UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21488 |

|

Cohen & Steers Global Infrastructure Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Francis C. Poli Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2017 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

To Our Shareholders:

We would like to share with you our report for the six months ended June 30, 2017. The net asset values (NAV) per share at that date were $18.94, $18.89, $18.99, $18.99 and $18.99 for Class A, Class C, Class I, Class R and Class Z shares, respectively.

The total returns for the Fund and its comparative benchmarks were:

| | Six Months Ended

June 30, 2017 | |

| Cohen & Steers Global Infrastructure Fund—Class A | | | 12.51 | % | |

| Cohen & Steers Global Infrastructure Fund—Class C | | | 12.11 | % | |

| Cohen & Steers Global Infrastructure Fund—Class I | | | 12.63 | % | |

| Cohen & Steers Global Infrastructure Fund—Class R | | | 12.38 | % | |

| Cohen & Steers Global Infrastructure Fund—Class Z | | | 12.63 | % | |

| FTSE Global Core Infrastructure 50/50 Net Tax Indexa | | | 12.99 | % | |

| S&P 500 Indexa | | | 9.34 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. Fund performance figures reflect fee waivers and/or expense reimbursements, where applicable, without which the performance would have been lower. Performance quoted does not reflect the deduction of the maximum 4.50% initial sales charge on Class A shares or the 1.00% maximum contingent deferred sales charge on Class C shares. The 1.00% maximum contingent deferred sales charge on Class C shares applies if redemption occurs on or before the one year anniversary date of their purchase. If such charges were included, returns would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund's investment company taxable income and net realized gains. Distributions in excess of the Fund's investment company taxable income and net realized gains are a return of capital distributed from the Fund's assets.

a The FTSE Global Core Infrastructure 50/50 Net Tax Index is a market-capitalization-weighted index of the worldwide infrastructure and infrastructure-related securities. Constituent weights are adjusted semi-annually according to three broad industry sectors: 50% utilities, 30% transportation, and a 20% mix of other sectors, including pipelines, satellites and telecommunication towers. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance.

1

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Market Review

Global listed infrastructure produced a strong total return during the period and outperformed the broader equity market. In general, stocks built on record highs made in the wake of November's U.S. Presidential election in anticipation of possible new stimulus measures and business-friendly policies, including tax cuts, regulatory rollbacks and infrastructure spending. Overall, equity markets were supported by a benign interest rate backdrop, as well as economic data that continued to suggest a strengthening global economy, although U.S. data was weaker than expected.

Growth in Europe continued to advance during the period, which prompted the European Central Bank to lower its risk assessment of the region, potentially paving the way for the eventual withdrawal of its aggressive stimulus measures. In Asia, Japan's government raised its overall view of the economy, citing stronger private consumption and an improved employment picture. In the U.S., the Federal Reserve responded to an improving economy and falling unemployment by raising its benchmark short-term interest rate in June by 0.25%—the third such increase since December 2016.

In this environment, the vast majority of infrastructure subsector returns were positive, with European companies generally outperforming their U.S. counterparts.

Fund Performance

The Fund had a positive total return during the period, although it underperformed its benchmark. Stock selection in the electric subsector was the largest contributor to relative performance during the period, partly driven by not owning a number of U.S.-based utilities that underperformed, including Dominion Resources and Public Service Enterprise Group. Additionally, our overweight in Kyushu Electric Power benefited performance, as the stock rose over 12% after a court ruled that the company may bring two of its nuclear reactors back online.

Favorable stock selection in midstream energy also aided relative performance, despite the subsector being weighed down by weak and volatile oil prices. Concerns lingered throughout the period that increased U.S. drilling activity and rising inventories could undermine efforts by the Organization of Petroleum Exporting Countries (OPEC) to stabilize oil markets through production cuts. In particular, we did not own Enbridge, which underperformed amid its pending merger with Spectra Energy.

The Fund's overweight in the communications subsector further contributed to relative performance, which outperformed following reports that U.S. telecommunications carriers will likely ramp up their network buildout plans in the second half of this year. European tower operators also rallied on renewed expectations of further consolidation within the space. We primarily benefited from our overweights in American Tower, El Towers and Crown Castle International.

The Fund's underweight in airports, which was the strongest performing subsector during the period, detracted from relative performance as many Europe-based operators benefited from improving passenger traffic and growing economic momentum throughout the region. In particular, we did not own Spain-based AENA and Germany-based Fraport AG, both of which outperformed.

2

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Stock selection in the diversified subsector also detracted from relative performance, driven in part by our overweight in Macquarie Infrastructure and our out-of-index allocation in Azure Global Power. Stock selection in railways further detracted from relative performance, hindered by our overweight in Central Japan Railway, which underperformed as a stronger yen overshadowed the outlook for favorable tourism demand. Additionally, our overweight in water detracted from relative performance, largely due to being overweight United Utilities Group and American Water Works, which underperformed during the period.

Impact of Foreign Currency on Fund Performance

The currency impact of the Fund's investments in foreign securities contributed to absolute performance during the period. Although the Fund reports its NAV and pays dividends in U.S. dollars, the Fund's investments denominated in foreign currencies are subject to foreign currency risk. Most currencies appreciated against the U.S. dollar, including the euro, U.K. pound and Japanese yen. Consequently, changes in the exchange rates between foreign currencies and the U.S. dollar were a net tailwind for absolute returns.

Sincerely,

| | | | |

| |

| |

| | | ROBERT S. BECKER | | BEN MORTON | |

| | | Portfolio Manager | | Portfolio Manager | |

The views and opinions in the preceding commentary are subject to change without notice and are as of the date of the report. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about the Cohen & Steers family of mutual funds, visit cohenandsteers.com. Here you will find fund net asset values, fund fact sheets and portfolio highlights, as well as educational resources and timely market updates.

Our website also provides comprehensive information about Cohen & Steers, including our most recent press releases, profiles of our senior investment professionals and their investment approach to each asset class. The Cohen & Steers family of mutual funds invests in major real asset categories including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions.

3

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)

Average Annual Total Returns—For Periods Ended June 30, 2017

| | | Class A

Shares | | Class C

Shares | | Class I

Shares | | Class R

Shares | | Class Z

Shares | |

1 Year (with sales charge) | | | 2.03 | %a | | | 5.10 | %b | | | — | | | | — | | | | — | | |

1 Year (without sales charge) | | | 6.84 | % | | | 6.10 | % | | | 7.16 | % | | | 6.68 | % | | | 7.24 | % | |

5 Years (with sales charge) | | | 8.82 | %a | | | 9.10 | % | | | — | | | | — | | | | — | | |

5 Years (without sales charge) | | | 9.83 | % | | | 9.10 | % | | | 10.17 | % | | | — | | | | — | | |

10 Years (with sales charge) | | | 3.66 | %a | | | 3.46 | % | | | — | | | | — | | | | — | | |

10 Years (without sales charge) | | | 4.14 | % | | | 3.46 | % | | | 4.48 | % | | | — | | | | — | | |

Since Inceptionc (with sales charge) | | | 7.74 | %a | | | 7.47 | % | | | — | | | | — | | | | — | | |

Since Inceptionc (without sales charge) | | | 8.12 | % | | | 7.47 | % | | | 8.47 | % | | | 4.58 | % | | | 5.08 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month end can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at NAV. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods presented above, the investment advisor waived fees and/or reimbursed expenses. Without this arrangement, performance would have been lower.

The annualized gross and net expense ratios for each class of shares as disclosed in the April 1, 2017 prospectus were as follows: Class A—1.35% and 1.35%; Class C—2.00% and 2.00%; Class I—1.08% and 1.00%; Class R—1.50% and 1.50%; and Class Z—1.00% and 1.00%. Through June 30, 2019, the investment advisor has contractually agreed to waive and/or reimburse the Fund's Class I shareholder service fee up to the maximum shareholder service fee of 0.10%. This contractual agreement can be amended at any time by agreement of the Fund and the investment advisor and will terminate automatically in the event of termination of the investment advisory agreement between the investment advisor and the Fund.

a Reflects a 4.50% front-end sales charge.

b Reflects a contingent deferred sales charge of 1.00%.

c Inception dates: May 3, 2004 for Class A, C and I shares and October 1, 2014 for Class R and Z shares.

4

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs including investment advisory fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2017—June 30, 2017.

Actual Expenses

The first line of the following table provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)—(Continued)

| | | Beginning

Account Value

January 1, 2017 | | Ending

Account Value

June 30, 2017 | | Expenses Paid

During Perioda

January 1, 2017–

June 30, 2017 | |

Class A | |

Actual (12.51% return) | | $ | 1,000.00 | | | $ | 1,125.10 | | | $ | 7.11 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 6.76 | | |

Class C | |

Actual (12.11% return) | | $ | 1,000.00 | | | $ | 1,121.10 | | | $ | 10.52 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,014.88 | | | $ | 9.99 | | |

Class I | |

Actual (12.63% return) | | $ | 1,000.00 | | | $ | 1,126.30 | | | $ | 5.27 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.01 | | |

Class R | |

Actual (12.38% return) | | $ | 1,000.00 | | | $ | 1,123.80 | | | $ | 7.90 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,017.36 | | | $ | 7.50 | | |

Class Z | |

Actual (12.63% return) | | $ | 1,000.00 | | | $ | 1,126.30 | | | $ | 5.27 | | |

Hypothetical (5% annual return before

expenses) | | $ | 1,000.00 | | | $ | 1,019.84 | | | $ | 5.01 | | |

a Expenses are equal to the Fund's Class A, Class C, Class I, Class R and Class Z annualized net expense ratios of 1.35%, 2.00%, 1.00%, 1.50% and 1.00%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

6

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

June 30, 2017

Top Ten Holdings

(Unaudited)

Security | | Value | | % of

Net

Assets | |

NextEra Energy | | $ | 12,828,201 | | | | 5.4 | | |

American Tower Corp. | | | 10,839,522 | | | | 4.6 | | |

Crown Castle International Corp. | | | 9,342,486 | | | | 4.0 | | |

Sempra Energy | | | 8,573,961 | | | | 3.6 | | |

American Water Works Co. | | | 7,922,916 | | | | 3.4 | | |

Ferrovial SA | | | 7,715,935 | | | | 3.3 | | |

CMS Energy Corp. | | | 7,606,737 | | | | 3.2 | | |

Xcel Energy | | | 7,161,822 | | | | 3.0 | | |

TransCanada Corp. | | | 7,070,591 | | | | 3.0 | | |

WEC Energy Group | | | 6,693,735 | | | | 2.8 | | |

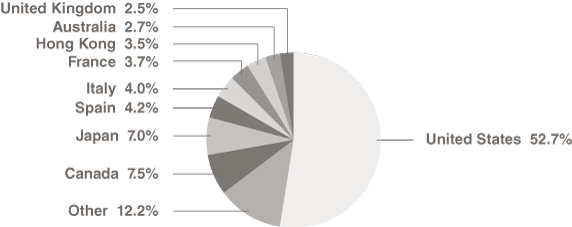

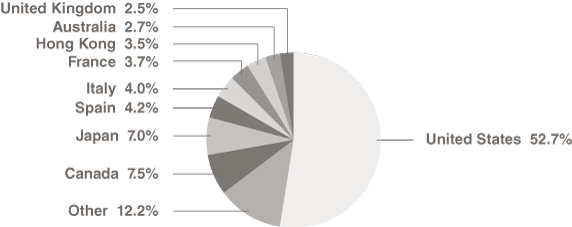

Country Breakdown

(Based on Net Assets)

(Unaudited)

7

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2017 (Unaudited)

| | | | | Number of

Shares/Units | | Value | |

COMMON STOCK | | 98.6% | | | | | | | | | |

AUSTRALIA | | 2.7% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | |

Spark Infrastructure Group | | | | | 3,153,324 | | | $ | 6,349,949 | | |

BRAZIL | | 2.5% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 1.0% | | | | | | | | | |

Energisa SA | | | | | 323,001 | | | | 2,328,252 | | |

WATER | | 1.5% | | | | | | | | | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | | | 367,729 | | | | 3,514,232 | | |

TOTAL BRAZIL | | | | | | | 5,842,484 | | |

CANADA | | 7.5% | | | | | | | | | |

PIPELINES—C-CORP | | 6.0% | | | | | | | | | |

Kinder Morgan Canada Ltd., 144Aa,b | | | | | 177,980 | | | | 2,172,596 | | |

Pembina Pipeline Corp. | | | | | 148,722 | | | | 4,925,671 | | |

TransCanada Corp. | | | | | 148,320 | | | | 7,070,591 | | |

| | | | 14,168,858 | | |

RAILWAYS | | 1.5% | | | | | | | | | |

Canadian Pacific Railway Ltd. | | | | | 21,992 | | | | 3,538,426 | | |

TOTAL CANADA | | | | | | | 17,707,284 | | |

CHINA | | 1.1% | | | | | | | | | |

TOLL ROADS | | | | | | | | | | | |

Jiangsu Expressway Co., Ltd., Class H (HKD) | | | | | 1,750,000 | | | | 2,470,077 | | |

FRANCE | | 3.7% | | | | | | | | | |

AIRPORTS | | 2.5% | | | | | | | | | |

Aeroports de Paris | | | | | 35,886 | | | | 5,791,489 | | |

TOLL ROADS | | 1.2% | | | | | | | | | |

Vinci SA | | | | | 34,455 | | | | 2,940,832 | | |

TOTAL FRANCE | | | | | | | 8,732,321 | | |

GERMANY | | 1.2% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | | | | | | | | | | |

Innogy SE, 144Aa | | | | | 72,986 | | | | 2,873,035 | | |

HONG KONG | | 3.5% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 2.5% | | | | | | | | | |

CLP Holdings Ltd. | | | | | 562,000 | | | | 5,945,757 | | |

See accompanying notes to financial statements.

8

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2017 (Unaudited)

| | | | | Number of

Shares/Units | | Value | |

MARINE PORTS | | 1.0% | | | | | | | | | |

China Merchants Port Holdings Co., Ltd. | | | | | 808,000 | | | $ | 2,240,578 | | |

TOTAL HONG KONG | | | | | | | 8,186,335 | | |

INDIA | | 1.1% | | | | | | | | | |

DIVERSIFIED | | 1.0% | | | | | | | | | |

Azure Power Global Ltd. (Mauritius) (USD)b | | | | | 133,589 | | | | 2,241,623 | | |

TOLL ROADS | | 0.1% | | | | | | | | | |

IRB InvIT Fund, 144Aa,b | | | | | 220,000 | | | | 333,553 | | |

TOTAL INDIA | | | | | | | 2,575,176 | | |

ITALY | | 4.0% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 2.2% | | | | | | | | | |

Ei Towers S.p.A. | | | | | 41,992 | | | | 2,429,232 | | |

Infrastrutture Wireless Italiane S.p.A., 144Aa | | | | | 486,455 | | | | 2,763,576 | | |

| | | | 5,192,808 | | |

PIPELINES—C-CORP | | 1.8% | | | | | | | | | |

Snam S.p.A. | | | | | 951,511 | | | | 4,147,107 | | |

TOTAL ITALY | | | | | | | 9,339,915 | | |

JAPAN | | 7.0% | | | | | | | | | |

ELECTRIC—INTEGRATED ELECTRIC | | 2.2% | | | | | | | | | |

Kyushu Electric Power Co. | | | | | 435,000 | | | | 5,275,305 | | |

RAILWAYS | | 4.8% | | | | | | | | | |

Central Japan Railway Co. | | | | | 36,300 | | | | 5,909,340 | | |

West Japan Railway Co. | | | | | 76,300 | | | | 5,383,568 | | |

| | | | 11,292,908 | | |

TOTAL JAPAN | | | | | | | 16,568,213 | | |

MEXICO | | 1.0% | | | | | | | | | |

TOLL ROADS | | | | | | | | | | | |

OHL Mexico SAB de CV | | | | | 1,640,288 | | | | 2,366,154 | | |

NEW ZEALAND | | 2.1% | | | | | | | | | |

AIRPORTS | | | | | | | | | | | |

Auckland International Airport Ltd. | | | | | 942,979 | | | | 4,926,936 | | |

See accompanying notes to financial statements.

9

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2017 (Unaudited)

| | | | | Number of

Shares/Units | | Value | |

SPAIN | | 4.2% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 0.9% | | | | | | | | | |

Red Electrica Corp. SA | | | | | 106,668 | | | $ | 2,228,895 | | |

TOLL ROADS | | 3.3% | | | | | | | | | |

Ferrovial SA | | | | | 347,601 | | | | 7,715,935 | | |

TOTAL SPAIN | | | | | | | | | 9,944,830 | | |

SWITZERLAND | | 1.5% | | | | | | | | | |

AIRPORTS | | | | | | | | | | | |

Flughafen Zuerich AG | | | | | 14,057 | | | | 3,450,848 | | |

THAILAND | | 0.3% | | | | | | | | | |

AIRPORTS | | | | | | | | | | | |

Airports of Thailand PCL | | | | | 532,600 | | | | 740,811 | | |

UNITED KINGDOM | | 2.5% | | | | | | | | | |

ELECTRIC—REGULATED ELECTRIC | | 0.9% | | | | | | | | | |

National Grid PLC | | | | | 169,426 | | | | 2,100,326 | | |

WATER | | 1.6% | | | | | | | | | |

United Utilities Group PLC | | | | | 341,503 | | | | 3,858,557 | | |

TOTAL UNITED KINGDOM | | | | | | | 5,958,883 | | |

UNITED STATES | | 52.7% | | | | | | | | | |

COMMUNICATIONS—TOWERS | | 8.5% | | | | | | | | | |

American Tower Corp. | | | | | 81,919 | | | | 10,839,522 | | |

Crown Castle International Corp. | | | | | 93,257 | | | | 9,342,486 | | |

| | | | 20,182,008 | | |

DIVERSIFIED | | 1.9% | | | | | | | | | |

Macquarie Infrastructure Co. LLC | | | | | 56,086 | | | | 4,397,143 | | |

ELECTRIC | | 21.9% | | | | | | | | | |

INTEGRATED ELECTRIC | | 6.4% | | | | | | | | | |

NextEra Energy | | | | | 91,545 | | | | 12,828,201 | | |

Pattern Energy Group | | | | | 91,337 | | | | 2,177,474 | | |

| | | | 15,005,675 | | |

See accompanying notes to financial statements.

10

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2017 (Unaudited)

| | | | | Number of

Shares/Units | | Value | |

REGULATED ELECTRIC | | 15.5% | | | | | | | | | |

Alliant Energy Corp. | | | | | 112,454 | | | $ | 4,517,277 | | |

CMS Energy Corp. | | | | | 164,470 | | | | 7,606,737 | | |

Edison International | | | | | 76,450 | | | | 5,977,626 | | |

Great Plains Energy | | | | | 160,626 | | | | 4,703,129 | | |

WEC Energy Group | | | | | 109,054 | | | | 6,693,735 | | |

Xcel Energy | | | | | 156,099 | | | | 7,161,822 | | |

| | | | 36,660,326 | | |

TOTAL ELECTRIC | | | | | | | 51,666,001 | | |

GAS DISTRIBUTION | | 6.0% | | | | | | | | | |

Atmos Energy Corp. | | | | | 67,501 | | | | 5,599,208 | | |

Sempra Energy | | | | | 76,044 | | | | 8,573,961 | | |

| | | | 14,173,169 | | |

PIPELINES | | 6.0% | | | | | | | | | |

PIPELINES—C-CORP | | 4.9% | | | | | | | | | |

Antero Midstream GP LPb | | | | | 73,539 | | | | 1,616,387 | | |

Cheniere Energyb | | | | | 39,964 | | | | 1,946,647 | | |

Kinder Morgan | | | | | 276,826 | | | | 5,303,986 | | |

ONEOK | | | | | 50,026 | | | | 2,609,356 | | |

| | | | 11,476,376 | | |

PIPELINES—MLP | | 1.1% | | | | | | | | | |

Hess Midstream Partners LPb | | | | | 91,729 | | | | 1,868,520 | | |

Rice Midstream Partners LP | | | | | 41,923 | | | | 835,944 | | |

| | | | 2,704,464 | | |

TOTAL PIPELINES | | | | | | | 14,180,840 | | |

RAILWAYS | | 5.0% | | | | | | | | | |

CSX Corp. | | | | | 91,103 | | | | 4,970,580 | | |

Norfolk Southern Corp. | | | | | 13,529 | | | | 1,646,479 | | |

Union Pacific Corp. | | | | | 48,178 | | | | 5,247,066 | | |

| | | | 11,864,125 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2017 (Unaudited)

| | | | | Number of

Shares/Units | | Value | |

WATER | | | 3.4% | | | | | | | | | | |

American Water Works Co. | | | | | 101,641 | | | $ | 7,922,916 | | |

TOTAL UNITED STATES | | | | | | | 124,386,202 | | |

TOTAL COMMON STOCK

(Identified cost—$192,117,104) | | | | | | | 232,419,453 | | |

SHORT-TERM INVESTMENTS | | | 3.2% | | | | | | | | | | |

MONEY MARKET FUNDS | | | | | | | | | | | | | |

State Street Institutional Treasury Money

Market Fund, Premier Class, 0.83%c | | | | | 7,600,000 | | | | 7,600,000 | | |

TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$7,600,000) | | | | | | | 7,600,000 | | |

TOTAL INVESTMENTS (Identified cost—$199,717,104) | | | 101.8 | % | | | | | | | 240,019,453 | | |

LIABILITIES IN EXCESS OF OTHER ASSETS | | | (1.8 | ) | | | | | | | (4,168,391 | ) | |

NET ASSETS | | | 100.0 | % | | | | | | $ | 235,851,062 | | |

Glossary of Portfolio Abbreviations

HKD Hong Kong Dollar

MLP Master Limited Partnership

USD United States Dollar

Note: Percentages indicated are based on the net assets of the Fund.

a Resale is restricted to qualified institutional investors. Aggregate holdings amounting to $8,142,760 or 3.5% of the net assets of the Fund, of which 0.0% are illiquid.

b Non-income producing security.

c Rate quoted represents the annualized seven-day yield of the fund.

See accompanying notes to financial statements.

12

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2017 (Unaudited)

Sector Summary | | % of

Net Assets | |

Electric | | | 33.3 | | |

Pipelines | | | 13.8 | | |

Railways | | | 11.3 | | |

Communications | | | 10.7 | | |

Toll Roads | | | 6.7 | | |

Water | | | 6.5 | | |

Airports | | | 6.4 | | |

Gas Distribution | | | 6.0 | | |

Diversified | | | 2.9 | | |

Other | | | 1.4 | | |

Marine Ports | | | 1.0 | | |

| | | | 100.0 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2017 (Unaudited)

ASSETS: | |

Investments in securities, at value (Identified cost—$199,717,104) | | $ | 240,019,453 | | |

Cash | | | 2,614,379 | | |

Foreign currency, at value (Identified cost—$137,901) | | | 137,487 | | |

Receivable for: | |

Dividends and interest | | | 749,917 | | |

Investment securities sold | | | 517,866 | | |

Fund shares sold | | | 449,318 | | |

Other assets | | | 2,474 | | |

Total Assets | | | 244,490,894 | | |

LIABILITIES: | |

Payable for: | |

Investment securities purchased | | | 6,879,598 | | |

Dividends declared | | | 824,590 | | |

Fund shares redeemed | | | 643,185 | | |

Investment advisory fees | | | 136,030 | | |

Shareholder servicing fees | | | 30,485 | | |

Administration fees | | | 3,910 | | |

Distribution fees | | | 1,484 | | |

Directors' fees | | | 165 | | |

Other liabilities | | | 120,385 | | |

Total Liabilities | | | 8,639,832 | | |

NET ASSETS | | $ | 235,851,062 | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 197,945,545 | | |

Dividends in excess of net investment income | | | (185,401 | ) | |

Accumulated net realized loss | | | (2,211,330 | ) | |

Net unrealized appreciation | | | 40,302,248 | | |

| | | $ | 235,851,062 | | |

See accompanying notes to financial statements.

14

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

June 30, 2017 (Unaudited)

CLASS A SHARES: | |

NET ASSETS | | $ | 45,095,194 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 2,381,530 | | |

Net asset value and redemption price per share | | $ | 18.94 | | |

Maximum offering price per share ($18.94 ÷ 0.955)a | | $ | 19.83 | | |

CLASS C SHARES: | |

NET ASSETS | | $ | 20,850,042 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,103,497 | | |

Net asset value and offering price per shareb | | $ | 18.89 | | |

CLASS I SHARES: | |

NET ASSETS | | $ | 169,754,967 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 8,938,336 | | |

Net asset value, offering and redemption price per share | | $ | 18.99 | | |

CLASS R SHARES: | |

NET ASSETS | | $ | 35,104 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,849 | | |

Net asset value, offering and redemption price per share | | $ | 18.99 | | |

CLASS Z SHARES: | |

NET ASSETS | | $ | 115,755 | | |

Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 6,094 | | |

Net asset value, offering and redemption price per share | | $ | 18.99 | | |

a On investments of $100,000 or more, the offering price is reduced.

b Redemption price per share is equal to the net asset value per share less any applicable contingent deferred sales charge of 1.00% on shares held for less than one year.

See accompanying notes to financial statements.

15

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2017 (Unaudited)

Investment Income: | |

Dividend income (net of $126,341 of foreign withholding tax) | | $ | 4,112,074 | | |

Expenses: | |

Investment advisory fees | | | 836,934 | | |

Distribution fees—Class A | | | 45,594 | | |

Distribution fees—Class C | | | 82,989 | | |

Distribution fees—Class R | | | 77 | | |

Shareholder servicing fees—Class A | | | 18,237 | | |

Shareholder servicing fees—Class C | | | 27,662 | | |

Shareholder servicing fees—Class I | | | 59,653 | | |

Registration and filing fees | | | 64,589 | | |

Professional fees | | | 56,559 | | |

Administration fees | | | 53,847 | | |

Transfer agent fees and expenses | | | 30,038 | | |

Shareholder reporting expenses | | | 26,765 | | |

Custodian fees and expenses | | | 22,851 | | |

Directors' fees and expenses | | | 9,417 | | |

Miscellaneous | | | 14,833 | | |

Total Expenses | | | 1,350,045 | | |

Reduction of Expenses (See Note 2) | | | (59,653 | ) | |

Net Expenses | | | 1,290,392 | | |

Net Investment Income (Loss) | | | 2,821,682 | | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | |

Investments | | | 7,529,049 | | |

Foreign currency transactions | | | (32,679 | ) | |

Net realized gain (loss) | | | 7,496,370 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | 15,863,702 | | |

Foreign currency translations | | | 5,827 | | |

Net change in unrealized appreciation (depreciation) | | | 15,869,529 | | |

Net Realized and Unrealized Gain (Loss) | | | 23,365,899 | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 26,187,581 | | |

See accompanying notes to financial statements.

16

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| | | For the

Six Months Ended

June 30, 2017 | | For the

Year Ended

December 31, 2016 | |

Change in Net Assets: | |

From Operations: | |

Net investment income (loss) | | $ | 2,821,682 | | | $ | 3,969,900 | | |

Net realized gain (loss) | | | 7,496,370 | | | | (3,541,734 | ) | |

Net change in unrealized appreciation

(depreciation) | | | 15,869,529 | | | | 16,514,477 | | |

Net increase (decrease) in net assets

resulting from operations | | | 26,187,581 | | | | 16,942,643 | | |

Dividends and Distributions to Shareholders from: | |

Net investment income: | |

Class A | | | (545,781 | ) | | | (523,549 | ) | |

Class C | | | (172,331 | ) | | | (199,000 | ) | |

Class I | | | (2,286,691 | ) | | | (2,911,355 | ) | |

Class R | | | (398 | ) | | | (185 | ) | |

Class Z | | | (1,553 | ) | | | (426 | ) | |

Return of capital: | |

Class A | | | — | | | | (162,011 | ) | |

Class C | | | — | | | | (105,201 | ) | |

Class I | | | — | | | | (752,918 | ) | |

Class R | | | — | | | | (62 | ) | |

Class Z | | | — | | | | (106 | ) | |

Total dividends and distributions to

shareholders | | | (3,006,754 | ) | | | (4,654,813 | ) | |

Capital Stock Transactions: | |

Increase (decrease) in net assets from Fund share

transactions | | | 2,301,701 | | | | (18,432,304 | ) | |

Total increase (decrease) in net assets | | | 25,482,528 | | | | (6,144,474 | ) | |

Net Assets: | |

Beginning of period | | | 210,368,534 | | | | 216,513,008 | | |

End of perioda | | $ | 235,851,062 | | | $ | 210,368,534 | | |

a Includes dividends in excess of net investment income of $185,401 and $329, respectively.

See accompanying notes to financial statements.

17

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following tables include selected data for a share outstanding throughout each period and other performance information derived from the financial statements. They should be read in conjunction with the financial statements and notes thereto.

| | | Class A | |

| | | For the Six | | For the Year Ended December 31, | |

| | | Months Ended | | | |

Per Share Operating Performance: | | June 30, 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

Net asset value, beginning of period | | $ | 17.04 | | | $ | 16.09 | | | $ | 18.59 | | | $ | 16.88 | | | $ | 14.49 | | | $ | 12.95 | | |

Income (loss) from investment operations: | |

Net investment income (loss)a | | | 0.22 | | | | 0.29 | | | | 0.28 | | | | 0.25 | | | | 0.20 | | | | 0.25 | | |

Net realized and unrealized gain (loss) | | | 1.91 | | | | 1.01 | | | | (1.78 | ) | | | 1.71 | | | | 2.42 | | | | 1.55 | | |

Total from investment operations | | | 2.13 | | | | 1.30 | | | | (1.50 | ) | | | 1.96 | | | | 2.62 | | | | 1.80 | | |

Less dividends and distributions to

shareholders from: | |

Net investment income | | | (0.23 | ) | | | (0.27 | ) | | | (0.29 | ) | | | (0.21 | ) | | | (0.23 | ) | | | (0.26 | ) | |

Net realized gain | | | — | | | | — | | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | |

Return of capital | | | — | | | | (0.08 | ) | | | — | | | | — | | | | — | | | | — | | |

Total dividends and distributions

to shareholders | | | (0.23 | ) | | | (0.35 | ) | | | (1.00 | ) | | | (0.25 | ) | | | (0.23 | ) | | | (0.26 | ) | |

Net increase (decrease) in net asset value | | | 1.90 | | | | 0.95 | | | | (2.50 | ) | | | 1.71 | | | | 2.39 | | | | 1.54 | | |

Net asset value, end of period | | $ | 18.94 | | | $ | 17.04 | | | $ | 16.09 | | | $ | 18.59 | | | $ | 16.88 | | | $ | 14.49 | | |

Total investment returnb,c | | | 12.51 | % | | | 8.02 | % | | | –8.10 | % | | | 11.57 | % | | | 18.20 | % | | | 14.04 | % | |

Ratios/Supplemental Data: | |

Net assets, end of period (in millions) | | $ | 45.1 | | | $ | 31.4 | | | $ | 38.1 | | | $ | 48.6 | | | $ | 33.3 | | | $ | 38.3 | | |

Ratio of expenses to average daily net

assets (before expense reduction) | | | 1.35 | %e | | | 1.35 | % | | | 1.33 | %f | | | 1.36 | % | | | 1.50 | % | | | 1.66 | % | |

Ratio of expenses to average daily net

assets (net of expense reduction) | | | 1.35 | %e | | | 1.35 | % | | | 1.33 | %f | | | 1.36 | % | | | 1.50 | % | | | 1.50 | % | |

Ratio of net investment income (loss)

to average daily net assets

(before expense reduction) | | | 2.41 | %e | | | 1.70 | % | | | 1.50 | %f | | | 1.36 | % | | | 1.24 | % | | | 1.66 | % | |

Ratio of net investment income (loss)

to average daily net assets

(net of expense reduction) | | | 2.41 | %e | | | 1.70 | % | | | 1.50 | %f | | | 1.36 | % | | | 1.24 | % | | | 1.82 | % | |

Portfolio turnover rate | | | 40 | %d | | | 89 | % | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | |

a Calculation based on average shares outstanding.

b Return assumes the reinvestment of all dividends and distributions at NAV.

c Does not reflect sales charges, which would reduce return.

d Not annualized.

e Annualized.

f Includes extraordinary expenses, related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.32% at the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.51%.

See accompanying notes to financial statements.

18

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class C | |

| | | For the Six | | For the Year Ended December 31, | |

| | | Months Ended | | | |

Per Share Operating Performance: | | June 30, 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

Net asset value, beginning of period | | $ | 16.99 | | | $ | 16.05 | | | $ | 18.54 | | | $ | 16.84 | | | $ | 14.46 | | | $ | 12.92 | | |

Income (loss) from investment operations: | |

Net investment income (loss)a | | | 0.15 | | | | 0.18 | | | | 0.15 | | | | 0.13 | | | | 0.10 | | | | 0.16 | | |

Net realized and unrealized gain (loss) | | | 1.91 | | | | 1.00 | | | | (1.76 | ) | | | 1.71 | | | | 2.41 | | | | 1.55 | | |

Total from investment operations | | | 2.06 | | | | 1.18 | | | | (1.61 | ) | | | 1.84 | | | | 2.51 | | | | 1.71 | | |

Less dividends and distributions to

shareholders from: | |

Net investment income | | | (0.16 | ) | | | (0.16 | ) | | | (0.17 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.17 | ) | |

Net realized gain | | | — | | | | — | | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | |

Return of capital | | | — | | | | (0.08 | ) | | | — | | | | — | | | | — | | | | — | | |

Total dividends and distributions

to shareholders | | | (0.16 | ) | | | (0.24 | ) | | | (0.88 | ) | | | (0.14 | ) | | | (0.13 | ) | | | (0.17 | ) | |

Net increase (decrease) in net asset value | | | 1.90 | | | | 0.94 | | | | (2.49 | ) | | | 1.70 | | | | 2.38 | | | | 1.54 | | |

Net asset value, end of period | | $ | 18.89 | | | $ | 16.99 | | | $ | 16.05 | | | $ | 18.54 | | | $ | 16.84 | | | $ | 14.46 | | |

Total investment returnb,c | | | 12.11 | % | | | 7.30 | % | | | –8.70 | % | | | 10.88 | % | | | 17.41 | % | | | 13.30 | % | |

Ratios/Supplemental Data: | |

Net assets, end of period (in millions) | | $ | 20.9 | | | $ | 21.1 | | | $ | 22.4 | | | $ | 26.1 | | | $ | 18.4 | | | $ | 16.0 | | |

Ratio of expenses to average daily net

assets (before expense reduction) | | | 2.00 | %e | | | 2.00 | % | | | 1.98 | %f | | | 2.01 | % | | | 2.15 | % | | | 2.31 | % | |

Ratio of expenses to average daily net

assets (net of expense reduction) | | | 2.00 | %e | | | 2.00 | % | | | 1.98 | %f | | | 2.01 | % | | | 2.15 | % | | | 2.15 | % | |

Ratio of net investment income (loss)

to average daily net assets

(before expense reduction) | | | 1.67 | %e | | | 1.04 | % | | | 0.85 | %f | | | 0.72 | % | | | 0.61 | % | | | 0.99 | % | |

Ratio of net investment income (loss)

to average daily net assets

(net of expense reduction) | | | 1.67 | %e | | | 1.04 | % | | | 0.85 | %f | | | 0.72 | % | | | 0.61 | % | | | 1.15 | % | |

Portfolio turnover rate | | | 40 | %d | | | 89 | % | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | |

a Calculation based on average shares outstanding.

b Return assumes the reinvestment of all dividends and distributions at NAV.

c Does not reflect sales charges, which would reduce return.

d Not annualized.

e Annualized.

f Includes extraordinary expenses, related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.97% at the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 0.86%.

See accompanying notes to financial statements.

19

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class I | |

| | | For the Six | | For the Year Ended December 31, | |

| | | Months Ended | | | |

Per Share Operating Performance: | | June 30, 2017 | | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

Net asset value, beginning of period | | $ | 17.09 | | | $ | 16.14 | | | $ | 18.64 | | | $ | 16.93 | | | $ | 14.52 | | | $ | 12.97 | | |

Income (loss) from investment operations: | |

Net investment income (loss)a | | | 0.24 | | | | 0.34 | | | | 0.33 | | | | 0.30 | | | | 0.26 | | | | 0.30 | | |

Net realized and unrealized gain (loss) | | | 1.92 | | | | 1.01 | | | | (1.78 | ) | | | 1.71 | | | | 2.43 | | | | 1.56 | | |

Total from investment operations | | | 2.16 | | | | 1.35 | | | | (1.45 | ) | | | 2.01 | | | | 2.69 | | | | 1.86 | | |

Less dividends and distributions to

shareholders from: | |

Net investment income | | | (0.26 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.26 | ) | | | (0.28 | ) | | | (0.31 | ) | |

Net realized gain | | | — | | | | — | | | | (0.71 | ) | | | (0.04 | ) | | | — | | | | — | | |

Return of capital | | | — | | | | (0.08 | ) | | | — | | | | — | | | | — | | | | — | | |

Total dividends and distributions

to shareholders | | | (0.26 | ) | | | (0.40 | ) | | | (1.05 | ) | | | (0.30 | ) | | | (0.28 | ) | | | (0.31 | ) | |

Net increase (decrease) in net asset value | | | 1.90 | | | | 0.95 | | | | (2.50 | ) | | | 1.71 | | | | 2.41 | | | | 1.55 | | |

Net asset value, end of period | | $ | 18.99 | | | $ | 17.09 | | | $ | 16.14 | | | $ | 18.64 | | | $ | 16.93 | | | $ | 14.52 | | |

Total investment returnb | | | 12.63 | % | | | 8.32 | % | | | –7.79 | % | | | 11.82 | % | | | 18.69 | % | | | 14.44 | % | |

Ratios/Supplemental Data: | |

Net assets, end of period (in millions) | | $ | 169.8 | | | $ | 157.8 | | | $ | 155.9 | | | $ | 175.9 | | | $ | 93.0 | | | $ | 53.5 | | |

Ratio of expenses to average daily net

assets (before expense reduction) | | | 1.07 | %d | | | 1.08 | % | | | 1.04 | %e | | | 1.10 | % | | | 1.16 | % | | | 1.31 | % | |

Ratio of expenses to average daily net

assets (net of expense reduction) | | | 1.00 | %d | | | 1.07 | % | | | 1.04 | %e | | | 1.10 | % | | | 1.15 | % | | | 1.15 | % | |

Ratio of net investment income (loss)

to average daily net assets

(before expense reduction) | | | 2.60 | %d | | | 1.97 | % | | | 1.80 | %e | | | 1.63 | % | | | 1.62 | % | | | 2.04 | % | |

Ratio of net investment income (loss)

to average daily net assets

(net of expense reduction) | | | 2.67 | %d | | | 1.98 | % | | | 1.80 | %e | | | 1.63 | % | | | 1.63 | % | | | 2.20 | % | |

Portfolio turnover rate | | | 40 | %c | | | 89 | % | | | 86 | % | | | 36 | % | | | 68 | % | | | 69 | % | |

a Calculation based on average shares outstanding.

b Return assumes the reinvestment of all dividends and distributions at NAV.

c Not annualized.

d Annualized.

e Includes extraordinary expenses, related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.03% at the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.81%.

See accompanying notes to financial statements.

20

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class R | |

| | | For the Six | | For the Year Ended

December 31, | | For the Period

October 1, 2014a | |

| | | Months Ended | | | | through | |

Per Share Operating Performance: | | June 30, 2017 | | 2016 | | 2015 | | December 31, 2014 | |

Net asset value, beginning of period | | $ | 17.09 | | | $ | 16.14 | | | $ | 18.64 | | | $ | 18.44 | | |

Income (loss) from investment operations: | |

Net investment income (loss)b | | | 0.22 | | | | 0.26 | | | | 0.25 | | | | 0.04 | | |

Net realized and unrealized gain (loss) | | | 1.90 | | | | 1.02 | | | | (1.78 | ) | | | 0.26 | | |

Total from investment operations | | | 2.12 | | | | 1.28 | | | | (1.53 | ) | | | 0.30 | | |

Less dividends and distributions to shareholders from: | |

Net investment income | | | (0.22 | ) | | | (0.25 | ) | | | (0.26 | ) | | | (0.10 | ) | |

Net realized gain | | | — | | | | — | | | | (0.71 | ) | | | — | | |

Return of capital | | | — | | | | (0.08 | ) | | | — | | | | — | | |

Total dividends and distributions to

shareholders | | | (0.22 | ) | | | (0.33 | ) | | | (0.97 | ) | | | (0.10 | ) | |

Net increase (decrease) in net asset value | | | 1.90 | | | | 0.95 | | | | (2.50 | ) | | | 0.20 | | |

Net asset value, end of period | | $ | 18.99 | | | $ | 17.09 | | | $ | 16.14 | | | $ | 18.64 | | |

Total investment returnc | | | 12.38 | %d | | | 7.89 | % | | | –8.22 | % | | | 1.61 | %d | |

Ratios/Supplemental Data: | |

Net assets, end of period (in 000s) | | $ | 35.1 | | | $ | 19.1 | | | $ | 8.8 | | | $ | 10.1 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.50 | %e | | | 1.49 | % | | | 1.48 | %f | | | 1.52 | %e | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.50 | %e | | | 1.49 | % | | | 1.48 | %f | | | 1.52 | %e | |

Ratio of net investment income (loss) to average

daily net assets (before expense reduction) | | | 2.41 | %e | | | 1.49 | % | | | 1.34 | %f | | | 0.98 | %e | |

Ratio of net investment income (loss) to average

daily net assets (net of expense reduction) | | | 2.41 | %e | | | 1.49 | % | | | 1.34 | %f | | | 0.98 | %e | |

Portfolio turnover rate | | | 40 | %d | | | 89 | % | | | 86 | % | | | 36 | %d | |

a Inception date.

b Calculation based on average shares outstanding.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Not annualized.

e Annualized.

f Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 1.47% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 1.35%.

See accompanying notes to financial statements.

21

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class Z | |

| | | For the Six | | For the Year Ended

December 31, | | For the Period

October 1, 2014a | |

| | | Months Ended | | | | through | |

Per Share Operating Performance: | | June 30, 2017 | | 2016 | | 2015 | | December 31, 2014 | |

Net asset value, beginning of period | | $ | 17.09 | | | $ | 16.13 | | | $ | 18.64 | | | $ | 18.44 | | |

Income (loss) from investment operations: | |

Net investment income (loss)b | | | 0.28 | | | | 0.36 | | | | 0.38 | | | | 0.07 | | |

Net realized and unrealized gain (loss) | | | 1.88 | | | | 1.01 | | | | (1.83 | ) | | | 0.25 | | |

Total from investment operations | | | 2.16 | | | | 1.37 | | | | (1.45 | ) | | | 0.32 | | |

Less dividends and distributions to shareholders from: | |

Net investment income | | | (0.26 | ) | | | (0.33 | ) | | | (0.35 | ) | | | (0.12 | ) | |

Net realized gain | | | — | | | | — | | | | (0.71 | ) | | | — | | |

Return of capital | | | — | | | | (0.08 | ) | | | — | | | | — | | |

Total dividends and distributions to

shareholders | | | (0.26 | ) | | | (0.41 | ) | | | (1.06 | ) | | | (0.12 | ) | |

Net increase (decrease) in net asset value | | | 1.90 | | | | 0.96 | | | | (2.51 | ) | | | 0.20 | | |

Net asset value, end of period | | $ | 18.99 | | | $ | 17.09 | | | $ | 16.13 | | | $ | 18.64 | | |

Total investment returnc | | | 12.63 | %d | | | 8.45 | % | | | –7.79 | % | | | 1.74 | %d | |

Ratios/Supplemental Data: | |

Net assets, end of period (in 000s) | | $ | 115.8 | | | $ | 16.0 | | | $ | 22.8 | | | $ | 10.1 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.00 | %e | | | 1.00 | % | | | 0.98 | %f | | | 1.02 | %e | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.00 | %e | | | 1.00 | % | | | 0.98 | %f | | | 1.02 | %e | |

Ratio of net investment income (loss) to average

daily net assets (before expense reduction) | | | 3.02 | %e | | | 2.10 | % | | | 2.06 | %f | | | 1.49 | %e | |

Ratio of net investment income (loss) to average

daily net assets (net of expense reduction) | | | 3.02 | %e | | | 2.10 | % | | | 2.06 | %f | | | 1.49 | %e | |

Portfolio turnover rate | | | 40 | %d | | | 89 | % | | | 86 | % | | | 36 | %d | |

a Inception date.

b Calculation based on average shares outstanding.

c Return assumes the reinvestment of all dividends and distributions at NAV.

d Not annualized.

e Annualized.

f Includes extraordinary expenses related to shareholder proxy expenses. Without these expenses, the ratio of expenses to average daily net assets (before expense reduction and net of expense reduction) would have been 0.97% and the ratio of net investment income to average daily net assets (before expense reduction and net of expense reduction) would have been 2.07%.

See accompanying notes to financial statements.

22

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Global Infrastructure Fund, Inc. (the Fund), was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The Fund's investment objective is total return. On December 6, 2016, the Board of Directors of the Fund approved the Fund's offering of Class F and Class T shares. Class F shares and Class T shares are currently not available for purchase. The authorized shares of the Fund are divided into seven classes designated Class A, C, F, I, R, T and Z shares. Each of the Fund's shares has equal dividend, liquidation and voting rights (except for matters relating to distribution and shareholder servicing of such shares).

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges (including NASDAQ) are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter (OTC) market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment advisor) to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment advisor, pursuant to delegation by the Board of Directors, to reflect the fair value of such securities.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at their closing net asset value.

23

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

The policies and procedures approved by the Fund's Board of Directors delegate authority to make fair value determinations to the investment advisor, subject to the oversight of the Board of Directors. The investment advisor has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment advisor determines that the bid and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain non-U.S. equity holdings to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the earlier closing of foreign markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund's investments is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities may or may not be an indication of the risk associated with investing in those securities.

24

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfer at the end of the period in which the underlying event causing the movement occurred. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. There were no transfers between Level 1 and Level 2 investments as of June 30, 2017.

The following is a summary of the inputs used as of June 30, 2017 in valuing the Fund's investments carried at value:

| | | Total | | Quoted Prices

in Active

Markets for

Identical

Investments

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Common Stock: | |

Thailand | | $ | 740,811 | | | $ | — | | | $ | 740,811 | | | $ | — | | |

Other Countries | | | 231,678,642 | | | | 231,678,642 | | | | — | | | | — | | |

Short-Term Investments | | | 7,600,000 | | | | — | | | | 7,600,000 | | | | — | | |

Total Investmentsa | | $ | 240,019,453 | | | $ | 231,678,642 | | | $ | 8,340,811 | | | $ | — | | |

a Portfolio holdings are disclosed individually on the Schedule of Investments.

Security Transactions, Investment Income and Expense Allocations: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions from Master Limited Partnerships (MLPs) are recorded as income and return of capital based on information reported by the MLPs and management's estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the MLPs and actual amounts may differ from the estimated amounts. Income, expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

25

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency exchange contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gains/losses are included in or are a reduction of ordinary income for federal income tax purposes.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid semi-annually. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the Fund based on the net asset value per share at the close of business on the payable date, unless the shareholder has elected to have them paid in cash.

Dividends from net investment income are subject to recharacterization for tax purposes. Based upon the results of operations for the six months ended June 30, 2017, the investment advisor considers it likely that a portion of the dividends will be reclassified to distributions from net realized gain upon the final determination of the Fund's taxable income after December 31, 2017, the Fund's fiscal year end.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Accordingly, no provision for federal income or excise tax is necessary. Dividend and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Security and foreign currency transactions and any gains realized by the Fund on the sale of securities in certain non-U.S. markets are subject to non-U.S. taxes. The Fund records a liability based on any unrealized gains on securities held in these markets in order to estimate the potential non-U.S. taxes due upon the sale of these securities. Management has analyzed the Fund's tax positions taken on federal and applicable state income tax returns as well as its tax positions in non-U.S. jurisdictions in which it trades for all open tax years and has concluded that as of June 30, 2017, no additional provisions for income tax are required in the Fund's financial statements. The Fund's tax positions for the tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service, state departments of revenue and by foreign tax authorities.

26

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 2. Investment Advisory, Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The investment advisor serves as the Fund's investment advisor pursuant to an investment advisory agreement (the investment advisory agreement). Under the terms of the investment advisory agreement, the investment advisor provides the Fund with day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the investment advisor receives a fee, accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund up to and including $1.5 billion and 0.65% of the average daily net assets above $1.5 billion.

For the six months ended June 30, 2017 and through June 30, 2019, the investment advisor has contractually agreed to waive and/or reimburse the Fund's Class I shareholder service fee up to the maximum shareholder service fee of 0.10%. This contractual agreement can be amended at any time by agreement of the Fund and the investment advisor and will terminate automatically in the event of termination of the investment advisory agreement between the investment advisor and the Fund. For the six months ended June 30, 2017, fees waived and/or expenses reimbursed totaled $59,653.

Under subadvisory agreements between the investment advisor and each of Cohen & Steers Asia Limited and Cohen & Steers UK Limited (collectively, the subadvisors), affiliates of the investment advisor, the subadvisors are responsible for managing the Fund's investments in certain non-U.S. holdings. For their services provided under the subadvisory agreements, the investment advisor (not the Fund) pays the subadvisors. The investment advisor allocates 50% of the investment advisory fee received from the Fund among itself and each subadvisor based on the portion of the Fund's average daily net assets managed by the investment advisor and each subadvisor.

Administration Fees: The Fund has entered into an administration agreement with the investment advisor under which the investment advisor performs certain administrative functions for the Fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the average daily net assets of the Fund. For the six months ended June 30, 2017, the Fund incurred $22,318 in fees under this administration agreement. On June 13, 2017, the Board of Directors of the Fund approved an amendment to the Fund's administration agreement with the investment advisor, effective October 1, 2017, increasing the administration fee to an annual rate of 0.04% of the average daily net assets of the Fund. Additionally, the Fund pays State Street Bank and Trust Company as co-administrator under a fund accounting and administration agreement.

Distribution Fees: Shares of the Fund are distributed by Cohen & Steers Securities, LLC (the distributor), an affiliated entity of the investment advisor. The Fund has adopted an amended distribution and service plan (the plan) pursuant to Rule 12b-1 under the 1940 Act. The plan provides that the Fund will pay the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.25% of the average daily net assets attributable to Class A and Class T shares, up to 0.75% of the average daily net assets attributable to Class C shares, and up to 0.50% of the average daily net assets attributable to Class R shares. In addition, with respect to Class R shares, such amounts may also be used to pay for services to Fund shareholders or services related to the maintenance of shareholder accounts. Class T shares are currently not available for purchase.

27

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

There is a maximum initial sales charge of 4.50% for Class A shares and 2.50% for Class T shares. Class T shares are currently not available for purchase. There is a contingent deferred sales charge (CDSC) of 1.00% on purchases of $1 million or more of Class A shares, which applies if redemption occurs within one year from purchase. There is a CDSC of 1.00% on Class C shares, which applies if redemption occurs within one year from purchase. For the six months ended June 30, 2017, the Fund has been advised that the distributor received $8,272, which represents a portion of the sales commissions paid by shareholders from the sale of Class A shares, and $0 and $2,293 of CDSC relating to redemptions of Class A and Class C shares, respectively. The distributor has advised the Fund that proceeds from the CDSC on these classes are used by the distributor to defray its expenses related to providing distribution-related services to the Fund in connection with the sale of these classes, including payments to dealers and other financial intermediaries for selling these classes. The payment of a CDSC may result in the distributor receiving amounts greater or less than the upfront commission paid by the distributor to the financial intermediary.

Shareholder Servicing Fees: For shareholder services, the Fund pays the distributor or its affiliates a fee, accrued daily, at an annual rate of up to 0.10% of the average daily net assets of the Fund's Class A, Class I and Class T shares and up to 0.25% of the average daily net assets of the Fund's Class C shares. The distributor is responsible for paying qualified financial institutions for shareholder services. Class T shares are currently not available for purchase.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers and/or employees of the investment advisor. The Fund does not pay compensation to directors and officers affiliated with the investment advisor except for the Chief Compliance Officer, who received compensation from the investment advisor, which was reimbursed by the Fund, in the amount of $1,337 for the six months ended June 30, 2017.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended June 30, 2017, totaled $89,263,774 and $88,794,364, respectively.

Note 4. Income Tax Information

As of June 30, 2017, the federal tax cost and net unrealized appreciation (depreciation) in value of securities held were as follows:

Cost for federal income tax purposes | | $ | 199,717,104 | | |

Gross unrealized appreciation | | $ | 42,129,110 | | |

Gross unrealized depreciation | | | (1,826,761 | ) | |

Net unrealized appreciation (depreciation) | | $ | 40,302,349 | | |

As of December 31, 2016, the Fund had a short-term capital loss carryforward of $5,135,335, which under current federal income tax rules, may offset capital gains recognized in any future period.

28

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

In addition, the Fund incurred ordinary losses of $329 after October 31, 2016, that it has elected to treat as arising in the following fiscal year.

Note 5. Capital Stock

The Fund is authorized to issue 400 million shares of capital stock, at a par value of $0.001 per share, classified in seven classes as follows: 50 million of Class A capital stock, 50 million of Class C capital stock, 50 million of Class F capital stock, 100 million of Class I capital stock, 50 million of Class R capital stock, 50 million of Class T capital stock and 50 million of Class Z capital stock. Class F shares and Class T shares are currently not available for purchase.

The Board of Directors of the Fund may increase or decrease the number of shares of common stock that the Fund has authority to issue. Transactions in Fund shares were as follows:

| | For the

Six Months Ended

June 30, 2017 | | For the

Year Ended

December 31, 2016 | |

| | Shares | | Amount | | Shares | | Amount | |

Class A: | |

Sold | | | 783,240 | | | $ | 14,687,179 | | | | 372,604 | | | $ | 6,399,789 | | |

Issued as reinvestment

of dividends and

distributions | | | 22,247 | | | | 421,580 | | | | 28,302 | | | | 497,485 | | |

| Redeemed | | | (266,629 | ) | | | (4,907,837 | ) | | | (928,126 | ) | | | (16,081,561 | ) | |

| Net increase (decrease) | | | 538,858 | | | $ | 10,200,922 | | | | (527,220 | ) | | $ | (9,184,287 | ) | |

Class C: | |

Sold | | | 142,190 | | | $ | 2,558,707 | | | | 125,252 | | | $ | 2,128,033 | | |

Issued as reinvestment

of dividends and

distributions | | | 7,173 | | | | 135,641 | | | | 11,777 | | | | 206,664 | | |

| Redeemed | | | (287,588 | ) | | | (5,357,586 | ) | | | (291,989 | ) | | | (4,957,805 | ) | |

| Net increase (decrease) | | | (138,225 | ) | | $ | (2,663,238 | ) | | | (154,960 | ) | | $ | (2,623,108 | ) | |

Class I: | |

| Sold | | | 1,222,739 | | | $ | 22,460,195 | | | | 2,926,104 | | | $ | 50,466,742 | | |

Issued as reinvestment

of dividends and

distributions | | | 85,389 | | | | 1,623,250 | | | | 149,630 | | | | 2,626,371 | | |

| Redeemed | | | (1,607,176 | ) | | | (29,423,666 | ) | | | (3,502,307 | ) | | | (59,719,530 | ) | |

| Net increase (decrease) | | | (299,048 | ) | | $ | (5,340,221 | ) | | | (426,573 | ) | | $ | (6,626,417 | ) | |

29

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

| | For the

Six Months Ended

June 30, 2017 | | For the

Year Ended

December 31, 2016 | |

| | Shares | | Amount | | Shares | | Amount | |

Class R: | |

| Sold | | | 905 | | | $ | 16,328 | | | | 821 | | | $ | 14,556 | | |

Issued as reinvestments

of dividends and

distributions | | | 15 | | | | 280 | | | | 4 | | | | 67 | | |

| Redeemed | | | (190 | ) | | | (3,680 | ) | | | (248 | ) | | | (4,193 | ) | |

| Net increase (decrease) | | | 730 | | | $ | 12,928 | | | | 577 | | | $ | 10,430 | | |

Class Z: | |

| Sold | | | 5,090 | | | $ | 90,033 | | | | 228 | | | $ | 3,893 | | |

Issued as reinvestment

of dividends and

distributions | | | 74 | | | | 1,413 | | | | 17 | | | | 308 | | |

| Redeemed | | | (7 | ) | | | (136 | ) | | | (724 | ) | | | (13,123 | ) | |

| Net increase (decrease) | | | 5,157 | | | $ | 91,310 | | | | (479 | ) | | $ | (8,922 | ) | |

Note 6. Other Risks

Common Stock Risk: While common stocks have historically generated higher average returns than fixed income securities over the long-term, common stock has also experienced significantly more volatility in those returns, although under certain market conditions, fixed-income investments may have comparable or greater price volatility. An adverse event, such as an unfavorable earnings report, may depress the value of common stock held by the Fund. Also, the price of common stock is sensitive to general movements in the stock market. A drop in the stock market may depress the price of common stock held by the Fund.

Infrastructure Companies Risk: Securities and instruments of infrastructure companies are more susceptible to adverse economic or regulatory occurrences affecting their industries. Infrastructure companies may be subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with environmental and other regulations, the effects of economic slowdown, surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Infrastructure companies may also be affected by or subject to high interest costs in connection with capital construction and improvement programs; difficulty in raising capital in adequate amounts on reasonable terms in periods of high inflation and unsettled capital markets; inexperience with and potential losses resulting from a developing deregulatory environment; costs associated with compliance with and changes in environmental and other regulations; regulation by various government authorities;

30

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)