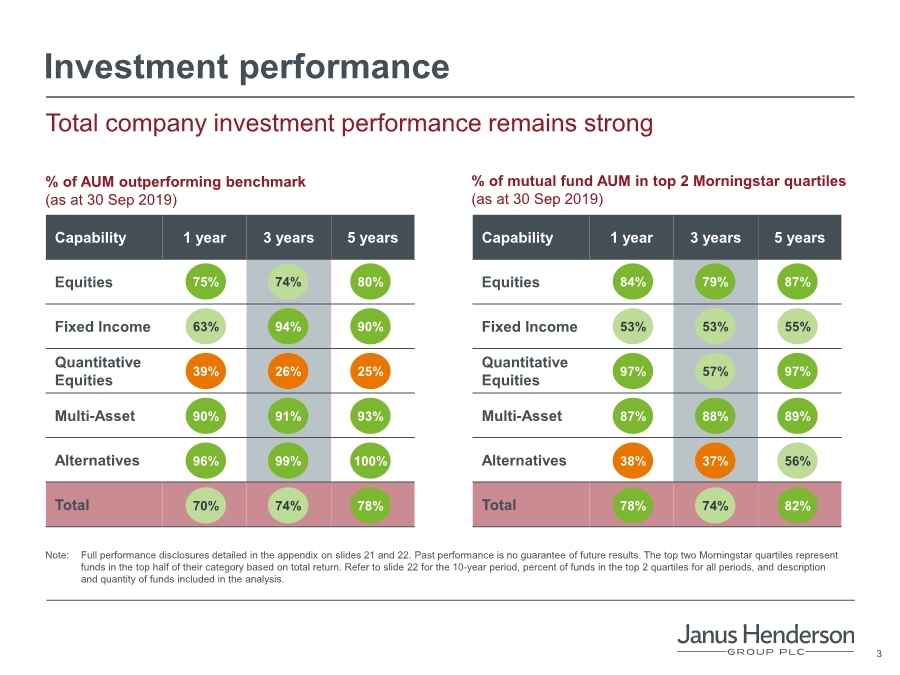

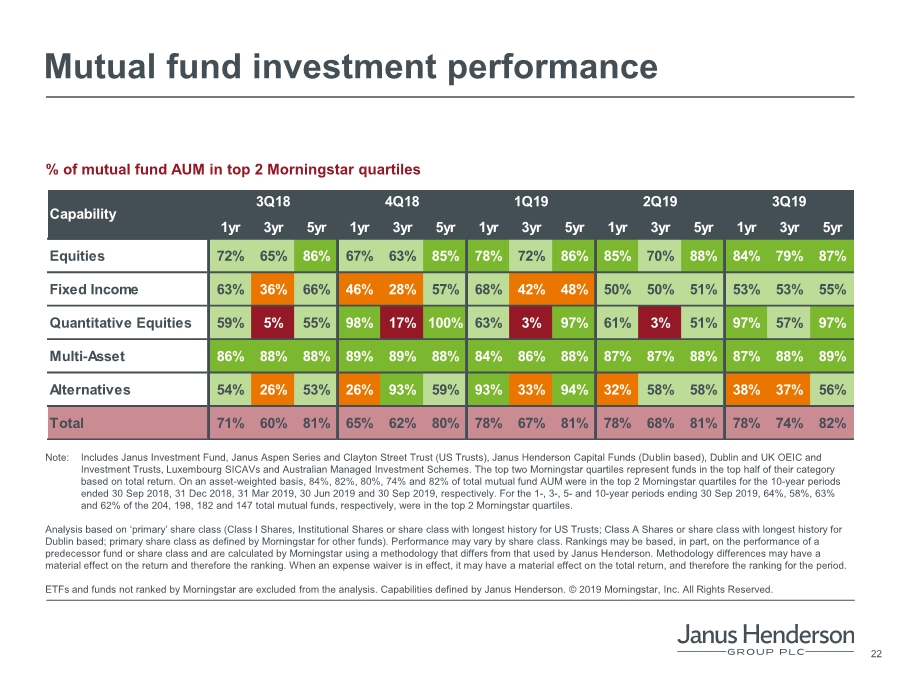

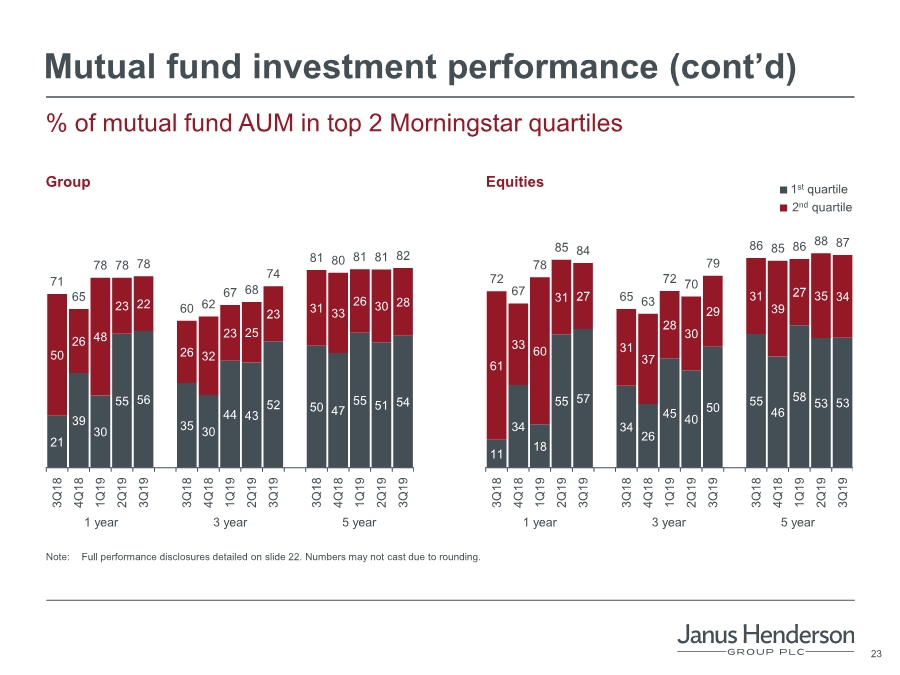

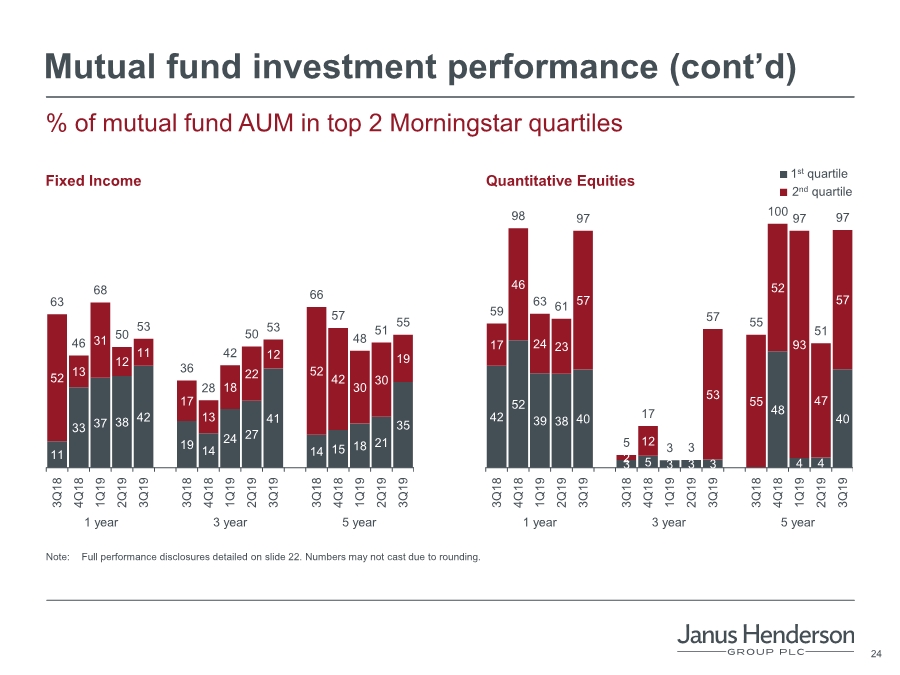

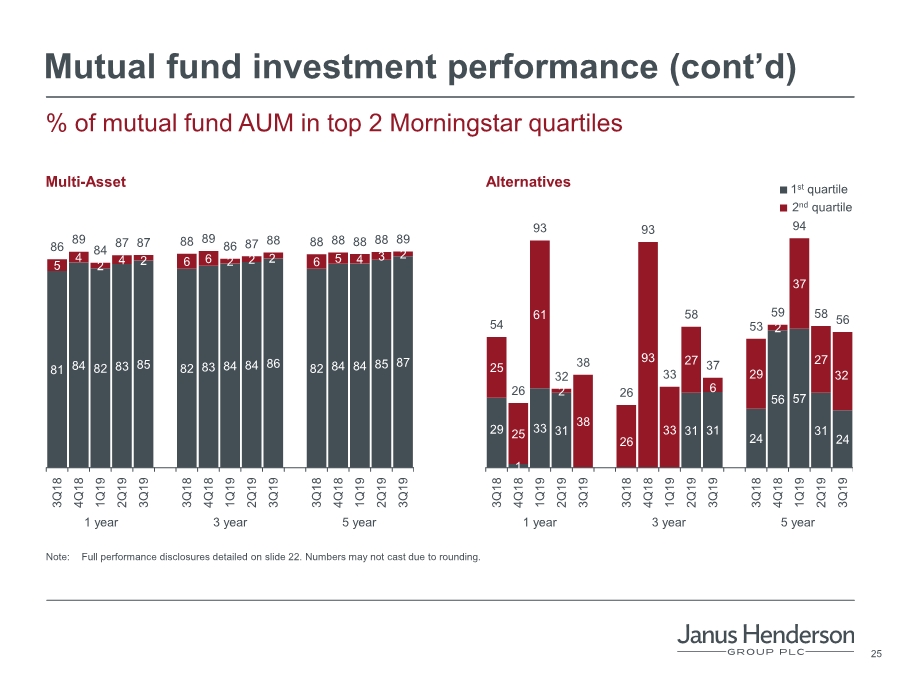

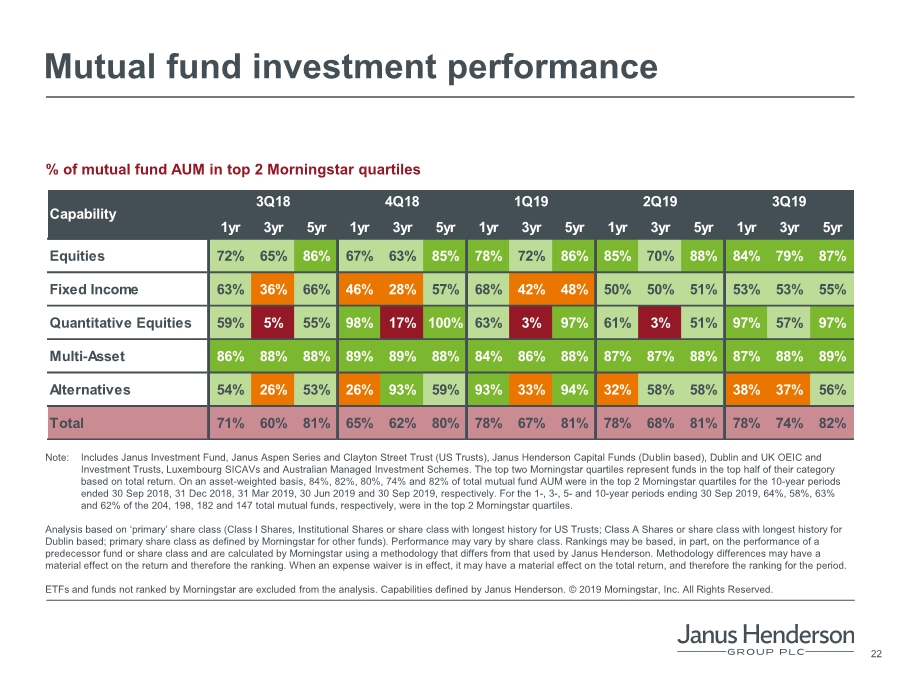

| 22 Mutual fund investment performance % of mutual fund AUM in top 2 Morningstar quartiles Note: Includes Janus Investment Fund, Janus Aspen Series and Clayton Street Trust (US Trusts), Janus Henderson Capital Funds (Dublin based), Dublin and UK OEIC and Investment Trusts, Luxembourg SICAVs and Australian Managed Investment Schemes. The top two Morningstar quartiles represent funds in the top half of their category based on total return. On an asset-weighted basis, 84%, 82%, 80%, 74% and 82% of total mutual fund AUM were in the top 2 Morningstar quartiles for the 10-year periods ended 30 Sep 2018, 31 Dec 2018, 31 Mar 2019, 30 Jun 2019 and 30 Sep 2019, respectively. For the 1-, 3-, 5- and 10-year periods ending 30 Sep 2019, 64%, 58%, 63% and 62% of the 204, 198, 182 and 147 total mutual funds, respectively, were in the top 2 Morningstar quartiles. Analysis based on ‘primary’ share class (Class I Shares, Institutional Shares or share class with longest history for US Trusts; Class A Shares or share class with longest history for Dublin based; primary share class as defined by Morningstar for other funds). Performance may vary by share class. Rankings may be based, in part, on the performance of a predecessor fund or share class and are calculated by Morningstar using a methodology that differs from that used by Janus Henderson. Methodology differences may have a material effect on the return and therefore the ranking. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period. ETFs and funds not ranked by Morningstar are excluded from the analysis. Capabilities defined by Janus Henderson. © 2019 Morningstar, Inc. All Rights Reserved. 1yr 3yr 5yr 1yr 3yr 5yr 1yr 3yr 5yr 1yr 3yr 5yr 1yr 3yr 5yr Equities 72% 65% 86% 67% 63% 85% 78% 72% 86% 85% 70% 88% 84% 79% 87% Fixed Income 63% 36% 66% 46% 28% 57% 68% 42% 48% 50% 50% 51% 53% 53% 55% Quantitative Equities 59% 5% 55% 98% 17% 100% 63% 3% 97% 61% 3% 51% 97% 57% 97% Multi-Asset 86% 88% 88% 89% 89% 88% 84% 86% 88% 87% 87% 88% 87% 88% 89% Alternatives 54% 26% 53% 26% 93% 59% 93% 33% 94% 32% 58% 58% 38% 37% 56% Total 71% 60% 81% 65% 62% 80% 78% 67% 81% 78% 68% 81% 78% 74% 82% 3Q19 Capability 3Q18 4Q18 1Q19 2Q19 |