Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| TRANZYME, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

5001 SOUTH MIAMI BOULEVARD, SUITE 300

DURHAM, NORTH CAROLINA 27703

PROXY STATEMENT

FOR THE 2012 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

The Board of Directors ofTRANZYME, INC. (referred to herein as "Tranzyme," the "Company," "we," "us" or "our") is soliciting your proxy to vote at the Company's 2012 Annual Meeting of Stockholders (referred to herein as, the "Annual Meeting") and at any adjournments or postponements thereof. The Annual Meeting will be held on Thursday, June 7, 2012 at 8:00 a.m. Eastern Daylight Time at the Homewood Suites located at 4603 Central Park Drive, Cardinal Room, Third Floor, Durham, NC 27703.

At the Annual Meeting, stockholders will be asked to vote on the matters described in the accompanying Notice of 2012 Annual Meeting of Stockholders and proxy statement.

This Notice of 2012 Annual Meeting of Stockholders and Proxy Statement and the accompanying 2011 Annual Report (referred to herein collectively as, the "Proxy Materials") provides information that you should read before you vote on the proposals that will be presented at the Annual Meeting. The Proxy Materials are being mailed to all record date stockholders for the first time on or about May 1, 2012.

We hope that as many stockholders as possible will personally attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, your vote is important. To assure your representation at the meeting, please sign and date the enclosed proxy card and return it promptly in the enclosed postage-paid envelope, or follow the alternative voting instructions on your proxy card. Sending in your proxy will not prevent you from voting in person at the Annual Meeting. If you vote in person by ballot at the Annual Meeting, that vote will revoke any prior proxy that you have submitted.

We look forward to seeing you at the Annual Meeting.

| | |

| | Sincerely yours, |

| |

Vipin K. Garg, Ph.D.

President & Chief Executive Officer

|

Durham, North Carolina

May 1, 2012

Table of Contents

5001 SOUTH MIAMI BOULEVARD, SUITE 300

DURHAM, NORTH CAROLINA 27703

NOTICE OF THE 2012 ANNUAL MEETING OF STOCKHOLDERS

| | | | |

| To Our Stockholders: | | | | |

Date and Time: |

|

Thursday, June 7, 2012 at 8:00 a.m. Eastern Daylight Time |

Place: |

|

Homewood Suites

4603 Central Park Drive

Cardinal Room, Third Floor

Durham, NC 27703 |

Items of Business: |

|

(1) |

|

To elect the following seven (7) nominees to our Board of Directors as directors, each to hold office until the Company's 2013 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal: |

| | | | |

| | | Vipin K. Garg, Ph.D. | | John H. Johnson |

| | | George B. Abercrombie | | Jean-Paul Castaigne, M.D. |

| | | Aaron Davidson | | Anne M. VanLent |

| | | Alex Zisson | | |

| | | | |

| | | (2) | | To hold a non-binding, advisory vote on the compensation of our named executive officers; |

|

|

(3) |

|

To hold a non-binding, advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; |

|

|

(4) |

|

To approve an amendment and restatement of the Tranzyme, Inc. 2011 Stock Option and Incentive Plan which increases the number of shares available for issuance; |

|

|

(5) |

|

To ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for our 2012 fiscal year; and |

|

|

(6) |

|

To transact such other business as may properly be brought before the meeting. |

Record Date: |

|

Stockholders of record as of the close of business on April 25, 2012 will be entitled to notice of, and to vote at, the meeting or any adjournment or postponement of the meeting. |

Voting: |

|

Your vote is important. Even if you plan to attend the Annual Meeting, you are urged to vote your shares by proxy before the meeting. To vote by proxy, please follow the instructions on the enclosed proxy card (or voting instruction card). |

| | |

| | | By Order of the Board of Directors |

|

|

Richard I. Eisenstadt

Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 7, 2012: This notice of the 2012 Annual Meeting of Stockholders and Proxy Statement and the accompanying 2011 Annual Report are available at http://ir.tranzyme.com/annual-proxy.cfm.

Table of Contents

Table of Contents

| | | | |

| | Page No. | |

|---|

Questions and Answers About the Annual Meeting and Voting | | | 2 | |

Security Ownership of Certain Beneficial Owners and Management | | |

8 | |

Proposal No. 1—Election of Directors | | |

12 | |

Board of Directors | | |

13 | |

Corporate Governance | | |

19 | |

Director Compensation | | |

21 | |

Executive Officers | | |

26 | |

Proposal No. 2—Advisory Vote on the Compensation of our Named Executive Officers | | |

28 | |

Proposal No. 3—Advisory Vote on the Frequency of the Advisory Vote on Executive Compensation | | |

29 | |

Executive Compensation | | |

30 | |

Compensation Committee Report | | |

48 | |

Certain Relationships and Related Party Transactions | | |

49 | |

Proposal No. 4—Amendment and Restatement of the Tranzyme, Inc. 2011 Stock Option and Incentive Plan | | |

50 | |

Audit Committee Report | | |

57 | |

Proposal No. 5—Ratification of the Selection of the Independent Registered Public Accounting Firm | | |

58 | |

Section 16(A) Beneficial Ownership Reporting Compliance | | |

59 | |

Other Matters and Discretionary Voting Authority | | |

59 | |

Stockholder Proposals for 2013 Annual Meeting Of Stockholders | | |

59 | |

Appendix A—Amended and Restated Tranzyme Inc. 2011 Stock Option and Incentive Plan | | | | |

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Directors of Tranzyme, Inc., sometimes referred to as the Company or Tranzyme, is soliciting your proxy to vote at the 2012 annual meeting of stockholders, including at any adjournments or postponements of the meeting. You are invited to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We intend to mail these proxy materials on or about May 1, 2012 to all stockholders of record entitled to vote at the annual meeting.

How do I attend the annual meeting?

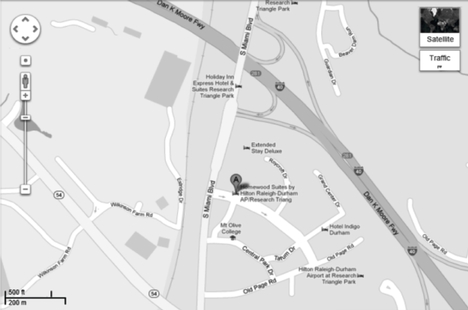

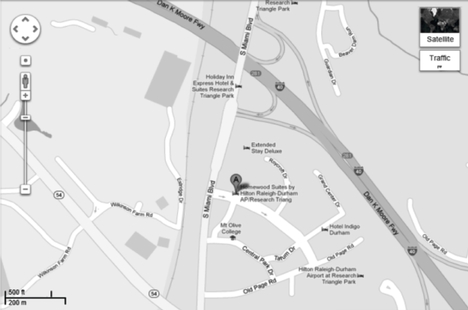

The meeting will be held on Thursday, June 7, 2012 at 8:00 a.m. Eastern Daylight Time at the Homewood Suites located at 4603 Central Park Drive, Cardinal Room, Third Floor, Durham, NC 27703. A map with driving directions to the annual meeting appears on the back cover of this proxy statement. Information on how to vote in person at the annual meeting is discussed below.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 25, 2012 will be entitled to vote at the annual meeting. On this record date, there were 24,607,888 shares of common stock outstanding and entitled to vote.

If on April 25, 2012 your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the annual meeting or vote by proxy. Whether or not you plan to attend the annual meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

If on April 25, 2012 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are five (5) matters scheduled for a vote:

- (1)

- To elect the following seven (7) nominees to our Board of Directors as directors, each to hold office until the Company's 2013 Annual Meeting of Stockholders and until his or her

2

Table of Contents

| | |

| Vipin K. Garg, Ph.D. | | John H. Johnson |

| George B. Abercrombie | | Jean-Paul Castaigne, M.D. |

| Aaron Davidson | | Anne M. VanLent |

| Alex Zisson | | |

- (2)

- To hold a non-binding, advisory vote on the compensation of our named executive officers;

- (3)

- To hold a non-binding, advisory vote on the frequency of the advisory vote on the compensation of our named executive officers;

- (4)

- To approve an amendment and restatement of the Tranzyme, Inc. 2011 Stock Option and Incentive Plan; and

- (5)

- To ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for our 2012 fiscal year.

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote "For" all the nominees to the Board of Directors or you may "Withhold" your vote for any nominee you specify. You may vote every "one year" or "two years" or "three years" for the vote on the frequency of the non-binding advisory vote on executive compensation. For each of the other matters to be voted on, you may vote "For" or "Against" or abstain from voting. The procedures for voting are fairly simple:

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

To vote in person, come to the annual meeting and we will give you a ballot when you arrive.

To vote using the proxy card, simply complete, sign and date the enclosed proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank

3

Table of Contents

or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 25, 2012.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, "For" Proposals 1, 2, 4 and 5 and "Every year" for Proposal 3. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

The Company will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

- •

- You may submit another properly completed proxy card with a later date.

- •

- You may send a timely written notice that you are revoking your proxy to our Secretary at 5001 South Miami Boulevard, Suite 300, Durham, North Carolina 27703.

- •

- You may attend the annual meeting and vote in person. Simply attending the annual meeting will not, by itself, revoke your proxy.

Your most current proxy card is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes "For" and "Withhold" votes, for the proposal regarding the frequency of the advisory vote on executive compensation votes for every "one year" or "two years" or "three years", and, with respect to other proposals, votes "For" and "Against," abstentions and, if applicable, broker non-votes. With respect to all proposals other than the proposal to elect directors and the proposal regarding the frequency of the advisory vote on executive compensation, abstentions

4

Table of Contents

will be counted towards the vote total for each proposal, and will have the same effect as "Against" votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What are "broker non-votes"?

Broker non-votes occur when a beneficial owner of shares held in "street name" does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed "non-routine." Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be "routine," but not with respect to "non-routine" matters.

How many votes are needed to approve each proposal?

- 1.

- Proposal No. 1 (Election of Directors)—The seven nominees receiving the highest number of affirmative votes of shares of common stock present at the Annual Meeting, either in person or by proxy, will be elected as directors to serve until our 2013 annual meeting of stockholders or until their successors are duly elected and qualified. Broker non-votes will be disregarded and have no effect on the outcome of the vote.

- 2.

- Proposal No. 2 (The advisory vote on executive compensation)—The approval, on an advisory (non-binding) basis, of the compensation of our named executive officers as described in this proxy statement requires the favorable vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions from voting will have the same effect as voting against the proposal. Broker non-votes are not considered voted for the proposal and have the effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of shares from which the majority is calculated.

- 3.

- Proposal No. 3 (The advisory vote on the frequency of the advisory vote on executive compensation)—The advisory (non-binding) proposal regarding how frequently advisory votes on executive compensation, such as Proposal No. 2, will occur requires a plurality of the votes cast for the three frequency options presented at the Annual Meeting. The frequency option that receives the most affirmative votes of all the votes cast on Proposal No. 3 is the frequency that will be deemed recommended by the Company's stockholders. Abstentions and broker non-votes will have no effect in determining the frequency option that is recommended by stockholders.

- 4.

- Proposal No. 4 (The approval of the amendment and restatement of the Tranzyme, Inc. 2011 Stock Option and Incentive Plan)—Approval of the amended and restated Tranzyme, Inc. 2011 Stock Option and Incentive Plan requires the favorable vote of a majority of the outstanding common shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions from voting will have the same effect as voting against the approval, and broker non-votes, if any, will be disregarded and have no effect on the outcome of the vote.

- 5.

- Proposal No. 5 (Ratification of the selection of Ernst & Young LLP as our independent auditors for 2012)—The ratification of the appointment of independent accountants requires the favorable vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions from voting will have the same effect as voting against the proposal. The ratification of the appointment of Ernst & Young LLP is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 5.

5

Table of Contents

What are the Board's recommendations?

The Board of Directors unanimously recommends that you vote your shares as follows:

- •

- FOR each of the seven (7) nominees to the Board of Directors (Proposal No. 1);

- •

- FOR the approval, on an advisory basis, of the compensation of our named executive officers (Proposal No. 2);

- •

- FOR a frequency of EVERY YEAR ("1 YEAR") for future advisory votes on executive compensation (Proposal No. 3);

- •

- FOR the amendment and restatement of the Tranzyme, Inc. 2011 Stock Option and Incentive Plan (Proposal No. 4); and

- •

- FOR ratification of the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2011 (Proposal No. 5).

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 24,607,888 shares outstanding and entitled to vote. Therefore, the holders of 12,303,945 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What is "householding" and how does it affect me?

We have adopted a procedure, approved by the Securities and Exchange Commission (referred to herein as, the "SEC"), called "householding." Under this procedure, stockholders of record who have the same address and last name will receive only one copy of the Proxy Materials, unless we are notified that one or more of these stockholders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Stockholders who participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Proxy Materials, or if you hold Tranzyme stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact Continental Stock Transfer & Trust Company by mail at 17 Battery Place, New York, NY 10004.

6

Table of Contents

If you participate in householding and wish to receive a separate copy of the Proxy Materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact Continental as indicated above.

If you are a beneficial owner, you can request information about householding from the organization that holds your shares.

What proxy materials are available on the Internet?

The letter to stockholders, proxy statement, Form 10-K and annual report to stockholders are available at http://ir.tranzyme.com/annual-proxy.cfm.

7

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us concerning the beneficial ownership of our common stock as of April 15, 2012 for:

- •

- each person known by us to beneficially own more than 5% of our common stock;

- •

- each of our directors (including director nominees);

- •

- each of our executive officers; and

- •

- all of our directors (including director nominees) and executive officers as a group.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In general, a person is deemed to be the beneficial owner of (i) any shares of our common stock over which such person has sole or shared voting power or investment power, plus (ii) any shares which such person has the right to acquire beneficial ownership of within 60 days of April 15, 2012, whether through the exercise of options, warrants or otherwise. Applicable percentages are based on 24,607,888 shares outstanding on April 15, 2012, adjusted as required by rules promulgated by the SEC. Unless otherwise indicated, the address of each beneficial owner named in the table is c/o Tranzyme, Inc., 5001 South Miami Boulevard, Suite 300, Durham, North Carolina 27703.

| | | | | | | |

Name and Address of Beneficial Owner | | Number of Shares

Beneficially Owned | | Percentage of Shares

Beneficially Owned | |

|---|

More than 5% Stockholders | | | | | | | |

Baker Brothers Life Sciences, L.P. and affiliates(1) | | | 3,829,730 | | | 15.56 | % |

667 Madison Avenue | | | | | | | |

New York, New York 10065 | | | | | | | |

H.I.G. Ventures and affiliates(2) | | |

3,027,291 | | |

12.29 |

% |

1450 Brickell Avenue, 31st Floor | | | | | | | |

Miami, Florida 33131 | | | | | | | |

Thomas, McNerney & Partners, L.P. and affiliates(3) | | |

3,027,286 | | |

12.29 |

% |

One Stamford Plaza | | | | | | | |

263 Tresser Boulevard, Suite 1600 | | | | | | | |

Stamford, Connecticut 06901 | | | | | | | |

Quaker BioVentures, L.P. and affiliates(4) | | |

2,574,791 | | |

10.46 |

% |

2929 Arch Street, Cira Centre | | | | | | | |

Philadelphia, Pennsylvania 19104-2868 | | | | | | | |

BDC Capital Inc.(5) | | |

2,238,825 | | |

9.10 |

% |

5 Place Ville Marie, Suite 300 | | | | | | | |

Montreal, Québec, Canada H3B 5E7 | | | | | | | |

T. Rowe Price Associates, Inc.(6) | | |

2,123,373 | | |

8.63 |

% |

100 E. Pratt Street | | | | | | | |

Baltimore, Maryland 21202 | | | | | | | |

QVT Financial LP(7) | | |

1,333,333 | | |

5.42 |

% |

1177 Avenue of the Americas, 9th Floor | | | | | | | |

New York, New York 10036 | | | | | | | |

Jennison Associates LLC(8) | | |

1,327,420 | | |

5.39 |

% |

466 Lexington Avenue | | | | | | | |

New York, NY 10017 | | | | | | | |

8

Table of Contents

| | | | | | | |

Name and Address of Beneficial Owner | | Number of Shares

Beneficially Owned | | Percentage of Shares

Beneficially Owned | |

|---|

Capital regional et coopérative Desjardins and affiliates(9) | | | 1,262,022 | | | 5.13 | % |

2 Complexe Desjardins, #1717 | | | | | | | |

P.O. Box 760 | | | | | | | |

Montreal, Québec, Canada H5B 1B8 | | | | | | | |

Directors and Named Executive Officers | | | | | | | |

Vipin K. Garg(10) | | | 541,546 | | | 2.15 | % |

Richard I. Eisenstadt(11) | | | 126,085 | | | * | |

Franck S. Rousseau | | | — | | | * | |

David S. Moore | | | 1,050 | | | * | |

Helmut Thomas(12) | | | 99,444 | | | * | |

George B. Abercrombie(13) | | | 15,000 | | | * | |

Jean-Paul Castaigne(14) | | | 30,387 | | | * | |

Aaron Davidson(15) | | | 3,027,291 | | | 12.29 | % |

John H. Johnson (16) | | | 50,000 | | | * | |

Anne VanLent(17) | | | 25,000 | | | * | |

Alex Zisson(18) | | | 3,027,286 | | | 12.29 | % |

All executive officers and directors as a group (11 persons)(19) | | | 6,943,089 | | | 27.18 | % |

- *

- Represents beneficial ownership of less than one percent of our common stock.

- (1)

- Consists of 3,540,015 shares held by Baker Brothers Life Sciences, L.P., 232,011 shares held by 667, L.P. and 57,704 shares held by 14159, L.P. By virtue of their ownership of entities that have the power to control the investment decisions of the limited partnerships listed in the prior sentence, Felix J. Baker and Julian C. Baker may each be deemed to be beneficial owners of shares owned by such entities and may be deemed to have shared power to vote or direct the vote of and shared power to dispose or direct the disposition of such securities. With respect to the ownership information relating to stockholders affiliated with Baker Brothers Life Sciences, L.P., we have relied on information supplied by Baker Brothers Life Sciences, L.P. on Amendment No. 2 to Schedule 13G filed with the Securities and Exchange Commission on March 15, 2012.

- (2)

- Consists of 3,002,291 shares of common stock held in record by H.I.G. Ventures—Tranzyme LLC ("LLC") and non-qualified stock options to purchase 25,000 shares of common stock held of record by Aaron Davidson that were exercisable as of, or, exercisable within 60 days of, April 15, 2012. Sami Mnaymneh and Anthony Tamer are the sole shareholders and directors of H.I.G.-GPH, Inc., which is the manager of LLC and as such has the power to direct all activities related thereto. Aaron Davidson, a director of Tranzyme, is a Managing Director of an affiliate of LLC. Messrs. Tamer, Mnaymneh and Davidson may be deemed to be indirect beneficial owners of the reported securities, but disclaim beneficial ownership in the securities, except to the extent of any pecuniary interest in such securities. With respect to the ownership information relating to stockholders affiliated with H.I.G. Ventures, we have relied on information supplied by H.I.G. Ventures on a Schedule 13G filed with the Securities and Exchange Commission on February 15, 2012 and other information known by the Company.

- (3)

- Consists of (i) 2,898,589 shares of common stock held of record by Thomas McNerney & Partners, L.P. ("TMP"); (ii) 92,743 shares of common stock held of record by TMP Nominee, LLC ("TMP Nominee"); (iii) 10,954 shares of common stock held of record by TMP Associates, L.P. ("TMP Associates"); and (iv) non-qualified stock options to purchase 25,000 shares of common stock held of record by Alex Zisson that were exercisable as of, or, exercisable within 60 days of, April 15, 2012. Thomas, McNerney & Partners, LLC ("TMP GP"), the general partner of TMP and TMP Associates, has voting and dispositive power over the shares held by TMP and TMP

9

Table of Contents

Associates. In addition, TMP Nominee has entered into an agreement that it shall vote and dispose of securities in the same manner as directed by TMP GP with respect to the shares held by TMP and TMP Associates. James E. Thomas and Peter H. McNerney are the managers of TMP Nominee and have shared voting and dispositive power over these securities provided that they are obligated to exercise this voting and dispositive power in the same manner as TMP LLC votes and disposes of the Issuer's other securities over which TMP LLC exercises voting and dispositive power. James E. Thomas, Peter H. McNerney, Alex Zisson, a director of Tranzyme, Pratik Shah and Eric Aguiar are the managers of TMP LLC. With respect to the ownership information relating to stockholders affiliated with TMP, we have relied on information supplied by TMP on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012 and other information known by the Company.

- (4)

- The shares listed above are beneficially held by each of Quaker BioVentures Capital, L.P., Quaker BioVentures, L.P. and Quaker BioVentures Capital, LLC. Quaker BioVentures Capital, L.P. is the general partner of Quaker BioVentures, L.P. and Quaker BioVentures Capital, LLC is the general partner of Quaker BioVentures Capital, L.P. With respect to the ownership information relating to stockholders affiliated with Quaker BioVentures, L.P., we have relied on information supplied by Quaker BioVentures, L.P. on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012.

- (5)

- With respect to the ownership information of BDC Capital Inc., we have relied on information supplied by BDC Capital Inc. on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012.

- (6)

- With respect to the ownership information of T. Rowe Price Associates, Inc., we have relied on information supplied by T. Rowe Price Associates, Inc. on Amendment No. 1 to a Schedule 13G filed with the Securities and Exchange Commission on February 13, 2012.

- (7)

- QVT Financial LP ("QVT Financial") is the investment manager for QVT Fund LP (the "Fund"), which beneficially owns 1,041,030 shares of common stock. QVT Financial is also the investment manager for Quintessence Fund L.P. ("Quintessence"), which beneficially owns 292,303 shares of Common Stock. QVT Financial has the power to direct the vote and disposition of the Common Stock held by the Fund and Quintessence. Accordingly, QVT Financial may be deemed to be the beneficial owner of an aggregate amount of 1,333,333 shares of Common Stock, consisting of the shares owned by the Fund and Quintessence. QVT Financial GP LLC, as General Partner of QVT Financial, may be deemed to beneficially own the same number of shares of Common Stock reported by QVT Financial. QVT Associates GP LLC, as General Partner of the Fund and Quintessence, may be deemed to beneficially own the aggregate number of shares of Common Stock owned by the Fund and Quintessence, and accordingly, QVT Associates GP LLC may be deemed to be the beneficial owner of an aggregate amount of 1,333,333 shares of Common Stock. With respect to the ownership information of stockholders affiliated with QVT Financial, we have relied on information supplied by QVT Financial on a Schedule 13G filed with the Securities and Exchange Commission on April 14, 2011.

- (8)

- With respect to the ownership information of Jennison Associates LLC, we have relied on information supplied by Jennison Associates LLC on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012.

- (9)

- Consists of (i) 1,232,301 shares of common stock held of record by Capital regional et coopérative Desjardins and (ii) 29,721 shares of common stock held of record by Desjardins-Innovatech S.E.C. With respect to the ownership information relating to stockholders affiliated with Capital regional et coopérative Desjardins, we have relied on information supplied by Capital regional et coopérative Desjardins on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012.

10

Table of Contents

- (10)

- Shares for Dr. Garg consist of 541,546 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (11)

- Shares for Mr. Eisenstadt consist of 126,085 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (12)

- Shares for Dr. Thomas consist of 99,444 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (13)

- Shares for Mr. Abercrombie consist of 15,000 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (14)

- Shares for Dr. Castaigne consist of 30,387 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (15)

- Consists of 3,002,291 shares of common stock held in record by H.I.G. Ventures—Tranzyme LLC ("LLC") and non-qualified stock options to purchase 25,000 shares of common stock held of record by Aaron Davidson that were exercisable as of, or, exercisable within 60 days of, April 15, 2012. Sami Mnaymneh and Anthony Tamer are the sole shareholders and directors of H.I.G.-GPH, Inc., which is the manager of LLC and as such has the power to direct all activities related thereto. Aaron Davidson, a director of Tranzyme, is a Managing Director of an affiliate of LLC. Messrs. Tamer, Mnaymneh and Davidson may be deemed to be indirect beneficial owners of the reported securities, but disclaim beneficial ownership in the securities, except to the extent of any pecuniary interest in such securities. With respect to the ownership information relating to stockholders affiliated with H.I.G. Ventures, we have relied on information supplied by H.I.G. Ventures on a Schedule 13G filed with the Securities and Exchange Commission on February 15, 2012 and other information known by the Company.

- (16)

- Shares for Mr. Johnson consist of 50,000 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (17)

- Shares for Ms. VanLent consist of 25,000 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

- (18)

- Consists of (i) 2,898,589 shares of common stock held of record by Thomas McNerney & Partners, L.P. ("TMP"); (ii) 92,743 shares of common stock held of record by TMP Nominee, LLC ("TMP Nominee"); (iii) 10,954 shares of common stock held of record by TMP Associates, L.P. ("TMP Associates"); and (iv) non-qualified stock options to purchase 25,000 shares of common stock held of record by Alex Zisson that were exercisable as of, or, exercisable within 60 days of, April 15, 2012. Thomas, McNerney & Partners, LLC ("TMP GP"), the general partner of TMP and TMP Associates, has voting and dispositive power over the shares held by TMP and TMP Associates. In addition, TMP Nominee has entered into an agreement that it shall vote and dispose of securities in the same manner as directed by TMP GP with respect to the shares held by TMP and TMP Associates. James E. Thomas and Peter H. McNerney are the managers of TMP Nominee and have shared voting and dispositive power over these securities provided that they are obligated to exercise this voting and dispositive power in the same manner as TMP LLC votes and disposes of the Issuer's other securities over which TMP LLC exercises voting and dispositive power. James E. Thomas, Peter H. McNerney, Alex Zisson, a director of Tranzyme, Pratik Shah and Eric Aguiar are the managers of TMP LLC. With respect to the ownership information relating to stockholders affiliated with TMP, we have relied on information supplied by TMP on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012 and other information known by the Company.

- (19)

- Includes 937,462 common stock options that were exercisable as of, or, exercisable within 60 days of, April 15, 2012.

11

Table of Contents

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board of Directors of the Company currently consists of seven directors. Pursuant to the provisions of the Company's certificate of incorporation and amended and restated bylaws, each member of our Board of Directors is to be elected each year to hold office for one year until the annual meeting of stockholders after such election and under their respective successors shall have been duly elected and qualified. Our Board, upon the recommendation of our Nominating and Corporate Governance Committee (referred to herein as, the "Nominating Committee"), has nominated the seven persons named below, and the Board also recommends that the stockholders elect all of the Board's director nominees at this year's Annual Meeting to serve until our 2013 Annual Meeting of Stockholders. The proxies solicited by this Proxy Statement cannot be voted for more than seven nominees at the Annual Meeting. It is the intention of the persons named in the accompanying proxy card, unless otherwise instructed, to vote to elect the nominees named herein. If any director nominee is unable or unwilling to serve as a nominee at the time of the Annual Meeting, the proxy holders may vote for a substitute nominee chosen by the present Board to fill the vacancy. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Biographical information and the attributes, skills and experience of each nominee that led our Nominating Committee and Board to determine that each person should serve as a director are discussed below.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS

VOTE "FOR" EACH OF THE NOMINEES

LISTED BELOW AS DIRECTORS (PROPOSAL NO. 1 ON THE PROXY CARD.

12

Table of Contents

BOARD OF DIRECTORS

The following information is furnished with respect to each of our directors, which information is as of April 25, 2012. Information about the number of shares of common stock beneficially owned by each director, directly and indirectly, appears previously under the heading "Security Ownership of Certain Beneficial Owners and Management."

MANAGEMENT DIRECTORS

| | | | | |

Name | | Age | | Position |

|---|

Vipin K. Garg, Ph.D. | | | 54 | | President, Chief Executive Officer and Director |

Vipin K. Garg, Ph.D. has served as our President and Chief Executive Officer since September 2000 and one of our directors since October 2000. Prior to joining us, he served as Chief Operating Officer of Apex Bioscience, Inc. (now Curacyte AG of Munich, Germany), where he was responsible for establishing a major strategic alliance with a Japanese pharmaceutical company and advancing the company's lead product into Phase 2 clinical development. Earlier he was Vice President of Product Development and Manufacturing at DNX, Inc. (NASDAQ: DNXX), and held management positions at Sunovion Pharmaceuticals, Inc. (formerly known as Sepracor Inc.) (acquired by Dainippon Sumitomo Pharma) and Bio-Response Inc. (acquired by Baxter International, Inc.). Dr. Garg has over twenty years of biotechnology industry experience in both technical and management positions and has managed combined operations in both the United States and Europe. Dr. Garg received his Ph.D. in Biochemistry in 1982 from the University of Adelaide, Australia, and his M.S. from Delhi University.

NON- MANAGEMENT DIRECTORS

| | | | | |

Name | | Age | | Position |

|---|

John H. Johnson(3) | | | 54 | | Chairman of the Board of Directors |

George B. Abercrombie(2)(3) | | | 57 | | Director |

Jean-Paul Castaigne, M.D.(1) | | | 66 | | Director |

Aaron Davidson(1)(3) | | | 44 | | Director |

Anne M. VanLent(2) | | | 64 | | Director |

Alex Zisson(1)(2) | | | 42 | | Director |

- (1)

- Member of Compensation Committee.

- (2)

- Member of Audit Committee.

- (3)

- Member of Nominating and Corporate Governance Committee.

John H. Johnson has served as the Chairman of our board of directors since November 2010. In February 2012, Mr. Johnson was named President and Chief Executive Office of Dendreon Corporation, where he also serves as a director (NASDAQ: DNDN). Mr. Johnson also serves on the board of directors of Cempra Pharmaceuticals (NASDAQ: CEMP). Mr. Johnson previously was the Chief Executive Officer and member of the board of directors of Savient Pharmaceuticals, Inc., or Savient (NASDAQ: SVNT), a position he held from January 2011 until January 2012. Prior to joining Savient, Mr. Johnson was the Senior Vice President and President of the Oncology Business Unit at Eli Lilly and Company, or Lilly, a position he held since November 2009. Prior to this appointment, he had served as Chief Executive Officer and director of ImClone Systems Inc., or ImClone, since August 2007 and was also a member of ImClone's board of directors until the company became a wholly-owned subsidiary of Lilly in November 2008. Previously, from 2005 until August 2007, he served as company group chairman of Johnson and Johnson's Worldwide Biopharmaceuticals unit. Mr. Johnson began his career at Pfizer Inc. and then joined Johnson and Johnson in 2000 to help lead the company into the

13

Table of Contents

anti-infectives market. He left Johnson and Johnson in 2000 to join Parkstone Medical Information Systems as president and CEO, returning in 2002 as worldwide vice president, CNS/Psychiatry. He was then appointed president of Ortho Biotech Products Inc. and subsequently became responsible for Ortho Biotech Canada Inc. until he was named company group chairman in 2005 of Johnson and Johnson's Worldwide Biopharmaceuticals unit. Mr. Johnson earned a B.S. degree from East Stroudsburg University of Pennsylvania. Mr. Johnson brings to our board more than two decades of experience in the biopharmaceutical and healthcare industry, including managing large product development pipelines and serving in key executive roles.

George B. Abercrombie has served as one of our directors since September 2011. He has been President and CEO of Abercrombie Advisors LLC, which offers consulting services to the pharmaceutical and biotechnology industries, since 2011. Previously, from 2001 to 2009, he served as President and Chief Executive Officer at Hoffmann-La Roche Inc., a division of Roche (SIX: RO, ROG; OTCQX: RHHBY), where he was responsible for leading the North American Pharmaceuticals Operations. He also served as a member of the Roche Pharmaceutical Executive Committee, which was responsible for developing and implementing global strategy for the Pharmaceuticals Division. Before joining Roche, Mr. Abercrombie was Senior Vice President, U.S. commercial operations at Glaxo Wellcome Inc. (NYSE: GSK). He joined Glaxo as Vice President and General Manager of the Glaxo Pharmaceuticals Division in 1993 following 10 years at Merck & Co., Inc. (NYSE: MRK), where he held a broad range of positions in sales, marketing, executive sales management and business development. Mr. Abercrombie currently serves as Chairman of the Board of Brickell Biotech, is a director of Biocryst Pharmaceuticals, Inc. (NASDAQ: BCRX), was a director at Inspire Pharmaceuticals (NASDAQ: ISPH) from 2010 until their acquisition by Merck in 2011 and was a director at Ziopharm Oncology (NASDAQ: ZIOP) in 2010. Mr. Abercrombie received a bachelor's degree in pharmacy from the University of North Carolina at Chapel Hill, and earned an M.B.A. from Harvard University. Mr. Abercrombie is qualified to serve as a director due to his wealth of executive management experience and because he has been the lead on many commercial activities in the pharmaceutical industry. He has been involved with various industry associations such as the University of North Carolina School of Pharmacy Foundation and the Duke University Fuqua School of Business Health Sector Advisory Board, the Board of Directors for the Pharmaceutical Research and Manufacturers of America (PhRMA) and the Johns Hopkins School of Hygiene and Public Health. He is also a member of the Board of Directors of Project HOPE, an organization dedicated to achieving sustainable advances in health care around the world.

Jean-Paul Castaigne, M.D. has served as one of our directors since June 2004. Dr. Castaigne is President and CEO of Angiochem Inc., or Angiochem, a position he has held since September 2006. Angiochem leverages its EPiC platform technology to create drugs that cross the blood brain barrier to treat brain diseases. In this capacity, he has advanced multiple clinical and preclinical drug candidates and leads the company's financing and partnering activities. Prior to joining Angiochem, he was COO and CSO of Conjuchem Inc. (TSX: CJB), or Conjuchem, a Montreal-based drug delivery company. Prior to joining Conjuchem in 2000, he was Vice President, World Wide Head of Global R&D at Groupe Fournier SA in France. Before that, he was with Novartis for over 10 years in a variety of international positions, including President and Managing Director for Sandoz Philippines and Director of Medical and R&D for Sandoz in France and as Corporate Vice-President, R&D, Medical and Regulatory in Canada, where he oversaw significant growth in the R & D operation. Earlier in his career, Dr. Castaigne worked for Cilag France (Johnson & Johnson) and Sanofi-Aventis in clinical and regulatory management. He received his M.D. from Paris University in 1975, held the position of Associate Professor of Oncology, Pneumology there in 1978, and received his advanced diploma in Management and Business Administration in 1987 from HEC Paris. We believe Dr. Castaigne's experience working in various pharmaceutical companies as well as his extensive knowledge of all aspects of our preclinical and clinical development plans make him a crucial member of our board of directors.

14

Table of Contents

Aaron Davidson has served as one of our directors since May 2005. Mr. Davidson is a Managing Director of H.I.G. BioVentures and focuses on investment opportunities in the life sciences sector. Prior to joining H.I.G. in 2004, he was a Vice President with Ventures West with a focus on venture investing in life science companies. Mr. Davidson began his career with Lilly, where he spent a decade in various management roles in the United States and Canada including business development, strategic planning, market research and financial planning. After Lilly he spent a year as the Vice President of Corporate Business Development at SYN-X Pharma Inc. Mr. Davidson currently serves on the boards of Alder Biopharmaceuticals, Inc., HyperBranch Medical Technology, Inc., NeurAxon Inc. and Novadaq Technologies Inc. (TSX: NDQ). He served on the board of Salmedix Inc. prior to its acquisition by Cephalon, Inc. in June 2005 and the board of Oncogenex Pharmaceuticals Inc. prior to their public listing. Mr. Davidson earned his MBA from Harvard Business School and a Bachelor of Commerce degree from McGill University. Mr. Davidson has substantial experience in business development, strategic planning, market research and financial planning and has served a director of numerous companies.

Anne M. VanLent has served as one of our directors since March 2011. Ms. VanLent is currently the President of AMV Advisors, a company which she founded in 2008 to provide corporate strategy and financial consulting services to emerging growth life sciences companies. From May 2002 through April 2008, Ms. VanLent was the Executive Vice President and Chief Financial Officer of Barrier Therapeutics, Inc., a company that developed and marketed prescription dermatology products that was publicly-traded before being acquired by Stiefel Laboratories in August 2008. From July 1997 to October 2001, she was the Executive Vice President—Portfolio Management for Sarnoff Corporation, a multidisciplinary research and development firm. From 1985 to 1993, she served as the Senior Vice President and Chief Financial Officer of The Liposome Company, Inc., a publicly-traded biopharmaceutical company. Ms. VanLent also currently serves as a director of and chair of the audit committee of Integra Life Sciences Holding Corporation (NasdaqGS: IART). She also served as a director of and chair of the audit committee of Penwest Pharmaceuticals, a NASDAQ-listed company from 1997 through its sale to Endo Pharmaceuticals, Inc. in the fall of 2010. Ms. VanLent received a B.A. degree in Physics from Mount Holyoke College. Ms. VanLent brings significant management experience in both public and private life sciences companies as well as expertise in financial and accounting matters that will enable her to serve as our audit committee financial expert.

Alex Zisson has served as one of our directors since May 2005. Since 2002, Mr. Zisson has been a Partner at Thomas, McNerney & Partners, a prominent health care venture capital firm that invests in life science and medical technology companies at all stages of development. He is currently a board member of several private life sciences companies, including Clarus Therapeutics, Inc, Celtator Pharmaceuticals, Inc. and InnoPharma, Inc. Before joining Thomas, McNerney & Partners, he spent 11 years in the research department at Hambrecht & Quist (and its successor firms Chase H&Q and JPMorgan H&Q). During his tenure at H&Q, Mr. Zisson led research teams covering the biotechnology, specialty pharmaceuticals, large-cap pharmaceuticals, drug delivery and diagnostics industries. After the merger of Chase H&Q and JPMorgan, Mr. Zisson also became the firm's Health Care Strategist. He graduated magna cum laude from Brown University, where he was elected to Phi Beta Kappa. Mr. Zisson serves on the board of directors of numerous life sciences companies, has extensive knowledge of the health care and biopharmaceutical industries and has been instrumental in our development since joining our board in 2005.

Composition of our Board of Directors

Our board of directors currently consists of seven members, of whom Jean-Paul Castaigne, Aaron Davidson and Alex Zisson were elected pursuant to the board composition provisions of a stockholders agreement. These board composition provisions terminated immediately prior to the closing of our initial public offering on April 1, 2011 and there are no further contractual obligations regarding the

15

Table of Contents

election of our directors. Our nominating and corporate governance committee and board of directors now consider a broad range of factors relating to the qualifications and background of nominees, which may include diversity, which is not limited to race, gender or national origin. We have no formal policy regarding board diversity. Our nominating and corporate governance committee's and board of directors' priority in selecting board members is identification of persons who will further the interests of our stockholders through their established records of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, and professional and personal experiences and expertise relevant to our growth strategy.

Director Independence. As required under the NASDAQ Stock Market, or NASDAQ, listing standards, a majority of the members of a listed company's Board of Directors must qualify as "independent," as affirmatively determined by the Board of Directors. Our Board of Directors consults with the Company's counsel to ensure that the Board of Directors' determinations are consistent with relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in pertinent listing standards of the NASDAQ, as in effect from time to time. Our board of directors has determined that all non-employee members of our board of directors, John H. Johnson, George B. Abercrombie, Jean-Paul Castaigne, M.D., Aaron Davidson, Anne M. VanLent and Alex Zisson, are independent under the applicable rules and regulations of the Securities and Exchange Commission and NASDAQ. There are no family relationships among any of our directors or executive officers.

Board Leadership Structure and Board's Role in Risk Oversight

The positions of Chairman of the board and chief executive officer are presently separated and have historically been separated at our company. We believe that separating these positions allows our chief executive officer to focus on our day-to-day business, while allowing our Chairman of the board to lead the board of directors in its fundamental role of providing advice to, and independent oversight of, management. Our board of directors recognizes the time, effort and energy that the chief executive officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the board of directors' oversight responsibilities continue to grow. Our board of directors also believes that this structure ensures a greater role for the independent directors in the oversight of our company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our board of directors. This leadership structure also is preferred by a significant number of our stockholders. Our board of directors believes its administration of its risk oversight function has not affected its leadership structure.

While our amended and restated bylaws and corporate governance guidelines do not require that our Chairman and chief executive officer positions be separate, our board of directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to product candidate development, technological uncertainty, dependence on collaborative partners, uncertainty regarding patents and proprietary rights, comprehensive government regulations, having no commercial manufacturing experience, marketing or sales capability or experience and dependence on key personnel as more full discussed under "Risk Factors" in our 2011 Annual Report. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

16

Table of Contents

Our board of directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily through committees of the board of directors, but the full board of directors has retained responsibility for general oversight of risks. Our board of directors satisfies this responsibility through full reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our company as our board of directors believes that full and open communication between management and the board of directors is essential for effective risk management and oversight.

Committees of Our Board of Directors

Our board of directors has established a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee, each of which operates pursuant to a charter adopted by our board of directors. The composition and functioning of all of our committees complies with all applicable requirements of the Sarbanes-Oxley Act of 2002, NASDAQ and the Securities and Exchange Commission rules and regulations. A brief description of these committees and their current membership follows.

Compensation Committee. The current members of our Compensation Committee are Alex Zisson, who is the chair of the committee, Aaron Davidson and Jean-Paul Castaigne. Each of the members of our Compensation Committee is independent under the applicable rules and regulations of the SEC, NASDAQ and the Internal Revenue Service. In 2011, the Compensation Committee met four times, either in person or by conference telephone. You can find the Compensation Committee charter on the "Investor Relations" page of our website,www.tranzyme.com, under the "Corporate Governance" tab. The Compensation Committee's responsibilities include:

- •

- reviewing and approving corporate goals and objectives relevant to compensation of our chief executive officer and other executive officers;

- •

- evaluating the performance of these officers in light of those goals and objectives;

- •

- setting the compensation of these officers based on such evaluations;

- •

- administering the issuance of stock options and other awards under our stock plans; and

- •

- reviewing and evaluating, at least annually, the performance of the Compensation Committee and its members, including compliance of the Compensation Committee with its charter.

Audit Committee. The current members of our Audit Committee are Anne VanLent, who is the chair of the committee, George B. Abercrombie and Alex Zisson. Mr. Abercrombie replaced John H. Johnson on the Audit Committee following the meeting of the Audit Committee held on February 23, 2012. All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our board has determined that Anne VanLent is an audit committee financial expert as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of NASDAQ. Each of the members of our Audit Committee is independent under the applicable rules and regulations of the SEC and NASDAQ. In 2011, the Audit Committee met four times, either in person or by conference telephone. You can find the Audit Committee charter on the "Investor Relations" page of our website,www.tranzyme.com, under the "Corporate Governance" tab. The Audit Committee's responsibilities include:

- •

- overseeing our corporate accounting and financial reporting process;

- •

- evaluating the independent auditors' qualifications, independence and performance;

- •

- determining the engagement of the independent auditors;

- •

- reviewing and approving the scope of the annual audit and the audit fee;

17

Table of Contents

- •

- discussing with management and the independent auditors the results of the annual audit and the review of our quarterly financial statements;

- •

- approving the retention of the independent auditors to perform any proposed permissible non-audit services;

- •

- monitoring the rotation of partners of the independent auditors on our engagement team as required by law;

- •

- reviewing our critical accounting policies and estimates;

- •

- overseeing our internal audit function; and

- •

- annually reviewing the Audit Committee charter and the Audit Committee's performance.

Nominating and Corporate Governance Committee. The current members of our Nominating and Corporate Governance Committee are Aaron Davidson, who is the chair of the committee, John H. Johnson and George B. Abercrombie. Each of the members of our Nominating and Corporate Governance Committee is independent under the applicable rules and regulations of the SEC and NASDAQ. In 2011, the Nominating and Corporate Governance Committee met one time. You can find the Nominating and Corporate Governance Committee charter on the "Investor Relations" page of our website,www.tranzyme.com, under the "Corporate Governance" tab. The Nominating and Corporate Governance Committee responsibilities include:

- •

- making recommendations to our board of directors regarding candidates for directorships and the size and composition of our board;

- •

- overseeing our corporate governance guidelines; and

- •

- reporting and making recommendations to our board concerning governance matters.

Other Committees. Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or Compensation Committee of any entity that has one or more executive officers serving on our board of directors or Compensation Committee.

Communications with our Board of Directors or Individual Directors

The Board provides to every stockholder the ability to communicate with the Board, as a whole, and with individual directors in his or her capacity as a member of the Board. Stockholders may send such communications to the attention of the Chairman of the Board or the applicable individual director by facsimile to (919) 474-0025 or by U.S. mail (including courier or expedited delivery service) to our principal executive offices, at 5001 South Miami Boulevard, Suite 300, Durham, North Carolina 27703. We will forward all such stockholder communications to the Chairman of the Board, as a representative of the Board, or to the director to whom the communication is addressed.

18

Table of Contents

CORPORATE GOVERNANCE

Corporate Governance Guidelines and Committee Charters

In connection with our initial public offering, the Board approved Corporate Governance Guidelines, and a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee each operates in accordance with a charter that has been adopted by the Board. The Corporate Governance Guidelines, together with these charters, provide the framework for the governance of the Company. You may view our Corporate Governance Guidelines and the charters on our corporate website atwww.tranzyme.com.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. We expect that any amendments to the code, or any waivers of its requirements, will be disclosed on our website.

Accounting and Auditing Matters Open Door Policy

We have adopted an Open Door Policy on Reporting Complaints Regarding Accounting and Auditing Matters to facilitate the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters, as well as the confidential, anonymous submission by our employees of concerns regarding these matters. Information regarding the process for reporting such complaints is available on our website atwww.tranzyme.com/contact.

Consideration of Director Candidates

Our Nominating and Corporate Governance Committee identifies, evaluates and recommends director candidates to our Board of Directors for nomination. The process followed by the Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to current directors and others for recommendations, use of professional search firms to identity potential candidates, meetings to evaluate potential candidates and interviews of selected candidates. The Company does not pay any fees to third parties to identify or evaluate potential nominees.

In considering candidates for director, the Nominating and Corporate Governance Committee will consider the appropriate qualities, skills and characteristics desired of nominees for Board members in the context of the current make-up of the Board. The Board as a whole should collectively possess a diverse range of skills, expertise, industry and other knowledge, and business and other experience useful to the effective oversight of our business. The Nominating and Corporate Governance Committee considers all of these qualities, and with respect to existing directors, the director's past attendance at meetings and participation in, and contributions to, the activities of the Board and committees of the Board on which the director served, when selecting, subject to ratification by our Board of Directors, candidates for director.

The Board does not have a policy with respect to the consideration of diversity in identifying director candidates. However, as noted above, the Board considers the diversity of the skills, expertise, industry and other knowledge, and business and other experience of the Board as a whole when evaluating director nominees.

Stockholders may recommend individuals to our Nominating and Corporate Governance Committee for consideration as potential director candidates by following the procedures set forth below under "Stockholder Nominations." The Nominating Committee will evaluate stockholder recommended candidates in the same manner as it evaluates candidates recommended by others.

19

Table of Contents

Stockholder Nominations. Our amended and restated bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board of Directors. The Nominating and Corporate Governance Committee also reviews, evaluates and proposes prospective candidates for our Board and considers nominees properly recommended by stockholders. Stockholders wishing to submit nominations must provide timely written notice to our Corporate Secretary in accordance with the Company's bylaws and otherwise follow the procedures set forth in the bylaws. Stockholders may contact the Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder nominations and proposals. For more information pertaining to stockholder proposals, see "Stockholder Proposals for 2013 Annual Meeting of Stockholders" below.

Related Person Transaction Policy

In connection with our initial public offering, the Board adopted a related person transaction policy that requires all future transactions between us and any director, executive officer, holder of five percent or more of any class of our capital stock or any member of the immediate family of, or entities affiliated with, any of them, or any other related persons (as defined in Item 404 of Regulation S-K) or their affiliates, in which the amount involved is equal to or greater than $120,000, be approved in advance by our Audit Committee. Any request for such a transaction must first be presented to our Audit Committee for review, consideration and approval. In approving or rejecting any such proposal, our Audit Committee is to consider the relevant facts and circumstances available and deemed relevant to the Audit Committee, including, but not limited to, the extent of the related party's interest in the transaction, and whether the transaction is on terms no less favorable to us than terms we could have generally obtained from an unaffiliated third party under the same or similar circumstances. For more information regarding these transactions, see "Certain Relationships and Related Party Transactions" in this proxy statement.

Policy governing director attendance at annual meetings of stockholders

Our policy is to encourage all of our directors to be present at our annual stockholder meetings.

Board and Committee Meetings

The following table sets forth the number of meetings held during the fiscal year 2011 by the Board and by each committee thereof. Each of the directors attended at least 75% of the total number of meetings of the Board and of the committees of which he was a member during the time each such individual was a member of the Board.

| | | | |

| | Number of Meetings Held | |

|---|

Board of Directors | | | 7 | |

Audit Committee | | | 4 | |

Compensation Committee | | | 4 | |

Nominating and Corporate Governance | | | 1 | |

20

Table of Contents

DIRECTOR COMPENSATION

General

Our Compensation Committee reviews and makes recommendations to the Board of Directors with respect to director compensation. In anticipation of the initial public offering, on March 2, 2011, our Board of Directors adopted a compensation program, which became effective upon the completion of the initial public offering on April 1, 2011 (referred to herein as, the Non-Employee Director Compensation Policy—April through June 2011"). Following the completion of our initial public offering, our Compensation Committee reviewed the 2011 Thelander Private Company Compensation Report as well as data available on a peer group of companies and information available through our directors' affiliations to (i) perform a review of our overall director and executive compensation, (ii) benchmark such compensation in relation to other comparable publicly traded companies with which we may compete for talent, and (iii) provide recommendations to ensure that our compensation programs continue to enable us to attract and retain qualified directors and executives through competitive compensation packages.

The peer group of companies used in the evaluation included a sampling of companies that had filed for or completed initial public offerings during the previous 24 months. The companies in the peer group were as follows:

| | |

| Anthera Pharmaceuticals | | Ironwood Pharmaceuticals |

| AVEO Pharmaceuticals | | Movetus |

| Ikaria | | Tengion |

Based on its review of the director compensation practices of our peer group and upon the recommendation of our Compensation Committee, our Board of Directors adopted the non-employee director compensation policy set forth below (referred to herein as, the "Non-Employee Director Compensation Policy—July 2011"), which became effective on July 1, 2011. Prior to the adoption of the Non-Employee Director Compensation Policy—April through June 2011, our non-employee directors unaffiliated with our venture capital investors received cash compensation of $1,000 per meeting attended in person, $750 per meeting attended telephonically, $500 per committee meeting attended and $750 per committee meeting attended as chairman of that committee.

Non-Employee Director Compensation Policy—April through June 2011

Set forth below is our Non-Employee Director Compensation Policy—April through June 2011, which became effective on April 1, 2011 and remained effective until the adoption of the Non-Employee Director Compensation Policy—July 2011. Directors who are our employees received no additional compensation (beyond their regular employee compensation) for their services. Dr. Garg is our only director who is also an employee of Tranzyme. Messrs. Davidson and Zisson opted to forego compensation under this program due to their affiliations with our venture capital investors. Dr. Gavin,

21

Table of Contents

who resigned from the board effective September 19, 2011 also opted to forego compensation under this program due to her affiliation with our venture capital investors.

| | | | |

Cash Compensation: | | | | |

Board Meetings: | | | | |

| | Per Meeting (in person) | | $2,500 |

| | Per Meeting (telephonically) | | $2,000 |

All Committee Meetings: | | Per Meeting | | $500 |

| | Per Meeting (chairman) | | $750 |

Equity Compensation: | | | | |

| | Chairman of the Board | | 60,000 options annually(1)(2) |

| | Non-employee director | | 30,000 options annually(1)(2) |

| | New director | | 30,000 options maximum(3) |

- (1)

- Annual option grants are made to all non-employee directors in office after each annual meeting of stockholders. Annual option grants vest 20% upon issuance and 20% on each three-month anniversary of the date of the grant.

- (2)

- At each Annual Meeting at which the director remains on the Board, the non-employee director will be eligible to receive an additional option to purchase a number of shares of the Company's common stock such that all options held by the Chairman represent approximately .25% and for other non-employee directors approximately 0.20%, respectively, of the Company's total number of outstanding shares of capital stock on a fully-diluted basis.

- (3)

- New director option grants are made on the date that a new non-employee director joins the Board. New director option grants vest 20% upon issuance and 20% on each three-month anniversary of the date of the grant.

Non-Employee Director Compensation Policy—July 2011

Set forth below is our Non-Employee Director Compensation Policy which became effective on July 1, 2011. Directors who are also our employees receive no additional compensation (beyond their

22

Table of Contents

regular employee compensation) for their services as directors. Dr. Garg is our only director who is also an employee of Tranzyme.

| | | | |

Cash Compensation: | | | | |

Retainers: | | | | |

| | Chairman of Board | | $10,000 per year(1) |

| | Audit Committee Chairman | | $8,000 per year(1) |

Board Meetings: | | | | |

| | Per Meeting (in person) | | $4,000 |

| | Per Meeting (telephonically) | | $3,000 |

All Committee Meetings: | | Per Meeting | | $1,000 |

Equity Compensation: | | | | |

| | Chairman of the Board | | 60,000 options annually(2)(3) |

| | Non-employee director | | 30,000 options annually(2)(3) |

| | New director | | 30,000 options maximum(4) |

- (1)

- Paid annually after the Company's Annual Meeting of Stockholders.

- (2)

- Annual option grants are made to all non-employee directors in office after each annual meeting of stockholders. Annual option grants vest 20% upon issuance and 20% on each three-month anniversary of the date of the grant.

- (3)