UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER: 811-21484

EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER: | Calamos Strategic Total Return Fund | |

ADDRESS OF PRINCIPAL EXECUTIVE OFFICES: | 2020 Calamos Court, Naperville, Illinois 60563-2787 | |

NAME AND ADDRESS OF AGENT FOR SERVICE: | John P. Calamos, Sr., President Calamos Advisors LLC 2020 Calamos Court Naperville, Illinois 60563-2787 | |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE: (630) 245-7200

DATE OF FISCAL YEAR END: October 31, 2011

DATE OF REPORTING PERIOD: November 1, 2010 through October 31, 2011

Item 1. Report to Shareholders

Experience and Foresight

About Calamos Investments

For more than 30 years, we have helped investors like you manage and build wealth to meet their long-term individual objectives by working to capitalize on the opportunities of the evolving global marketplace. We launched our first open-end mutual fund in 1985 and our first closed-end fund in 2002. Today, we manage five closed-end funds. Three are enhanced fixed-income offerings, which pursue high current income from income and capital gains. Two are total-return oriented offerings, which seek current income, with increased emphasis on capital gains potential. Calamos Strategic Total Return Fund (CSQ), falls into this category. Please see page 5 for a more detailed overview of our closed-end offerings.

We are dedicated to helping our clients build and protect wealth. We understand when you entrust us with your assets, you also entrust us with your achievements, goals and aspirations. We believe we best honor this trust by making investment decisions guided by integrity, by discipline, and by our conscientious research.

We believe that an active, risk-conscious approach is essential for wealth creation. In the 1970s, we pioneered strategies that seek to participate in equity market upside and mitigate some of the potential risks of equity market volatility. Our investment process seeks to manage risk at multiple levels and draws upon our experience investing through multiple market cycles.

We have a global perspective. We believe that globalization offers tremendous opportunities for countries and companies all over the world. In our view, this creates significant opportunities for investors. In our U.S., global and international portfolios, we are seeking to capitalize on the potential growth of the global economy.

We believe there are opportunities in all markets. Our history traces back to the 1970s, a period of significant volatility and economic concerns. We have invested through multiple market cycles, each with its own challenges. Out of this experience comes our belief that the flipside of volatility is opportunity.

| 1 | ||||

| 5 | ||||

| 6 | ||||

| 9 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

JOHN P. CALAMOS, SR.

CEO/Co-CIO

Dear Fellow Shareholder:

Welcome to your annual report for the year ended October 31, 2011. This report includes commentary from our investment team, as well as a listing of portfolio holdings, financial statements and highlights, and detailed information about the performance and allocation of your fund. I invite you to read it carefully.

Calamos Strategic Total Return Fund (CSQ) is an income oriented total return fund. This means we are focused not only on delivering a competitive stream of distributions, but also on total return.

We believe that the Fund’s dynamic, global approach has enhanced our ability to deliver steady distributions and capital appreciation over the reporting period.

During the reporting period, CSQ provided steady monthly distributions. We believe the Fund’s annual distribution rate, which was 7.25% on a market price basis as of October 31, 2011, was very competitive, given the low interest rates in many segments of the bond market. In our view, the Fund’s distributions illustrate the benefits of a global, multi-asset class approach and flexible allocation strategy. We discuss the Fund’s performance and strategy in greater detail in the Q&A section beginning on page 6.

Steady and competitive distributions

We understand that many closed-end fund investors seek steady, predictable distributions instead of distributions that fluctuate. Therefore, this Fund has a level rate distribution policy. As part of this policy, we aim to keep distributions consistent from month to month, and at a level that we believe can be sustained over the long term. In setting the Fund’s distribution rate, the investment management team and the Fund’s Board of Directors consider the interest rate, market and economic environment. We also factor in our assessment of individual securities and asset classes. (For additional information on our level rate distribution policy, please see “The Calamos Closed-End Funds: An Overview” on page 5 and “Level Rate Distribution Policy” on page 36.)

| CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 1 |

Letter to Shareholders

Market environment

Overall, the reporting period was characterized by significant market volatility. Concerns about slowing global growth and developed market government debt proved especially troubling to investors. In the wake of discouraging debt ceiling negotiations, the U.S. saw its government debt downgraded by Standard and Poor’s, while unemployment and housing weakness remained persistent. The eurozone faced far more acute pressures, as its members sought to find a solution to Greece’s troubled balance sheet and anxieties grew about the European banking system as a whole. As the period progressed, investors became increasingly concerned about the potential for a double-dip recession in the U.S. After a significant two-year rally, equities and corporate securities corrected sharply during the third quarter of 2011. In particular, market participants worried that companies with higher earnings growth estimates would face stronger headwinds in a more difficult economic environment.

Despite the challenges of the annual period, the U.S. equity, high-yield bond and convertible securities markets posted positive performance. Equities performed the strongest, with the S&P 500 Index gaining 8.09%. Convertible securities returned 2.01%, as measured by the BofA Merrill Lynch All U.S. Convertible Ex-Mandatory Index. High-yield bonds performed robustly, as measured by the Credit Suisse High Yield Index, up 5.62%.

Within the high-yield market, new issuance was more robust at the start of the period, but slowed significantly as investors became more cautious amid increasing volatility. However, even as market pressures intensified, the number and volume of defaults remained low. Convertible issuance remained muted throughout the period, as a low rate environment encouraged companies to issue non-convertible, rather than convertible debt.

We see opportunity

The global economy faces complex issues that will take time to resolve. We expect continued volatility as these challenges are addressed. Even so, now more than ever, we believe that the global economy and financial markets offer many compelling opportunities for long-term investors who take a highly selective and active approach.

We have positioned the Fund to reflect our expectation for slower but positive growth in the U.S. economy and the global economy as a whole. Perhaps most importantly, having faced their own debt and banking struggles, the emerging markets may remain a powerful engine for growth, one that we believe can create continued opportunities for U.S.-based companies. Also, although the U.S. may not be on a normal trajectory for economic recovery, we see encouraging signs that a healing process has begun. Corporate balance sheets remain strong overall, and we are encouraged by positive earnings announcements. Most companies have wisely refinanced and restructured debt and U.S. consumers have taken steps to deleverage. There has been some market clearing, due to business restructuring as well as merger and acquisition activity.

| 2 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT |

Letter to Shareholders

Our team has identified many companies that we believe are adapting to the global economic environment with innovation. In particular, we are favoring growth companies with geographically diversified revenues, well-recognized global brands, robust distribution networks and experienced management teams. We believe that multinational companies with healthy balance sheets provide more attractive risk and reward characteristics because they are well positioned to capitalize on the significant growth opportunities that exist, for example, those in emerging markets.

From an investment themes standpoint, we continue to favor companies that are positioned to benefit from corporate capital spending, global infrastructure build-out and the growing prosperity of emerging market consumers. This has led us to companies in the information technology, energy, industrials and consumer-oriented sectors. We also have identified companies in the energy and materials sectors that we believe are positioned to benefit from a weaker dollar and from continued government efforts to boost asset values. In contrast, we are cautious about companies that are tied solely to U.S. or European GDP, and those that may be more affected by government debt burdens and a complex regulatory environment, including companies in the financials, health care and utilities sectors.

Moreover, despite some of the uncertainties in the macro environment, we believe equity valuations remain compelling by and large. For example, by some of our measures, many of the growth-oriented equities in this Fund are at multi-decade valuation lows relative to other asset classes.

In selecting high-yield bonds and convertible securities for this Fund, we seek to balance yield and risk considerations. We therefore favor companies that we believe offer reliable debt servicing, respectable balance sheets and good cash flows. As part of our active approach, we subject each investment to our rigorous fundamental credit research. We continue to find many securities that meet our criteria.

Our use of leverage

We have the flexibility to utilize leverage in this Fund. Over the long term, we believe that the judicious use of leverage provides us with opportunities to enhance total return and support the Fund’s distribution rate. Leverage strategies typically entail borrowing at short-term interest rates and investing the proceeds at higher rates of return. During the reporting period, we believed the prudent use of leverage would be advantageous given the economic environment, specifically the low borrowing costs we were able to secure. Overall, our use of leverage contributed favorably to the returns of the Fund, as the performance of the Fund’s holdings exceeded the costs of our borrowing activities.

| CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 3 |

Letter to Shareholders

Consistent with our focus on risk management, we have employed techniques to hedge against a rise in interest rates. We have used interest rate swaps to manage the borrowing costs associated with our leverage activities. Interest rate swaps allow us to “lock down” an interest rate we believe to be attractive. Although rates are at historically low levels across much of the fixed-income market, history has taught us that rates can rise quickly, in some cases, in a matter of months. We believe that the Fund’s use of interest rate swaps is beneficial because it provides a degree of protection should a rise in rates occur.

We take an active, independent approach

We recognize that ups and downs in the markets can be discouraging for investors. Yet, market volatility is always a factor when investing. In fact, we firmly believe that market volatility can create opportunities for those who take an active, long-term and disciplined approach.

As we invest on behalf of Fund shareholders, we seek to be ahead of the curve and global in our perspective. We believe our dynamic allocation approach has been instrumental to the results we have achieved over full market cycles and will continue to be, particularly given the low rates currently available in many segments of the fixed-income marketplace.

If you would like any additional information about this Fund or our other closed-end offerings, please contact your financial advisor or our client services team at 800.582.6959 (Monday through Friday from 8:00 a.m. to 6:00 p.m., Central Time). We also invite you to visit us at calamos.com.

We thank you for your continued trust.

Sincerely,

John P. Calamos, Sr.

CEO and Co-CIO

Calamos Advisors LLC

This report is for informational purposes only and should not be considered investment advice.

| 4 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT |

The Calamos Closed-End Funds: An Overview

In our closed-end funds, we draw upon decades of investment experience, including a long history of opportunistically blending asset classes in an attempt to capture upside potential while managing downside risk. We launched our first closed-end fund in 2002.

Closed-end funds are long-term investments. Most focus on providing monthly distributions, but there are important differences among individual closed-end funds. Calamos closed-end funds can be grouped into two broad categories: (1) enhanced fixed-income and (2) total return. Funds in both groups provide a monthly distribution stream and invest in a combination of asset classes.

| OBJECTIVE: ENHANCED FIXED INCOME | OBJECTIVE: TOTAL RETURN | |

Portfolios Positioned to Pursue High Current Income from Income and Capital Gains | Portfolios Positioned to Seek Current Income, with Increased Emphasis on Capital Gains Potential | |

Calamos Convertible Opportunities and Income Fund (Ticker: CHI) | Calamos Global Total Return Fund (Ticker: CGO) | |

| Invests in high-yield and convertible securities, primarily in U.S. markets | Invests in equities and higher-yielding convertible securities and corporate bonds, in both U.S. and non-U.S. markets | |

Calamos Convertible and High Income Fund (Ticker: CHY) | Calamos Strategic Total Return Fund (Ticker: CSQ) | |

| Invests in high-yield and convertible securities, primarily in U.S. markets | Invests in equities and higher-yielding convertible securities and corporate bonds, primarily in U.S. markets | |

Calamos Global Dynamic Income Fund (Ticker: CHW) | ||

Invests in global fixed-income securities, alternative investments and equities |

Our Level Rate Distribution Policy

Closed-end fund investors often look for a steady stream of income. Recognizing this, Calamos closed-end funds have a level rate distribution policy in which we aim to keep monthly income consistent through the disbursement of net investment income, net realized short-term capital gains and, if necessary, return of capital. We set distributions at levels that we believe are sustainable for the long term. Our team is focused on delivering an attractive monthly distribution, while maintaining a long-term focus on risk management. The level of the funds’ distributions can be greatly influenced by market conditions, including the interest rate environment. The funds’ distributions will depend on the individual performance of positions the funds hold, our view of the benefits of retaining leverage, fund tax considerations, and maintaining regulatory requirements.

For more information about any of these funds, we encourage you to contact your financial advisor or Calamos Investments at 800.582.6959 (Monday through Friday from 8:00 a.m. to 6:00 p.m., Central Time). You can also visit us at www.calamos.com.

For more information on our level rate distribution policy, please see page 36.

| CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 5 |

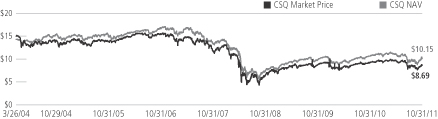

| TOTAL RETURN* AS OF 10/31/11 | ||||||||

Common Shares – Inception 3/26/04 |

| |||||||

| 1 Year | Since Inception** | |||||||

On Market Price | 2.72% | 1.20% | ||||||

On NAV | 5.84% | 3.92% | ||||||

*Total return measures net investment income and net realized gain or loss from Fund investments, and change in net unrealized appreciation or depreciation, assuming reinvestment of income and net realized gains distributions. **Annualized since inception. |

| |||||||

| SECTOR WEIGHTINGS | ||||

Information Technology | 18.2 | % | ||

Energy | 17.4 | |||

Health Care | 14.2 | |||

Industrials | 11.6 | |||

Materials | 8.3 | |||

Consumer Staples | 7.2 | |||

Financials | 6.9 | |||

Consumer Discretionary | 6.8 | |||

Telecommunication Services | 5.5 | |||

Utilities | 0.5 | |||

Sector Weightings are based on managed assets and may vary over time. Sector Weightings exclude any government/sovereign bonds or options on broad market indexes the Fund may hold.

STRATEGIC TOTAL RETURN FUND

INVESTMENT TEAM DISCUSSION

The Calamos Investment Management Team, led by Co-Chief Investment Officers John P. Calamos, Sr. and Nick P. Calamos, CFA, discusses the Fund’s strategy, performance and positioning for the one-year period ended October 31, 2011.

Q. To provide a context for its performance, please discuss the Fund’s strategy and role within an asset allocation.

A. Calamos Strategic Total Return Fund (CSQ) is a total return oriented offering that seeks to provide a steady stream of income paid out on a monthly basis. We invest in a diversified portfolio of equities, convertible securities and high-yield securities. The allocation to each asset class is dynamic, and reflects our view of the economic landscape as well as the potential of individual securities. By combining these asset classes, we believe that we are well positioned over the long term to generate capital gains as well as income. This broader range of security types also provides us with increased opportunities to manage the risk and reward characteristics of the portfolio over full market cycles. Through this approach, we seek to offer investors an attractive monthly distribution, as well as equity participation.

While we invest primarily in securities of U.S. issuers, we favor those companies that are actively participating in globalization with geographically diversified revenue streams and global business strategies. We emphasize companies that we believe offer reliable debt servicing, respectable balance sheets and good prospects for sustainable growth.

Q. How did the Fund perform over the reporting period?

A. The Fund gained 5.84% on a net asset value (NAV) basis for the one-year period ended October 31, 2011, while the S&P 500 Index gained 8.09%. On a market price basis, the Fund returned 2.72% for the same period.

Q. How do NAV and market price return differ?

A. Closed-end funds trade on exchanges, where the price of shares may be driven by factors other than the value of the underlying securities. The price of a share in the market is called market value. Market price may be influenced by factors unrelated to the performance of the fund’s holdings. A fund’s NAV return measures the return of the individual securities of the portfolio, less fund expenses. It also measures how a manager was able to capitalize on market opportunities. Because we believe closed-end funds are best utilized as a long-term holding within asset allocations, we believe that NAV return is the better measure of a fund’s performance.

| 6 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT |

Investment Team Discussion

SINCE INCEPTION MARKET PRICE AND NAV HISTORY THROUGH 10/31/11

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted.

Q. Please discuss the Fund’s distributions during the annual period.

A. We employ a level rate distribution policy within this Fund, with the goal of providing shareholders with a consistent distribution stream. The Fund provided a steady distribution stream over the period. Monthly distributions were $0.0525 per share, and the Fund’s annual distribution rate was 7.25% of market price as of October 31, 2011.

We believe that the Fund’s distribution rate and level remained attractive and competitive, as low interest rates limited yield opportunities in much of the marketplace. For example, as of October 31, 2011, the dividend yield of S&P 500 Index stocks averaged 2.1%. Yields also remained low within the U.S. government bond market, with 10-Year U.S. Treasurys and 30-Year U.S. Treasurys yielding 2.2% and 3.2%, respectively.

Q. The Fund is currently trading at a discount to its NAV. Please discuss this discount.

A. As of the close of the reporting period, the Fund was trading at a discount of 14.38%. This means that its market share price is 14.38% less than its NAV price. As we have noted in the past, we believe that this may be favorable for long-term investors seeking to purchase shares because investors can buy shares of the portfolio at a price that is lower than the fair value of the portfolio, as measured by its NAV.

Q. What factors influenced performance over the reporting period?

A. An underweight position to the financial sector relative to the S&P 500 Index proved advantageous, as did our security selection decisions. The Fund’s underweight reflects our long-standing concerns about the potential risks within much of the sector. For example, we believe unfolding regulation and deleveraging may hinder revenue and profit growth in many banks.

In contrast, security selection within the consumer discretionary sector lagged the S&P 500 Index, specifically the Fund’s stakes in the internet retail and apparel and accessories and luxury goods industries. Security selection in the information technology sector also hindered performance, with holdings in the home entertainment software and computer hardware industries underperforming. Further, the Fund’s stakes in convertible issues and high-yield corporate bonds hindered performance relative to the all-equity S&P 500 Index.

| CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 7 |

Investment Team Discussion

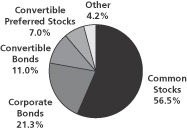

ASSET ALLOCATION AS OF 10/31/11

Fund asset allocations are based on total investments and may vary over time.

Q. How is the Fund positioned?

A. We have found securities across asset classes that we believe support our focus on income-oriented total return. We also increased the Fund’s allocation of common stocks from 51% to 56% during the reporting period and slightly reduced exposure to convertibles and high-yield bonds.

In regard to the Fund’s common stock holdings, we have generally favored larger U.S.-based global businesses, with diversified revenues and strong brands. We believe that these companies may be particularly well positioned to capitalize on the growth trends we see around the world, including those related to emerging markets.

As of the end of the reporting period, corporate bonds were about 21% of the portfolio and convertible securities were 18% of the portfolio. In regard to the Fund’s convertible securities and corporate bonds, we seek out companies that we believe offer reliable debt servicing and the potential for credit upgrades. Where possible, we also favor those with global business strategies. In keeping with our risk-conscious approach to income, we favored a mix of investment-grade credits and credits from the higher tiers of the high-yield universe. High-yield bonds are generally recognized as credits with ratings less than BBB.

From a sector perspective, we believe we have found the most compelling opportunities within the information technology and energy sectors, where we have increased the Fund’s holdings. We decreased the Fund’s positions in the financial, consumer discretionary and materials sectors.

Q. What is your outlook for the Fund?

A. We continue to believe that this is an environment that requires active security selection and a risk-conscious, long-term perspective. We anticipate slower but positive growth in the U.S. and global economies. Challenges remain, including for investors who seek income. We expect continued volatility in the financial market, and we believe that investors should also be prepared for the possibility of inflation and rising interest rates.

Against this backdrop, we believe the Fund’s dynamic multi-asset class approach and our proprietary research position it well. Because this Fund can invest in corporate bonds, convertible securities, and equities, we believe we have enhanced opportunities to pursue income, manage risks and enhance return potential. Additionally, we remain optimistic about many U.S. companies with global strategies and reach and believe that the U.S. markets may provide considerable opportunities for the Fund’s income-oriented approach to total return.

| 8 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT |

Schedule of Investments October 31, 2011

| PRINCIPAL AMOUNT | VALUE | |||||||||

| CORPORATE BONDS (24.6%) | ||||||||||

| Consumer Discretionary (4.7%) | ||||||||||

| 13,102,000 | DISH Network Corp. 7.125%, 02/01/16 | $ | 13,986,385 | |||||||

| 14,370,000 | Hanesbrands, Inc.ൠ3.770%, 12/15/14 | 14,334,075 | ||||||||

| Jaguar Land Rover, PLC* | ||||||||||

| 3,381,000 | 8.125%, 05/15/21 | 3,347,190 | ||||||||

| 1,902,000 | 7.750%, 05/15/18 | 1,892,490 | ||||||||

| 6,086,000 | Jarden Corp.µ 7.500%, 05/01/17 | 6,542,450 | ||||||||

| 4,226,000 | Liberty Media Corp. 8.250%, 02/01/30 | 4,099,220 | ||||||||

| 2,958,000 | Live Nation Entertainment, Inc.µ* 8.125%, 05/15/18 | 2,854,470 | ||||||||

| 4,129,000 | MGM Resorts International 7.500%, 06/01/16 | 3,943,195 | ||||||||

| 2,637,000 | NetFlix, Inc. 8.500%, 11/15/17 | 2,749,073 | ||||||||

| Royal Caribbean Cruises, Ltd. | ||||||||||

| 10,989,000 | 7.500%, 10/15/27 | 10,686,802 | ||||||||

| 3,888,000 | 7.250%, 06/15/16 | 4,140,720 | ||||||||

| 3,381,000 | Service Corp. International 7.000%, 05/15/19 | 3,566,955 | ||||||||

| 1,479,000 | Wynn Las Vegas, LLC 7.750%, 08/15/20 | 1,634,295 | ||||||||

|

| |||||||||

| 73,777,320 | ||||||||||

|

| |||||||||

| Consumer Staples (1.6%) | ||||||||||

| 5,706,000 | Chiquita Brands International, Inc.µ 7.500%, 11/01/14 | 5,748,795 | ||||||||

| 4,776,000 | Darling International, Inc. 8.500%, 12/15/18 | 5,384,940 | ||||||||

| 12,679,000 | Smithfield Foods, Inc. 7.750%, 07/01/17 | 13,756,715 | ||||||||

|

| |||||||||

| 24,890,450 | ||||||||||

|

| |||||||||

| Energy (4.4%) | ||||||||||

| 19,019,000 | NOK | Aker Solutions, ASA 8.700%, 06/26/14 | 3,695,261 | |||||||

| 2,958,000 | Basic Energy Services, Inc.* 7.750%, 02/15/19 | 2,972,790 | ||||||||

| 2,143,000 | Berry Petroleum Company 8.250%, 11/01/16 | 2,234,077 | ||||||||

| 3,381,000 | Brigham Exploration Company 8.750%, 10/01/18 | 4,006,485 | ||||||||

| 2,367,000 | Carrizo Oil & Gas, Inc.µ 8.625%, 10/15/18 | 2,414,340 | ||||||||

| 3,381,000 | Clayton Williams Energy, Inc.* 7.750%, 04/01/19 | 3,144,330 | ||||||||

| 4,480,000 | Complete Production Services, Inc. 8.000%, 12/15/16 | 4,681,600 | ||||||||

| 6,762,000 | Comstock Resources, Inc. 8.375%, 10/15/17 | 6,964,860 | ||||||||

| PRINCIPAL AMOUNT | VALUE | |||||||||

| 4,649,000 | Concho Resources, Inc.µ 8.625%, 10/01/17 | $ | 5,090,655 | |||||||

| Frontier Oil Corp. | ||||||||||

| 3,787,000 | 6.875%, 11/15/18 | 3,881,675 | ||||||||

| 845,000 | 8.500%, 09/15/16 | 895,700 | ||||||||

| 2,536,000 | GulfMark Offshore, Inc.µ 7.750%, 07/15/14 | 2,504,300 | ||||||||

| 2,147,000 | HollyFrontier Corp. 9.875%, 06/15/17 | 2,361,700 | ||||||||

| 2,536,000 | Pride International, Inc. 8.500%, 06/15/19 | 3,211,951 | ||||||||

| 4,226,000 | SESI, LLC 6.875%, 06/01/14 | 4,247,130 | ||||||||

| Swift Energy Company | ||||||||||

| 6,762,000 | 8.875%, 01/15/20µ | 7,167,720 | ||||||||

| 5,456,000 | 7.125%, 06/01/17 | 5,565,120 | ||||||||

| 3,880,000 | Trinidad Drilling, Ltd.µ* 7.875%, 01/15/19 | 4,083,700 | ||||||||

| 507,000 | Unit Corp. 6.625%, 05/15/21 | 499,395 | ||||||||

|

| |||||||||

| 69,622,789 | ||||||||||

|

| |||||||||

| Financials (2.3%) | ||||||||||

| 14,065,000 | Leucadia National Corp.µ 8.125%, 09/15/15 | 15,260,525 | ||||||||

| 8,453,000 | Nuveen Investments, Inc. 10.500%, 11/15/15 | 8,495,265 | ||||||||

| 2,958,000 | OMEGA Healthcare Investors, Inc. 7.500%, 02/15/20 | 3,150,270 | ||||||||

| 8,875,000 | Senior Housing Properties Trustµ 8.625%, 01/15/12 | 8,977,693 | ||||||||

|

| |||||||||

| 35,883,753 | ||||||||||

|

| |||||||||

| Health Care (2.6%) | ||||||||||

| 4,226,000 | Community Health Systems, Inc.µ 8.875%, 07/15/15 | 4,336,932 | ||||||||

| 4,649,000 | Endo Pharmaceuticals Holdings,Inc.µ* 7.000%, 07/15/19 | 5,044,165 | ||||||||

| 5,072,000 | Giant Funding Corp.* 8.250%, 02/01/18 | 5,363,640 | ||||||||

| HealthSouth Corp. | ||||||||||

| 2,113,000 | 7.750%, 09/15/22µ | 2,123,565 | ||||||||

| 1,691,000 | 7.250%, 10/01/18 | 1,699,455 | ||||||||

| Mylan, Inc.* | ||||||||||

| 4,226,000 | 7.875%, 07/15/20µ | 4,754,250 | ||||||||

| 3,521,000 | 7.625%, 07/15/17 | 3,908,310 | ||||||||

| Valeant Pharmaceuticals International, Inc.* | ||||||||||

| 7,607,000 | 7.000%, 10/01/20 | 7,568,965 | ||||||||

| 1,268,000 | 6.750%, 10/01/17 | 1,274,340 | ||||||||

| 5,500,000 | Warner Chilcott Company, LLC 7.750%, 09/15/18 | 5,761,250 | ||||||||

|

| |||||||||

| 41,834,872 | ||||||||||

|

| |||||||||

| See accompanying Notes to Schedule of Investments | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 9 |

Schedule of Investments October 31, 2011

| PRINCIPAL AMOUNT | VALUE | |||||||||

| Industrials (2.1%) | ||||||||||

| 3,857,000 | Abengoa, SA* 8.875%, 11/01/17 | $ | 3,914,855 | |||||||

| 3,381,000 | BE Aerospace, Inc. 8.500%, 07/01/18 | 3,710,648 | ||||||||

| Belden, Inc. | ||||||||||

| 1,479,000 | 7.000%, 03/15/17 | 1,493,790 | ||||||||

| 528,000 | 9.250%, 06/15/19 | 567,600 | ||||||||

| 3,829,000 | H&E Equipment Services, Inc.µ 8.375%, 07/15/16 | 3,896,007 | ||||||||

| 4,226,000 | Spirit AeroSystems Holdings, Inc. 7.500%, 10/01/17 | 4,564,080 | ||||||||

| 1,691,000 | Terex Corp. 8.000%, 11/15/17 | 1,669,863 | ||||||||

| Triumph Group, Inc. | ||||||||||

| 5,258,000 | 8.625%, 07/15/18 | 5,810,090 | ||||||||

| 1,707,000 | 8.000%, 11/15/17 | 1,835,025 | ||||||||

| 924,000 | Tutor Perini Corp. 7.625%, 11/01/18 | 866,250 | ||||||||

| 4,226,000 | WESCO Distribution, Inc. 7.500%, 10/15/17 | 4,352,780 | ||||||||

|

| |||||||||

| 32,680,988 | ||||||||||

|

| |||||||||

| Information Technology (1.8%) | ||||||||||

| 2,536,000 | Amkor Technology, Inc. 7.375%, 05/01/18 | 2,574,040 | ||||||||

| 4,649,000 | Audatex North America, Inc.* 6.750%, 06/15/18 | 4,741,980 | ||||||||

| Equinix, Inc. | ||||||||||

| 3,804,000 | 7.000%, 07/15/21 | 4,060,770 | ||||||||

| 3,550,000 | 8.125%, 03/01/18µ | 3,887,250 | ||||||||

| 761,000 | Fidelity National Information Services, Inc. 7.875%, 07/15/20 | 835,198 | ||||||||

| 824,000 | Hynix Semiconductor, Inc.* 7.875%, 06/27/17 | 848,720 | ||||||||

| 9,298,000 | iGATE Corp.µ* 9.000%, 05/01/16 | 9,298,000 | ||||||||

| 1,509,000 | Lexmark International, Inc.µ 6.650%, 06/01/18 | 1,677,374 | ||||||||

|

| |||||||||

| 27,923,332 | ||||||||||

|

| |||||||||

| Materials (2.4%) | ||||||||||

| 1,691,000 | Allegheny Ludlum Corp.µ 6.950%, 12/15/25 | 1,867,926 | ||||||||

| 9,298,000 | FMG Resources* 8.250%, 11/01/19 | 9,437,470 | ||||||||

| 2,285,000 | Nalco Company 8.250%, 05/15/17 | 2,547,775 | ||||||||

| 2,730,000 | Sealed Air Corp.* 8.125%, 09/15/19 | 2,968,875 | ||||||||

| 2,570,000 | Silgan Holdings, Inc. 7.250%, 08/15/16 | 2,724,200 | ||||||||

| PRINCIPAL AMOUNT | VALUE | |||||||||

| Steel Dynamics, Inc. | ||||||||||

| 5,215,000 | 7.750%, 04/15/16µ | $ | 5,514,862 | |||||||

| 1,183,000 | 7.625%, 03/15/20 | 1,259,895 | ||||||||

| 9,256,000 | Union Carbide Corp.~ 7.875%, 04/01/23 | 11,188,005 | ||||||||

|

| |||||||||

| 37,509,008 | ||||||||||

|

| |||||||||

| Telecommunication Services (2.7%) | ||||||||||

| Frontier Communications Corp. | ||||||||||

| 14,116,000 | 9.000%, 08/15/31µ | 13,904,260 | ||||||||

| 3,212,000 | 8.250%, 04/15/17 | 3,444,870 | ||||||||

| 5,542,000 | MetroPCS Wireless, Inc.µ 7.875%, 09/01/18 | 5,666,695 | ||||||||

| 12,282,000 | Qwest Communications International, Inc.µ 7.750%, 02/15/31 | 12,097,770 | ||||||||

| Windstream Corp. | ||||||||||

| 3,381,000 | 7.750%, 10/15/20µ | 3,550,050 | ||||||||

| 3,381,000 | 7.500%, 04/01/23 | 3,448,620 | ||||||||

|

| |||||||||

| 42,112,265 | ||||||||||

|

| |||||||||

TOTAL CORPORATE BONDS (Cost $373,364,124) | 386,234,777 | |||||||||

|

| |||||||||

| CONVERTIBLE BONDS (11.5%) | ||||||||||

| Consumer Discretionary (1.7%) | ||||||||||

| 15,000,000 | Liberty Media Corp. (Time Warner, Inc.)§ 3.125%, 03/30/23 | 16,800,000 | ||||||||

| 13,164,000 | Liberty Media Corp. (Viacom, CBS Corp. - Class B)§ 3.250%, 03/15/31 | 10,613,475 | ||||||||

|

| |||||||||

| 27,413,475 | ||||||||||

|

| |||||||||

| Financials (1.4%) | ||||||||||

| 20,020,000 | Affiliated Managers Group, Inc. 3.950%, 08/15/38 | 21,796,775 | ||||||||

|

| |||||||||

| Health Care (0.4%) | ||||||||||

| 5,000,000 | Shire, PLC 2.750%, 05/09/14 | 5,766,403 | ||||||||

|

| |||||||||

| Industrials (0.7%) | ||||||||||

| 12,038,000 | Trinity Industries, Inc. 3.875%, 06/01/36 | 11,556,480 | ||||||||

|

| |||||||||

| Information Technology (5.0%) | ||||||||||

| 11,000,000 | Electronic Arts, Inc.µ* 0.750%, 07/15/16 | 11,247,500 | ||||||||

| 31,500,000 | Intel Corp. 2.950%, 12/15/35 | 33,941,250 | ||||||||

| 11,000,000 | Lam Research Corp.* 1.250%, 05/15/18 | 10,876,250 | ||||||||

| 9,900,000 | Linear Technology Corp.µ 3.000%, 05/01/27 | 10,407,375 | ||||||||

| 10 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | See accompanying Notes to Schedule of Investments |

Schedule of Investments October 31, 2011

| PRINCIPAL AMOUNT | VALUE | |||||||||

| 10,418,000 | Nuance Communications, Inc.* 2.750%, 11/01/31 | $ | 11,485,845 | |||||||

|

| |||||||||

| 77,958,220 | ||||||||||

|

| |||||||||

| Materials (2.3%) | ||||||||||

| 3,698,000 | Allegheny Technologies, Inc. 4.250%, 06/01/14 | 5,038,525 | ||||||||

| 12,500,000 | Anglo American, PLC 4.000%, 05/07/14 | 18,126,574 | ||||||||

| 9,000,000 | AngloGold Ashanti, Ltd.µ 3.500%, 05/22/14 | 10,350,000 | ||||||||

| 2,000,000 | Newmont Mining Corp.µ 3.000%, 02/15/12 | 2,925,000 | ||||||||

|

| |||||||||

| 36,440,099 | ||||||||||

|

| |||||||||

TOTAL CONVERTIBLE BONDS (Cost $180,361,006) | 180,931,452 | |||||||||

|

| |||||||||

| U.S. GOVERNMENT AND AGENCY SECURITIES (1.1%) | ||||||||||

| United States Treasury Note~ | ||||||||||

| 14,792,000 | 1.000%, 03/31/12 | 14,850,384 | ||||||||

| 2,536,000 | 0.875%, 01/31/12 | 2,541,648 | ||||||||

|

| |||||||||

TOTAL U.S. GOVERNMENT AND AGENCY SECURITIES (Cost $17,378,604) | 17,392,032 | |||||||||

|

| |||||||||

| SOVEREIGN BONDS (1.4%) | ||||||||||

| Federal Republic of Brazil | ||||||||||

| 2,916,000 | BRL | 10.000%, 01/01/12 | 17,497,546 | |||||||

| 845,000 | BRL | 10.000%, 01/01/13 | 5,059,556 | |||||||

|

| |||||||||

TOTAL SOVEREIGN BONDS (Cost $21,919,895) | 22,557,102 | |||||||||

|

| |||||||||

| SYNTHETIC CONVERTIBLE SECURITIES (5.8%) | ||||||||||

| Corporate Bonds (4.4%) | ||||||||||

| Consumer Discretionary (0.9%) | ||||||||||

| 2,398,000 | DISH Network Corp. 7.125%, 02/01/16 | 2,559,865 | ||||||||

| 2,630,000 | Hanesbrands, Inc.ൠ3.770%, 12/15/14 | 2,623,425 | ||||||||

| Jaguar Land Rover, PLC* | ||||||||||

| 619,000 | 8.125%, 05/15/21 | 612,810 | ||||||||

| 348,000 | 7.750%, 05/15/18 | 346,260 | ||||||||

| 1,114,000 | Jarden Corp.µ 7.500%, 05/01/17 | 1,197,550 | ||||||||

| 774,000 | Liberty Media Corp. 8.250%, 02/01/30 | 750,780 | ||||||||

| 542,000 | Live Nation Entertainment, Inc.µ* 8.125%, 05/15/18 | 523,030 | ||||||||

| 756,000 | MGM Resorts International 7.500%, 06/01/16 | 721,980 | ||||||||

| 483,000 | NetFlix, Inc. 8.500%, 11/15/17 | 503,528 | ||||||||

| PRINCIPAL AMOUNT | VALUE | |||||||||

| Royal Caribbean Cruises, Ltd. | ||||||||||

| 2,011,000 | 7.500%, 10/15/27 | $ | 1,955,697 | |||||||

| 712,000 | 7.250%, 06/15/16 | 758,280 | ||||||||

| 619,000 | Service Corp. International 7.000%, 05/15/19 | 653,045 | ||||||||

| 271,000 | Wynn Las Vegas, LLC 7.750%, 08/15/20 | 299,455 | ||||||||

|

| |||||||||

| 13,505,705 | ||||||||||

|

| |||||||||

| Consumer Staples (0.3%) | ||||||||||

| 1,044,000 | Chiquita Brands International, Inc.µ 7.500%, 11/01/14 | 1,051,830 | ||||||||

| 874,000 | Darling International, Inc. 8.500%, 12/15/18 | 985,435 | ||||||||

| 2,321,000 | Smithfield Foods, Inc. 7.750%, 07/01/17 | 2,518,285 | ||||||||

|

| |||||||||

| 4,555,550 | ||||||||||

|

| |||||||||

| Energy (0.8%) | ||||||||||

| 3,481,000 | NOK | Aker Solutions, ASA 8.700%, 06/26/14 | 676,334 | |||||||

| 542,000 | Basic Energy Services, Inc.* 7.750%, 02/15/19 | 544,710 | ||||||||

| 392,000 | Berry Petroleum Company 8.250%, 11/01/16 | 408,660 | ||||||||

| 619,000 | Brigham Exploration Company 8.750%, 10/01/18 | 733,515 | ||||||||

| 433,000 | Carrizo Oil & Gas, Inc.µ 8.625%, 10/15/18 | 441,660 | ||||||||

| 619,000 | Clayton Williams Energy, Inc.* 7.750%, 04/01/19 | 575,670 | ||||||||

| 820,000 | Complete Production Services, Inc. 8.000%, 12/15/16 | 856,900 | ||||||||

| 1,238,000 | Comstock Resources, Inc. 8.375%, 10/15/17 | 1,275,140 | ||||||||

| 851,000 | Concho Resources, Inc.µ 8.625%, 10/01/17 | 931,845 | ||||||||

| Frontier Oil Corp. | ||||||||||

| 693,000 | 6.875%, 11/15/18 | 710,325 | ||||||||

| 155,000 | 8.500%, 09/15/16 | 164,300 | ||||||||

| 464,000 | GulfMark Offshore, Inc.µ 7.750%, 07/15/14 | 458,200 | ||||||||

| 393,000 | HollyFrontier Corp. 9.875%, 06/15/17 | 432,300 | ||||||||

| 464,000 | Pride International, Inc. 8.500%, 06/15/19 | 587,676 | ||||||||

| 774,000 | SESI, LLC 6.875%, 06/01/14 | 777,870 | ||||||||

| Swift Energy Company | ||||||||||

| 1,238,000 | 8.875%, 01/15/20µ | 1,312,280 | ||||||||

| 999,000 | 7.125%, 06/01/17 | 1,018,980 | ||||||||

| 710,000 | Trinidad Drilling, Ltd.µ* 7.875%, 01/15/19 | 747,275 | ||||||||

| See accompanying Notes to Schedule of Investments | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 11 |

Schedule of Investments October 31, 2011

| PRINCIPAL AMOUNT | VALUE | |||||||||

| 93,000 | Unit Corp. 6.625%, 05/15/21 | $ | 91,605 | |||||||

|

| |||||||||

| 12,745,245 | ||||||||||

|

| |||||||||

| Financials (0.4%) | ||||||||||

| 2,575,000 | Leucadia National Corp.µ 8.125%, 09/15/15 | 2,793,875 | ||||||||

| 1,547,000 | Nuveen Investments, Inc. 10.500%, 11/15/15 | 1,554,735 | ||||||||

| 542,000 | OMEGA Healthcare Investors, Inc. 7.500%, 02/15/20 | 577,230 | ||||||||

| 1,625,000 | Senior Housing Properties Trustµ 8.625%, 01/15/12 | 1,643,803 | ||||||||

|

| |||||||||

| 6,569,643 | ||||||||||

|

| |||||||||

| Health Care (0.4%) | ||||||||||

| 774,000 | Community Health Systems, Inc.µ 8.875%, 07/15/15 | 794,318 | ||||||||

| 851,000 | Endo Pharmaceuticals Holdings, Inc.µ* 7.000%, 07/15/19 | 923,335 | ||||||||

| 928,000 | Giant Funding Corp.* 8.250%, 02/01/18 | 981,360 | ||||||||

| HealthSouth Corp. | ||||||||||

| 387,000 | 7.750%, 09/15/22µ | 388,935 | ||||||||

| 309,000 | 7.250%, 10/01/18 | 310,545 | ||||||||

| Mylan, Inc.* | ||||||||||

| 774,000 | 7.875%, 07/15/20µ | 870,750 | ||||||||

| 644,000 | 7.625%, 07/15/17 | 714,840 | ||||||||

| Valeant Pharmaceuticals International, Inc.* | ||||||||||

| 1,393,000 | 7.000%, 10/01/20 | 1,386,035 | ||||||||

| 232,000 | 6.750%, 10/01/17 | 233,160 | ||||||||

|

| |||||||||

| 6,603,278 | ||||||||||

|

| |||||||||

| Industrials (0.4%) | ||||||||||

| 706,000 | Abengoa, SA* 8.875%, 11/01/17 | 716,590 | ||||||||

| 619,000 | BE Aerospace, Inc. 8.500%, 07/01/18 | 679,352 | ||||||||

| Belden, Inc. | ||||||||||

| 271,000 | 7.000%, 03/15/17 | 273,710 | ||||||||

| 97,000 | 9.250%, 06/15/19 | 104,275 | ||||||||

| 701,000 | H&E Equipment Services, Inc.µ 8.375%, 07/15/16 | 713,267 | ||||||||

| 774,000 | Spirit AeroSystems Holdings, Inc. 7.500%, 10/01/17 | 835,920 | ||||||||

| 309,000 | Terex Corp. 8.000%, 11/15/17 | 305,138 | ||||||||

| Triumph Group, Inc. | ||||||||||

| 962,000 | 8.625%, 07/15/18 | 1,063,010 | ||||||||

| 313,000 | 8.000%, 11/15/17 | 336,475 | ||||||||

| 169,000 | Tutor Perini Corp. 7.625%, 11/01/18 | 158,438 | ||||||||

| 774,000 | WESCO Distribution, Inc. 7.500%, 10/15/17 | 797,220 | ||||||||

|

| |||||||||

| 5,983,395 | ||||||||||

|

| |||||||||

| PRINCIPAL AMOUNT | VALUE | |||||||||

| Information Technology (0.3%) | ||||||||||

| 464,000 | Amkor Technology, Inc. 7.375%, 05/01/18 | $ | 470,960 | |||||||

| 851,000 | Audatex North America, Inc.* 6.750%, 06/15/18 | 868,020 | ||||||||

| Equinix, Inc. | ||||||||||

| 696,000 | 7.000%, 07/15/21 | 742,980 | ||||||||

| 650,000 | 8.125%, 03/01/18µ | 711,750 | ||||||||

| 139,000 | Fidelity National Information Services, Inc. 7.875%, 07/15/20 | 152,553 | ||||||||

| 151,000 | Hynix Semiconductor, Inc.* 7.875%, 06/27/17 | 155,530 | ||||||||

| 1,702,000 | iGATE Corp.µ* 9.000%, 05/01/16 | 1,702,000 | ||||||||

| 276,000 | Lexmark International, Inc.µ 6.650%, 06/01/18 | 306,796 | ||||||||

|

| |||||||||

| 5,110,589 | ||||||||||

|

| |||||||||

| Materials (0.4%) | ||||||||||

| 309,000 | Allegheny Ludlum Corp.µ 6.950%, 12/15/25 | 341,330 | ||||||||

| 1,702,000 | FMG Resources* 8.250%, 11/01/19 | 1,727,530 | ||||||||

| 418,000 | Nalco Holding Company 8.250%, 05/15/17 | 466,070 | ||||||||

| 500,000 | Sealed Air Corp.* 8.125%, 09/15/19 | 543,750 | ||||||||

| 470,000 | Silgan Holdings, Inc. 7.250%, 08/15/16 | 498,200 | ||||||||

| Steel Dynamics, Inc. | ||||||||||

| 955,000 | 7.750%, 04/15/16µ | 1,009,912 | ||||||||

| 217,000 | 7.625%, 03/15/20 | 231,105 | ||||||||

| 1,694,000 | Union Carbide Corp.~ 7.875%, 04/01/23 | 2,047,589 | ||||||||

|

| |||||||||

| 6,865,486 | ||||||||||

|

| |||||||||

| Telecommunication Services (0.5%) | ||||||||||

| Frontier Communications Corp. | ||||||||||

| 2,584,000 | 9.000%, 08/15/31µ | 2,545,240 | ||||||||

| 588,000 | 8.250%, 04/15/17 | 630,630 | ||||||||

| 1,015,000 | MetroPCS Wireless, Inc.µ 7.875%, 09/01/18 | 1,037,837 | ||||||||

| 2,248,000 | Qwest Communications International, Inc.µ 7.750%, 02/15/31 | 2,214,280 | ||||||||

| Windstream Corp. | ||||||||||

| 619,000 | 7.750%, 10/15/20µ | 649,950 | ||||||||

| 619,000 | 7.500%, 04/01/23 | 631,380 | ||||||||

|

| |||||||||

| 7,709,317 | ||||||||||

|

| |||||||||

| TOTAL CORPORATE BONDS | 69,648,208 | |||||||||

|

| |||||||||

| 12 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | See accompanying Notes to Schedule of Investments |

Schedule of Investments October 31, 2011

| PRINCIPAL AMOUNT | VALUE | |||||||||

| U.S. Government and Agency Securities (0.2%) | ||||||||||

| United States Treasury Note~ | ||||||||||

| 2,708,000 | 1.000%, 03/31/12 | $ | 2,718,689 | |||||||

| 464,000 | 0.875%, 01/31/12 | 465,033 | ||||||||

|

| |||||||||

| TOTAL U.S. GOVERNMENT AND AGENCY SECURITIES | 3,183,722 | |||||||||

|

| |||||||||

| Sovereign Bonds (0.3%) | ||||||||||

| Federal Republic of Brazil | ||||||||||

| 534,000 | BRL | 10.000%, 01/01/12 | 3,204,283 | |||||||

| 155,000 | BRL | 10.000%, 01/01/13 | 928,084 | |||||||

|

| |||||||||

| TOTAL SOVEREIGN BONDS | 4,132,367 | |||||||||

|

| |||||||||

| NUMBER OF CONTRACTS | VALUE | |||||||||

| Purchased Options (0.9%) # | ||||||||||

| Consumer Discretionary (0.3%) | ||||||||||

| 635 | Amazon.com, Inc. Call, 01/19/13, Strike $240.00 | 1,790,700 | ||||||||

| 240 | Priceline.com, Inc. Call, 01/19/13, Strike $520.00 | 2,204,400 | ||||||||

|

| |||||||||

| 3,995,100 | ||||||||||

|

| |||||||||

| Information Technology (0.6%) | ||||||||||

| 565 | Apple, Inc. Call, 01/19/13, Strike $395.00 | 3,847,650 | ||||||||

| 6,100 | Dell, Inc. Call, 01/19/13, Strike $15.00 | 1,808,650 | ||||||||

| 5,800 | EMC Corp. Call, 01/19/13, Strike $25.00 | 1,841,500 | ||||||||

| 3,600 | Oracle Corp. Call, 01/19/13, Strike $30.00 | 2,250,000 | ||||||||

|

| |||||||||

| 9,747,800 | ||||||||||

|

| |||||||||

| TOTAL PURCHASED OPTIONS | 13,742,900 | |||||||||

|

| |||||||||

TOTAL SYNTHETIC CONVERTIBLE SECURITIES (Cost $90,129,647) | 90,707,197 | |||||||||

|

| |||||||||

| NUMBER OF SHARES | VALUE | |||||||||

| CONVERTIBLE PREFERRED STOCKS (9.6%) | ||||||||||

| Consumer Staples (0.7%) | ||||||||||

| 111,900 | Bunge, Ltd. 4.875% | 10,840,312 | ||||||||

|

| |||||||||

| Energy (3.9%) | ||||||||||

| 560,000 | Apache Corp.µ 6.000% | 31,528,000 | ||||||||

| 26,000 | Chesapeake Energy Corp.* 5.750% | 30,225,000 | ||||||||

|

| |||||||||

| 61,753,000 | ||||||||||

|

| |||||||||

| Financials (3.0%) | ||||||||||

| 42,562 | Bank of America Corp. 7.250% | 36,433,072 | ||||||||

| 165,000 | MetLife, Inc. 5.000% | 11,205,150 | ||||||||

|

| |||||||||

| 47,638,222 | ||||||||||

|

| |||||||||

NUMBER OF SHARES | VALUE | |||||||||

| Industrials (0.4%) | ||||||||||

| 47,933 | Stanley Black & Decker, Inc. 4.750% | $ | 5,486,891 | |||||||

|

| |||||||||

| Materials (0.9%) | ||||||||||

| 180,000 | Vale, SAµ 6.750% | 13,752,000 | ||||||||

|

| |||||||||

| Utilities (0.7%) | ||||||||||

| 200,000 | NextEra Energy, Inc. 7.000% | 10,280,000 | ||||||||

|

| |||||||||

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $165,538,000) | 149,750,425 | |||||||||

|

| |||||||||

| NUMBER OF UNITS | VALUE | |||||||||

| STRUCTURED EQUITY-LINKED SECURITIES (3.4%) +* | ||||||||||

| Energy (1.3%) | ||||||||||

| 166,300 | Credit Suisse Group (Baker Hughes, Inc.) 8.000%, 01/31/12 | 10,244,080 | ||||||||

| 365,000 | Deutsche Bank, AG (Chesapeake Energy Corp.) 8.000%, 01/24/12 | 10,869,700 | ||||||||

|

| |||||||||

| 21,113,780 | ||||||||||

|

| |||||||||

| Health Care (0.8%) | ||||||||||

| 120,000 | Deutsche Bank, AG (Biogen) 8.000%, 12/13/11 | 11,823,600 | ||||||||

|

| |||||||||

| Information Technology (1.3%) | ||||||||||

| 430,000 | Barclays Capital, Inc. (EMC Corp.) 8.000%, 12/23/11 | 10,767,200 | ||||||||

| 279,300 | Credit Suisse Group (Autodesk, Inc.) 8.000%, 01/31/12 | 10,267,068 | ||||||||

|

| |||||||||

| 21,034,268 | ||||||||||

|

| |||||||||

TOTAL STRUCTURED EQUITY-LINKED SECURITIES (Cost $58,996,056) | 53,971,648 | |||||||||

|

| |||||||||

| NUMBER OF SHARES | VALUE | |||||||||

| COMMON STOCKS (77.2%) | ||||||||||

| Consumer Discretionary (1.5%) | ||||||||||

| 400,000 | Carnival Corp.µ | 14,084,000 | ||||||||

| 300,000 | CBS Corp.µ | 7,743,000 | ||||||||

| 89,912 | General Motors Company# | 2,324,225 | ||||||||

|

| |||||||||

| 24,151,225 | ||||||||||

|

| |||||||||

| Consumer Staples (7.3%) | ||||||||||

| 908,496 | Archer-Daniels-Midland Company | 26,291,874 | ||||||||

| 850,000 | Coca-Cola Companyµ | 58,072,000 | ||||||||

| See accompanying Notes to Schedule of Investments | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 13 |

Schedule of Investments October 31, 2011

| NUMBER OF SHARES | VALUE | |||||||||

| 365,000 | Companhia de Bebidas das Americas | $ | 12,307,800 | |||||||

| 250,000 | Kimberly-Clark Corp.µ | 17,427,500 | ||||||||

|

| |||||||||

| 114,099,174 | ||||||||||

|

| |||||||||

| Energy (13.2%) | ||||||||||

| 405,000 | Baker Hughes, Inc. | 23,485,950 | ||||||||

| 800,000 | BP, PLCµ | 35,344,000 | ||||||||

| 425,000 | Chevron Corp.µ | 44,646,250 | ||||||||

| 65,000 | CNOOC, Ltd. | 12,259,650 | ||||||||

| 545,000 | ConocoPhillipsµ | 37,959,250 | ||||||||

| 100,000 | Diamond Offshore Drilling, Inc. | 6,554,000 | ||||||||

| 290,000 | Exxon Mobil Corp.µ | 22,646,100 | ||||||||

| 165,000 | Schlumberger, Ltd. | 12,122,550 | ||||||||

| 50,000 | EUR | Technip, SA | 4,727,853 | |||||||

| 150,000 | EUR | TOTAL, SA | 7,826,586 | |||||||

|

| |||||||||

| 207,572,189 | ||||||||||

|

| |||||||||

| Financials (2.3%) | ||||||||||

| 42,000 | American International Group, Inc.# | 1,036,980 | ||||||||

| 500,000 | Bank of America Corp.µ | 3,415,000 | ||||||||

| 172,745 | Citigroup, Inc.µ | 5,457,014 | ||||||||

| 600,000 | JPMorgan Chase & Companyµ | 20,856,000 | ||||||||

| 158,074 | Lincoln National Corp.µ | 3,011,310 | ||||||||

| 71,676 | Wells Fargo & Company | 1,857,125 | ||||||||

|

| |||||||||

| 35,633,429 | ||||||||||

|

| |||||||||

| Health Care (15.2%) | ||||||||||

| 455,990 | Bristol-Myers Squibb Companyµ | 14,404,724 | ||||||||

| 300,000 | Eli Lilly and Companyµ | 11,148,000 | ||||||||

| 945,000 | Johnson & Johnsonµ | 60,848,550 | ||||||||

| 2,559,134 | Merck & Company, Inc.µ | 88,290,123 | ||||||||

| 3,300,000 | Pfizer, Inc.µ | 63,558,000 | ||||||||

|

| |||||||||

| 238,249,397 | ||||||||||

|

| |||||||||

| Industrials (12.3%) | ||||||||||

| 230,000 | Boeing Companyµ | 15,131,700 | ||||||||

| 1,025,000 | Eaton Corp.µ | 45,940,500 | ||||||||

| 3,135,000 | General Electric Companyµ | 52,385,850 | ||||||||

| 480,000 | Honeywell International, Inc.µ | 25,152,000 | ||||||||

| 200,000 | Illinois Tool Works, Inc.µ | 9,726,000 | ||||||||

| 450,000 | Masco Corp.µ | 4,320,000 | ||||||||

| 135,000 | EUR | Siemens, AGµ | 14,150,821 | |||||||

| 335,000 | United Technologies Corp.µ | 26,123,300 | ||||||||

|

| |||||||||

| 192,930,171 | ||||||||||

|

| |||||||||

| Information Technology (15.8%) | ||||||||||

| 1,550,000 | Applied Materials, Inc. | 19,096,000 | ||||||||

| 250,000 | Canon, Inc.µ | 11,387,500 | ||||||||

| 600,000 | eBay, Inc.µ# | 19,098,000 | ||||||||

| 735,000 | TWD | HTC Corp. | 16,518,062 | |||||||

| 1,787,000 | Intel Corp.µ | 43,852,980 | ||||||||

| NUMBER OF SHARES | VALUE | |||||||||

| 1,625,000 | Microsoft Corp.µ | $ | 43,273,750 | |||||||

| 300,000 | Nintendo Company, Ltd.µ | 5,751,840 | ||||||||

| 2,200,000 | Nokia Corp. | 14,806,000 | ||||||||

| 800,000 | QUALCOMM, Inc.µ | 41,280,000 | ||||||||

| 540,000 | SAP, AGµ | 32,594,400 | ||||||||

|

| |||||||||

| 247,658,532 | ||||||||||

|

| |||||||||

| Materials (5.3%) | ||||||||||

| 572,800 | Barrick Gold Corp. | 28,353,600 | ||||||||

| 400,000 | Dow Chemical Companyµ | 11,152,000 | ||||||||

| 700,000 | Freeport-McMoRan Copper & Gold, Inc. | 28,182,000 | ||||||||

| 300,000 | Goldcorp, Inc.µ | 14,652,000 | ||||||||

|

| |||||||||

| 82,339,600 | ||||||||||

|

| |||||||||

| Telecommunication Services (4.3%) | ||||||||||

| 1,225,000 | AT&T, Inc.µ | 35,904,750 | ||||||||

| 450,000 | EUR | France Telecom, SA | 8,090,473 | |||||||

| 639,000 | Verizon Communications, Inc.µ | 23,630,220 | ||||||||

|

| |||||||||

| 67,625,443 | ||||||||||

|

| |||||||||

TOTAL COMMON STOCKS (Cost $1,493,777,803) | 1,210,259,160 | |||||||||

|

| |||||||||

| RIGHTS (0.0%) # | ||||||||||

| Consumer Discretionary (0.0%) | ||||||||||

| 280,000 | Escrow General Motors Corp. Rights | 78,736 | ||||||||

| 150,000 | Escrow General Motors Corp. Rights | 168,750 | ||||||||

|

| |||||||||

TOTAL RIGHTS (Cost $386,744) | 247,486 | |||||||||

|

| |||||||||

| WARRANTS (0.2%) # | ||||||||||

| Consumer Discretionary (0.2%) | ||||||||||

| 81,739 | General Motors Company 07/10/16, Strike $10.00 | 1,385,476 | ||||||||

| 81,739 | General Motors Company 07/10/19, Strike $18.33 | 964,520 | ||||||||

|

| |||||||||

TOTAL WARRANTS (Cost $12,673,055) | 2,349,996 | |||||||||

|

| |||||||||

| SHORT TERM INVESTMENT (1.8%) | ||||||||||

| 27,509,746 | Fidelity Prime Money Market Fund - Institutional Class (Cost $27,509,746) | 27,509,746 | ||||||||

|

| |||||||||

| TOTAL INVESTMENTS (136.6%) | 2,141,911,021 | ||||||||

|

| |||||||||

| LIABILITIES, LESS OTHER ASSETS (-36.6%) | (574,030,870 | ) | ||||||||

|

| |||||||||

| | NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS (100.0%) | $ | 1,567,880,151 | |||||||

|

| |||||||||

| 14 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | See accompanying Notes to Schedule of Investments |

Schedule of Investments October 31, 2011

NOTES TO SCHEDULE OF INVESTMENTS

| ‡ | Variable rate or step bond security. The rate shown is the rate in effect at October 31, 2011. |

| µ | Security, or portion of security, is held in a segregated account as collateral for note payable aggregating a total value of $1,093,470,295. $536,038,357 of the collateral has been re-registered by the counterparty. |

| * | Securities issued and sold pursuant to a Rule 144A transaction are excepted from the registration requirement of the Securities Act of 1933, as amended. These securities may only be sold to qualified institutional buyers (“QIBs”), such as the Fund. Any resale of these securities must generally be effected through a sale that is registered under the Act or otherwise exempted from such registration requirements. At October 31, 2011, the value of 144A securities that could not be exchanged to the registered form is $182,567,438 or 11.6% of net assets applicable to common shareholders. |

| ~ | Security, or portion of security, is segregated as collateral (or potential collateral for future transactions) for written options and swaps. The aggregate value of such securities is $21,364,974. |

| § | Securities exchangeable or convertible into securities of one or more entities that are different than the issuer. Each entity is identified in the parenthetical. |

| # | Non-income producing security. |

| + | Structured equity-linked securities are designed to simulate the characteristics of the equity security in the parenthetical. |

FOREIGN CURRENCY ABBREVIATIONS

| BRL | Brazilian Real | |

| EUR | European Monetary Unit | |

| NOK | Norwegian Krone | |

| TWD | New Taiwanese Dollar |

Note: Value for securities denominated in foreign currencies is shown in U.S. dollars. The principal amount for such securities is shown in the respective foreign currency. The date on options represents the expiration date of the option contract. The option contract may be exercised at any date on or before the date shown.

INTEREST RATE SWAPS

| COUNTERPARTY | FIXED RATE (FUND PAYS) | FLOATING RATE (FUND RECEIVES) | TERMINATION DATE | NOTIONAL AMOUNT | UNREALIZED APPRECIATION/ (DEPRECIATION) | |||||||||

| BNP Paribas, SA | 1.8525% quarterly | 3 month LIBOR | 09/14/12 | $ | 108,100,000 | $ | (1,499,145 | ) | ||||||

| BNP Paribas, SA | 2.5350% quarterly | 3 month LIBOR | 03/09/14 | 90,000,000 | (4,446,441 | ) | ||||||||

| BNP Paribas, SA | 2.9700% quarterly | 3 month LIBOR | 07/03/14 | 75,000,000 | (4,857,774 | ) | ||||||||

| BNP Paribas, SA | 2.0200% quarterly | 3 month LIBOR | 03/09/12 | 60,000,000 | (490,000 | ) | ||||||||

| BNP Paribas, SA | 3.3550% quarterly | 3 month LIBOR | 06/09/14 | 60,000,000 | (4,559,537 | ) | ||||||||

| BNP Paribas, SA | 2.1350% quarterly | 3 month LIBOR | 07/03/12 | 52,000,000 | (654,687 | ) | ||||||||

| BNP Paribas, SA | 2.4700% quarterly | 3 month LIBOR | 06/11/12 | 40,000,000 | (617,250 | ) | ||||||||

|

| |||||||||||||

| $ | (17,124,834 | ) | ||||||||||||

|

| |||||||||||||

| See accompanying Notes to Financial Statements | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 15 |

Statement of Assets and Liabilities October 31, 2011

ASSETS | ||||

Investments in securities, at value (cost $2,442,034,680) | $ | 2,141,911,021 | ||

Receivables: | ||||

Accrued interest and dividends | 13,883,986 | |||

Investments sold | 8,788,824 | |||

Prepaid expenses | 39,225 | |||

Other assets | 235,956 | |||

| ||||

Total assets | 2,164,859,012 | |||

| ||||

LIABILITIES | ||||

Unrealized depreciation on interest rate swaps | 17,124,834 | |||

Payables: | ||||

Note payable | 576,000,000 | |||

Investments purchased | 1,574,052 | |||

Affiliates: | ||||

Investment advisory fees | 1,736,880 | |||

Deferred compensation to trustees | 235,956 | |||

Financial accounting fees | 20,011 | |||

Trustees’ fees and officer compensation | 3,561 | |||

Other accounts payable and accrued liabilities | 283,567 | |||

| ||||

Total liabilities | 596,978,861 | |||

| ||||

NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | $ | 1,567,880,151 | ||

| ||||

COMPOSITION OF NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | ||||

Common stock, no par value, unlimited shares authorized 154,514,000 shares issued and outstanding | $ | 2,100,527,141 | ||

Undistributed net investment income (loss) | (22,943,300 | ) | ||

Accumulated net realized gain (loss) on investments, foreign currency transactions and interest rate swaps | (192,444,598 | ) | ||

Unrealized appreciation (depreciation) of investments, foreign currency translations and interest rate swaps | (317,259,092 | ) | ||

| ||||

NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | $ | 1,567,880,151 | ||

| ||||

Net asset value per common shares based upon 154,514,000 shares issued and outstanding | $ | 10.15 | ||

| ||||

| 16 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | See accompanying Notes to Financial Statements |

Statement of Operations Year Ended October 31, 2011

INVESTMENT INCOME | ||||

Interest | $ | 47,960,966 | ||

Dividends | 54,300,453 | |||

Securities lending income | 301,552 | |||

Dividend taxes withheld | (810,677 | ) | ||

| ||||

Total investment income | 101,752,294 | |||

| ||||

EXPENSES | ||||

Investment advisory fees | 21,881,324 | |||

Interest expense and related fees | 8,374,090 | |||

Financial accounting fees | 249,381 | |||

Printing and mailing fees | 197,862 | |||

Custodian fees | 138,271 | |||

Registration fees | 136,510 | |||

Accounting fees | 120,915 | |||

Audit fees | 107,480 | |||

Trustees’ fees and officer compensation | 74,348 | |||

Transfer agent fees | 31,278 | |||

Legal fees | (27,323 | ) | ||

Other | 142,091 | |||

| ||||

Total expenses | 31,426,227 | |||

| ||||

NET INVESTMENT INCOME (LOSS) | 70,326,067 | |||

| ||||

REALIZED AND UNREALIZED GAIN (LOSS) | ||||

Net realized gain (loss) from: | ||||

Investments, excluding purchased options | 1,385,295 | |||

Purchased options | (273,908 | ) | ||

Foreign currency transactions | (37,510 | ) | ||

Interest rate swaps | (10,575,839 | ) | ||

Change in net unrealized appreciation/(depreciation) on: | ||||

Investments, excluding purchased options | 11,665,747 | |||

Purchased options | (1,555,742 | ) | ||

Foreign currency translations | (1,042 | ) | ||

Interest rate swaps | 7,322,439 | |||

| ||||

NET GAIN (LOSS) | 7,929,440 | |||

| ||||

NET INCREASE (DECREASE) IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS RESULTING FROM OPERATIONS | $ | 78,255,507 | ||

| ||||

| See accompanying Notes to Financial Statements | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 17 |

Statements of Changes in Net Assets

| YEAR ENDED OCTOBER 31, | ||||||||

| 2011 | 2010 | |||||||

OPERATIONS | ||||||||

Net investment income (loss) | $ | 70,326,067 | $ | 78,139,439 | ||||

Net realized gain (loss) | (9,501,962 | ) | (34,543,823 | ) | ||||

Change in unrealized appreciation/(depreciation) | 17,431,402 | 189,589,487 | ||||||

| ||||||||

Net increase (decrease) in net assets applicable to common shareholders resulting from operations | 78,255,507 | 233,185,103 | ||||||

| ||||||||

DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM | ||||||||

Net investment income | (77,683,237 | ) | (78,719,537 | ) | ||||

Return of capital | (19,660,583 | ) | (18,624,283 | ) | ||||

| ||||||||

Net decrease in net assets from distributions to common shareholders | (97,343,820 | ) | (97,343,820 | ) | ||||

| ||||||||

TOTAL INCREASE (DECREASE) IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | (19,088,313 | ) | 135,841,283 | |||||

| ||||||||

NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | ||||||||

Beginning of year | $ | 1,586,968,464 | $ | 1,451,127,181 | ||||

| ||||||||

End of year | 1,567,880,151 | 1,586,968,464 | ||||||

| ||||||||

Undistributed net investment income (loss) | $ | (22,943,300 | ) | $ | (29,416,351 | ) | ||

| 18 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | See accompanying Notes to Financial Statements |

Statement of Cash Flows Year Ended October 31, 2011

CASH FLOWS FROM OPERATING ACTIVITIES: | ||||

Net increase/(decrease) in net assets from operations | $ | 78,255,507 | ||

Adjustments to reconcile net increase/(decrease) in net assets from operations to net cash used for operating activities: | ||||

Purchase of investment securities | (738,336,704 | ) | ||

Net proceeds from disposition of short term investments | 25,890,192 | |||

Proceeds from disposition of investment securities | 711,669,214 | |||

Amortization and accretion of fixed-income securities | (1,286,433 | ) | ||

Net realized gains/losses from investments, excluding purchased options | (1,385,295 | ) | ||

Net realized gains/losses from purchased options | 273,908 | |||

Change in unrealized appreciation or depreciation on investments, excluding purchased options | (11,665,747 | ) | ||

Change in unrealized appreciation or depreciation on purchased options | 1,555,742 | |||

Change in unrealized appreciation or depreciation on interest rate swaps | (7,322,439 | ) | ||

Net change in assets and liabilities: | ||||

(Increase)/decrease in assets: | ||||

Accrued interest and dividends receivable | 2,940,468 | |||

Prepaid expenses | (516 | ) | ||

Other assets | (24,109 | ) | ||

Increase/(decrease) in liabilities: | ||||

Payables to affiliates | (27,316 | ) | ||

Other accounts payable and accrued liabilities | (192,652 | ) | ||

| ||||

Net cash provided by/(used in) operating activities | $ | 60,343,820 | ||

| ||||

CASH FLOWS FROM FINANCING ACTIVITIES: | ||||

Distributions to common shareholders | (97,343,820 | ) | ||

Proceeds from note payable | 37,000,000 | |||

| ||||

Net cash provided by/(used in) financing activities | $ | (60,343,820 | ) | |

| ||||

Cash at beginning of year | $ | — | ||

| ||||

Cash at end of year | $ | — | ||

| ||||

Supplemental disclosure | ||||

Cash paid for interest and related fees | $ | 8,420,458 | ||

| ||||

| See accompanying Notes to Financial Statements | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 19 |

Note 1 – Organization and Significant Accounting Policies

Organization. Calamos Strategic Total Return Fund (the ”Fund”) was organized as a Delaware statutory trust on December 31, 2003 and is registered under the Investment Company Act of 1940 (the “1940 Act”) as a diversified, closed-end management investment company. The Fund commenced operations on March 26, 2004. The Fund’s investment objective is to provide total return through a combination of capital appreciation and current income. Under normal circumstances, the Fund invests primarily in common and preferred stocks and income producing securities such as investment grade and below investment grade debt securities.

Fund Valuation. The valuation of the Fund’s investments is in accordance with policies and procedures adopted by and under the ultimate supervision of the board of trustees.

Fund securities that are traded on U.S. securities exchanges, except option securities, are valued at the last current reported sales price at the time a Fund determines its net asset value (“NAV”). Securities traded in the over-the-counter market and quoted on The NASDAQ Stock Market are valued at the NASDAQ Official Closing Price, as determined by NASDAQ, or lacking a NASDAQ Official Closing Price, the last current reported sale price on NASDAQ at the time the Fund determines its NAV.

When a last sale or closing price is not available, equity securities, other than option securities, that are traded on a U.S. securities exchange and other equity securities traded in the over-the-counter market are valued at the mean between the most recent bid and asked quotations in accordance with guidelines adopted by the board of trustees. Each option security traded on a U.S. securities exchange is valued at the mid-point of the consolidated bid/ask quote for the option security, also in accordance with guidelines adopted by the board of trustees. Each over-the-counter option that is not traded through the Options Clearing Corporation is valued based on a quotation provided by the counterparty to such option under the ultimate supervision of the board of trustees.

Fixed income securities, certain convertible preferred securities, and non-exchange traded derivatives are normally valued by independent pricing services or by dealers or brokers who make markets in such securities. Valuations of such fixed income securities, certain convertible preferred securities, and non-exchange traded derivatives consider yield or price of equivalent securities of comparable quality, coupon rate, maturity, type of issue, trading characteristics and other market data and do not rely exclusively upon exchange or over-the-counter prices.

Trading on European and Far Eastern exchanges and over-the-counter markets is typically completed at various times before the close of business on each day on which the New York Stock Exchange (“NYSE”) is open. Each security trading on these exchanges or over-the-counter markets may be valued utilizing a systematic fair valuation model provided by an independent pricing service approved by the board of trustees. The valuation of each security that meets certain criteria in relation to the valuation model is systematically adjusted to reflect the impact of movement in the U.S. market after the foreign markets close. Securities that do not meet the criteria, or that are principally traded in other foreign markets, are valued as of the last reported sale price at the time the Fund determines its NAV, or when reliable market prices or quotations are not readily available, at the mean between the most recent bid and asked quotations as of the close of the appropriate exchange or other designated time. Trading of foreign securities may not take place on every NYSE business day. In addition, trading may take place in various foreign markets on Saturdays or on other days when the NYSE is not open and on which the Fund’s NAV is not calculated.

If the pricing committee determines that the valuation of a security in accordance with the methods described above is not reflective of a fair value for such security, the security is valued at a fair value by the pricing committee, under the ultimate supervision of the board of trustees, following the guidelines and/or procedures adopted by the board of trustees.

The Fund also may use fair value pricing, pursuant to guidelines adopted by the board of trustees and under the ultimate supervision of the board of trustees, if trading in the security is halted or if the value of a security it holds is materially affected by events occurring before the Fund’s pricing time but after the close of the primary market or exchange on which the security is listed. Those procedures may utilize valuations furnished by pricing services approved by the board of trustees, which may be based on market transactions for comparable securities and various relationships between securities that are generally recognized by institutional traders, a computerized matrix system, or appraisals derived from information concerning the securities or similar securities received from recognized dealers in those securities.

When fair value pricing of securities is employed, the prices of securities used by a Fund to calculate its NAV may differ from market quotations or official closing prices. In light of the judgment involved in fair valuations, there can be no assurance that a fair value assigned to a particular security is accurate.

| 20 | CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT |

Notes to Financial Statements

Investment Transactions. Investment transactions are recorded on a trade date basis. Net realized gains and losses from investment transactions are reported on an identified cost basis. Interest income is recognized using the accrual method and includes accretion of original issue and market discount and amortization of premium. Dividend income is recognized on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information becomes available after the ex-dividend date.

Foreign Currency Translation. Values of investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using a rate quoted by a major bank or dealer in the particular currency market, as reported by a recognized quotation dissemination service.

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign currency gains or losses arise from disposition of foreign currency, the difference in the foreign exchange rates between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the ex-date or accrual date and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes (due to the changes in the exchange rate) in the value of foreign currency and other assets and liabilities denominated in foreign currencies held at period end.

Allocation of Expenses Among Funds. Expenses directly attributable to the Fund are charged to the Fund; certain other common expenses of Calamos Advisors Trust, Calamos Investment Trust, Calamos Convertible Opportunities and Income Fund, Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Global Total Return Fund and Calamos Global Dynamic Income Fund are allocated proportionately among each fund to which the expenses relate in relation to the net assets of each fund or on another reasonable basis.

Use of Estimates. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

Income Taxes. No provision has been made for U.S. income taxes because the Fund’s policy is to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended, and distribute to shareholders substantially all of the Fund’s taxable income and net realized gains.

Dividends and distributions paid to shareholders are recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. generally accepted accounting principles. To the extent these “book/tax” differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment. These differences are primarily due to differing treatments for foreign currency transactions, contingent payment debt instruments and methods of amortizing and accreting for fixed income securities. The financial statements are not adjusted for temporary differences.

The Fund recognized no liability for uncertain tax positions. A reconciliation is not provided as the beginning and ending amounts of unrecognized benefits are zero, with no interim additions, reductions or settlements. Tax years 2007 – 2010 remain subject to examination by the U.S. and the State of Illinois tax jurisdictions.

Indemnifications. Under the Fund’s organizational documents, the Fund is obligated to indemnify its officers and trustees against certain liabilities incurred by them by reason of having been an officer or trustee of the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund’s management expects the risk of material loss in connection to a potential claim to be remote.

Note 2 – Investment Adviser and Transactions With Affiliates Or Certain Other Parties

Pursuant to an investment advisory agreement with Calamos Advisors LLC (“Calamos Advisors”), the Fund pays an annual fee, payable monthly, equal to 1.00% based on the average weekly managed assets. “Managed assets” means a fund’s total assets

| CALAMOS STRATEGIC TOTAL RETURN FUND ANNUAL REPORT | 21 |

Notes to Financial Statements

(including any assets attributable to any leverage that may be outstanding) minus total liabilities (other than debt representing financial leverage).

Pursuant to a financial accounting services agreement, during the year the Fund paid Calamos Advisors a fee for financial accounting services payable monthly at the annual rate of 0.0175% on the first $1 billion of combined assets, 0.0150% on the next $1 billion of combined assets and 0.0110% on combined assets above $2 billion (for purposes of this calculation “combined assets” means the sum of the total average daily net assets of Calamos Investment Trust, Calamos Advisors Trust, and the total average weekly managed assets of Calamos Convertible and High Income Fund, Calamos Strategic Total Return Fund, Calamos Convertible Opportunities and Income Fund, Calamos Global Total Return Fund and Calamos Global Dynamic Income Fund). Financial accounting services include, but are not limited to, the following: managing expenses and expense payment processing; monitoring the calculation of expense accrual amounts; calculating, tracking and reporting tax adjustments on all assets; and monitoring trustee deferred compensation plan accruals and valuations. The Fund pays its pro rata share of the financial accounting services fee payable to Calamos Advisors based on its relative portion of combined assets used in calculating the fee.

The Fund reimburses Calamos Advisors for a portion of compensation paid to the Fund’s Chief Compliance Officer. This compensation is reported as part of “Trustees’ fees and officer compensation” expense on the Statement of Operations.

A trustee and certain officers of the Fund are also officers and directors of Calamos Advisors. Such trustee and officers serve without direct compensation from the Fund.