Exhibit 99.1

SILVERCREST MINES INC.

ANNUAL GENERAL MEETING OF SHAREHOLDERS

INFORMATION CIRCULAR

GENERAL INFORMATION

This Information Circular is furnished to the holders (“shareholders”) of common shares (“Common Shares”) of SilverCrest Mines Inc. (the “Company”) by management of the Company in connection with the solicitation of proxies to be voted at the annual general meeting (the “Meeting”) of the shareholders to be held at the Metropolitan Hotel Vancouver, 645 Howe Street, Vancouver, British Columbia on Wednesday, June 11, 2014 at 11:00 a.m. (Vancouver time) and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

All dollar ($) amounts stated in this Information Circular refer to Canadian dollars, unless United States dollars (U.S.$) are indicated.

PROXIES

Solicitation of Proxies

The enclosed Proxy is solicited by and on behalf of management of the Company. The persons named in the enclosed Proxy form are management-designated proxyholders. A registered shareholder desiring to appoint some other person (who need not be a shareholder) to represent the shareholder at the Meeting may do so either by inserting such other person’s name in the blank space provided in the Proxy form or by completing another form of proxy. To be used at the Meeting, proxies must be received by Computershare Trust Company of Canada, Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 by 11:00 a.m. (Vancouver time) on June 9, 2014 or, if the Meeting is adjourned, by 11:00 a.m. (Vancouver time), on the second last business day prior to the date on which the Meeting is reconvened, or may be accepted by the chairman of the Meeting prior to the commencement of the Meeting. Solicitation will be primarily by mail, but some proxies may be solicited personally or by telephone by regular employees or directors of the Company at a nominal cost. The cost of solicitation by management of the Company will be borne by the Company.

Notice and Access Process

The Company has decided to take advantage of the notice-and-access provisions (“Notice and Access”) under the Canadian Securities Administrators’ National Instrument 54-101—Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) for the delivery of the Information Circular to its shareholders for the Meeting. The use of the alternative Notice and Access procedures in connection with the Meeting helps reduce paper use, as well as the Company’s printing and mailing costs.

Under Notice and Access, instead of receiving printed copies of the Information Circular, shareholders receive a notice (“Notice and Access Notification”) with information on the Meeting date, location and purpose, as well as information on how they may access the Information Circular electronically or request a paper copy. The Company will arrange to mail paper copies of the Information Circular to those registered and beneficial shareholders who have existing instructions on their account to receive paper copies of the Company’s proxy-related materials.

Non-Registered Holders

Only registered holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

| (a) | in the name of an Intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans, or |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited (CDS)) of which the Intermediary is a participant. |

Non-Registered Holders who have not objected to their Intermediary disclosing certain ownership information about themselves to the Company are referred to as “NOBOs”. Those Non-Registered Holders who have objected to their Intermediary disclosing ownership information about themselves to the Company are referred to as “OBOs”.

In accordance with the requirements of NI 54-101 of the Canadian Securities Administrators, the Company has distributed the Notice and Access Notification in connection with this Meeting to Intermediaries and clearing agencies for onward distribution to Non-Registered Holders.

The Company will not be paying for Intermediaries to deliver to OBOs (who have not otherwise waived their right to receive proxy-related materials) copies of proxy-related materials and related documents (including the Notice and Access Notification). Accordingly, an OBO will not receive copies of proxy-related materials and related documents unless the OBO’s Intermediary assumes the costs of delivery.

Intermediaries which receive the proxy-related materials (including Notice and Access Notification) are required to forward the proxy-related materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries often use service companies to forward the proxy-related materials to Non-Registered Holders.

Generally, Non-Registered Holders who have not waived the right to receive proxy-related materials (including OBOs who have made the necessary arrangements with their Intermediary for the payment of delivery and receipt of such proxy-related materials) will be sent a voting instruction form which must be completed, signed and returned by the Non-Registered Holder in accordance with the Intermediary’s directions on the voting instruction form. In some cases, such Non-Registered Holders will instead be given a proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy does not need to be signed by the Non-Registered Holder, but, to be used at the Meeting, needs to be properly completed and deposited with Computershare as described under “Solicitation of Proxies”.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or Proxy form is to be delivered.

Revocability of Proxies

A registered shareholder who has given a Proxy may revoke it by an instrument in writing that is

| (a) | executed by the shareholder giving same or by the shareholder’s attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and |

| (b) | delivered either to the registered office of the Company (19th Floor, 885 West Georgia Street, Vancouver, British Columbia V6C 3H4) at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, or to the chairman of the Meeting on the day of the Meeting or any adjournment thereof before any vote in respect of which the Proxy is to be used shall have been taken, |

or in any other manner provided by law.

Non-Registered Holders who wish to revoke a voting instruction form or a waiver of the right to receive proxy-related materials should contact their Intermediaries for instructions.

Voting of Proxies

Common Shares represented by a shareholder’s Proxy form will be voted or withheld from voting in accordance with the shareholder’s instructions on any ballot that may be called for at the Meeting and, if the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of any instructions, the management-designated proxyholder named on the Proxy form will cast the shareholder’s votes in favour of the passage of the resolutions set forth herein and in the Notice of Meeting.

The enclosed Proxy form confers discretionary authority upon the persons named therein with respect to (a) amendments or variations to matters identified in the Notice of Meeting and (b) other matters which may properly come before the Meeting or any adjournment thereof. At the time of printing of this Information Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the Notice of Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

Only Common Shares carry voting rights at the Meeting, with each Common Share carrying the right to one vote. The board of directors of the Company (“Board of Directors” or “Board”) has fixed April 28, 2014 as the record date for the determination of shareholders entitled to receive notice of and to vote at the Meeting and at any adjournment thereof, and only shareholders of record at the close of business on that date are entitled to such notice and to vote at the Meeting. As of April 28, 2014, 118,728,205 Common Shares were issued and outstanding as fully paid and non-assessable.

To the knowledge of the directors and executive officers of the Company, as at April 28, 2014, no person beneficially owned, or exercised control or direction over, directly or indirectly, shares carrying 10% or more of the voting rights attached to the Company's issued and outstanding Common Shares.

VOTES NECESSARY TO PASS RESOLUTIONS AT THE MEETING

Under the Company’s Articles, the quorum for the transaction of business at the Meeting consists of two shareholders entitled to vote at the Meeting, whether present in person or represented by proxy. Under the Business Corporations Act (British Columbia) and the Company’s Articles, a simple majority of the votes cast at the Meeting (in person or by proxy) is required in order to pass the resolutions referred to in the accompanying Notice of Meeting.

APPOINTMENT OF AUDITOR

The persons named in the enclosed Proxy form intend to vote for the appointment of Davidson & Company, Chartered Accountants, as the auditor of the Company to hold office until the next annual general meeting of shareholders of the Company.

ELECTION OF DIRECTORS

The Company currently has six directors. In order for the Company to have another independent director, at the Meeting, shareholders will be asked to fix the number of directors at seven and elect seven directors.

The persons named below are the seven nominees of management for election as directors. Each director elected will hold office until the next annual general meeting or until his successor is elected or appointed, unless the director’s office is earlier vacated under any of the relevant provisions of the Articles of the Company or the Business Corporations Act (British Columbia). It is the intention of the persons named by management as proxyholders in the enclosed proxy form to vote for the election to the Board of Directors of those persons hereinafter designated as nominees for election as directors. The Board of Directors does not contemplate that any of such nominees will be unable to serve as a director; however, if for any reason any of the proposed nominees do not stand for election or are unable to serve as such, proxies in favour of management designees will be voted for another nominee in their discretion unless the shareholder has specified in the shareholder’s proxy form that the shareholder’s shares are to be withheld from voting in the election of directors.

The following table sets out the name of each of the persons proposed to be nominated for election as a director; all positions and offices in the Company presently held by him; his present principal occupation, business or employment (and, in the case of Dunham L. Craig, a new director nominee, and N. Eric Fier, nominated for election at a shareholders’ meeting of the Company for the first time, also their principal occupation and employment for the last five years); the period during which he has served as a director; and the number of Common Shares that he has advised are beneficially owned, or controlled or directed, directly or indirectly, as of April 28, 2014.

Name, place of residence

and positions with

the Company | Principal occupation, business or employment | Period served

as a director | Common

Shares

beneficially

owned or

controlled |

Dunham L. Craig British Columbia, Canada | President and CEO of Geologix Explorations Inc. (mineral exploration company) since September 2005 | — | Nil |

J. Scott Drever British Columbia, Canada Director, Chairman and Chief Executive Officer | Chairman and Chief Executive Officer of the Company; Chief Executive Officer of Goldsource Mines Inc. (mineral exploration company); President of Nemesis Enterprises Ltd. (management consulting company) | Since November 5, 2002 | 1,516,226 |

N. Eric Fier British Columbia, Canada Director, President and Chief Operating Officer | President (since June, 2013) and Chief Operating Officer (since May 2003) of the Company; Chief Operating Officer of Goldsource Mines Inc. since June 2010; President of Maverick Mining Consultants Inc. since July 2001; Market Director of EBA Engineering Consultants Ltd. from October 2003 to October 2013 | Since June 11, 2013 | 1,282,027 |

British Columbia, Canada Director | Professional Mining Engineer; President of Ross Glanville & Associates Ltd.( mining consulting firm); Chairman of Clifton Star Resources Ltd. (mineral exploration company) | Since June 15, 2011 | 20,000 |

Barney Magnusson British Columbia, Canada Director and Chief Financial Officer | Chief Financial Officer of the Company; Chief Financial Officer of Goldsource Mines Inc. (mineral exploration company); President of Adapa Management Ltd. (management and investment company) | Since May 23, 2003 | 1,695,727 |

British Columbia, Canada Director | President of Goldcliff Resource Corporation (mineral exploration company) | Since June 28, 2006 | 125,500 |

British Columbia, Canada Director | Corporate Director | Since May 23, 2003 | 110,000 |

_________________________

(1) Member of Audit Committee.

(2) Member of Corporate Governance and Nominating Committee.

(3) Member of Compensation Committee.

Pursuant to the advance notice policy of the Company adopted by the Board of Directors on April 24, 2013, subject to shareholder approval which was obtained on June 11, 2013, any additional director nominations for the Meeting must be received by the Company in compliance with the advance notice policy by May 9, 2014. The Company will publish details of any such additional director nominations through a public announcement in accordance with the Advance Notice Policy.

Majority Voting Policy

The Board of Directors has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under this policy, if a nominee does not receive the affirmative vote of at least the majority of votes cast, the director shall promptly tender a resignation for consideration by the Corporate Governance and Nominating Committee and the Board. The Corporate Governance and Nominating Committee shall consider the resignation and recommend to the Board the action to be taken with respect to such offered resignation, which may include: accepting the resignation, maintaining the director but addressing what the Corporate Governance and Nominating Committee believes to be the underlying cause of the withheld votes, resolving that the director will not be re-nominated in the future for election, or rejecting the resignation and explaining the basis for such determination. Further to Toronto Stock Exchange (“TSX”) rules that will become effective June 30, 2014, the Board shall accept such director’s resignation absent exceptional circumstances.

The Corporate Governance and Nominating Committee in making its recommendation, and the Board in making its decision, may consider any factors or other information they consider appropriate and relevant. Any director who tenders his resignation pursuant to the Majority Voting Policy may not participate in the recommendation of the Corporate Governance and Nominating Committee or the decision of the Board with respect to his resignation. The Board will act on the recommendation of the Corporate Governance and Nominating Committee within 90 days after the shareholder meeting at which the election of directors occurred. Following the Board’s decision, the Company will promptly issue a press release disclosing the Board’s determination (and, if applicable, the reasons for rejecting the resignation).

If the Board accepts any tendered resignation in accordance with the Majority Voting Policy, then the Board may (i) proceed to fill the vacancy through the appointment of a new director, or (ii) determine not to fill the vacancy and instead decrease the size of the Board. If a director’s resignation is not accepted by the Board, such director will continue to serve until the next annual meeting and until his successor is duly elected, or his earlier resignation or removal; alternatively, the director shall otherwise serve for such shorter time and under such other conditions as determined by the Board, considering all of the relevant facts and circumstances.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Other than as disclosed herein, none of the proposed directors is, as at the date of this Information Circular, or has been, within the ten years preceding the date of this Information Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that

| (a) | was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (collectively, an “Order”), when such Order was issued while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company; or |

| (b) | was subject to an Order that was issued after such person ceased to be a director, chief executive officer or chief financial officer of the relevant company, and which resulted from an event that occurred while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company. |

Ross O. Glanville, a director of the Company, was also a director of Clifton Star Resources Inc. (“Clifton”) when the British Columbia Securities Commission (“BCSC”) issued a cease trade order on July 22, 2011 in connection with Clifton’s failure to file technical reports and material change reports in the required forms in respect of disclosure of Clifton’s mineral resource estimates on its material properties. After changes in Clifton’s management and three of the members of the Board of Directors (as well as the appointment of Mr. Glanville as Chairman of Clifton), and the filing of the relevant documents, the BCSC revoked the cease trade order on March 5, 2012.

The current directors of the Company (with the exception of Ross O. Glanville) were directors and/or executive officers of the Company in December 2010 when the Company received notification of administrative proceedings from the United States Securities and Exchange Commission (“SEC”). This notification was issued as a result of a registration statement filed in 1999 by Strathclair Ventures Ltd. (“Strathclair”), a predecessor company to the Company which was under different management until the Company assumed control in 2003. The order alleged that Strathclair (now the Company) had not filed periodic reports with the SEC sufficient to maintain its registration in the United States. Following discussions with the SEC and in order to remedy the situation, the Company entered into a consent order with the SEC dated January 10, 2011 through which the Company agreed to the revocation of the registration of its common shares under the United States Securities Exchange Act of 1934. As a result, broker-dealers in the United States were unable to effect transactions in the common shares of the Company. On May 31, 2011, the Company filed a registration statement on Form 40-F for the purpose of registering its common shares under the United States Securities Exchange Act of 1934. Upon the registration statement taking effect on August 1, 2011, broker dealers in the United States were able to effect transactions in common shares of the Company in the United States.

Other than as disclosed herein , no proposed director is, as at the date of this Information Circular, or has been, within the ten years preceding the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

No proposed director has, within the ten years preceding the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

No proposed director has been subject to (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

CORPORATE GOVERNANCE DISCLOSURE

The Canadian Securities Administrators have adopted National Instrument 58-101–Disclosure of Corporate Governance Practices (“NI 58-101”) which requires issuers to disclose on an annual basis their corporate governance practices in accordance with NI 58-101. Corporate governance disclosure of the Company is set out in Appendix A to this Information Circular.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

Set out below are particulars of compensation paid to the following persons (the “Named Executive Officers” or “NEOs”):

| (a) | the person who acted as the Company’s chief executive officer (“CEO”) for any part of the Company’s most recently completed financial year; |

| (b) | the person who acted as the Company’s chief financial officer (“CFO”) for any part of the Company’s most recently completed financial year; |

| (c) | each of the three most highly compensated executive officers of the Company (including any of its subsidiaries), or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the Company’s most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the Company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year. |

In respect of the Company’s financial year ended December 31, 2013, the Company had five Named Executive Officers, namely J. Scott Drever (Chairman and Chief Executive Officer), Barney Magnusson (Chief Financial Officer), N. Eric Fier (President and Chief Operating Officer), Brent McFarlane (Vice-President, Operations), and Marcio Fonseca (Vice-President, Corporate Development).

Compensation Discussion and Analysis

Executive and Employee Compensation Objectives and Philosophy

The Board of Directors recognizes that the Company’s success depends greatly on its ability to attract, retain and motivate superior performing employees, which can only occur if the Company has an appropriately structured and implemented compensation program.

The principal objectives of the Company’s executive compensation program are as follows:

| (a) | to attract and retain qualified executive officers, which includes having compensation that is competitive within the marketplace; |

| (b) | to align executives’ interests with those of the shareholders; and |

| (c) | to reward demonstration of both leadership and performance. |

The Company does not have a formal compensation program with set benchmarks. Individual compensation is not directly tied to performance goals which are based on any specific objective and identifiable measure, such as the Company’s share price or earnings per share. However, the Company does have a compensation program which seeks to reward an executive officer’s current and future expected performance. Individual performance is reviewed for all executive officers based largely on a qualitative evaluation of the Company’s achievement of corporate milestones and objectives.

Compensation Review Process

The Compensation Committee is tasked with the responsibility of, among other things, recommending to the Board compensation policies and guidelines for the Company and for implementing and overseeing compensation policies approved by the Board.

The Compensation Committee also reviews on an annual basis the cash compensation, performance and overall compensation package of each executive officer, including the Named Executive Officers. It then submits to the Board recommendations with respect to basic salary, bonus and participation in equity compensation arrangements for each executive officer. In considering executive officers other than the Chief Executive Officer, the Compensation Committee shall take into account the recommendation of the Chief Executive Officer.

The Compensation Committee considered the implications of the risks associated with the Company’s compensation policies and practices and concluded that, given the nature of the Company’s business and the role of the Compensation Committee in overseeing the Company’s executive compensation practices, the compensation policies and practices do not serve to encourage any Named Executive Officer to take inappropriate or excessive risks, and no risks were identified arising from the Company’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Company.

Elements of Executive Compensation Program

The Company’s compensation program consists of the following elements:

| (a) | base salary or consulting fees; |

| (b) | performance bonus payments; and |

| (c) | equity participation though the Company’s Stock Option Plan. |

Base Salary or Consulting Fees

In determining the annual base consulting fees, the Board of Directors, with the recommendation of the Compensation Committee (which, in turn, received advice from an independent compensation consulting firm — see “Compensation Governance”), considered the following factors:

| (a) | the particular responsibilities related to the position; |

| (b) | salaries paid by other companies in the mining industry which were similar in size as the Company, at the same stage of development as the Company and considered comparable to the Company; |

| (c) | the experience level of the Named Executive Officer; and |

| (d) | the amount of time and commitment which the Named Executive Officer devoted to the Company and is expected to devote to the Company in the future. |

The Compensation Committee annually reviews the base consulting fees payable to the Named Executive Officers based on the aforementioned criteria to ensure that compensation levels are competitive and fair.

Performance Bonus Payments

The performance bonuses are payable in cash or through equity-based compensation, and the amount payable is based on the Compensation Committee’s assessment of the Company’s performance for the year (with advice from the independent compensation consulting firm). Factors considered in determining bonus amounts include individual performance, financial criteria (such as successful financings, project management performance) and operational criteria (such as significant mineral property acquisitions, resource growth, revenue and profit growth, and the attainment of other corporate milestones).

In determining the award of performance bonuses, including the amounts thereof, the Board of Directors uses its discretion and takes into consideration the Company’s annual achievements, without assigning any quantifiable weight or factor in respect of any particular achievement or corporate milestone.

In respect of the 2013 financial year, the Board of Directors, with the recommendation of the Compensation Committee, awarded performance bonuses to the management companies of the Named Executive Officers. In awarding the performance bonuses, the Board considered the following significant achievements of the Company in 2013:

| · | Surpassed production guidance which was revised upwards during the year and produced 2.66 million silver equivalent ounces. |

| · | Total revenues reported from the Santa Elena Mine during 2013 were U.S.$54.9 million, mine operating earnings (after deducting depreciation, depletion and amortization costs) for the year were U.S.$28.9 million, and net earnings for the year were U.S.$8.5 million or U.S.$0.08 per share. |

| · | Secured Scotiabank line of credit for U.S.$40 million on favourable terms for “safety net” against a further downturn in markets, which was viewed as raising the Company’s profile in the financing arena. |

| · | Implemented Systems Application Programming (SAP) enterprise system on budget and on schedule for increased controls, reporting and cost tracking efficiencies. |

| · | Successfully added five investment analysts (for a current total of nine) who follow the Company. |

| · | Managed to generate operating cash cost per silver equivalent ounce lower than market guidance of U.S.$8.50 per ounce. |

| · | Completed Santa Elena Pre-Feasibility Study for the expansion plan, which established a project net present value of U.S.$243.7 million and internal rate of return of 88% for current compliant reserves. |

| · | Discovered three new zones at Santa Elena with potential to add two to four more years to production, with mineralization open in most directions. |

| · | Successfully negotiated amendments to the existing Santa Elena surface rights agreement, with extension to 20 years remaining. |

| · | Completed La Joya Preliminary Economic Assessment which established a project net present value of U.S.$133 million and internal rate of return of 30% for current compliant resources. |

There is no restriction on Named Executive Officers or directors regarding the purchase of financial instruments including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the Named Executive Officer or director. For the financial year ended December 31, 2013, no Named Executive Officer or director, directly or indirectly, purchased any financial instruments or employed a strategy to hedge or offset a decrease in market value of equity securities granted as compensation or held.

Equity Participation

The Company provides for equity participation in the Company through its Stock Option Plan. See “Option-based Awards”. The granting of stock options is intended to encourage the maximization of shareholder value by better aligning the interests of the executive officers with the interests of shareholders.

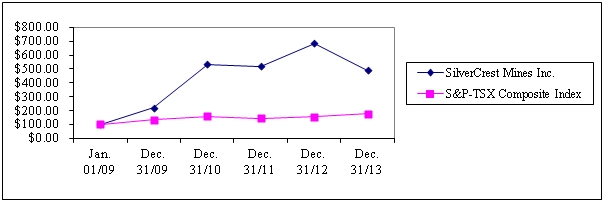

Performance Graph

The following graph compares the total cumulative shareholder return for $100 invested in Common Shares of the Company for the Company’s five most recently completed financial years commencing from January 1, 2009 to December 31, 2013 with the cumulative total return of the S&P/TSX Composite Index. Share prices are based on trading of the Common Shares on the TSX-V. The Company graduated to the TSX on February 24, 2014.

Prior to 2011, the Company was an advanced mineral exploration company with mineral properties under development. In 2011, the Company evolved into a commercial producer of precious metals, namely silver and gold. The Company’s stock performance as indicated in the graph below is largely dependent upon the success of exploration activities, continued commercial production, additional development, the market price of specific commodities, and the financial health of the mining sector in general. As such, compensation for the NEOs during the periods shown in the graph below has been determined in accordance with industry comparables and without reference to the trend of the Company’s stock performance shown in the graph.

| | | Jan. 01/09 | | | Dec. 31/09 | | | Dec. 31/10 | | | Dec. 31/11 | | | Dec. 31/12 | | | Dec. 31/13 | |

| SilverCrest Mines Inc. | | $ | 100.00 | | | $ | 218.92 | | | $ | 532.43 | | | $ | 518.92 | | | $ | 686.49 | | | $ | 489.19 | |

| S&P-TSX Composite Index | | $ | 100.00 | | | $ | 135.05 | | | $ | 158.83 | | | $ | 145.00 | | | $ | 155.42 | | | $ | 175.61 | |

Option-based Awards

Options may be granted to purchase Common Shares on terms that the Board of Directors may determine, with recommendations from the Compensation Committee and subject to the limitations of the Company’s Stock Option Plan and the requirements of applicable regulatory authorities. The Compensation Committee is mandated to review and make recommendations to the Board regarding the remuneration of executive officers, the granting of stock options to directors, executive officers, employees and consultants of the Company and the remuneration and compensation policies, including the Stock Option Plan.

Individual grants are determined by an assessment of the individual’s current and expected future performance, level of responsibilities, the importance of his or her position and contribution to the Company, and previous option grants and exercise prices.

The Company has a “rolling 10%” Stock Option Plan (the “Option Plan”) which was adopted by the Board of Directors on May 1, 2013 and approved by the shareholders of the Company on June 11, 2013.

The Option Plan includes the following provisions:

| ● | The Option Plan is administered by a “Committee” which means the Board of Directors of the Company or such committee of the Board of Directors that the Board of Directors has designated to administer the Option Plan. |

| ● | The number of Common Shares to be reserved and authorized for issuance pursuant to options granted under the Option Plan is 10% of the issued and outstanding Common Shares from time to time. |

| ● | The exercise price for options granted under the Option Plan will not be less than the “Market Price” of the Common Shares (which, under the Option Plan, is the last closing price of the Common Shares on TSX before the date of option grant) or such other minimum exercise price as may be required or permitted by the TSX. |

| ● | Options may be exercisable for a term of up to ten years, subject to earlier termination in the event of death or the optionee’s cessation of services to the Company. |

| ● | The vesting for each option shall be determined by the Committee at the time that the option is granted and shall be specified in the option agreement or certificate in respect of the option. |

| ● | Options granted to any optionee who is a director, officer, employee or consultant shall expire the earlier of: (a) that date which is 90 days (30 days for optionees engaged in investor relations activities) after the optionee ceases to be in at least one of such categories unless an earlier date is provided for in the optionee’s option agreement or certificate; and (b) the expiry of the option period. The Company may extend the period specified in the aforementioned clause (a) in respect of any option for a specified period up to the expiry of the option period, subject to any applicable regulatory approvals. |

| ● | Options are non-transferable and non-assignable, except by will and by the laws of descent and distribution. During the lifetime of an optionee, the option may be exercised only by the optionee. |

| ● | In the event of the death of an optionee while in service to the Company or a related entity of the Company, each outstanding option held by the optionee (to the extent then vested and not exercised) shall be exercisable until the earlier of (a) the expiration of one year following such death unless an earlier date is provided for in the option agreement or certificate with respect to the option, and (b) the expiry of the option period, but only by the persons to whom the optionee’s rights under the option shall pass by the optionee’s will or by the laws of descent and distribution. |

| ● | If the expiry date of any option would otherwise occur during or within 10 business days following the end of a period in which the trading of the Common Shares is restricted by the policies of the Company (a “Blackout Period”), then the expiry date of such option shall be extended to the date which is the 10th business day following the expiration of the Blackout Period. |

| ● | The Committee may, in its discretion but subject to any necessary regulatory approvals, provide for the extension of the exercisability of a stock option, accelerate the vesting or exercisability of any option, eliminate or make less restrictive any restrictions contained in an option, waive any restriction or other provision of the Option Plan or an option or otherwise amend or modify an option in any manner that is either (a) not adverse to the optionee or (b) consented to by such optionee. |

| ● | If there is a takeover bid or tender offer made for all or any of the issued and outstanding Common Shares (a “Bid”), then the Committee may, by resolution, permit all outstanding options to become immediately exercisable in order to permit the Common Shares issuable under such options to be tendered to such Bid. If the Bid is not completed within the time specified therein or all of the Common Shares tendered by the Optionee pursuant to the Bid are not taken up or paid for by the offeror in respect thereof, the Common Shares received pursuant to such exercise, including any Common Shares that are not taken up and paid for pursuant to the Bid, may be returned by the Optionee to the Company, and the Option shall be reinstated as if it had not been exercised. |

| ● | In lieu of exercising an option, the Committee may permit an optionee to elect to receive, without payment by the optionee of any additional consideration, Common Shares equal to the value of the option (or the portion thereof being exercised) by surrender of the option to the Company, together with written notice reflecting such “cashless” exercise. In such event, the optionee shall receive that number of Common Shares, disregarding fractions, which, when multiplied by the market price on the date of the cashless exercise, have a total value equal to the product of that number of Common Shares subject to the option times the difference between the market price on the date of the cashless exercise and the option exercise price. For the purpose of cashless exercises of options, the market price of one Common Share as of a particular cashless exercise date is the volume weighted average trading price of one Common Share on the TSX, or another stock exchange where the majority of the trading volume and value of the Common Shares occurs, for the five trading days immediately preceding such date. |

| ● | The Board may in its absolute discretion amend the Option Plan without shareholder approval at any time, provided that no such amendment will adversely affect any outstanding options granted thereunder without the optionee’s consent. Without limiting the generality of the foregoing, the Board may make the following types of amendments to the Option Plan without shareholder approval: |

| | (a) | any amendment pertaining to the vesting provisions of each option; |

| | | |

| | (b) | any amendment to the terms of the Option Plan relating to the effect of termination, cessation of employment, disability or death of an Optionee on the right to exercise options; |

| | | |

| | (c) | any amendment as may be necessary or desirable to bring the Option Plan into compliance with securities, corporate or tax laws and the rules and policies of any stock exchange upon which the Common Shares are from time to time listed; |

| | | |

| | (d) | any amendment of a “housekeeping” nature including, but not limited to, amendments of a clerical, grammatical or typographical nature; |

| | | |

| | (e) | any amendment with respect to the administration of the Option Plan; |

| | | |

| | (f) | any amendment to correct any defect, supply any information or reconcile any inconsistency in the Option Plan in such manner and to such extent as shall be deemed necessary or advisable to carry out the purposes of the Option Plan; |

| | | |

| | (g) | any amendment to the termination provisions of the Option Plan or any option, other than an amendment extending the expiry date of such option beyond its original expiry date; |

| | | |

| | (h) | any amendment to the class of eligible persons that may participate under the Option Plan; and |

| | | |

| | (i) | any other amendments, whether fundamental or otherwise, not requiring shareholder approval under applicable law or the rules, regulations and policies of any stock exchange on which the Company’s shares are listed and of all securities commissions or similar securities regulatory authorities having jurisdiction over the Company. |

Any amendment to the Option Plan is also subject to any necessary approvals of any stock exchange or regulatory body having jurisdiction over the securities of the Company and, where required for such approvals, the approval of the shareholders of the Company.

The Company does not provide any financial assistance to optionees in order to facilitate the purchase of Common Shares issuable pursuant to the exercise of options granted under the Option Plan.

The policies of the TSX require that the unallocated securities under all security based compensation arrangements which do not have a fixed maximum aggregate number of securities issuable thereunder (such as the Option Plan) be re-approved by an issuer’s shareholders every three years after the date of initial shareholder approval of the compensation arrangement.

As at the date hereof, the total number of Common Shares issuable under outstanding options granted under the Stock Option Plan is 8,130,000, representing 6.8% of the issued and outstanding Common Shares of the Company.

Compensation Governance

The Company has established a Compensation Committee that is currently comprised of three members (Ross O. Glanville, George W. Sanders and Graham C. Thody), all of whom are independent. Messrs. Glanville, Sanders and Thody have human resource and compensation experience relevant to providing oversight and advice on the Company’s executive compensation practices. Mr. Glanville presently serves as a member of the compensation committee of Clifton Star Resources Ltd., a TSX Venture Exchange (“TSX-V”) listed mineral exploration company, and has previously served on the compensation committees of two other publicly-traded companies. Messrs. Sanders and Thody have previously served on compensation committees of other public companies.

The Compensation Committee members have the necessary experience to enable them to make decisions on the suitability of the Company’s compensation policies or practices. The Compensation Committee’s responsibilities, powers and operation are described in Appendix A - “Corporate Governance Disclosure”.

In January 2013, the Compensation Committee engaged Roger Gurr & Associates (“Gurr & Associates”) to review the compensation of executive officers and directors of the Company, and to provide recommendations as to appropriate ranges of compensation for such individuals. To the Company’s knowledge, Gurr & Associates did not provide any services other than the aforementioned engagement to the Company, its affiliates, or any of their directors and officers prior to and during 2013.

Prior to January 2013, the Company has never retained any consultant or advisor to assist the Board of Directors or the Compensation Committee in determining compensation for any of the Company’s directors and executive officers. Accordingly, during the financial years ended December 31, 2013 and December 31, 2012, the aggregate fees billed by each consultant or advisor, or any of its affiliates, for services related to determining compensation for any of the Company’s directors and executive officers and for other services is set out as follows:

| | Executive Compensation – Related Fees | All Other Fees |

| Roger Gurr & Associates | | |

Year ended December 31, 2013 | $24,000 | Nil |

Year ended December 31, 2012 | Nil | Nil |

Summary Compensation Table

The following table is a summary of compensation paid to the Named Executive Officers in respect of the Company’s financial years ended December 31, 2013, 2012 and 2011.

Name and Principal Position | Year | ($) | Share-based awards ($) | ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total compensation ($) |

Annual incentive plans(3) | Long-term incentive plans |

J. Scott Drever Chairman and Chief Executive Officer | 2013 2012 2011 | 325,000 275,000 225,000 | Nil Nil Nil | 282,666 397,218 252,692 | 200,000 200,000 112,500 | Nil Nil Nil | Nil Nil Nil | | 807,666 872,218 590,192 |

Barney Magnusson Chief Financial Officer | 2013 2012 2011 | 285,000 240,000 225,000 | Nil Nil Nil | 282,666 397,218 252,692 | 175,000 175,000 112,500 | Nil Nil Nil | Nil Nil Nil | | 742,666 812,218 590,192 |

N. Eric Fier President and Chief Operating Officer | 2013 2012 2011 | 325,000 275,000 225,000 | Nil Nil Nil | 282,666 397,218 252,692 | 220,000 200,000 212,500 | Nil Nil Nil | Nil Nil Nil | | 827,666 872,218 690,192 |

Brent McFarlane Vice-President, Operations | 2013 2012 2011 | | Nil Nil Nil | 161,523 158,887 267,770 | | Nil Nil Nil | Nil Nil Nil | | 593,160 528,887 526,196 |

Vice-President, Corporate Development | 2013 | 238,333 | Nil | 161,523 | 150,000 | Nil | Nil | | 549,857 |

______________________________

| (1) | Amounts under this column were paid as a consulting fee to the management company controlled by each Named Executive Officer, respectively. See below for further details. Such amount represents all of the consulting fees paid to the management company which can be attributed to the applicable Named Executive Officer’s services as an executive officer of the Company. Amounts are prior to applicable taxes. |

| (2) | The grant date fair value of each option granted is estimated on the date of grant using the Black-Scholes option pricing model, with the following assumptions: risk free interest rate of 1.65% (2013), 1.21% (2012) and 1.74% (2011); expected share price volatility of 56.01% (2013), 70.89% (2012) and 68% (2011); expected option life of 4.57 years (2013), 4.34 years (2012) and 4.37 years (2011); expected forfeiture rate of 1.3% (2013), 1.33% (2012) and 0.55% (2011); and expected dividend rate of nil. This methodology was chosen to be consistent with the fair value as determined in accordance with international accounting standards. |

| (3) | Amounts under this column were paid as a performance bonus to the management company controlled by each Named Executive Officer, respectively. Amounts are prior to applicable taxes. |

| (4) | The aggregate amount of perquisites and other personal benefits, securities or property paid to each Named Executive Officer or to his respective management company did not exceed the lesser of $50,000 and 10% of each Named Executive Officer’s total consulting fee for the financial year. |

| (5) | Amount was paid and earned in United States dollars and converted into Canadian dollars for the purposes hereof at the exchange rate of U.S.$1.00=$1.0318 (2013), U.S.$1.00=$1.00 (2012) and U.S.$1.00=$0.99 (2011). |

| (6) | Mr. Fonseca joined the Company as Vice-President, Corporate Development on January 31, 2013. |

Effective September 15, 2011, the Company entered into a management consulting agreement with each of Nemesis Enterprises Ltd. (“Nemesis”), a company wholly-owned by J. Scott Drever, Adapa Management Ltd. (“Adapa”), a company wholly-owned by Barney Magnusson, and Maverick Consultants Inc. (“Maverick”), a company wholly-owned by N. Eric Fier, whereby the Company retained each of Nemesis, Adapa and Maverick to provide executive, managerial and consulting services to the Company and, in particular, to provide the respective services of Messrs. Drever, Magnusson and Fier as executive officers of the Company in their appointed positions. In consideration for the services of Nemesis, Adapa and Maverick, the Company agreed to pay each party consulting fees at the base rate of $225,000 per year plus applicable taxes, payable in equal monthly instalments, commencing as of September 15, 2011, and subject to increases as the Board in its discretion may determine from time to time. These management consulting agreements superseded and replaced the previous management consulting agreements in effect prior to September 15, 2011, which provided for compensation at the same annual base rates. The Compensation Committee approved an increase effective as of January 1, 2012 to the annual base rate payable to each of Nemesis and Maverick to $275,000 and to Adapa to $240,000. The Compensation Committee approved an increase effective as of January 1, 2013 to the annual base rate payable to each of Nemesis and Maverick to $325,000 and to Adapa to $285,000.

The Company also entered into a management consulting agreement made effective January 25, 2011 with Huichoro US LLC (“Huichoro”), a company wholly-owned by Brent McFarlane and his spouse, whereby the Company retained Huichoro to provide the services of Mr. McFarlane to serve as Vice-President, Operations of the Company. In consideration for the services of Huichoro, the Company agreed to pay Huichoro consulting fees at the base rate of U.S.$175,000 per year payable in equal monthly instalments, commencing as of February 15, 2011, subject to increases as the Board in its discretion may determine from time to time. The Compensation Committee approved increases to the annual base rate payable to Huichoro to U.S.$195,000 effective as of January 1, 2012, to U.S.$230,000 effective as of January 1, 2013, and to U.S.$250,000 effective as of May 1, 2013.

The increases to the annual base rates payable to Nemesis, Maverick, Adapa and Huichoro were made after taking into consideration the growth of the Company during the mentioned periods and upon reviewing levels of compensation payable to executive officers in other companies of similar size and operations to that of the Company.

In addition, the Company entered in a management consulting agreement made effective January 30, 2013 with Margeo Consulting Inc. (“Margeo”), a company wholly-owned by Marcio Fonseca, whereby the Company retained Margeo to provide the services of Mr. Fonseca to serve as Vice-President, Corporate Development of the Company commencing effective March 1, 2013. In consideration for the services of Margeo, the Company agreed to pay Margeo consulting fees at the base rate of $260,000 per year payable in equal monthly instalments, and subject to increases as the President of the Company or the Board in their respective discretion may determine from time to time.

Each of the management consulting agreements of Nemesis, Maverick, Adapa and Margeo was for a term of one year (with automatic renewals of consecutive one-year terms), and the management consulting agreement of Huichoro was for an initial term of two years with renewal upon mutual agreement. Each of the management consulting agreements entitles the consultant to terminate its respective agreement by giving three months’ written notice to the Company, and the Company to terminate each management consulting agreement with immediate effect upon notice to the consultant, provided that, if such termination was for any reason other than material breach of the consultant’s obligations thereunder, the Company shall pay to the consultant a termination payment equal to 1.5 times of both the then applicable base rate per annum payable to the consultant and any bonus paid or payable to the consultant by the Company in respect of the Company’s most recently completed financial year (or, in the case of Mr. Fonseca, one times both the then applicable base rate per annum payable to the consultant and any bonus paid or payable to the consultant by the Company in respect of the Company’s most recently completed financial year).

Incentive Plan Awards

Outstanding share-based awards and option-based awards

The following table sets forth all option-based awards and share-based awards outstanding at the end of the financial year ended December 31, 2013 with respect to the Named Executive Officers.

| Name | Option-based Awards | Share-based Awards |

Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

| J. Scott Drever | | 0.50 | Jul. 22, 2014 | 262,000 | N/A | N/A | N/A |

| 1.05 | Sep. 10, 2015 | 133,000 |

| 1.65 | Aug. 2, 2016 | 40,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec 13, 2018 | 45,500 |

| Barney Magnusson | | 0.50 | Jul. 22, 2014 | 262,000 | N/A | N/A | N/A |

| 1.05 | Sep. 10, 2015 | 133,000 |

| 1.65 | Aug. 2, 2016 | 40,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec 13, 2018 | 45,500 |

| N. Eric Fier | | 0.50 | Jul. 22, 2014 | 262,000 | N/A | N/A | N/A |

| 1.05 | Sept. 10, 2015 | 133,000 |

| 1.65 | Aug. 2, 2016 | 40,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec. 13, 2018 | 45,500 |

| Brent McFarlane | | 1.94 | Feb. 15, 2016 | Nil | N/A | N/A | N/A |

| 1.65 | Aug. 2, 2016 | 16,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec. 13, 2018 | 26,000 |

| Marcio Fonseca | | 2.60 | Jan. 31, 2018 | Nil | N/A | N/A | N/A |

| 1.68 | Dec. 13, 2018 | 26,000 |

____________________________________

| (1) | Represents the difference between the market value of the Common Shares underlying the options on December 31, 2013 (based on $1.81 closing price of the Common Shares on the TSX-V on that date). |

| (2) | As at December 31, 2013, these stock options were fully vested. |

| (3) | As at December 31, 2013, 75% of these stock options had vested and the final 25% vest on June 5, 2014. |

| (4) | As at December 31, 2013, 25% of these stock options had vested and an additional 25% vest on each of June 13, 2014, December 13, 2014 and June 13, 2015. |

| (5) | As at December 31, 2013, 50% of these stock options had vested and an additional 25% vest on each of January 31, 2014 and July 31 , 2014. |

Incentive plan awards – value vested or earned during the year

The following table sets forth the value of option-based awards and share-based awards which vested during the financial year ended December 31, 2013, and the value of non-equity incentive plan compensation (i.e. performance bonuses) earned during the financial year ended December 31, 2013, with respect to the Named Executive Officers.

| Named Executive Officer | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

| J. Scott Drever | 58,750 | N/A | 200,000 |

| Barney Magnusson | 58,750 | N/A | 175,000 |

| N. Eric Fier | 58,750 | N/A | 220,000 |

| Brent McFarlane | 23,500 | N/A | |

| Marcio Fonseca | Nil | N/A | 150,000 |

___________________________

| (1) | Amount was paid and earned in US dollars, and translated into Canadian dollars for the purposes hereof at the rate of US$1.00 = $1.0318. |

Pension Plan Benefits

The Company does not have a pension plan or deferred compensation plan.

Termination and Change of Control Benefits

Other than as described below, the Company does not have any contracts, agreements, plans or arrangements that provide for payments to or for the benefit of a Named Executive Officer at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change of control of the Company or a change in a Named Executive Officer’s responsibilities.

The Company has entered into a management consulting agreement (collectively, the “Management Agreements”) with each of Nemesis, Adapa, Maverick, Huichoro and Margeo (each, a “Consultant”) pursuant to which J. Scott Drever, Barney Magnusson, N. Eric Fier, Brent McFarlane and Marcio Fonseca provide their respective services as executive officers of the Company. For further details on the Management Agreements, see “Summary Compensation Table” and below.

The table below summarizes the estimated incremental payments related to termination scenarios under the Management Agreements assuming the events occurred on December 31, 2013. If a change of control of the Company had occurred on December 31, 2013, the total cost to the Company of related payments to the Consultants is estimated at $4,713,697. United States dollar denominated amounts have been translated using an exchange rate of U.S.$1.00=$1.0318.

| Consultant (NEO) | Termination without Cause | Change of Control |

| Nemesis (J. Scott Drever) | $787,500 | |

| Adapa (Barney Magnusson) | $690,000 | |

| Maverick (N. Eric Fier) | $817,500 | |

| Huichoro (Brent McFarlane) | U.S.$627,500 | |

| Margeo (Marcio Fonseca) | $410,000 | |

_____________________________

| (1) | Payable in the event of termination within six months of a change of control or resignation within three months of a change of control. |

| (2) | Payable in the event of termination within six months of a change of control. |

Each Management Agreement provides that the Company may terminate the agreement with immediate effect upon delivery of written notice to the Consultant and payment to the Consultant of an amount equal to 1.5 times (one times for Margeo) of both the then applicable base rate per annum payable to the Consultant and any bonus paid or payable to the Consultant in respect of the Company’s most recent financial year.

Each Management Agreement (other than Huichoro’s Management Agreement) also provides that if there is a change of control of the Company (as defined below) and either (a) within six months after such event, the Company delivers written notice to the Consultant terminating its respective Management Agreement; or (b) within three months after such event, the Consultant delivers written notice to the Company terminating its Management Agreement prior to accepting renewed terms of engagement following a change of control, the Company shall, upon the effective date of termination, pay to the Consultant an amount equal to two times of both the then applicable base rate per annum payable to the Consultant and any bonus paid or payable to the Consultant in respect of the Company’s most recent financial year.

In respect of Huichoro’s Management Agreement, if there is a change of control of the Company and, within six months after such event, the Company delivers written notice to Huichoro terminating its Management Agreement, the Company shall, upon the effective date of termination, pay to Huichoro an amount equal to two times the then applicable base rate plus any bonus paid or payable to Huichoro in respect of the most recently completed financial year of the Company.

For the purposes of the Management Agreements, “change of control” means an occurrence (a) where less than 51% of the Board of Directors of the Company are composed of continuing directors; or (b) where any person or persons acting jointly or in concert acquires more than 50% of the total voting rights attached to all classes of shares then outstanding in the Company having under all circumstances the right to vote on any resolution concerning the election of directors (a “Takeover”). For the purposes of the Management Agreements, a “continuing director” is a member of the Board of Directors of the Company on the day preceding the date of a Takeover, or a person who becomes a member of the Board of Directors of the Company subsequent to the date of the particular Management Agreement by the approval of at least a majority of the members of the Board of Directors who were members of the Board of Directors on the day preceding the date of a Takeover.

The Management Agreements also require each Consultant and Named Executive Officer to enter into a separate confidentiality and non-competition agreement with the Company. In particular, each Consultant and Named Executive Officer has agreed that, commencing from the term of the Management Agreement and for a period of two years following termination thereof, such person shall not, either individually or with any other person, whether as principal, agent, shareholder, officer, advisor, manager, employee or otherwise, except with the Company’s written consent:

| (a) | acquire, lease or otherwise obtain or control any beneficial, direct or indirect interest in mineral rights or other rights or lands in any mineral property in which the Company holds or is negotiating to acquire an interest or within a distance of five kilometres from any point on the outer perimeter of any such property, |

| (b) | conduct any exploration or production activities or otherwise work on or in respect of any mineral property within a distance of five kilometres from any point on the outer perimeter of such property, |

| (c) | solicit, divert or hire away, or attempt to solicit, divert, or hire away, any independent contractor or any person employed by any member of the Company and its affiliates or persuade or attempt to persuade any such individual to terminate his or her contract or employment with any member of the Company and its affiliates, or |

| (d) | impair or seek to impair the reputation of any member of the Company and its affiliates, or impair or seek to impair any relationships that any member of the Company and its affiliates has with its employees, customers, suppliers, agents or other parties with which any member of the Company and its affiliates does business or has contractual relations. |

If, despite the prohibition set forth in the preceding paragraphs, a Consultant or Named Executive Officer acquires, leases or otherwise obtains or controls any interest, directly or indirectly, in breach of any of the preceding paragraphs, such person shall notify the Company of such acquisition within the 30 days immediately following the date of such acquisition and the Consultant or Named Executive Officer shall agree, upon demand by the Company, to convey or cause to be conveyed such interest to the Company as soon as practicable thereafter.

Director Compensation

Director Compensation Table

| Name | Fees earned ($) | Share-based awards ($) | Option-based awards(1) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compen- sation ($) | Total ($) |

| Ross O. Glanville | 49,000 | N/A | 161,523 | Nil | N/A | Nil | 210,523 |

| George W. Sanders | 49,000 | N/A | 161,523 | Nil | N/A | Nil | 210,523 |

| Graham C. Thody | 55,000 | N/A | 161,523 | Nil | N/A | Nil | 216,523 |

___________________________

| (1) | The grant date fair value of each option granted is estimated on the date of grant using the Black-Scholes option pricing model, with the following assumptions: risk free interest rate of 1.65%; expected share price volatility of 56.01%; expected option life of 4.57 years; expected forfeiture rate of 1.3%; and expected dividend rate of nil. This methodology was chosen to be consistent with the fair value as determined in accordance with international accounting standards. |

The Company has implemented a standard compensation arrangement pursuant to which each non-executive director is paid fees for acting as a director (including as a member of a Board committee). Effective as of January 1, 2013, each non-executive director earns an annual retainer of $30,000 and $1,000 for each meeting attended. The Chair of the Audit Committee also earns an annual fee of $12,000 and each of the Chairs of the Compensation Committee and the Corporate Governance and Nominating Committee earns an annual fee of $6,000.

Outstanding share-based awards and option-based awards

The following table sets forth all option-based awards and share-based awards outstanding at the end of the financial year ended December 31, 2013 with respect to the directors who are not Named Executive Officers.

| Name | Option-based Awards | Share-based Awards |

Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options(1) ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) | Market or payout value of vested share-based awards not paid out or distributed ($) |

| Ross O. Glanville | | 1.17 | Jun. 17, 2016 | 128,000 | N/A | N/A | N/A |

| 1.65 | Aug. 2, 2016 | 16,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec. 13, 2018 | 26,000 |

| George W. Sanders | | 1.05 | Sept. 10, 2015 | 114,000 | N/A | N/A | N/A |

| 1.65 | Aug. 2, 2016 | 16,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec. 13, 2018 | 26,000 |

| Graham C. Thody | | 0.45 | Jan. 8, 2014 | 136,000 | N/A | N/A | N/A |

| 0.50 | Jul. 22, 2014 | 98,250 |

| 1.05 | Sep. 10, 2015 | 114,000 |

| 1.65 | Aug. 2, 2016 | 16,000 |

| 2.60 | Dec. 5, 2017 | Nil |

| 1.68 | Dec. 13, 2018 | 26,000 |

________________________________

| (1) | Represents the difference between the market value of the Common Shares underlying the options on December 31, 2013 (based on $1.81 closing price of the Common Shares on the TSX-V on that date). |

| (2) | As at December 31, 2013, these stock options were fully vested. |

| (3) | As at December 31, 2013, 75% of these stock options had vested and the final 25% vest on June 5, 2014. |

| (4) | As at December 31, 2013, 25% of these stock options had vested and an additional 25% vest on each of June 13, 2014, December 13, 2014 and June 13, 2015. |

Incentive plan awards – value vested or earned during the year

The following table sets forth the value of option-based awards and share-based awards which vested during the financial year ended December 31, 2013, and the value of non-equity incentive plan compensation earned during the financial year ended December 31, 2013, with respect to the directors who are not Named Executive Officers.

| Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

| Ross O. Glanville | 23,500 | N/A | Nil |

| George W. Sanders | 23,500 | N/A | Nil |

| Graham C. Thody | 23,500 | N/A | Nil |

SECURITIES AUTHORIZED FOR ISSUANCE

UNDER EQUITY COMPENSATION PLANS

The following table sets out information on the Company’s equity compensation plans under which Common Shares are authorized for issuance as at December 31, 2013.

EQUITY COMPENSATION PLAN INFORMATION

| Plan Category | Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

Equity compensation plans approved by securityholders(1) | 8,985,000 | $1.69 | 1,906,820(2) |

| Equity compensation plans not approved by securityholders | N/A | N/A | N/A |

| Total | 8,985,000 | | 1,906,820 |

| | ___________________________ |

| (2) | Based on a total of 10,891,820 Common Shares that may be reserved and authorized for issuance pursuant to options granted under the Option Plan, representing 10% of the issued and outstanding Common Shares as at December 31, 2013. |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As at the date hereof, no director or executive officer of the Company, no proposed nominee for election as a director of the Company, no associate of any such director, executive officer or proposed nominee (including companies controlled by them), no employee of the Company or any of its subsidiaries, and no former executive officer, director or employee of the Company or any of its subsidiaries, is indebted to the Company or any of its subsidiaries (other than for “routine indebtedness” as defined under applicable securities legislation) or is indebted to another entity where such indebtedness is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or any of its subsidiaries.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No informed person (i.e. insider) of the Company, no proposed director of the Company, and no associate or affiliate of any informed person or proposed director has had any material interest, direct or indirect, in any transaction since January 1, 2013 or in any proposed transaction which has materially affected or would materially affect the Company.

MANAGEMENT CONTRACTS

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

Reconfirmation of Shareholder Rights Plan

The Company’s current shareholder rights plan (the “Rights Plan”) was made effective on May 21, 2008 and was originally approved by the shareholders of the Company on June 26, 2008 and was reconfirmed by the shareholders of the Company on June 15, 2011. In accordance with its terms, the Rights Plan will expire at the termination of the Meeting unless the shareholders of the Company reconfirm the Rights Plan. The Rights Plan will continue in effect so long as it is reconfirmed by the shareholders of the Company at every third annual general meeting thereafter. Accordingly, shareholders of the Company are being asked to reconfirm the Rights Plan at the Meeting.

A summary of the Rights Plan is contained in the Company’s information circular dated May 27, 2008, copies of which were previously distributed to shareholders for the Company’s 2008 annual meeting. A complete copy of the Rights Plan was also filed on SEDAR on May 22, 2008 and is accessible at www.sedar.com or may be obtained by sending a written request to the Chief Executive Officer of the Company at the Company’s head office located at Suite 501, 570 Granville Street, Vancouver, British Columbia V6C 3P1.

The text of the proposed resolution to reconfirm the Rights Plan is as follows:

“BE IT RESOLVED AS AN ORDINARY RESOLUTION THAT:

| | 1. | The Company’s shareholder rights plan made effective as of May 21, 2008 and originally approved by the shareholders of the Company on June 26, 2008 is hereby approved, ratified and reconfirmed, and that the Board of Directors of the Company be authorized to make any changes thereto as may be required by the Toronto Stock Exchange; and |

| | 2. | Any officer or director of the Company is authorized and directed to execute and deliver all such documents and instruments and to do all such acts as in the opinion of such officer or director may be necessary or desirable to give effect to this resolution.” |

A simple majority of the votes cast at the Meeting (in person or by proxy) is required in order to pass the above resolution.

OTHER MATTERS

Management of the Company is not aware of any other matters to come before the Meeting other than as set forth in the Notice of the Meeting. If any other matter properly comes before the Meeting, it is the intention of the persons named in the enclosed Proxy form to vote the shares represented thereby in accordance with their best judgment on such matter.

ADDITIONAL INFORMATION

Additional information relating to the Company is available on SEDAR at www.sedar.com.

Financial Information

Financial information relating to the Company is provided in the Company’s comparative financial statements and management’s discussion and analysis for its financial year ended December 31, 2013, which are available on SEDAR and may also be obtained by sending a written request to the Chief Executive Officer of the Company at the Company’s head office located at Suite 501, 570 Granville Street, Vancouver, British Columbia V6C 3P1.

Audit Committee Disclosure

Pursuant to the Canadian Securities Administrators’ National Instrument 52-110—Audit Committees, disclosure relating to the Company’s Audit Committee and Audit Committee Charter is contained in Item 10 and Appendix A, respectively, of the Company’s Annual Information Form dated March 28, 2014 for the financial year ended December 31, 2013 filed on SEDAR on March 31, 2014.

DATED as of the 30th day of April, 2014.

BY ORDER OF THE BOARD

“J. Scott Drever”

J. SCOTT DREVER

Chairman and CEO

APPENDIX A

SILVERCREST MINES INC.

(the “Company”)

CORPORATE GOVERNANCE DISCLOSURE

| | Disclosure Requirements | | Comments |

| | Board of Directors | | |

| | Disclose the identity of directors who are independent | | Ross O. Glanville George W. Sanders Graham C. Thody Dunham L. Craig (director nominee) |

| | Disclose the identity of directors who are not independent, and describe the basis for that determination | | J. Scott Drever - Executive officer of the Company N. Eric Fier - Executive officer of the Company Barney Magnusson - Executive officer of the Company |

| | Disclose whether or not a majority of the directors are independent. If the majority of directors are not independent, describe what the board of directors does to facilitate its exercise of independent judgement in carrying out its responsibilities. | | The Board is currently composed of six directors, three of whom are independent. The Board facilitates its exercise of independent judgement in carrying out its responsibilities by having its standing Board committees being wholly comprised of independent directors. If management’s director nominees are all elected at the Meeting, the Board will be composed of seven directors, the majority of whom will be independent. |

| | If a director is presently a director of another issuer that is a reporting issuer (or the equivalent) in a jurisdiction or a foreign jurisdiction, identify both the director and the other issuer | | J. Scott Drever – Goldsource Mines Inc. Ross O. Glanville – Clifton Star Resources Ltd.

Archon Minerals Limited Baja Mining Corporation Graham C. Thody – Geologix Explorations Inc. Goldsource Mines Inc. UEX Corporation George W. Sanders – Bitterroot Resources Ltd. Goldcliff Resource Corporation Dunham L. Craig – Geologix Explorations Inc. (director nominee) |

| | Disclosure Requirements | | Comments |

| | Disclose whether or not the independent directors hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. If the independent directors hold such meetings, disclose the number of meetings held since the beginning of the issuer’s most recently completed financial year. If the independent directors do not hold such meetings, describe what the board does to facilitate open and candid discussion among its independent directors | | The independent directors meet at least twice a year and as many times as may be necessary without any non-independent director or member of management in attendance. Since January 1, 2013, there have been 2 meetings of the independent directors. |

| | Disclose whether or not the chair of the board is an independent director. If the board has a chair or lead director who is an independent director, disclose the identity of the independent chair or lead director, and describe his or her role and responsibilities. If the board has neither a chair that is independent nor a lead director that is independent, describe what the board does to provide leadership for its independent directors | | J. Scott Drever is the Chairman of the Board and is not an independent director.

In view of the Chairman not being independent, Graham C. Thody acts as the lead director. The role and responsibilities of the lead director include ensuring that specific responsibilities and functions that are the responsibility and function of outside directors are effectively carried out and the results reported to the Board as appropriate, and monitoring, facilitating and promoting the efficient organization and conduct of the Board function and the independence of the Board in the discharge of its responsibilities.