Exhibit 99.1

| Press Release November 12, 2014 Page 1 / 23 | |

| ||

CorpBanca Announces

Third Quarter 2014 Financial Report;

Santiago, Chile, November 12, 2014. CORPBANCA (NYSE:BCA; SSE: CORPBANCA), a Chilean financial institution offering a wide variety of corporate and retail financial products and services, today announced its financial results for the third quarter ended September 30, 2014. This report is based on unaudited consolidated financial statements prepared in accordance with Chilean generally accepted accounting principles. Solely for the convenience of the reader, U.S. dollar amounts in this report have been translated from Chilean nominal pesos at our internal exchange rate as of September 30, 2014 of Ch$597.66 per U.S. dollar. Industry data contained herein has been obtained from the information provided by the Superintendency of Banks and Financial Institutions (“SBIF”).

Financial Highlights In 3Q 2014, Net Income attributable to shareholders totalled Ch$54,646 million (Ch$ 0.1606 per share or US$ 0.4030 per ADR), reflecting a 94.1% increase when compared to 3Q 2013 year over year1 (YoY). The main drivers for this YoY increase were: (i) the commercial activity in Chile and Colombia; (ii) the positive impact of higher inflation rate in the local market combined with a lower monetary policy interest rate; as well as (iii) asset and liability management performance and; (iv) the consolidation of Helm Bank for a full three months in 3Q 2014, as compared to two months in 3Q 2013. Total loans (excluding interbank and contingent loans) reached Ch$14,687.7 billion as of September 30, 2014, allowing CorpBanca to achieve a market share of 11.97%, an increase of 51 basis points (bp) as compared to 4Q 2013 as a result of all business segments performance, highlighting the contribution of project finance and infrastructure activity. As of September 30, 2014 CorpBanca was the fourth largest private bank in Chile in terms of loans and deposits, and had closed the gap to the third ranked bank. As of September 30, 2014, according to the Colombian Superintendency of Finance CorpBanca also ranks as the sixth largest private bank in Colombia in terms of total assets, total loans and total deposits. During 3Q 2014: | Mr. Fernando Massú, CEO The results during the 3Q 2014 showed a significant improvement compared to last year (YoY), as we expected. 3Q 2014 results fully consolidated Helm Bank, although one-time integration costs still partially offset the benefits of the acquisition. CorpBanca’s 3Q 2014 performance reflected a greater business diversification, which resulted in more stable revenue streams. Despite a lower GDP growth rate in Chile during 2014, local commercial activity remains favorable as in previous quarters. Along with a positive economic trend in Colombia, our cross border operations continue to increase their contribution to consolidated net income. To date CorpBanca Colombia post-merger synergies are being generated as scheduled initially. The extensive Tax Reform Bill passed in Chile in September 2014 had a non-material negative net impact of Ch$1,022 million, equivalent to 0.6% of the Year to Date Net Income or 0.1% of the equity attributable to shareholders. |

1 “Year over Year” state for the comparison between 3Q 2014 and 3Q 2013;

“Quarter over quarter” state for the comparison between 3Q 2014 and 2Q 2014.

| Press Release November 12, 2014 Page 2 / 23 | |

During 3Q 2014: Net operating profit increased by 62.2% YoY, due to our greater diversity in our operations both in Chile and Colombia as well as the consolidation of Helm Bank for a full three months in 3Q 2014 in comparison to only two months for 3Q 2013; and asset and liability management. Net operating profit increased by 9.7% quarter over quarter QoQ; mainly due, once separated from the impact of our fiscal hedge2 effect, asset and liability management and provisions releases. Net provisions for loan losses decreased by 26.6% YoY and by 23.8% QoQ; as the result of provisions releases consecutive to debt payments and increases in guarantees associated with commercial loans. Total operating expenses increased by 36.1% YoY and by 7.7% QoQ, primarily due to higher expense in our Chilean operation and as the result of the consolidation of Helm Bank for a full three months in 3Q 2014, in comparison to only two months for 3Q 2013, as well as one-time expenses related to the Colombian merger process. | In September 2014 we issued senior bonds in the international market, for US$750 million in line with our strategy to diversify funding sources, strengthen liquidity and financed commercial activities. In connection with the pending merger between Itaú Chile and CorpBanca, on October 16th, another important step in regulatory approval process was achieved when the Brazilian Central Bank authorized Itaú Unibanco to participate indirectly in the equity of the merged bank. We expect to finalize the merger during the first half of 2015, once the regulatory and shareholders approvals have been obtained. |

2 Fiscal hedge: correspond to a derivative that is used to cover the valuation of our investment in Colombia for tax purposes from the volatility of exchange rate of US$/Ch$. This effect has to be analyzed along with income tax expenses.

| Press Release November 12, 2014 Page 3 / 23 | |

General Information

Market Share

| In Chile our market share as of September 2014 on an unconsolidated basis reached 7.5 %, an increase of 20 bp in comparison to as of December 2013, reflecting our growing commercial activity during the first half, highlighting project finance and infrastructure performance. As of September 30, 2014, according to the Superintendency of Bank and Institutional Finance (SBIF), we were the fourth largest private bank in Chile in terms of the overall size of our loan portfolio, with 12.0 % of market share on a consolidated basis. During 3Q 2013, CorpBanca added US$5.3 billion in loans through the acquisition of Helm Bank, which contributed to our increase in market share on a consolidated basis. In Colombia, despite the ongoing process of the Helm Bank merger our market share remained stable, reaching 6.5% as of September 30, 2014, according to Superintendencia Financiera de Colombia, reflecting favorable economic fundamentals, low banking penetration and increasing commercial activity. |

Net Income3 (12 months trailing in millions of Chilean pesos)

| The chart to the left shows our 12 months trailing Net Income from December 31, 2006 through September 30, 2014. During this period, our Net Income for the 12 month trailing September 30, 2014 reached record levels of Ch$198,434 billion, an increase by 44% YoY. Net Income for 3Q 2014 was Ch$54.7 billion. |

3Net Income attributable to shareholders; for 2013 excludes Ch$16,000 million of one-time profits from the sale of 31 real estates asset.

| Press Release November 12, 2014 Page 4 / 23 |

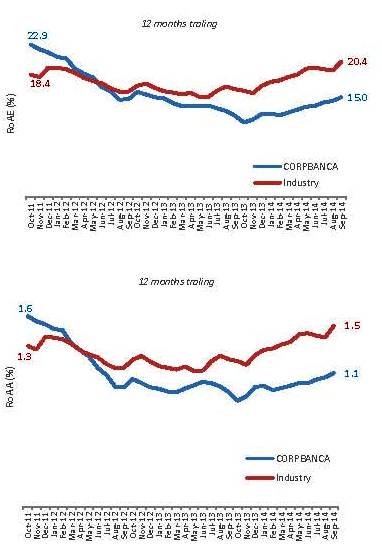

RoAE – RoAA

| We achieved an average annual return on equity (RoAE*) of 17.3% between January 2011 and September 2014. Capital increases between 2011 and 2013 to enable our organic growth in Chile and our acquisitions in Colombia, totaling approximately US$1,570 million (+137.1% increase over the same time period) impacted our RoAE since the third quarter of 2011. * Equity: Average equity attributable to shareholders excluding net income and provision for mandatory dividends. Regarding our return on average asset (RoAA) between January 2011 and October 2013 the main drivers were: (i) the increase in our corporate loans (with lower credit risk profiles and lower spreads than in our retail loans in 2011 and beginning of 2012); (ii) the accrual of Banco Santander Colombia’s (now known as CorpBanca Colombia) Net Income commencing in the second half of 2012 and of Helm Bank for the last five months of 2013 compared to a full year in 2014. The shift in the trend between October 2013 and September 2014 was the result of (i) consolidation of CorpBanca Colombia since 2013 and of Helm Bank since 2014 and (ii) the higher UF variation (LTM) observed in September 2014 (Δ+2.20% in 3Q 2013 vs. Δ+4.57% in 3Q 2014) along with decreasing monetary policy interest rate in Chile. CorpBanca’s 3Q 2014 performance reflected greater business diversification, which resulted in more stable revenue streams. |

| Press Release November 12, 2014 Page 5 / 23 | |

Risk Index (Loan loss allowances / Total loans)

| Consistent with one of our core pillars, according to the SBIF, CorpBanca has maintained one of the lowest credit risk indexes (total loan loss allowances / total loans) in the banking industry in Chile. |

NPL (%)

| CorpBanca´s high asset quality was maintained following the acquisition of Banco Santander Colombia in May 2012 and Helm Bank in August 2013. The chart to the left illustrates how our consolidated non-performing loan (NPL) ratio compares to the industry average in Chile. We believe that our risk management processes and methodology enables us to identify risks and resolve potential problems on a timely basis. For a country breakdown see Section VIII. |

BIS Ratio (%) – TIER I (%)

| An increase of capital during 1Q 2013, in connection with the acquisition of Helm Bank additionally improved the trend in our BIS ratio in 2013. |

| Press Release November 12, 2014 Page 6 / 23 | |

| |

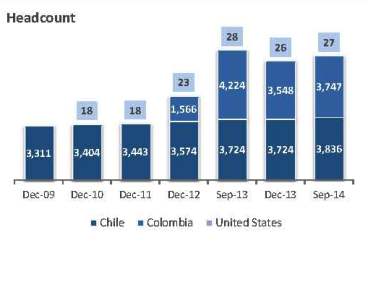

| Our distribution network in Chile provides integrated financial services and products to our customers through diverse channels, including ATMs, traditional branches, internet banking and telephone banking. As of September 30, 2014, we operated 127 branch offices in Chile, which included 70 branches operating under the brand CorpBanca, one operating in New York and 56 branches operating under the brand Banco Condell, our consumer finance division, in all case fully customized to attend our customer basis. In addition, as of September 30, 2014, we owned and operated 410 ATMs in Chile, and our customers had access to over 8,007 ATMs in Chile through our agreement with Redbanc S.A., or Redbanc. We utilize a number of different sales channels including account executives, sales forces and the internet to attract potential new clients. Our branch system serves as the main delivery network for our full range of products and services. CorpBanca Colombia’s distribution channel also provides integrated financial services and products to our customers in Colombia through diverse channels, including ATMs, branches, internet banking and telephone banking. As of September 30, 2014, CorpBanca Colombia operated 176 branch offices in Colombia and owned and operated 183 ATMs, while providing its customers with access to over 13,679 ATMs through Colombia’s financial institutions. CorpBanca Colombia also utilizes a number of different sales channels including account executives, telemarketing and internet banking to attract potential new clients. CorpBanca Colombia’s branch systems serve as the main distribution network for our full range of products and services. As of September 30, 2014, on a consolidated basis we had a headcount of 3,836 employees in Chile, 3,747 employees in Colombia (including Panama) and 27 employees in the United States. |

| |

4 On September 2014, Colombia’s branches figure definition was modified, including seven “small offices”. |

5 Figures in 2014 are not comparable to prior years. Since 2014, Colombia’s headcount figure included all subsidiaries (483 employees).

| Press Release November 12, 2014 Page 7 / 23 | |

Management’s Discussion and Analysis

I) Consolidated Financial Performance Review

Our consolidated Net Income attributable to shareholders reported in 3Q 2014 was Ch$54,646 million, representing an increase of 94.1% YoY. The main drivers for this increase YoY were: (i) the commercial activity in Chile and Colombia; (ii) the positive impact of higher inflation rate in Chile combined with a lower monetary policy rate; as well as (iii) asset and liability management performance and; (iv) incorporation of Helm Bank for a full three months in 3Q 2014, as compared to two months in 3Q 2013.

The following table set forth the components of our consolidated net income for the quarters ended September 30, 2014 and 2013 and June 31, 2014:

| Quarterly Consolidated Income Statements (unaudited) | ||||||

| Quarter | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | 3Q14 | 2Q14 | 3Q13 | 3Q14/3Q13 | 3Q14/2Q14 | |

| Net interest income | 152,058 | 162,961 | 138,306 | 9.9% | -6.7% | |

| Net fee and commission income | 42,672 | 44,954 | 31,047 | 37.4% | -5.1% | |

| Net total financial transactions | 59,130 | 37,109 | 7,151 | 726.9% | 59.3% | |

| Other operating income | 7,489 | 3,416 | 3,769 | 98.7% | 119.2% | |

| Other operating expenses | (10,248) | (3,304) | (5,418) | 89.1% | 210.2% | |

| Net operating profit before loan losses | 251,101 | 245,136 | 174,855 | 43.6% | 2.4% | |

Provision for loan losses (1) | (25,613) | (33,602) | (34,894) | -26.6% | -23.8% | |

| Net operating profit | 235,736 | 214,838 | 145,379 | 62.2% | 9.7% | |

| Operating expenses | (129,083) | (119,825) | (94,843) | 36.1% | 7.7% | |

| Operating income | 96,405 | 91,709 | 45,118 | 113.7% | 5.1% | |

| Income from investments in other companies | 386 | 781 | (1) | - | -50.6% | |

| Income before taxes | 96,791 | 92,490 | 45,117 | 114.5% | 4.7% | |

| Income tax expense | (31,016) | (19,419) | (10,987) | 182.3% | 59.7% | |

| Minority interest | (11,129) | (7,815) | (5,976) | 86.2% | 42.4% | |

| Net income attributable to shareholders | 54,646 | 65,256 | 28,154 | 94.1% | -16.3% | |

(1) Includes Provision for Contingent loans.

II) Unconsolidated Financial Performance Review: Chile and Colombia

The following table presents the results generated in each of Chile and Colombia for the 3Q 2014 to show separately the impact of each country’s operation on the consolidated results of CorpBanca. The financial results of CorpBanca Chile include some expenses associated with our Colombian operations, particularly: (i) interest expenses in connection with the part of the acquisition of Banco Santander Colombia (now known as CorpBanca Colombia) that was not funded with equity; (ii) amortization of the intangible assets generated in the Banco Santander Colombia further to the acquisition of Helm Bank; and (iii) the impact of our fiscal hedge6.

These adjusted results for 3Q 2014 allow primarily the separation of the Chilean results from any impact related to our Colombian operations. The adjusted 3Q 2014 results presents, in our opinion, an unbiased result achieved in Chile:

| Press Release November 12, 2014 Page 8 / 23 | |

| 3Q 2014 | 3Q 2014 Adjusted | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | Consolidated | Chile | Colombia | Adjustments | Chile | Colombia | 3Q14/3Q13 Chile |

| Net interest income | 152,058 | 73,814 | 78,244 | 1,690 | 75,504 | 76,554 | -5.1% |

| Net fee and commission income | 42,672 | 24,634 | 18,038 | 24,634 | 18,038 | 33.2% | |

| Total financial transactions, net | 59,130 | 28,816 | 30,314 | (14,388) | 14,428 | 44,702 | 240.0% |

| Other operating income | 7,489 | 1,880 | 5,609 | 1,880 | 5,609 | -19.5% | |

| Other operating expenses | (10,248) | (3,769) | (6,479) | (3,769) | (6,479) | -10.2% | |

| Net operating profit before loan losses | 251,101 | 125,375 | 125,726 | (12,698) | 112,677 | 138,424 | 12.2% |

| Provision for loan losses (1) | (25,613) | (5,581) | (20,032) | (5,581) | (20,032) | -73.4% | |

| Net operating profit | 225,488 | 119,794 | 105,694 | (12,698) | 107,096 | 118,392 | 34.8% |

| Operating expenses | (129,083) | (63,119) | (65,964) | 3,158 | (59,961) | (69,122) | 42.6% |

| Operating income | 96,405 | 56,675 | 39,730 | (9,539) | 47,136 | 49,269 | 26.0% |

| Income from investments in other companies | 386 | 18 | 368 | 18 | 368 | -1.900.0% | |

| Income before taxes | 96,791 | 56,693 | 40,098 | (9,539) | 47,154 | 49,637 | 26.1% |

| Income tax expense | (31,016) | (21,689) | (9,327) | 16,246 | (5,443) | (25,573) | -39.0% |

| Net income | 65,775 | 35,004 | 30,771 | 6,707 | 41,711 | 24,064 | 46.5% |

| Efficiency Ratio | 51.4% | 50.3% | 52.5% | 53.2% | 49.9% | ||

(1) Includes Provision for Contingent loans.

Our operations in Chile generated Ch$41,711 million of Adjusted Net Income in 3Q 2014 while our operations in Colombia generated Ch$24,064 million. These figures show that greater business diversification has resulted in an increasing revenue stream.

Adjustments are related to:

| i. | Ch$1,690 million associated with funding for the acquisition of CorpBanca Colombia. |

| ii. | Ch$14,388 million of hedge taxes in US$ (counterpart in income tax expense, not included here). |

| iii. | Ch$3,158 million of intangibles asset amortization and integration costs in Colombia. |

Consolidated Net Operating Profits before Loan Losses

Net operating profit increased by 43.6% YoY, due to growing activity in both Chile and Colombia as well as the consolidation of ex- Helm Bank, for a full three months in 3Q 2014 in comparison to only two months for 3Q 2013; and asset and liability management.

Net operating profit increased by 9.7% QoQ; mainly due to (i) an increase in income from financial operations, associated with asset and liability management once separated from the fiscal hedge impact.

Consolidated Net interest income

Our net interest income was Ch$152,058 million in 3Q 2014, an increase of 9.9% as compared to Ch$138,306 million for the same period in 2013 primarily as a result of higher commercial activity and inflation and the full consolidation of ex- Helm Bank in 3Q 2014 in comparison to only two months for 3Q 2013.

On a QoQ analysis, our net interest income decreased by 6.7% in comparison to 2Q 2014, due to a lower quarterly inflation growth rate.

| Press Release November 12, 2014 Page 9 / 23 | |

The increase in our interest income was lower than the increase in our total interest-earning assets, due to a lower increase in the variation of the UF7 that increased by 0.60% vs. 1.75% in 3Q 2014 and 2Q 2014, respectively. Net interest margin (net interest income divided by average interest-earning assets) decreased from 4.28% to 3.74% from 3Q 2013 to 3Q 2014. On the other hand, our twelve months trailing net interest margin trend was positive, increasing from 1.4% as of September 30, 2013 to 2.4% as of September 30, 2014. During the third quarter of 2014, the Central Bank of Chile reduced its monetary policy interest rate from 4.00% to 3.25%. At the same time, inflation rates and their effects on results through the Unidad de Fomento variation (LTM) were higher in 3Q 2014 compared to 3Q 2013 (4.57% versus 2.20%).

Consolidated Fees and Commission from services

| Quarter | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | 3Q14 | 2Q14 | 3Q13 | 3Q14/3Q13 | 3Q14/2Q14 | |

| Banking services(*) | 30,717 | 29,537 | 23,962 | 28.2% | 4.0% | |

| Securities brokerage services | 203 | 343 | 434 | -53.2% | -40.8% | |

| Mutual fund management | 2,170 | 2,147 | 1,405 | 54.5% | 1.1% | |

| Insurance brokerage | 3,083 | 2,967 | 2,605 | 18.3% | 3.9% | |

| Financial advisory services | 6,020 | 9,422 | 2,080 | 189.5% | -36.1% | |

| Legal advisory services | 480 | 537 | 562 | -14.6% | -10.7% | |

| Net fee and commission income | 42,672 | 44,954 | 31,047 | 37.4% | -5.1% | |

| (*) Includes consolidation adjustments. | ||||||

Our net service fee income for 3Q 2014 was Ch$42,672 million, representing a 37.4% increase when compared to Ch$31,047 million obtained in 3Q 2013. The YoY increase was primarily the result of (i) financial advisory services structuring fees related to project finance and infrastructure activity (ii) the consolidation of ex- Helm Bank and Helm Insurance Brokerage (Helm Corredor de Seguros).

Consolidated Net Total Financial Transaction

| Quarter | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | 3Q14 | 2Q14 | 3Q13 | 3Q14/3Q13 | 3Q14/2Q14 | |

| Trading and investment income: | ||||||

| Trading investments | 5,402 | 17,592 | 4,902 | |||

| Trading financial derivatives contracts | 42,999 | 24,054 | 7,168 | 499.9% | 78.8% | |

| Other | 16,776 | 9,051 | (2,451) | - | 85.3% | |

| Net income from financial operations | 65,177 | 50,697 | 9,619 | 577.6% | 28.6% | |

| Foreign exchange profit (loss), net | (6,047) | (13,588) | (2,468) | 145.0% | -55.5% | |

| - | - | |||||

| Net total financial transactions position | 59,130 | 37,109 | 7,151 | 726.9% | 59.3% | |

Net income from financial activities increased by Ch$22,021 million, or 59.3%, QoQ mainly due to:

| i. | The positive asset and liability management performance during the third quarter related. The gap between Asset and Liability indexed to the UF reached approximately Ch$ 927,663 million for 3Q 2014, equivalent to $9,277 million for each 100 bp of variation of the UF. |

Market Risk exposure related to proprietary trading investment is strongly limited; the bank’s strategy is focused on its core business.

| Press Release November 12, 2014 Page 10 / 23 | |

A significant number of derivatives are client-driven or derivatives used in order to either achieve economic hedges or accounting hedges.

Consolidated Provisions for loan losses (for Commercial and Retail loans) (1)

| Quarter | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | 3Q14 | 2Q14 | 3Q13 | 3Q14/3Q13 | 3Q14/2Q14 | |

| Commercial, net of loan loss recoveries | (6,775) | (12,851) | (22,417) | -69.8% | -47.3% | |

| Residential mortgage, net of loan loss recoveries | (1,196) | (519) | 769 | - | 130.4% | |

| Consumer, net of loan loss recoveries | (17,485) | (19,185) | (14,829) | 17.9% | -8.9% | |

| Others | (37) | (36) | 990 | - | 2.8% | |

| Net provisions for loan losses | (25,493) | (32,591) | (35,487) | -28.2% | -21.8% | |

(1) Excludes provision for Contingent loans.

Expenses from provisions for loan losses for 3Q 2014 decreased by 21.8% or Ch$7.098 million QoQ and by 28.2% or Ch$ 9,994 million YoY, in both case primarily as the result of significant releases of provisions that were recognized following relevant debt payments and increases in guarantees associated to commercial loans.

Consolidated Operating expenses

| Quarter | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | 3Q14 | 2Q14 | 3Q13 | 3Q14/3Q13 | 3Q14/2Q14 | |

| Personnel salaries and expenses | 56,466 | 56,359 | 46,600 | 21.2% | 0.2% | |

| Administrative expenses | 58,528 | 49,894 | 37,098 | 57.8% | 17.3% | |

| Depreciation and amortization | 14,089 | 13,572 | 11,145 | 26.4% | 3.8% | |

| Impairment | - | - | - | - | - | |

| Operating expenses | 129,083 | 119,825 | 94,843 | 36.1% | 7.7% | |

Operating expenses for 3Q 2014 increased by 36.1% equivalent to Ch$34,240 million YoY. Of this YoY increase, 54% corresponds to our Chilean operation, resulting from collective negotiation, higher bonus provisions, as well as higher salaries expenses, advisory consulting fees and rent. The remaining 46% correspond to Colombian operations, due to the consolidation of Helm Bank in 3Q 2013 and one-time expenses related to the merger process.

Consolidated Tax expenses

Our Income tax expenses increased by 59.7% equivalent to Ch$ 11.597 QoQ, due to higher Ch$/US$ exchange rate8, impacting the valuation of our investment in Colombia translated into Chilean pesos.

On September, 2014, several changes to the current system of income tax and other taxes were introduced in Chile. An important aspect among the main changes was the progressive increase in the statutory corporate tax rate, which allows companies to choose between to tax schemes:

| i. | The first, titled “partially integrated schemes”, establishes a progressive increase of the statutory corporate tax rate to 21%, 22.5%, 24%, 25.5% and 27% for years 2014, 2015, 2016, 2017 and 2018, respectively. Under this system the company will receive partial tax benefits for reinvesting profits. |

| ii. | The second, titled “income attributed schemes”, establishes a progressive increase of the statutory corporate tax rate to 21%, 22.5%, 24% and 25% for years 2014, 2015, 2016 and 2017, respectively. In this case the company will benefit from a lower statutory corporate tax rate but will not receive tax benefits for reinvesting profits. |

| Press Release November 12, 2014 Page 11 / 23 | |

In accordance with International Standards Financial Information, the impact on results must be recognized immediately, for an amount determined by applying to temporary differences the rate that is expected to be recovered or settled. As of September 30, 2014, the Bank registered a non-material negative net impact of Ch$ 1,022 million.

We maintained an effective income tax rate in 3Q 2014 approximately 3% below the statutory corporate tax rate for CorpBanca, excluding our Colombian and New York operations.

III) Consolidated Assets and liabilities

Consolidated Loan portfolio (1)

| Quarter ended | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | Sep-14 | Jun-14 | Sep-13 | Sep-14/Sep-13 | Sep-14/Jun-14 | |

| Wholesale lending | 10,520,089 | 10,553,087 | 9,454,372 | 11.3% | -0.3% | |

| Chile | 6,445,088 | 6,449,152 | 6,036,036 | 6.8% | -0.1% | |

| Commercial loans | 5,503,426 | 5,456,985 | 5,131,859 | 7.2% | 0.9% | |

| Foreign trade loans | 535,094 | 576,456 | 514,409 | 4.0% | -7.2% | |

| Leasing and Factoring | 406,568 | 415,711 | 389,768 | 4.3% | -2.2% | |

| Colombia | 4,075,001 | 4,103,935 | 3,418,336 | 19.2% | -0.7% | |

| Commercial loans | 3,476,026 | 3,521,132 | 2,947,104 | 17.9% | -1.3% | |

| Foreign trade loans | - | - | - | - | - | |

| Leasing and Factoring | 598,975 | 582,803 | 471,232 | 27.1% | 2.8% | |

| Retail lending | 4,167,580 | 4,049,406 | 3,496,260 | 19.2% | 2.9% | |

| Chile | 2,257,122 | 2,208,116 | 1,978,081 | 14.1% | 2.2% | |

| Consumer loans | 569,082 | 547,245 | 498,581 | 14.1% | 4.0% | |

| Residential mortgage loans | 1,688,040 | 1,660,871 | 1,479,500 | 14.1% | 1.6% | |

| Colombia | 1,910,458 | 1,841,290 | 1,518,179 | 25.8% | 3.8% | |

| Consumer loans | 1,350,419 | 1,308,547 | 1,089,498 | 23.9% | 3.2% | |

| Residential mortgage loans | 560,039 | 532,743 | 428,681 | 30.6% | 5.1% | |

| TOTAL LOANS | 14,687,669 | 14,602,493 | 12,950,632 | 13.4% | 0.6% | |

| Chile | 8,702,210 | 8,657,268 | 8,014,117 | 8.6% | 0.5% | |

| Colombia | 5,985,459 | 5,945,225 | 4,936,515 | 21.2% | 0.7% | |

(1) Contingent loans under IFRS are not considered part of the Loan portfolio.

Our total loans increased by 13.4%, or Ch$1,737 billion, YoY, from Ch$12,951 billion as of September 30, 2013 to Ch$14,688 billion as of September 30, 2014, reflecting higher commercial activity in CorpBanca Colombia.

Our wholesale lending increased by 11.3% or Ch $1,066 billion YoY due to the growing corporate activity during 3Q 2014 in Colombia.

Our retail lending increased by 19.2%, or Ch$ 671 billion, YoY, as a result of an increase in our retail segment in both Chile and Colombia.

The growth rate QoQ in our loan portfolio in Chile (primarily wholesale banking) was flat, reflecting reduced commercial activity during this quarter in comparison to June 2014 due to a lower GDP growth rate in Chile.

| Press Release November 12, 2014 Page 12 / 23 | |

Consolidated Securities Portfolio

| Quarter ended | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | Sep-14 | Jun-14 | Sep-13 | Sep-14/Sep-13 | Sep-14/Jun-14 | |

| Trading investments | 242,933 | 497,366 | 456,334 | -46.8% | -51.2% | |

| Available-for-sale investments | 895,494 | 627,449 | 664,823 | 34.7% | 42.7% | |

| Held-to-maturity investments | 230,783 | 258,069 | 205,790 | 12.1% | -10.6% | |

| Total Financial Investments | 1,369,210 | 1,382,884 | 1,326,947 | 3.2% | -1.0% | |

Our investment portfolio consists of trading, available-for-sale and held-to-maturity securities. Trading instruments correspond to fixed income securities acquired to generate gains from short-term price fluctuations or brokerage margins. Trading instruments are stated at fair value.

Investment instruments are classified in two categories: held-to-maturity investments and instruments available-for-sale. On a consolidated basis, we currently have a small portfolio of held-to-maturity investments, related to our Colombian operations. All other investment instruments are considered available-for-sale. Investment instruments are initially recognized at cost, which includes transaction costs. Instruments available-for-sale at each subsequent period-end are valued at their fair value according to market prices or based on valuation models. Unrealized gains or losses arising from changes in the fair value are charged or credited to equity accounts.

In addition to regulatory liquidity risk controls, we have also set internal liquidity limits, in order to safeguard CorpBanca’s payment capacity in the event of illiquid conditions; a minimum has been established for the instruments portfolio that enables cash flows to be quickly generated either through liquidation or because they can be used as collateral for new funding sources. As part of our policy, we have developed two internal liquidity models.

Minimum Liquidity Requirement: In order to ensure that CorpBanca will permanently hold enough liquid assets to meet all payments derived from obligations to third parties in the bank over the next three days, we set a limit on the minimum amount of liquid assets to be held on a daily basis.

Liquidity Coverage Ratio (LCR): We seek to ensure that, even under adverse conditions, we have access to the funds necessary to cover client needs and maturing liabilities. The purpose of the LCR model is to evaluate our funding capacity assuming a hypothetical scenario of illiquidity. The LCR is based on a stress scenario which assumes that an unusually large proportion of liabilities will be withdrawn over the next 20 days according with a stressed volatility and liquid assets will have to cover excess requirements.

Consolidated Funding strategy

| As of the three months ended | Change (%) | |||||

| (Expressed in millions of Chilean pesos) | Sep-14 | Jun-14 | Sep-13 | Sep-14/Sep-13 | Sep-14/Jun-14 | |

| Demand deposits | 4,224,680 | 4,170,880 | 3,302,652 | 27.9% | 1.3% | |

| Time deposits and saving accounts | 8,017,350 | 7,897,235 | 7,335,835 | 9.3% | 1.5% | |

| Investments sold under repurchase agreements | 50,872 | 296,380 | 350,489 | -85.5% | -82.8% | |

| Mortgage finance bonds | 101,784 | 107,570 | 126,872 | -19.8% | -5.4% | |

| Bonds | 2,095,407 | 1,647,939 | 1,564,380 | 33.9% | 27.2% | |

| Subordinated bonds | 902,729 | 895,372 | 757,378 | 19.2% | 0.8% | |

| Interbank borrowings | 14,528 | 15,220 | 16,243 | -10.6% | -4.5% | |

| Foreign borrowings | 1,470,031 | 1,498,473 | 1,262,484 | 16.4% | -1.9% | |

| Press Release November 12, 2014 Page 13 / 23 | |

Our current funding strategy is to use all sources of funding in accordance with their costs, their availability and our general asset and liability management strategy.

On August 1, 2010, we implemented a local bond program for a maximum amount of UF150 million at any time outstanding. Under the local bond program, we are able to issue two types of bonds: (i) senior bonds, up to an aggregate amount of UF100 million, which can be divided into 28 series of senior bonds (from AB to AZ and from BA to BC), with a maturity ranging from 3 to 30 years and an interest rate of 3%, and (ii) subordinated bonds, up to an aggregate amount of UF50 million, which can be divided into 16 series (from BD to BS), with a maturity ranging from 20 to 35 years and an interest rate of 4%. For all the series of bonds that can be issued under the local bond program, the amortization of capital will be made in full at maturity. The principal owed in connection with outstanding senior and subordinated bonds is due at maturity and interest relating thereto is due bi-annually. The objective of the local bond program is to structure the future issuances of debt of CorpBanca in a way that provides for diverse alternatives of placements in order to manage efficiently its outstanding indebtedness. Under the local bond program, in 2010, we issued bonds in the Chilean market in the amount of UF18.8 million (Ch$403,364). In addition, on October 29, 2012 and October 31, 2012, we issued subordinated bonds in the local Chilean market in the aggregate amount of UF6.6 million (Ch$149,779 million). In June 2014 we issued Ch$ 1,647,939 million (UF 68,596,643) in senior bonds and Ch$ 895,372 million (UF 37,270,502) in subordinated bonds.

On July 22, 2014, we obtained a syndicated loan facility, for US$490 million, the largest in Chile, in line with our strategy to diversify funding sources, strengthen liquidity and financed commercial activities.

During 2013, CorpBanca deepened its strategic objective of diversifying its sources of funding, in order to strengthen its ability to react to funding liquidity risk events and lower market relevance of institutional investors as a source of funds. In January 16, 2013, CorpBanca issued US$800 million aggregate principal amount of 3.125% Senior Notes. As CorpBanca has been growing at a slower pace than in previous periods in order to enhance business relationship with our clients and improve our profitability, this issuance has allowed us to reduce deposits and at the same time to be less dependent on institutional investors. This strategy allowed the bank to partly offset the temporary increase on our cost of funding during 3Q 2013. In June 2014, we issued UF3.000.000 (Ch$ 74,771 million) in senior local bonds; in line with our goal of asset and liability management and growth.

On September 23th, 2014 CorpBanca placed US$750,000,000 aggregate principal amount of 3.875% Senior Notes in international market, primarily to fund lending activities.

Consolidated Shareholders’ Equity

As of September 30, 2014, according to the SBIF CorpBanca was the fourth largest private bank in Chile, based on equity9 (Ch$ 1,551 billion or US$ 2,595.4 billion as of September 30, 2014). Following a capital increase of 47,000,000,000 common shares during 1Q 2013, we had 340,358,194.2 thousand shares outstanding and a market capitalization of Ch$2,600.3 billion, US$4,350.8 million, (based on a share price of Ch$ 6.847 pesos per share) as of September 30, 2014.

(i) On January 18, 2013, we raised capital in the aggregate amount of Ch$66,751.2 million through the issuance of 10,680,200,621 common shares, including common shares in the form of ADSs, in the United States and elsewhere outside of Chile; (ii) on February 7, 2013, we raised capital in the aggregate amount of Ch$106,361.9 million in connection with the investment by certain investment funds of the International Finance Corporation, or IFC, a member of the World Bank Group, and IFC Asset Management Company to acquire a 5% equity interest in CorpBanca, or the IFC Investment, pursuant to an investment agreement with CorpGroup, Compañía Inmobiliaria y de Inversiones Saga SpA, and CorpGroup Inversiones Bancarias Ltda.; and (iii) on February 14, 2013, we raised capital in the aggregate amount of Ch$120,927.7 million during a pre-emptive rights offering under Chilean law in connection with the authorization by the Board of Directors on November 27, 2012 to issue 47,000,000,000 common shares.

| Press Release November 12, 2014 Page 14 / 23 | |

The acquisition of Helm Bank in Colombia resulted in an equity revaluation, reflected in an 8.2% increase in the equity base during the third quarter 2013.

IV) Ownership structure and share performance

Ownership structure

As of September 30, 2014, CorpBanca was controlled by Corp Group Banking S.A. and other companies related to Mr. Alvaro Saieh and his family:

| Stock Holder | % of Total Share Capital |

| Corp Group Banking S.A. | 43.73% |

| Cía. Inmob. y de Inversiones Saga SpA(1) | 6.15% |

| Cía. de Seguros CorpVida S.A. | - |

| Cía. de Seguros CorpSeguros S.A. | - |

| Others investment companies | - |

| Total Saieh Group | 49.88% |

| IFC | 5.00% |

| Sierra Nevada Investment Chile Dos Ltda. (Santo Domingo Group) | 2.88% |

| Others | 42.24% |

| ADRs holders and Foreign investors | 20.89% |

| AFPs (Administradoras de Fondos de Pensiones) | 0.77% |

| Securities Brokerage | 7.76% |

| Insurance Companies(2) | 2.66% |

| Other minority shareholders(3) | 10.16% |

| . | |

| Total | 100.00% |

| (1) Includes 926,513,842 shares owned by Saga that are under custody. |

| (2) Since November 2013, includes CorpVida and CorpSeguros (1.43%) which are no longer controlled by the Saieh Group. |

| (3) Includes Moneda’s funds with a total of 3.42% ownership. |

| Press Release November 12, 2014 Page 15 / 23 | |

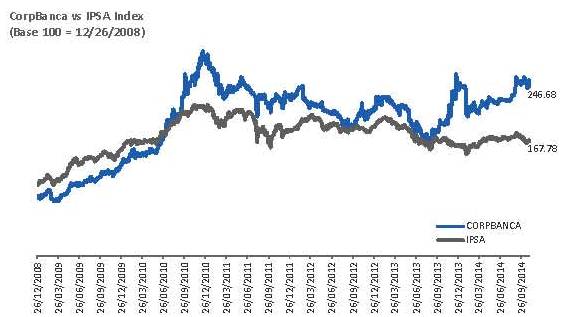

ADR price evolution and local share price evolution

| ADR Price | |

| As of 09/30/2014 | US$19.22 |

| Maximum (LTM) | US21.15 |

| Minimum (LTM) | US$15.82 |

| Local Share Price | |

| 09/30/2014 | Ch$7.640 |

| Maximum (LTM) | Ch$7.71 |

| Minimum (LTM) | Ch$5.45 |

| Press Release November 12, 2014 Page 16 / 23 | |

| Market capitalization | US$ 4,350.8million |

| P/E (LTM) | 12.13 |

| P/BV (09/30/2013) | 1.36 |

| Dividend yield* | 4.1% |

| * Based on closing price on the day the dividend payment was announced. |

Dividends

The following table shows dividends per share distributed during the past five years:

| Charged to Fiscal Year | Year paid | Net Income (Ch$mn) | % Distributed | Distributed Income (Ch$mn) | Pesos per Share (Ch$ of each year) |

| 2008 | 2009 | 56,310 | 100% | 56,310 | 0.2545258600 |

| 2009 | 2010 | 85,109 | 100% | 85,109 | 0.3750821300 |

| 2010 | 2011 | 119,043 | 100% | 119,043 | 0.5246280300 |

| 2011 | 2012 | 122,849 | 100% | 122,849 | 0.4906940357 |

| 2012 | 2013 | 120,080 | 50% | 60,040 | 0.1764023878 |

| 2013 | 2014 | 155,093 | 57% | 88,403 | 0.2597360038 |

CorpBanca paid its annual dividend of Ch$0.2597360038/share in Chile on March, 13, 2014, equivalent to a payout ratio of 57% and to a dividend yield of 4.1%, as well as an increase of 47.2% compared to the dividend paid in 2013.

| Press Release November 12, 2014 Page 17 / 23 | |

V) Credit risk ratings

International credit risk ratings

On a global scale, CorpBanca is rated by two world-wide recognized agencies: Moody´s Investors Service and Standard & Poor´s Ratings Services (S&P).

On June 13, 2014, Moody´s Investors Service affirmed its rating review for ‘possible upgrade’, on the long and short term ratings of CorpBanca. On placing the ratings of CorpBanca on ‘review for upgrade’, Moody’s noted the benefits a change of control with respect to the merged bank could have on CorpBanca’s funding flexibility, margins, and capital.

| Moody´s | Rating |

| Long-term foreign currency deposits | Baa3 |

| Short-term fforeign currency deposits | Prime-3 |

| Bank financial strength | D+ |

| Outlook | Review for upgrade |

On August 29, 2014, Standard & Poor´s Ratings Services affirmed the ratings on CorpBanca and the ‘Watch Developing’ as consequence of the merger agreement with Itaú Chile. The creditwatch developing listing reflected the potential impact of the merger on the ratings of CorpBanca and S&P’s assessment of Itaú- CorpBanca’s capital, business position, funding and liquidity, and the nature and strength of external support (either from government or group support) that this new entity may receive.

| Standard & Poor´s | Rating |

| Long-term issuer credit rating | BBB |

| Short-term issuer credit rating | A-2 |

| CreditWatch | Developing |

Local Credit risk ratings

On a national scale, CorpBanca is rated by Feller Rate, International Credit Rating Chile (ICR) and Humphreys.

On May 30 2014, Feller Rate affirmed the ratings on CorpBanca following the announcement of the merger agreement with Itaú Chile. The outlook was confirmed as ‘Stable’, reflecting Feller Rate’s assessment that both banks will be successful in the integration process and that the new bank will benefit from (i) a strengthen competitive position, both local and regional, and (ii) significant synergies in the medium term.

| Feller Rate | Rating |

| Long-term issuer credit rating | AA |

| Senior unsecured bonds | AA |

| Subordinated bonds | AA- |

| Short-term issuer credit rating | Nivel 1+ |

| Shares | 1ª Clase Nivel 1 |

| Outlook | Stable |

On May 30, 2014, ICR affirmed CorpBanca’s ‘AA’ ratings on long term debt, ‘AA-’ rating on subordinated debt, ‘Nivel 1+’ on short term deposits and ‘Primera Clase Nivel 1’ rating on shares, and its ‘Developing’ outlook ,

| Press Release November 12, 2014 Page 18 / 23 | |

reflecting that fact that the merger between CorpBanca and Itaú Chile is still subject to regulatory and shareholders’ approval.

| ICR | Rating |

| Long-term issuer credit rating | AA |

| Senior unsecured bonds | AA |

| Subordinated bonds | AA- |

| Short-term issuer credit rating | Nivel 1+ |

| Shares | 1ª Clase Nivel 1 |

| Outlook | Developing |

On July 30, 2014, Humphreys upgraded CorpBanca’s ratings from ‘AA-’ to ‘AA’ on long term deposit and senior unsecured debt, affirmed CorpBanca’s ‘Nivel 1+’ ratings on short term deposit and upgraded CorpBanca’s rating from ‘A+’ to ‘AA-’ ratings on long term subordinated debt. At the same time, Humphreys changed its outlook to ‘Stable’ from ‘Positive’.

| Humphreys | Rating |

| Long-term issuer credit rating | AA |

| Senior unsecured bonds | AA |

| Subordinated bonds | AA- |

| Short-term issuer credit rating | Nivel 1+ |

| Shares | 1ª Clase Nivel 1 |

| Outlook | Stable |

| Press Release November 12, 2014 Page 19 / 23 | |

VI) Quarterly Consolidated Income Statements (unaudited)

| For the three months ended | Change (%) | |||||||

| Sep-14 | Sep-14 | Jun-14 | Sep-13 | Sep-14/Sep-13 | Sep-14/Jun-14 | |||

US$ thousands | Ch$ millions | |||||||

| Interest income | 515,748 | 308,242 | 347,260 | 296,216 | 4.1% | -11.2% | ||

| Interest expense | (261,326) | (156,184) | (184,299) | (157,910) | -1.1% | -15.3% | ||

| Net interest income | 254,422 | 152,058 | 162,961 | 138,306 | 9.9% | -6.7% | ||

| Fee and commission income | 89,876 | 53,715 | 54,293 | 38,522 | 39.4% | -1.1% | ||

| Fee and commission expense | (18,477) | (11,043) | (9,339) | (7,475) | 47.7% | 18.2% | ||

| Net fee and commission income | 71,398 | 42,672 | 44,954 | 31,047 | 37.4% | -5.1% | ||

| Net income from financial operations | 109,054 | 65,177 | 50,697 | 9,619 | 577.6% | 28.6% | ||

| Foreign exchange profit (loss), net | (10,118) | (6,047) | (13,588) | (2,468) | 145.0% | -55.5% | ||

| Total financial transactions, net | 98,936 | 59,130 | 37,109 | 7,151 | 726.9% | 59.3% | ||

| Other operating income | (4,616) | (2,759) | 112 | (1,649) | 67.3% | - | ||

| Net operating profit before loan losses | 420,140 | 251,101 | 245,136 | 174,855 | 43.6% | 2.4% | ||

Provision for loan losses (1) | (42,855) | (25,613) | (33,602) | (34,894) | -26.6% | -23.8% | ||

| Net operating profit | 394,432 | 235,736 | 214,838 | 145,379 | 62.2% | 9.7% | ||

| Personnel salaries and expenses | (94,478) | (56,466) | (56,359) | (46,600) | 21.2% | 0.2% | ||

| Administrative expenses | (97,929) | (58,528) | (49,894) | (37,098) | 57.8% | 17.3% | ||

| Depreciation and amortization | (23,574) | (14,089) | (13,572) | (11,145) | 26.4% | 3.8% | ||

| Impairment | - | - | - | - | - | - | ||

| Operating expenses | (215,981) | (129,083) | (119,825) | (94,843) | 36.1% | 7.7% | ||

| Total operating expenses | (233,128) | (139,331) | (123,129) | (100,261) | 39.0% | 13.2% | ||

| Operating income | 161,304 | 96,405 | 91,709 | 45,118 | 113.7% | 5.1% | ||

| Income from investments in other companies | 646 | 386 | 781 | (1) | - | -50.6% | ||

| Income before taxes | 161,950 | 96,791 | 92,490 | 45,117 | 114.5% | 4.7% | ||

| Income tax expense | (51,896) | (31,016) | (19,419) | (10,987) | 182.3% | 59.7% | ||

| Net income from ordinary activities | 110,054 | 65,775 | 73,071 | 34,130 | 92.7% | -10.0% | ||

| Net income from discontinued operations | - | - | - | - | - | - | ||

| Net income attributable to: | ||||||||

| Minority interest | (18,621) | (11,129) | (7,815) | (5,976) | 86.2% | 42.4% | ||

| Net income attributable to shareholders | 91,433 | 54,646 | 65,256 | 28,154 | 94.1% | -16.3% | ||

(1) Includes Provision for Contingent loans and net of loan loss recoveries.

| Press Release November 12, 2014 Page 20 / 23 | |

VII) Consolidated Balance Sheet (unaudited)

| As of the three months ended | Change (%) | |||||||

| Sep-14 | Sep-14 | Jun-14 | Sep-13 | Sep-14/Sep-13 | Sep-14/Jun-14 | |||

| US$ thousands | Ch$ millions | |||||||

| Assets | ||||||||

| Cash and deposits in banks | 1,787,317 | 1,068,208 | 1,006,475 | 720,953 | 48.2% | 6.1% | ||

| Unsettled transactions | 981,543 | 586,629 | 356,744 | 262,876 | 123.2% | 64.4% | ||

| Trading investments | 406,474 | 242,933 | 497,366 | 456,334 | -46.8% | -51.2% | ||

| Available-for-sale investments | 1,498,334 | 895,494 | 627,449 | 664,823 | 34.7% | 42.7% | ||

| Held-to-maturity investments | 386,144 | 230,783 | 258,069 | 205,790 | 12.1% | -10.6% | ||

| Investments under resale agreements | 445,633 | 266,337 | 198,415 | 163,676 | 62.7% | 34.2% | ||

| Financial derivatives contracts | 1,177,631 | 703,823 | 581,755 | 321,248 | 119.1% | 21.0% | ||

| Interbank loans, net | 1,266,133 | 756,717 | 505,480 | 668,576 | 13.2% | 49.7% | ||

| Loans and accounts receivable from customers | 24,575,290 | 14,687,668 | 14,602,491 | 12,950,630 | 13.4% | 0.6% | ||

| Loan loss allowances | -556,887 | -332,829 | (329,084) | -304,048 | 9.5% | 1.1% | ||

| Loans and accounts receivable from customers, net of loan loss allowances | 24,018,405 | 14,354,840 | 14,273,408 | 12,646,583 | 13.5% | 0.6% | ||

| Investments in other companies | 28,886 | 17,264 | 16,170 | 12,551 | 37.6% | 6.8% | ||

| Intangible assets | 1,482,826 | 886,226 | 887,645 | 864,608 | 2.5% | -0.2% | ||

| Property, plant and equipment | 167,908 | 100,352 | 100,366 | 94,547 | 6.1% | 0.0% | ||

| Current taxes | 0 | 0 | - | 0 | - | - | ||

| Deferred taxes | 164,149 | 98,105 | 94,124 | 65,946 | 48.8% | 4.2% | ||

| Other assets | 689,780 | 412,254 | 275,886 | 227,254 | 81.4% | 49.4% | ||

| Total Assets | 34,501,161 | 20,619,964 | 19,679,351 | 17,375,764 | 18.7% | 4.8% | ||

| Liabilities | ||||||||

| Deposits and other demand liabilities | 7,068,701 | 4,224,680 | 4,170,880 | 3,302,652 | 27.9% | 1.3% | ||

| Unsettled transactions | 948,337 | 566,783 | 328,697 | 217,760 | 160.3% | 72.4% | ||

| Investments sold under repurchase agreements | 85,119 | 50,872 | 296,380 | 350,489 | -85.5% | -82.8% | ||

| Time deposits and other time liabilities | 13,414,567 | 8,017,350 | 7,897,235 | 7,335,835 | 9.3% | 1.5% | ||

| Financial derivatives contracts | 1,025,481 | 612,889 | 454,086 | 224,615 | 172.9% | 35.0% | ||

| Interbank borrowings | 2,459,644 | 1,470,031 | 1,498,473 | 1,262,484 | 16.4% | -1.9% | ||

| Issued debt instruments | 5,186,762 | 3,099,920 | 2,650,881 | 2,448,630 | 26.6% | 16.9% | ||

| Other financial liabilities | 24,308 | 14,528 | 15,220 | 16,243 | -10.6% | -4.5% | ||

| Current taxes | 42,886 | 25,631 | 8,485 | 38,275 | -33.0% | 202.1% | ||

| Deferred taxes | 306,236 | 183,025 | 192,840 | 190,974 | -4.2% | -5.1% | ||

| Provisions | 340,819 | 203,694 | 172,917 | 154,473 | 31.9% | 17.8% | ||

| Other liabilities | 401,344 | 239,867 | 118,569 | 97,419 | 146.2% | 102.3% | ||

| Total Liabilities | 31,304,203 | 18,709,270 | 17,804,663 | 15,639,849 | 19.6% | 5.1% | ||

| Equity | - | - | ||||||

| Capital | 1,307,698 | 781,559 | 781,559 | 781,559 | 0.0% | 0.0% | ||

| Reserves | 862,728 | 515,618 | 515,618 | 515,702 | 0.0% | 0.0% | ||

| Valuation adjustment | 79,043 | 47,241 | 50,963 | -49,000 | - | -7.3% | ||

| Retained Earnings: | - | - | ||||||

| Retained earnings or prior periods | 212,044 | 126,730 | 126,730 | 60,040 | 111.1% | 0.0% | ||

| Income for the period | 267,796 | 160,051 | 105,405 | 100,710 | 58.9% | 51.8% | ||

| Minus: Provision for mandatory dividend | -133,899 | -80,026 | (52,703) | -50,355 | 58.9% | 51.8% | ||

| Attributable to bank shareholders | 2,595,410 | 1,551,173 | 1,527,572 | 1,358,656 | 14.2% | 1.5% | ||

| Non-controlling interest | 601,548 | 359,521 | 347,116 | 377,259 | -4.7% | 3.6% | ||

| Total Equity | 3,196,958 | 1,910,694 | 1,874,688 | 1,735,915 | 10.1% | 1.9% | ||

| Total equity and liabilities | 34,501,161 | 20,619,964 | 19,679,351 | 17,375,764 | 18.7% | 4.8% | ||

| Press Release November 12, 2014 Page 21 / 23 | |

VIII) Quarterly Consolidated Evolution Selected Performance Ratios (unaudited)

| As of and for the three months ended | |||||

| Sep-13 | Dec-13 | Mar-14 | Jun-14 | Sep-14 | |

| Capitalization | |||||

TIER I (Core capital) Ratio(4) | 9.14% | 9.37% | 9.03% | 9.01% | 8.91% |

BIS Ratio(4) | 13.10% | 13.43% | 12.73% | 12.72% | 12.59% |

| Shareholders’ equity / Total assets | 9.99% | 9.82% | 9.19% | 9.53% | 9.27% |

| Shareholders’ equity / Total liabilities | 11.10% | 10.89% | 10.12% | 10.53% | 10.21% |

| Profitability | |||||

Net interest income / Avg. interest-earning assets(1)(2) (NIM) | 4.28% | 4.09% | 4.10% | 4.22% | 3.74% |

Net operating profit before loan losses / Avg. total assets(1) | 4.59% | 5.56% | 4.92% | 5.11% | 4.98% |

Net operating profit before loan losses / Avg. interest-earning assets(1)(2) | 5.58% | 6.72% | 6.15% | 6.44% | 6.17% |

RoAA (before taxes), over Avg. total assets(1) | 1.15% | 2.03% | 1.67% | 1.90% | 1.92% |

RoAA (before taxes), over Avg. interest-earning assets(1)(2) | 1.40% | 2.46% | 2.09% | 2.40% | 2.38% |

RoAE (before taxes)(1)(3) | 13.0% | 23.1% | 19.2% | 21.6% | 22.9% |

RoAA, over Avg. total assets(1) | 0.87% | 1.37% | 1.03% | 1.50% | 1.31% |

RoAA, over Avg. interest-earning assets(1)(2) | 1.06% | 1.66% | 1.29% | 1.89% | 1.62% |

RoAE(1)(3) | 7.62% | 13.08% | 9.49% | 14.63% | 11.97% |

| Efficiency | |||||

Operating expenses / Avg. total assets(1) | 2.42% | 2.71% | 2.43% | 2.46% | 2.56% |

Operating expenses/ Avg. total loans(1) | 3.23% | 3.62% | 3.35% | 3.41% | 3.53% |

| Operating expenses / Operating revenues | 52.6% | 48.7% | 49.4% | 48.2% | 51.4% |

| Market information (period-end) | |||||

| Diluted Earnings per share before taxes (Ch$ per share) | 0.1326 | 0.2604 | 0.2255 | 0.2717 | 0.2844 |

| Diluted Earnings per ADR before taxes (US$ per ADR) | 0.3943 | 0.7421 | 0.6144 | 0.7374 | 0.7137 |

| Diluted Earnings per share (Ch$ per share) | 0.0827 | 0.1598 | 0.1180 | 0.1917 | 0.1606 |

| Diluted Earnings per ADR (US$ per ADR) | 0.2461 | 0.4553 | 0.3213 | 0.5202 | 0.4030 |

Total Shares Outstanding (Thousands)(4) | 340,358,194.2 | 340,358,194.2 | 340,358,194.2 | 340,358,194.2 | 340,358,194.2 |

| Ch$ exchange rate for US$1.0 | 504.22 | 526.41 | 550.62 | 552.81 | 597.66 |

| COP$ exchange rate for Ch$1.0 | 0.2643 | 0.2736 | 0.2798 | 0.2945 | 0.2943 |

| Quarterly UF variation | 1.04% | 0.94% | 1.27% | 1.75% | 0.60% |

Monetary Policy Interest Rate(5) | 5.00% | 4.50% | 4.00% | 4.00% | 3.25% |

(1) Annualized figures when appropriate.

(2) Interest-earning assets: Total loans and financial investments.

(3) Equity: Average equity attributable to shareholders excluding net income and accrual for mandatory dividends.

(4) During the second and first quarters 2012 and 2013, respectively, the bank increased its capital base.

(5) As of the close of the month.

| Press Release November 12, 2014 Page 22 / 23 | |

| As of and for the three months ended | |||||

| Sep-13 | Dec-13 | Mar-14 | Jun-14 | Sep-14 | |

| Asset quality | |||||

| Risk Index (Loan loss allowances / Total loans ) | 2.35% | 2.35% | 2.29% | 2.25% | 2.27% |

Prov. for loan losses / Avg. total loans(1) | 1.19% | 0.78% | 0.92% | 0.96% | 0.70% |

Prov. for loan losses / Avg. total assets(1) | 0.89% | 0.59% | 0.66% | 0.69% | 0.51% |

| Prov. for loan losses / Net operating profit before loans losses | 19.4% | 10.5% | 13.5% | 13.5% | 10.2% |

| Prov. for loan losses / Net income | 102.2% | 42.7% | 64.5% | 46.0% | 38.9% |

PDL / Total loans(2) | 0.52% | 0.47% | 0.46% | 0.46% | 0.46% |

| Coverage PDL´s | 430.7% | 497.5% | 498.4% | 498.4% | 498.4% |

NPL / Total loans(3) | 1.21% | 1.12% | 1.04% | 1.02% | 1.12% |

| Coverage NPL´s | 193.98% | 213.44% | 222.75% | 225.71% | 205.63% |

| Total NPLs | 149.526 | 140.068 | 134.939 | 141.962 | 160.294 |

| NPLs Chile | 89.089 | 93.190 | 90.018 | 92.788 | 102.143 |

| NPLs Colombia | 60.437 | 46.878 | 44.921 | 49.174 | 58.151 |

| Total Loans | 12.356.122 | 12.527.795 | 12.945.075 | 13.917.125 | 14.282.941 |

| Loans Chile | 7.761.942 | 7.696.619 | 7.828.931 | 8.279.361 | 8.297.480 |

| Loans Colombia | 4.594.180 | 4.831.176 | 5.116.145 | 5.637.764 | 5.985.460 |

| NPL/Loans Total | 1,21% | 1,12% | 1,04% | 1,02% | 1,12% |

| NPL/Loans Chile | 1,15% | 1,21% | 1,15% | 1,12% | 1,23% |

| NPL/Loans Colombia | 1,32% | 0,97% | 0,88% | 0,87% | 0,97% |

| LLR Total | 290.052 | 298.958 | 300.581 | 320.420 | 329.610 |

| LLR Chile | 119.814 | 120.822 | 117.513 | 114.622 | 112.624 |

| LLR Colombia | 170.238 | 178.136 | 183.068 | 205.798 | 216.985 |

| Coverage NPL Total | 193,98% | 213,44% | 222,75% | 225,71% | 205,63% |

| Coverage NPL Chile | 134,49% | 129,65% | 130,54% | 123,53% | 110,26% |

| Coverage NPL Colombia | 281,68% | 380,00% | 407,53% | 418,51% | 373,14% |

| Castigos Total (YTD) | 83.168 | 107.558 | 23.537 | 53.056 | 81.838 |

| Castigos Chile (YTD) | 33.968 | 46.685 | 8.908 | 18.526 | 29.602 |

| Castigos Colombia (YTD) | 49.200 | 60.873 | 14.629 | 34.530 | 52.236 |

(1) Annualized figures when appropriate.

(2) PDL: Past due loans; all installments that are more than 90 days overdue.

(3) NPL: Non-performing loans; full balance of loans with one installment 90 days or more overdue.

| Press Release November 12, 2014 Page 23 / 23 | |

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements. Forward-looking information is often, but not always, identified by the use of words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “forecast”, “target”, “project”, “may”, “will”, “should”, “could”, “estimate”, “predict” or similar words suggesting future outcomes or language suggesting an outlook. These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed ItaúChile-CorpBanca’s merger, integration plans and expected synergies, the expected timing of completion of the transaction, anticipated future financial and operating performance and results, including estimates for growth. These statements are based on the current expectations of CorpBanca’s management. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, (1) CorpBanca and Itaú Unibanco may be unable to obtain shareholder approvals required for the merger; (2) CorpBanca and Itaú Unibanco may be unable to obtain regulatory approvals required for the merger, or required regulatory approvals may delay the merger or result in the imposition of conditions that could have a material adverse effect on the combined company or cause CorpBanca and Itaú Unibanco to abandon the merger; (3) conditions to the closing of the merger may not be satisfied; (4) an unsolicited offer of another company to acquire assets or capital stock of Itaú Unibanco or CorpBanca could interfere with the merger; (5) problems may arise in successfully integrating the businesses of CorpBanca and Itaú Unibanco, which may result in the combined company not operating as effectively and efficiently as expected; (6) the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies; (7) the credit ratings of the combined company or its subsidiaries may be different from what CorpBanca and Itaú Unibanco expect; (8) the businesses of CorpBanca and Itaú Unibanco may suffer as a result of uncertainty surrounding the merger; (9) the industry may be subject to future regulatory or legislative actions that could adversely affect CorpBanca and Itaú Unibanco; and (10) CorpBanca and Itaú Unibanco may be adversely affected by other economic, business, and/or competitive factors. Forward-looking statements and information are based on current beliefs as well as assumptions made by and information currently available to CorpBanca’s management. Although management considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks that predictions, forecasts, projections and other forward-looking statements will not be achieved. We caution readers not to place undue reliance on these statements as a number of important factors could cause the actual results to differ materially from the beliefs, plans, objectives, expectations and anticipations, estimates and intentions expressed in such forward-looking statements. Furthermore, the forward-looking statements contained in this press release are made as of the date of this press release and CorpBanca does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

| CONTACT INFORMATION: |

| Eugenio Gigogne |

| CFO, CorpBanca |

| Santiago, Chile |

| Phone: (562) 2660-2555 |

| investorrelations@corpbanca.cl |

| Claudia Labbé |

| Head of Investor Relations, CorpBanca |

| Santiago, Chile |

| Phone: (562) 2660-2699 |

| claudia.labbe@corpbanca.cl |

| Nicolas Bornozis |

| President, Capital Link |

| New York, USA |

| Phone: (212) 661-7566 |

| nbornozis@capitallink.com |