Investor Presentation Fourth Quarter and Year End 2022

Safe Harbor Statement and Disclaimer Forward-Looking Statements In this presentation, “we,” “our,” “us,” “Five Star" or “the Company” refers to Five Star Bancorp, a California corporation, and our consolidated subsidiaries, including Five Star Bank, a California state- chartered bank, unless the context indicates that we refer only to the parent company, Five Star Bancorp. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on the Company’s expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties, which change over time, and other factors which could cause actual results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. If one or more of the factors affecting the Company’s forward-looking information and statements proves incorrect, then the Company’s actual results, performance or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this press release. Therefore, the Company cautions you not to place undue reliance on the Company’s forward-looking information and statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 under the section entitled “Risk Factors,” and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company disclaims any duty to revise or update the forward-looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward-looking statements, except as specifically required by law. Industry Information This presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade, and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys, and studies) is accurate and reliable, we have not independently verified such information. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Finally, forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. Unaudited Financial Data Numbers contained in this presentation for the quarter ended December 31, 2022 and for other quarterly periods are unaudited. Additionally, numbers contained in this presentation for the full fiscal year ended December 31, 2022 are unaudited. As a result, subsequent information may cause a change in certain accounting estimates and other financial information, including the Company’s allowance for loan losses, fair values, and income taxes. Non-GAAP Financial Measures The Company uses financial information in its analysis of the Company’s performance that is not in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company’s financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. See the appendix to this presentation for a reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures. Fourth Quarter 2022 Investor Presentation | 2

Agenda Fourth Quarter 2022 Investor Presentation | 3 •Company Overview •Financial Highlights •Loans and Credit Quality •Deposit and Capital Overview •Financial Results

Company Overview Fourth Quarter 2022 Investor Presentation | 4

Company Overview Nasdaq: Headquarters: Asset Size: Loans Held for Investment: Deposits: Bank Branches: Fourth Quarter 2022 Investor Presentation | 5 FSBC Rancho Cordova, California $3.2 billion $2.8 billion $2.8 billion 7 Note: Balances are as of December 31, 2022. Five Star is a community business bank that was founded to serve the commercial real estate industry. Today, the markets we serve have expanded to meet customer demand and now include manufactured housing and storage, faith-based, government, nonprofits, and more.

Executive Team Fourth Quarter 2022 Investor Presentation | 6 James Beckwith President and Chief Executive Officer Five Star since 2003 John Dalton Senior Vice President and Chief Credit Officer Five Star since 2011 Mike Lee Senior Vice President and Chief Regulatory Officer Five Star since 2005 Michael Rizzo Senior Vice President and Chief Banking Officer Five Star since 2005 Brett Wait Senior Vice President and Chief Information Officer Five Star since 2011 Lydia Ramirez Senior Vice President and Chief Operations and Chief DE&I Officer Five Star since 2017 Heather Luck Senior Vice President and Chief Financial Officer Five Star since 2018 Shelley Wetton Senior Vice President and Chief Marketing Officer Five Star since 2015

Financial Highlights Fourth Quarter 2022 Investor Presentation | 7

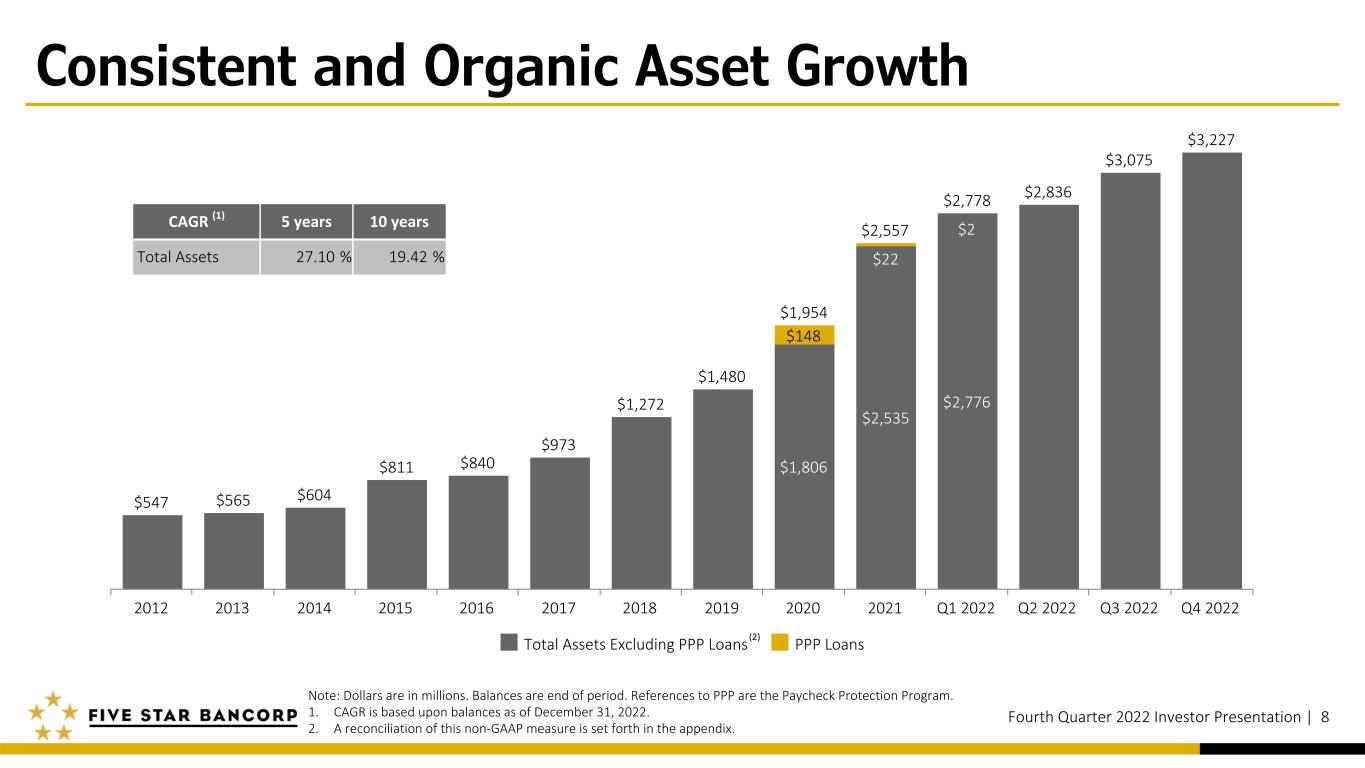

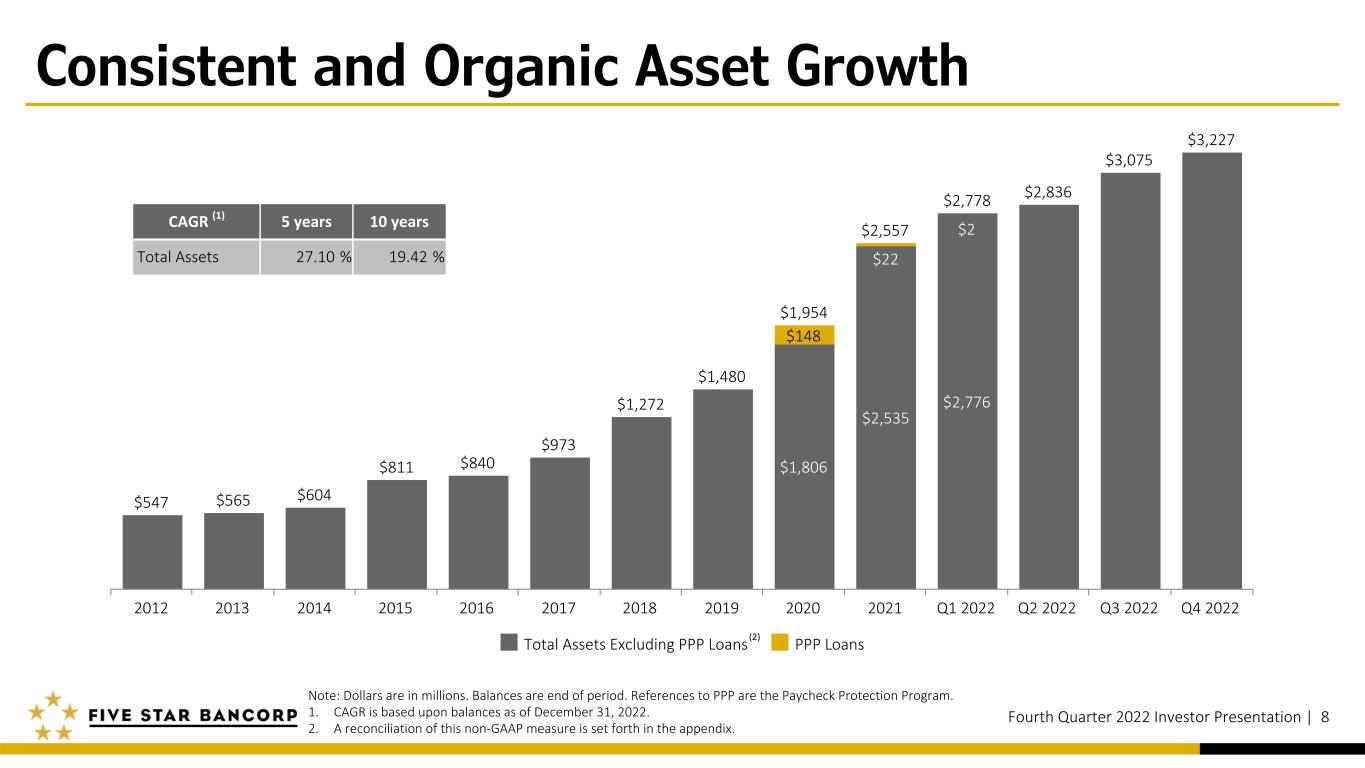

$547 $565 $604 $811 $840 $973 $1,272 $1,480 $1,954 $2,557 $2,778 $2,836 $3,075 $3,227 $1,806 $2,535 $2,776 $148 $22 $2 Total Assets Excluding PPP Loans PPP Loans 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Consistent and Organic Asset Growth Fourth Quarter 2022 Investor Presentation | 8 Note: Dollars are in millions. Balances are end of period. References to PPP are the Paycheck Protection Program. 1. CAGR is based upon balances as of December 31, 2022. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) CAGR (1) 5 years 10 years Total Assets 27.10 % 19.42 %

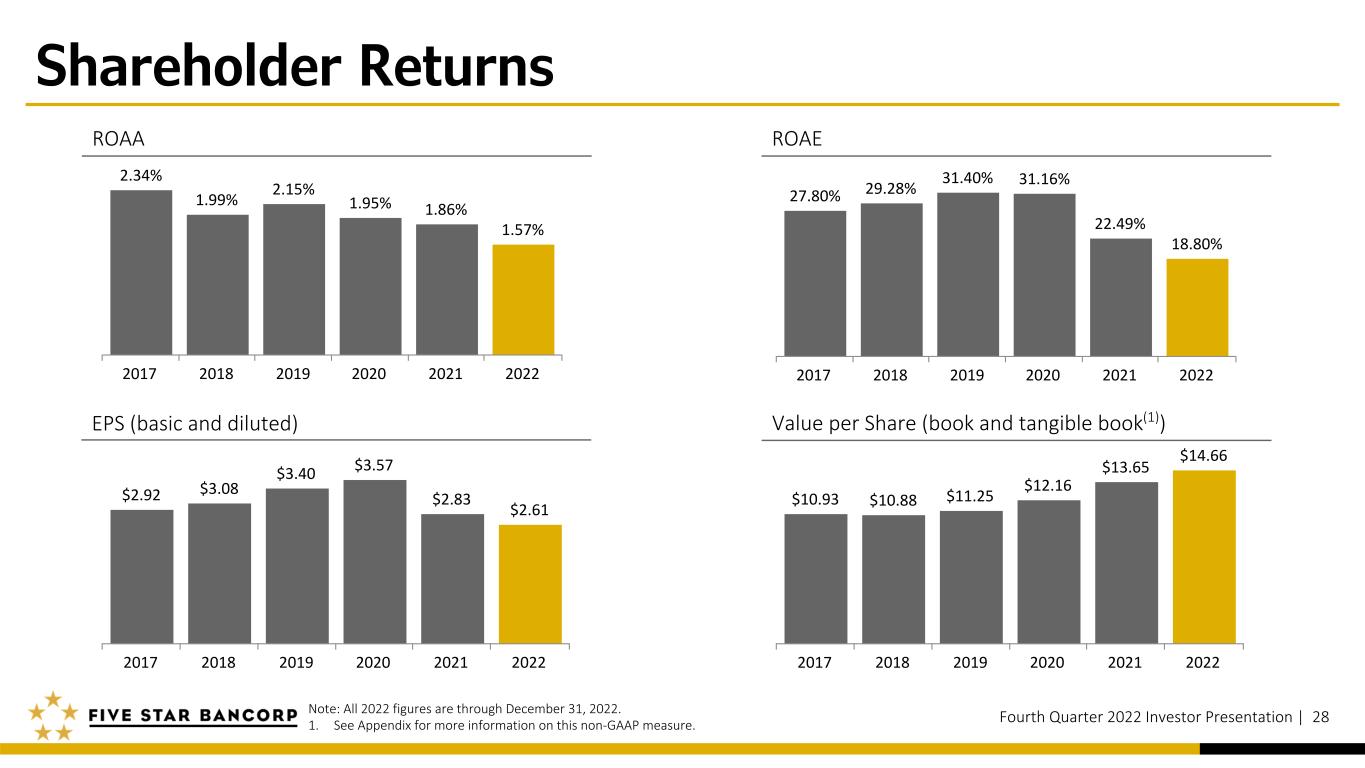

Financial Highlights Fourth Quarter 2022 Investor Presentation | 9 (dollars in millions except per share data) For the three months ended For the year ended 12/31/2022 9/30/2022 12/31/2021 12/31/2022 12/31/2021 Profitability Net income $ 13.3 $ 11.7 $ 11.3 $ 44.8 $ 42.4 Return on average assets ("ROAA") 1.70 % 1.60 % 1.82 % 1.57 % 1.86 % Return on average equity ("ROAE") 21.50 % 19.35 % 19.15 % 18.80 % 22.49 % Earnings per share (basic and diluted) $ 0.77 $ 0.68 $ 0.66 $ 2.61 $ 2.83 Net Interest Margin Net interest margin 3.83 % 3.86 % 3.67 % 3.75 % 3.64 % Average loan yield 5.12 % 4.75 % 4.71 % 4.75 % 4.82 % Average loan yield, excluding PPP loans(1) 5.12 % 4.75 % 4.56 % 4.73 % 4.70 % PPP income $ — $ — $ 1.1 $ 0.6 $ 6.2 PPP loans forgiven, paid off, and charged off $ — $ — $ 39.7 $ 22.1 $ 236.5 Total cost of funds 1.16 % 0.62 % 0.16 % 0.57 % 0.19 % 12/31/2022 12/31/2021 Asset Quality Nonperforming loans to loans held for investment 0.01 % 0.03 % Allowance for loan losses to loans held for investment 1.02 % 1.20 % # of PPP loans outstanding — 60 Balance of PPP loans outstanding $ — $ 22.1 # of loans in a COVID-19 deferment period — 6 Balance of loans in a COVID-19 deferment period $ — $ 12.2 Note: Yields are based on average balance and annualized quarterly interest income. 1. A reconciliation of this non-GAAP measure is set forth in the appendix.

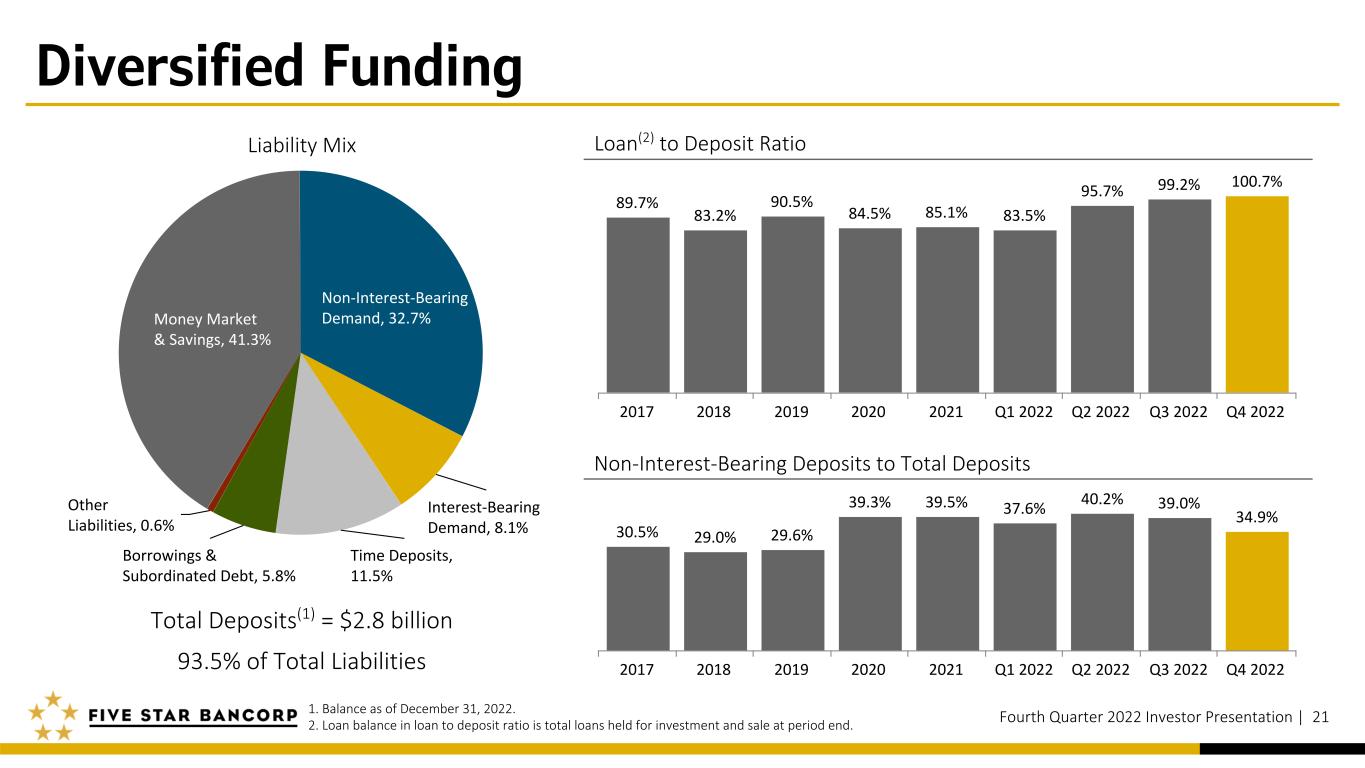

Financial Highlights - December 31, 2022 Fourth Quarter 2022 Investor Presentation | 10 Growth • Continued balance sheet growth with $856.9 million of growth in loans held for investment and $496.1 million in deposit growth since December 31, 2021. Funding • Non-interest-bearing deposits comprised 34.91% of total deposits, compared to 39.04% as of September 30, 2022 and 39.46% as of December 31, 2021. • Deposits comprised 93.53% of total liabilities, as compared to 92.21% of total liabilities as of September 30, 2022 and 98.46% of total liabilities as of December 31, 2021. Capital • All capital ratios were above well-capitalized regulatory thresholds. • On October 21, 2022 and January 20, 2023, the Company announced cash dividends of $0.15 per share for the three months ended September 30, 2022 and December 31, 2022, respectively.

Loans and Credit Quality Fourth Quarter 2022 Investor Presentation | 11

$148 $22 4.93% 5.28% 5.45% 4.96% 4.71% 5.12%Non-PPP Loans PPP Loans Average Loan Yield Average Loan Yield Excluding PPP Loans Consistent Loan Growth To ta l L oa ns (M ill io ns ) $183 $121 $61 $22 $2 4.95% 4.73% 4.90% 4.71% 4.53% 4.48% 4.75% 5.12% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Fourth Quarter 2022 Investor Presentation | 12 Note: Loan balances are end of period loans held for investment. Yields are based on average balance and annualized quarterly interest income. 1. CAGR is based upon balances as of December 31, 2022. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) Quarterly Trend To ta l L oa ns (M ill io ns ) $148 $22 4.93% 5.28% 5.45% 4.96% 4.82% 4.75% 2017 2018 2019 2020 2021 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Annual Trend CAGR (1) 5 years Total Loans 29.31 %

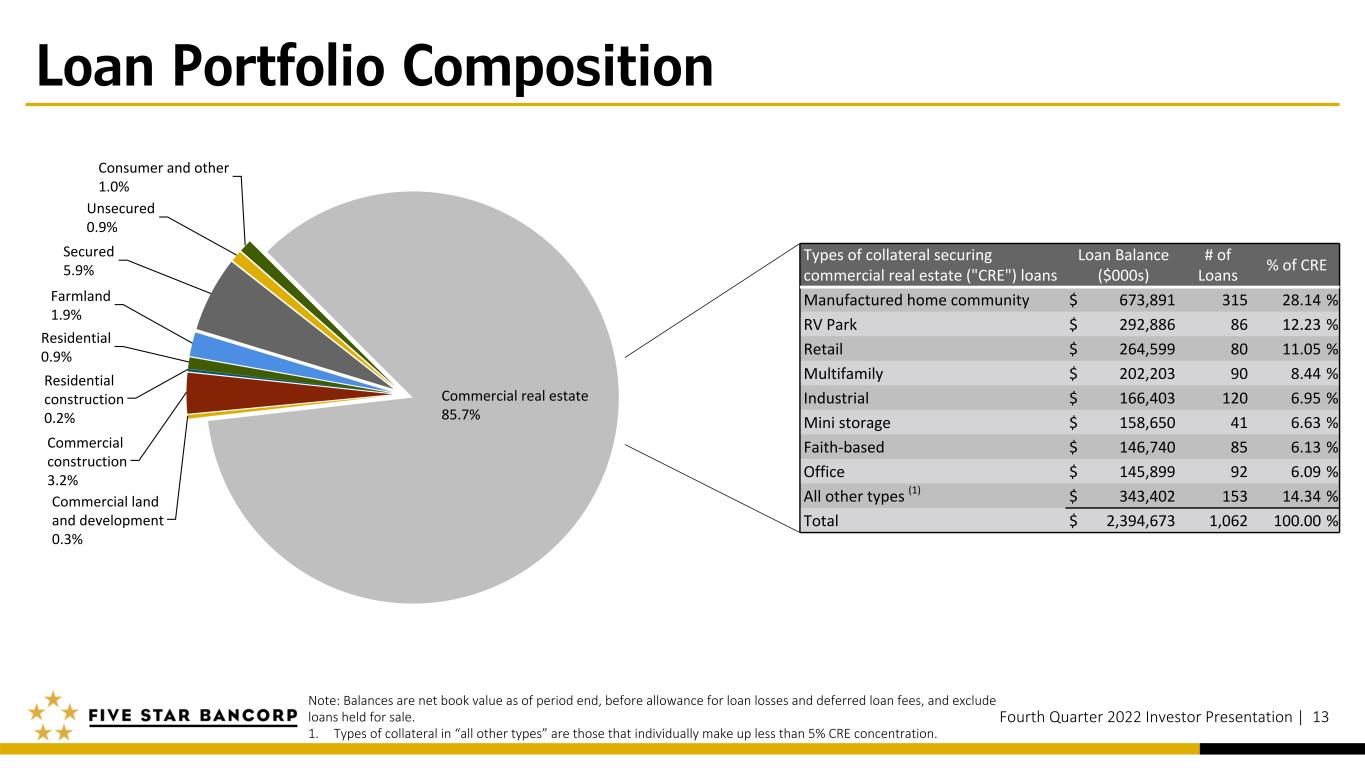

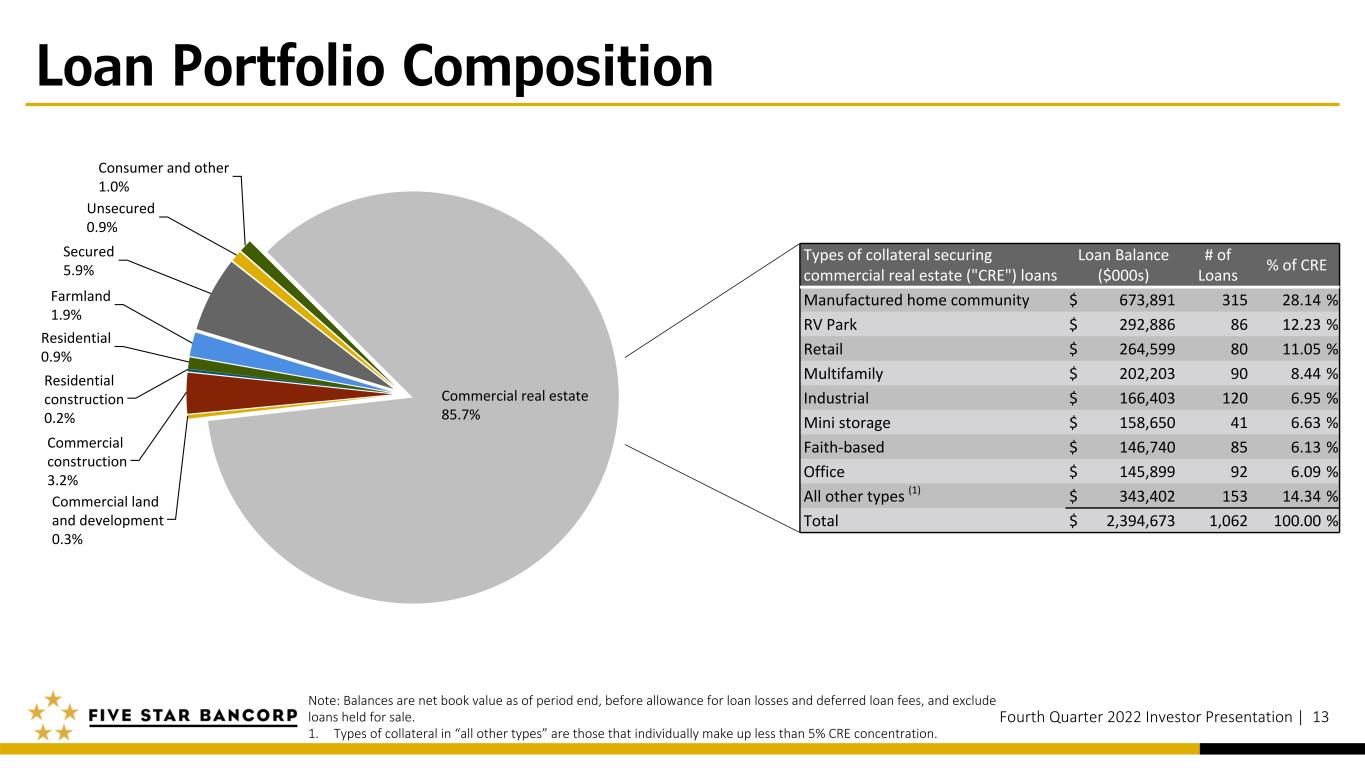

Loan Portfolio Composition Fourth Quarter 2022 Investor Presentation | 13 Commercial real estate 85.7% Commercial land and development 0.3% Commercial construction 3.2% Residential construction 0.2% Residential 0.9% Farmland 1.9% Secured 5.9% Unsecured 0.9% PPP 0.0% Consumer and other 1.0% Types of collateral securing commercial real estate ("CRE") loans Loan Balance ($000s) # of Loans % of CRE Manufactured home community $ 673,891 315 28.14 % RV Park $ 292,886 86 12.23 % Retail $ 264,599 80 11.05 % Multifamily $ 202,203 90 8.44 % Industrial $ 166,403 120 6.95 % Mini storage $ 158,650 41 6.63 % Faith-based $ 146,740 85 6.13 % Office $ 145,899 92 6.09 % All other types (1) $ 343,402 153 14.34 % Total $ 2,394,673 1,062 100.00 % Note: Balances are net book value as of period end, before allowance for loan losses and deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration.

$674M $293M $265M $202M $166M $159M $147M $146M $343M $1,175M $506M $490M $460M $366M $290M $383M $310M $705M Loan Balance Collateral Value Manufactured home community RV Park Retail Multifamily Industrial Mini storage Faith-based Office All other types $0M $200M $400M $600M $800M $1,000M $1,200M $1,400M CRE Collateral Values Fourth Quarter 2022 Investor Presentation | 14 (1) Note: Balances are net book value as of period end, before allowance for loan losses and deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration.

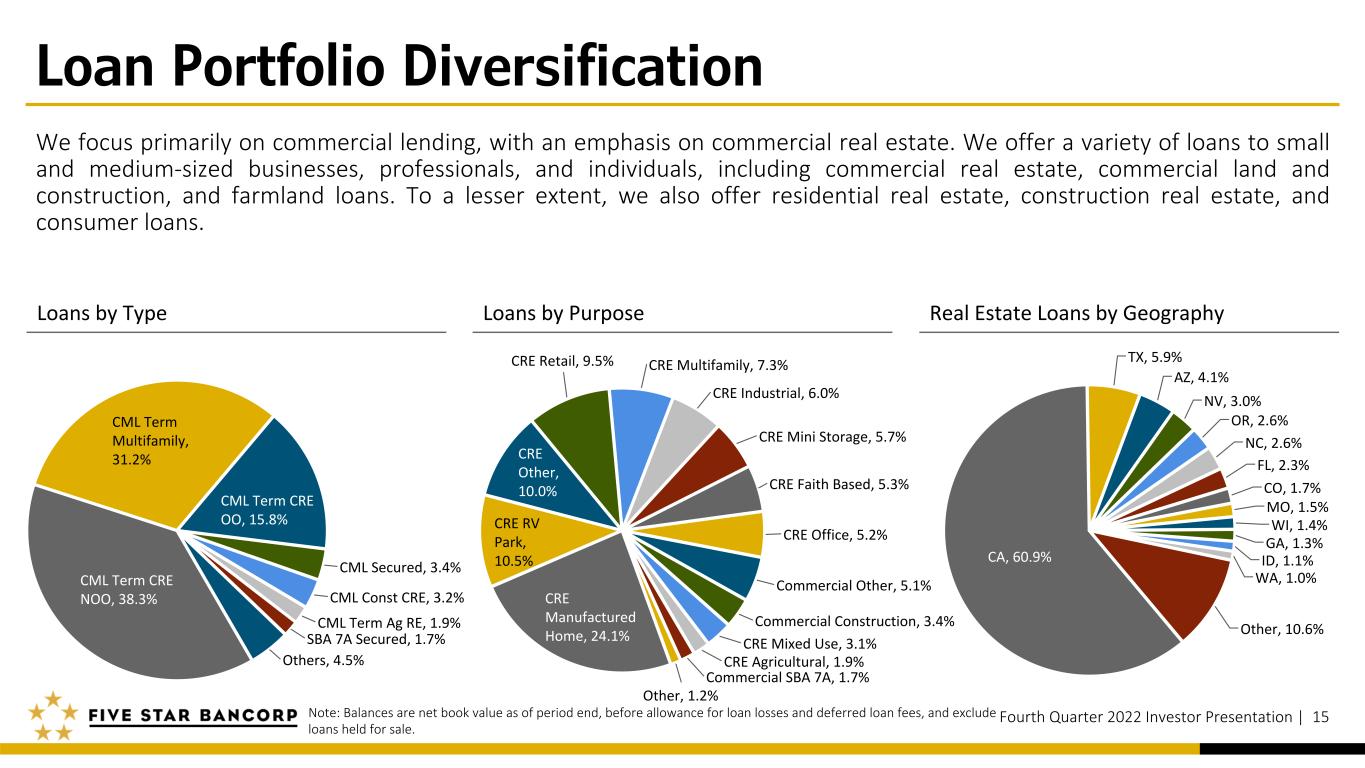

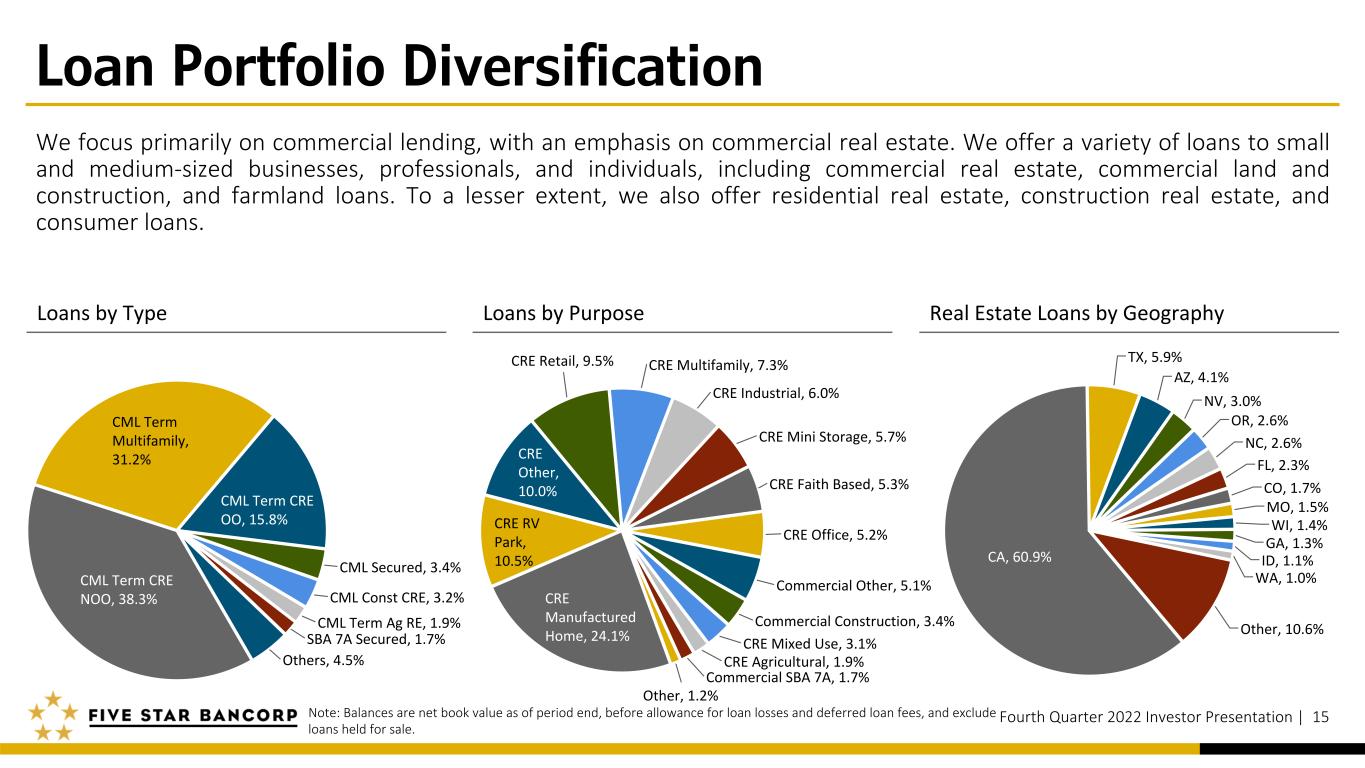

Loan Portfolio Diversification We focus primarily on commercial lending, with an emphasis on commercial real estate. We offer a variety of loans to small and medium-sized businesses, professionals, and individuals, including commercial real estate, commercial land and construction, and farmland loans. To a lesser extent, we also offer residential real estate, construction real estate, and consumer loans. Fourth Quarter 2022 Investor Presentation | 15Note: Balances are net book value as of period end, before allowance for loan losses and deferred loan fees, and exclude loans held for sale. Loans by Type Loans by Purpose Real Estate Loans by Geography CML Term CRE NOO, 38.3% CML Term Multifamily, 31.2% CML Term CRE OO, 15.8% CML Secured, 3.4% CML Const CRE, 3.2% CML Term Ag RE, 1.9% SBA 7A Secured, 1.7% Others, 4.5% CA, 60.9% TX, 5.9% AZ, 4.1% NV, 3.0% OR, 2.6% NC, 2.6% FL, 2.3% CO, 1.7% MO, 1.5% WI, 1.4% GA, 1.3% ID, 1.1% WA, 1.0% Other, 10.6% CRE Manufactured Home, 24.1% CRE RV Park, 10.5% CRE Other, 10.0% CRE Retail, 9.5% CRE Multifamily, 7.3% CRE Industrial, 6.0% CRE Mini Storage, 5.7% CRE Faith Based, 5.3% CRE Office, 5.2% Commercial Other, 5.1% Commercial Construction, 3.4% CRE Mixed Use, 3.1% CRE Agricultural, 1.9% Commercial SBA 7A, 1.7% Other, 1.2%

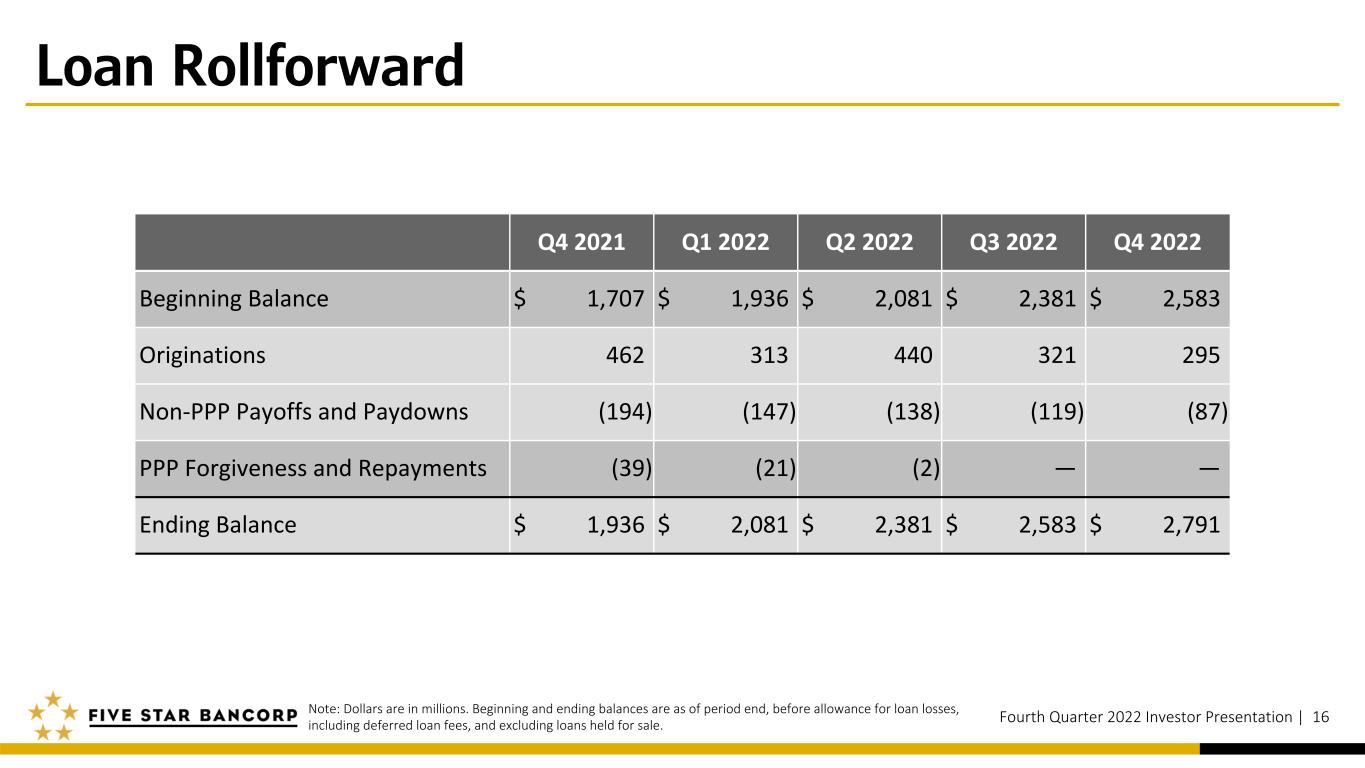

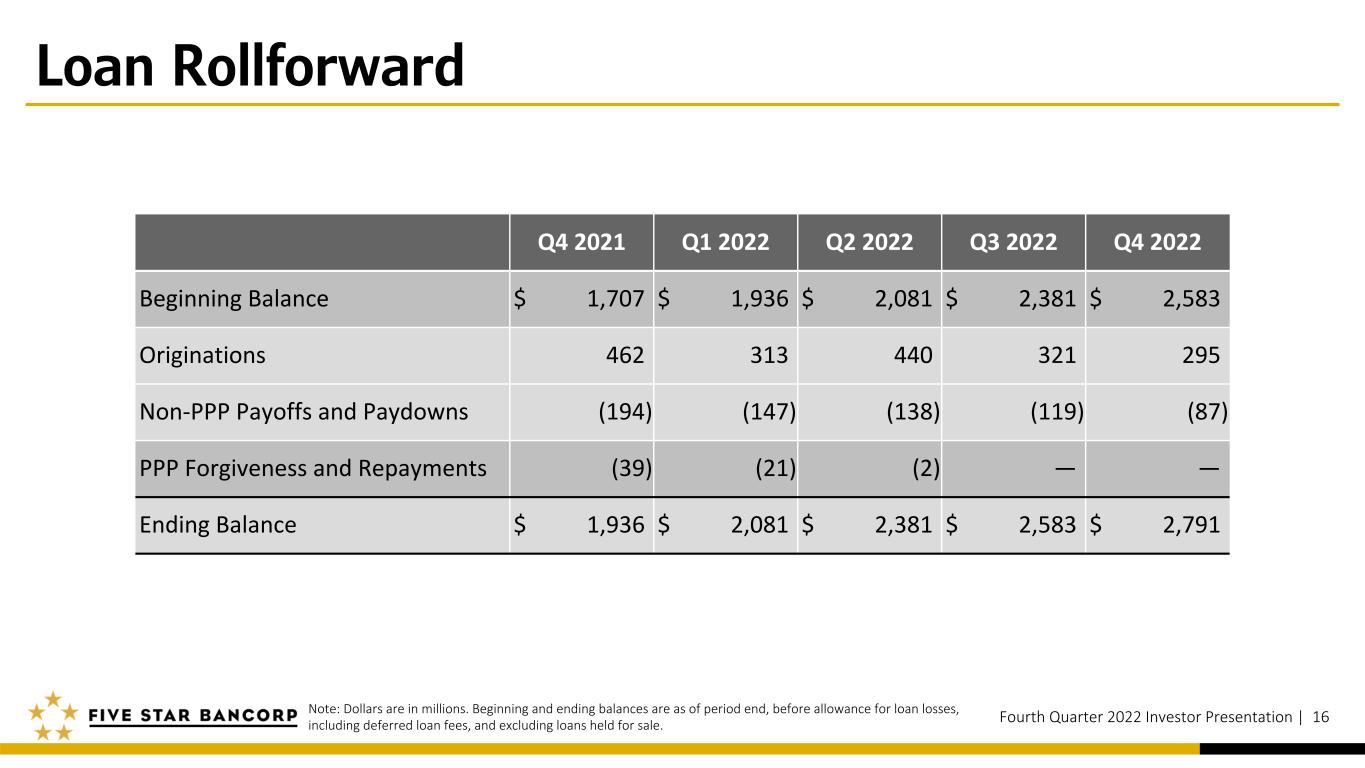

Loan Rollforward Fourth Quarter 2022 Investor Presentation | 16Note: Dollars are in millions. Beginning and ending balances are as of period end, before allowance for loan losses, including deferred loan fees, and excluding loans held for sale. Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Beginning Balance $ 1,707 $ 1,936 $ 2,081 $ 2,381 $ 2,583 Originations 462 313 440 321 295 Non-PPP Payoffs and Paydowns (194) (147) (138) (119) (87) PPP Forgiveness and Repayments (39) (21) (2) — — Ending Balance $ 1,936 $ 2,081 $ 2,381 $ 2,583 $ 2,791

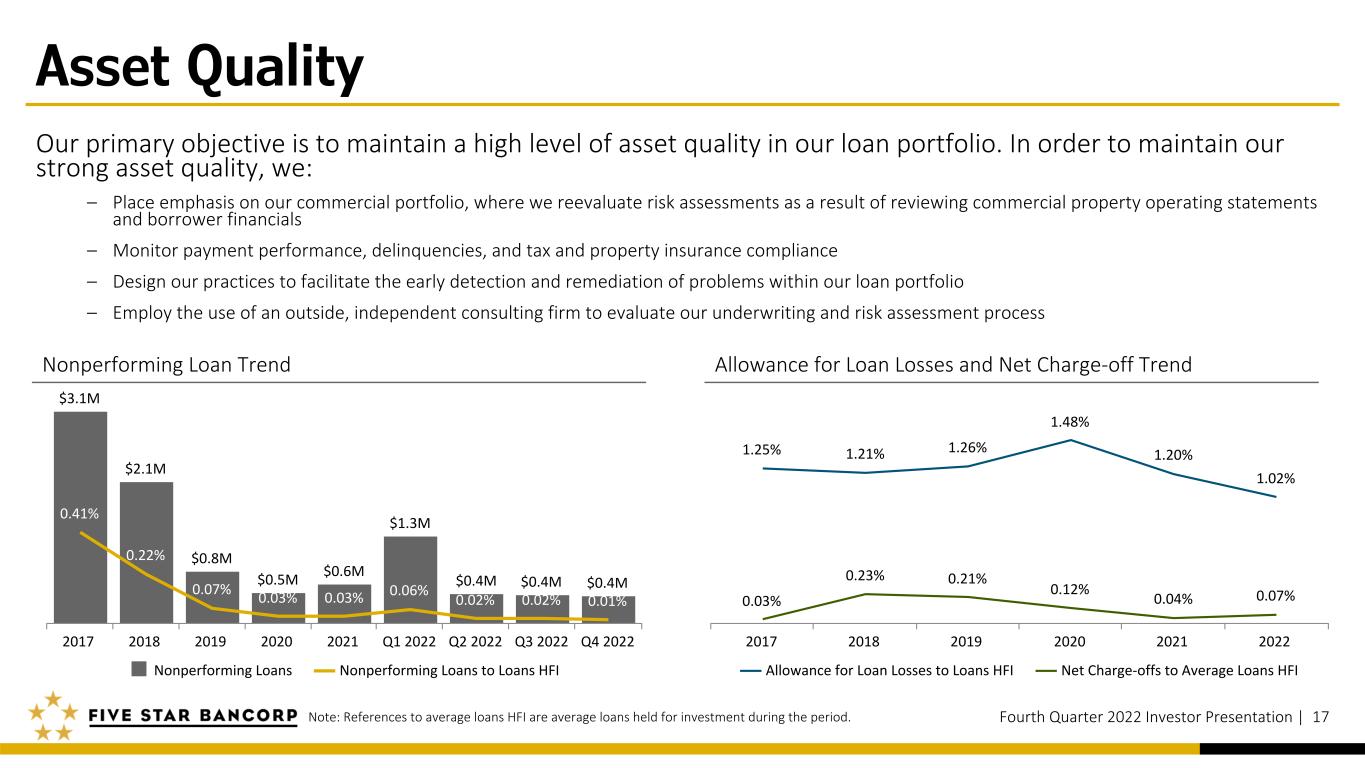

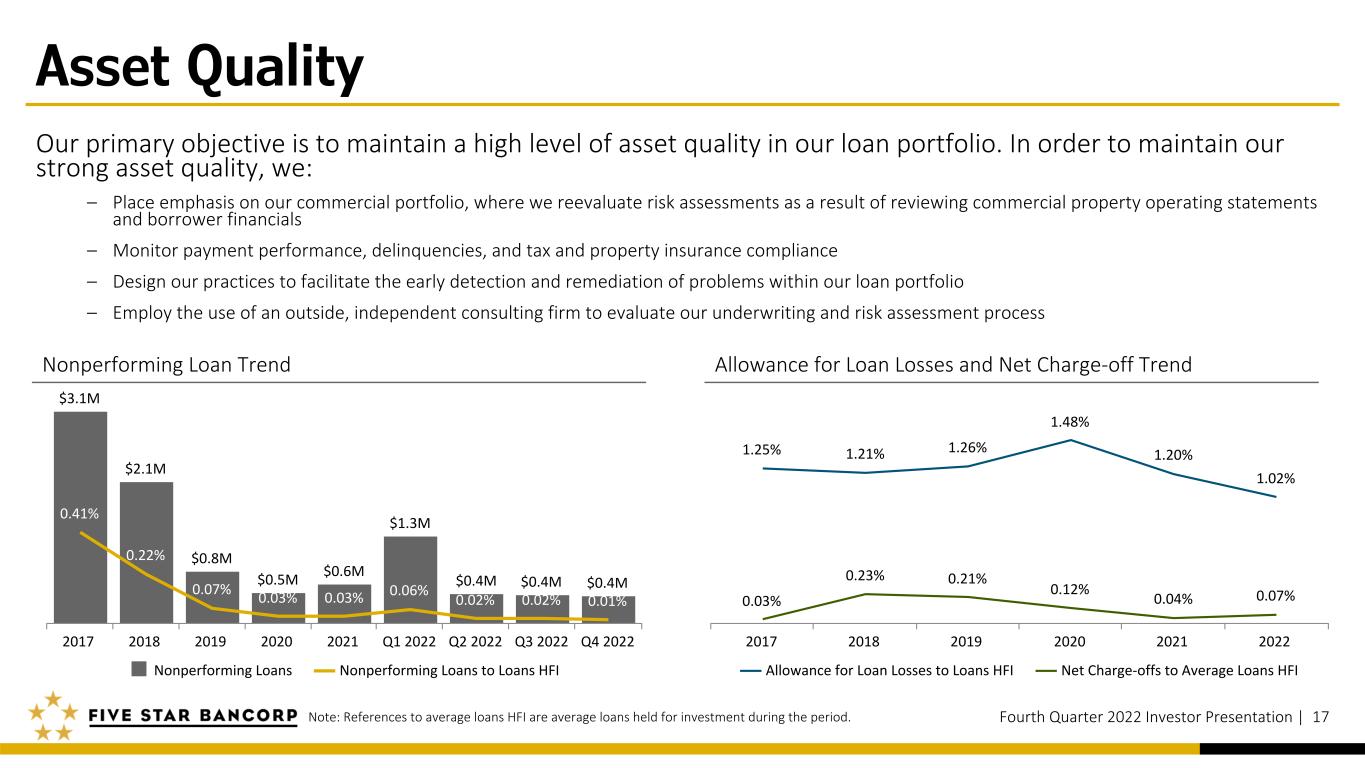

Asset Quality Our primary objective is to maintain a high level of asset quality in our loan portfolio. In order to maintain our strong asset quality, we: – Place emphasis on our commercial portfolio, where we reevaluate risk assessments as a result of reviewing commercial property operating statements and borrower financials – Monitor payment performance, delinquencies, and tax and property insurance compliance – Design our practices to facilitate the early detection and remediation of problems within our loan portfolio – Employ the use of an outside, independent consulting firm to evaluate our underwriting and risk assessment process Fourth Quarter 2022 Investor Presentation | 17 Nonperforming Loan Trend Allowance for Loan Losses and Net Charge-off Trend Note: References to average loans HFI are average loans held for investment during the period. $3.1M $2.1M $0.8M $0.5M $0.6M $1.3M $0.4M $0.4M $0.4M 0.41% 0.22% 0.07% 0.03% 0.03% 0.06% 0.02% 0.02% 0.01% Nonperforming Loans Nonperforming Loans to Loans HFI 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 1.25% 1.21% 1.26% 1.48% 1.20% 1.02% 0.03% 0.23% 0.21% 0.12% 0.04% 0.07% Allowance for Loan Losses to Loans HFI Net Charge-offs to Average Loans HFI 2017 2018 2019 2020 2021 2022

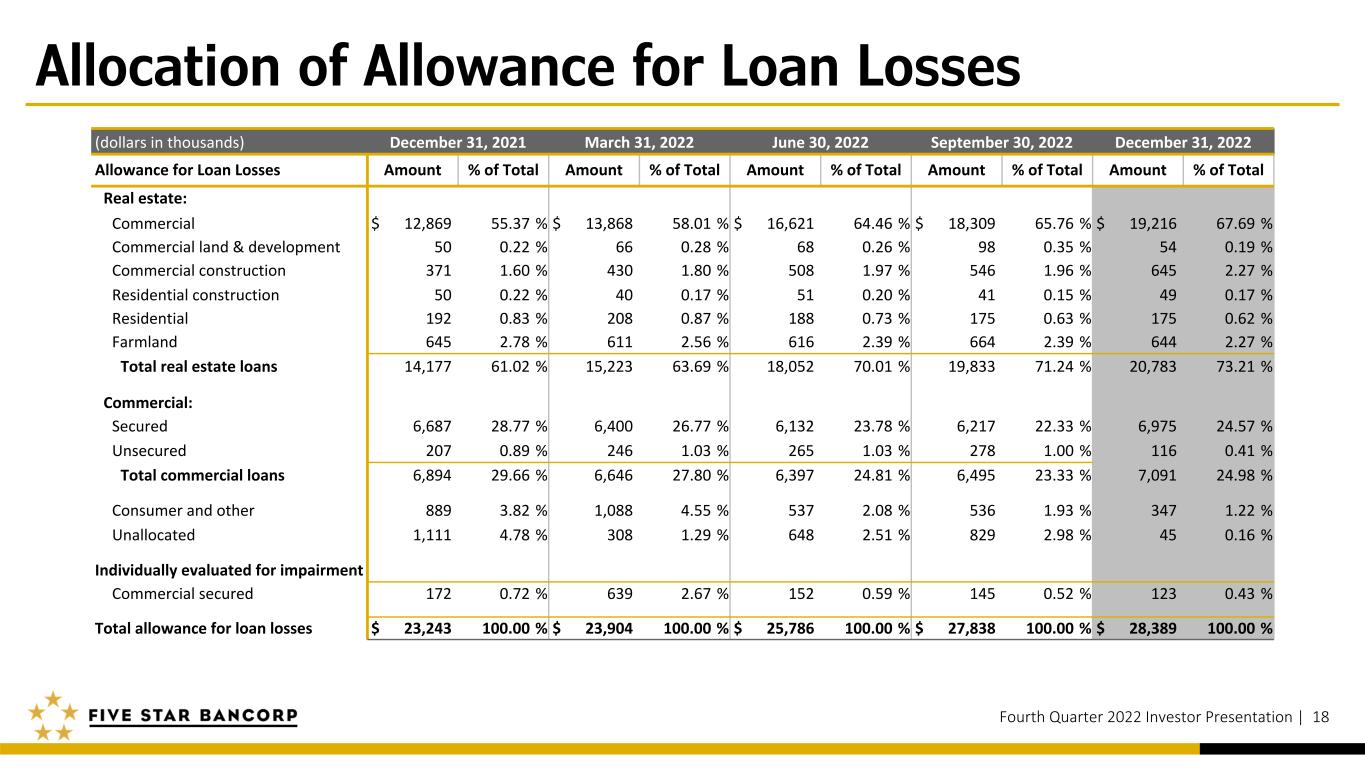

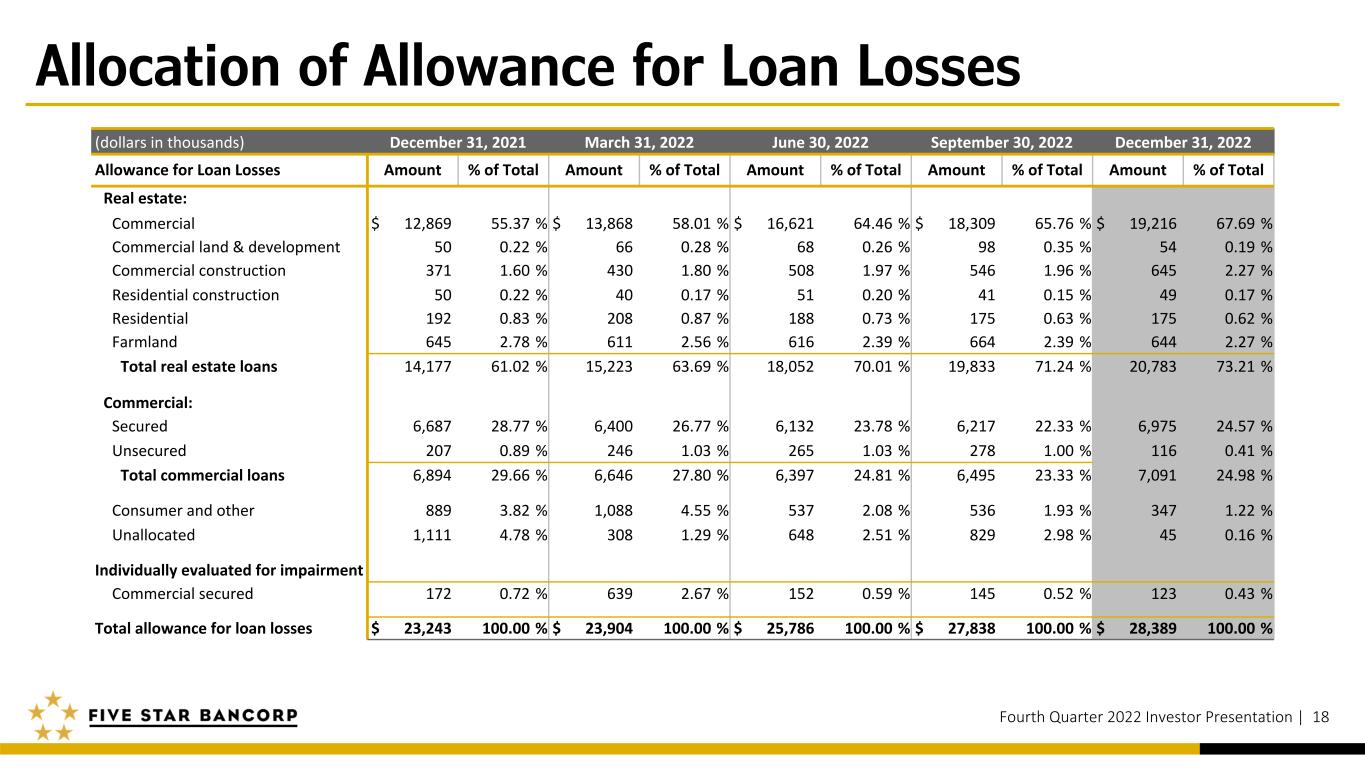

Allocation of Allowance for Loan Losses Fourth Quarter 2022 Investor Presentation | 18 (dollars in thousands) December 31, 2021 March 31, 2022 June 30, 2022 September 30, 2022 December 31, 2022 Allowance for Loan Losses Amount % of Total Amount % of Total Amount % of Total Amount % of Total Amount % of Total Real estate: Commercial $ 12,869 55.37 % $ 13,868 58.01 % $ 16,621 64.46 % $ 18,309 65.76 % $ 19,216 67.69 % Commercial land & development 50 0.22 % 66 0.28 % 68 0.26 % 98 0.35 % 54 0.19 % Commercial construction 371 1.60 % 430 1.80 % 508 1.97 % 546 1.96 % 645 2.27 % Residential construction 50 0.22 % 40 0.17 % 51 0.20 % 41 0.15 % 49 0.17 % Residential 192 0.83 % 208 0.87 % 188 0.73 % 175 0.63 % 175 0.62 % Farmland 645 2.78 % 611 2.56 % 616 2.39 % 664 2.39 % 644 2.27 % Total real estate loans 14,177 61.02 % 15,223 63.69 % 18,052 70.01 % 19,833 71.24 % 20,783 73.21 % Commercial: Secured 6,687 28.77 % 6,400 26.77 % 6,132 23.78 % 6,217 22.33 % 6,975 24.57 % Unsecured 207 0.89 % 246 1.03 % 265 1.03 % 278 1.00 % 116 0.41 % Total commercial loans 6,894 29.66 % 6,646 27.80 % 6,397 24.81 % 6,495 23.33 % 7,091 24.98 % Consumer and other 889 3.82 % 1,088 4.55 % 537 2.08 % 536 1.93 % 347 1.22 % Unallocated 1,111 4.78 % 308 1.29 % 648 2.51 % 829 2.98 % 45 0.16 % Individually evaluated for impairment Commercial secured 172 0.72 % 639 2.67 % 152 0.59 % 145 0.52 % 123 0.43 % Total allowance for loan losses $ 23,243 100.00 % $ 23,904 100.00 % $ 25,786 100.00 % $ 27,838 100.00 % $ 28,389 100.00 %

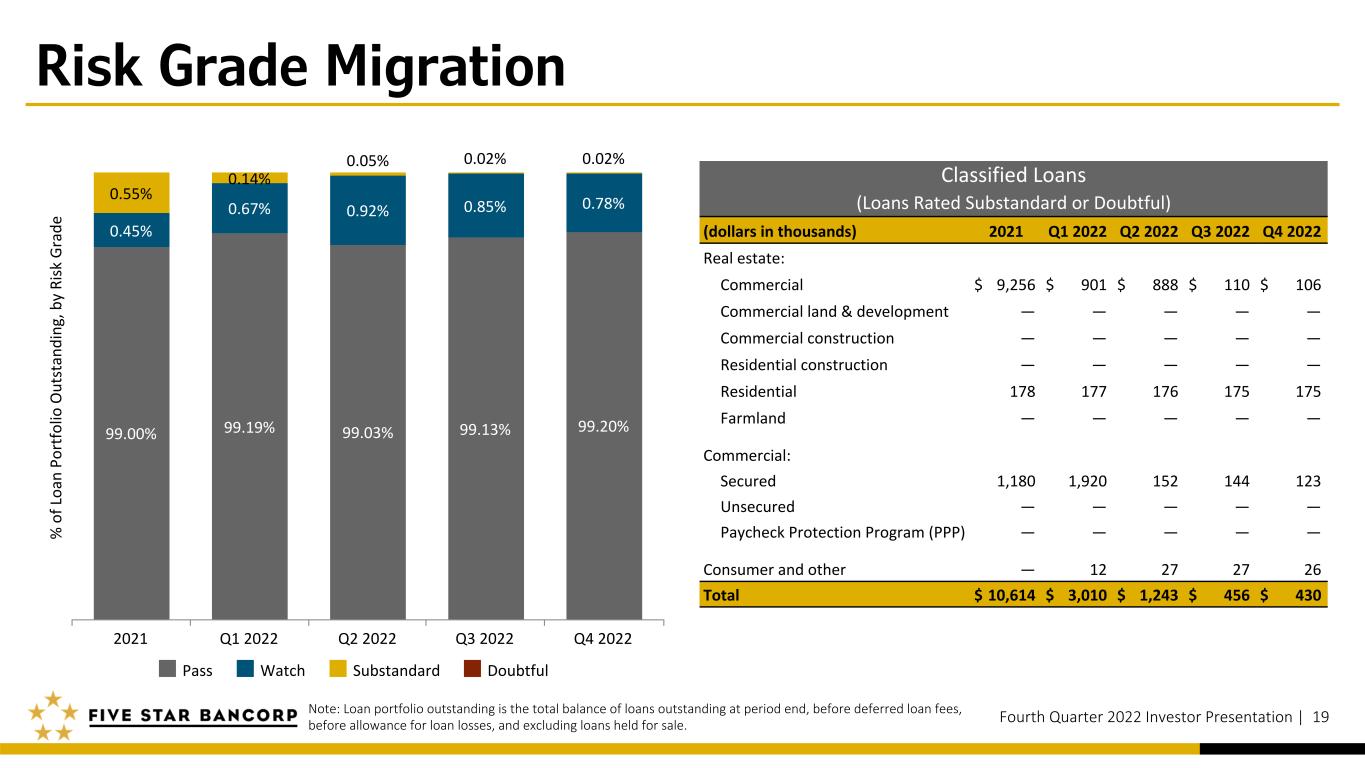

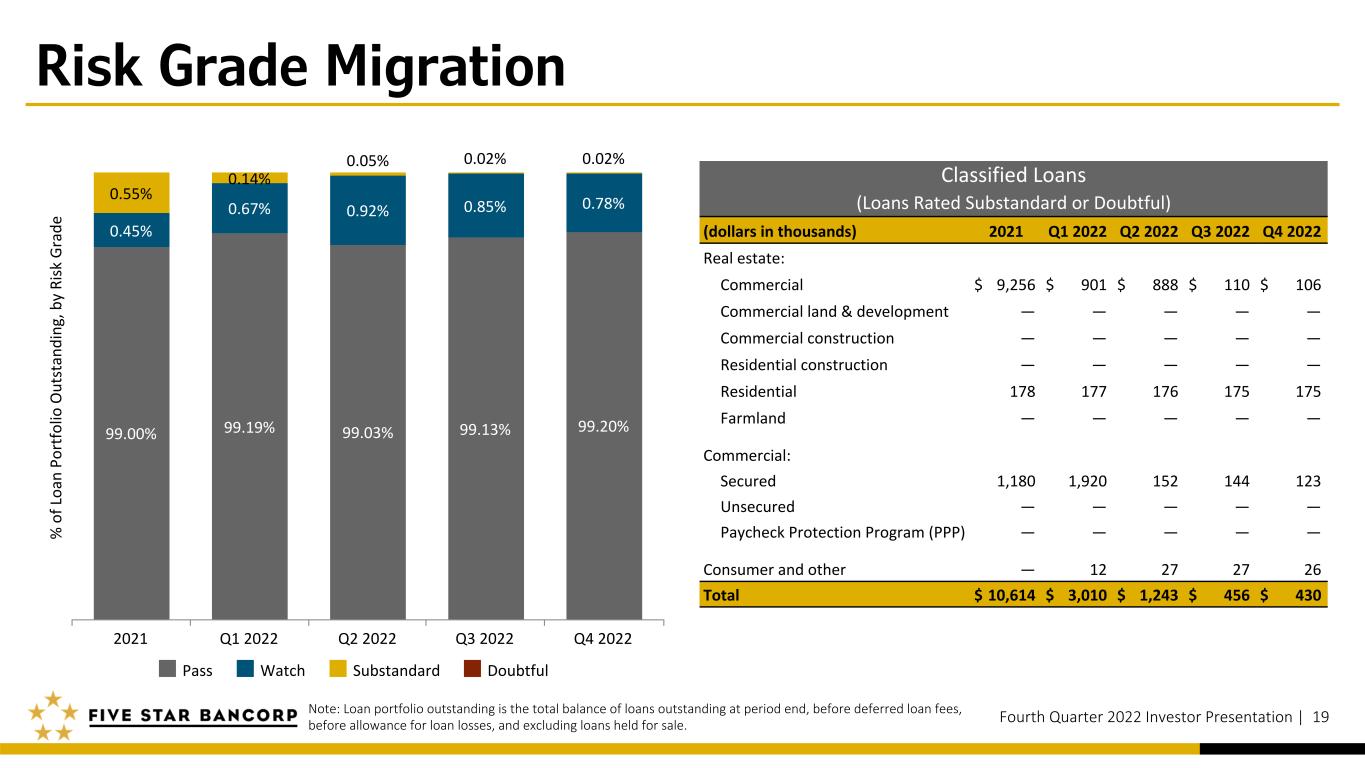

Risk Grade Migration Fourth Quarter 2022 Investor Presentation | 19 Classified Loans (Loans Rated Substandard or Doubtful) (dollars in thousands) 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Real estate: Commercial $ 9,256 $ 901 $ 888 $ 110 $ 106 Commercial land & development — — — — — Commercial construction — — — — — Residential construction — — — — — Residential 178 177 176 175 175 Farmland — — — — — Commercial: Secured 1,180 1,920 152 144 123 Unsecured — — — — — Paycheck Protection Program (PPP) — — — — — Consumer and other — 12 27 27 26 Total $ 10,614 $ 3,010 $ 1,243 $ 456 $ 430 % o f L oa n Po rt fo lio O ut st an di ng , b y Ri sk G ra de 99.00% 99.19% 99.03% 99.13% 99.20% 0.45% 0.67% 0.92% 0.85% 0.78%0.55% 0.14% 0.05% 0.02% 0.02% Pass Watch Substandard Doubtful 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Note: Loan portfolio outstanding is the total balance of loans outstanding at period end, before deferred loan fees, before allowance for loan losses, and excluding loans held for sale.

Deposit and Capital Overview Fourth Quarter 2022 Investor Presentation | 20

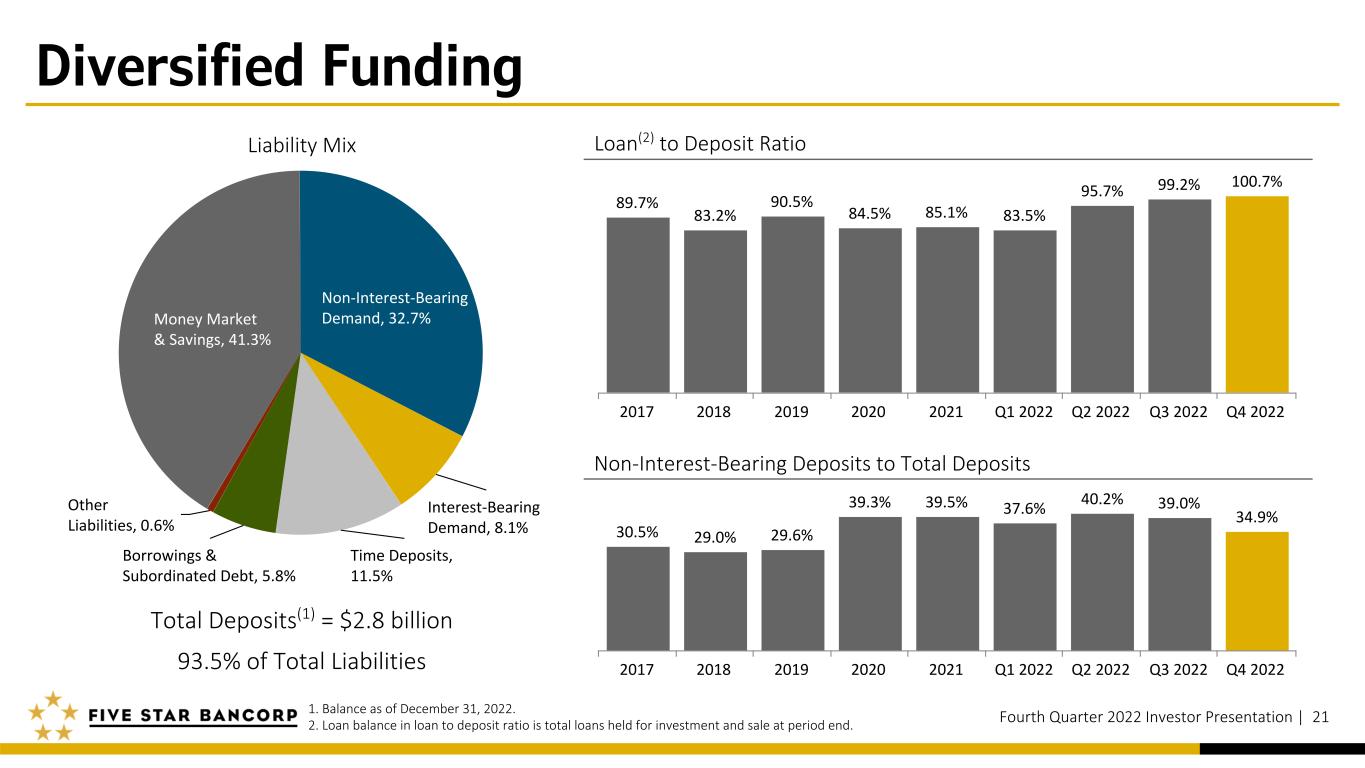

Diversified Funding Fourth Quarter 2022 Investor Presentation | 21 Total Deposits(1) = $2.8 billion 93.5% of Total Liabilities Liability Mix 1. Balance as of December 31, 2022. 2. Loan balance in loan to deposit ratio is total loans held for investment and sale at period end. Loan(2) to Deposit Ratio Non-Interest-Bearing Deposits to Total Deposits 89.7% 83.2% 90.5% 84.5% 85.1% 83.5% 95.7% 99.2% 100.7% 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 30.5% 29.0% 29.6% 39.3% 39.5% 37.6% 40.2% 39.0% 34.9% 2017 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Money Market & Savings, 41.3% Non-Interest-Bearing Demand, 32.7% Interest-Bearing Demand, 8.1% Time Deposits, 11.5% Borrowings & Subordinated Debt, 5.8% Other Liabilities, 0.6%

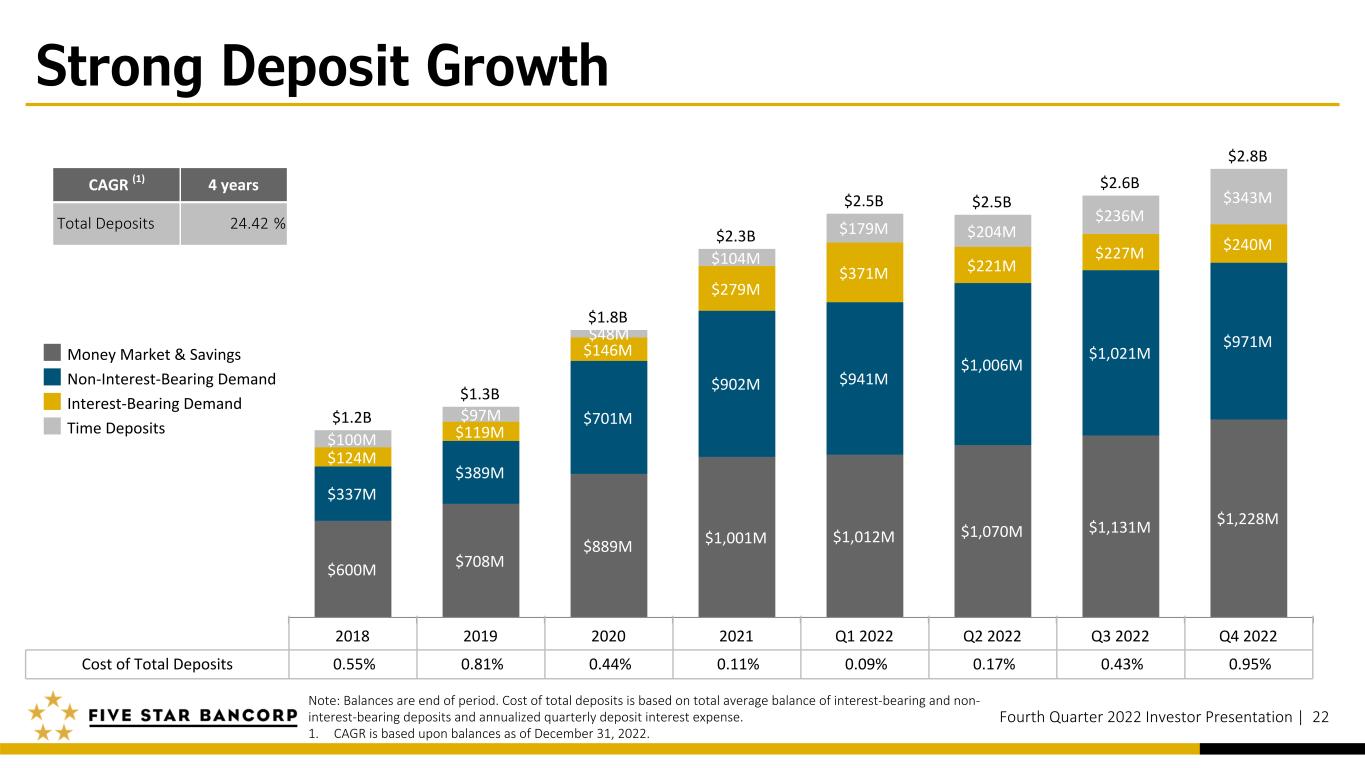

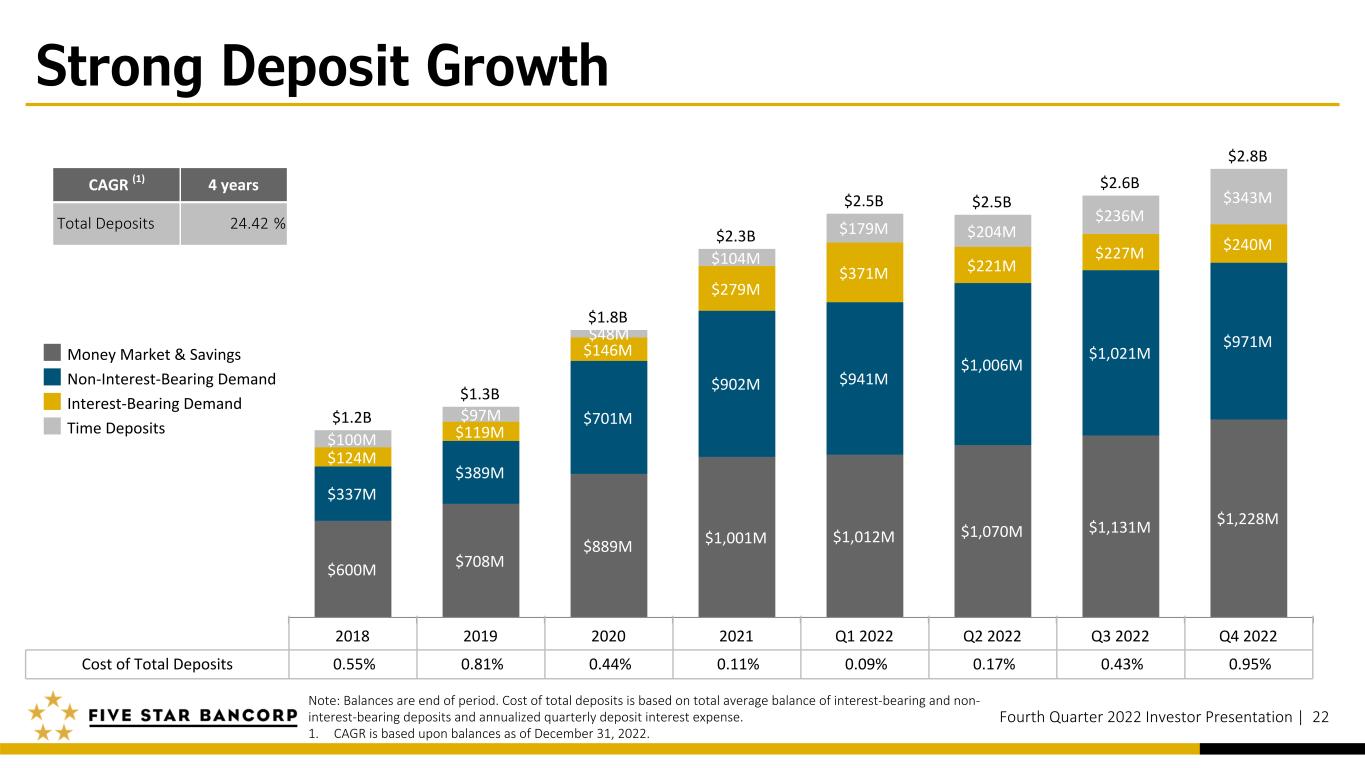

$1.2B $1.3B $1.8B $2.3B $2.5B $2.5B $2.6B $2.8B $600M $708M $889M $1,001M $1,012M $1,070M $1,131M $1,228M $337M $389M $701M $902M $941M $1,006M $1,021M $971M $124M $119M $146M $279M $371M $221M $227M $240M $100M $97M $48M $104M $179M $204M $236M $343M Money Market & Savings Non-Interest-Bearing Demand Interest-Bearing Demand Time Deposits 2018 2019 2020 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Strong Deposit Growth Fourth Quarter 2022 Investor Presentation | 22 Note: Balances are end of period. Cost of total deposits is based on total average balance of interest-bearing and non- interest-bearing deposits and annualized quarterly deposit interest expense. 1. CAGR is based upon balances as of December 31, 2022. Cost of Total Deposits 0.55% 0.81% 0.44% 0.11% 0.09% 0.17% 0.43% 0.95% CAGR (1) 4 years Total Deposits 24.42 %

Capital Ratios Fourth Quarter 2022 Investor Presentation | 23 Tier 1 Leverage Ratio Tier 1 Capital to RWA Total Capital to RWA Common Equity Tier 1 to RWA Note: References to RWA are risk-weighted assets. 8.26% 6.81% 7.51% 6.58% 9.47% 8.60% 2017 2018 2019 2020 2021 2022 9.32% 7.48% 8.21% 8.98% 11.44% 8.99% 2017 2018 2019 2020 2021 2022 9.32% 7.48% 8.21% 8.98% 11.44% 8.99% 2017 2018 2019 2020 2021 2022 13.23% 10.79% 11.52% 12.18% 13.98% 12.46% 2017 2018 2019 2020 2021 2022

Financial Results Fourth Quarter 2022 Investor Presentation | 24

Earnings Track Record Fourth Quarter 2022 Investor Presentation | 25 $10.9M $10.6M $13.3M $14.1M $14.5M $16.3M $18.8M $20.0M Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 $0.0M $2.5M $5.0M $7.5M $10.0M $12.5M $15.0M $17.5M $20.0M $22.5M 1. A reconciliation of this non-GAAP measure is set forth in the appendix. $46.3M $48.8M $69.6M $37.3M $47.1M $62.9M Pre-tax, pre-provision net income Pre-tax net income 2020 2021 2022 $0.0M $10.0M $20.0M $30.0M $40.0M $50.0M $60.0M $70.0M $80.0M (1) Quarterly Trend of Pre-Tax, Pre-Provision Net Income (1) Annual Trend

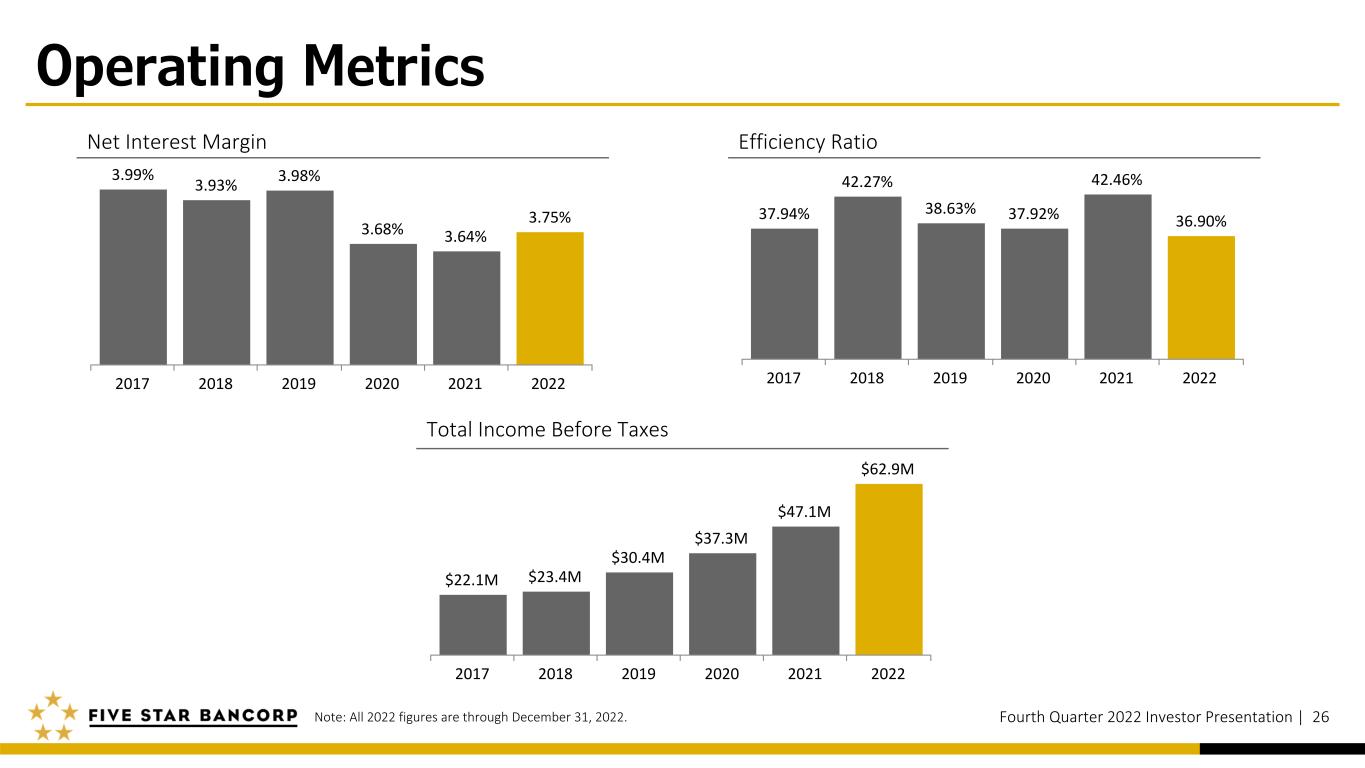

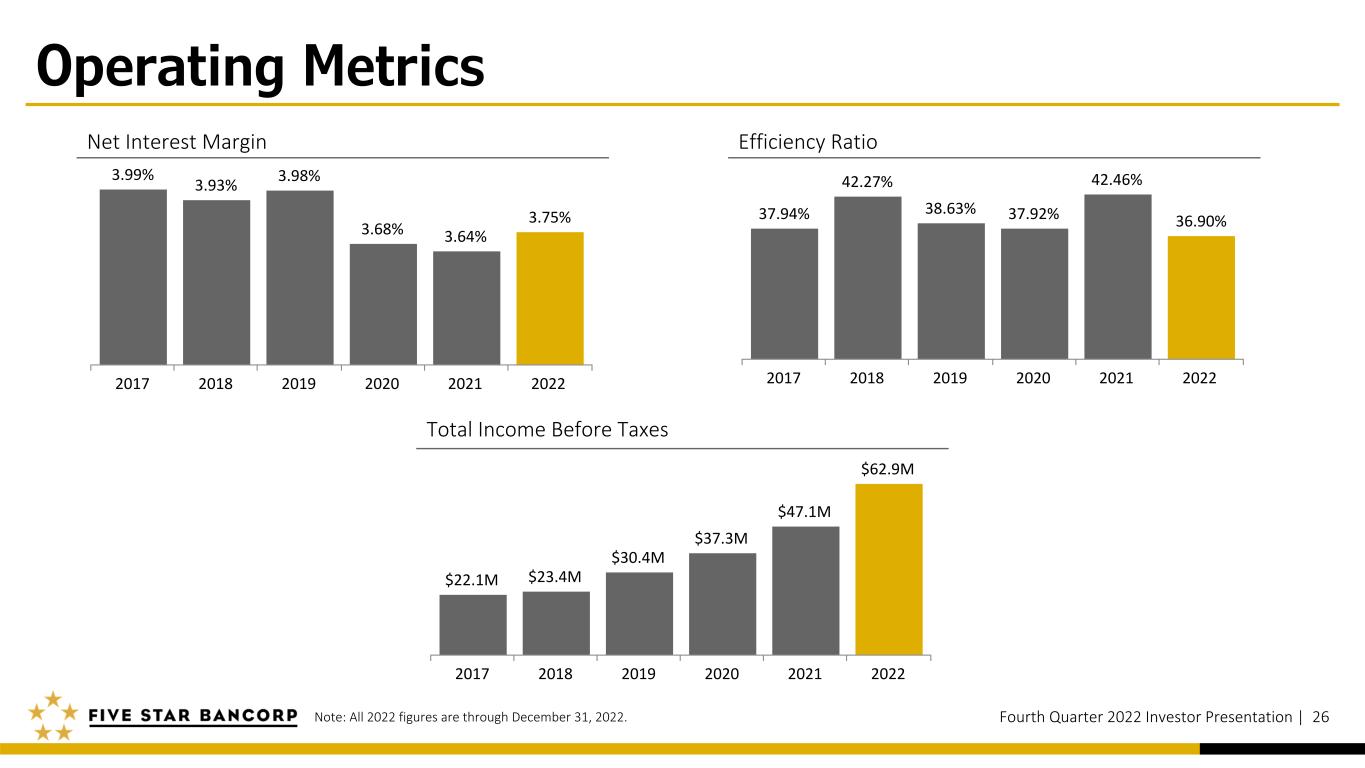

Operating Metrics Fourth Quarter 2022 Investor Presentation | 26 Efficiency RatioNet Interest Margin 3.99% 3.93% 3.98% 3.68% 3.64% 3.75% 2017 2018 2019 2020 2021 2022 37.94% 42.27% 38.63% 37.92% 42.46% 36.90% 2017 2018 2019 2020 2021 2022 Note: All 2022 figures are through December 31, 2022. Total Income Before Taxes $22.1M $23.4M $30.4M $37.3M $47.1M $62.9M 2017 2018 2019 2020 2021 2022

Non-interest Income and Expense Comparison Fourth Quarter 2022 Investor Presentation | 27 (dollars in thousands) For the three months ended For the year ended 12/31/2022 9/30/2022 12/31/2021 12/31/2022 12/31/2021 Non-interest Income Service charges on deposit accounts $ 97 $ 132 $ 116 $ 467 $ 424 Net gain on sale of securities — — 15 5 724 Gain on sale of loans 637 548 1,072 2,934 4,082 Loan-related fees 407 447 391 2,207 1,306 FHLB stock dividends 193 152 102 546 372 Earnings on bank-owned life insurance 119 102 57 412 237 Other income 148 52 37 586 135 Total non-interest income $ 1,601 $ 1,433 $ 1,790 $ 7,157 $ 7,280 Non-interest Expense Salaries and employee benefits $ 5,698 $ 5,645 $ 5,209 $ 22,571 $ 19,825 Occupancy and equipment 511 515 544 2,059 1,938 Data processing and software 839 797 656 3,091 2,494 Federal Deposit Insurance Corporation insurance 245 195 160 850 700 Professional services 553 792 444 2,467 3,792 Advertising and promotional 568 512 499 1,908 1,300 Loan-related expenses 358 262 136 1,287 1,045 Other operating expenses 1,945 1,454 1,370 6,436 4,949 Total non-interest expense $ 10,717 $ 10,172 $ 9,018 $ 40,669 $ 36,043

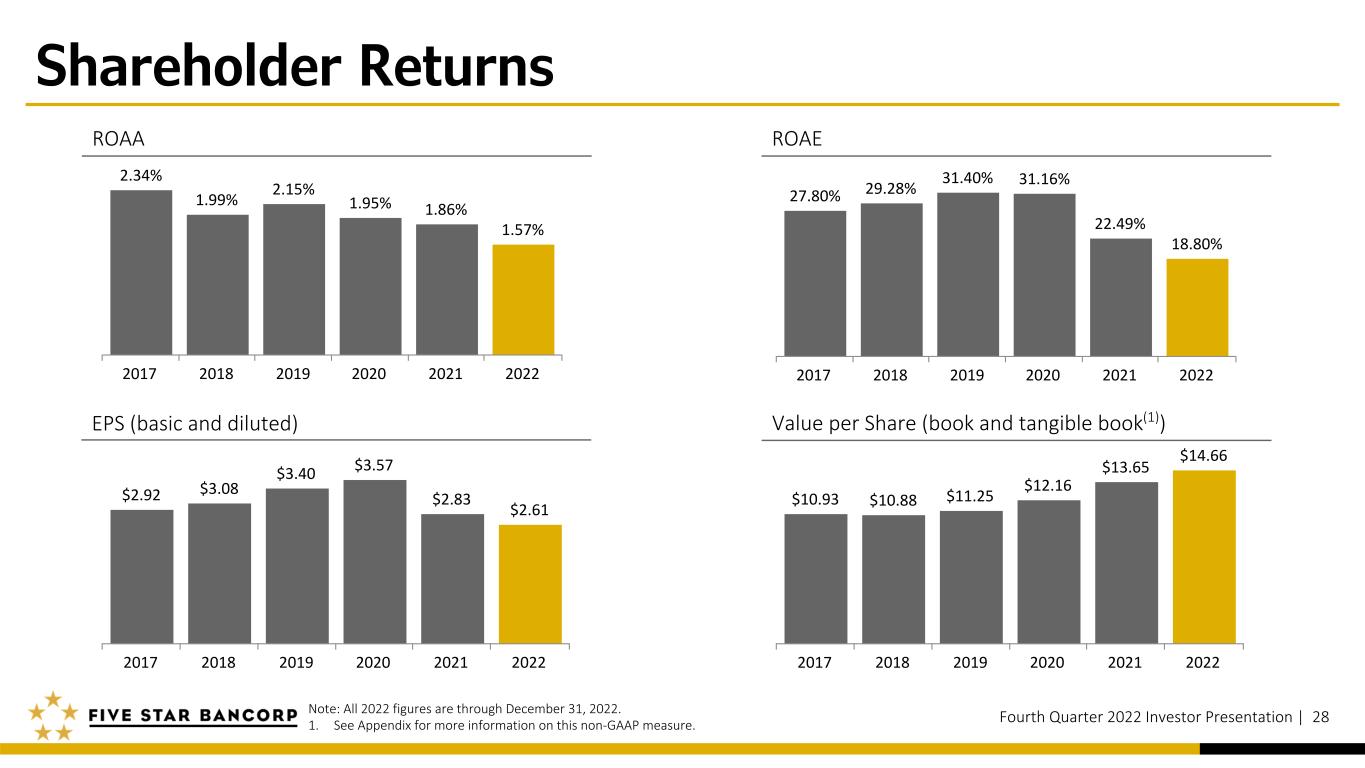

Shareholder Returns Fourth Quarter 2022 Investor Presentation | 28 ROAA ROAE EPS (basic and diluted) Value per Share (book and tangible book(1)) Note: All 2022 figures are through December 31, 2022. 1. See Appendix for more information on this non-GAAP measure. 2.34% 1.99% 2.15% 1.95% 1.86% 1.57% 2017 2018 2019 2020 2021 2022 27.80% 29.28% 31.40% 31.16% 22.49% 18.80% 2017 2018 2019 2020 2021 2022 $2.92 $3.08 $3.40 $3.57 $2.83 $2.61 2017 2018 2019 2020 2021 2022 $10.93 $10.88 $11.25 $12.16 $13.65 $14.66 2017 2018 2019 2020 2021 2022

We strive to become the top business bank in all markets we serve through exceptional service, deep connectivity, and customer empathy. We are dedicated to serving real estate, agricultural, faith-based, and small to medium-sized enterprises. We aim to consistently deliver value that meets or exceeds the expectations of our shareholders, customers, employees, business partners, and community. “We are grateful to work with community partners like Five Star Bank who advocate for the strength and resilience of our region’s most vulnerable children and adults.” Doug Bergman, President and CEO, UCP of Sacramento and Northern California Pictured with Harold Ashe, UCP of Sacramento and Northern California Foundation Board of Trustees “Roebbelen Contracting has been improving lives in our community for over 60 years, not just in our work as a general contractor, but in the meaningful ways we give back. We are pleased to have a banking partner in Five Star Bank who shares our values and is an integral part of our community. We both offer the resources, sophistication and reach of a large national firm while maintaining the agility, spirit and fire of a small company. We look forward to serving our customers and community for many years to come.” Ken Wenham, President and CEO, Roebbelen Contracting Pictured with James Beckwith, President and CEO, Five Star Bank Five Star Bank is proud to partner with Sacramento Municipal Utility District (SMUD), a leader in clean energy and zero carbon innovation. Together, Five Star Bank and SMUD support customers across the Sacramento region in choosing clean energy solutions that reduce their carbon footprint at home, at work and on the road. We will continue to do our part to lead the way in protecting our environment, improving public health, and powering the Capital Region forward with innovative clean energy solutions. Pictured Left to Right: Brandy Bolden, Chief Customer Officer, SMUD; Paul Lau, CEO and General Manager, SMUD; Lora Anguay, Chief Zero Carbon Officer, SMUD

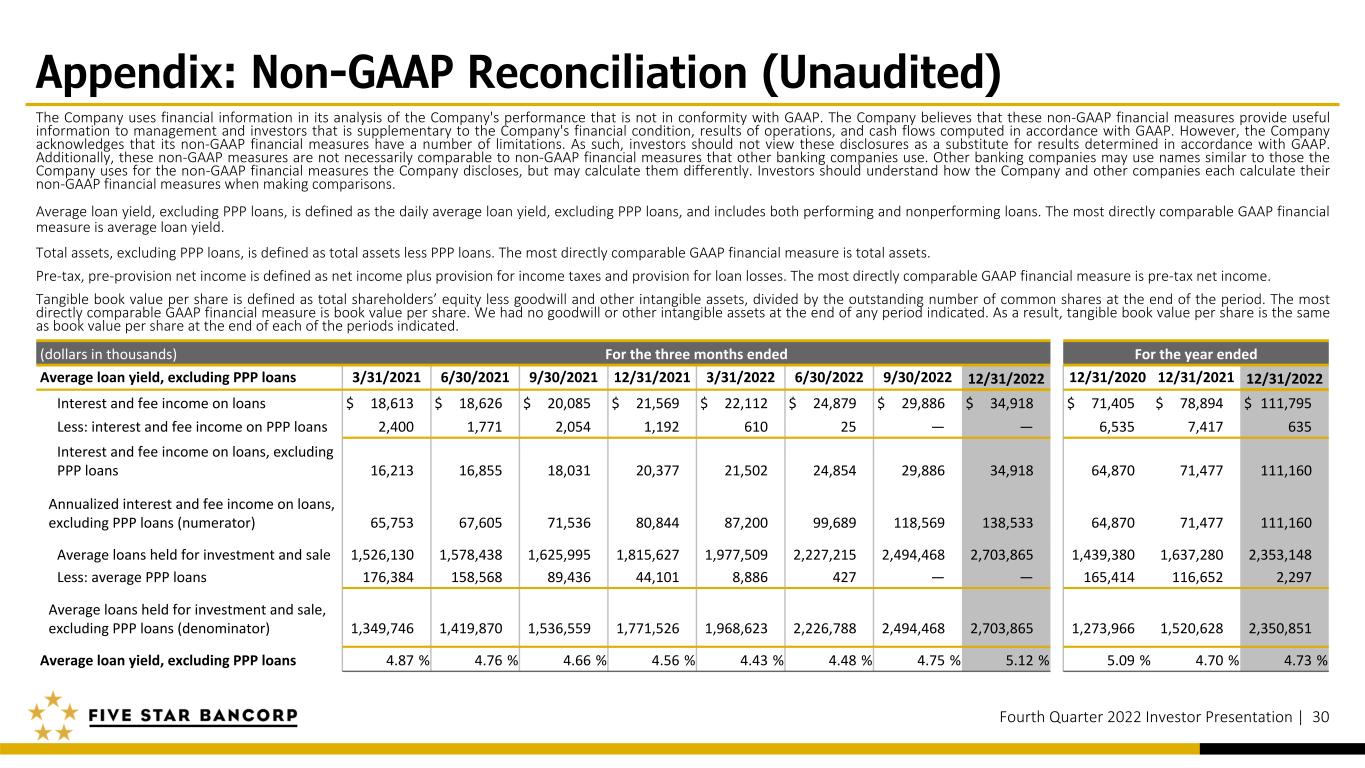

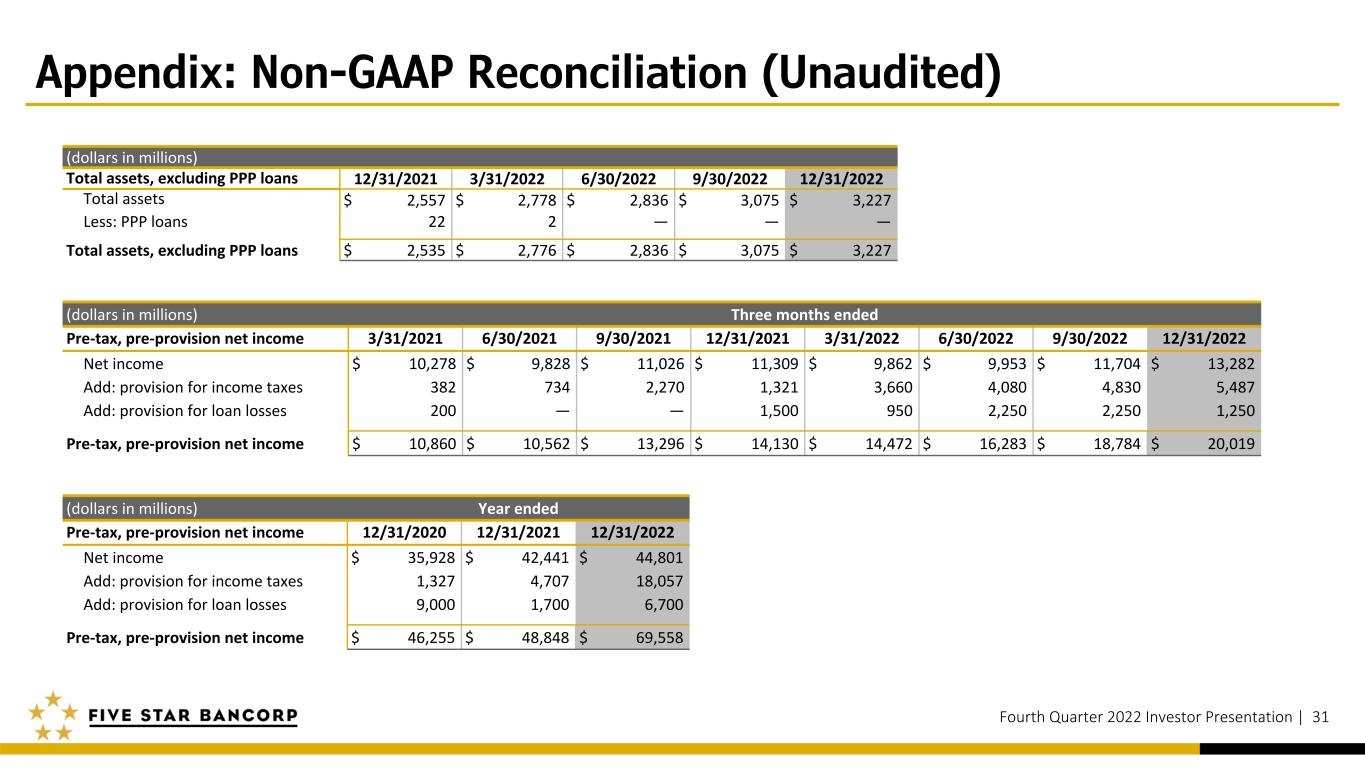

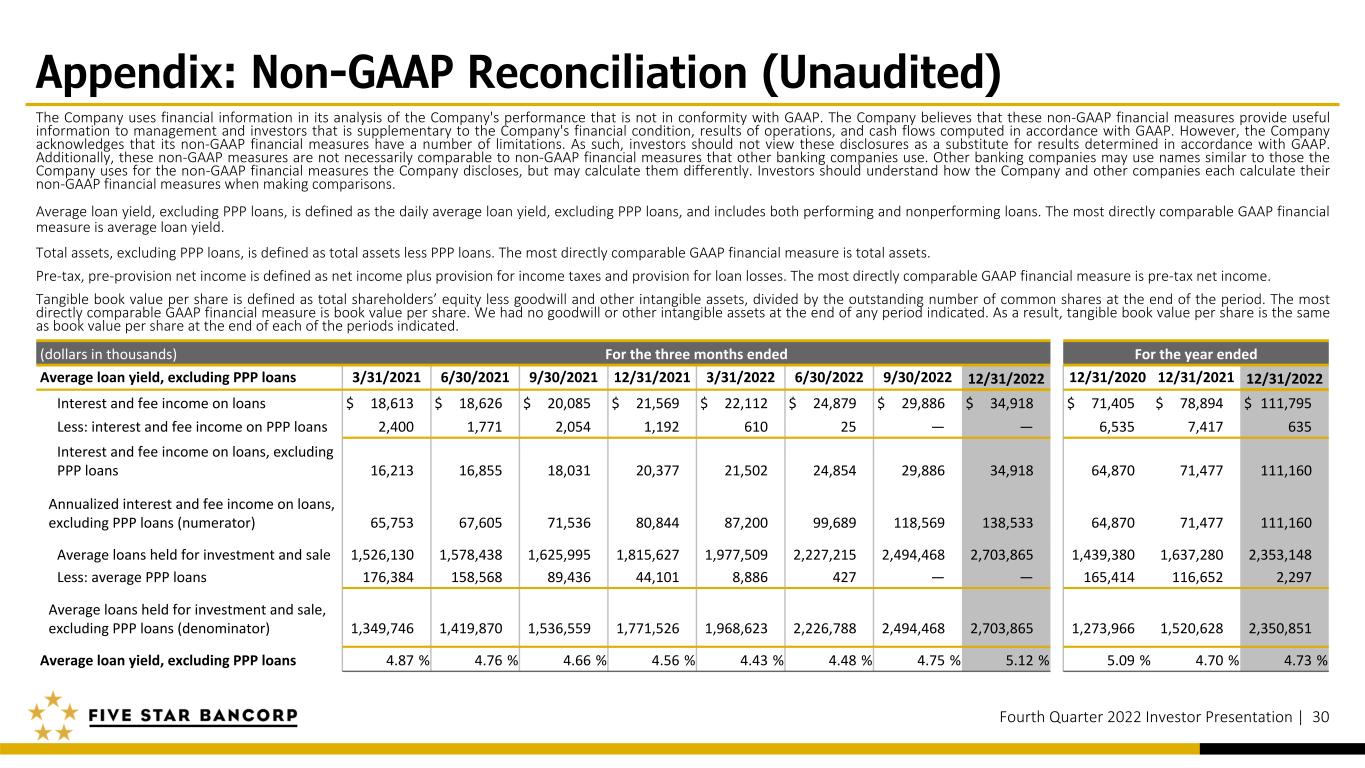

Appendix: Non-GAAP Reconciliation (Unaudited) The Company uses financial information in its analysis of the Company's performance that is not in conformity with GAAP. The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company's financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. As such, investors should not view these disclosures as a substitute for results determined in accordance with GAAP. Additionally, these non-GAAP measures are not necessarily comparable to non-GAAP financial measures that other banking companies use. Other banking companies may use names similar to those the Company uses for the non-GAAP financial measures the Company discloses, but may calculate them differently. Investors should understand how the Company and other companies each calculate their non-GAAP financial measures when making comparisons. Average loan yield, excluding PPP loans, is defined as the daily average loan yield, excluding PPP loans, and includes both performing and nonperforming loans. The most directly comparable GAAP financial measure is average loan yield. Total assets, excluding PPP loans, is defined as total assets less PPP loans. The most directly comparable GAAP financial measure is total assets. Pre-tax, pre-provision net income is defined as net income plus provision for income taxes and provision for loan losses. The most directly comparable GAAP financial measure is pre-tax net income. Tangible book value per share is defined as total shareholders’ equity less goodwill and other intangible assets, divided by the outstanding number of common shares at the end of the period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets at the end of any period indicated. As a result, tangible book value per share is the same as book value per share at the end of each of the periods indicated. Fourth Quarter 2022 Investor Presentation | 30 (dollars in thousands) For the three months ended For the year ended Average loan yield, excluding PPP loans 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 12/31/2020 12/31/2021 12/31/2022 Interest and fee income on loans $ 18,613 $ 18,626 $ 20,085 $ 21,569 $ 22,112 $ 24,879 $ 29,886 $ 34,918 $ 71,405 $ 78,894 $ 111,795 Less: interest and fee income on PPP loans 2,400 1,771 2,054 1,192 610 25 — — 6,535 7,417 635 Interest and fee income on loans, excluding PPP loans 16,213 16,855 18,031 20,377 21,502 24,854 29,886 34,918 64,870 71,477 111,160 Annualized interest and fee income on loans, excluding PPP loans (numerator) 65,753 67,605 71,536 80,844 87,200 99,689 118,569 138,533 64,870 71,477 111,160 Average loans held for investment and sale 1,526,130 1,578,438 1,625,995 1,815,627 1,977,509 2,227,215 2,494,468 2,703,865 1,439,380 1,637,280 2,353,148 Less: average PPP loans 176,384 158,568 89,436 44,101 8,886 427 — — 165,414 116,652 2,297 Average loans held for investment and sale, excluding PPP loans (denominator) 1,349,746 1,419,870 1,536,559 1,771,526 1,968,623 2,226,788 2,494,468 2,703,865 1,273,966 1,520,628 2,350,851 Average loan yield, excluding PPP loans 4.87 % 4.76 % 4.66 % 4.56 % 4.43 % 4.48 % 4.75 % 5.12 % 5.09 % 4.70 % 4.73 %

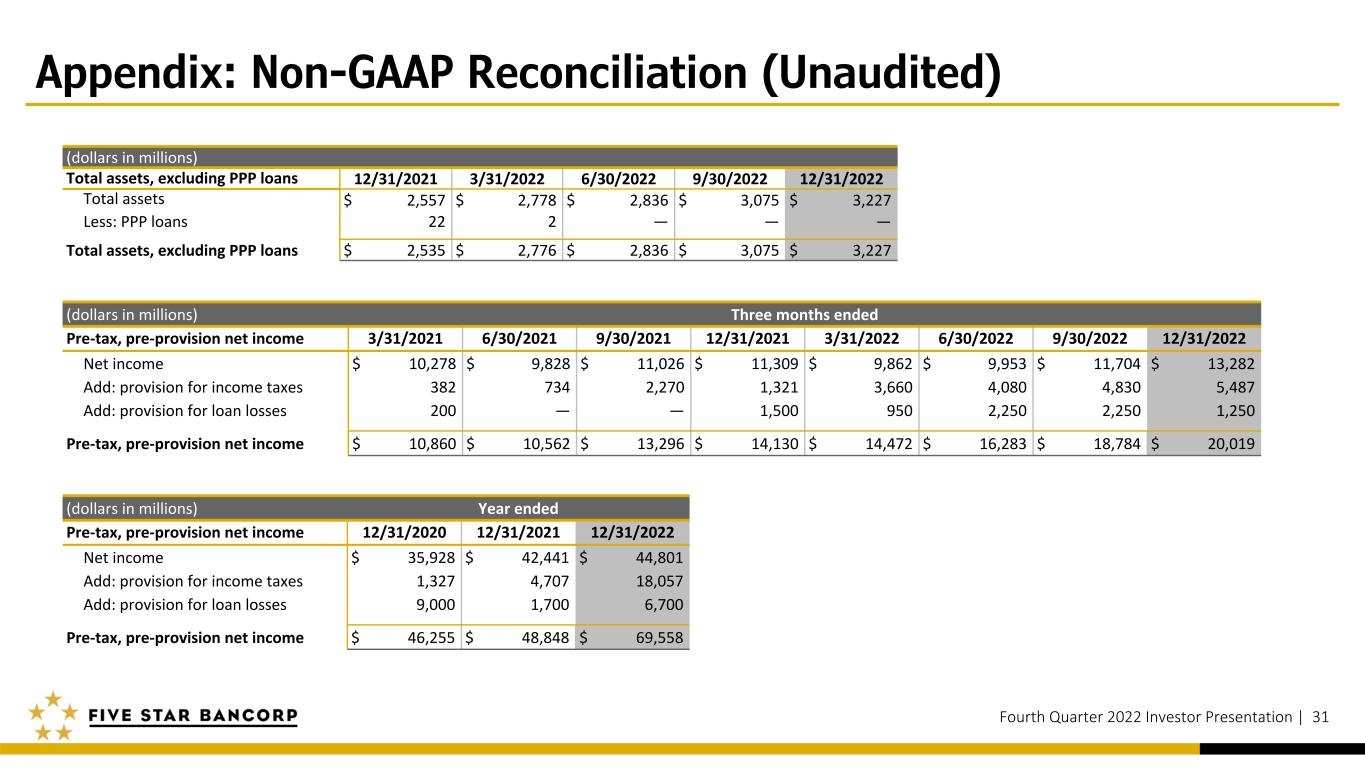

Appendix: Non-GAAP Reconciliation (Unaudited) Fourth Quarter 2022 Investor Presentation | 31 (dollars in millions) Total assets, excluding PPP loans 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 Total assets $ 2,557 $ 2,778 $ 2,836 $ 3,075 $ 3,227 Less: PPP loans 22 2 — — — Total assets, excluding PPP loans $ 2,535 $ 2,776 $ 2,836 $ 3,075 $ 3,227 (dollars in millions) Three months ended Pre-tax, pre-provision net income 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 Net income $ 10,278 $ 9,828 $ 11,026 $ 11,309 $ 9,862 $ 9,953 $ 11,704 $ 13,282 Add: provision for income taxes 382 734 2,270 1,321 3,660 4,080 4,830 5,487 Add: provision for loan losses 200 — — 1,500 950 2,250 2,250 1,250 Pre-tax, pre-provision net income $ 10,860 $ 10,562 $ 13,296 $ 14,130 $ 14,472 $ 16,283 $ 18,784 $ 20,019 (dollars in millions) Year ended Pre-tax, pre-provision net income 12/31/2020 12/31/2021 12/31/2022 Net income $ 35,928 $ 42,441 $ 44,801 Add: provision for income taxes 1,327 4,707 18,057 Add: provision for loan losses 9,000 1,700 6,700 Pre-tax, pre-provision net income $ 46,255 $ 48,848 $ 69,558