UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | |

| ¨ | | Definitive Additional Materials | | |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Hansen Medical, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | 5. | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | 3. | | Filing Party: |

| | 4. | | Date Filed: |

March 20, 2014

Dear Stockholder:

I am pleased to invite you to attend to Hansen Medical, Inc.’s 2014 Annual Meeting of stockholders, to be held on Tuesday, April 29, 2014 at our offices at 800 East Middlefield Road, Mountain View, California 94043. The meeting will begin promptly at 10:00 a.m., local time.

At this year’s meeting, you will be asked to approve the election of the two nominees for director named in the accompanying proxy statement and to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2014. You will also be asked to approve, on a non-binding advisory basis, the compensation of our named executive officers (as defined in the accompanying proxy statement).

I urge you to vote, as the Board of Directors has recommended:

| | 1. | To elect each of our director nominees; |

| | 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2014; and |

| | 3. | To cast your advisory votes to approve the compensation of our named executive officers. |

Attached you will find a notice of meeting (which includes a notice of internet availability of our proxy materials) and proxy statement that contains further information about these items, as well as specific details of the meeting.

Only our stockholders of record at the close of business on March 4, 2014 are entitled to vote at the meeting. A list of registered stockholders entitled to vote at the meeting will be available at our office located at 800 East Middlefield Road, Mountain View, California 94043, for ten days prior to the meeting and at the meeting.

We are relying on the Securities and Exchange Commission rule that allows us to furnish our proxy materials to our stockholders over the internet rather than in paper form. We believe this delivery process reduces our environmental impact and lowers the costs of printing and distributing our proxy materials without hindering our stockholders’ timely access to this important information.

I cordially invite all stockholders to attend the meeting in person. However, to assure your representation at the meeting, I urge you to submit your proxy as promptly as possible.

Your vote is important. Whether or not you expect to attend, please date, sign, and return your proxy card, or vote via telephone or the internet according to the instructions in the proxy statement, as soon as possible to assure that your shares will be represented and voted at the Annual Meeting. If you attend the Annual Meeting, you may vote your shares in person even though you have previously voted by proxy if you follow the instructions in the proxy statement.

On behalf of your Board of Directors, thank you for your continued support and interest.

|

Sincerely,

|

Christopher P. Lowe Interim Chief Executive Officer |

800 East Middlefield Road

Mountain View, CA 94043

T 888-404-5801 F 650-404-5901

www.hansenmedical.com

HANSEN MEDICAL, INC.

800 East Middlefield Road

Mountain View, CA 94043

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On April 29, 2014

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of stockholders ofHANSEN MEDICAL, INC., a Delaware corporation (the “Company”). The meeting will be held on Tuesday, April 29, 2014 at 10:00 a.m. local time at 800 East Middlefield Road, Mountain View, California 94043 for the following purposes:

| | • | | Election of the two Class II directors nominated by our Board of Directors to serve for a three-year term and until their successors are elected (Proposal 1); |

| | • | | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 2); |

| | • | | Non-binding advisory vote to approve the compensation of our named executive officers (Proposal 3); and |

| | • | | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice.

The record date for the Annual Meeting is March 4, 2014. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

|

| By Order of the Board of Directors, |

|

|

| PETER J. MARIANI |

| Chief Financial Officer |

Mountain View, California

March 20, 2014

You are cordially invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, please vote over the telephone or internet as instructed in these materials or submit your proxy as promptly as possible in order to ensure your representation at the Annual Meeting. Even if you have voted by proxy, you may still vote in person if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 29, 2014

The proxy statement and our Annual Report on Form 10-K are available at

http://www.hansenmedical.com/investor-relations/proxy-materials.php

TABLE OF CONTENTS

i

ii

HANSEN MEDICAL, INC.

800 East Middlefield Road

Mountain View, CA 94043

PROXY STATEMENT

FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS

April 29, 2014

Your proxy is solicited by the Board of Directors of Hansen Medical, Inc.® (also referred to as the “Company” or “Hansen”) for use at the 2014 Annual Meeting of Stockholders (also referred to as the “Annual Meeting”). Your vote is very important. For this reason, the Board of Directors is requesting that you allow your shares to be represented at the 2014 Annual Meeting of Stockholders by the proxies named on the proxy card. In connection with the solicitation of proxies by the Board of Directors, we are sending a Notice of Internet Availability of Proxy Materials (also referred to as the “Notice”) to our stockholders of record as of March 4, 2014. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. We intend to mail the Notice to all stockholders of record on or about March 20, 2014.

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (also referred to as the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we are sending a Notice to our stockholders of record as of March 4, 2014. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. If you choose to receive future proxy materials electronically, you will receive an email next year with instructions containing a link to the proxy materials and a link to the proxy voting site. Your election to receive proxy materials electronically or in printed form by mail will remain in effect until you terminate your election. We believe that this process allows us to provide our stockholders with the information they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

Will I receive any other proxy materials by mail?

We do not expect to send any proxy materials by mail unless requested by you.

How do I attend the Annual Meeting?

The Annual Meeting will be held on Tuesday, April 29, 2014, at 10:00 a.m. Pacific Time at our offices at 800 East Middlefield Road, Mountain View, California 94043. Information on how to vote in person at the Annual Meeting is discussed below.

You will be admitted to the Annual Meeting if you were a Hansen stockholder or joint holder as of the close of business on March 4, 2014, or you have authority to vote under a valid proxy for the Annual Meeting. You should be prepared to present photo identification for admittance. In addition, if you are a stockholder of record, your name will be verified against the list of stockholders of record prior to admittance to the Annual Meeting. If you are a beneficial owner, you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to March 4, 2014, a copy of the voting instruction form provided by your

1

broker, trustee, or nominee, or other similar evidence of ownership. If you are a stockholder who is a natural person and not an entity, you and your immediate family members will be admitted to the Annual Meeting, provided you and they comply with the above procedures.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 4, 2014 will be entitled to vote at the Annual Meeting. On this record date, there were 110,611,857 shares of common stock outstanding. Each share is entitled to one vote.

Stockholder of Record: Shares Registered in Your Name. If on March 4, 2014 your shares were registered directly in your name with our transfer agent, Computershare Shareowner Services LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy on the internet or over the telephone as instructed below, or ask for, fill out and return a proxy card, to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on March 4, 2014 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

| | 1. | Election of the two Class II directors nominated by our Board of Directors to serve for a three-year term and until their successors are elected (Proposal 1) |

| | 2. | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 2); and |

| | 3. | Non-binding advisory vote to approve the compensation of our named executive officers (Proposal 3). |

What are the Board of Directors’ recommendations?

Our Board of Directors unanimously recommends that you vote:

| | 1. | “FOR” the election of each of the two nominees named in this proxy statement to serve on the Board of Directors; |

| | 2. | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| | 3. | “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers. |

What if another matter is properly brought before the meeting?

We will also consider any other business that properly comes before the Annual Meeting. As of March 20, 2014, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the persons named in the proxy card or voting instruction form will vote the shares they represent using their best judgment.

2

How do I vote?

For Proposal 1, you may either vote “FOR” each nominee to the Board of Directors or you may withhold your vote from any nominee you specify. For Proposals 2 and 3, you may vote “FOR” or “AGAINST” or abstain from voting. The procedures for voting are fairly simple:

Voting by Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, or vote by proxy on the internet or by mail. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

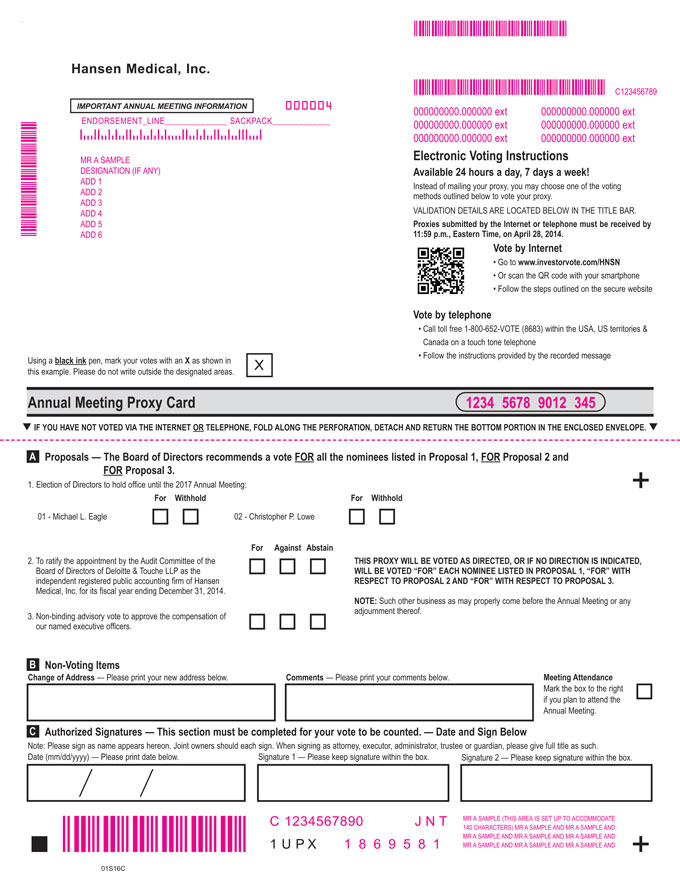

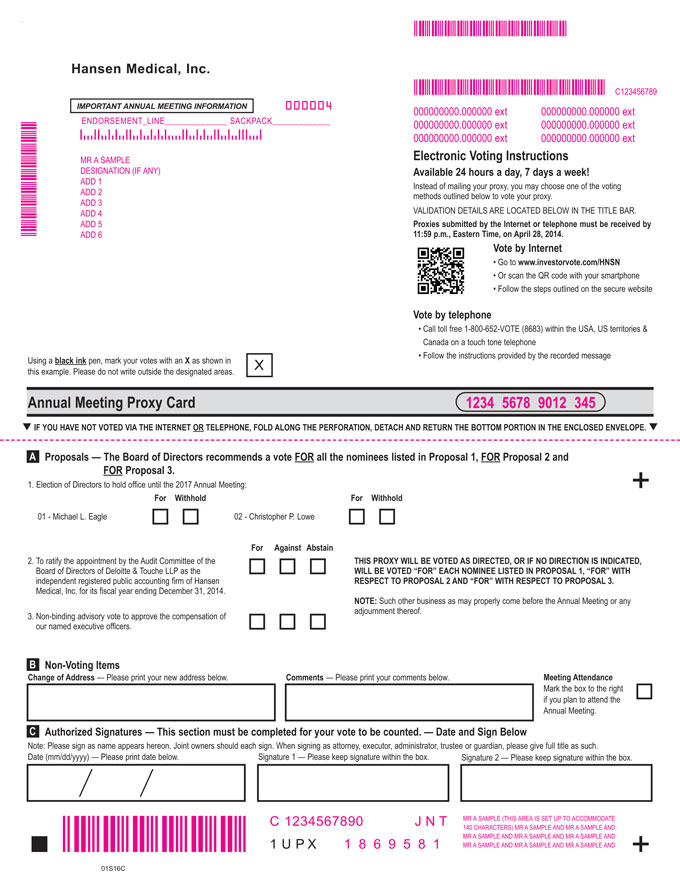

| | • | | To vote by telephone, dial toll-free 1-800-652-8683 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m. Eastern Daylight Savings Time on April 28, 2014 to be counted. |

| | • | | To vote on the internet, go to www.investorvote.com/HNSN to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m. Eastern Daylight Savings Time on April 28, 2014 to be counted. |

| | • | | To vote by mail, you may do so by first requesting printed copies of the proxy materials by mail and then filling out the proxy card and sending it back in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

| | • | | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

Voting by Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from Hansen. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker or bank, or contact your broker or bank to request a proxy form.

We provide internet and telephone proxy voting to allow you to vote your shares online or by telephone, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access or telephone call, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of March 4, 2014.

What if I submit a proxy card but do not make specific choices?

Voting by Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and return a signed and dated proxy card or otherwise vote without marking any voting selections, your shares will be voted as follows:

| | • | | “FOR” the election of each of the two nominees named in this proxy statement to serve on the Board of Directors; |

| | • | | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

3

| | • | | “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers. |

If any other matter is properly presented at the Annual Meeting, your proxy holder (one of the individuals named on the proxy card) will vote your shares as recommended by the Board of Directors or, if no recommendation is given, will vote your shares using his or her best judgment.

Voting by Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each of the Notices to ensure that all of your shares are voted.

How many copies should I receive if I share an address with another stockholder?

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single Notice addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are our stockholders will be “householding” our proxy materials. A single Notice will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Notice, please notify your broker. Direct your written request to Corporate Secretary, Hansen Medical, Inc., 800 East Middlefield Road, Mountain View, CA 94043 or contact Peter J. Mariani at (650) 404-5800. Stockholders who currently receive multiple Notices at their addresses and would like to request “householding” of their communications should contact their brokers.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of four ways:

| | • | | You may grant a subsequent proxy by telephone or through the internet, provided that your subsequent proxy must be received by 11:59 P.M. Eastern Time on April 28, 2014; |

| | • | | You may submit another properly completed proxy card bearing a later date, which must be received before the final vote; |

| | • | | You may send a timely written notice that you are revoking your proxy to Hansen’s Corporate Secretary at 800 East Middlefield Road, Mountain View, CA 94043, which must be received before the final vote; or |

4

| | • | | You may attend the Annual Meeting and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR,” “WITHHOLD” and broker non-votes with respect to the election of directors, and, with respect to Proposals 2 and 3, “FOR” and “AGAINST” votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote, will be counted towards the vote total for each proposal and will have the same effect as “Against” votes.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-discretionary.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “discretionary,” but not with respect to “non-discretionary” matters. Discretionary matters include the ratification of the selection of independent accountants. Accordingly, if you own shares through a nominee, such as a broker or a bank, the nominee will not be able to vote your shares with respect to Proposals 1 and 3.

How many votes are needed to approve each proposal?

| | • | | For the election of directors, Proposal 1, the two nominees receiving the most “FOR” votes (from the holders of votes of shares present in person or represented by proxy and entitled to vote on the election of directors) will be elected. Only votes “FOR” or “WITHHELD” will affect the outcome. Broker non-votes will have no effect. Proxies may not be voted for a greater number of persons than the number of nominees named. |

| | • | | To be approved, Proposal 2, to ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of Hansen for its fiscal year ending December 31, 2014, must receive “FOR” votes from the holders of a majority of shares present at the meeting either in person or by proxy. If you “ABSTAIN” from voting, it will have the same effect as an “AGAINST” vote. |

| | • | | To be approved, Proposal 3, to approve a non-binding advisory resolution regarding the compensation of our named executive officers must receive a “FOR” vote from the holders of a majority of shares present and entitled to vote either in person or by proxy. If you “ABSTAIN” from voting, it will have the same effect as an “AGAINST” vote. Broker non-votes will have no effect. |

What is a quorum?

We need a quorum of stockholders to hold our Annual Meeting. A quorum exists when at least a majority of the outstanding shares entitled to vote on the record date, March 4, 2014, are represented at the Annual Meeting either in person or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the Annual Meeting. Stockholders who vote “ABSTAIN” on any proposal and discretionary votes and non-votes by brokers, banks and related agents on routine proposals will be counted towards the quorum requirement.

5

How can I find out the results of the voting at the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. The final results will be published in a Current Report on Form 8-K which we expect to file with the SEC by May 5, 2014. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Current Report on Form 8-K to publish the final results.

I also have access to Hansen’s Annual Report on Form 10-K. Is that a part of the proxy materials?

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, as filed with the SEC on March 13, 2014, is available on the internet along with the Notice and other proxy materials at http://www.hansenmedical.com/investor-relations/corporate-profile.php. This document constitutes our Annual Report to Stockholders, and is being made available to all stockholders entitled to receive notice of and to vote at the Annual Meeting.

When are stockholder proposals due for next year’s Annual Meeting?

If you wish to submit a proposal to be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by November 20, 2014, to Hansen’s Corporate Secretary at 800 East Middlefield Road, Mountain View, CA 94043. If you wish to submit a proposal that is not to be included in next year’s proxy materials, but that may be considered at the 2015 Annual Meeting, or nominate a director pursuant to our Bylaws, you must provide specified information to us between December 30, 2014 and January 29, 2015; provided, however, that if our 2015 Annual Meeting is held before March 30, 2014 or after May 29, 2014, you must provide that specified information to us between the 120th day prior to the 2015 Annual Meeting and not later than the 90th day prior to the 2015 Annual Meeting or the 10th day following the day on which we first publicly announce of the date of the 2015 Annual Meeting. If you wish to do so, please review our Bylaws, which contain a description of the information required to be submitted as well as additional requirements about advance notice of stockholder proposals and director nominations.

6

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors (also referred to as the “Board”), is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board of Directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board of Directors to fill a vacancy in a class, including a vacancy created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified.

Our Board of Directors presently has nine members, with two members in the class whose term expires in 2014, three members in the class whose term expires in 2015 and four members in the class whose term expires in 2016. Accordingly, we have nominated two directors for election at the Annual Meeting. Each of the nominees listed below is currently a director of the Company. If elected at the Annual Meeting, each of these nominees would continue to serve until the 2017 Annual Meeting and until their successor is elected and has qualified, or, if sooner, until the director’s death, resignation or removal. Although we do not have a formal policy regarding attendance by members of the Board of Directors at our Annual Meetings, directors are encouraged to attend. Six of our directors attended our 2013 Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The two nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. Shares represented by executed proxies cannot be voted for more than two nominees. Each person nominated for election has agreed to serve if elected and our management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee and each director whose term expires or will continue after the Annual Meeting. We have determined that each of these director nominees possesses the requisite communication skills, personal integrity, business judgment, ability to make independent analytical inquiries, and willingness to devote adequate time and effort necessary to serve as an effective member of the Board. Other specific experiences, qualifications, attributes or skills of nominees that contributed to our conclusion that the nominees should serve as directors are noted below.

Class II Director Nominees for Election for a Three-Year Term Expiring at the 2017 Annual Meeting

Michael L. Eagle

Mr. Eagle, age 66, has served as a member of our Board of Directors since February 2012 and as the Chairman of our Board of Directors since December 2012. Mr. Eagle previously served as the Vice President of Global Manufacturing for Eli Lilly and Company from 1993 through 2001 and held a number of executive management positions with Eli Lilly and Company and its subsidiaries throughout his career there. Since retiring from Eli Lilly and Company, he has been a founding member of Barnard Life Sciences, LLC, a life sciences consulting company. Mr. Eagle is a member of the board of directors and serves on the audit committee of Cadence Pharmaceuticals, Inc., a biopharmaceutical company, and is a member of the board of directors and serves on the audit and compensation committees of Somaxon Pharmaceuticals, Inc., a specialty pharmaceutical company. Mr. Eagle holds a B.M.E. from Kettering University and an M.S.I.A. from Purdue University. Mr. Eagle’s more than forty years of experience in executive management and engineering, primarily focused on the manufacture of pharmaceutical products and medical devices, and his experience on the boards of other public companies contributed to our conclusion that he should serve as a director.

7

Christopher P. Lowe

Mr. Lowe, age 46, has served as a member of our Board of Directors since September 2006 and as our Interim Chief Executive Officer since February 2014. Mr. Lowe served as Vice President, Administration and Chief Financial Officer of Anthera Pharmaceuticals, Inc., a drug development company, from November 2007 through June 2013, and additionally served as its Chief Business Officer from January 2011 until June 2013. Since leaving Anthera, Mr. Lowe was an independent consultant to life sciences companies until joining FLG Partners, LLC, a CFO consulting, services and board advisory firm, as a partner in January 2014. Mr. Lowe served as Vice President, Finance and Administration of Asthmatx, Inc., a medical device company, since September 2005 and as its Chief Financial Officer from January 2006 to November 2007. Mr Lowe also serves on the board of Pacific Pharmaceutical Services, a cGMP facility providing temperature controlled storage, powder dispensing, in-house label printing and clinical trial materials labeling, clinical distribution logistics and CMC advisory services to the pharmaceutical industry, clinical researchers and academic laboratories.Mr. Lowe holds a B.S. from California Polytechnic State University, San Luis Obispo and an M.B.A. from Saint Mary’s University, Texas. Mr. Lowe’s understanding of our industry, his senior management experience with companies in our industry and his ability to serve as a financial expert on our Audit Committee contributed to our conclusion that he should serve as a director.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A“FOR” VOTE IN FAVOR OF EACH NAMED NOMINEE.

Class III Directors Continuing in Office Until the 2015 Annual Meeting

Dr. Stephen Newman

Dr. Newman, age 63, has served as a member of our Board of Directors since July 2012. Having served in increasingly senior positions at Tenet Healthcare Corporation over the past 14 years, Dr. Newman has extensive healthcare operations experience. In his recently completed role as Vice Chairman, Dr. Newman led Tenet’s health information technology project deployment, the company’s medical staff development efforts and its quality, safety and service initiative. Prior to his appointment to Vice Chairman in January 2012, Dr. Newman served as Corporate Chief Operating Officer, Executive Vice President, for five years, where his responsibilities included strategic and operational oversight of Tenet’s 49 hospitals and 100 ambulatory and imaging centers. Before his tenure at Tenet, Dr. Newman served as President and Chief Executive Officer of HCA’s Louisville HealthCare Network, where he had operating responsibilities for three hospitals and 3,000 employees within a $500 million business. Dr. Newman currently serves on the board of directors of Cadence Pharmaceuticals, Inc. and is member of its nominating and corporate governance committee. Dr. Newman served on the board of directors of Optimer Pharmaceuticals, Inc. from 2012 through October 2013, and was a member of its audit committee, compensation committee and nominating and corporate governance committee. Dr. Newman also currently serves on the Federal Reserve Bank of Atlanta’s Labor, Education and Healthcare Council and recently completed a five year term on the Board of Directors of the Federation of American Hospitals. Dr. Newman holds an MBA from Tulane University’s AB Freeman School of Business, an M.D. from the University of Tennessee Center for Health Sciences and a Bachelor’s degree from Rutgers University. Dr. Newman’s extensive, senior management experience in healthcare operations and his ability to provide insight into the customers of our products contributed to our conclusion that he should serve as a director.

William R. Rohn

William R. Rohn, age 70, has served as a member of our Board of Directors since March 2012. Mr. Rohn served as Chief Operating Officer of Biogen Idec, the successor company to IDEC Pharmaceuticals, a biotechnology company, from 2003 until 2005. From 1998 until 2003, Mr. Rohn was President and Chief Operating Officer of IDEC Pharmaceuticals, a biotechnology company. Mr. Rohn joined IDEC in 1993 as Senior Vice President, Commercial and Corporate Development and was appointed Senior Vice President, Commercial Operations in 1996. From 1985 until 1993, Mr. Rohn was employed by Adria Laboratories, a pharmaceutical

8

company that has since been acquired by Pfizer Inc., most recently as Senior Vice President of Sales and Marketing. Mr. Rohn is a director of Sophiris Bio Inc. and private entities. Mr. Rohn holds a Bachelor’s degree in Marketing from Michigan State University and completed graduate-level coursework in Business Administration at Indiana State University. Mr. Rohn’s knowledge of our industry and his prior and current experience as a senior officer and director of other healthcare companies contributed to our conclusion that he should serve as a director.

Will K. Weinstein

Will K. Weinstein, age 73, has served as a member of our Board of Directors since July 2013. Currently, Mr. Weinstein serves as a Financial and Investment Advisor and Money Manager to a number of individuals and corporations active in the equity markets. He is also a limited partner of Conifer Securities in San Francisco. Mr. Weinstein was a Governor of the Midwest Stock Exchange for five years, and also served for five years as a Governor of the American Stock Exchange until its merger with Nasdaq in 1998. Mr. Weinstein was Chairman and CEO of Genesis Merchant Group Securities in San Francisco from 1989 until it was sold in 1997. He then started and managed a hedge fund and two private equity partnerships. Prior to Genesis, he was the Investment and Financial Policy Advisor to the Pritzker family in Chicago. Previously, Mr. Weinstein was the Managing Partner of Montgomery Securities in San Francisco and Chairman of its Investment Policy Committee. He was also a member of the Executive Committee of Oppenheimer and Co. and its partner in charge of trading in the 1970’s. Mr. Weinstein is a member of the board of directors of the Osher Center for Integrative Medicine in San Francisco, and he recently joined the board of the San Francisco State University Foundation, where he is a member of the endowment and athletic committees. Mr. Weinstein’s previous board affiliations include DHL Incorporated, Butterfield & Butterfield, Beverly Enterprises, Mt. Zion Hospital, the San Francisco Chapter of the Juvenile Diabetes Research Foundation, the San Francisco Performances, the Robert H. Lurie Comprehensive Cancer Center, the UCSF Department of Prostate Cancer Advocacy Core and the City College of San Francisco Foundation. He was a member of a former California Controller’s Advisory Council for Investment and served as the West Coast Chair for Bridging the Rift Foundation. Mr. Weinstein also teaches Ethics in both the Business School and Law School at the University of Hawaii Manoa and has lectured worldwide on the subject. The Board appointed Mr. Weinstein as a director in 2013 due to, among other things, his extensive experience in financial services as well as his knowledge in the field of corporate ethics and governance.

Class I Directors Continuing in Office Until the 2016 Annual Meeting

Marjorie L. Bowen

Marjorie Bowen, age 49, has served as a member of our Board of Directors since July 2013. Ms. Bowen is an experienced public and private company director who is a qualified financial expert and is well versed in corporate governance matters. In addition to Hansen, Ms. Bowen has served as a director for four publicly listed companies (Dune Energy and Illinois Power Generating Co., and previously, Talbots, and Texas Industries, Inc.) as well as four privately held companies. Ms. Bowen’s directorships follow a nearly 20 year career in investment banking at Houlihan Lokey, advising boards of public companies on transactional, strategic and other shareholder matters, and heading the firm’s industry leading fairness opinion practice. During her nearly two decades at Houilhan Lokey Ms. Bowen was an active deal advisor to public company boards, a product and practice leader, as well as a member of the firm’s senior management. Ms. Bowen has amassed a broad base of experience on virtually every type of corporate finance transaction for both healthy and distressed companies. Ms. Bowen holds a B.A. from Colgate University and an M.B.A. from the University of Chicago. The Board appointed Ms. Bowen as a director in 2013 due to, among other things, her nearly 25 years of experience in advising both public and private companies as an investment banker and corporate director.

Kevin Hykes

Mr. Hykes, age 48, has served as a member of our Board of Directors since July 2009. Mr. Hykes is currently an Operating Partner at Versant Ventures and the Chairman and CEO of Metavention, Inc., an early-stage medical device company focused on the development of interventional therapies for the treatment of type 2

9

diabetes. From March 2010 until December 2012, Mr. Hykes was the President and Chief Executive Officer at Cameron Health, Inc., an implantable defibrillator company, which was acquired by Boston Scientific Corporation in June 2012. From May 2008 to March 2010, Mr. Hykes served as the Chief Commercial Officer at Visiogen, Inc., a developer of products for cataract and refractive patients, which was acquired by Abbott Laboratories in October 2009. Previously, Mr. Hykes was employed by Medtronic, Inc., from 1992 to 2008, including as Vice President, Healthcare Systems, from December 2005 to May 2008 and as Vice President, Heart Failure Business, from May 2003 to December 2005. Mr. Hykes holds a B.A. in Business Administration from the University of Wisconsin, Madison and an M.B.A. from the J.L. Kellogg Graduate School of Management at Northwestern University. Mr. Hykes’ knowledge of our industry, his experience as a senior officer of other medical device companies and his ability to provide insight into our sales and marketing strategies contributed to our conclusion that he should serve as a director.

Jack W. Schuler

Jack W. Schuler, age 73, has served as a member of our Board of Directors since August 2013. Mr. Schuler is a co-founder and partner in Crabtree Partners LLC, a private investment firm in Lake Forest, IL. Mr. Schuler worked for Texas Instruments from 1964 to 1972 in France, Germany, and Japan. From 1972 to 1989, he was employed by Abbott Laboratories in various positions, the last four years as President and Chief Operating Officer. He currently serves on the board of directors for Accelerate Technologies, Quidel Corporation, and Stericycle and is a trustee of Carleton College. He received a B.S. degree in Mechanical Engineering from Tufts University and an M.B.A. degree from Stanford University Graduate School of Business Administration. The Board appointed Mr. Schuler as a director in 2013 due to, among other things, his experience as both a medical device executive and an investor and advisor to medical device companies and due to the Company’s obligations under a rights agreement with certain investors in the Company’s August 2013 private placement financing. See “Previous Selection of Directors.”

Nadim Yared

Mr. Yared, age 46, has served as a member of our Board of Directors since July 2012. Mr. Yared’s career in the medical device industry has spanned nearly 20 years. He currently serves as the President and Chief Executive Officer of CVRx, Inc., a privately-held medical device company developing the Barostim neo™ system, an active implantable device for the treatment of hypertension and heart failure. During his seven years in this position, Mr. Yared has helped CVRx raise significant funding to develop the company’s next generation technology and conduct clinical trials. Preceding his term at CVRx, Mr. Yared served as Vice President and General Manager of Medtronic, Inc. for four years. During his tenure, he directed sales, marketing, business development, product/technology development and manufacturing of surgical medical imaging products. Until 2002, Mr. Yared held increasingly senior positions at GE Medical Systems over a period of nine years. Much of his focus during this time was medical device sales and marketing management. Mr. Yared also currently serves on the boards of the medical device industry trade group, AdvaMedand te medical device innovation consortium, MDIC, a public-private partnership. Mr. Yared holds an M.B.A. from Insead in Paris France, and an engineering degree from Ecole Nationale Superieure des Telecommunications. Mr. Yared’s knowledge of our industry, his current experience as a Chief Executive Officer of a medical device company, his prior senior management experiences in the medical industry, and his ability to provide insight into our engineering, marketing and sales strategies contributed to our conclusion that he should serve as a director.

Previous Selection of Directors

In August 2013, our Board of Directors appointed Jack Schuler as a director in connection with a rights agreement with certain investors in the Company’s August 2013 private placement financing. We agreed to nominate Mr. Schuler or any other person nominated by Mr. Schuler and reasonably acceptable to us if he is unavailable, for so long as the Schuler Family Foundation (or an affiliate thereof) continues to beneficially own at least 50% of the shares and warrants initially issued to it in the private placement transaction.

10

CORPORATE GOVERNANCE

Independence of the Board of Directors

As required under the listing standards of The Nasdaq Stock Market (“Nasdaq”), a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by its board of directors. Our Board of Directors consults with our outside legal counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant transactions or relationships between each director, or any of his or her family members, and the Company, our senior management and our independent auditors, the Board of Directors has affirmatively determined that the following eight directors who presently serve on our Board of Directors are independent directors within the meaning of the applicable Nasdaq listing standards: Ms. Bowen, Mr. Eagle, Mr. Hykes, Dr. Newman, Mr. Rohn, Mr. Schuler, Mr. Weinstein and Mr. Yared. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. Lowe, the Company’s Interim Chief Executive Officer, is not an independent director by virtue of his interim employment with the Company. There are no familial relationships among our directors and executive officers.

Meetings of the Board of Directors

The Board of Directors met 19 times during the fiscal year ended December 31, 2013. Each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member during 2013. As required under applicable Nasdaq listing standards, during the fiscal year ended December 31, 2013, the Company’s independent directors met at least four times in regularly scheduled executive sessions at which only independent directors were present.

Information Regarding the Board of Directors and its Committees

The Board of Directors has four standing committees: an Audit Committee, a Commercial Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. (In addition, the Board has delegated limited authority to a one person equity award committee as described below.) The following table provides membership and meeting information for the fiscal year ended December 31, 2013 for each of the Board committees:

| | | | | | | | | | | | | | | | |

Name | | Audit | | | Commercial | | | Compensation | | | Nominating and

Corporate

Governance | |

Marjorie L. Bowen | | | X | | | | | | | | | | | | | |

Michael L. Eagle | | | | | | | | | | | | | | | | |

Kevin Hykes | | | | | | | X | * | | | X | | | | | |

Christopher P. Lowe | | | X | * | | | | | | | X | | | | | |

Stephen L. Newman, M.D. | | | X | | | | | | | | | | | | X | * |

William Rohn | | | | | | | X | | | | X | * | | | | |

Jack W. Schuler | | | | | | | | | | | X | | | | | |

Will K. Weinstein | | | | | | | | | | | | | | | X | |

Nadim Yared | | | | | | | X | | | | | | | | X | |

| | | | |

Total meetings in fiscal 2013 | | | 5 | | | | 5 | | | | 9 | | | | 3 | |

11

Below is a description of each committee of the Board of Directors. The Board of Directors has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, to oversee our corporate accounting and financial reporting processes, systems of internal control over financial reporting and audits of its financial statements. For this purpose, the Audit Committee performs several functions. Among other things, our Audit Committee:

| | • | | evaluates the performance of and assesses the qualifications of the independent auditors; |

| | • | | determines and approves the engagement of the independent auditors; |

| | • | | determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; |

| | • | | reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; |

| | • | | monitors the rotation of partners of the independent auditors on our audit engagement team as required by law; |

| | • | | reviews and approves or rejects all related-party transactions; |

| | • | | confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; |

| | • | | establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and |

| | • | | meets to review our annual audited financial statements and quarterly financial statements with management and the independent auditor, including reviewing the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

As of December 31, 2013, the Audit Committee consisted of three directors: Mr. Lowe (Chairman), Ms. Bowen and Dr. Newman. In October 2013, Mr. Eagle resigned from the Audit Committee and Ms. Bowen was appointed to the Audit Committee. The Audit Committee met five times during the fiscal year ended December 31, 2013. On February 9, 2014, Mr. Lowe resigned as a member of the Audit Committee, Ms. Bowen was appointed as the Chairman of the Audit Committee and Mr. Eagle was appointed as a member of the Audit Committee. The Audit Committee has adopted a written charter that is available to stockholders on our website at http://www.hansenmedical.com/investor-relations/corporate-governance.php.

The Board of Directors reviews the Nasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of our Audit Committee are independent (as independence is currently defined in Nasdaq listing standards). The Board of Directors has also determined that Ms. Bowen and Mr. Lowe are each an “audit committee financial expert” as defined under applicable SEC rules.

12

Report of the Audit Committee of the Board of Directors(1)

The Audit Committee has reviewed and discussed with management of the Company the audited financial statements of the Company that are included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013. The Audit Committee has discussed with Deloitte & Touche LLP, its independent registered public accounting firm, the matters required to be discussed under the applicable rules adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from Deloitte & Touche LLP, its independent registered public accounting firm, required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm its independence. Based on the foregoing, the Audit Committee unanimously recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013.

From the members of our Audit Committee:

Marjorie L. Bowen, Chairman

Michael L. Eagle

Dr. Stephen L. Newman

Commercial Committee

The Commercial Committee was formed in October 2012. As of December 31, 2013, the Commercial Committee consisted of three directors: Mr. Hykes (Chairman), Dr. Rohn and Mr. Yared. All members of our Commercial Committee are independent (as independence is currently defined in Nasdaq listing standards). The Commercial Committee met five times during the fiscal year ended December 31, 2013.

The Commercial Committee of our Board of Directors acts on behalf of the Board to oversee our sales and marketing strategies. Among other things, the Commercial Committee:

| | • | | carries out periodic in-depth reviews of the sales strategies and plans for marketing and selling the Company’s currently marketed devices and evaluates resulting sales performance; |

| | • | | reviews the pre-marketing and commercial launch strategies for the Company’s pre-launch products; |

| | • | | reviews the proposed contractual relationships with key distributors and sales channel partners prior to entering into such relationships and assesses the effectiveness of the working relationships with key distributors and sales channel partners on an annual basis; |

| | • | | reviews the organization structure, compensation structure, capabilities and resources available to the commercial functions, and makes recommendations to executive management and the Compensation Committee with regard to these functions; and |

| | • | | acts as counsel to the Chief Executive Officer on matters related to commercial strategy. |

Compensation Committee

The Compensation Committee was formed in October 2004. As of December 31, 2013, the Compensation Committee consisted of four directors: Mr. Rohn (Chairman), Mr. Hykes, Mr. Lowe and Mr. Schuler (who was appointed to the Compensation Committee in October 2013). All members of our Compensation Committee are independent (as independence is currently defined in Nasdaq listing standards). On February 9, 2014, Mr. Lowe resigned as a member of the Compensation Committee in order to become our Interim Chief Executive Officer. The Compensation Committee met nine times during the fiscal year ended December 31, 2013.

| (1) | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference into any filing of Hansen under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended. |

13

The Compensation Committee of the Board of Directors acts on behalf of the Board to review, adopt and oversee the Company’s compensation strategy, policies, plans and programs, including:

| | • | | establishment of corporate and individual performance objectives relevant to the compensation of the Company’s executive officers and other senior management and evaluation of performance in light of these stated objectives; |

| | • | | review and determination or recommendation, as applicable, of the compensation and other terms of employment or service, including severance and change-in-control arrangements, of the executive officers and non-employee directors; |

| | • | | review and approval of appropriate insurance coverage for our officers and directors; |

| | • | | administration of the Company’s equity compensation plans, deferred compensation plans and other similar plans and programs; |

| | • | | reviewing with management our compensation-related disclosures, including the Compensation Discussion and Analysis included in this proxy, and recommending that the Board include such Compensation Discussion and Analysis in proxy statements and other Company filings; |

| | • | | overseeing our submission to stockholder votes of matters related to compensation, including approval of equity compensation plans and non-binding advisory votes approving executive compensation and the frequency of such votes, and considering compensation strategy, plans, programs and policies in light of the results of such votes; and |

| | • | | annually review our risk management processes relating to our compensation programs, including determination of whether any such program encourages undue or inappropriate risk-taking by our personnel that is reasonably likely to have a material adverse effect on us. |

The current written charter is available to stockholders on the Company’s website at

http://www.hansenmedical.com/investor-relations/corporate-governance.php.

Compensation Committee Processes and Procedures

The agenda for each Compensation Committee meeting is usually developed by the Chief Executive Officer and the Chairman of the Compensation Committee, with input from the Chief Financial Officer and the Vice President, Human Resources. The Compensation Committee meets regularly in executive session and with various members of management. From time to time, outside advisors or consultants may be invited by the Compensation Committee to make presentations, provide compensation and financial data or other background information or advice or otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in or be present during any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the sole authority to retain, at the Company’s expense, compensation consultants, legal counsel and other advisors to assist in its evaluation of executive and director compensation, including the authority to approve the advisors’ reasonable fees and other retention terms.

To assist it in making 2013 compensation decisions, the Compensation Committee retained J. Thelander Associates as its independent compensation consultant. J. Thelander Associates serves at the pleasure of the Compensation Committee rather than our management and its fees are approved by the Compensation Committee. J. Thelander Associates provides the Compensation Committee with data about the compensation paid by our peer group and other employers who compete with the Company for executives, updates the

14

Compensation Committee on new developments in areas that fall within the Compensation Committee’s jurisdiction, and is available to advise the Compensation Committee regarding all of its responsibilities, including best practices and market trends in executive compensation. J. Thelander Associates also provides data and recommendations concerning the compensation of our non-employee directors.

The Compensation Committee also retained Enright & Associates, an independent compensation consultant, to assist the Compensation Committee and the Board of Directors in conducting a 360 degree performance appraisal for Mr. Barclay in 2013. In October 2013, the Compensation Committee engaged Compensia, an independent compensation consultant, to assist the Compensation Committee in its deliberations on compensation payable to our named executive officers in 2014. Our Compensation Committee has assessed the independence of J. Thelander Associates, Enright & Associates and Compensia pursuant to SEC and Nasdaq listing rules and determined that their work did not give rise to any conflicts of interest.

Typically, the Compensation Committee makes most significant adjustments, if any, to annual compensation and determines target bonus and equity awards at one or more meetings held during the fourth quarter of the preceding year. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of the Company’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer on which compensation determinations are then made. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines whether, and if so in what manner, to recommend to the full Board of Directors any adjustments to his compensation as well as equity awards to be granted.

For all executives and directors, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, survey data, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive and director stock ownership information, Company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, and recommendations of the Compensation Committee’s compensation consultant, including analyses of executive and director compensation paid at other companies identified by the consultant.

As required under its charter, the Compensation Committee reviews, discusses and assesses its own performance at least annually. As required under applicable law and current Nasdaq listing standards, the Compensation Committee also periodically, but at least annually, reviews and assesses the adequacy of its charter, including the Compensation Committee’s role and responsibilities.

The performance and compensation process and specific determinations of the Compensation Committee with respect to executive compensation for the fiscal year ended December 31, 2013 are described in greater detail in the Compensation Discussion and Analysis section of this proxy statement.

Compensation Committee Interlocks and Insider Participation

As of December 31, 2013, the Compensation Committee consisted of four directors: Mr. Rohn (Chairman), Mr. Hykes, Mr. Lowe and Mr. Schuler (who was appointed a member of the Compensation Committee in October 2013). During 2013, none of these directors were a then present or former officer or employee of the Company. On February 9, 2014, Mr. Lowe resigned from the Compensation Committee and was appointed as our interim Chief Executive Officer. None of our executive officers currently serves, or has served during the last completed fiscal year, on the Compensation Committee or Board of Directors of any other entity that has one or

15

more executive officers serving as a member of our Board of Directors or Compensation Committee. We have had a Compensation Committee for nine and a half years. Prior to establishing the Compensation Committee, our full Board of Directors made decisions relating to compensation of our executive officers.

Equity Award Committee

Our Board of Directors has delegated to an Equity Award Committee, comprised of one member of the Board, a limited power to grant stock options and restricted stock units under certain circumstances. The Equity Award Committee may only grant awards to newly hired non-executive employees who do not directly report to the sole member of the Equity Award Committee; such awards must have a four-year vesting schedule with a one-year cliff, and must be made pursuant to a form of stock option or stock unit agreement adopted by the Board of Directors or the Compensation Committee. The awards granted by the Equity Award Committee cannot exceed either (i) 100,000 shares to any individual in any calendar year or (ii) 500,000 shares in total to all individuals in any calendar year, and the number of shares subject to each award must also be within guidelines established by the Board of Directors or the Compensation Committee from time to time. Stock option grants are effective on the last trading day of the calendar month occurring on or after the date of approval by the Equity Award Committee or, if later, the employee’s employment commencement date. Restricted stock unit grants are effective on the date of approval by the Equity Award Committee or, if later, the employee’s employment commencement date. The sole member of the Equity Award Committee is appointed by the action of the full Board of Directors, considering the recommendation of the Nominating and Corporate Governance Committee, if any. Christopher P. Lowe, our Interim Chief Executive Officer, is currently the sole member of the Equity Award Committee.

Board Leadership Structure

Under the Board of Director’s current leadership structure, Mr. Eagle, an independent, non-management member of the Board, serves as the Chairman of our Board of Directors. As Chairman, Mr. Eagle has authority to call meetings of our Board of Directors and presides over meetings of our Board of Directors. In addition, in his role as Chairman, Mr. Eagle coordinates with the Chief Executive Officer on agendas for meetings of the Board of Directors and on the quality, quantity and timeliness of information submitted by management to independent directors, serves as the principal liaison between the independent directors and the Chief Executive Officer, and has such further responsibilities as the Board of Directors may designate from time to time. While the Board believes that the current and past separation of the chairman and principal executive officer positions has served our company well, the Board does not believe that it is appropriate to prohibit one person from serving as both chairman and chief executive officer. However, at the present time, based on the skills, experience and time availability of Mr. Eagle, the other members of the Board and of management, having a separate Chairman of the Board of Director and Chief Executive Officer enhances the Board’s oversight of management, the Board’s independence and our overall leadership structure. The Board is aware of the dynamic environment in which the Company operates and periodically assesses whether the current leadership structure remains appropriate.

Risk Oversight Management

The Board of Directors takes an active role, as a whole and at the committee level, in overseeing management of our company’s risks. Our management keeps the Board of Directors apprised of significant risks facing the company and the approach being taken to understand, manage and mitigate such risks. Specifically, strategic risks are overseen by the full Board of Directors; financial risks are overseen by the Audit Committee; risks relating to compensation plans and arrangements are overseen by the Compensation Committee; risks associated with director independence and potential conflicts of interest are overseen by the Nominating and Corporate Governance Committee; and risks associated with our marketing and sales operations are overseen by the Commercial Committee. Additional review or reporting on enterprise risks is conducted as needed or as requested by our Chairman, our full Board of Directors, our independent directors or the appropriate committee.

16

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, recommending to the Board of Directors for selection candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and developing a set of corporate governance principles for the Company. As of December 31, 2013, the Nominating and Corporate Governance Committee was comprised of three directors: Dr. Newman (Chairman), Mr. Yared and Mr. Weinstein. In October 2013, Mr. Hykes resigned from the Nominating and Corporate Governance Committee and Mr. Weinstein was appointed to the Nominating and Corporate Governance Committee. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Nasdaq listing standards). The Nominating and Corporate Governance Committee met three times during the fiscal year ended December 31, 2013. The Nominating and Corporate Governance Committee has adopted a written charter that is available to stockholders on the Company’s website at http://www.hansenmedical.com/investor-relations/corporate-governance.php.

The Board of Directors and the Company seek to maintain a Board comprised of members who can productively contribute to the success of the Company. Accordingly, the Nominating and Corporate Governance Committee reviews the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board and the perceived needs of the Company at that time. This assessment includes consideration of issues of, among other things, judgment, diversity, age, skills, background and industry knowledge. However, the Board retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee considers diversity, age, skills and such other factors as it deems appropriate given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. In 2013, the Nominating and Corporate Governance Committee engaged KFA Search, Inc. to assist in identifying and selecting potential director candidates. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

At this time, the Nominating and Corporate Governance Committee does not have a policy with regard to the consideration of director candidates recommended by stockholders. The Nominating and Corporate Governance Committee believes that it is in the best position to identify, review, evaluate and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board of Directors.

Stockholder Communications with the Board of Directors

The Company has not established a formal process related to stockholder communications with the Board of Directors due to the limited number of such communications historically. Nevertheless, every effort has been

17

made to ensure that the views of stockholders are heard by the full Board of Directors or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. We believe our responsiveness to stockholder communications to the Board of Directors has been appropriate. Our stockholders may direct communications to a particular director or to the directors generally, in care of Hansen Medical, Inc., 800 East Middlefield Road, Mountain View, CA 94043.

Code of Business Conduct and Ethics

We have adopted the Hansen Medical, Inc. Code of Business Conduct and Ethics, which applies to all directors and employees, including executive officers, including, without limitation, our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Code of Business Conduct and Ethics is available on our website at http://www.hansenmedical.com/investor-relations/corporate-governance.php. If we grant any waivers from, or makes any substantive amendments to, a provision of the Code of Business Conduct and Ethics, we will promptly disclose the nature of the amendment or waiver on our website. In addition, we intend to promptly disclose (1) the nature of any amendment to our Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and (2) the nature of any waiver, including an implicit waiver, from a provision of our Code of Business Conduct and Ethics that is granted to one of these specified officers, the name of such person who is granted the waiver and the date of the waiver on our website in the future. The inclusion of our website address in this report does not include or incorporate by reference the information on our website into this proxy statement.

Director Compensation

Our non-employee directors are eligible to receive the cash and equity compensation described below. These amounts were reviewed against the non-employee director compensation practices of a group of peer companies in December 2012, and, to narrow the disparity between our non-employee director compensation and that of the peer group, the base retainer was increased and an additional retainer for the chairman of the Board of Directors was added effective for 2013. This peer group was the same group of similarly-situated peer companies that we used to evaluate 2013 compensation for our Chief Executive Officer and Chief Financial Officer.

| | • | | $35,000 per year for service as a Board of Directors member; |

| | • | | An additional $25,000 per year for service as chairman of the Board of Directors; |

| | • | | $12,000 per for service as chairman of the Audit Committee; |

| | • | | $5,000 per year for service as chairman of the Compensation Committee, Nominating and Corporate Governance Committee and/or the Commercial Committee; |

| | • | | $2,000 per year for service as non-chairman member of the Audit Committee; |

| | • | | $1,000 per year for service as non-chairman member of the Compensation Committee, Nominating and Corporate Governance Committee and/or Commercial Committee; |

| | • | | $1,500 for each Board of Directors meeting attended in person ($500 for meetings attended by video or telephone conference); |

| | • | | $500 for each Audit Committee meeting attended ($1,000 for the chairman of the Audit Committee for each meeting attended); and |

| | • | | $500 for each meeting attended of the Compensation Committee, Nominating and Corporate Governance Committee and/or Commercial Committee. |

We also reimburse our non-employee directors for their reasonable expenses incurred in attending meetings of our Board of Directors and of committees of our Board of Directors.

18

Non-employee directors receive automatic grants of non-statutory stock options under our 2006 Equity Incentive Plan. For purposes of our automatic director grant program, a non-employee director is a director who is not employed by us and who does not receive compensation from us or have a business relationship with us that would require disclosure under certain SEC rules. Each non-employee director joining our Board of Directors is automatically granted a non-statutory stock option to purchase 50,000 shares of our common stock with an exercise price equal to the fair market value of our common stock on the grant date. This initial option will vest ratably over 36 months of service.