| | | | |

| | 355 South Grand Avenue Los Angeles, California 90071-1560 Tel: +1.213.485.1234 Fax: +1.213.891.8763 www.lw.com |

| |

| | FIRM / AFFILIATE OFFICES |

| | Abu Dhabi | | Moscow |

| | Barcelona | | Munich |

| | Beijing | | New Jersey |

| | Boston | | New York |

| | Brussels | | Orange County |

| | Chicago | | Paris |

| | Doha | | Riyadh |

| | Dubai | | Rome |

| | Frankfurt | | San Diego |

| | Hamburg | | San Francisco |

| | Hong Kong | | Shanghai |

| | Houston | | Silicon Valley |

| | London | | Singapore |

| | Los Angeles | | Tokyo |

| | Madrid | | Washington, D.C. |

| | Milan | | |

July 11, 2012

VIA EMAIL AND OVERNIGHT COURIER

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

| | |

Attention: | | Michael McTiernan, Assistant Director |

| | Sandra B. Hunter, Staff Attorney |

| | Howard Efron, Staff Accountant |

| | Jessica Barberich, Assistant Chief Accountant |

| |

Re: | | Spirit Realty Capital, Inc. (f/k/a Spirit Finance Corporation) |

| | File No. 333- 177904 – Financial Statements to be Filed in Registration Statement on Form S-11 with Respect to Significant Lessee |

Ladies and Gentlemen:

Spirit Realty Capital, Inc. (“Spirit”) respectfully requests that the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) not object with respect to the financial information of a significant lessee of Spirit to be included by Spirit in Spirit’s above-referenced Registration Statement on Form S-11, which was initially filed with the Commission on November 10, 2011 and subsequently amended on December 22, 2011, February 13, 2012, March 16, 2012, May 8, 2012 and June 8, 2012 (the “Registration Statement”).

Background Information and Facts

As disclosed in the Registration Statement, Spirit leases a significant amount of its real estate assets to ShopKo Stores Operating Co. LLC (“ShopKo”) and leases a lesser, though not an immaterial, amount of real estate assets to Pamida Stores Operating Co. LLC (“Pamida”) under long-term, triple-net leases. On February 7, 2012, a merger became effective between Specialty Retail Shops Holding Corp. (“Specialty Retail”), the parent company of Shopko,

July 11, 2012

Page 2

and Pamida Holding Company, Inc. (“Pamida Holding”), the parent company of Pamida. The merged entity is referred to in this letter as “Shopko/Pamida.” Based on information provided by Specialty Retail, prior to the merger, Specialty Retail and Pamida Holding were both owned by SKO Group Holding, LLC and as such were considered to have common ownership. Thus, Specialty Retail accounted for the merger as a related party asset transfer between entities under common control in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 805 (“ASC 805”),Business Combinations.

As set forth in the Registration Statement, as of March 31, 2012, Shopko/Pamida contributed 30.0% of Spirit’s total annual rent. Shopko/Pamida operates as a multi-department general merchandise retailer and retail health services provider, primarily in mid-size and larger communities in the Midwest, Pacific Northwest, North Central and Western Mountain states. Currently, Spirit leases 181 properties to Shopko/Pamida, 179 of which are leased pursuant to three master leases. Prior to Specialty Retail’s merger with Pamida Holding, Spirit leased 114 properties to Shopko (which would have contributed 26.4% of Spirit’s annual rent as of March 31, 2012) and 67 properties to Pamida (which would have contributed 3.6% of Spirit’s annual rent as of March 31, 2012). The leases relating to the Shopko and Pamida properties are now guaranteed by Specialty Retail.

Consistent with our letter to the staff of the Commission, on October 5, 2011, to which your response dated October 19, 2011, concurred in connection with the financial statements to be filed by Spirit relating to Shopko, Spirit has included the financial statements of Specialty Retail in the Registration Statement.

Specialty Retail is a private company that has a 52/53-week fiscal year that ends on the Saturday closest to January 31st of each year. Under the master lease agreements between Shopko/Pamida and Spirit, Specialty Retail is required to deliver audited financial statements to Spirit within 75 days of its fiscal year end and unaudited interim financial statements within 45 days of each of quarter end.

On June 27, 2012, Specialty Retail delivered to Spirit Specialty Retail’s unaudited condensed consolidated financial statements as of April 28, 2012 and January 28, 2012 and for the 13 weeks ended April 28, 2012 and April 30, 2011 (collectively, the “Interim Financial Statements”). The Interim Financial Statements have been retrospectively revised to reflect the merger (and present Specialty Retail and Pamida Holding on a combined basis). In addition, Specialty Retail had previously delivered to Spirit Specialty Retail’s audited consolidated financial statements as of January 28, 2012 and January 29, 2011 and for each of the years in the three-year period ended January 28, 2012 (the “Year End Financial Statements”). The Year End Financial Statements have not been retrospectively revised to reflect the merger. Specialty Retail’s independent registered public accounting firm, KPMG LLP, has orally confirmed to Spirit that it is prepared to deliver its consent to the inclusion of its report dated April 23, 2012 in the next amendment to the Registration Statement based on the inclusion in the Registration Statement of the Interim Financial Statements and the Year Financial Statements, each in the form described above.

July 11, 2012

Page 3

Spirit respectfully requests that the Staff not object to Spirit’s position that the Year End Financial Statements are not required to be retrospectively revised to reflect the merger in order for the Registration Statement to be declared effective.

Basis for Interpretation and Division’s Non-Objection

The Division of Corporation Finance’s Financial Reporting Manual (“FRM”), Section 13400,Change in the Reporting Entity or a Business Combination Accounted for in a Manner Similar to a Pooling of Interests, states in relevant part that:

“SFAS 154 [ASC 250] requires that a change in the reporting entity or the consummation of a transaction accounted for in a manner similar to a pooling of interests, i.e., a reorganization of entities under common control, be retrospectively applied to the financial statements of all prior periods when the financial statements are issued for a period that includes the date the change in reporting entity or the transaction occurred.”

In addition, ASC 805-50-45-2 and 5 provide that in a reorganization of entities under common control:

“The financial statements of the receiving entity shall report results of operations for the period in which the transfer occurs as though the transfer of net assets or exchange of equity interests had occurred at the beginning of the period. Results of operations for that period will thus comprise those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period.

* * *

Financial statements and financial information presented for prior years also shall be retrospectively adjusted to furnish comparative information. All adjusted financial statements and financial summaries shall indicate clearly that financial data of previously separate entities are combined. However, the comparative information in prior years shall only be adjusted for periods during which the entities were under common control.”

Based on the information in the Interim Financial Statements and the Year End Financial Statements, Spirit understands that both Specialty Retail and Pamida Holding were under common control for all prior comparative periods. If Specialty Retail was a registrant

July 11, 2012

Page 4

subject to the financial reporting requirements of the Securities Act of 1933, as amended (the “Securities Act”), its financial statements would be required to be retrospectively revised for all prior periods when its financial statements were issued for a period that included the merger, i.e., its Interim Financial Statements and Year End Financial Statements would be required to be retrospectively revised when such financial statements were required to be filed in a registration statement under Regulation S-X.

However, Specialty Retail is not a registrant under the Securities Act, and, as a private company, Regulation S-X’s compulsory reporting obligations would generally not apply to it. In the normal course, Specialty Retail would, instead, issue its financial statements on an annual basis and, in this case, as a result of the merger, would retrospectively restate its financial statements for all prior periods when preparing its 2013 fiscal year end financial statements, i.e., when its financial statements were issued by it for the completed year that included the merger. As such, Specialty Retail does not believe it is currently required to retrospectively revise its Year End Financial Statements.

In addition, based on correspondence with Specialty Retail, Spirit understands that, if Specialty Retail were required to retrospectively revise its Year End Financial Statements prior to preparing its 2013 fiscal year end financial statements, it would place a substantial financial burden on Specialty Retail and take significant time. Such a delay would also place a substantial burden on Spirit, effectively preventing it from conducting its initial public offering for an extended period of time.

Request for Relief

In the event the Staff does permit Spirit to proceed on the basis of the foregoing analysis, Spirit respectfully seeks relief on an informal basis pursuant to Rule 3-13 of Regulation S-X, as Spirit believes that its proposed presentation of Specialty Retail’s financial information is consistent with the protection of investors. Spirit respectfully submits that, consistent with FRM Section 2340,Properties Subject to Net Lease, the Interim Financial Statements and Year End Financial Statements provide potential investors sufficient financial information in order to evaluate the risk to Spirit from Specialty Retail’s tenant concentration. First, the Interim Financial Statements, which reflect Specialty Retail’s most recent results, have been retrospectively revised to reflect the merger. Second, Note 15 to Specialty Retail’s Year End Financial Statements provides a pro forma presentation of combined net sales and earnings from operations of the Specialty Retail and Pamida Holding as if the merger had occurred at the beginning of Specialty Retail’s fiscal year ended January 29, 2011. Third, Specialty Retail’s Year End Financial Statements already include the financials of Shopko (which would have contributed 26.4% of Spirit’s annual rent as of March 31, 2012 or 88.0% of Shopko/Pamida’s 30.0% contribution to Spirit’s annual rent as of March 31, 2012) and therefore already substantially reflects the risk to Spirit from Specialty Retail’s tenant concentration. Finally, Spirit has revised the disclosure in the S-11 (supplementally attached as Exhibit A hereto) to discuss the impact of the merger on the risk to Spirit from Specialty Retail’s tenant concentration. The revised disclosure also provides additional analysis to assist investors in comparing the financial data presented across periods.

* * *

July 11, 2012

Page 5

We would be happy to discuss this letter and the information set forth herein at your convenience to assist you in your consideration of this request. Of course, Spirit will also endeavor to provide any additional information that you may request in connection with your consideration of this matter. If you have any questions, please feel free to contact the undersigned at 213-891-8371.

Very truly yours,

/s/ Julian T.H. Kleindorfer

Julian T.H. Kleindorfer

of Latham & Watkins LLP

| cc: | Thomas H. Nolan, Jr., Spirit Realty Capital, Inc. |

Peter M. Mavoides, Spirit Realty Capital, Inc.

Michael A. Bender, Spirit Realty Capital, Inc.

Edward Sonnenschein, Latham & Watkins LLP

Craig E. Chapman, Sidley Austin LLP

James O’Connor, Sidley Austin LLP

Bartholomew A. Sheehan, Sidley Austin LLP

July 11, 2012

Page 6

EXHIBIT A

[Attached]

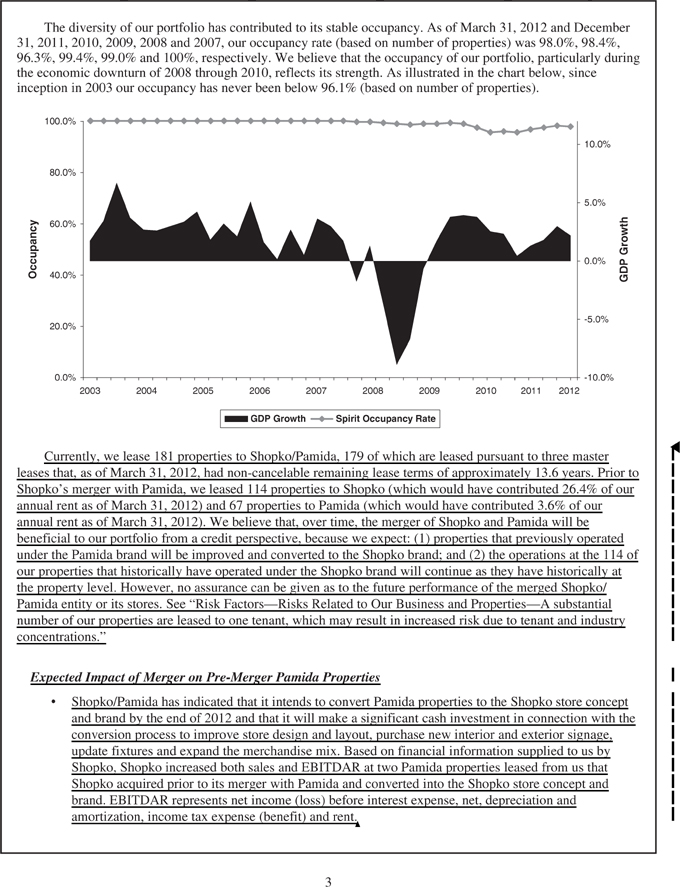

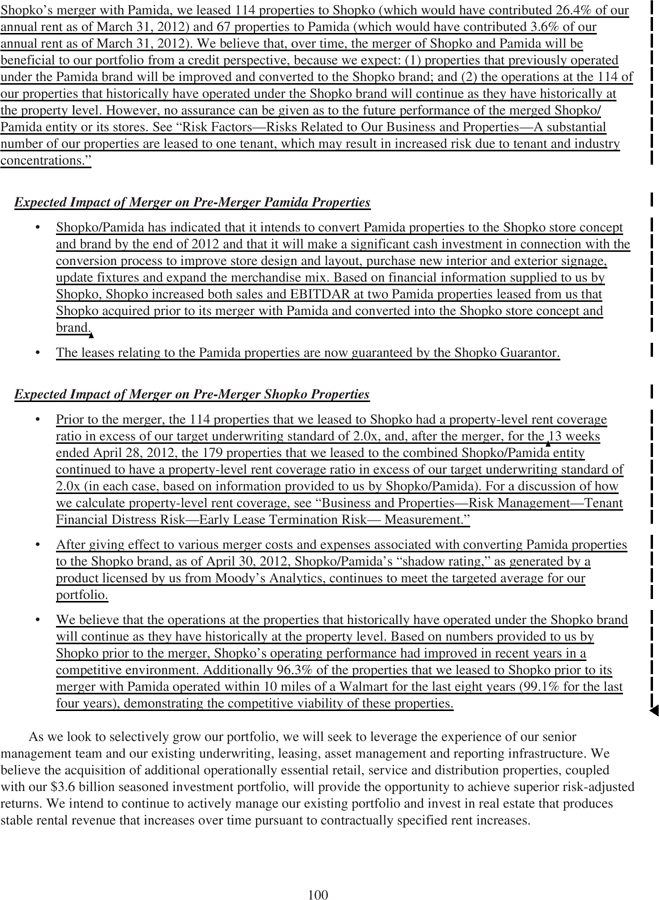

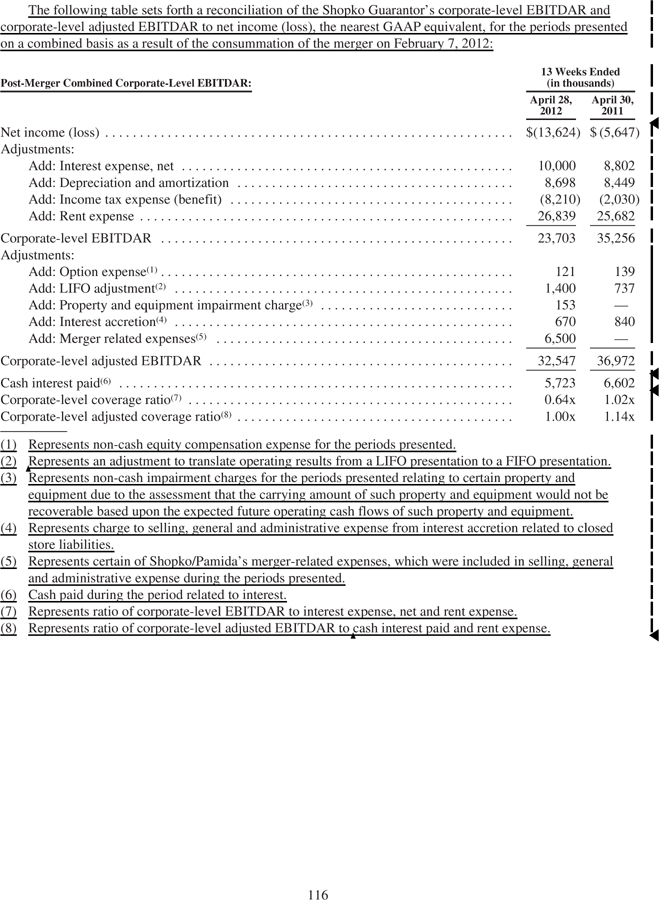

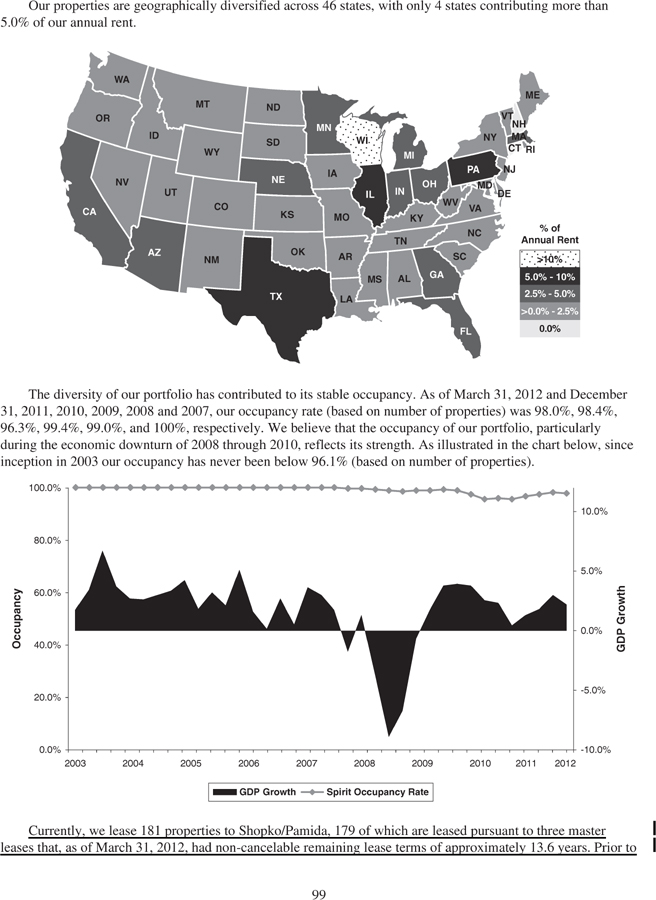

The diversity of our portfolio has contributed to its stable occupancy. As of March 31, 2012 and December 31, 2011, 2010, 2009, 2008 and 2007, our occupancy rate (based on number of properties) was 98.0%, 98.4%, 96.3%, 99.4%, 99.0% and 100%, respectively. We believe that the occupancy of our portfolio, particularly during the economic downturn of 2008 through 2010, reflects its strength. As illustrated in the chart below, since inception in 2003 our occupancy has never been below 96.1% (based on number of properties). Currently, we lease 181 properties to Shopko/Pamida, 179 of which are leased pursuant to three master leases that, as of March 31, 2012, had non-cancelable remaining lease terms of approximately 13.6 years. Prior to Shopko’s merger with Pamida, we leased 114 properties to Shopko (which would have contributed 26.4% of our annual rent as of March 31, 2012) and 67 properties to Pamida (which would have contributed 3.6% of our annual rent as of March 31, 2012). We believe that, over time, the merger of Shopko and Pamida will be beneficial to our portfolio from a credit perspective, because we expect: (1) properties that previously operated under the Pamida brand will be improved and converted to the Shopko brand; and (2) the operations at the 114 of our properties that historically have operated under the Shopko brand will continue as they have historically at the property level. However, no assurance can be given as to the future performance of the merged Shopko/ Pamida entity or its stores. See “Risk Factors—Risks Related to Our Business and Properties—A substantial number of our properties are leased to one tenant, which may result in increased risk due to tenant and industry concentrations.” Expected Impact of Merger on Pre-Merger Pamida Properties • Shopko/Pamida has indicated that it intends to convert Pamida properties to the Shopko store concept and brand by the end of 2012 and that it will make a significant cash investment in connection with the conversion process to improve store design and layout, purchase new interior and exterior signage, update fixtures and expand the merchandise mix. Based on financial information supplied to us by Shopko, Shopko increased both sales and EBITDAR at two Pamida properties leased from us that Shopko acquired prior to its merger with Pamida and converted into the Shopko store concept and brand. EBITDAR represents net income (loss) before interest expense, net, depreciation and amortization, income tax expense (benefit) and rent.

• The leases relating to the Pamida properties are now guaranteed by Specialty Retail Shops Holding Corp., the parent company of Shopko, or the Shopko Guarantor. Expected Impact of Merger on Pre-Merger Shopko Properties • Prior to the merger, the 114 properties that we leased to Shopko had a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x, and, after the merger, for the 13 weeks ended April 28, 2012, the 179 properties that we leased to the combined Shopko/Pamida entity continued to have a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x (in each case, based on information provided to us by Shopko/Pamida). For a discussion of how we calculate property-level rent coverage, see “Business and Properties—Risk Management—Tenant Financial Distress Risk—Early Lease Termination Risk— Measurement.” • After giving effect to various merger costs and expenses associated with converting Pamida properties to the Shopko brand, as of April 30, 2012, Shopko/Pamida’s “shadow rating,” as generated by a product licensed by us from Moody’s Analytics, Inc., or Moody’s Analytics, continues to meet the targeted average for our portfolio. • We believe that the operations at the properties that historically have operated under the Shopko brand will continue as they have historically at the property level. Based on numbers provided to us by Shopko prior to the merger, Shopko’s operating performance had improved in recent years in a competitive environment. Additionally, 96.3% of the properties that we leased to Shopko prior to its merger with Pamida operated within 10 miles of a Walmart for the last eight years (99.1% for the last four years), demonstrating the competitive viability of these properties. As we look to selectively grow our portfolio, we will seek to leverage the experience of our senior management team and our existing underwriting, leasing, asset management and reporting infrastructure. We believe the acquisition of additional operationally essential retail, service and distribution properties, coupled with our $3.6 billion seasoned investment portfolio, will provide the opportunity to achieve superior risk-adjusted returns. We intend to continue to actively manage our existing portfolio and invest in real estate that produces stable rental revenue that increases over time pursuant to contractually specified rent increases. Our History We were formed in 2003 and became a public company in December 2004. We were subsequently taken private by a consortium of private investors in August 2007 in a transaction that was structured and led by an affiliate of Macquarie Capital (USA) Inc., one of the underwriters of this offering, which we refer to as our privatization. Following our privatization, we initially continued to execute our business plan and grow our portfolio. However, during 2008, in response to deteriorating economic conditions, we shifted our focus to reducing our indebtedness and managing our portfolio. From January 1, 2008 to March 31, 2012, we reduced our indebtedness by $628.5 million. The vast majority of the owned properties in our portfolio as of March 31, 2012 were acquired prior to our privatization. We have recently augmented our senior management team through the addition of executives with significant real estate, capital markets and net lease industry experience. Thomas H. Nolan, Jr., our Chief Executive Officer, has been active in the real estate industry for over 25 years, holding numerous leadership positions in private and public real estate companies. Peter M. Mavoides, our President and Chief Operating Officer, has been active in the single-tenant, net lease industry for over 13 years, holding leadership positions for the past 8 years. Under our new leadership, we have begun to pursue acquisition opportunities and have completed approximately $80 million of acquisitions since September 30, 2011. We have elected to be taxed as a REIT for federal income tax purposes commencing with our taxable year ended December 31, 2003. We believe that we have been organized and have operated in a manner that has allowed us to qualify as a REIT for federal income tax purposes commencing with such taxable year, and we intend to continue operating in such a manner.

annual rent as of March 31, 2012). Currently, we lease 181 properties to Shopko/Pamida, 179 of which are leased pursuant to three master leases. Specialty Retail Shops Holding Corp., parent company of Shopko/Pamida, guarantees the Shopko/Pamida leases. Shopko/Pamida’s future financial condition and results of operations will depend, in part, upon the successful integration of Shopko and Pamida, which operated as separate companies prior to their merger in February 2012. Based on Shopko/Pamida’s public statements, it is our understanding that Shopko/Pamida intends to convert Pamida locations to the Shopko store concept and brand. In connection with this conversion, Shopko/Pamida will likely incur additional costs, including costs associated with liquidating Pamida merchandise, restocking Pamida locations and converting Pamida locations to the Shopko brand. We expect that these expenses will reduce the property-level rent coverage ratio and the ratio of corporate-level EBITDAR to net interest and rent expense of the Shopko Guarantor. Though we believe that expenses of the merged Shopko/ Pamida entity will normalize over time, it is also possible that the expected benefits of the Shopko/Pamida merger ultimately will not be realized, will only partially be realized or may take longer to realize than anticipated. If the Shopko/Pamida integration costs more than expected or if expected benefits do not materialize over the intermediate term, Shopko/Pamida’s creditworthiness may deteriorate, and it may seek rent discounts or deferrals from us or default in its lease obligations to us. Because a significant portion of our revenues are derived from rental revenues received from Shopko/ Pamida, defaults, breaches or delay in payment of rent by it may materially and adversely affect us. Effective January 2009, we began deferring collection and recognition of a portion of Shopko’s rent for a two-year period totaling $3.0 million in the aggregate and postponed scheduled contingent rent increases during this time. In September 2010, Shopko repaid, and we recognized, the total accumulated deferred amount ($2.6 million) plus interest before its contractual due dates. As agreed, the scheduled contingent rent increase from Shopko was postponed from its originally scheduled date of June 2009 to June 2011, at which time Shopko began to pay and we began to recognize the increased rent amount. As a result of the significant number of properties leased to Shopko/Pamida, our results of operations and financial condition will be closely tied to the performance of its stores and the retail industry in which it operates. Shopko/Pamida operates as a multi-department general merchandise retailer and retail health services provider primarily in mid-size and larger communities in the Midwest, Pacific Northwest, North Central and Western Mountain states. Shopko/Pamida is subject to the following risks, as well as other risks that we are not currently aware of, that could adversely affect its ability to pay rent to us: • The retail industry in which it operates is highly competitive, which could limit growth opportunities and reduce profitability. Shopko/Pamida competes with other discount retail merchants as well as mass merchants, catalog merchants, internet retailers and other general merchandise, apparel and household merchandise retailers. It faces strong competition from large national discount retailers, such as Walmart, Kmart and Target, and mid-tier merchants such as Kohl’s and JCPenney. • Shopko/Pamida stores are geographically located in a limited number of regions, particularly in the Midwest, Pacific Northwest, North Central and Western Mountain states. Adverse economic conditions in these regions may materially and adversely affect its results of operations, retail sales and ability to make payments to us under the leases. • Fluctuations in quarterly performance and seasonality in retail operations may cause Shopko/Pamida’s results of operations to vary considerably from quarter to quarter and could adversely affect its cash flows. • Shopko/Pamida stores are dependent on the efficient functioning of its distribution networks. Problems that cause delays or interruptions in the distribution networks could materially and adversely affect its results of operations. • Shopko/Pamida stores depend on attracting and retaining quality employees. Many employees are entry level or part-time employees with historically high rates of turnover.

If Shopko/Pamida experiences declines in its business, financial condition or results of operations, it may request discounts or deferrals on the rents it pays to us, seek to terminate its master leases with us or close certain of its stores, all of which could decrease the amount of revenue we receive from it. Decreases in the amount of revenue received from Shopko/Pamida could materially and adversely affect us. The Shopko Guarantor’s audited financial statements for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 have not yet been retrospectively restated to give effect to Shopko’s merger with Pamida, and, when these financial statements are retrospectively restated, it is likely that the financial condition and results of operations of the combined company for such periods will be inferior to those of the Shopko Guarantor on a stand-alone basis as a result of the change in presentation. Prior to their merger on February 7, 2012, Shopko and Pamida were entities under common control, and their merger will be accounted for as a related party asset transfer between entities under common control. As a result, the Shopko Guarantor’s annual financial statements for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 will be retrospectively restated to give effect to Shopko’s merger with Pamida. The Shopko/Pamida Guarantor’s audited financial statements for these fiscal years, which have been provided to us by Shopko and are included in this prospectus, have not yet been retrospectively restated to give effect to Shopko’s merger with Pamida. Shopko/Pamida has advised us that audited financial statements for these fiscal years retrospectively restated to give effect to the Pamida merger have not yet been prepared. However, the Shopko Guarantor’s unaudited interim financial statements for the 13 weeks ended April 28, 2012 and April 30, 2011, which have been provided to us by Shopko/Pamida and are also included in this prospectus, have been retrospectively restated to give effect to Shopko’s merger with Pamida. For the 13 weeks ended April 28, 2012, the Shopko Guarantor’s net loss increased to $13.6 million, as compared to a net loss of $5.6 million for the 13 weeks ended April 30, 2011. For more information about the operating performance and financial condition of the Shopko Guarantor, see the unaudited and audited financial statements of the Shopko Guarantor included in this prospectus. We can provide no information regarding the Shopko Guarantor’s financial condition or results of operations for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 that gives retrospective effect to Shopko’s February 7, 2012 merger with Pamida. When the Shopko Guarantor’s annual financial statements are retrospectively restated to give effect to its merger with Pamida, it is likely that the financial condition and results of operations of the combined company that includes Pamida for such periods will be inferior to those of the Shopko Guarantor on a stand-alone basis. One tenant, operating in the building materials industry, leases a substantial number of our properties that contribute 6.7% of our annual rent and has been adversely affected by the current economic environment, which may result in increased risk of tenant default. Approximately $6.9 million of net annual cash flow, representing $18.4 million (6.7% of our annual rent) less non-cash revenue and non-recourse commercial mortgage-backed security, or CMBS, debt service, was generated by 109 properties that we master lease to 84 Properties, LLC and its affiliates. 84 Properties, LLC and its affiliates, which we collectively refer to as 84 Lumber, are privately held building materials and services suppliers to professional contractors and build-it-yourselfers that operate more than 280 stores, component plants, door shops, installation centers and engineered wood product shops in 33 states. Because a significant portion of our revenues is derived from rental revenues received from 84 Lumber, defaults, breaches or delay in payment of rent by 84 Lumber may materially and adversely affect us.

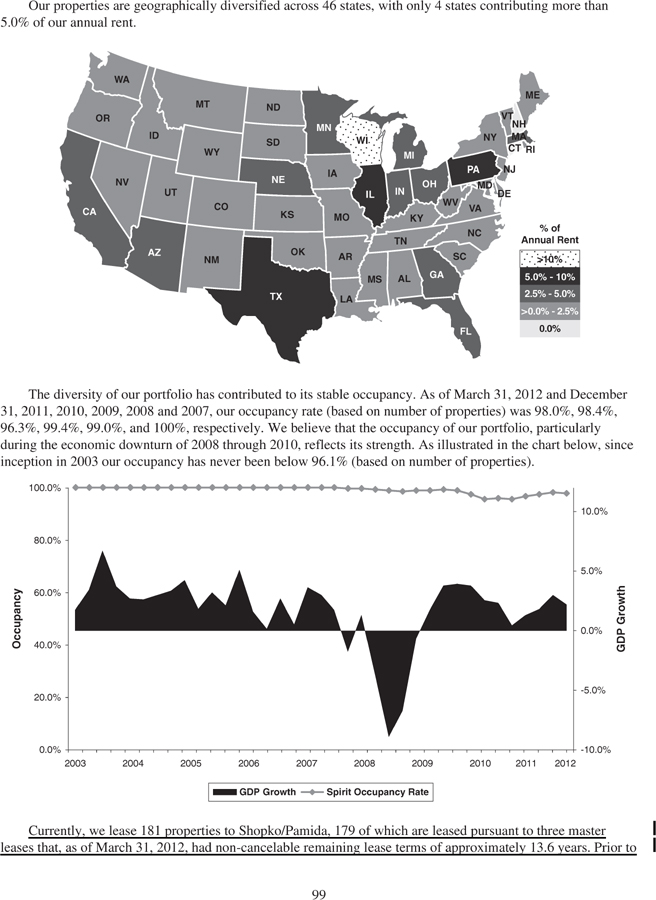

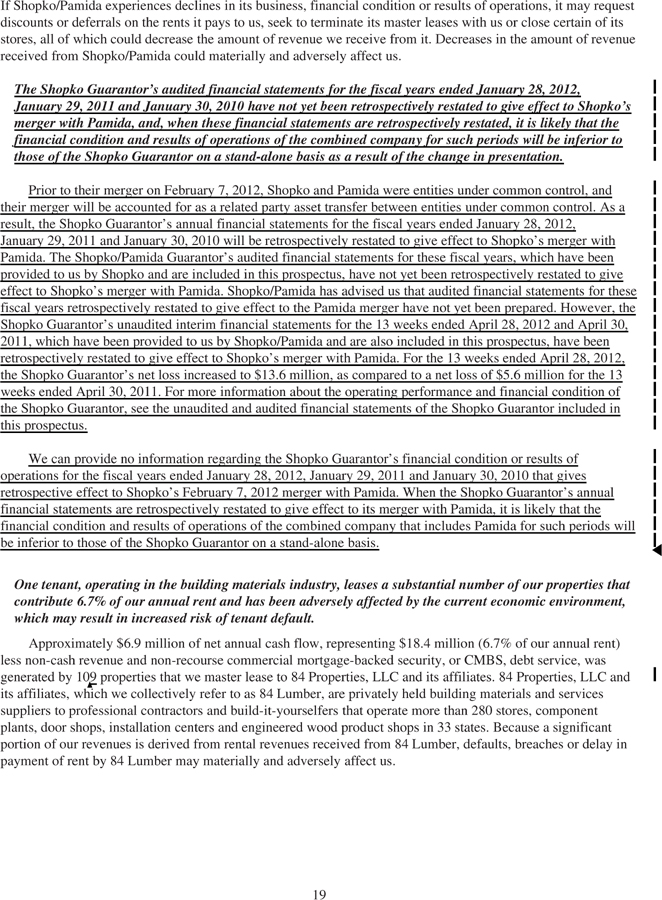

Our properties are geographically diversified across 46 states, with only 4 states contributing more than 5.0% of our annual rent. The diversity of our portfolio has contributed to its stable occupancy. As of March 31, 2012 and December 31, 2011, 2010, 2009, 2008 and 2007, our occupancy rate (based on number of properties) was 98.0%, 98.4%, 96.3%, 99.4%, 99.0%, and 100%, respectively. We believe that the occupancy of our portfolio, particularly during the economic downturn of 2008 through 2010, reflects its strength. As illustrated in the chart below, since inception in 2003 our occupancy has never been below 96.1% (based on number of properties). Currently, we lease 181 properties to Shopko/Pamida, 179 of which are leased pursuant to three master leases that, as of March 31, 2012, had non-cancelable remaining lease terms of approximately 13.6 years. Prior to

Shopko’s merger with Pamida, we leased 114 properties to Shopko (which would have contributed 26.4% of our annual rent as of March 31, 2012) and 67 properties to Pamida (which would have contributed 3.6% of our annual rent as of March 31, 2012). We believe that, over time, the merger of Shopko and Pamida will be beneficial to our portfolio from a credit perspective, because we expect: (1) properties that previously operated under the Pamida brand will be improved and converted to the Shopko brand; and (2) the operations at the 114 of our properties that historically have operated under the Shopko brand will continue as they have historically at the property level. However, no assurance can be given as to the future performance of the merged Shopko/ Pamida entity or its stores. See “Risk Factors—Risks Related to Our Business and Properties—A substantial number of our properties are leased to one tenant, which may result in increased risk due to tenant and industry concentrations.” Expected Impact of Merger on Pre-Merger Pamida Properties • Shopko/Pamida has indicated that it intends to convert Pamida properties to the Shopko store concept and brand by the end of 2012 and that it will make a significant cash investment in connection with the conversion process to improve store design and layout, purchase new interior and exterior signage, update fixtures and expand the merchandise mix. Based on financial information supplied to us by Shopko, Shopko increased both sales and EBITDAR at two Pamida properties leased from us that Shopko acquired prior to its merger with Pamida and converted into the Shopko store concept and brand. • The leases relating to the Pamida properties are now guaranteed by the Shopko Guarantor. Expected Impact of Merger on Pre-Merger Shopko Properties • Prior to the merger, the 114 properties that we leased to Shopko had a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x, and, after the merger, for the 13 weeks ended April 28, 2012, the 179 properties that we leased to the combined Shopko/Pamida entity continued to have a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x (in each case, based on information provided to us by Shopko/Pamida). For a discussion of how we calculate property-level rent coverage, see “Business and Properties—Risk Management—Tenant Financial Distress Risk—Early Lease Termination Risk— Measurement.” • After giving effect to various merger costs and expenses associated with converting Pamida properties to the Shopko brand, as of April 30, 2012, Shopko/Pamida’s “shadow rating,” as generated by a product licensed by us from Moody’s Analytics, continues to meet the targeted average for our portfolio. • We believe that the operations at the properties that historically have operated under the Shopko brand will continue as they have historically at the property level. Based on numbers provided to us by Shopko prior to the merger, Shopko’s operating performance had improved in recent years in a competitive environment. Additionally 96.3% of the properties that we leased to Shopko prior to its merger with Pamida operated within 10 miles of a Walmart for the last eight years (99.1% for the last four years), demonstrating the competitive viability of these properties. As we look to selectively grow our portfolio, we will seek to leverage the experience of our senior management team and our existing underwriting, leasing, asset management and reporting infrastructure. We believe the acquisition of additional operationally essential retail, service and distribution properties, coupled with our $3.6 billion seasoned investment portfolio, will provide the opportunity to achieve superior risk-adjusted returns. We intend to continue to actively manage our existing portfolio and invest in real estate that produces stable rental revenue that increases over time pursuant to contractually specified rent increases.

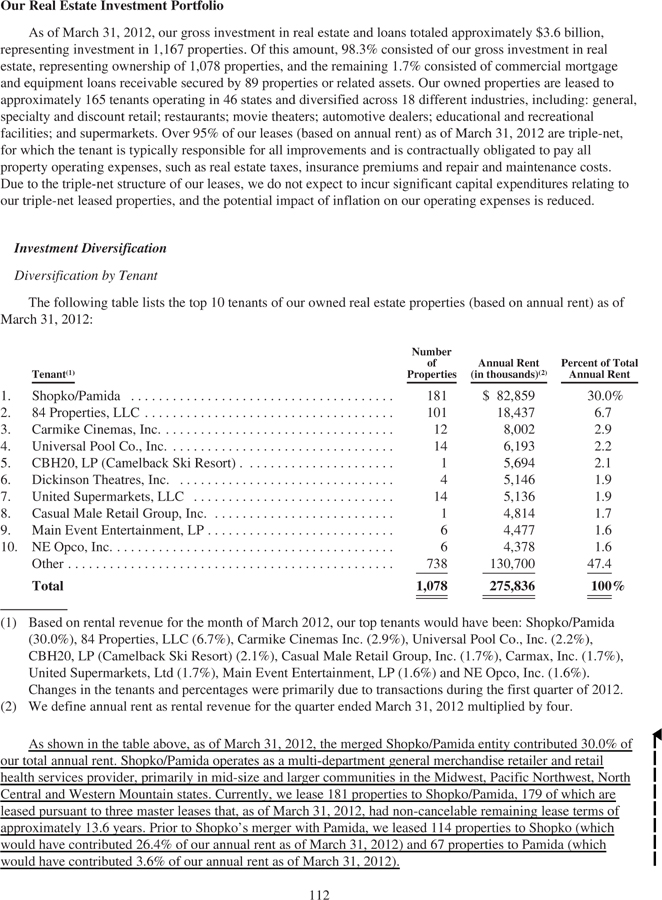

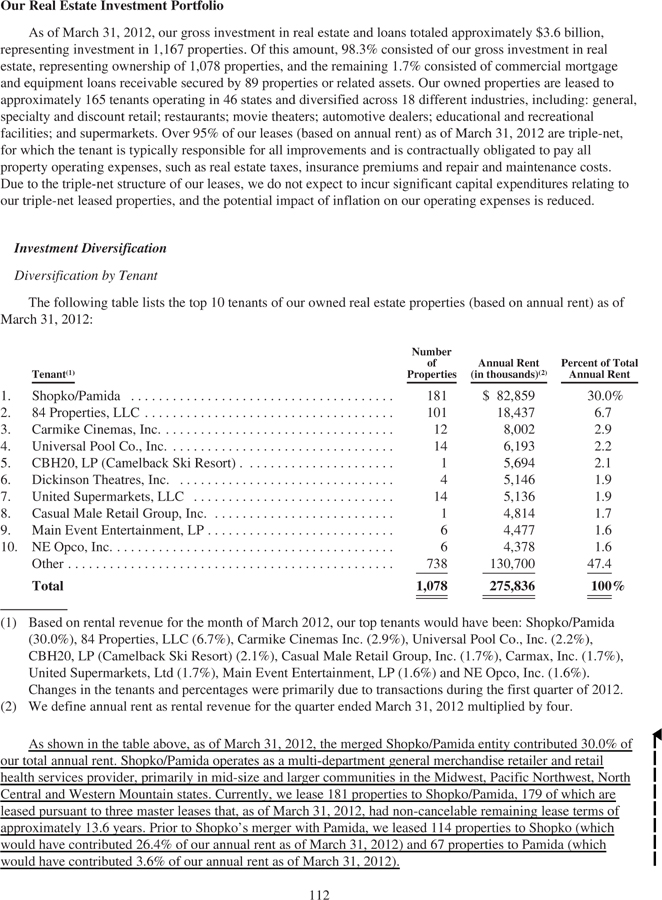

Our Real Estate Investment Portfolio As of March 31, 2012, our gross investment in real estate and loans totaled approximately $3.6 billion, representing investment in 1,167 properties. Of this amount, 98.3% consisted of our gross investment in real estate, representing ownership of 1,078 properties, and the remaining 1.7% consisted of commercial mortgage and equipment loans receivable secured by 89 properties or related assets. Our owned properties are leased to approximately 165 tenants operating in 46 states and diversified across 18 different industries, including: general, specialty and discount retail; restaurants; movie theaters; automotive dealers; educational and recreational facilities; and supermarkets. Over 95% of our leases (based on annual rent) as of March 31, 2012 are triple-net, for which the tenant is typically responsible for all improvements and is contractually obligated to pay all property operating expenses, such as real estate taxes, insurance premiums and repair and maintenance costs. Due to the triple-net structure of our leases, we do not expect to incur significant capital expenditures relating to our triple-net leased properties, and the potential impact of inflation on our operating expenses is reduced. Investment Diversification Diversification by Tenant The following table lists the top 10 tenants of our owned real estate properties (based on annual rent) as of March 31, 2012: Number of Annual Rent Percent of Total Tenant(1) Properties (in thousands)(2) Annual Rent 1. Shopko/Pamida 181 $ 82,859 30.0% 2. 84 Properties, LLC 101 18,437 6.7 3. Carmike Cinemas, Inc 12 8,002 2.9 4. Universal Pool Co., Inc 14 6,193 2.2 5. CBH20, LP (Camelback Ski Resort) 1 5,694 2.1 6. Dickinson Theatres, Inc 4 5,146 1.9 7. United Supermarkets, LLC 14 5,136 1.9 8. Casual Male Retail Group, Inc 1 4,814 1.7 9. Main Event Entertainment, LP 6 4,477 1.6 10. NE Opco, Inc 6 4,378 1.6 Other 738 130,700 47.4 Total 1,078 275,836 100% (1) Based on rental revenue for the month of March 2012, our top tenants would have been: Shopko/Pamida (30.0%), 84 Properties, LLC (6.7%), Carmike Cinemas Inc. (2.9%), Universal Pool Co., Inc. (2.2%), CBH20, LP (Camelback Ski Resort) (2.1%), Casual Male Retail Group, Inc. (1.7%), Carmax, Inc. (1.7%), United Supermarkets, Ltd (1.7%), Main Event Entertainment, LP (1.6%) and NE Opco, Inc. (1.6%). Changes in the tenants and percentages were primarily due to transactions during the first quarter of 2012. (2) We define annual rent as rental revenue for the quarter ended March 31, 2012 multiplied by four. As shown in the table above, as of March 31, 2012, the merged Shopko/Pamida entity contributed 30.0% of our total annual rent. Shopko/Pamida operates as a multi-department general merchandise retailer and retail health services provider, primarily in mid-size and larger communities in the Midwest, Pacific Northwest, North Central and Western Mountain states. Currently, we lease 181 properties to Shopko/Pamida, 179 of which are leased pursuant to three master leases that, as of March 31, 2012, had non-cancelable remaining lease terms of approximately 13.6 years. Prior to Shopko’s merger with Pamida, we leased 114 properties to Shopko (which would have contributed 26.4% of our annual rent as of March 31, 2012) and 67 properties to Pamida (which would have contributed 3.6% of our annual rent as of March 31, 2012).

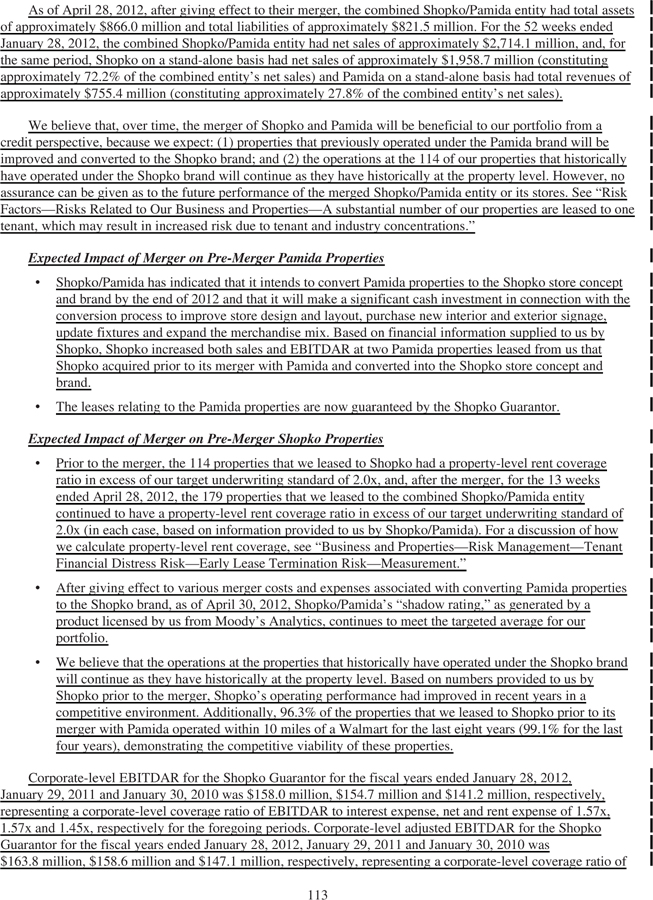

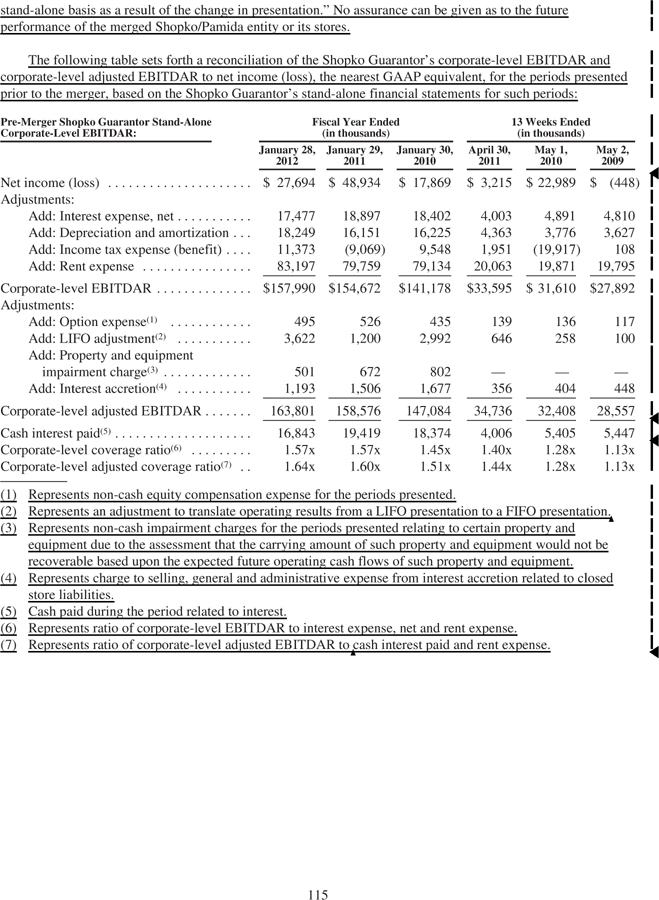

As of April 28, 2012, after giving effect to their merger, the combined Shopko/Pamida entity had total assets of approximately $866.0 million and total liabilities of approximately $821.5 million. For the 52 weeks ended January 28, 2012, the combined Shopko/Pamida entity had net sales of approximately $2,714.1 million, and, for the same period, Shopko on a stand-alone basis had net sales of approximately $1,958.7 million (constituting approximately 72.2% of the combined entity’s net sales) and Pamida on a stand-alone basis had total revenues of approximately $755.4 million (constituting approximately 27.8% of the combined entity’s net sales). We believe that, over time, the merger of Shopko and Pamida will be beneficial to our portfolio from a credit perspective, because we expect: (1) properties that previously operated under the Pamida brand will be improved and converted to the Shopko brand; and (2) the operations at the 114 of our properties that historically have operated under the Shopko brand will continue as they have historically at the property level. However, no assurance can be given as to the future performance of the merged Shopko/Pamida entity or its stores. See “Risk Factors—Risks Related to Our Business and Properties—A substantial number of our properties are leased to one tenant, which may result in increased risk due to tenant and industry concentrations.” Expected Impact of Merger on Pre-Merger Pamida Properties • Shopko/Pamida has indicated that it intends to convert Pamida properties to the Shopko store concept and brand by the end of 2012 and that it will make a significant cash investment in connection with the conversion process to improve store design and layout, purchase new interior and exterior signage, update fixtures and expand the merchandise mix. Based on financial information supplied to us by Shopko, Shopko increased both sales and EBITDAR at two Pamida properties leased from us that Shopko acquired prior to its merger with Pamida and converted into the Shopko store concept and brand. • The leases relating to the Pamida properties are now guaranteed by the Shopko Guarantor. Expected Impact of Merger on Pre-Merger Shopko Properties • Prior to the merger, the 114 properties that we leased to Shopko had a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x, and, after the merger, for the 13 weeks ended April 28, 2012, the 179 properties that we leased to the combined Shopko/Pamida entity continued to have a property-level rent coverage ratio in excess of our target underwriting standard of 2.0x (in each case, based on information provided to us by Shopko/Pamida). For a discussion of how we calculate property-level rent coverage, see “Business and Properties—Risk Management—Tenant Financial Distress Risk—Early Lease Termination Risk—Measurement.” • After giving effect to various merger costs and expenses associated with converting Pamida properties to the Shopko brand, as of April 30, 2012, Shopko/Pamida’s “shadow rating,” as generated by a product licensed by us from Moody’s Analytics, continues to meet the targeted average for our portfolio. • We believe that the operations at the properties that historically have operated under the Shopko brand will continue as they have historically at the property level. Based on numbers provided to us by Shopko prior to the merger, Shopko’s operating performance had improved in recent years in a competitive environment. Additionally, 96.3% of the properties that we leased to Shopko prior to its merger with Pamida operated within 10 miles of a Walmart for the last eight years (99.1% for the last four years), demonstrating the competitive viability of these properties. Corporate-level EBITDAR for the Shopko Guarantor for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 was $158.0 million, $154.7 million and $141.2 million, respectively, representing a corporate-level coverage ratio of EBITDAR to interest expense, net and rent expense of 1.57x, 1.57x and 1.45x, respectively for the foregoing periods. Corporate-level adjusted EBITDAR for the Shopko Guarantor for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 was $163.8 million, $158.6 million and $147.1 million, respectively, representing a corporate-level coverage ratio of

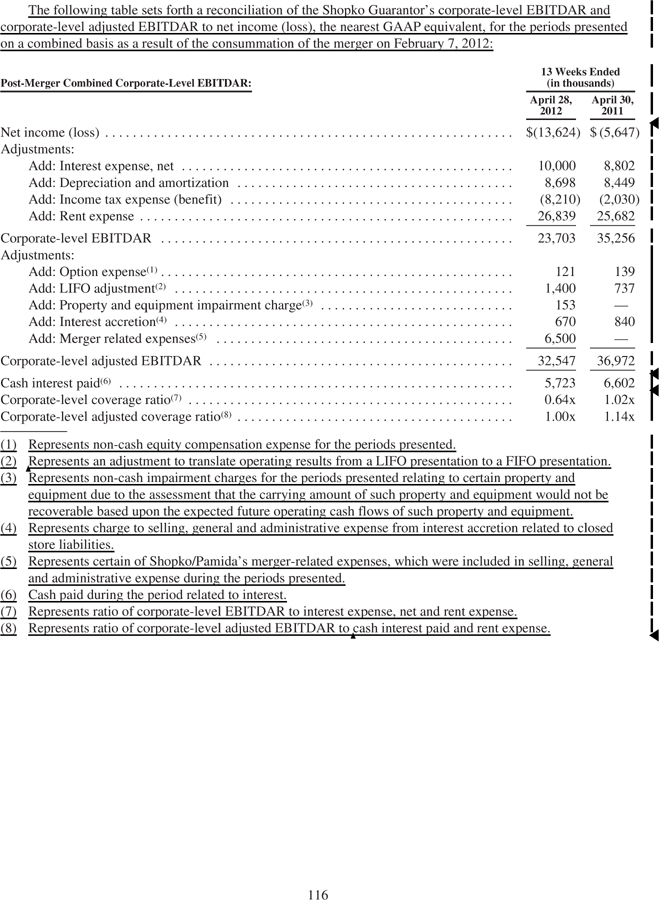

adjusted EBITDAR to cash interest paid and rent expense of 1.64x, 1.60x and 1.51x, respectively for the foregoing periods. This information is based upon the Shopko Guarantor’s audited financial statements for the relevant fiscal years, which have not been retrospectively restated on a combined basis to give effect to Shopko’s merger with Pamida, which was completed on February 7, 2012. Prior to their merger, Shopko and Pamida were entities under common control, and their merger will be accounted for as a related party asset transfer between entities under common control. As a result, the Shopko Guarantor’s annual financial statements for these fiscal years will be retrospectively restated on a combined basis to give effect to Shopko’s merger with Pamida, and we expect that the corporate-level coverage ratios of EBITDAR to interest expense, net and rent expense of the combined company that includes Pamida for these prior fiscal years will be retrospectively restated to be lower than those of the Shopko Guarantor on a stand-alone basis as a result of the change in presentation. During the 13 weeks ended April 28, 2012, net sales of the merged Shopko/Pamida entity increased by approximately $21.1 million to $666.8 million as compared to the 13 weeks ended April 30, 2011. For the 13 weeks ended April 28, 2012, corporate-level EBITDAR and corporate-level adjusted EBITDAR for the Shopko Guarantor were $23.7 million and $32.5 million, respectively, representing a corporate-level coverage ratio of EBITDAR to interest expense, net and rent expense and a corporate-level coverage ratio of adjusted EBITDAR to cash interest paid and rent expense of 0.64x and 1.00x, respectively. For the 13 weeks ended April 30, 2011, corporate-level EBITDAR and corporate-level adjusted EBITDAR for the Shopko Guarantor were $35.3 million and $37.0 million, respectively, representing a corporate-level coverage ratio of EBITDAR to interest expense, net and rent expense and a corporate-level coverage ratio of adjusted EBITDAR to cash interest paid and rent expense of 1.02x and 1.14x, respectively. In addition to certain of the items included in deriving adjusted EBITDAR, we believe that the Shopko Guarantor’s results of operations for the 13 weeks ended April 28, 2012, the period during which period the Shopko/Pamida merger was completed, were adversely affected by (1) other increases in selling, general and administrative expenses and (2) other costs, including costs associated with liquidating Pamida merchandise, restocking Pamida properties and converting Pamida properties to the Shopko brand. Additionally, the retail industry generally exhibits seasonality, with the first quarter of each fiscal year typically contributing a disproportionately small percentage of annual EBITDAR. For example, prior to its merger with Pamida, the first 13 weeks of each of Shopko’s last three fiscal years contributed 21.3%, 20.4% and 19.7%, respectively, of its annual EBITDAR. However, no assurance can be given that the combined Shopko/ Pamida entity will exhibit seasonality similar to that of Shopko on a stand-alone basis or that the historical seasonality trends of the retail industry will persist. Corporate-level EBITDAR represents net income (loss) before interest expense, net, depreciation and amortization, income tax expense (benefit) and rent. For a reconciliation of corporate-level EBITDAR to net income (loss), the nearest GAAP equivalent, see below. Corporate-level adjusted EBITDAR represents net income (loss) before interest expense, net, depreciation and amortization, income tax expense (benefit) and rent, as further adjusted to eliminate the impact of certain items we do not consider indicative of the Shopko Guarantor’s core operating performance and for which the Shopko Guarantor is allowed to adjust in calculating EBITDAR under the terms of its leases with us. For a reconciliation of corporate-level adjusted EBITDAR to net income (loss), the nearest GAAP equivalent, see below. Shopko/Pamida’s financial condition and results of operations will depend, in part, upon the successful integration of the Pamida acquisition and the conversion of most Pamida properties to the Shopko store concept and brand. The conversion of the Pamida properties will likely involve additional costs, and these costs may reduce the Shopko Guarantor’s EBITDAR and corporate-level coverage ratio of EBITDAR to interest expense, net and rent expense in future periods. See “Risk Factors—Risks Related to Our Business and Properties—A substantial number of our properties are leased to one tenant, which may result in increased risk due to tenant and industry concentrations” and “Risk Factors—Risks Related to Our Business and Properties—The Shopko Guarantor’s audited financial statements for the fiscal years ended January 28, 2012, January 29, 2011 and January 30, 2010 have not yet been retrospectively restated to give effect to Shopko’s merger with Pamida, and, when these financial statements are retrospectively restated, it is likely that the financial condition and results of operations of the combined company for such periods will be inferior to those of the Shopko Guarantor on a

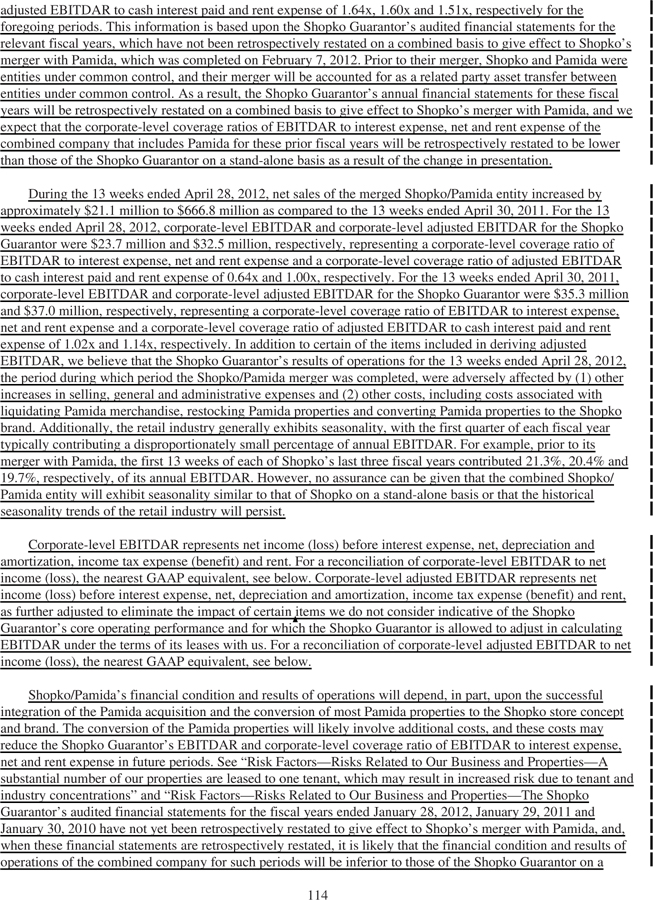

stand-alone basis as a result of the change in presentation.” No assurance can be given as to the future performance of the merged Shopko/Pamida entity or its stores. The following table sets forth a reconciliation of the Shopko Guarantor’s corporate-level EBITDAR and corporate-level adjusted EBITDAR to net income (loss), the nearest GAAP equivalent, for the periods presented prior to the merger, based on the Shopko Guarantor’s stand-alone financial statements for such periods: Pre-Merger Shopko Guarantor Stand-Alone Fiscal Year Ended 13 Weeks Ended Corporate-Level EBITDAR: (in thousands) (in thousands) January 28, January 29, January 30, April 30, May 1, May 2, 2012 2011 2010 2011 2010 2009 Net income (loss) $ 27,694 $ 48,934 $ 17,869 $ 3,215 $ 22,989 $ (448) Adjustments: Add: Interest expense, net 17,477 18,897 18,402 4,003 4,891 4,810 Add: Depreciation and amortization 18,249 16,151 16,225 4,363 3,776 3,627 Add: Income tax expense (benefit) 11,373 (9,069) 9,548 1,951 (19,917) 108 Add: Rent expense 83,197 79,759 79,134 20,063 19,871 19,795 Corporate-level EBITDAR $157,990 $154,672 $141,178 $33,595 $ 31,610 $27,892 Adjustments: Add: Option expense(1) 495 526 435 139 136 117 Add: LIFO adjustment(2) 3,622 1,200 2,992 646 258 100 Add: Property and equipment impairment charge(3) 501 672 802 — — — Add: Interest accretion(4) 1,193 1,506 1,677 356 404 448 Corporate-level adjusted EBITDAR 163,801 158,576 147,084 34,736 32,408 28,557 Cash interest paid(5) 16,843 19,419 18,374 4,006 5,405 5,447 Corporate-level coverage ratio(6) 1.57x 1.57x 1.45x 1.40x 1.28x 1.13x Corporate-level adjusted coverage ratio(7) 1.64x 1.60x 1.51x 1.44x 1.28x 1.13x (1) Represents non-cash equity compensation expense for the periods presented. (2) Represents an adjustment to translate operating results from a LIFO presentation to a FIFO presentation. (3) Represents non-cash impairment charges for the periods presented relating to certain property and equipment due to the assessment that the carrying amount of such property and equipment would not be recoverable based upon the expected future operating cash flows of such property and equipment. (4) Represents charge to selling, general and administrative expense from interest accretion related to closed store liabilities. (5) Cash paid during the period related to interest. (6) Represents ratio of corporate-level EBITDAR to interest expense, net and rent expense. (7) Represents ratio of corporate-level adjusted EBITDAR to cash interest paid and rent expense.

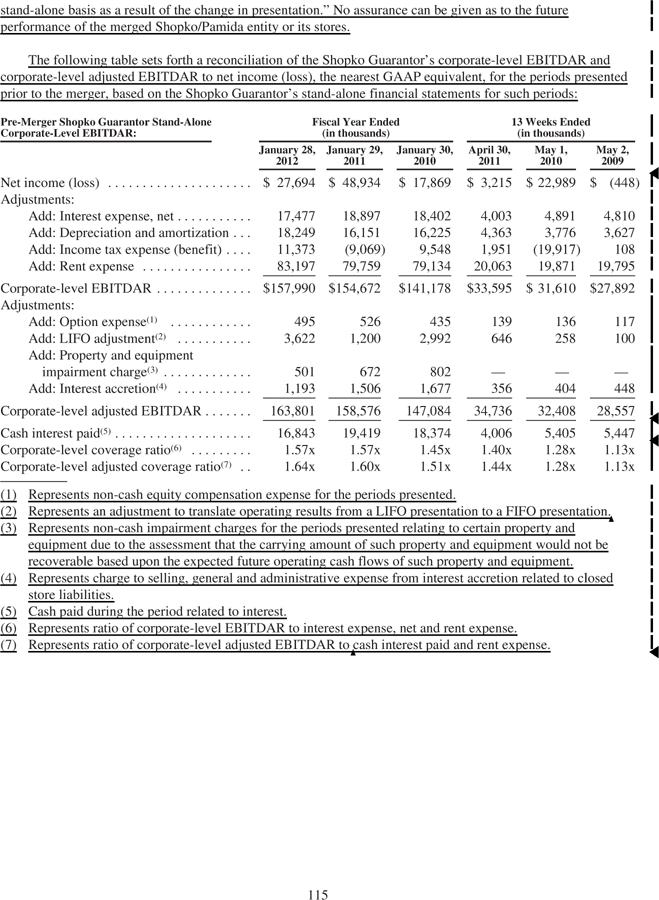

The following table sets forth a reconciliation of the Shopko Guarantor’s corporate-level EBITDAR and corporate-level adjusted EBITDAR to net income (loss), the nearest GAAP equivalent, for the periods presented on a combined basis as a result of the consummation of the merger on February 7, 2012: 13 Weeks Ended Post-Merger Combined Corporate-Level EBITDAR: (in thousands) April 28, April 30, 2012 2011 Net income (loss) $(13,624) $ (5,647) Adjustments: Add: Interest expense, net 10,000 8,802 Add: Depreciation and amortization 8,698 8,449 Add: Income tax expense (benefit) (8,210) (2,030) Add: Rent expense 26,839 25,682 Corporate-level EBITDAR 23,703 35,256 Adjustments: Add: Option expense(1) 121 139 Add: LIFO adjustment(2) 1,400 737 Add: Property and equipment impairment charge(3) 153 — Add: Interest accretion(4) 670 840 Add: Merger related expenses(5) 6,500 — Corporate-level adjusted EBITDAR 32,547 36,972 Cash interest paid(6) 5,723 6,602 Corporate-level coverage ratio(7) 0.64x 1.02x Corporate-level adjusted coverage ratio(8) 1.00x 1.14x (1) Represents non-cash equity compensation expense for the periods presented. (2) Represents an adjustment to translate operating results from a LIFO presentation to a FIFO presentation. (3) (s)Represents non-cash impairment charges for the periods presented relating to certain property and equipment due to the assessment that the carrying amount of such property and equipment would not be recoverable based upon the expected future operating cash flows of such property and equipment. (4) Represents charge to selling, general and administrative expense from interest accretion related to closed store liabilities. (5) Represents certain of Shopko/Pamida’s merger-related expenses, which were included in selling, general and administrative expense during the periods presented. (6) Cash paid during the period related to interest. (7) Represents ratio of corporate-level EBITDAR to interest expense, net and rent expense. (8) Represents ratio of corporate-level adjusted EBITDAR to cash interest paid and rent expense.