- UCTT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ultra Clean (UCTT) DEF 14ADefinitive proxy

Filed: 20 Apr 05, 12:00am

UNITED STATES |

| [_] Preliminary Proxy Statement | [_] Soliciting Material Under Rule 14a-12 |

| [_] Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] Definitive Proxy Statement |

| [_] Definitive Additional Materials |

ULTRA CLEAN HOLDINGS, INC. —————————————————————————————— Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [_] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: ——————————————————————————————————————— |

| (2) | Aggregate number of securities to which transaction applies: ——————————————————————————————————————— |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): ——————————————————————————————————————— |

| (4) | Proposed maximum aggregate value of transaction: ——————————————————————————————————————— |

| (5) | Total fee paid: ——————————————————————————————————————— |

| [_] | Fee paid previously with preliminary materials: |

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: ——————————————————————————————————————— |

| (2) | Form, Schedule or Registration Statement No.: ——————————————————————————————————————— |

| (3) | Filing Party: ——————————————————————————————————————— |

| (4) | Date Filed: ——————————————————————————————————————— |

ULTRA CLEAN HOLDINGS, INC. Notice of 2005 Annual Meeting of Stockholders of Ultra Clean Holdings, Inc. |

| Date: | Friday, May 20, 2005 | |

| Time: | Doors open: | 9:30 a.m. Pacific Daylight Time |

| Meeting begins: | 10:00 a.m. Pacific Daylight Time | |

| Place: | Davis Polk & Wardwell 1600 El Camino Real Menlo Park, CA 94025 | |

| Purposes: | • Elect our directors. | |

| • Ratify the appointment of our independent auditors. | ||

| • Conduct other business if properly raised. | ||

| Who Can Vote: | Only stockholders of record on April 12, 2005 may vote at the meeting. | |

| All stockholders are cordially invited to attend the meeting. At the meeting you will hear a report on our business and have a chance to meet some of our directors and executive officers. Our 2004 Annual Report is enclosed. | ||

Whether you expect to attend the meeting or not, please complete, sign, date and promptly return the enclosed proxy card in the postage-prepaid envelope we have provided. You may change your vote and revoke your proxy at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement. | ||

| KEVIN L. GRIFFIN | |

| Secretary | |

| April 20, 2005 |

| TABLE OF CONTENTS |

i |

ULTRA CLEAN HOLDINGS, INC. PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS |

| Who May Vote |

Holders of our common stock, as reflected in our records on April 12, 2005, may vote at the meeting. This proxy statement and the enclosed proxy card are being sent to our stockholders on or about April 22, 2005. Each share of common stock that you owned on the record date entitles you to one vote on each matter properly brought before the meeting. Holding Shares as a “Beneficial Owner” (or in “Street Name”) Most stockholders are considered the “beneficial owners” of their shares, that is, they hold their shares through a broker, bank or nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name”. Stockholder of Record: If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares. If you are a stockholder of record, we are sending these proxy materials directly to you. As our stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for your vote. Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank, or nominee (who is considered the stockholder of record with respect to those shares). As the beneficial owner, you have the right to direct your broker, bank, or nominee on how to vote if you follow the instructions you receive from your broker, bank, or nominee. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting, unless you bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 12, 2005, the record date for voting. |

| How to Vote |

You may vote in person at the meeting or by proxy. All valid proxies properly executed and received by us prior to or at the meeting will be voted in accordance with the instructions they contain. We recommend that you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting. |

| How Proxies Work |

This proxy statement is furnished in connection with the solicitation of proxies by Ultra Clean’s Board of Directors for use at the Annual Meeting and at any adjournment of that meeting. Giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some or none of our director candidates. You may also vote for or against the other proposals, or abstain from voting. If no instruction is specified as to how your shares will be voted on a particular matter, your shares be voted FOR the election of each of the named nominees for director, FOR the ratification of the appointment of Deloitte & Touche LLP as our independent auditors and, with respect to any other matter that may come before the Annual Meeting, as recommended by our Board of Directors or otherwise in the proxies’ discretion. If you hold your shares in street name, your broker, bank or nominee will include a voting instruction card with this proxy statement. You should vote your shares by following the instructions provided on the voting instruction card. In addition to voting in writing, your broker, bank or nominee may also provide instructions for voting using the telephone or over the Internet. |

| Revoking a Proxy |

All stockholders have the right to revoke a previously submitted proxy at any time before the Annual Meeting, or by voting in person at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy before it is voted by: |

| • | Submitting a new proxy with a later date than the previously submitted proxy; | |

| • | Notifying our Secretary in writing before the meeting; or | |

| • | Voting in person at the meeting. |

If you are a beneficial holder, you should follow the instructions provided to you by your broker, bank or nominee as to how to revoke your proxy. You may also revoke your proxy by voting in person at the meeting, provided you comply with the requirements indicated below. |

| Attending in Person |

Any stockholder of record may vote in person. All meeting attendees may be asked to present a valid, government-issued photo identification, such as a driver’s license or passport, before entering the meeting. If you are a beneficial owner and your shares are held in the name of your broker, bank or nominee, you must bring to the meeting an account statement or letter from the nominee indicating that you beneficially owned the shares on April 12, 2005, the record date for voting. |

| Matters to be Presented |

We are not aware of any matters to be presented other than those described in this proxy statement. If any matters not described in this proxy statement are properly presented at the meeting, the proxies will use their own judgment to determine how to vote your shares. |

| Contacting Ultra Clean |

If you have questions or would like more information about the Annual Meeting, you can contact us in any of the following ways: |

| • | By telephone: | (650) 323-4100 | |

| • | By writing: | Secretary | |

| Ultra Clean Holdings, Inc. | |||

| 150 Independence Drive | |||

| Menlo Park, CA 94025 | |||

| Deadline for Submitting Stockholder Proposals for the 2006 Annual Meeting |

| • | each person or group known by us to own beneficially more than five percent of our common stock; |

2 |

| • | each of our directors and named executive officers individually; and | |

| • | all directors and officers as a group. |

In accordance with Securities and Exchange Commission rules, beneficial ownership includes voting or investment power with respect to securities and includes the shares issuable pursuant to stock options that are exercisable within 60 days of March 31, 2005. Shares issuable pursuant to stock options are deemed outstanding for computing the ownership percentage of the person holding such options but are not outstanding for computing the ownership percentage of any other person. The percentage of beneficial ownership for the following table is based on 16,372,689 shares of common stock outstanding as of March 31, 2005. Unless otherwise indicated, the address of each of the named individuals is c/o Ultra Clean Holdings, Inc., 150 Independence Drive, Menlo Park, California 94025. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock. |

| Shares Beneficially owned | ||||||||

| Name and Address of Beneficial Owner | Number | Percent | ||||||

| Greater than 5% Stockholders | ||||||||

| FP-Ultra Clean, LLC(1) | 9,029,900 | 55.15 | % | |||||

| c/o Francisco Partners, L.P. | ||||||||

| 2882 Sand Hill Road, | ||||||||

| Suite 280 | ||||||||

| Menlo Park, CA 94025 | ||||||||

| Mazama Capital Management, Inc.(2) | 1,606,638 | 9.81 | % | |||||

| One S.W. Columbia, Suite 1500 | ||||||||

| Portland, OR 97258 | ||||||||

| Named Executive Officers and Directors | ||||||||

| Clarence L. Granger(3) | 529,707 | 3.19 | % | |||||

| Kevin L. Griffin(4) | 146,137 | * | ||||||

| Deborah Hayward(5) | 43,244 | * | ||||||

| Phillip A. Kagel(6) | 5,000 | * | ||||||

| Sowmya Krishnan Ph.D.(7) | 43,819 | * | ||||||

| Bruce Wier(8) | 104,455 | * | ||||||

| Brian R. Bachman(9) | 4,375 | * | ||||||

| Susan H. Billat(9) | 4,375 | * | ||||||

| Dipanjan Deb(1)(10) | 9,034,275 | 55.16 | % | |||||

| Kevin C. Eichler(10) | 5,375 | * | ||||||

| David ibnAle(1)(10) | 9,034,275 | 55.16 | % | |||||

| Thomas M. Rohrs(11) | 78,072 | * | ||||||

| All named executive officers and directors as a group (12 persons) | 10,003,209 | 59.49 | % | |||||

| ——————————— |

| * | Less than 1%. |

| (1) | Based on a Schedule 13G filed with the Securities and Exchange Commission jointly by FP-Ultra Clean, LLC (“FP-Ultra Clean”), Francisco Partners L.P. (“Francisco Partners”) and Francisco Partners GP, LLC (“Francisco GP”) on October 13, 2004. The shares are owned beneficially and of record by FP-Ultra Clean. All of the membership interests of FP-Ultra Clean are beneficially owned by Francisco Partners, and Francisco GP is the general partner of Francisco Partners. Messrs. Deb and ibnAle, members of management of Francisco Partners, disclaim beneficial ownership of the securities held by Francisco Partners, FP-Ultra Clean and Francisco GP. |

| (2) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2005. |

| (3) | Includes 216,562 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| (4) | Includes 70,312 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| (5) | Includes 42,578 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| (6) | Mr. Kagel resigned as our Senior Vice President, Chief Financial Officer on March 24, 2005. Information provided in this proxy statement with respect to Mr. Kagel is being provided voluntarily, as he was not a named executive officer in 2004. |

| (7) | Includes 24,869 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

3 |

| (8) | Includes 51,380 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| (9) | Represents shares subject to common stock options that are exercisable within 60 days of March 31, 2005. |

| (10) | Includes 4,375 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| (11) | Includes 15,572 shares subject to common stock options exercisable within 60 days of March 31, 2005. |

| Name | Age | Director Since | ||||||

| Brian R. Bachman | 60 | 2004 | ||||||

| Susan H. Billat | 54 | 2004 | ||||||

| Dipanjan Deb | 35 | 2002 | ||||||

| Kevin C. Eichler | 45 | 2004 | ||||||

| Clarence L. Granger | 56 | 2002 | ||||||

| David T. ibnAle | 33 | 2002 | ||||||

| Thomas M. Rohrs | 54 | 2003 | ||||||

Set forth below is information about each of our nominees for director: Clarence L. Granger has served as our Chief Executive Officer since November 2002, as our President and Chief Operating Officer since March 1999 and as a director since May 2002. Mr. Granger served as our Executive Vice President and Chief Operating Officer from January 1998 to March 1999 and as our Executive Vice President of Operations from April 1996 to January 1998. Prior to joining Ultra Clean in April 1996, he served as Vice President of Media Operations for Seagate Technology from 1994 to 1996. Prior to that, Mr. Granger worked for HMT Technology as Chief Executive Officer from 1993 to 1994, as Chief Operating Officer from 1991 to 1993 and as President from 1989 to 1994. Prior to that, Mr. Granger worked for Xidex as Vice President and General Manager, Thin Film Disk Division, from 1988 to 1989, as Vice President, Santa Clara Oxide Disk Operations, from 1987 to 1988, as Vice President, U.S. Tape Operations, from 1986 to 1987 and as Director of Engineering from 1983 to 1986. Mr. Granger holds a master of science degree in industrial engineering from Stanford University and a bachelor of science degree in industrial engineering from the University of California at Berkeley. Brian R. Bachman has served as a director of Ultra Clean since March 2004. Mr. Bachman was the Chief Executive Officer and Vice Chairman of Axcelis Technologies, Inc. from May 2000 to January 2002. Prior to that, he was Senior Vice President and Group Executive-Hydraulics, Semiconductor Equipment and Specialty Controls of Eaton Corporation from December 1995 to July 2000 and Vice President and general manager for the Standard Products Business Group of Philips Semiconductors B.V. from 1991 to 1995. Mr. Bachman is on the board of directors of Keithley Instruments, Inc. and Kulicke and Soffa Industries, Inc. Susan H. Billat has served as a director of Ultra Clean since March 2004. Since 2002, Ms. Billat has been a Principal at Benchmark Strategies, which she founded in 1990. Prior to that, she was a Managing Director and Senior Research Analyst for semiconductor equipment and foundries at Robertson Stephens & Company from 1996 to 2002 and senior Vice President of Marketing for Utratech Stepper from 1994 to 1996. Prior to 1990, Ms. Billat spent four years in executive positions in the semiconductor equipment industry and twelve years in operations management, engineering management and process engineering in the semiconductor industry. Ms. Billat is on the board of directors of PDF Solutions, Inc. Ms. Billat holds bachelor and masters of science degrees in physics from Georgia Tech and completed further graduate studies in electrical engineering and engineering management at Stanford University. Dipanjan Deb has served as a director of Ultra Clean since November 2002. Mr. Deb is a founder of Francisco Partners and has been a partner since its formation in August 1999. Prior to joining Francisco Partners, Mr. Deb was a Principal with Texas Pacific Group from 1998 to 1999. Earlier in his career, |

4 |

| Percentage stock ownership | Percent of nominees for election to our Board of Directors | |||||

| 25% or more | 50 | % | ||||

| Less than 25% | 25 | % | ||||

| Less than 20% | 20 | % | ||||

| Less than 10% | 10 | % | ||||

| Less than 5% | 0 | % | ||||

Director Responsibilities.We are governed by our Board of Directors and its various committees that meet throughout the year. Our Board of Directors currently consists of seven directors. During 2004, there were 12 meetings of our Board of Directors. We expect directors to attend and prepare for all meetings of the Board of Directors and the meetings of the committees on which they serve. During 2004 each of our directors attended more than 75% of the aggregate of all meetings of the Board of Directors and any committees on which he or she served. Executive Sessions of the Independent Directors.Our independent directors have the opportunity to meet in an executive session following each regularly scheduled meeting of the Board of Directors. Lead Director. On February 9, 2005, our Board of Directors appointed Mr. ibnAle to serve as our lead director. The duties of the lead director include: (i) presiding at all meetings of the Board of Directors, (ii) serving as a liaison between our Chief Executive Officer and the Board of Directors, (iii) approving information and materials sent to the Board of Directors, (iv) approving the meeting agenda for meetings of the Board of Directors, and (v) approving meeting schedules to assure that there is sufficient time for discussion of all items. The lead director also has the authority to call meetings of the Board of Directors. Corporate Governance. Our Board of Directors has adopted corporate governance guidelines. These guidelines address items such as the standards, qualifications and responsibilities of our directors and director candidates, and corporate governance policies and standards applicable to us in general. In addition, we have a code of business conduct and ethics which applies to all of our employees, including our executive officers, and our directors. Both our corporate governance guidelines and our code of business conduct and ethics are available on the corporate governance section of our website atwww.uct.com under the heading “Investor Relations.” The charters of the Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee are also available in the corporate governance section of our website. Communicating with our Board of Directors. Any stockholder wishing to communicate with our Board of Directors may send a letter to the address specified on page 2 of this proxy statement. Communications that are intended specifically for non-employee directors should be sent to the attention of the Chairman of the Nominating and Corporate Governance Committee. |

5 |

| The Audit Committee was created by our Board of Directors to: | |

| • | assist our Board of Directors in its oversight of | |

| • | the integrity of our financial statements; | |

| • | the qualifications, independence and performance of our independent auditors; and | |

| • | our compliance with legal and regulatory requirements; and | |

| • | prepare the Audit Committee report required by the rules of the Securities and Exchange Commission, which report can be found on page 9 of this proxy statement. |

In addition, any transaction in which one of our directors has a conflict of interest must be disclosed to our Board of Directors and reviewed by the Audit Committee. Under our corporate governance guidelines, if a director has a conflict of interest, the director must disclose the interest to the Audit Committee and our Board of Directors and must recuse himself or herself from participation in the discussion and must not vote on the matter. The Audit Committee is authorized to retain special legal, accounting or other advisors in order to seek advice or information with respect to all matters under consideration, including potential conflicts of interest. A copy of this committee’s charter is attached to this proxy statement asAppendix A and is also available in the corporate governance section of our website at www.uct.com. For the 2004 audit cycle, including the Audit Committee report included in this proxy statement, the members of the Audit Committee were Messrs. Bachman, Eichler and ibnAle and Ms. Billat. The current members of our Audit Committee are Messrs. Bachman and Eichler and Ms. Billat. Our Board of Directors has determined that each current member of the committee is independent as defined under NASDAQ Stock Market and Securities and Exchange Commission rules. Our Board of Directors has concluded that all members of the Audit Committee qualify as Audit Committee financial experts as defined by Securities and Exchange Commission rules. The Audit Committee met four times in 2004. Compensation Committee. The Compensation Committee was created by our Board of Directors to: |

| • | oversee our compensation and benefits policies generally, including the issuance of stock options; | |

| • | evaluate senior executive performance and review our management succession plan; | |

| • | oversee and set compensation for our senior executives; and | |

| • | prepare the report on executive compensation that Securities and Exchange Commission rules require, which can be found on page 13 of this proxy statement. |

A copy of this committee’s charter is available in the corporate governance section of our website at www.uct.com. Our Compensation Committee consists of Messrs. Bachman, Deb, ibnAle and Rohrs. Our Board of Directors has determined that Messrs. Bachman and Rohrs are independent as defined under NASDAQ Stock Market and the Securities and Exchange Commission rules. Messrs. Deb and ibnAle are not independent, as permitted by NASDAQ Stock Market rules applicable to “controlled companies.” The Compensation Committee met three times in 2004. Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee was created by our Board of Directors to: |

| • | identify qualified individuals to fill any independent director positions on our Board of Directors and recommend such individuals to our Board of Directors for election at the next annual or special meeting of stockholders at which directors are to be elected or to fill any vacancies or newly created directorships that may occur between such meetings; | |

| • | recommend directors for appointment to committees of our Board of Directors; | |

| • | make recommendations to our Board of Directors as to determinations of director independence; | |

| • | evaluate the performance of our Board of Directors; | |

6 |

| • | oversee and set compensation for our directors; and | |

| • | develop, recommend and oversee compliance with our corporate governance guidelines and code of business conduct and ethics. |

| • | mergers, acquisitions or certain sales of assets; |

7 |

| • | any liquidation, dissolution or bankruptcy; | |

| • | issuances of securities; | |

| • | determination of compensation and benefits for our Chief Executive Officer and Chief Financial Officer; | |

| • | appointment or dismissal of any of the chairman of our Board of Directors, Chief Executive Officer, Chief Financial Officer or any other executive officer in any similar capacity; | |

| • | amendments to the Stockholder’s Agreement or exercise or waiver of rights under the Stockholder’s Agreement; | |

| • | amendments to our charter or bylaws; | |

| • | any increase or decrease in the number of directors that comprise our Board of Directors; | |

| • | the declaration of dividends or other distributions; | |

| • | any incurrence or refinancing of indebtedness in excess of $10 million; | |

| • | approval of our business plan, budget and strategy; and | |

| • | modification of our long-term business strategy. |

| Fiscal Year Ended | ||||||||

| December 31, 2004 | December 31, 2003 | |||||||

| Audit fees | $ | 384,370 | $ | 886,370 | ||||

| Audit-related fees | 210,362 | 0 | ||||||

| Tax fees | 121,700 | 71,790 | ||||||

| Other fees | 0 | 100,000 | ||||||

8 |

Audit fees consist of services rendered to us and our subsidiaries for the audit of our annual financial statements, reviews of our quarterly financial statements and audit services provided in connection with other statutory or regulatory filings. Fiscal 2003 also includes review of our registration statement on Form S-1 and other materials and services related to our initial public offering. Audit-related fees consist of fees billed for services related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” Fiscal 2004 also includes fees related to services related to evaluating a potential acquisition that was terminated during the third quarter of 2004. Tax fees consist of fees billed for professional services for tax compliance and tax advice. These services consist of assistance regarding federal, state and international tax compliance and assistance with the preparation of various tax returns. Other fees consist of non-audit services, including fees in connection with the analysis of gross margin by customer. All services provided by Deloitte & Touche were pre-approved in accordance with the Audit Committee’s pre-approval policies. The Audit Committee is currently composed of three directors, each of whom meet the requirements of applicable NASDAQ Stock Market and Securities and Exchange Commission rules for independence. Until March 24, 2005, the one-year anniversary of our initial public offering, Mr. ibnAle, who is not independent due to his affiliation with FP-Ultra Clean, LLC, our controlling stockholder, was also a member of the Audit Committee as permitted by NASDAQ Stock Market and Securities and Exchange Commission rules. The key responsibilities of our committee are set forth in our charter, which was adopted by us and approved by our Board of Directors and is attached to this proxy statement asAppendix A. We serve in an oversight capacity and are not intended to be part of Ultra Clean’s operational or managerial decision-making process. Ultra Clean’s management is responsible for preparing the consolidated financial statements, and its independent auditors are responsible for auditing those statements. Our principal purpose is to monitor these processes. In this context, we met and held discussions with management and the independent auditors. Management represented to us that Ultra Clean’s consolidated financial statements were prepared in accordance with generally accepted accounting principles applied on a consistent basis, and we have reviewed and discussed the quarterly and annual earnings press releases and consolidated financial statements with management and the independent auditors. We also discussed with the independent auditors matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), as amended, and rule 2-07 (communications with Audit Committee) of Regulation S-X. We discussed with the independent auditors the auditors’ independence from Ultra Clean and its management, including the matters, if any, in the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees). We also considered whether the independent auditors’ provision of audit and non-audit services to Ultra Clean is compatible with maintaining the auditors’ independence. Based on the reviews and discussions referred to above, we have recommended to our Board of Directors, and our Board of Directors has approved, that the audited financial statements be included in Ultra Clean’s Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission. We have appointed Deloitte & Touche LLP as Ultra Clean’s independent auditors for 2005. Members of the Audit Committee Kevin C. Eichler, Chairman |

9 |

This table sets forth certain information regarding the annual and long-term compensation we paid to or for our President and Chief Executive Officer and each of our other executive officers named in the table (the “named executive officers”) for each of our last two fiscal years. |

| Name and Principal Position | Year | Annual Compensation | Long-Term Compensation(1) | All Other Compensation ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Salary ($) | Bonus ($) | Other Annual Compensation ($)(2)(3) | Number of Securities Underlying Options (#) | ||||||||||

| Clarence L. Granger | 2004 | 298,846 | 126,837 | 968 | — | 508,589 | (4) | ||||||

| President, Chief Executive Officer, Chief Operating Officer | 2003 | 233,077 | 33,932 | 1,055 | — | 10,480 | (5) | ||||||

| Kevin L. Griffin(6) | 2004 | 161,923 | 80,330 | — | — | 141,984 | (7) | ||||||

| Acting Chief Financial Officer and Vice President, Chief Administrative Officer | 2003 | 179,663 | 16,287 | — | — | — | |||||||

| Bruce Wier | 2004 | 196,834 | 39,742 | 723 | 5,000 | 109,804 | (8) | ||||||

| Vice President Engineering | 2003 | 180,838 | 19,138 | 837 | — | 9,643 | (9) | ||||||

| Deborah Hayward | 2004 | 141,350 | 118,468 | (10) | — | 31,250 | 3,164 | (11) | |||||

| Vice President Sales | 2003 | 110,298 | 70,415 | (10) | — | — | 2,956 | (11) | |||||

| Sowmya Krishnan, Ph.D. | 2004 | 165,383 | 33,823 | 244 | 25,000 | 39,894 | (12) | ||||||

| Vice President of Technology and Chief Technology Officer | 2003 | 123,654 | 8,551 | — | — | 3,700 | (11) | ||||||

| Phillip A. Kagel(13) | 2004 | 81,130 | 27,768 | — | 185,000 | — | |||||||

| Former Senior Vice President, Chief Financial Officer | 2003 | — | — | — | — | — | |||||||

| ———————— | |

| (1) | On December 31, 2004, Messrs. Granger, Griffin and Weir and Dr. Krishnan held 79,650, 22,750, 15,926 and 5,688 shares of restricted stock, respectively, with a value of $482,679, $137,865, $96,512 and $34,469, respectively, based on our common stock closing price of $6.06 on December 31, 2004. |

| (2) | Amounts include tax gross-up reimbursements for executives’ life insurance premiums. |

| (3) | Excludes small amounts of perquisites such as executive disability insurance and car allowance, which do not exceed $50,000 or 10% of executive’s annual salary. |

| (4) | Amount includes company contribution of $9,750 under Ultra Clean’s 401(k) Plan, $1,740 reimbursed for executive’s life insurance premium and $497,099 paid to executive for redemption of the Bonus Notes, including interest (see “Certain Relationships and Related Transactions—Transactions with Management and Directors”). |

| (5) | Amount includes company contribution of $8,740 under Ultra Clean’s 401(k) Plan and $1,740 reimbursed for executive’s life insurance premium. |

| (6) | Mr. Griffin served as our Chief Financial Officer from February 2000 through August 2004, at which time he assumed the position of Vice President, Chief Administrative Officer. In March 2005, following the resignation of Mr. Kagel, Mr. Griffin assumed the office of Acting Chief Financial Officer. |

| (7) | This amount reflects redemption of the Bonus Notes, including interest (see “Certain Relationships and Related Transactions—Transactions with Management and Directors”). |

| (8) | Amount includes company contribution of $8,858 under Ultra Clean’s 401(k) Plan, $1,505 reimbursed for executive’s life insurance premium and $99,442 paid to executive for redemption of the Bonus Notes, including interest (see “Certain Relationships and Related Transactions—Transactions with Management and Directors”). |

| (9) | Amount includes company contribution of $8,138 under Ultra Clean’s 401(k) Plan and $1,505 reimbursed for executive’s life insurance premium. |

| (10) | This amount reflects sales commissions paid to executive. |

| (11) | This amount reflects company contribution under Ultra Clean’s 401(k) Plan. |

| (12) | Amount includes company contribution of $4,054 to Ultra Clean’s 401(k) Plan, $35,470 paid to executive for redemption of the Bonus Notes, including interest (see “Certain Relationships and Related Transactions—Transactions with Management and Directors”) and $370 reimbursed for executive’s life insurance premium. |

| (13) | Mr. Kagel joined Ultra Clean as our Senior Vice President, Chief Financial Officer in August 2004 and resigned in March 2005. |

10 |

| Individual Grants | Potential Realizable Value At Assumed Annual Rates of Appreciation for Option Term($)(1) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | |||||||||||||

| Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in 2004(%) | Exercise Price ($/Share) | Expiration Dates | ||||||||||

| 5% | 10% | ||||||||||||

| Clarence L. Granger | — | — | — | — | — | — | |||||||

| Kevin L. Griffin | — | — | — | — | — | — | |||||||

| Bruce Wier | 5,000 | 1.04 | 7.00 | March 24, 2014 | 22,011 | 55,781 | |||||||

| Deborah Hayward | 31,250 | 6.52 | 7.00 | March 24, 2014 | 137,571 | 348,631 | |||||||

| Sowmya Krishnan, Ph.D. | 25,000 | 5.22 | 7.00 | March 24, 2014 | 110,057 | 278,905 | |||||||

| Phillip A. Kagel | 185,000 | 38.62 | 6.73 | August 2, 2014 | 783,005 | 1,984,289 | |||||||

| ——————————— | |

| (1) | In accordance with Securities and Exchange Commission rules, these columns show estimated hypothetical gains that could accrue for the respective options, assuming that the market price of our common stock appreciates from the date of grant over a period of 10 years at an annualized rate of 5% and 10%, respectively. The disclosure of 5% and 10% assumed rates is required by Securities and Exchange Commission rules and does not represent our estimate or projection of future common stock price or stock price growth. |

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options at December 31, 2004 (#) | Value of Unexercised In-the-Money Options at December 31, 2004 ($)(1) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||

| Clarence L. Granger | — | — | 176,458 | 208,542 | 892,877 | 1,055,223 | |||||||

| Kevin L. Griffin | — | — | 57,291 | 67,709 | 289,892 | 342,608 | |||||||

| Bruce Wier | — | — | 40,677 | 53,073 | 205,826 | 243,249 | |||||||

| Deborah Hayward | — | — | 26,953 | 66,797 | 136,382 | 179,868 | |||||||

| Sowmya Krishnan, Ph.D. | — | — | 14,323 | 41,927 | 72,474 | 85,651 | |||||||

| Phillip A. Kagel | — | — | 0 | 185,000 | 0 | 0 | |||||||

| ——————————— | |

| (1) | Based on $6.06 per share, which was the closing price of our common stock on December 31, 2004, minus the exercise price multiplied by the number of shares issuable on exercise of the option. |

Equity Compensation Plan Information This table summarizes our equity plan information as of December 31, 2004. |

| Plan Category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||

|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders: (1) | 1,572,414 | $ | 3.01 | 1,979,285 | ||||

| Equity compensation plans not approved by security holders | — | — | — | |||||

| Total | 1,572,414 | — | 1,979,285 | |||||

| ——————————— | |

| (1) | Consists of the Amended and Restated Stock Incentive Plan and, for purposes of column (c), the Employee Stock Purchase Plan. The number of shares available under our Amended and Restated Stock Incentive Plan automatically increases each year, beginning January 1, 2005 through January 1, 2014, by an amount equal to the lesser of (i) 370,228 shares, (ii) 2% of the number of shares of the common stock outstanding on the date of the increase or (iii) an amount determined by the Board of Directors. |

11 |

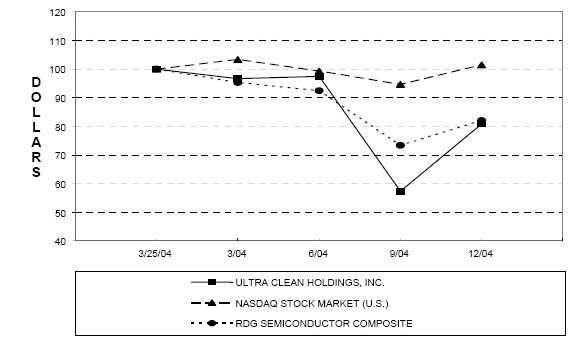

the deferred amount, payable on June 30 and December 31 of each year. Under his employment agreement, Mr. Granger is eligible to receive an annual bonus of up to $150,000, subject to the satisfaction of performance goals as may be set by our Board of Directors. In the event that Mr. Granger is terminated by us without cause at any time or Mr. Granger resigns within six months after a change of control with good reason, he is entitled to continue to receive the amount of his base salary for 12 months (offset by any income earned by him during such 12 months), 12 months’ accelerated vesting of his options and health plan benefits for 12 months (or, if earlier, until he becomes eligible for group health coverage with another employer). Employment Agreement with Kevin L. Griffin We entered into an employment agreement with Kevin L. Griffin in April 2005. Under this agreement, Mr. Griffin will continue to receive a base salary of $200,000 and participate in an executive bonus plan. In the event that Mr. Griffin is terminated by us without cause before March 24, 2006, he will receive a cash payment equal to $20,000, 6 months of accelerated vesting of his stock options, full accelerated vesting of restricted stock that he acquired in November 2002, and health plan benefits for 12 months (or, if earlier, until he becomes eligible for group health coverage with another employer). Separation Agreement with Phillip A. Kagel Phillip A. Kagel resigned as Ultra Clean’s Senior Vice President, Chief Financial Officer on March 24, 2005. In connection with his separation of employment, we agreed to pay Mr. Kagel seven months of salary and health benefits. Compensation Committee Interlocks and Insider Participation No member of our Compensation Committee is on the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or its Compensation Committee. Additional information concerning transactions between us and entities affiliated with members of our Compensation Committee is included in this proxy statement under the caption “Certain Relationships and Related Transactions”. The graph set forth below compares the cumulative total return to stockholders on our common stock between March 25, 2004 and December 31, 2004 with the cumulative total return of the Nasdaq Stock Market and the RDG Semiconductor Composite. The graph assumes that $100 was invested on March 25, 2004 in our common stock and on February 29, 2004 in each of the foregoing indices and assumes the reinvestment of dividends, if any. No dividends have been declared or paid on our common stock. Stockholder returns over the period indicated should not be considered indicative of future stockholder returns. |

| COMPARISON OF 10 MONTH CUMULATIVE TOTAL RETURN* AMONG ULTRA CLEAN HOLDINGS, INC., THE NASDAQ STOCK MARKET ( U.S. ) INDEX AND THE RDG SEMICONDUCTOR COMPOSITE INDEX |

|

| * $100 invested on 3/25/04 in stock or on 2/29/04 in index-including reinvestment of dividends. Fiscal year ending December 31. |

12 |

13 |

We will pay the cost of this proxy solicitation. In addition to soliciting proxies by mail, we expect that some of our employees may also solicit stockholders for the same type of proxy, personally and by telephone. None of these employees will receive any additional or special compensation for doing this. We may also reimburse banks, brokerage firms and nominees for their expenses in sending proxy materials to their customers who are beneficial owners of our common stock and obtaining their voting instructions. ANNUAL REPORT ON FORM 10-K WE WILL PROVIDE WITHOUT CHARGE TO EACH PERSON SOLICITED BY THIS PROXY STATEMENT, ON THE WRITTEN REQUEST OF SUCH PERSON, A COPY OF OUR ANNUAL REPORT ON FORM 10-K, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION FOR OUR MOST RECENT FISCAL YEAR. SUCH WRITTEN REQUESTS SHOULD BE ADDRESSED ATTN: SECRETARY AT OUR ADDRESS SET FORTH ON PAGE 2 OF THIS PROXY STATEMENT. |

14 |

Audit Committee Charter ULTRA CLEAN HOLDINGS, INC. Audit Committee Charter Purpose |

| The Audit Committee is created by the Board of Directors of the Company (the “Board”) to: | |

| • | assist the Board in its oversight of |

| • | the integrity of the financial statements of the Company; | |

| • | the qualifications, independence and performance of the Company’s independent auditors; and | |

| • | compliance by the Company with legal and regulatory requirements; and | |

| • | prepare the audit committee report that Securities and Exchange Commission rules require to be included in the Company’s annual proxy statement. |

Membership The Audit Committee shall consist of at least three members comprised solely of independent directors meeting the independence and experience requirements of Securities and Exchange Commission rules and regulations and Nasdaq or stock exchange requirements, subject to any applicable grace periods from or exceptions to such requirements. At least one member of the Audit Committee shall be an “audit committee financial expert” within the meaning of Securities and Exchange Commission rules and regulations. Audit Committee members may not serve on the audit committees of more than two other public companies. The Nominating and Corporate Governance Committee shall recommend to the Board nominees for appointment to the Audit Committee as vacancies or newly created positions occur. Audit Committee members shall be appointed by the Board and may be removed by the Board at any time. The Nominating and Corporate Governance Committee shall recommend to the Board, and the Board shall designate, the Chairman of the Audit Committee. Responsibilities In addition to any other responsibilities which may be assigned from time to time by the Board, the Audit Committee is responsible for the following matters. Independent Auditors |

| • | The Audit Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of any accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company (subject, if applicable, to stockholder ratification), and each such accounting firm must report directly to the Audit Committee. |

A-1 |

| • | The Audit Committee has the sole authority and responsibility to select, evaluate and, where appropriate, replace the independent auditors of the Company (subject to any required stockholder ratification). |

| • | The Audit Committee shall pre-approve the audit services and non-audit services to be provided by the Company’s independent auditors before the auditors are engaged to render services. The Audit Committee may delegate its authority to pre-approve services to one or more Audit Committee members;provided that such designees present any such approvals to the full Audit Committee at the next Audit Committee meeting. |

| • | The Audit Committee shall review and approve the scope and staffing of the independent auditors’ annual audit plan(s). |

| • | The Audit Committee shall evaluate the independent auditors’ qualifications, performance and independence and shall present its conclusions with respect thereto to the full Board on no less than an annual basis. As part of each such evaluation, the Audit Committee shall: |

| • | to the extent required by Securities and Exchange Commission rules and regulations or by Nasdaq or stock exchange requirements, obtain and review one or more written reports from the Company’s independent auditors: | |

| • | describing the independent auditors’ internal quality-control procedures; | |

| • | describing any material issues raised by (i) the most recent internal quality-control review or peer review of the auditing firm or (ii) any inquiry or investigation by governmental or professional authorities, within the preceding five years, regarding one or more independent audits carried out by the auditing firm and any steps taken to deal with any such issues; and | |

| • | delineating all relationships between the independent auditors and the Company consistent with Independence Standards Board Standard No. 1; | |

| • | review any reports issued by the Company’s independent auditors pursuant to Section 10A of the Securities Exchange Act of 1934; | |

| • | actively engage in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the auditors and take, or recommend that the full Board take, appropriate action to oversee the independence of the outside auditors; | |

| • | review and evaluate the senior members of the independent auditors team(s), particularly the partners on the audit engagement teams; | |

| • | consider whether the audit engagement team partners should be rotated more frequently than is required by law so as to assure continuing auditor independence; | |

| • | consider on an annual basis whether the independent auditors should be rotated so as to assure continuing auditor independence; and | |

| • | obtain the opinion of management of the independent auditors’ performance. |

A-2 |

| • | The Audit Committee must approve the hiring by the Company of any current employee of the independent auditors or any person who has been an employee of the independent auditors within five years of his proposed hire date by the Company. |

Financial Statements; Disclosure and Other Risk Management and Compliance Matters |

| • | The Audit Committee shall review with management and the independent auditors, in separate meetings if the Audit Committee deems it appropriate: |

| • | the annual audited financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” prior to the filing of the Company’s Form 10-K; | |

| • | the quarterly financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” prior to the filing of the Company’s Form 10-Q; | |

| • | any analyses or other written communications prepared by management and/or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements; | |

| • | the critical accounting policies and practices of the Company; | |

| • | related-party transactions and off-balance sheet transactions and structures; | |

| • | any major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles; | |

| • | the Company’s practices with respect to the use of non-GAAP financial information in its public disclosures; and | |

| • | regulatory and accounting initiatives or actions applicable to the Company (including any Securities and Exchange Commission investigations or proceedings). | |

| • | The Audit Committee shall review the Company’s earnings press releases and all financial information, including earnings guidance to be provided, and presentations to be made, to analysts and rating agencies, paying particular attention to the use of non-GAAP financial information, in all cases prior to the release thereof. |

| • | The Audit Committee shall, in conjunction with the Company’s Chief Executive Officer and Chief Financial Officer, review the Company’s internal controls and disclosure controls and procedures, including whether there are any significant deficiencies in the design or operation of such controls and procedures, material weaknesses in such controls and procedures, any corrective actions taken with regard to such deficiencies and weaknesses and any fraud involving management or other employees with a significant role in such controls and procedures. |

| • | The Audit Committee shall review and discuss with the independent auditors any audit problems or difficulties and management’s response thereto, including those matters required to be discussed with the Audit Committee by the auditors pursuant to Statement on Auditing Standards No. 61, as amended, such as: |

A-3 |

| • | any restrictions on the scope of the independent auditors’ activities or access to requested information; | |

| • | any accounting adjustments that were noted or proposed by the auditors but were “passed” (as immaterial or otherwise); | |

| • | any communications between the audit team and the audit firm’s national office regarding material auditing or accounting issues presented by the engagement; | |

| • | any management or internal control letter issued, or proposed to be issued, by the auditors; and | |

| • | any significant disagreements between the Company’s management and the independent auditors. | |

| • | The Audit Committee shall have sole authority over the resolution of any disagreements between management and the independent auditors regarding the Company’s financial reporting. |

| • | The Audit Committee shall review the Company’s policies and practices with respect to risk assessment and risk management, including discussing with management the Company’s major financial risk exposures and the steps that have been taken to monitor and control such exposures. |

| • | All complaints received by the Company regarding accounting, internal accounting controls or auditing matters shall be directed to the Chairman of the Audit Committee, and the Audit Committee shall establish procedures for the retention and treatment all such complaints. |

| • | The Audit Committee shall establish procedures for the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters, and the Audit Committee shall review any significant concerns so submitted. |

| • | The Audit Committee shall prepare the audit committee report that Securities and Exchange Commission rules and regulations require to be included in the Company’s annual proxy statement. |

| • | The Audit Committee shall review actual or potential conflicts of interest involving directors and shall determine whether such director or directors may vote on any issue as to which there may be a conflict. |

Corporate Governance Matters |

| • | The Audit Committee shall review and consider requests for waivers of the Company’s Code of Business Conduct and Ethics for the Company’s directors, executive officers and other senior financial officers and shall make a recommendation to the Board with respect to any such request for a waiver. |

Reporting to the Board |

| • | The Audit Committee shall report to the Board as often as necessary or advisable (as determined by the Audit Committee) or as requested by the Board as to any recommendations or issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications, independence and performance of the Company’s outside auditors, any funding requirements for the outside auditors, Audit |

A-4 |

| Committee and any advisors retained by the Audit Committee to assist it in its responsibilities and any other matters that the Audit Committee deems appropriate or as requested by the Board. | |

| • | The Audit Committee shall review and assess the adequacy of this charter and recommend any proposed changes to the Nominating and Corporate Governance Committee as often as necessary or advisable (as determined by the Audit Committee). |

| • | The Audit Committee shall perform other activities related to this charter as requested by the Board. |

Authority The Audit Committee has the authority to retain independent legal, financial, accounting or other advisors as it determines necessary to carry out its duties and shall have access to any officer or employee of the Company or the Company’s outside counsel, independent auditors or external parties, and may request that any such person or parties meet with any members of, or advisers to, the Audit Committee and the Audit Committee may otherwise seek information from any of the foregoing. The Audit Committee has the authority to conduct or authorize investigations into any matters within its scope of responsibility. The Audit Committee may delegate its authority to subcommittees or the Chairman of the Audit Committee when it deems such delegation to be appropriate and in the best interest of the Company. Procedures The Audit Committee shall meet as often as it determines is appropriate to carry out its responsibilities under this charter, but on no less than a quarterly basis. The Chairman of the Audit Committee, in consultation with the other Audit Committee members, shall determine the frequency and length of committee meetings and shall set meeting agendas consistent with this charter. All committee members are expected to attend each meeting, in person or via tele- or video-conference. Meeting minutes will be taken. On a periodic basis and at least quarterly, the Audit Committee shall meet separately with management and with the independent auditors. Limitations Inherent in the Audit Committee’s Role It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with GAAP. This is the responsibility of management and the independent auditors. Furthermore, while the Audit Committee is responsible for reviewing the Company’s policies and practices with respect to risk assessment and management, it is the responsibility of the Chief Executive Officer and management to determine the appropriate level of the Company’s exposure to risk. |

A-5 |