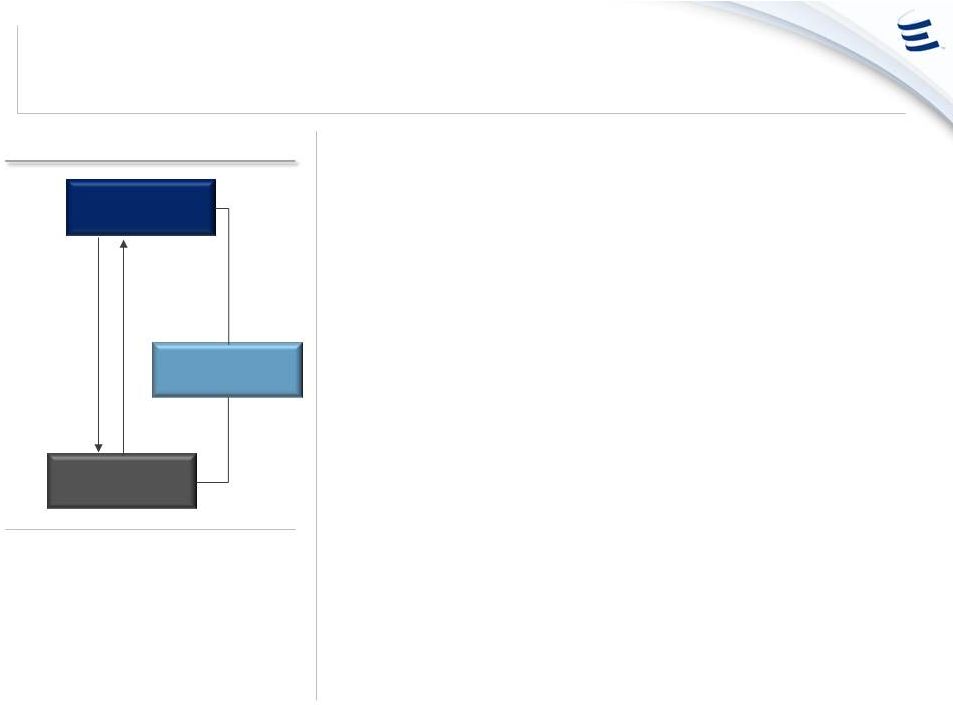

BAKKEN PROJECT & SXL GP/IDR EXCHANGE TRANSACTION 2 TRANSACTION OVERVIEW: TRANSACTION OVERVIEW: – ETE to receive additional Class H Units tracking 40% of the economics of Sunoco Logistics Partners L.P. (“SXL”) GP and IDRs – ETP to receive 45% interest in Bakken pipeline project, 30.8 million ETP units currently held at ETE, which it will retire, and cash consideration – ETE and ETP would agree to an IDR subsidy credit for 2015 & 2016 – Transaction expected to be credit neutral to both ETE and ETP IMPACT TO ETP: IMPACT TO ETP: – Approximately $8.0 billion of expected net capital expenditures (before adjusting for the increased capital required for ETP’s increased stake in the Bakken pipeline project) IMPACT TO ETE: IMPACT TO ETE: Exchange Transaction Structure ETE 45% Bakken pipeline project interest 30.8 million ETP LP units & Cash Bakken Pipeline Project 40% SXL GP/IDRs interest IDR subsidy credit 75% interest Mutually beneficial transaction that provides ETP with continued strong growth via organic projects and managing its cost of capital and allows ETE to continue its long- term strategy towards becoming a pure-play GP • Energy Transfer Partners, L.P. (“ETP”) to acquire 45% interest in the Bakken pipeline project from Energy Transfer Equity, L.P. (“ETE”) and reduce common units outstanding in a transaction value anticipated at approximately $3.75 billion (the “Transaction”) • The Transaction is subject to the negotiation of definitive agreements between ETE and ETP related to the Transaction, the approval of the board of directors of ETE and ETP and the approval of the conflicts committees of such boards • Transaction to be effective January 1, 2015 although anticipated closing will be Q1 2015 following the record dates for Q4 2014 distributions • Upon redemption of the 30.8 million ETP common units, ETP’s outstanding common units will be reduced to approximately 322 million, benefiting ETP through the elimination of quarterly distributions and incentive distribution obligations to ETE with respect to those redeemed units • Transaction is expected to be breakeven to ETP DCF per unit in 2015 and accretive to DCF per unit in 2016 and thereafter • ETP expects to benefit from owning a larger interest (increase from 30% to 75%) of the Bakken pipeline Project • Cash consideration from ETE will provide ETP with a portion of the capital necessary to fund its extensive portfolio of board-approved growth projects • ETE will own Class H units that will entitle ETE to receive approximately 90% of the GP/IDR cash flows from SXL • Continues ETE’s long-term strategy to become a pure-play GP • Transaction is expected to be mildly dilutive to ETE DCF per unit in 2015 and accretive to DCF per unit in 2016 and thereafter ETP |