EXECUTION VERSION STOCK PURCHASE AGREEMENT dated as of October 25, 2023 by and among ULTRA CLEAN HOLDINGS, INC., HOFFMAN INSTRUMENTATION SUPPLY, INC., THE STOCKHOLDERS OF HOFFMAN INSTRUMENTATION SUPPLY, INC., and LVL3 INSTRUMENTATION LLC, as Representative of the Company Equityholders relating to the purchase and sale of 100% of the Common Stock of HOFFMAN INSTRUMENTATION SUPPLY, INC.

i TABLE OF CONTENTS PAGE ARTICLE 1 DEFINITIONS Section 1.01. Definitions .....................................................................................................2 Section 1.02. Other Definitional and Interpretative Provisions .......................................20 ARTICLE 2 PURCHASE AND SALE Section 2.01. Purchase and Sale .......................................................................................21 Section 2.02. Purchase Price; Estimated Closing Statement; Allocation of Purchase Price .......................................................................................................................22 Section 2.03. Closing; Pre-Closing Deliverables; Closing Deliverables.........................24 Section 2.04. Company Stock Option Payments; CBA Payments ....................................27 Section 2.05. Closing Balance Sheet; Post-Closing Statement ........................................27 Section 2.06. Post-Closing Adjustment of Purchase Price ...............................................30 Section 2.07. Release of Adjustment Holdback Fund .......................................................31 Section 2.08. Contingent Installment Payment; Post-Closing Earnout Payments ...........31 Section 2.09. Withholding Taxes ......................................................................................36 ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF THE COMPANY Section 3.01. Corporate Existence and Power .................................................................37 Section 3.02. Authorization...............................................................................................37 Section 3.03. Governmental Authorization .......................................................................38 Section 3.04. Noncontravention ........................................................................................38 Section 3.05. Capitalization ..............................................................................................38 Section 3.06. Subsidiaries .................................................................................................39 Section 3.07. Financial Statements ...................................................................................40 Section 3.08. Absence of Certain Changes .......................................................................40 Section 3.09. No Undisclosed Material Liabilities ...........................................................43 Section 3.10. Material Contracts ......................................................................................43 Section 3.11. Tax Matters .................................................................................................46 Section 3.12. Litigation .....................................................................................................48 Section 3.13. Compliance with Laws and Court Orders ..................................................48 Section 3.14. Properties ....................................................................................................49 Section 3.15. Products ......................................................................................................51 Section 3.16. Intellectual Property ...................................................................................51 Section 3.17. Data Privacy and Cybersecurity .................................................................55 Section 3.18. Insurance Coverage ....................................................................................55 Section 3.19. Licenses and Permits ..................................................................................56 Section 3.20. Top Vendors ................................................................................................57

ii Section 3.21. Inventories...................................................................................................57 Section 3.22. Receivables .................................................................................................57 Section 3.23. Finders’ Fees ..............................................................................................58 Section 3.24. Employees ...................................................................................................58 Section 3.25. Employee Benefit Plans ..............................................................................58 Section 3.26. Labor Matters .............................................................................................62 Section 3.27. Environmental Matters ...............................................................................62 Section 3.28. Related Party Transactions.........................................................................64 ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF SELLERS Section 4.01. Corporate Existence and Power .................................................................64 Section 4.02. Authorization...............................................................................................65 Section 4.03. Governmental Authorization .......................................................................65 Section 4.04. Noncontravention ........................................................................................65 Section 4.05. Ownership of Shares ...................................................................................65 Section 4.06. Finders’ Fees ..............................................................................................66 ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF BUYER Section 5.01. Corporate Existence and Power .................................................................66 Section 5.02. Authorization...............................................................................................66 Section 5.03. Governmental Authorization .......................................................................67 Section 5.04. Noncontravention ........................................................................................67 Section 5.05. Financing ....................................................................................................67 Section 5.06. Litigation .....................................................................................................67 Section 5.07. R&W Insurance Policy ...............................................................................67 Section 5.08. Finders’ Fees ..............................................................................................67 Section 5.09. Purchase for Investment .............................................................................68 ARTICLE 6 COVENANTS OF BUYER AND SELLERS Section 6.01. Further Assurances .....................................................................................68 Section 6.02. Public Announcements ................................................................................68 Section 6.03. Confidentiality .............................................................................................69 Section 6.04. D&O Tail Policy .........................................................................................69 Section 6.05. R&W Insurance Policy ...............................................................................69 Section 6.06. Preservation of Books and Records; Access to Information ......................70 Section 6.07. Reimbursements for Tenant Improvements .................................................70 ARTICLE 7 TAX MATTERS Section 7.01. Pre-Closing Filing and Payment ................................................................71 Section 7.02. Straddle Tax Period Allocation ..................................................................71

iii Section 7.03. Cooperation ................................................................................................72 Section 7.04. Termination of Tax Sharing Agreements ....................................................72 Section 7.05. Tax Contests ................................................................................................72 Section 7.06. Tax Refunds .................................................................................................73 Section 7.07. Tax Deductions ...........................................................................................73 Section 7.08. Post-Closing Actions ...................................................................................74 Section 7.09. Transfer Taxes ............................................................................................74 Section 7.10. Survival .......................................................................................................74 ARTICLE 8 EMPLOYEE BENEFITS SECTION 8.01. Employee Matters ......................................................................................74 ARTICLE 9 SURVIVAL; INDEMNIFICATION; R&W INSURANCE Section 9.01. Survival .......................................................................................................75 Section 9.02. Indemnification ...........................................................................................76 Section 9.03. Independent Investigation; Waiver of Other Representations ....................78 Section 9.04. Third Party Claim Procedures....................................................................80 Section 9.05. Direct Claim Procedures ............................................................................81 Section 9.06. R&W Insurance Policy Process ..................................................................82 Section 9.07. Purchase Price Adjustment .........................................................................82 Section 9.08. Certain Limitations .....................................................................................82 ARTICLE 10 HOLDER REPRESENTATIVE Section 10.01. Designation of Holder Representative ......................................................83 Section 10.02. Decisions Binding .....................................................................................84 Section 10.03. Liability of the Holder Representative ......................................................84 Section 10.04. Indemnification of the Holder Representative ..........................................84 Section 10.05. Replacement of Holder Representative .....................................................84 Section 10.06. Holder Representative Fund .....................................................................85 ARTICLE 11 MISCELLANEOUS Section 11.01. Notices.......................................................................................................85 Section 11.02. Amendments and Waivers .........................................................................86 Section 11.03. Expenses ....................................................................................................86 Section 11.04. Disclosure Schedule References ...............................................................87 Section 11.05. Successors and Assigns .............................................................................87 Section 11.06. Governing Law..........................................................................................88 Section 11.07. Jurisdiction ...............................................................................................88 Section 11.08. WAIVER OF JURY TRIAL ........................................................................88 Section 11.09. Counterparts; Effectiveness ......................................................................88

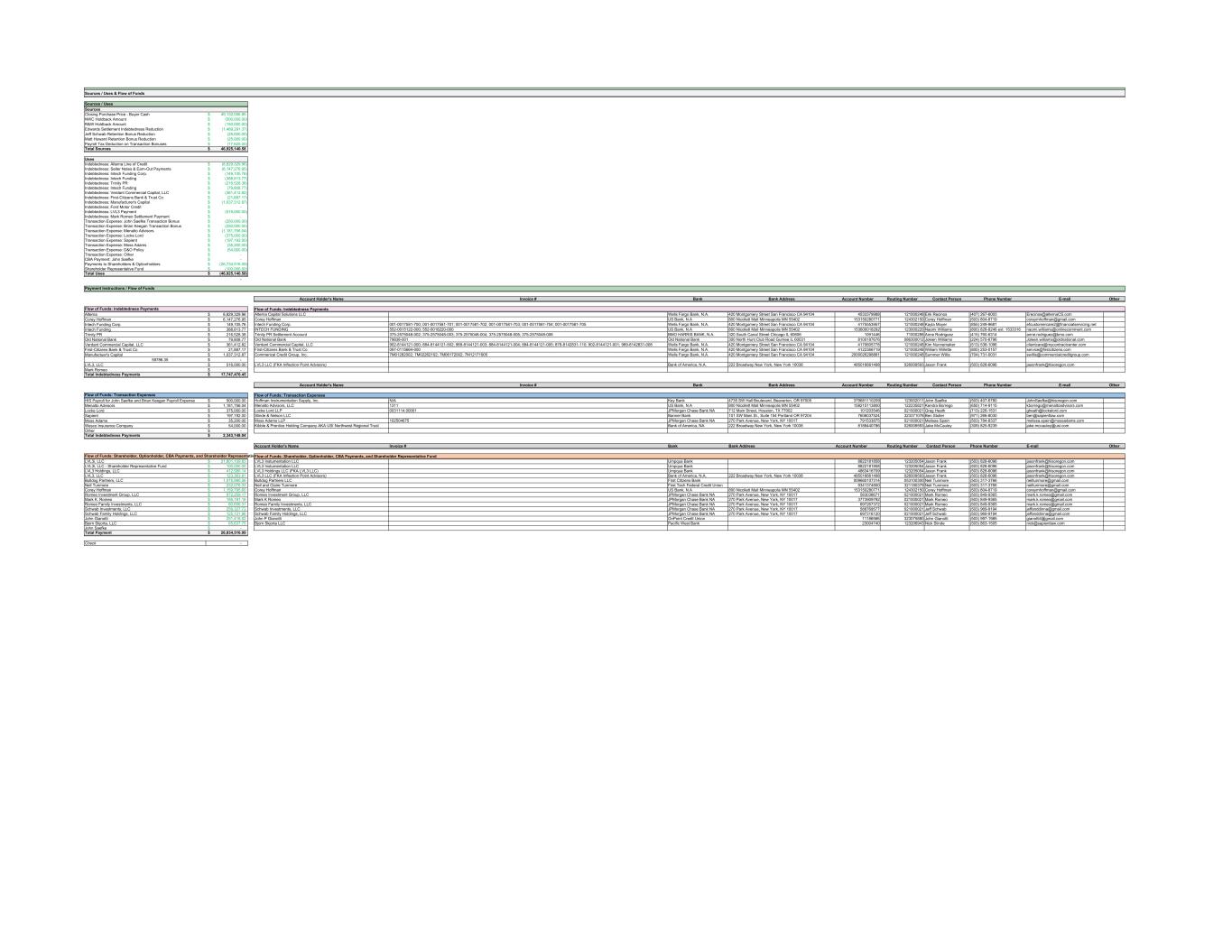

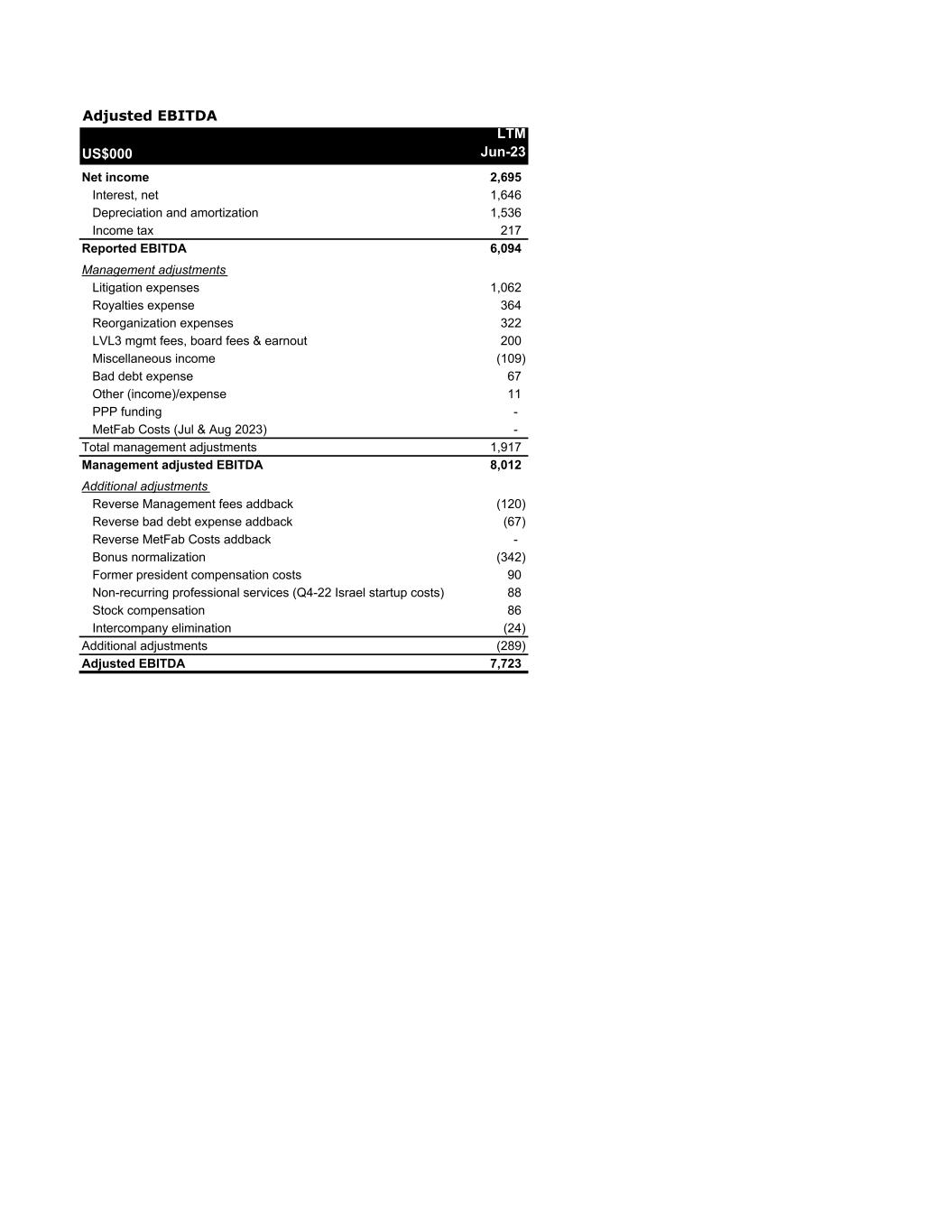

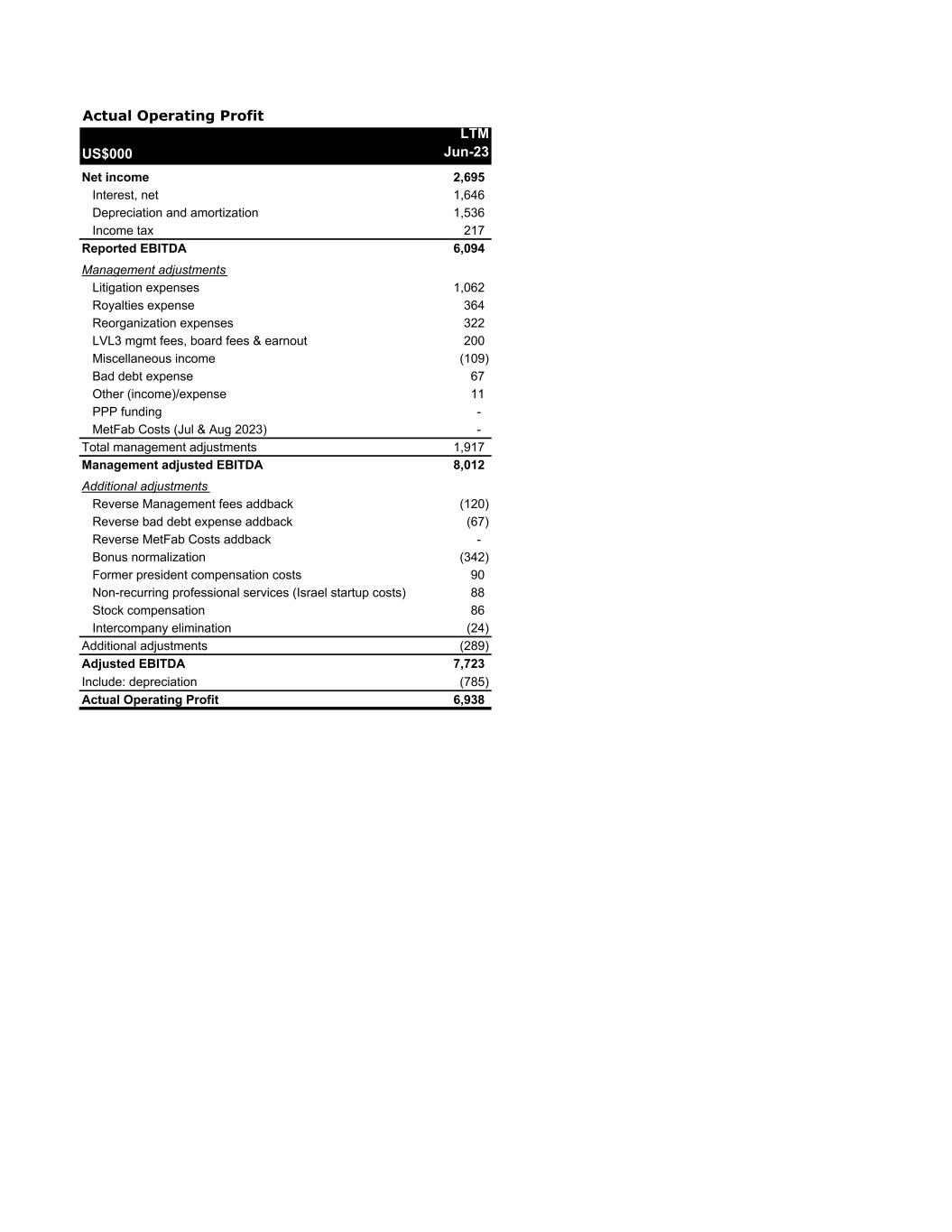

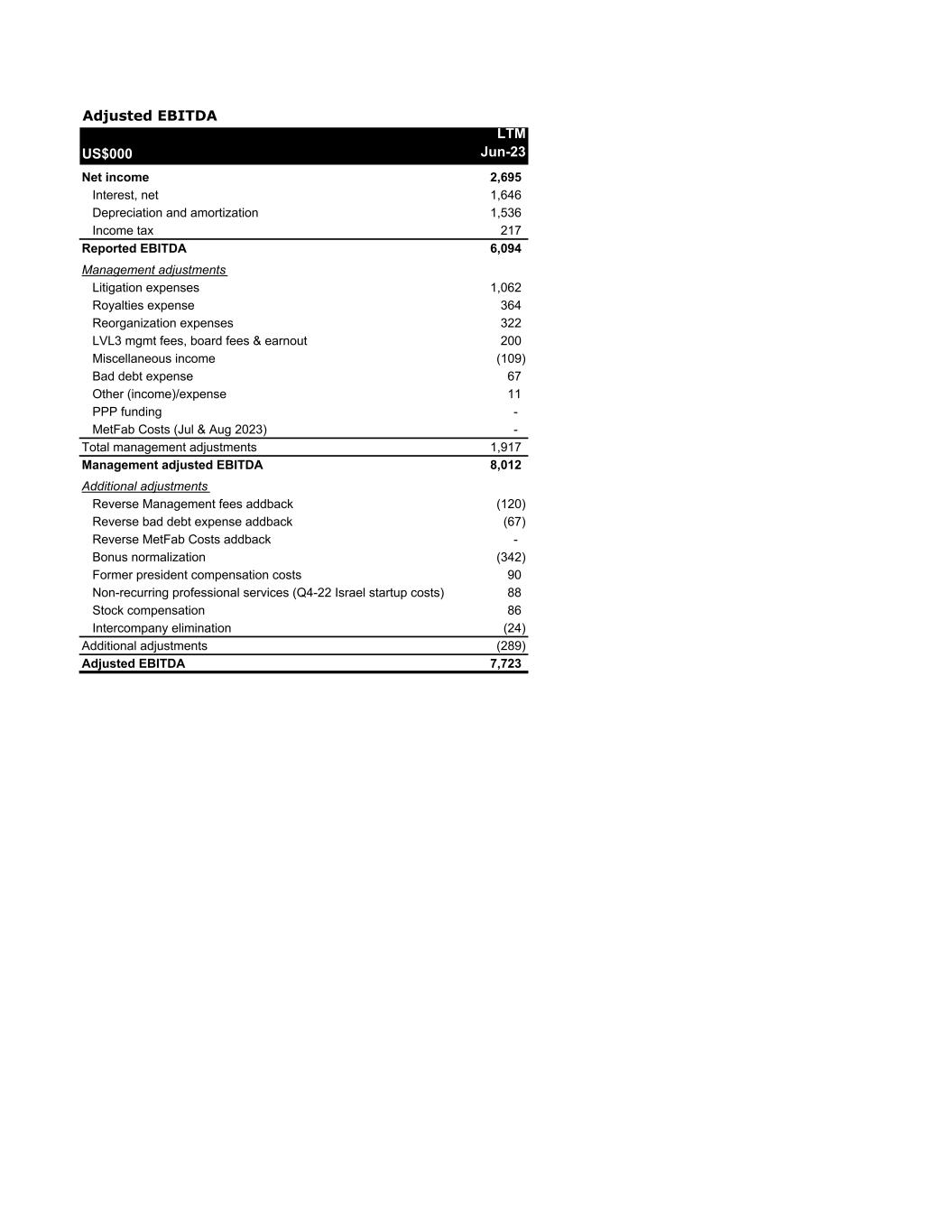

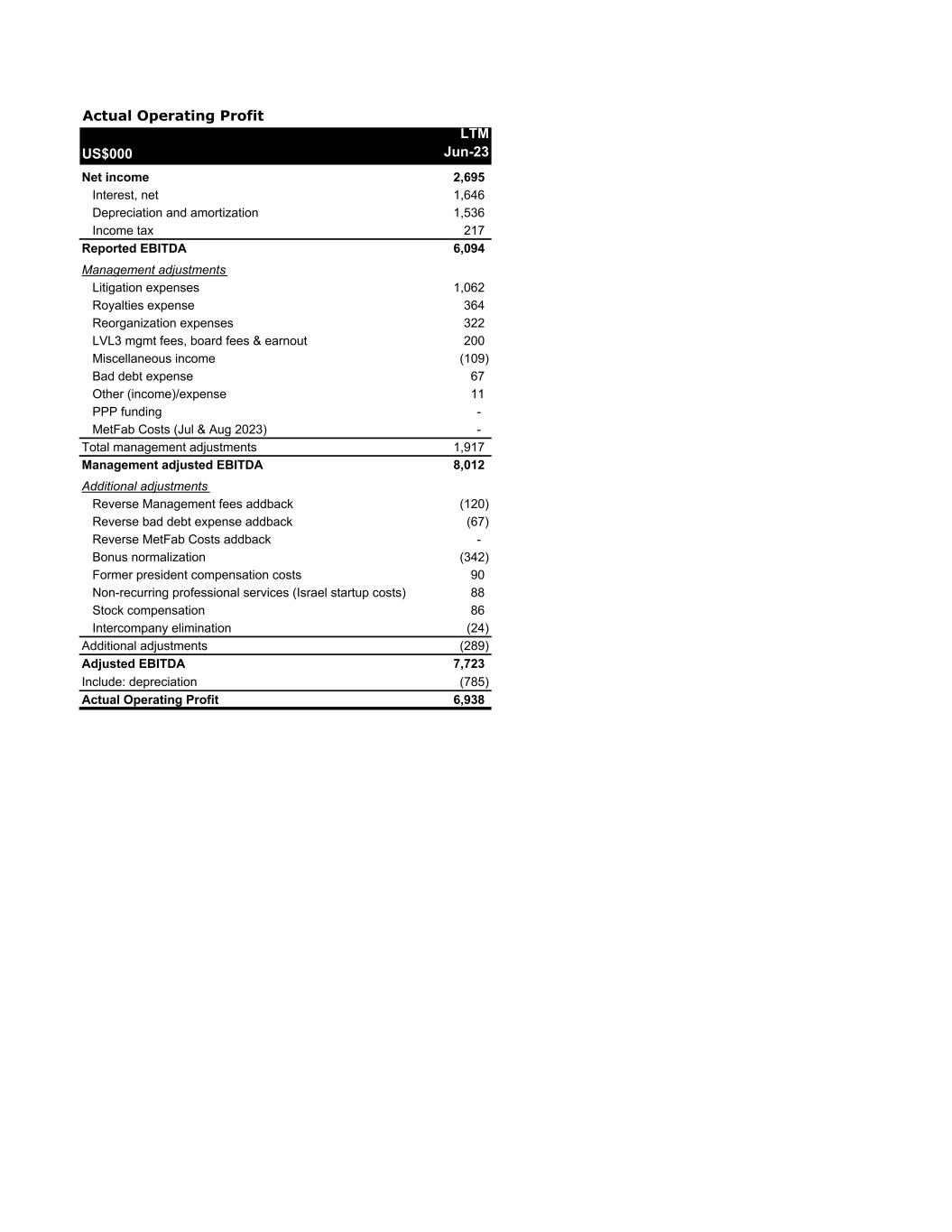

iv Section 11.10. Entire Agreement ......................................................................................88 Section 11.11. Severability ...............................................................................................89 Section 11.12. Specific Performance ................................................................................89 Section 11.13. Conflict Waiver; Attorney-Client Privilege ..............................................89 Section 11.14. Affiliate Liability .......................................................................................90 Section 11.15. No Third Party Beneficiaries ....................................................................91 Section 11.16. Release of Claims ......................................................................................91 Exhibits Exhibit A: Form of Optionholder Letter Exhibit B: Form of Warrant Termination Agreement Exhibit C: Form of CBA Holder Letter Schedules Company Disclosure Schedule Schedule I: Stockholders Schedule II: Estimated Closing Statement Schedule III: Payment Instructions Schedule IV: Key Employees Schedule V: Accounting Principles Schedule VI: Adjusted EBITDA Calculation Schedule VII: Operating Profit Calculation

STOCK PURCHASE AGREEMENT This STOCK PURCHASE AGREEMENT (this “Agreement”) dated as of October 25, 2023 is made by and among Ultra Clean Holdings, Inc., a Delaware corporation (the “Buyer”), Hoffman Instrumentation Supply, Inc. d/b/a HIS Innovations Group, an Oregon corporation (the “Company”), the Stockholders (as defined below) listed on Schedule I hereto (each, a “Seller” and collectively, the “Sellers”) and LVL3 Instrumentation LLC, an Oregon limited liability company, solely in its capacity as representative of the Company Equityholders as set forth herein (the “Holder Representative”). Each of the Buyer, the Company and each Seller are referred to herein as a “Party” and collectively as the “Parties”. W I T N E S S E T H: WHEREAS, the Stockholders set forth on Schedule I hereto collectively own all of the issued and outstanding shares of Company Common Stock (as defined below), as of the Closing; WHEREAS, the Sellers desire to sell to Buyer, and Buyer desires to purchase from the Sellers, all of the issued and outstanding shares of Company Common Stock, upon the terms, in the manner and subject to the conditions set forth in this Agreement; WHEREAS, this Agreement, the other Transaction Documents (as defined below) and the transactions contemplated hereby and thereby (collectively, the “Transactions”) have been duly adopted and approved by the requisite actions of the Company, the Sellers and Buyer; WHEREAS, on or prior to the date hereof, each (a) Optionholder (as defined below) has delivered to the Company a letter in the form attached hereto as Exhibit A (each, an “Optionholder Letter”), (b) Warrantholder (as defined below) has delivered to the Company warrant termination agreement the form attached hereto as Exhibit B (each, a “Warrant Termination Agreement”) and (c) each CBA Holder (as defined below) has delivered to the Company a letter in the form attached hereto as Exhibit C (each, a “CBA Holder Letter”); WHEREAS, concurrently with the execution and delivery of this Agreement, and as a condition and inducement to Buyer’s willingness to enter into this Agreement, each of the individuals listed on Schedule IV of this Agreement has entered into a restricted stock unit letter agreement with an Affiliate of Buyer, to become effective at Closing; and WHEREAS, (i) concurrently with the execution and delivery of this Agreement, Buyer is acquiring, in connection with the consummation of the Transactions, a representation and warranty insurance policy covering certain representations and warranties set forth in this Agreement (the “R&W Insurance Policy”), and (ii) Buyer has provided to the Company and the Holder Representative a true and complete copy of the form of the binders for the R&W Insurance Policy and will, substantially concurrent with the execution hereof, pay any applicable deposits required to be paid in connection therewith;

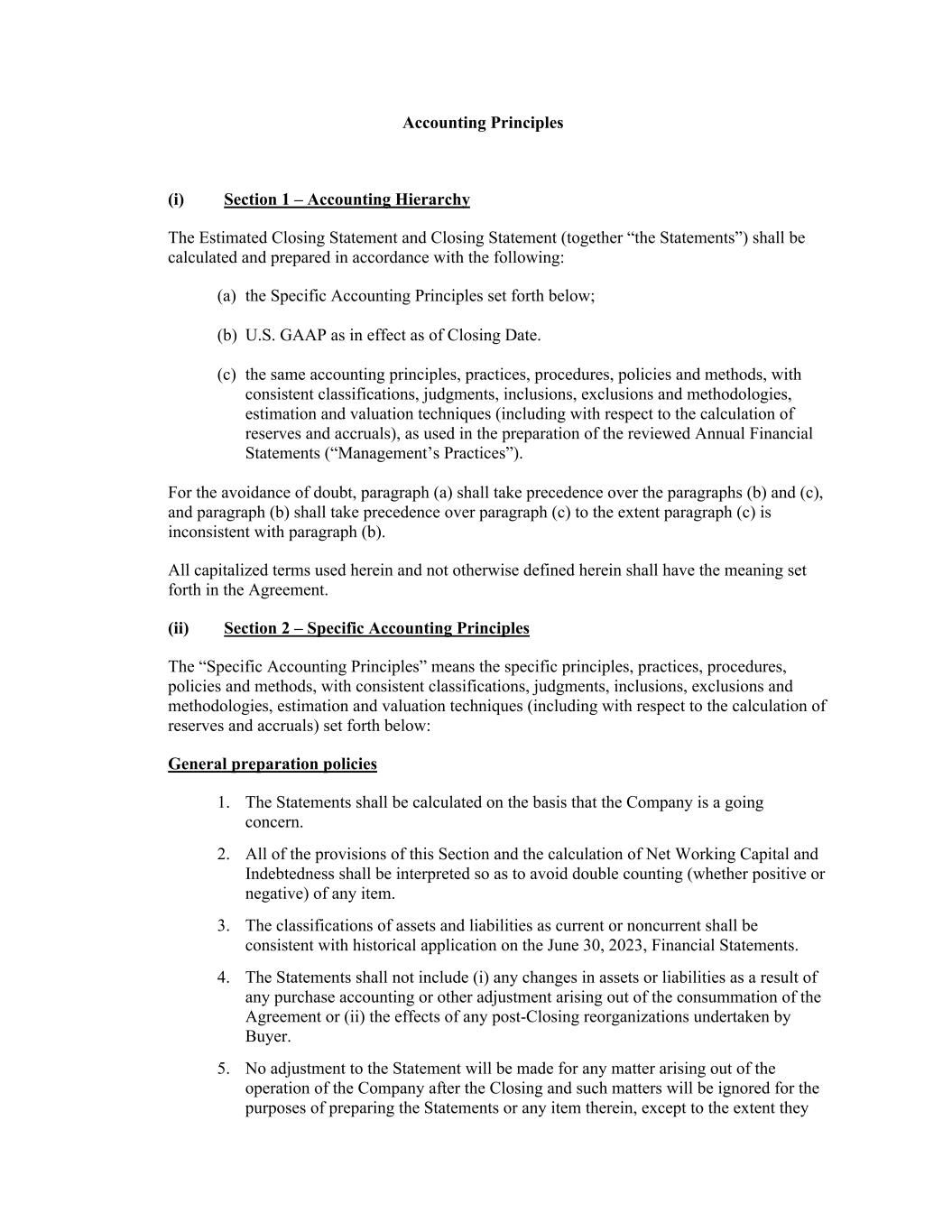

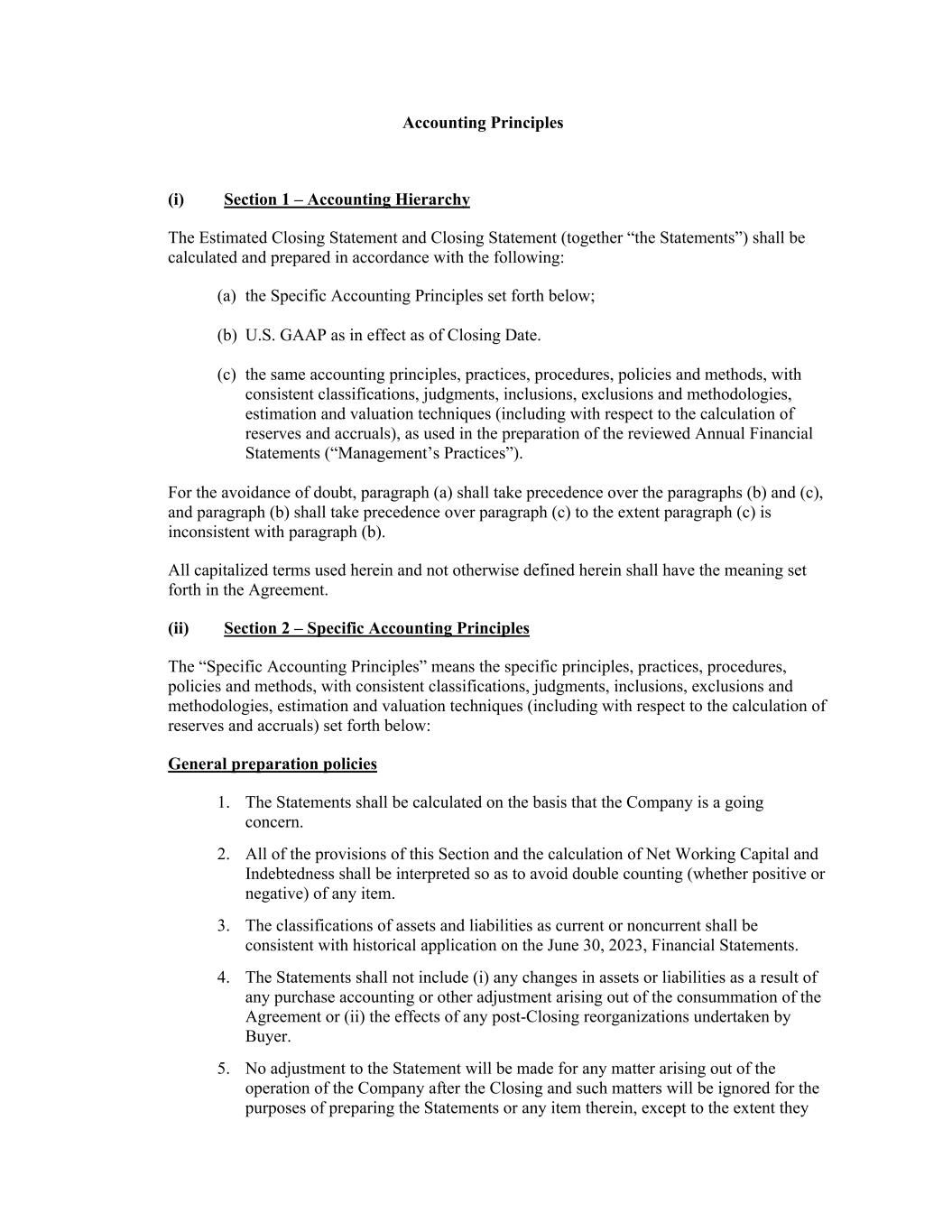

2 NOW, THEREFORE, in consideration of the foregoing and the representations, warranties, covenants and agreements contained herein, the Parties hereto agree as follows: ARTICLE 1 DEFINITIONS Section 1.01. Definitions. (a) The following terms, as used herein, have the following meanings: “Accounting Principles” means U.S. GAAP applied consistently with the past practices of the Company (to the extent in accordance with GAAP), except as set forth on Schedule V. “Action” means any action, suit, inquiry, hearing, investigation, audit (including Tax audit), litigation, arbitration, mediation, grievance, prosecution or proceeding (including any civil, criminal, administrative, regulatory, investigative or appellate proceeding). “Adjustment Holdback Amount” means $500,000. “Advisor Expenses” means any fees, costs or expenses that become payable to Manalto Advisors, LLC or any of its Affiliates or Representatives following the Closing pursuant to that certain Letter Agreement, dated November 7, 2020, by and between Manalto Advisors, LLC and the Company or otherwise. “Affiliate” means, with respect to any Person, any other Person who, as of the relevant time for which the determination of affiliation is being made, directly or indirectly controls, is controlled by or is under common control with such Person. For purposes of this definition, “control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have correlative meanings. For the avoidance of doubt, following the Closing, the Affiliates of Buyer shall include the Company. “Anti-Boycott Laws” means 15 C.F.R. pt. 760 et seq. and 26 U.S.C. §§ 908 and 999, as om time amended fr to time, and other similar laws and regulations applicable to the Sellers or the Company or its Subsidiaries. “Anti-Corruption Laws” means the Foreign Corrupt Practices Act of 1977, as amended, and any rules or regulations thereunder, or any other Applicable Law regarding anti-corruption in the United States or any non-U.S. jurisdiction applicable to the Sellers or the Company or its Subsidiaries . “Applicable Law” means, with respect to any Person, any transnational, domestic or foreign federal, state or local law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, judgment, decree, ruling or other similar requirement enacted, adopted, promulgated or applied by a Governmental

3 Authority that is binding upon or applicable to such Person, as amended unless expressly specified otherwise. “Base Cash Consideration” means $50,000,000. “Balance Sheet” means the unaudited consolidated balance sheet of the Company and its Subsidiaries as of the Balance Sheet Date. “Balance Sheet Date” means June 30, 2023. “Business Day” means a day, other than Saturday, Sunday or other day on which commercial banks in New York, New York are authorized or required by Applicable Law to close. “Buyer Fundamental Representation” means those representations and warranties in Section 5.01, Section 5.02, Section 5.04(a) and Section 5.08. “Cash” means the aggregate amount of cash, bank deposits and marketable securities (but, in the case of marketable securities, only short-term, highly liquid investments that are readily convertible to known amounts of cash within forty-five (45) days and are so near their maturity that they present insignificant risk of changes in value because of changes in interest rates); provided that Cash shall (i) be calculated net of (x) restricted balances (including security deposits, bond guarantees, collateral reserve accounts and amounts held in escrow) to the extent not freely usable, distributable or transferable (including as a result of Taxes imposed as a result of such use, distribution or transfer), and (y) outstanding outbound checks, draws, ACH debits and wire transfers and (ii) include inbound checks, draws, ACH credits and wire transfers deposited or available for deposit to the extent there has been a reduction of accounts receivable that would have otherwise been taken into account in Closing Net Working Capital in respect thereof. “Calculation Time” means 11:59 p.m. Pacific Time on October 25, 2023. “CBA” means each cash-equivalent award granted under a Company Equity Plan, whether vested or unvested, that is outstanding and unsettled as of immediately prior to the Closing. “CBA Holder” means, as of immediately prior to the Closing, the holder of a CBA in his, her or its capacity as such. “CBA Share” means, with respect to the CBA Holder, an amount equal to (a) one percent (1%) multiplied by (b) a fraction, the numerator of which is 87,745 and the denominator of which is the Fully Diluted Number. “CBA Threshold” means, without giving effect to the CBA Share, that $34,000,000 of Purchase Price has been actually received by, or is actually due and payable to, the Stockholders, Optionholders and Warrantholders.

4 “Change of Control Event” means, with respect to any Person, the occurrence of any of the following transactions with respect to such Person following the Closing Date: (a) a sale of all or substantially all of the assets and properties of such Person (or any successor to all or substantially all of the assets of such Person) to a Person other than an Affiliate of the Buyer; (b) a merger, consolidation, reconstitution or similar transaction involving such Person (or any successor to all or substantially all of the assets of such Person), the result of which is that a Person other than an Affiliate of Buyer directly or indirectly owns or controls 50% or more of the voting securities of the continuing or surviving entity immediately after such transaction; or (c) a sale or exchange, directly or indirectly, of the issued and outstanding equity interests of such Person (or any successor to all or substantially all of the assets of such Person) by the direct or indirect holders thereof in a single transaction, or series of related transactions, the result of which a Person other than an Affiliate of the Buyer owns or controls, directly or indirectly, 50% or more of the voting securities of such Person (or any successor to all or substantially all of the assets of such Person) immediately after such transaction; provided that a Change of Control Event of Buyer shall not constitute a Change of Control Event of the Company (or any successor to all or substantially all of the assets of the Company). “Closing Consideration” means an amount in cash equal to (i) the Estimated Purchase Price, minus (ii) the Adjustment Holdback Amount, minus (iii) the Indemnity Holdback Amount. “COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, and any rules or regulations promulgated thereunder. “Code” means the Internal Revenue Code of 1986, as amended, and any rules or regulations promulgated thereunder. “Collective Bargaining Agreement” means any written or oral agreement, memorandum of understanding or other contractual obligation between the Company or any of its Subsidiaries and any labor organization or other authorized employee representative collectively representing Service Providers. “Company Common Stock” means the common stock, no par value, of the Company. “Company Disclosure Schedule” means the disclosure schedule dated as of the date of this Agreement and delivered by the Company to Buyer in connection with the execution and delivery of this Agreement. “Company Employee” means an employee of the Company or any of its Subsidiaries. “Company Equityholder” means each Stockholder, Optionholder, CBA Holder and Warrantholder. “Company Equity Plan” means the Company’s 2019 Omnibus Equity Incentive Plan, or any other plan, arrangement or standalone agreement adopted or entered into by

5 the Company or any of its Affiliates pursuant to which it may or has granted or issued to any current or former Service Provider any equity or equity-based awards relating to Company Common Stock, including options, warrants, restricted units, unit appreciation rights, phantom units, profits interests or any other similar award. “Company Fundamental Representation” means those representations and warranties in Section 3.01(a), Section 3.02, Section 3.04(a), Section 3.05, Section 3.06, and Section 3.23. “Company Stock Option” means each option to purchase shares of Company Common Stock granted under a Company Equity Plan, whether vested or unvested, that is outstanding and unexercised as of immediately prior to the Closing. “Company Warrant” means each warrant exercisable for, exchangeable into, or otherwise settled in shares of Company Common Stock, whether vested or unvested, that is outstanding and unexercised as of the Closing. “Continuing Employees” has the meaning specified in Section 8.01. “Contract” means any written or oral agreement, lease, sublease, license, sublicense, contract, sale or purchase order, instrument, obligation, or commitment that is or purports to be legally binding, including any exhibits, annexes, appendices or attachments thereto, and any amendments, modifications, supplements, extension or renewals thereof. “COVID-19” means the infectious disease known as coronavirus disease 2019, or COVID-19, caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), and any evolutions thereof or related or associated epidemics, pandemics or disease outbreaks. “Employee Plan” means any (i) “employee benefit plan” as defined in Section 3(3) of ERISA, (ii) compensation, employment, consulting, severance, termination protection, change in control, transaction bonus, retention or similar plan, agreement, arrangement, program or policy or (iii) other plan, agreement, arrangement, program or policy providing for compensation, bonuses, profit-sharing, equity or equity-based compensation or other forms of incentive or deferred compensation, vacation benefits, insurance (including any self-insured arrangement), medical, dental, vision, prescription or fringe benefits, life insurance, relocation or expatriate benefits, perquisites, disability or sick leave benefits, employee assistance program, workers’ compensation, supplemental unemployment benefits or post-employment or retirement benefits (including compensation, pension, health, medical or insurance benefits), in each case whether or not written (x) that is sponsored, maintained, administered, contributed to or entered into by the Company or any of its Affiliates for the current or future benefit of any current or former Service Provider or (y) for which the Company or any of its Subsidiaries has any direct or indirect liability. For the avoidance of doubt, a Collective Bargaining Agreement shall constitute an agreement for purposes of clauses (ii) and (iii).

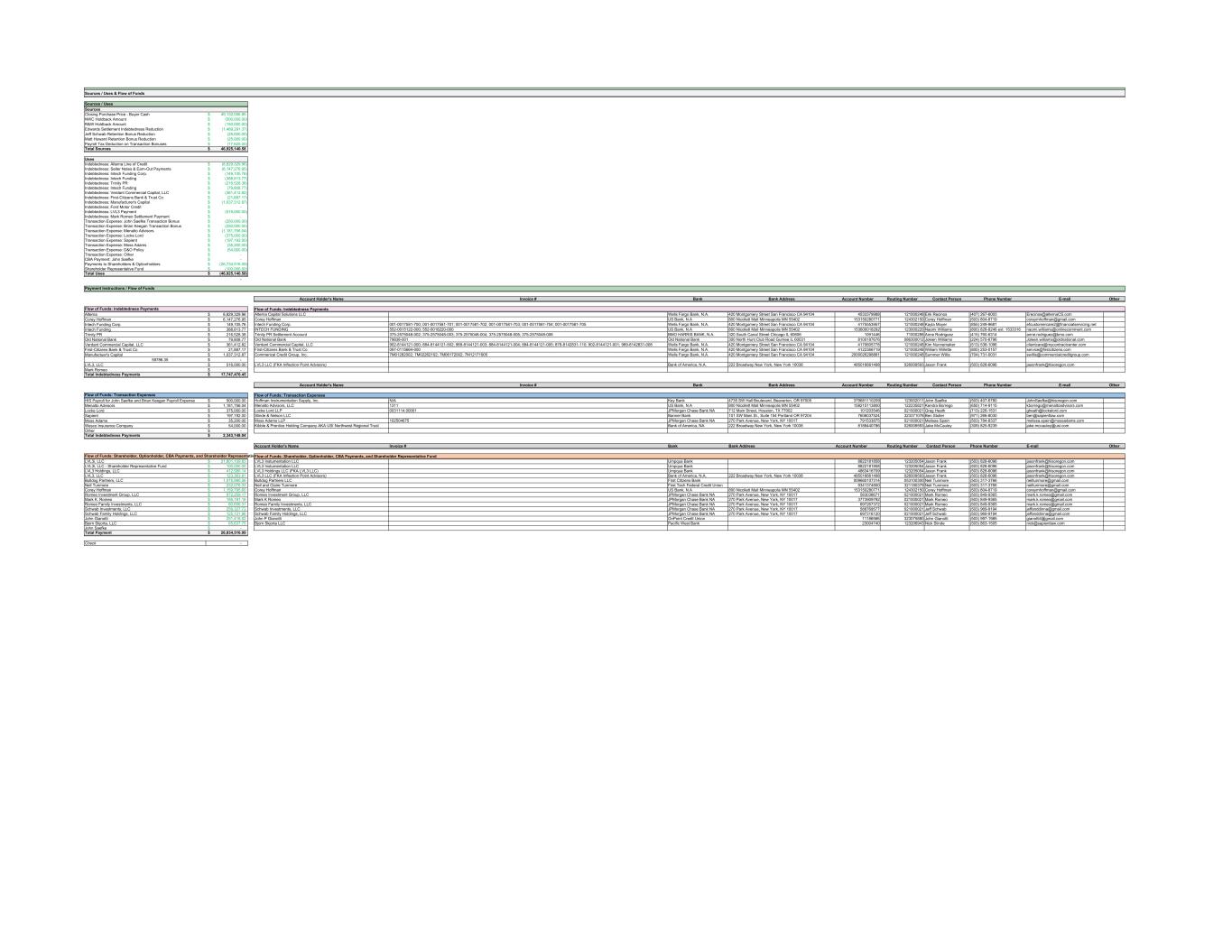

6 “Employee Welfare Benefit Plan” has the meaning specified in Section 3(1) of ERISA. “Environmental Laws” means any Applicable Law or any binding enforcement agreement with any Governmental Authority, relating to protection of human health and safety (as related to exposure to Hazardous Substances), the environment, or to Hazardous Substances. “Environmental Permits” means all permits, licenses, franchises, certificates, approvals and other similar authorizations of Governmental Authorities relating to or required by Environmental Laws and affecting, or relating in any way to, the business of the Company or any of its Subsidiaries as currently conducted. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and any rules or regulations promulgated thereunder. “ERISA Affiliate” with respect to an entity means any other entity that, together with such first entity, would be treated as a single employer under Section 414 of the Code. “Estimated Cash” means $1,005,625.00, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of Closing Cash as of the date hereof. “Estimated CBA Consideration” means $0.00, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the CBA Consideration as of the date hereof. “Estimated Indebtedness” means $19,154,070.66, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of Indebtedness as of the date hereof. “Estimated Option Consideration” means $33,481.78, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the Option Consideration as of the date hereof. “Estimated Per Share Closing Consideration” means $294.17, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the Per Share Closing Consideration as of the date hereof. “Estimated Purchase Price” means an amount in cash equal to (i) the Base Cash Consideration, plus (ii) the Estimated Cash, plus (iii) the difference, which may be a positive or negative number, between (x) the Estimated Working Capital and (y) the Target Working Capital, minus (iv) the Estimated Indebtedness, minus (v) the Estimated Transaction Expenses. “Estimated Share Consideration” means $26,801,034.31, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the Share Consideration as of the date hereof.

7 “Estimated Transaction Expenses” means $2,383,773.04, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the Company’s Transaction Expenses as of the date hereof. “Estimated Warrant Consideration” means $0.00, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of the Warrant Consideration as of the date hereof. “Estimated Working Capital” means $7,972,556.71, as set forth on the Estimated Closing Statement, which is the Company’s good faith estimate of Closing Net Working Capital as of the date hereof. “Export and Import Control Laws” means (i) U.S. laws, regulations, or orders governing imports, exports, and customs, (ii) non-U.S. laws, regulations, or orders governing imports, exports, and customs in all other countries in which the Company has conducted and/or currently conducts business, and (iii) Anti-Boycott Laws. “Fraud” means, with respect to any Party, (i) an intentional misrepresentation of a material fact in a specific representation or warranty expressly set forth in Article 3, Article 4 or Article 5; (ii) with actual knowledge by the Party making such representation or warranty that such representation or warranty was materially false when made (iii) with the specific intent on the part of the Party making such representation or warranty to induce the Party to which such representation or warranty was made to act, or refrain from acting, in reliance upon such materially false representation or warranty (iv) that such receiving Party, in justifiable reliance upon such materially false representation or warranty took or refrained from taking action; and (v) such Party actually suffered damage by reason of such reliance. For the avoidance of doubt, “Fraud” does not include (a) constructive fraud, statutory fraud, equitable fraud, negligent misrepresentation or omission or promissory fraud or (b) any fraud based on constructive knowledge, negligent misrepresentation or recklessness. “Fully Diluted Number” means, without duplication, immediately prior to the Closing: (i) the aggregate number of shares of Company Common Stock issued and outstanding, plus (ii) the aggregate number of shares of Company Common Stock issuable upon the exercise of all Company Stock Options outstanding immediately prior to the Closing (regardless of whether any such outstanding Company Stock Option has become exercisable in accordance with the Company Equity Plan and/or any other terms applicable to it), plus (iii) the aggregate number of shares of Company Common Stock issuable upon the exercise of all Company Warrants outstanding immediately prior to the Closing (regardless of whether any such outstanding Company Warrant has become exercisable in accordance with the Company Warrant and/or any other terms applicable to it); provided, that (a) each share of Company Common Stock held in the Company’s treasury immediately prior to the Closing shall not be included in the calculation of the Fully Diluted Number, (b) no Company Common Stock issuable upon the exercise of any Company Stock Option outstanding immediately prior to Closing shall be included in the calculation of the Fully Diluted Number unless and until the aggregate Purchase Price then paid or due and payable divided by the Fully Diluted Number (without giving effect to clauses (b) and

8 (c) of this proviso) exceeds the exercise price per share of such Company Stock Option, and (c) no Company Common Stock issuable upon the exercise of any Company Warrant outstanding immediately prior to the Closing shall be included in the calculation of the Fully Diluted Number unless and until the aggregate Purchase Price then paid or due and payable divided by the Fully Diluted Number (without giving effect to clauses (b) and (c) of this proviso) exceeds the exercise price per share of such Company Warrant. For the avoidance of doubt, the Fully Diluted Number shall be recalculated with respect to any portion of the Purchase Price that becomes due and payable following the Closing (as if such amounts and all previously paid amounts had been due and payable at the Closing) at such time as Payment Instructions are required to be delivered by the Holder Representative to Buyer pursuant to this Agreement. “Fundamental Representations” means the Company Fundamental Representations, the Seller Fundamental Representations and the Buyer Fundamental Representations. “Generative AI Tools” means any and all artificial intelligence tools, machine learning algorithms (including large language models), neural networks, and other similar systems, Software or platforms, in each case, capable of producing any type of content or output (including, but not limited to, text (including Software code), imagery, video, audio, data or other media). “Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence or which govern its internal affairs, including the charter, articles or certificate of incorporation, association or formation, bylaws, operating agreement, limited liability company agreement, partnership agreement, investor rights’ agreement, shareholders’ agreement, voting agreement, voting trust agreement, joint venture agreement, registration rights agreement and any similar agreement, and any amendments or supplements to any of the foregoing. “Governmental Authority” means any transnational, domestic or foreign federal, state or local governmental, regulatory or administrative authority, department, court, agency or official, including any political subdivision thereof. “Hazardous Substances” means any pollutant, contaminant, waste or chemical in the form, concentration or condition of which it is regulated by or may form a basis of liability under Environmental Laws as toxic, radioactive, ignitable, corrosive, reactive or otherwise hazardous or having any constituent elements displaying any of the foregoing produc-, bycharacteristics, including petroleum, its derivatives ts and other hydrocarbons, or any per- or polyfluoroalkyl substances in the form and to the extent regulated under any Environmental Law. “Holdback Fund” means an amount equal to the Adjustment Holdback Amount, plus the Indemnity Holdback Amount withheld from the aggregate Purchase Price at Closing by Buyer.

9 “Indebtedness” means, without duplication, with respect to the Company, calculated in accordance with the Accounting Principles, all obligations and other Liabilities (including all obligations in respect of principal, accrued interest, penalties, fees, prepayment penalties (other than prepayment penalties in respect of Indebtedness owed to Manufacturers Capital, Intech Funding Corp, or First Citizens Bank) breakage costs, premiums and other expenses) of the Company for (i) borrowed money (including overdraft facilities), (ii) evidenced by notes, bonds, debentures or similar Contracts or securities, (iii) created or arising under any conditional sale or other title retention agreement issued or assumed as full or partial payment with respect to property acquired by the Company (even though the rights and remedies of the seller or lender under such agreement in the event of default are limited to repossession or sale of such property), (iv) secured by a purchase money mortgage or other Lien to secure all or part of the purchase price of the property subject to such Lien, (v) for the deferred purchase price of assets, property, goods or services, including all seller notes, earnout payments and purchase price adjustment payments, (vi) for capitalized liabilities of the Company as lessee under leases that are capitalized or required to be capitalized in accordance with the Accounting Principles, which for the avoidance of doubt shall exclude any impact of operating leases capitalized in accordance with the Financial Accounting Standards Board’s Accounting Standards Update 2016-02, Leases (Topic 842), (vii) obligations under or in respect of letters of credit, acceptance credit, bankers’ acceptances or similar facilities (to the extent drawn), (viii) for Contracts relating to interest rate and currency protection, swap agreements, collar agreements and other hedging agreements (at the termination value thereof), (ix) in respect of forward sale and purchase agreements, (x) for all unpaid income Taxes of the Company and its Subsidiaries accrued (or required under U.S. GAAP to be accrued) for any Pre-Closing Tax Period (including (A) any liability for Taxes or other liabilities as a result of or relating to Section 965 or an election under Section 965(h) of the Code and (B) any Taxes required to be included under Sections 951 or 951A of the Code with respect to any non-U.S. Subsidiaries for the taxable year of such non-U.S. Subsidiaries that includes (but does not end on) the Closing Date, calculated as if the taxable year of each controlled foreign corporation (within the meaning of Section 957 of the Code) giving rise to such amounts ended on the Closing Date), (xi) any accrued but unpaid obligation or liability in respect of underfunded or unfunded defined benefit pension plans or retiree health or welfare benefit plans or deferred compensation plans, (xii) severance or other termination-related payments or obligations that are due or accrued as of the Closing but unpaid (except to the extent taken into account as a Transaction Expense or Closing Net Working Capital), (xiii) the employer portion of any payroll, social security, employment and similar Taxes payable or incurred in connection with the payments described in clauses (xi) and (xii), (xiv) the maximum amount of unpaid settlement obligations under those certain settlement agreements set forth on Section 1.01-DEBT of the Company Disclosure Schedule, (xv) any other amounts payable by the Company to a Related Party that remains unpaid as of the Closing other than ordinary course employment compensation consistent with the applicable salary or wage rate set forth in Section Section 3.24(a) of the Company Disclosure Schedule; and (xvi) in the nature of guarantees of the obligations described in clauses (i) through (xvi) above of any other Person. For the avoidance of doubt, Indebtedness includes all Specified Debt and all other Indebtedness included on the Estimated Closing Statement.

10 “Indemnified Taxes” means any and all Taxes (a) for which the Company or any of its Subsidiaries is liable attributable to any Pre-Closing Tax Period, together with any interest, penalty or addition to Tax accruing after the Closing Date on any Taxes described in this clause (a), (b) of any Person for which the Company or any of its Subsidiaries is liable as a transferee or successor, by Contract or pursuant to any Applicable Law, (c) arising out of or resulting from any inclusion under Sections 951 or 951A of the Code (or any similar or corresponding provision of state or local Law) in respect of any “foreign corporation” owned (directly or indirectly) by the Company to the extent such inclusion results from any transactions or ownership of assets occurring between (x) the beginning of the taxable year of such foreign corporation that includes the Closing Date and (y) the Closing, or (d) any Taxes resulting from any breach or inaccuracy of any representation set forth in Section 3.11, provided, however, that the foregoing Indemnified Taxes will not include any Taxes (A) to the extent accounted for or included as a liability in the Closing Indebtedness, Closing Company Transaction Expenses or the Closing Net Working Capital, (B) that are attributable to any action taken outside the ordinary course of business on the Closing Date after the Closing that is not contemplated by this Agreement or (C) in the case of Taxes otherwise described the preceding clause (d), would not have been payable but for the unavailability, in any Taxable period (or portion thereof) beginning after the Closing Date, of any amount of any tax attribute of the Company or any of its Subsidiaries (including net operating loss or Tax credit) originally arising in a Pre-Closing Tax Period. “Indemnity Holdback Amount” means $150,000. “Intellectual Property Rights” means any and all intellectual property and similar proprietary rights throughout the world, including all (i) inventions, whether or not patentable, reduced to practice or made the subject of one or more pending patent applications, (ii) national and multinational statutory invention registrations, patents and patent applications (including all provisionals, non-provisionals, reissues, divisionals, continuations, continuations-in-part, extensions, supplementary protection certificates and reexaminations thereof and all foreign equivalents of the foregoing) registered or applied for in the United States and all other nations throughout the world, and all inventions disclosed in each such registration, patent or patent application, (iii) trademarks, service marks, brand names, trade dress, logos, certifications, trade names, corporate names, domain names and social media identifiers and accounts, in the United States and all other nations throughout the world, including all variations, derivations, combinations, registrations and applications for registration of the foregoing and all goodwill associated therewith, (iv) copyrights (whether or not registered), works of authorship, mask work rights, and registrations and applications for registration thereof in the United States and all other nations throughout the world, including all derivative works, moral rights, renewals, extensions, reversions or restorations associated with such copyrights, now or hereafter provided by law, regardless of the medium of fixation or means of expression, (v) Software, (vi) trade secrets, know-how and other confidential or proprietary information (including manufacturing and production processes and procedures and techniques, results of experimentation and testing, technical data and research and development information) and, whether or not confidential, business information (including pricing and cost information, business and marketing plans and customer and supplier lists), (vii) industrial designs (whether or not registered) and all registrations and

11 applications therefor, (viii) databases and data collections, (ix) rights of publicity, (x) copies and tangible embodiments of any of the foregoing, in whatever form or medium, (xi) all rights to apply for, obtain, prosecute, claim priority to, register, maintain and defend any of the foregoing, (xii) all rights in all of the foregoing provided by treaties, conventions and common law and (xiii) all rights to sue or recover and retain damages, costs and attorneys’ fees for past, present and future infringement, misappropriation or other violation of any of the foregoing. “International Plan” means any Employee Plan that is not a U.S. Plan. “IRS” means the Internal Revenue Service. “IT Assets” means any and all computers, Software, firmware, middleware, servers, workstations, routers, hubs, switches, data communications lines, and other information technology assets and equipment (including laptops and mobile devices), and all documentation related to any of the foregoing, in each case, owned by, or licensed or leased to (or purported to be owned by or licensed or leased to), the Company or any Subsidiary. “knowledge” of any Person that is not an individual means the knowledge of such Person’s officers after reasonable inquiry. “Liability” means any debt, liability or obligation, whether due or to become due, absolute or contingent, inchoate or otherwise, matured or unmatured, liquidated or unliquidated, accrued or unaccrued, known or unknown, secured or unsecured, or determined or determinable, and includes all costs and expenses relating thereto. “Licensed Intellectual Property Rights” means any and all Intellectual Property Rights owned by a third party and licensed or sublicensed, or purported to be licensed or sublicensed, to either the Company or any Subsidiary or for which the Company or any Subsidiary has obtained, or has purported to have obtained, a covenant not to be sued or similar right. “Lien” means, with respect to any property or asset, any mortgage, lien, pledge, charge, security interest, license, encumbrance or other adverse claim of any kind in respect of such property or asset. For the purposes of this Agreement, a Person shall be deemed to own subject to a Lien any property or asset which it has acquired or holds subject to the interest of a vendor or lessor under any conditional sale agreement, capital lease or other title retention agreement relating to such property or asset. “Material Adverse Effect” means a material adverse effect on (i) the condition (financial or otherwise), business, assets or results of operations of the Company and its Subsidiaries, taken as a whole, excluding any adverse effect resulting from (A) changes in the general economic or political conditions in the United States not having a materially disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to other participants in the industry in which the Company and any of its Subsidiaries operate, (B) changes (including changes of Applicable Law, including in compliance with Applicable Laws resulting from or relating to COVID-19 or other disease, virus, or outbreak) or conditions generally affecting the industry in which the Company and its

12 Subsidiaries operate and not specifically relating to or having a materially disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to other participants in the industry in which the Company and its Subsidiaries operate, (C) acts of war, sabotage or terrorism or natural disasters involving the United States of America not having a materially disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to other participants in the industry in which the Company and its Subsidiaries operate, (D) the public announcement of this Agreement or the Transactions contemplated by this Agreement, (E) the failure of the Company to meet, with respect to any period or periods, any internal projections, forecasts, estimates of earnings or revenues, or business plans (except that the underlying causes of any such changes may be considered in determining whether a Material Adverse Effect has occurred), or (F) crises affecting public health, safety or welfare, including any epidemic, pandemic, or disease outbreak (including the COVID-19 virus), public health emergencies, including the continuation, escalation or worsening of such conditions not specifically relating to or having a materially disproportionate effect on the Company and its Subsidiaries, taken as a whole, relative to other participants in the industry in which the Company and its Subsidiaries operate, or (ii) the Company’s or any Seller’s ability to consummate the transactions contemplated by this Agreement. “Multiemployer Plan” means a “multiemployer plan” as defined in Section 3(37) of ERISA. “Net Working Capital” means (A) the sum of the current assets of the Company and its Subsidiaries (excluding Closing Cash, intercompany receivables that are not eliminated in consolidation and all income Tax assets, and any deferred tax assets), minus (B) the sum of the current liabilities of the Company and its Subsidiaries (excluding Closing Indebtedness, any amounts accrued for Closing Company Transaction Expenses and all income Tax liabilities and any deferred tax liabilities, but including, for the avoidance of doubt, an accrual for 2023 employee bonuses), in the case of each component of (A) and (B), determined in accordance with the Accounting Principles. “Optionholder” means, as of immediately prior to the Closing, each holder of a Company Stock Option in his, her or its capacity as such. “Order” means any judgment, decree, injunction, ruling, award, subpoena, verdict or order of any Governmental Authority or arbitrator. “Owned Intellectual Property Rights” means any and all Intellectual Property Rights owned, or purported to be owned, by either the Company or any Subsidiary. “PBGC” means the Pension Benefit Guaranty Corporation. “Permitted Equity Liens” means (a) restrictions on any sale, assignment or transfer of securities under applicable securities Laws, and (b) restrictions on any sale, assignment or transfer of the Company Common Stock or other equity interests of the Company or its Subsidiaries set forth in the Governing Documents of the Company or its Subsidiaries.

13 “Permitted Liens” means (a) statutory Liens for Taxes not yet due and payable or the amount or validity of which is being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with the Accounting Principles, (b) mechanics’, carriers’, workers’, repairers’ and similar statutory Liens arising or incurred in the ordinary course of business for amounts not overdue, (c) Liens arising in the ordinary course of business under worker’s compensation, unemployment insurance, social security, retirement and similar legislation, (d) Liens or other defects, the existence of which have not had and would not reasonably be expected to have, individually or in the aggregate, any material impact on the Company or any of its Subsidiaries, (e) Liens for which either affirmative title insurance coverage, bonding or an indemnification in favor of the Company or any of its Subsidiaries that is the titleholder to the subject property has been obtained and is in effect, (f) Liens securing the Indebtedness reflected as liabilities in the Financial Statements or referred to in notes to the Financial Statements, (g) with respect to the Real Property, (i) Liens imposed or promulgated by Applicable Law with respect to real property, including zoning, entitlement, building and other land use regulations imposed by Governmental Authorities having jurisdiction over the Real Property, which are not violated by the current use or occupancy of the applicable Real Property or the business operated thereon and (ii) covenants, conditions, restrictions, easements and other similar matters that would be disclosed by an inspection or accurate survey of any parcel of Real Property; provided that the same, individually and in the aggregate, do not impair in any material respect the occupancy, use or operation of any Real Property for purposes of the ownership or operation of the business of the Company and its Subsidiaries, (h) Liens that shall be released, waived or otherwise terminated at or prior to the Closing, and (i) Liens identified on Section 1.01-PL of the Company Disclosure Schedule. “Per Option Share Closing Consideration” means, with respect to each share of Company Common Stock subject to a Company Stock Option outstanding as of immediately prior to the Closing (after giving effect to any acceleration resulting from or in connection with the transactions contemplated by this Agreement), an amount equal to the excess of the Estimated Per Share Closing Consideration over the exercise price per share of such Company Stock Option as set forth on the Payment Instructions; provided that if the exercise price per share of such Company Stock Option exceeds the Estimated Per Share Closing Consideration, then the Per Option Share Closing Consideration shall be $0. “Per Share Closing Consideration” means a dollar amount equal to the quotient obtained by dividing (i) the Closing Consideration, plus the aggregate exercise price in respect of all Company Stock Options outstanding immediately prior to the Closing (to the extent such Company Stock Options are included in the Fully Diluted Number), plus the aggregate exercise price in respect of all Company Warrants outstanding immediately prior to the Closing (to the extent such Company Warrants are included in the Fully Diluted Number) by (ii) the Fully Diluted Number. “Per Warrant Share Closing Consideration” means, with respect to each share of Company Common Stock subject to a Company Warrant outstanding as of immediately prior to the Closing (after giving effect to any acceleration resulting from or in connection with the transactions contemplated by this Agreement), an amount equal to the excess of

14 the Estimated Per Share Closing Consideration over the exercise price per share of such Company Warrant as set forth on the Payment Instructions; provided that if the exercise price per share of such Company Warrant exceeds the Estimated Per Share Closing Consideration, then the Per Warrant Share Closing Consideration shall be $0. “Person” means an individual, corporation, partnership, limited liability company, association, trust or other entity or organization, including a Governmental Authority. “Personal Information” means, “personal information,” “personally identifiable information,” “personal data,” and any terms of similar import, in each case as defined under any Applicable Law relating to data privacy, data protection, cybersecurity and/or the processing of such information or data. “Pre-Closing Tax Period” means any Tax period ending on or before the Closing Date; and, with respect to a Straddle Tax Period, the portion of such Tax period ending on the Closing Date. “Pro Rata Indemnity Share” means, with respect to each Seller, a fraction (expressed as a percentage) (i) the numerator of which is the Fully Diluted Number of shares of Company Common Stock held or deemed held by such Seller immediately prior to the Closing, and (ii) the denominator of which is the aggregate Fully Diluted Number of shares held by all Sellers immediately prior to the Closing, as set forth as the “Pro Rata Indemnity Share” opposite each Seller’s name on the Payment Instructions; provided for the avoidance of doubt, (a) that the aggregate Pro Rata Indemnity Shares of all Sellers shall equal one hundred percent (100%) and (b) Pro Rata Indemnity Shares shall be recalculated with respect to any portion of the Purchase Price that becomes due and payable following the Closing at such time as Payment Instructions are required to be delivered by the Holder Representative pursuant to this Agreement. “Pro Rata Share” means, with respect to each Stockholder, Optionholder and Warrantholder, a fraction (expressed as a percentage) (i) the numerator of which is the Fully Diluted Number of shares of Company Common Stock held or deemed held by such Stockholder, Optionholder and Warrantholder immediately prior to the Closing, and (ii) the denominator of which is the Fully Diluted Number, in each case as of immediately prior to the Closing, as set forth as the “Pro Rata Share” opposite such Person’s name on the Payment Instructions; provided that for the avoidance of doubt, (a) the aggregate Pro Rata Shares of all Stockholders, Optionholders and Warrantholders shall equal one hundred percent (100%) and (b) the Pro Rata Shares shall be recalculated with respect to any portion of the Purchase Price that becomes due and payable following the Closing at such time as Payment Instructions are required to be delivered by the Holder Representative to Buyer pursuant to this Agreement. “Related Party” means, with respect to any Person, such Person’s direct or indirect Affiliates, Subsidiaries, members, managers, general or limited partners, other equityholders, successors, assignees, directors, officers, employees or immediate family members (or any direct or indirect Affiliates, Subsidiaries, representatives, members,

15 managers, general partners, other equityholders, successors, assignees, directors, officers, employees or immediate family members of any of the foregoing). “Release” means any release, spill, leak, pumping, pouring, emitting, emptying, discharge, injection, escape, leaching, dumping, placing, discarding, abandonment, disposal, deposit, dispersing or migration into or through the environment. “Representatives” means, with respect to any Person, the partners, employees, officers, directors, managers, members, equity financial orowners, agents, consultants, other advisors, counsel or other representatives of such Person or any of its Affiliates. “Sanctioned Country” means any country or other territory that is itself the subject of comprehensive Sanctions (as of the date of this Agreement, Cuba, Iran, North Korea, Syria, and the Crimea, Donetsk, and Luhansk regions of Ukraine). “Sanctions” means economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time by any Sanctions Authority. “Sanctions Authority” means (i) the United States (including the United States Department of Commerce, the United States Department of State, and the United States Department of the Treasury’s Office of Foreign Assets Control), (ii) the United Nations Security Council, (iii) the European Union, (iv) the United Kingdom, including HM’s Treasury, and (v) the respective Governmental Authorities of any of the foregoing. “Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002. “Seller Employee Plan” means any Employee Plan that is sponsored, maintained or entered into by a Seller or any of its Affiliates other than the Company or any of its Subsidiaries. “Seller Fundamental Representation” means, with respect to any Seller, those representations and warranties in Section 4.01, Section 4.02, Section 4.04(a), Section 4.05 and Section 4.06. “Service Provider” means any director, officer, employee, consultant, advisor, individual independent contractor or other similar service provider of the Company or any of its Subsidiaries. “Software” means any and all (i) software, computer programs, applications, systems, specifications and embedded versions thereof (including operating systems) and all software implementation of algorithms (including those for artificial intelligence technologies, machine learning technologies and deep learning technologies), models and methodologies, firmware, middleware, APIs, development and design tools, applets, compilers and assemblers, whether in source code, object code, human readable form or other form, (ii) databases, data files and compilations, including any and all libraries, data and collections of data, whether machine readable, on paper or otherwise, (iii) text, diagrams, descriptions, flow-charts and other work product used to design, plan, organize and develop any of the foregoing, screens, user interfaces, report formats, firmware,

16 microcode and implementations, development tools, templates, menus, buttons and icons, (iv) technology supporting, and the contents and audiovisual displays of, any internet site(s) and (v) documentation, other works of authorship and media, including programmers’ notes and source code annotations, user manuals and training materials, relating to or embodying any of the foregoing or on which any of the foregoing is recorded. “Stockholder” means a holder of Company Common Stock immediately prior to Closing. “Straddle Tax Period” means a Tax period that begins on or before the Closing Date and ends thereafter. “Subsidiary” means, with respect to any Person, any entity of which securities or other ownership interests having ordinary voting power to elect a majority of the board of directors or other persons performing similar functions are at the time directly or indirectly owned by such Person. “Target Working Capital” means $9,955,821.92. “Tax” means (i) any tax, levy, governmental fee or other like assessment or charge of any kind whatsoever (including any payments required to be made to any state abandoned property administrator or other public official pursuant to an abandoned property, escheat or similar Law), together with any interest, penalty, addition to tax or additional amount, and any liability for any of the foregoing as transferee or successor, (ii) in the case of the Company or any of its Subsidiaries, liability for the payment of any amount of the type described in clause (i) as a result of being or having been before the Closing a member of an affiliated, consolidated, combined, unitary or similar group, or a party to any agreement or arrangement, as a result of which liability of such Company or any of its Subsidiaries to a Governmental Authority is determined or taken into account with reference to the activities of any other Person and (iii) liability of the Company or any of its Subsidiaries for the payment of any amount as a result of being party to any Tax Sharing Agreement. “Tax Return” means any Tax return, statement, report, election, declaration, disclosure, schedule or form (including any estimated tax or information return or report) filed or required to be filed with any Taxing Authority. “Tax Sharing Agreement” means any agreement or arrangement (whether or not written) entered into prior to the Closing binding the Company or any of its Subsidiaries that provide for the allocation, apportionment, sharing or assignment of any Tax Liability or benefit, or the transfer or assignment of income, revenues, receipts, or gains for the purpose of determining any Person’s Tax Liability (other than any customary commercial contract entered into in the ordinary course of business the principal subject matter of which is not Taxes). “Taxing Authority” means any Governmental Authority responsible for the imposition or collection of any Tax.

17 “Title IV Plan” means any Employee Plan (other than any Multiemployer Plan) that is subject to Title IV of ERISA. “Transaction Documents” means this Agreement, the Optionholder Letters, the Warrant Termination Agreements and the CBA Holder Letters. “Transaction Expenses” means (i) all fees, costs and other expenses of any investment bankers, financial advisors, attorneys, accountants and other consultants, advisors or other Representatives incurred by or on behalf of, or payable by, the Company and each of its Subsidiaries in connection with the preparation for, negotiation or consummation of the transactions contemplated by the Transaction Documents, including the Holder Representative Fund ,(ii) any assignment, change in control or similar fees expressly due and payable as a result of the execution and delivery of this Agreement and ns contemplatedthe other Transaction Documents or the consummation of the transactio hereby or thereby, including any stay or retention, change in control, transaction or similar bonuses, compensation, incentive and/or severance payments, equity or equity-based compensation arrangement or other payment to be made to any Service Provider arising as a result of, or in connection with, the execution or delivery of this Agreement or the other Transaction Documents or the consummation of the transactions contemplated hereby or thereby, but, in each case, not any such amount payable in connection with actions taken by Buyer after the Closing; provided, that, notwithstanding anything in the foregoing to the contrary, this clause (ii) shall include (to the extent unpaid as of the Closing) or exclude the retention amounts that become payable following the Closing as set forth on Section 1.01-TX of the Company Disclosure Schedules, (iii) any fees, costs, expenses and other Liabilities incurred (or that would be incurred or made) as a result of the termination or settlement of any Related Party Contract or account that is required to be terminated or settled pursuant to Section 3.28(c), (iv) fifty percent (50%) of the costs associated with the D&O Tail as provided for in Section 6.04, and (v) the employer portion of any payroll, employment or similar Taxes associated with any payments arising as a result of the execution or delivery of this Agreement or the other Transaction Documents or the consummation of the transactions contemplated hereby or thereby, including the payments contemplated by clauses (ii) and (iii) above and payments relating to the Company Stock Options and the CBA (including Post-Closing Payments, with such amounts to be deducted from the aggregate amount of any Post-Closing Payment); provided that Transaction Expenses shall not include, and Buyer shall bear, all costs and expenses related to the R&W Insurance Policy, including the total premium, underwriting costs, brokerage commission, and other fees and expenses of such policy . “Transaction Expenses Payoff Instructions” means reasonably satisfactory documentation setting forth an itemized list of all, and amounts of all, Unpaid Transaction Expenses, including the identity of each payee, dollar amounts owed and wire transfer instructions, an IRS Form W-9 for such payee, and any other information necessary to effect the final payment in full thereof. “Transfer Tax” means sales, use, transfer, real property transfer, recording, documentary, value added, stamp, registration and stock transfer Taxes and any similar

18 Taxes (and any applicable interest or penalties and the cost of preparing and filing Tax Returns with respect thereto). “Unpaid Transaction Expenses” means the aggregate amount of Transaction Expenses that are unpaid as of immediately prior to the Closing. “U.S. GAAP” means generally accepted accounting principles in the United States, applied on a basis consistent with the Company’s past practices used in preparing the Financial Statements. “U.S. Plan” means any Employee Plan that covers Service Providers located primarily within the United States. “Warrantholder” means, as of immediately prior to the Closing, each holder of a Company Warrant in his, her or its capacity as such. “WARN” means the Worker Adjustment and Retraining Notification Act and any comparable foreign, state or local law. (b) Each of the following terms is defined in the Section set forth opposite such term: Term Section 2024 Base Earnout Amount 2.08(c)(i) 2024 Earnout Payment 2.08(b)(i) 2024 Operating Profit Threshold 2.08(c)(ii) 2024 Shortfall Earnout Amount 2.08(c)(iii) 2025 Base Earnout Amount 2.08(c)(iv) 2025 Earnout Payment 2.08(b)(ii) 2025 Operating Profit Threshold 2.08(c)(v) 2025 Shortfall Earnout Amount 2.08(c)(vi) Accounting Referee 2.05(c) Actual 2023 EBITDA 2.08(c)(vii) Actual Operating Profit 2.08(c)(viii) Adjustment Shortfall Amount 2.06(a)(i)(B) Aggregate Base Earnout Amount 2.08(c)(ix) Agreement Preamble Annual Financial Statements 3.07(a) Applicable Data Protection Law 3.17(a) Applicable Data Protection Requirements 3.17(a) Buyer Preamble Buyer Indemnified Parties 9.02(a) Buyer Released Parties 11.16(a) Calculation Objection Notice 2.08(d)(iii) CBA Consideration 2.02(d) CBA Holder Letter Recitals Closing 2.03(a)

19 Closing Balance Sheet 2.05 Closing Cash 2.05 Closing Company Transaction Expenses 2.05 Closing Date 2.03(a) Closing Indebtedness 2.05 Closing Net Working Capital 2.05 Closing Purchase Price 2.05 Company Preamble Company Insurance Policies 3.18 Company Organizational Documents 3.01 Company Securities 3.05(b) Contest 7.05 Contingent Installment Payment Amount 2.08(a) Contingent Payment 2.08(d)(iii) Contingent Payment Calculation Statements 2.08(d)(ii) Contingent Payment Calculations 2.08(d)(ii) Contingent Payment Determination Date 2.08(d)(iii) Continuing Employees 8.01 D&O Tail 6.04 Data Breach 3.17(b) Deductible 9.02(c)(i) De Minimis Loss 9.02(c)(i) Direct Claim 9.05 e-mail 11.01 Earnout Calculation 2.08(d)(ii) Earnout Calculation Delivery Date 2.08(d)(ii) Earnout Calculation Statement 2.08(d)(ii) Earnout Payments 2.08(b)(ii) Estimated Closing Statement 2.02(b) Final Adjustment Amount 2.05 Financial Statements 3.07(a) Holder Representative Preamble Holder Representative Fund 10.06(a) Indemnified Party 9.04(a) Indemnifying Party 9.04(a) Installment Calculation 2.08(d)(i) Installment Calculation Delivery Date 2.08(d)(i) Installment Calculation Statement 2.08(d)(i) Interim Financial Statements 3.07(a) Losses 9.02(a) Majority Company Equityholders 10.05(a) Material Contract 3.10(a) New Plans 8.01 Non-Recourse Party 11.14 Notice of Objection 2.05(b) Option Consideration 2.02(d)

20 Optionholder Letter Recitals Overpayment Amount 2.06(a)(i) Payment Instructions 2.02(d) Payoff Amount 2.03(b)(i) Payoff Letter 2.03(b)(i) Permits 3.19(a) Post Closing Payment 2.02(d) Pre-Closing Tax Return 7.01(a) Privileged Communications 11.13(c) Post-Closing Statement 2.05 Purchase Price 2.02 R&W Insurance Policy Recitals Real Property 3.14(a) Real Property Lease 3.14(b) Related Party Contract 3.10(a)(xxi) Review Period 2.08(d)(iii) Section 280G Payments 3.25(o) Seller or Sellers Preamble Seller Indemnified Parties 9.02(e) Seller Released Matters 11.16(a) Seller Releasing Parties 11.16(a) Seller Warranty Breach 9.02(c) Sellers Group Law Firm 11.13(a) Share Consideration 2.02(d) Shortfall Amount 2.08(c)(x) Shortfall Operating Profit Target 2.08(c)(xi) Specified Breach 9.02(d) Specified Debt 2.03(b)(i) Subsidiary Securities 3.06(b)(ii) Survival Termination Date 9.01 Top Vendors 3.20 Third-Party Claim 9.04(a) Transactions Recitals Underpayment Amount 2.06(a)(ii) Update Report 2.08(g) Waived Payments 3.25(o) Warrant Consideration 2.02(d) Warranty Cap 9.02(c)(iii) Section 1.02. Other Definitional and Interpretative Provisions. The words “hereof,” “herein” and “hereunder” and words of like import used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. The captions herein are included for convenience of reference only and shall be ignored in the construction or interpretation hereof. References to Articles, Sections, Exhibits and Schedules are to Articles, Sections, Exhibits and Schedules of this Agreement unless otherwise specified. All Exhibits and Schedules annexed hereto or referred to herein,

21 including the Company Disclosure Schedule, are hereby incorporated in and made a part of this Agreement as if set forth in full herein. Any capitalized terms used in any Exhibit or Schedule but not otherwise defined therein shall have the meaning as defined in this Agreement, and any accounting term not otherwise defined herein has the meaning assigned to it in accordance with U.S. GAAP. Any singular term in this Agreement shall be deemed to include the plural, and any plural term the singular. References to “him,” “her,” “it,” “itself” and other like references shall be deemed to include the masculine or feminine reference, as the case may be. Whenever the words “include,” “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation,” whether or not they are in fact followed by those words or words of like import. “Writing,” “written” and comparable terms refer to printing, typing and other means of reproducing words (including by electronic media) in a visible form. The word “will” shall be construed to have the same meaning and effect as the word “shall.” The word “or” when used in this Agreement is not exclusive. References to any statute, rule, regulation, law or Applicable Law shall be deemed to refer to all Applicable Laws as amended or supplemented and to any rules, regulations and interpretations promulgated thereunder as of the Closing Date. References to any Contract are to that Contract as amended, modified or supplemented from time to time in accordance with the terms hereof and thereof; provided that with respect to any Contract required to be listed on any schedules hereto, or any Contract required by any Transaction Document to be disclosed, all amendments, modifications, supplements, extensions and renewals thereto must also be listed on the appropriate schedule and copies thereof disclosed. References to any Person include the successors and permitted assigns of such Person. References from or through any date mean, unless otherwise specified, from and including or through and including, respectively. References to “days” shall refer to calendar days unless Business Days are specified. When calculating the period of time before which, within which or following which any act is to be done or step taken, the date that is the reference date in beginning the calculation of such period shall be excluded (for example, if an action is to be taken within two (2) days of a triggering event and such event occurs on a Tuesday, then the action must be taken by the end of the day on Thursday) and if the last day of such period is a non-Business Day, the period in question shall end on the next succeeding Business Day. References to “ordinary course,” “ordinary course of business,” “ordinary course of business consistent with past practice” or phrases of similar import shall in each case mean “in the ordinary course of business consistent with past practice”. All monetary figures shall be in United States dollars unless otherwise specified. The parties have participated jointly in the negotiation and drafting of this Agreement and each has been represented by counsel of its choosing and, in the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the parties and no presumption or burden of proof shall arise favoring or disfavoring any party by virtue of the authorship of any provision of this Agreement. ARTICLE 2 PURCHASE AND SALE Section 2.01. Purchase and Sale. Upon the terms and subject to the conditions of this Agreement, each Seller shall sell to Buyer, and Buyer shall purchase from each Seller, all

22 of the issued and outstanding shares of Company Common Stock held by such Seller at the Closing, free and clear from all Liens (other than Permitted Equity Liens) and together with all rights of any nature whatsoever that attach (or may in the future attach) to such shares of Company Common Stock. The Sellers hereby waive, subject to and at and after the Closing, all rights of pre-emption or other restrictions on transfer that may exist in relation to the shares of Company Common Stock under the Company Organizational Documents or otherwise. Buyer shall not be obliged to close the sale or purchase of any of the shares of Company Common Stock held by the Sellers unless the sale or purchase of all of the shares of Company Common Stock is closed simultaneously in accordance with this Agreement and the Company’s Governing Documents. Section 2.02. Purchase Price; Estimated Closing Statement; Allocation of Purchase Price. (a) The aggregate purchase price (“Purchase Price”) payable for the Company Common Stock, Company Stock Options, CBA and Company Warrant shall be the amount of cash calculated as follows: (i) the Base Cash Consideration; (ii) plus the amount, if any, by which Closing Net Working Capital exceeds Target Working Capital; (iii) minus the amount, if any, by which Target Working Capital exceeds Closing Net Working Capital; (iv) plus Closing Cash; (v) minus Closing Indebtedness; (vi) minus Closing Company Transaction Expenses; (vii) plus the Contingent Installment Payment Amount (if any) due to the Company Equityholders pursuant to Section 2.08(a); (viii) plus any Earnout Payment due to the Company Equityholders pursuant to Section 2.08(b). (b) Prior to the date hereof, the Company prepared and delivered to Buyer and the Holder Representative a statement (the “Estimated Closing Statement”) (including all calculations in reasonable detail and supporting schedules) attached hereto as Schedule II, setting forth in reasonable detail the Company’s good faith estimate as of the Closing Date of (i) Estimated Working Capital, (ii) Estimated Cash, (iii) Estimated Indebtedness, (iv) Estimated Transaction Expenses, (v) the Estimated Purchase Price based thereon, (vi) the Estimated Share Consideration, (vii) the Estimated Option Consideration, (viii) the Estimated CBA Consideration, (ix) the Estimated Warrant Consideration, (x) the Estimated Per Share Closing Consideration, (xi) the Per Option Share Closing