Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| ý | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010 |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-31946

HOSPIRA, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 20-0504497 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

275 North Field Drive

Lake Forest, Illinois 60045

(Address of principal executive offices, including zip code)

(224) 212-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of Exchange on which each class is registered |

|---|

| Common Stock, par value $0.01 per share | | New York Stock Exchange |

| Preferred Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: Common Stock:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesý Noo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Noý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesý Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesý Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filerý | | Accelerated filero | | Non-accelerated filero

(Do not check if a smaller

reporting company) | | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yeso Noý

The aggregate market value of registrant's common stock held by non-affiliates of the registrant on June 30, 2010 (the last business day of the registrant's most recently completed second fiscal quarter), was approximately $9,593.7 million.

Registrant had 166,646,244 shares of common stock outstanding as of February 9, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the registrant's definitive Proxy Statement to be filed in connection with the 2011 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K where indicated. The definitive 2011 Proxy Statement will be filed on or about March 25, 2011.

Table of Contents

HOSPIRA, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | |

| |

| | Page Number |

|---|

PART I | | 1 |

Item 1 | | Business | |

1 |

Item 1A | | Risk Factors | |

14 |

Item 1B | | Unresolved Staff Comments | |

25 |

Item 2 | | Properties | |

26 |

Item 3 | | Legal Proceedings | |

26 |

| | Executive Officers of Hospira | |

28 |

PART II | |

30 |

Item 5 | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

30 |

Item 6 | | Selected Financial Data | |

32 |

Item 7 | | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

33 |

Item 7A | | Quantitative and Qualitative Disclosures About Market Risk | |

54 |

Item 8 | | Financial Statements and Supplementary Data | |

56 |

Item 9 | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

106 |

Item 9A | | Controls and Procedures | |

106 |

Item 9B | | Other Information | |

106 |

PART III | |

107 |

Item 10 | | Directors, Executive Officers and Corporate Governance | |

107 |

Item 11 | | Executive Compensation | |

107 |

Item 12 | | Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters | |

107 |

Item 13 | | Certain Relationships and Related Transactions, and Director Independence | |

108 |

Item 14 | | Principal Accountant Fees and Services | |

108 |

PART IV | |

109 |

Item 15 | | Exhibits and Financial Statement Schedules | |

109 |

Table of Contents

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of the federal securities laws. Hospira intends that these forward-looking statements be covered by the safe harbor provisions for forward-looking statements in the federal securities laws. In some cases, these statements can be identified by the use of forward-looking words such as "may," "will," "should," "anticipate," "estimate," "expect," "plan," "believe," "predict," "potential," "project," "intend," "could" or similar expressions. In particular, statements regarding Hospira's plans, strategies, prospects and expectations regarding its business and industry are forward-looking statements. You should be aware that these statements and any other forward-looking statements in this document only reflect Hospira's expectations and are not guarantees of performance. These statements involve risks, uncertainties and assumptions. Many of these risks, uncertainties and assumptions are beyond Hospira's control, and may cause actual results and performance to differ materially from its expectations. Important factors that could cause Hospira's actual results to be materially different from its expectations include (i) the risks and uncertainties described in "Item 1A. Risk Factors" and (ii) the factors described in "Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations." Accordingly, you should not place undue reliance on the forward-looking statements contained in this annual report. These forward-looking statements speak only as of the date on which the statements were made. Hospira undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

Overview

Hospira, Inc. ("Hospira") is a global specialty pharmaceutical and medication delivery company that develops, manufactures and markets products that help improve the safety, cost and productivity of patient care. Hospira's portfolio includes generic acute-care and oncology injectables, as well as integrated infusion therapy and medication management products. Hospira products are used by hospitals and alternate site providers, such as clinics, home healthcare providers and long-term care facilities.

Hospira conducts operations worldwide and is managed in three reportable segments: Americas; Europe, Middle East and Africa ("EMEA"); and Asia Pacific ("APAC"). The Americas segment includes the United States ("U.S."), Canada and Latin America; the EMEA segment includes Europe, the Middle East and Africa; and the APAC segment includes Asia, Japan, Australia and New Zealand. In all segments, Hospira sells a broad line of products, including specialty injectable and other pharmaceuticals and medication management products. For financial information relating to Hospira's segments and principal product lines and other geographic information, see Note 23 to the consolidated financial statements included in Part II, Item 8 of this document, which is incorporated herein by reference. Unless the context requires otherwise, the disclosures in Items 1 and 1A relate to all three reportable segments.

General Development of Business

Hospira was incorporated in Delaware on September 16, 2003, as a wholly owned subsidiary of Abbott Laboratories ("Abbott"). Hospira's business first began operation as part of Abbott in the 1930s. As part of a plan to spin off its core hospital products business ("spin-off"), Abbott transferred the assets and liabilities relating to Hospira's business to Hospira and, on April 30, 2004, distributed Hospira's common stock to Abbott's shareholders. On that date, Hospira began operating as an

1

Table of Contents

independent company, and on May 3, 2004, Hospira's common stock began trading on the New York Stock Exchange under the symbol "HSP."

In March 2009, Hospira announced details of a restructuring and optimization plan ("Project Fuel"), which has been ongoing over the last two years. Project Fuel has included the following activities: optimizing the product portfolio, evaluating non-strategic assets and streamlining the organizational structure. For further information related to Project Fuel, including the financial impact of the project, see the section captioned Project Fuel in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations," which is incorporated herein by reference. In addition to Project Fuel, Hospira is actively working to maintain a culture of continuous improvement as part of its strategy to improve margins and cash flows, reduce operating costs and optimize operations.

In March 2010, Hospira completed its acquisition of the generic injectable pharmaceuticals business of Orchid Chemicals & Pharmaceuticals Ltd. ("Orchid Pharma") for $381.0 million, which was purchased by and operates under the name Hospira Healthcare India Private Limited ("Hospira India"), a wholly-owned subsidiary of Hospira. The acquisition included a beta-lactam antibiotic formulations manufacturing complex and pharmaceutical research and development facility, as well as a generic injectable dosage-form product portfolio and pipeline. Hospira also acquired some of Orchid Pharma's long-term land leases in India, which were held by Orchid Pharma for their anticipated future expansion. To ensure Hospira's manufacturing capacity aligns with expected future commercial growth and demand, Hospira may be taking steps in India over the next few years to prepare for the expansion of Hospira's global manufacturing footprint.

Products

Hospira offers the following types of products and services:

| | |

Product Line | | Description |

|---|

| Specialty Injectable Pharmaceuticals | | • Approximately 200 injectable generic drugs in multiple dosages and formulations |

| | | • Proprietary specialty injectables, including PrecedexTM (dexmedetomidine HCl), a proprietary drug for sedation |

| | | • Biosimilars, including RetacritTM (erythropoietin zeta), a biosimilar erythropoietin, used primarily in the treatment of anemia in dialysis and in certain oncology applications, and NivestimTM , a biosimilar filgrastim used for the treatment of low white blood cells in patients who have received a chemotherapeutic agent |

Other Pharmaceuticals | | • Large volume intravenous ("I.V.") solutions and nutritional products |

| | | • Contract manufacturing services |

Medication Management | | • Infusion pumps and dedicated administration sets |

| | | • Hospira MedNetTM safety software system and related services |

| | | • Software applications and devices that support point-of-care medication administration |

| | | • Gravity administration sets |

| | | • Other device products |

2

Table of Contents

Specialty Injectable Pharmaceuticals

Hospira's specialty injectable pharmaceutical products primarily consist of generic injectable pharmaceuticals. These products provide customers with a lower-cost alternative to branded products, when the patent protection has expired, when patents have been declared invalid, or when the products do not infringe the patents of others. These drugs' therapeutic areas include analgesia, anesthesia, anti-infectives, cardiovascular, oncology, and other areas. All of Hospira's generic injectable pharmaceuticals in the U.S. include unit-of-use bar-code labels that can be used to support safer medication delivery. Hospira primarily procures the active pharmaceutical ingredients in these products from third-party suppliers.

Beginning in 2009 and for the first half of 2010, Hospira's specialty injectable pharmaceutical products included oxaliplatin, a major oncolytic drug used in the treatment of colon cancer. Hospira exited the U.S. oxaliplatin market on June 30, 2010, pursuant to a settlement agreement related to ongoing patent litigation. Hospira intends to re-launch its oxaliplatin products pursuant to a royalty-free license on August 9, 2012. Also during 2010, Hospira continued to broaden its global portfolio with the introduction into new markets of 11 drugs that the company had previously launched in other markets. Hospira launched several new generic injectable pharmaceutical products in the U.S. including a 2 gram freeze-dried powder presentation of gemcitabine (an oncolytic drug used to treat a variety of cancers) and piperacillin/tazobactam for injection (an antibiotic used to treat patients with moderate to severe infections). In the U.S., Hospira also launched meropenem for injection, a beta-lactam anti-infective and the first product to launch in the U.S. that was manufactured by Hospira India. In EMEA, Hospira launched the oncolytic drug, docetaxel, and in APAC, Hospira launched two oncolytic drugs, gemcitabine and irinotecan in certain markets.

Hospira's specialty injectable pharmaceuticals also include biosimilar products, which are large complex molecules derived from cells that are demonstrated to be similar to an approved biologic product. Hospira's first biosimilar, RetacritTM, was originally launched in 2008 and is currently available in 19 EMEA countries. In 2010, Hospira announced the start of a U.S. Phase I clinical trial for RetacritTM in patients with renal dysfunction who have anemia. Also, Hospira launched its second biosimilar, NivestimTM , in Europe in mid-2010. In 2010, NivestimTM received approval for the Australian market by the Australian Therapeutic Goods Administration.

Hospira believes that novel drug delivery formulations and formats are key points of product differentiation for generic injectable pharmaceuticals. Hospira offers a wide variety of drug delivery options, and believes that its products assist its customers' efforts to enhance safety, increase productivity and reduce waste. Hospira's drug delivery formats include standard offerings in ampoules and flip-top vials, which clinicians can use with standard syringes. Hospira's proprietary drug delivery options include CarpujectTM and iSecureTM prefilled syringes, AnsyrTM prefilled needleless emergency syringe systems, First ChoiceTM ready-to-use premixed formulations and the ADD-VantageTM system for preparing drug solutions from prepackaged drug powders or concentrates.

Hospira's specialty injectable pharmaceutical products also include PrecedexTM (dexmedetomidine HCl), a proprietary sedative. PrecedexTM is licensed to Hospira in the Americas and APAC segments, and in the Middle East and Africa. Hospira sells and markets PrecedexTM for use in non-intubated patients requiring sedation, as well as intubated and mechanically ventilated patients. During 2010, Hospira received approval for the long-term use of PrecedexTM in Japan.

During 2010, Hospira completed its acquisition of Javelin Pharmaceuticals Inc. ("Javelin Pharma"). The acquisition will enable Hospira to take advantage of synergies between Hospira's PrecedexTM and Javelin Pharma's main product candidate, DylojectTM, a post-operative pain management drug currently awaiting U.S. Food and Drug Administration ("FDA") approval. In October 2010, Hospira received a

3

Table of Contents

complete response letter from the FDA regarding DylojectTM and Hospira is working to respond to the letter. Hospira and its third party manufacturer continue to work closely with FDA to address any items raised as part of the regulatory process and the timing of resolution is uncertain.

During 2010, Hospira also entered into two collaborative agreements. Hospira entered into a licensing agreement with DURECT Corporation to develop and market DURECT's POSIDURTM, a long-acting version of the anesthetic bupivacaine currently in Phase III clinical trials. Hospira will co-develop the drug and will have exclusive marketing rights in the U.S. and Canada following regulatory approval. Hospira and Kiadis Pharma B.V. ("Kiadis") entered into a collaborative agreement to develop, license, and commercialize Kiadis' ATIRTM drug candidate. ATIRTM is a personalized hematology product designed for blood cancer patients in need of allogeneic bone marrow transplantation who cannot locate a matched donor. The product is designed to enable any family member to act as a donor and is being developed to reduce transplant related mortality caused by infections and graft-versus-host disease. Hospira was granted exclusive marketing rights to ATIRTM for Europe, the Middle East, Africa, Australia, Japan and parts of Asia. Hospira will be responsible for regulatory approval and sales and marketing of the product.

Other Pharmaceuticals

Hospira's other pharmaceuticals primarily consist of large volume I.V. solutions, nutritionals and contract manufacturing services.

Hospira offers infusion therapy solutions and related supplies that include I.V. solutions for general use, I.V. nutrition products, and solutions for the washing and cleansing of wounds or surgical sites. All of Hospira's injectable I.V. solutions in the U.S. include unit-of-use bar-code labels that can be used to support medication management efforts. Hospira also offers infusion therapy solutions in its VisIVTM next-generation non-PVC, non-DEHP I.V. container, an I.V. bag with advanced safety and environmentally friendly features.

Hospira's One2One services group provides formulation development, filling and finishing of injectable and oral drugs worldwide. Hospira works with its proprietary pharmaceutical and biotechnology customers to develop stable injectable forms of their drugs, and Hospira fills and finishes those and other drugs into containers and packaging selected by the customer. The customer then sells the finished products under its own label. Hospira's One2One manufacturing services group does not generally manufacture active pharmaceutical ingredients, but offers a wide range of filling and finishing services in a variety of delivery systems. As part of Project Fuel, in 2009 and early 2010, Hospira sold its facilities in Salisbury, Australia, and Wasserburg, Germany, respectively, which primarily performed contract manufacturing.

Medication Management

Medication management includes electronic drug delivery pumps, safety software and disposable administration sets dedicated to Hospira pumps. These sets are used to deliver I.V. fluids and medications. Hospira also offers software maintenance agreements and other service offerings. Hospira estimates that approximately 575,000 of its electronic drug delivery pumps were in use on a global basis as of December 31, 2010. Hospira's electronic drug delivery pumps include Hospira's general infusion system, SymbiqTM; the Plum A+TM line of infusion pumps; Hospira's patient-controlled analgesia device, LifeCare PCATM; the GemStarTM ambulatory infusion pump; and the PlumTM XLD infusion pump.

Hospira believes that electronic drug delivery pumps with enhanced systems capabilities have become a key contributor in efforts to improve medication management programs and reduce the

4

Table of Contents

incidence of medication errors. Some of Hospira's pumps use bar coding to read drug labels that are compatible with other Hospira products, reducing the opportunity for drug infusion errors. Hospira offers the Hospira MedNetTM safety software system, which has been designed to enable hospitals to customize intravenous drug dosage limits and track drug delivery to prevent medication errors. Through its drug library and programmable drug dosage limits, the system can help ensure that medication is infused within hospital-defined dose guidelines and best practices. The wireless network version of the Hospira MedNetTM system establishes real-time send-and-receive capability and can interface with select hospital and pharmacy information systems. Hospira continues to work with hospital information technology companies to integrate the Hospira MedNetTM system with other systems.

The Hospira MedNetTM system is standard in the SymbiqTM infusion system, and is also available as an additional feature for the Plum A+TM line, and LifeCare PCATM devices, which, when aggregated represent the majority of Hospira's line of electronic drug delivery pumps. Hospira also offers safety software with its GemStarTM pump.

Medication management includes TheraDoc, Inc. and its Infection Control AssistantTM and Antibiotic AssistantTM products, which are software applications that automate hospital-wide surveillance for infection-related events and optimize the utilization of antimicrobials. In 2010, Hospira introduced the Anticoagulation AssistantTM knowledge module, which helps reduce the risk of adverse events associated with anticoagulation therapy.

Medication management also includes gravity administration sets and other device products, including needlestick safety products and programs to support Hospira's customers' needlestick prevention initiatives. LifeShieldTM, CLAVETM and MicroCLAVETM connectors are one-piece valves that directly connect syringes filled with medications to a patient's I.V. line without the use of needles. ICU Medical's CLAVETM connectors are a component of administration sets sold by Hospira to its customers in the U.S. and select markets outside the U.S.

Sales, Customers and Distribution

Sales. Net sales (gross sales less reductions for wholesaler chargebacks, rebates, returns and other allowances) in the Americas segment accounted for approximately 80% of Hospira's 2010 net sales. Net sales in the EMEA and APAC segments comprised approximately 12% and 8%, respectively, of 2010 net sales. Hospira's sales organizations include sales professionals who sell across its major product lines, as well as product specialists who promote its medication management products, or who market and sell PrecedexTM and select other products. Hospira also has extensive experience contracting with, marketing to and servicing members of the major group purchasing organizations ("GPOs") in the U.S.

Customers. Hospira's primary customers in the Americas segment include hospitals, wholesalers, integrated delivery networks ("IDN") and alternate site facilities. In the U.S., a substantial portion of Hospira's product is sold to GPO member hospitals and through wholesalers and distributors. Net sales through the largest four wholesalers that supply products to many end-users accounted for approximately 40% of global net sales during 2010. As end-users have multiple ways to access Hospira's products, including through more than one wholesaler or distributor, and, in some cases, from Hospira directly, Hospira believes that it is not dependent on any single wholesaler or distributor for distribution of its products. Hospira has no single end-use customer that accounts for more than 10% of net sales. Hospira has pricing agreements for specified products with the major GPOs in the U.S., including Amerinet, Inc.; HealthTrust Purchasing Group LP; MedAssets, Inc.; Novation, LLC; PACT, LLC; and Premier Purchasing Partners, LP. The scope of products included in these agreements varies by GPO.

5

Table of Contents

Hospira's primary customers in the EMEA and APAC segments are hospitals and wholesalers that Hospira serves through its own sales force and its distributors. The majority of Hospira's business in the EMEA and APAC segments is conducted through contracting with individual hospitals or through regional or national tenders whereby Hospira submits bids to sell its products.

Distribution. In the Americas segment, Hospira's products are primarily distributed in the U.S. through a network of company-operated distribution facilities and public warehouses, as well as through external distributors. The U.S. distribution facilities Hospira operates are located in Atlanta, Georgia; Dallas, Texas; King of Prussia, Pennsylvania; Los Angeles, California; and Pleasant Prairie, Wisconsin. For the remainder of the Americas segment outside the U.S., Hospira utilizes third-party logistics providers, including operations in Toronto, Canada, and several smaller warehouses in Canada and Latin America.

In the EMEA and APAC segments, Hospira manages its distribution operations mainly through third-party logistics providers. Hospira's regional headquarters are located in Royal Leamington Spa, United Kingdom, for EMEA and Melbourne, Australia, for APAC. Hospira has direct commercial infrastructure in some countries and operates through distributors in others.

Seasonal Aspects, Backlog and Renegotiation

There are no significant seasonal aspects to Hospira's consolidated net sales. Hospira believes that backlogged orders do not represent a material portion of its sales or provide a meaningful indication of future sales. During 2010, Hospira experienced an increase in backlogs due to supply constraints which decreased by year-end. No material portion of Hospira's business is subject to renegotiation of profits or termination of contracts at the election of the government.

Product Development and Manufacturing

Hospira's product development programs are concentrated in the areas of specialty injectable pharmaceuticals and medication management. Hospira's research and development expenses were $300.5 million in 2010, $240.5 million in 2009, and $211.9 million in 2008. Hospira also maintains an active development program to support its injectable pharmaceutical contract manufacturing relationships. Hospira engages in programs to bring new products to market that are unique or that enhance the effectiveness, ease of use, productivity, safety or reliability of existing product lines. Hospira also engages in programs to expand the use of products in new markets or new applications. Hospira operates significant product development facilities in Lake Forest, Illinois; McPherson, Kansas; San Diego, California; Mulgrave, Victoria, Australia; Adelaide, South Australia, Australia; and Irungattukottai, India.

In Hospira's specialty injectable pharmaceuticals product line, Hospira is actively working to develop small molecule compounds. For certain of these compounds, Hospira is actively pursuing a strategy of challenging the intellectual property of proprietary pharmaceutical companies in an effort to be the first generic company to the market. Hospira is also actively working to develop and commercialize biosimilars. For a discussion of Hospira's developments in 2010 related to biosimilars, see the discussion of Hospira's products under "Item 1. Business." In 2009, Hospira acquired worldwide rights to the biosimilar version of filgrastim and a biologic manufacturing facility from PLIVA Hrvatska d.o.o. This is in alignment with Hospira's biosimilars strategy, which is to expand its biosimilars portfolio and capabilities with measured investment and risk. In 2008, Hospira entered into a process development and bulk drug manufacturing relationship with Human Genome Sciences ("HGS") for biosimilar products for the U.S. market. In 2009, Hospira entered into an agreement with Celltrion, Inc. and Celltrion Healthcare, Inc. to develop and market eight biosimilar molecules, five of

6

Table of Contents

which are new to Hospira's biosimilar portfolio. Hospira's biosimilar pipeline has 11 biosimilar products.

Hospira continues to invest in PrecedexTM for expansion of clinical use and has selectively invested in various other proprietary systems and molecules that align with its business strategy. In 2009, Hospira and ChemGenex Pharmaceuticals Limited ("ChemGenex") entered into a collaborative agreement to develop, license, and commercialize a ChemGenex proprietary oncology product candidate in EMEA. In 2010, Hospira acquired Javelin Pharma and entered into a licensing agreement with DURECT Corporation to develop and market DURECT's POSIDURTM. For further information related to those developments, see the discussion of Hospira's products under "Item 1. Business."

Hospira's key programs in the area of medication management products include the development of advanced infusion platforms and systems, including its Hospira MedNetTM safety software system, and systems that emphasize ease of use for clinicians, including its SymbiqTM infusion pump. Hospira has entered into alliances with several leading information technology companies to develop interfaces that enable the Hospira MedNetTM system to be used with a variety of hospital information systems and to improve cost efficiencies in patient management. Hospira expects to continue entering into strategic alliances as part of its "open architecture system" strategy for the Hospira MedNetTM system.

As of December 31, 2010, Hospira operated 12 manufacturing facilities globally. Hospira's principal manufacturing facilities are identified in Item 2 of this report. Hospira's largest facilities, located in Rocky Mount, North Carolina; Austin, Texas; LaAurora, Costa Rica; McPherson, Kansas; and Mulgrave, Victoria, Australia, account for a significant portion of Hospira's manufacturing output. Hospira's manufacturing facility in Irungattukottai, India and its joint venture manufacturing facility near Ahmedabad, India may also be significant manufacturing facilities for Hospira in 2011. During 2010, Hospira temporarily shut down certain of its production lines to respond to certain quality issues cited in a 2010 warning letter as described in "Quality Assurance" in Item 1. If Hospira experiences any further significant interruption of manufacturing at any of the foregoing facilities, such an interruption could materially and adversely affect Hospira's ability to manufacture and sell its products.

Hospira has a joint venture with Cadila Healthcare Limited, an Indian domestic pharmaceutical company located in Ahmedabad, India. The joint venture, Zydus Hospira Oncology Pvt. Ltd. ("ZHOPL"), operates a manufacturing facility in a special economic zone outside of Ahmedabad, India, that has been inspected and approved by the United Kingdom's Medicines and Healthcare Products Regulatory Agency and the FDA. Since 2009, the facility has been manufacturing a number of cytotoxic drugs for sale by both Cadila and Hospira in their respective exclusive territories in the United States, Europe and other countries. In addition, in 2010 and 2011, Hospira has entered into separate and independent contract manufacturing agreements with ZHOPL for the production of numerous other cytotoxic drugs that Hospira will sell under its own label throughout the world.

Raw Materials and Components

While Hospira produces some materials, components and active pharmaceutical ingredients at its manufacturing sites, the majority are sourced on a global basis from third-party suppliers.

Although many of the materials and components Hospira uses to produce its products are readily available from multiple suppliers, Hospira relies on supply from a single source for many raw materials and components. For example, Hospira relies on certain proprietary components available exclusively from ICU Medical. ICU Medical's CLAVETM and MicroCLAVETM connector products are components of administration sets that represented approximately 15% of Hospira's 2010 U.S. net sales. In addition, Hospira purchases some of its other raw materials, components and active pharmaceutical ingredients

7

Table of Contents

from single suppliers for reasons of quality assurance, sole-source availability, cost effectiveness or constraints resulting from regulatory requirements.

To manage risk, Hospira works closely with its suppliers to ensure continuity of supply. In addition, Hospira attempts to diversify its sources of materials and continually evaluates alternate-source suppliers. In certain circumstances, it may pursue regulatory qualification of alternative sources, depending upon the strength of its existing supplier relationships, the reliability of its current supplier base, and the time and expense associated with the regulatory process. A change in suppliers could require significant effort or investment by Hospira in circumstances where the items supplied are integral to the performance of its products or incorporate unique technology. The loss of certain supply arrangements, including certain arrangements for active pharmaceutical ingredients, certain commodities, and the CLAVETM supply arrangement with ICU Medical (which continues through 2014) would have a material adverse effect on its business.

Quality Assurance

Hospira has developed and implemented quality systems and concepts throughout its organization. Hospira is actively involved in setting quality policies and managing internal and external quality performance. Its quality assurance department provides quality leadership and supervises its quality systems. An active audit program, utilizing both internal and external auditors, monitors compliance with applicable regulations, standards and internal policies. In addition, Hospira's facilities are subject to periodic inspection by the FDA and other regulatory authorities. Hospira has received notices from regulatory authorities alleging violations of applicable regulations and standards, and Hospira has developed definitive action plans, implemented remedial programs and modified its practices to address these issues.

During 2009, Hospira received a warning letter from the FDA related to Hospira's corrective action plans with respect to the failure of certain AC power cords manufactured by a third party. The recall was limited to device power cords with a certain prong design that could crack and fail at/or inside the plug. In October 2010, the FDA notified Hospira that it appeared that Hospira had addressed the warning letter deficiencies and that future FDA inspections would further assess the adequacy and sustainability of these corrections. In December 2010, the FDA notified Hospira that the AC power cord recall activities were completed and the FDA considered the recall terminated.

During 2010, Hospira received a warning letter from the FDA in connection with the FDA's inspection of Hospira's pharmaceutical and device manufacturing facilities located in Rocky Mount, North Carolina, and Clayton, North Carolina (the "2010 warning letter"). In the warning letter, the FDA cites current good manufacturing practice deficiencies related to particulate in certain emulsion products at the Clayton facility and the failure to adequately validate the processes used to manufacture products at the Rocky Mount facility. The warning letter also asserts other inadequacies, including procedures related to the Quality Control unit, investigations, and medical reporting obligations. The warning letter asserts that some of the deficiencies were repeat observations from a prior inspection conducted in April 2009, and include a similar violation cited in the August 2009 warning letter related to the AC power cords. The FDA did not believe that Hospira had identified the root cause(s) of the problems and had adequately resolved them. The warning letter also questioned whether Hospira's interim plans ensured the quality of products that were manufactured at the facilities while implementing the corrective actions and validation activities. Hospira has made significant progress on completing a comprehensive review of its manufacturing operations to ensure compliance with applicable regulations. In January 2011, the FDA completed an inspection of the Clayton facility with no observations noted by the inspector.

8

Table of Contents

Nothing in either the October or December 2010 letters precludes any future regulatory action by the FDA should violations be observed in subsequent inspections or through other means, and these letters do not relieve Hospira from the responsibility to assure compliance with the Food, Drug and Cosmetic Act in the future. The FDA's warning letters are publicly available on the FDA's Web site. Hospira has responded to the 2010 warning letter and is working closely with the FDA to conclude this matter.

In April 2010, Hospira placed a voluntary hold on all shipments to new customers of SymbiqTM, a large volume infusion device. Hospira initiated this hold after it received an unexplained increase in customer complaints related to the failure of the SymbiqTM to alarm at the end of infusion therapy under certain use conditions. In June 2010, Hospira notified customers on interim steps to be taken by customers to mitigate this issue and to avoid the use conditions that can lead to the failure of the SymbiqTM to alarm at the end of infusion therapy. In August 2010, Hospira initiated a set recall related to the issue. Additionally, Hospira notified customers of reports of unrestricted flow when the SymbiqTM infusion set cassette is improperly removed from the pump before the pump's cassette door is fully opened. Hospira cautioned customers to allow the pump's cassette door to fully open before removing the infusion set as the pump may not alarm when the infusion set is improperly removed. The FDA has classified each of these actions as a Class I recall and Hospira is working closely with the FDA to conclude these matters. Further, Hospira is developing a solution to improve the performance of the pump and the issues therewith. Hospira has not asked customers to return or cease using their SymbiqTM pumps.

In December 2010, Hospira informed the FDA that Hospira had received a small number of customer reports associated with the PlumTM pumps regarding failure of the pump's audible alarm under certain conditions. Hospira has provided notice to customers notifying them of the corrective action plan. For the Plum A+TM pumps, the alarm failures are associated with the alarm assembly which will need to be replaced. For the Plum XLTM pumps, the alarm failure is associated with fluid ingress and physical damage to the alarm assembly over time. Plum XLTM customers are being asked to follow the proper cleaning procedure and inspect the alarm assembly for physical damage during routine maintenance. This action is classified as a field recall and FDA is not requiring Hospira to remove PlumTM pumps from the market or halt production.

For further discussion of these other remedial actions, Hospira's responses to the warning letters, and the resulting financial impact, see the section captioned "Certain Quality and Product Related Matters" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

Competition

Hospira's industry is highly competitive. Hospira believes that the most effective competitors in its industry are those focused on product quality and performance, breadth of product offering, and manufacturing efficiency as well as the ability to develop and deliver cost-effective products that help hospitals improve the safety of patient care, reduce medication errors and provide high quality care. These are increasingly important factors in a healthcare environment that requires increasing levels of efficiency and productivity.

Hospira's most significant competitors in pharmaceuticals include Baxter International Inc. ("Baxter"), Bedford Laboratories (a division of Boehringer Ingelheim), Fresenius Medical Care AG, Sandoz, Teva Pharmaceuticals ("Teva"), as well as divisions of several multinational pharmaceutical companies. Local manufacturers of pharmaceuticals also compete with Hospira on a country-by-country basis. Hospira's most significant competitors in medication management include Baxter, B. Braun Melsungen AG, CareFusion and Fresenius Medical Care AG. Hospira believes that it is one of the

9

Table of Contents

leading competitors, in terms of U.S. market share, in each of its major product lines, and believes that its size, scale, customer relationships and breadth of product line are significant contributors to its market positions. Hospira believes that to further its competitive position it must continue to invest significantly in, and successfully execute, its research and product development activities, and optimize its manufacturing efficiency and productivity. Particularly, for its pharmaceutical products, Hospira seeks to maximize its opportunity to establish a "first-to-market" position for its generic injectable drugs, and for its medication management products, Hospira seeks to differentiate its products through technological innovation and an integrated approach to drug delivery. These efforts will depend heavily on the success of Hospira's research and development programs.

In the EMEA segment, competitors include Teva, Sandoz, Actavis, Fresenius Kabi, Mylan Inc., Stada Arzneimittel AG, and Baxter. The use of generic pharmaceuticals is subject to variations in the structure of health care systems (including purchasing practices) and government policies regarding the use of generic products and pricing, which all lead to differing levels of customer acceptance. There are different policies and levels of generic penetration in each country in EMEA, causing the competition for generic pharmaceuticals to differ widely. In EMEA, competitors tend to vary by country and are often smaller in scale than those in the U.S., although some consolidation and geographic expansion is now occurring. Teva is the largest company that competes with Hospira in the generic oncology market across Europe. Hospira's other key competitors vary from country to country.

The use of generic pharmaceuticals in the APAC segment is subject to variations in government policies and public perception. In Australia, generic penetration is moderate and growing primarily due to changes in government support. Competitors include Sandoz and Teva, a number of smaller competitors and the innovator companies. In Asia, Hospira sells its products primarily to hospitals. Hospira's competition in Asia tends to be with the originator companies and multinational companies such as Teva and Actavis. In Japan, the market share of generic pharmaceutical products traditionally has been low because of quality perceptions, product format and other regulatory differences in comparison to other markets. The Japanese government is actively pursuing a program to double generic usage. Laws in Japan have been introduced to allow for easier substitution of generics for branded pharmaceuticals and to change financial incentives for hospitals and clinics to use generics, in a government sponsored effort to reduce costs, which is believed to have resulted in an increased acceptance of generic pharmaceutical products.

Patents, Trademarks and Other Intellectual Property

When possible, Hospira seeks patent and trademark protection for its products. Hospira owns, or has licenses under, a substantial number of patents, patent applications, trademarks and trademark applications. Principal products and their related trademarks are discussed in "Item 1. General Development of Business." Hospira believes that no single patent, trademark, or related group of patents or trademarks are material in relation to Hospira's business as a whole. Hospira is in patent litigation concerning its proprietary product, PrecedexTM. The patents at issue in that litigation are detailed in "Item 3. Legal Proceedings." While this drug is not material to Hospira's business as a whole or its segments, it is significant to Hospira's specialty injectable pharmaceutical product line. PrecedexTM is licensed to Hospira in the Americas and APAC segments, and in the Middle East and Africa.

Employees

As of December 31, 2010, Hospira had approximately 14,000 employees. Hospira believes that it generally has a good relationship with its employees and the works councils and unions that represent certain employees.

10

Table of Contents

Governmental Regulation and Other Matters

Hospira's operations and business activities are subject to extensive legal and regulatory requirements that are enforced by numerous governmental agencies in the countries in which it does business. If it were determined that Hospira was not in compliance with these laws and regulations, Hospira could be subject to criminal and/or civil liability and other material adverse effects. Hospira has compliance programs in place to ensure compliance with these laws and believes that it is in compliance in all material respects with applicable laws and regulations, including those described below.

Drug and Medical Device Laws

Most of Hospira's products and facilities and those of Hospira's suppliers are subject to drug and medical device laws and regulations promulgated by the FDA and national and supranational regulatory authorities outside the U.S., including Health Canada's Health Products and Foods Branch, the U.K.'s Medicines and Healthcare Products Regulatory Agency, the European Medicines Agency for the Evaluation of Medicinal Products for Human Use and Australia's Therapeutic Goods Agency. These authorities regulate a range of activities including, among other matters, manufacturing, post-marketing studies in humans, advertising and promotion, product labeling, post-marketing surveillance and reporting of adverse events.

All aspects of Hospira's manufacturing and distribution of regulated products and those of Hospira's suppliers are subject to substantial governmental oversight. Facilities used for the production, packaging, labeling, storage and distribution of drugs and medical devices must be registered with the FDA and other regulatory authorities. All manufacturing activities for these products must be conducted in compliance with current good manufacturing practices. Hospira's manufacturing facilities and those of Hospira's suppliers are subject to periodic, routine and for-cause inspections to verify compliance with current good manufacturing practices. New manufacturing facilities or the expansion of existing facilities require inspection and approval by the FDA and other regulatory authorities before products produced at that site can enter commercial distribution. If, upon inspection, the FDA or another regulatory agency finds that a manufacturer has failed to comply with current good manufacturing practices, it may take various enforcement actions, including, but not limited to, issuing a warning letter or similar correspondence, mandating a product recall, seizing violative product, imposing civil penalties, and referring the matter to a law enforcement authority for criminal prosecution. These actions could result in, among other things, substantial modifications to Hospira's business practices and operations; a total or partial shutdown of production in one or more of Hospira's facilities while Hospira or Hospira's suppliers remedy the alleged violation; the inability to obtain future pre-market clearances or approvals; and withdrawals or suspensions of current products from the market. Any of these events could disrupt Hospira's business and have a material adverse effect on Hospira's revenues, profitability and financial condition. For information related to the 2009 and 2010 warning letters received by Hospira and other voluntary recalls and corrective actions in 2009 and 2010, see the sections captioned "Quality Assurance" above, and "Certain Quality and Product Related Matters" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

Hospira continues to make improvements to our products to further reduce patient safety issues. Based upon our consultations with the FDA and other regulatory authorities, these improvements may require Hospira to initiate recalls or corrective actions if the improvement reduces the health risk posed by the product and not making the improvements to the on-market product is deemed a patient safety issue. See discussion regarding corrective actions to Hospira's pumps under the section captioned "Certain Quality and Product Related Matters" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations."

11

Table of Contents

Hospira's sales and marketing activities for its products, particularly its prescription drugs and medical devices, are also highly regulated. Regulatory authorities have the power to mandate the discontinuation of promotional materials, practices and programs that include information beyond the scope of the indications in the approved or cleared labeling or that are not in compliance with specific regulatory requirements.

Some of Hospira's drug products are considered controlled substances and are subject to additional regulation by the U.S. Drug Enforcement Administration ("DEA") and various state and international authorities. These drugs, which have varying degrees of potential for abuse, require specialized controls for production, storage and distribution to prevent theft and diversion.

Hospira continues investing in the development of generic and/or similar versions of currently marketed biopharmaceuticals. Since 2005, the European Medicines Agency has implemented guidelines which provided a pathway for the approval of certain biosimilars in the European Union. In 2010, the "Patient Protection and Affordable Care Act" ("PPACA") was passed and signed into law in the U.S. This legislation includes new authorization for the FDA to approve companies to market these products in the U.S. In addition, other provisions, such as the medical device excise tax of the PPACA, will also have an impact on Hospira in the future.

Healthcare Fraud and Abuse Laws

As a manufacturer and distributor of prescription drugs and medical products to hospitals and other healthcare providers, Hospira and its customers are subject to laws which apply to Medicare, Medicaid, and other federal and state healthcare programs in the U.S. One such law, the Anti-kickback Statute, prohibits the solicitation, offer, payment or receipt of remuneration in return for referral or purchase, or in return for the recommending or arranging for the referral or purchase, of products covered by the programs. The Anti-kickback Statute provides a number of exceptions or "safe harbors" for particular types of transactions. While Hospira generally does not file claims for reimbursement from government payors, the U.S. federal government has asserted theories of liability against manufacturers under the Federal False Claims Act, which prohibits the submission of false claims to Medicare, Medicaid, and other state and federal programs. Many states have similar fraud and abuse laws which apply to Hospira.

Anti-bribery Laws

Hospira's global activities are subject to the U.S. Foreign Corrupt Practices Act ("U.S. FCPA") and other countries' anti-bribery laws that have been enacted in support of the Organization for Economic Cooperation and Development's Anti-bribery Convention. These laws prohibit companies and individuals from offering or providing anything of value to government officials with the intent of inappropriately gaining a business advantage. They also require companies to maintain accurate books and records and internal financial controls. A new anti-bribery law that will become effective in April 2011 is the U.K. Bribery Act of 2010. In addition to prohibitions similar to the U.S. FCPA, this law also prohibits commercial bribery and makes it a crime for a company to fail to prevent bribery. Companies have the burden of proving that they have adequate procedures in place to prevent bribery. The enforcement of such laws in the U.S. and elsewhere has increased dramatically in the past few years, and authorities have indicated that the pharmaceutical and medical device industry will be a significant focus for enforcement efforts. Hospira has a compliance program in place to ensure compliance with these laws by its employees and agents and to communicate its expectations of compliance to third parties, including its distributors.

Environmental Laws

Hospira's manufacturing operations are subject to many requirements under environmental laws. In the U.S., the Environmental Protection Agency and similar state agencies administer laws which

12

Table of Contents

restrict the emission of pollutants into the air, the discharge of pollutants into bodies of water and the disposal of hazardous substances. The failure to obtain a permit for certain activities may be a violation of environmental laws. Most environmental agencies also have the power to shut down an operation if it is operating in violation of environmental laws. U.S. laws also allow citizens to bring private enforcement actions in some situations. Outside the U.S., the environmental laws and their enforcement vary, and can be more burdensome. For example, in some European countries, there are environmental taxes and laws requiring manufacturers to take back used products at the end of their useful life. This does not currently have a significant impact on Hospira's products, but such laws are expanding rapidly in Europe. Hospira has management systems in place that are intended to minimize the potential for violation of these laws.

Other environmental laws address the contamination of land and groundwater, and require the clean-up of such contamination. Hospira has been involved with a number of sites at which clean-up has been required, some as the sole owner and responsible party, and some as a contributor in conjunction with other parties. Hospira believes that environmental compliance has not had, and will not have, a material adverse effect on our operations, results or competitive position.

Safety and Health Laws

In the U.S., the Occupational Safety and Health Act sets forth requirements for conditions of the workplace. Hospira's operations are subject to many of these requirements, particularly in connection with Hospira's employees' use of equipment and chemicals at manufacturing sites that pose a potential health or safety hazard.

Transportation Laws

Hospira's operations include transporting materials defined as "hazardous" over land, sea and through the air. All of these activities are regulated under laws administered by the U.S. Department of Transportation and similar agencies outside the U.S. They include complex requirements for packing, labeling and recordkeeping.

Customs, Export and Anti-boycott Laws

The import and export of products, technology, equipment and other business materials across national borders are subject to regulation by U.S. agencies, including the U.S. Customs and Border Protection, the Bureau of Industry and Security, Department of Commerce and the Office of Foreign Assets Control—Treasury Department, as well as other national and supranational regulatory authorities. As the importer and exporter of products and technologies, Hospira must comply with all applicable customs, export and anti-boycott laws and regulations and must pay fees and duties on certain shipments.

State Laws

There are numerous legal and regulatory requirements imposed by individual states in the U.S. on pharmaceutical and medical device companies doing business in those states. For example, several states and the District of Columbia either require the tracking and reporting of specific types of interactions which pharmaceutical and medical device companies have with healthcare professionals or restrict such interactions. A similar requirement arose under the PPACA to track spending on physicians and teaching institutions, beginning on January 1, 2012. The 2012 data will be reportable to an agency of the federal government in 2013. This reporting requirement is expected to preempt some but not all of the state disclosure requirements.

13

Table of Contents

Other Laws

Hospira is also subject to a variety of other laws, directives and regulations in and outside of the U.S., including income, value added and excise taxes. Hospira stays abreast of, and plans for, proposed legislation that could significantly affect our operations.

Available Information

Copies of Hospira's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, are available free of charge through the Investor Relations section of Hospira's Web site (www.hospira.com) as soon as reasonably practicable after Hospira electronically files or furnishes such material to the Securities and Exchange Commission ("SEC").

Hospira's corporate governance guidelines, code of business conduct and the charters of its audit, compensation, governance and public policy, and science, technology and quality committees are all available in the Investor Relations section of Hospira's Web site (www.hospira.com) or by sending a request to: Corporate Governance Materials Request, Hospira General Counsel and Secretary, Hospira, Inc., 275 North Field Drive, Dept. NLEG, Bldg. H1, Lake Forest, Illinois 60045.

Hospira also routinely posts important information for investors on its Web site (www.hospira.com) in its Investor Relations section. Hospira may use this Web site as a means of disclosing material, non-public information and for complying with its disclosure obligations under SEC Regulation FD. Accordingly, investors should monitor the Investor Relations portion of Hospira's Web site, in addition to following Hospira's press releases, SEC filings, and public conference calls and webcasts.

Information contained on Hospira's Web site shall not be deemed incorporated into, or to be a part of, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Hospira's business, financial condition, results of operations and cash flows are subject to various risks and uncertainties, including those described below. These risks and uncertainties may cause (1) Hospira's sales and results of operations to fluctuate significantly; (2) Hospira's past performance to not be indicative of future performance; and (3) Hospira's actual performance to differ materially from Hospira's expectations or projections. The risks described below may not be the only risks Hospira faces. Additional risks that Hospira does not yet know of or that Hospira currently thinks are immaterial may also impair its business operations. This Form 10-K also contains forward-looking statements that involve risks and uncertainties. Hospira's results could materially differ from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below. See the section captioned "Forward-Looking Statements."

Hospira faces significant competition and may not be able to compete effectively.

The healthcare industry is highly competitive. Hospira competes with many companies that range from small, highly focused companies to large diversified healthcare manufacturers that have access to greater financial, marketing, technical and other resources. There has been consolidation by Hospira's competitors and customer base, which has resulted in pricing and sales pressures, causing competition to become more intense. Hospira's present or future products could be rendered obsolete or uneconomical by technological advances by competitors or by the introduction of competing products by one or more of its competitors. To remain competitive and bolster its competitive position, Hospira believes that it must successfully execute various strategic plans, including expanding its research and development initiatives and productivity, lowering its operating costs, and improving its business processes. These initiatives may result in significant expenditures and ultimately may not be successful. Hospira's failure to compete effectively could cause it to lose market share to its competitors and have a material adverse effect on its sales and profitability.

14

Table of Contents

If Hospira does not successfully introduce new products in a timely manner, its sales and operating results may decline.

A key component to Hospira's strategy is effective execution of its research and development activities. Without the timely introduction of new products and enhancements, Hospira's products may become obsolete over time, causing its sales and operating results to suffer. If Hospira does not continue to develop generic injectable pharmaceuticals in a timely manner, its competitors may develop products that are more competitive than Hospira's, and Hospira could find it more difficult to renew or expand GPO pricing agreements or to obtain new agreements. The ability to launch a generic pharmaceutical product at or before generic market formation is important to that product's profitability. Prices for generic products typically decline, sometimes dramatically, following market formation, as additional companies receive approvals to market that product and competition intensifies. If a company can be "first to market," such that the branded drug is the only other competition for a period of time, higher levels of sales and profitability can be achieved. With increasing competition in the generic product market, the timeliness with which Hospira can market new generic products will increase in importance. If Hospira is unable to bring its generic products to market on a timely basis, and secure "first to market" positions, its sales and profitability could be adversely impacted.

Hospira is also actively working to develop and commercialize biosimilar products. Hospira has entered into several agreements described under "Product Development and Manufacturing" related to expanding its biosimilars portfolio and capabilities. The success of our biosimilars activities depends on several factors, including among other factors, the adoption of certain laws and regulations, ability to obtain regulatory approvals, and the success of the arrangements with third parties. These activities will require a substantial investment of the company's resources, which may not result in commercially successful products.

In 2010, the Patient Protection Affordable Care Act was passed and signed into law in the U.S. This legislation includes new authorization to the FDA to approve companies to market biosimilar products in the U.S. The regulations under this law have not been developed yet. Those regulations may delay or prevent generic drug producers such as Hospira from offering certain products, such as biosimilar products in key territories, which could harm Hospira's ability to grow its business. Hospira may not be able to generate future sales of such products in certain jurisdictions and may not realize the anticipated benefits of its investments in the development, manufacture and sale of such products. Delays in receipt of, or failure to obtain, approvals for product candidates could result in delayed realization of product revenues and in substantial additional costs.

Hospira faces similar risks if it does not introduce new versions or upgrades to its medication management portfolio. Innovations generally require a substantial investment in product development before Hospira can determine their commercial viability, and Hospira may not have the financial resources necessary to fund these innovations. Even if Hospira succeeds in creating new product candidates from these innovations, such innovations may still fail to result in commercially successful products.

The success of new product offerings will depend on several factors, including Hospira's ability to properly anticipate customer needs, obtain timely regulatory approvals, and manufacture quality products in an economic and timely manner. Even if Hospira is able to successfully develop new products or enhancements, they may not produce sales equal to or greater than the costs of development or may not avoid infringing the proprietary rights of third parties. They may be quickly rendered obsolete by changing customer preferences or the introduction by competitors of products embodying new technologies or features. Moreover, innovations may not become successful because of difficulties encountered in achieving positive clinical outcomes, meeting safety, efficacy or other regulatory requirements of government agencies, or obtaining favorable pricing on such products.

15

Table of Contents

Finally, innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice, and uncertainty over third-party reimbursement.

Failure to effectively manage efforts or to realize the benefits under product collaboration agreements may harm Hospira's business and profitability.

Hospira collaborates with other companies for the development, regulatory approval, manufacturing and marketing of new products in both the specialty injectable pharmaceutical and medication management product lines. Hospira has entered into collaboration agreements relating to the long-term development and commercialization of proprietary and biosimilar products, which Hospira views as an important long-term opportunity for its specialty injectable pharmaceutical product line. Hospira's ability to benefit from these arrangements will depend on its ability to successfully manage these arrangements and the performance of the other parties to these arrangements. Hospira and the other parties to these arrangements may not efficiently work together, leading to higher-than-anticipated costs and delays in important activities under the arrangements. The other parties to these arrangements may not devote the resources that are required for the arrangement to be successful. These arrangements are often governed by complex agreements that may be subject to differing interpretations by the parties, which may result in disputes.

The development of proprietary and biosimilar products may require substantial investment by Hospira. Hospira may not be able to realize the expected benefits of such investment. These factors are often beyond the control of Hospira, and could harm Hospira's sales, product development efforts and profitability.

Hospira is subject to the cost-containment efforts of wholesalers, distributors, third-party payors and government organizations, which could have a material adverse effect on our sales and profitability.

Hospira relies on drug wholesalers to assist in the distribution of its generic injectable pharmaceutical products. While Hospira has business arrangements in place with its major drug wholesalers, if Hospira is required to pay fees not contemplated by its existing arrangements, Hospira will incur additional costs to distribute its products, which may harm Hospira's profitability.

Hospira's products and services are sold to hospitals and alternate site providers, such as clinics, home healthcare providers and long-term care facilities which receive reimbursement for the healthcare services provided to their patients from third-party payors, such as government programs, private insurance plans and managed-care programs. These third-party payors are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement for medical products and services. Levels of reimbursement, if any, may be decreased in the future, and future healthcare reform legislation, regulations or changes to reimbursement policies of third-party payors may otherwise adversely affect the demand for and price levels of Hospira's products, which could have a material adverse effect on Hospira's sales and profitability.

In markets outside the U.S., Hospira's business has experienced downward pressure on product pricing as a result of the concentrated buying power of governments as principal customers and the use of bid-and-tender sales methods whereby Hospira is required to submit a bid for the sale of its products. Hospira's failure to offer acceptable prices to these customers could have a material adverse effect on its sales and profitability in these markets.

If Hospira is unable to obtain or maintain its GPO and IDN pricing agreements, sales of its products could decline.

Many existing and potential customers for Hospira's products have combined to form GPOs, and IDNs in an effort to lower costs. A small number of GPOs influence a majority of sales to Hospira's hospital customers in the U.S. GPOs and IDNs negotiate pricing arrangements with medical supply

16

Table of Contents

manufacturers and distributors, and these negotiated prices are made available to a GPO's or an IDN's affiliated hospitals and other members. Failure to negotiate advantageous pricing and purchasing arrangements could cause Hospira to lose market share to its competitors and have a material adverse effect on its sales and profitability.

Hospira has pricing agreements for certain products with the major GPOs in the U.S., including Amerinet, Inc.; HealthTrust Purchasing Group LP; MedAssets, Inc.; Novation, LLC; PACT, LLC; and Premier Purchasing Partners, LP. It is important for Hospira to continue to maintain pricing arrangements with major GPOs. In order to maintain these relationships, Hospira must offer a reliable supply of high-quality, regulatory-compliant products. Hospira also needs to maintain a broad product line and be price-competitive. Several GPO contracts are up for renewal or extension each year. Moreover, some of the agreements may be terminated on 60 or 90 days' notice, while others may not be terminated without breach until the end of their contracted term. If Hospira is unable to renew or extend one or more of those contracts, or one or more of the contracts are terminated, and Hospira cannot replace lost business, Hospira's sales and profitability will decline. There has been consolidation among major GPOs, and further consolidation may occur. The effect of consolidation is uncertain, and consolidation may impair Hospira's ability to contract with GPOs in the future.

The GPOs also have a variety of business relationships with Hospira's competitors and may decide to enter into pricing agreements for, or otherwise prefer, products other than Hospira's. While GPOs negotiate incentives for members to purchase specified products from a given manufacturer or distributor, GPO pricing agreements allow customers to choose between the products covered by the arrangement and another manufacturer's products, whether or not purchased under a negotiated pricing agreement. As a result, Hospira may face competition for its products even within the context of its GPO pricing agreements.

Changes in the buying patterns of Hospira's customers could adversely affect Hospira's operating results.

During 2010, sales through the four largest wholesalers that supply products to many end-users accounted for approximately 40% of Hospira's global net sales. Hospira's profitability may be impacted by changes in the buying patterns of these wholesalers, or any other major distributor, or wholesale customer. Their buying patterns may change as a result of end-use buyer purchasing decisions, end-use customer demand, pricing, or other factors, which could adversely affect Hospira's results of operations.

Hospira and its suppliers and customers are subject to various governmental regulations, and it could be costly to comply with these regulations and to develop compliant products and processes. In addition, failure to comply with these regulations could subject us to sanctions which could adversely affect our business, results of operations and financial condition.

Hospira's products are subject to rigorous regulation by the FDA, and numerous other national, supranational, federal and state governmental authorities. The process of obtaining regulatory approvals to market a drug or medical device, particularly from the FDA and governmental authorities outside the U.S., can be costly and time-consuming, and approvals might not be granted for future products on a timely basis, if at all. To ensure ongoing customer safety, regulatory agencies such as the FDA may re-evaluate their current approval processes and may impose additional requirements. In addition, the FDA and others may impose increased or enhanced regulatory inspections for domestic or foreign plants.

The FDA, along with other regulatory agencies around the world, has been experiencing a backlog of generic drug and medical device applications, which has delayed approvals of new products. Those delays have become longer, and may continue to increase in the future. These delays can result in higher levels of unapproved inventory and increased costs due to excess and obsolescence exposures.

17

Table of Contents

Hospira's collaborative partners and suppliers may not be able to remain in compliance with applicable FDA and other material regulatory requirements once it has obtained clearance or approval for a product. These requirements include, among other things, regulations regarding manufacturing practices, product labeling, advertising and postmarketing reporting, and adverse event reports and field alerts. In addition, manufacturing flaws, component failures, design defects, off-label uses or inadequate disclosure of product related information could result in an unsafe condition or the injury or death of a patient. Hospira may be required by regulatory authorities, or determine on its own, to issue a safety alert, recall or temporarily cease production and sale of certain products to resolve manufacturing and product quality concerns. All of these events could harm Hospira's sales, margins and profitability in the affected periods and may have a material adverse effect on Hospira's business.

For information related to the 2009 and 2010 FDA warning letters received by Hospira and other voluntary recalls and corrective actions, including those related to Hospira's pumps , see the section captioned "Quality Assurance" under Item 1 above and "Management's Discussion and Analysis of Financial Condition and Results of Operation" in Part II, Item 7. In response to certain quality issues, Hospira placed a voluntary hold on all shipments to new customers of SymbiqTM. Also during 2010, Hospira temporarily shut down certain of its production lines to respond to the quality issues cited in the 2010 warning letter. Hospira has also been working with third-party consultants in connection with the 2010 warning letter, who have been overseeing Hospira's activities to ensure it is developing compliant processes and procedures. These activities have increased the time to get product to market. If the FDA is not satisfied with Hospira's progress, this could result in longer delays to market or additional production line shut-downs. The FDA could find additional violations in subsequent inspections or through other means. In some circumstances, adverse events arising from or associated with the design, manufacture or marketing of our products could result in the suspension or delay of regulatory reviews of our applications for new product approvals or clearances. Any of the foregoing could disrupt our business and harm our reputation, resulting in an adverse effect on our results of operations and financial condition.

Hospira is also subject to various federal, state, and foreign laws pertaining to foreign corrupt practices and healthcare fraud and abuse, including anti-kickback and false claims laws. Violations of these laws are punishable by criminal and/or civil sanctions, including, in some instances, substantial fines, imprisonment and exclusion from participation in national, federal and state healthcare programs, including Medicare, Medicaid, and Veterans' Administration health programs and health programs outside the U.S. These laws and regulations are broad in scope and are subject to evolving interpretations, which could require Hospira to alter one or more of its sales or marketing practices. In addition, violations of these laws, or allegations of such violations, could disrupt Hospira's business and result in a material adverse effect on Hospira's sales, profitability and financial condition.

For a more detailed listing of the laws and regulations that significantly affect Hospira's business and operations, see the section captioned in Item 1. "Governmental Regulation and Other Matters." Any adverse regulatory action, or action taken by Hospira to maintain appropriate regulatory compliance, with respect to these laws and regulations could disrupt Hospira's business and have a material adverse effect on its sales, profitability and financial condition. Furthermore, an adverse regulatory action with respect to any Hospira product, operating procedure or manufacturing facility could materially harm Hospira's reputation in the marketplace.

Proposed changes in FDA regulations or actions related to infusion pumps and medical devices may lead to increased costs and delays, which could negatively impact Hospira's business.

In April 2010, the FDA issued a draft guidance document entitled "Total Product Life Cycle: Infusion Pump-Premarket Notification [510(k)] Submissions." Through this new draft guidance, the FDA has established additional pre-market requirements for infusion pumps. The proposed guidance is subject to further revisions by the FDA, but the FDA's expectation is that the guidelines should be

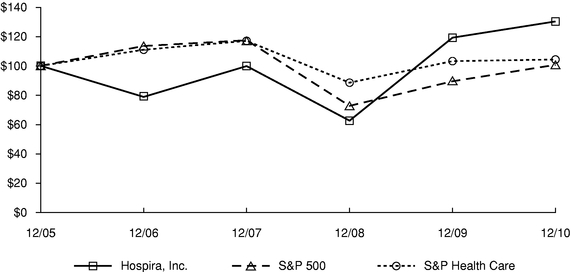

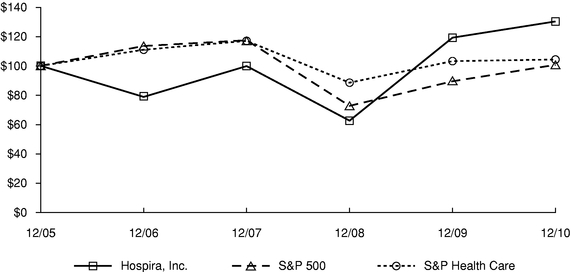

18