Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

HLCSQ similar filings

- 1 Nov 07 Helicos BioSciences Reports Third Quarter 2007 Financial Results

- 3 Oct 07 Departure of Directors or Principal Officers

- 18 Sep 07 Regulation FD Disclosure

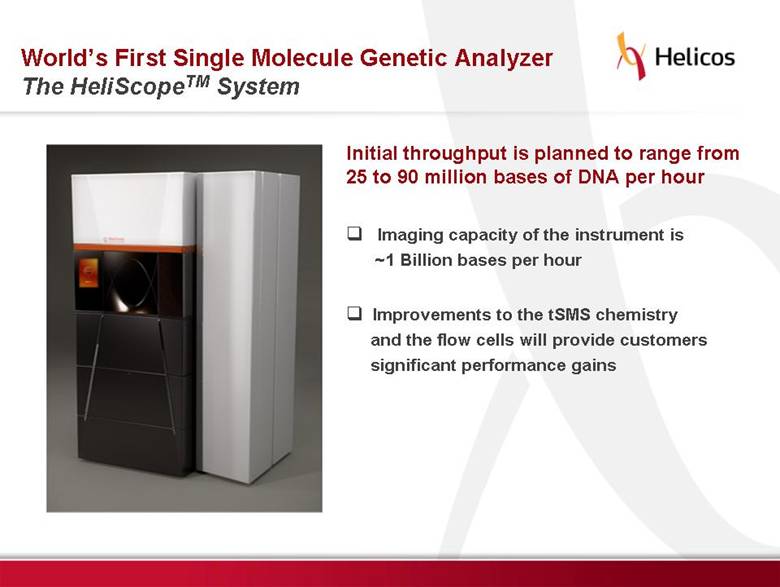

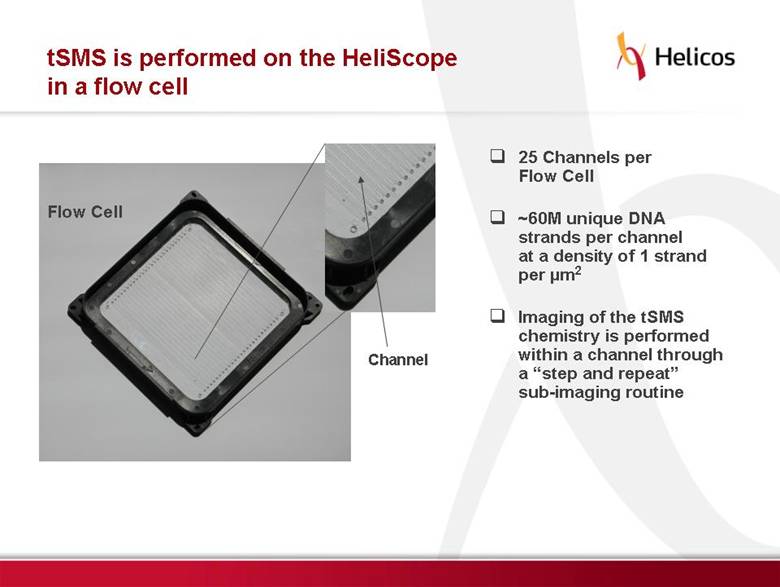

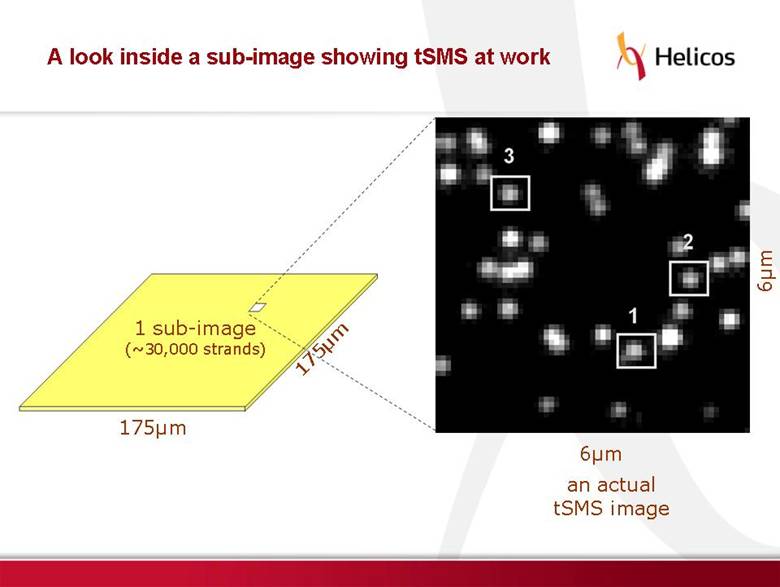

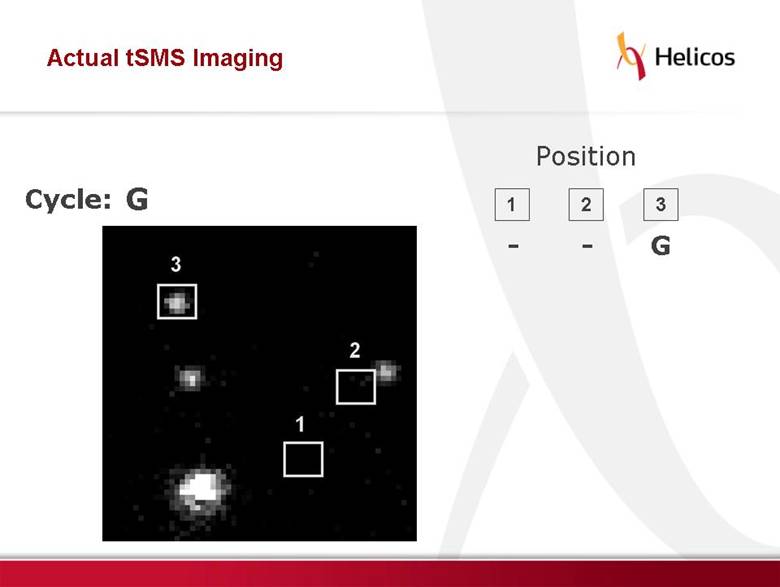

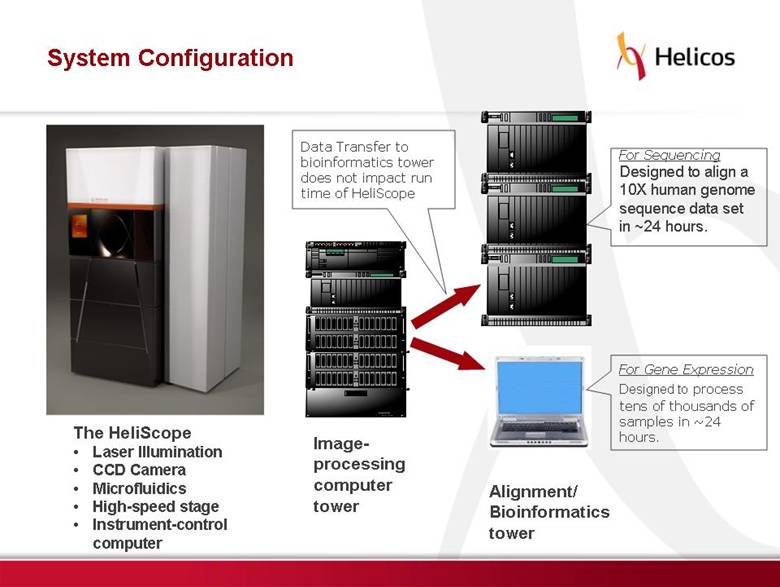

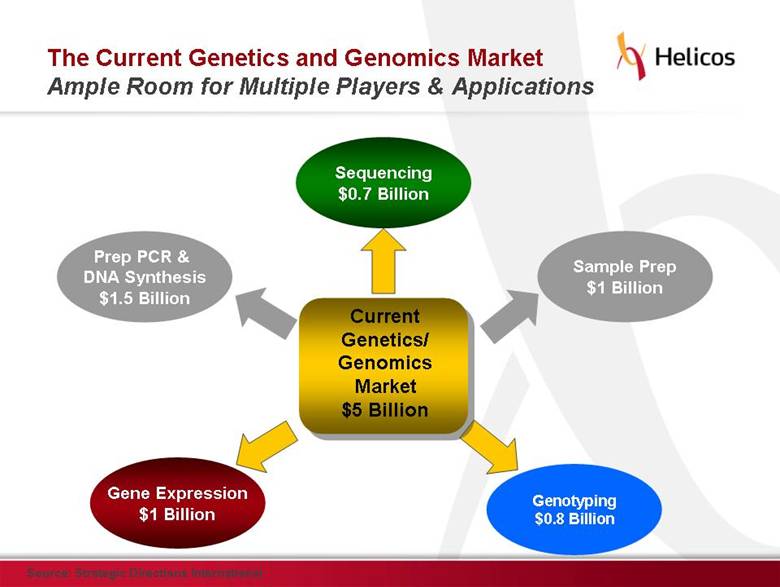

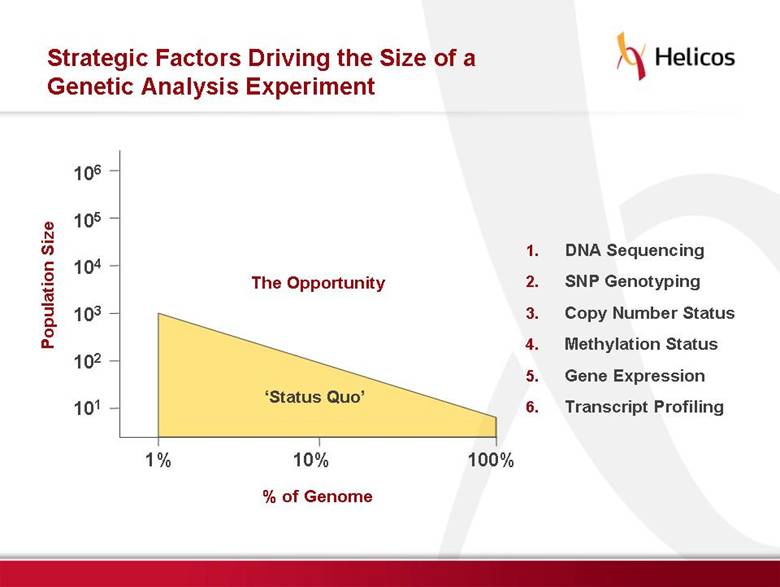

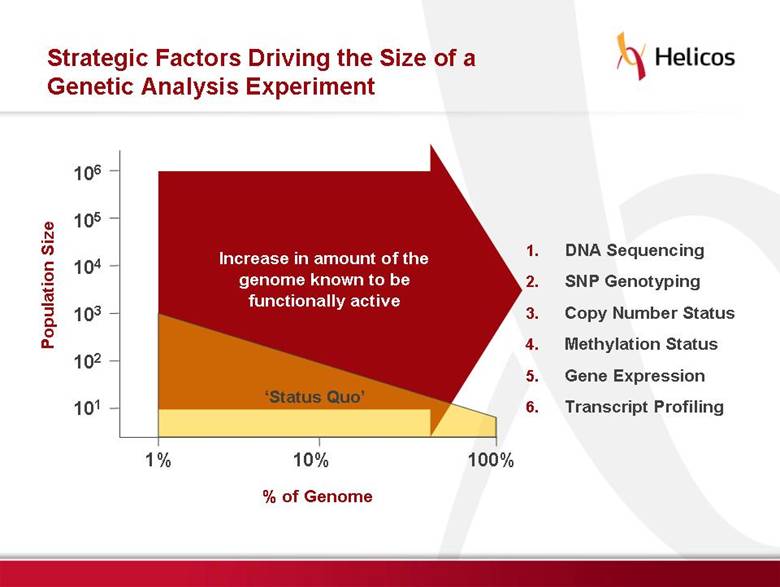

- 15 Aug 07 Investor Presentation August 2007 © 2007 Helicos BioSciences Corporation

- 10 Aug 07 Departure of Directors or Principal Officers

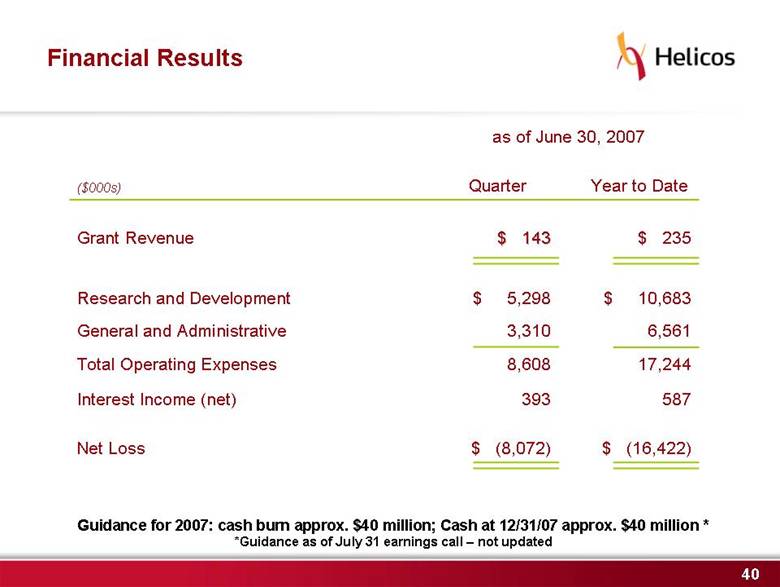

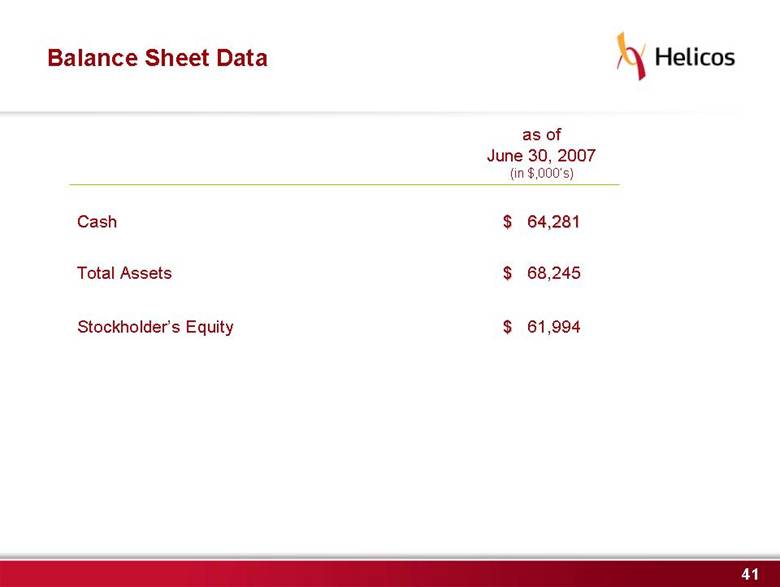

- 31 Jul 07 Helicos BioSciences Reports Second Quarter 2007 Financial Results

- 29 Jun 07 Other Events

Filing view

External links