UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| | | | | | | |

| Filed by the Registrant | x | | Filed by a Party other than the Registrant | ¨ |

|

| | |

| Check the appropriate box: |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under § 240.14a-12 |

BORDERFREE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): | | | | | |

| x | | No fee required. | | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | |

| | | (1 | ) | Title of each class of securities to which transaction applies: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (2 | ) | Aggregate number of securities to which transaction applies: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (4 | ) | Proposed maximum aggregate value of transaction: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (5 | ) | Total fee paid: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | |

| ¨ | | Fee paid previously with preliminary materials. | | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | Amount previously paid: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (2 | ) | Form, Schedule or Registration Statement No.: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (3 | ) | Filing party: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | (4 | ) | Date filed: |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

March 20, 2015

Dear Borderfree, Inc. Stockholder:

We are pleased to invite you to attend the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of Borderfree, Inc. (“Borderfree” or the "Company") to be held on Thursday, April 30, 2015 at 8:00 a.m., Eastern Time, at the offices of Goodwin Procter LLP, 620 8th Avenue, New York, NY 10018.

Details regarding the Annual Meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope that you will cast your vote as soon as possible. You may vote over the Internet or in person at the Annual Meeting or, if you received printed proxy materials, by mailing a proxy card or voting by telephone. Please review the instructions on the Notice and on the proxy card regarding your voting options.

Thank you for your ongoing support of and continued interest in Borderfree. We look forward to seeing you at our Annual Meeting.

Sincerely,

/s/Michael A. DeSimone

Michael A. DeSimone

Chief Executive Officer

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the meeting, whether or not you plan to attend the meeting, please vote your shares as promptly as possible over the Internet by following the instructions on the Notice or, if you receive your printed proxy materials in the mail, by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the meeting and save Borderfree the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors, unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your voting decision before the date of the Annual Meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if the record holder of your ordinary shares is a broker, bank or other nominee, and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

BORDERFREE, INC.

292 Madison Avenue

New York, NY 10017

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 30, 2015

Notice is hereby given that the Company will hold its 2015 Annual Meeting of Stockholders (the "Annual Meeting") of Borderfree, Inc. on Thursday, April 30, 2015 at 8:00 a.m., Eastern Time, at the offices of Goodwin Procter LLP, 620 8th Avenue, New York, NY 10018. At the Annual Meeting, stockholders will consider and act upon the following matters:

| |

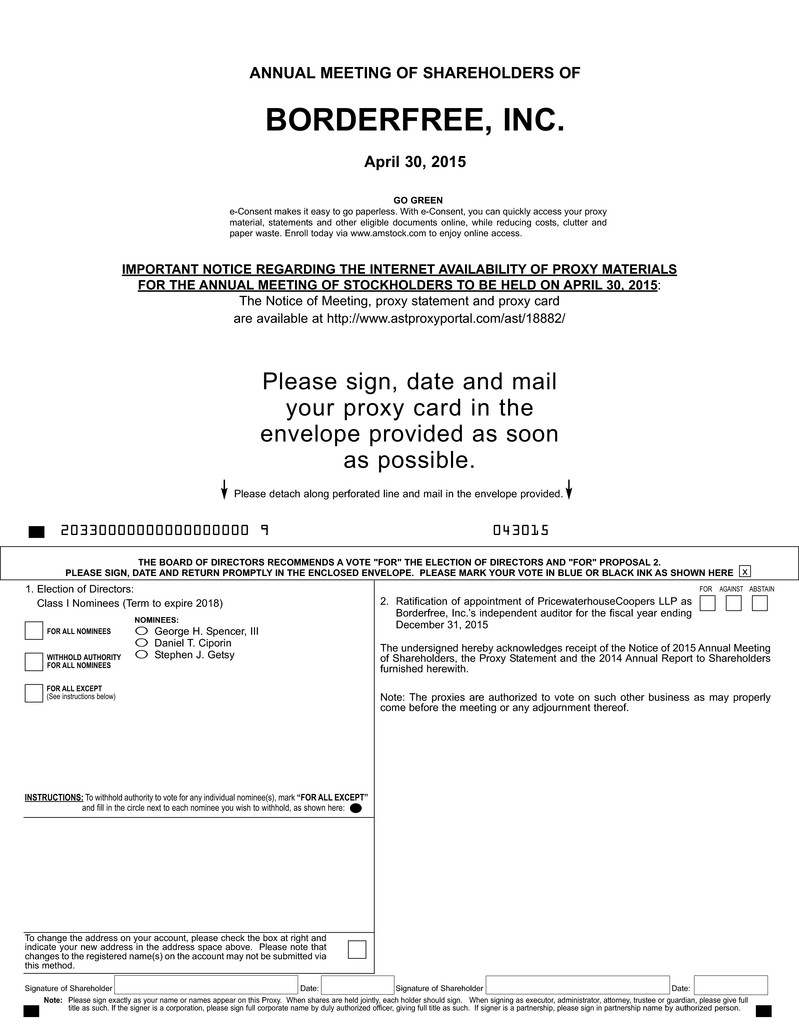

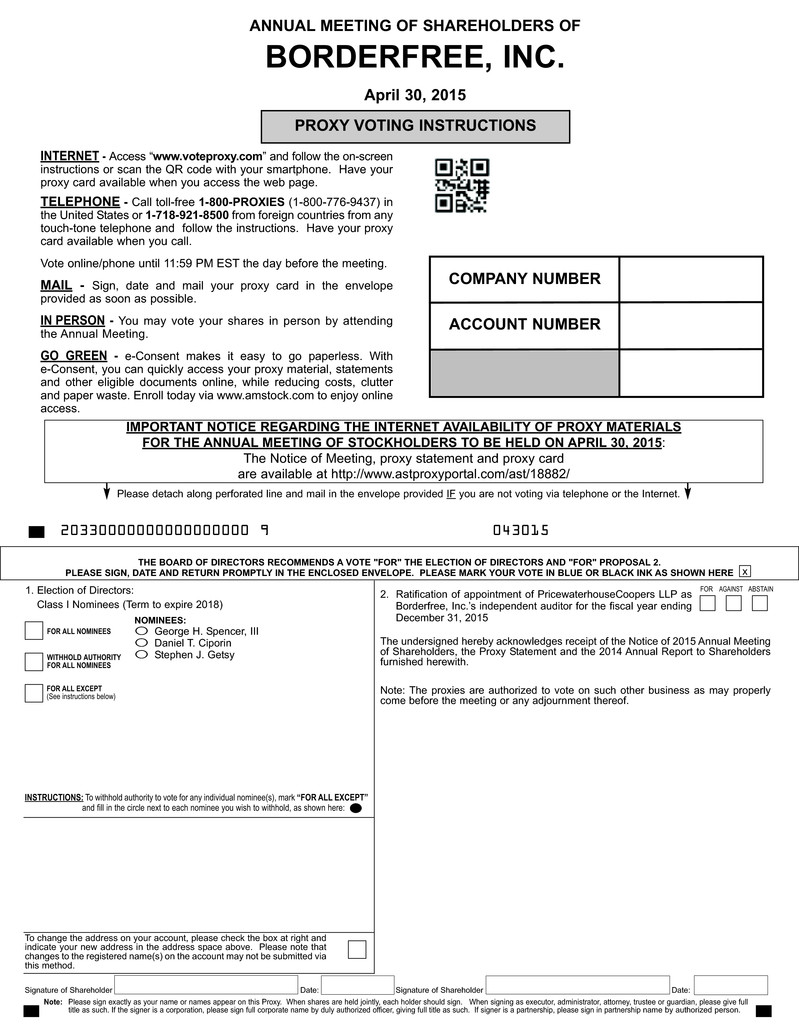

| 1. | To elect three Class I directors, George H. Spencer, III, Daniel T. Ciporin and Stephen J. Getsy, nominated by our board of directors, each to serve for a term ending in 2018, or until his successor has been duly elected and qualified; |

| |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP, an independent registered accounting firm, as our independent auditors for the year ending December 31, 2015; and |

| |

| 3. | To transact such other business as may properly come before the 2015 Annual Meeting or any adjournment or postponement thereof. |

Stockholders of record on our books at the close of business on March 16, 2015, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. If you are a stockholder of record, please vote in one of these three ways:

|

| | | | | | |

Vote over the Internet, by going to the website of our tabulator, American Stock Transfer & Trust Company, LLC, at www.voteproxy.com, and following the instructions for internet voting shown on the enclosed proxy card; |

| | | | | | | |

Vote by Telephone, by calling (800) 776-9437 in the United States or (718) 921-8500 from foreign countries and following the recorded instructions; or |

| | | | | | | |

Vote by Mail, by completing and signing your enclosed proxy card and mailing it in the enclosed postage prepaid envelope. If you vote over the internet or telephone, please do not mail your proxy card. |

If your shares are held in "street name", that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

You may obtain directions to the location of the Annual Meeting by contacting investor relations at (646) 679-5246. Whether or not you plan to attend the Annual Meeting in person, we urge you to take the time to vote your shares.

By Order of the Board of Directors,

/s/Michael A. DeSimone

Michael A. DeSimone

Chief Executive Officer and Director

New York, NY

March 20, 2015

TABLE OF CONTENTS

BORDERFREE, INC.

292 Madison Avenue

New York, NY 10017

PROXY STATEMENT

For the Annual Meeting of Stockholders on April 30, 2015

This proxy statement (this "Proxy Statement") and the accompanying Notice of 2015 Annual Meeting of Stockholders (the "Notice") are being furnished in connection with the solicitation of proxies by our board of directors for use at the 2015 Annual Meeting of Stockholders, to be held on Thursday, April 30, 2015 at 8:00 a.m., Eastern Time, at the offices of Goodwin Procter LLP, 620 8th Avenue, New York, NY 10018, and at any adjournment or postponement thereof.

All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of 2015 Annual Meeting of Stockholders.

We made this Proxy Statement available to stockholders beginning on March 20, 2015.

In this Proxy Statement, the terms “Borderfree,” “the company,” “we,” “us,” and “our” refer to Borderfree, Inc. The mailing address of our principal executive offices is Borderfree, Inc., 292 Madison Avenue, New York, NY 10017.

|

|

| IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS |

| |

| For the 2015 Annual Meeting of Stockholders on April 30, 2015 |

| |

This proxy statement and the 2014 Annual Report to Stockholders are available for viewing, printing and downloading at www.voteproxy.com. |

| |

| A copy of our Annual Report on Form 10-K (including financial statements and schedules) for the year ended December 31, 2014, as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to: |

| Borderfree, Inc. |

| Attn. Investor Relations |

| 292 Madison Avenue |

| New York, NY 10017 |

| Telephone: (646) 679-5246 |

| |

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2014 are also available on the SEC's website, www.sec.gov. |

| |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive these proxy materials?

We are providing these proxy materials to you in connection with the solicitation by our board of directors (our "board"), of proxies to be voted at our 2015 Annual Meeting of Stockholders (the "Annual Meeting"), to be held at the offices of Goodwin Procter LLP, 620 8th Avenue, New York, NY 10018 on Thursday, April 30, 2015 at 8:00 a.m., Eastern Time.

Who can vote at the Annual Meeting?

Our board has fixed March 16, 2015 as the record date for the Annual Meeting. As of such date, there were 32,047,361 shares of common stock outstanding. If you were a stockholder of record on the record date, you are entitled to vote (in person or by proxy) all of the shares that you held on that date at the Annual Meeting and at any postponement or adjournment thereof.

How do I vote?

If your shares are registered directly in your name, you may vote:

| |

| • | Over the Internet: You may vote over the Internet by following the instructions provided in the Notice or, if you receive your proxy materials by U.S. mail, by following the instructions on the proxy card. You must submit your internet proxy before 11:59 p.m., Eastern Time, on April 29, 2015, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| |

| • | By Telephone: If you receive your proxy materials by U.S. mail, you may vote by telephone by following the instructions on the proxy card. You must submit your telephone proxy before 11:59 p.m., Eastern Time, on April 29, 2015, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| |

| • | By Mail: If you receive your proxy materials by U.S. mail, complete and sign the accompanying proxy card and mail it in the enclosed postage prepaid envelope to American Stock Transfer & Trust Company, LLC. American Stock Transfer & Trust Company, LLC, must receive the proxy card not later than April 29, 2015, the day before the Annual Meeting, for your proxy to be valid and your vote to count. Your shares will be voted according to your instructions. |

If you do not specify how you want your shares voted, they will be voted as recommended by our board.

| |

| • | In Person at the Meeting: If you are a stockholder as of the record date, you may vote in person at the meeting. Submitting a proxy will not prevent a stockholder from attending the Annual Meeting, revoking their earlier-submitted proxy, and voting in person. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. |

If your shares are held in "street name," meaning they are held for your account by a broker or other nominee, please follow their instructions.

If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not direct how your shares should be voted on each item, the persons named as proxies will vote for the election of the nominees for director and for the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment, although we have not received timely notice of any other matters that may be properly presented for voting at the Annual Meeting.

Can I change my vote?

If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the Annual Meeting. To do so, you must do one of the following:

| |

| 1. | Vote over the internet or by telephone as instructed above. Only your latest internet or telephone vote is counted. You may not change your vote over the internet or by telephone after 11:59 p.m., Eastern Time, on April 29, 2015. |

| |

| 2. | Sign a new proxy and submit it as instructed above. Only your latest dated proxy, received by American Stock Transfer & Trust Company, LLC, not later than April 29, 2015, will be counted. |

| |

| 3. | Attend the Annual Meeting, request that your proxy be revoked and vote in person as instructed above. Attending the Annual Meeting will not revoke your internet vote, telephone vote or proxy, as the case may be, unless you specifically request it. |

If your shares are held in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also vote in person at the Annual Meeting if you obtain a broker's proxy as described in the answer above.

Will my shares be voted if I do not return my proxy?

If your shares are registered directly in your name, your shares will not be voted if you do not vote over the internet, by telephone, by returning your proxy or by ballot at the Annual Meeting.

If your shares are held in street name, your broker or other nominee may, under certain circumstances, vote your shares if you do not timely return your proxy. Brokers can vote their customers' unvoted shares on discretionary matters but cannot vote such shares on non-discretionary matters. If you do not timely return a proxy to your broker to vote your shares, your broker may, on discretionary matters, either vote your shares or leave your shares unvoted.

The election of directors (Proposal 1) is a non-discretionary matter. The ratification of the appointment of our independent auditors (Proposal 2) is a discretionary matter.

Votes withheld from any nominee, abstentions and “broker nonvotes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum. Shares voting “withheld” have no effect on the election of directors. If your shares are held through a broker, those shares will not be voted in the election of directors unless you affirmatively provide the broker instructions on how to vote. Abstentions have no effect on the ratification of the appointment of our independent auditors for the fiscal year ending December 31, 2015.

We encourage you to provide voting instructions to your broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Annual Meeting according to your instructions.

How many shares must be present to hold the Annual Meeting?

A majority of our outstanding shares of common stock entitled to vote on the record date must be present to hold the Annual Meeting and conduct business. This is called a quorum for purposes of determining whether a quorum exists, and we count as present any shares that are voted over the internet, by telephone, by completing and submitting a proxy or that are represented in person at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares held in street name by banks, brokers or nominees that indicate on their proxies that they do not have authority to vote those shares on Proposal 1. If a quorum is not present, we expect to adjourn the Annual Meeting until we obtain a quorum.

What vote is required to approve each proposal and how are votes counted?

Proposal 1—Election of Three Class I Directors

The three nominees for Class I director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Proposal 1 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal I. Shares held in street name by brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 1 will not be counted as votes FOR or WITHHELD from any nominee and will be treated as "broker non-votes." Broker non-votes will have no effect on the voting on Proposal 1. With respect to Proposal 1, you may:

| |

| • | vote FOR all three nominees; |

| |

| • | vote FOR one nominee and WITHHOLD your vote from the other nominees; |

| |

| • | vote FOR two nominees and WITHHOLD your vote from the other nominee; or |

| |

| • | WITHHOLD your vote from all three nominees. |

Votes that are withheld will not be included in the vote tally for the election of directors and will not affect the results of the vote.

Proposal 2—Ratification of Appointment of Independent Auditors

To approve Proposal 2, stockholders holding a majority of the votes cast on the matter must vote FOR the proposal. Proposal 2 is a discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee may vote your unvoted shares on Proposal 2. If you vote to ABSTAIN on Proposal 2, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. Voting to ABSTAIN will have no effect on the voting on Proposal 2.

Although stockholder approval of our audit committee’s appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2015 is not required, we believe that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the Annual Meeting, our audit committee may reconsider its appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2015.

Are there other matters to be voted on at the Annual Meeting?

We do not know of any matters that may come before the Annual Meeting other than the election of three Class I directors and the ratification of the appointment of our independent auditors. If any other matters are properly presented at the Annual Meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment on the matter.

Where can I find the voting results?

We will announce preliminary results at the Annual Meeting. We will report the final voting results in a Current Report on Form 8-K within four business days following the adjournment of the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

What are the costs of soliciting these proxies?

We will bear the cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may solicit proxies without additional compensation. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy material to beneficial owners. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the proxies.

BOARD OF DIRECTORS AND MANAGEMENT

Information Regarding Directors and Director Nominees

Our certificate of incorporation provides for the classification of our board into three classes, each having as nearly an equal number of directors as possible. The terms of service of the three classes are staggered so that the term of one class expires each year.

Our board currently consists of eight members. Class I consists of George H. Spencer, III, Daniel T. Ciporin and Stephen J. Getsy, each with a term ending in 2015. Class II consists of Ofer Timor and Isaac Hillel, each with a term ending in 2016. Class III consists of Michael A. DeSimone, William G. Bock and Beth M. Pritchard, each with a term ending in 2017.

At each annual meeting of stockholders, directors are elected for a full term of three years to continue or succeed those directors whose terms are expiring. Upon the recommendation of our nominating and corporate governance committee, our board has nominated Messrs. Spencer, Ciporin and Getsy for re-election at the Annual Meeting as Class I directors, each to serve until 2018.

Director Qualifications

The following table and biographical descriptions provide information as of March 1, 2015 relating to each director and director nominee, including his or her age and period of service as a director of our company; his or her committee memberships; his or her business experience during the past five years, including directorships at other public companies; his or her community activities; and the other experience, qualifications, attributes or skills that led our board to conclude he or she should serve as a director of our company.

|

| | | | |

| Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

| Class I Director Nominees to be elected at the 2015 Annual Meeting (terms expiring in 2018) | | | | |

| | | | | |

| George H. Spencer, III | | 51 | | Mr. Spencer has served as a member of our board of directors since December 2003. Mr. Spencer co-founded Seyen Capital in 2006 and has been a managing director since its formation. Mr. Spencer also serves as a senior consultant to Adams Street Partners, LLC, which he co-founded and where he served as a Partner from 1999 to October 2006. Mr. Spencer has served on the boards of directors of several companies, including SPS Commerce (NASDAQ: SPSC), Convio and several other private companies. We believe that Mr. Spencer is qualified to serve as a director based on his experience as a seasoned investor and a current and former director of several companies and his knowledge of the industry in which we operate. |

| Audit Committee | | | |

| Compensation Committee | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| Daniel T. Ciporin | | 57 | | Mr. Ciporin has served as our chairman of our board of directors since April 2010. Since March 2007, Mr. Ciporin has held various roles at Canaan Partners, a venture capital firm, and is most recently a general partner at the firm. From March 2006 to March 2007, Mr. Ciporin served as chairman of the Internet Lab, a U.S.-Israeli incubator for early-stage consumer internet startups. From January 1999 to June 2005, Mr. Ciporin was the former chairman and chief executive officer of Shopping.com, an online comparison shopping website, which eBay acquired in August 2005. From June 1997 to January 1999, Mr. Ciporin served as senior vice president of MasterCard International, where he managed global debit services. We believe that Mr. Ciporin is qualified to serve as a director based on his experience as a seasoned investor and a current and former director of many companies and his knowledge of the industry in which we operate. |

| Chairman of the Board | | | |

| Compensation Committee | | | |

| Nominating and Corporate | | | |

| Governance Committee | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| Stephen J. Getsy | | 70 | | Mr. Getsy has been a member of our board of directors since December 2003. Mr. Getsy serves as chief executive officer of On-Line Ventures, Inc., a private equity investment and development firm, which he founded in November 1993. Mr. Getsy has served on the boards of directors of several public and private companies. Additionally, Mr. Getsy has held technical and senior management positions in the information technology industry with companies such as IBM (NYSE: IBM), ADP (NYSE: ADP) and Fiserv (NASDAQ: FISV). We believe that Mr. Getsy is qualified to serve as a director based on his service on other public company boards and his experience in the industry in which we operate. |

| Audit Committee | | | |

| Nominating and Corporate | | | |

| Governance Committee | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

| Class II Directors (terms expiring in 2016) | | | | |

| | | | | |

| Ofer Timor | | 62 | | Mr. Timor has served as a member of our board of directors since December 2004. Mr. Timor co-founded Inimiti, a venture capital firm, in 2012, and has been a managing partner since its formation. Prior to that, Mr. Timor co-founded Delta Ventures Ltd. in 1999, and has been a managing partner since its formation. Prior to Delta Ventures, Mr. Timor was President of Jacada Ltd. (formerly known as Client/Server Technology Ltd.), a software and services company, from 1994 to 1999. Mr. Timor has served on the boards of directors of several private companies. We believe that Mr. Timor is qualified to serve as a director based on his experience as a seasoned investor and a current and former director of several companies and his knowledge of the industry in which we operate. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| Isaac Hillel | | 56 | | Mr. Hillel has been a member of our board of directors since March 2001. Mr. Hillel has been with Pitango Venture Capital since 2000 and is currently a managing general partner. Prior to joining Pitango, Mr. Hillel served as Executive Vice President at NEC Computers (formerly known as Packard Bell NEC), an electronics and computing solutions company, where he oversaw its computer divisions in Europe, the Middle East and Africa. Mr. Hillel currently serves on the boards of directors of several private companies. We believe that Mr. Hillel is qualified to serve as a director based on his experience as a seasoned investor and a current and former director of many companies and his knowledge of the industry in which we operate. |

| Compensation Committee | | | |

| Nominating and Corporate | | | |

| Governance Committee | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

| Class III Directors (terms expiring in 2017) | | | | |

| | | | | |

| Michael A. DeSimone | | 49 | | Mr. DeSimone has served as our chief executive officer and a member of our board of directors since May 2006. From September 2004 to May 2006, Mr. DeSimone served as our senior vice president of sales and marketing. Prior to joining our company, Mr. DeSimone served as vice president of operations and business solutions for Travelex, a leading independent foreign exchange business. We believe that Mr. DeSimone is qualified to serve as a director based on the perspective and experience he brings as our chief executive officer and his experience as a seasoned executive. |

| Chief Executive Officer | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| William G. Bock | | 64 | | Mr. Bock has been a member of our board of directors since July 2012. Mr. Bock is President of Silicon Laboratories Inc. (NASDAQ: SLAB). He is also a member of the board of directors of Silicon Laboratories Inc., where he previously served as senior vice president and chief financial officer from 2006 to 2011. Mr. Bock is a member of the board of directors of Entropic Communications (NASDAQ: ENTR) where he is a member of its audit committee. Mr. Bock also previously served as chairman of the board of directors of Convio (NASDAQ:CNVO) until its acquisition by Blackbaud in April 2012. Mr. Bock is also a senior advisor to Foros, a financial services firm that provides mergers & acquisitions and corporate financial advisory services. Mr. Bock is also a director and advisor for a number of venture capital backed private technology companies. Mr. Bock co-founded the Entrepreneurs Foundation of Central Texas in 1999 and continues to serve as its chairman. Mr. Bock participated in the venture capital industry from 2001 to 2006, primarily as a general partner with CenterPoint Ventures. Before his venture capital career, Mr. Bock held senior executive positions with three venture-backed companies: Dazel Corporation, where Mr. Bock was president and chief executive officer until it was acquired by Hewlett Packard; Tivoli Systems, where Mr. Bock was executive vice president and chief operating officer, through its initial public offering until it was acquired by IBM; and Convex Computer Corporation, which completed an initial public offering, where Mr. Bock served initially as senior vice president and chief financial officer and subsequently as senior vice president of worldwide sales. Mr. Bock began his career with Texas Instruments. We believe that Mr. Bock is qualified to serve as a director based on his service on other public company boards, broad industry experience, and extensive financial leadership experience. |

| Audit Committee | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| Beth M. Pritchard | | 68 | | Ms. Pritchard has been a member of our board of directors since October 2014. Ms. Pritchard has served as a principal and strategic advisor for Sunrise Beauty Studio, LLC, a developer and manufacturer of personal care and fragrance products, since 2009. Ms. Pritchard also has served as North American Advisor to M.H. Alshaya Co., a diverse franchisee group based in the Middle East, since 2009. From 2006 to 2009, Ms. Pritchard was the President and Chief Executive Officer and subsequent Vice Chairman of Dean & DeLuca, Inc., a retailer of gourmet and specialty foods. Ms. Pritchard was the President and Chief Executive Officer of Organized Living Inc., a retailer of home and office storage and organization products, from 2004 to 2005. From 1991 to 2003, Ms. Pritchard held executive positions with Limited Brands, Inc., the parent company of specialty retailers, serving as President and Chief Executive Officer of Bath & Body Works, Chief Executive Officer of Victoria’s Secret Beauty and Chief Executive Officer of The White Barn Candle Company. Ms. Pritchard currently serves on the board of directors of Vitamin Shoppe, Inc. Ms. Pritchard also serves as a director and member of the compensation committee of Zale Corporation, a director and member of the human resources/compensation committee of Shoppers Drug Mart Corporation and a director and member of the compensation committee and the nominating and corporate governance committee of Cabela’s, Inc. Ms. Pritchard also served as a director of Ecolab Inc. from 2004 to 2010, Borders Group, Inc. from 2000 to 2007, and Albertson’s Inc. from 2004 to 2006. We believe that Ms. Pritchard is qualified to serve as a director due to her extensive experience in the retail industry as the Chief Executive Officer of multi-store retailers and her service on the boards of directors of retailers. |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Corporate Governance Matters and Guidelines

Our board believes that good corporate governance is important to ensure that our company is managed for the long-term benefit of our stockholders. This section describes key corporate governance guidelines and practices that we have adopted. Complete copies of the corporate governance guidelines, committee charters and Code of Business Conduct described below are available on our website at http://investors.borderfree.com/corporate-governance.cfm. Alternatively, you can request a copy of any of these documents by writing us at: Borderfree, Inc., 292 Madison Avenue, New York, NY 10017.

Corporate Governance Guidelines

Our board has adopted corporate governance guidelines to assist it in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. These guidelines should be interpreted in accordance with any requirements imposed by applicable federal or state law or regulation, NASDAQ and our certificate of incorporation and bylaws. These principles, which set forth a framework for the conduct of our board’s business, provide that:

| |

| • | the principal responsibility of the directors is to oversee our management and to hold our management accountable for the pursuit of our corporate objectives; |

| |

| • | a majority of the members of our board shall be independent directors; |

| |

| • | the independent directors meet regularly in executive session; |

| |

| • | directors have full and free access to management and, as necessary and appropriate, independent advisors; |

| |

| • | new directors participate in an orientation program and all directors are encouraged to attend director education programs; and |

| |

| • | at least annually, our board and its committees conduct a self-evaluation to determine whether they are functioning effectively. |

Although these corporate governance guidelines have been approved by the Board, it is expected that these guidelines will evolve over time as customary practice and legal requirements change. In particular, guidelines that encompass legal, regulatory or exchange requirements as they currently exist will be deemed to be modified as and to the extent that such legal, regulatory or exchange requirements are modified. In addition, the guidelines may also be amended by the Board at any time as it deems appropriate.

Board Determination of Independence

Our company's corporate governance guidelines provide that the board shall comprise a majority of directors who, in the business judgment of the board, qualify as independent directors under applicable listing standards of The NASDAQ Stock Market LLC (“NASDAQ”). There are no family relationships among any of our directors or executive officers.

Each director’s relationships with our company (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) that have been identified were reviewed, and only those directors (i) who in the opinion of the board have no relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and (ii) who otherwise meet the requirements of the NASDAQ listing standards are considered independent.

The board has determined that each of Messrs. Spencer, Ciporin, Getsy, Timor, Hillel, Bock and Ms. Pritchard is independent under applicable NASDAQ listing standards for membership on the board. The board has also determined that each of these directors is independent under applicable SEC rules and the NASDAQ listing standards for service on the various committees of the board on which they serve. Mr. DeSimone is not independent as a result of his employment with our company as our chief executive officer. A majority of the members of the Board meets the independence standards of the NASDAQ listing standards.

At least annually, the Board will evaluate all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, the Board will make an annual determination of whether each director is independent within the meaning of NASDAQ’s, the SEC’s, and our applicable committees’ independence standards.

Director Nomination Process

The Board is responsible for selecting its own members. The Board delegates the selection and nomination process to the nominating and corporate governance committee, with the expectation that other members of the Board, and of management, will be requested to take part in the process as appropriate. The process followed by the nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members, management, search firms and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of the nominating and corporate governance committee and the board and through such other methods as the nominating and corporate governance committee deems to be helpful to identify candidates.

Criteria and Diversity

In considering whether to recommend any particular candidate for inclusion in the board’s slate of recommended director nominees, the nominating and corporate governance committee applies the criteria specified in our corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of our business and industry, experience, diligence, conflicts of interest and ability to act in the interests of stockholders. In evaluating proposed director candidates, the nominating and corporate governance committee may consider, in addition to the minimum qualifications and other criteria for Board membership approved by the Board from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence and the needs of the Board. The nominating and corporate governance committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee.

Our board does not have a formal policy with respect to diversity, but our corporate governance guidelines provide that an objective of board composition is to bring to our company a variety of perspectives and skills derived from high quality business and professional experience. Our board recognizes its responsibility to ensure that nominees for our board possess appropriate qualifications and reflect a reasonable diversity of personal and professional experience, skills, backgrounds and perspectives. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our board to promote our strategic objectives and to fulfill its responsibilities to our stockholders.

The director biographies on pages 9 to 11 indicate each director or director nominee’s experience, qualifications, attributes and skills that led the board to conclude that each should continue to serve as a member of our board. Our board believes that each of the directors and director nominees has had substantial achievement in his or her professional and personal pursuits and possesses the background, talents and experience that our board desires and that will contribute to the best interests of our company and to long-term stockholder value.

Stockholder Nominations

Stockholders may recommend individuals to the nominating and corporate governance committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Secretary, Borderfree, Inc., 292 Madison Avenue, New York, NY 10017. The information required for such recommendations to be considered is specified in our by-laws. Assuming that appropriate biographical and background material has been provided on a timely basis, the nominating and corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our by-laws to directly nominate director candidates, without any action or recommendation on the part of the nominating and corporate governance committee or the board, by following the procedures set forth under “Stockholder Proposals for 2016 Annual Meeting.” If the board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement and proxy card for the next annual meeting. Otherwise, candidates nominated by stockholders in accordance with the procedures set forth in our by-laws will not be included in our proxy statement and proxy card for the next annual meeting.

Board Meetings and Attendance

Our board met five times during 2014, either in person or by teleconference, and acted by written consent on two occasions. During 2014, each of our directors attended at least 75% of the board meetings and at least 75% of the meetings of the committees on which he or she then served. Our Board regularly holds executive sessions of the independent directors. Executive sessions do not include employee directors or directors who do not qualify as independent under NASDAQ and SEC rules.

It is our policy that members of our Board are encouraged to attend annual meetings of our stockholders.

Board Leadership Structure

Our corporate governance guidelines provide that the nominating and corporate governance committee shall periodically assess the board’s leadership structure, including whether the offices of chairman of the board and chief executive officer should be separate. Our guidelines provide the board with flexibility to determine whether the two roles should be combined or separated based upon our needs and the board’s assessment of its leadership from time to time. We currently separate the roles of chief executive officer and chairman of the board. Our chief executive officer is responsible for setting the strategic direction for our company and the day to day leadership and performance of our Company, while our chairman of the board presides over meetings of the board, including executive sessions of the board, and performs oversight responsibilities. The board has not appointed a lead independent director. Our board has three standing committees that currently consist of, and are chaired by, independent directors. Our board delegates substantial responsibilities to the committees, which then report their activities and actions back to the full board. We believe that the independent committees of our board and their chairpersons promote effective independent governance. We believe this structure represents an appropriate allocation of roles and responsibilities for our company at this time because it strikes an effective balance between management and independent leadership participation in our board proceedings.

Board Committees

Our board has established three standing committees—the audit committee, the compensation committee and the nominating and corporate governance committee—each of which operates under a charter that has been approved by our board. Current copies of each committee's charter are available on our website at http://investors.borderfree.com/corporate-governance.cfm.

Current committee memberships are set forth in the table below:

|

| | | | | | |

| | | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| | | | | | | |

| Daniel T. Ciporin* | | | | £ | | £ |

| William G. Bock | | m | | | | |

| Michael A. DeSimone** | | | | | | |

| Stephen J. Getsy | | £ | | | | £ |

| Isaac Hillel | | | | £ | | m |

| Beth M. Pritchard | | | | | | |

| George H. Spencer, III | | £ | | m | | |

| Ofer Timor | | | | | | |

|

| |

| * | Chairman of the Board |

| ** | Chief Executive Officer |

| m | Chair |

| £ | Member |

Audit Committee

Our audit committee oversees our corporate accounting and financial reporting process and assists the board of directors in monitoring our financial systems and our legal and regulatory compliance. Our audit committee will also, among other things:

| |

| • | oversee the work of our independent auditors; |

| |

| • | approve the hiring, discharging and compensation of our independent auditors; |

| |

| • | approve engagements of the independent auditors to render any audit or permissible non-audit services; |

| |

| • | review the qualifications and independence of the independent auditors; |

| |

| • | monitor the rotation of partners of the independent auditors on our engagement team as required by law; |

| |

| • | review our consolidated financial statements and review our critical accounting policies and estimates; |

| |

| • | review the adequacy and effectiveness of our internal controls; and |

| |

| • | review and discuss with management and the independent auditors the results of our annual audit and interim consolidated financial statements. |

The members of our audit committee are Messrs. Bock, Spencer and Getsy. Mr. Bock is our audit committee chairman. Our board of directors has concluded that the composition of our audit committee meets the requirements for independence under, and the functioning of our audit committee complies with, the current requirements of SEC rules and regulations, and Mr. Bock is our audit committee financial expert as defined under SEC rules and regulations. The audit committee met ten times during 2014, either in person or by teleconference.

Compensation Committee

Our compensation committee oversees our corporate compensation programs. The compensation committee will also, among other things:

| |

| • | review and approve corporate goals and objectives relevant to compensation of our chief executive officer and other executive officers; |

| |

| • | evaluate the performance of our executive officers in light of established goals and objectives; |

| |

| • | review and recommend compensation of our executive officers based on its evaluations; |

| |

| • | review and recommend compensation of our directors; |

| |

| • | administer the issuance of stock options and other awards under our stock plans; |

| |

| • | evaluate and assess potential and current compensation advisors in accordance with the independence standards in the applicable NASDAQ rules; |

| |

| • | retain and approve the compensation of any compensation advisers; |

| |

| • | review and approve our policies and procedures for the grant of equity based awards; |

| |

| • | prepare the compensation committee report required by SEC rules to be included in our annual proxy statement; and |

| |

| • | review and discuss with management the compensation disclosure required to be included in our annual proxy statement or Annual Report on Form 10-K. |

In reviewing and approving these matters, our compensation committee considers such matters as it deems appropriate, including our financial and operating performance, the alignment of interests of our executive officers and our stockholders and our ability to attract and retain qualified individuals. For executive compensation decisions, our compensation committee typically considers the recommendations of our chief executive officer other than with respect to decisions related to his own compensation.

Our compensation committee has not established any formal policies or guidelines for allocating compensation between current and long-term equity compensation, or between cash and non-cash compensation. In determining the amount and mix of compensation elements and whether each element provides the correct incentives and rewards for performance consistent with our short-term and long-term goals and objectives, our compensation committee relies on its judgment about each individual's performance in a rapidly changing business environment rather than adopting a formulaic approach to compensatory decisions that are too narrowly responsive to short-term changes in business performance. In making determinations about performance, our compensation committee does not solely rely on formal goals or metrics, but rather takes into account input from appropriate members of management with respect to an individual's performance, as well as its own observations.

Our compensation committee has the authority under its charter to engage the services of a consulting firm or other outside advisor to assist it in designing our compensation programs and in making compensation decisions. Since 2013, our compensation committee has engaged Compensia, Inc. to review our compensation plans and procedures to provide additional information about comparative compensation offered by peer companies, market survey information and information about trends in executive compensation.

The members of our compensation committee are Messrs. Spencer, Ciporin and Hillel. Mr. Spencer is the chairman of our compensation committee. Our board of directors has determined that each of Messrs. Spencer, Ciporin and Hillel are “independent” for compensation committee purposes as that term is defined under the applicable rules. The compensation committee met two times during 2014, either in person or by teleconference, and acted by written consent on five occasions.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee oversees and assists our board of directors in reviewing and recommending corporate governance policies and nominees for election to our board of directors. The nominating and corporate governance committee will also, among other things:

| |

| • | evaluate and make recommendations regarding the organization and governance of the board of directors and its committees; |

| |

| • | assess the performance of members of the board of directors and make recommendations regarding committee and chair assignments; |

| |

| • | establish procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders; |

| |

| • | develop and recommend to the board of directors a set of corporate governance guidelines; |

| |

| • | recommend to the board of directors the persons to be nominated for election as directors and to each of the board's committees; and |

| |

| • | recommend desired qualifications for board of directors membership and conduct searches for potential members of the board of directors. |

The members of our nominating and corporate governance committee are Messrs. Ciporin, Getsy and Hillel. Mr. Hillel is the chairman of our nominating and corporate governance committee. Our board of directors has determined that each member of our nominating and corporate governance committee is independent under the applicable rules of NASDAQ. The nominating and corporate governance committee met once during 2014.

Our board of directors may from time to time establish other committees.

Risk Oversight

Our board administers its risk oversight function directly and through its committees. The audit committee receives regular reports from members of senior management on areas of material risk to the company, including operational, financial, legal, regulatory, strategic and reputational risks. As part of its charter, our audit committee regularly discusses with management our major risk exposures, their potential financial impact on our company and the steps we take to manage them. In addition, our compensation committee assists the board in fulfilling its oversight responsibilities with respect to the management and risks arising from our compensation policies and programs. Our nominating and corporate governance committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers and corporate governance.

Communicating with the Directors

Our board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. The Chairman of the nominating and corporate governance committee, with the assistance of our General Counsel, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the other directors as they consider appropriate.

Under procedures approved by a majority of the independent directors, communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our General Counsel considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters that are duplicative communications.

Stockholders who wish to send communications on any topic to the board should address such communications to: Board of Directors, c/o Secretary, Borderfree, Inc., 292 Madison Avenue, New York, NY 10017.

Additionally, we have established a confidential process for reporting, investigating and resolving employee and other third party concerns related to accounting, auditing and similar matters under the Sarbanes-Oxley Act of 2002. Stockholders may confidentially provide information to one or more of our directors by contacting a representative at our whistleblower hotline who will forward the information to the appropriate director. The whistleblower hotline is operated by an independent, third party service. Within the United States and Canada, the whistleblower hotline can be reached by telephone, toll-free, at (866) 869-5217. There is also an online reporting option: https://www.openboard.info/BRDR/index.cfm.

Standards of Business Conduct

We have adopted a written Code of Business Conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer or persons performing similar functions. We have posted a current copy of the Code of Business Conduct on our website at http://investors.borderfree.com/corporate-governance.cfm. A copy of the Code of Business Conduct and Ethics may also be obtained, free of charge, upon a request directed to: Borderfree, Inc., 292 Madison Avenue, New York, NY 10017, Attention: General Counsel. In addition, we intend to post on our website all disclosures that are required by law or NASDAQ’s listing standards concerning amendments to, or waivers from, any provision of the Code of Business Conduct.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee are Messrs. Ciporin, Hillel and Spencer (Chair). None of the members of the compensation committee was an employee or officer of our company during 2014, a former officer of our company or had any other relationships with us during 2014 that require disclosure under the proxy rules and regulations promulgated by the SEC.

During the last fiscal year, none of our executive officers served as: (1) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our compensation committee; (2) a director of another entity, one of whose executive officers served on our compensation committee; or (3) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Board.

Executive Officers Who Are Not Directors

Certain information regarding our executive officers who are not also directors, as of March 1, 2015, is set forth below.

|

| | | | |

| Name | | Age | | Position |

| | | | | |

| Edwin A. Neumann | | 47 | | Chief Financial Officer |

| Kris Green | | 39 | | Chief Strategy Officer |

| Brian Singh Dhatt | | 38 | | Chief Technology Officer |

| Michael J. Ganci | | 48 | | Executive Vice President, Client Management |

Edwin A. Neumann has served as our chief financial officer since December 2010. Prior to joining our company, from December 2001 to December 2010, Mr. Neumann held several key executive roles at Charming Shoppes, Inc., a multi-brand, multi-channel apparel retailer, and was most recently senior vice president and chief operating officer at Charming Direct, its ecommerce division.

Kris Green has served as our chief strategy officer since January 2012. From January 2009 to January 2012, Mr. Green served as our chief marketing officer. From February 2007 to January 2009, Mr. Green served as a business development and marketing consultant to our company. From August 2001 to January 2007, Mr. Green held key sales, product development and finance roles at Canada Post Borderfree, a cross-border ecommerce company, which our company acquired in March 2012.

Brian Singh Dhatt has served as our chief technology officer since March 2013. Prior to joining our company, from November 2010 to March 2013, Brian served as Vice President of Product and Engineering for Gilt City, an online sales site specializing in localized, lifestyle-themed offers, and a subsidiary of Gilt Groupe, Inc. From May 2012 to March 2013, Mr. Dhatt also served in the same role for Jetsetter, an online sales site that provides members offers on travel experiences, and a subsidiary of Gilt Groupe, Inc. From April 2006 to April 2010, Mr. Dhatt served as the Chief Technology Officer at Sugar, Inc. (currently named POPSUGAR Inc.), a company which specializes in online publishing in the fashion and culture space.

Michael J. Ganci has served as our executive vice president of client management since September 2013. Prior to joining our company, Mr. Ganci spent 19 years at IBM where he held various leadership positions in IBM’s Client Management, Retail Global Services and Distribution Sector Industry Solutions groups. Most recently, Mr. Ganci comes to us from eBay’s Enterprise Group (formerly GSI Commerce) where he held various senior roles in client management and professional services working with over 80 brands and retailers such as Polo Ralph Lauren, Dick’s Sporting Goods, Toys R Us, Petsmart, Zales, Radio Shack, BBW and Fifth & Pacific.

Report of the Audit Committee of the Board of Directors

The information contained in this audit committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that we specifically incorporate this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

This report is submitted by the audit committee of the Board. The Audit Committee consists of the three directors whose names appear below. None of the members of the Audit Committee is an officer or employee of our company, and the Board has determined that each member of the audit committee is “independent” for Audit Committee purposes as that term is defined under Rule 10A-3 of the Exchange Act, and the applicable NASDAQ Stock Market rules. Each member of the Audit Committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NASDAQ Stock Market. The Board has designated Mr. Bock as an “audit committee financial expert,” as defined under the applicable rules of the SEC. The Audit Committee operates under a written charter adopted by the Board. The Audit Committee’s general role is to assist the Board in monitoring our financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

The Audit Committee has reviewed our audited financial statements for 2014 and has discussed these financial statements with our management and PricewaterhouseCoopers LLP, our independent registered public accounting firm.

The Audit Committee has also received from, and discussed with, our independent registered public accounting firm various communications that our independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by Public Company Accounting Oversight Board, or PCAOB, Auditing Standard No. 16, Communications with Audit Committees.

Our independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter from the independent auditor required by PCAOB Rule 3526 (Communicating with Audit Committees Concerning Independence), as modified or supplemented, regarding the independent auditor’s independence. The Audit Committee has discussed with our independent registered public accounting firm its independence from us.

Based on its discussions with management and our independent registered public accounting firm, and its review of the representations and information provided by management and our independent registered public accounting firm, the Audit Committee recommended to our Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2014.

By the Audit Committee of the Board of Directors of Borderfree, Inc.

William G. Bock (Chair)

Stephen J. Getsy

George H. Spencer, III

EXECUTIVE AND DIRECTOR COMPENSATION AND RELATED MATTERS

Summary Compensation Table

The following table sets forth information regarding the compensation awarded to, earned by, or paid to each of our named executive officers during the fiscal years ended December 31, 2014 and 2013. As an emerging growth company, we have opted to comply with the executive compensation disclosure rules applicable to "smaller reporting companies" as such term is defined in the rules promulgated under the Securities Exchange Act of 1934, which require compensation disclosure for our chief executive officer and the two most highly compensated executive officers (other than the chief executive officer) who are serving as executive officers at the end of the last completed fiscal year for services rendered to us in all capacities for the years ended December 31, 2014 and 2013. These individuals are named executive officers for 2014 and 2013.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Awards ($)(2) | | Non-Equity Incentive Plan Compensation ($)(3) | | All Other Compensation ($)(4) | | Total ($) |

| | | | | | | | | | | | | | | |

| Michael A. DeSimone | | 2014 | | $ | 400,000 |

| | — |

| | $ | 1,164,430 |

| | $ | 100,000 |

| | $ | 480,115 |

| | $ | 2,144,545 |

|

| Chief Executive Officer (Principal Executive Officer) | | 2013 | | 341,667 |

| | — |

| | 461,301 |

| | 109,375 |

| | 2,550 |

| | 914,893 |

|

| Edwin A. Neumann | | 2014 | | 300,000 |

| | — |

| | 404,796 |

| | 60,000 |

| | 153,988 |

| | 918,784 |

|

| Chief Financial Officer (Principal Financial Officer) | | 2013 | | 298,333 |

| | — |

| | — |

| | 75,000 |

| | 2,550 |

| | 375,883 |

|

| Kris Green (1) | | 2014 | | 284,627 |

| | — |

| | 559,723 |

| | 57,068 |

| | — |

| | 901,418 |

|

| Chief Strategy Officer | | 2013 | | 235,350 |

| | — |

| | — |

| | 70,605 |

| | — |

| | 305,955 |

|

|

| |

| (1) | Mr. Green is paid in Canadian dollars and his compensation has been converted into U.S. dollars using the currency exchange rate as of December 31, 2014 of 1 Canadian dollar to 0.8599 U.S. dollars, and as of December 31, 2013 of 1 Canadian dollar to 0.9414 U.S. dollars. |

| (2) | The amounts reported in the Stock Awards column represent the grant date fair value of the stock options granted to the non-employee directors during 2014, computed in accordance with ASC Topic 718. The Assumptions used in calculating the grant date fair value of the stock options reported in the Stock Awards column are set forth in Note 12 in the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2014. The amounts reported in this column reflect the accounting cost for these stock-based awards, and do not correspond to the actual economic value that may be received by the non-employee directors from the awards. |

| (3) | The amounts reported reflect performance-based payments awarded based on the achievement of certain corporate and individual performance goals under our executive bonus plan. |

| (4) | The amounts reported reflect forgiveness of notes receivable in 2014 of $477,515 for Mr. DeSimone and $151,388 for Mr. Neumann and a discretionary match made by us based on eligible compensation related to the Borderfree, Inc. 401(k) Plan. |

Executive Compensation Arrangements

Historically, our executive compensation program has reflected our growth and development-oriented corporate culture. To date, the compensation of Mr. DeSimone, our chief executive officer, and the other executive officers identified in the Summary Compensation Table above, or the named executive officers, has consisted of a combination of base salary, bonuses and long-term incentive compensation in the form of stock options. Our named executive officers and all salaried employees are also eligible to receive health and welfare benefits. Our chief executive officer, chief financial officer and chief strategy officer have offer letters or employment agreements, which include severance provisions, with us.

Employee Benefits

Our named executive officers are eligible for the same benefits available to our employees generally. These include participation in a tax-qualified 401(k) plan and group health, dental, life and disability insurance plans. The type and extent of benefits offered are intended to be competitive within our industry.

Potential Payments Upon Termination and Change in Control

Our chief executive officer, chief financial officer and chief strategy officer have offer letters or employment agreements, which include severance provisions, with us.

Pension Benefits

We do not offer any defined benefit pension plans.

Nonqualified Deferred Compensation

We do not offer any nonqualified deferred compensation plans.

Outstanding Equity Awards at Fiscal Year-End

The following table summarizes the outstanding equity awards held by each named executive officer as of December 31, 2014:

|

| | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

| | | Number of Securities Underlying Unexercised Options (#) | | | | | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($) |

| | | | | | | | |

| | | | �� | | | | |

| | | | | | | Option Exercise Price ($) | | Option Expiration Date | | |

| Name | | Exercisable | | Unexercisable | | | | |

| | | | | | | | | | | | | |

| Michael A. DeSimone | | 26,160 |

| (1) | 113,360 |

| | $ | 16.00 |

| | 3/20/2024 | | 113,360 |

| | $ | 1,015,706 |

|

| | | 56,358 |

| (2) | 86,019 |

| | 6.71 |

| | 6/10/2023 | | 86,109 |

| | 770,730 |

|

| Edwin A. Neumann | | 9,095 |

| (1) | 39,407 |

| | 16.00 |

| | 3/20/2024 | | 39,407 |

| | 353,087 |

|

| Kris Green | | 12,576 |

| (1) | 54,498 |

| | 16.00 |

| | 3/20/2024 | | 54,498 |

| | 488,302 |

|

| | | 107,255 |

| (3) | — |

| | 0.28 |

| | 12/13/2020 | | — |

| | — |

|

| | | 97,401 |

| (4) | — |

| | 0.28 |

| | 9/11/2018 | | — |

| | — |

|

| | | 119,952 |

| (5) | — |

| | 0.28 |

| | 3/4/2018 | | — |

| | — |

|

| | | 22,306 |

| (6) | — |

| | 0.28 |

| | 7/19/2017 | | — |

| | — |

|

|

| |

| (1) | This stock option vests in equal monthly installments over a four-year period beginning on April 20, 2014 and will become fully vested on March 20, 2018. |

| (2) | This stock option vests in equal monthly installments over a four-year period beginning on June 30, 2013 and will become fully vested on May 31, 2017. |

| (3) | This stock option vests in equal monthly installments over a four-year period beginning on December 13, 2010 and became fully vested on November 13, 2014. |

| (4) | This stock option vested in equal monthly installments over a three-year period beginning on September 11, 2008 and became fully vested on August 11, 2011. |

| (5) | This stock option vested in equal monthly installments over a three-year period beginning on March 4, 2008 and became fully vested on February 4, 2011. |

| (6) | This stock option vested in equal monthly installments over a three-year period beginning on July 19, 2007 and became fully vested on June 19, 2010. |

Compensation Risk Assessment

We believe that although a portion of the compensation provided to our executive officers and other employees is performance-based, our executive compensation program does not encourage excessive or unnecessary risk taking. This is primarily due to the fact that our compensation programs are designed to encourage our executive officers and other employees to remain focused on both short-term and long-term strategic goals, in particular in connection with our pay-for-performance compensation philosophy. As a result, we do not believe that our compensation programs are reasonably likely to have a material adverse effect on us.

Director Compensation

The following table presents the total compensation for each person who served as a non-employee member of our board of directors during 2014. Other than as set forth in the table and described more fully below, we did not pay any compensation, make any equity awards or non-equity awards to, or pay any other compensation to any of the non-employee members of our board of directors in 2014. Mr. DeSimone, who is also our chief executive officer, receives no compensation for his services as a director and, consequently, is not included in this table. The compensation received by Mr. DeSimone as our employee during 2014 is set forth in the section of this proxy statement captioned "Executive and Director Compensation and Related Matters—Summary Compensation Table."

|

| | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)(1) | | All Other Compensation ($) | | Total |

| | | | | | | | | |

| Daniel T. Ciporin | | $ | 38,438 |

| | $ | 149,760 |

| | — |

| | $ | 188,198 |

|

| William G. Bock | | 33,750 |

| | 149,760 |

| | — |

| | 183,510 |

|

| Stephen J. Getsy | | 28,125 |

| | 149,760 |

| | — |

| | 177,885 |

|

| Isaac Hillel | | 29,063 |

| | 149,760 |

| | — |

| | 178,823 |

|

| Beth M. Pritchard | | 7,500 |

| | — |

| | — |

| | 7,500 |

|

| George H. Spencer, III | | 33,750 |

| | 149,760 |

| | — |

| | 183,510 |

|

| Ofer Timor | | 22,500 |

| | 149,760 |

| | — |

| | 172,260 |

|

|

| |

| (1) | The amounts reported in the Stock Awards column represent the grant date fair value of the stock options granted to the non-employee directors during 2014, computed in accordance with ASC Topic 718. The Assumptions used in calculating the grant date fair value of the stock options reported in the Stock Awards column are set forth in Note 12 in the Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2014. The amounts reported in this column reflect the accounting cost for these stock-based awards, and do not correspond to the actual economic value that may be received by the non-employee directors from the awards. |

Our policy has been and will continue to be to reimburse our non-employee directors for their travel, lodging and other reasonable expenses incurred in attending meetings of our board of directors and committees of the board of directors.

Upon election to our board, each of our non-employee directors will be granted an option to purchase $182,500 worth of equity awards (equal to approximately 20,368 shares, based on the December 31, 2014 closing market price of $8.96 per share), subject to monthly vesting over a three-year period from the vesting start date. In addition, each of these directors who has served as a director for at least six months prior to our annual stockholder meeting will be granted, annually, an option to purchase $85,000 worth of equity awards (equal to approximately 9,486 shares, based on the December 31, 2014 closing market price of $8.96 per share), subject to monthly vesting over a one-year period from the vesting start date. The exercise price of the options will be greater than or equal to the fair market value of a share of our common stock at the time of grant. Each of these directors will also annually receive $30,000 for general availability and participation in meetings and conference calls of our board of directors, to be paid quarterly. Additionally, the chairperson of our board will annually receive $15,000, the audit committee chairperson will annually receive $15,000, an audit committee member will annually receive $5,000, the compensation committee chairperson will annually receive $10,000, a compensation committee member will annually receive $3,750, the nominating and corporate governance committee chairperson will annually receive $5,000 and a nominating and corporate governance committee member will annually receive $2,500.

Report of the Compensation Committee

The information contained in this Compensation Committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this Compensation Committee report shall be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that we specifically incorporate this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

Our Compensation Committee has reviewed and discussed the executive and director compensation section of this proxy statement with our management. Based on this review and discussion, the Compensation Committee recommended to our Board that such executive and director compensation section be included in this proxy statement.

By the Compensation Committee of the Board of Directors of Borderfree, Inc.

George H. Spencer, III (Chair)

Daniel T. Ciporin

Isaac Hillel

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS