Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

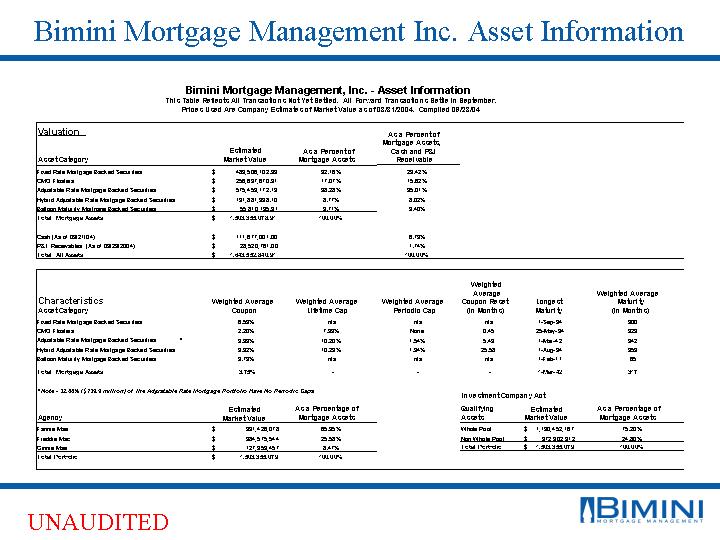

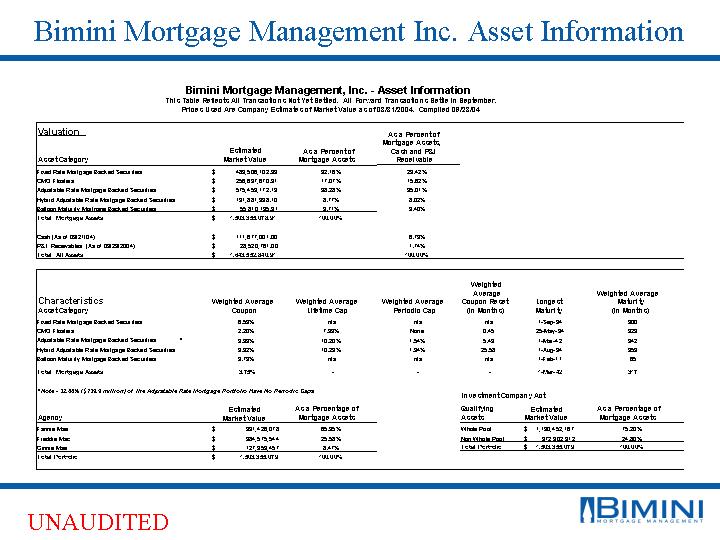

Bimini Mortgage Management, Inc. Asset Information

Bimini Mortgage Management, Inc. - Asset Information

This Table Reflects All Transactions Not Yet Settled. All Forward Transactions Settle In September.

Prices Used Are Company Estimates of Market Value as of 08/31/2004. Compiled 09/23/04

Valuation

Asset Category | | Estimated

Market Value | | As a Percent of

Mortgage Assets | | As a Percent of

Mortgage Assets,

Cash and P&I

Receivable | |

Fixed Rate Mortgage Backed Securities | | $ | 483,506,102.39 | | 32.16 | % | 29.42 | % |

CMO Floaters | | $ | 256,697,670.31 | | 17.07 | % | 15.62 | % |

Adjustable Rate Mortgage Backed Securities | | $ | 575,459,172.19 | | 38.28 | % | 35.01 | % |

Hybrid Adjustable Rate Mortgage Backed Securities | | $ | 131,881,938.10 | | 8.77 | % | 8.02 | % |

Balloon Maturity Mortgage Backed Securities | | $ | 55,810,195.91 | | 3.71 | % | 3.40 | % |

Total: Mortgage Assets | | $ | 1,503,355,078.91 | | 100.00 | % | | |

| | | | | | | |

Cash (As of 09/21/04) | | $ | 111,677,001.00 | | | | 6.79 | % |

P&I Receivables (As of 09/23/2004) | | $ | 28,520,761.00 | | | | 1.74 | % |

Total: All Assets | | $ | 1,643,552,840.91 | | | | 100.00 | % |

Characteristics

Asset Category | | Weighted Average

Coupon | | Weighted Average

Lifetime Cap | | Weighted Average

Periodic Cap | | Weighted

Average

Coupon Reset | | Longest

Maturity | | Weighted Average

Maturity | |

| | | | | | | | (in Months) | | | | (in Months) | |

Fixed Rate Mortgage Backed Securities | | 6.53 | % | n/a | | n/a | | n/a | | 1-Sep-34 | | 300 | |

CMO Floaters | | 2.20 | % | 7.93 | % | None | | 0.45 | | 25-May-34 | | 329 | |

Adjustable Rate Mortgage Backed Securities * | | 3.33 | % | 10.20 | % | 1.54 | % | 5.43 | | 1-Mar-42 | | 342 | |

Hybrid Adjustable Rate Mortgage Backed Securities | | 3.92 | % | 10.23 | % | 1.94 | % | 25.58 | | 1-Aug-34 | | 353 | |

Balloon Maturity Mortgage Backed Securities | | 3.79 | % | n/a | | n/a | | n/a | | 1-Feb-11 | | 65 | |

Total: Mortgage Assets | | 3.75 | % | — | | — | | — | | 1-Mar-42 | | 317 | |

* Note - 32.68% ($139.9 million) of The Adjustable Rate Mortgage Portfolio Have No Periodic Caps

Agency | | Estimated

Market Value | | As a Percentage of

Mortgage Assets | |

Fannie Mae | | $ | 991,426,078 | | 65.95 | % |

Freddie Mac | | $ | 384,575,544 | | 25.58 | % |

Ginnie Mae | | $ | 127,353,457 | | 8.47 | % |

Total Portfolio | | $ | 1,503,355,079 | | 100.00 | % |

Investment Company Act

Qualifying

Assets | | Estimated

Market Value | | As a Percentage of

Mortgage Assets | |

Whole Pool | | $ | 1,130,452,167 | | 75.20 | % |

Non Whole Pool | | $ | 372,902,912 | | 24.80 | % |

Total Portfolio | | $ | 1,503,355,079 | | 100.00 | % |

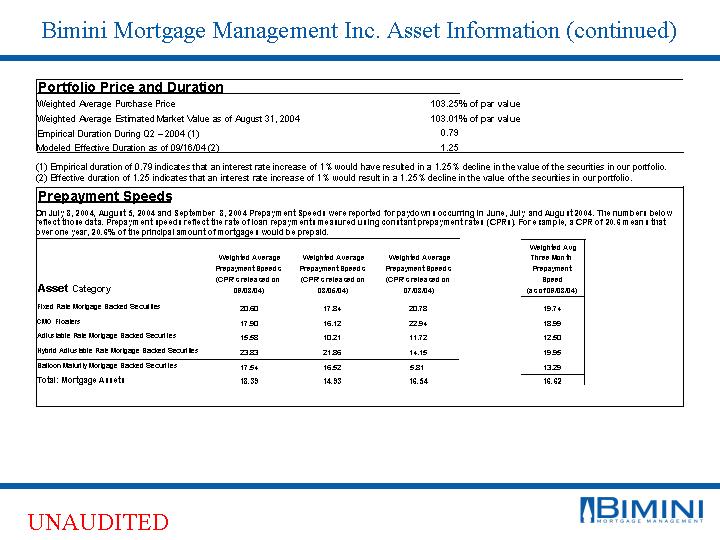

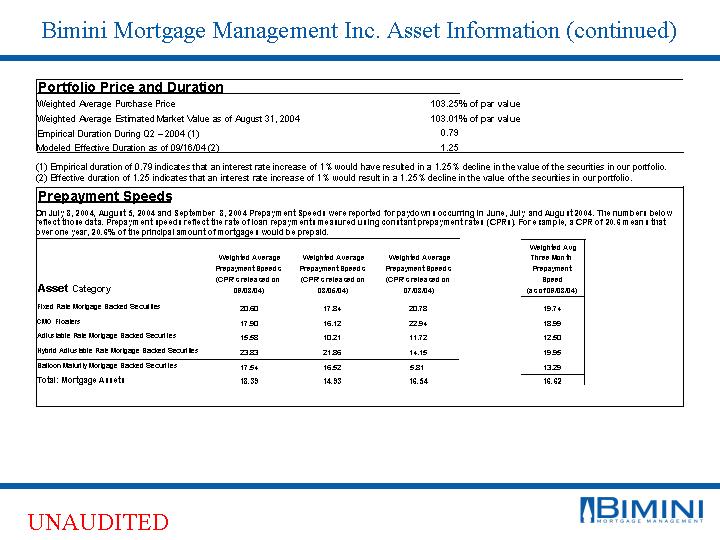

Portfolio Price and Duration

Weighted Average Purchase Price | | | 103.25 | % of par value |

Weighted Average Estimated Market Value as of August 31, 2004 | | | 103.01 | % of par value |

Empirical Duration During Q2 - 2004 (1) | | 0.79 | |

Modeled Effective Duration as of 09/16/04 (2) | | 1.25 | |

(1) Empirical duration of 0.79 indicates that an interest rate increase of 1% would have resulted in a 0.79% decline in the value of the securities in our portfolio.

(2) Effective duration of 1.25 indicates that an interest rate increase of 1% would result in a 1.25% decline in the value of the securities in our portfolio.

Prepayment Speeds

On July 8, 2004, August 5, 2004 and September 8, 2004 Prepayment Speeds were reported for paydowns occurring in June, July and August 2004. The numbers below reflect those data. Prepayment speeds reflect the rate of loan repayments measured using constant prepayment rates (CPRs). For example, a CPR of 20.6 means that over one year, 20.6% of the principal amount of mortgages would be prepaid.

Asset Category | | Weighted Average

Prepayment Speeds

(CPR’s released on

09/08/04) | | Weighted Average

Prepayment Speeds

(CPR’s released on

08/05/04) | | Weighted Average

Prepayment Speeds

(CPR’s released on

07/08/04) | | Weighted Avg

Three Month

Prepayment

Speed

(as of 09/08/04) | |

Fixed Rate Mortgage Backed Securities | | 20.60 | | 17.84 | | 20.78 | | 19.74 | |

CMO Floaters | | 17.90 | | 16.12 | | 22.94 | | 18.99 | |

Adjustable Rate Mortgage Backed Securities | | 15.58 | | 10.21 | | 11.72 | | 12.50 | |

Hybrid Adjustable Rate Mortgage Backed Securities | | 23.83 | | 21.86 | | 14.15 | | 19.95 | |

Balloon Maturity Mortgage Backed Securities | | 17.54 | | 16.52 | | 5.81 | | 13.29 | |

Total: Mortgage Assets | | 18.39 | | 14.93 | | 16.54 | | 16.62 | |

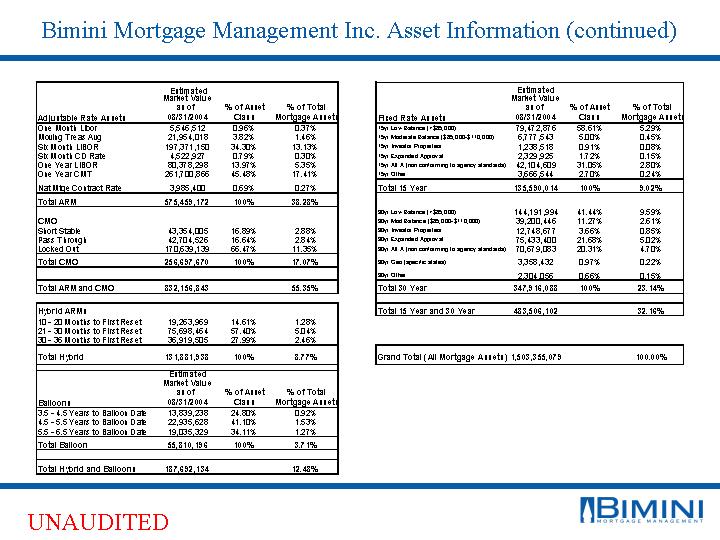

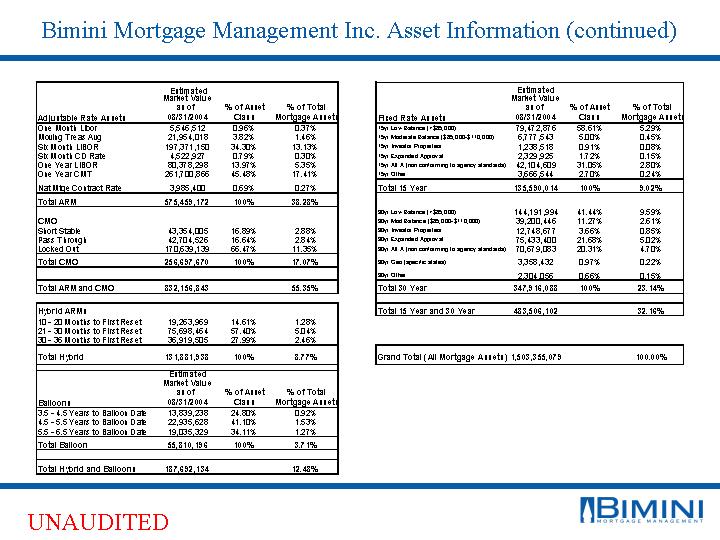

Adjustable Rate Assets | | Market Value

as of

08/31/2004 | | % of Asset

Class | | % of Total

Mortgage Assets | |

One Month Libor | | 5,546,512 | | 0.96 | % | 0.37 | % |

Moving Treas Avg | | 21,954,018 | | 3.82 | % | 1.46 | % |

Six Month LIBOR | | 197,371,150 | | 34.30 | % | 13.13 | % |

Six Month CD Rate | | 4,522,927 | | 0.79 | % | 0.30 | % |

One Year LIBOR | | 80,378,298 | | 13.97 | % | 5.35 | % |

One Year CMT | | 261,700,866 | | 45.48 | % | 17.41 | % |

| | | | | | | |

Nat Mtge Contract Rate | | 3,985,400 | | 0.69 | % | 0.27 | % |

Total ARM | | 575,459,172 | | 100 | % | 38.28 | % |

| | | | | | | |

CMO | | | | | | | |

Short Stable | | 43,354,005 | | 16.89 | % | 2.88 | % |

Pass Through | | 42,704,526 | | 16.64 | % | 2.84 | % |

Locked Out | | 170,639,139 | | 66.47 | % | 11.35 | % |

Total CMO | | 256,697,670 | | 100 | % | 17.07 | % |

| | | | | | | |

Total ARM and CMO | | 832,156,843 | | | | 55.35 | % |

Hybrid ARMs | | | | | | | |

10 - 20 Months to First Reset | | 19,263,969 | | 14.61 | % | 1.28 | % |

21 - 30 Months to First Reset | | 75,698,464 | | 57.40 | % | 5.04 | % |

30 - 36 Months to First Reset | | 36,919,505 | | 27.99 | % | 2.46 | % |

| | | | | | | |

Total Hybrid | | 131,881,938 | | 100 | % | 8.77 | % |

Balloons | | Estimated

Market Value

as of

08/31/2004 | | % of Asset

Class | | % of Total

Mortgage Assets | |

3.5 - 4.5 Years to Balloon Date | | 13,839,238 | | 24.80 | % | 0.92 | % |

4.5 - 5.5 Years to Balloon Date | | 22,935,628 | | 41.10 | % | 1.53 | % |

5.5 - 6.5 Years to Balloon Date | | 19,035,329 | | 34.11 | % | 1.27 | % |

Total Balloon | | 55,810,196 | | 100 | % | 3.71 | % |

| | | | | | | |

Total Hybrid and Balloons | | 187,692,134 | | | | 12.48 | % |

Fixed Rate Assets | | Estimated

Market Value

as of

08/31/2004 | | % of Asset

Class | | % of Total

Mortgage Assets | |

15yr Low Balance (<$85,000) | | 79,472,876 | | 58.61 | % | 5.29 | % |

15yr Moderate Balance ($85,000 - $110,000) | | 6,777,543 | | 5.00 | % | 0.45 | % |

15yr Investor Properties | | 1,238,518 | | 0.91 | % | 0.08 | % |

15yr Expanded Approval | | 2,329,925 | | 1.72 | % | 0.15 | % |

15yr Alt A (non conforming to agency standards) | | 42,104,609 | | 31.05 | % | 2.80 | % |

15yr Other | | 3,666,544 | | 2.70 | % | 0.24 | % |

Total 15 Year | | 135,590,014 | | 100 | % | 9.02 | % |

| | | | | | | |

30yr Low Balance (<$85,000) | | 144,191,994 | | 41.44 | % | 9.59 | % |

30yr Mod Balance ($85,000 - $110,000) | | 39,200,446 | | 11.27 | % | 2.61 | % |

30yr Investor Properties | | 12,748,677 | | 3.66 | % | 0.85 | % |

30yr Expanded Approval | | 75,433,400 | | 21.68 | % | 5.02 | % |

30yr Alt A (non conforming to agency standards) | | 70,679,083 | | 20.31 | % | 4.70 | % |

30yr Geo (specific states) | | 3,358,432 | | 0.97 | % | 0.22 | % |

30yr Other | | 2,304,056 | | 0.66 | % | 0.15 | % |

Total 30 Year | | 347,916,088 | | 100 | % | 23.14 | % |

| | | | | | | |

Total 15 Year and 30 Year | | 483,506,102 | | | | 32.16 | % |

| | | | | | | |

Grand Total (All Mortgage Assets) | | 1,503,355,079 | | | | 100.00 | % |

The Value of ARMs In A Diversified Portfolio

ARM Portfolio Reset (Interest Rate Adjustment) Schedule as A Percent of

Bimini’s ARM and Hybrid Current Value as of 09/23/2004

[CHART]

Bimini Mortgage Management, Inc. Liability Information (09/23/2004)

| | | | Wtd Avg | | Longest | |

Counterparty | | $ Outstanding | | Maturity (days) | | Maturity | |

Bear Stearns | | 58,043,000 | | 37 | | 15-Dec-04 | |

Countrywide Secs | | 43,429,000 | | 103 | | 1-Jun-05 | |

Daiwa Secs | | 70,160,000 | | 21 | | 20-Oct-04 | |

Bank of America | | 183,608,000 | | 60 | | 31-Jan-05 | |

Deutsche Bank | | 305,028,000 | | 70 | | 4-Feb-05 | |

Nomura | | 189,189,000 | | 136 | | 23-Mar-05 | |

JP Morgan Secs | | 4,086,000 | | 265 | | 15-Jun-05 | |

Lehman Bros | | — | | | | 0-Jan-00 | |

UBS Securities | | 251,267,000 | | 44 | | 15-Dec-04 | |

Goldman Sachs | | 56,150,000 | | 1 | | 24-Sep-04 | |

Cantor Fitzgerald | | 33,845,000 | | 51 | | 15-Feb-05 | |

Freddie Mac | | 224,613,000 | | 97 | | 15-Feb-05 | |

Citigroup | | 4,421,000 | | 28 | | 21-Oct-04 | |

Morgan Stanley | | 17,644,000 | | 55 | | 18-Nov-04 | |

Total | | $ | 1,441,483,000 | | | | | |

| | | | | | | | |

| | | | Longest | |

Sector | | Wtd Avg Maturity | | Maturity | |

| | (days) | | | |

Fixed Rate | | 68 | | 15-Jun-05 | |

Adjst Rate MBS | | 103 | | 1-Jun-05 | |

Hybrids Adj Rate | | 67 | | 23-Mar-05 | |

CMO Floating Rate | | 16 | | 26-Oct-04 | |

Baloon Maturity | | 46 | | 19-Nov-04 | |