Exhibit 99.(k)(i)

Prudential Global Funding LLC

Financial Statements and Report of Independent Auditors

December 31, 2013 and 2012, and for the

Three Years Ended December 31, 2013

Prudential Global Funding LLC

Table of Contents

December 31, 2013 and 2012

Independent Auditors Report | 2 |

| |

Statements of Financial Condition | 3 |

| |

Statements of Operations | 4 |

| |

Statements of Changes in Members’ Equity | 5 |

| |

Statements of Cash Flows | 6 |

| |

Notes to Financial Statements | 7 |

Independent Auditor’s Report

To the Members of Prudential Global Funding LLC:

We have audited the accompanying financial statements of Prudential Global Funding, LLC, which comprise the statements of financial condition as of December 31, 2013 and December 31, 2012 and the related statements of operations, changes in members’ equity and cash flows for each of the three years in the period ended December 31, 2013.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on the financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Company’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Prudential Global Funding, LLC at December 31, 2013 and December 31, 2012, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Emphasis of Matter

The Company is a member of a group of affiliated companies and, as described in Notes 1, 2 and 10 to the financial statements, has extensive transactions and relationships with members of the group. Because of these affiliated relationships, it is possible that the terms of these transactions may not be the same as those that would result from transactions among unrelated parties.

July 21, 2014

PricewaterhouseCoopers LLP, 300 Madison Avenue, New York, NY 10017

T: (646) 471 3000, F: (646) 471 8320, www.pwc.com/us

2

Prudential Global Funding LLC

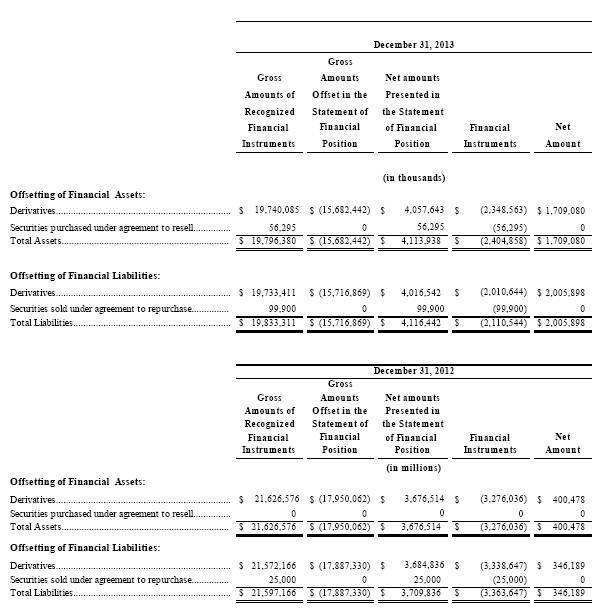

Statements of Financial Condition

December 31, 2013 and 2012

The accompanying notes are an integral part of these financial statements.

3

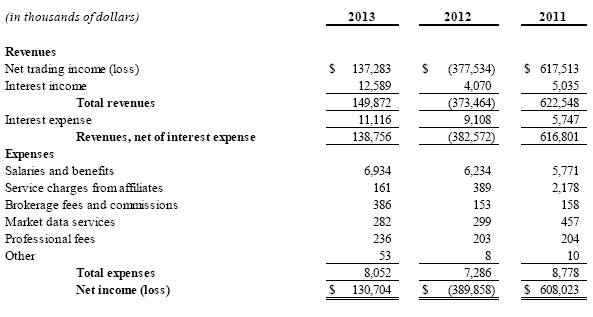

Prudential Global Funding LLC

Statements of Operations

Years Ended December 31, 2013, 2012 and 2011

The accompanying notes are an integral part of these financial statements.

4

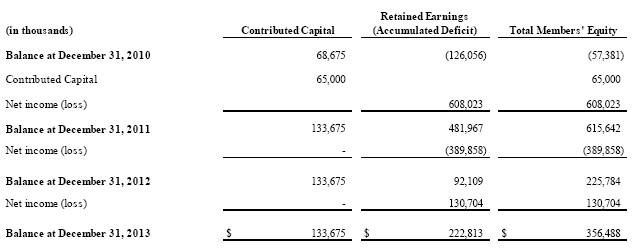

Prudential Global Funding LLC

Statements of Changes in Members’ Equity

Years Ended December 31, 2013, 2012 and 2011

The accompanying notes are an integral part of these financial statements.

5

Prudential Global Funding LLC

Statements of Cash Flows

Years Ended December 31, 2013, 2012 and 2011

The accompanying notes are an integral part of these financial statements.

6

Prudential Global Funding LLC

Notes to Financial Statements

1. Organization and Nature of Operations

Prudential Global Funding LLC, formerly Prudential Global Funding, Inc., (the “Company”) is organized under the laws of the State of Delaware. The Company principally acts as a derivatives conduit facilitating derivative and related activity for the Prudential Insurance Company of America (“PICA”) and other subsidiaries of Prudential Financial, Inc. (“Prudential”). The Company is a dual-member limited liability company that is owned by PICA and Pruco Life Insurance Company, an Arizona Corporation (“PLAZ”). PICA and PLAZ have ownership percentages of 99% and 1%, respectively. PLAZ is a wholly owned subsidiary of PICA.

The Company typically earns a spread for executing transactions between affiliates and unrelated third parties (“third parties”). This spread, which in the aggregate represents substantially all of the Company’s net trading income from core business operations, can vary from a percentage of a basis point to several basis points depending upon the nature of the transaction. The spread is determined based on an estimated profit margin that takes into account anticipated collateral and capital requirements, the credit quality of the counterparty, as well as the fixed costs incurred to support the Company’s operations.

Besides spread income, Net trading income (loss) includes an adjustment for the change in the fair value related to non-performance risk (NPR). The Company’s fair value estimate considers the risk that obligations arising from over-the-counter (OTC) derivative transactions will not be fulfilled by either counterparty, which may include a related party. The NPR adjustment relates only to the uncollateralized portion of a counterparty’s credit exposure or amount in excess of our bilateral collateral arrangements. Collateral arrangements with internal counterparties can differ from those with external counterparties. Certain internal agreements, particularly with most domestic insurance companies, have collateral posting thresholds at zero, limiting uncollateralized exposure to overnight settlements. Other internal agreements generally give the counterparty the option to make collateral calls. This can result in significantly less collateral posted by some internal counterparties with the Company. As each counterparty’s uncollateralized balance changes in size and fair value, the impact of the NPR adjustment on the fair value estimate can change significantly between the periods.

2. Summary of Significant Accounting Policies

Basis of Presentation

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

The Company has extensive transactions and relationships with PICA and other affiliates. Due to these relationships, it is possible that the terms of these transactions are not the same as those that would result from transactions among wholly unrelated parties.

Reclassifications

Certain amounts in prior years have been reclassified to conform to the current year presentation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. The Company’s estimates are most significantly impacted by market and credit risks (See Note 8). Actual results could differ from those estimates.

The most significant estimates include those used in determining the valuation of investments including derivatives (in the absence of quoted market values) and amounts recoverable from unsecured bankrupt counterparties (See Note 12).

7

Prudential Global Funding LLC

Notes to Financial Statements

Fair Value of Financial Instruments

The fair value of certain cash equivalents, trading assets, trading liabilities, and derivative financial instruments receivable and payable are equal to their carrying value presented in the Statements of Financial Condition. Cash and certain cash equivalents, accounts receivable, other assets, securities purchased under agreements to resell, and other liabilities generally approximate their respective fair value due to the short-term nature of such investments.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, amounts due from banks, certain money market investments and highly liquid debt investments with an original maturity of three months or less when purchased. As discussed in Note 10, the money market instruments represent shares of the Dryden Core Fund.

Gains and losses, including changes in fair value, on the highly liquid debt instruments are recorded as net trading income (loss). Dividends received on money market instruments and interest earned or incurred on trading positions is recorded as interest income or expense.

Trading Assets and Liabilities

Trading assets, at fair value and trading liabilities, at fair value are recorded on the trade date. Fair value is based on active market prices or broker or dealer quotations. See Note 4 for more information on fair value.

Trading assets, at fair value consist of highly liquid debt instruments with a maturity of greater than three months and less than twelve months when purchased.

Trading assets pledged, at fair value are securities pledged as collateral to counterparties, which in all cases the secured party has the right to rehypothecate.

Trading liabilities are securities sold, but not yet purchased, and represent liabilities resulting from the sale of securities that are borrowed by the Company. The Company’s affiliated clearing broker borrows securities on behalf of the Company or the Company purchases securities under agreements to resell to satisfy the delivery requirements of these sales.

Gains and losses, including changes in fair value, on trading positions are recorded as net trading income (loss). Interest earned or incurred on trading positions is recorded as interest income or expense.

Securities Purchased Under Agreements to Resell and Securities Sold Under Agreements to Repurchase

Securities purchased under resale agreements and securities sold under repurchase agreements are treated as collateralized financing transactions and are carried in the Statements of Financial Condition at the amounts at which the securities will be subsequently resold or repurchased, plus accrued interest. The Company takes possession of securities purchased under agreements to resell through its custodian and makes delivery of securities sold under agreements to repurchase. The fair value of securities is monitored, and additional collateral may be obtained or provided when considered appropriate to protect against credit exposure.

Interest income or expense on securities purchased under resale agreements and securities sold under repurchase agreements is recognized over the life of the transactions.

Derivative Financial Instruments Receivable and Payable, at Fair Value

Derivative financial instruments receivable and payable are recorded on trade date and are carried at fair value. Unrealized and realized gains and losses are reflected in Net trading income (loss). The Company’s policy is to

8

Prudential Global Funding LLC

Notes to Financial Statements

use mid-market pricing in determining its best estimate of fair value. Derivative positions are recorded at fair value, generally by obtaining quoted market prices or through the use of valuation models. Values can be affected by changes in interest rates, foreign exchange rates, financial indices, values of securities or commodities, credit spreads, market volatility, expected returns and liquidity. Values can also be affected by changes in estimates and assumptions, including those related to counterparty behavior, used in valuation models. See Note 4 for more information on fair value.

The Company nets the fair value of all derivative financial instruments with all counterparties for which a master netting arrangement has been executed.

The Company manages credit risk by entering into derivative transactions with creditworthy counterparties and obtaining collateral where appropriate and customary, and by limiting single party credit exposures. The Company nets cash collateral against counterparty derivative balances on the Statements of Financial Condition. Securities collateral is not recognized on the Statements of Financial Condition. At December 31, 2013 and 2012, the Company had received collateral from external and affiliate counterparties which is comprised of cash of $168 million and $2,346 million, respectively, and securities with an internal market value of $2,366 million and $3,276 million, respectively. The Company posted cash collateral to external and affiliate counterparties of $202 million and $2,284 million as of December 31, 2013 and 2012, respectively. The Company posted securities collateral to external and affiliate counterparties of $2,028 million and $3,339 million as of December 31, 2013 and 2012, respectively. See Note 10 for more information on securities collateral.

Revenue

As described above, the Company earns revenue primarily based on the spread between offsetting transactions it has entered into with both affiliated and unaffiliated counterparties. The Company also earns income from proprietary trading activities. See Note 5 for more information on revenue from trading activities.

Salaries and Benefits Expense

PGF does not have its own employees. PGF personnel are employed by Prudential, and all employee-related expenses are allocated from Prudential. Employee benefits expenses include costs for funded and non-funded, contributory and non-contributory defined benefit pension plans of Prudential. Some of these benefits are based on final group earnings and length of service while others are based on an account balance, which takes into consideration age, service and earnings during career. Prudential sponsors voluntary savings plans for the Company’s employee’s 401(k) plans. The plans provide for salary reduction contributions by employees and matching contributions by the Company of up to 4 percent of annual salary. The expense allocated to the Company for the matching contribution to the plans was $75 thousand, $71 thousand and $73 thousand in 2013, 2012 and 2011, respectively.

The Company’s allocation of net expense for the pension plans was $215 thousand, $156 thousand and $161 thousand in 2013, 2012 and 2011, respectively.

Share-based Payments

Prudential issues employee share-based compensation awards to certain of its employees, and the Company is charged for a share of this cost. The awards, which are issued under a plan authorized by Prudential Board of Directors, are subject to specific vesting conditions; generally the awards vest ratably over a three-year period, “the nominal vesting period,” or at the date the employee retires (as defined by the plan), if earlier. Compensation costs of awards to employees, such as stock options, are measured at fair value and expensed over the period during which an employee is required to provide service in exchange for the award (vesting period). For awards granted prior to January 1, 2006 that specify an employee vests in the award upon retirement, Prudential accounts for those awards using the nominal vesting period approach. Under this approach, the Company records its share of compensation expense over the nominal vesting period. If the employee retires before the end of the nominal vesting period, any remaining unrecognized compensation cost is recognized at the date of retirement. For awards granted subsequent to January 1, 2006, compensation cost is recognized on the

9

Prudential Global Funding LLC

Notes to Financial Statements

date of grant for awards issued to retirement-eligible employees, or over the period from the grant date to the date retirement eligibility is achieved, if that is expected to occur during the nominal vesting period.

The Company was charged $137 thousand, $100 thousand and $91 thousand for stock option expenses in 2013, 2012 and 2011, respectively. Additionally, the Company was charged $513 thousand, $411 thousand and $338 thousand in 2013, 2012 and 2011 for restricted stock-based compensation, respectively. These costs are recorded as a component of Salaries and benefits on the Statement of Operations.

Income Taxes

The Company is a dual-member limited liability company. In accordance with federal and applicable state tax law, the Company is treated as a partnership of its member owners, PICA and PLAZ, and, as such, is generally not subject to federal, state and local income tax. The Company intends to conduct its affairs such that it will not be subject to income tax in any jurisdiction. Accordingly, no provision is made for income taxes in the accompanying financial statements.

The member owners are included in the consolidated federal income tax return of Prudential. The member owners also file separate state income tax returns and are included in certain consolidated state income tax returns.

Adoption of New Accounting Pronouncements

In December 2013, the FASB issued updated guidance establishing a single definition of a public entity for use in financial accounting and reporting guidance. This new guidance is effective for all current and future reporting periods and did not have a significant effect on the Company’s consolidated financial position, results of operations, or financial statement disclosures.

In July 2013, the FASB issued new guidance regarding derivatives. The guidance permits the Fed Funds Effective Swap Rate (or Overnight Index Swap Rate) to be used as a U.S. benchmark interest rate for hedge accounting, in addition to the United States Treasury rate and London Inter-Bank Offered Rate (“LIBOR”). The guidance also removes the restriction on using different benchmark rates for similar hedges. The guidance is effective for qualifying new or redesignated hedging relationships entered into on or after July 17, 2013, and should be applied prospectively. Adoption of the guidance did not have a significant effect on the Company’s consolidated financial position, results of operations, and financial statement disclosures.

In December 2011 and January 2013, the Financial Accounting Standards Board (“FASB”) issued updated guidance regarding the disclosure of recognized derivative instruments (including bifurcated embedded derivatives), repurchase agreements and securities borrowing/lending transactions that are offset in the statement of financial position or are subject to an enforceable master netting arrangement or similar agreement (irrespective of whether they are offset in the statement of financial position). This new guidance requires an entity to disclose information on both a gross and net basis about instruments and transactions within the scope of this guidance. This new guidance is effective for interim or annual reporting periods beginning on or after January 1, 2013, and should be applied retrospectively for all comparative periods presented. The disclosures required by this guidance are included in Note 3.

In May 2011, the FASB issued updated guidance regarding the fair value measurements and disclosure requirements. The updated guidance clarifies existing guidance related to the application of fair value measurement methods and requires expanded disclosures. This new guidance is effective for the first interim or annual reporting period beginning after December 15, 2011 and should be applied prospectively. The Company adopted this guidance effective January 1, 2012. The required disclosures are provided in Note 4. Adoption of this guidance did not have a material effect on the Company’s financial condition or results of operations.

In April 2011, the FASB issued updated guidance regarding the assessment of effective control for repurchase agreements. This new guidance is effective for the first interim or annual reporting period beginning on or after

10

Prudential Global Funding LLC

Notes to Financial Statements

December 15, 2011 and should be applied prospectively to transactions or modifications of existing transactions that occur on or after the effective date. The Company’s adoption of this guidance effective January 1, 2012 did not have a material effect on the Company’s financial condition, results of operations, and financial statement disclosures.

3. Derivative Financial Instruments

Types of Derivative Financial Instruments

Derivatives are financial instruments whose values are derived from interest rates, foreign exchange rates, financial indices, values of securities or commodities, credit spreads, market volatility, expected returns, and liquidity. Derivative financial instruments used by the Company primarily include interest rate swaps, currency swaps, swaptions, credit default swaps, forwards, futures, and option contracts and may be exchange-traded or contracted in the over-the-counter (OTC) market. The Company transacts most of its third party derivative financial instruments with global investment banking institutions. The fair value of derivative financial instruments can be affected by changes in interest rates, foreign exchange rates, financial indices, values of securities or commodities, credit spreads, market volatility and liquidity, as well as other factors. The fair value can also be affected by changes in estimates and assumptions, including those related to counterparty behavior and non-performance risk used in pricing models.

Under interest rate swaps, the Company agrees to exchange, at specified intervals, the difference between two defined interest rate amounts calculated by reference to an agreed notional principal amount. Generally, no cash is exchanged at the outset of the contract and no principal payments are made. Cash is paid or received based on the terms of the swap. These transactions are entered into pursuant to master agreements that provide for a single net payment to be made by one counterparty at each due date.

Under currency forwards, the Company agrees to deliver or receive a specified amount of an identified currency at a specified future date. Typically, the price is agreed upon at the time of the contract and payment for such a contract is made at the specified future date.

Under currency swaps, the Company agrees to exchange, at specified intervals, the difference in value between one currency and another at a forward exchange rate and this is calculated by reference to an agreed principal amount. Generally, the principal amount of each currency is exchanged at the beginning and termination of the currency swap by each party. These transactions are entered into pursuant to master agreements that provide for a single net payment to be made by one counterparty for payments made in the same currency at each due date.

Under swaption agreements, the buyer has the right, but not the obligation, to enter into an interest rate swap at a specific date in the future, at a particular fixed rate, for a particular term. Similarly, under option agreements, the buyer has the right, but not the obligation, to purchase a referenced asset at a particular date or dates in the future for an agreed upon price.

Under credit derivatives, the Company agrees to make or receive payments contingent upon the occurrence of a specified credit event associated with a specific cash instrument or instruments. Depending on whether the Company is a writer or buyer of the derivative, the Company will receive or make premium payments under such contracts.

Under exchange-traded futures transactions, the Company agrees to purchase or sell a specified number of contracts, the values of which are determined by the values of underlying referenced investments, and to post variation margin on a daily basis in an amount equal to the difference in the daily market values of those contracts.

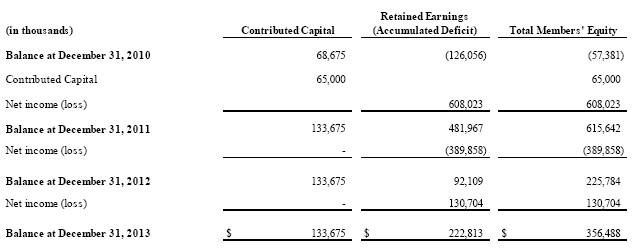

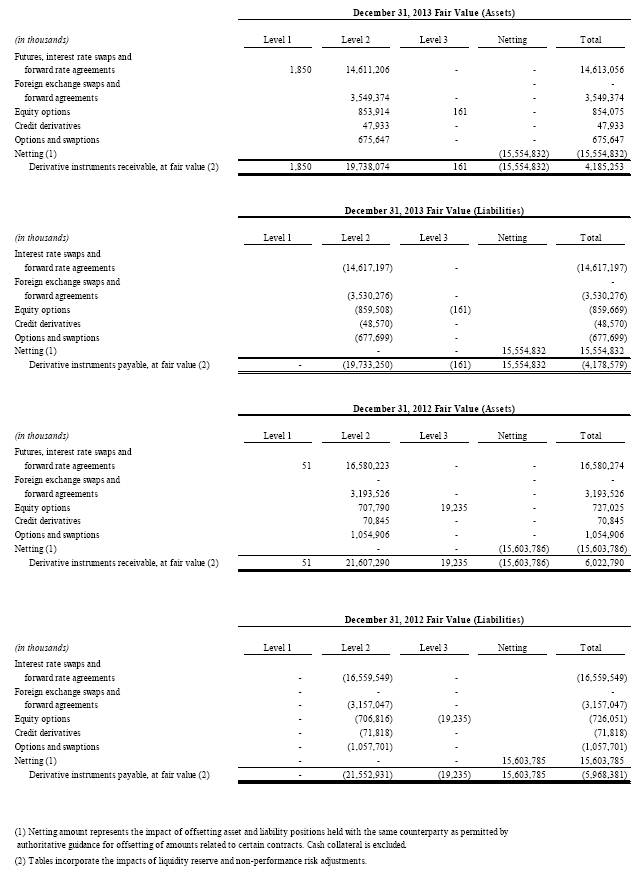

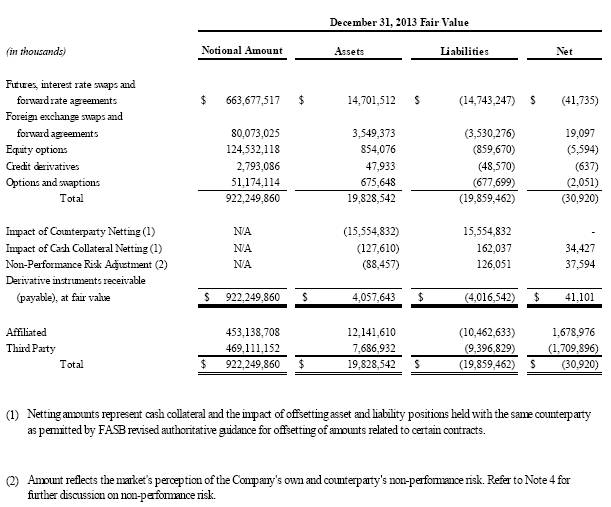

The tables below set forth a summary of the gross notional amount and fair value of derivative contracts held or issued by the Company, a reconciliation of such amounts to the presentation of derivative financial instruments

11

Prudential Global Funding LLC

Notes to Financial Statements

pursuant to authoritative guidance for offsetting of amounts related to certain contracts in the statement of financial condition, and a breakdown of affiliated and third party amounts.

12

Prudential Global Funding LLC

Notes to Financial Statements

13

Prudential Global Funding LLC

Notes to Financial Statements

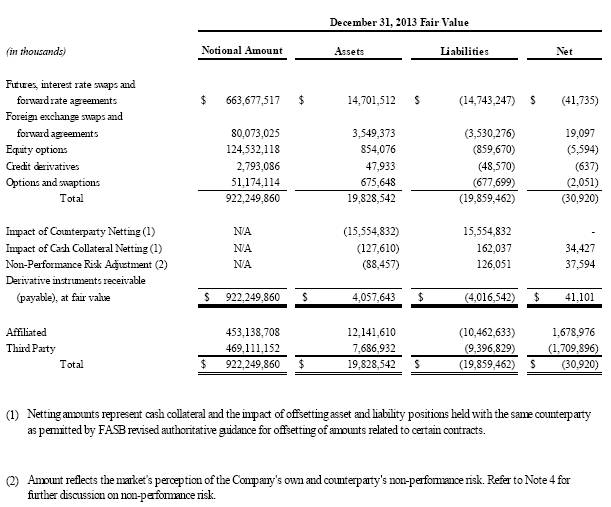

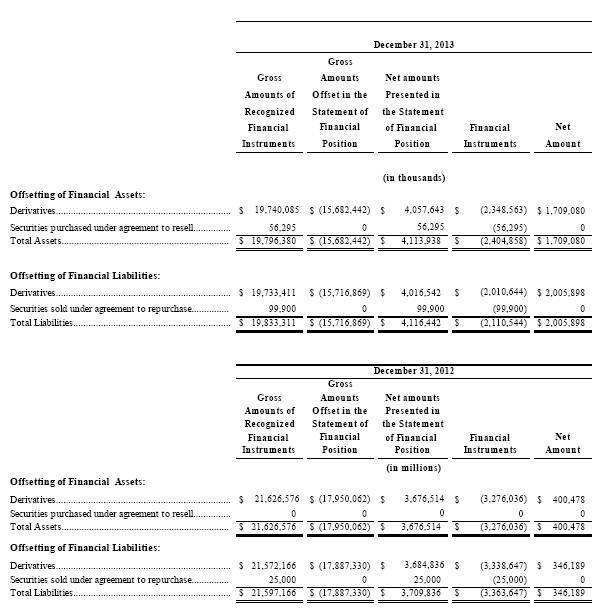

Offsetting Assets and Liabilities

The following table presents recognized derivative instruments (including bifurcated embedded derivatives), and repurchase and reverse repurchase agreements that are offset in the balance sheet, and/or are subject to an enforceable master netting arrangement or similar agreement, irrespective of whether they are offset in the balance sheet.

For information regarding the rights of offset associated with the derivative assets and liabilities in the table above see footnote 8. For securities purchased under agreements to resell and securities sold under agreements to repurchase, the Company monitors the value of the securities and maintains collateral, as appropriate, to protect against credit exposure. Where the Company has entered into repurchase and resale agreements with the same counterparty, in the event of default, the Company would generally be permitted to exercise rights of offset. For additional information on the Company’s accounting policy for securities repurchase and resale agreements, see Note 2.

14

Prudential Global Funding LLC

Notes to Financial Statements

Credit Derivatives Written

The following tables set forth the Company’s exposure from credit derivatives where the Company has written credit protection, by rating of the underlying credits as of the dates indicated. Liabilities positions are in parentheses.

The following table sets forth the composition of the Company’s credit derivatives where the Company has written credit protection including credit protection by industry category as of the dates indicated.

15

Prudential Global Funding LLC

Notes to Financial Statements

In addition to selling credit protection, the Company has also purchased credit protection using credit derivatives. As of December 31, 2013 and 2012, the Company had $1,458 million and $2,771 million of outstanding notional amounts, reported at fair value as a $43 million liability and a $39 million liability, respectively.

4. Fair Value of Assets and Liabilities

Fair Value Measurement

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The authoritative guidance around fair value established a framework for measuring fair value that includes a hierarchy used to classify the inputs used in measuring fair value. The hierarchy prioritizes the inputs to valuation techniques used to measure fair value into three levels. The level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement. The levels of the fair value hierarchy are as follows:

Level 1 — Fair value is based on unadjusted quoted prices in active markets that are accessible to the Company for identical assets or liabilities. These generally provide the most reliable evidence and are used to measure fair value whenever available. Active markets are defined as having the following for the measured asset/liability: (i) many transactions, (ii) current prices, (iii) price quotes not varying substantially among market makers, (iv) narrow bid/ask spreads, and (v) most information publicly available. The Company’s Level 1 assets include certain cash equivalents and derivative contracts that are traded in an active exchange market. Prices are obtained from readily available sources for market transactions involving identical assets or liabilities.

Level 2 — Fair value is based on significant inputs, other than Level 1 inputs, that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability through corroboration with observable market data. Level 2 inputs include quoted market prices in active markets for similar assets and liabilities, quoted market prices in markets that are not active for identical or similar assets or liabilities and other market observable inputs. The Company’s Level 2 assets and liabilities include: cash equivalents, trading assets and liabilities, including certain highly liquid debt instruments with maturities less than ninety days, and certain over-the-counter (OTC) derivatives. Valuations are generally obtained from third party pricing services for identical or comparable assets or liabilities or through the use of valuation methodologies using observable market inputs.

16

Prudential Global Funding LLC

Notes to Financial Statements

The majority of the Company’s derivative positions are traded in the OTC derivative market and are classified within Level 2 in the fair value hierarchy. OTC derivatives classified within Level 2 are valued using models generally accepted in the financial services industry that use actively quoted or observable market input values from external market data providers, non-binding broker-dealer quotations, third-party pricing vendors and/or recent trading activity. The fair values of most OTC derivatives, including forward rate agreements, interest rate and cross currency swaps and single name credit default swaps are determined using discounted cash flow models. The fair values of European style option contracts are determined using Black-Scholes option pricing models. These models’ key assumptions include the contractual terms of the respective contract, along with significant observable inputs, including interest rates, currency rates, credit spreads, yield curves, equity prices, index dividend yields, non-performance risk and volatility.

OTC derivative contracts are executed under master netting agreements with counterparties with a Credit Support Annex, or CSA, which is a bilateral ratings-sensitive agreement that requires collateral postings at established credit threshold levels. These agreements protect the interests of the Company and its counterparties, should either party suffer credit rating deterioration. The vast majority of the Company’s derivative agreements are with highly rated major international financial institutions.

A consideration of non-performance risk is required for all derivatives that are at fair value. Historically, the Company utilized the credit spread embedded in the London Interbank Offered Rate (“LIBOR”) curve to reflect non-performance risk for its derivative assets and liabilities. However, in light of the developments in 2009, including further clarification regarding the application of non-performance risk in the market, the Company determined that the credit spread embedded in the LIBOR curve was no longer indicative of the market participants’ view of the Company’s non-performance risk. As a result, to reflect the market’s perception of the Company and its counterparty’s non-performance risk, the Company incorporates additional spreads over LIBOR into the discount rate used in determining the fair value of OTC derivative assets and liabilities. However, the non-performance risk adjustment is applied only to the uncollateralized portion of the OTC derivative assets and liabilities, after consideration of the impacts of two-way collateral posting. Most OTC derivative contracts have bid and ask prices that are actively quoted or can be readily obtained from external market data providers. The Company’s policy is to use mid-market pricing in determining its best estimate of fair value.

Level 3 includes OTC derivatives where the bid-ask spreads are generally wider than derivatives classified within Level 2 thus requiring more judgment in estimating the mid-market price of such derivatives. Derivatives classified as Level 3 include first-to-default credit basket swaps, look-back equity options and other structured products. These derivatives are valued based upon models with some significant unobservable market inputs or inputs from less actively traded markets. The fair values of first-to-default credit basket swaps are derived from relevant observable inputs such as: individual credit default spreads, interest rates, recovery rates and unobservable model-specific input values such as correlation between different credits within the same basket. Look-back equity options and other structured options and derivatives are valued using simulation models such as the Monte Carlo technique. The input values for look-back equity options are derived from observable market indices such as interest rates, dividend yields, equity indices as well as unobservable model-specific input values such as certain volatility parameters. Level 3 methodologies are validated through periodic comparison of the Company’s fair values to broker-dealer values.

Liquidity valuation adjustments are made to reflect the cost of exiting significant risk positions, and consider the bid-ask spread, maturity, complexity, and other specific attributes of the underlying derivative position. Fair values can also be affected by changes in estimates and assumptions including those related to counterparty behavior used in valuation models. Non-performance risk, as addressed above, for Level 2 derivative assets and liabilities is consistently applied for Level 3 derivative assets and liabilities.

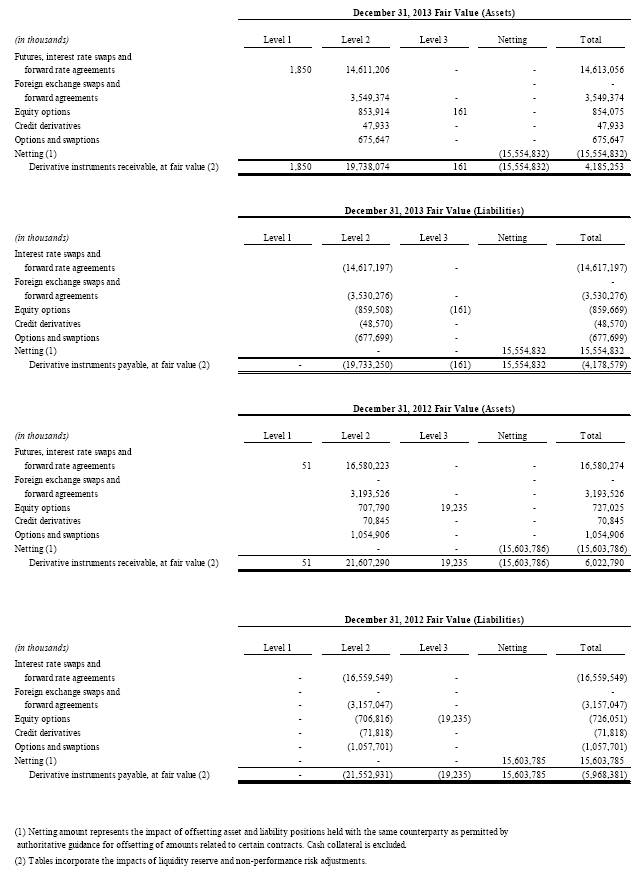

The table below presents the balances of assets and liabilities measured at fair value on a recurring basis, as of December 31, 2013 and 2012.

17

Prudential Global Funding LLC

Notes to Financial Statements

The tables below provide a summary of the fair value of derivative contracts held or issued by the Company and a reconciliation of such amounts to the presentation of derivative financial instruments pursuant to authoritative guidance for offsetting of amounts related to certain contracts in the Statement of Financial Condition as of December 31, 2013 and 2012.

18

Prudential Global Funding LLC

Notes to Financial Statements

19

Prudential Global Funding LLC

Notes to Financial Statements

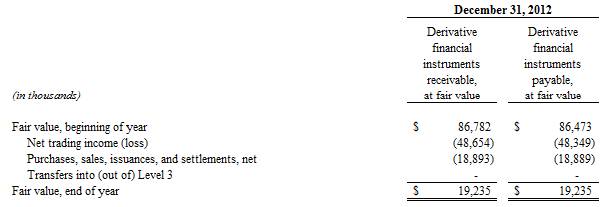

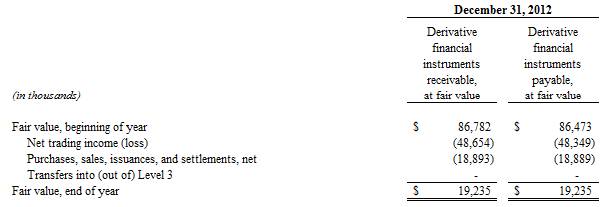

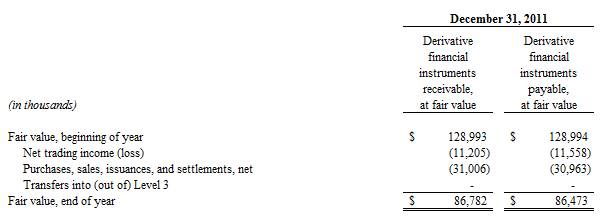

The following tables provide a summary of the changes in fair value of Level 3 assets and liabilities for the years ended December 31, 2013, 2012 and 2011. The tables also include, in Net trading income (loss) the portion of gains or losses included in income for the three years ended attributable to unrealized gains or losses related to those assets and liabilities still held.

20

Prudential Global Funding LLC

Notes to Financial Statements

There were no transfers between Level 1 and Level 2 for the years ended December 31, 2013, 2012 and 2011.

Fair Value of Financial Instruments

The Company believes that due to the short-term nature of certain assets and liabilities, the carrying value approximates fair value. These assets include: securities purchased under agreements to resell and securities sold under agreements to repurchase. These assets and liabilities would generally be classified as level 2 under the fair value hierarchy, except for cash, which would be classified as level 1, accounts receivable.

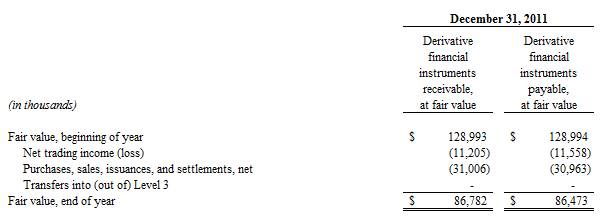

5. Trading Activities

The table below sets forth Net trading income (loss) by type of financial instrument.

21

Prudential Global Funding LLC

Notes to Financial Statements

6. Trading Assets and Liabilities

7. Securities Purchased Under Agreements to Resell

The Company enters into purchases of securities under agreements to resell substantially identical securities. At December 31, 2013 and 2012, the agreements amounted to approximately $56 million and $0, respectively, and consisted of U.S. Government securities. As of December 31, 2013 and 2012, the Company had received securities as collateral that can be repledged, sold or otherwise used during the normal course of business. Of these, securities with a fair value of approximately $56 million and $2 thousand, respectively, were repledged, sold or otherwise used generally as collateral under repurchase agreements or to cover short sales. The amounts advanced under these agreements are reflected as assets on the Statements of Financial Condition. Additionally, the Company is eligible to receive additional collateral based on the fair value of the underlying securities held.

8. Market and Credit Risk

The Company’s risk management program includes the identification and the measurement of various forms of risk, the establishment of risk thresholds and the creation of processes intended to maintain risks within these thresholds while optimizing returns on the underlying assets or liabilities. The Company considers risk management an integral part of its core business.

Market Risk

In the normal course of business, the Company enters into transactions in trading assets, trading liabilities and financial contracts with off-balance-sheet risk. These instruments are carried at their current estimated fair value, generally by obtaining quoted market prices or through the use of pricing models. Values can be affected by changes in interest rates, foreign exchange rates, financial indices, value of securities or commodities, credit spreads, market volatility, and liquidity, as well as other factors. Values can also be affected by changes in estimates and assumptions used in pricing models. Any change in these variables could result in adjustment of the amounts recognized on the financial statements being included currently in both the Statements of Financial Condition and Operations.

22

Prudential Global Funding LLC

Notes to Financial Statements

The Company is also exposed to market risk due to the fluctuation in the market or fair value of securities owned and securities sold but not yet purchased (if any). Securities sold, but not yet purchased, represent obligations to the Company to deliver specified securities at contracted prices and thereby create a liability to purchase the securities at prevailing future market prices. Accordingly, these transactions result in off-balance sheet risk as the Company’s ultimate obligation to satisfy the sale of securities sold, but not yet purchased may exceed the amount recognized in the Statements of Financial Condition.

The Company’s primary components of market risk include interest rate risk, foreign exchange risk, swap spread risk, volatility risk and yield curve risk. These are monitored on a daily basis across all products by calculating the profit and loss impact of potential changes in market risks over a one-day period. The Company primarily manages risk by entering into offsetting OTC derivative contracts between affiliated and external counterparties. Further, to manage exposure to these risks in connection with its trading activities, the Company may hedge its exposure by purchasing or selling futures contracts, entering into forward contracts, purchasing or selling government securities, purchasing or selling exchange traded interest rate or equity options, or entering into offsetting transactions. These hedging instruments are carried at fair value and contain elements of market and credit risk associated with the execution, settlement, and financing of these instruments similar to the financial contracts described above.

Credit Risk

The Company is exposed to credit-related losses in the event of non-performance by counterparties to financial derivative transactions. The Company manages credit risk by entering into derivative transactions with highly rated major international financial institutions and other creditworthy counterparties and by obtaining collateral where appropriate. Additionally, limits are set on single party credit exposures which are subject to periodic management review.

The credit exposure of the Company’s OTC derivative transactions is represented by the contracts with a positive fair value (market value) at the reporting date. To reduce credit exposures, the Company seeks to (i) enter into OTC derivative transactions pursuant to master agreements that provide for a netting of payments and receipts with a single counterparty and (ii) enter into agreements that allow the use of credit support annexes (CSAs), which are bilateral rating-sensitive agreements that require collateral postings at established threshold levels. The Company effects exchange-traded futures and options transactions through regulated exchanges. These transactions are settled on a daily basis, thereby reducing credit risk exposure in the event of non-performance by counterparties to such financial instruments.

Under fair value measurements, the Company incorporates the market’s perception of its own and the counterparty’s non-performance risk in determining the fair value of the portion of its OTC derivative assets and liabilities that are uncollateralized. Credit spreads are applied to the derivative fair values on a net basis by counterparty. To reflect the Company’s own credit spread, a proxy based on relevant debt spreads is applied to OTC derivative net liability positions. Similarly, the Company’s counterparty’s credit spread is applied to OTC derivative net asset positions. At December 31, 2013, the Company’s non-performance risk adjustment for derivative assets and liabilities recorded in Derivative financial instruments receivable and payable was $88 million and $126 million, respectively. At December 31, 2012, the Company’s non-performance risk adjustment for derivative assets and liabilities recorded in Derivative financial instruments receivable and payable was $35 million and $12 million, respectively. The change in the non-performance risk adjustment is recorded in Net trading income (loss).

Certain of the Company’s derivative agreements with some of its counterparties contain credit-risk-related triggers. If the Company’s credit rating were to fall below a certain level, the counterparties to the derivative instruments could request termination at the then fair value of the derivative or demand immediate full collateralization on derivative instruments in net liability positions. If a downgrade occurred and the derivative positions were terminated, the Company anticipates it would be able to replace the derivative positions with other counterparties in the normal course of business. The aggregate fair value of all derivative instruments with credit-risk-related contingent features that are in a net liability position was $4,017 million and $3,685 million as of

23

Prudential Global Funding LLC

Notes to Financial Statements

December 31, 2013 and 2012, respectively. In the normal course of business the Company has posted net cash and securities collateral related to these instruments of $2,165 million to third parties and $65 million to affiliate counterparties as of December 31, 2013 and $63 million to third parties and $5,558 million to affiliate counterparties as of December 31, 2012. If the credit-risk-related contingent features underlying these agreements had been triggered on December 31, 2013 and 2012, the Company estimates that it would be required to post a maximum of $60 million and $0 million, respectively, of additional collateral to its counterparties. See Note 10 for more information on securities collateral.

Credit Risk Concentrations

Concentrations of credit risk exist when a number of counterparties are engaged in similar activities and have similar economic characteristics that would cause their ability to meet contractual obligations to be similarly affected by changes in economic or other conditions. The Company’s external counterparties are highly rated major international institutions in the banking and finance industry. The Company’s affiliate counterparties are subsidiaries of Prudential.

The Company manages credit risk by entering into master netting agreements and requiring collateral postings at established thresholds (See Note 4). The Company holds collateral posted in the form of cash and securities (See Notes 2 and 10). As discussed above, the Company’s credit exposure is represented by the contracts with a positive fair market value. If a counterparty fails to perform according to contract terms and if the collateral proved to be of no value, the maximum amount of loss due to credit risk that the Company would incur is equal to the gross fair value of all derivative assets with the counterparty. As of December 31, 2013 and 2012, the Company’s gross derivative assets were $19,829 million and $21,662 million, respectively (See Note 3).

9. Income Taxes

The Company is a Dual-Member Limited Liability Company. In accordance with federal and applicable state tax law, the Company is treated as a partnership of its member owners, PICA and PLAZ. The members are included in the consolidated federal income tax return of Prudential. The member owners also file separate state income tax returns and are included in certain consolidated state income tax returns.

All federal and state income tax liabilities and/or benefits are passed through to the member owners in accordance with the Internal Revenue Code. Accordingly, no provision is made for taxes in the accompanying financial statements.

10. Transactions with Related Parties

Guarantee

The Company’s payment obligations under derivative financial instruments have been guaranteed by an affiliate of the Company. This credit enhancement is integral to the Company’s business operations. The maximum exposure under these guarantees may be calculated at any point by estimating the replacement cost, on a net present value basis, for each guaranteed contract for which there is a cost. While this amount will vary as a result of changes in fair value, the maximum exposure under this guarantee, net of non-performance risk, at December 31, 2013 and 2012 was the entire derivative liability balance of approximately $4,017 million and $3,685 million, respectively. The Company does not pay a fee in consideration for this guarantee. No payments have been required under this guarantee since inception.

Affiliate OTC Derivative Contracts

In the ordinary course of business the Company transacts OTC derivatives with its affiliates. For these OTC contracts, the Company has a substantially equal and offsetting position with external counterparties. See Note 3 for a summary of the gross notional and fair value of derivative contracts.

24

Prudential Global Funding LLC

Notes to Financial Statements

Service Agreement

The Company’s general and administrative expenses are charged to the Company using allocation methodologies based on business processes. The Company periodically reviews its allocation methodology and may adjust it from time to time. Management believes that such methodology is reasonable. The Company operates under service and lease agreements whereby services of officers and employees, supplies, use of equipment and office space are provided by Prudential. Under these agreements, the expenses were approximately $7.1 million, $6.6 million, and $7.9 million in 2013, 2012 and 2011, respectively.

Related receivables and payables under the aforementioned agreements are billed monthly and quarterly. The related payables included in “Other liabilities” were approximately $0 and $0.6 million at December 31, 2013 and 2012, respectively.

Securities Posted as Collateral

As many of the Company’s transactions with third parties are a direct result of transactions with affiliates, the Company maintains custody of collateral from affiliates for purposes of repledging amounts to third parties and affiliates, which are not included in the accompanying Statements of Financial Condition.

At December 31, 2013, the Company received securities collateral of $535 million from third parties and $1,831 million from affiliates, $2,028 million of which was rehypothecated. At December 31, 2012, the Company received securities collateral of $2,892 million from third parties and $384 million from affiliates, all of which was rehypothecated. The Company posted none of its own securities as collateral at December 31, 2013 and 2012, respectively.

Dryden Core Fund

At December 31, 2013 and 2012, the Company had cash equivalents of $170 million and $1 thousand in the Dryden Core Fund (“Core fund”). The Core fund entails participating subsidiaries sending excess cash to Prudential on a daily basis. The result is a “pool” of net investments at Prudential, which is invested in short term investments and earns dividends. The dividends earned on the pool are allocated out to each Core fund participant based on their proportional shares of the Core fund. Prudential Investment Management, Inc., an affiliate of the Company, manages and administers the Core fund.

11. Commitments and Contingencies

In the normal course of business, the Company enters into contracts that contain representations that provide general indemnifications relating to the derivative financial instruments and master netting agreements or the use of third party products or services. While future exposure under these arrangements is unknown, based on experience, the Company expects the risk of loss to be remote.

The Company is subject to legal and regulatory actions in the ordinary course of its business. Refer to Note 12 for discussion on material litigation. The Company’s litigation and regulatory matters are subject to many uncertainties, and given their complexity and scope, their outcome cannot be predicted. It is possible that the Company’s results of operations or cash flow could be materially affected by an ultimate unfavorable resolution of pending litigation and regulatory matters depending, in part, upon the results of operations or cash flow for such period. In light of the unpredictability of the Company’s litigation and regulatory matters, it is also possible that in certain cases an ultimate unfavorable resolution of one or more pending litigation or regulatory matters could have a material adverse effect on the Company’s financial condition. Management believes, however, that, based on information currently known to it, the ultimate outcome of all pending litigation and regulatory matters, after consideration of applicable reserves and rights to indemnification, is not likely to have a material adverse effect on the Company’s financial condition.

25

Prudential Global Funding LLC

Notes to Financial Statements

The Company may enter into agreements that contain features that meet the definition of a guarantee under FASB authoritative guidance for guarantees. The guidance defines a guarantee to be a contract that contingently requires the Company to make payments (either in cash, financial instruments, other assets, shares of our stock or provision of services) to a third party based on specific changes in an underlying variable that is related to an asset, a liability, or an equity security of the related party. The Company’s agreements, which are more fully described in Note 3, contingently require us to pay amounts based upon changes in market prices and interest rates and the occurrence of specified credit events. These derivative contracts include credit derivatives for the sale of credit protection, and written options, such as interest rate options, swaptions, foreign exchange rate options, and equity security options.

The Company writes credit default swap obligations requiring payment of principal due in exchange for the reference credit obligation, depending on the nature or occurrence of specified events for the referenced entities. In the event of a specified credit event, the Company’s maximum amount at risk, assuming the value of referenced credits become worthless, is approximately $1,411 million and $2,800 million at December 31, 2013 and 2012, respectively. The Company’s credit default swaps generally have maturities of five years or less. These agreements are offset with related parties.

The Company is a party to complex European look-back option agreements with third parties which could require the Company to make payments related to a shortfall between a protected high watermark value and the net asset value of identified investment funds at certain maturity dates. While the Company’s ultimate obligation under such agreements cannot be predicted, the agreements require the counterparty to follow certain parameters and proprietary mathematical formulae in making investment decisions. The Company believes these restraints and other parameters of the agreements reduce the risk that the Company will have to perform under these agreements. Additionally, the Company has offsetting agreements with a related party. Both the third party and related party options are recorded at fair value in the financial statements.

12. Lehman Brothers Holdings Inc.

As a result of the Chapter 11 bankruptcy petition filed by Lehman Brothers Holdings Inc. (“LBHI”) on September 15, 2008, the Company recorded losses approximating $75 million during 2008 related to the unsecured portion of its counterparty exposure on derivative transactions it had entered into with LBHI and its affiliates. The amount was recorded as a receivable of approximately $86 million, less a reserve of approximately $75 million recorded in Net trading income with expected recoveries of approximately $11 million.

On March 31, 2011, it was agreed through mediation that the Company would pay Lehman Brothers Special Financing (“LBSF”) $65 million to settle a collateral dispute related to the LBHI bankruptcy in 2008. The Company received a capital contribution from its members in the amount of $65 million. Payment of this claim was executed on May 17, 2011. The impact of this subsequent event was reflected in the 2010 financial statements in “Other liabilities” and “Net trading loss.”

On April 17, 2012, the Company received information relating to future expected payments in the amount of $12.2 million. The impact of this subsequent event was reflected in the 2011 financial statements in “Accounts receivable” and “Net trading income (loss)”. On April 17, 2012 and October 1, 2012, the Company received payments in connection with the LBHI bankruptcy proceedings in the amounts of $6.8 million and $4.6 million, respectively which have been reflected in the 2012 financial statements in “Cash and cash equivalents” and “Accounts receivable.”

On April 3, 2013, notice was received from Lehman Counsel in Switzerland that the LBSF schedule of claims had been established, and the Company’s claim in the amount of 218 million Swiss Francs (approximately $234 million USD) had been admitted. The Company concluded that there were sufficient facts and circumstances to expect that it will receive a payment on its LBSF claim within the range of $35 million to $140 million USD. The Company took into consideration external market quotes related to the settlement and concluded the best estimate within the range was 50% of our total claim or approximately $117 million USD. On April 9, 2013 the Company entered into a hedge for 109 million Swiss Francs ($117 million USD) to hedge the foreign exchange

26

Prudential Global Funding LLC

Notes to Financial Statements

exposure of the expected claim. Accordingly, the Company reduced its allowance against the Lehman receivables by $117 million, with expected recoveries for both the LBHI and LBSF claims now totaling approximately $140 million. The impact of this subsequent event has been reflected in the 2012 financial statements in “Accounts receivable” and “Net Trading income (loss).” The net Accounts receivable balance for the two claims as of December 31, 2012 was $128.6 million.

On April 4, 2013, October 3, 2013, and December 13, 2013 the Company received payments in connection with the LBHI bankruptcy proceedings in the amount of $5.8 million, $6.8 million, and $23 million respectively.

On July 31, 2013 the Company received a broker quote from Royal Bank of Scotland that increased the recovery percentage of PGF’s claim. PGF increased the LBSF accounts receivable by $18.8 million. Due to broker quotes received from Royal Bank of Scotland, Credit Suisse, and Bank of America Merrill Lynch (received between January 6, 2014 and January 8, 2014) PGF increased the LBSF receivable by $9.2 million. There was also $6.5 million remeasurement gain (offset in separate hedge) for the 2013 financial statements.

As of December 31, 2013 there is a remaining net receivable of $128.5 million for both the USD (LBHI) and CHF (LBSF) claims, which has been reflected in the 2013 financial statements in “Cash and cash equivalents” and “Accounts receivable.”

13. Subsequent Events

In preparing these financial statements, the Company has evaluated events and transactions for potential recognition or disclosure. Subsequent events have been evaluated through July 21, 2014 which is the date the financial statements were issued.

On April 4, 2014, the Company received an unexpected payment in connection with the LBHI bankruptcy proceedings in the amount of $7.5 million and the receivable was increased as of 1Q 2014.There was also a $1 million remeasurement gain on the Swiss receivable as of 1Q 2014 (offset in separate hedge). These subsequent events resulted in a $7.5 million increase to the receivable that is reflected in the 2013 PGF Financial Statements.

On June 4, 2014, the Company received a payment in connection with the LBSF bankruptcy proceedings in the amount of 84 million CHF ($93.8 million USD) that will lower the Lehman accounts receivable balance.

On June 10, 2014, the Company received a broker quote from Bank of America Merrill Lynch that estimated a remaining distribution amount of $20 million or 10% of the original claim. Accordingly, the NY Claim receivable was increased by $19 million for a net receivable balance of USD $20 million as of June 30, 2014. The quotes also estimated a remaining distribution of 9.75% of the original CHF 218 million Swiss Claim, accordingly the Swiss Claim receivable was decreased by CHF 9 million ($10 million USD) to a net receivable balance of CHF 21 million as of June 30, 2014. These subsequent events resulted in a $9 million increase to the receivable that is reflected in the 2013 PGF Financial Statements.

27