalcounsel@agltd.com) (or his or her successor or designee) and, unless otherwise required by law, will make no disclosure or production until the Company or its Affiliates have had a reasonable opportunity to contest the right of the requesting person or entity to such disclosure or production. 3.8. Effect of Covenants. Nothing in this Section 3 shall be construed to adversely affect the rights that the Company would possess in the absence of the provisions of such Section. SECTION 4 RELEASE AND WAIVER As part of this Agreement, and in consideration of the additional payments provided to you in accordance with this Agreement, you are required to execute the First Release, in the form set forth as Exhibit A of this Agreement, and the Second Release, in the form set forth as Exhibit B of this Agreement, which are attached to and form a part of this Agreement. This Agreement (including all Exhibits to this Agreement), and the commitments and obligations of all parties hereunder: (a) shall become final and binding immediately following the expiration of your right to revoke the execution of the Second Release in accordance with paragraph 2(d) of the release; (b) shall not become final and binding until the expiration of such right to revoke; and (c) shall not become final and binding if you revoke such execution. SECTION 5 MISCELLANEOUS 5.1. Amendment. This Agreement may be amended or canceled only by mutual agreement of the parties in writing, without the consent of any other person. So long as you live, no person, other than the parties hereto, shall have any rights under or interest in this Agreement or the subject matter hereof. It is the intention of the parties that the payments and benefits to which you could become entitled under this Agreement not be subject to accelerated recognition of income or imposition of additional tax under Code Section 409A, and the Agreement shall be construed in a manner that is consistent with this intent. 5.2. Waiver of Breach. The waiver by either you or the Company (or its Affiliates) of a breach of any provision of this Agreement shall not operate as or be deemed a waiver of any 6

subsequent breach by either you or the Company. Continuation of benefits hereunder by the Company following a breach by you of any provision of this Agreement shall not preclude the Company from thereafter exercising any right that it may otherwise independently have to terminate said benefits based upon the same violation. 5.3. Effect of Breach. You acknowledge that the Company would be irreparably injured by your violation of Section 3, and you agree that the Company , in addition to any other remedies available to them for such breach or threatened breach, shall be entitled to a preliminary injunction, temporary restraining order, or other equivalent relief, restraining you from any actual or threatened breach of Section 3. If a bond is required to be posted in order for the Company to secure an injunction or other equitable remedy, the parties agree that said bond need not be more than a nominal sum. You acknowledge that each of the covenants contained in Section 3 are an essential part of this Agreement and a condition to the Company’s agreement to provide the payments and benefits described in Section 2. If any covenant or term of Sections 3 is determined to be invalid or unenforceable in any instance, such determination shall not prevent the reassertion thereof with respect of any other breach or violation. If, in any proceeding, a court (or other tribunal) refuses to enforce the covenants contained in Sections 3 because such covenants cover too extensive a geographic area or too long a period of time, any such covenant shall be deemed amended to the extent (but only to the extent) required by law to permit its enforceability hereunder. You also agree that, if you ever challenge the validity of this Agreement, the First Release or the Second Release or if you breach the terms of this Agreement, the First Release or the Second Release or the terms of any applicable grant agreement pursuant to the LTIP, you will forfeit your right to any unpaid payments pursuant to this Agreement and, if paid prior to such breach, you agree to repay the Separation Payments to the Company together with an amount equal to any gain received as a result of the RSU Distributions and the PSU Distributions. 5.4. Severability. The invalidity or unenforceability of any provision of this Agreement will not affect the validity or enforceability of any other provision of this Agreement, and this Agreement will be construed as if such invalid or unenforceable provision were omitted (but only to the extent that such provision cannot be appropriately reformed or modified); provided, however, that if one or more provisions of the First and Second Release are invalid or unenforceable, the Company may, in its sole discretion, elect to have the entire Agreement treated as invalid and unenforceable. 5.5. Other Agreements. Except as otherwise specifically provided in this Agreement, this instrument constitutes the entire agreement between you and the Company and supersedes all prior agreements and understandings, written or oral, including, without limitation, the Employment Agreement and any other agreements that may have been made by and between you and the Company or its predecessors or Affiliates; provided, however, that for the avoidance of doubt, as noted in Section 3 of this Agreement, you agree that you remain bound by all applicable terms of the LTIP and all award agreements for awards previously granted to you pursuant to the LTIP. 5.6. Governing Law. This Agreement shall be construed in accordance with the laws of the State of New York without regard to the conflict of law provisions of any state. 5.7. Costs. The parties shall each bear their own costs, attorneys’ fees and other fees incurred in connection with this Agreement and the First and Second Release. 7

5.8. Exhibits, Other Documents. Except as otherwise expressly provided in this Agreement, or except where the context clearly requires otherwise, all references in this Agreement to “the Agreement” or “this Agreement” shall be deemed to include references to each of the Exhibits to this Agreement. To the extent that the terms of this Agreement (including the Exhibits to this Agreement) provide that your rights or obligations set forth in this Agreement (including the Exhibits to this Agreement) are to be determined under, or are to be subject to, the terms of any other plan or other document, this Agreement (including the Exhibits to this Agreement) shall be deemed to incorporate by reference such plan or other document. 5.9. Counterparts. This Agreement may be executed in more than one counterpart, but all of which together will constitute one and the same agreement. If you accept the terms of this Agreement, please indicate your acceptance by signing and returning a copy of this Agreement to the undersigned, along with a signed copy of Exhibit A (First Release) and a signed copy of Exhibit B (Second Release) within the time period specified on or after your Separation Date. Very truly yours, Assured Guaranty Ltd. and its Affiliates By: /s/ Dominic Frederico___________ Name: Dominic Frederico Its: President and Chief Executive Officer Accepted and agreed: Date: December 31, 2019 _____ _/s/ Bruce Stern ____________ Name: Bruce Stern 8

Offer Date: December 31, 2019 EXHIBIT A RELEASE AND WAIVER 1. This document is attached to, is incorporated into, and forms a part of, the separation agreement dated December 31, 2019 (the “Agreement”) by and between Bruce Stern (the “Executive”) and Assured Guaranty Ltd. (the “Company”). The Executive, on behalf of himself and the other Executive Releasors, releases and forever discharges the Company and the other Company Releasees from any and all Claims which the Executive now has or claims, or might hereafter have or claim (or the other Executive Releasors may have, to the extent that it is derived from a Claim which the Executive may have), against the Company Releasees based upon or arising out of any matter or thing whatsoever, occurring or arising on or before the date of this Release and Waiver, including, but not limited to, Claims that arise out of or relate to the Executive’s employment by the Company and its Affiliates as defined in the Agreement and/or the Executive’s termination or resignation therefrom. However, nothing in this Release and Waiver shall constitute a release of any Claims of the Executive (or other Executive Releasors) for a breach by the Company of the Agreement; or purport to release any claims which may not lawfully be released. 2. For purposes of this Release and Waiver, the terms set forth below shall have the following meanings: (a) The term “Agreement” shall include the Agreement and the Exhibits thereto, and including the plans and arrangements under which the Executive is entitled to benefits in accordance with the Agreement and the Exhibits. (b) The term “Claims” shall include (except for claims for breach of the Agreement) any and all rights, claims, demands, debts, dues, sums of money, accounts, attorneys’ fees, complaints, judgments, executions, actions and causes of action of any nature whatsoever, known or unknown, cognizable at law or equity, shall include claims related to pay, commission, hours, bonuses, pension, disability, physical or mental affliction, benefits including vacation days and payment for unused vacation, reimbursement for expenses, terms and conditions of employment and claims of discrimination on account of age, race, color, sex, sexual harassment, sexual orientation, marital status, disability, national origin, citizenship, religion, or retaliation and shall include, without limitation, claims arising under (or alleged to have arisen under) (i) the Age Discrimination in Employment Act of 1967, as amended; (ii) Title VII of the Civil Rights Act of 1964, as amended; (iii) The Civil Rights Act of 1991; (iv) Section 1981 through 1988 of Title 42 of the United States Code, as amended; (v) the Employee Retirement Income Security Act of 1974, as amended; (vi) The Immigration Reform Control Act, as amended; (vii) The Americans with Disabilities Act of 1990, as amended; (viii) The National Labor Relations Act, as amended; (ix) The Fair Labor Standards Act, as amended; (x) The Occupational Safety and Health Act, as amended; (xi) The Family and Medical Leave Act of 1993; (xii) the Sarbanes-Oxley Act; (xiii) the federal Worker Adjustment and Retraining Notification Act and any similar state laws; (xiv) any state antidiscrimination law; (xv) any state or local wage and hour law; (xvi) any other local, state or federal law, regulation or ordinance; (xvii) any whistleblower Exhibit A – Page 1

law; (xviii) any public policy, contract, tort, or common law; or (xix) any allegation for costs, fees, or other expenses including attorneys’ fees incurred in these matters. (Executive specifically releases any claim based on any amendment to the laws referenced, whenever such amendment was enacted, and specifically releases any claim under the Lily Ledbetter Fair Pay Act and any new laws enacted after January 1, 2009. Executive does not, however, release any claim which the statute provides may not be released under any circumstances.) (c) The term “Company Releasees” shall include the Company and its Affiliates, and their officers, directors, trustees, members, representatives, agents, employees, shareholders, partners, attorneys, assigns, administrators and fiduciaries under any employee benefit plan of the Company and its Affiliates, and insurers, and their predecessors and successors. (d) The term “Executive Releasors” shall include the Executive, and his family, heirs, executors, representatives, agents, insurers, administrators, successors, assigns, and any other person claiming through the Executive. 3. The following provisions are applicable to and made a part of the Agreement and this Release and Waiver: (a) By this Release and Waiver, the Executive Releasors do not release or waive any right or claim which they may have which arises after the date of execution of this Release and Waiver. (b) In exchange for this Release and Waiver, the Executive hereby acknowledges that he has received separate consideration beyond that to which he is otherwise entitled under the Company’s policy or applicable law. (c) The Company hereby expressly advises the Executive to consult with an attorney of his choosing prior to executing this Release and Waiver. (d) The Executive has twenty-one (21) days from the Offer Date to consider whether or not to execute this Release and Waiver. In the event of such execution, the Executive has a further period of seven (7) days from the date of said execution in which to revoke said execution. This Release and Waiver will not become effective until expiration of such revocation period. (e) This Release and Waiver, and the commitments and obligations of all parties under the Agreement: (i) shall become final and binding immediately following the expiration of the Executive’s right to revoke the execution of this Release and Waiver in accordance with paragraph 2(d) of this Exhibit A; (ii) shall not become final and binding until the expiration of such right to revoke; and (iii) shall not become final and binding if the Executive revokes such execution. Exhibit A – Page 2

4. The Executive hereby acknowledges that he has carefully read and understands the terms of the Agreement and this Release and Waiver and each of his rights as set forth therein. _____________________________ Bruce Stern Date: _______________________ [Signature page to Exhibit A: Executive Release and Waiver] Exhibit A – Page 3

EXHIBIT B RELEASE AND WAIVER 1. This document is attached to, is incorporated into, and forms a part of, the separation agreement dated December 31, 2019 (the “Agreement”) by and between Bruce Stern (the “Executive”) and Assured Guaranty Ltd. (the “Company”). The Executive, on behalf of himself and the other Executive Releasors, releases and forever discharges the Company and the other Company Releasees from any and all Claims which the Executive now has or claims, or might hereafter have or claim (or the other Executive Releasors may have, to the extent that it is derived from a Claim which the Executive may have), against the Company Releasees based upon or arising out of any matter or thing whatsoever, occurring or arising on or before the date of this Release and Waiver, including, but not limited to, Claims that arise out of or relate to the Executive’s employment by the Company and its Affiliates as defined in the Agreement and/or the Executive’s termination or resignation therefrom. However, nothing in this Release and Waiver shall constitute a release of any Claims of the Executive (or other Executive Releasors) for a breach by the Company of the Agreement; or purport to release any claims which may not lawfully be released. 2. For purposes of this Release and Waiver, the terms set forth below shall have the following meanings: (a) The term “Agreement” shall include the Agreement and the Exhibits thereto, and including the plans and arrangements under which the Executive is entitled to benefits in accordance with the Agreement and the Exhibits. (b) The term “Claims” shall include (except for claims for breach of the Agreement) any and all rights, claims, demands, debts, dues, sums of money, accounts, attorneys’ fees, complaints, judgments, executions, actions and causes of action of any nature whatsoever, known or unknown, cognizable at law or equity, shall include claims related to pay, commission, hours, bonuses, pension, disability, physical or mental affliction, benefits including vacation days and payment for unused vacation, reimbursement for expenses, terms and conditions of employment and claims of discrimination on account of age, race, color, sex, sexual harassment, sexual orientation, marital status, disability, national origin, citizenship, religion, or retaliation and shall include, without limitation, claims arising under (or alleged to have arisen under) (i) the Age Discrimination in Employment Act of 1967, as amended; (ii) Title VII of the Civil Rights Act of 1964, as amended; (iii) The Civil Rights Act of 1991; (iv) Section 1981 through 1988 of Title 42 of the United States Code, as amended; (v) the Employee Retirement Income Security Act of 1974, as amended; (vi) The Immigration Reform Control Act, as amended; (vii) The Americans with Disabilities Act of 1990, as amended; (viii) The National Labor Relations Act, as amended; (ix) The Fair Labor Standards Act, as amended; (x) The Occupational Safety and Health Act, as amended; (xi) The Family and Medical Leave Act of 1993; (xii) the Sarbanes-Oxley Act; (xiii) the federal Worker Adjustment and Retraining Notification Act and any similar state laws; (xiv) any state antidiscrimination law; (xv) any state or local wage and hour law; (xvi) any other local, state or federal law, regulation or ordinance; (xvii) any whistleblower law; (xviii) any public policy, contract, tort, or common law; or (xix) any allegation for costs, fees, or other expenses including attorneys’ fees incurred in these matters. Exhibit B – Page 1

(Executive specifically releases any claim based on any amendment to the laws referenced, whenever such amendment was enacted, and specifically releases any claim under the Lily Ledbetter Fair Pay Act and any new laws enacted after January 1, 2009. Executive does not, however, release any claim which the statute provides may not be released under any circumstances.) (c) The term “Company Releasees” shall include the Company and its Affiliates, and their officers, directors, trustees, members, representatives, agents, employees, shareholders, partners, attorneys, assigns, administrators and fiduciaries under any employee benefit plan of the Company and its Affiliates, and insurers, and their predecessors and successors. (d) The term “Executive Releasors” shall include the Executive, and his family, heirs, executors, representatives, agents, insurers, administrators, successors, assigns, and any other person claiming through the Executive. 3. The following provisions are applicable to and made a part of the Agreement and this Release and Waiver: (a) By this Release and Waiver, the Executive Releasors do not release or waive any right or claim which they may have which arises after the date of execution of this Release and Waiver. (b) In exchange for this Release and Waiver, the Executive hereby acknowledges that he has received separate consideration beyond that to which he is otherwise entitled under the Company’s policy or applicable law. (c) The Company hereby expressly advises the Executive to consult with an attorney of his choosing prior to executing this Release and Waiver. (d) The Executive has had at least twenty-one (21) days from the Offer Date to consider whether or not to execute this Release and Waiver. In the event of such execution, the Executive has a further period of seven (7) days from the date of said execution in which to revoke said execution. This Release and Waiver will not become effective until expiration of such revocation period. (e) This Release and Waiver, and the commitments and obligations of all parties under the Agreement: (i) shall become final and binding immediately following the expiration of the Executive’s right to revoke the execution of this Release and Waiver in accordance with paragraph 2(d) of this Exhibit B; (ii) shall not become final and binding until the expiration of such right to revoke; and (iii) shall not become final and binding if the Executive revokes such execution. Exhibit B – Page 2

4. The Executive hereby acknowledges that he has carefully read and understands the terms of the Agreement and this Release and Waiver and each of his rights as set forth therein. _____________________________ Bruce Stern Date: _______________________ [Signature page to Exhibit B: Executive Release and Waiver] Exhibit B – Page 3

EXHIBIT C TREATMENT OF OUTSTANDING GRANTS UNDER LTIP Type of Base Amount Payment/Vesting Date Comments* Compensation 2018 RSU Grant 11,442 units Distribution of shares in Cash payment for dividend equivalents, if any, following February 2021 distribution. Distribution of shares in settlement of RSUs subject to your compliance with terms of this Agreement and the terms of the grant agreement. 2019 RSU Grant 6,983 units Distribution of shares in Cash payment for dividend equivalents, if any, following February 2022 distribution. Distribution of shares in settlement of RSUs subject to your compliance with terms of this Agreement and the terms of the grant agreement. 2018 PSU Grant 11,442 units Distribution of shares in Cash payment for dividend equivalents, if any, following February 2021. Total number of distribution. Distribution of shares in settlement of shares to be distributed equal to PSUs subject to your compliance with terms of this number of PSUs multiplied by Agreement and the terms of the grant agreement. the Performance Percentage Actual amount to be paid depends on actual performance multiplied by the Pro-Rata through performance period. Units may vest up to 200% Fraction. Pro-Rata Fraction depending on actual performance as determined by shall equal 799/1095 if Compensation Committee prior to distribution date. Separation Date is 5/1/20. 2019 TSR PSU 5,237 units Distribution of shares in Cash payment for dividend equivalents, if any, following Grant February 2022. Total number distribution. Distribution of shares in settlement of of shares to be distributed equal PSUs subject to your compliance with terms of this to number of PSUs multiplied Agreement and the terms of the grant agreement. by the Performance Percentage Actual amount to be paid depends on actual performance multiplied by the Pro-Rata through performance period. Units may vest up to 250% Fraction. Pro-Rata Fraction depending on actual performance as determined by shall equal 428/1095 if Compensation Committee prior to distribution date. Separation Date is 5/1/20. 2019 Growth in 5,237 units Distribution of shares in Cash payment for dividend equivalents, if any, following ABV PSU Grant February 2022. Total number distribution. Distribution of shares in settlement of of shares to be distributed equal PSUs subject to your compliance with terms of this to number of PSUs multiplied Agreement and the terms of the grant agreement. by the Performance Percentage Actual amount to be paid depends on actual performance multiplied by the Pro-Rata through performance period. Units may vest up to 200% Fraction. Pro-Rata Fraction depending on actual performance as determined by shall equal 428/1095 if Compensation Committee prior to distribution date. Separation Date is 5/1/20. Exhibit B – Page 1