Table of Contents

As filed with the Securities and Exchange Commission on March 29, 2005

Registration No. 333-121602

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Madison River Communications Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 4813 | 20-0511398 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

103 South Fifth Street

Mebane, North Carolina 27302

(919) 563-1500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul H. Sunu

Chief Financial Officer and Secretary

Madison River Communications Corp.

103 South Fifth Street

Mebane, North Carolina 27302

(919) 563-1500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gary P. Cullen Skadden, Arps, Slate, Meagher & Flom LLP 333 West Wacker Drive Chicago, Illinois 60606 (312) 407-0700 | Robert Evans III Shearman & Sterling LLP 599 Lexington Avenue New York, New York 10022 (212) 848-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||

Common stock, par value $0.01 per share | $345,000,000 | $40,607 |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

| (2) | Includes shares that may be sold, if any, pursuant to the underwriters’ overallotment option. |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 29, 2005

PROSPECTUS

Shares

Madison River Communications Corp.

Common Stock

This is the initial public offering of common stock of Madison River Communications Corp. All of the shares of common stock are being sold by us. We intend to use the proceeds from shares being sold in this offering less the related underwriting discount to repurchase that same number of shares from some of our existing equity investors at a per share purchase price equal to the public offering price in this offering less the related underwriting discount. Some of the existing equity investors from whom we will repurchase shares are affiliates of Goldman, Sachs & Co., an underwriter participating in the offering. We anticipate that the public offering price will be between $ and $ per share.

We have applied to list our common stock on the Nasdaq National Market under the symbol “MRCC.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12.

| Per Share | Total | |||||

Public offering price | $ | $ | ||||

Underwriting discount | $ | $ | ||||

Proceeds, before expenses, to Madison River Communications Corp. | $ | $ | ||||

We have granted the underwriters an option to purchase up to additional shares of common stock at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover over-allotments, if any. We intend to use the proceeds from any shares sold pursuant to the underwriters’ over-allotment option less the related underwriting discount to repurchase an equivalent number of shares from some of our existing equity investors at a per share purchase price equal to the public offering price in this offering less the related underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2005.

| Lehman Brothers | Merrill Lynch & Co. |

| Goldman, Sachs & Co. |

| JPMorgan | Wachovia Securities |

| Deutsche Bank Securities | Jefferies & Company, Inc. | Legg Mason Wood Walker Incorporated |

The date of this prospectus is , 2005

Table of Contents

| 1 | ||

| 12 | ||

| 27 | ||

| 28 | ||

| 32 | ||

| 33 | ||

| 43 | ||

| 44 | ||

| 45 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 47 | |

| 73 | ||

| 74 | ||

| 86 | ||

| 98 | ||

Security Ownership of Certain Beneficial Owners and Management | 106 | |

| 109 | ||

| 114 | ||

| 119 | ||

| 124 | ||

| 126 | ||

| 130 | ||

| 134 | ||

| 134 | ||

| 134 | ||

| F-1 |

Table of Contents

The following is a summary of some of the information contained in this prospectus. In addition to this summary, we urge you to read the more detailed information, including the financial statements and related notes and the “Risk Factors” section, included elsewhere in this prospectus.

Our Company

We operate rural telephone companies that serve business and residential customers primarily in Alabama, Georgia, Illinois and North Carolina. A rural telephone company is a local telephone company that provides basic telephone service in rural areas throughout the United States. Our four rural telephone companies provide a variety of telecommunications services to business and residential customers in their franchised territories, including local and long distance voice services, broadband digital subscriber line, or DSL, services and dial-up Internet services as well as telephone directory and other miscellaneous services. We also provide local and long distance voice services and high-speed data services to medium and large businesses in the markets near our franchised territories. We believe there is growth potential within the markets we serve.

We were founded with the goal of acquiring, integrating and improving operations at rural telephone companies. Since 1998, we have acquired four rural telephone companies, and we believe our disciplined approach to operations has allowed us to improve the operations at each of them.

Our rural telephone companies benefit from limited competition and a favorable regulatory environment, which we believe leads to stable operations. Competition is typically limited in areas served by rural telephone companies because they primarily are sparsely populated and rural, with predominantly residential customers. Accordingly, the cost of operations and capital investment requirements for new entrants is high. At the same time, existing state and federal regulations permit us to charge rates that enable us to recover our operating costs plus a reasonable rate of return on our invested capital (as determined by relevant regulatory authorities).

At December 31, 2004, we had 233,307 connections in service, comprising 193,092 voice access lines and 40,215 DSL and high-speed data connections. For the year ended December 31, 2004, we had total revenues of $194.4 million, operating income of $54.1 million and net income of $6.3 million. Excluding the effect of a $6.4 million income tax benefit recognized in 2004, we would have had a net loss of $0.1 million for the year ended December 31, 2004. As of December 31, 2004, we had an accumulated deficit of $204.9 million and working capital of $8.5 million. We currently have a substantial amount of indebtedness. Following consummation of this offering and the other transactions described under “The Transactions,” we expect to have approximately $455.6 million of outstanding indebtedness.

Our Strengths

We believe we are distinguished by the following strengths, each of which we believe will contribute to the production of stable cash flows:

| · | Long-standing local operations with limited competition. Active in our markets for over 50 years, we believe our thorough knowledge of the markets we operate in, our established operations and our reputation for a high standard of service give us a competitive advantage. |

| · | Proven track record of service growth. We have succeeded in consistently growing the services used by our customers by offering an integrated bundle of local, long-distance and Internet and enhanced data services as well as other enhanced services such as call waiting and caller identification. |

| · | Technologically advanced and scalable network infrastructure. We have substantially completed our investment in a technologically advanced network capable of delivering a full suite of telecommunications services to our customers. |

1

Table of Contents

| · | Disciplined approach to operations. We bring a disciplined approach to operations, including a strict budgeting process and providing our employees with incentives to meet operating targets and improve cash flows. |

| · | Successful track record of acquisitions and integration. We have acquired four rural telephone companies since 1998 and have successfully integrated them within our organization and have improved their business and operations. |

| · | Experienced and proven management team. Our top five officers average over 30 years experience in the telecommunications industry and have managed us through the integration of our four acquisitions. |

| · | Geographically diversified markets. We principally operate in four states, limiting our exposure to regulatory or operating risk in any one state. |

Our Strategy

Our objective is to maintain and strengthen our position as a leading provider of telecommunications services in our target markets in the Southeast and Midwest. The key elements of our strategy include:

| · | Continuing to improve operating efficiencies by providing centrally managed resources and sharing best practices across our operations. |

| · | Taking a disciplined approach to capital expenditures. |

| · | Improving on our competitive position through superior service offerings by continuing to add new services and providing bundled offerings. |

| · | Expanding market position through knowledge of local markets and strong customer retention. |

| · | Growing through selective acquisitions. |

The Transactions

As used in this prospectus, the “transactions” collectively refer to the following:

| · | The Reorganization Transactions. Pursuant to a series of mergers, immediately prior to this offering, 100% of the outstanding shares of common stock of Madison River Communications Corp., or Madison River Communications, will be owned by current direct or indirect holders of member units of Madison River Telephone, LLC, or Madison River Telephone, and Madison River Communications will own, directly and indirectly, 100% of the outstanding equity interests in Madison River Telephone. |

| · | This Offering.The proceeds from this offering of common stock by Madison River Communications, together with the proceeds from borrowings under the new credit facilities described below and cash on hand, will be used to finance the share repurchase, debt repayment and refinancing and minority interest redemption described below and to pay the bonuses, fees and expenses relating to the transactions. The proceeds of this offering will not be used for our ongoing business operations. This offering is conditioned on the closing of the new credit facilities. |

| · | New Credit Facilities. Concurrently with the closing of this offering, Madison River Capital, LLC, one of our subsidiaries, will enter into new senior secured credit facilities, referred to as the “new credit facilities,” with a syndicate of lenders. The new credit facilities will consist of seven-year term loan facilities providing for senior secured term loans in an aggregate principal amount of $455.6 million and a seven-year revolving credit facility providing for up to $75.0 million in revolving loans. See “Description of New Credit Facilities” for a more detailed description of the new credit facilities. |

2

Table of Contents

| · | Share Repurchase.Immediately following this offering, we will use the proceeds from shares of common stock being sold in this offering less the related underwriting discount to repurchase that same number of shares from some of our existing equity investors immediately following the reorganization transactions at a per share purchase price equal to the public offering price in this offering less the related underwriting discount. We will use the proceeds from any shares sold pursuant to the underwriters’ over-allotment option less the related underwriting discount to repurchase an equivalent number of shares from those same holders at the same repurchase price. Some of the holders from whom we will repurchase shares are affiliates of Goldman, Sachs & Co., an underwriter participating in this offering. |

| · | Debt Repayment and Refinancing.We will repay or refinance $ million aggregate principal amount of our existing debt, and pay accrued and unpaid interest thereon together with applicable premiums. |

| · | Redemption of Minority Interest in Coastal Communications, Inc. At the closing of this offering, we will repurchase the minority interest in our subsidiary, Coastal Communications, Inc., for an aggregate purchase price of $3.0 million. |

Each of the transactions is described more fully under “The Transactions,” “Use of Proceeds” and “Description of New Credit Facilities.”

3

Table of Contents

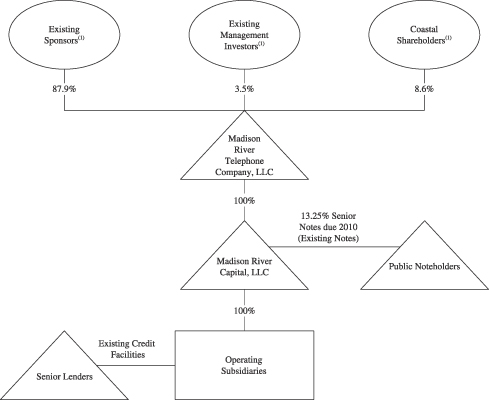

Pre-Transactions Ownership and Corporate Structure

The chart below illustrates our ownership and corporate structure prior to consummation of the transactions.

| (1) | The existing equity investors of Madison River Telephone are (1) affiliates of each of Madison Dearborn Partners, Goldman, Sachs & Co. and Providence Equity Partners, referred to collectively as the “existing sponsors,” (2) the former shareholders of Coastal Utilities, Inc., a rural telephone company we acquired in March 2000, referred to as the “Coastal shareholders” and (3) certain members of our management, referred to as the “existing management investors.” In addition, Madison River Telephone holds Class D units in itself to fund its obligations under its long-term incentive plan. Goldman, Sachs & Co. is one of the underwriters participating in this offering and some of its affiliates are some of our existing sponsors, will have shares of our common stock repurchased by us with a portion of the proceeds from this offering and will continue to own shares in Madison River Communications following the transactions. See “Security Ownership of Certain Beneficial Owners and Management.” |

4

Table of Contents

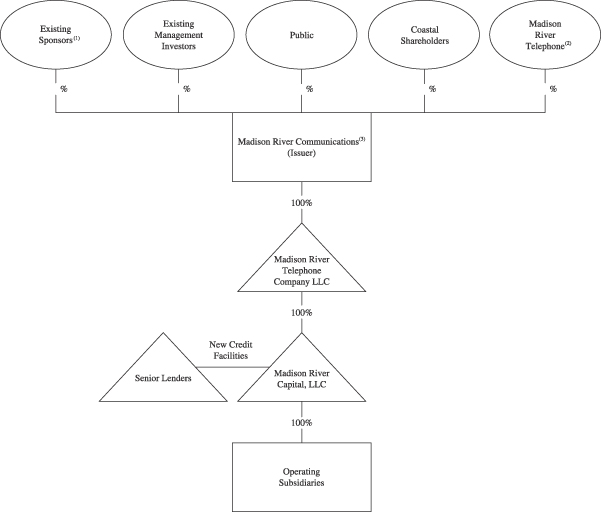

Post-Transactions Ownership and Corporate Structure

The chart below illustrates our ownership and corporate structure following the transactions.

| (1) | Affiliates of Goldman, Sachs & Co., one of the underwriters participating in this offering, are some of our existing sponsors, will have shares of our common stock repurchased by us with a portion of the proceeds from this offering and will continue to own shares in Madison River Communications following the transactions. See “Security Ownership of Certain Beneficial Owners and Management.” |

| (2) | Reflects shares of common stock of Madison River Communications to be held by Madison River Telephone to fund its obligations under its long-term incentive plan. See “The Transactions.” |

| (3) | Madison River Communications will own 100% of the outstanding equity interests in Madison River Telephone directly and indirectly through wholly owned subsidiaries. |

5

Table of Contents

The Offering

Shares of common stock offered by Madison River Communications Corp. | shares ( shares if the underwriters’ over-allotment option is exercised in full). |

Shares of common stock to be repurchased from some of our existing equity investors | shares ( shares if the underwriters’ over-allotment option is exercised in full). |

Shares of common stock to be outstanding following the offering and the share repurchase | shares ( shares if the underwriters’ over-allotment option is exercised in full). |

The total number of shares being offered by this prospectus represents % of the number of shares to be outstanding following the offering and after giving effect to the share repurchase (or % if the underwriters’ over-allotment option is exercised in full).

Dividends | Upon completion of this offering, our board of directors will adopt a dividend policy that reflects an intention to distribute a substantial portion of the cash generated by our business in excess of operating needs, interest and principal payments on our indebtedness, capital expenditures, taxes and future reserves, if any, as regular quarterly dividends to our stockholders. |

In accordance with our dividend policy, we currently intend to pay an initial dividend of $ per share on or about , 2005 and to continue to pay quarterly dividends at an annual rate of $ per share for the first full year following the closing of this offering, but only if and to the extent dividends are declared by our board of directors and permitted by applicable law and the terms of our new credit facilities. Dividend payments are not guaranteed, and our board of directors may decide, in its absolute discretion, at any time and for any reason, not to pay dividends. Dividends on our common stock are not cumulative. See “Dividend Policy and Restrictions.” |

Our new credit facilities will generally restrict the amount of dividends we may pay at any time to the “Restricted Payments Basket Amount,” which is equal to the sum of “Available Cash” plus $50 million minus dividends paid to date, and will suspend our ability to pay dividends if our “total leverage ratio” for the most recently ended four fiscal quarter period exceeds 5.10 to 1.00. In addition, our new credit facilities will prohibit the payment of dividends if an event of default thereunder shall have occurred and be continuing or would occur as a result thereof. See “Dividend Policy and Restrictions” and “Description of New Credit Facilities” for a definition of the above terms as well as a more detailed discussion of the restrictions on our ability to pay dividends. |

6

Table of Contents

Dividends paid by us, to the extent paid out of our earnings and profits, or E&P, as computed for U.S. federal income tax purposes, will be taxable as dividend income. Under current law, dividend income of U.S. individuals is generally taxable at long-term capital gains rates. Dividends paid by us in excess of our E&P will be treated first as a non-taxable return of capital and then as a gain from the sale of common stock. We currently expect that dividends for the foreseeable future will be paid out of our E&P. For a more complete description, see “Material U.S. Federal Income Tax Considerations.” |

Use of Proceeds | We expect to receive gross proceeds from this offering of approximately $ million, assuming a public offering price of $ per share, the mid-point of the range shown on the cover of this prospectus (or $ million if the underwriters’ over-allotment option is exercised in full). We will use the proceeds from this offering, together with borrowings under our new credit facilities and cash on hand, for the repurchase of shares from some of our existing equity investors, the repayment and refinancing of existing debt, to finance the other transactions and to pay related bonuses, fees and expenses, and not for our ongoing business operations. Some of our existing equity investors from whom we will repurchase shares are affiliates of Goldman, Sachs & Co., an underwriter participating in this offering. See “The Transactions” and “Use of Proceeds.” |

Listing | We have applied to list our common stock on the Nasdaq National Market under the symbol “MRCC.” |

General Information About This Prospectus

Unless we specifically state otherwise, all information in this prospectus:

| · | assumes no exercise of the over-allotment option granted to the underwriters; and |

| · | excludes shares reserved and available for future grant or issuance under our Omnibus Stock Plan. |

Our Corporate Information

Madison River Communications was formed as a holding company under Delaware law in December 2003 and has not conducted any independent operations. Madison River Communications will not have direct operations but, following the reorganization transactions, it will directly or indirectly, through one or more wholly-owned subsidiaries, be primarily engaged in the provision of telecommunications services and solutions to business and residential customers. In this prospectus, “we,” “our” and “us” refer to Madison River Communications Corp. and its direct and indirect subsidiaries after giving effect to the reorganization transactions, unless the context otherwise requires.

Our principal executive offices are located at 103 South Fifth Street, Mebane, North Carolina 27302, and our telephone number at that address is (919) 563-1500. Our Internet address is www.madisonriver.net. www.madisonriver.net is a textual reference only, meaning that the information contained on the website is not part of this prospectus and is not incorporated in this prospectus by reference.

7

Table of Contents

Summary Historical Financial and Operating Data

The following table presents summary historical financial and operating data about us. Madison River Communications was formed in December 2003 to serve as a holding company for our business. Madison River Communications has not commenced operations and has no assets or liabilities. In order to facilitate this offering, we will consummate the reorganization transactions pursuant to which Madison River Communications will become the successor to Madison River Telephone. See “The Transactions.” Since Madison River Communications has not commenced operations, Madison River Telephone is considered the predecessor to Madison River Communications for accounting purposes.

The following summary historical financial data for Madison River Telephone for the three years ended and as of December 31, 2004 have been derived from Madison River Telephone’s audited consolidated financial statements and related notes included in the back of this prospectus. The following summary as adjusted balance sheet data gives effect to the transactions as described under “The Transactions” and “Use of Proceeds,” as if the transactions had been consummated on December 31, 2004.

This summary historical financial and operating data should be read in conjunction with the information contained in “Selected Historical Financial and Operating Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Madison River Telephone’s audited consolidated financial statements and related notes included elsewhere in this prospectus.

| Year Ended December 31, | ||||||||||||

| 2004 | 2003 | 2002 | ||||||||||

| (dollars in thousands) | ||||||||||||

Statement of Operations Data: | ||||||||||||

Revenues | $ | 194,374 | $ | 186,460 | $ | 184,201 | ||||||

Operating income | 54,095 | 42,472 | 28,858 | |||||||||

Net income (loss) | 6,325 | (16,465 | ) | (40,683 | ) | |||||||

Other Financial Data: | ||||||||||||

Capital expenditures | $ | 14,643 | $ | 12,223 | $ | 12,344 | ||||||

Net cash provided by operating activities | 38,793 | 43,665 | 32,092 | |||||||||

Net cash used in investing activities | (12,460 | ) | (10,019 | ) | (10,714 | ) | ||||||

Net cash used in financing activities | (19,917 | ) | (25,457 | ) | (23,030 | ) | ||||||

EBITDA(a) | 106,492 | 98,184 | 76,775 | |||||||||

Adjusted EBITDA(b) | 105,690 | 103,286 | 88,553 | |||||||||

As of December 31, 2004 | ||||||

| Actual | As Adjusted | |||||

| (Unaudited) | ||||||

| (dollars in thousands) | ||||||

Balance Sheet Data: | ||||||

Cash and cash equivalents | $ | 34,559 | ||||

Total assets | 782,686 | |||||

Long-term debt, including current portion | 639,269 | 455,556 | ||||

Redeemable members’ capital | 213,749 | — | ||||

Total members’ capital(c) | (189,562 | ) | — | |||

Stockholders’ equity | — | |||||

(footnotes on following page)

8

Table of Contents

| As of December 31, | ||||||

| 2004 | 2003 | 2002 | ||||

Connections In Service: (Unaudited) | ||||||

Voice access lines(d) | 193,092 | 200,365 | 206,597 | |||

DSL and high-speed data connections(e) | 40,215 | 24,863 | 17,128 | |||

Total connections in service | 233,307 | 225,228 | 223,725 | |||

| (a) | EBITDA consists of our net income (loss) before income tax (expense) benefit, interest expense and depreciation and amortization. We believe that net cash provided by operating activities is the most directly comparable financial measure to EBITDA under generally accepted accounting principles. EBITDA is presented because we believe it is a useful indicator of our ability to service our long-term debt, capital expenditures and working capital requirements as well as pay dividends. EBITDA should not be considered in isolation. EBITDA is not a measurement of financial performance under generally accepted accounting principles and should not be considered as an alternative to cash flows from operating activities as a measure of our liquidity or as an alternative to net income (loss) as an indicator of our operating performance or any other measure of performance derived in accordance with generally accepted accounting principles. EBITDA is not a complete measure of our profitability as it does not include costs and expenses for depreciation and amortization, interest expense and income taxes; nor is EBITDA a complete net cash flow measure as it does not include uses of cash to fund our long-term debt, capital expenditure and working capital requirements or to pay dividends. Other companies in our industry may present EBITDA differently than we do. |

Set forth below is a reconciliation of our net cash provided by operating activities to EBITDA:

| Year Ended December 31, | ||||||||||||

| 2004 | 2003 | 2002 | ||||||||||

| (dollars in thousands) | ||||||||||||

Net cash provided by operating activities | $ | 38,793 | $ | 43,665 | $ | 32,092 | ||||||

Adjustments: | ||||||||||||

Depreciation and amortization | (45,003 | ) | (52,054 | ) | (50,649 | ) | ||||||

Deferred long-term compensation | (2,921 | ) | (5,429 | ) | (5,284 | ) | ||||||

Deferred income taxes | 6,269 | 4,117 | (6,771 | ) | ||||||||

Losses on investments carried on the equity method | (156 | ) | (193 | ) | (3,338 | ) | ||||||

Realized gain on extinguishment of debt | 3,184 | — | — | |||||||||

Realized losses on marketable equity securities | — | (343 | ) | (3,985 | ) | |||||||

Other non-cash items | 462 | 657 | (315 | ) | ||||||||

Changes in operating assets and liabilities | 5,697 | (6,885 | ) | (2,433 | ) | |||||||

Net income (loss) | 6,325 | (16,465 | ) | (40,683 | ) | |||||||

Income tax (benefit) expense | (6,418 | ) | (1,846 | ) | 1,584 | |||||||

Interest expense | 61,582 | 64,441 | 65,225 | |||||||||

Depreciation and amortization | 45,003 | 52,054 | 50,649 | |||||||||

EBITDA | $ | 106,492 | $ | 98,184 | $ | 76,775 | ||||||

(footnotes continued on following page)

9

Table of Contents

| (b) | Adjusted EBITDA refers to the defined term in our new credit facilities that will be an important determinant in our ability to pay dividends under our new credit facilities. In addition, covenants in our new credit facilities will contain ratios based on Adjusted EBITDA. Adjusted EBITDA differs from EBITDA as defined above. Adjusted EBITDA will be defined in our new credit facilities as: (1) consolidated net income, as determined in accordance with U.S. generally accepted accounting principles, or GAAP; plus (2) the following items, to the extent deducted in determining consolidated net income: (a) Consolidated Interest Expense (as defined under “Description of New Credit Facilities”); (b) provision for income taxes; (c) depreciation and amortization expense; (d) costs and expenses related to this offering and the other transactions described under the caption “The Transactions,” including any related bonuses; (e) unrealized losses on financial derivatives recognized in accordance with SFAS No. 133; (f) noncash, stock-based compensation expense; (g) extraordinary or unusual losses (including extraordinary or unusual losses on permitted sales of assets and casualty events); (h) losses on sales of assets other than in the ordinary course of business; (i) other non-recurring or unusual costs, expenses or losses, including, without limitation, costs, expenses or losses relating to securities offerings, investments or acquisitions, incurred after the closing date of the new credit facilities to the extent not exceeding, in the aggregate, $10.0 million; (j) compensation expense arising from deemed dividends, the payment of dividends or the equivalent on shares of Madison River Communications common stock issued under its Omnibus Stock Plan, any other incentive stock plans or Madison River Telephone’s long-term incentive plans; and (k) all other non-cash items that reduce such consolidated net income for which no cash is expected to be paid in the twelve months following the date of determination;minus (3) the following items, to the extent included in determining consolidated net income: (a) unrealized gains on financial derivatives recognized in accordance with SFAS No. 133; (b) extraordinary or unusual gains (including extraordinary or unusual gains on permitted sales of assets and casualty events); (c) gains on sales of assets other than in the ordinary course of business; and (d) all other non-cash income, other than the accrual of revenue in the ordinary course (including the non-cash portion of any Rural Telephone Bank or RTFC patronage capital allocation). If our Adjusted EBITDA were to decline below certain levels, covenants in our new credit facilities that are based on Adjusted EBITDA, including our fixed charge coverage and total leverage ratio covenants, may be violated and could cause, among other things, a default under our new credit facilities, or result in our inability to pay dividends under the restricted payment covenant contained in our new credit facilities. These covenants are summarized under “Description of New Credit Facilities.” |

(footnotes continued on following page)

10

Table of Contents

The following table sets forth a reconciliation of our net cash provided by operating activities to Adjusted EBITDA:

| Year Ended December 31, | ||||||||||||

| 2004 | 2003 | 2002 | ||||||||||

| (dollars in thousands) | ||||||||||||

Net cash provided by operating activities | $ | 38,793 | $ | 43,665 | $ | 32,092 | ||||||

Adjustments: | ||||||||||||

Depreciation and amortization | (45,003 | ) | (52,054 | ) | (50,649 | ) | ||||||

Deferred long-term compensation | (2,921 | ) | (5,429 | ) | (5,284 | ) | ||||||

Deferred income taxes | 6,269 | 4,117 | (6,771 | ) | ||||||||

Losses on investments carried on the equity method | (156 | ) | (193 | ) | (3,338 | ) | ||||||

Realized gain on extinguishment of debt | 3,184 | — | — | |||||||||

Net realized losses on marketable equity securities | — | (343 | ) | (3,985 | ) | |||||||

Other non-cash items | 462 | 657 | (315 | ) | ||||||||

Changes in operating assets and liabilities | 5,697 | (6,885 | ) | (2,433 | ) | |||||||

Consolidated net income (loss) | 6,325 | (16,465 | ) | (40,683 | ) | |||||||

plus: | ||||||||||||

Consolidated interest expense | 61,582 | 64,441 | 65,225 | |||||||||

Provision for income taxes | (6,418 | ) | (1,846 | ) | 1,584 | |||||||

Depreciation and amortization | 45,003 | 52,054 | 50,649 | |||||||||

Non-cash stock-based compensation expense—long-term incentive plan | 2,921 | 5,429 | 5,284 | |||||||||

Non-cash stock-based compensation expense—other | 183 | 36 | — | |||||||||

Other non-cash items: | ||||||||||||

Share of losses in unconsolidated company accounted for using the equity method | 156 | 193 | 1,240 | |||||||||

Impairment charges on investments in unconsolidated subsidiaries | — | — | 2,098 | |||||||||

Net realized losses on marketable equity securities | — | 343 | 3,985 | |||||||||

minus: | ||||||||||||

Realized gain on retirement of debt | (3,184 | ) | — | — | ||||||||

Non-cash income—non-cash portion of RTFC patronage capital allocation | (878 | ) | (899 | ) | (829 | ) | ||||||

Adjusted EBITDA | $ | 105,690 | $ | 103,286 | $ | 88,553 | ||||||

| (c) | Includes members’ interest, accumulated deficit and accumulated other comprehensive income (loss). |

| (d) | Voice access lines refer to each line of local telephone service provided to residential and business customers. |

| (e) | DSL and high-speed data connections are the high-speed connections provided to end users for purposes of accessing the Internet. |

11

Table of Contents

An investment in our common stock involves a number of risks. In addition to the other information contained in this prospectus, prospective investors should give careful consideration to the following factors.

Risks Relating to Our Common Stock and Our New Credit Facilities

Our dividend policy may limit our ability to pursue growth opportunities.

Upon completion of this offering, our board of directors will adopt a dividend policy that reflects an intention to distribute a substantial portion of the cash generated by our business in excess of operating needs, interest and principal payments on our indebtedness, capital expenditures, taxes and future reserves, if any, as regular quarterly dividends to our stockholders. As a result, we may not retain a sufficient amount of cash to finance a material expansion of our business or to fund our operations consistent with past levels of funding in the event of a significant business downturn. In addition, because a significant portion of cash available to pay dividends will be distributed to holders of our common stock under our dividend policy, our ability to pursue any material expansion of our business, including through acquisitions or increased capital spending, will depend more than it otherwise would on our ability to obtain third party financing, which may not be available to us at acceptable pricing levels or with acceptable terms, or at all.

You may not receive the level of dividends provided for in the dividend policy our board of directors will adopt upon the closing of this offering or any dividends at all.

We are not obligated to pay dividends, and our board may amend or revoke our dividend policy at any time. Dividend payments are not guaranteed and are within the absolute discretion of our board of directors. Future dividends with respect to shares of our common stock, if any, will depend on, among other things, our results of operations, working capital requirements, financial condition, contractual restrictions, business opportunities, anticipated cash needs, provisions of applicable law and other factors that our board of directors may deem relevant.

We may not have cash in the future to pay dividends. We might not generate sufficient cash from operations in the future to pay dividends on our common stock in the intended amounts or at all. Our dividend policy is based upon our current assessment of our business and the environment in which we operate, our cash needs and our investment opportunities, and that assessment could change based on operational, regulatory, competitive or technological developments (which could, for example, increase our need for capital expenditures), new growth opportunities or other factors. If our cash flows from operations for future periods were to fall below our minimum expectations, we would need either to reduce or eliminate dividends or, to the extent permitted under the terms of our new credit facilities, raise cash from other sources. We will not be able to borrow under our new credit facilities to fund dividends. If we were to use working capital or permanent borrowings to fund dividends, we would have less cash and/or borrowing capacity available for future dividends and other purposes, which could negatively affect our financial condition, results of operations or liquidity and our ability to maintain or expand our business.

Delaware law restricts our ability to pay dividends. Under Delaware law, Madison River Communications’ board of directors and the board of directors for our corporate subsidiaries may declare and pay dividends only to the extent of “surplus,” which is defined as total assets at fair market value minus total liabilities, minus statutory capital, or if there is no surplus, out of net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. Also, under Delaware law, our limited liability company subsidiaries generally may only make distributions to us to the extent that at the time of the distribution, after giving effect to such distribution, all liabilities do not exceed the fair market value of the assets of such limited liability companies.

The reduction or elimination of dividends may negatively affect the market price of our common stock.

12

Table of Contents

We are a holding company, with no revenue generating operations of our own. We depend on the performance of our subsidiaries and their ability to make distributions to us.

Madison River Communications is a holding company with no business operations, sources of income or assets of its own other than the 100% ownership interest in Madison River Telephone, which itself is a holding company, it will have upon consummation of the reorganization transactions. Because all of our operations are conducted by our subsidiaries, our cash flow and our ability to repay our debt and other obligations and to pay dividends to our stockholders are dependent upon cash dividends and distributions or other transfers from our subsidiaries.

We may be unable to access the cash flow of our subsidiaries. A number of our subsidiaries will be a party to or subject to our new credit facilities and are or may in the future be a party to other borrowing agreements that restrict the payment of dividends to us, and such subsidiaries are likely to continue to be subject to such restrictions and prohibitions for the foreseeable future. In addition, the ability of our subsidiaries to pay interest and dividends or make other payments or distributions will depend on their respective operating results and may be subject to further restrictions under, among other things, the laws of their jurisdiction of organization.

In addition, the assets of our subsidiaries will be subject to the prior claims of all creditors, including trade creditors, of those subsidiaries. In the event of a bankruptcy, liquidation, dissolution, reorganization or similar proceeding of any of our subsidiaries, holders of their indebtedness and their trade creditors will generally be entitled to payment of their claims from assets of those subsidiaries before any assets are made available for distribution to us. As of December 31, 2004, after giving effect to the transactions as if they had been consummated as of such date, our subsidiaries would have had $ million of outstanding liabilities, including trade payables.

As a result of the foregoing, we may be unable to receive cash through distributions or other payments from Madison River Telephone in sufficient amounts to pay dividends on our common stock.

Our significant amount of long-term indebtedness could restrict our ability to pay dividends on our common stock, limit our operational flexibility or otherwise affect our financial condition.

We have now and, following the consummation of the transactions, will continue to have a significant amount of long-term indebtedness. After giving effect to the transactions, we estimate that we will have total indebtedness of $455.6 million and that $75.0 million will be available for borrowing under our new credit facilities.

Our substantial level of indebtedness could have important consequences to the holders of our common stock, including the following:

| · | a significant portion of our cash flow from operations is likely to be dedicated to the payment of the principal of and interest on our indebtedness, thereby reducing funds available for working capital, capital expenditures, future operations and business opportunities, dividends on our common stock and/or other general corporate purposes; |

| · | we may have limited flexibility to plan for, or react to, changes in our business, market conditions and the industry in which we operate; |

| · | our ability to withstand competitive pressures may be reduced and we may be more vulnerable to general adverse economic and industry conditions; |

| · | our ability in the future to obtain additional financing for working capital, capital expenditures, future business opportunities and other general corporate requirements may be limited; and |

| · | our ability to refinance our indebtedness could be limited. |

We may be able to incur substantially more indebtedness, which would increase the risks described above associated with our substantial indebtedness.

We may be able to incur substantial amounts of additional indebtedness in the future. While the terms of the new credit facilities will limit our ability to incur additional indebtedness, such terms do not and will not prohibit

13

Table of Contents

us from incurring substantial amounts of additional indebtedness for specific purposes or under certain circumstances. Any additional indebtedness incurred by us could increase the risks associated with our substantial indebtedness.

We have experienced net losses for most of our history, and if we experience losses in the future, we may not be able to generate sufficient cash flow to meet our obligations or pay dividends on our common stock.

Although we generated net income of $6.3 million for the year ended December 31, 2004, excluding the effect of a $6.4 million tax benefit, we would have had a net loss of $0.1 million. In addition, we have incurred losses for several prior fiscal years, and we may incur losses in the future. For example, we incurred net losses of $16.5 million and $40.7 million for the fiscal years ended December 31, 2003 and 2002, respectively. We may not sustain profitability in the future or be able to generate cash flow sufficient to meet our interest and principal payment obligations, pay dividends on our common stock or fund our other capital needs such as working capital for future growth and capital expenditures.

We are subject to restrictive debt covenants and other requirements related to our new credit facilities that may limit our business flexibility by imposing operating and financial restrictions on our business.

Covenants in our new credit facilities will impose significant operating and financial restrictions on us. These restrictions will include, among other things, a limitation on:

| · | indebtedness and guarantees; |

| · | liens and negative pledges; |

| · | investments; |

| · | certain restricted payments; |

| · | mergers, acquisitions and asset sales; |

| · | transactions with affiliates; |

| · | changes in business conducted; and |

| · | prepayment of or repurchase of subordinated indebtedness. |

These restrictions could limit our ability to obtain future financing, make acquisitions, fund capital expenditures, withstand downturns in our business or take advantage of business opportunities. Furthermore, the new credit facilities will also require us to maintain specified total leverage and fixed charge coverage ratios, and will require us to make annual mandatory prepayments with 50% of our excess cash flow as well as under other circumstances. Our ability to comply with the ratios or tests may be affected by events beyond our control, including prevailing economic, financial and industry conditions.

A breach of any of these covenants, ratios or tests could result in a default under the new credit facilities. Upon the occurrence of an event of default under the new credit facilities, the lenders could elect to declare all amounts outstanding under the new credit facilities to be immediately due and payable. If the lenders accelerate the payment of the indebtedness under the new credit facilities, our assets may not be sufficient to repay in full this indebtedness and our other indebtedness.

If we are not able to refinance our new credit facilities at maturity on favorable terms or at all, our ability to pay dividends will be impaired and we will be in default under the new credit facilities.

Our new credit facilities will mature in full in 2012. We may not be able to renew or refinance the new credit facility, or any renewal or refinancing may occur on less favorable terms. If we are unable to refinance or renew our new credit facilities, our failure to repay all amounts due on the maturity date would cause a default

14

Table of Contents

under the new credit facilities. In addition, our interest expense may increase significantly if we refinance our new credit facilities on terms that are less favorable to us than the terms of our new credit facilities. Either of these events would impair our ability to pay dividends.

We will require a significant amount of cash, which may not be available to us, to service our debt, including our new credit facilities, fund our liquidity needs and pay dividends on our common stock.

Our ability to make payments on, or to refinance or repay our debt, to fund planned capital expenditures and expand our business will depend largely upon our future operating performance. Our future operating performance is subject to general economic, financial, competitive, legislative and regulatory factors, as well as other factors that are beyond our control. Our business may not generate cash flow in an amount sufficient to enable us to pay our debt service obligations or fund our other liquidity and capital needs as a result of any of these factors. We estimate that we will need approximately $40.0 million to meet our debt service obligations and planned capital expenditure needs in 2005. If we do not generate enough cash flow for such purposes, we will not be able to pay dividends on our common stock. If we are unable to generate sufficient cash to service our debt requirements, we will be required to refinance our existing indebtedness. We may not be able to refinance any of our debt, including our new credit facilities, under such circumstances on commercially reasonable terms or at all. If we are unable to refinance our debt or obtain new financing under these circumstances, we would have to consider other options, including:

| · | sales of certain assets to meet our debt service requirements; |

| · | sales of equity; and |

| · | negotiations with our lenders to restructure the applicable debt. |

Our new credit facilities could restrict our ability to do some of these things. If we are forced to pursue any of the above options under distressed conditions, our business and/or the value of our common stock could be adversely affected.

Before this offering, there has been no public market for our common stock. This may cause volatility in the trading price of the common stock, which could negatively affect the value of your investment.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock will be determined by negotiations between us and the underwriters and may not be indicative of the market price for our common stock in the future. It is possible that an active trading market for our common stock will not develop or be sustained after the offering. Even if a trading market develops, the market price of our common stock may fluctuate widely as a result of various factors, such as period-to-period fluctuations in our operating results, sales of our common stock by principal stockholders, developments in the telecommunications industry, the failure of securities analysts to cover our common stock after this offering or changes in financial estimates by analysts, competitive factors, regulatory developments, economic and other external factors, general market conditions and market conditions affecting the stock of telecommunications companies in particular. In addition, if we do not pay dividends, either in accordance with our dividend policy or at all, your shares of common stock could become less liquid and the market price of our common stock could decline. Telecommunications companies have in the past experienced extreme volatility in the trading prices and volumes of their securities, which has often been unrelated to operating performance. Any such market volatility may have a significant adverse effect on the market price of our common stock.

Future sales, or the possibility of future sales, of a substantial amount of our common stock may depress the price of the shares of our common stock.

Future sales, or the availability for sale in the public market, of substantial amounts of our common stock could adversely affect the prevailing market price of our common stock, and could impair our ability to raise capital through future sales of equity securities.

15

Table of Contents

Upon consummation of this offering, there will be shares of common stock outstanding, and we will have reserved shares of common stock for issuance under our Omnibus Stock Plan. The shares of common stock sold in this offering will be freely transferable without restriction or further registration under the Securities Act. The remaining shares of common stock outstanding, including the shares owned by our existing equity investors, will be restricted securities within the meaning of Rule 144 under the Securities Act, but will be eligible for resale subject to applicable volume, manner of sale, holding period and other limitations of Rule 144.

We, our executive officers and directors and our existing equity investors have agreed to a “lock-up,” meaning that, subject to specified exceptions, neither we nor they will sell any shares without the prior consent of the representatives of the underwriters for 180 days after the date of this prospectus. Following this offering, shares of common stock held by those persons will be subject to the lock-up. Following the expiration of this 180-day lock-up period, all of the shares of Madison River Communications’ common stock owned by these persons will be eligible for future sale, subject to the applicable volume, manner of sale, holding period and other limitations of Rule 144. Finally, our existing equity investors and some members of management, who collectively will hold shares of common stock immediately following the consummation of this offering, have registration rights with respect to the common stock that they will retain, or may acquire upon the exercise of options, following this offering.

We may issue shares of Madison River Communications’ common stock, or other securities, from time to time as consideration for future acquisitions and investments. In the event any such acquisition or investment is significant, the number of shares of Madison River Communications’ common stock, or the number or aggregate principal amount, as the case may be, of other securities that we may issue may in turn be significant. We may also grant registration rights covering those shares or other securities in connection with any such acquisitions and investments.

As a new investor, you will experience immediate and substantial dilution.

Investors purchasing common stock in the offering will experience immediate and substantial dilution in the net tangible book value of their shares. At an initial public offering price of $ per share, the mid-point of the range set forth on the cover page of this prospectus, dilution to new investors is $ per share. If we seek additional capital in the future, the issuance of shares of common stock or securities convertible into shares of common stock in order to obtain such capital may lead to further dilution of your equity investment.

Our existing equity investors will collectively have the power to exercise substantial influence over all matters submitted to our stockholders for approval. As a result, the influence of our public stockholders over significant corporate actions will be limited.

Following the consummation of this offering and our repurchase of shares from certain of our existing equity investors, our existing equity investors will hold approximately % of the outstanding shares of Madison River Communications’ common stock (or % if the underwriters’ over-allotment option is exercised in full). As a result, after this offering, our existing equity investors will collectively have the power to exercise substantial influence over all matters submitted to stockholders for approval, including the election of directors, amendments to our certificate of incorporation and any transaction that requires the approval of stockholders. So long as our existing equity investors continue to own a significant amount of the outstanding shares of Madison River Communications’ common stock, they will continue to be able to strongly influence our decisions. This concentration of ownership could have the effect of delaying, deferring or preventing a change in control, merger or tender offer, which would deprive you of an opportunity to receive a premium for your shares and may negatively affect the market price of the common stock. Moreover, our existing equity investors could effectively receive a premium for transferring ownership to third parties that would not inure to your benefit.

16

Table of Contents

Conflicts of interests between our existing sponsors and us or you could have an adverse affect on our business and your investment.

Conflicts of interests between our existing sponsors and us or you could arise in the future, and these conflicts may not be resolved in our or your favor. For instance, our existing sponsors have and may, in the future, make significant investments in other telecommunications companies, including investments in cable companies, competitive local exchange carriers and other rural telephone companies. Affiliates of Providence Equity Partners, one of our existing sponsors, have a significant investment in Consolidated Communications Holdings, Inc., which is a rural telephone company that competes with us for acquisitions from time to time. Affiliates of Goldman, Sachs & Co., another of our existing sponsors, have investments in a number of telecommunications companies, including significant investments in New Edge Networks, which may compete with us as a competitive local exchange carrier in each of our franchised territories, and Cebridge Connections, which offers Internet services which may compete with our Internet services in Illinois and Louisiana. In addition, as permitted by Section 122(17) of the General Corporation Law of the State of Delaware, our certificate of incorporation will renounce certain interests or expectancies in specified corporate opportunities, transactions or other matters offered to any director of ours who is not also one of our officers or employees and who is affiliated with one of our existing sponsors or to any affiliate of such director. These directors and their affiliates have the right to engage in and no obligation to communicate or offer to us any such corporate opportunity, transaction or other matter, and we will have no right in or to any such opportunity, transaction or other matter. Subject to their fiduciary duties to us, these directors may have conflicts of interest with us as a result of these opportunities and may compete with us. In addition, through their significant ownership interest in us, our existing sponsors may seek to influence us to take courses of action that, in their judgment, could enhance their investment in us, but which might involve risks to, or otherwise adversely affect, us or you.

Our organizational documents and Delaware law could limit another party’s ability to acquire us and deprive our investors of the opportunity to obtain a takeover premium for their securities.

A number of provisions in Madison River Communications’ certificate of incorporation and bylaws and certain provisions of Delaware law will make it difficult for another company to acquire us and for you to receive any related takeover premium for your securities. For example, Madison River Communications’ organizational documents provide that stockholders generally may not act by written consent and only stockholders representing at least 50% in voting power may request that Madison River Communications’ board of directors call a special meeting. Madison River Communications’ organizational documents also authorize the issuance of common stock and preferred stock without stockholder approval and upon such terms as the board of directors may determine. The rights of the holders of shares of Madison River Communications’ common stock will be subject to, and may be adversely affected by, the rights of holders of shares of preferred stock that may be issued in the future.

Risks Relating to Our Business and Industry

If we are not able to sustain our revenues, our earnings and cash flow from operations will decrease.

We may not be able to stabilize the recent decline in our voice access lines. Beginning with the second quarter of 2002, we have seen the number of voice access lines we serve in certain of our established markets decline due to a number of factors affecting our markets, including but not limited to, competition and recession. We may not be able to maintain our current number of voice access lines or stabilize the decline in the number of such lines even if we were to expand the markets we serve.

Consumers may not continue to purchase our services. In order to maintain our customer base and revenues from our services, we must continue to provide attractive service offerings and compete effectively with other service providers, including wireless service providers and cable companies on, among other things, price, quality and variety of services. Although bundled service offerings have successfully resulted in our customers using additional services in the past, we cannot ensure that we will be able to continue to provide additional services to our customers.

17

Table of Contents

Prices may decline. The prices that we can charge our customers for services, including voice communications, high-speed data and Internet access and egress services, could decline due to the following factors, among others:

| · | lower prices offered by our competitors for similar services or bundled services that include voice, data, Internet access or other services we offer; |

| · | changes in the federal or state regulations that encourage competition have the impact of reducing the prices we may charge for our services; |

| · | efforts by long distance carriers and others to lower the fees paid to us for use of our network in offering their services; |

| · | reduction of the universal service fund established by the Federal Communications Commission, or FCC, due to an increased number of participants accessing the fund or changes in the regulation that determines the amounts we receive under, and contribute to, the fund; |

| · | the creation of excess capacity resulting from the installation by us and our competitors, some of whom are expanding capacity on their existing networks or developing new networks, of fiber and related equipment; and |

| · | technological advances that permit substantial increases in, or better usage of, the capacity of our transmission media. |

We operate in local regions and, as a result, are highly dependent on economic conditions in the local markets we serve.

We are sensitive to, and our success will be substantially affected by, local economic and other factors affecting the local communities that we serve. In recent months, we have seen declines in the number of voice access lines we serve in our established markets due to a number of factors. At December 31, 2004, our RLEC operations served 181,212 voice access lines, which is a decrease of 4,691 voice access lines from 185,903 voice access lines in service at December 31, 2003. The predominant share of voice access line losses have occurred as a result of storm-related damages from Hurricane Ivan in September 2004 at our rural telephone company in Alabama, Gulf Telephone Company. As of December 31, 2004, approximately 2,840 voice access lines were disconnected as a result of damages from the hurricane. In addition, we have experienced voice access line losses in our Illinois operations, Gallatin River, due to a persistent weakness in the local economies that Gallatin River serves. We are not certain of the trend for voice access lines or other connections in this market in the near future. Furthermore, military officials at Fort Stewart in Hinesville, Georgia, announced that the 3rd Infantry Division stationed there has fully deployed as of February 2005 and that the deployment could last up to fourteen months. One of our rural telephone companies, Coastal Utilities, Inc., serves the Hinesville area, including the military base. The full extent of the impact on our operations is difficult to predict and will vary depending on, among other factors, the duration of the troop deployment. Therefore, we are unable at this time to project the range of the impact of this deployment on Coastal Utilities, Inc. or on our operations as a whole. These factors, which are beyond our control, could adversely affect our business or results of operations.

Significant and growing competition may adversely affect our revenues and profitability.

The telecommunications industry is highly competitive. As characteristics of our markets change, regulatory barriers are removed and entry costs decrease, the likelihood of local competitors entering our markets may increase. Significant and potentially larger competitors could enter our markets at almost any time.

We face competition from wireless telecommunications providers, which may increase as wireless technology improves. We also face competition from other current and future market entrants, including cable television companies, competitive local exchange carriers, voice-over-Internet protocol, or VOIP, providers, electric utilities, microwave carriers, Internet service providers and private networks built by large end users and

18

Table of Contents

municipalities. For example, we face competition for high-speed access to the Internet from cable TV companies in each of our markets, and we expect that competition will intensify. Many potential competitors for our services have, and some potential competitors are likely to enjoy, substantial competitive advantages, including name recognition and financial, technical, marketing and other resources that are greater than ours. Increased competition could lead to loss of revenues and profitability as a result of numerous factors, including continued declines in our voice access lines, price reductions, fewer sales, reduced operating margins and the loss of market share.

Rapidly changing communications technology and other factors may have a material adverse effect on our business and our cash flows.

The telecommunications industry is subject to rapid and significant changes in technology. The effect of these technological changes on our business is difficult to predict and plan for in advance. These changes could require us to incur significant capital expenditures to maintain or improve our competitive position. We may not be able to obtain timely access to new technology on satisfactory terms or incorporate new technology into our systems in a cost effective manner, or at all. Further, new technologies and products may not be compatible with our existing technologies and systems. New technologies and products may reduce the prices for our services or be superior to, and render obsolete, the products and technologies we use. If we do not replace or upgrade our technology and equipment that becomes obsolete, we will not be able to compete effectively. Technological changes in the communications industry may have a material adverse effect on our business and may affect our ability to achieve sufficient cash flow to provide adequate working capital, to service our indebtedness or pay dividends on our common stock.

We rely primarily on Nortel Switching equipment for our telephone switching equipment, use fiber for connections between network node locations and use twisted copper pair cable to connect end users to our network. Network node locations include host and remote switching points and digital transmission equipment located in the field.

Alternative technologies for our switching equipment include small computers known as “soft switches,” which perform central office switching functions and other forms of digital switching devices. Such devices are generally less expensive and have more flexible software capabilities. Such devices also may interact more easily with digital devices, compared to our legacy network which is primarily analog.

Alternative technologies for inter-nodal optic fiber include high capacity point-to-point microwave radio systems. Such systems require additional FCC licenses and are generally not competitive with the use of fiber due to lack of capacity and the ability to increase capacity with equipment upgrades.

Alternative technologies for our twisted pair copper distribution cable include coaxial cable, wireless transmission, and optic fiber. These alternative technologies may be capable of higher transmission rates and of interacting with digital devices. For example, coaxial cable and fiber are all capable of transmissions in excess of 20 megabits per second.

In addition to technological advances, other factors could require us to further expand or adapt our network, including an increasing number of customers, demand for greater data transmission capacity, failure of our technology and equipment to support operating results anticipated in our business plan and changes in our customers’ service requirements. Expanding or adapting our network could require substantial additional financial, operational and managerial resources, any of which may not be available to us.

The transmission speed for services across our network is a significant factor in the demand for some of our services. While we are capable of providing multi-megabit transmission speeds across our network between a central office and the end user, the actual data transmission speed over our network may fluctuate due to various factors. Such factors include the diameter of the copper strands, the distance between the network nodes and the user location, and interference from high speed transmissions on adjoining copper pair. If our network is unable

19

Table of Contents

to provide services to our customers at speeds that are competitive, we may lose our customers to competitors, which would adversely affect our results of operations.

We may have difficulty sustaining revenue growth if the market for DSL-based services fails to develop, grows more slowly than anticipated or becomes saturated with competitors.

We expect that an increasing amount of our revenues will come from providing DSL-based services. For the years ended December 31, 2004 and December 31, 2003, DSL-based services represented 9.3% and 6.6%, respectively, of our total revenues. The market for business and residential high-speed Internet access is in the early stages of development and is highly competitive. Because we offer and expect to expand our offering of services to a new and evolving market and because current and future competitors are likely to introduce competing services, it is difficult for us to predict the rate at which this market will grow. Various providers of high-speed digital communications services are testing products from a number of suppliers for various applications, and it is unclear if DSL will offer the same or more attractive price-performance characteristics. The markets for our DSL-based services could fail to develop, grow more slowly than anticipated or become saturated with competitors. This could have an adverse effect on our results of operations.

We may have difficulties executing our growth strategy and managing our growth effectively.

Currently, we operate our business and provide our services primarily as an incumbent local exchange carrier in our franchised territories. We also provide edge-out services as a competitive local exchange carrier in territories that are in close proximity to our franchised territories. Our business plan is to expand our business by adding new customers for both our incumbent local exchange carrier operations and, to a limited degree, our edge-out services. In addition, we are providing new services to our existing customers. Demand and market acceptance for any new products and services we introduce, whether in existing or new markets, are subject to a high level of uncertainty. Our inability to expand our services or to enter new markets effectively could have a material adverse effect on our business or results of operations, including our ability to service our indebtedness or pay dividends on our common stock.

Our business plan will, if successfully implemented, result in growth of our operations, which may place a significant strain on our management, financial and other resources. To achieve and sustain growth we must, among other things, monitor operations, meet competitive challenges, control costs, maintain regulatory compliance, maintain effective quality controls and significantly expand our internal management, technical, provisioning, information, billing, customer service and accounting systems. We cannot guarantee that we will successfully obtain, integrate and use the employee, management, operational and financial resources necessary to manage a developing and expanding business in an evolving, regulated and increasingly competitive industry.

Our growth depends in part on our ability to find suitable businesses to acquire. In addition, the risks associated with acquisitions may result in operating difficulties and may have other harmful consequences.

Our business plan focuses on growing our business in part through acquisitions. Any future acquisitions will depend on our ability to identify suitable acquisition candidates, to negotiate acceptable terms for their acquisition and to finance those acquisitions. We will also face competition for suitable acquisition candidates that may increase our costs and limit the number of suitable acquisition candidates available. In addition, future acquisitions by us could result in the incurrence of additional indebtedness and contingent liabilities, which could have a material adverse effect on our ability to generate cash flow, provide adequate working capital, service our indebtedness or pay dividends on our common stock. Any future acquisitions could also expose us to increased risks, including, among others:

| · | the difficulty of integrating the acquired operations, personnel, network and other support systems; |

| · | the potential disruption of our ongoing business and diversion of resources and management time; |

| · | the inability to generate revenues from acquired businesses sufficient to offset acquisition costs; |

20

Table of Contents

| · | the risks of entering markets in which we have little or no direct prior experience; |

| · | the risk that federal or state regulators may condition approval of a proposed acquisition on our acceptance of conditions that may adversely affect our overall financial results; |

| · | difficulties in the integration of departments, systems, including accounting systems, technologies, books and records and procedures, as well as in maintaining uniform standards and controls, including internal accounting controls, procedures and policies; |

| · | expenses of any undisclosed or potential legal liabilities; |

| · | the impairment of relationships with employees, unions or customers as a result of changes in management; and |

| · | the impairment of supplier relationships. |

As a result, we cannot guarantee that we will be able to consummate any acquisitions in the future or that any acquisitions, if completed, would be successfully integrated into our existing operations.

To date, we have grown in large part through the acquisition of local telephone companies and other operating assets. Our future operations depend largely upon our ability to manage our business successfully. If we are successful in making additional acquisitions, our management team will have to manage a more complex organization and a larger number of operations than we have previously operated. We may not be successful in integrating the various acquisitions. In addition, we may discover information in the course of the integration of these acquisitions that may have an adverse effect on our business or results of operations.

We may not be able to grow or sustain our current positive cash flow from our edge-out services or our business plan for our edge-out services may not result in a viable, sustainable line of business capable of funding its own operations in future years in our edge-out markets as a whole.

In 2002, our edge-out operating results reflected a significant decrease in the utilization of cash. In 2004 and 2003, our edge-out services generated positive cash flow from operations and for the year ended December 31, 2004, our edge-out operations had a net operating loss of approximately $9.8 million. Growth and profitability in our edge-out services line of business may require interconnection and resale terms and pricing which depend, in part, on federal and state regulatory decisions and court interpretations of legislation, all of which are outside of our control and subject to change in ways that are difficult to predict. As a result, we may not be able to grow or sustain our current positive cash flow from operations from this line of business or our business plan may not result in a viable, sustainable line of business capable of funding its own operations in future years in our edge-out markets as a whole. Our inability to execute our business plan for our edge-out services could have a material adverse effect on our financial position, results of operations or cash flows.

Network disruptions could adversely affect our ability to provide service to our customers.

The success of our operations will require that our network provide competitive reliability and adequate capacity and security. Some of the risks to our network and infrastructure include:

| · | physical damage; |

| · | power loss from, among other things, adverse weather conditions, which occurred during Hurricane Ivan; |

| · | capacity limitations; |

| · | software and hardware defects; |

| · | breaches of security, including sabotage, tampering, computer viruses and break-ins; and |

| · | other disruptions that are beyond our control. |

21

Table of Contents