Publishing Group, LLC

JPMorgan Annual High Yield Conference February 1, 2005

Forward looking statements

This presentation contains forward-looking statements as that term is used under the Private Securities Litigation Act of 1995. These forward-looking statements are based on the current assumptions, expectations and projections of the Company’s management about future events. Although we believe that these statements are based on reasonable assumptions, the Company can give no assurance that they will prove to be correct. Numerous factors, including those related to market conditions and those detailed in the confidential offering memorandum and from time-to-time in the Company’s filings with the Securities and Exchange Commission, may cause results of the Company to differ materially from those anticipated in these forward-looking statements. Many of the factors that will determine the Company’s future results are beyond the ability of the Company to control or predict. These forward-looking statements are subject to risks and uncertainties and, therefore, actual results may differ materially. The Company cautions you not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All references to “Company” and “MORRIS PUBLISHING GROUP, LLC” as used throughout this presentation refer to MORRIS PUBLISHING GROUP, LLC and its subsidiaries. All references to “Issuer” as used throughout this presentation refer to MORRIS PUBLISHING GROUP, LLC

1

Definitions

“EBITDA”- Earnings before net interest expense, including amortization of debt issuance costs, provision for income taxes, depreciation and amortization expense.

EBITDA is not a measure of performance defined in accordance with accounting principles generally accepted in the United States of America. Our management believes that EBITDA is useful to investors in evaluating our performance because it is a commonly used financial analysis tool for measuring and comparing media companies in areas of operating performance. EBITDA should not be considered as an alternative to net income as an indicator of our performance or as an alternative to net cash provided by operating activities as a measure of liquidity and may not be comparable to similarly titled measures used by other companies.

2

Morris Publishing Group, LLC overview

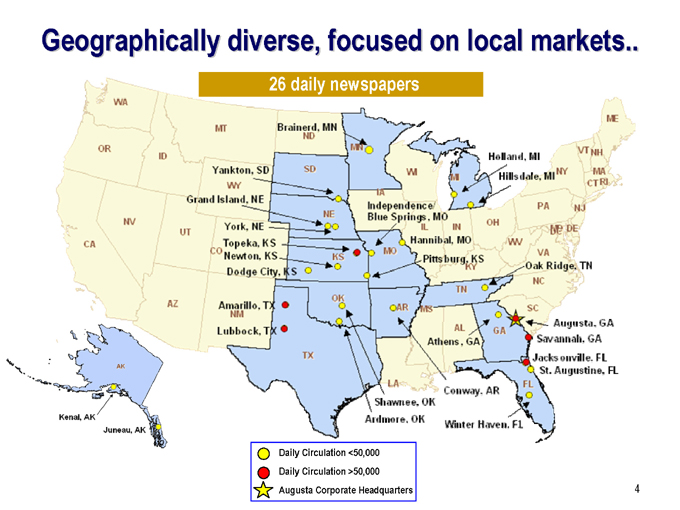

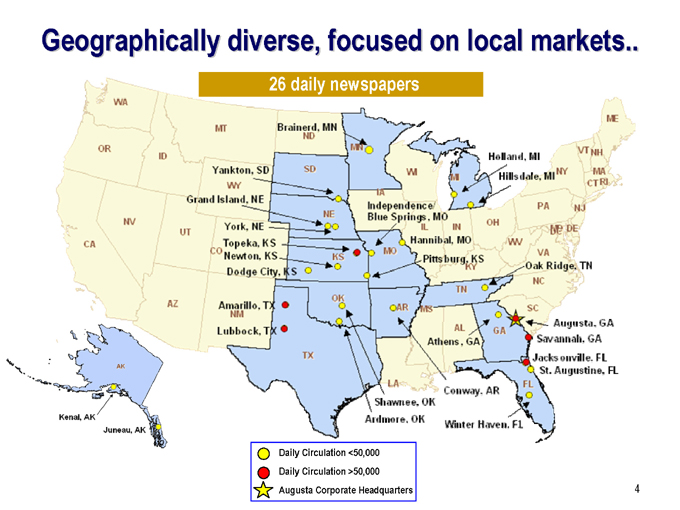

Morris operates 26 daily and 12 non-daily and 23 free community newspapers in both metropolitan and suburban areas in 14 states, with circulation ranging in size from less than 2,000 to just over 161,000. More than 750,000 people in the United States purchase Morris’ Sunday newspapers each week and more than 675,000 purchase it each day, ranking it among the top 25 newspaper publishers in the US.

Morris’ newspapers operate in mid-sized to small markets and its content, both print and online, is focused on local news and community events in addition to national and international news.

Morris’ commitment to the high quality of newspapers and their editorial integrity assure reader loyalty.

Maintains a leading competitive position in all of its markets. Morris has a highly experienced senior management team with an average of over 29 years of experience in the publishing industry.

3

Geographically diverse, focused on local markets..

26 daily newspapers

Daily Circulation <50,000 Daily Circulation >50,000

Augusta Corporate Headquarters

4

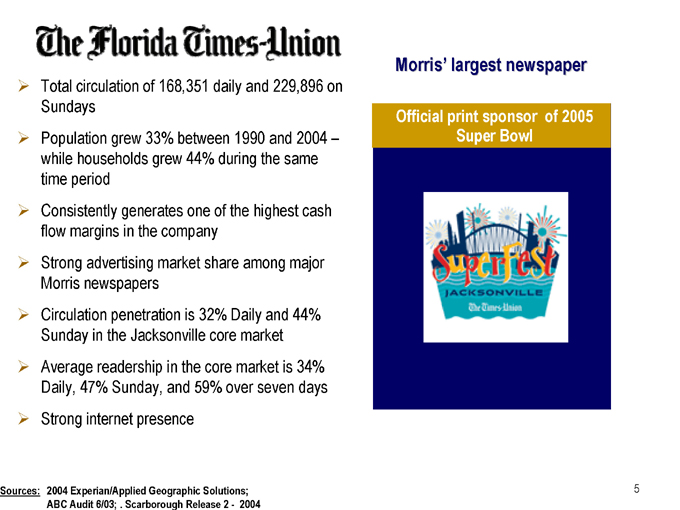

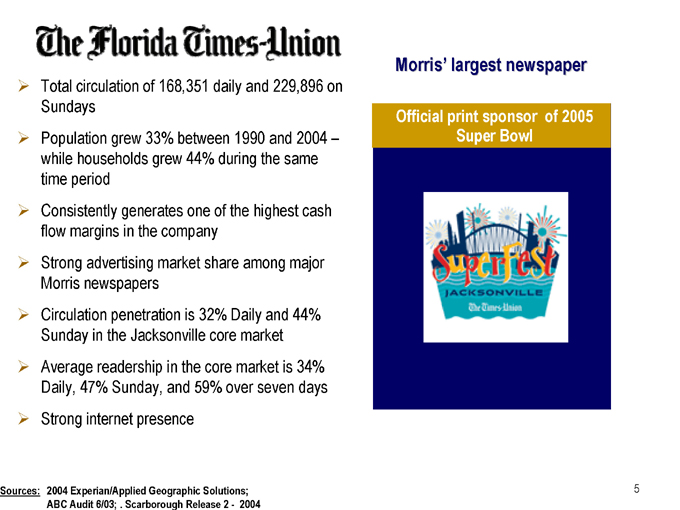

Morris’ largest newspaper

Total circulation of 168,351 daily and 229,896 on Sundays Population grew 33% between 1990 and 2004 –while households grew 44% during the same time period Consistently generates one of the highest cash flow margins in the company Strong advertising market share among major Morris newspapers Circulation penetration is 32% Daily and 44% Sunday in the Jacksonville core market Average readership in the core market is 34% Daily, 47% Sunday, and 59% over seven days Strong internet presence

Official print sponsor of 2005 Super Bowl

Sources: 2004 Experian/Applied Geographic Solutions; ABC Audit 6/03; . Scarborough Release 2—2004

5

Other key daily newspapers

Amarillo

Isolated market – 96% of daily newspaper circulation Owns 43% of the local advertising revenue

Augusta

Household growth is expected to exceed U.S. average by 8% through 2009 The second largest and oldest city in Georgia, Augusta welcomes the greatest names in golf at the famed Masters® Tournament each spring

Lubbock

Home to Texas Tech University and its 28,000 students

Among the strongest profit margin of any newspaper in the group

Savannah

Rapidly growing market with strong manufacturing and tourist sectors and the nation’s largest single-terminal container port facility.

Household growth projected to exceed U.S. average by 25% through 2009

Topeka

High advertising and newsroom color capacity through renovation of packaging and distribution facility and new press State capital of Kansas with little print competition

Sources: 2004 Experian/Applied Geographic Solutions; ABC Audits 2003-2004.

6

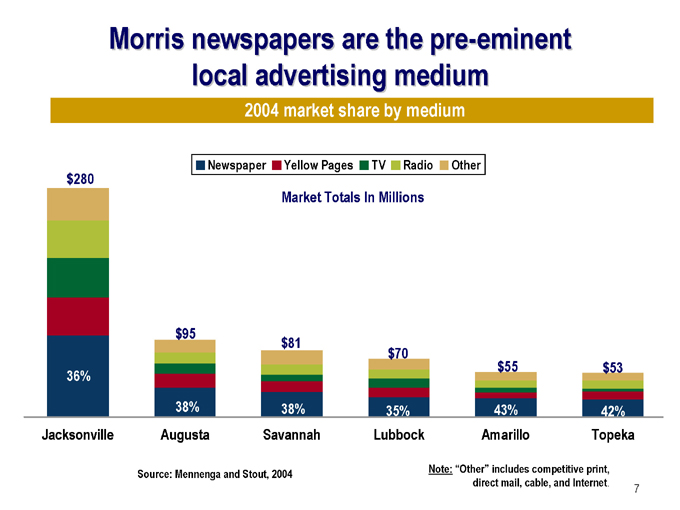

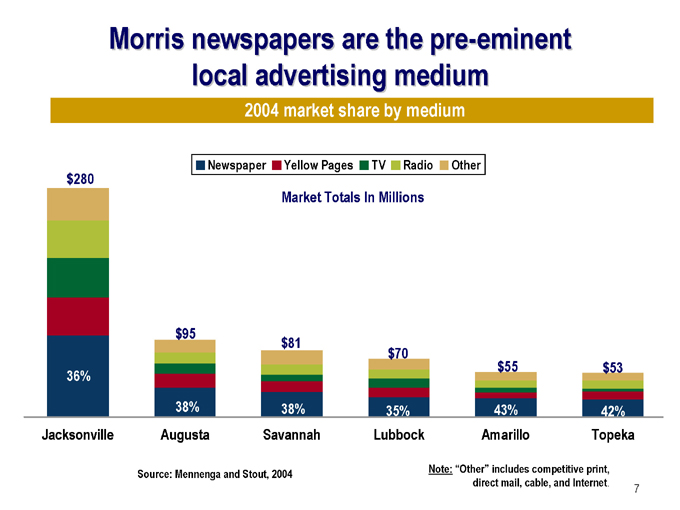

Morris newspapers are the pre-eminent local advertising medium

2004 market share by medium

Newspaper Yellow Pages TV Radio Other

Market Totals In Millions $280

36% $95

38% $81

38% $70

35% $55

43% $53

42%

Jacksonville Augusta Savannah Lubbock Amarillo Topeka

Source: Mennenga and Stout, 2004

Note: “Other” includes competitive print, direct mail, cable, and Internet.

7

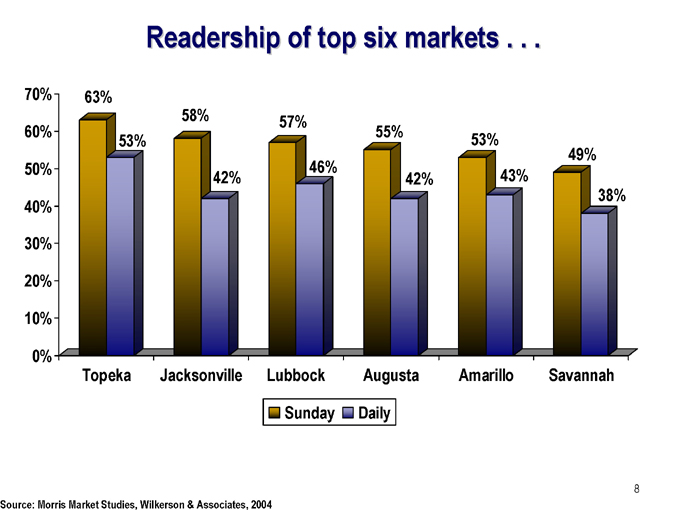

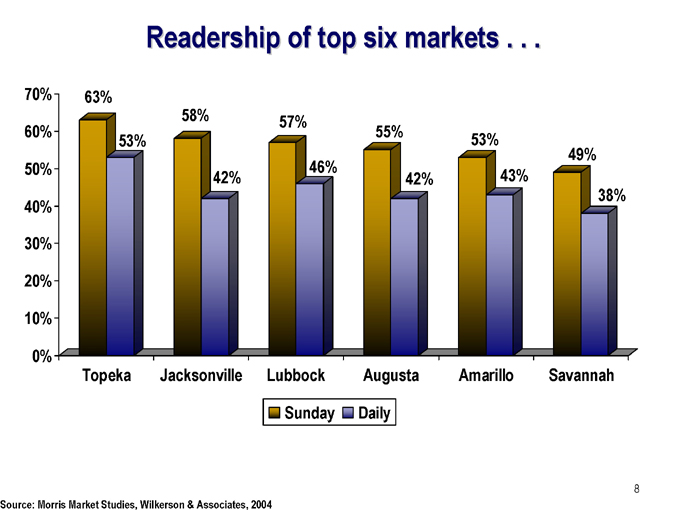

Readership of top six markets . . .

70% 60% 50% 40% 30% 20% 10% 0%

63%

53%

58%

42%

57%

46%

55%

42%

53%

43%

49%

38%

Topeka Jacksonville Lubbock Augusta Amarillo Savannah

Sunday Daily

Source: Morris Market Studies, Wilkerson & Associates, 2004

8

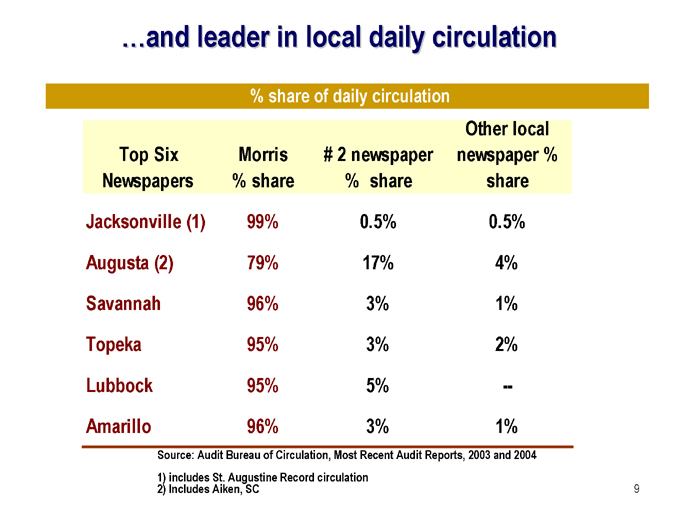

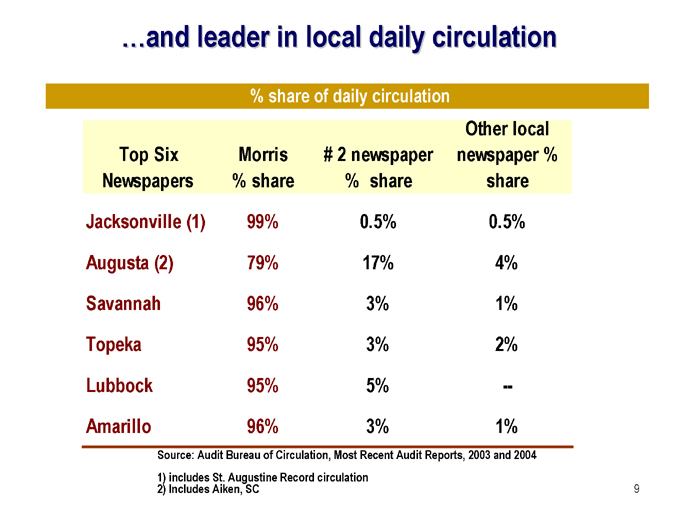

…and leader in local daily circulation

% share of daily circulation

Top Six Newspapers

Morris % share

# 2 newspaper % share

Other local newspaper % share

Jacksonville (1) 99% 0.5% 0.5% Augusta (2) 79% 17% 4% Savannah 96% 3% 1% Topeka 95% 3% 2% Lubbock 95% 5% — Amarillo 96% 3% 1%

Source: Audit Bureau of Circulation, Most Recent Audit Reports, 2003 and 2004 1) includes St. Augustine Record circulation 2) Includes Aiken, SC

9

Also focusing on “niche” publications

Maximizing market share with internet and niche publications

10

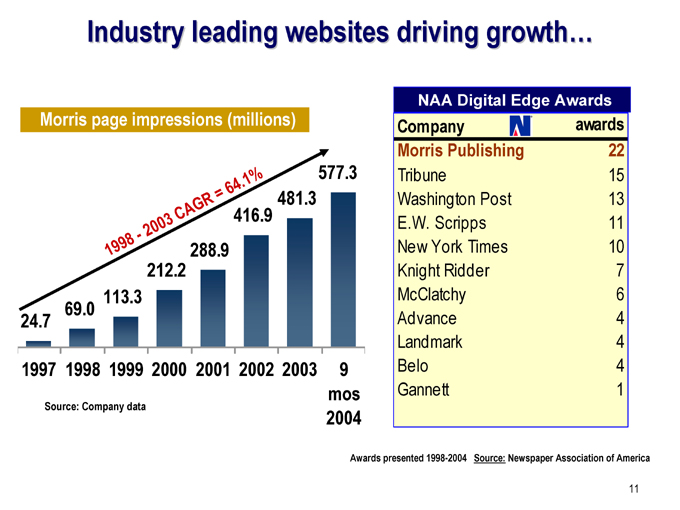

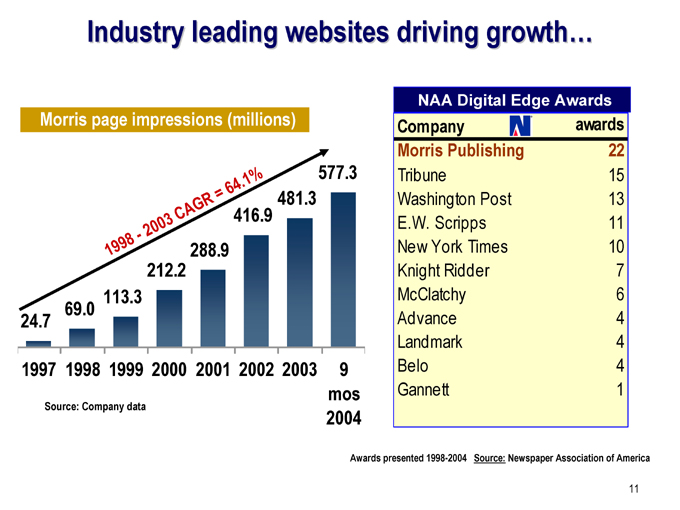

Industry leading websites driving growth…

Morris page impressions (millions)

NAA Digital Edge Awards

Company awards

Morris Publishing 22

Tribune 15 Washington Post 13 E.W. Scripps 11 New York Times 10 Knight Ridder 7 McClatchy 6 Advance 4 Landmark 4 Belo 4 Gannett 1

1998 - 2003 CAGR = 64.1%

24.7

69.0

113.3

212.2

288.9

416.9

481.3

577.3

1997 1998 1999 2000 2001 2002 2003

9 mos 2004

Source: Company data

Awards presented 1998-2004 Source: Newspaper Association of America

11

Strategy.........

Be the pre-eminent source of news, information, advertising and entertainment in our markets by:

Remaining an aggressive, agile, innovative and market-driven company, leading our markets by building strong communities.

Creating marketplaces, grow market share and maintain financial strength by creating, acquiring and continually improving products, multimedia platforms, services, and our efficiency.

Providing our valued employees an environment which both motivates and inspires them to continue to produce superior products and to further enhance customer service.

12

Current initiatives…

Market and product development:

Improving our local news and information content.

Corporate Vice President of News position created to further enhance news and editorial quality of newspapers.

Completion in December 2004 of readership survey of all twenty six daily newspapers.

Implementing corporate sponsored training programs and workshops to enhance advertising sales.

Developing niche publications in current and new markets.

Skirt Magazine based in Charleston and introduced in the Augusta, Charlotte, Charleston, Savannah and Jacksonville markets.

13

Current initiatives-continued....

Enhancing our websites to complement our daily newspapers:

Implementing user registration across our newspaper websites.

Implementing technology, supporting behavioral analysis, segmentation and the targeting of newspaper website users for marketing both online and print.

Implementing unique technology providing more information on websites to supplement our printed newspaper.

Testing community generated content gathered through our websites.

Establishing customer self service enabling our customers to place advertising, manage subscriptions and more directly control their relationship with the newspaper.

14

Current initiatives-continued…

Improving capabilities…service and efficiencies:

Utilizing new business platform developed through shared services efforts that allows us to improve service to our subscribers and advertisers:

Centralized call center for subscriber service.

Centralized credit, collection and billing for advertisers. Increased service levels.

Centralized call center for subscriber retention focusing on retaining current subscribers:

Offering enhanced payment methods. Lengthened subscription periods. Selling product value.

Simplifying, standardizing & centralizing most accounting and administrative functions through shares services.

Expect to fully implement by end of 2006 creating labor and purchasing savings of up to $10 million per year.

15

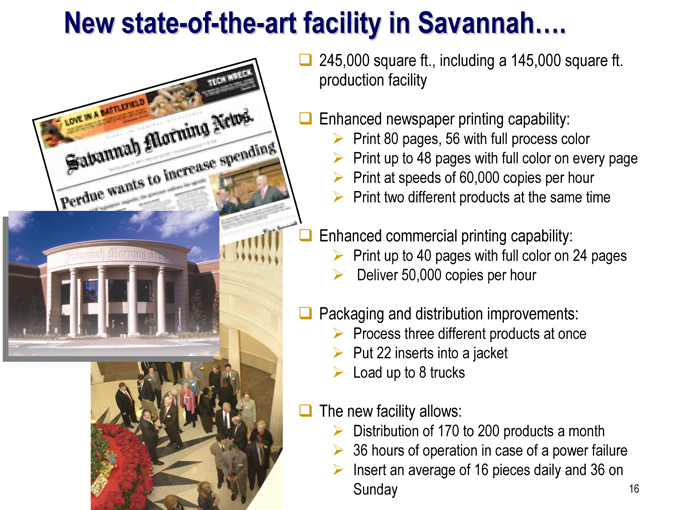

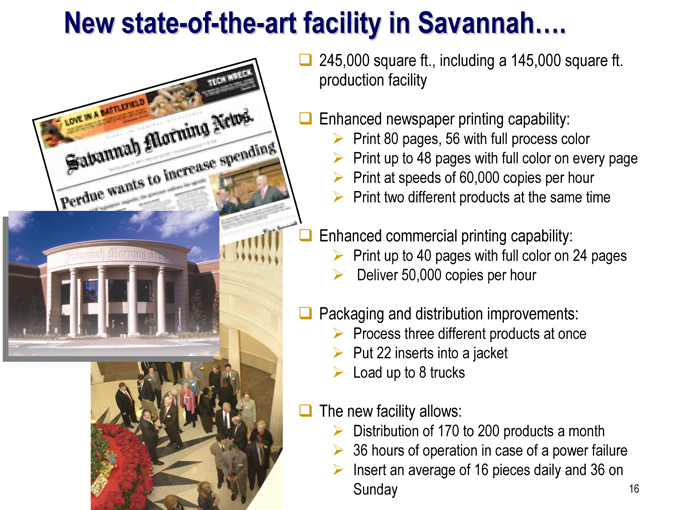

New state-of-the-art facility in Savannah....

245,000 square ft., including a 145,000 square ft. production facility

Enhanced newspaper printing capability:

Print 80 pages, 56 with full process color Print up to 48 pages with full color on every page Print at speeds of 60,000 copies per hour Print two different products at the same time

Enhanced commercial printing capability:

Print up to 40 pages with full color on 24 pages Deliver 50,000 copies per hour

Packaging and distribution improvements:

Process three different products at once Put 22 inserts into a jacket Load up to 8 trucks

The new facility allows:

Distribution of 170 to 200 products a month 36 hours of operation in case of a power failure Insert an average of 16 pieces daily and 36 on Sunday

16

Publishing Group, LLC

Financial Overview

Advertising revenue growth…

% increase- 9 months 2004 vs. 2003

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

5.2%

1

Our current advertising mix....

9 months ending September 30, 2004

Retail 51.6%

Classified 40.7%

National 7.7%

2

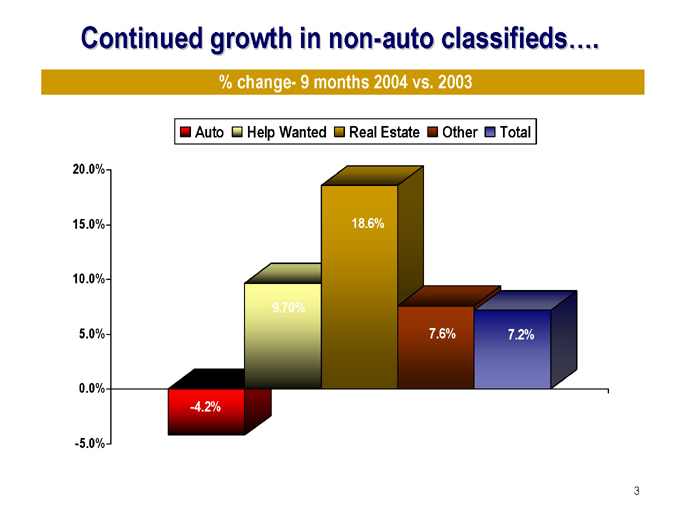

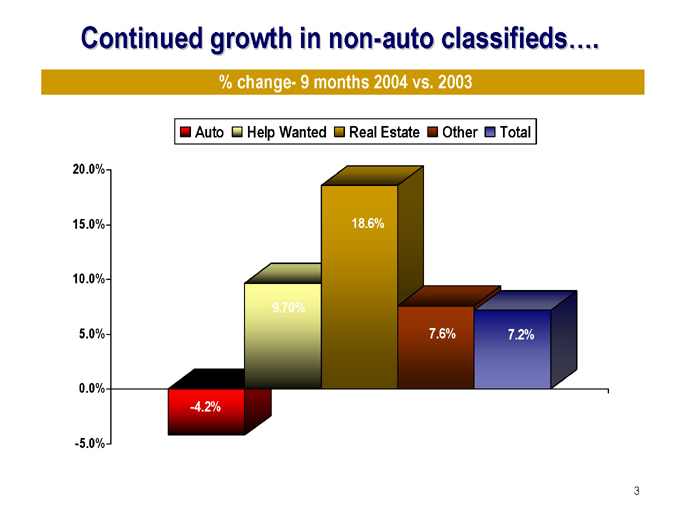

Continued growth in non-auto classifieds....

% change- 9 months 2004 vs. 2003

Auto Help Wanted Real Estate Other Total

20.0%

15.0%

10.0%

5.0%

0.0%

-5.0%

-4.2%

9.70%

18.6%

7.6%

7.2%

3

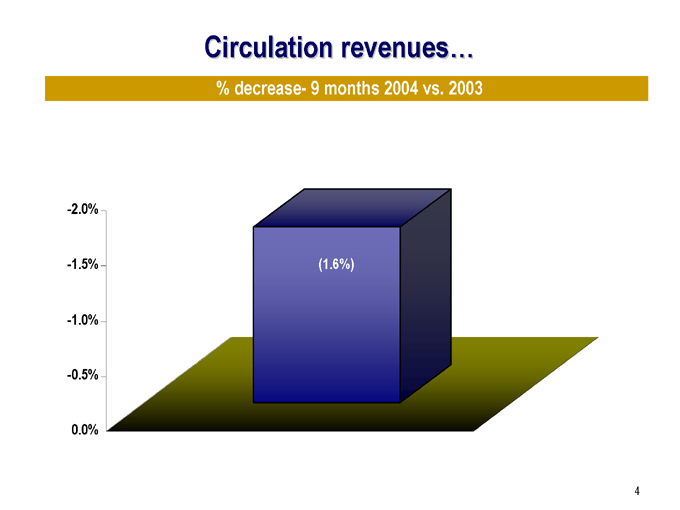

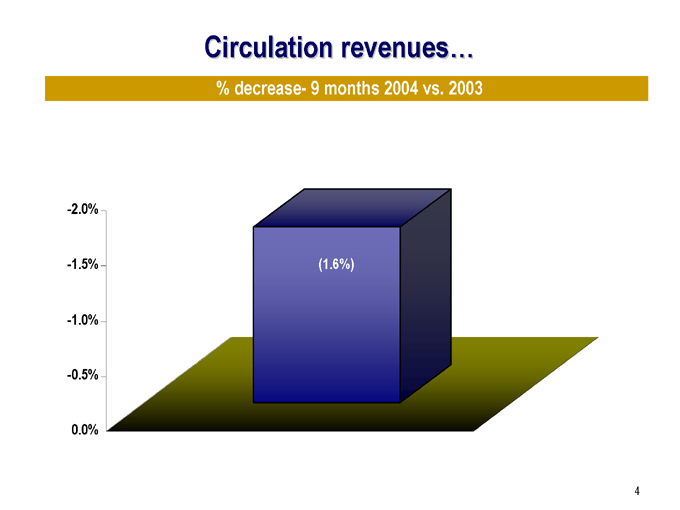

Circulation revenues…

% decrease- 9 months 2004 vs. 2003

-2.0%

-1.5%

-1.0%

-0.5%

0.0%

(1.6%)

4

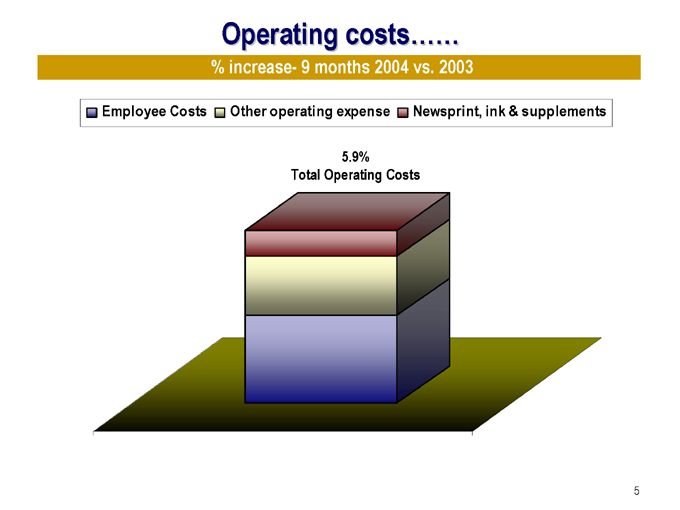

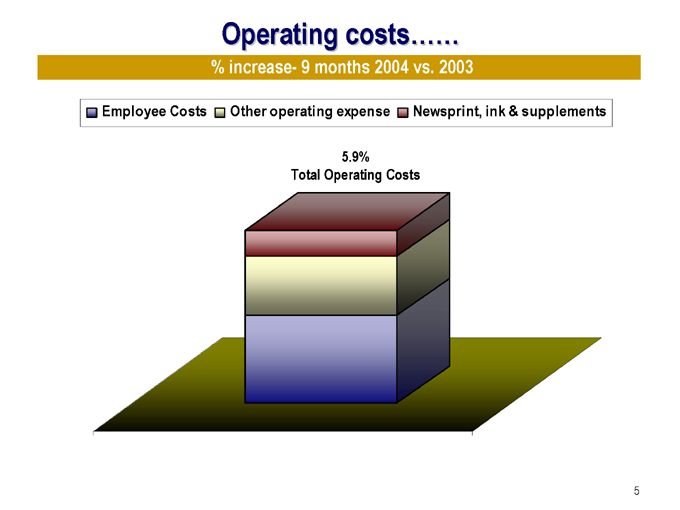

Operating costs .......

% increase- 9 months 2004 vs. 2003

Employee Costs Other operating expense Newsprint, ink & supplements

5.9% Total Operating Costs

5

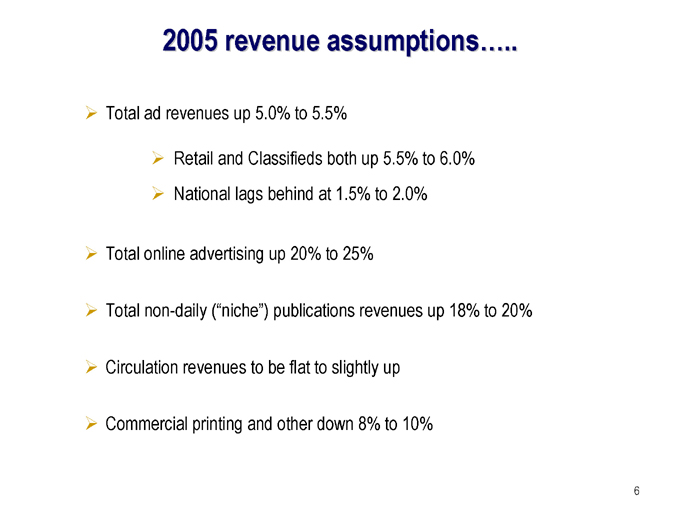

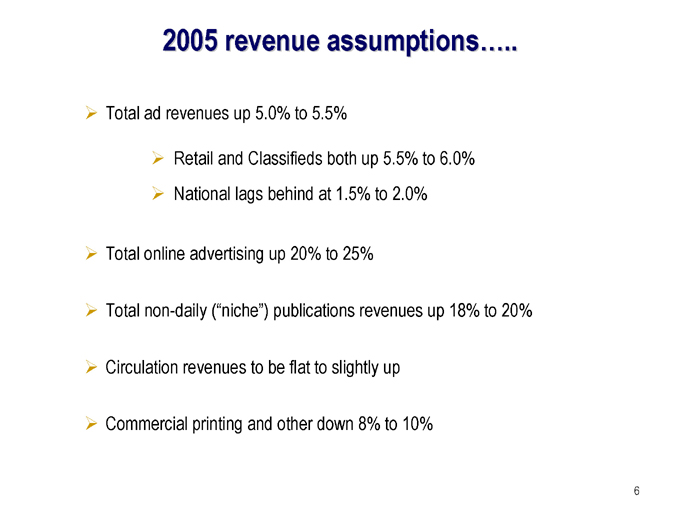

2005 revenue assumptions .....

Total ad revenues up 5.0% to 5.5%

Retail and Classifieds both up 5.5% to 6.0% National lags behind at 1.5% to 2.0%

Total online advertising up 20% to 25%

Total non-daily (“niche”) publications revenues up 18% to 20% Circulation revenues to be flat to slightly up Commercial printing and other down 8% to 10%

6

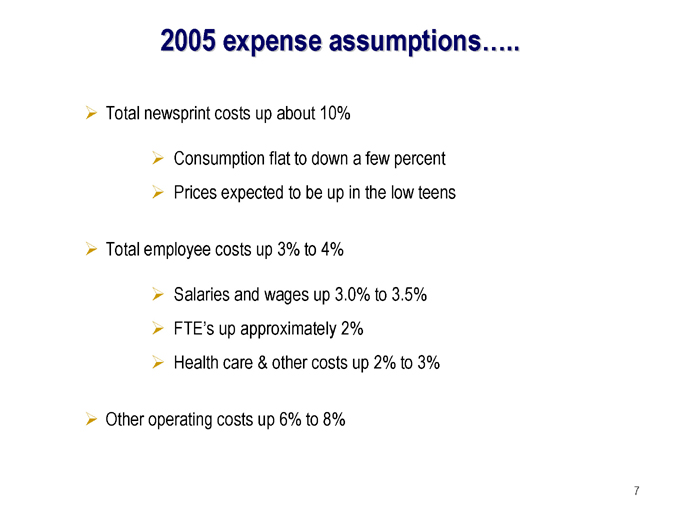

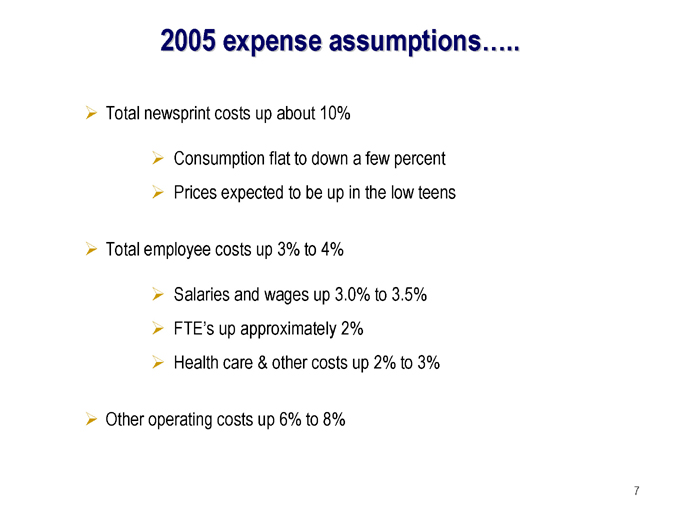

2005 expense assumptions .....

Total newsprint costs up about 10%

Consumption flat to down a few percent Prices expected to be up in the low teens

Total employee costs up 3% to 4%

Salaries and wages up 3.0% to 3.5% FTE’s up approximately 2% Health care & other costs up 2% to 3%

Other operating costs up 6% to 8%

7

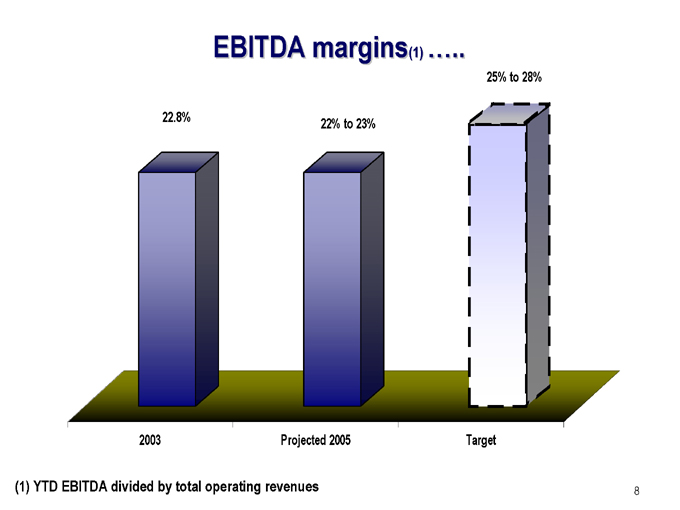

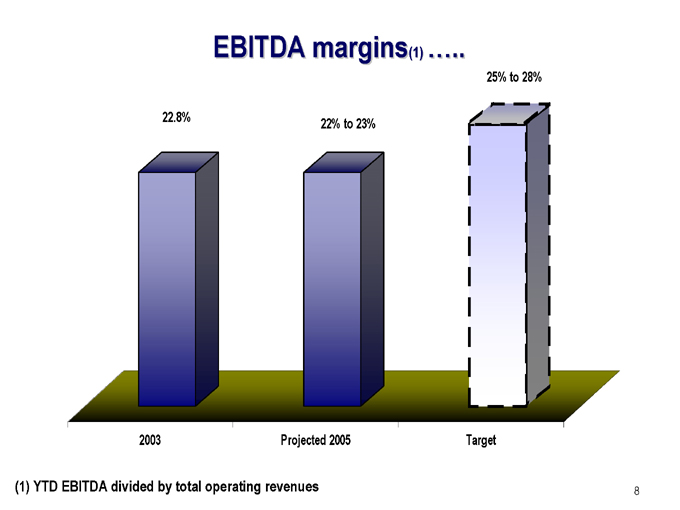

EBITDA margins(1).....

25% to 28%

22.8% 22% to 23%

2003 Projected 2005 Target

(1) YTD EBITDA divided by total operating revenues

8

Publishing Group, LLC

Capital Structure

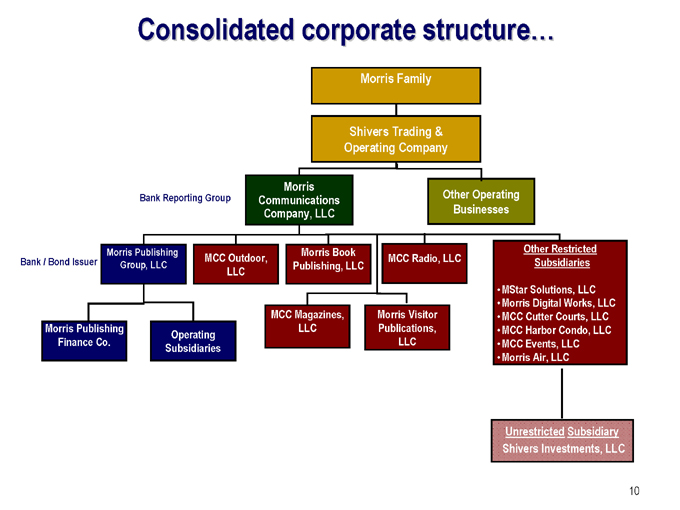

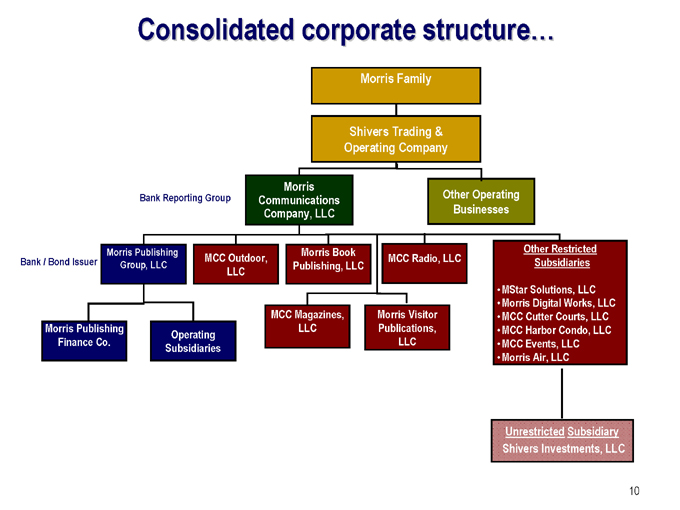

Consolidated corporate structure…

Morris Family

Shivers Trading & Operating Company

Bank Reporting Group

Morris Communications Company, LLC

Other Operating Businesses

Bank / Bond Issuer

Morris Publishing Group, LLC

MCC Outdoor, LLC

Morris Book Publishing, LLC

MCC Radio, LLC

Other Restricted Subsidiaries

Morris Publishing Finance Co.

Operating Subsidiaries

MCC Magazines, LLC

Morris Visitor Publications, LLC

MStar Solutions, LLC Morris Digital Works, LLC MCC Cutter Courts, LLC MCC Harbor Condo, LLC MCC Events, LLC Morris Air, LLC

Unrestricted Subsidiary Shivers Investments, LLC

10

Capital structure…

as of September 30, 2004

Senior Debt

Revolver (Sept ’10) $10 Tranche loan-A (Sept ‘10) $100 Tranche loan-C (March ‘11) $150 Total Senior credit facilities* $260 New Senior subordinated notes** $300

Total debt $560

Member’s deficit ($199)

Total capitalization $361

Total debt/ LTM EBITDA 5.7x LTM EBITDA/ Interest expense 4.1x

*Bank Debt **Bond Issuer

11

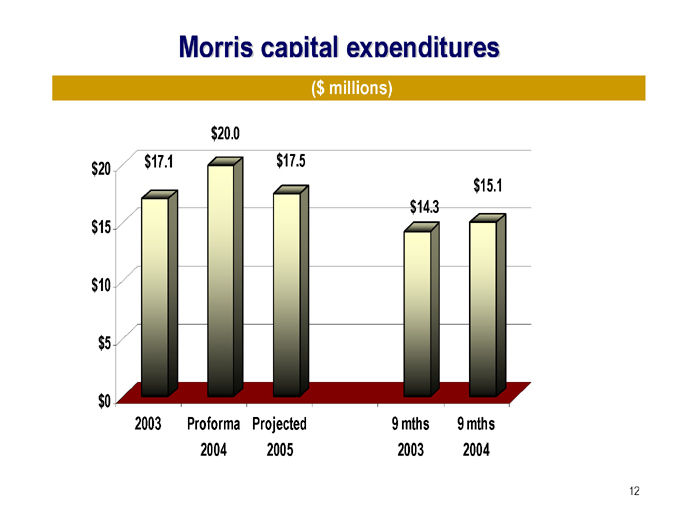

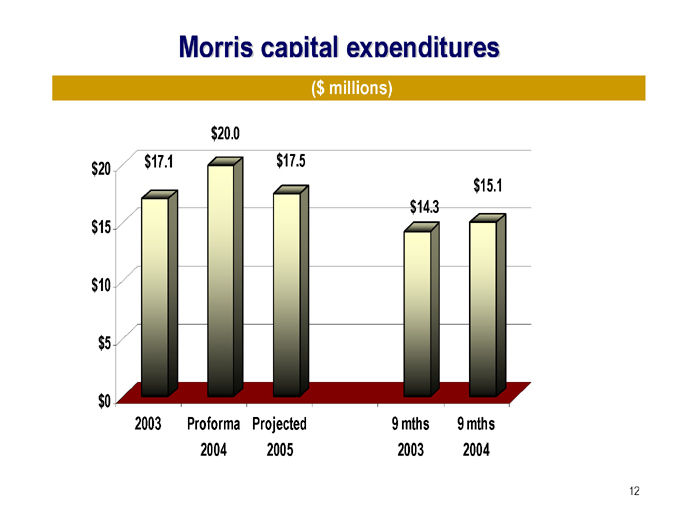

Morris capital expenditures

($ millions) $20.0 $17.1 $17.5 $14.3 $15.1 $20 $15 $10 $5 $0

2003

Proforma 2004

Projected 2005

9 mths 2003

9 mths 2004

12