Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-38103

JANUS HENDERSON GROUP PLC

(Exact name of registrant as specified in its charter)

Jersey, Channel Islands

(State or other jurisdiction of

incorporation or organization) | 98-1376360

(I.R.S. Employer Identification No.) |

201 Bishopsgate London, United Kingdom

(Address of principal executive offices) | EC2M3AE

(Zip Code) |

+44 (0) 20 7818 1818

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $1.50 Per Share Par Value | JHG | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2024, the aggregate market value of common equity held by non-affiliates was $5,381,586,868.43. As of February 25, 2025, there were 157,557,812 shares of the Company’s common stock, $1.50 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates by reference portions of the registrant's definitive proxy statement relating to its 2025 Annual General Meeting of Shareholders (the “Proxy Statement”) to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

JANUS HENDERSON GROUP PLC

2024 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

PART I

FORWARD-LOOKING STATEMENTS

Certain statements in this report not based on historical facts are “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (“Securities Act”). Such forward-looking statements involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those discussed. These include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects or future events. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

Various risks, uncertainties, assumptions and factors that could cause our future results to differ materially from those expressed by the forward-looking statements included in this report include, but are not limited to, recent changes in interest rates and inflation, volatility or disruption in financial markets, our investment performance as compared to third-party benchmarks or competitive products, redemptions and other withdrawals from the funds and accounts we manage, and other risks, uncertainties, assumptions, and factors discussed under headings such as “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures About Market Risk,” and in other filings or furnishings made by the Company with the Securities and Exchange Commission (“SEC”) from time to time.

Overview

Janus Henderson Group plc (“JHG,” the “Company,” “we,” “us,” “our” and similar terms), a company incorporated and registered in Jersey, Channel Islands, is an independent global asset manager, specializing in investment management across all major asset classes. Through its predecessor companies, JHG traces its linage back to 1934 when Henderson Group plc (“Henderson”) was founded.

We are a client-focused global business with approximately 2,300 employees worldwide and assets under management (“AUM”) of $378.7 billion as of December 31, 2024. We have operations in North America, the United Kingdom (“UK”), continental Europe, Latin America, Japan, Asia and Australia. Our mission is to help clients define and achieve superior financial outcomes through differentiated insights, disciplined investments and world-class service. We are mindful that our thinking and investments help shape the futures of millions of people as we fulfill our purpose of “Investing in a brighter future together.” We manage a broad range of investment products for institutional and retail investors across four capabilities: Equities, Fixed Income, Multi-Asset and Alternatives.

Clients entrust money to us, either their own or money they manage or advise on for their clients, and expect us to deliver the benefits specified in their mandate or by the prospectus for the fund in which they invest. We measure the amount of these funds as AUM. AUM increases or decreases primarily depending on our ability to attract and retain client investments, on investment performance and as a function of market and currency movements. AUM is also impacted when we invest in new asset management teams or businesses or divest from existing businesses.

Clients pay a management fee, which is usually calculated as a percentage of AUM. Certain investment products are also subject to performance fees, which vary based on when performance hurdles or other specified criteria are achieved. The level of assets subject to such fees can positively or negatively affect our revenue. Management and performance fees are generated from a diverse group of funds and other investment products and are the primary drivers of our revenue. We believe that the more diverse the range of investment strategies from which management and performance fees are derived, the more successful our business model will be through market cycles.

Strategy

Our strategy is based on three strategic pillars: Protect & Grow, Amplify and Diversify. Our strategy is centered on the belief that a combination of relentless focus and disciplined execution across our core business will drive future success as a global active asset manager. Specifically, our strategy lays a strong foundation for sustained organic growth and opportunistic inorganic growth to create value for all of our stakeholders: clients, shareholders and employees. Each of our three strategic pillars is further detailed below.

| | ● | Protect and grow our core business: We have identified existing opportunities in our core business where we believe we can increase market share, including regional intermediary distribution and good-performing smaller strategies. |

| | ● | Amplify strengths not fully leveraged: Our investment and client service strengths can be amplified with adjacent products, channels, geographies and vehicles (e.g., Institutional and development and expansion of other products). |

| | ● | Diversify where clients give us the right to win: We are seeking to expand our investment capabilities in areas where our clients are seeking more solutions from us and new investment capabilities that can open new client types (e.g., private credit and emerging market debt). |

Financial Highlights

We present our financial results in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”); however, JHG management evaluates the profitability of the Company and its ongoing operations using non-GAAP financial measures that are consistent with internal management reporting. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, for additional information on non-GAAP adjusted measures, including a reconciliation to the comparable GAAP measure.

| | | Year ended December 31, | |

| | | 2024 | | | 2023 | | | 2022 | |

GAAP basis (in millions, except per share data): | | | | | | | | | | | | |

Revenue | | $ | 2,473.2 | | | $ | 2,101.8 | | | $ | 2,203.6 | |

Operating expenses | | $ | 1,827.5 | | | $ | 1,618.1 | | | $ | 1,713.8 | |

Operating income | | $ | 645.7 | | | $ | 483.7 | | | $ | 489.8 | |

Operating margin | | | 26.1 | % | | | 23.0 | % | | | 22.2 | % |

Net income attributable to JHG | | $ | 408.9 | | | $ | 392.0 | | | $ | 372.4 | |

Diluted earnings per share | | $ | 2.56 | | | $ | 2.37 | | | $ | 2.23 | |

| | | | | | | | | | | | | |

Adjusted basis (in millions, except per share data): | | | | | | | | | | | | |

Revenue | | $ | 1,940.8 | | | $ | 1,645.9 | | | $ | 1,705.3 | |

Operating expenses | | $ | 1,272.7 | | | $ | 1,137.2 | | | $ | 1,128.6 | |

Operating income | | $ | 668.1 | | | $ | 508.7 | | | $ | 576.7 | |

Operating margin | | | 34.4 | % | | | 30.9 | % | | | 33.8 | % |

Net income attributable to JHG | | $ | 563.7 | | | $ | 435.2 | | | $ | 433.8 | |

Diluted earnings per share | | $ | 3.53 | | | $ | 2.63 | | | $ | 2.60 | |

Assets Under Management

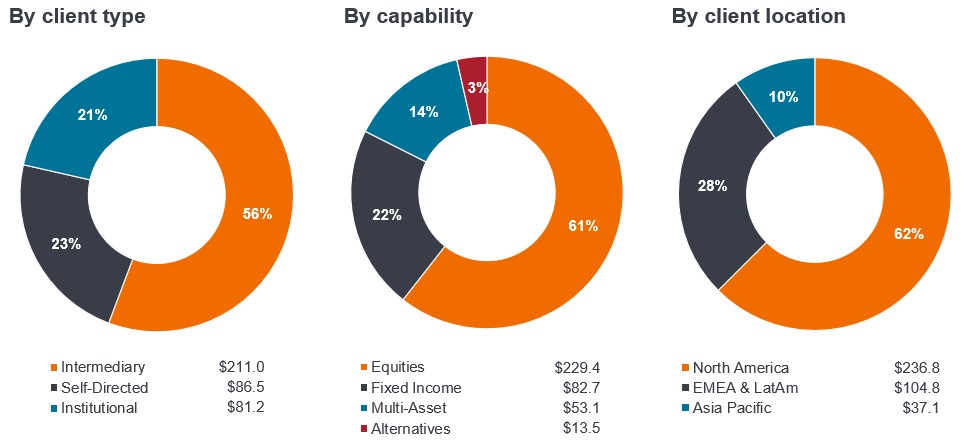

Our AUM by client type, capability and client location as of December 31, 2024, is presented below (in billions).

Client Type and Distribution Channel

We have a diverse group of intermediary, self-directed and institutional clients around the globe. While we seek to leverage our global model where possible, we also recognize the importance of tailoring our services to the needs of clients in different regions. For this reason, we maintain a local presence in most of the markets in which we operate and provide investment material that takes into account local customs, preferences and language needs. We have a global distribution team of approximately 400 staff members. A description of each client type and distribution channel is presented below.

Intermediary Channel

The intermediary channel distributes U.S. mutual funds, separately managed accounts (“SMAs”), exchange-traded funds (“ETFs”), UK Open Ended Investment Companies (“OEICs”), Société d’Investissement À Capital Variable (“SICAVs”), Collective Investment Trusts (“CITs”) and Undertakings for Collective Investments in Transferable Securities (“UCITS”) through financial intermediaries, including banks, broker-dealers, financial advisors, fund platforms and discretionary wealth managers. We have made significant investments to grow our presence in the financial advisor subchannel, including enhancing our technology platform and recruiting highly seasoned leaders and client relationship managers. At December 31, 2024, AUM in our intermediary channel totaled $211.0 billion, or 56% of total AUM.

Self-Directed Channel

The self-directed channel serves individual investors who invest in our products through a mutual fund supermarket or directly with us. At December 31, 2024, AUM in our self-directed channel totaled $86.5 billion, or 23% of total AUM.

Institutional Channel

The institutional channel serves corporations, endowments, pension funds, foundations, Taft-Hartley funds, public fund clients and sovereign entities, with distribution direct to the plan sponsor and through consultants. At December 31, 2024, AUM in our institutional channel totaled $81.2 billion, or 21% of total AUM.

Investment Capabilities

Equities

We offer a wide range of equity strategies encompassing different geographic focuses and investment styles. The Equities teams include those with a global perspective, those with a regional focus (including the U.S., Europe and Asia) and those invested in specialist sectors. A range of growth, value and absolute return styles are employed. These teams generally apply processes based on fundamental research and bottom-up stock picking. As of December 31, 2024, AUM in our Equities capability totaled $229.4 billion, or 61% of total AUM.

Fixed Income

Our Fixed Income teams provide coverage across the asset class, applying a wide range of innovative and differentiated techniques in support of a variety of investment objectives and risk criteria. Our fixed income offering includes teams that apply global unconstrained approaches as well as teams with more focused mandates — based in the U.S., Europe, Asia and Australia. The capabilities of these teams are available through individual strategies and, where appropriate, combined to create multi-strategy offerings. As of December 31, 2024, AUM in our Fixed Income capability totaled $82.7 billion, or 22% of total AUM.

Multi-Asset

Our Multi-Asset capability includes teams in the U.S. and UK that focus on balanced, multi-asset income and strategic asset allocation, as well as multiple adaptive asset allocation strategies. As of December 31, 2024, AUM in our Multi-Asset capability totaled $53.1 billion, or 14% of total AUM.

Alternatives

Our Alternatives capability includes teams with various areas of focus and approach. Alternatives brings together a cross-asset class combination of alpha generation, risk management and efficient beta replication strategies. These include Global Multi-Strategy, Managed Futures, Risk Premia and Global Commodities, Private Credit, and Long/Short Equity. As of December 31, 2024, AUM in our Alternatives capability totaled $13.5 billion, or 3% of total AUM.

Client Locations

North America

Our North America region serves clients throughout North America and represents our largest geographical concentration of AUM. The North America distribution network serves a diverse set of clients across financial intermediaries, institutions and self-directed channels. As of December 31, 2024, total North America AUM was $236.8 billion, and we employed 173 and 190 investment and distribution professionals, respectively.

EMEA and Latin America

Our EMEA (“Europe, the Middle East and Africa”) and Latin America region serves clients throughout the UK and Continental Europe and supports our evolving business in Latin America and the Middle East. The region includes a strong retail and institutional client base in the UK; strong relationships with global distributors in Continental Europe; and an organic build-out of our Latin America business, which is gaining momentum. As of December 31, 2024, total EMEA and Latin America AUM was $104.8 billion, and the region employed 165 and 156 investment and distribution professionals, respectively.

Asia Pacific

Our Asia Pacific region serves clients throughout Australia, Japan and other regions of Asia. Australian distribution offers a suite of global and domestic capabilities. Our broader business in the Asia Pacific region continues to evolve with growing brand presence. As of December 31, 2024, Asia Pacific AUM was $37.1 billion, and the region employed 42 and 73 investment and distribution professionals, respectively.

Human Capital

With approximately 2,300 employees worldwide, we are proud of our global presence and our wide array of backgrounds and viewpoints, alongside a broad range of skills and experiences, are critical to achieving our purpose of Investing in a Brighter Future Together. We aim to create a workplace characterized by accountability, excellence and innovation by living our Values — Clients Come First - Always, Execution Supersedes Intention, Together We Win, Diversity Improves Results and Truth Builds Trust — and to encourage a sense of belonging and common objective across our employee base.

Our people-focused culture is driven by collaboration and connection. We recognize that the success of JHG is dependent on the unique talents and contributions of our workforce, and we are invested in our employees’ success. We are committed to:

| | ● | Attracting great people into roles with a sense of purpose; |

| | ● | Helping them realize their highest potential and make a real impact; and |

| | ● | Supporting their ambitions throughout their career. |

Headcount

As of December 31, 2024 and 2023, we had 2,340 and 2,196 employees, respectively. Our workforce includes trainees, apprentices and fixed-term employees working alongside our permanent part- and full-time employees. Contractors and other temporary employees are excluded in the tables below.

2024 Headcount | Permanent | Fixed-Term Worker | Trainee & Apprentice | Total |

EMEA | 1,037 | 25 | 18 | 1,080 |

North America | 1,065 | — | 3 | 1,068 |

Asia Pacific | 183 | 7 | 2 | 192 |

Total | 2,285 | 32 | 23 | 2,340 |

2023 Headcount | Permanent | Fixed-Term Worker | Trainee & Apprentice | Total |

EMEA | 980 | 31 | 22 | 1,033 |

North America | 977 | — | 1 | 978 |

Asia Pacific | 174 | 9 | 2 | 185 |

Total | 2,131 | 40 | 25 | 2,196 |

Talent Acquisition

We build our workforce from within our existing talent pool whenever possible. If we are unable to identify the right candidate for an open position from within, we look externally for the best talent. We search for candidates through a variety of different channels to ensure we access the highest potential candidates who will drive innovation and sustain our competitive edge. Where possible, our internal talent acquisition team will source for this talent directly. Where necessary, we will engage the support of external recruitment consultants or search firms, whose values and methods of recruitment align with our goals of finding the best talent in the market.

Professional Development

We are committed to helping people realize their highest potential and fostering a culture that prioritizes and supports personal and professional development for individuals, leaders and teams across the organization. Employees own their individual development, and we are invested in a wide variety of programs to support their ambitions. Ongoing development opportunities include business acumen (our industry and products), understanding our clients, leadership development, mentoring schemes, global collaboration and culture, career development, interpersonal communication, presentation skills and technology training. We encourage and financially support continuing education through a tuition reimbursement program for employees wishing to pursue approved degree programs.

Employee Engagement

We value feedback from our employees. We look for opportunities to solicit their opinions and insights to help us understand what we are doing well and potential areas of improvement. In 2024, approximately 86% of our employees responded to our annual employee opinion survey. Results are shared with our Board of Directors and are cascaded from senior leaders to all employees. Managers and employees develop action plans to address topics of concern and continually improve our workplace. In addition to the 2024 employee opinion survey, we:

| | ● | Placed significant focus on the adoption and embedding of our rearticulated mission, values and purpose to encourage a sense of belonging and common objective across our employee base; |

| | ● | Continued to dedicate time and resources to employee career progression by hosting a career week where employees participated in live learning events and discussions; invested in our high potential talent through the Leadership Excellence and Development program (“LEAD”); and relaunched our early careers initiatives across the globe; and |

| | ● | Added to or enhanced our benefits and wellbeing offerings across the globe, including improving our employee share purchase plans and increasing our family-friendly leave policies globally with increased paternity pay and enhanced “equal/shared leave” policies. |

Our People

Diversity Improves Results is embedded as a core value in our Mission, Values and Purpose and is a guiding principle towards creating an inclusive environment that promotes true meritocracy, cultural awareness and respect. For many years, we have believed that organizations, and the clients they serve, benefit greatly from a diversity of viewpoints, experiences and backgrounds. That diversity of thought leads to better business decision making for our clients and their clients. We believe that diversification of viewpoints among our people is just as important as diversification within our investment portfolios and helps to produce the best results, outcomes and service for our global client base.

Employee Compensation and Benefits

Our compensation framework is designed to recognize great work and reinforce the alignment of interests among our employees, clients and shareholders. We regularly review industry benchmark data and maintain competitive compensation levels to ensure we are able to attract and retain top talent. Variable incentive compensation for most of our employees is funded based on JHG profits. While individual awards are fully discretionary, performance assessments take into account financial and strategic (non-financial) factors, including company, department, team and individual performance.

The ongoing health and well-being of our employees is important to us, and we offer a wide array of benefits, resources and tools to help our employees and their families to live healthy, balanced and happy lifestyles. We support our employees’ financial goals and retirement saving by making contributions toward their retirement and pension plans and offering an employee stock purchase plan.

Turnover

We monitor and analyze turnover, including voluntary, involuntary and reduction in force (“RIF”)/layoffs. Our voluntary turnover rates are consistent with a certain benchmark for our industry. We develop talent profiles and succession plans to ensure we are cultivating the next generation of leaders to contribute to our long-term business success. These provide us with the ability to effectively manage turnover and to retain and develop our most highly skilled employees.

Intellectual Property

We have used, registered and/or applied to register certain trademarks, service marks and trade names to distinguish our sponsored investment products and services from those of our competitors in the jurisdictions in which we operate, including the U.S., the UK, the European Union (“EU”), Australia, China, Japan and Singapore. These trademarks, service marks and trade names are important to us and, accordingly, we actively enforce our trademarks, service marks and trade name rights. Our brand has been, and continues to be, extremely well-received both in the asset management industry and with clients.

Seasonality

Our revenue streams are not seasonal in nature, with management fees and other income generally accruing evenly throughout the year. However, performance fee revenue is the exception. Performance fees are specified in certain fund and client contracts and are based on investment performance either on an absolute basis or compared to an established index over a specified period of time. These fees are often subject to a high-water mark (“HWM”). Performance fees are recognized at the end of the contractual period (typically monthly, quarterly or annually) if the stated performance criteria are achieved. Certain fund and client contracts allow for negative performance fees where there is underperformance against the relevant index. Given the uncertain nature of performance fees, they tend to fluctuate from period to period.

Competition

The investment management industry is relatively mature and saturated with competitors that provide similar services. As such, we encounter significant competition in all areas of our business. We compete with other investment managers, mutual fund advisers, brokerage and investment banking firms, insurance companies, hedge funds, venture capitalists, banks and other financial institutions, many of which have proprietary access to certain distribution channels and are larger, have greater capital resources and have a broader range of product choices and investment capabilities than we do. In addition, the marketplace for investment products is rapidly changing, investors are becoming more sophisticated, the demand for and access to investment advice and information are becoming more widespread, passive investment strategies are more prevalent, and more investors are demanding investment vehicles that are customized to their individual requirements.

We believe our ability to successfully compete in the investment management industry depends upon our ability to achieve consistently strong investment performance, provide exceptional client service, and develop and innovate products that will best serve our clients.

Regulation

The investment management industry is subject to extensive federal, state and international laws and regulations intended to benefit and protect investment advisory clients and investors in pooled investment vehicles, such as those managed, advised or subadvised by us. The costs of complying with such laws and regulations have grown significantly in recent years and may continue to grow in the future, which could significantly increase our costs of doing business as a global asset manager. These laws and regulations generally grant supervisory agencies broad administrative powers, including the power to limit or restrict the conduct of businesses and to impose sanctions for failure to comply with laws and regulations. Possible consequences for failure to comply include voiding of investment advisory and subadvisory agreements, suspension of individual employees (particularly investment management and sales personnel), limitations on engaging in certain lines of business for specified periods of time, revocation of registrations, disgorgement of profits, and imposition of censures and fines. Further, failure to comply with such laws and regulations may provide the basis for civil litigation that may also result in significant costs and reputational harm to us.

U.S. Regulation

Certain of our U.S. subsidiaries are subject to laws and regulations from a number of government agencies and self-regulatory bodies, including the SEC, U.S. Department of Justice, U.S. Department of Labor (“DOL”), Financial Industry Regulatory Authority (“FINRA”), Internal Revenue Service, U.S. Commodity Futures Trading Commission (“CFTC”) and National Futures Association (“NFA”). We continue to see enhanced legislative and regulatory interest in the regulation of financial services and investment products in the U.S. through existing and proposed rules and regulations, regulatory priorities and pronouncements, enforcement actions and general discussions around expanded and updated requirements. For example, the SEC has recently proposed and/or adopted a number of new rules covering a wide range of topics, including derivatives usage; liquidity management; marketing; swing pricing; safeguarding of client assets; outsourcing of covered functions; cybersecurity; predictive analytics; shareholder and regulatory reporting; fund names; and environmental, social and governance (“ESG”) disclosures. We also continue to see continued enforcement of, and changes in enforcement practices around, existing laws, rules and regulations, including new applications of the compliance program rule to address current regulatory gaps (e.g., maintenance of electronic records and “off-channel” communications). While the nature, pace and scope of regulatory change and enforcement may change, it will remain an area of uncertainty and potential risk and cost for us and other regulated entities.

Investment Advisory Laws and Regulations

Our subsidiaries, Janus Henderson Investors US LLC (“JHIUS”), Privacore Capital Advisors, LLC (“PCA”) and Victory Park Capital Advisors, LLC (“VPC”), are registered investment advisers under the Investment Advisers Act of 1940, as amended (“Advisers Act”), and regulated by the SEC. The Advisers Act requires registered investment advisers to comply with numerous and pervasive obligations, including fiduciary duties, disclosure obligations, recordkeeping requirements, custodial obligations, operational and marketing restrictions, and registration and reporting requirements. Certain of our employees may also be registered with regulatory authorities in various states and subject to oversight and regulation by such states’ regulatory agencies where consistent with the Advisers Act.

Investment Company Laws and Regulations

Our subsidiaries, JHIUS and PCA, act as adviser or subadviser to mutual funds, ETFs and other types of registered investment companies, which are registered with the SEC pursuant to the Investment Company Act of 1940, as amended (“1940 Act”). Certain of our subsidiaries, such as JHIUS and VPC, also serve as adviser or subadviser to investment products that are not required to be registered under the 1940 Act. As an adviser or subadviser to pooled investment vehicles that operate under exemptions to the 1940 Act and related regulations, we are subject to various requirements relating to operations, fees charged, sales, accounting, recordkeeping, disclosure and governance. In addition, the adviser or subadviser to a registered investment company generally has obligations with respect to the qualification of the registered investment company under the Internal Revenue Code of 1986, as amended (“Code”).

Broker-Dealer Regulations

Our subsidiary, Janus Henderson Distributors US LLC (“JHD”), is registered with the SEC under the Exchange Act and is a member of FINRA, the U.S. securities industry’s self-regulatory organization. JHD is a limited-purpose broker-dealer, which acts as the general distributor and/or agent for the sale and distribution of shares of U.S. mutual funds that are sponsored by certain of our subsidiaries, as well as the distribution of certain exchange-traded products (“ETPs”) and other pooled investment vehicles. The SEC imposes various requirements on registered broker-dealers’ operations, including disclosure, recordkeeping and accounting. FINRA has established conduct rules for all securities transactions among broker-dealers and private investors, trading rules for the over-the-counter (“OTC”) markets and operational rules for its member firms. The SEC and FINRA also impose net capital requirements on registered broker-dealers.

JHD is subject to regulation under state law. The federal securities laws prohibit states from imposing substantive requirements on broker-dealers that exceed those under federal law. This does not preclude the states from imposing registration requirements on broker-dealers that operate within their jurisdiction or from sanctioning broker-dealers and their employees for engaging in misconduct.

Employee Retirement Income Security Act

Certain of our subsidiaries are also subject to the Employee Retirement Income Security Act (“ERISA”) and related regulations to the extent they are considered fiduciaries under ERISA with respect to some of their investment advisory clients. ERISA-related provisions of the Code and regulations issued by the DOL impose duties on persons who are fiduciaries under ERISA and prohibit some transactions involving the assets of each ERISA plan that is a client of a subsidiary of ours, as well as some transactions by the fiduciaries and various other related parties of such plans.

U.S. Commodity Futures Trading Commission

Certain of our subsidiaries are registered with the CFTC as commodity pool operators (“CPOs”) and/or commodity trading advisers (“CTAs”), and certain of our subsidiaries have become members of the NFA in connection with the operation of certain of our products. The Commodity Exchange Act and related regulations generally impose certain registration, reporting and disclosure requirements on CPOs; CTAs; and products that utilize the futures, swaps and other derivatives that are subject to CFTC regulation. These rules adopted by the CFTC eliminated or limited previously available exemptions and exclusions from many CFTC requirements and impose additional registration and reporting requirements for operators of certain registered investment companies and certain other pooled vehicles that use or trade in futures, swaps and other derivatives that are subject to CFTC regulation. The CFTC or NFA may institute proceedings to enforce applicable rules and regulations, and violations may result in fines, censure or the termination of CPO and/or CTA registration and NFA membership.

State Laws and Regulations

As reflected above, certain of our activities, products, entities and employees are also subject to state laws and regulations. Those laws and regulations reinforce, supplement and, in certain cases, extend beyond the federal laws and regulations in various respects. For instance, the processing of personal information of California residents is subject to the California Consumer Privacy Act (“CCPA”), as amended by the California Privacy Rights Act (“CPRA”). Similar to the EU Global Data Protection Regulation, the CCPA and CPRA create rights in favor of natural persons and impose obligations on businesses for the handling, disclosure and deletion of personal information. Other U.S. states have adopted similarly comprehensive data privacy laws over the past several years. The failure to comply with applicable state laws and regulations may result in fines, heightened regulatory scrutiny, litigation and/or reputational harm.

International Regulation

UK

The Financial Conduct Authority (“FCA”) regulates certain of our subsidiaries, as well as products and services we offer and manage in the UK. The FCA’s powers are derived from the Financial Services and Markets Act 2000 (“FSMA”), and FCA authorization is required to conduct any investment management business in the UK under the FSMA. The FCA’s Handbook of Rules and Guidance governs UK-authorized firms’ capital resources requirements, senior management arrangements, systems and controls, conduct of business and interaction with clients and the markets. The FCA also regulates the design and manufacture of UK-domiciled investment funds intended for public distribution and, on a more limited basis, those that are for investment by professional investors.

Europe

Certain of our UK-regulated entities previously (until December 31, 2020) had to comply with a range of EU regulatory measures and are required to comply with EU law, which was transposed into UK legislation under the European Union (Withdrawal) Act of 2018 (“EUWA”). These measures include the Markets in Financial Instruments Directive (“MiFID II”). MiFID II regulates the provision of investment services and the conduct of investment activities throughout the European Economic Area (“EEA”), and the UK version of MiFID II (implemented through UK primary and secondary legislation under the EUWA and FCA rules) regulates the provision of similar services in the UK. MiFID II establishes detailed requirements for the governance, organization and conduct of business of investment firms and regulated markets. It also includes pre- and post-trade transparency requirements for equity markets and extensive transaction reporting requirements.

The EU’s Alternative Investment Fund Managers Directive (“AIFMD”) was transposed into EU member state law. AIFMD regulates managers of, and service providers to, alternative investment funds (“AIFs”) that are domiciled and offered in the EU and that are not authorized as retail funds under the UCITS directive discussed below. The AIFMD also regulates the marketing within the EU of all AIFs, including those domiciled outside the EU. Compliance with the AIFMD’s requirements may restrict AIF marketing and imposes compliance obligations in the form of remuneration policies; capital requirements; reporting requirements; leverage oversight; valuation; reporting stakes in EU companies; the domicile, duties and liability of custodians; and liquidity management. The UK has adopted the AIFMD rules principally via secondary legislation FCA rules.

UCITS are investment funds regulated at the EU level under the UCITS Directive V. UCITS are capable of being freely marketed throughout the EU on the basis of a single authorization in a member state — so-called passporting. UCITS covers a range of matters relating to UCITS, including the fund structure and domicile of UCITS, service providers to UCITS and marketing arrangements. In addition, UCITS funds are distributed in other jurisdictions outside the EU where marketing and sales are governed by local country-specific regulations. The UK has adopted the UCITS rules through the framework of secondary legislation and FCA rules, although UCITS established in the UK cannot benefit from the passporting arrangement described below.

Following the UK’s withdrawal from the EU (“Brexit”) on January 31, 2020, the UK and the EU entered into a transition period (“Transition Period”) during which directly effective EU law continued to apply in the UK, and the UK continued to be treated as a member state of the EU. The Transition Period ended on December 31, 2020, and since then, directly effective EU law is no longer applicable in the UK, although the UK has retained certain EU legislation governing financial services under the EUWA. One of the effects of the end of the Transition Period (irrespective of the retention of EU law under the EUWA) is that financial services firms authorized in the UK lost their passporting rights. “Passporting” is an arrangement under which firms authorized in an EU member state (or a non-EU state that is an EEA member) can rely on authorization in their “home” EEA member state to provide regulated services throughout the EEA. Because UK-authorized firms can no longer passport their services throughout the EEA, the extent to which UK-authorized firms can continue to provide services to customers in the EEA will now be dependent on regulatory requirements and regulators’ expectations in the individual EEA member states in which the UK-authorized firm wishes to provide services. Discussions between the EU and UK regarding equivalence of the EU and UK regulatory frameworks are ongoing. The way in which UK firms provide services in EEA member states may change depending on the outcome of these discussions.

Luxembourg

In Luxembourg, our subsidiary, Janus Henderson Investors Europe S.A. (“JHIESA”), is authorized and regulated by the Commission de Surveillance du Secteur Financier as a UCITS management company, with additional regulatory permissions to provide portfolio management services regulated under MiFID II. JHIESA has established six branches: Italy (Milan), Germany (Frankfurt), Spain (Madrid), France (Paris), the Netherlands (Amsterdam) and Denmark (Copenhagen). The main objective of these branches is the distribution of JHG products within the EU. Since September 2022, the Danish branch has also made use of JHIESA’s extended portfolio management permissions under MiFID II. JHIESA has been appointed management company of the following funds and fund structures:

| | ● | Two UCITS umbrella funds, incorporated under the laws of Luxembourg in the form of a SICAV; |

| | ● | One UCITS umbrella fund, incorporated under the laws of Ireland in the form of an umbrella investment company with segregated liability between funds with variable capital; and |

| | ● | One AIF umbrella fund, incorporated under the laws of Ireland in the form of an open-ended unit trust. |

Jersey

Janus Henderson Investors (Jersey) Limited is registered under Article 9 of the Financial Services (Jersey) Law 1998, as amended (“Law”) in respect of Fund Services Business. The company was established to operate a fund management business in Jersey, providing portfolio management services to funds and segregated mandates. The company is authorized and supervised by the Jersey Financial Services Commission in respect of its activities.

Switzerland

Janus Henderson Investors (Schweiz) AG (“JHI Schweiz”) is regulated by the Swiss Federal Act on Financial Services (“FinSA”). JHI Schweiz performs fund distribution of JHG funds in Switzerland and acts as the Swiss Representative Office for one of the JHG UK-authorized investment managers when marketing investment management services to Swiss investors. Under FinSA, the main requirements for JHI Schweiz are the affiliation to an ombudsman’s office, the client adviser registration, compliance manual, certain disclosures to investors and client segmentation.

United Arab Emirates

Janus Henderson Emerging Markets Private Investments Limited (“JHEMPIL”) is authorized and regulated by the Financial Services Regulatory Authority (“FSRA”) in the Abu Dhabi Global Market (“ADGM”) financial center. JHEMPIL conducts the regulated activities of managing collective investment funds, arranging deals in investments and advising on investments or credit. JHEMPIL is subject to the ADGM legal framework which includes the Abu Dhabi Law No 4 of 2013, which sets out the governance, legislative and regulatory framework and activities to be carried on in the ADGM and the Financial Services and Markets Regulations, which establishes the legislative and regulatory framework for financial services in ADGM. The investment strategies managed by JHEMPIL are private credit, private equity and regional real estate.

Singapore

In Singapore, our subsidiary, Janus Henderson Investors (Singapore) Limited (“JHISL”), is licensed with the Monetary Authority of Singapore (“MAS”) as a Capital Market Services License holder and an exempt financial adviser to conduct regulated activities in fund management and dealing in capital market products. It is subject to various laws, including the Securities and Futures Act, the Financial Advisers Act and the subsidiary legislation promulgated pursuant to these acts, which are administered by the MAS. Our asset management subsidiary and its employees conducting regulated activities specified in the Securities and Futures Act or the Financial Advisers Act are required to be licensed with the MAS. JHISL is also registered with South Korea’s Financial Services Commission (“FSC”) as a cross-border discretionary investment manager and investment advisor.

Australia

In Australia, several of our subsidiaries operate under an Australian Financial Services license, and their activities are governed primarily by the Corporations Act 2001 (Cth) and its associated regulations. Their main regulator is the Australian Securities and Investments Commission (“ASIC”), which is Australia’s integrated corporate, markets, financial services and consumer credit regulator. ASIC imposes certain conditions on licensed financial services organizations that apply to our subsidiaries, including requirements relating to capital resources, operational capability and controls. Multiple subsidiaries also act as product issuers for ETFs that are Quoted Managed Funds on the Cboe exchange (“Cboe”) and the AQUA market of the Australian Securities Exchange (“ASX”). Therefore, our subsidiaries must comply with the Cboe operating rules and procedures as well as the ASX Operating Rules and the ASX Operating Rules Procedures. Another key regulator is the Australian Transaction Reports and Analysis Centre (“AUSTRAC”), which applies a number of reporting and other obligations under the Anti-Money Laundering and Countering Financing of Terrorism Act 2006 (“AML/CFT Act”).

Hong Kong

In Hong Kong, our subsidiary, Janus Henderson Investors Hong Kong Limited, is subject to the Securities and Futures Ordinance (“SFO”) and related legislation, which govern the securities and futures markets and regulate the offerings of investments to the public. This legislation is administered by the Securities and Futures Commission (“SFC”), which is also empowered under the SFO to establish standards for compliance as well as codes and guidelines. Our subsidiary and its employees conducting any of the regulated activities specified in the SFO are required to be licensed with the SFC and are subject to the rules, codes and guidelines issued by the SFC from time to time.

Japan

In Japan, our subsidiary, Janus Henderson Investors (Japan) Limited, is subject to the Financial Instruments and Exchange Act and the Act on Investment Trusts and Investment Corporations. These laws are administered and enforced by the Japanese Financial Services Agency, which establishes standards for compliance, including capital adequacy and financial soundness requirements, customer protection requirements and conduct of business rules.

This regulatory agency has broad supervisory and disciplinary powers, including, among others, the power to temporarily or permanently revoke the authorization to conduct regulated business, suspend registered employees, and censure and fine both regulated businesses and their registered employees.

Other

Our operations in Ireland are regulated by the Central Bank of Ireland.

Many of the non-U.S. securities exchanges and regulatory authorities have imposed rules (and others may impose rules) relating to capital requirements applicable to our foreign subsidiaries. These rules, which specify minimum capital requirements, are designed to measure general financial integrity and liquidity, and require that a minimum amount of assets be kept in relatively liquid form.

ESG and Climate Disclosure Regulations

ESG topics and climate-related disclosures continue to be the focus of increased regulatory scrutiny across jurisdictions. While there is uncertainty regarding federal regulations on ESG disclosure under the new administration in the U.S., we expect state laws and regulations regarding these topics to continue to evolve and impose new and additional requirements. Outside of the U.S., the EU has published the corporate sustainability reporting directive (“CSRD”) which requires EU businesses to report on the environmental and social impact of their business activities, and on the business impact of their ESG efforts and initiatives. In the UK, the FCA published a new regime on sustainability disclosure requirements (“SDR”) and investment labels, which will be applicable to our UK subsidiaries in 2024. We are continuing to evaluate how the evolving regulations will impact JHG and its subsidiaries.

Available Information

We make available free of charge our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments thereto as soon as reasonably practicable after such filings are made with the SEC. These reports may be obtained through our Investor Relations website (ir.janushenderson.com) and are available in print at no charge upon request by any shareholder. The contents of our website are not incorporated herein for any purpose. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

Charters for the Audit Committee, Human Capital and Compensation Committee, Governance and Nominations Committee, and Risk Committee of our Board of Directors, as well as our Corporate Governance Guidelines, Code of Business Conduct and Code of Ethics for Senior Financial Officers (our “Senior Officer Code”) are posted on the Investor Relations website (ir.janushenderson.com) and are available in print at no charge upon request by any shareholder. Within the time period prescribed by the SEC and New York Stock Exchange (“NYSE”) regulations, we will post on our website any amendment to our Senior Officer Code or our Code of Business Conduct and any waivers thereof for directors or executive officers. The information on our website is not incorporated by reference into this report.

Corporate Information

We are a public limited company incorporated in Jersey, Channel Islands, and tax resident in the UK. Our registered address in Jersey, Channel Islands is 13 Castle Street, St Helier, Jersey JE1 1ES. Our principal business address is 201 Bishopsgate, London, EC2M 3AE, United Kingdom, and our telephone number is +44 (0) 20 7818 1818.

An investment in our common stock involves various risks, including those mentioned below and those that are discussed from time to time in our periodic filings with the SEC. Investors should carefully consider these risks, along with the other information contained in this report, before making an investment decision regarding our common stock. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. Any of these risks could have a material adverse effect on our financial condition, results of operations and value of our common stock.

Market and Investment Performance Risks

Our results of operations and financial condition are primarily dependent on the value, composition and relative investment performance of our AUM, all of which are subject to fluctuation caused by factors outside of our control.

We derive our revenues primarily from investment management and related services we provide to institutional and retail investors worldwide through our investment products. Our investment management fees typically are calculated as a percentage of the market value of our AUM. Certain of our investment products are also subject to performance fees, which vary based on a product’s relative performance as compared to a benchmark index. As a result, our revenues are dependent on the value, composition and investment performance of our AUM, all of which are subject to fluctuation caused by factors outside of our control.

Factors that could cause our AUM and revenue to decline include the following:

| | ● | Declines in equity markets. Our AUM is concentrated in the U.S. and European equity markets. Equity securities may decline in value as a result of many factors, including an issuer’s actual or perceived financial condition and growth prospects, investor perception of an industry or sector, changes in currency exchange rates, changes in regulations, inflation, labor disputes or shortages, supply chain issues, natural disasters, and geopolitical and economic risks. Declines in the equity markets, or in the market segments in which our investment products are concentrated, have in the past, and could in the future, cause our AUM to decrease. |

| | ● | Declines in fixed income markets. Fixed income investment products also constitute a large portion of our AUM. Fixed income securities may decline in value as a result of various factors, principally increases in interest rates (partly due to inflationary expectations), changes in currency exchange rates, changes in relative yield among instruments with different maturities (including as a result of shifts in the U.S. treasury yield curve), geopolitical and general economic risks, available liquidity in the markets in which a security trades, an issuer’s actual or perceived creditworthiness, or an issuer’s ability to meet its obligations. Declines in the fixed income markets, or in the market segments in which our investment products are concentrated, have in the past, and could in the future, cause our AUM to decrease. |

| | ● | Investment performance. Our investment performance, along with achieving and maintaining superior distribution and client service, is critical to the success of our business. Strong investment performance has historically stimulated sales of our investment products. Poor investment performance as compared to third-party benchmarks or competitive products has in the past, and could in the future, lead to a decrease in sales of investment products we manage and stimulate redemptions from existing products, generally lowering the overall level of our AUM and reducing our management fees, and may have an adverse effect on our revenue and net income. In addition, certain of our investment products are subject to performance fees that are based either on investment performance as compared to an established benchmark index or on positive absolute return over a specified period of time. If our investment products that are subject to performance fees underperform, our revenue, results of operations and financial condition may be adversely affected. In addition, performance fees subject our revenue to increased volatility. No assurance can be given that past or present investment performance in the investment products we manage is indicative of future performance. |

Our revenue and profitability would be adversely affected by any reduction in our AUM as a result of redemptions and other withdrawals from the funds and accounts we manage.

Investors may reduce their investments in the funds and accounts we manage, or reduce their investments generally, for many reasons, including:

| | ● | In response to adverse market conditions; |

| | ● | To pursue other investment opportunities; |

| | ● | To reallocate investments to lower-fee strategies; |

| | ● | To take profits from their investments; |

| | ● | As a result of poor investment performance of the funds and accounts we manage; |

| | ● | As a result of the failure or negative performance of investment products offered by competitors that could lead investors to lose confidence in similar investment products we manage, irrespective of the investment performance of such products; |

| | ● | As a consequence of damage to our reputation; |

| | ● | Due to portfolio risk characteristics, which could cause investors to move assets to other investment managers; or |

| | ● | As a result of changes to the investor’s business model that could cause them to reduce their investments with us, such as moving away from a sub-advised business model or exiting the mutual fund business. |

In addition, the loss of key personnel or significant investment management professionals could reduce the attractiveness of our products to current and potential clients and adversely affect our revenues and profitability.

Volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results.

The capital and credit markets may, from time to time, experience volatility and disruption worldwide. Declines in global financial market conditions have in the past, and could in the future, result in significant decreases in our AUM, revenues and income. Such declines have had, and may in the future have, an adverse impact on our results of operations. We may need to modify our business, strategies or operations, and we may be subject to additional constraints or costs in order to compete in a changing global economy and business environment.

Disruptions in the markets, to market participants and to the operations of third parties whose functions are integral to our ETF platforms may adversely affect the prices at which ETFs trade, particularly during periods of market volatility.

The trading price of an ETF’s shares or units fluctuates continuously throughout trading hours. While an ETF’s creation/redemption feature and the arbitrage mechanism are designed to make it more likely that the ETF’s shares or units normally will trade at prices close to the ETF’s net asset value (“NAV”), exchange prices may deviate significantly from the NAV. ETF market prices are subject to numerous potential risks, including:

| | ● | Significant market volatility; |

| | ● | Imbalances in supply and demand; |

| | ● | Trading halts invoked by a stock exchange; and |

| | ● | Inability or unwillingness of market markers, authorized participants, settlement systems or other market participants to perform functions necessary for an ETF’s arbitrage mechanism to function effectively. |

If market events lead to instances where an ETF trades at prices that deviate significantly from the ETF’s NAV or indicative value, or trading halts are invoked by the relevant stock exchange or market, investors may lose confidence in ETF products and sell their holdings, which may cause the ETF’s AUM, revenue and earnings to decline.

Illiquidity in certain securities in which we invest may negatively impact the financial condition of our investment products and may impede our ability to effect redemptions.

Some of our funds or mandates invest in certain securities or other assets in which the secondary trading market is illiquid or does not exist. Illiquidity may occur with respect to the securities of a specific issuer, based on industry, sector or geographic region, or with respect to an asset class or an investment type. An illiquid trading market may increase market volatility and may make it difficult to sell investments promptly without suffering a loss. This may have an adverse impact on the investment performance of such funds and mandates, and on our AUM, revenues and results of operations.

Investors in certain funds we manage have contractual terms that provide for a shorter notice period for redemptions or withdrawals than the time period during which these funds may be able to sell underlying investments within the fund. This liquidity mismatch may be exacerbated during periods of market illiquidity and, in circumstances in which there are high levels of investor redemptions, it may be necessary for us to impose restrictions on redeeming investors or suspend redemptions. Such actions could increase the risk of legal claims by investors and regulatory investigations and/or fines and may adversely affect our reputation.

Changes in the value of our seeded investment products could adversely affect our earnings and financial condition.

We have a significant seed portfolio. Periodically, we add new investment strategies to our investment product offering and provide the initial cash investment, or seeding, to facilitate the launch of the new product. We may also provide substantial supplemental capital to an existing investment product to accelerate the growth of a strategy and attract outside investment in the product. A decline in the valuation of these seeded investments could negatively impact our earnings and financial condition.

We could be adversely impacted by changes in assumptions used to calculate pension assets and liabilities.

We provide retirement benefits for our current and former employees in the UK through the Janus Henderson Group Pension Scheme (“UK Pension Scheme”). The UK Pension Scheme operates a number of defined benefit sections, which closed to new entrants on November 15, 1999, and a money purchase section. As of December 31, 2024, the UK Pension Scheme had a net pension asset of $68.3 million. Our funding obligations for the UK Pension Scheme may be adversely affected by many factors, including poorer than expected long-term return on plan assets; longer life expectancy; changes in actuarial assumptions by reference to which our contributions are assessed, such as changes to assumptions on interest rates and inflation; changes to the regulatory regime for funding defined benefit pension schemes in the UK; and other factors. We may also be subject to obligations to contribute funds or take other action imposed by the Pension Protection Fund in connection with the UK Pension Scheme. If we were required to increase our contributions in the future to cover any increased funding shortfall, levy by the Pension Protection Fund and/or expenses in the UK Pension Scheme, our results and financial condition could be adversely affected.

The global scope of our business subjects us to currency exchange rate risk that may adversely impact revenue and income.

We generate a substantial portion of our revenue in Great British pounds (“GBP”), euros (“EUR”) and Australian dollars (“AUD”). As a result, we are subject to foreign currency exchange risk relative to the U.S. dollar (“USD”), our financial reporting currency, through our non-U.S. operations, including through our exposure to non-USD income, expenses, assets and liabilities of our overseas subsidiaries, as well as net assets and liabilities denominated in a currency other than USD. Fluctuations in the exchange rates to the USD have adversely affected, and may continue to adversely affect, our financial results from one period to the next. In addition, there is risk associated with the foreign exchange revaluation of balances held by certain of our subsidiaries for which the local currency is different from our functional currency.

We could be impacted by counterparty or client defaults.

In periods of significant market volatility, the deteriorating financial condition of one financial institution may materially and adversely impact the performance of others. We, and the funds and accounts we manage, have exposure to many different counterparties, and routinely execute transactions with counterparties across the financial industry. As a result, we and our managed funds and accounts may be exposed to credit, operational or other risks in the event of a default by a counterparty or client, or in the event of other unrelated systemic market failures.

Business and Strategic Risks

We operate in a highly competitive environment, and revenue from fees may be reduced.

The investment management business is highly competitive. In recent years, established firms and new entrants to the asset management industry have expanded their application of technology, including the use of robo advisers and artificial intelligence (“AI”), to provide services to clients. Our traditional fee structures may be subject to downward pressure due to these factors. Moreover, the asset management industry is facing transformative pressures and trends from a variety of different sources, including a trend toward lower fee investment products, as evidenced by the movement toward passively managed mutual funds and the growth of lower cost funds such as exchange-traded, smart beta and quantitative funds. Fees for actively managed investment products may continue to come under increased pressure if such products fail to outperform returns for comparable passively managed products or as a consequence of regulatory intervention. Fee reductions on existing or future new business, as well as changes in regulations pertaining to fees, could adversely affect our results of operations and financial condition. Additionally, we compete with investment management companies on the basis of investment performance, fees, diversity of products, distribution capability, scope and quality of services, reputation and the ability to develop new investment products to meet the changing needs and preferences of investors. Failure to adequately compete could adversely affect our AUM, results of operations and financial condition.

Our success depends on our key personnel, and our financial performance could be negatively affected by the loss of their services.

The success of our business is highly dependent on our ability to attract, retain and motivate highly skilled and often highly specialized technical, executive, sales and investment management personnel. The market for qualified investment and sales professionals is extremely competitive and is characterized by the frequent movement of portfolio managers, analysts and salespeople among different firms. Any changes to management structure, shifts in corporate culture, changes to corporate governance authority, or adjustments or reductions to compensation could affect our ability to retain key personnel and could result in legal claims. To retain certain key personnel, we may be required to increase compensation to such individuals, resulting in additional expense. Laws and regulations could impose restrictions on the amount of compensation paid by financial institutions, as well as the processes for paying and deferring compensation, which could restrict our ability to compete effectively for qualified professionals. In addition, technological advancements in our industry, including with respect to AI and machine learning technologies, could result in increased demand and competition for qualified professionals with such skills and technological knowledge. There can be no assurance that we will be successful in finding, attracting and retaining qualified individuals, and the departure of key personnel, particularly those personnel responsible for managing client funds that account for a high proportion of our revenue, could cause us to lose clients, which could have a material adverse effect on our AUM, results of operations and financial condition. Effective succession planning is also important to our long-term success. Failure to ensure effective transfer of knowledge and smooth transitions involving key employees could hinder our strategic planning and execution.

We are dependent upon third-party distribution channels to access clients and potential clients.

Our ability to market and distribute our investment products is significantly dependent on access to the client base of financial intermediaries, such as insurance companies, defined contribution plan administrators, securities firms, broker-dealers, financial advisors, multi-managers, banks and other distribution channels. These companies generally offer their clients’ various investment products in addition to, and competitive with, products offered by us. In addition, our existing relationships with third-party distributors and access to new distributors could be adversely affected by recent consolidation within the financial services industry. Consolidation may result in increased distribution costs, a reduction in the number of third parties distributing our investment products or increased competition to access third-party distribution channels. Moreover, fiduciary regulations have led to significant shifts in distributors’ business models and more limited product offerings, and additional fiduciary or other regulations could lead to further changes, potentially resulting in reduced distribution of certain of our products. Our inability to access clients through third-party distribution channels could adversely affect our business prospects, AUM, results of operations and financial condition.

The global scope of our business subjects us to market-specific political, economic and other risks that may adversely impact our revenue and income generated overseas.

Our global portfolios and revenue derived from managing these portfolios are subject to significant risks of loss as a result of political, economic and diplomatic developments; currency fluctuations; social instability; global hostilities; changes in governmental policies, regulation and enforcement; expropriation; nationalization; asset confiscation; and changes in legislation related to ownership of non-U.S. securities.

Individual financial, equity, debt and commodity markets may be adversely affected by financial, economic, political, electoral, diplomatic or other instabilities that are particular to the country or region in which a market is located, and such events may also adversely impact other markets. Global economic conditions also affect the mix, market values and levels of our AUM and are difficult to predict. Political, economic and environmental events in any country or region could result in significant declines in equity and/or fixed income securities with exposure to such a country or region and, to the extent that we have a concentration of AUM in such a country or region, could result in a material adverse effect on our AUM, results of operations and financial condition. For example, the ongoing conflicts in Ukraine and the Middle East have significantly impacted the global economy and financial markets and may continue to have an adverse impact on our investment performance and flows in certain products. There is a risk that these conflicts, as well as any future conflicts, may spread more broadly, increasing the potential adverse impact on our AUM, results of operations and financial condition. We will continue to monitor any direct and indirect impacts of these circumstances on our business, financial results and operations, although it is not possible to predict the broader consequences of these ongoing conflicts at this time.

In addition, international trading markets, particularly in some emerging market countries, are often smaller, less liquid, less regulated and significantly more volatile than those in the U.S. Local regulatory environments may vary widely in terms of scope, adequacy and sophistication. Moreover, regulators in non-U.S. jurisdictions could change their policies or laws in a manner that might restrict or otherwise impede our ability to distribute or authorize products or maintain our authorizations in their respective markets. Similarly, local distributors and their policies and practices, as well as financial viability, may also vary widely or be inconsistent, less developed or less mature than other, more internationally focused distributors. As our business grows in non-U.S. markets, any ongoing and future business, political, economic or social unrest affecting these markets may have a negative impact on the long-term investment climate in these and other areas, and, as a result, our AUM and the revenue and income we generate from these markets may be negatively affected.

Our reputation is critical to the success of our business. Harm to our reputation could reduce our AUM and impact sales, which could adversely affect our revenue and net income.

We believe that our brand name is well-received both in the asset management industry and with our clients, reflecting the fact that our brand, like our business, is based in part on trust and confidence. If our reputation is harmed, existing clients may reduce their investments or withdraw from funds we manage, or funds may terminate or reduce AUM under their management agreements with us, which could reduce our AUM and negatively impact our revenue and profitability.

As part of our business, we are required to continuously manage actual and potential conflicts of interest, including situations where our services to a particular client conflict, or are perceived to conflict, with the interests of another client or those of JHG or our employees. The willingness of clients to enter into transactions in which such a conflict might arise may be affected if we fail, or appear to fail, to deal appropriately with conflicts of interest. In addition, failure to appropriately manage potential, perceived or actual conflicts could damage our reputation and give rise to litigation or regulatory enforcement actions.

Our reputation could also be damaged by factors such as:

| | ● | Litigation; |

| | ● | Regulatory action; |

| | ● | Loss of key personnel; |

| | ● | Operational failures; |

| | ● | Underperformance of our investment products; |

| | ● | Fraud, misconduct or mismanagement, theft, loss or misuse of client data by our personnel or third parties; |

| | ● | Failure to manage conflicts of interest or satisfy fiduciary responsibilities; and |

| | ● | Negative publicity or press speculation (whether or not any such allegations or claims are valid or ultimately disproved, dismissed or withdrawn). |

Reputational harm may cause us to lose current clients and we may be unable to continue to attract new clients or develop new business. If we fail to effectively address the underlying causes of any harm to our reputation, our financial results and future business prospects would likely be adversely affected.

The carrying value of goodwill and other intangible assets on our balance sheet could become impaired, which would adversely affect our results of operations.

At December 31, 2024, our goodwill and intangible assets totaled $4,023.7 million. The value of these assets may not be realized for a variety of reasons, including significant redemptions, loss of clients, damage to brand name and unfavorable economic conditions. We have recorded goodwill and intangible asset impairments in the past and could incur similar charges in the future. Under U.S. GAAP, goodwill and intangible assets with indefinite lives are not amortized but are tested for impairment annually or more often if an event or circumstance indicates that an impairment loss may have been incurred. Other intangible assets with finite lives are amortized on a straight-line basis over their estimated useful lives and reviewed whenever there is an indication of impairment. Should such reviews indicate impairment, a reduction of the carrying value of the intangible asset could occur, resulting in a charge that may, in turn, adversely affect our results of operations and financial condition.

Our business depends on investment management agreements that are subject to termination, non-renewal or reductions in fees.

We derive revenue from investment management agreements with investment funds, institutional investors and other investors. These agreements generally provide investors or, in some cases, the independent directors of applicable investment funds, with significant latitude to terminate such contracts, withdraw funds or liquidate funds, or to remove Janus Henderson as a fund's investment advisor (or equivalent). We also manage our U.S. mutual funds under management agreements that may be terminated by either party with notice, or in the event of an “assignment” (as defined in the Investment Company Act), and must be approved and renewed annually by the independent members of each fund’s board of directors or trustees or its shareholders, as required by law. U.S. mutual funds, investment funds or other investors may choose to exercise such termination rights at any time. The annual review of investment management agreements with U.S. mutual funds, as required by law, could result in a reduction in our advisory fee revenues. The termination of, or failure to renew, one or more of these agreements could have a material adverse effect on our AUM, results of operations and financial condition.

Our expenses are subject to fluctuations that could materially affect our operating results.

Our results of operations are dependent on our level of expenses, which can vary significantly for many reasons, including:

| | ● | Changes in the level and scope of our operating expenses in response to market conditions or regulations; |

| | ● | Variations in the level of total compensation expense due to changes in bonuses and stock-based awards, changes in employee benefit costs due to regulatory or plan design changes, changes in our employee count and mix, competitive factors, market performance and other factors; |

| | ● | Expenses incurred to support distribution of our investment strategies and services, develop new strategies and services, and enhance our technology, compliance and other infrastructure; |

| | ● | Impairments of intangible assets or goodwill; and |

| | ● | Impact of inflation and interest rate changes. |

Increases in the level of our expenses, or our inability to reduce the level of expenses when necessary, could materially affect our operating results.

We may engage in strategic transactions that could pose risks to our business, financial condition and global operations.