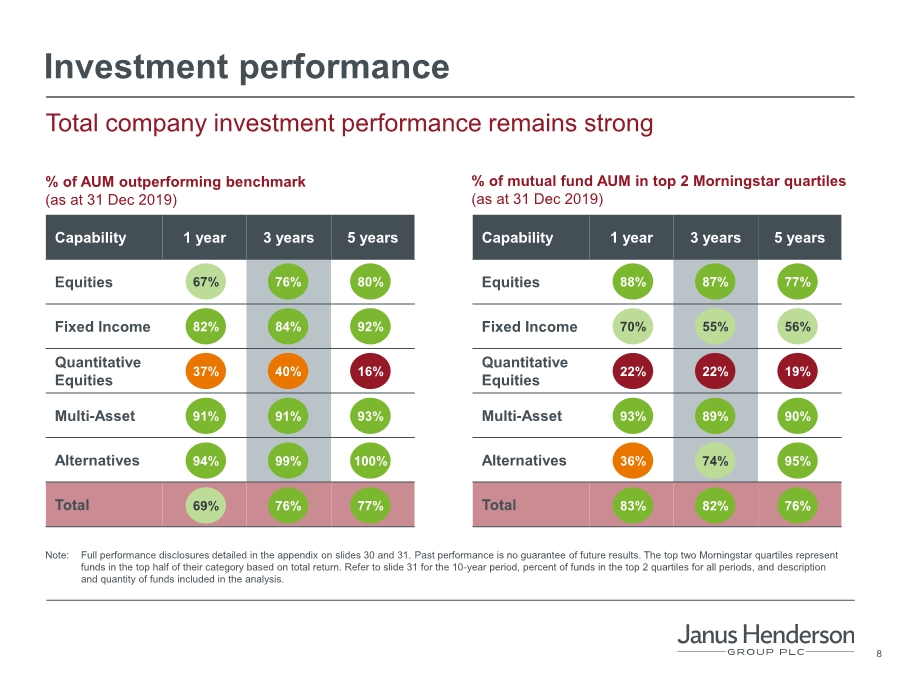

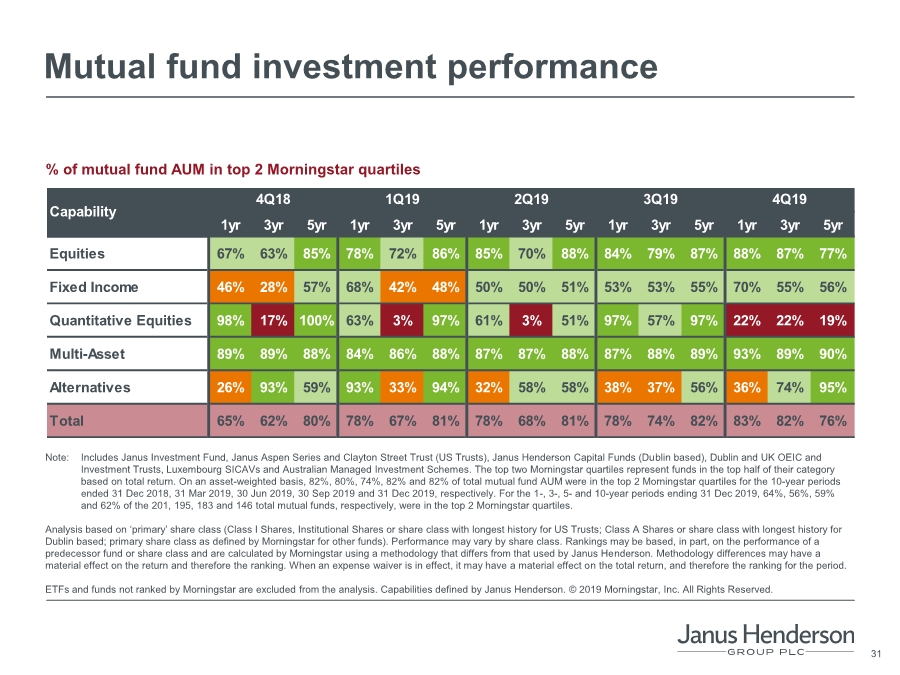

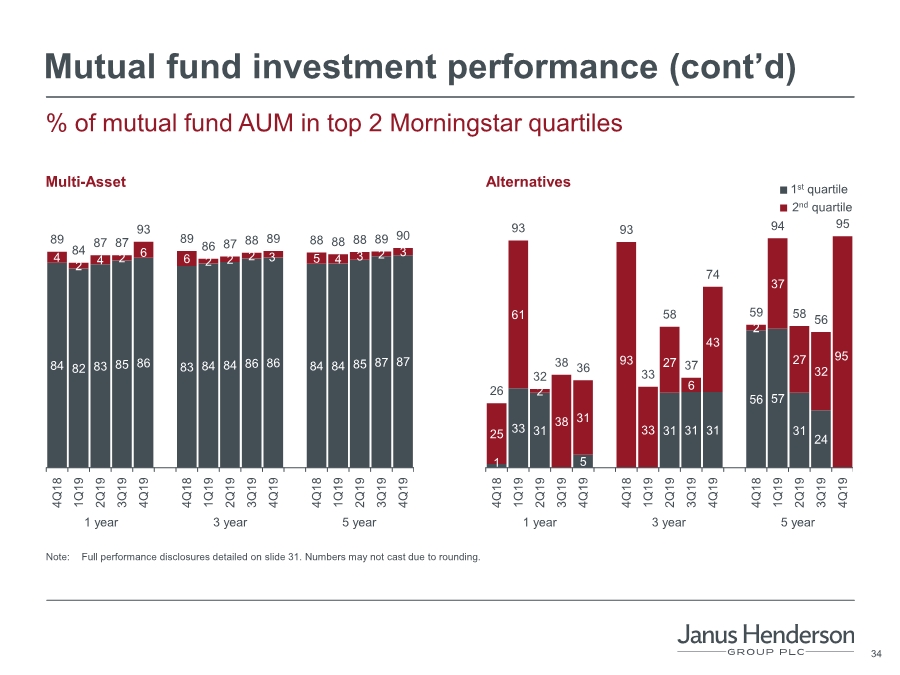

| 44 Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar RatingTM metrics. The Morningstar RatingTM for funds, or ‘star rating’, is calculated for funds with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. Ratings may vary by share class. As at 31 Dec 2019, 77%, 70% and 70% of US mutual fund assets under management have a 4 or 5 star Morningstar RatingTM for the 3-, 5-, and 10-year periods, respectively. As at 31 Dec 2019, 53%, 58%, 49% and 46% of US mutual funds have a 4 or 5 star Morningstar RatingTM for the Overall, 3-, 5-, and 10-year periods, respectively. Based on primary share class (Class I Shares, Institutional Shares or share class with longest history) for 55, 55, 53 and 39 funds for the Overall, 3-, 5- and 10-year periods, respectively. Ratings and/or rankings may be based, in part, on the performance of a predecessor fund or share class and are calculated by Morningstar using a methodology that differs from that used by Janus Henderson. Methodology differences may have a material effect on the return and therefore the rating/ranking. When an expense waiver is in effect, it may have a material effect on the total return or yield, and therefore the ranking and/or rating for the period. Forward looking information This presentation includes statements concerning potential future events involving Janus Henderson Group plc that could differ materially from the events that actually occur. The differences could be caused by a number of factors including those factors identified in Janus Henderson Group’s Annual Report on Form 10-K for the fiscal year ended 31 December 2018, on file with the Securities and Exchange Commission (Commission file no. 001-38103), including those that appear under headings such as ‘Risk Factors’ and ‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’. Many of these factors are beyond the control of the company and its management. Any forward-looking statements contained in this presentation are as of the date on which such statements were made. The company assumes no duty to update them, even if experience, unexpected events, or future changes make it clear that any projected results expressed or implied therein will not be realised. Annualised, pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results. No public offer The information, statements and opinions contained in this presentation do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of any offer to buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. Not all products or services are available in all jurisdictions. Mutual funds in the US distributed by Janus Henderson Distributors. Please consider the charges, risks, expenses and investment objectives carefully before investing. For a US fund prospectus or, if available, a summary prospectus containing this and other information, please contact your investment professional or call 800.668.0434. Read it carefully before you invest or send money. Janus Henderson, Janus, Henderson, Intech and Knowledge. Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. Janus Henderson Investors 201 Bishopsgate, London EC2M 3AE Tel: 020 7818 1818 Fax: 020 7818 1819 |