EXECUTION VERSION 741716996.2 Assured Guaranty US Holdings Inc. Assured Guaranty Ltd. $500,000,000 3.150% Senior Notes due 2031 UNDERWRITING AGREEMENT May 19, 2021 Goldman Sachs & Co. LLC BofA Securities, Inc. as Representatives of the Several Underwriters c/o Goldman Sachs & Co. LLC 200 West Street, New York, New York 10282-2198 c/o BofA Securities, Inc. One Bryant Park New York, New York 10036 Ladies and Gentlemen: Assured Guaranty US Holdings Inc., a Delaware corporation (the “Issuer”), proposes to issue and sell to the several underwriters named in Schedule A hereto (the “Underwriters”) $500,000,000 aggregate principal amount of its 3.150% Senior Notes due 2031 (the “Notes”), to be issued under an indenture, dated as of May 1, 2004 (the “Indenture”), among the Issuer, Assured Guaranty Ltd., a Bermuda company (the “Guarantor”), and The Bank of New York Mellon, as Trustee (the “Trustee”). Goldman Sachs & Co. LLC and BofA Securities, Inc. have agreed to act as representatives of the several Underwriters (in such capacity, the “Representatives”) in connection with the offering and sale of the Securities (as defined below). Pursuant to the Indenture, the Guarantor has agreed to fully and unconditionally guarantee (the “Guarantee,” and together with the Notes, the “Securities”), the payment of principal of, premium, if any, and interest on the Notes. The Issuer and the Guarantor hereby confirm their agreement with the Underwriters as follows: SECTION 1. Representations and Warranties. Each of the Issuer and the Guarantor, jointly and severally, hereby represents, warrants and covenants to each Underwriter as follows: i. Registration Statement and Prospectus. The Issuer and the Guarantor have prepared and filed with the Securities and Exchange Commission (the “Commission”) an Exhibit 1.1

2 741716996.2 “automatic shelf registration statement” (as defined in Rule 405 under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (collectively, the “Securities Act”)) on Form S-3 (File No. 333-238919), which contains a base prospectus (the “Base Prospectus”), to be used in connection with the public offering and sale of the Securities. Such registration statement, in the form in which it became effective under the Securities Act, including the financial statements, exhibits and schedules thereto, including any required information deemed to be a part thereof at the time of effectiveness pursuant to Rule 430B under the Securities Act, is called the “Registration Statement.” Any preliminary prospectus supplement to the Base Prospectus that describes the Securities and the offering thereof and is used prior to filing of the final prospectus is called, together with the Base Prospectus, a “preliminary prospectus.” The term “Prospectus” shall mean the final prospectus supplement relating to the Securities, together with the Base Prospectus, that is first filed pursuant to Rule 424(b) under the Securities Act after the date and time that this Agreement is executed and delivered by the parties hereto (the “Execution Time”). Any reference herein to the Registration Statement, any preliminary prospectus or the Prospectus shall be deemed to refer to and include the documents incorporated by reference therein pursuant to Item 12 of Form S-3 under the Securities Act; any reference to any amendment or supplement to any preliminary prospectus or the Prospectus shall be deemed to refer to and include any documents filed after the date of such preliminary prospectus or Prospectus, as the case may be, under the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and incorporated by reference in such preliminary prospectus or Prospectus, as the case may be; and any reference to any amendment to the Registration Statement shall be deemed to refer to and include any annual report of the Guarantor filed pursuant to Section 13(a) or 15(d) of the Exchange Act after the effective date of the Registration Statement that is incorporated by reference in the Registration Statement. All references in this Agreement to the Registration Statement, a preliminary prospectus, the Prospectus, or any amendments or supplements to any of the foregoing, shall include any copy thereof filed with the Commission pursuant to the Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”). ii. Compliance with Registration Requirements. The Registration Statement automatically became effective upon filing under the Securities Act. The Issuer and the Guarantor have complied to the Commission’s satisfaction with all requests of the Commission for additional or supplemental information. No stop order suspending the effectiveness of the Registration Statement is in effect, the Commission has not issued any order or notice preventing or suspending the use of the Registration Statement, any preliminary prospectus or the Prospectus, and no proceedings for such purpose have been instituted or are pending or, to the best knowledge of the Issuer and the Guarantor, are contemplated or threatened by the Commission. Each preliminary prospectus and the Prospectus when filed complied in all material respects with the Securities Act and, if filed by electronic transmission pursuant to EDGAR (except as may be permitted by Regulation S-T under the Securities Act), was identical to the copy thereof delivered to the Underwriters for use in connection with the offer and sale of the Securities. Each of the Registration Statement and any post-effective amendment thereto, at the time it became effective and at the date hereof, complied and will comply in all material respects with the Securities Act and did not and will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to make the statements therein not misleading. The Prospectus, as amended or supplemented, as of its date, at the time of

3 741716996.2 any filing pursuant to Rule 424(b) under the Securities Act and at the Closing Date (as defined herein), did not and will not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading The representations and warranties set forth in the two immediately preceding sentences do not apply to (i) the Form T-1 Statements of Eligibility under the Trust Indenture Act of 1939, as amended (the “Trust Indenture Act”), or (ii) statements in or omissions from the Registration Statement or any post-effective amendment thereto, or the Prospectus, or any amendments or supplements thereto, made in reliance upon and in conformity with information relating to any Underwriter furnished to the Issuer and the Guarantor by any Underwriter through the Representatives expressly for use therein, it being understood and agreed that the only such information furnished by any Underwriter consists of the information described as such in Section 7(b) hereof. There is no contract or other document required to be described in a preliminary prospectus or the Prospectus or to be filed as exhibits to the Registration Statement that has not been described or filed as required. The documents incorporated by reference in a preliminary prospectus and the Prospectus, when they became effective or were filed with the Commission, as the case may be, conformed in all material respects to the requirements of the Securities Act or the Exchange Act, as applicable. Any further documents so filed and incorporated by reference in a preliminary prospectus or the Prospectus or any further amendment or supplement thereto, when such documents become effective or are filed with the Commission, as the case may be, will conform in all material respects to the requirements of the Securities Act or the Exchange Act, as applicable, and the rules and regulations of the Commission thereunder. iii. Disclosure Package. The term “Disclosure Package” shall mean (i) the preliminary prospectus dated May 19, 2021, as amended or supplemented as of the Applicable Time (as defined below), (ii) the issuer free writing prospectuses as defined in Rule 433 under the Securities Act (each, an “Issuer Free Writing Prospectus”), if any, identified in Schedule B hereto, (iii) any other free writing prospectus that the parties hereto shall hereafter expressly agree in writing to treat as part of the Disclosure Package and (iv) the Final Term Sheet (as defined herein), which also shall be identified in Schedule B hereto. As of 3:00 p.m. (Eastern time) on the date of this Agreement (the “Applicable Time”), the Disclosure Package did not contain any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The preceding sentence does not apply to statements in or omissions from the Disclosure Package based upon and in conformity with written information furnished to the Issuer and the Guarantor by any Underwriter through the Representatives expressly for use therein, it being understood and agreed that the only such information furnished by or on behalf of any Underwriter consists of the information described as such in Section 7(b) hereof. iv. The Issuer and the Guarantor Not Ineligible Issuers. At the Execution Time, neither the Issuer nor the Guarantor was an Ineligible Issuer (as defined in Rule 405 under the Securities Act), without taking account of any determination by the Commission pursuant to Rule 405 under the Securities Act that it is not necessary that the Issuer or the Guarantor be considered an Ineligible Issuer.

4 741716996.2 v. Well-Known Seasoned Issuers. (i) At the time of filing the Registration Statement, (ii) at the time of the most recent amendment thereto for the purposes of complying with Section 10(a)(3) of the Securities Act (whether such amendment was by post-effective amendment, incorporated report filed pursuant to Section 13 or 15(d) of the Exchange Act or form of prospectus), (iii) at the time the Issuer or the Guarantor or any person acting on their behalf (within the meaning, for this clause only, of Rule 163(c) under the Securities Act) made any offer relating to the Securities in reliance on the exemption of Rule 163 under the Securities Act, and (iv) at the Execution Time of this Agreement, each of the Issuer and the Guarantor was and is a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act. vi. Issuer Free Writing Prospectuses. Any Issuer Free Writing Prospectus, as of its issue date and at all subsequent times through the completion of the offering or until any earlier date that the Issuer and the Guarantor notified or notifies the Representatives as described in the next sentence, did not, does not and will not include any information that conflicted, conflicts or will conflict with the information contained in the Registration Statement, a preliminary prospectus or the Prospectus. If at any time following issuance of an Issuer Free Writing Prospectus there occurred or occurs an event or development as a result of which such Issuer Free Writing Prospectus conflicted or would conflict with the information contained in the Registration Statement, a preliminary prospectus or the Prospectus, the Issuer and the Guarantor have promptly notified or will promptly notify the Representatives and have promptly amended or supplemented or will promptly amend or supplement, at their own expense, such Issuer Free Writing Prospectus to eliminate or correct such conflict. The foregoing two sentences do not apply to statements in or omissions from any Issuer Free Writing Prospectus based upon and in conformity with written information furnished to the Issuer and the Guarantor by any Underwriter specifically through the Representatives expressly for use therein, it being understood and agreed that the only such information furnished by any Underwriter consists of the information described as such in Section 7(b) hereof. vii. Distribution of Offering Material. Neither the Issuer nor the Guarantor have distributed or will distribute, prior to the later of the Closing Date and the completion of the Underwriters’ distribution of the Securities, any offering material in connection with the offering and sale of the Securities other than a preliminary prospectus, the Prospectus, any Issuer Free Writing Prospectus reviewed and consented to by the Representatives and included in Schedule B hereto or the Registration Statement. The Representatives shall provide notice to the Issuer and the Guarantor if the distribution of the Securities has not been completed on the Closing Date, and upon such later date as the distribution of the Securities has been completed. viii. No Applicable Registration, Preemptive or Other Similar Rights. There are no persons with registration or other similar rights to have any equity or debt securities registered for sale under the Registration Statement or included in the offering contemplated by this Agreement, except for such rights as have been duly waived. ix. No Material Adverse Change. Neither the Guarantor nor any of its subsidiaries (including the Issuer) has sustained since the date of the latest audited financial statements included in the Disclosure Package and the Prospectus any material loss or interference with its business from fire, explosion, flood or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, otherwise than as set forth or

5 741716996.2 contemplated in the Disclosure Package and the Prospectus; and, since the respective dates as of which information is given in the Disclosure Package and the Prospectus, there has not been any change in the share capital or capital stock, as the case may be, or long-term debt of the Guarantor or any of its subsidiaries (including the Issuer) or any material adverse change, or any development involving a prospective material adverse change, in or affecting the business, financial condition, shareholders’ equity, or results of operations of the Guarantor and its subsidiaries (including the Issuer), taken as a whole (a “Material Adverse Change”), otherwise than as set forth or contemplated in the Disclosure Package and the Prospectus. x. Incorporation and Good Standing of the Guarantor. The Guarantor has been duly incorporated and is validly existing as an exempted company in good standing under the laws of Bermuda, with corporate power and authority to own its properties and conduct its business as described in the Disclosure Package and the Prospectus, and has been duly qualified as a foreign corporation for the transaction of business and is in good standing under the laws of each other jurisdiction in which it owns or leases properties or conducts any business so as to require such qualification, or is subject to no material liability or disability by reason of the failure to be so qualified in any such jurisdiction. xi. Incorporation and Good Standing of Subsidiaries. Each subsidiary (including the Issuer) of the Guarantor has been duly incorporated or organized (as applicable) and is validly existing and in good standing, to the extent such concept is applicable, under the laws of its jurisdiction of incorporation or organization (as applicable), with power and authority (corporate or other, as applicable) to own its properties and conduct its business as described in the Disclosure Package and the Prospectus, and has been duly qualified as a foreign corporation or other entity, as applicable, for the transaction of business and is in good standing, to the extent such concept is applicable, under the laws of each other jurisdiction in which it owns or leases properties or conducts any business so as to require such qualification, or is subject to no material liability or disability by reason of the failure to be so qualified in any such jurisdiction. xii. Capitalization. The Guarantor has an authorized capitalization as set forth in each of the Disclosure Package and the Prospectus under the caption “Capitalization,” and all of the issued shares of share capital of the Guarantor have been duly and validly authorized and issued, are fully paid and non-assessable; and all of the issued shares of share capital of each subsidiary (including the Issuer) of the Guarantor have been duly and validly authorized and issued, are fully paid and non-assessable and (except for directors’ qualifying shares) are owned directly or indirectly by the Guarantor, free and clear of all liens, encumbrances, equities or claims. xiii. Authorization of Agreement. This Agreement has been duly authorized, executed and delivered by the Issuer and the Guarantor. xiv. Authorization of the Indenture. The Indenture has been duly authorized by the Issuer and the Guarantor, has been duly qualified under the Trust Indenture Act and, when executed and delivered by the Issuer and the Guarantor, and assuming due authorization, execution and delivery thereof by the Trustee, will constitute a valid and binding agreement of the Issuer and the Guarantor, enforceable against the Issuer and the Guarantor in accordance with its terms, except as the enforcement thereof may be limited by bankruptcy, insolvency (including, without limitation, all laws relating to fraudulent transfers), reorganization, moratorium or other similar

6 741716996.2 laws affecting the enforcement of creditors’ rights generally or by general equitable principles (regardless of whether enforcement is considered in a proceeding in equity or at law). xv. Authorization of the Notes. The Notes have been duly authorized by the Issuer and, when the Notes have been executed and authenticated in accordance with the provisions of the Indenture and delivered to and paid for by the Underwriters pursuant to this Agreement, the Notes will constitute legal, valid and binding obligations of the Issuer entitled to the benefits of the Indenture, enforceable against the Issuer in accordance with their terms, except as the enforcement thereof may be limited by bankruptcy, insolvency (including, without limitation, all laws relating to fraudulent transfers), reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally or by general equitable principles (regardless of whether enforcement is considered in a proceeding in equity or at law). The Notes will be in the form contemplated by the Indenture. xvi. Authorization of the Guarantee. The Guarantee has been duly authorized by the Guarantor and, when the Indenture has been duly executed and delivered by the parties thereto and the Notes have been executed and authenticated in accordance with the provisions of the Indenture and delivered to and paid for by the Underwriters pursuant to this Agreement, the Guarantee will constitute a legal, valid and binding obligation of the Guarantor enforceable against the Guarantor in accordance with its terms, except as the enforcement thereof may be limited by bankruptcy, insolvency (including, without limitation, all laws relating to fraudulent transfers), reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally or by general equitable principles (regardless of whether enforcement is considered in a proceeding in equity or at law). xvii. Description of the Indenture, the Notes and the Guarantee. The Indenture, the Notes and the Guarantee will conform in all material respects to all statements relating thereto contained in the Prospectus and such description conforms, in all material respects, to the rights set forth in the instruments defining the same. xviii. Non-Contravention of Existing Agreements; No Further Authorizations or Approvals Required. The compliance by the Issuer and the Guarantor with all of the provisions of this Agreement, the Indenture, the Notes and the Guarantee and the consummation of the transactions contemplated herein and therein, including, but not limited to, the issuance and sale of the Securities, will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, (i) any indenture, mortgage, deed of trust, loan agreement or other agreement or instrument to which the Guarantor or any of its subsidiaries (including the Issuer) is a party or by which the Guarantor or any of its subsidiaries (including the Issuer) is bound or to which any of the property or assets of the Guarantor or any of its subsidiaries (including the Issuer) is subject, (ii) the provisions of the Memorandum of Association or the Bye- laws of the Guarantor or the Certificate of Incorporation or the bylaws of the Issuer, or (iii) any statute or any rule or regulation or order, judgment or decree of any court or governmental agency or body having jurisdiction over the Guarantor or any of its subsidiaries (including the Issuer) or any of their respective properties, except, in the case of clauses (i) and (iii) above, for such violations that would not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the business, financial condition, shareholders’ equity, or results of operations of the Guarantor and its subsidiaries (including the Issuer) taken as a whole (a

7 741716996.2 “Material Adverse Effect”); and no consent, approval, authorization, order, registration or qualification of or with any such court or governmental agency or body (“Governmental Authorizations”) is required for the sale of the Securities or the consummation by the Issuer and the Guarantor of the transactions contemplated by this Agreement, the Indenture, the Notes and the Guarantee, except (A) such Governmental Authorizations as have been duly obtained and are in full force and effect and copies of which have been furnished to the Representatives and (B) such Governmental Authorizations as may be required under state securities laws, Blue Sky laws, insurance securities laws or any laws of jurisdictions outside the United States in connection with the purchase and distribution of the Securities by or for the account of the Underwriters. xix. Absence of Violations and Defaults. Neither the Guarantor nor any of its subsidiaries (including the Issuer) is (i) in violation of its Memorandum of Association or Bye- laws or comparable organizational documents or (ii) in default in the performance or observance of any material obligation, agreement, covenant or condition contained in any indenture, mortgage, deed of trust, loan agreement, lease or other agreement or instrument to which it is a party or by which it or any of its properties may be bound, except, in the case of clause (ii) for any such default that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. xx. All Necessary Permits, etc. Each of the Guarantor and its subsidiaries (including the Issuer) possesses all consents, authorizations, approvals, orders, licenses, certificates, or permits issued by any regulatory agencies or bodies (collectively, “Permits”) which are necessary to conduct the business now conducted by it as described in the Disclosure Package and the Prospectus, except where the failure to possess such Permits would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect; all of such Permits are valid and in full force and effect, except where the invalidity of such Permits or the failure to be in full force and effect would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. There is no pending, or to the Issuer’s and the Guarantor’s knowledge, threatened action, suit, proceeding or investigation against or involving the Guarantor and its subsidiaries (including the Issuer), and neither the Issuer nor the Guarantor knows of any reasonable basis for any such action, suit, proceeding or investigation, that individually or in the aggregate would reasonably be expected to lead to the revocation, modification, termination, suspension or any other material impairment of the rights of the holder of any such Permit, except for such revocation, modification, termination, suspension or other material impairment that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. xxi. Compliance with Insurance Laws. Except as described in the Disclosure Package and the Prospectus, each of the Guarantor and its insurance subsidiaries is duly registered, licensed or admitted as an insurer or reinsurer or as an insurance holding company, as the case may be, under applicable insurance holding company statutes or other insurance laws (including laws that relate to companies that control insurance companies) and the rules, regulations and interpretations of the insurance regulatory authorities thereunder (collectively, “Insurance Laws”) in each jurisdiction where it is required to be so licensed or admitted to conduct its business as described in the Disclosure Package and the Prospectus, except where the failure to be so registered, licensed or admitted would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Except as described in the Disclosure Package and the Prospectus, each of the Guarantor and its insurance subsidiaries has all other necessary authorizations, approvals, orders,

8 741716996.2 consents, certificates, permits, registrations and qualifications of and from, and has made all declarations and filings with, all insurance regulatory authorities necessary to conduct their respective businesses as described in the Disclosure Package and the Prospectus, and all of the foregoing are in full force and effect, except where the failure to have such authorizations, approvals, orders, consents, certificates, permits, registrations or qualifications, the failure to make such declarations and filings, or the failure to be in full force and effect would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Except as otherwise described in the Disclosure Package and the Prospectus, none of the Guarantor nor any of its insurance subsidiaries has received any notification from any insurance regulatory authority to the effect that any additional authorization, approval, order, consent, certificate, permit, registration or qualification is needed to be obtained by either the Guarantor or any of its insurance subsidiaries to conduct its business as currently conducted, except where the failure to have such additional authorization, approval, order, consent, certificate, permit, registration or qualification would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Except as otherwise described in the Disclosure Package and the Prospectus, no insurance regulatory authority has issued to the Issuer or any subsidiary any order impairing, restricting or prohibiting (A) the payment of dividends by any of the Guarantor’s subsidiaries, (B) the making of a distribution on any subsidiary’s share capital, (C) the repayment to the Guarantor of any loans or advances to any of its subsidiaries (including the Issuer) from the Guarantor, (D) the repayment to the Issuer of any loans or advances to any of its subsidiaries from the Issuer, or (E) the transfer of any of the Issuer’s subsidiary’s property or assets to the Guarantor or any other subsidiary of the Guarantor (including the Issuer). Each of the Guarantor, the Issuer, Assured Guaranty Re Ltd., Assured Guaranty Re Overseas Ltd., Assured Guaranty Corp., Assured Guaranty (Europe) SA, Assured Guaranty UK Limited and Assured Guaranty Municipal Corp. maintains its books and records in accordance with all applicable Insurance Laws, except where the failure to so maintain its books and records would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. xxii. Bermuda Tax Assurances. Each of the Guarantor, Assured Guaranty Re Ltd. and Assured Guaranty Re Overseas Ltd. has received from the Bermuda Minister of Finance (the “Minister”) an assurance under The Exempted Undertakings Tax Protection Act, 1966 of Bermuda to the effect that, in the event of there being enacted in Bermuda any legislation imposing tax computed on profits or income or computed on any capital asset, gain or appreciation, or any tax of the nature of estate duty or inheritance tax, then the imposition of any such tax shall not be applicable to the Guarantor, Assured Guaranty Re Ltd. or Assured Guaranty Re Overseas Ltd. or any of their operations or their shares, debentures or other obligations, until March 31, 2035 (subject to certain provisos expressed in such assurance), and the Guarantor has not received any notification to the effect (and is not otherwise aware) that such assurances may be revoked or otherwise not honored by the Bermuda government. xxiii. Related Person Insurance Income. Except as disclosed in the Disclosure Package and the Prospectus, Assured Guaranty Re Ltd. intends to operate in a manner that is intended to ensure that either (i) the related person insurance income of such company does not equal or exceed 20% of such company’s gross insurance income for any taxable year in the foreseeable future or (ii) at all times during each taxable year for the foreseeable future less than 20% of the voting power and less than 20% of the value of the shares of Assured Guaranty Re Ltd. is owned (directly or indirectly) by persons who are (directly or indirectly) insured (each, an “insured”) under any

9 741716996.2 policy of insurance or reinsurance issued by Assured Guaranty Re Ltd. or related persons to any such insured. xxiv. Accuracy of Statements. The statements set forth in the Disclosure Package and the Prospectus under the caption “Description of the Notes and the Guarantee”, insofar as they purport to constitute a summary of the terms of the Indenture, the Notes and the Guarantee, and under the caption “Certain Tax Consequences”, and in the Guarantor’s Annual Report on Form 10-K for the year ended December 31, 2020, under the captions “Part I—Item 1—Business—Regulation” and “Part I—Item 3—Legal Proceedings,” insofar as they purport to describe the provisions of the laws and documents referred to therein, are true, accurate and complete in all material respects. The Indenture, the Securities and this Agreement will be in substantially the form filed or incorporated by reference, as the case may be, as an exhibit to the Registration Statement. xxv. Internal Controls and Procedures. The Guarantor maintains a system of internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Exchange Act) designed by, or under the supervision of, the Guarantor’s principal executive officer and principal financial officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The Guarantor’s internal control over financial reporting was effective as of the end year ended December 31, 2020, and there have been no changes in the Guarantor’s internal control over financial reporting since such time and the Guarantor is not aware of any material weaknesses in its internal control over financial reporting. xxvi. No Material Action or Proceeding. Other than as set forth in the Disclosure Package and the Prospectus, there are no legal or governmental proceedings pending to which the Guarantor or any of its subsidiaries (including the Issuer) is a party or of which any property of the Guarantor or any of its subsidiaries (including the Issuer) is the subject which, if determined adversely to the Guarantor or any of its subsidiaries (including the Issuer), would, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect; and, to the best of the Guarantor’s and the Issuer’s knowledge, no such proceedings are threatened or contemplated by governmental authorities or threatened by others. xxvii. Not an “Investment Company.” Neither the Issuer nor the Guarantor is and, after giving effect to the offering and sale of the Securities, will not be an “investment company”, as such term is defined in the Investment Company Act of 1940, as amended. xxviii. No Stamp Duty, Transfer, Excise or Similar Tax. No Underwriter and no subsequent purchaser of the Securities is subject to any stamp duty, transfer, excise or similar tax imposed in Bermuda in connection with the offering or sale of the Securities to the Underwriters or to any subsequent purchaser. xxix. Bermuda Exempted Companies. There are no currency exchange control laws or withholding taxes, in each case of Bermuda, that would be applicable to (1) the payment of interest or principal on the Securities by the Issuer or the Guarantor (other than as may apply to residents of Bermuda for Bermuda exchange control purposes) or (2) the payment of dividends, interest or principal by the any of the Guarantor’s subsidiaries to such subsidiary’s parent company. The Bermuda Monetary Authority has designated the Guarantor, Assured Guaranty Re Ltd. and

10 741716996.2 Assured Guaranty Re Overseas Ltd. (Assured Guaranty Re Ltd. and Assured Guaranty Re Overseas Ltd. are collectively referred to as the “Bermuda Subsidiaries”) as non-resident for exchange control purposes. Each of the Guarantor and the Bermuda Subsidiaries are “exempted companies” under Bermuda law and have not (A) acquired and do not hold any land in Bermuda except land required for its business held by way of lease or tenancy for terms of not more than 50 years, (B) acquired and do not hold land in Bermuda except with the consent of the Minister, land by way of lease or tenancy which is used to provide accommodation or recreational facilities for officers and employees of the Company for a term not exceeding 21 years, (C) taken mortgages on land in Bermuda to secure an amount in excess of $50,000, without the consent of the Minister, (D) acquired any bonds or debentures secured by any land in Bermuda, except bonds or debentures issued by the government of Bermuda or a public authority of Bermuda, or (E) conducted their business in a manner that is prohibited for “exempted companies” under Bermuda law. None of the Guarantor or any of the Bermuda Subsidiaries has received notification from the Bermuda Monetary Authority or any other Bermuda governmental authority of proceedings relating to the modification or revocation of its designation as non-resident for exchange control purposes, its permission to issue and transfer the Securities, or its status as an “exempted company” under Bermuda law. xxx. Independent Accountants. PricewaterhouseCoopers LLP, who have expressed their opinion with respect to the financial statements and the related notes thereto of the Guarantor and its subsidiaries (including the Issuer), are independent public accountants with respect to the Guarantor and the Issuer, as required by the Securities Act and the Exchange Act and the rules and regulations of the Commission thereunder. xxxi. Preparation of the Financial Statements. The consolidated financial statements incorporated by reference in the Registration Statement, the Disclosure Package and the Prospectus present fairly in all material respects the financial condition, results of operations and cash flows of the entities purported to be shown thereby at the dates and for the periods indicated and have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis throughout the periods indicated (except as stated therein or in the notes thereto) and conform in all material respects with the rules and regulations adopted by the Commission under the Securities Act and the Exchange Act. xxxii. Significant Subsidiaries. Assured Guaranty Corp., Assured Guaranty Re Ltd., Assured Guaranty Municipal Corp., Assured Guaranty Municipal Holdings Inc., Assured Guaranty UK Limited and Assured Guaranty US Holdings Inc. are the only significant subsidiaries of the Guarantor as that term is defined in Rule 1-02(w) of Regulation S-X of the rules and regulations of the Commission under the Securities Act. xxxiii. No Unlawful Contributions or Other Payments. Neither the Guarantor nor any of its subsidiaries (including the Issuer) nor, to the knowledge of the Guarantor or the Issuer, any director, officer, agent, employee or controlled affiliate of the Guarantor or any of its subsidiaries (including the Issuer), acting in such capacities, has taken any action, directly or indirectly, that would result in a material violation by such persons of any Anti-Corruption Laws (as defined below), including, without limitation, making use of the mails or any means or instrumentality of interstate commerce corruptly in furtherance of an offer, payment, promise to pay or authorization of the payment of any money, or other property, gift, promise to give, or authorization of the giving

11 741716996.2 of anything of value to any “foreign official” (as such term is defined in the FCPA (defined below)) or any foreign political party or official thereof or any candidate for foreign political office, in contravention of the FCPA in any material respect, and the Guarantor, its subsidiaries (including the Issuer) and, to the knowledge of the Guarantor and the Issuer, its controlled affiliates have conducted their businesses in compliance with the Anti-Corruption Laws in all material respects and have instituted and maintain policies and procedures designed to ensure, and which are reasonably expected to continue to ensure, continued compliance therewith. “Anti-Corruption Laws” mean the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder (the “FCPA”), the Bribery Act 2010 of the United Kingdom or any other applicable anti-corruption, anti-bribery or related law, statute or regulation (collectively, the “Anti- Corruption Laws”). Neither the Guarantor nor any of its subsidiaries (including the Issuer) will use, directly or indirectly, the proceeds of the offering in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any Person in violation of the Anti-Corruption Laws. xxxiv. No Conflict with Money Laundering Laws. The operations of the Guarantor and its subsidiaries (including the Issuer) are and have been conducted at all times in compliance in all material respects with applicable financial recordkeeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the money laundering statutes of all applicable jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines issued, administered or enforced by any governmental agency (collectively, the “Money Laundering Laws”) and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Guarantor or any of its subsidiaries with respect to the Money Laundering Laws is pending or, to the best knowledge of the Guarantor or the Issuer, threatened. xxxv. No Conflict with OFAC Laws. (i) Neither the Guarantor nor any of its subsidiaries (including the Issuer), nor any director or officer thereof, nor, to the knowledge of the Guarantor or the Issuer, any other employee, agent, controlled affiliate or representative of the Guarantor or any of its subsidiaries (including the Issuer), is (X) an individual or entity (“Person”) that is, or is owned or controlled by a Person that is the subject of any sanctions administered or enforced by the U.S. Department of Treasury’s Office of Foreign Assets Control, the United Nations Security Council, the European Union, Her Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions”), nor (Y) located, organized or resident in a country or territory that is the subject of Sanctions (including, without limitation, Burma/Myanmar, Cuba, Iran, Libya, North Korea, Sudan and Syria), and (ii) neither the Guarantor nor the Issuer will, directly or indirectly, use the proceeds of the offering, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture or other Person, to fund or facilitate any activities or business of or with any Person, or in any country or territory that, at the time of such funding or facilitation, is the subject of Sanctions. xxxvi. Information Technology. The Guarantor’s and its subsidiaries’ (including the Issuer’s) information technology assets and equipment, computers, systems, networks, hardware, software, websites, applications, and databases (collectively, “IT Systems”) are adequate for, and operate and perform in all material respects as required in connection with the operation of the business of the Guarantor and its subsidiaries as currently conducted, free and clear of all material bugs, errors, defects, Trojan horses, time bombs, malware and other corruptants, except as would

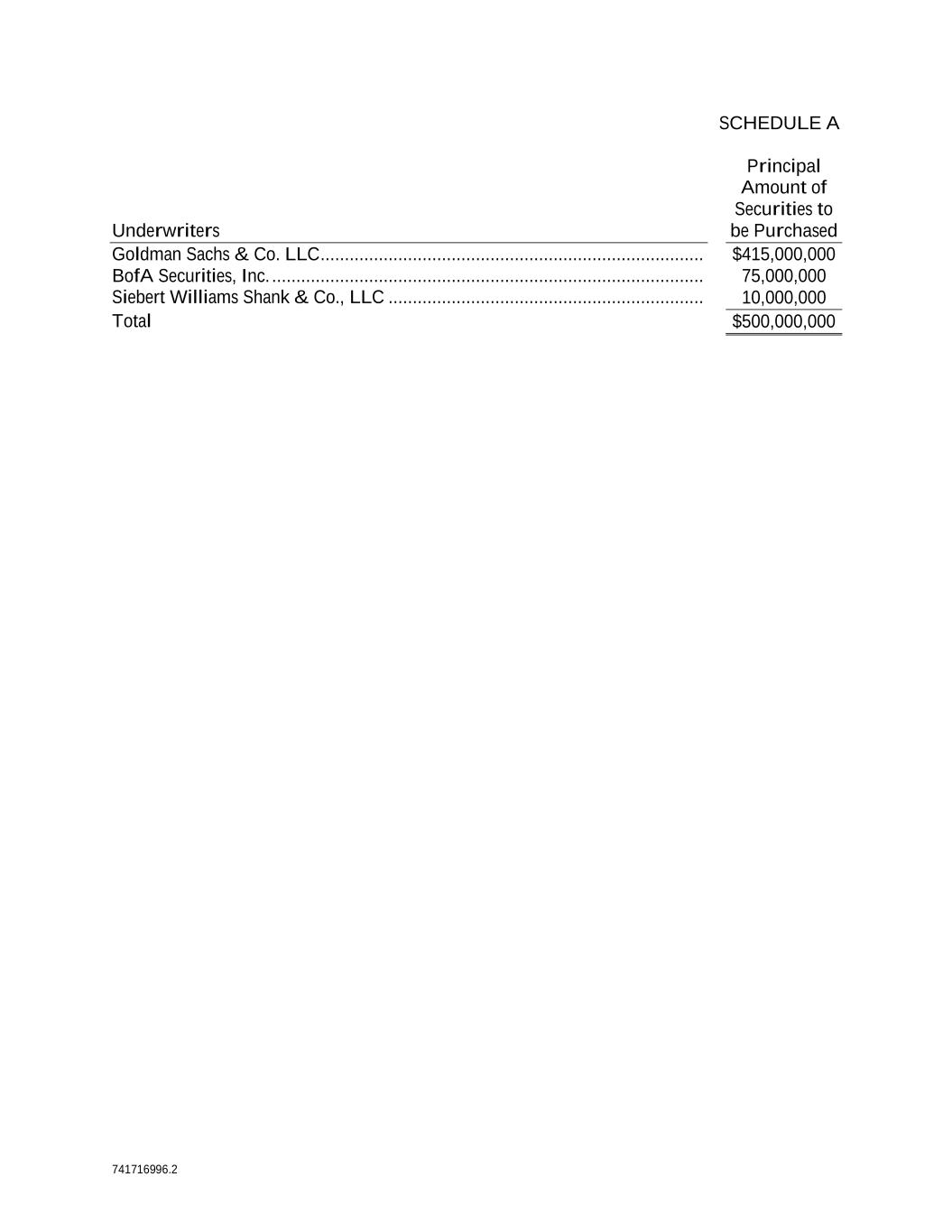

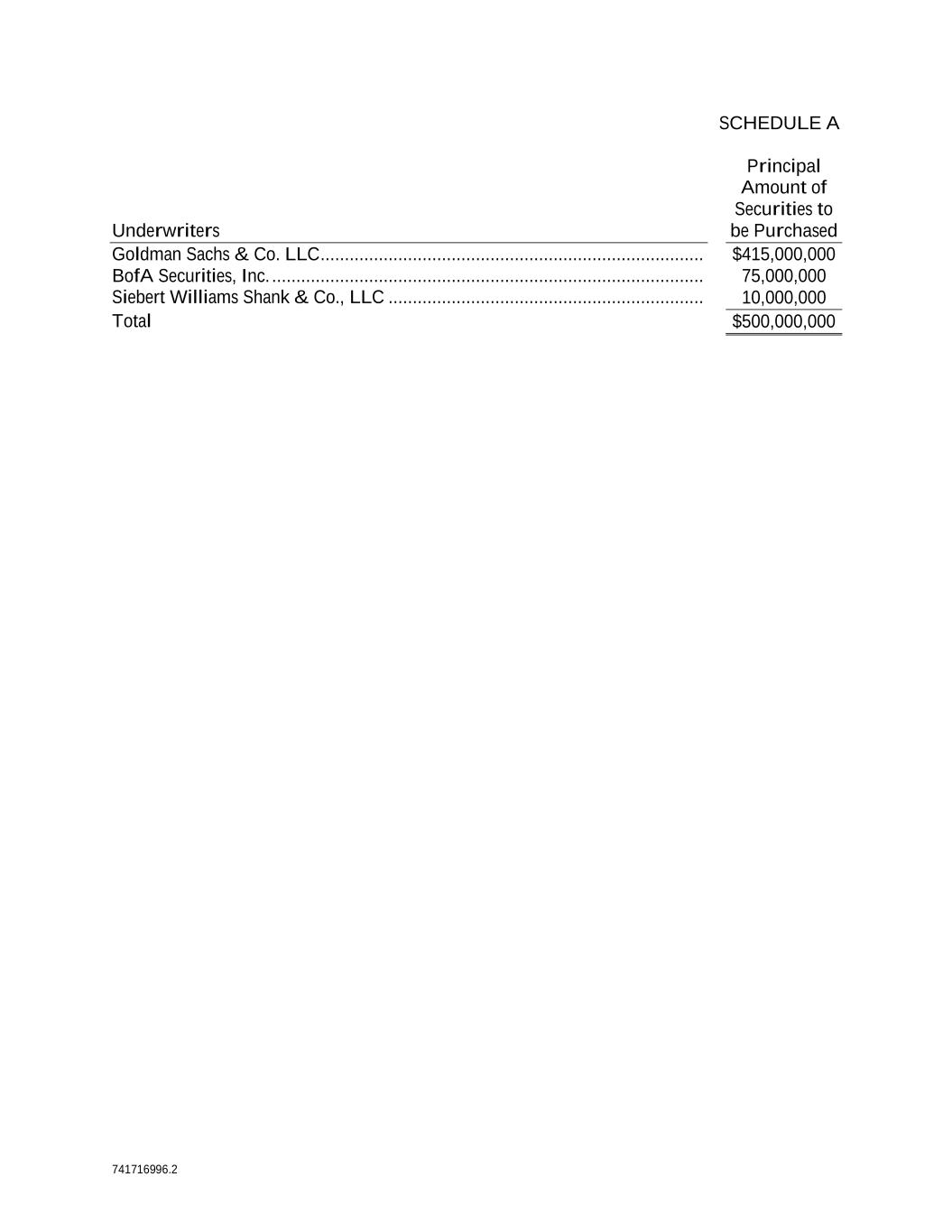

12 741716996.2 not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. The Guarantor and its subsidiaries (including the Issuer) have implemented and maintained reasonable controls, policies, procedures, and safeguards to maintain and protect their material confidential information and the integrity, continuous operation, redundancy and security of all IT Systems and data (including all personal, personally identifiable, sensitive, confidential or regulated data (“Personal Data”)) used in connection with their businesses, and there have been no material breaches, violations, outages or unauthorized uses of or accesses to same, except for those that have been remedied without material cost or liability or the duty to notify any other person, nor any material incidents under internal review or investigations relating to the same. The Guarantor and its subsidiaries (including the Issuer) are presently in compliance in all respects with all applicable laws or statutes and all judgments, orders, rules and regulations of any court or arbitrator or governmental or regulatory authority, internal policies and contractual obligations relating to the privacy and security of IT Systems and Personal Data and to the protection of such IT Systems and Personal Data from unauthorized use, access, misappropriation or modification, except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Any certificate signed by an officer of the Issuer and delivered to the Representatives or to counsel for the Underwriters shall be deemed to be a representation and warranty by the Issuer to each Underwriter as to the matters set forth therein. SECTION 2. Purchase, Sale and Delivery of the Securities. (a) Purchase and Sale of the Securities. On the basis of the representations and warranties herein contained and subject to the terms and conditions herein set forth, the Issuer agrees to sell to each Underwriter, severally and not jointly, and each Underwriter, severally and not jointly, agrees to purchase from the Issuer the respective principal amount of Securities set forth in Schedule A opposite the name of such Underwriter, at a purchase price equal to 99.067% of the principal amount thereof, plus accrued interest, if any, from May 26, 2021, to the date of payment and delivery. (b) The Closing Date. Delivery of certificates for the Securities to be purchased by the Underwriters and payment therefor shall be made at the offices of Willkie Farr & Gallagher LLP, 787 Seventh Avenue, New York, New York 10019 (or at such other place, including remotely by electronic transmission), at 10:00 a.m. New York City time on May 26, 2021 or such other later date not more than three business days after such date as the Representatives shall designate by notice to the Issuer (the time and date of such closing are called the “Closing Date”). (c) Public Offering of the Securities. The Representatives hereby advise the Issuer and the Guarantor that the Underwriters intend to offer for sale to the public, as described in the Prospectus, their respective portions of the Securities as soon after this Agreement has been executed as the Representatives, in their sole judgment, have determined is advisable and practicable. (d) Payment for the Securities. Payment for the Securities shall be made on the Closing Date by wire transfer of immediately available funds to a bank account designated by the Issuer against delivery to the Representatives for the respective accounts of the Underwriters of certificates for the Securities to be purchased by them. It is understood that each Underwriter has

13 741716996.2 authorized the Representatives, for its account, to accept delivery of, receipt for, and make payment of the purchase price for, the Securities which it has agreed to purchase. The Representatives, in their individual capacity and not as representatives of the Underwriters, may (but shall not be obligated to) make payment of the purchase price for the Securities to be purchased by any Underwriter whose funds have not been received by the Closing Date, but such payment shall not relieve such Underwriter from its obligations hereunder. (e) Delivery of the Securities. Delivery of the Securities shall be made through the facilities of The Depository Trust Company unless the Representatives shall otherwise instruct. Certificates for the Securities shall be in global form and registered in such names and in such denominations as the Representatives may request upon at least forty eight hours’ prior notice to the Issuer. Time shall be of the essence, and delivery at the time and place specified in this Agreement is a further condition to the obligations of the Underwriters. (f) Delivery of Prospectuses to the Underwriters. Not later than 10:00 a.m. on the second business day following the date the Securities are first released by the Underwriters for sale to the public, the Issuer and the Guarantor shall deliver or cause to be delivered copies of the Prospectus in such quantities and at such places as the Representatives shall request. SECTION 3. Covenants. Each of the Issuer and the Guarantor, jointly and severally, hereby covenants and agrees with each Underwriter as follows: (a) Review of Proposed Amendments and Supplements. During the period beginning at the Applicable Time and ending on the later of the Closing Date or such date, as in the opinion of counsel for the Underwriters, the Prospectus is no longer required by law to be delivered in connection with sales by an Underwriter or a dealer, including in circumstances where such requirement may be satisfied pursuant to Rule 172 under the Securities Act (the “Prospectus Delivery Period”), prior to amending or supplementing the Registration Statement, the Disclosure Package or the Prospectus (including any amendment or supplement through incorporation by reference of any report filed under the Exchange Act), the Issuer and the Guarantor shall furnish to the Representatives for review a copy of each such proposed amendment or supplement, and neither the Issuer nor the Guarantor shall file or use any such proposed amendment or supplement to which the Representatives reasonably object. The Representatives shall provide notice to the Issuer if the Prospectus Delivery Period has not ended on the date of the Closing Date, and upon such later date as the Prospectus Delivery Period has ended. (b) Securities Act Compliance. During the Prospectus Delivery Period, the Issuer and the Guarantor shall promptly advise the Representatives in writing (i) of the receipt of any comments of, or requests for additional or supplemental information from, the Commission, (ii) of the time and date of any filing of any post-effective amendment to the Registration Statement or any amendment or supplement to any preliminary prospectus or the Prospectus, (iii) of the time and date that any post-effective amendment to the Registration Statement becomes effective and (iv) of the issuance by the Commission of any stop order suspending the effectiveness of the Registration Statement or of any order or notice preventing or suspending the use of the Registration Statement, any preliminary prospectus or the Prospectus or the initiation or threatening of any proceeding for that purpose or pursuant to Section 8A of the Securities Act. The Issuer and the Guarantor each shall use its best efforts to prevent the issuance of any such stop

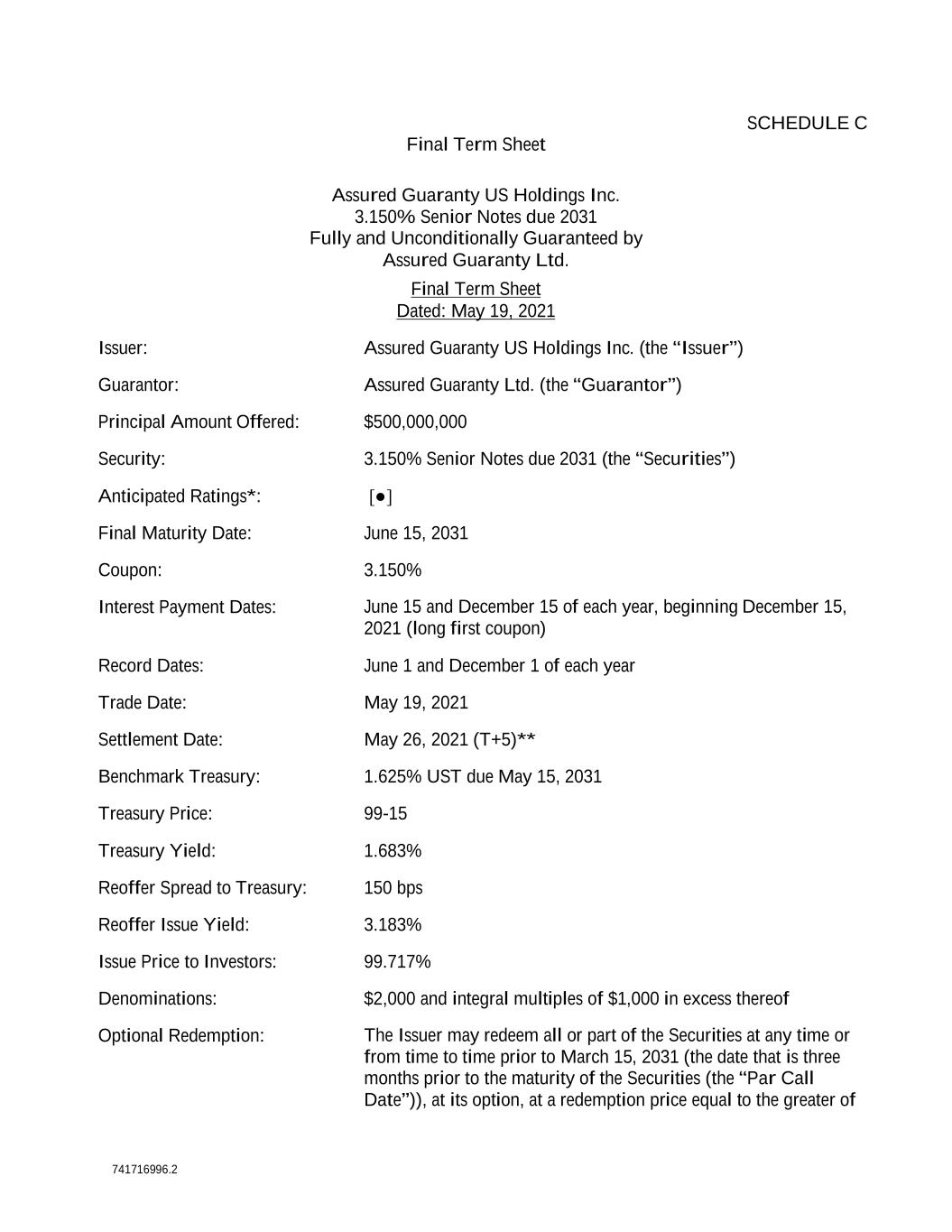

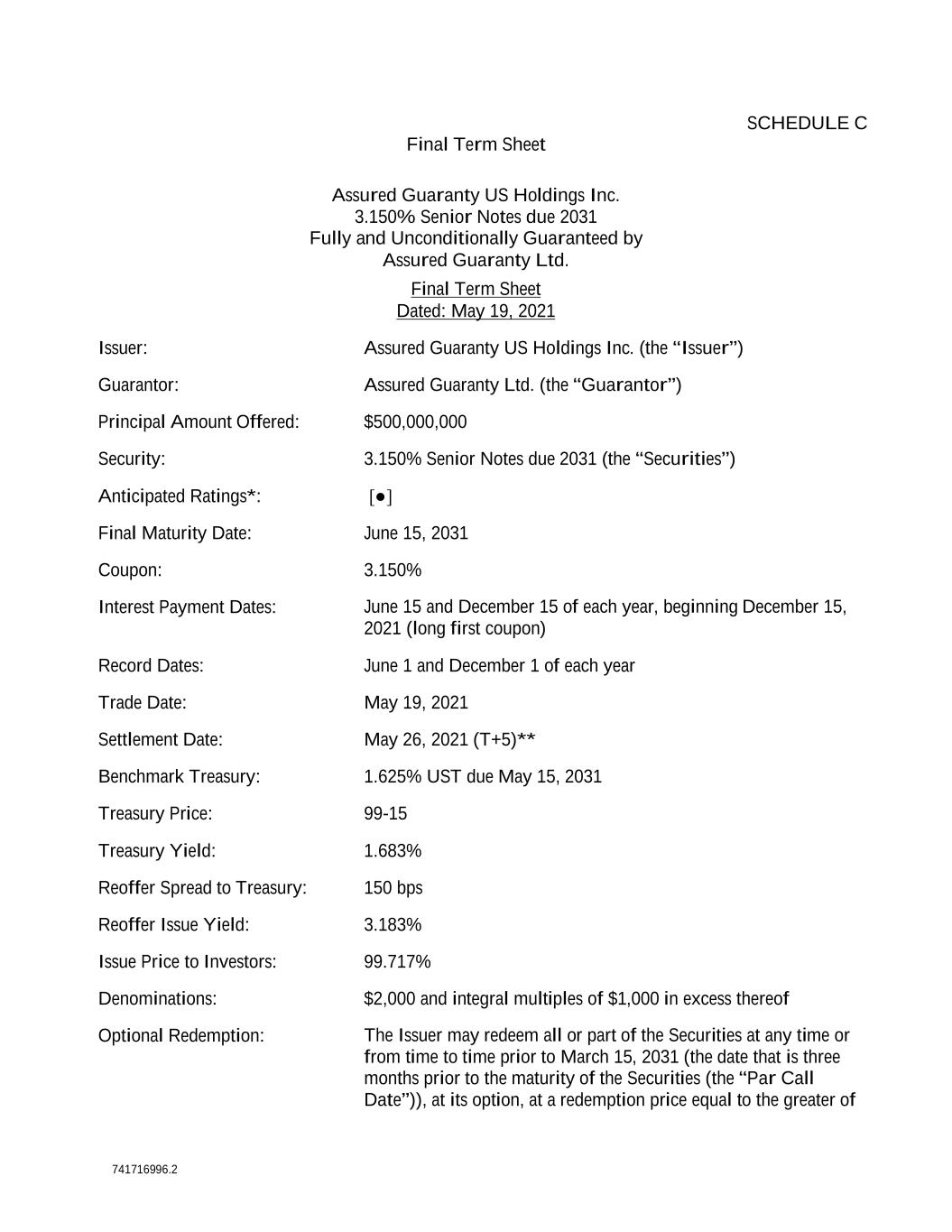

14 741716996.2 order or prevention or suspension of such use during the Prospectus Delivery Period. If during the Prospectus Delivery Period the Commission shall enter any such stop order or order or notice of prevention or suspension at any time, the Issuer and the Guarantor each will use its best efforts to obtain the lifting of such order at the earliest possible moment, or will file a new registration statement and use its best efforts to have such new registration statement declared effective as soon as practicable. Additionally, the Issuer and the Guarantor each agree that it shall comply with the provisions of Rules 424(b) and 430B, as applicable, under the Securities Act, including with respect to the timely filing of documents thereunder, and will use its reasonable efforts to confirm that any filings made by the Issuer or the Guarantor under such Rule 424(b) were received in a timely manner by the Commission. (c) Exchange Act Compliance. The Issuer and the Guarantor, during the Prospectus Delivery Period, will file all documents required to be filed with the Commission pursuant to the Exchange Act within the time periods required by the Exchange Act. (d) Amendments and Supplements to the Registration Statement, Prospectus and Other Securities Act Matters. If, during the Prospectus Delivery Period, any event or development shall occur or condition exist as a result of which the Disclosure Package or the Prospectus as then amended or supplemented would include any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein in the light of the circumstances under which they were made or then prevailing, as the case may be, not misleading, or if it shall be necessary to amend or supplement the Disclosure Package or the Prospectus, or to file under the Exchange Act any document incorporated by reference in the Disclosure Package or the Prospectus, in order to make the statements therein, in the light of the circumstances under which they were made or then prevailing, as the case may be, not misleading, or if, in the opinion of the Representatives, it is otherwise necessary to amend or supplement the Registration Statement, the Disclosure Package or the Prospectus, or to file under the Exchange Act any document incorporated by reference in the Disclosure Package or the Prospectus, or to file a new registration statement containing the Prospectus, in order to comply with law, including in connection with the delivery of the Prospectus, the Issuer and the Guarantor agree to (i) notify the Representatives of any such event or condition and (ii) promptly prepare (subject to Section 3(a) hereof), file with the Commission (and use their best efforts to have any amendment to the Registration Statement or any new registration statement to be declared effective) and furnish at their own expense to the Underwriters and to dealers, amendments or supplements to the Registration Statement, the Disclosure Package or the Prospectus, or any new registration statement, necessary in order to make the statements in the Disclosure Package or the Prospectus as so amended or supplemented, in the light of the circumstances under which they were made or then prevailing, as the case may be, not misleading or so that the Registration Statement, the Disclosure Package or the Prospectus, as amended or supplemented, will comply with law. (e) Final Term Sheet. The Issuer and the Guarantor will prepare a final term sheet containing solely a description of the Securities, including the price at which the Securities are to be sold to the public, in a form approved by the Representatives and attached hereto as Schedule C, and will file such term sheet pursuant to Rule 433(d) under the Securities Act within the time required by such rule (such term sheet, the “Final Term Sheet”).

15 741716996.2 (f) Permitted Free Writing Prospectuses. Each of the Issuer and the Guarantor represents that it has not made, and agrees that, unless it obtains the prior written consent of the Representatives, it will not make, and each Underwriter, severally and not jointly, represents that it has not made, and agrees that, unless it obtains the prior written consent of the Issuer and the Guarantor, it will not make, in each case, any offer relating to the Securities that constitutes or would constitute an Issuer Free Writing Prospectus or that would otherwise constitute a “free writing prospectus” (as defined in Rule 405 under the Securities Act) required to be filed by the Issuer or the Guarantor with the Commission or retained by the Issuer or the Guarantor under Rule 433 under the Securities Act; provided that the prior written consent of the Representatives hereto shall be deemed to have been given in respect of the Issuer Free Writing Prospectuses included in Schedule B hereto. Any such free writing prospectus consented to by the Representatives is hereinafter referred to as a “Permitted Free Writing Prospectus.” The Issuer and the Guarantor each agree that (i) it has treated and will treat, as the case may be, each Permitted Free Writing Prospectus as an Issuer Free Writing Prospectus, and (ii) has complied and will comply, as the case may be, with the requirements of Rules 164 and 433 under the Securities Act applicable to any Permitted Free Writing Prospectus, including in respect of timely filing with the Commission, legending and record keeping. The Issuer and the Guarantor consent to the use by the Underwriters of a free writing prospectus that (a) is not an Issuer Free Writing Prospectus, and (b) contains only (i) information describing the preliminary terms of the Securities or their offering, (ii) information permitted by Rule 134 under the Securities Act or (iii) information that describes the final terms of the Securities or their offering and that is included in the Final Term Sheet of the Issuer and the Guarantor contemplated in Section 3(e). (g) Copies of the Disclosure Package and the Prospectus. The Issuer and the Guarantor agree to furnish the Underwriters, without charge, during the Prospectus Delivery Period, as many copies of the Disclosure Package and the Prospectus and any amendments and supplements thereto (including any documents incorporated or deemed incorporated by reference therein) as the Underwriters may request. (h) Copies of the Registration Statement. The Issuer and the Guarantor will furnish to the Representatives and counsel for the Underwriters signed copies of the Registration Statement (including exhibits thereto). (i) Blue Sky Compliance. The Issuer and the Guarantor shall cooperate with the Representatives and counsel for the Underwriters to qualify or register the Securities for sale under (or obtain exemptions from the application of) the state securities or blue sky laws or Canadian provincial securities laws or other foreign laws of those jurisdictions designated by the Representatives, and shall comply with such laws and shall continue such qualifications, registrations and exemptions in effect so long as required for the distribution of the Securities. Neither the Issuer nor the Guarantor shall be required to qualify as a foreign corporation or to take any action that would subject either the Issuer or the Guarantor to general service of process in any such jurisdiction where it is not presently qualified or where it would be subject to taxation as a foreign corporation, other than those arising out of the offering or sale of the Securities in any jurisdiction where it is not now so subject. The Issuer and the Guarantor will advise the Representatives promptly of the suspension of the qualification or registration of (or any such exemption relating to) the Securities for offering, sale or trading in any jurisdiction or any initiation or threat of any proceeding for any such purpose, and in the event of the issuance of any order

16 741716996.2 suspending such qualification, registration or exemption, the Issuer and the Guarantor each shall use their best efforts to obtain the withdrawal thereof at the earliest possible moment. (j) Registration Statement Fees. The Issuer and the Guarantor will pay the fees applicable to the Registration Statement in connection with the offering of the Securities within the time required by Rule 456(b)(1)(i) under the Securities Act (without reliance on the proviso to Rule 456(b)(1)(i) under the Securities Act) and in compliance with Rule 456(b) and Rule 457(r) under the Securities Act. (k) Earnings Statement. The Guarantor and, to the extent separately required pursuant to Rule 158 under the Securities Act, the Issuer will timely file such reports pursuant to the Exchange Act as are necessary in order to make generally available to its securityholders as soon as practicable an earnings statement for the purposes of, and to provide the benefits contemplated by, the last paragraph of Section 11(a) of the Securities Act. (l) Agreement Not to Offer or Sell Additional Securities. During the period commencing on the date hereof and ending on the Closing Date, the Issuer and the Guarantor will not, without the prior written consent of the Representatives (which consent may be withheld at the sole discretion of the Representatives), directly or indirectly, sell, offer, contract or grant any option to sell, pledge, transfer or establish an open “put equivalent position” or liquidate or decrease a “call equivalent position” within the meaning of Rule 16a-1(h) under the Exchange Act, or otherwise dispose of or transfer (or enter into any transaction which is designed to, or might reasonably be expected to, result in the disposition of), or announce the offering of, or file any registration statement under the Securities Act in respect of, any debt securities or warrants to purchase or otherwise acquire debt securities, in each case issued or guaranteed by the Guarantor or any of its subsidiaries, including the Issuer, substantially similar to the Securities, other than commercial paper issued in the ordinary course of business, and other than as contemplated by this Agreement with respect to the Securities. (m) No Manipulation of Price. Neither the Guarantor nor the Issuer will take, directly or indirectly, any action designed to cause or result in, or that has constituted or might reasonably be expected to constitute, under the Exchange Act or otherwise, the stabilization or manipulation of the price of any securities of the Guarantor or the Issuer to facilitate the sale or resale of the Securities. The Representatives, on behalf of the several Underwriters, may, in their sole discretion, waive in writing the performance by the Issuer or the Guarantor of any one or more of the foregoing covenants or extend the time for their performance. SECTION 4. Payment of Expenses. The Issuer and the Guarantor, jointly and severally, covenant and agree with the Underwriters that the Issuer and the Guarantor will pay, or cause to be paid, in such proportions as the Issuer and the Guarantor may agree among themselves, all costs, fees and expenses incurred in connection with the performance of their obligations hereunder and in connection with the transactions contemplated hereby, including without limitation: (i) the fees and expenses associated with listing the Securities on the New York Stock Exchange; (ii) all necessary issue, transfer and other stamp taxes in connection with the issuance and sale of the Securities to the Underwriters; (iii) the fees, disbursements and expenses of the Issuer’s and the

17 741716996.2 Guarantor’s counsel and accountants in connection with the registration of the Securities under the Securities Act and all other expenses in connection with the preparation, printing and filing of the Registration Statement, any preliminary prospectus and the Prospectus and amendments and supplements thereto and the mailing and delivering of copies thereof to the Underwriters and dealers; (iv) the cost of printing or producing any Agreement among Underwriters, this Agreement, the Blue Sky Memorandum, closing documents (including any compilations thereof) and any other documents in connection with the offering, purchase, sale and delivery of the Securities; (v) all expenses in connection with the qualification of the Securities for offering and sale under state securities laws as provided in Section 3(i) hereof, including the properly documented fees and disbursements of counsel for the Underwriters in connection with such qualification and in connection with the Blue Sky Memorandum (such fees and disbursements not to exceed $14,000); (vi) the filing fees incident to, and the properly documented fees and disbursements of counsel for the Underwriters in connection with, securing any required review by FINRA of the terms of the sale of the Securities; (vii) any fees charged by rating agencies for rating the Securities; (viii) the fees and expenses of the Trustee and any paying agent (including related fees and expenses of any counsel to such parties); (ix) the costs and expenses of the Issuer and the Guarantor relating to presentations or meetings undertaken in connection with the marketing of the offering and sale of the Securities to prospective investors and the Underwriters’ sales forces, including, without limitation, expenses associated with the production of road show slides and graphics, fees and expenses of any consultants engaged in connection with the road show presentations, travel, lodging and other expenses incurred by the officers of the Issuer and the Guarantor and any such consultants, and the cost of any aircraft chartered in connection with the road show; and (x) all other costs and expenses incident to the performance of the Issuer’s and the Guarantor’s obligations hereunder which are not otherwise specifically provided for in this section. It is understood, however, that, except as provided in this Section and Sections 6, 7 and 10 hereof, the Underwriters will pay all of their own costs and expenses, including the fees of its counsel and any advertising expenses connected with any offers that they may make. SECTION 5. Conditions of the Obligations of the Underwriters. The obligations of the several Underwriters to purchase and pay for the Securities as provided herein on the Closing Date shall be subject to the accuracy of the representations and warranties on the part of the Issuer and the Guarantor contained herein and set forth in Section 1 hereof as of the date hereof and as of the Closing Date, to the accuracy of the statements of the Issuer and the Guarantor made in any certificates pursuant to the provisions hereof, to the timely performance by the Issuer and the Guarantor of their respective covenants and obligations hereunder, and to each of the following additional conditions: (a) Accountants’ Comfort Letter. On the date hereof, the Representatives shall have received from PricewaterhouseCoopers LLP, independent public accountants for the Issuer and the Guarantor, a letter dated the date hereof addressed to the Underwriters, in form and substance satisfactory to the Underwriters, containing statements and information of the type customarily included in accountants “comfort letters” to underwriters with respect to the financial information contained or incorporated by reference in the Registration Statement, the Disclosure Package and the Prospectus. (b) Compliance with Registration Requirements; No Stop Order. For the period from the Execution Time to the Closing Date:

18 741716996.2 (i) the Issuer and the Guarantor shall have filed any preliminary prospectus and the Prospectus with the Commission (including the information required by Rule 430B under the Securities Act) in the manner and within the time period required by Rule 424(b) under the Securities Act; or the Issuer and the Guarantor shall have filed a post-effective amendment to the Registration Statement containing the information required by such Rule 430B, and such post-effective amendment shall have become effective; (ii) the Final Term Sheet, and any other material required to be filed by the Issuer or the Guarantor pursuant to Rule 433(d) under the Securities Act shall have been filed with the Commission within the applicable time periods prescribed for such filings under such Rule 433; and (iii) no stop order suspending the effectiveness of the Registration Statement, or any post-effective amendment to the Registration Statement, shall be in effect and no proceedings for such purpose shall have been instituted or threatened by the Commission. (c) No Material Adverse Change or Ratings Agency Change. For the period from the Execution Time to the Closing Date: (i) in the judgment of the Representatives there shall not have occurred any Material Adverse Change; (ii) there shall not have been any change or decrease specified in the letter or letters referred to in paragraph (a) of this Section 5 which is, in the sole judgment of the Representatives, so material and adverse as to make it impractical or inadvisable to proceed with the offering or delivery of the Securities as contemplated by the Disclosure Package and the Prospectus; and (iii) there shall not have occurred any downgrading, nor shall any notice have been given of any intended or potential downgrading or of any review for a possible change that does not indicate the direction of the possible change, in the rating accorded any securities of or guaranteed by the Issuer or the Guarantor or any of their subsidiaries by any “nationally recognized statistical rating organization” as such term is defined under Section 3(a)(62) of the Exchange Act. (d) Opinion of Counsel for the Issuer and the Guarantor. On the Closing Date, the Representatives shall have received a favorable opinion from each of the following, dated as of the Closing Date: (i) Mayer Brown LLP, U.S. counsel for the Issuer and the Guarantor, the form of which opinion is attached hereto as Exhibit A; (ii) Ling Chow, Esq., general counsel of the Issuer and the Guarantor, the form of which opinion is attached hereto as Exhibit B; (iii) Conyers Dill & Pearman, special Bermuda counsel for the Guarantor, the form of which opinion is attached hereto as Exhibit C.

19 741716996.2 (e) Opinion of Counsel for the Underwriters. On the Closing Date, the Representatives shall have received the favorable opinion of Willkie Farr & Gallagher LLP, counsel for the Underwriters, dated as of such Closing Date, in form and substance satisfactory to, and addressed to, the Representatives, with respect to the issuance and sale of the Securities, the Registration Statement, the Prospectus (together with any supplement thereto), the Disclosure Package and other related matters as the Representatives may reasonably require, and the Issuer and the Guarantor shall have furnished to such counsel such documents as it requests for the purpose of enabling it to pass upon such matters. (f) Officers’ Certificate. On the Closing Date, the Representatives shall have received a written certificate executed by the Chairman of the Board, Chief Executive Officer, President, Chief Financial Officer or Chief Accounting Officer of each of the Issuer and the Guarantor, dated as of such Closing Date, to the effect that the signers of such certificate have carefully examined the Registration Statement, the Prospectus and any amendment or supplement thereto, the Disclosure Package and any amendment or supplement thereto and this Agreement, to the effect set forth in subsections (b) and (c)(iii) of this Section 5, and further to the effect that: (i) for the period from the Execution Time to such Closing Date, there has not occurred any Material Adverse Change; (ii) the representations and warranties of the Issuer and the Guarantor set forth in Section 1(a) of this Agreement are true and correct on and as of such Closing Date with the same force and effect as though expressly made on and as of such Closing Date; and (iii) the Issuer and the Guarantor have complied with all the agreements hereunder and satisfied all the conditions on its part to be performed or satisfied hereunder at or prior to such Closing Date. (g) Bring-down Comfort Letter. On the Closing Date, the Representatives shall have received from PricewaterhouseCoopers LLP, independent public accountants for the Issuer and the Guarantor, a letter dated such date, in form and substance satisfactory to the Representatives, to the effect that they reaffirm the statements made in the letter furnished by them pursuant to subsection (a) of this Section 5, except that the specified date referred to therein for the carrying out of procedures shall be no more than three business days prior to such Closing Date. (h) Additional Documents. On or before the Closing Date, the Representatives and counsel for the Underwriters shall have received such information, documents and opinions as they may reasonably require for the purposes of enabling them to pass upon the issuance and sale of the Securities, as contemplated herein, or in order to evidence the accuracy of any of the representations and warranties, or the satisfaction of any of the conditions or agreements, herein contained. If any condition specified in this Section 5 is not satisfied when and as required to be satisfied, this Agreement may be terminated by the Representatives by notice to the Issuer and the Guarantor at any time on or prior to the Closing Date, which termination shall be without liability on the part of any party to any other party, except that Section 4, Section 6, Section 7, Section 8 and Section 17 shall at all times be effective and shall survive such termination.

20 741716996.2 SECTION 6. Reimbursement of Underwriters’ Expenses. If this Agreement is terminated by the Underwriters pursuant to Section 5 or Section 10(i), or if the sale to the Underwriters of the Securities on the Closing Date is not consummated because of any refusal, inability or failure on the part of either the Issuer or the Guarantor to perform any agreement herein or to comply with any provision hereof, the Issuer and the Guarantor agree to reimburse the Representatives and the other Underwriters (or such Underwriters as have terminated this Agreement with respect to themselves), severally and in such proportion as set forth in Section 8, upon demand for all out- of-pocket expenses that have been reasonably incurred by the Representatives and the Underwriters in connection with the proposed purchase and the offering and sale of the Securities, including but not limited to fees and disbursements of counsel, printing expenses, travel expenses, postage, facsimile and telephone charges. SECTION 7. Indemnification. (a) Indemnification of the Underwriters. Each of the Issuer and the Guarantor, jointly and severally, agree to indemnify and hold harmless each Underwriter, its directors, officers, partners, employees and agents, and each person, if any, who controls or is under common control with any Underwriter within the meaning of the Securities Act and the Exchange Act against any loss, claim, damage, liability or expense, as incurred, to which such Underwriter or such director, officer, partner, employee, agent, controlling person or person under common control with such Underwriter may become subject, insofar as such loss, claim, damage, liability or expense (or actions in respect thereof as contemplated below) arises out of or is based (i) upon any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement, or any amendment thereto, including any information deemed to be a part thereof pursuant to Rule 430A, Rule 430B or Rule 430C under the Securities Act, or the omission or alleged omission therefrom of a material fact required to be stated therein or necessary to make the statements therein not misleading; or (ii) upon any untrue statement or alleged untrue statement of a material fact contained in any Issuer Free Writing Prospectus, the information contained in the Final Term Sheet, any preliminary prospectus or the Prospectus (or any amendment or supplement thereto), or any “road show” (as defined in Rule 433 under the Securities Act) not constituting an Issuer Free Writing Prospectus (a “Non-IFWP Road Show”) or the omission or alleged omission therefrom of a material fact, in each case, necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, and to reimburse each Underwriter, its officers, directors, partners, employees, agents and each such controlling person and person under common control with such Underwriter for any and all expenses (including the fees and disbursements of counsel chosen by the Representatives) as such expenses are reasonably incurred by such Underwriter, or its officers, directors, partners, employees, agents, such controlling person or person under common control with such Underwriter in connection with investigating, defending, settling, compromising or paying any such loss, claim, damage, liability, expense or action; provided, however, that the foregoing indemnity agreement shall not apply to any loss, claim, damage, liability or expense to the extent, but only to the extent, arising out of or based upon any untrue statement or alleged untrue statement or omission or alleged omission made in reliance upon and in conformity with written information furnished to the Issuer and the Guarantor by the Underwriters through the Representatives expressly for use in the Registration Statement, any Issuer Free Writing Prospectus, any preliminary prospectus or the Prospectus (or any amendment or supplement thereto). The indemnity agreement set forth in this Section 7(a) shall be in addition to any liabilities that the Issuer and the Guarantor may otherwise have.

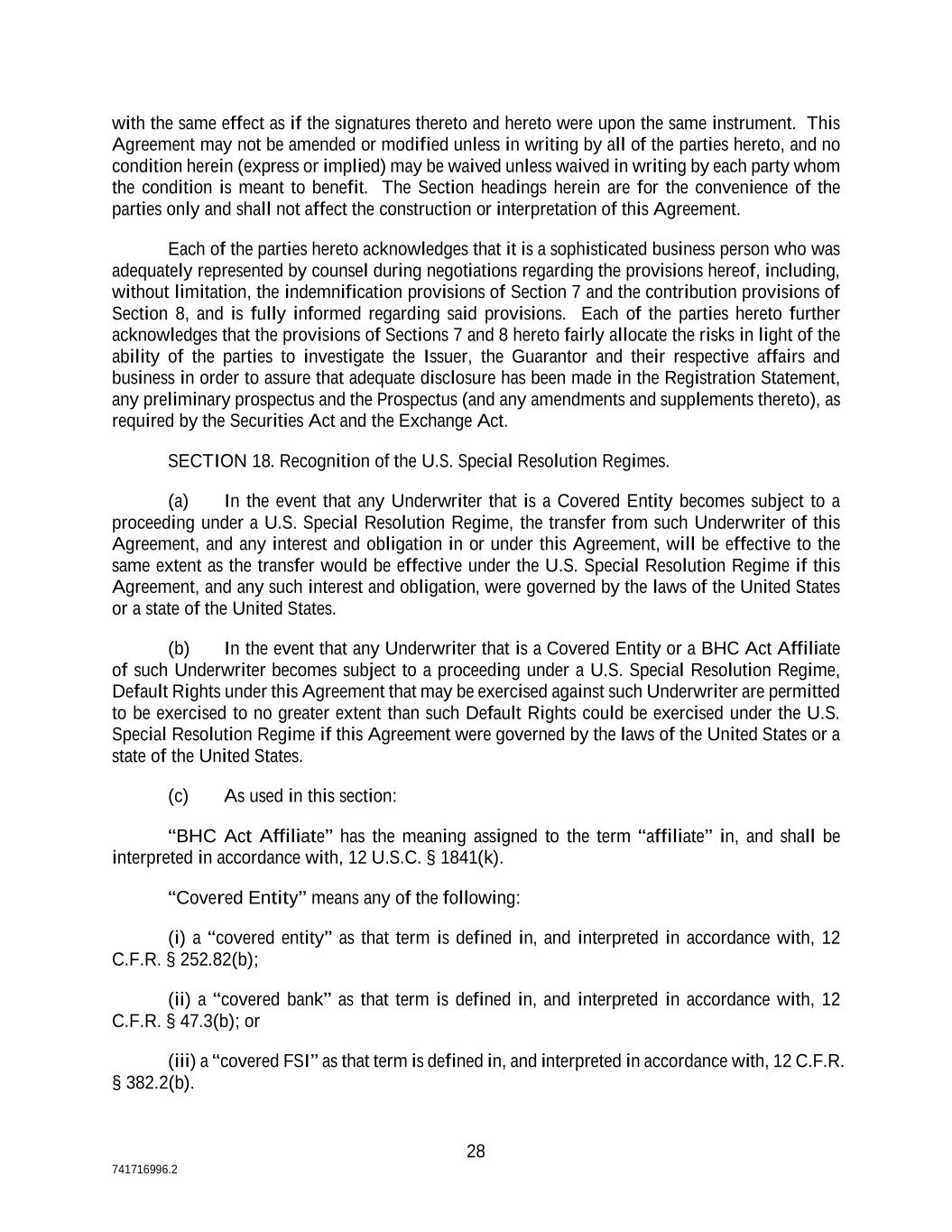

21 741716996.2 (b) Indemnification of the Issuer, the Guarantor, their Directors and Officers. Each Underwriter agrees, severally and not jointly, to indemnify and hold harmless the Issuer and the Guarantor, each of its directors, each of its officers who signed the Registration Statement and each of its directors and officers and each person if any, who controls the Issuer or the Guarantor within the meaning of the Securities Act or the Exchange Act against any loss, claim, damage, liability or expense, as incurred, to which the Issuer, the Guarantor, or any such director or officer, or any such controlling person may become subject, insofar as such loss, claim, damage, liability or expense (or actions in respect thereof as contemplated below) arises out of or is based (i) upon any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement, or any amendment thereto, or the omission or alleged omission therefrom of a material fact required to be stated therein or necessary to make the statements therein not misleading; or (ii) upon any untrue statement or alleged untrue statement of a material fact contained in any Issuer Free Writing Prospectus, any preliminary prospectus or the Prospectus (or any amendment or supplement thereto), or any Non-IFWP Road Show, or the omission or alleged omission therefrom of a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, in each case to the extent, and only to the extent, that such untrue statement or alleged untrue statement or omission or alleged omission was made in the Registration Statement, any Issuer Free Writing Prospectus, any preliminary prospectus or the Prospectus (or any amendment or supplement thereto) or any Non-IFWP Road Show, in reliance upon and in conformity with written information furnished to the Issuer and the Guarantor by the Representatives expressly for use therein; and to reimburse the Issuer, the Guarantor or any such director or officer or any such controlling person for any legal and other expense reasonably incurred by the Issuer, the Guarantor or any such director or officer or any such controlling person in connection with investigating, defending, settling, compromising or paying any such loss, claim, damage, liability, expense or action. The Issuer and the Guarantor hereby acknowledge that the only information that the Underwriters have furnished to them through the Representatives expressly for use in the Registration Statement, any Issuer Free Writing Prospectus, any preliminary prospectus or the Prospectus (or any amendment or supplement thereto) or any Non- IFWP Road Show are the statements set forth in the third paragraph, the first, second and third sentences of the eighth paragraph and the ninth paragraph under the caption “Underwriting (Conflicts of Interest)” in the Prospectus. The indemnity agreement set forth in this Section 7(b) shall be in addition to any liabilities that each Underwriter may otherwise have. (c) Notifications and Other Indemnification Procedures. Promptly after receipt by an indemnified party under this Section 7 of notice of the commencement of any action, such indemnified party will, if a claim in respect thereof is to be made against an indemnifying party under this Section 7, notify the indemnifying party in writing of the commencement thereof; but the failure to so notify the indemnifying party (i) will not relieve it from liability under paragraph (a) or (b) above unless and to the extent it did not otherwise learn of such action and such failure results in the forfeiture by the indemnifying party of substantial rights and defenses and (ii) will not, in any event, relieve the indemnifying party from any liability other than the indemnification obligation provided in paragraph (a) or (b) above. In case any such action is brought against any indemnified party and such indemnified party seeks or intends to seek indemnity from an indemnifying party, the indemnifying party will be entitled to participate in, and, to the extent that it shall elect, jointly with all other indemnifying parties similarly notified, by written notice delivered to the indemnified party promptly after receiving the aforesaid notice from such indemnified party, to assume the defense thereof with counsel satisfactory to such indemnified