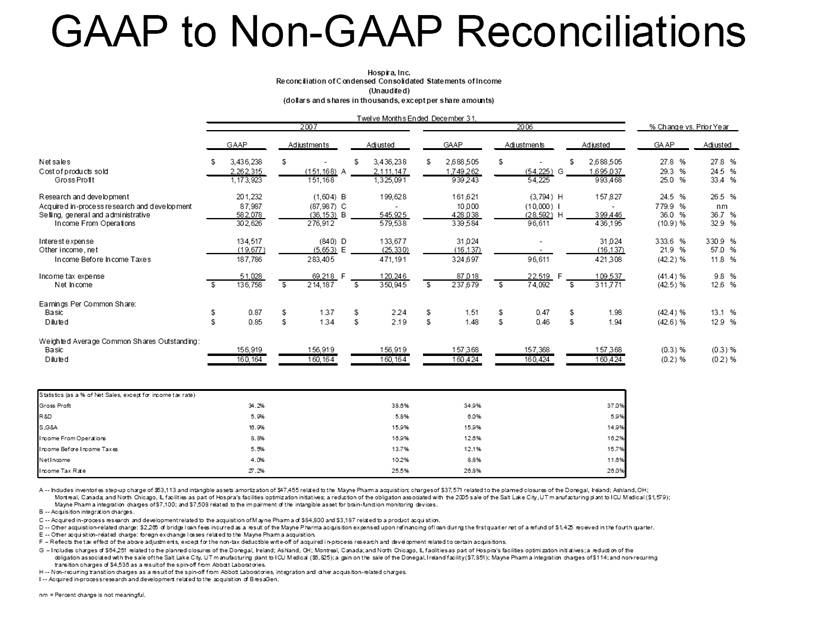

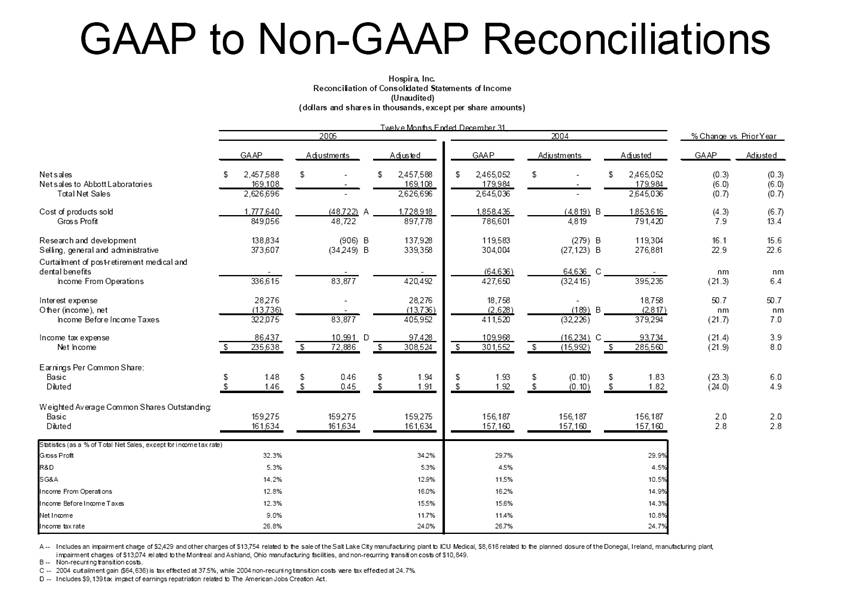

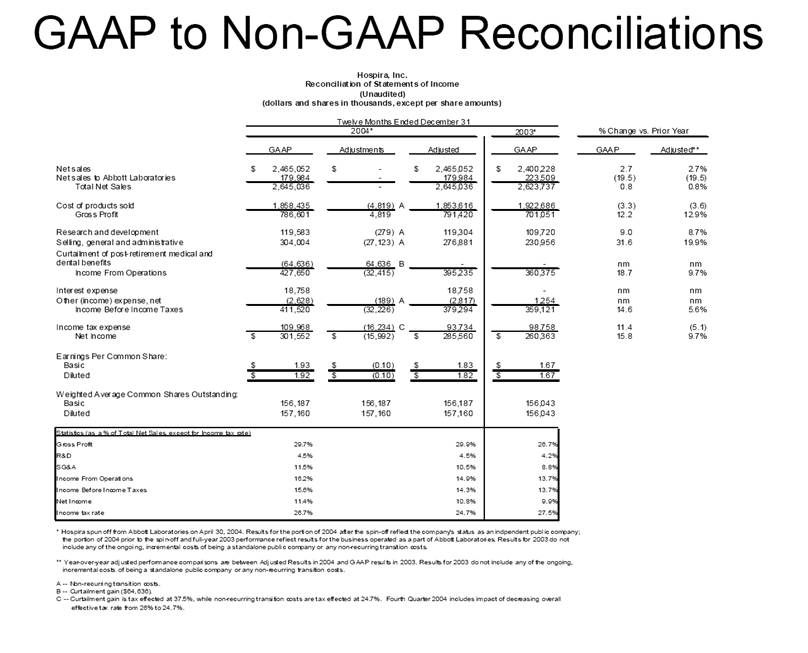

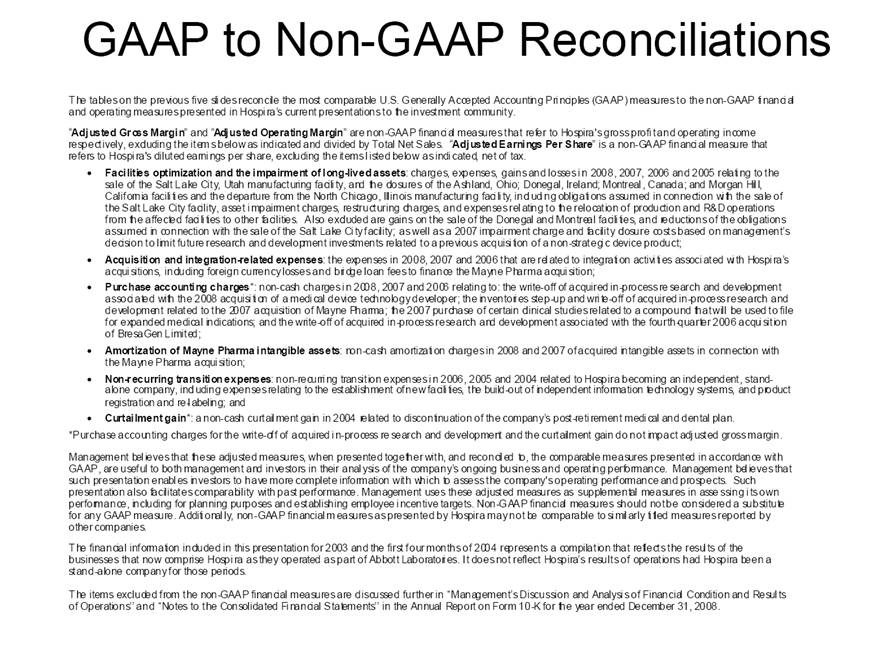

| GAAP to Non-GAAP Reconciliations GAAP Adjustments Adjusted GAAP Adjustments Adjusted GAAP Adjusted Net sales 2,527,714 $ - $ 2,527,714 $ 2,457,588 $ - $ 2,457,588 $ 2.9 2.9 Net sales to Abbott Laboratories 160,791 - 160,791 169,108 - 169,108 (4.9) (4.9) Total Net Sales 2,688,505 - 2,688,505 2,626,696 - 2,626,696 2.4 2.4 Cost of products sold 1,749,262 (54,225) A 1,695,037 1,777,640 (48,722) E 1,728,918 (1.6) (2.0) Gross Profit 939,243 54,225 993,468 849,056 48,722 897,778 10.6 10.7 Research and development 161,621 (3,794) B 157,827 138,834 (906) B 137,928 16.4 14.4 Acquired in-process research and development 10,000 (10,000) C - - - - nm nm Selling, general and administrative 428,038 (28,592) D 399,446 373,607 (34,249) B 339,358 14.6 17.7 Income From Operations 339,584 96,611 436,195 336,615 83,877 420,492 0.9 3.7 Interest expense 31,024 - 31,024 28,276 - 28,276 9.7 9.7 Other (income), net (16,137) - (16,137) (13,736) - (13,736) 17.5 17.5 Income Before Income Taxes 324,697 96,611 421,308 322,075 83,877 405,952 0.8 3.8 Income tax expense 87,018 22,519 109,537 86,437 10,991 F 97,428 0.7 12.4 Net Income 237,679 $ 74,092 $ 311,771 $ 235,638 $ 72,886 $ 308,524 $ 0.9 1.1 Earnings Per Common Share: Basic 1.51 $ 0.47 $ 1.98 $ 1.48 $ 0.46 $ 1.94 $ 2.0 2.1 Diluted 1.48 $ 0.46 $ 1.94 $ 1.46 $ 0.45 $ 1.91 $ 1.4 1.6 Weighted Average Common Shares Outstanding: Basic 157,368 157,368 157,368 159,275 159,275 159,275 (1.2) (1.2) Diluted 160,424 160,424 160,424 161,634 161,634 161,634 (0.7) (0.7) Statistics (as a % of Total Net Sales, except for income tax rate) Gross Profit 34.9% 37.0% 32.3% 34.2% R&D 6.0% 5.9% 5.3% 5.3% SG&A 15.9% 14.9% 14.2% 12.9% Income From Operations 12.6% 16.2% 12.8% 16.0% Income Before Income Taxes 12.1% 15.7% 12.3% 15.5% Net Income 8.8% 11.6% 9.0% 11.7% Income tax rate 26.8% 26.0% 26.8% 24.0% A -- Includes costs of $64,251 related to the announced closures of the Donegal, Ireland; Ashland, OH; Montreal, Canada; and North Chicago, IL facilities as part of Hospira's facilities optimization initiatives; a reduction of the obligation associated with the sale of the Salt Lake City, UT manufacturing plant to ICU Medical ($6,825); a gain on the sale of the Donegal, Ireland facility ($7,851); integration costs associated with the acquisition of Mayne Pharma of $114; and non-recurring transition costs of $4,536. B -- Non-recurring transition costs. C -- Acquired in-process research and development related to the acquisition of BresaGen. D -- Includes integration charges of $1,820 related to the acquisition of Mayne Pharma, integration charges of $95 related to the acquisition of BresaGen, and non-recurring transition costs of $26,677. E -- Includes an impairment charge of $2,429 and other charges of $13,754 related to the sale of the Salt Lake City, UT manufacturing plant to ICU Medical; $8,616 related to the closure of the Donegal, Ireland facility as part of Hospira's manufacturing optimization initiatives; impairment charges of $13,074 related to the Montreal, Canada and Ashland, Ohio manufacturing facilities; and non-recurring transition costs of $10,849. F -- Includes $9,139 tax impact of earnings repatriation related to The American Jobs Creations Act. Hospira, Inc. Reconciliation of Consolidated Statements of Income 2006 2005 Twelve Months Ended December 31 (Unaudited) (dollars and shares in thousands, except per share amounts) % Change vs. Prior Year |