Investor Presentation Fourth Quarter and Year End 2024

Safe Harbor Statement and Disclaimer Forward-Looking Statements In this presentation, “we,” “our,” “us,” “Five Star," or “the Company” refers to Five Star Bancorp, a California corporation, and our consolidated subsidiaries, including Five Star Bank, a California state- chartered bank, unless the context indicates that we refer only to the parent company, Five Star Bancorp. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results, and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on the Company’s expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties, which change over time, and other factors which could cause actual results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. If one or more of the factors affecting the Company’s forward-looking information and statements proves incorrect, then the Company’s actual results, performance, or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this presentation. Therefore, the Company cautions you not to place undue reliance on the Company’s forward-looking information and statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024, and September 30, 2024, in each case under the section entitled “Risk Factors,” and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company disclaims any duty to revise or update the forward-looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward-looking statements, except as specifically required by law. Industry Information This presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade, and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys, and studies) is accurate and reliable, we have not independently verified such information. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Finally, forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. Unaudited Financial Data Numbers contained in this presentation for the quarter ended December 31, 2024 and for other quarterly periods are unaudited. Additionally, numbers contained in this presentation for the full fiscal year ended December 31, 2024 are unaudited. As a result, subsequent information may cause a change in certain accounting estimates and other financial information, including the Company’s allowance for credit losses, fair values, and income taxes. Non-GAAP Financial Measures The Company uses financial information in its analysis of the Company’s performance that is not in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company’s financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. See the appendix to this presentation for a reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures. Fourth Quarter 2024 Investor Presentation | 2

Agenda Fourth Quarter 2024 Investor Presentation | 3 •Company Overview •Financial Highlights •Loans and Credit Quality •Deposit and Capital Overview •Financial Results

Company Overview Fourth Quarter 2024 Investor Presentation | 4

Executive Team Fourth Quarter 2024 Investor Presentation | 5 James Beckwith President and Chief Executive Officer Five Star since 2003 John Dalton Senior Vice President and Chief Credit Officer Five Star since 2011 Mike Lee Senior Vice President and Chief Regulatory Officer Five Star since 2005 Michael Rizzo Executive Vice President and Chief Banking Officer Five Star since 2005 Brett Wait Senior Vice President and Chief Information Officer Five Star since 2011 Lydia Ramirez Executive Vice President and Chief Operating Officer Five Star since 2017 Heather Luck Executive Vice President and Chief Financial Officer Five Star since 2018 Shelley Wetton Senior Vice President and Chief Marketing Officer Five Star since 2015 DJ Kurtze Executive Vice President and San Francisco Bay Area President Five Star since 2023

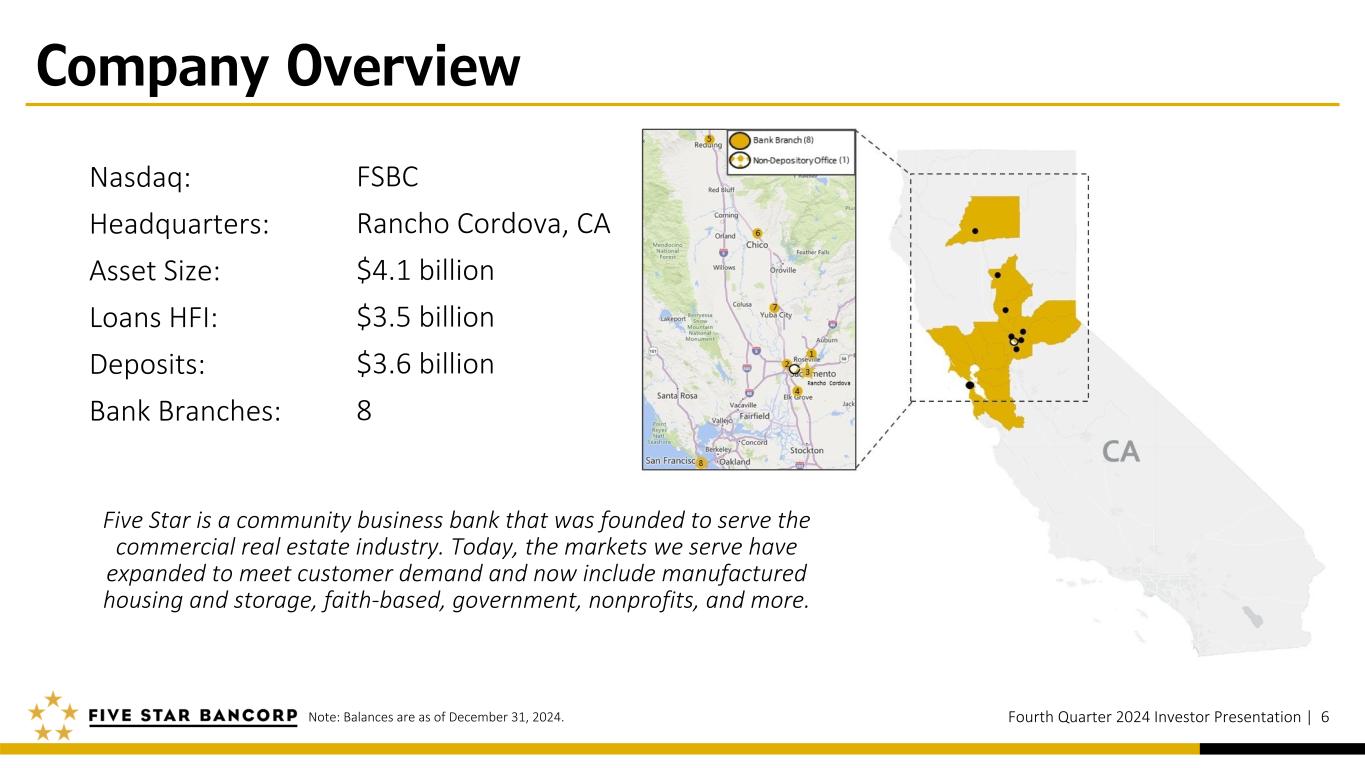

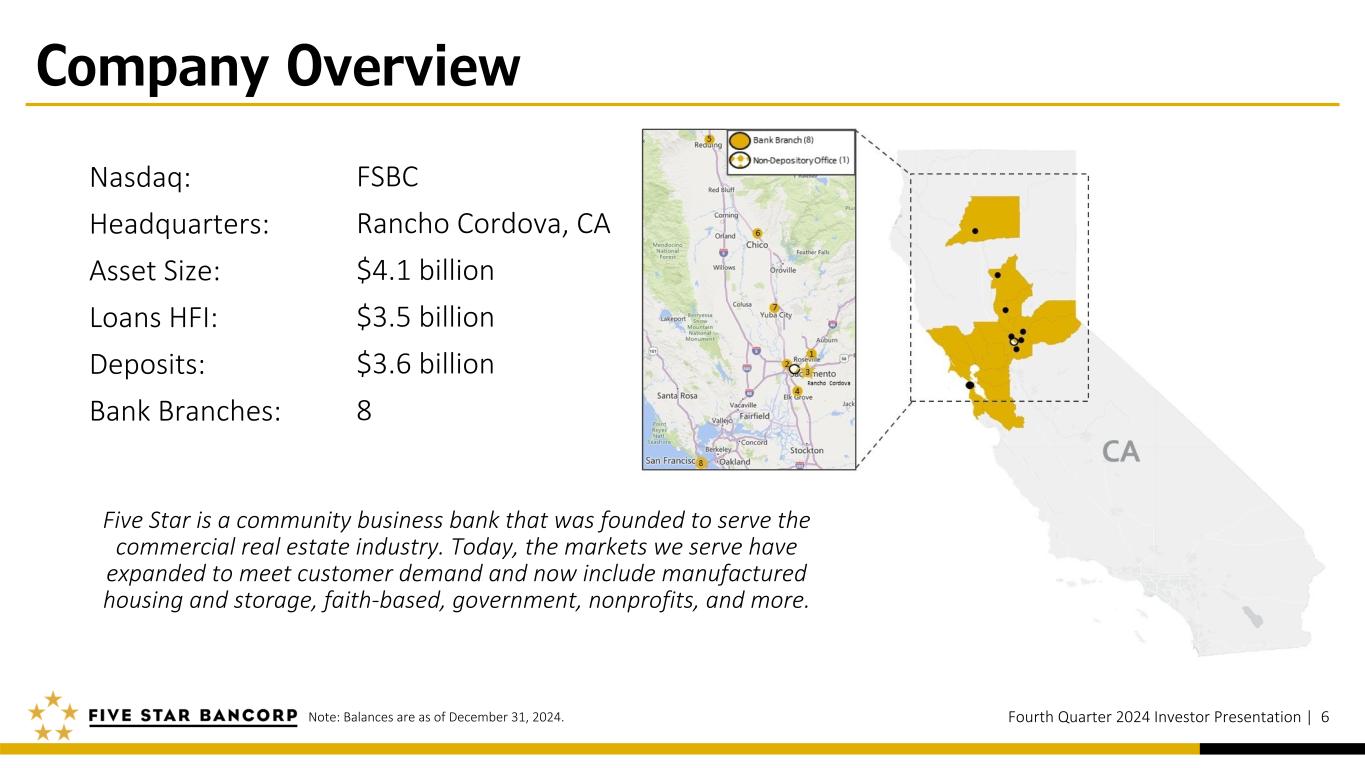

Company Overview Nasdaq: Headquarters: Asset Size: Loans HFI: Deposits: Bank Branches: Fourth Quarter 2024 Investor Presentation | 6 FSBC Rancho Cordova, CA $4.1 billion $3.5 billion $3.6 billion 8 Note: Balances are as of December 31, 2024. Five Star is a community business bank that was founded to serve the commercial real estate industry. Today, the markets we serve have expanded to meet customer demand and now include manufactured housing and storage, faith-based, government, nonprofits, and more.

Financial Highlights Fourth Quarter 2024 Investor Presentation | 7

$604 $811 $840 $973 $1,272 $1,480 $1,954 $2,557 $3,227 $3,593 $3,476 $3,634 $3,887 $4,053 $1,806 $2,535 $148 $22 Total Assets Excluding PPP Loans PPP Loans 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Consistent and Organic Asset Growth Fourth Quarter 2024 Investor Presentation | 8 Note: Dollars are in millions. Balances are end of period. References to PPP are the Paycheck Protection Program. 1. CAGR is based upon balances as of December 31, 2024. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) CAGR (1) 5 years 10 years Total Assets 22.33% 20.97%

Financial Highlights - December 31, 2024 Fourth Quarter 2024 Investor Presentation | 9 Growth • Continued balance sheet growth with increases in loans held for investment of $451.0 million and increases in deposits of $531.1 million since December 31, 2023. Funding • Non-interest-bearing deposits comprised 25.93% of total deposits, compared to 26.67% as of September 30, 2024 and 27.46% as of December 31, 2023. • Deposits comprised 97.30% of total liabilities, as compared to 97.22% of total liabilities as of September 30, 2024 and 91.52% of total liabilities as of December 31, 2023. Liquidity • Insured and collateralized deposits were approximately $2.4 billion, representing 66.92% of total deposits, compared to 63.90% as of September 30, 2024. • Cash and cash equivalents were $352.3 million, representing 9.90% of total deposits, compared to 7.38% as of September 30, 2024 and 10.62% as of December 31, 2023. Capital • All capital ratios were above well-capitalized regulatory thresholds. • On October 17, 2024 and January 16, 2025, the Company declared cash dividends of $0.20 per share for the three months ended September 30, 2024 and December 31, 2024, respectively.

Loans and Credit Quality Fourth Quarter 2024 Investor Presentation | 10

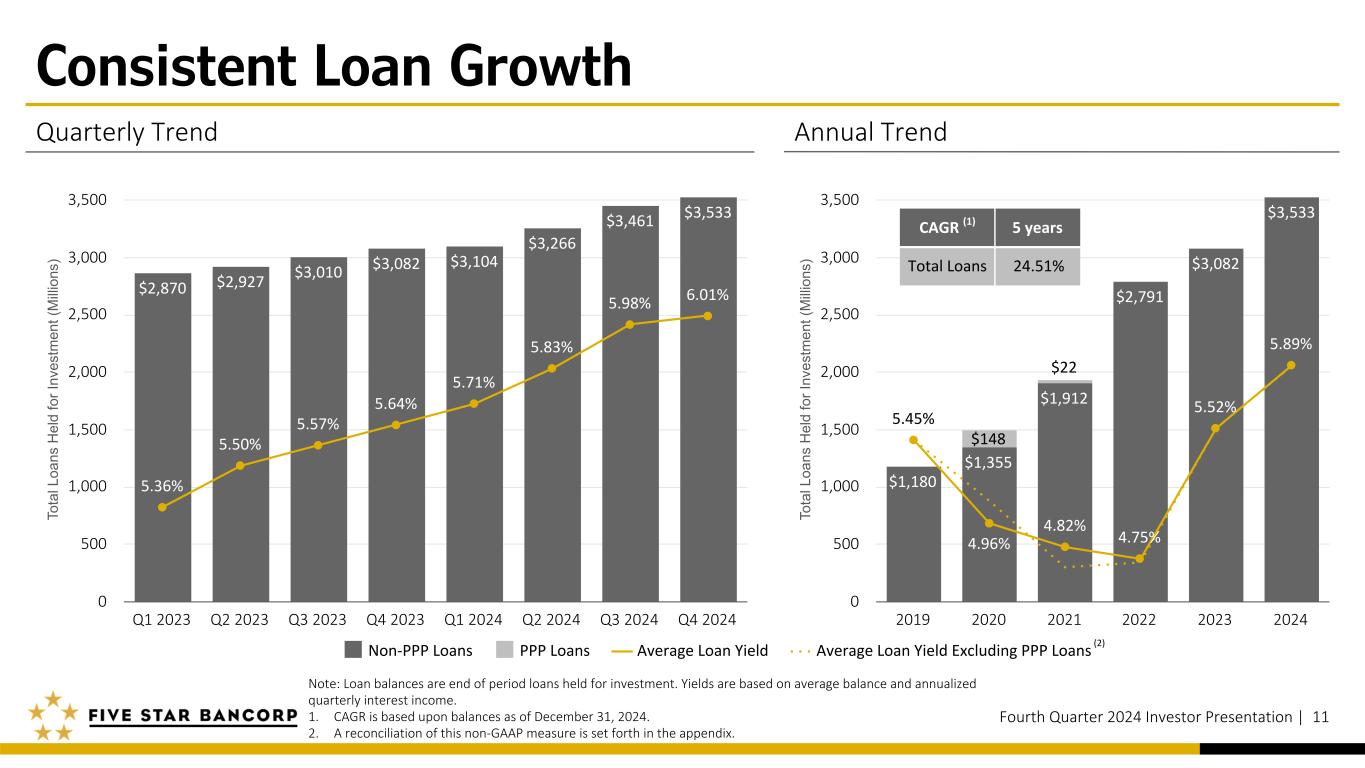

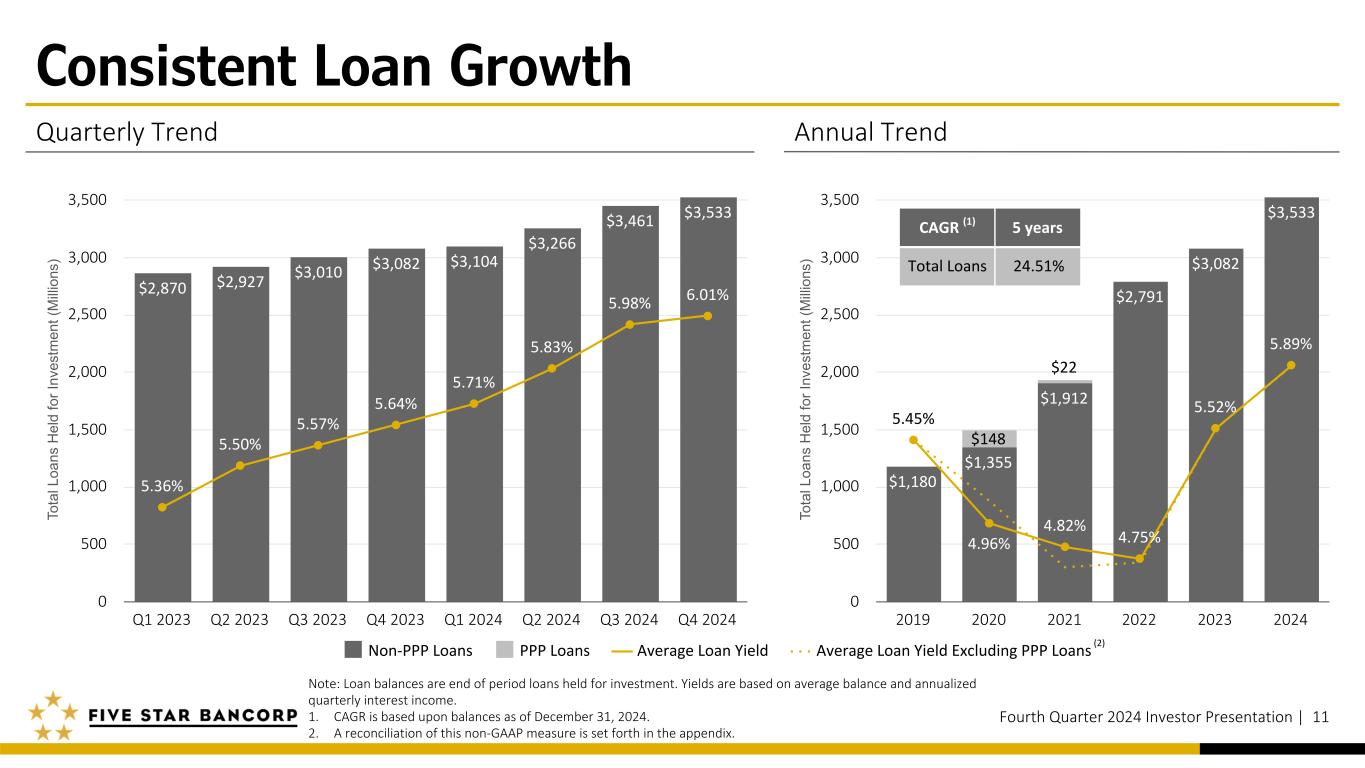

$148 $22 4.93% 5.28% 5.45% 4.96% 4.71% 6.01%Non-PPP Loans PPP Loans Average Loan Yield Average Loan Yield Excluding PPP Loans Consistent Loan Growth To ta l L oa ns H el d fo r I nv es tm en t ( M ill io ns ) $2,870 $2,927 $3,010 $3,082 $3,104 $3,266 $3,461 $3,533 5.36% 5.50% 5.57% 5.64% 5.71% 5.83% 5.98% 6.01% Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Fourth Quarter 2024 Investor Presentation | 11 Note: Loan balances are end of period loans held for investment. Yields are based on average balance and annualized quarterly interest income. 1. CAGR is based upon balances as of December 31, 2024. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) Quarterly Trend To ta l L oa ns H el d fo r I nv es tm en t ( M ill io ns ) $1,180 $1,355 $1,912 $2,791 $3,082 $3,533 $148 $22 5.45% 4.96% 4.82% 4.75% 5.52% 5.89% 2019 2020 2021 2022 2023 2024 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Annual Trend CAGR (1) 5 years Total Loans 24.51%

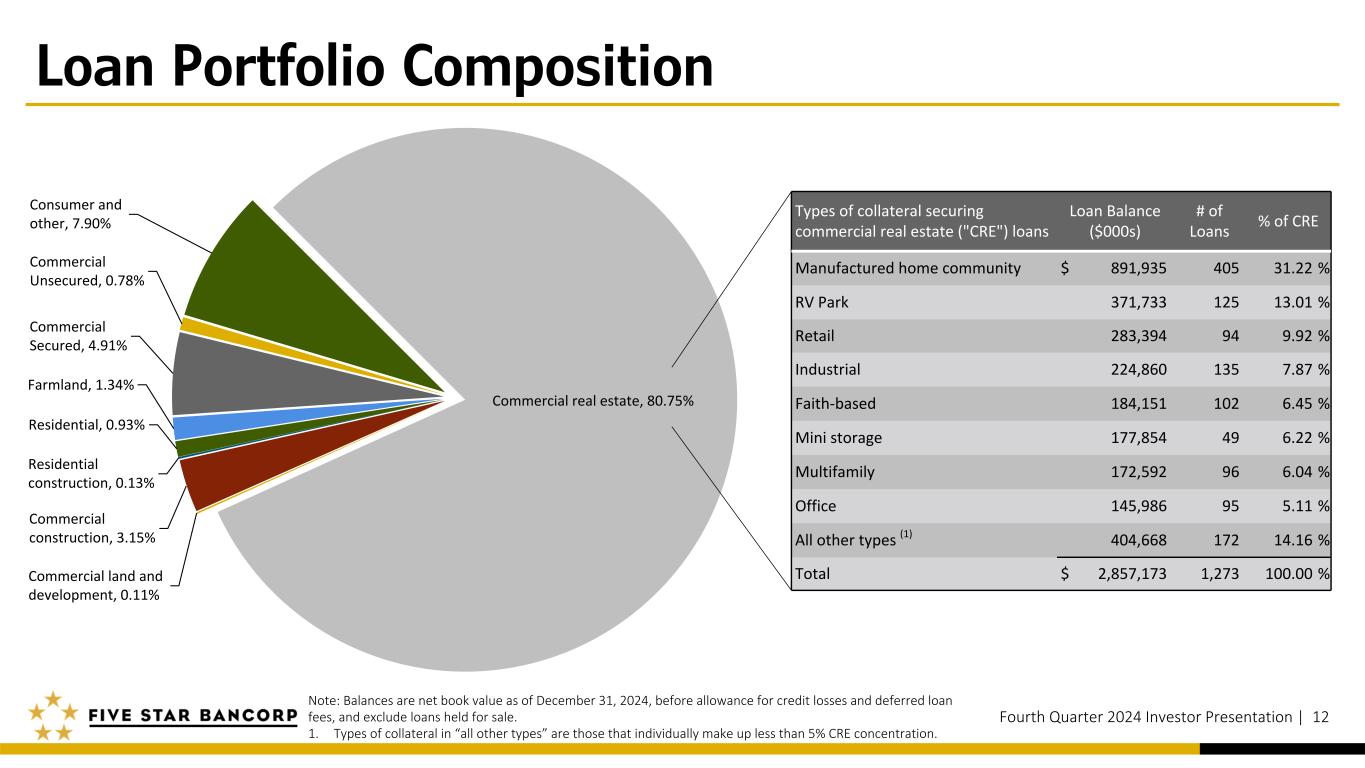

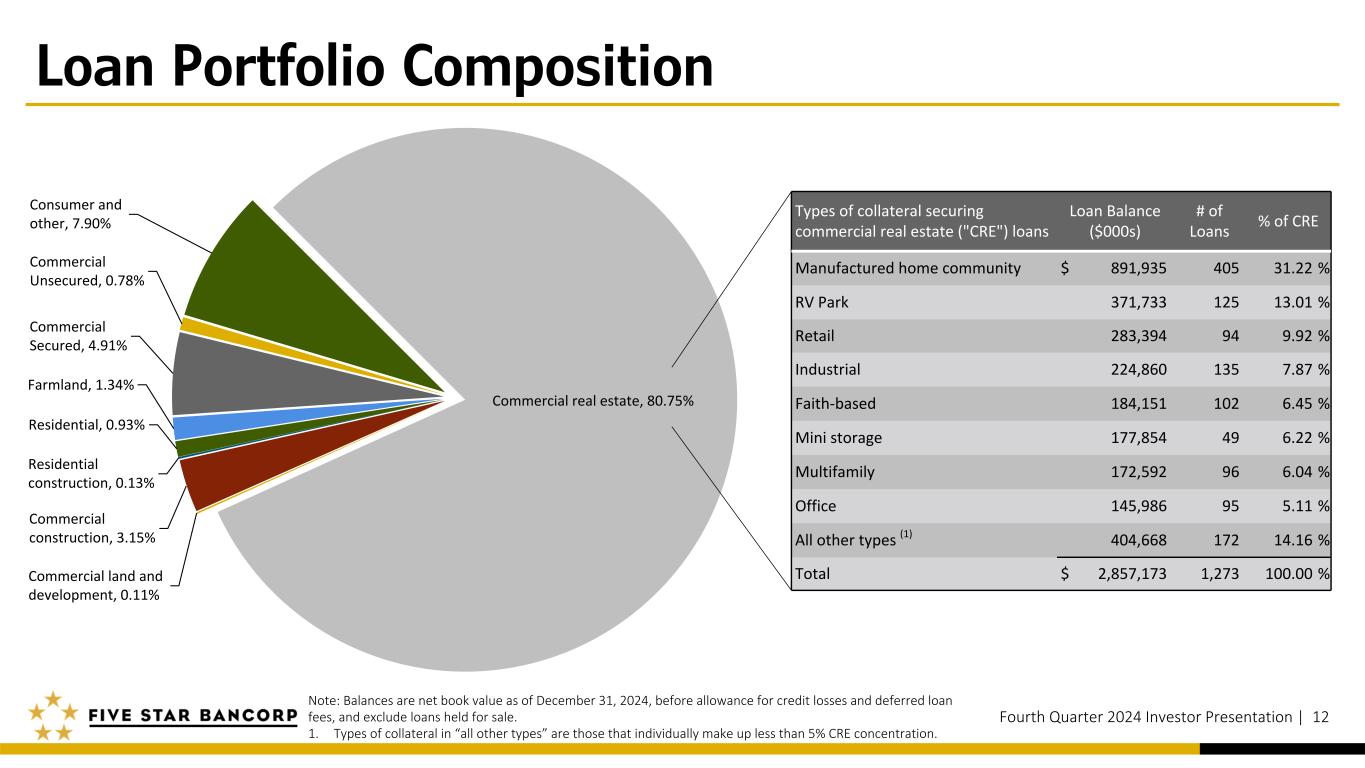

Loan Portfolio Composition Fourth Quarter 2024 Investor Presentation | 12 Commercial real estate, 80.75% Commercial land and development, 0.11% Commercial construction, 3.15% Residential construction, 0.13% Residential, 0.93% Farmland, 1.34% Commercial Secured, 4.91% Commercial Unsecured, 0.78% PPP, 0.00% Consumer and other, 7.90% Types of collateral securing commercial real estate ("CRE") loans Loan Balance ($000s) # of Loans % of CRE Manufactured home community $ 891,935 405 31.22 % RV Park 371,733 125 13.01 % Retail 283,394 94 9.92 % Industrial 224,860 135 7.87 % Faith-based 184,151 102 6.45 % Mini storage 177,854 49 6.22 % Multifamily 172,592 96 6.04 % Office 145,986 95 5.11 % All other types (1) 404,668 172 14.16 % Total $ 2,857,173 1,273 100.00 % Note: Balances are net book value as of December 31, 2024, before allowance for credit losses and deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration.

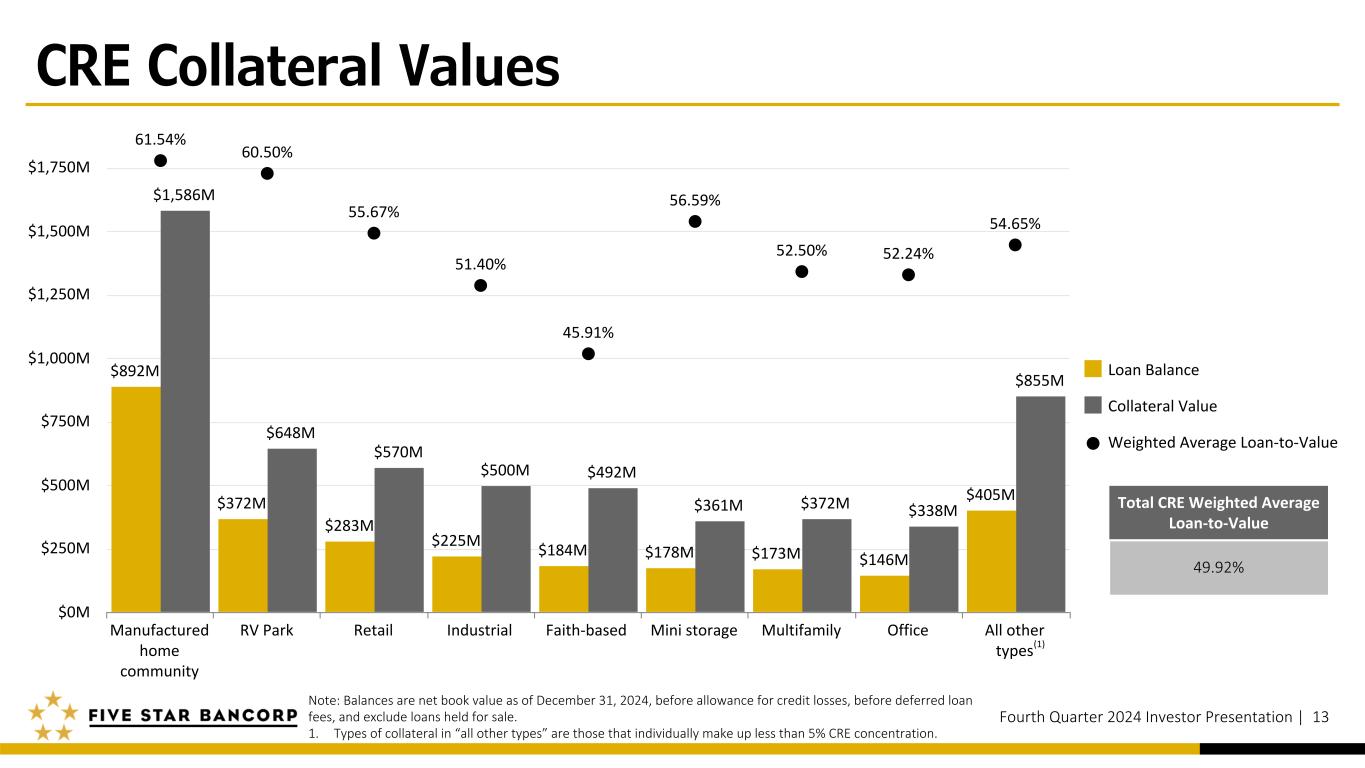

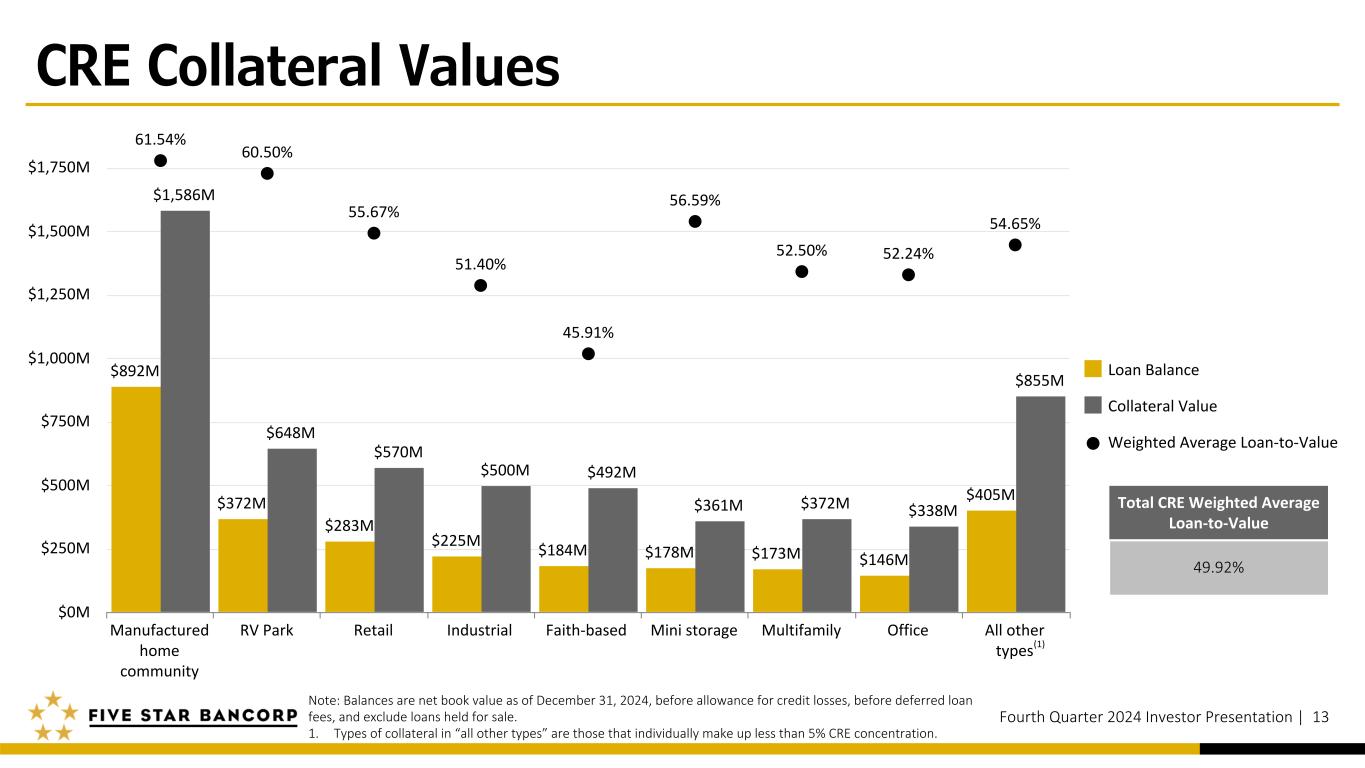

$892M $372M $283M $225M $184M $178M $173M $146M $405M $1,586M $648M $570M $500M $492M $361M $372M $338M $855M 61.54% 60.50% 55.67% 51.40% 45.91% 56.59% 52.50% 52.24% 54.65% Loan Balance Collateral Value Weighted Average Loan-to-Value Manufactured home community RV Park Retail Industrial Faith-based Mini storage Multifamily Office All other types $0M $250M $500M $750M $1,000M $1,250M $1,500M $1,750M CRE Collateral Values Fourth Quarter 2024 Investor Presentation | 13 (1) Note: Balances are net book value as of December 31, 2024, before allowance for credit losses, before deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration. Total CRE Weighted Average Loan-to-Value 49.92%

Loan Portfolio Diversification We focus primarily on commercial lending, with an emphasis on commercial real estate. We offer a variety of loans to small and medium-sized businesses, professionals, and individuals, including commercial real estate, commercial land and construction, and farmland loans. To a lesser extent, we also offer residential real estate, construction real estate, and consumer loans. Fourth Quarter 2024 Investor Presentation | 14Note: Balances are net book value as of December 31, 2024, before allowance for credit losses, before deferred loan fees, and exclude loans held for sale. Loans by Type Loans by Purpose Real Estate Loans by Geography CML Term CRE NOO, 36.4% CML Term Multifamily, 30.1% CML Term CRE OO, 14.0% CSM Unsecured, 7.7% CML Const CRE, 3.1% CML Secured, 2.9%CML Term Ag RE, 1.3% SBA 7A Secured, 1.2% Others, 3.3% CA, 57.7% TX, 7.2% NC, 3.1% AZ, 2.9% FL, 2.5% OR, 2.4% NV, 2.3%GA, 1.9%TN, 1.7%CO, 1.3% WI, 1.2% MO, 1.2% WA, 1.2% PA, 1.1% Other, 12.3% CRE Manufactured Home, 25.2% CRE Other, 11.5% CRE RV Park, 10.5% CRE Retail, 8.0% Consumer Unsecured, 7.7% Commercial Other, 7.7% CRE Industrial, 6.4% CRE Faith-based, 5.2% CRE Mini Storage, 5.0%CRE Multifamily, 4.9% CRE Office, 4.1% Commercial Construction, 3.3% Others, 0.5%

Loan Rollforward Fourth Quarter 2024 Investor Presentation | 15Note: Dollars are in millions. Beginning and ending balances are as of period end, before allowance for credit losses, including deferred loan fees, and excluding loans held for sale. $135 $254 $135 $144 $150 $390 $334 $263 $(38) $(158) $(39) $(59) $(51) $(155) $(99) $(119)$(18) $(39) $(13) $(13) $(77) $(73) $(41) $(72) Originations & Advances Paydowns Payoffs Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Beginning Balance $ 2,791 $ 2,870 $ 2,927 $ 3,010 $ 3,082 $ 3,104 $ 3,266 $ 3,461 Ending Balance $ 2,870 $ 2,927 $ 3,010 $ 3,082 $ 3,104 $ 3,266 $ 3,461 $ 3,533

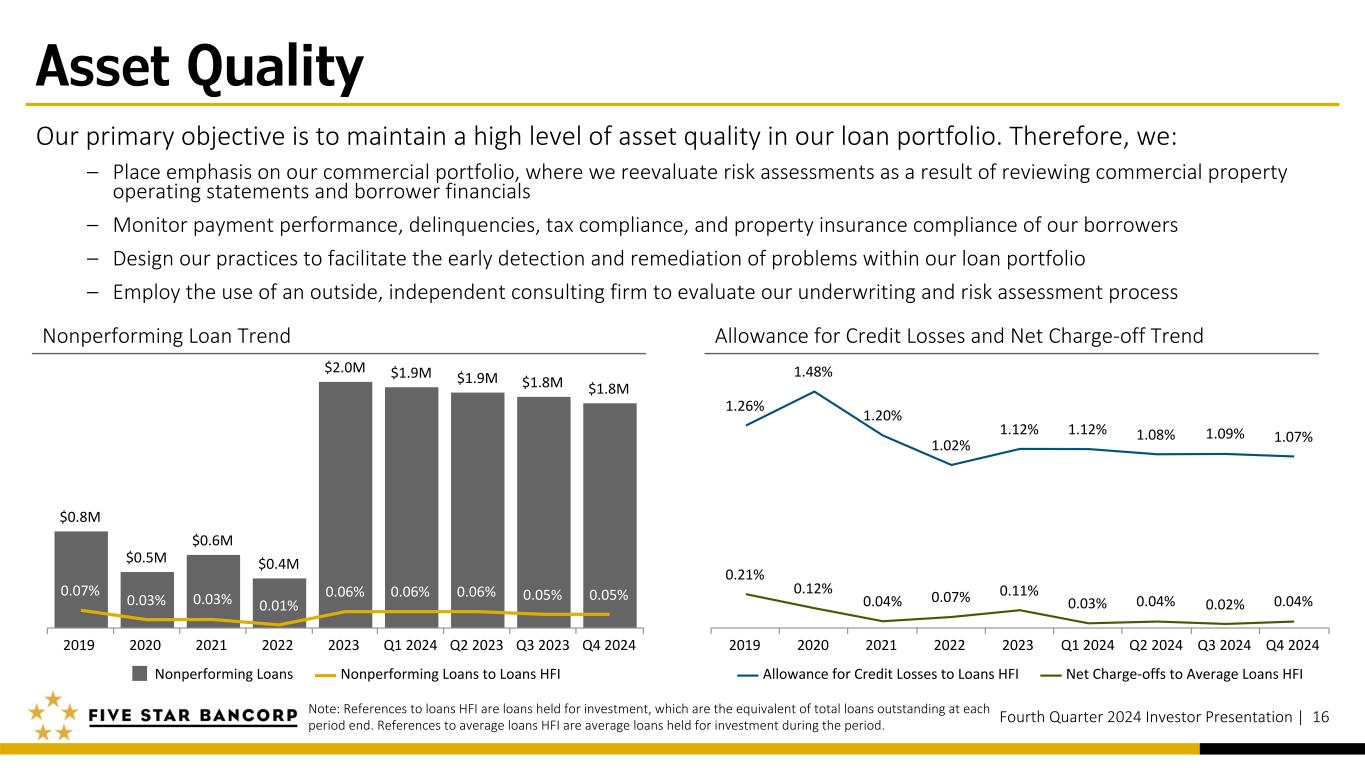

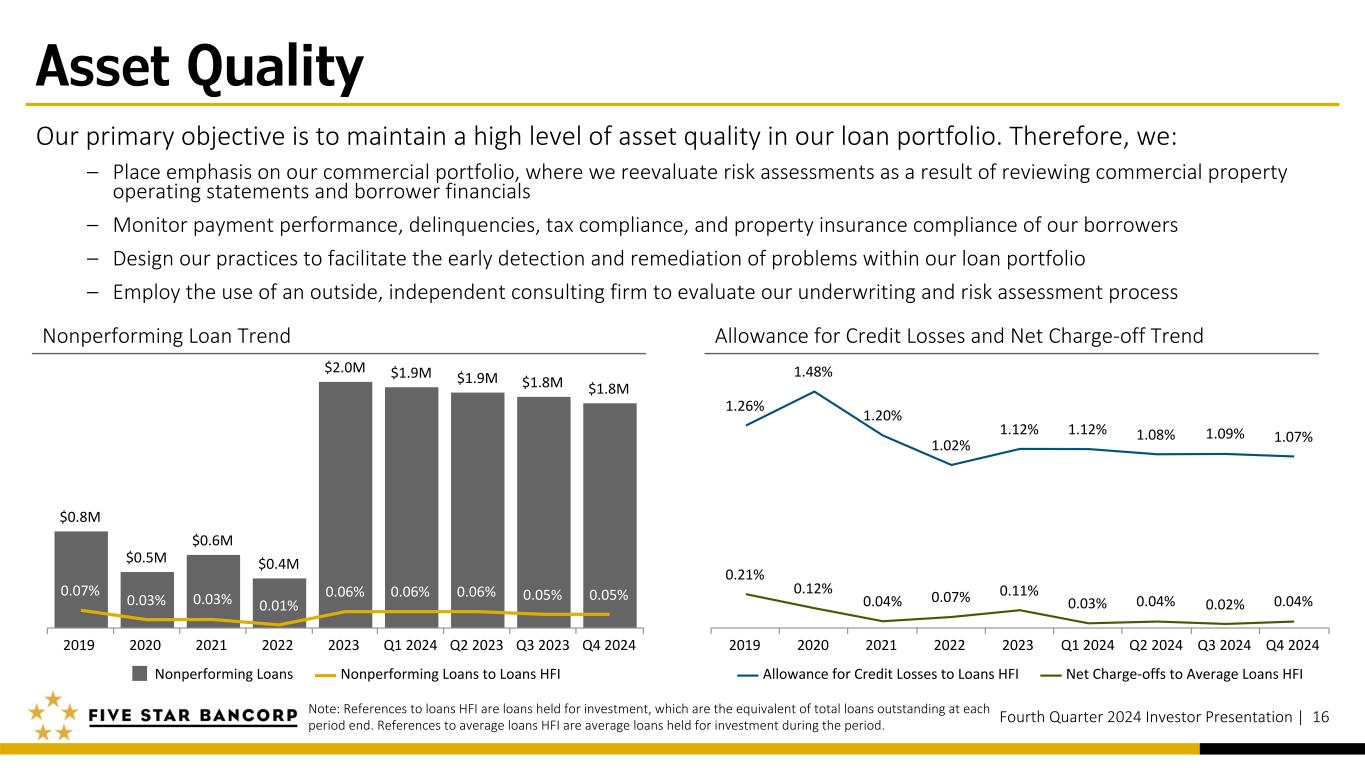

Asset Quality Fourth Quarter 2024 Investor Presentation | 16 Nonperforming Loan Trend Allowance for Credit Losses and Net Charge-off Trend Note: References to loans HFI are loans held for investment, which are the equivalent of total loans outstanding at each period end. References to average loans HFI are average loans held for investment during the period. $0.8M $0.5M $0.6M $0.4M $2.0M $1.9M $1.9M $1.8M $1.8M 0.07% 0.03% 0.03% 0.01% 0.06% 0.06% 0.06% 0.05% 0.05% Nonperforming Loans Nonperforming Loans to Loans HFI 2019 2020 2021 2022 2023 Q1 2024 Q2 2023 Q3 2023 Q4 2024 1.26% 1.48% 1.20% 1.02% 1.12% 1.12% 1.08% 1.09% 1.07% 0.21% 0.12% 0.04% 0.07% 0.11% 0.03% 0.04% 0.02% 0.04% Allowance for Credit Losses to Loans HFI Net Charge-offs to Average Loans HFI 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Our primary objective is to maintain a high level of asset quality in our loan portfolio. Therefore, we: – Place emphasis on our commercial portfolio, where we reevaluate risk assessments as a result of reviewing commercial property operating statements and borrower financials – Monitor payment performance, delinquencies, tax compliance, and property insurance compliance of our borrowers – Design our practices to facilitate the early detection and remediation of problems within our loan portfolio – Employ the use of an outside, independent consulting firm to evaluate our underwriting and risk assessment process

Allocation of Allowance for Credit Losses Fourth Quarter 2024 Investor Presentation | 17 (in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Allowance for Credit Losses Amount % of Total Amount % of Total Amount % of Total Amount % of Total Amount % of Total Real estate: Commercial $ 29,015 84.27 % $ 28,895 83.40 % $ 24,708 69.79 % $ 26,217 69.74 % $ 25,864 68.44 % Commercial land & development 178 0.52 % 164 0.47 % 72 0.20 % 89 0.24 % 78 0.21 % Commercial construction 718 2.08 % 697 2.01 % 1,097 3.10 % 1,756 4.67 % 2,268 6.00 % Residential construction 89 0.26 % 114 0.33 % 100 0.28 % 47 0.13 % 64 0.17 % Residential 151 0.44 % 164 0.47 % 195 0.55 % 284 0.76 % 270 0.71 % Farmland 399 1.16 % 438 1.26 % 402 1.14 % 581 1.55 % 607 1.61 % Total real estate loans 30,550 88.73 % 30,472 87.94 % 26,574 75.06 % 28,974 77.09 % 29,151 77.14 % Commercial: Secured 3,314 9.62 % 3,262 9.41 % 7,386 20.86 % 6,049 16.10 % 5,866 15.52 % Unsecured 189 0.55 % 259 0.75 % 214 0.60 % 251 0.67 % 278 0.74 % Total commercial loans 3,503 10.17 % 3,521 10.16 % 7,600 21.46 % 6,300 16.77 % 6,144 16.26 % Consumer and other 378 1.10 % 660 1.90 % 1,232 3.48 % 2,309 6.14 % 2,496 6.60 % Total allowance for credit losses $ 34,431 100.00 % $ 34,653 100.00 % $ 35,406 100.00 % $ 37,583 100.00 % $ 37,791 100.00 %

Risk Grade Migration Fourth Quarter 2024 Investor Presentation | 18 Classified Loans (Loans Rated Substandard or Doubtful) (in thousands) 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Real estate: Commercial $ 1,892 $ 1,852 $ 1,822 $ 1,787 $ 2,587 Commercial land and development — — — — — Commercial construction — — — — — Residential construction — — — — — Residential — — — — — Farmland — — — — — Commercial: Secured 72 66 60 54 48 Unsecured — — — — — Consumer and other 12 11 10 9 9 Total $ 1,976 $ 1,929 $ 1,892 $ 1,850 $ 2,644 % of Loan Portfolio Outstanding by Risk Grade: Pass 98.66 % 98.27 % 98.17 % 97.33 % 96.44 % Watch 1.28 % 1.67 % 1.77 % 2.62 % 3.49 % Substandard 0.06 % 0.06 % 0.06 % 0.05 % 0.07 % Note: Loan portfolio outstanding is the total balance of loans outstanding at period end, before deferred loan fees, before allowance for loan losses, and excluding loans held for sale.

Deposit and Capital Overview Fourth Quarter 2024 Investor Presentation | 19

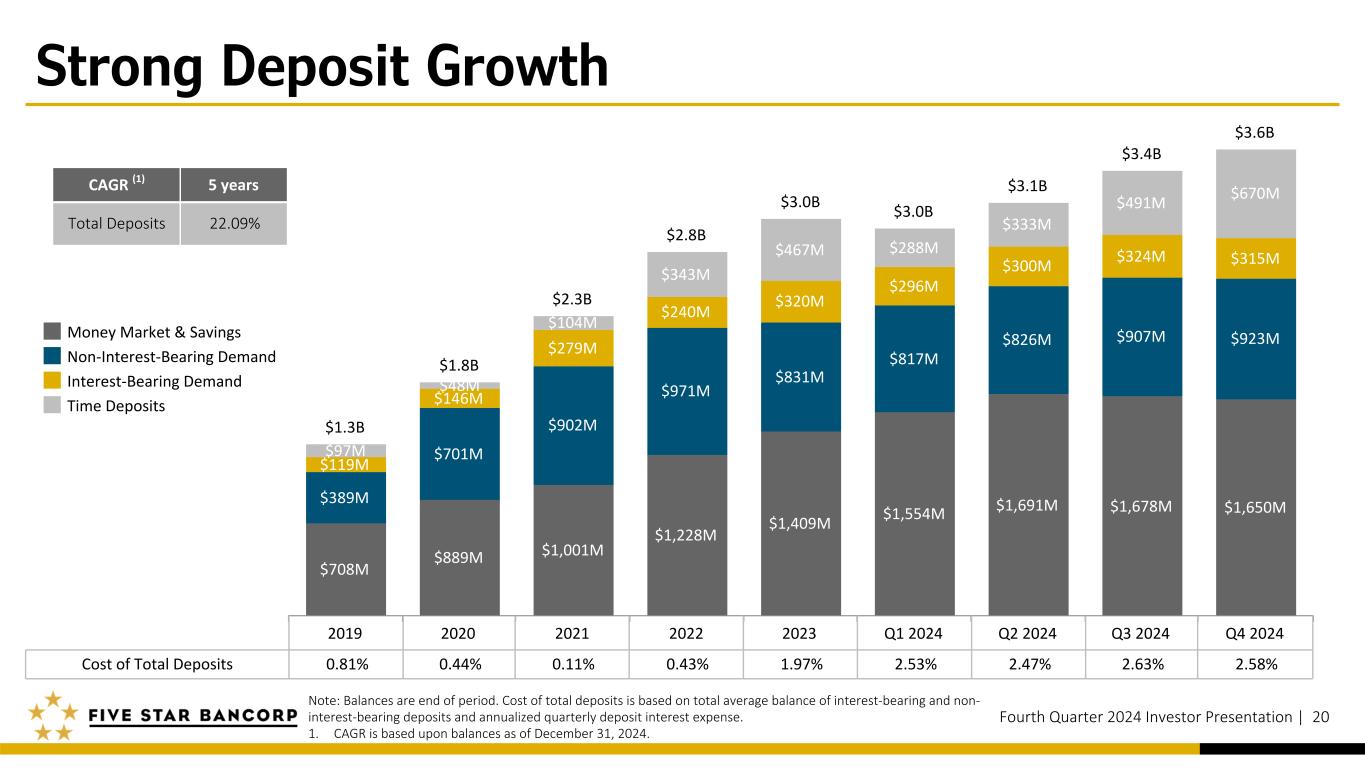

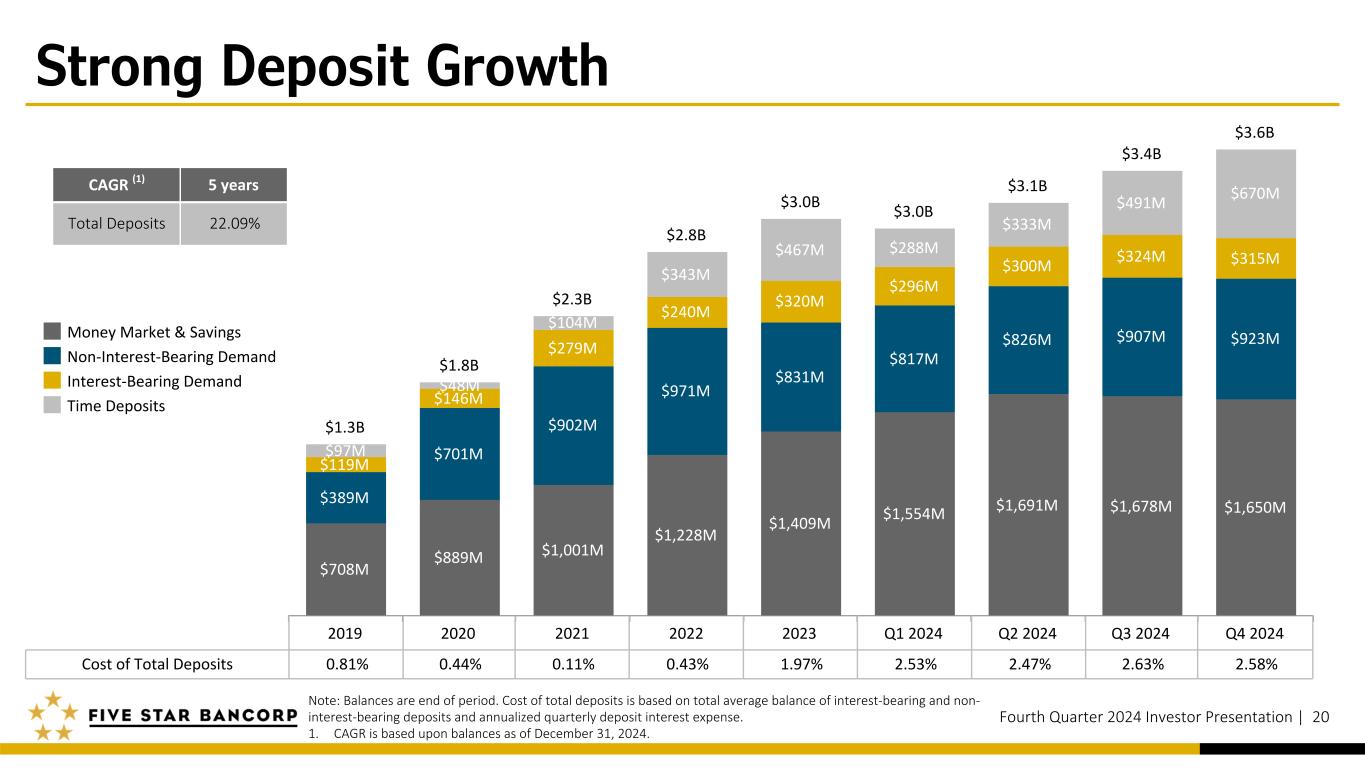

$1.3B $1.8B $2.3B $2.8B $3.0B $3.0B $3.1B $3.4B $3.6B $708M $889M $1,001M $1,228M $1,409M $1,554M $1,691M $1,678M $1,650M$389M $701M $902M $971M $831M $817M $826M $907M $923M $119M $146M $279M $240M $320M $296M $300M $324M $315M $97M $48M $104M $343M $467M $288M $333M $491M $670M Money Market & Savings Non-Interest-Bearing Demand Interest-Bearing Demand Time Deposits 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Strong Deposit Growth Fourth Quarter 2024 Investor Presentation | 20 Note: Balances are end of period. Cost of total deposits is based on total average balance of interest-bearing and non- interest-bearing deposits and annualized quarterly deposit interest expense. 1. CAGR is based upon balances as of December 31, 2024. Cost of Total Deposits 0.81% 0.44% 0.11% 0.43% 1.97% 2.53% 2.47% 2.63% 2.58% CAGR (1) 5 years Total Deposits 22.09%

Diversified Funding Fourth Quarter 2024 Investor Presentation | 21 Total Deposits(1) = $3.6 billion 97.3% of Total Liabilities Liability Mix 1. Balance as of December 31, 2024. 2. Loan balance in loan to deposit ratio is total loans held for investment and sale at period end. Loan(2) to Deposit Ratio Non-Interest-Bearing Deposits to Total Deposits 90.5% 84.5% 85.1% 100.7% 102.2% 105.4% 103.9% 101.9% 99.4% 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 29.6% 39.3% 39.5% 34.9% 27.5% 27.7% 26.2% 26.7% 25.9% 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Money Market, 41.7% Non-Interest- Bearing Demand, 25.2% Time Deposits, 18.3% Interest-Bearing Demand, 8.6% Savings, 3.4% Borrowings & Subordinated Debt, 2.0% Other Liabilities, 0.8%

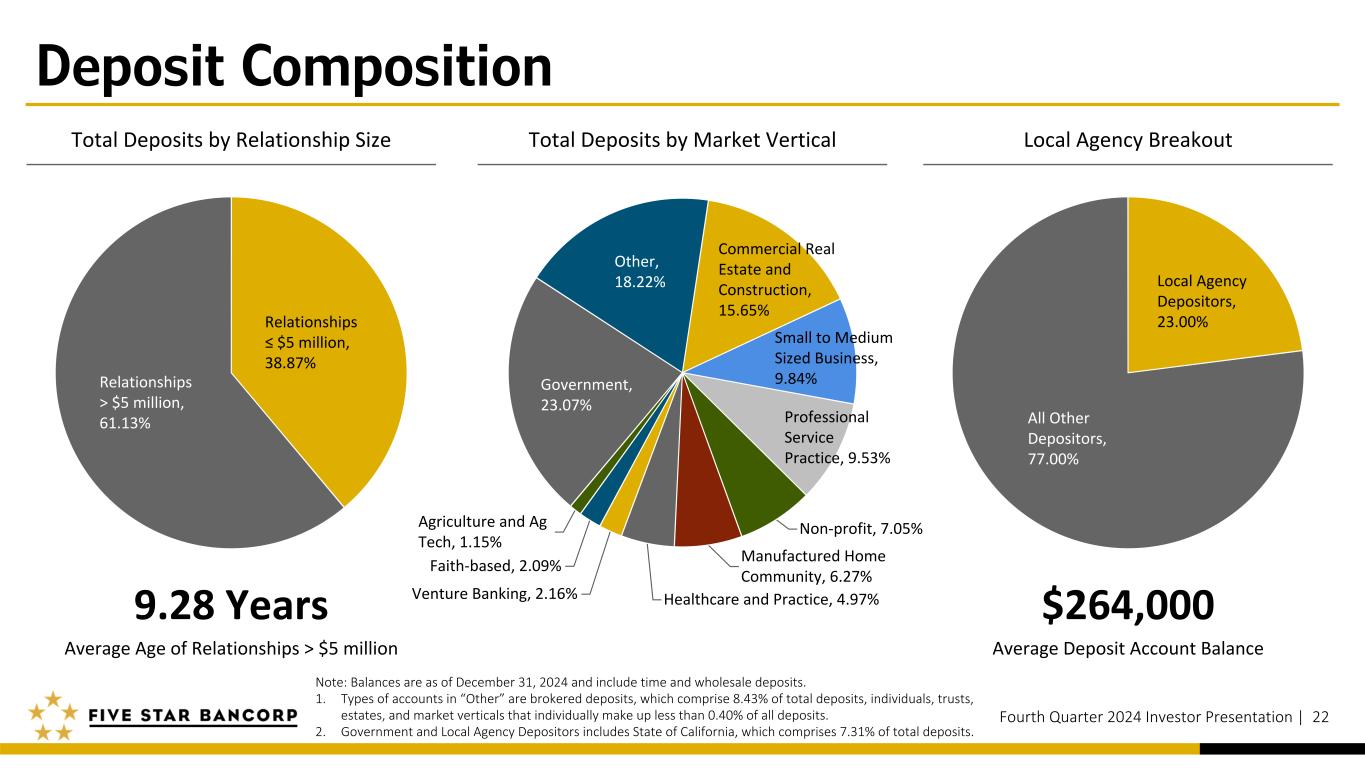

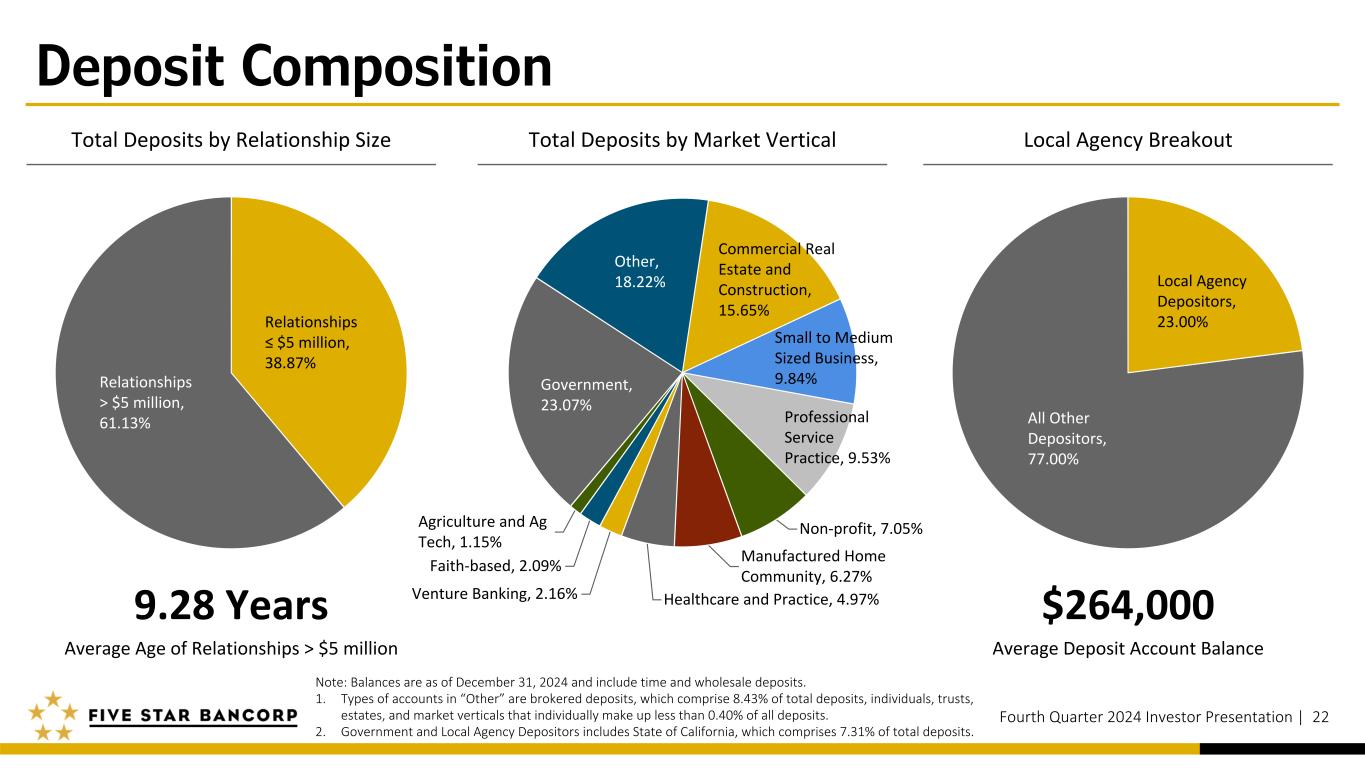

Deposit Composition Fourth Quarter 2024 Investor Presentation | 22 Note: Balances are as of December 31, 2024 and include time and wholesale deposits. 1. Types of accounts in “Other” are brokered deposits, which comprise 8.43% of total deposits, individuals, trusts, estates, and market verticals that individually make up less than 0.40% of all deposits. 2. Government and Local Agency Depositors includes State of California, which comprises 7.31% of total deposits. Total Deposits by Relationship Size Local Agency BreakoutTotal Deposits by Market Vertical Local Agency Depositors, 23.00% All Other Depositors, 77.00% Government, 23.07% Other, 18.22% Commercial Real Estate and Construction, 15.65% Small to Medium Sized Business, 9.84% Professional Service Practice, 9.53% Non-profit, 7.05% Manufactured Home Community, 6.27% Healthcare and Practice, 4.97%Venture Banking, 2.16% Faith-based, 2.09% Agriculture and Ag Tech, 1.15% Relationships > $5 million, 61.13% Relationships ≤ $5 million, 38.87% 9.28 Years Average Age of Relationships > $5 million $264,000 Average Deposit Account Balance

Capital Ratios Fourth Quarter 2024 Investor Presentation | 23 Tier 1 Leverage Ratio Tier 1 Capital to RWA Total Capital to RWA Common Equity Tier 1 to RWA Note: References to RWA are risk-weighted assets. 7.51% 6.58% 9.47% 8.60% 8.73% 10.05% 2019 2020 2021 2022 2023 2024 8.21% 8.98% 11.44% 8.99% 9.07% 11.02% 2019 2020 2021 2022 2023 2024 8.21% 8.98% 11.44% 8.99% 9.07% 11.02% 2019 2020 2021 2022 2023 2024 11.52% 12.18% 13.98% 12.46% 12.30% 13.99% 2019 2020 2021 2022 2023 2024

Financial Results Fourth Quarter 2024 Investor Presentation | 24

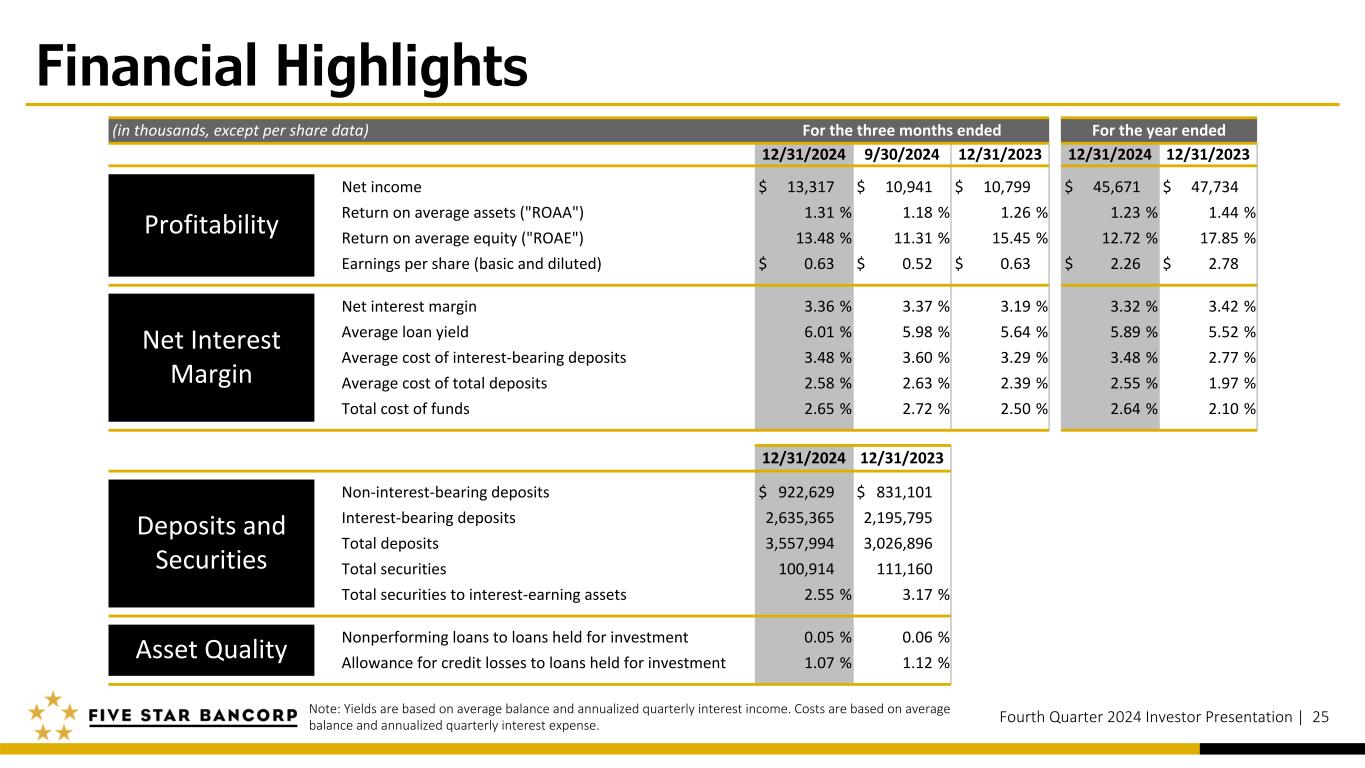

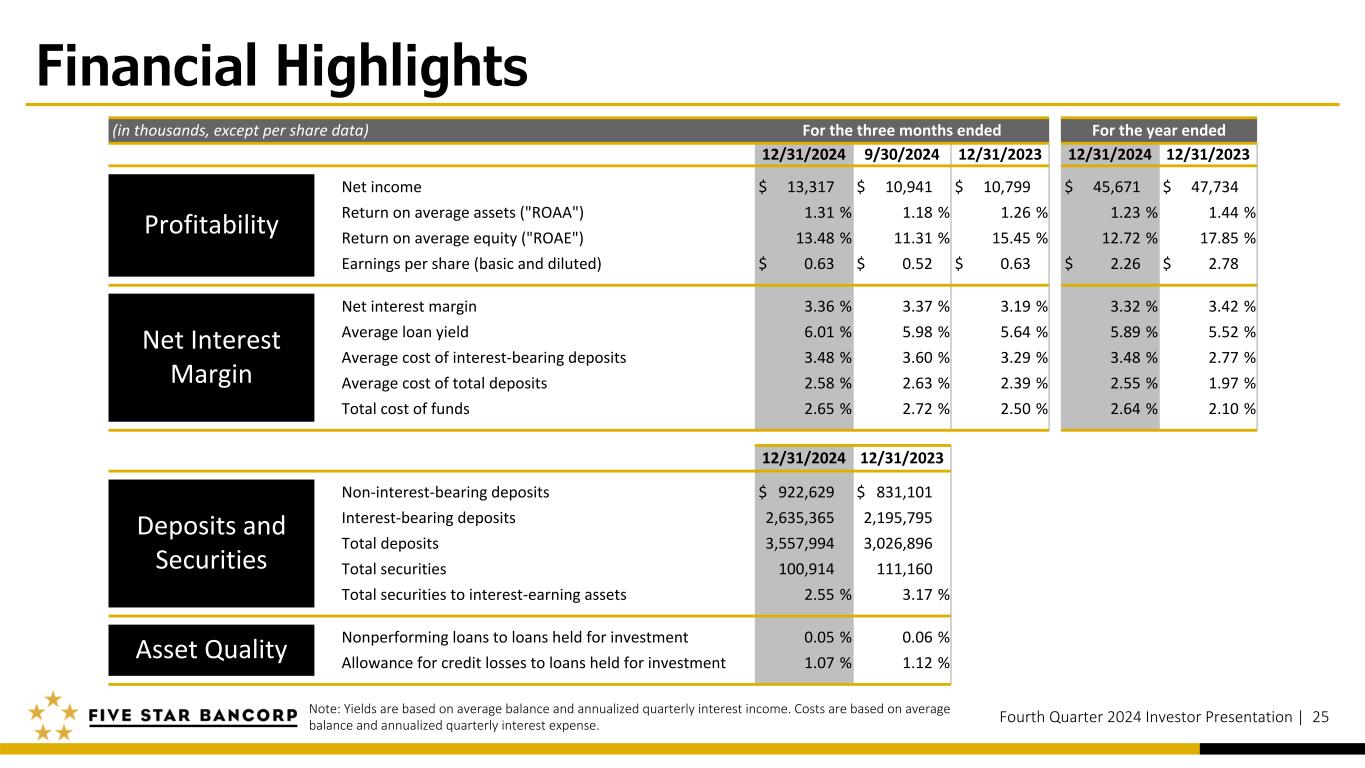

Financial Highlights Fourth Quarter 2024 Investor Presentation | 25 (in thousands, except per share data) For the three months ended For the year ended 12/31/2024 9/30/2024 12/31/2023 12/31/2024 12/31/2023 Profitability Net income $ 13,317 $ 10,941 $ 10,799 $ 45,671 $ 47,734 Return on average assets ("ROAA") 1.31 % 1.18 % 1.26 % 1.23 % 1.44 % Return on average equity ("ROAE") 13.48 % 11.31 % 15.45 % 12.72 % 17.85 % Earnings per share (basic and diluted) $ 0.63 $ 0.52 $ 0.63 $ 2.26 $ 2.78 Net Interest Margin Net interest margin 3.36 % 3.37 % 3.19 % 3.32 % 3.42 % Average loan yield 6.01 % 5.98 % 5.64 % 5.89 % 5.52 % Average cost of interest-bearing deposits 3.48 % 3.60 % 3.29 % 3.48 % 2.77 % Average cost of total deposits 2.58 % 2.63 % 2.39 % 2.55 % 1.97 % Total cost of funds 2.65 % 2.72 % 2.50 % 2.64 % 2.10 % 12/31/2024 12/31/2023 Deposits and Securities Non-interest-bearing deposits $ 922,629 $ 831,101 Interest-bearing deposits 2,635,365 2,195,795 Total deposits 3,557,994 3,026,896 Total securities 100,914 111,160 Total securities to interest-earning assets 2.55 % 3.17 % Asset Quality Nonperforming loans to loans held for investment 0.05 % 0.06 % Allowance for credit losses to loans held for investment 1.07 % 1.12 % Note: Yields are based on average balance and annualized quarterly interest income. Costs are based on average balance and annualized quarterly interest expense.

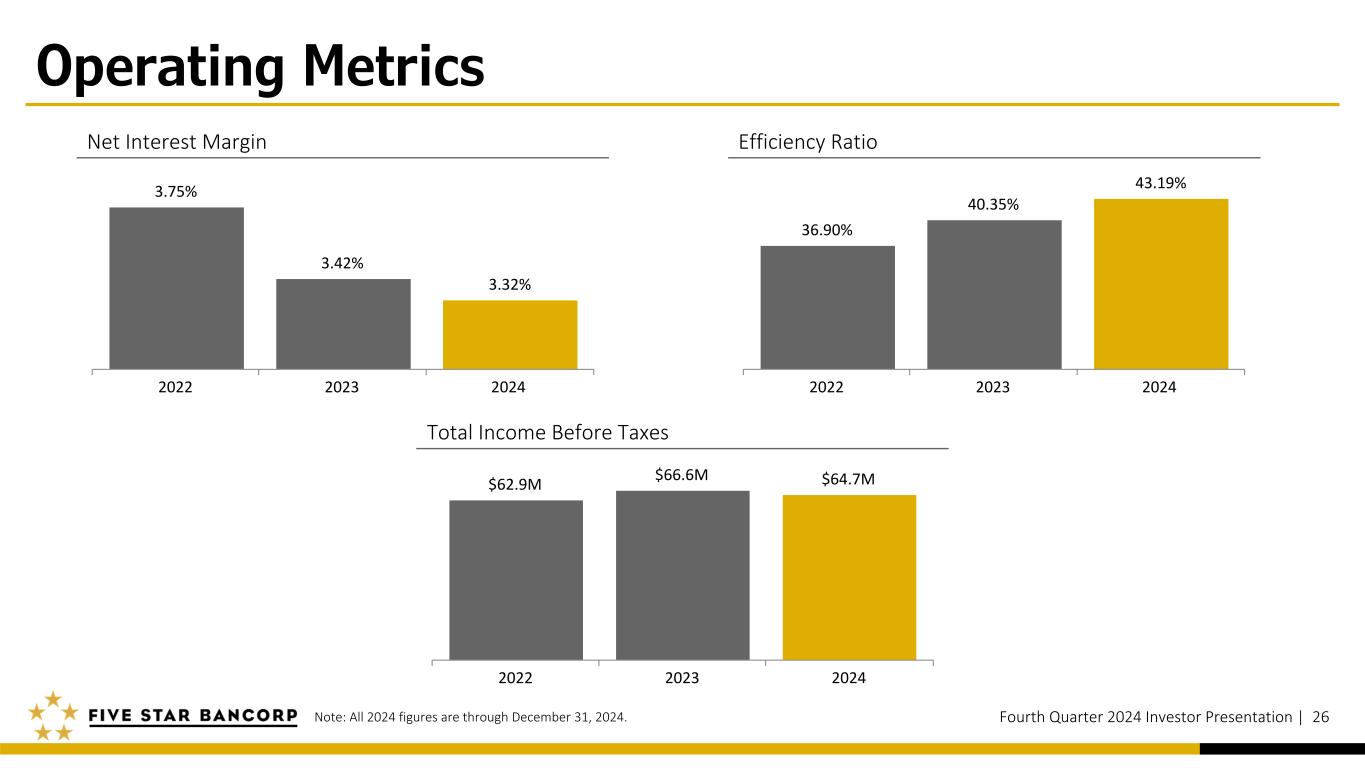

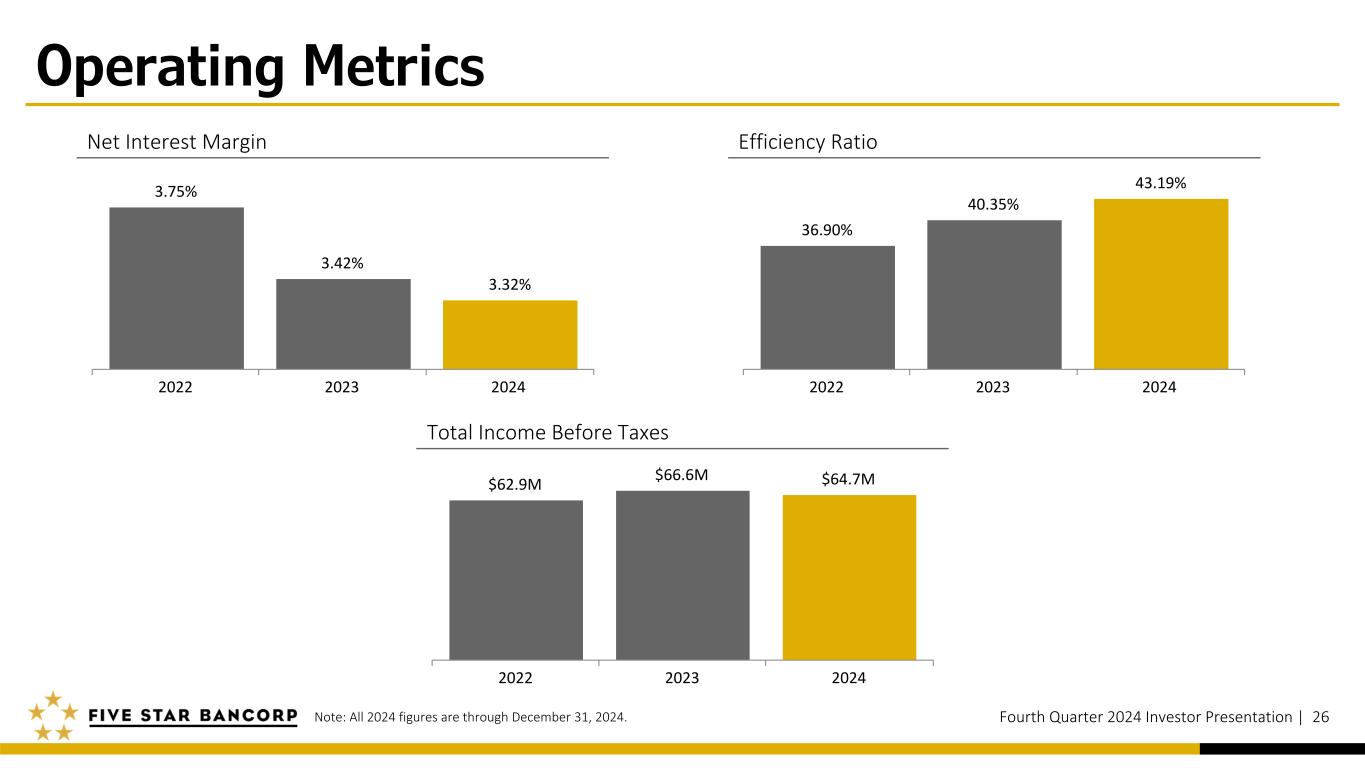

Operating Metrics Fourth Quarter 2024 Investor Presentation | 26 Efficiency RatioNet Interest Margin 3.75% 3.42% 3.32% 2022 2023 2024 36.90% 40.35% 43.19% 2022 2023 2024 Note: All 2024 figures are through December 31, 2024. Total Income Before Taxes $62.9M $66.6M $64.7M 2022 2023 2024

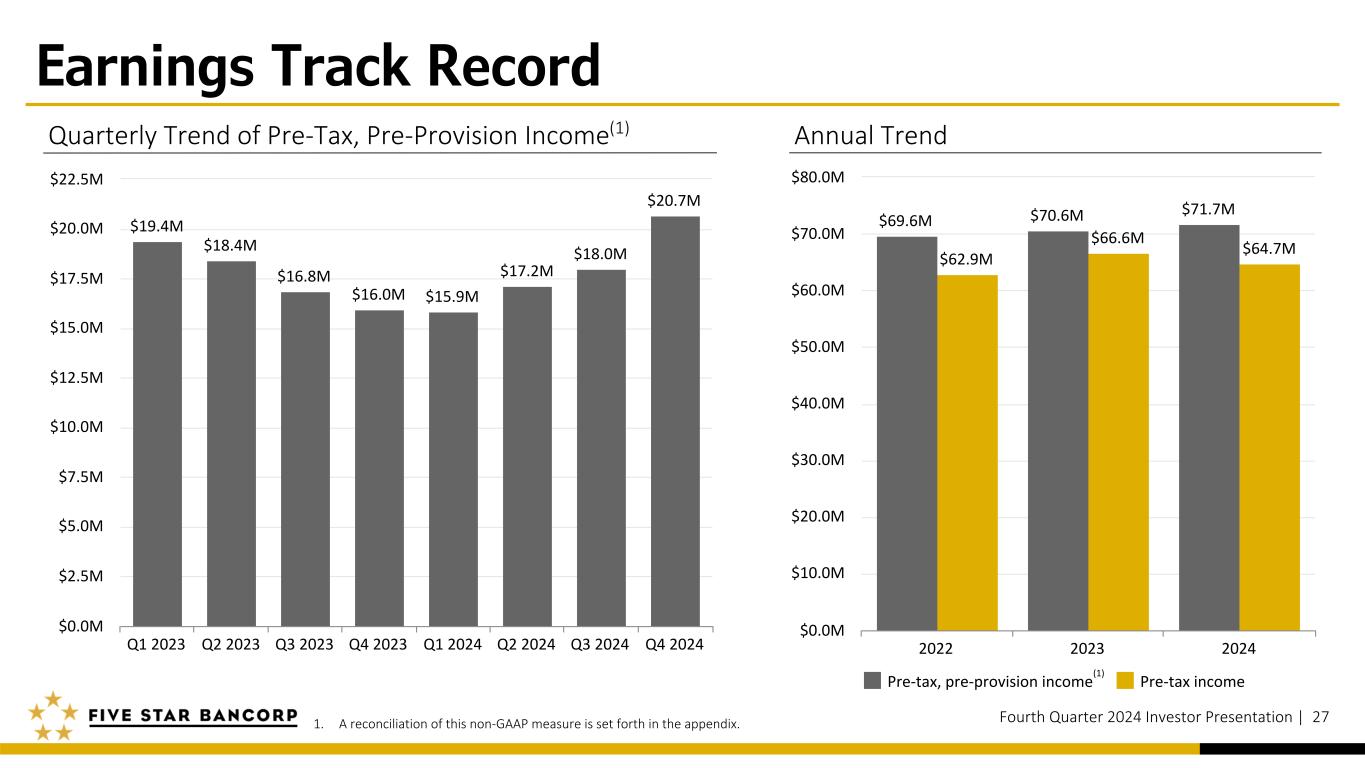

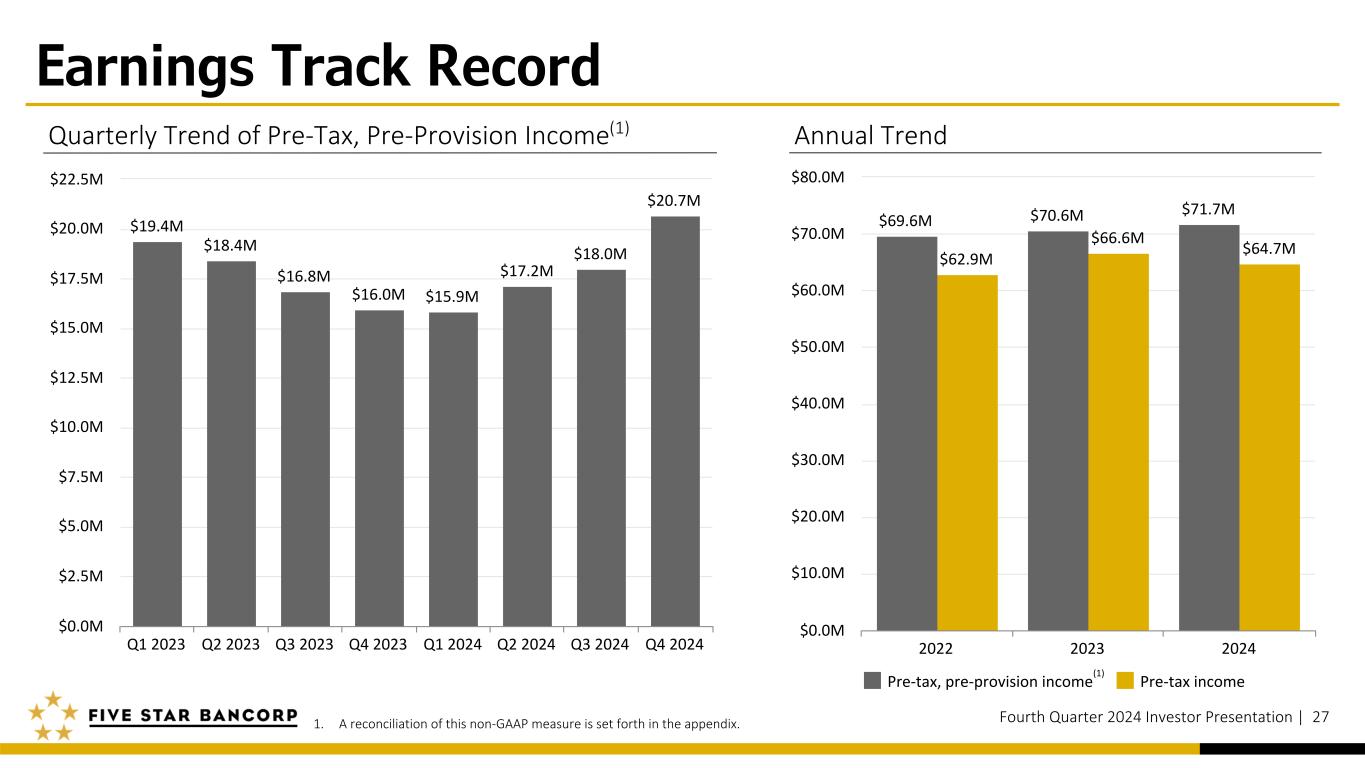

Earnings Track Record Fourth Quarter 2024 Investor Presentation | 27 $19.4M $18.4M $16.8M $16.0M $15.9M $17.2M $18.0M $20.7M Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $0.0M $2.5M $5.0M $7.5M $10.0M $12.5M $15.0M $17.5M $20.0M $22.5M 1. A reconciliation of this non-GAAP measure is set forth in the appendix. $69.6M $70.6M $71.7M $62.9M $66.6M $64.7M Pre-tax, pre-provision income Pre-tax income 2022 2023 2024 $0.0M $10.0M $20.0M $30.0M $40.0M $50.0M $60.0M $70.0M $80.0M (1) Quarterly Trend of Pre-Tax, Pre-Provision Income(1) Annual Trend

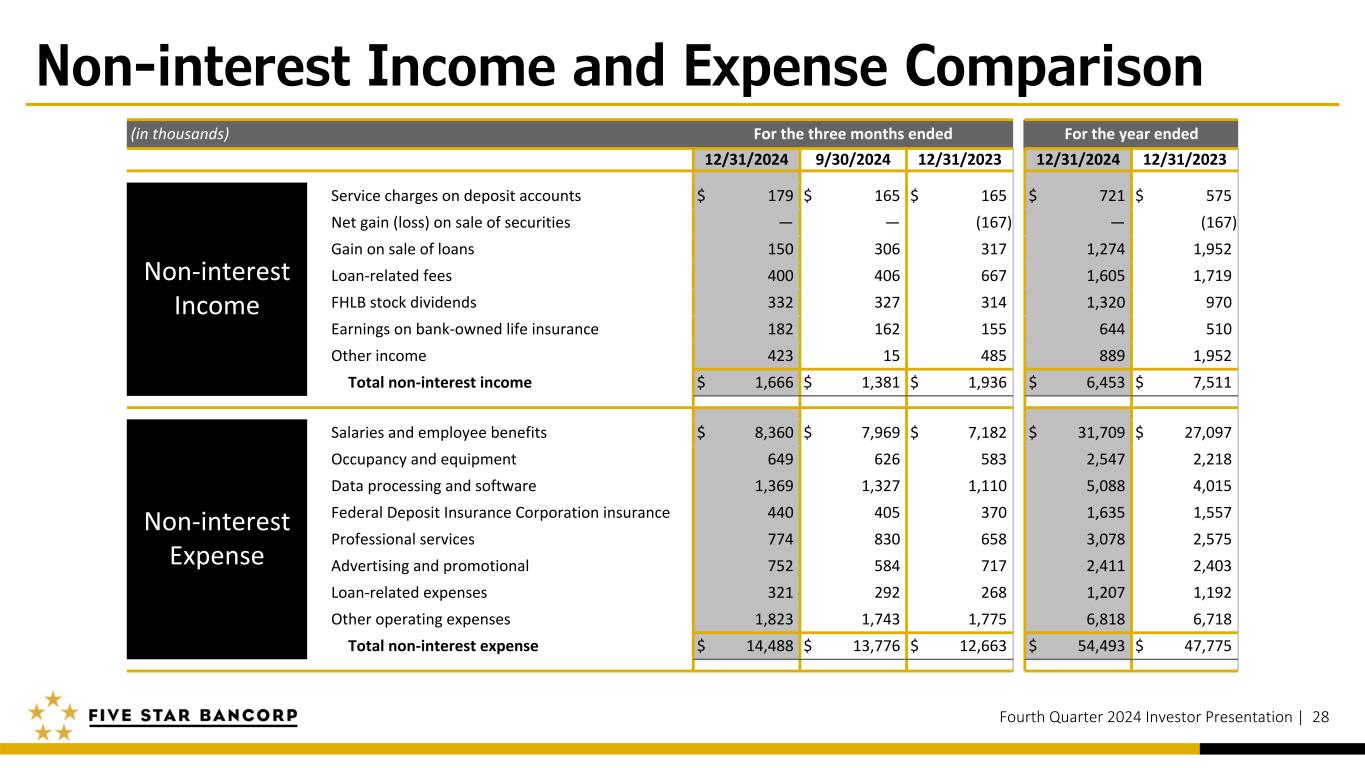

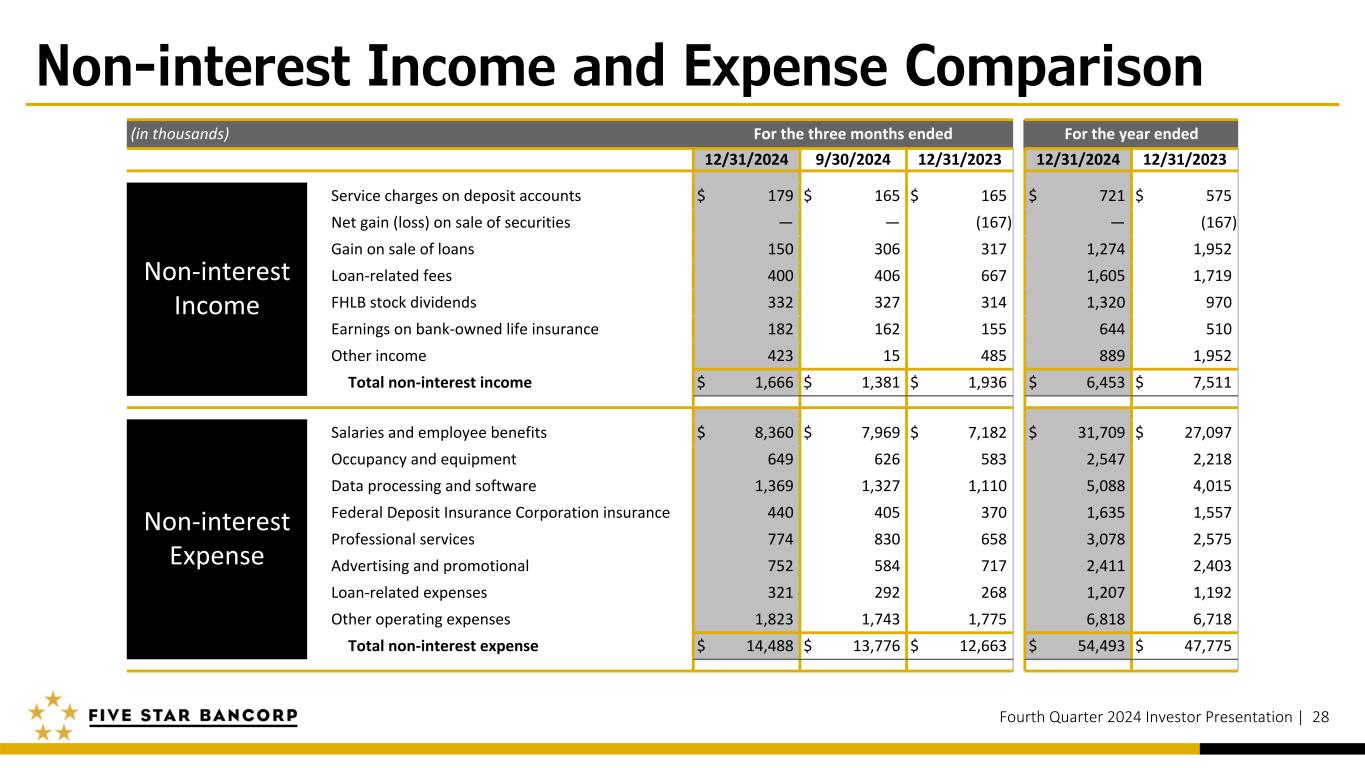

Non-interest Income and Expense Comparison Fourth Quarter 2024 Investor Presentation | 28 (in thousands) For the three months ended For the year ended 12/31/2024 9/30/2024 12/31/2023 12/31/2024 12/31/2023 Non-interest Income Service charges on deposit accounts $ 179 $ 165 $ 165 $ 721 $ 575 Net gain (loss) on sale of securities — — (167) — (167) Gain on sale of loans 150 306 317 1,274 1,952 Loan-related fees 400 406 667 1,605 1,719 FHLB stock dividends 332 327 314 1,320 970 Earnings on bank-owned life insurance 182 162 155 644 510 Other income 423 15 485 889 1,952 Total non-interest income $ 1,666 $ 1,381 $ 1,936 $ 6,453 $ 7,511 Non-interest Expense Salaries and employee benefits $ 8,360 $ 7,969 $ 7,182 $ 31,709 $ 27,097 Occupancy and equipment 649 626 583 2,547 2,218 Data processing and software 1,369 1,327 1,110 5,088 4,015 Federal Deposit Insurance Corporation insurance 440 405 370 1,635 1,557 Professional services 774 830 658 3,078 2,575 Advertising and promotional 752 584 717 2,411 2,403 Loan-related expenses 321 292 268 1,207 1,192 Other operating expenses 1,823 1,743 1,775 6,818 6,718 Total non-interest expense $ 14,488 $ 13,776 $ 12,663 $ 54,493 $ 47,775

Shareholder Returns Fourth Quarter 2024 Investor Presentation | 29 ROAA ROAE EPS (basic and diluted) Value per Share (book and tangible book(1)) Note: All 2024 figures are through December 31, 2024. 1. See Appendix for more information on this non-GAAP measure. 1.57% 1.44% 1.23% 2022 2023 2024 18.80% 17.85% 12.72% 2022 2023 2024 $2.61 $2.78 $2.26 2022 2023 2024 $14.66 $16.56 $18.60 2022 2023 2024

Five Star Bank customer, Visit Sacramento, ensures our region is a leading destination for meetings, conventions, travel trade and leisure, which support the vitality of our regional economy by driving almost $200 million in visitor spending annually. Their vision is for every person in the world to say, “I want to visit Sacramento!” David Eadie, Chief Sports & Entertainment Officer Sonya Bradley, Chief DEI & Community Relations Officer Mariles Krock, Chief Convention Sales & Services Officer Kari Miskit, Chief Operating Officer & Media Relations Mike Testa, President & CEO Five Star Bank customer, Cristo Rey High School Sacramento, is a Catholic, fully-accredited college preparatory high school. They offer a focused curriculum designed to support students not only in being accepted to college, but in graduating from college. Their goal is to educate the “whole person,” that is the mind, body and spirit of each student. They offer a challenging academic curriculum, as well as opportunities for co-curricular, spiritual and religious formation. Dave Lucchetti, Five Star Bancorp Retired Board Chair Father Christopher Calderon, President Cristo Rey Students Five Star Bank supports our customer, Street Soccer USA ("SSUSA"), and their mission to fight poverty and strengthen communities through soccer. SSUSA serves youth and special needs populations including families experiencing homelessness, and adults recovering from addiction/substance abuse and mental health diagnoses. SSUSA is the official partner of the Homeless World Cup and Street Child World Cup. We share their mission to fight poverty and strengthen others as they encourage positive changes in their players' lives. Sienna Jackson, Homeless World Cup 2023 Sacramento, California – Team USA Lisa Wrightsman, Managing Director, SSUSA and Homeless World Cup 2010 Rio De Janeiro, Brazil – Team USA Angela Draws, Homeless World Cup 2014 Santiago, Chile – Team USA We strive to become the top business bank in all markets we serve through exceptional service, deep connectivity, and customer empathy. We are dedicated to serving real estate, agricultural, faith-based, and small to medium-sized enterprises. We aim to consistently deliver value that meets or exceeds the expectations of our shareholders, customers, employees, business partners, and community.

Appendix: Non-GAAP Reconciliation (Unaudited) The Company uses financial information in its analysis of the Company's performance that is not in conformity with GAAP. The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company's financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. As such, investors should not view these disclosures as a substitute for results determined in accordance with GAAP. Additionally, these non-GAAP measures are not necessarily comparable to non-GAAP financial measures that other banking companies use. Other banking companies may use names similar to those the Company uses for the non-GAAP financial measures the Company discloses, but may calculate them differently. Investors should understand how the Company and other companies each calculate their non-GAAP financial measures when making comparisons. Average loan yield, excluding PPP loans, is defined as the daily average loan yield, excluding PPP loans, and includes both performing and nonperforming loans. The most directly comparable GAAP financial measure is average loan yield. We had no PPP loans nor interest and fee income on PPP loans for the periods shown in this presentation other than the years ended December 31, 2020, 2021, and 2022. As a result, average loan yield, excluding PPP loans, is the same as daily average loan yield for all periods presented other than the years ended December 31, 2020, 2021, and 2022. Reconciliations for such periods are provided below. Total assets, excluding PPP loans, is defined as total assets less PPP loans. The most directly comparable GAAP financial measure is total assets. We had no PPP loans as of the period ends shown in this presentation other than as of December 31, 2020 and 2021. As a result, total assets, excluding PPP loans, is the same as total assets for all periods presented, other than as of December 31, 2020 and 2021. Reconciliations for such periods are provided below. Pre-tax, pre-provision income is defined as pre-tax income plus provision for credit losses. The most directly comparable GAAP financial measure is pre-tax income. Tangible book value per share is defined as total shareholders’ equity less goodwill and other intangible assets, divided by the outstanding number of common shares at the end of the period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets at the end of any period indicated. As a result, tangible book value per share is the same as book value per share at the end of each of the periods indicated. Fourth Quarter 2024 Investor Presentation | 31

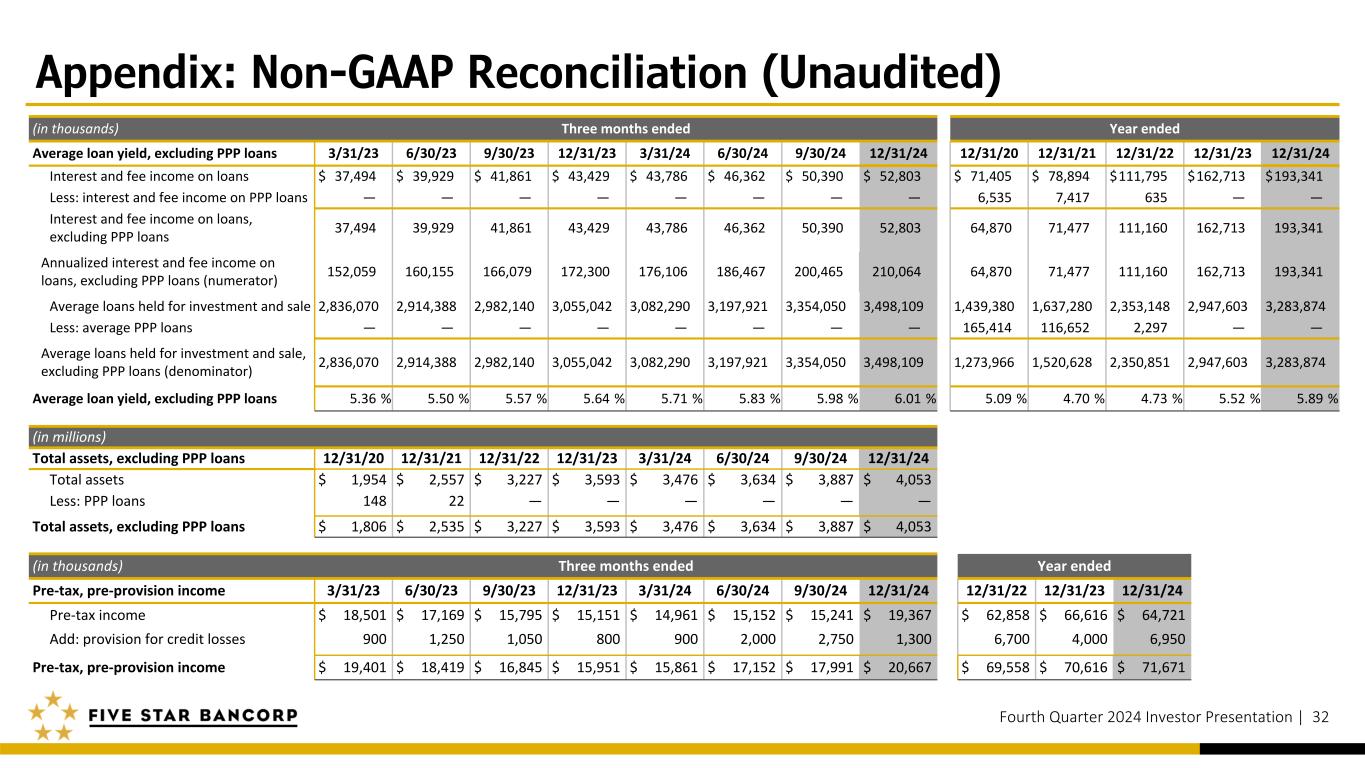

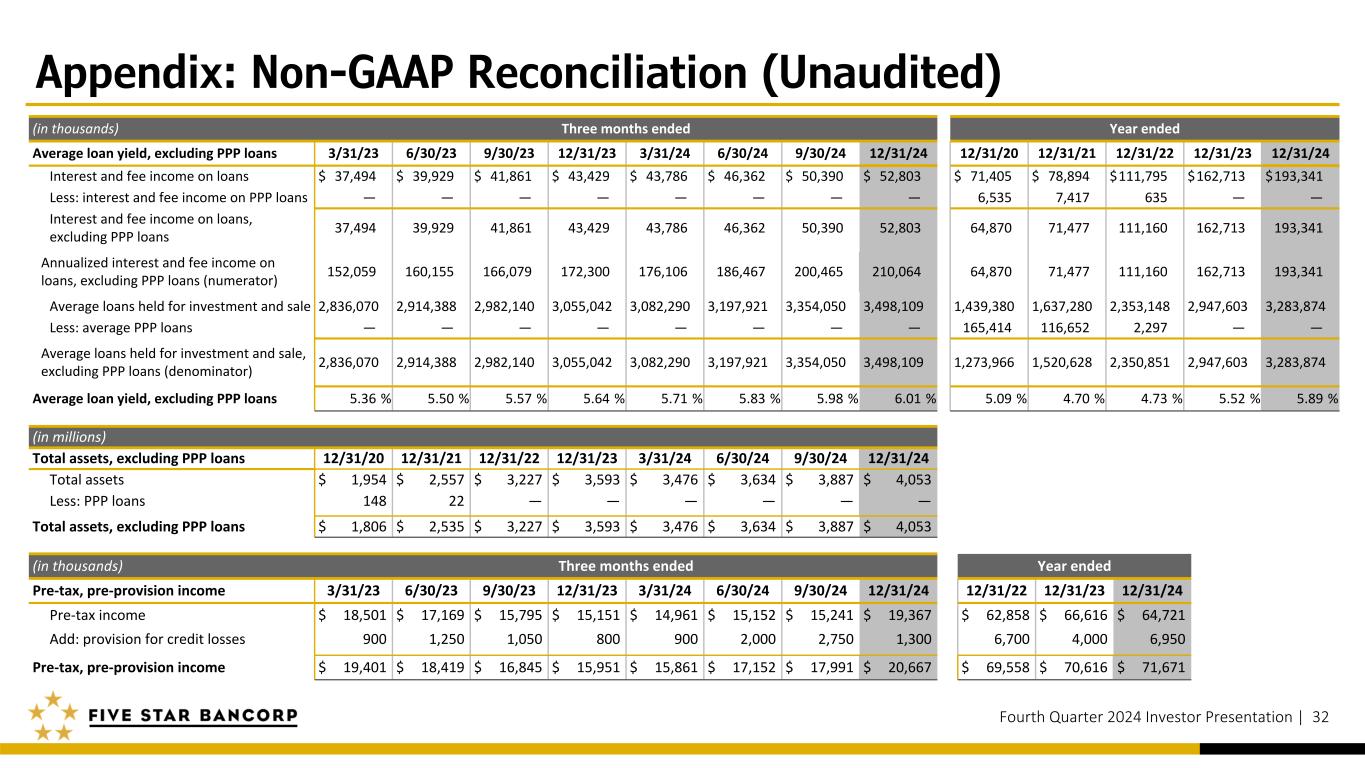

Appendix: Non-GAAP Reconciliation (Unaudited) Fourth Quarter 2024 Investor Presentation | 32 (in millions) Total assets, excluding PPP loans 12/31/20 12/31/21 12/31/22 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 Total assets $ 1,954 $ 2,557 $ 3,227 $ 3,593 $ 3,476 $ 3,634 $ 3,887 $ 4,053 Less: PPP loans 148 22 — — — — — — Total assets, excluding PPP loans $ 1,806 $ 2,535 $ 3,227 $ 3,593 $ 3,476 $ 3,634 $ 3,887 $ 4,053 (in thousands) Three months ended Year ended Pre-tax, pre-provision income 3/31/23 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 12/31/22 12/31/23 12/31/24 Pre-tax income $ 18,501 $ 17,169 $ 15,795 $ 15,151 $ 14,961 $ 15,152 $ 15,241 $ 19,367 $ 62,858 $ 66,616 $ 64,721 Add: provision for credit losses 900 1,250 1,050 800 900 2,000 2,750 1,300 6,700 4,000 6,950 Pre-tax, pre-provision income $ 19,401 $ 18,419 $ 16,845 $ 15,951 $ 15,861 $ 17,152 $ 17,991 $ 20,667 $ 69,558 $ 70,616 $ 71,671 (in thousands) Three months ended Year ended Average loan yield, excluding PPP loans 3/31/23 6/30/23 9/30/23 12/31/23 3/31/24 6/30/24 9/30/24 12/31/24 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 Interest and fee income on loans $ 37,494 $ 39,929 $ 41,861 $ 43,429 $ 43,786 $ 46,362 $ 50,390 $ 52,803 $ 71,405 $ 78,894 $ 111,795 $ 162,713 $ 193,341 Less: interest and fee income on PPP loans — — — — — — — — 6,535 7,417 635 — — Interest and fee income on loans, excluding PPP loans 37,494 39,929 41,861 43,429 43,786 46,362 50,390 52,803 64,870 71,477 111,160 162,713 193,341 Annualized interest and fee income on loans, excluding PPP loans (numerator) 152,059 160,155 166,079 172,300 176,106 186,467 200,465 210,064 64,870 71,477 111,160 162,713 193,341 Average loans held for investment and sale 2,836,070 2,914,388 2,982,140 3,055,042 3,082,290 3,197,921 3,354,050 3,498,109 1,439,380 1,637,280 2,353,148 2,947,603 3,283,874 Less: average PPP loans — — — — — — — — 165,414 116,652 2,297 — — Average loans held for investment and sale, excluding PPP loans (denominator) 2,836,070 2,914,388 2,982,140 3,055,042 3,082,290 3,197,921 3,354,050 3,498,109 1,273,966 1,520,628 2,350,851 2,947,603 3,283,874 Average loan yield, excluding PPP loans 5.36 % 5.50 % 5.57 % 5.64 % 5.71 % 5.83 % 5.98 % 6.01 % 5.09 % 4.70 % 4.73 % 5.52 % 5.89 %